Simple Freelance Invoice Template for Efficient Billing

When working independently, ensuring smooth financial transactions is crucial for maintaining professional relationships and a steady cash flow. A well-structured billing document not only outlines payment details clearly but also reflects professionalism. It serves as a formal request for compensation, highlighting the agreed-upon terms between you and your clients.

Having a reliable format for these financial documents can significantly reduce administrative stress. Whether you’re providing a service or completing a project, a clear and concise document can speed up payment processes and help avoid misunderstandings. This guide will explore how to create and personalize such documents to match your unique business needs.

With the right structure, you can maintain a consistent and efficient method of handling payments, ensuring that your work is compensated promptly and without confusion. The goal is to keep it straightforward, with just the necessary details, so both you and your client have a clear understanding of the financial arrangement.

Why Freelancers Need Invoice Templates

For independent workers, managing payment requests efficiently is essential to ensure timely compensation and maintain professionalism. Without a clear and organized approach to documenting charges, delays and misunderstandings can arise. A well-designed document that outlines the terms of payment can help eliminate confusion and streamline the entire process.

Using a standardized format saves time and effort when billing clients. With a pre-structured layout, you won’t have to start from scratch every time you need to request payment. This consistency not only makes the process faster but also ensures that all necessary details are included, reducing the chance of errors or omissions.

Here are a few key reasons why independent workers should adopt a consistent approach to payment documentation:

| Benefit | Description |

|---|---|

| Professional Appearance | Clients are more likely to pay promptly when they receive a formal and clear payment request that looks professional. |

| Time-Saving | A pre-designed document allows you to quickly fill in the required details without having to create one from scratch each time. |

| Consistency | Using a structured approach ensures that you don’t miss any important details, such as payment terms or client information. |

| Legal Protection | A formal request acts as a legal record of the transaction, providing clarity in case of disputes. |

| Efficient Payment Tracking | Having a uniform document makes it easier to track outstanding payments and keep accurate records. |

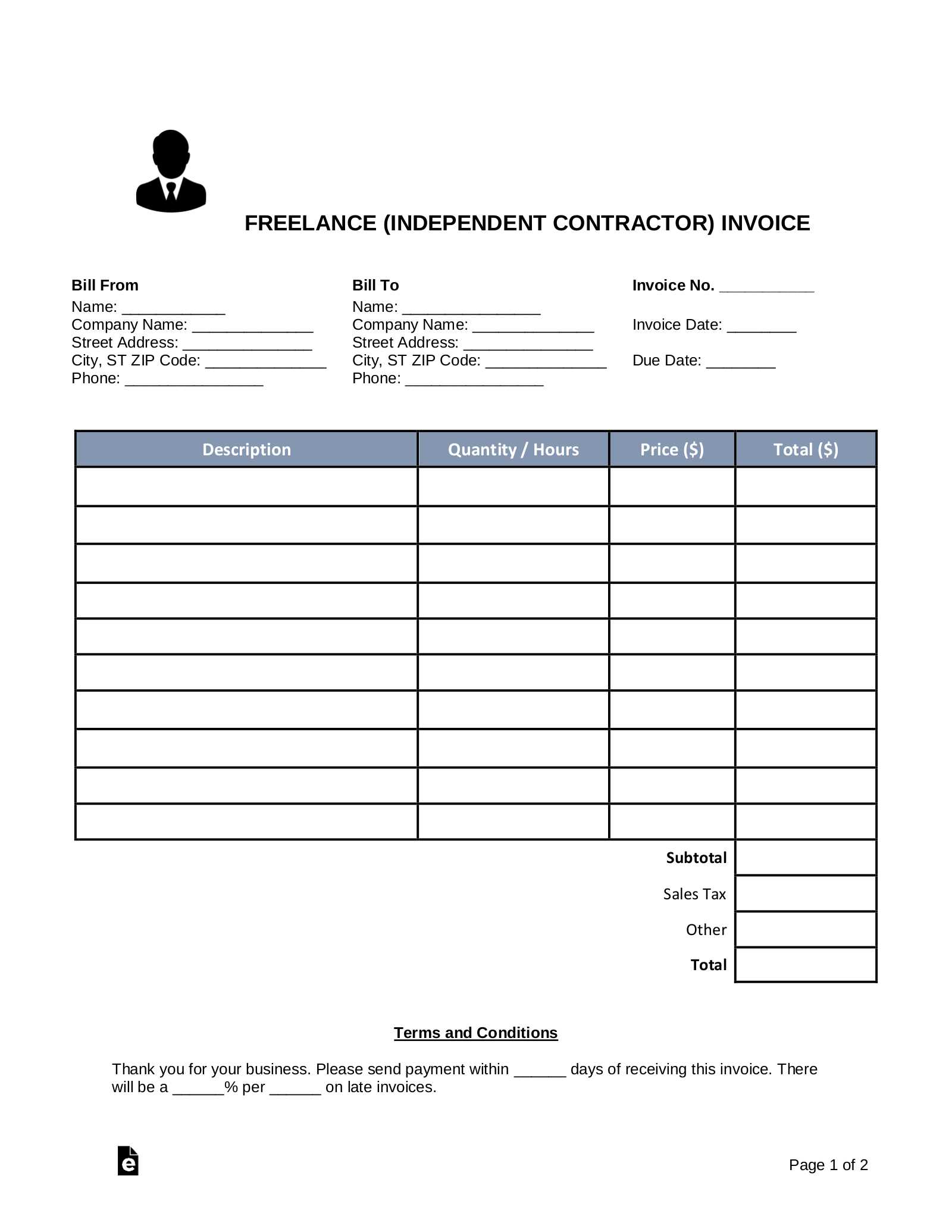

Creating a Professional Invoice for Clients

When requesting payment for completed work, it’s essential to present your billing document in a manner that reflects your professionalism and attention to detail. A clear and well-organized statement not only helps ensure timely payment but also establishes trust with your clients. By including all necessary information in a structured format, you convey a sense of reliability and competence.

A well-crafted payment request includes several key elements that make it both informative and professional. These details provide clarity on the scope of work completed, the terms of payment, and any additional costs that may apply. Below are the essential components to include in any formal request for payment:

| Element | Description |

|---|---|

| Contact Information | Include your name, business name (if applicable), address, phone number, and email address, along with the client’s contact details. |

| Unique Reference Number | A unique number helps both you and your client easily track the document for future reference. |

| Detailed Description of Services | Clearly outline the work completed, the duration, and any specific milestones or deliverables achieved. |

| Amount Due | Break down the charges, including any hourly rates, fixed fees, or additional expenses incurred during the project. |

| Payment Terms | Specify the due date, accepted payment methods, and any late payment fees or early payment discounts. |

| Taxes | Clearly list any applicable taxes, such as VAT, that should be added to the total amount due. |

Including these key elements in your billing document not only ensures transparency but also makes the payment process smoother for both you and your client. The clearer and more professional the document, the more likely it is that you will maintain a strong working relationship and prompt payments moving forward.

Essential Information for Payment Requests

To ensure that both you and your client are clear on the terms of payment, it’s important to include specific details in your billing document. A complete and well-structured request helps avoid misunderstandings and ensures that all parties are aligned on expectations. Key pieces of information provide clarity on the services rendered, the amount due, and how payment should be made.

When crafting a payment document, make sure to include these critical components that will help facilitate prompt and accurate payments:

| Information | Description |

|---|---|

| Your Details | Provide your full name, business name (if applicable), address, phone number, and email so the client can contact you easily. |

| Client Information | List your client’s contact details, including their name, company (if applicable), address, and email for accurate communication. |

| Document Number | Assign a unique number to each billing document for better tracking and reference. |

| Services Provided | Clearly describe the work completed, including the dates and any agreed-upon milestones or deliverables. |

| Amount Due | Specify the total amount owed, breaking down the charges, including hourly rates, fixed fees, or additional costs. |

| Payment Terms | Outline the due date for payment, accepted payment methods, and any late payment penalties or early payment discounts. |

| Tax Information | Clearly state any taxes or VAT that apply to the total amount due. |

By ensuring that all these essential elements are present in your payment request, you can help establish trust with your client while minimizing the risk of payment delays or disputes. A well-organized document reflects professionalism and encourages timely payments.

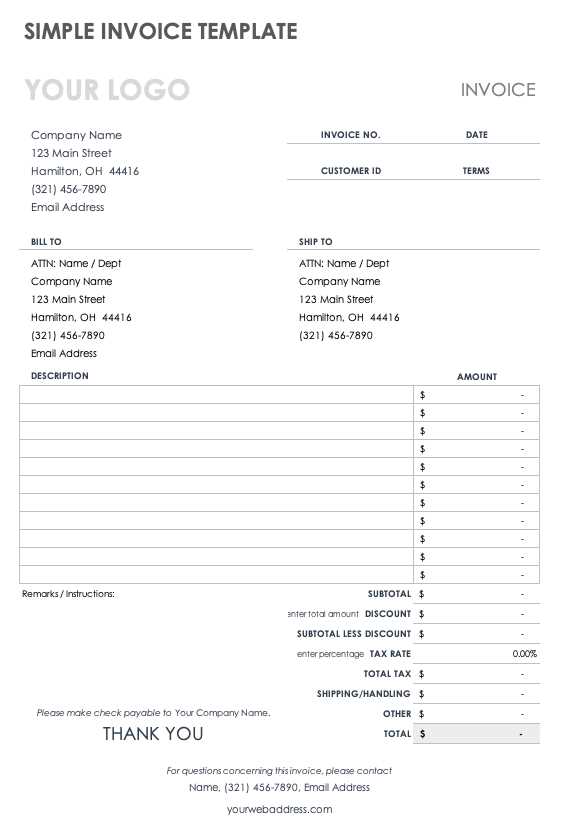

How to Customize Your Payment Document

When creating a payment request, it’s important to tailor the format to reflect your unique business needs and the nature of your work. Customizing your billing format allows you to add personal touches, align with branding, and ensure that all necessary details are included. A well-customized document helps you maintain professionalism while also making it easier for clients to understand the charges and payment terms.

There are several key areas to focus on when personalizing your payment document to suit your specific requirements. Consider the following elements to make your billing process more effective:

| Customizable Element | How to Personalize |

|---|---|

| Business Logo | Include your company logo or brand image at the top of the document to enhance brand recognition and establish a professional appearance. |

| Color Scheme | Match the document’s color scheme to your brand colors to create a cohesive and visually appealing design. |

| Payment Details | Adjust payment terms such as the due date, payment methods, and late fees according to your business policies and client agreements. |

| Itemized List of Services | Break down your charges by each service provided, indicating the quantity, rate, and total for better clarity and transparency. |

| Additional Notes | Include personalized notes, such as a thank-you message, reminders about upcoming projects, or any special instructions for the client. |

| Payment Methods | Highlight the specific payment methods you accept (bank transfer, PayPal, credit cards, etc.) to make it easier for your client to pay. |

By adjusting these key elements, you can ensure that your payment documents are both professional and functional, offering a smooth experience for you and your clients. Customization not only reflects your business’s identity but also helps clients feel confident in the clarity and professionalism of your billing process.

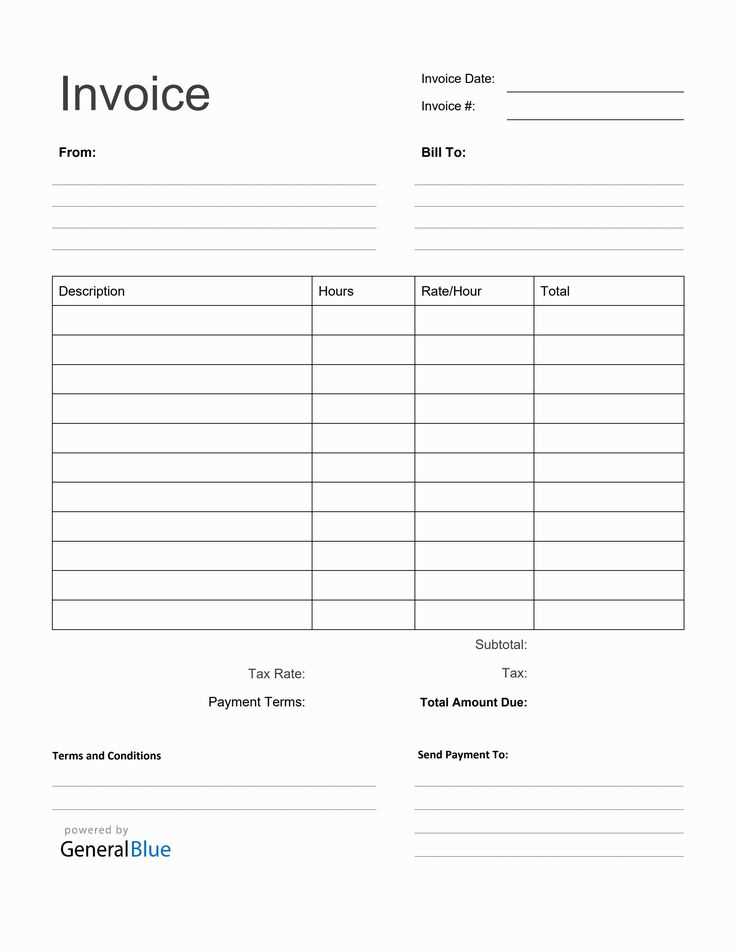

Choosing the Right Payment Request Format

Selecting the appropriate structure for your billing document is crucial for clarity and ease of use. The right format ensures that all necessary details are presented in an organized way, making it easy for your client to understand the charges and terms. It also helps avoid any potential confusion, ensuring prompt payment. The format you choose can depend on your business style, the complexity of the work, and the preferences of your clients.

Different Formats to Consider

There are various formats available to choose from, each suited for different needs. The most common options include:

- Basic Layout: A clean, simple design that highlights the most important information–ideal for small projects or recurring work with straightforward terms.

- Detailed Breakdown: A more comprehensive structure that includes itemized services, taxes, and additional fees–better suited for larger projects or clients requiring extensive details.

Considerations When Choosing a Format

Before deciding on a format, consider the following:

- Client Expectations: If your clients expect detailed billing, opt for a more thorough format. For others, a simpler approach might suffice.

- Work Complexity: Larger or more technical projects may benefit from a format that clearly outlines each phase of the work completed, along with corresponding charges.

- Legal and Tax Requirements: Depending on your location, you may need to include certain legal or tax-related details in your documents, such as tax IDs or VAT numbers.

By considering your specific needs and the preferences of your clients, you can select the right format that ensures clarity and efficiency in your payment requests.

Top Software for Managing Payment Requests

Using the right software to manage your payment documents can save you time and reduce errors. The best tools not only help you create and send professional payment requests but also offer features like tracking, reminders, and integration with accounting systems. Choosing the right software is crucial for simplifying your billing process and keeping your financials organized.

Popular Tools to Consider

There are a variety of software options available, each offering unique features suited to different business needs. Here are some top choices:

- QuickBooks: A well-known accounting software that includes robust features for managing payments, taxes, and client records, making it ideal for those looking for an all-in-one solution.

- FreshBooks: Known for its user-friendly interface, FreshBooks is great for small business owners who need to quickly create payment requests and track time and expenses.

- Wave: A free tool offering essential invoicing and accounting features. It’s perfect for entrepreneurs who want basic functionality without a hefty price tag.

- Zoho Invoice: This platform allows for a high degree of customization and integration with other Zoho tools, making it ideal for businesses that need flexibility.

Key Features to Look For

When choosing a tool, look for features that make your billing process easier and more efficient:

- Automated Reminders: A feature that sends payment reminders to clients, helping ensure timely payments without additional effort.

- Customizable Templates: Pre-built formats that can be tailored to your brand, saving you time while maintaining a professional look.

- Multi-Currency Support: Useful if you work with international clients and need to issue invoices in different currencies.

- Tax Calculation: Automatic tax calculations can save time and help you stay compliant with local tax laws.

By selecting the right software, you can automate much of the billing process, reduce administrative tasks, and keep your financial records organized and up to date.

How to Organize Your Payment Requests

Staying organized with your billing documents is key to ensuring that payments are processed smoothly and on time. Proper organization allows you to quickly access past requests, track overdue payments, and maintain a clear financial record. With the right approach, you can simplify the process and avoid unnecessary stress when it comes time to send or follow up on requests for payment.

Creating a Filing System

One of the most important steps in organizing your payment documents is setting up a clear and accessible filing system. Whether you prefer digital or physical storage, consistency is key. Here are some methods to consider:

- Digital Folders: Create separate folders for each client or project, and save all related payment requests in these folders. You can use cloud storage for easy access from any device.

- File Naming Conventions: Develop a standardized naming system (e.g., “ClientName_Date_InvoiceNumber”) to quickly identify and sort documents.

- Paper Files: If you prefer hard copies, use labeled folders or binders to separate requests by client or date.

Tracking Payment Status

To avoid missed payments, it’s important to track the status of each payment request. Here are a few ways to stay on top of payments:

- Spreadsheets: Use a simple spreadsheet to track the status of each document–whether it’s “Paid,” “Pending,” or “Overdue.” Include columns for due dates and any notes on follow-ups.

- Accounting Software: If you use accounting software, most tools will automatically track payment statuses and send reminders for overdue requests.

- Manual Logs: For a more traditional approach, keep a paper log or calendar where you note the due dates and payment status of each request.

By keeping your billing documents well-organized and tracking payment progress, you can ensure that your finances remain in order and that you’re able to follow up quickly if necessary.

Common Mistakes to Avoid in Payment Requests

While creating billing documents may seem straightforward, it’s easy to overlook important details that can cause delays or confusion. Avoiding common mistakes can help you maintain a professional reputation and ensure timely payments. By paying attention to the finer points, you can avoid issues like miscommunication, errors in amounts, or even legal complications.

Key Errors to Watch Out For

Here are some of the most common mistakes that can lead to delays or misunderstandings:

- Incorrect or Missing Contact Information: Always ensure that both your details and your client’s are accurately listed. Double-check email addresses, phone numbers, and payment details to prevent miscommunications.

- Failure to Include a Unique Reference Number: Omitting a reference number can lead to confusion, especially if clients have multiple ongoing projects with you. A unique number helps both parties track and reference the document more easily.

- Vague Descriptions of Work: Be specific when outlining the work completed. Ambiguity can cause confusion and may lead to disputes about what was delivered.

- Forgetting to List Payment Terms: Not specifying the due date or payment method can delay the process. Clearly outline when and how you expect to be paid, including any applicable late fees or discounts for early payment.

- Errors in Amounts or Calculations: Simple math errors can lead to mistrust and delayed payments. Always double-check your figures, including taxes and any added fees, to ensure accuracy.

- Ignoring Tax and Legal Requirements: If you’re required to include taxes or other legal information, such as your tax ID number, make sure it is correctly listed. Failing to do so can lead to problems with compliance or your client’s accounting department.

How to Prevent These Mistakes

Here are some tips to help you avoid these common pitfalls:

- Review All Information: Always double-check the details, especially before sending a document to your client.

- Use a Standardized Format: A consistent layout can help ensure you don’t miss any key details, making it easier to avoid mistakes.

- Automate When Possible: Consider using software that automates calculations, reminders, and document tracking. This minimizes the chances of human error.

- Seek Feedback: If you’re unsure about the content or format, ask a colleague or professional for feedback before sending the request.

By av

Setting Payment Terms on Payment Requests

Clearly defined payment terms are essential for ensuring timely and accurate payments. When you outline the expectations regarding payment schedules, methods, and any additional conditions, both you and your client have a clear understanding of when and how the transaction will take place. By setting clear terms upfront, you minimize the chances of confusion and ensure that your business operates smoothly.

Key Elements to Include in Payment Terms

Here are some crucial details to consider when setting payment terms:

- Due Date: Specify the exact date when the payment is expected. This helps avoid confusion and ensures both parties are aligned on timing.

- Accepted Payment Methods: List the payment options available, such as bank transfer, credit card, PayPal, or other methods. Make it clear which options you accept to avoid any delays.

- Late Fees: Include any penalties for late payments. Clearly define how much the fee will be and when it will be applied. For example, you may charge a specific percentage per day or a fixed amount after a certain number of days.

- Early Payment Discounts: If you offer discounts for early payments, make sure to specify the amount or percentage off if payment is made before a certain date.

- Payment Instalments: If you agree to receive payment in multiple stages, outline the dates and amounts of each instalment, along with any milestones that trigger the payments.

Best Practices for Setting Clear Terms

To ensure that your payment terms are effective and easy to follow, here are a few best practices:

- Be Clear and Concise: Avoid ambiguity when describing your terms. Use simple language and be specific about the due date, fees, and payment methods.

- Communicate Early: Set payment terms at the beginning of the project or contract. Having everything clearly stated before the work begins helps both parties avoid misunderstandings.

- Use Consistent Terms: Develop a standard set of terms that you use for all clients, while allowing some flexibility for special cases. Consistency helps clients become familiar with your expectations.

- Reinforce the Terms: Include the payment terms in both your billing document and any contracts, ensuring that your client has multiple references to the terms you’v

How to Track Outstanding Payment Requests

Tracking unpaid payment documents is essential for maintaining a healthy cash flow and ensuring that no amount goes overlooked. By keeping an accurate record of outstanding payments, you can follow up promptly with clients who haven’t settled their balances. This proactive approach helps you stay on top of your finances and avoid unnecessary delays in receiving payment.

Here are some effective methods to track unpaid amounts and keep your billing organized:

Tracking Method Description Manual Logs For those who prefer a traditional approach, maintain a log where you record all payments received and those still pending. Include key details such as the due date and amount owed for easy reference. Spreadsheets Create a simple spreadsheet to track the status of each request. Organize columns for client names, dates, amounts, and payment status (e.g., Paid, Pending, Overdue). Accounting Software Use accounting tools like QuickBooks, Xero, or FreshBooks that automatically track payment statuses. These tools can send reminders and help you manage multiple clients and payments in one place. Online Payment Platforms If you use platforms like PayPal or Stripe, they typically offer built-in tracking for payments. You can easily see which payments have been processed and which are still pending. To maintain accuracy and avoid confusion, it’s important to update your tracking system regularly. Here are a few tips for staying on top of overdue payments:

- Set Reminders: Use calendar tools or software features to set reminders for follow-ups on overdue payments, ensuring that you don’t miss any opportunities to chase up outstanding balances.

- Regular Reviews: Make it a habit to review your accounts on a weekly or monthly basis to stay on top of what’s outstanding and what’s been paid.

- Communicate Promptly: As soon as a payment becomes overdue, send a polite reminder. Be clear about the due date and provide easy instructions on how to pay if necessary.

By staying organized and using the right tools to track unpaid requests, you can maintain financial control and reduce the chances of

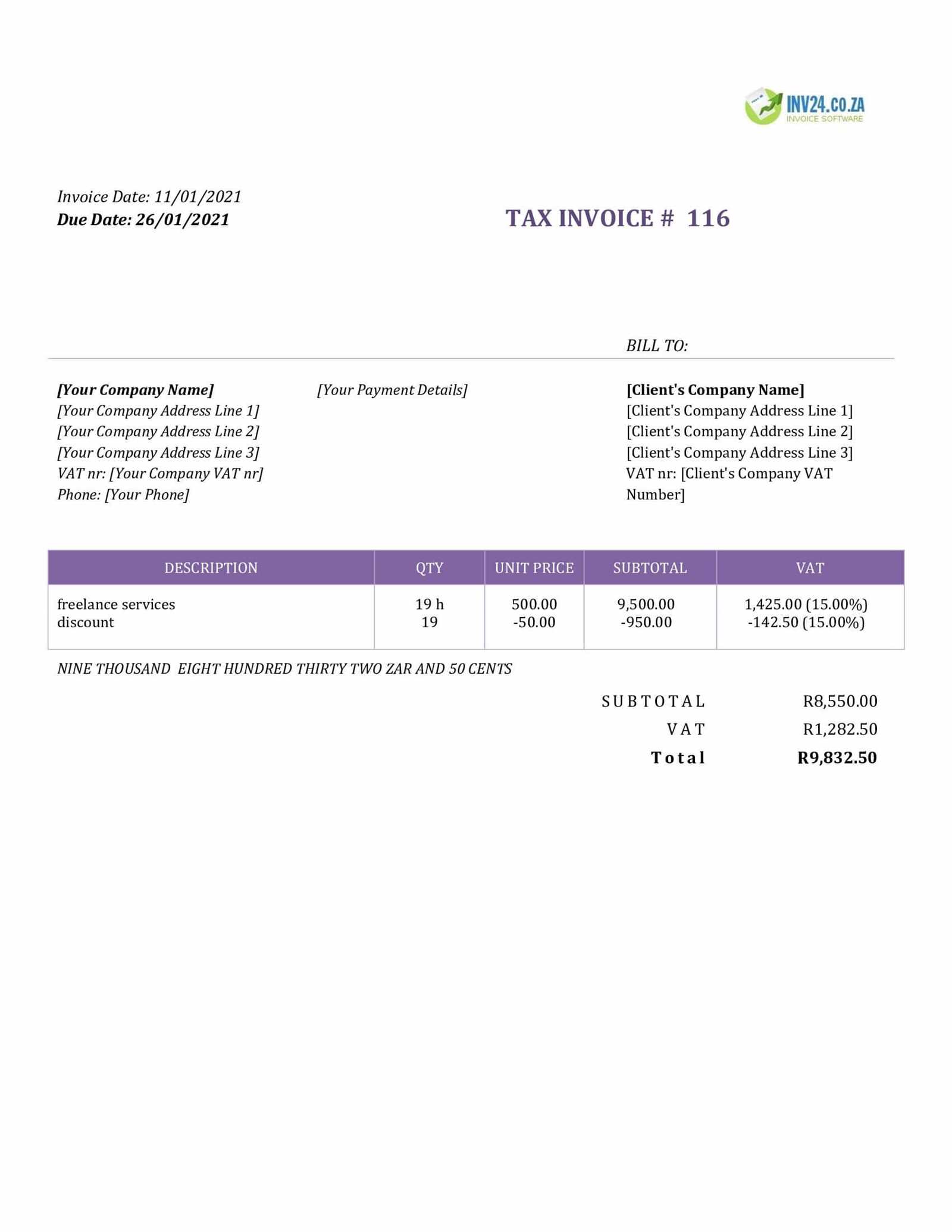

Free Billing Documents for Independent Contractors

For independent workers, having access to free, professional-looking billing documents can save both time and money. These documents allow you to quickly create clear and organized records of the work completed and the amount owed, ensuring a smooth payment process. Many online resources offer free customizable formats that you can tailor to your specific needs, making it easy to send requests without investing in expensive software or services.

Here are some great sources for free billing documents that can be used for various types of projects:

- Microsoft Word: Word offers several free, downloadable billing document designs that can be customized with your details, payment terms, and work descriptions.

- Google Docs: Google provides a range of free and easy-to-edit templates through its Google Drive platform, which are ideal for quick invoicing and cloud storage.

- Canva: Canva offers free templates with a professional design aesthetic. It’s a great choice if you want to add your branding or personalize the look of your billing documents.

- Zoho Invoice: Zoho provides a free online tool with customizable formats, which also integrates with other Zoho applications for business management.

- PayPal: If you use PayPal, you can create and send billing documents directly through their platform. They offer free, customizable templates with easy payment options for clients.

These free resources allow you to generate professional documents quickly, without the need for advanced software. Whether you need a basic template or a more detailed layout, you can find a solution that fits your style and business needs. Choosing the right format not only saves you time but also ensures that your payment requests are clear, consistent, and easy for your clients to understand.

How to Add Taxes to Your Payment Request

When you’re billing for services or products, including taxes in your payment documents is essential for compliance and transparency. Depending on your location and type of work, tax requirements can vary, but it’s important to ensure that the appropriate amount is clearly stated. This helps clients understand the total cost, and it ensures that you’re collecting and reporting the right amount for tax purposes.

Steps to Add Taxes

Here’s how to correctly include taxes in your billing documents:

- Identify the Tax Rate: Determine the tax rate that applies to your business. This could be a sales tax, value-added tax (VAT), or service tax, depending on your location and the nature of the service or product.

- Calculate the Tax Amount: Multiply the total amount of your services by the applicable tax rate. For example, if your service costs $100 and the tax rate is 10%, the tax amount would be $10.

- Include a Tax Line: In your payment document, list the tax amount as a separate line item. This helps make it clear to the client what portion of the total amount is tax.

- Clarify the Tax Rate: Next to the tax amount, include the percentage or rate that was applied. This ensures the client understands how the tax was calculated.

- Check for Exemptions: If any portion of the payment is tax-exempt, make sure to note that in your document. Some services or products may qualify for tax exemptions, depending on your location and industry.

Best Practices for Tax Inclusion

To avoid confusion and ensure that everything is transparent, follow these best practices:

- Stay Updated on Tax Rates: Tax rates can change over time, so make sure to keep up-to-date with any modifications in your local tax laws.

- Use Software for Calculation: Many accounting tools and online platforms can automatically calculate taxes based on the amount and the applicable rate, helping you avoid mistakes.

- Separate Taxes Clearly: Always show taxes as a distinct line item on your document to ensure that your client can clearly see the breakdown of charges.

- Offer Discounts Before Tax: If you offer discounts, apply them before calculating the tax, unless the tax law in your region specifies otherwise.

By including taxes clearly and accurately, you ensure that both you and your client are on the same page regarding the final amount due, and you maintain compliance with local tax regulations.

Using Billing Documents for Better Cash Flow

Maintaining a steady cash flow is crucial for the financial health of any business, especially when you’re managing multiple clients and projects. By creating and sending payment requests promptly, you can ensure that you receive payment in a timely manner, allowing your business to run smoothly. Proper use of these documents can also help you manage your finances more effectively, minimizing late payments and helping you plan for upcoming expenses.

Here are some strategies for using billing documents to improve cash flow:

Set Clear Payment Terms

Clearly defined payment terms are essential for reducing delays in receiving funds. Specify due dates, payment methods, and any late fees upfront. Clients are more likely to pay on time when they understand the expectations and consequences of late payments. Additionally, offer multiple payment options to make it easier for clients to pay quickly.

Send Requests Promptly

Don’t wait too long to send your billing documents. The sooner you send them after completing the work, the sooner you’ll receive payment. Ideally, send them within a few days of project completion to maintain momentum and keep cash flow consistent.

Offer Discounts for Early Payment

Incentivizing early payment can be an effective way to improve cash flow. Offer a small discount (e.g., 2-5%) for clients who pay within a certain period, such as 7 or 10 days. This not only encourages prompt payments but also strengthens client relationships by rewarding timely behavior.

Follow Up on Overdue Payments

Don’t hesitate to follow up on unpaid requests. Set reminders for yourself and reach out politely but firmly if the payment hasn’t been received by the due date. A well-timed reminder can often resolve a delay before it becomes a bigger issue.

Use Software for Automation

Take advantage of accounting or billing software that automates payment tracking and sends reminders for overdue balances. Automated invoicing tools help streamline your cash flow management by reducing the need for manual follow-ups and ensuring consistency in your billing process.

By using billing documents effectively and incorporating these strategies, you can maintain a steady cash flow, avoid disruptions to your operations, and focus more on growing your business rather than managing overdue payments.

Creating Recurring Payment Requests for Clients

For businesses offering ongoing services or products, setting up recurring payment requests can streamline the billing process and ensure consistent cash flow. By automating this process, you save time on administrative tasks while offering clients a predictable payment schedule. This approach is especially beneficial for long-term contracts, subscription-based services, or maintenance plans that require regular invoicing.

Here are the key steps to create recurring payment requests:

How to Set Up Recurring Payments

Follow these steps to set up a reliable system for recurring billing:

Step Description 1. Determine Payment Frequency Decide how often the client will be billed, whether it’s weekly, monthly, quarterly, or annually. Choose a frequency that aligns with the nature of your services or products. 2. Specify the Amount Clearly define the amount the client will be charged for each billing cycle. Make sure both parties agree on this amount upfront to avoid confusion later. 3. Include Relevant Details Ensure that your payment requests include all necessary details, such as a description of the ongoing service, the payment terms, and any applicable taxes or fees. 4. Set Up Automated Reminders Use invoicing software that automatically sends out payment reminders and documents on the scheduled dates. This eliminates the need for manual intervention and ensures payments are never missed. 5. Monitor and Adjust Regularly check the status of recurring payments and make adjustments as needed, whether it’s for price changes, service updates, or payment method updates. Benefits of Recurring Billing

Setting up recurring payment requests offers several advantages:

- Predictable Revenue: Recurring payments help create a steady stream of income, which makes cash flow more predictable and reduces financial uncertainty.

- Reduced Administrative Work: Once set up, recurring payments require minimal oversight, saving you time on creating and sending individual documents each billing cycle.

- Improved Client Retention: Clients appreciate the convenience of a set schedule for payments, and this consistency can lead to better long-term relationships.

- Automation and Accuracy: Automated reminders and payment tracking ensure you don’t miss any payments, reducing the risk of human error in the billing process.

By offering recurring payment requests, you can enhance both your business operations and client satisfaction. It ensures you receive timely payments while allowing clients to easily manage their payments over time.

Legal Considerations in Payment Requests

When creating payment documents for your services, it’s important to ensure that they comply with relevant legal requirements. These documents not only serve as a record of the transaction but also protect both you and your client in case of any disputes or misunderstandings. Understanding the legal aspects of these documents helps to avoid potential complications and ensures that you are operating within the bounds of the law.

Key Legal Elements to Include

To avoid issues and ensure that your payment documents are legally sound, make sure to include the following essential elements:

- Payment Terms: Clearly state the terms under which you expect to be paid. This includes the payment due date, any late fees or interest for overdue payments, and acceptable payment methods.

- Client and Business Details: Include your full legal name or business name, contact information, and tax identification number, as well as the client’s details. This helps ensure that the document is recognized as a formal contract.

- Description of Services: Provide a detailed description of the services or products provided, including the dates of service, quantities, and rates. This clarity will help prevent disputes regarding the work completed.

- Legal Jurisdiction: In the event of a legal dispute, it’s important to specify the jurisdiction or legal location under which any legal action will be taken. This ensures that both parties understand where disputes will be resolved.

Protecting Yourself with Clear Terms

In addition to basic details, including specific legal protections in your payment documents can prevent misunderstandings down the line. For example:

- Intellectual Property Rights: If your work involves intellectual property (such as designs, content, or software), include a clause that outlines who holds the rights to the work and under what conditions the client can use it.

- Confidentiality Agreements: If you’re working on a sensitive project, a non-disclosure agreement (NDA) may be appropriate to ensure that both parties respect confidentiality.

- Refund and Dispute Policies: Make it clear whether you offer refunds or exchanges, and provide a process for resolving disputes that might arise between you and your clients.

By including these important legal considerations in your payment documents, you protect yourself from potential risks and create a transparent, professional relationship with your clients. It’s always advisable to consult with a legal expert or accountant to ensure that your documents are compliant with local regulations.