Simple Invoice HTML Template for Quick and Easy Billing

In the world of business transactions, clear and professional documentation is essential for smooth financial exchanges. Having a well-structured document for requesting payment can streamline processes and leave a positive impression on clients. By designing a document that is easy to understand, businesses can ensure accurate communication of payment expectations and details.

Whether you’re an entrepreneur, freelancer, or part of a larger company, generating billing paperwork can be a time-consuming task. However, with the right approach, it’s possible to create a polished and functional document that meets both practical and aesthetic needs. The key is to focus on clarity, simplicity, and a design that enhances readability without unnecessary complexity.

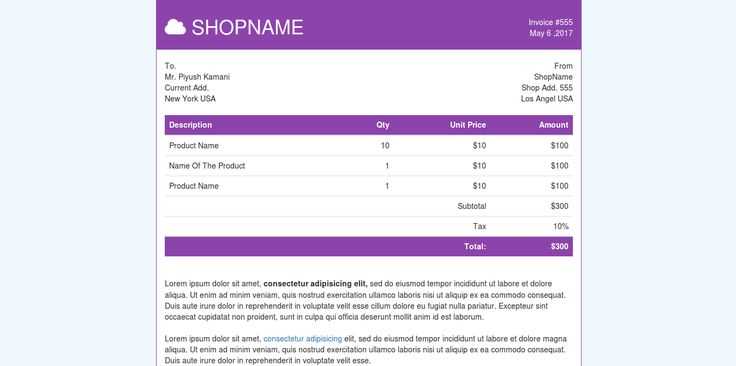

Crafting an effective payment request involves organizing key information in a way that is intuitive and visually appealing. Basic elements such as contact information, payment terms, and itemized charges must be presented in a clean layout. This ensures that both the sender and receiver can quickly reference the necessary details without confusion.

Utilizing digital tools to generate such documents not only saves time but also offers the flexibility to personalize and adjust the design to reflect your brand identity. These documents can be easily shared online, reducing the need for paper-based processes while maintaining professionalism.

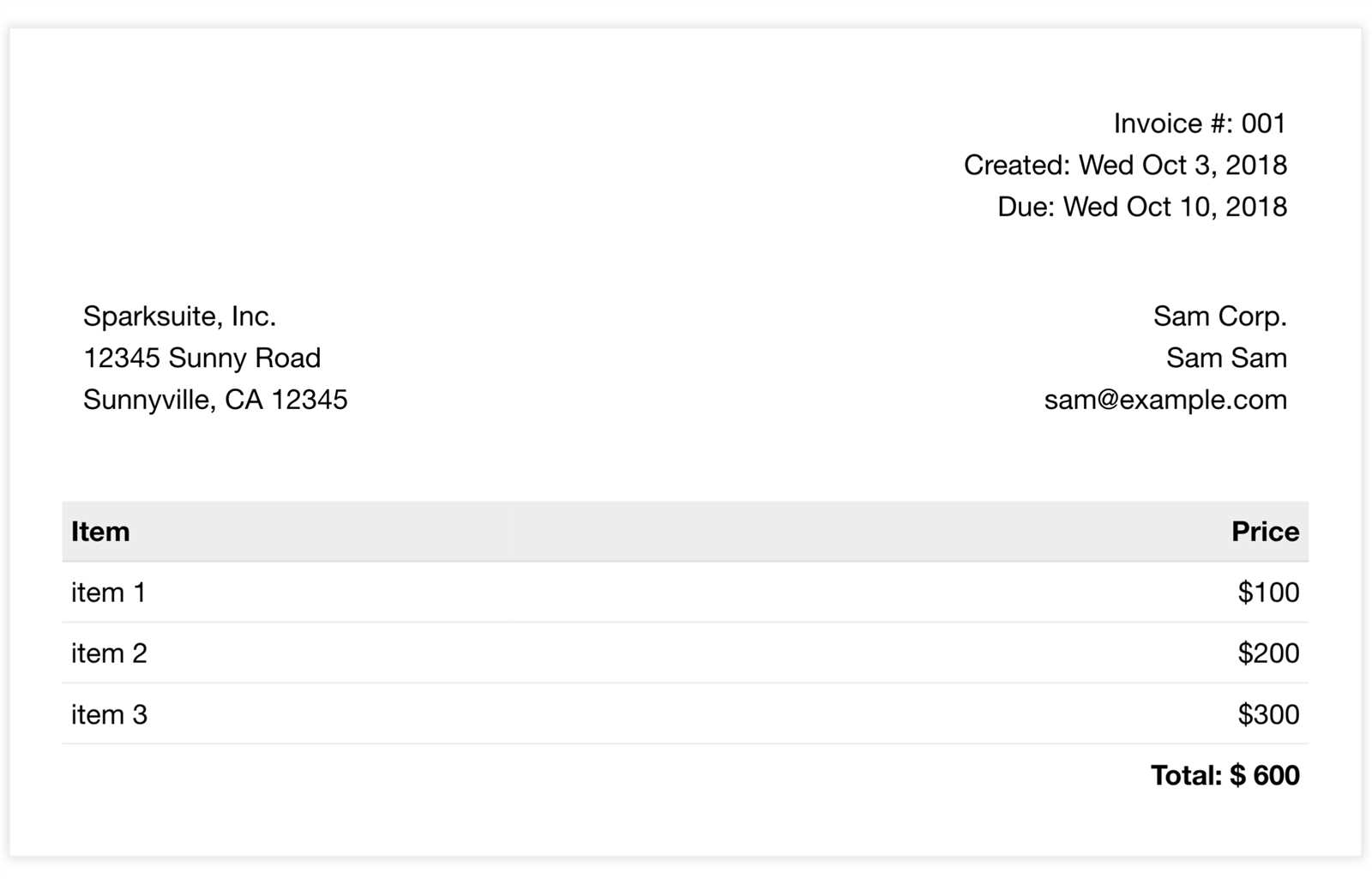

Simple Invoice HTML Template

Creating a well-organized billing document is crucial for maintaining professionalism and ensuring smooth transactions. The key to an effective payment request is clarity and ease of understanding. By structuring the content in a way that highlights important details, businesses can facilitate faster payments and avoid misunderstandings.

To achieve this, it’s essential to focus on a clean layout that prioritizes key information such as the recipient’s details, list of goods or services provided, and total charges. A streamlined design ensures that all relevant elements are easy to find and interpret. With minimal distractions, clients can quickly assess the required action and proceed with the payment process.

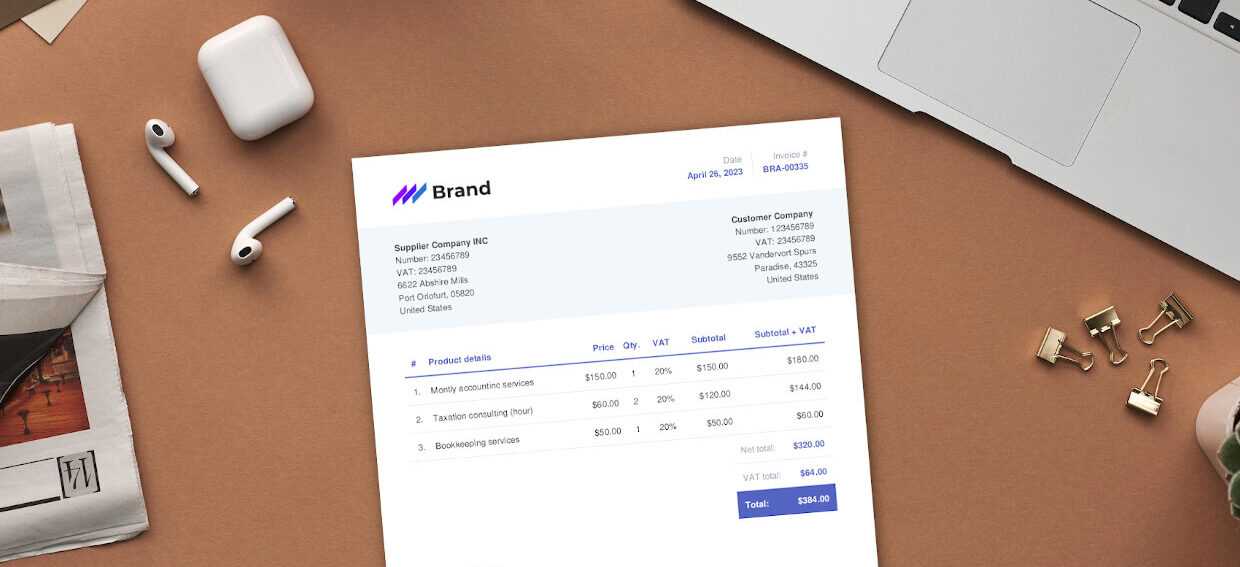

Customization is another important factor. The ability to adjust fonts, colors, and logos allows companies to align the document with their brand identity while still keeping the content professional. This creates a unique touch without compromising on the essential functionality of the document.

Leveraging digital formats also offers the advantage of flexibility. The document can be sent electronically, making it convenient and eco-friendly. Additionally, this method supports easy storage and quick reference for future needs, ensuring that all records are organized and accessible at any time.

Why Choose an HTML Invoice Template

Opting for a structured digital document for billing purposes offers significant advantages over traditional methods. A well-designed format allows for flexibility in customization, making it easier to adjust the layout, fonts, and other visual elements according to specific business needs. With this approach, businesses can ensure that their documents are not only functional but also align with their brand identity.

Another major benefit is the efficiency in creating and sending such documents. Unlike manual invoicing, a digital version can be quickly generated, saving time and reducing the potential for human error. This makes it easier to stay on top of financial operations, especially for freelancers or small businesses that handle multiple transactions on a regular basis.

Additionally, using an online-based system ensures that all documents are stored in a secure, easily accessible format. This eliminates the need for paper records, reducing clutter and enhancing organization. As a result, managing payment histories and tracking outstanding balances becomes a much simpler task.

Benefits of Using HTML for Invoices

Adopting a digital format for generating payment requests brings several advantages that can significantly improve workflow and professionalism. With an organized structure, it becomes easier to customize and adapt documents to specific needs while maintaining a clean, user-friendly appearance. This approach eliminates the limitations of traditional paper-based systems and offers greater flexibility for businesses.

One of the main benefits of using a digital structure is the ease of customization. Adjusting the layout, fonts, and adding elements such as logos or branding is quick and simple, allowing companies to create a document that reflects their unique identity. In addition, the document’s design can be optimized for both readability and aesthetic appeal, making it easier for clients to understand important details at a glance.

Another advantage is efficiency. Digital documents can be generated and sent in a matter of minutes, reducing the time spent on administrative tasks. With built-in fields for essential details, the risk of human error is minimized, ensuring that important information like payment terms, amounts, and dates are accurate every time.

The ability to store these documents electronically provides added convenience. Records are easy to access, share, and track without the need for physical storage, helping businesses maintain organized financial records. Below is an example of a simple structure for presenting charges:

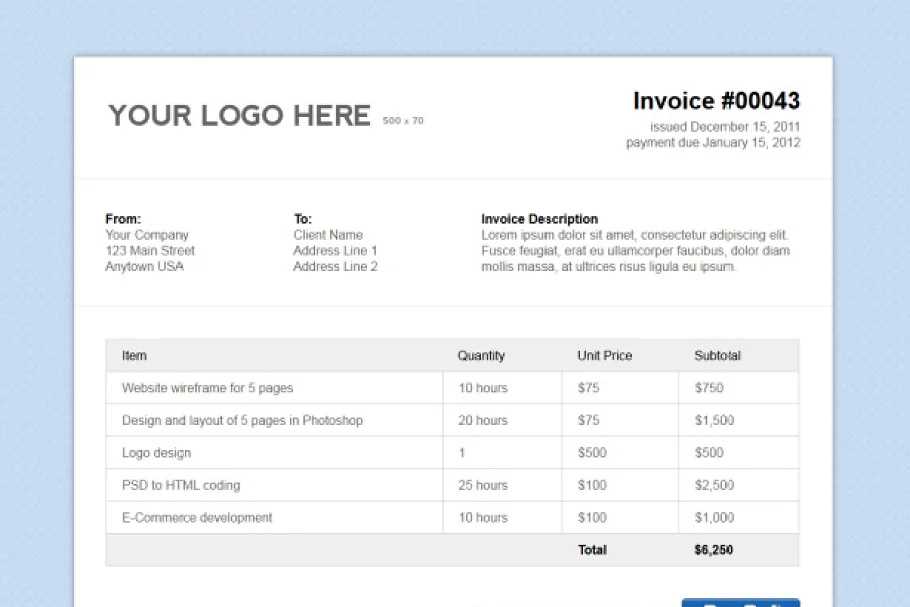

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Web Design | 1 | $500 | $500 |

| Hosting Fee | 1 | $50 | $50 |

| Total | $550 |

By implementing such systems, businesses can streamline their operations and focus more on their core activities, while ensuring all financial transactions are clear and professionally presented.

How to Customize an Invoice Template

Tailoring a billing document to meet your specific needs is crucial for creating a professional and personalized experience for your clients. Customization allows you to adjust various elements of the document to reflect your brand, ensure clarity, and maintain consistency across all communications. The process involves editing the layout, adding your company details, and adjusting the design to match your business style.

Adjusting the Layout and Design

The layout is one of the first things you should modify. A clean, well-organized design helps ensure that your client can easily find all the necessary information. You can change the overall structure by adjusting the position of key sections, such as the company name, client details, and the list of services provided. Additionally, adding your company logo and brand colors can help give the document a professional and cohesive look.

Editing Key Sections and Information

After adjusting the layout, the next step is to modify the content itself. This includes entering accurate details such as your business name, contact information, payment terms, and the breakdown of charges. The more clear and concise the details, the easier it will be for your client to process the payment. Below is an example of how you might structure the breakdown of charges:

| Item Description | Quantity | Unit Price | Amount |

|---|---|---|---|

| Consultation Services | 3 hours | $75 | $225 |

| Web Development | 1 | $600 | $600 |

| Total | $825 |

After updating the key sections, you can also experiment with fonts, line spacing, and overall color schemes. Ensuring the final product is visually appealing and legible is as important as the information it contains.

Essential Features of a Good Invoice

A well-crafted billing document ensures clear communication, fosters trust, and helps prevent delays in payments. The right structure makes it easy for recipients to understand the payment details and reduces any ambiguity. Below are key elements that every effective billing document should include for optimal clarity and functionality.

- Company Information: Display the sender’s company name, address, and contact details prominently. This helps establish legitimacy and allows the recipient to reach out if needed.

- Client Details: Include the recipient’s name, address, and contact information. This customization strengthens the business relationship and ensures accurate record-keeping.

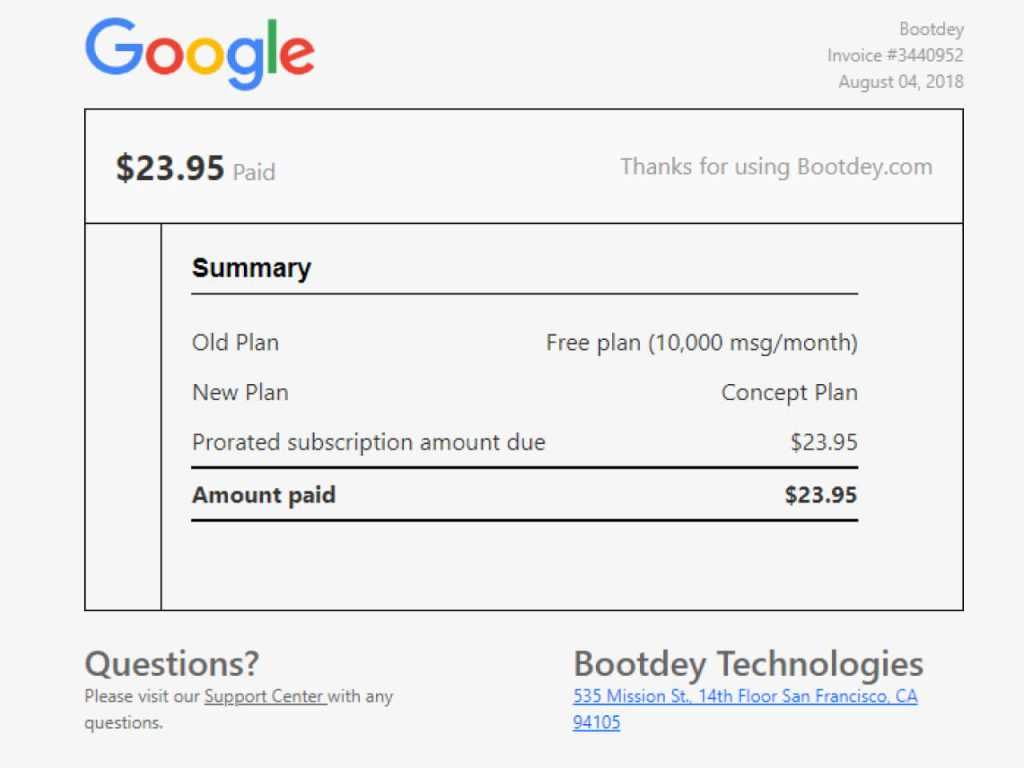

- Unique Identifier: Assign a unique number or code to each document. This makes it easier to track payments and reference specific transactions if questions arise.

- Issue Date and Due Date: Clearly mark the date the document is issued and the payment deadline. This creates a clear timeline and helps

Step-by-Step Guide to Creating Invoices

A structured billing document helps clarify the terms of transactions and ensures timely payment. The following steps outline a straightforward approach to crafting a clear and professional billing record that meets standard business requirements.

-

Start with Your Business Details: At the top of the document, add your company’s name, logo, and essential contact information. This establishes professionalism and helps the client identify the sender.

-

Include Client Information: List the recipient’s name, address, and contact details. Personalizing each record fosters a strong professional relationship and minimizes administrative errors.

-

Step-by-Step Guide to Creating Invoices

A structured billing document helps clarify the terms of transactions and ensures timely payment. The following steps outline a straightforward approach to crafting a clear and professional billing record that meets standard business requirements.

-

Start with Your Business Details: At the top of the document, add your company’s name, logo, and essential contact information. This establishes professionalism and helps the client identify the sender.

-

Include Client Information: List the recipient’s name, address, and contact details. Personalizing each record fosters a strong professional relationship and minimizes administrative errors.

-

Assign a Unique Document Number: Use a unique identifier, such as a number or alphanumeric code, for tracking purposes. A clear numbering system helps streamline record-keeping and simplifies future reference.

-

Add Dates: Specify both the issue date and the expected payment date. These dates set clear expectations for when the payment process begins and ends.

-

List Provided Goods or Services: Use an itemized format to detail each product or service, including descriptions, quantities, and individual rates. This transparency makes the document easy to understand and reduces potential disputes.

-

Calculate the Total Amount: Clearly indicate the final amount due, including any applicable taxes or discounts. Highlighting the total due reduces the risk of misunderstandings.

-

Specify Payment Options: Include accepted methods of payment, along with any necessary account details or links. Offering multiple payment options can expedite the transaction process.

-

Add Terms and Conditions: Mention any additional policies or conditions, such as late fees or refund policies. Clear terms support a smooth and professional exchange.

-

Provide Contact Information for Queries: Include a phone number or email for any follow-up questions. Easy access to support encourages prompt communication and resolution if issues arise.

How to Include Payment Terms and Details

Clear and concise payment conditions are essential for a smooth transaction process. Defining these terms upfront helps both parties understand expectations, deadlines, and payment methods, reducing the likelihood of misunderstandings and delays. Here are the key components to include in the payment section.

Specify the Due Date: Clearly indicate when the payment is expected. Stating the deadline prominently establishes a clear timeframe, ensuring both parties are aware of the timeline.

How to Include Payment Terms and Details

Clear and concise payment conditions are essential for a smooth transaction process. Defining these terms upfront helps both parties understand expectations, deadlines, and payment methods, reducing the likelihood of misunderstandings and delays. Here are the key components to include in the payment section.

Specify the Due Date: Clearly indicate when the payment is expected. Stating the deadline prominently establishes a clear timeframe, ensuring both parties are aware of the timeline.

Outline Accepted Payment Methods: List the available options, such as bank transfers, credit cards, or online payment platforms. Adding instructions for each method ensures the client has all necessary information to complete the transaction quickly.

Define Late Fees or Penalties: Mention any penalties for overdue payments. Clearly stating these terms helps motivate prompt payment and sets expectations for consequences in case of delays.

Include Early Payment Discounts (if applicable): Offering a discount for early settlement can be an effective incentive. If applicable, specify the discount rate and conditions to encourage faster payments.

Provide Contact Information for Payment Queries: Add a phone number or email for any questions related to payments. This makes it easy for the recipient to resolve issues quickly, reducing the chance of delays.

These elements help create a transparent, structured document that facilitates timely and efficient transactions.

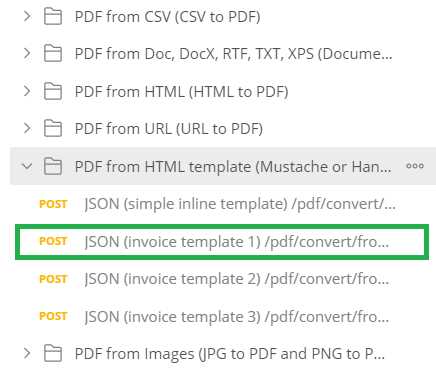

Integrating Your Invoice with Other Tools

Connecting billing documents with other business applications can enhance efficiency, improve accuracy, and streamline financial workflows. Integration allows for seamless data flow between different platforms, helping reduce manual entry and keeping records synchronized across systems. Below are key integration options to consider for an effective setup.

Accounting Software: Syncing with accounting platforms enables automatic data transfer, helping maintain accurate financial records. This connection simplifies expense tracking, tax preparation, and overall financial reporting.

Customer Relationship Management (CRM): Integrating with a CRM system helps keep client data up to date and accessible. This allows your team to view billing history within the client profile, streamlining communication and improving service.

Payment Gateways: Linking directly to online payment services allows clients to settle transactions quickly and securely. Integration with gateways can automate payment status updates, reducing administrative tasks and improving cash flow.

Common Mistakes to Avoid in Invoices

Ensuring accuracy and clarity in billing documents is essential for smooth financial transactions and maintaining professional relationships. However, some frequent errors can lead to misunderstandings, delayed payments, or even loss of trust. Below are key mistakes to avoid to create clear and effective documents.

- Missing Key Information: Omitting essential details like dates, contact information, or descriptions of services can confuse recipients and delay payments. Always double-check that each document includes all necessary elements.

- Inconsistent Numbering: Using a random or inconsistent numbering system makes it difficult to track records. Adopt a sequential format for clear and reliable tracking.

- Using HTML and CSS for Better Styling

Effective styling enhances the readability and professionalism of billing documents, making them easier for clients to review and understand. By leveraging structured elements and CSS, you can create an organized, visually appealing layout that highlights key information and improves overall usability.

Structuring Content with Tables

Tables are ideal for organizing line items, descriptions, and costs in a clear format. They ensure that each detail is aligned, making it easy for recipients to identify individual items and their associated costs.

Description Quantity Unit Price Total Service A How to Test Your HTML Template

Thorough testing is essential to ensure that your billing document displays correctly across devices, is fully functional, and provides a smooth user experience. By carefully reviewing key aspects of the design and usability, you can identify and resolve potential issues before using the document in a real-world scenario.

Check Cross-Browser Compatibility

Different web browsers may interpret design elements slightly differently, which can affect the appearance of your document. Test your layout on popular browsers such as Chrome, Firefox, Safari, and Edge to verify consistent presentation. Adjust any layout issues with CSS to ensure uniformity across platforms.

Test on Multiple Devices

Since clients may view your document on a variety of devices, it’s important to verify that it displays properly on both desktop and mobile screens. Use responsive design techniques to

Making Your Template PDF-Friendly

Creating a document that converts well to PDF format ensures that recipients can easily download, print, and store a copy for their records. PDF-friendly design requires attention to layout, fonts, and styles to maintain readability and formatting when exported. Below are key considerations for optimizing your document for PDF compatibility.

Use Print-Friendly Fonts and Layout

Select standard, legible fonts like Arial, Times New Roman, or Helvetica to ensure consistency across devices and in the PDF format. Avoid overly complex fonts or colors that may not display accurately in a PDF. Additionally, structure content in a clear and logical layout to preserve readability, as complex layouts may shift when converted.

Define Page Margins and Dimensions

When designing for PDF, set specific page dimensions and margins that align with standard print sizes, such as A4 or Letter. Using CSS, you can apply @media print rules to control the printed appearance, ensuring that elements fit well within the page without clipping or excessive white space.

Avoid Interactive Elements: Since PDF

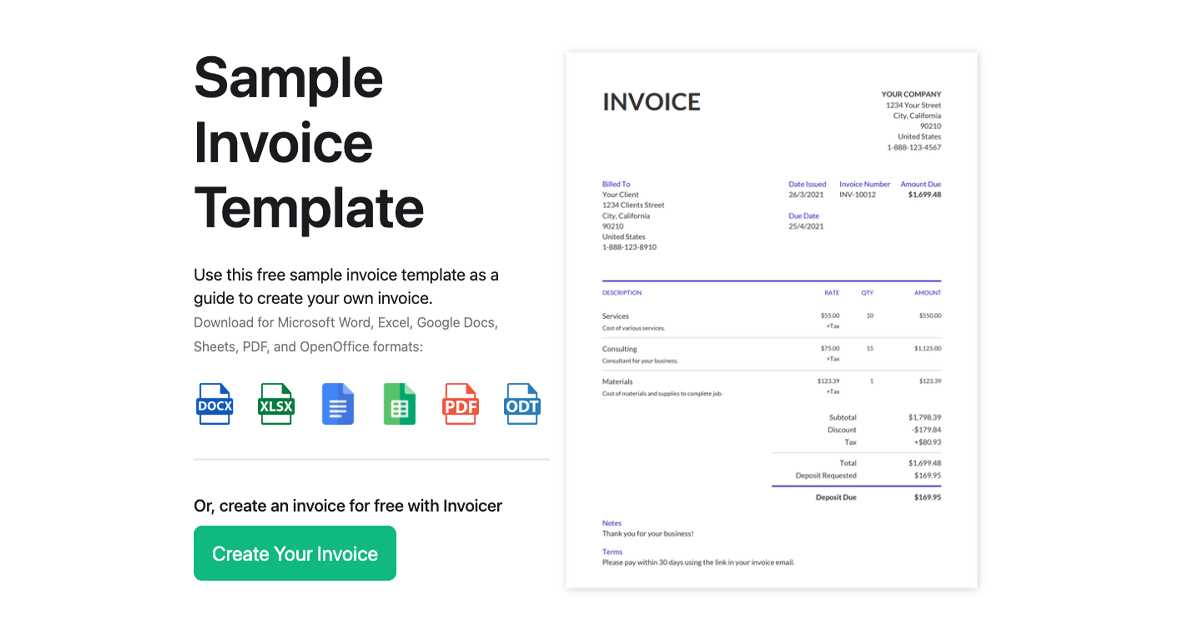

Free Resources for HTML Invoice Templates

Using ready-made resources can save time and provide inspiration when building professional billing documents. Many platforms offer free, customizable files that can be easily tailored to suit various business needs. Here is a list of popular resources where you can find quality designs at no cost.

- GitHub Repositories: GitHub hosts numerous open-source projects with a wide range of customizable designs. Searching for “billing document designs” or similar keywords can yield templates created and shared by developers worldwide.

- BootstrapMade: This platform offers free, responsive layouts designed with the Bootstrap framework. They are ideal for those who want a modern, adaptable look that’s easy to customize with CSS.

- CodePen: A popular resource for developers, CodePen contains user-contributed designs that can be directly copied and modified. Search for billing-related tags to find minimalist, creative layouts ready for use.

- Free CSS: Free CSS provides a

Security Considerations for Sending Invoices

When sharing billing documents electronically, safeguarding sensitive information is essential to prevent unauthorized access, data breaches, and potential financial fraud. Implementing secure practices helps protect both you and your clients. Below are key strategies to enhance security when distributing financial documents.

Use Secure Delivery Channels

- Email Encryption: Always use encryption when sending documents via email. Encrypting messages helps protect sensitive information from unauthorized access during transmission.

- Secure File-Sharing Platforms: Consider using file-sharing services with encryption and access controls. Platforms like Dropbox or Google Drive allow you to set permissions and create password-protected links.

- Direct Downloads from Secure Websites: If possible, allow clients to download documents directly from your secure website. Implement HTTPS and ensure the download process is safe and reliable.

Protect Sensitive Information

- Redact Unnecessary Details: Avoid including sensitive information that isn’t required, such

How to Track and Manage Your Invoices

Efficient tracking and management of financial documents is crucial for maintaining organized records, ensuring timely payments, and avoiding errors. By using systematic approaches and tools, you can keep a clear overview of your financial transactions and avoid the stress of missing payments or overlooking critical details.

Organizing Your Records

Create a Centralized System: Store all billing documents in one secure, easily accessible location. Use cloud storage or dedicated software to keep everything organized. Categorizing by client, date, or status will make finding specific documents faster and easier.

Label and Number Documents: Consistently label each record with a unique reference number or code to prevent confusion. This makes it easier to locate specific documents and track their status. Establish a clear numbering system and keep it consistent for all future records.

Monitoring Payment Status

- Set Payment Reminders: Use calendar reminders or automated alerts to notify you of upcoming due dates. This will help you stay on top of pending payments and avoid late fees.

- Track Outstanding Payments: Maintain a list of unpaid transactions and their due dates. Regularly update this list to monitor the status and ensure no payment is forgotten.

- Follow Up on Late Payments: If payments are overdue, send polite reminders to clients, or implement late fee policies as a deterrent.

Use Accounting Software: Consider using accounting or billing software that can automatically track payment statuses, generate reports, and send reminders. These tools simplify the management process, reducing manual work and potential errors.

By applying these strategies, you can streamline the tracking and management of your financial records, ensuring timely payments and maintaining efficient operations.

Best Practices for Invoice Maintenance

Proper maintenance of financial documents ensures accuracy, timeliness, and compliance. By implementing systematic methods and organizing strategies, you can avoid mistakes, prevent delays, and maintain clear records for future reference. Below are some best practices that help streamline the ongoing management of billing records.

1. Consistent Record Keeping: Always maintain organized, up-to-date records of all transactions. This includes storing copies of issued documents, payment receipts, and any relevant communications. Use digital tools or dedicated software to categorize and search for documents quickly.

2. Regular Reconciliation: Frequently reconcile your financial records with your bank statements or payment platforms to ensure that all transactions have been accounted for. This helps identify any discrepancies and resolve issues before they become larger problems.

3. Backup Your Data: Regularly back up your financial records to prevent data loss. Whether using cloud storage or local backups, having copies ensures that important information remains safe and accessible in case of system failures or security breaches.

4. Keep Track of Payment Terms: Stay consistent with payment terms and ensure they are clear to clients. Implement a system for tracking when payments are due, and be sure to follow up promptly on overdue payments to maintain cash flow.

5. Legal Compliance: Ensure that your documents comply with local regulations regarding taxes, record retention, and other financial obligations. Periodically review your practices to stay updated with any changes in the law that could affect your processes.

By following these best practices, you can ensure smooth, organized, and professional management of your financial records, leading to better financial stability and less administrative overhead.

-

-