Free Simple Invoice Template Excel Download

Managing finances and keeping track of payments can be a challenging task for many businesses. The need for accurate, professional-looking records is essential, but not everyone has access to advanced software or design skills. Fortunately, there are accessible tools that simplify this process without requiring specialized knowledge or expensive tools.

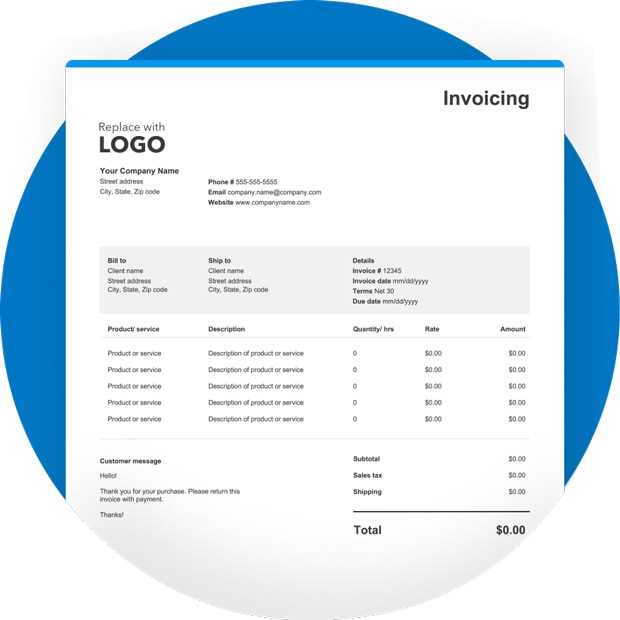

One of the most efficient ways to handle this is by using a ready-made spreadsheet that can be customized for any business. These customizable files offer a practical solution for creating clear and organized billing records with minimal effort. Whether you’re a small business owner or a freelancer, these resources help streamline financial documentation, making invoicing fast and easy.

Why rely on complex software when a simple document can provide all the features you need? These straightforward files are designed to cover all the necessary elements, from itemized charges to tax calculations, while keeping things clear and easy to update. With the right approach, you can manage your billing tasks smoothly and effectively with no extra hassle.

Free Excel Templates for Invoices

Creating professional billing records doesn’t have to be complicated. With the right tools, you can easily generate detailed documents to manage payments, track services, and stay organized. Many resources are available online that allow you to access ready-made documents, providing a quick solution for businesses of all sizes.

These resources offer a wide range of customizable formats suitable for various industries, ensuring that every need is met without the need for complex software. Using a simple file can save you time and ensure consistency in your records, all while maintaining a professional appearance.

- Accessible templates for easy customization

- Pre-designed fields for adding business details

- Clear sections for product and service descriptions

- Automatic calculations for totals and taxes

- Adjustable formats to fit your specific needs

By using these pre-built documents, you can create organized, easy-to-read records that align with your business requirements. Whether you are managing small-scale operations or need a solution for larger projects, these resources simplify the process without overwhelming you with unnecessary steps.

Why Use Simple Invoice Templates

Creating accurate and professional payment records is essential for any business. However, the process can often feel overwhelming without the right tools. Using pre-designed formats helps streamline this task, making it easy to organize charges, track payments, and maintain clarity in your financial documentation.

Opting for straightforward, customizable sheets allows you to focus on your core business activities rather than spending time on formatting and calculations. These resources are designed to simplify the process, ensuring that you have all the necessary information in one place, ready to share with clients or colleagues.

By using such solutions, businesses can maintain consistency, reduce the risk of errors, and ensure that every transaction is documented properly. These formats are adaptable, allowing you to tailor them to suit your specific requirements without needing any advanced software or design skills.

How to Download Excel Invoice Templates

Getting the right document format for managing billing is quick and simple. With just a few steps, you can find and obtain customizable files that suit your needs. These files are designed to help you stay organized, keeping all your payment details in one place and making the entire process more efficient.

Here is a step-by-step guide on how to access and save these resources:

| Step | Action |

|---|---|

| 1 | Search for available resources online using a reliable platform |

| 2 | Browse through various formats based on your preferences and needs |

| 3 | Select the document that suits your business type |

| 4 | Click on the link or button to access the file |

| 5 | Save the file to your computer for later use |

Once you’ve obtained the file, you can open it on your computer, make necessary adjustments, and start using it immediately. This process ensures that you always have access to well-organized, easy-to-use documents whenever you need them.

Benefits of Using Excel for Invoices

Using a spreadsheet for managing payment records offers numerous advantages, particularly for small businesses and freelancers. The flexibility and simplicity of a spreadsheet format allow users to create, modify, and track financial documents without relying on complex software. It also provides an accessible platform to handle billing tasks efficiently while keeping everything organized.

Cost-Effective Solution

One of the main advantages of utilizing a spreadsheet for financial documentation is that it is a cost-effective solution. Most users already have access to spreadsheet software, making it a great alternative to expensive accounting programs. With just a few clicks, you can create professional-looking records without additional costs or subscriptions.

Customizability and Flexibility

Another key benefit is the high degree of customizability. Users can easily adjust the layout, add new sections, or modify calculations to suit specific business needs. This flexibility ensures that the document can grow with your business and adapt to changing requirements, all while maintaining a consistent format across all transactions.

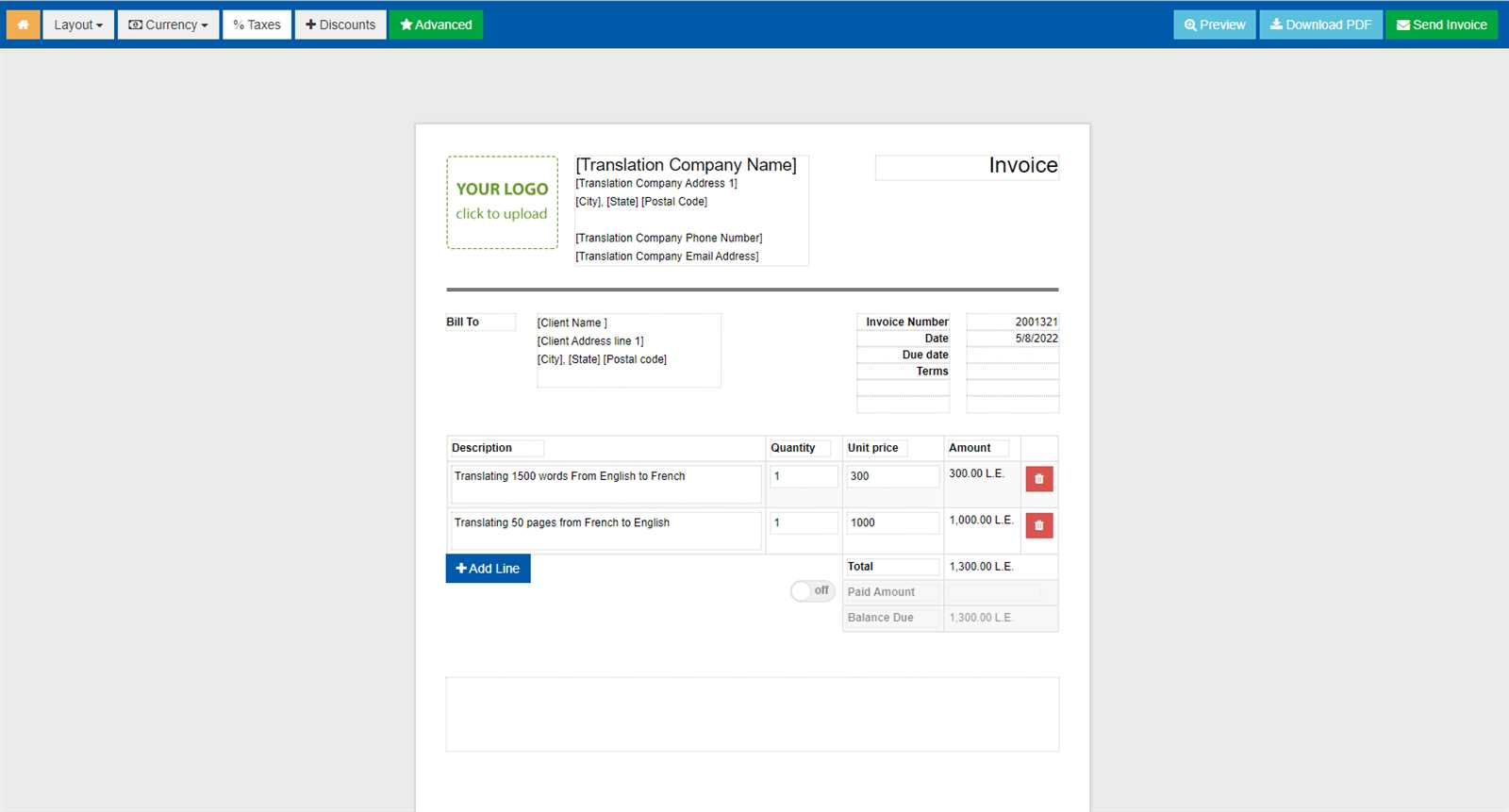

Step-by-Step Guide to Invoice Customization

Customizing your billing documents allows you to personalize them according to your business needs and branding. With a few simple steps, you can adjust the layout, add specific information, and ensure the document looks professional. This guide will walk you through the process of modifying your records to suit your requirements.

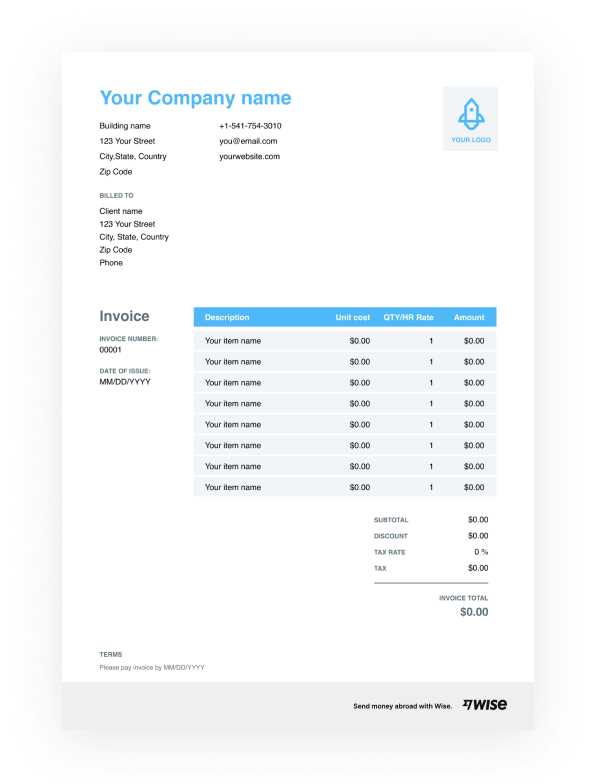

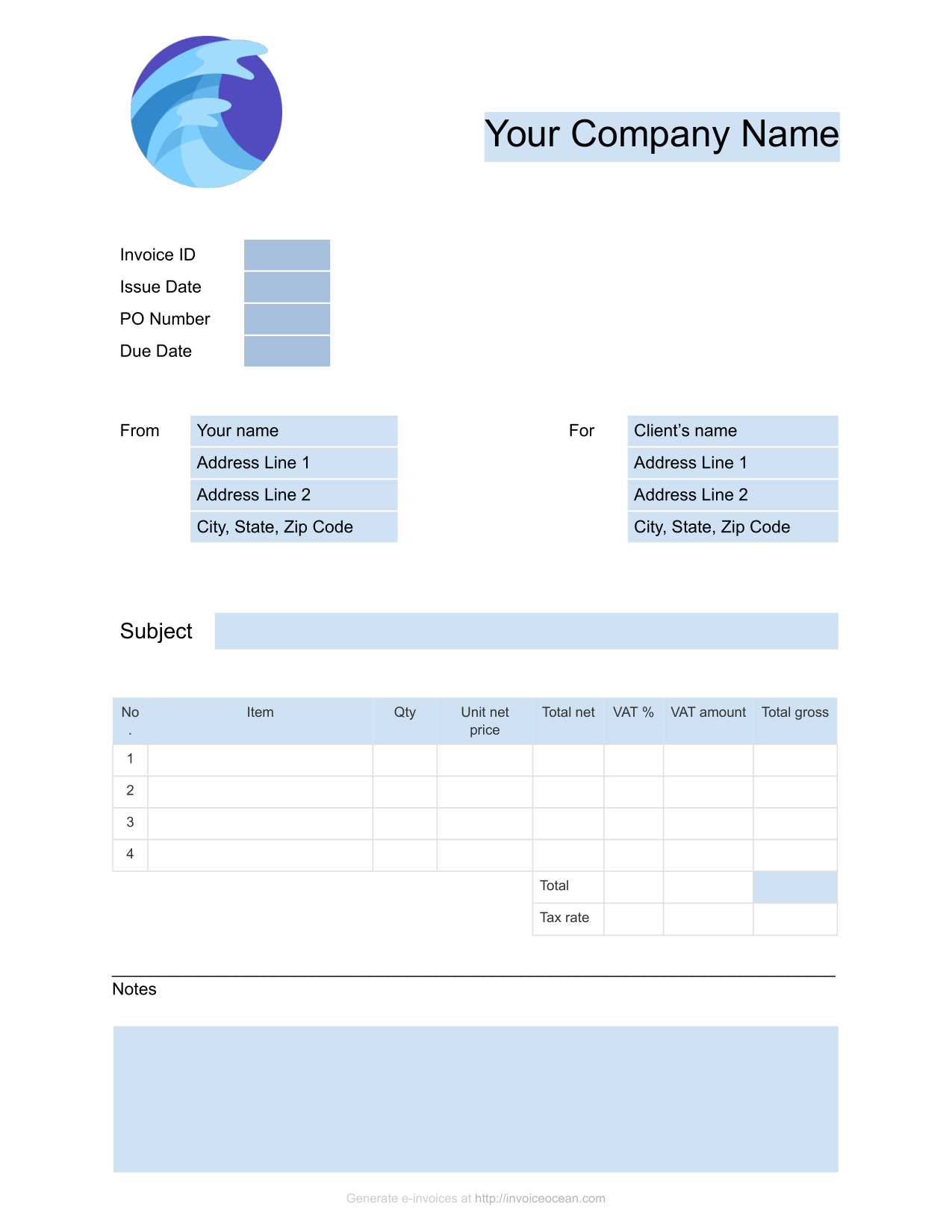

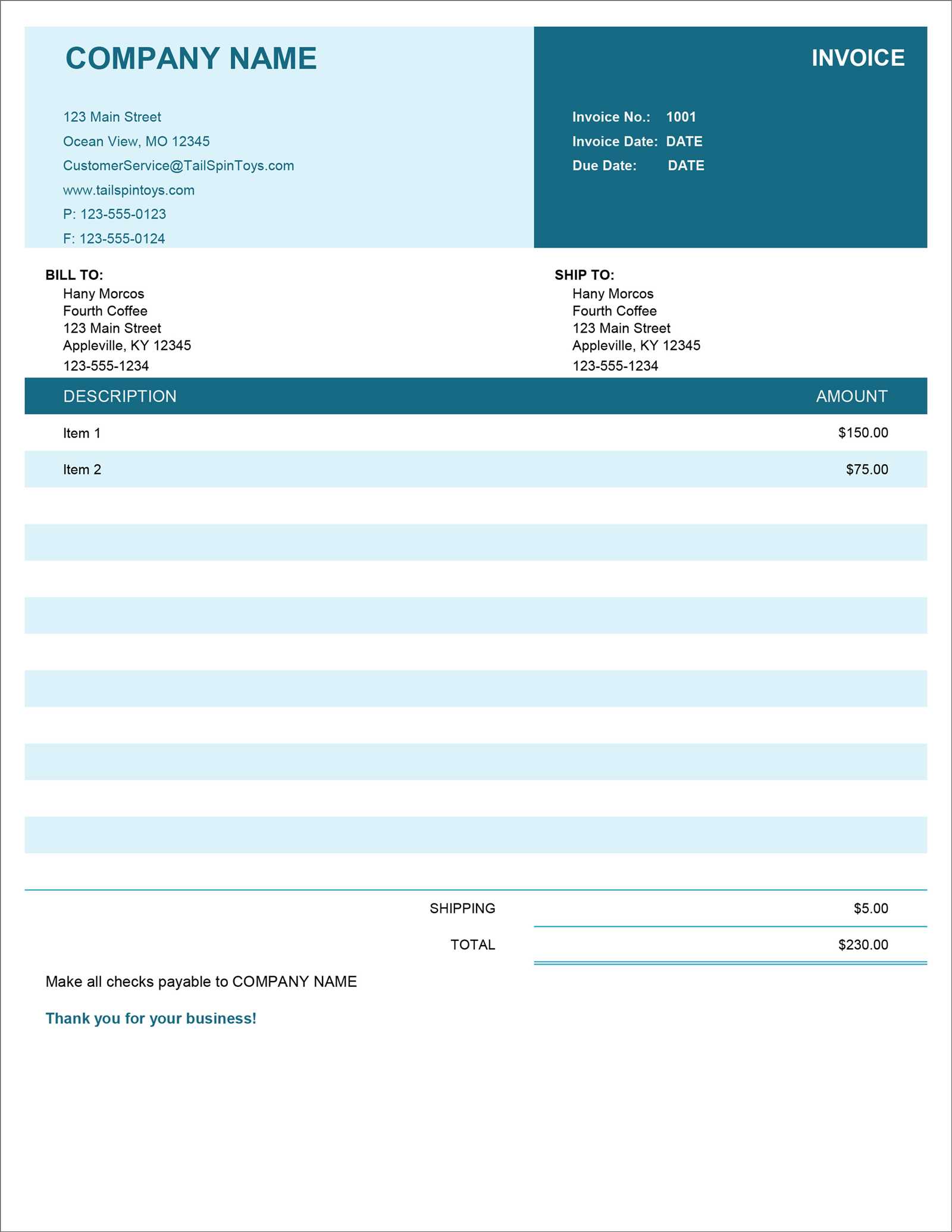

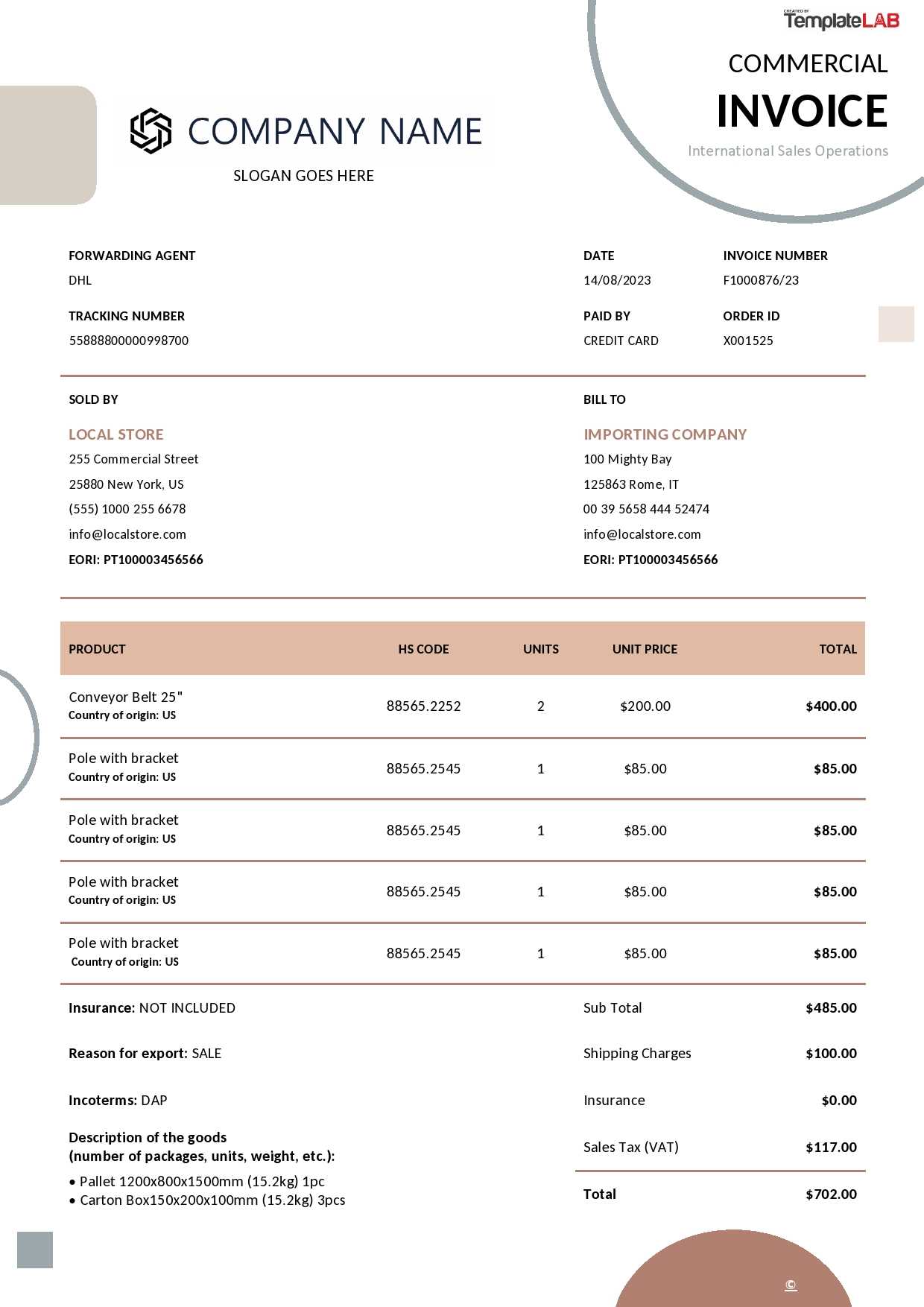

Step 1: Set Up Business Details

Start by entering your business name, address, and contact information at the top of the document. Make sure this section is clear and easy to read, as it helps establish your identity on the record. Additionally, include your business logo if you have one, which adds a personal touch and enhances professionalism.

Step 2: Modify Line Items and Calculations

Next, focus on the sections that detail the products or services provided. Adjust the columns to reflect the descriptions, quantities, and prices of the items you’re billing for. You can also set up automatic calculations to calculate totals and taxes, ensuring that every figure is accurate and consistent.

Once you’ve made these changes, your document will be customized and ready for use. This process can be repeated for each new transaction, making it easy to stay organized without needing to start from scratch every time.

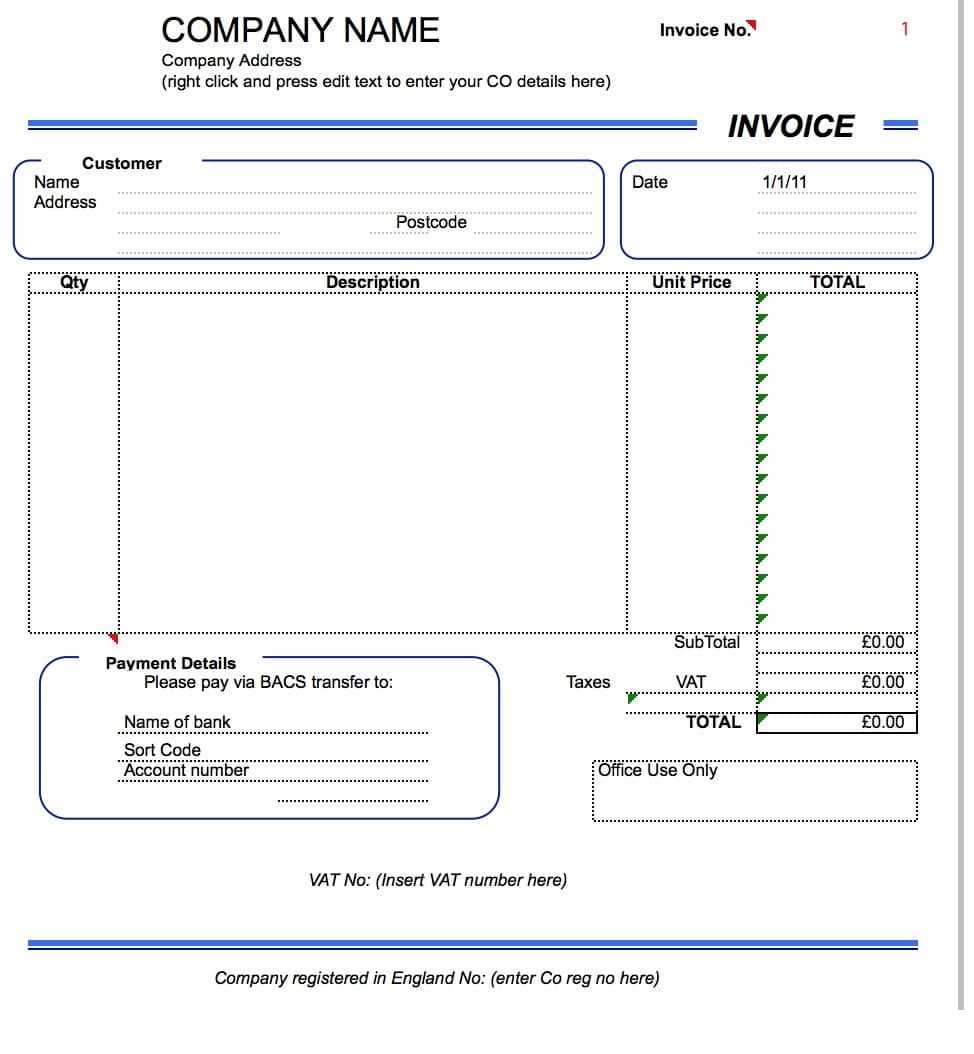

Key Features of Simple Invoice Templates

When it comes to managing your billing, having a well-structured document is essential. A good format should cover all necessary details while remaining clear and easy to use. The following features make these documents an ideal choice for business owners looking to streamline their payment processes and maintain accurate records.

Clear Structure for Easy Use

One of the key advantages of using a pre-designed sheet is its clear and straightforward structure. The layout is typically designed to make it easy for you to fill in information like customer details, product descriptions, and amounts due. This saves time and ensures that no important data is overlooked.

Automatic Calculations

Another important feature is the inclusion of automatic calculations. These formulas can instantly compute totals, taxes, and discounts, which reduces the chance of errors and speeds up the process. With everything calculated for you, all you need to do is input the numbers, and the document takes care of the rest.

These features make the documents highly efficient and effective, whether you’re managing small-scale orders or handling multiple clients at once. With just a few adjustments, you can create professional-looking records that meet all your business needs.

Common Mistakes to Avoid in Invoices

Creating clear and accurate payment records is crucial for smooth business operations. However, even small errors can lead to confusion and delays in payments. To ensure your billing process runs smoothly, it’s important to avoid common mistakes that can impact the professionalism and accuracy of your documents.

- Missing Contact Information: Always include both your business details and your client’s contact information. Without this, it can be difficult to track payments or resolve any disputes that may arise.

- Incorrect Payment Terms: Be sure to clearly state the payment due date and any applicable late fees. Ambiguity in terms can lead to delayed payments.

- Omitting Item Descriptions: Each charge should be clearly described, leaving no room for misunderstanding. Without sufficient details, clients may question the billing amount.

- Failing to Double-Check Calculations: Always verify that totals, taxes, and discounts are calculated correctly. Mistakes here can undermine your credibility and lead to payment delays.

- Not Including a Unique Reference Number: Assigning a unique reference number helps you track invoices easily and ensures your clients can reference specific documents when making payments.

By keeping these mistakes in mind and taking steps to avoid them, you can ensure that your documents are both professional and accurate, making the billing process smoother for both you and your clients.

How to Add Your Business Details

Including accurate business information is a critical part of creating professional payment records. Properly displaying your contact details ensures that clients can easily reach you if needed, and it also establishes your identity on the document. This section will guide you through the process of adding your business information in a clear and organized way.

Step 1: Business Name and Logo

Start by adding your business name at the top of the document. This should be prominent and easy to spot. If you have a business logo, include it near the name to help brand your record. This adds a personal touch and ensures the document is visually aligned with your company’s image.

Step 2: Contact Information

Next, include your address, phone number, email address, and website, if applicable. This makes it easy for clients to contact you in case they have any questions or need further clarification regarding the document. Be sure to check that the contact details are up-to-date to avoid communication issues.

Once you’ve added your business information, your document will look more professional and make it easier for clients to reach out if necessary.

Tips for Creating Professional Invoices

Creating well-designed billing documents is essential for maintaining a professional appearance and ensuring smooth transactions with clients. Clear, accurate, and well-organized records not only help streamline your business operations but also foster trust with customers. Here are some helpful tips to make sure your records stand out and maintain professionalism.

Use a Clean and Organized Layout

Ensure that your document has a clean layout with clear headings and sections. Break the content into easily identifiable blocks such as customer details, itemized charges, and totals. This makes it simple for clients to quickly find the information they need and helps maintain a professional tone throughout the document.

Double-Check All Information

Always double-check the details you’ve entered, including prices, quantities, and dates. Errors in calculations or client information can create confusion and delay payments. Additionally, make sure that you’ve included all necessary fields such as payment terms and due dates to avoid any misunderstandings.

By following these tips, you can create documents that are not only functional but also reflect the professionalism of your business. Consistency and attention to detail will ensure that your clients receive accurate and easy-to-read records every time.

How to Calculate Total and Taxes

Accurately calculating the total amount due, including applicable taxes, is a crucial part of creating payment records. It’s important to ensure that all amounts are correctly summed up and that any tax obligations are applied consistently. In this section, we’ll walk you through the process of calculating totals and taxes in a straightforward way.

Step 1: Add Up the Subtotal

Begin by adding the cost of all the items or services provided. This will give you the subtotal, which is the total amount before taxes or discounts. Ensure that each item is correctly listed with the right quantity and unit price. Here is an example table to illustrate:

| Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 2 | $50.00 | $100.00 |

| Service B | 1 | $75.00 | $75.00 |

| Subtotal | $175.00 | ||

Step 2: Apply Taxes

Once you have the subtot

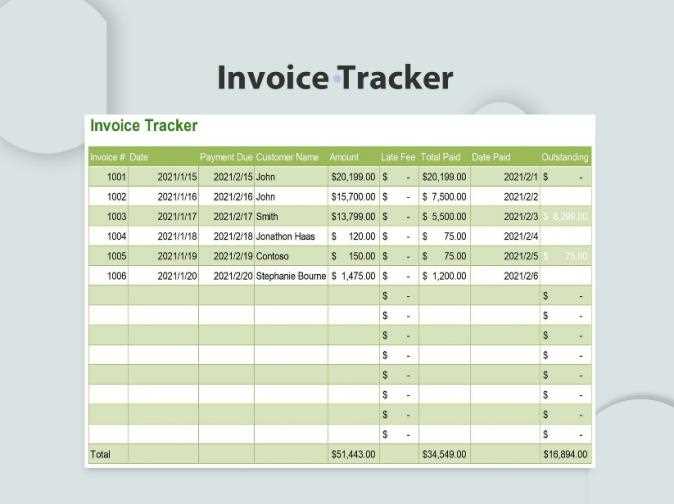

Best Practices for Organizing Invoices

Effective organization of payment records is essential for maintaining smooth business operations. A well-structured system allows for easy access, tracking, and management of financial documents, helping ensure that payments are received on time and any discrepancies are easily resolved. Here are some key practices to help you organize your records efficiently.

- Use Consistent Numbering – Always assign a unique number to each document. This makes it easier to track and reference specific transactions when needed. Consider using a sequential numbering system for simplicity.

- Sort by Date – Keep your records sorted by date to stay on top of upcoming due dates. Sorting chronologically helps avoid missing any payments and makes it easier to identify overdue amounts.

- Group by Client – For large volumes of documents, grouping records by client can streamline organization. This method allows you to quickly access all transactions related to a specific client.

- Keep Digital and Physical Copies – It’s a good idea to maintain both digital and physical copies of important records. Storing files digitally provides easy access, while physical copies can serve as backups or official documents when necessary.

- Track Payment Status – Maintain a system to track the payment status of each document. This could include marking paid, pending, or overdue, and should be updated regularly to reflect current payment status.

By following these best practices, you’ll ensure that your records remain organized, accessible, and accurate, which will help improve overall efficiency and reduce the chances of missing important deadlines.

What to Include in Your Invoice

To ensure that your billing documents are clear, professional, and complete, it is crucial to include all necessary details. Properly formatted records not only help maintain transparency but also protect both parties in case of disputes. Below is a guide to the essential elements that should always be included in your financial records.

Key Information for Clear Identification

Your document should clearly identify both you and your client. Include your business name, address, contact information, and tax identification number. Similarly, provide the client’s details, such as their name, company name (if applicable), and address. This helps to avoid any confusion regarding who is involved in the transaction.

Details of Goods or Services Provided

List all items or services that were delivered, including a description of each, the quantity, and the unit price. This breakdown ensures that both parties are on the same page regarding what was provided. Be as specific as possible to avoid any misunderstandings about the scope of work or products supplied.

Additionally, be sure to include the total amount due, payment terms, and any applicable taxes or discounts. These details help keep the transaction clear and avoid any future confusion or delays in payment.

How to Save and Share Your Invoice

Once your financial document is complete, it’s important to store it securely and share it with the recipient efficiently. Proper storage ensures you can easily access the document in the future, while sharing it correctly ensures that the client receives it promptly and can act on it without delay.

To begin, save your document in a format that is both universally accessible and preserves its integrity. Common formats include PDF, which maintains the layout and prevents accidental changes. You can also save the document in spreadsheet or word processing formats if edits are needed later, but keep in mind that PDF is the most widely accepted format for official transactions.

When it comes to sharing, email is the most convenient and secure method. Attach the document to a message, and include a brief note summarizing the details and reminding the recipient of the payment due date. If you are sharing the document in person or through other means, ensure that it is properly printed or shared in a format that is easy for the client to review.

For businesses that handle many documents, consider using cloud storage services to organize and manage files. This will allow you to access, share, and track documents from any device while keeping everything securely backed up.

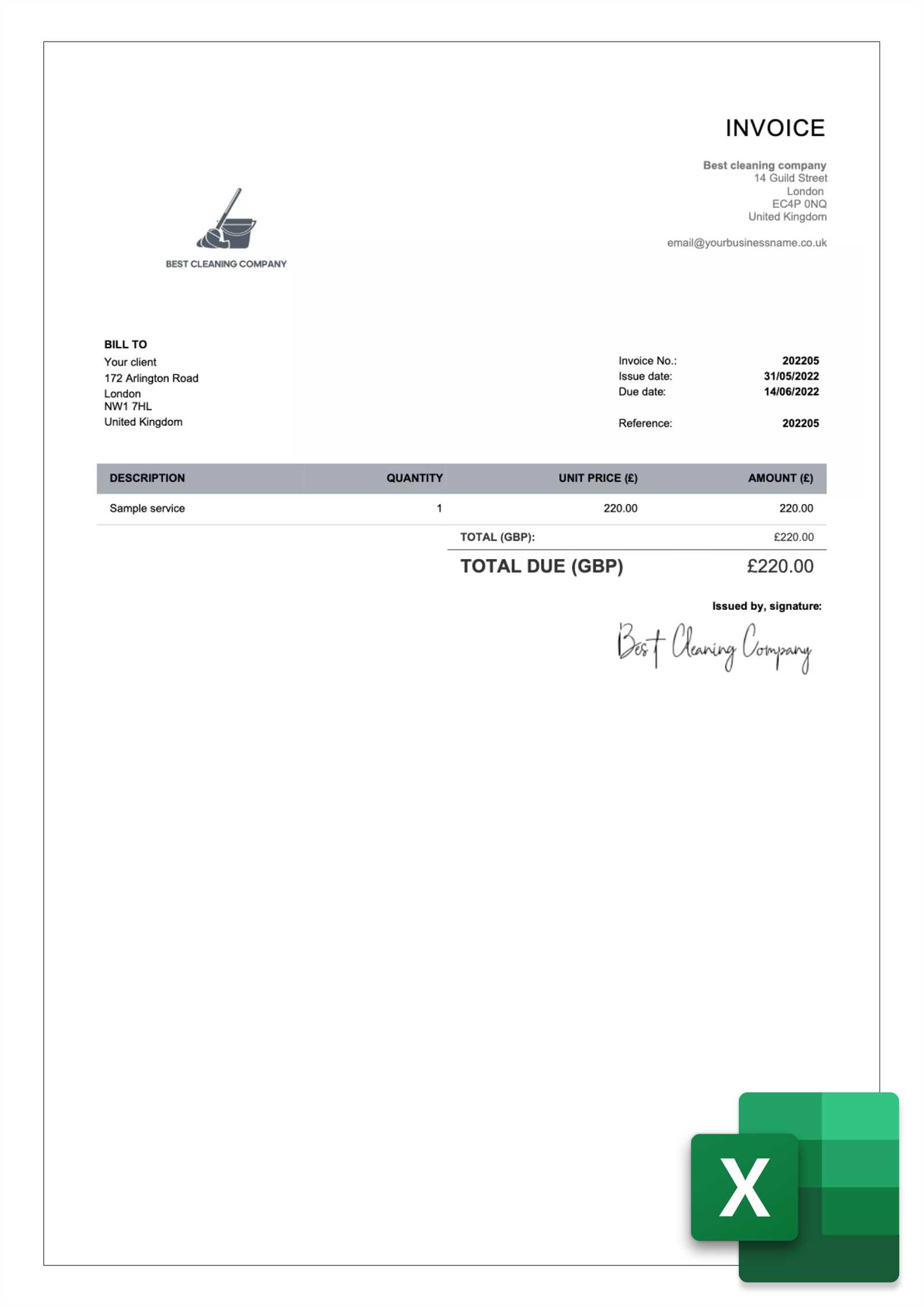

Simple Invoice Template for Small Business

Managing financial transactions efficiently is essential for every small business. One key element in this process is creating clear, structured documents for payments and services provided. A well-organized record helps avoid confusion, ensures transparency, and supports smooth operations between business owners and their clients. Having a standardized document format for billing can simplify this task and save time, especially when consistency is maintained across all transactions.

Key Elements for Effective Billing Statements

To create a well-structured billing record, it’s crucial to include certain details. These include the business’s contact information, a unique reference number for each transaction, a list of the products or services provided, and the corresponding amounts. Moreover, the total due and payment terms should be clearly stated, along with any applicable taxes or discounts. Organizing this information in an easy-to-read format ensures both parties understand the details of the transaction.

Sample Layout for Billing Records

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 2 | $50 | $100 |

| Service B | 1 | $150 | $150 |

| Subtotal | $250 | ||

| Sales Tax (5%) | $12.50 | ||

| Total Amount Due | $262.50 | ||

By incorporating these components into your billing system, you ensure clarity and professionalism in every transaction. Additionally, using a consistent format can make tracking payments and managing business finances much easier in the long run.

How to Personalize Your Invoice Design

Creating a unique look for your billing documents can make a significant impact on how clients perceive your business. Customizing the appearance not only reflects your brand’s identity but also ensures that your records stand out in a professional and memorable way. Personalizing the layout, colors, fonts, and logo can help create a lasting impression and improve client relations.

Key Elements for Customizing Your Documents

When personalizing your billing records, it’s important to focus on a few key elements that will make the design distinct yet functional. These elements include the company logo, contact information, font styles, and the color scheme. Each of these can be adjusted to align with your brand’s overall aesthetic while maintaining the clarity and readability of the document.

Example of a Personalized Layout

| Product or Service | Quantity | Price | Amount |

|---|---|---|---|

| Consultation Fee | 1 | $200 | $200 |

| Web Design Package | 1 | $800 | $800 |

| Subtotal | $1000 | ||

| Discount (10%) | -$100 | ||

| Total Due | $900 | ||

Using a customized design not only strengthens your brand presence but also makes the document easier to navigate for your clients. With well-placed elements such as your business name, logo, and contact details, clients will instantly recognize who the document is from, creating a sense of professionalism and trust. Keep in mind that while personalization is key, maintaining a balance between design and functionality is crucial to ensure clarity and ease of use.

Free Invoice Templates for Freelancers

For freelancers, having an easy-to-use, professional document to request payments is crucial for maintaining a smooth business operation. Whether you provide creative services, consulting, or technical work, an organized record of what was delivered and the payment terms is essential. With the right structure, you can quickly generate statements that both reflect your business’s professionalism and help track your earnings efficiently.

Essential Features for Freelancer Billing Records

When preparing a statement, freelancers should focus on key details that outline the work completed, the amount due, and any payment terms or deadlines. It’s also important to include information such as the client’s name, service descriptions, and the total due. A clean, well-structured format helps avoid misunderstandings and ensures that clients have all the necessary information for payment processing.

Sample Structure for Freelancer Billing

| Description of Service | Hours Worked | Rate | Amount |

|---|---|---|---|

| Graphic Design for Website | 10 | $50 | $500 |

| Content Writing | 5 | $40 | $200 |

| Subtotal | $700 | ||