Simple Excel Invoice Template for Effortless Billing

Managing payments and keeping track of transactions is a crucial part of any business. A well-organized method to document sales, services, or goods provided can save time, reduce errors, and ensure smoother operations. With the right tools, you can create and manage these records with ease, making financial tracking a seamless task.

One of the most effective ways to create professional payment records is through a digital document. This method allows you to quickly adjust the format to suit your specific needs, while also offering flexibility in design and calculation. Whether you are a freelancer, small business owner, or entrepreneur, a customizable document can streamline your billing process and enhance your productivity.

In this guide, we will explore how to set up a structured and user-friendly billing document that caters to various business needs. From essential calculations to adding personal branding, you’ll learn how to craft a functional tool that simplifies financial tracking. With just a few adjustments, this document can become a vital asset in your daily operations.

Simple Excel Invoice Template for Beginners

For those just starting out in business or freelance work, having an organized way to record payments and manage financial transactions is essential. With the right structure, even those without accounting experience can easily create documents that track payments, services provided, and outstanding balances. This approach not only makes billing simpler but also ensures that all necessary information is clear and professional-looking.

By utilizing a basic, customizable document, beginners can quickly generate detailed records that meet their needs. The key to success lies in understanding the core elements of such a document–like including customer details, itemizing charges, and calculating totals. Once you grasp these fundamentals, the process becomes intuitive and fast, allowing you to focus on other aspects of your business.

In this section, we will guide you through creating your first professional-looking document from scratch. You’ll learn how to structure your work, add necessary fields, and adjust the layout to suit your style–all with a minimal learning curve. Whether you’re issuing one-off bills or managing multiple clients, this tool will help you stay organized and present yourself in a polished way.

How to Create Your First Invoice

Creating a professional billing document for the first time can seem daunting, but it doesn’t have to be. With a few key steps, you can easily produce a document that clearly outlines the goods or services provided, the total cost, and payment terms. This process ensures that both you and your clients are on the same page, which helps maintain good business relationships and ensures timely payments.

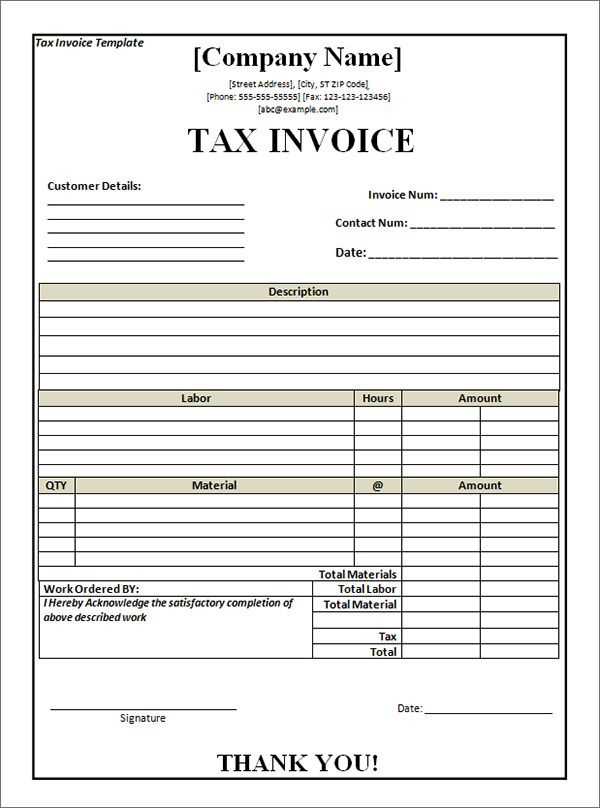

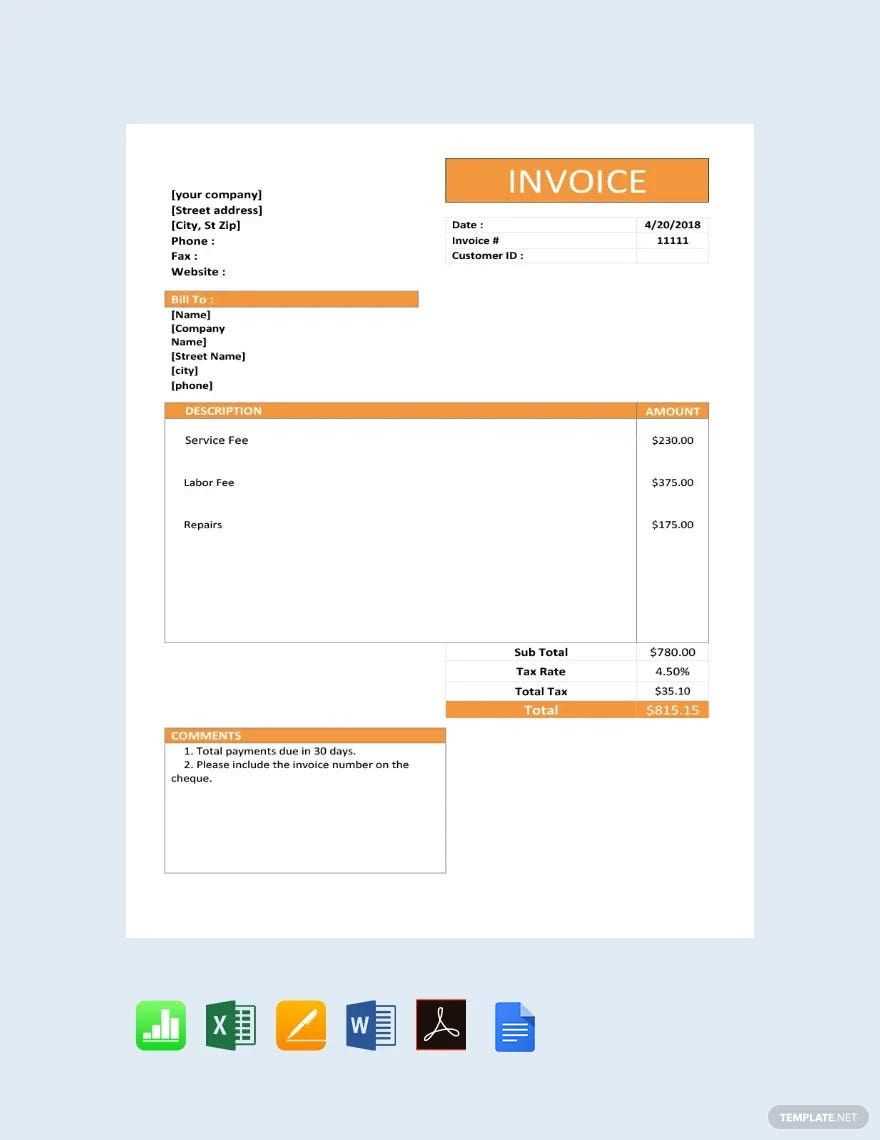

The first step is to include essential details such as the recipient’s name, contact information, and a unique reference number for easy tracking. Then, list the products or services provided, their individual costs, and any applicable taxes or discounts. The total amount due should be clearly stated, along with your payment instructions and deadlines.

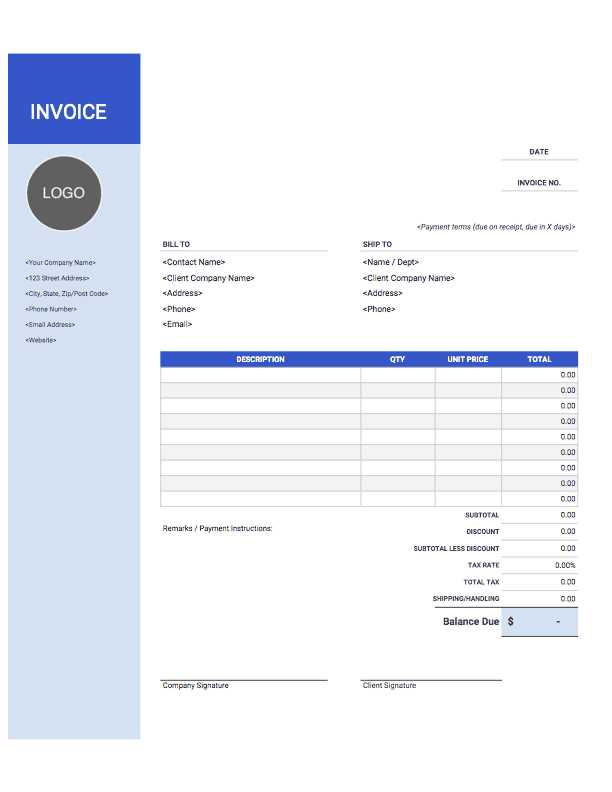

Once the basic elements are in place, it’s important to format the document in a way that’s both professional and easy to understand. Keep the layout clean, with clear headings and enough spacing between sections. You can also customize the design with your company’s logo or branding to make the document reflect your business identity. By following these steps, you’ll have a well-structured document ready for use in no time.

Customizing Excel Invoice for Your Business

Every business has its unique needs when it comes to billing. Customizing a billing document allows you to align it with your brand and ensure that all necessary information is clearly communicated. From adjusting the layout to adding specific fields, making the document your own can help you maintain a professional image while providing clients with all the details they need.

Start by personalizing the design to reflect your business identity. Adding your logo, company colors, and contact information at the top of the document ensures that it looks polished and recognizable. You can also modify the font and style to match your brand’s aesthetic, giving your document a cohesive feel.

Next, think about the specific details that your business requires. For example, if you offer recurring services, you might want to include sections for payment schedules or subscription terms. Additionally, adjusting fields like discounts, taxes, or additional fees can help tailor the document to different types of transactions. By fine-tuning the layout and content, you create a document that’s not only functional but also an extension of your business.

Top Features of an Excel Invoice Template

When creating a billing document for your business, certain features can make a significant difference in ease of use and functionality. A well-designed record helps streamline the process, ensures accuracy, and provides a professional look that enhances client trust. From automatic calculations to customizable fields, the right document can make financial tracking effortless and efficient.

Automatic Calculations

One of the key features of an effective billing document is the ability to automate calculations. By using built-in formulas, you can instantly calculate totals, taxes, and any discounts applied to the services or goods. This eliminates the risk of manual errors and ensures that your numbers are always accurate.

Customizable Fields and Layout

The flexibility to add or remove fields is another important feature. Depending on your business type, you may need sections for product descriptions, payment terms, or recurring billing details. With a customizable layout, you can adjust the document to fit your specific needs, making it easier to track and manage different types of transactions.

Benefits of Using Excel for Invoicing

Utilizing a spreadsheet application for billing can significantly simplify the financial management process for businesses of any size. It offers a range of advantages, from ease of use to greater flexibility, making it an ideal tool for creating and tracking payment records. Below are some key benefits of using this tool for managing your transactions:

- Cost-Effective – Spreadsheet software is often free or already available, making it an affordable option for small businesses and freelancers.

- Customizable – You can easily modify the layout, fields, and calculations to suit the unique needs of your business, whether you’re selling products, services, or both.

- Automation – With built-in formulas, you can automate calculations such as totals, taxes, and discounts, reducing the likelihood of human error.

- Data Organization – All your payment records can be stored in one place, making it easy to search, sort, and retrieve past transactions whenever needed.

- Time-Saving – Creating and sending a billing record is fast, and you can reuse templates to generate future records in just a few clicks.

- Easy to Share – Once the document is ready, it’s simple to email or share it with clients, ensuring that payment details are communicated clearly and efficiently.

By leveraging these benefits, businesses can save time, reduce errors, and improve their overall billing process.

How to Calculate Taxes in Excel Invoices

When creating billing records, calculating taxes accurately is crucial to ensure compliance and maintain transparency with your clients. The right tool can help automate this process, so you don’t have to manually calculate tax amounts each time. With the use of formulas and built-in functions, you can easily calculate and apply tax rates to your sales or services, saving time and minimizing errors.

To calculate taxes, you simply need to follow these steps:

- Step 1: Identify the taxable items. This could be products or services that are subject to tax based on your local tax laws.

- Step 2: Determine the tax rate. This is usually a percentage, such as 10%, that applies to the taxable amount.

- Step 3: Use a formula to calculate the tax amount. For example, if the total amount before tax is in cell A2 and the tax rate is in B2, the formula in cell C2 would be

=A2*B2to calculate the tax. - Step 4: Add the tax amount to the original price. This ensures that the final total includes both the cost of the product or service and the applicable tax.

By applying these simple steps, you can quickly and accurately calculate taxes and integrate them into your billing document. This not only helps ensure compliance but also makes the billing process smoother and more efficient for both you and your clients.

How to Include Payment Terms in Invoices

Clearly defining payment terms in your billing document is essential for avoiding misunderstandings and ensuring that you are paid on time. Payment terms outline when and how clients are expected to make payments, and they help set the expectations for both parties. By specifying these terms in a clear and concise manner, you create a professional standard that promotes transparency and fosters trust with your clients.

Key Elements to Include

When adding payment terms to your billing record, consider the following elements:

- Payment Due Date: Specify the exact date by which the payment should be made, whether it’s a specific day of the month or a certain number of days after the issue date.

- Accepted Payment Methods: Clearly state the ways you accept payments, such as bank transfer, credit card, or online payment systems.

- Late Fees or Penalties: If applicable, include a note about any late fees or interest charges for overdue payments to encourage timely settlements.

- Early Payment Discounts: Offering discounts for early payment can incentivize clients to pay ahead of schedule. Specify the percentage and the deadline for the discount.

- Partial Payments: If you allow partial payments, state the amount and frequency of installments, along with any terms associated with them.

Where to Place Payment Terms

Payment terms should be placed in a prominent location within your document. Typically, they are listed toward the bottom or in a dedicated section near the total amount due, ensuring they are easy to locate. Keep the language simple and straightforward, avoiding legal jargon, so that your clients can quickly understand their obligations.

By including clear and precise payment terms in your billing document, you reduce the chances of confusion and establish a clear framework for handling financial transactions.

Easy Ways to Track Payments in Excel

Keeping track of payments is essential for maintaining a healthy cash flow and ensuring that all transactions are properly recorded. By using the right tools and organization techniques, you can easily monitor outstanding balances, track payment statuses, and quickly identify any overdue amounts. With just a few adjustments to your document, you can automate and streamline this process, saving time and reducing the risk of errors.

Here are some practical ways to track payments efficiently:

- Use Conditional Formatting: Highlight overdue payments or those nearing their due date by applying conditional formatting rules. This way, you can instantly spot any outstanding balances that require follow-up.

- Create a Payment Status Column: Add a column labeled “Payment Status” where you can mark each transaction as “Paid,” “Pending,” or “Overdue.” This will give you a clear overview of which payments are still pending and which have been completed.

- Set Up Payment Reminders: If using formulas, you can set reminders based on due dates. For example, you can create a formula that alerts you when a payment is overdue or if it’s approaching the due date.

- Use a Running Total: Create a column that calculates the remaining balance after each payment is made. This way, you can easily track how much has been paid and how much is still owed.

- Track Multiple Payment Methods: If clients are paying via different methods (bank transfer, credit card, check), include columns for each method. This ensures you can track all incoming payments, regardless of how they were made.

By integrating these tracking features, you can have a clear and organized system that helps you stay on top of all payments and reduces the likelihood of overlooking any outstanding balances.

Design Tips for a Professional Invoice

Creating a well-designed billing document not only ensures clarity and accuracy but also reflects your professionalism. A clean, organized layout makes it easier for clients to understand the details of the transaction, while a polished design enhances your brand image. By following some key design tips, you can ensure that your document looks both professional and easy to read, which can improve your relationship with clients and encourage timely payments.

Key Elements for a Professional Look

Here are some design principles to consider when creating a billing document:

- Branding: Include your company logo, colors, and contact information at the top to make the document visually aligned with your brand identity.

- Clear Structure: Organize the content into sections, such as customer details, service descriptions, and payment breakdowns, to make the document easy to navigate.

- Consistent Fonts: Use one or two professional fonts that are easy to read. Avoid using too many font styles or sizes, as this can make the document appear cluttered.

- Spacing: Ensure there is enough white space between sections to keep the document from feeling cramped. Proper spacing helps guide the reader’s eye and makes the content more digestible.

- Bold Key Information: Highlight essential details such as the total amount due, payment due date, and customer information by using bold or larger text.

Organizing the Details

Here’s an example of how you might organize the essential information in a clean, structured format:

| Item | Descript

Using Formulas to Automate Invoices

Automating calculations within a billing document can save you time and reduce the risk of errors. By using built-in formulas, you can easily calculate totals, taxes, discounts, and other values without having to manually input them each time. This streamlining allows you to focus more on your business and less on repetitive tasks, making the billing process faster and more efficient. Here are a few basic formulas you can use to automate your financial records:

Here’s an example of how you might structure these formulas within a billing document:

|

||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|