Simple Invoice Template for Tracking Hours Worked

Efficiently managing payment requests is essential for any professional or freelancer. Using the right document to outline work and compensation can save valuable time while ensuring clarity for both parties. A well-organized record helps to maintain accuracy and fosters trust in business relationships.

Creating a clear and effective record is crucial when tracking services provided. By employing a straightforward approach, you can easily showcase your work and present payment expectations. This helps to avoid misunderstandings and accelerates the process of receiving compensation.

Whether you’re managing multiple clients or simply aiming to improve your workflow, having an accessible system in place is key. With the right tool, you can focus on your tasks while minimizing administrative hassle.

Simple Invoice Template for Hours Worked

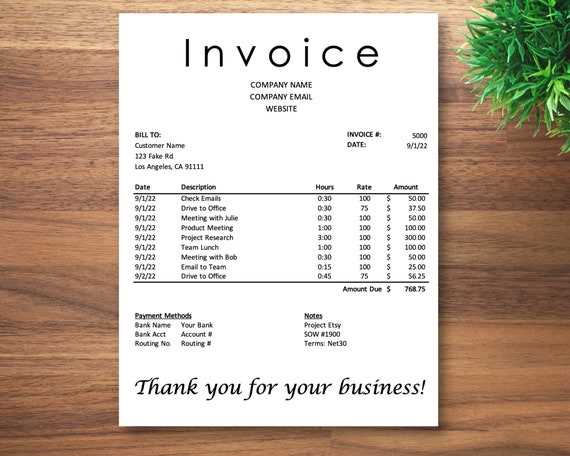

Keeping track of the time you dedicate to a project or client is essential for ensuring you receive the right compensation. Having a clear structure to outline your services, the amount of time spent, and the agreed rate makes it easier for both you and the client to stay on the same page. This approach not only streamlines payment processes but also enhances professionalism.

Essential Components of a Time-Based Billing Record

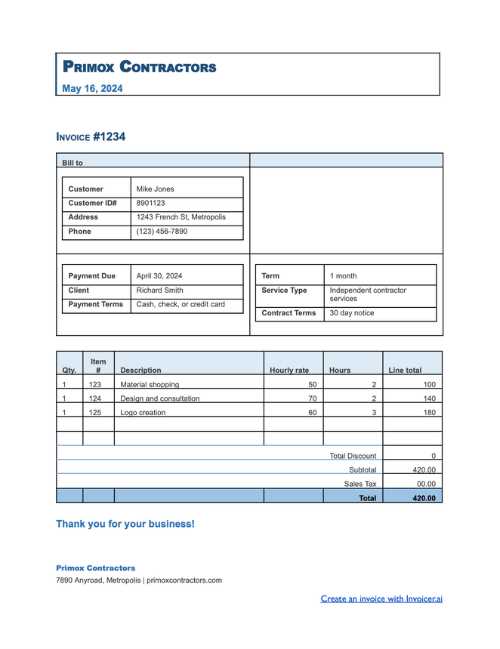

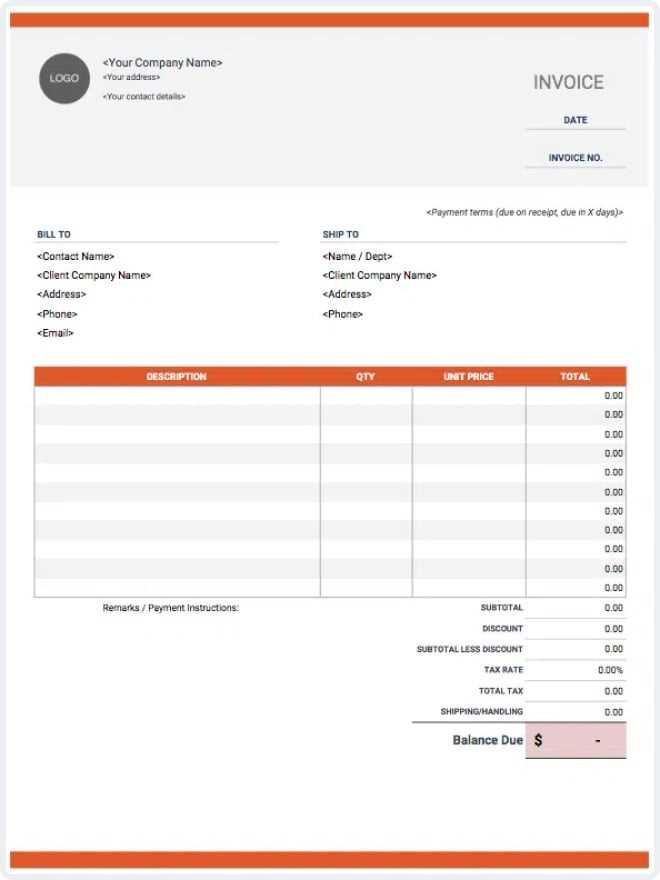

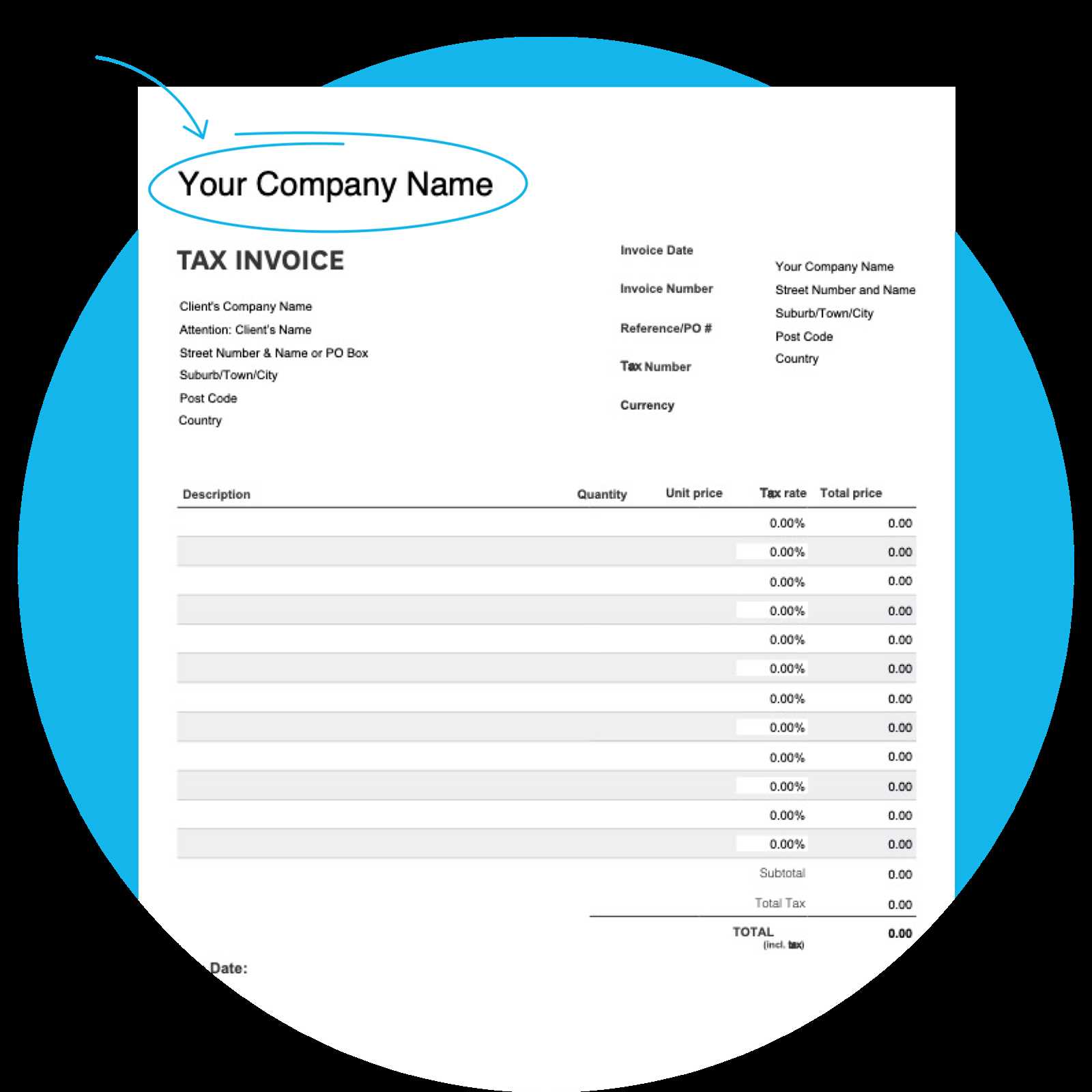

The document should include key elements such as your contact information, the client’s details, the description of services provided, and the total amount due. It’s important to list each task or project phase, alongside the time spent on it. Adding a section to break down rates and payment terms ensures full transparency.

Customizing Your Record for Efficiency

When choosing a system to manage your payments, it’s crucial to find one that suits your specific needs. Whether it’s a downloadable file or an automated solution, customization options like pre-set rate fields, automated time calculations, and easy-to-read formatting can significantly reduce administrative work. Streamlining the process allows you to focus on your actual work rather than the paperwork.

Why You Need an Invoice Template

Having a clear and consistent way to request payment is essential for maintaining smooth financial transactions with clients or employers. A structured document ensures that both parties understand the work completed, the amount owed, and the agreed-upon terms. This not only facilitates timely payments but also prevents confusion or disputes.

Clarity and Professionalism in Every Transaction

Using a standardized document helps maintain a professional image, providing a clean and organized way to communicate billing details. When all necessary information is presented clearly, it reflects well on you as a contractor or service provider. Clients are more likely to pay promptly when the process is straightforward and transparent. Clarity breeds trust, which is crucial for long-term business relationships.

Time-Saving and Consistency

Instead of creating new records from scratch with each project, a pre-made structure saves time and effort. With fields already in place, you can focus on filling in the relevant details instead of worrying about formatting. Consistency is key–having a reliable method for tracking payments allows you to avoid errors and stay organized across multiple clients or assignments.

How to Customize Your Invoice Template

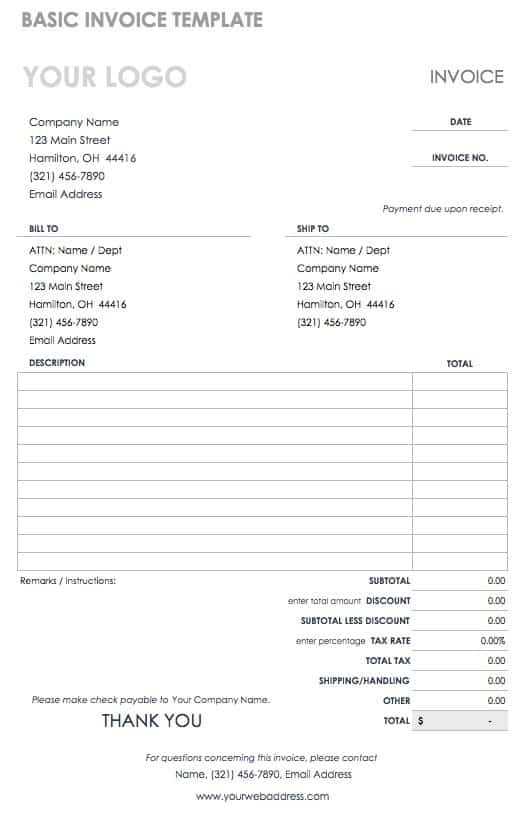

Tailoring your payment request document to meet your specific needs ensures that it fits your business style and the services you offer. Customizing the layout and content of the form not only makes it more professional but also improves efficiency in processing payments. The right modifications can make your documents clearer and more user-friendly for both you and your clients.

Adjusting Key Sections for Clarity

Start by ensuring that all critical information is easily accessible. Personalize sections like client details, the description of services, and the payment breakdown to reflect the nature of your work. Below is an example of how to structure the main components:

| Section | Description |

|---|---|

| Contact Information | Include your name, address, and phone number, as well as your client’s details for reference. |

| Description of Services | List each task or project milestone with brief details, ensuring clarity on what was provided. |

| Amount Due | Provide a clear breakdown of the amount due, including rates and any additional fees or discounts. |

Adding Personal Touches and Branding

Customizing the design and layout helps convey your brand identity. Choose colors, fonts, and logos that align with your business. A visually appealing document not only stands out but also reinforces your professionalism. Adding a personal note or a thank you message at the end can also enhance the client experience, making them feel valued.

Best Formats for Time Tracking Invoices

When documenting the amount of time spent on various tasks, the format you choose plays a crucial role in ensuring that information is clearly communicated and easy to understand. Different formats offer various advantages depending on your needs, whether you’re working with a single client or managing multiple projects. The right format will help both you and your clients stay organized and on top of payments.

Choosing Between Digital and Printable Formats

There are a variety of formats available, but the two most common options are digital and printable. Digital formats, such as Excel spreadsheets or PDFs, offer the advantage of automatic calculations, easy sharing, and the ability to store records electronically. Printable versions can be handy for clients who prefer physical copies or when you need to sign off on documents in person.

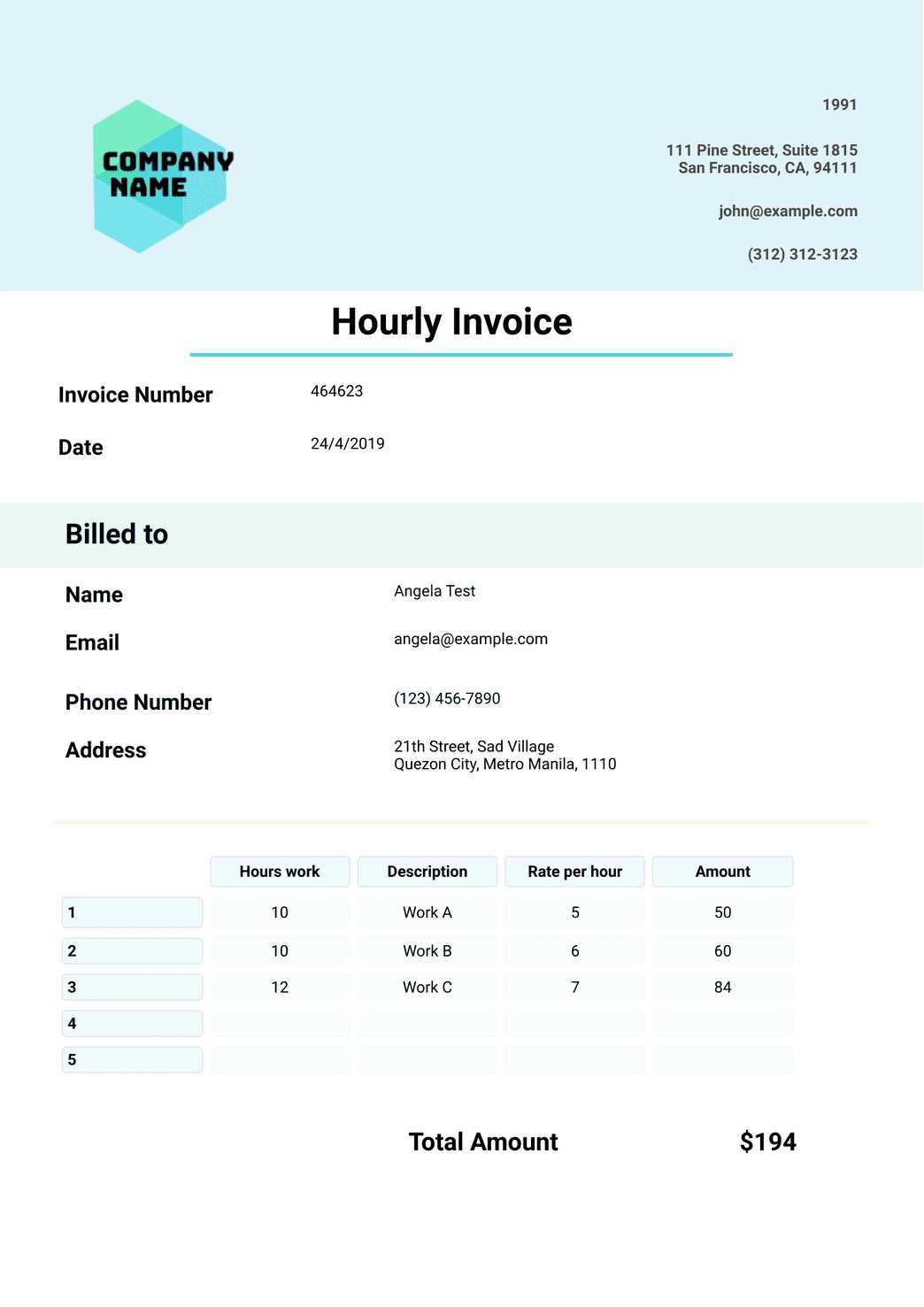

Table Structure for Easy Breakdown

One of the most effective ways to present detailed information about services provided is through a table format. This makes it easy for both you and your clients to see how time was spent and the corresponding costs. Below is an example of how to organize this data:

| Task Description | Time Spent | Rate | Total Amount |

|---|---|---|---|

| Consultation | 2 hours | $50/hr | $100 |

| Development | 5 hours | $60/hr | $300 |

| Testing | 3 hours | $55/hr | $165 |

This format helps both you and the client easily review and verify the time spent on each task, making the process more transparent and straightforward.

Key Elements of an Hourly Invoice

To ensure clarity and transparency when requesting payment, it’s important to include all relevant details in your billing document. A well-organized statement not only helps the client understand what they’re paying for, but it also makes it easier to track your earnings over time. Including the right components guarantees that the document is both professional and effective.

The most essential parts of a time-based billing statement include accurate client information, a detailed breakdown of the services provided, and a clear calculation of the amount due. By organizing these elements, you create a document that is straightforward and easy to process. Here are the key components to include:

1. Contact Information

Begin by listing your name, business name (if applicable), address, and contact information. Don’t forget to add your client’s details as well. This helps ensure that both parties are clearly identified and any issues with payment or correspondence can be quickly addressed.

2. Service Description

Provide a brief but clear description of the tasks or services rendered. Be specific about what was completed to avoid any misunderstandings. The more detailed you are, the less room there is for confusion. Include any relevant project milestones or objectives that were met during the period.

3. Time and Rate Calculation

Break down the amount of time spent on each task and the rate agreed upon. This section is crucial for clients who are paying based on time. Be sure to list each task individually, so the client knows exactly what they’re being billed for and can verify the charges.

4. Total Amount Due

Summarize the charges, including any applicable taxes, fees, or discounts. Be sure to make the total amount clearly visible and easy to understand. Providing a clear, itemized list helps ensure that the client has no questions about the payment amount.

Free vs Paid Invoice Templates

When choosing a system to create your billing documents, one of the first decisions is whether to opt for a free option or invest in a paid solution. Each option offers distinct advantages and limitations, depending on the specific needs of your business. Understanding the key differences can help you select the best approach to streamline your payment processes and enhance your professionalism.

Advantages of Free Options

Free billing systems can be a great starting point for those who are just beginning or working with a limited budget. Many free options provide basic functionality, allowing you to create and send documents without spending any money. Here are some benefits of free solutions:

- Cost-effective: No upfront investment is required, making it accessible for small businesses or freelancers.

- Simple to use: Many free tools are designed to be straightforward, ideal for users without a lot of experience in document creation.

- Available templates: Several free tools offer a variety of pre-designed formats, which can save you time on customization.

Limitations of Free Options

While free solutions may be tempting, they often come with restrictions that could limit your flexibility in the long run. Common limitations include:

- Limited customization: You may not be able to personalize the design to fit your brand or business needs.

- Fewer features: Free tools often lack advanced functionalities such as automatic calculations or the ability to track payments.

- Ads or branding: Many free tools display advertisements or place watermarks on your documents, which can detract from a professional appearance.

Benefits of Paid Options

Investing in a paid system often unlocks advanced features and customization options that can significantly improve your efficiency and professionalism. These platforms typically offer:

- More customization: The ability to modify the layout, color schemes, and include your logo ensures your documents reflect your brand identity.

- Advanced features: Tools like automated time tracking, recurring billing, and direct payment integrations save you time and reduce errors.

- Better support: Paid services often come with customer support, ensuring you can get help quickly if any issues arise.

Making the Right Choice

Ultimately, the decision between free and paid options depends on your specific business needs. If you’re just starting out and only need bas

How to Calculate Hours for Invoicing

Accurately calculating the time spent on a project is critical when determining how much to charge a client. Whether you are billing based on an hourly rate or tracking your time for a specific service, knowing how to measure and document the duration of each task is essential for transparent and fair billing. Here’s a guide on how to approach this process effectively.

Tracking Time Effectively

The first step in accurate time calculation is tracking every moment spent on a project. Using a timer or time tracking software can help ensure that no time is overlooked or underreported. Be specific about the tasks you’re working on and record the start and end times to provide clear evidence of the time spent.

Calculating Total Time

Once you have recorded the time spent on each task, you’ll need to calculate the total. For billing purposes, it’s important to make sure that the time is rounded appropriately, depending on your agreement with the client. Some may prefer increments of 15 minutes, while others may allow for rounding to the nearest half hour or hour.

| Task Description | Start Time | End Time | Time Spent |

|---|---|---|---|

| Consultation | 10:00 AM | 11:15 AM | 1 hour 15 minutes |

| Design Work | 11:30 AM | 2:00 PM | 2 hours 30 minutes |

| Development | 2:30 PM | 5:00 PM | 2 hours 30 minutes |

In the example above, you would simply add the time for each task to calculate the total. Make sure to convert all minutes to decimal hours if necessary, especially when working with an hourly rate. Accurate time tracking ensures you get paid for every minute spent on the project.

Choosing the Right Invoice Design

The design of your billing document is just as important as the information it contains. A well-designed record not only helps convey professionalism but also makes it easier for clients to understand the details of the payment. Choosing the right layout, fonts, and structure can improve both the aesthetic appeal and functionality of your document.

Prioritize Clarity and Readability

The most important aspect of any billing record is clarity. Your client should be able to quickly identify key details such as the amount due, payment terms, and the services provided. A clean, well-organized layout helps prevent confusion and ensures that your clients are confident in the document’s accuracy. Use clear headings and ensure that there is plenty of space between sections to avoid clutter.

Customization and Branding

Incorporating your company logo and using your brand’s colors can make your billing documents stand out and reflect your identity. Customizing the design can also help create a consistent look across all business materials, reinforcing your brand image. Keep the overall design professional and straightforward, but don’t hesitate to add small design elements that align with your business style. Consistency is key when it comes to building a professional brand image.

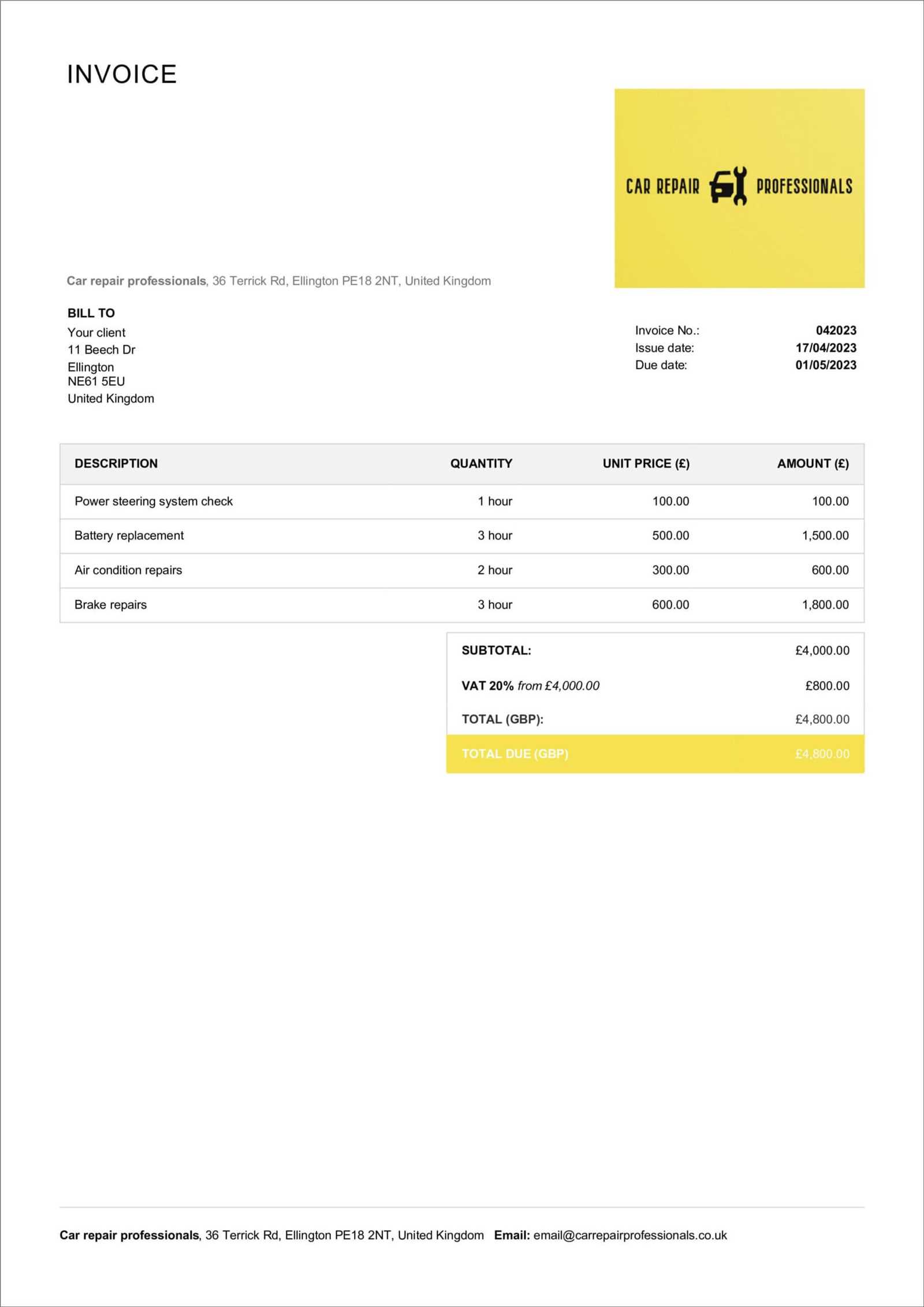

How to Add Taxes and Discounts

When preparing a billing document, it’s important to include any applicable taxes and discounts to ensure the final amount is correct. Properly accounting for taxes ensures compliance with local regulations, while discounts can help incentivize early payment or reward loyal clients. Understanding how to apply these adjustments effectively is key to maintaining transparency and trust in your transactions.

Adding Taxes to Your Total

To include taxes, first identify the applicable tax rate for the region or type of service you provide. Once you have the rate, calculate the amount by multiplying the subtotal by the tax percentage. For example, if the subtotal is $500 and the tax rate is 8%, the tax amount would be $40. Add this to the subtotal to get the total amount due. Be sure to list the tax rate clearly on the document to avoid confusion.

Applying Discounts

Discounts can be applied as a percentage or a fixed amount, depending on the agreement with the client. To calculate a percentage discount, multiply the subtotal by the discount rate. For instance, if the subtotal is $500 and you offer a 10% discount, the discount amount would be $50. Subtract this amount from the subtotal to determine the discounted total. Always clearly state the discount rate and the reason for the discount to maintain transparency.

Here is an example of how taxes and discounts might appear on a billing document:

| Description | Amount |

|---|---|

| Subtotal | $500.00 |

| Tax (8%) | $40.00 |

| Discount (10%) | -$50.00 |

| Total Due | $490.00 |

By clearly showing taxes and discounts, you ensure the client understands exactly how the total was calculated and can verify the adjustments made.

Common Mistakes When Using Invoices

When creating payment requests, even small errors can lead to misunderstandings, delays, or disputes with clients. Whether it’s missing key information or improper calculations, these mistakes can complicate the payment process and impact your business reputation. Recognizing and avoiding common pitfalls can help ensure smoother transactions and timely payments.

1. Missing Essential Information

One of the most frequent mistakes is leaving out crucial details, such as your contact information, the client’s name, or the agreed-upon payment terms. If any key components are missing, the client may delay payment or require clarification, which can waste valuable time. Always double-check that the document includes:

- Your business name and contact details

- Client’s name and billing address

- A detailed breakdown of the services or tasks completed

- Payment due date and terms

2. Incorrect Calculations

Another common issue is inaccurate calculations, whether it’s the total amount due, taxes, or discounts. Small errors in adding up figures can lead to larger problems down the line. To avoid this, always double-check your math, especially when working with multiple items or rates. Using software or a calculator can reduce the chances of errors.

3. Not Specifying Payment Terms

Many people forget to clearly outline payment terms, such as when the payment is due, whether there are late fees, or what methods of payment are accepted. A lack of clear terms can cause confusion and delays, so be sure to include any relevant conditions like:

- Payment due date

- Late payment fees, if applicable

- Accepted payment methods (bank transfer, credit card, PayPal, etc.)

Properly specifying these details helps ensure that both parties are aligned on expectations and can avoid future conflicts.

How to Make Invoices Professional

Creating a polished and professional billing document is crucial for maintaining a strong relationship with clients and ensuring timely payments. A well-designed, clear, and detailed payment request reflects positively on your business and enhances your credibility. Here are some steps to elevate the quality of your billing documents and make them look more professional.

1. Use a Clean and Organized Layout

The layout of your billing document should be neat and easy to read. A cluttered or disorganized structure can confuse your client and lead to misunderstandings. Use plenty of white space, align text properly, and group related information together. This improves readability and makes it easier for clients to find what they need quickly.

2. Include Your Branding

Adding your logo, business name, and color scheme to the billing document can create a more polished, branded experience for your clients. Consistency in design across all communication materials helps establish a professional image. You don’t need elaborate graphics, but incorporating subtle elements of your brand identity shows attention to detail.

3. Be Detailed and Clear

Ensure that every task, service, or product is clearly outlined in the document, with the corresponding costs and time spent. Clients should have no difficulty understanding what they are paying for. Detailed descriptions not only prevent confusion but also enhance your credibility by showcasing the value of the work you’ve completed.

4. Use Professional Language and Tone

Keep the tone formal and polite throughout the document. Avoid using slang or overly casual language. Phrases like “Thank you for your business” or “If you have any questions, please don’t hesitate to contact me” can help convey professionalism and build rapport with your clients.

Example of a Professional Billing Document

Here’s an example of a well-organized, professional billing statement that includes all the necessary details:

| Task Description | Time Spent | Rate | Total | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Consultation Call | 1 hour | $50/hr | $50 | ||||||||||||

| Project Research | 3 hours | $60/hr | $180 |

| Tool | Features | Best For |

|---|---|---|

| FreshBooks | Automatic document creation, recurring invoices, online payments | Freelancers, small businesses |

| QuickBooks | Customizable templates, recurring billing, payment reminders | Mid-sized businesses, accountants |

| Zoho Invoice | Automated payment tracking, multi-currency support, reports | International businesses, remote teams |

2. Set Up Recurring Billing

If you offer services on a regular basis, setting up automated recurring billing can be a huge time-saver. With recurring billing, payment requests are automatically generated and sent at specified intervals, ensuring you never forget to bill your clients. This also reduces the chance of late payments and keeps your income predictable.

- Fixed Monthly Services: Set a specific date for clients to be billed each month.

- Hourly Retainers: Automatically generate requests based on the time spent each period.

3. Use Payment Reminders

Automated reminders can ensure that clients are aware of upcoming or overdue payments. Many tools will automatically send reminders before and after a payment due date. These reminders can be tailored to include personalized messages, such as payment terms or late fees, which helps encourage timely settlements without needing to manually track them.

- Pre-Due Reminders: Notify clients a few days before the payment is due.

- Late Payment Notices: Send automatic follow-up emails if payment is overdue.

4. Integrate with Payment Gateways

To make the entire process seamless, you can integrate your billing system with online payment platforms like PayPal, Stripe, or Square. This allows your clients to pay directly from the payment request with just a few clicks. Integrat

Using Invoices for Business Record Keeping

Maintaining accurate and organized financial records is essential for any business. One of the most effective ways to keep track of income and expenses is by using billing documents. These documents serve not only as a tool for requesting payment, but also as a valuable resource for financial tracking and future planning. Properly organized records provide a clear view of your business’s financial health and can be critical for tax purposes, audits, and decision-making.

1. Keep Track of Income and Payments

Each billing document serves as a record of money owed and the payments received. By organizing these documents chronologically, you create a clear audit trail that shows how much revenue your business generates over time. This can help you analyze cash flow, identify trends, and make informed business decisions. Additionally, having these records available can simplify your tax filing process and provide a solid foundation if you need to seek financial advice or funding.

2. Use Records for Tax Preparation

Accurate and up-to-date payment records are essential when it comes to tax reporting. The detailed information in your billing documents–including amounts, dates, and client details–can be used to calculate taxable income and deductions. Keeping these records organized ensures that you can easily provide necessary documentation during tax season, which helps avoid errors and potential fines from tax authorities.

By incorporating billing records into your regular business management practices, you can ensure that your financial data is always accurate, well-organized, and readily available when needed.