Simple Blank Invoice Template for Quick and Easy Billing

Generating accurate and clear billing statements is essential for any business or freelancer. A well-structured document not only ensures timely payments but also reflects professionalism. In this guide, we’ll explore the importance of using pre-designed structures that simplify the invoicing process, making it easier to handle transactions with clients.

Whether you’re a small business owner, freelancer, or contractor, having a reliable format for your bills helps avoid confusion and mistakes. With the right setup, you can quickly generate detailed records, saving time and reducing errors. These formats can be customized to suit your specific needs while maintaining a polished appearance that builds trust with your clients.

Learn how easy it can be to set up a system that works for you, using tools that streamline your accounting tasks and help keep your financial records organized. By utilizing these straightforward solutions, you can focus more on growing your business rather than worrying about the technicalities of billing.

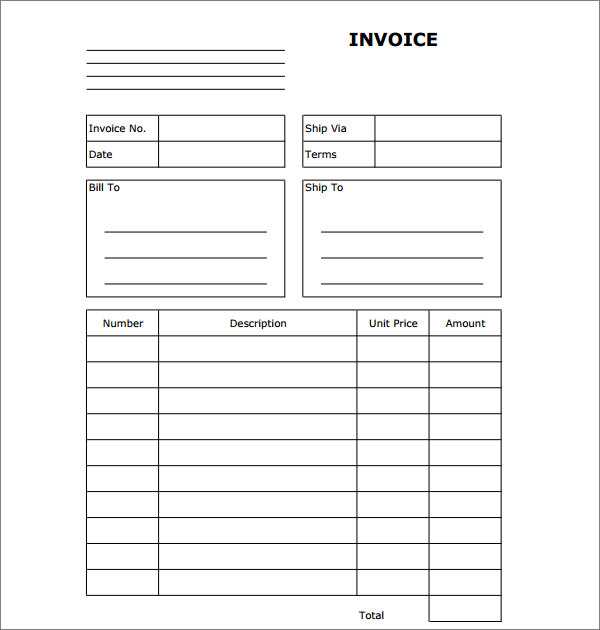

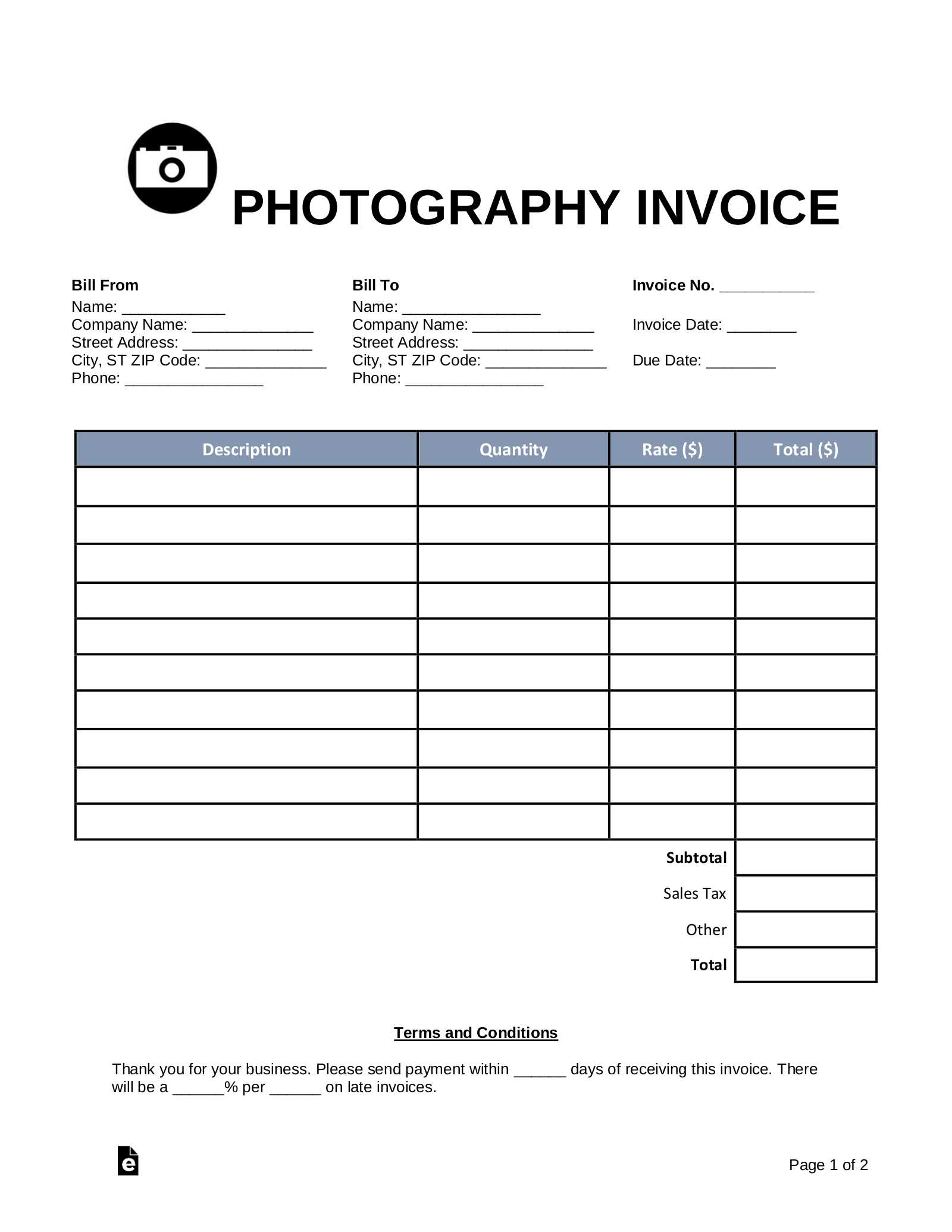

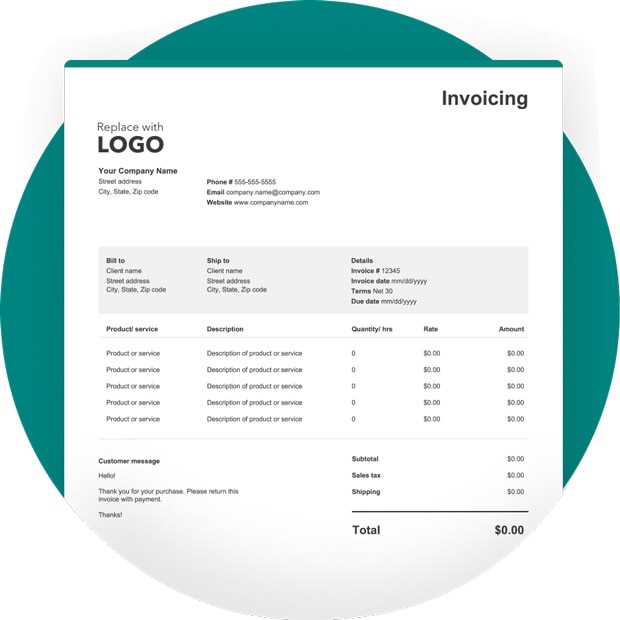

Simple Blank Invoice Template Overview

Creating a well-organized billing document is a crucial part of managing any business or freelance career. The right structure helps ensure that payments are processed smoothly, all necessary details are included, and clients receive clear information about the charges. A versatile and easy-to-use layout can save time, reduce errors, and keep your records consistent.

Such a design can be adapted to different industries, allowing for customization while retaining a professional appearance. These documents typically feature a clean and straightforward layout, focusing on key data like services provided, amounts owed, and payment terms. Here’s a closer look at the essential features of an effective billing document:

- Contact Information: Clear identification of both the client and the business.

- Detailed Charges: Breakdown of products, services, or time billed.

- Due Date: Clear mention of payment deadlines.

- Payment Instructions: Easy-to-follow guidance on how to settle the balance.

- Professional Design: A clean, readable format that looks trustworthy and credible.

By utilizing such a structure, you ensure that your billing process is straightforward and efficient, contributing to a smoother financial workflow. With just a few adjustments, this kind of document can fit any situation and become a valuable tool in your business management routine.

Why Use a Blank Invoice Template

Having a pre-designed document for billing offers numerous advantages for businesses and freelancers alike. Rather than creating each statement from scratch, you can quickly generate consistent and professional records with minimal effort. This streamlined approach saves time, reduces mistakes, and ensures that your financial communications are clear and accurate.

Using a ready-to-fill document makes it easy to include all the necessary details in the correct format. This ensures that no important information, such as payment terms, client details, or service descriptions, is overlooked. Here are some key benefits of using this approach:

- Consistency: Each document follows the same structure, creating a uniform look for all communications.

- Efficiency: Quickly customize fields without having to manually adjust the layout or formatting each time.

- Professional Appearance: A well-organized design projects a credible and trustworthy image to clients.

- Accuracy: Helps avoid missing crucial details like due dates, amounts owed, or contact information.

- Time-Saving: Reduces the amount of time spent on paperwork, allowing more focus on other aspects of the business.

By using a pre-structured billing document, businesses can ensure smoother transactions and more efficient financial management, while maintaining a high level of professionalism.

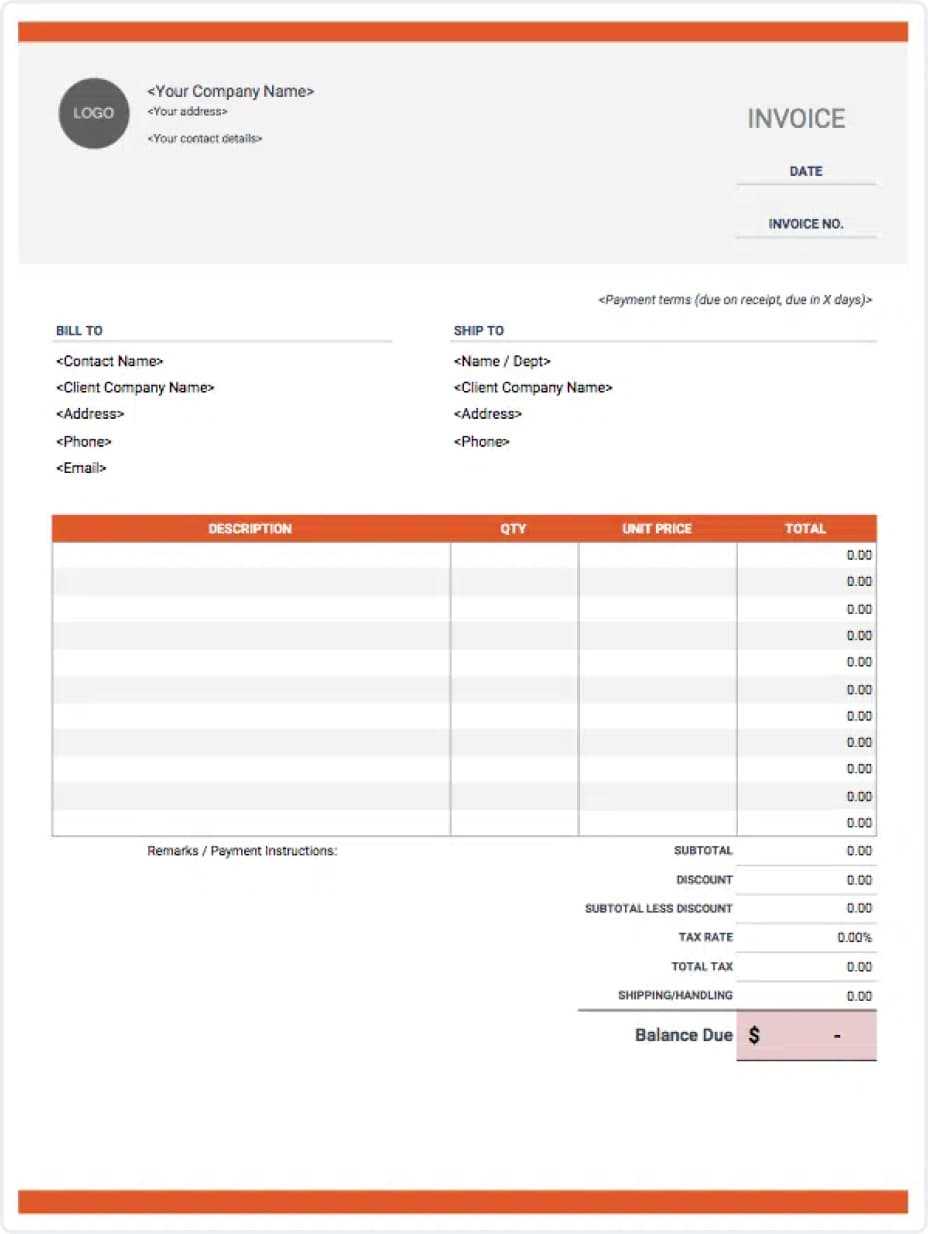

How to Customize Your Invoice Template

Customizing your billing document allows you to tailor it to your specific needs, ensuring that all relevant details are included while maintaining a professional look. Whether you’re adjusting the design or adding unique fields, the ability to personalize your statement can make a significant difference in how it’s perceived by clients. The following steps outline how to make these adjustments effectively.

Adjusting Layout and Design

One of the first things to customize is the layout. You can adjust the header, font styles, and spacing to match your brand’s aesthetics. For example, adding your company logo or changing the color scheme can help create a cohesive look across all your business materials. It’s important to ensure that the design remains clean and easy to read, as clutter can make important information harder to digest.

Modifying Fields and Information

Next, consider what information is most relevant for your business. Depending on your services, you may need to add specific fields such as project numbers, hourly rates, or discount details. Make sure all mandatory sections like client contact details, payment due dates, and descriptions of goods or services provided are present. Custom fields can be added to better track additional data, such as sales tax, shipping costs, or multiple payment methods.

By personalizing your document in this way, you can make it more aligned with your business needs while ensuring clarity for your clients.

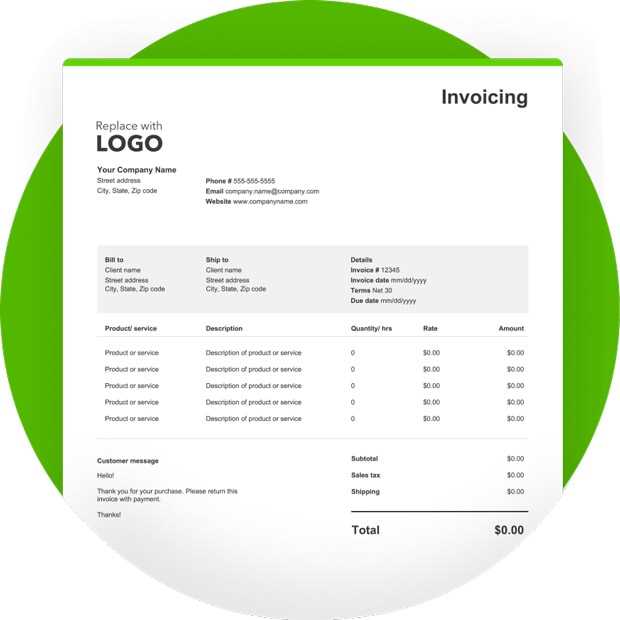

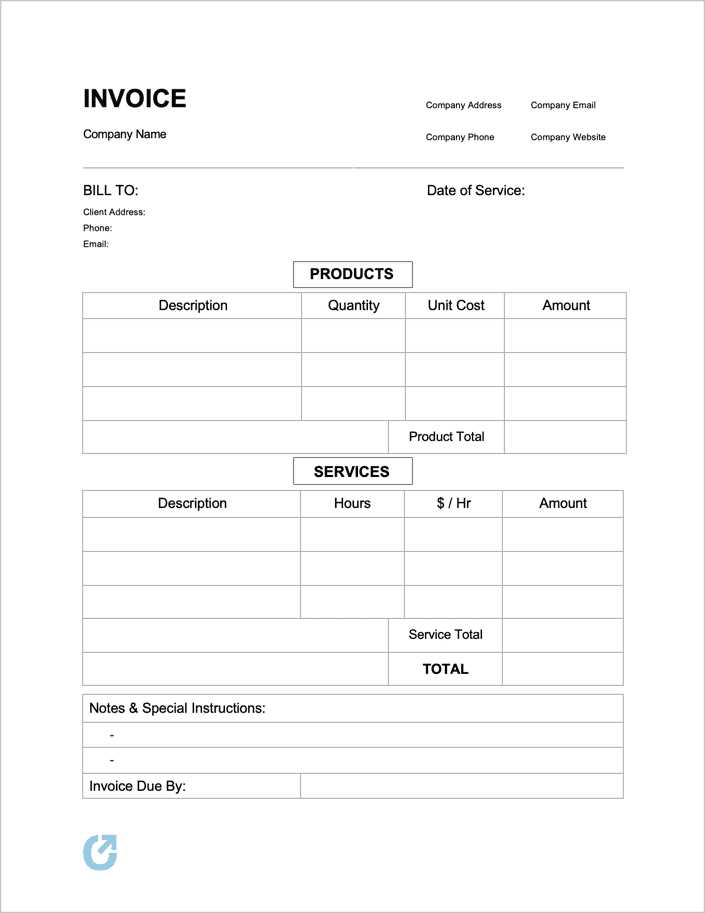

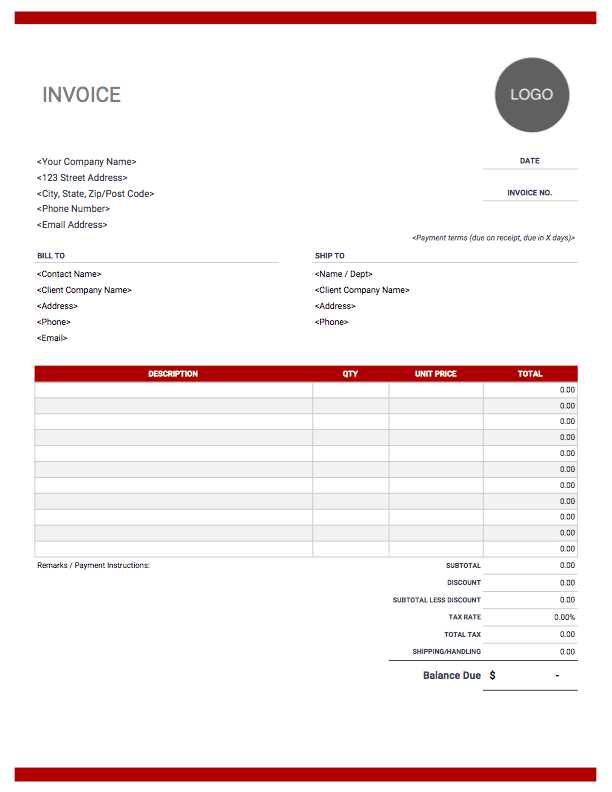

Key Information to Include in Invoices

To ensure smooth transactions and clear communication with your clients, it’s essential to include all necessary details in your billing documents. Properly documenting charges, payment terms, and other key information helps prevent confusion and delays. Here are the most important elements that should always be included:

Essential Details for Accuracy

- Business Information: Include your company name, address, phone number, and email for easy contact.

- Client Information: Clearly state your client’s name, business name (if applicable), and their contact details.

- Unique Reference Number: A unique identification number helps both parties track the document and maintain proper records.

- Issue Date: The date the document is created and sent to the client.

- Due Date: Clearly indicate when the payment is due to avoid any confusion over deadlines.

Details of Charges

- Description of Products/Services: Include a clear breakdown of what you provided, with quantity, unit prices, and total amounts.

- Subtotal: The sum of all items or services before taxes or discounts.

- Taxes and Additional Fees: Specify any applicable taxes or extra charges, such as shipping or handling.

- Total Amount Due: The final amount your client needs to pay, including all relevant taxes and discounts.

Incorporating these key elements will not only make your billing documents complete but also enhance the professionalism of your communications, helping to foster trust and avoid misunderstandings.

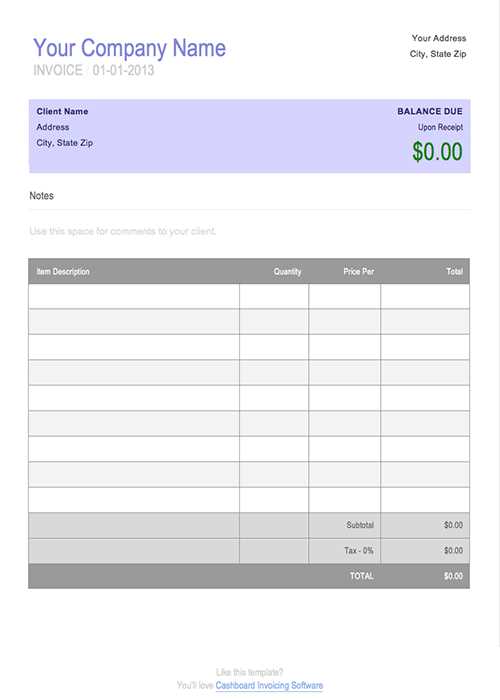

Free Invoice Templates for Small Businesses

For small businesses, managing financial records efficiently is crucial to staying organized and ensuring timely payments. One of the easiest ways to do this is by using ready-made documents that can be quickly customized for each transaction. These free, customizable structures help small business owners create professional records without the need for expensive software or complex accounting tools.

Why Use Pre-Made Billing Structures

Utilizing free billing formats offers a range of benefits for small enterprises, including:

- Cost-Effective: Free options allow you to maintain professionalism without additional costs, which is ideal for businesses with tight budgets.

- Time-Saving: Pre-made designs speed up the process, allowing you to generate documents in minutes instead of starting from scratch.

- Consistency: Using a consistent format across all your communications reinforces your brand identity and makes your paperwork easier to manage.

Where to Find Free Templates

There are many online resources offering no-cost options for small businesses to download and customize their billing statements. Some platforms even allow you to select from various designs, tailored for different industries, ensuring that your documents suit your business style. Popular sources include:

- Microsoft Office Templates: Word and Excel offer several free downloadable options suitable for small businesses.

- Google Docs: Simple and effective templates available through Google’s free tools, which can be easily edited and shared.

- Specialized Websites: Many websites dedicated to small business resources offer free, customizable solutions with user-friendly interfaces.

By using these free options, small businesses can maintain a professional appearance and stay organized while keeping overhead costs low.

Benefits of Using a Blank Invoice

Utilizing a ready-to-fill document for billing offers several advantages, especially for businesses and freelancers who need to maintain consistency and professionalism without spending extra time on design. By adopting a standardized structure, you ensure that all the essential details are included, reducing errors and improving efficiency in your financial processes.

Improved Efficiency and Time-Saving

One of the main benefits of using a pre-designed structure is the significant amount of time it saves. Instead of manually formatting each document or tracking down missing fields, you can focus on filling in the necessary details. This quick process enables you to send out bills faster, ensuring that payments are made on time.

- Consistency: By using the same structure for every transaction, you create uniformity in your financial documents, which makes it easier to organize and track payments.

- Quick Customization: Ready-made forms allow for easy customization to fit different client needs, product descriptions, or payment methods without changing the overall design.

Professional Appearance

A well-organized billing document projects a professional image to clients, which is essential for building trust and credibility. A standardized layout ensures that clients always receive clear and accurate statements, making them feel confident about the transaction. In addition, this consistency reinforces your business’s attention to detail and commitment to quality.

- Clear Communication: Every aspect of the document is designed to be easily understood, ensuring that clients have no trouble interpreting the charges or terms.

- Brand Consistency: A customized design that includes your logo and company information can help establish a strong brand presence.

Incorporating a pre-set structure into your billing workflow provides both practical and professional benefits, ultimately streamlining your financial processes while boosting your reputation with clients.

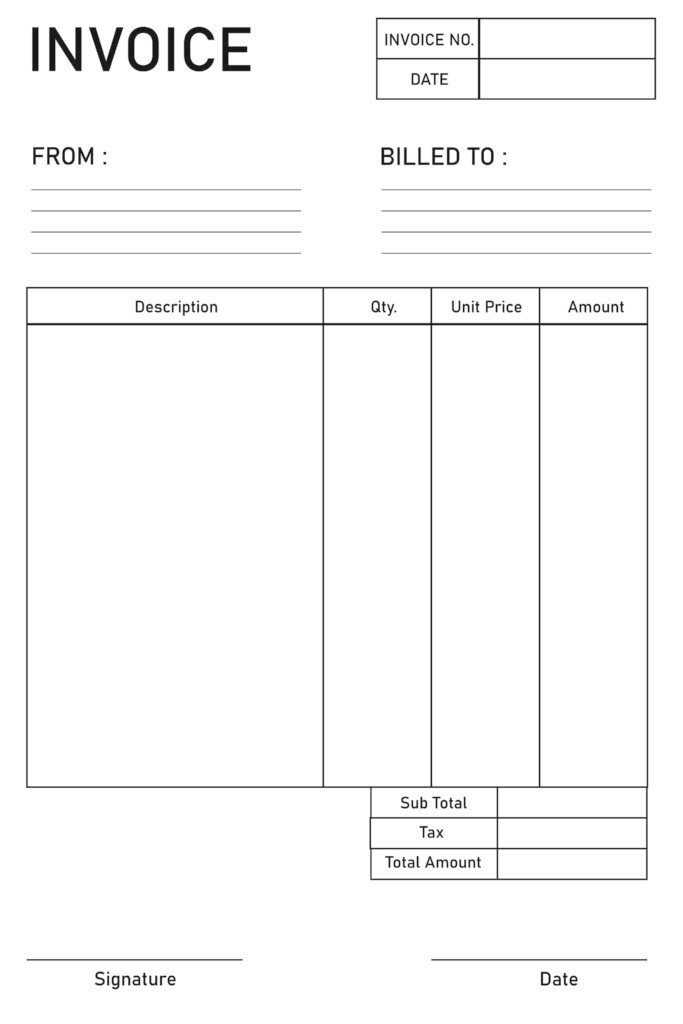

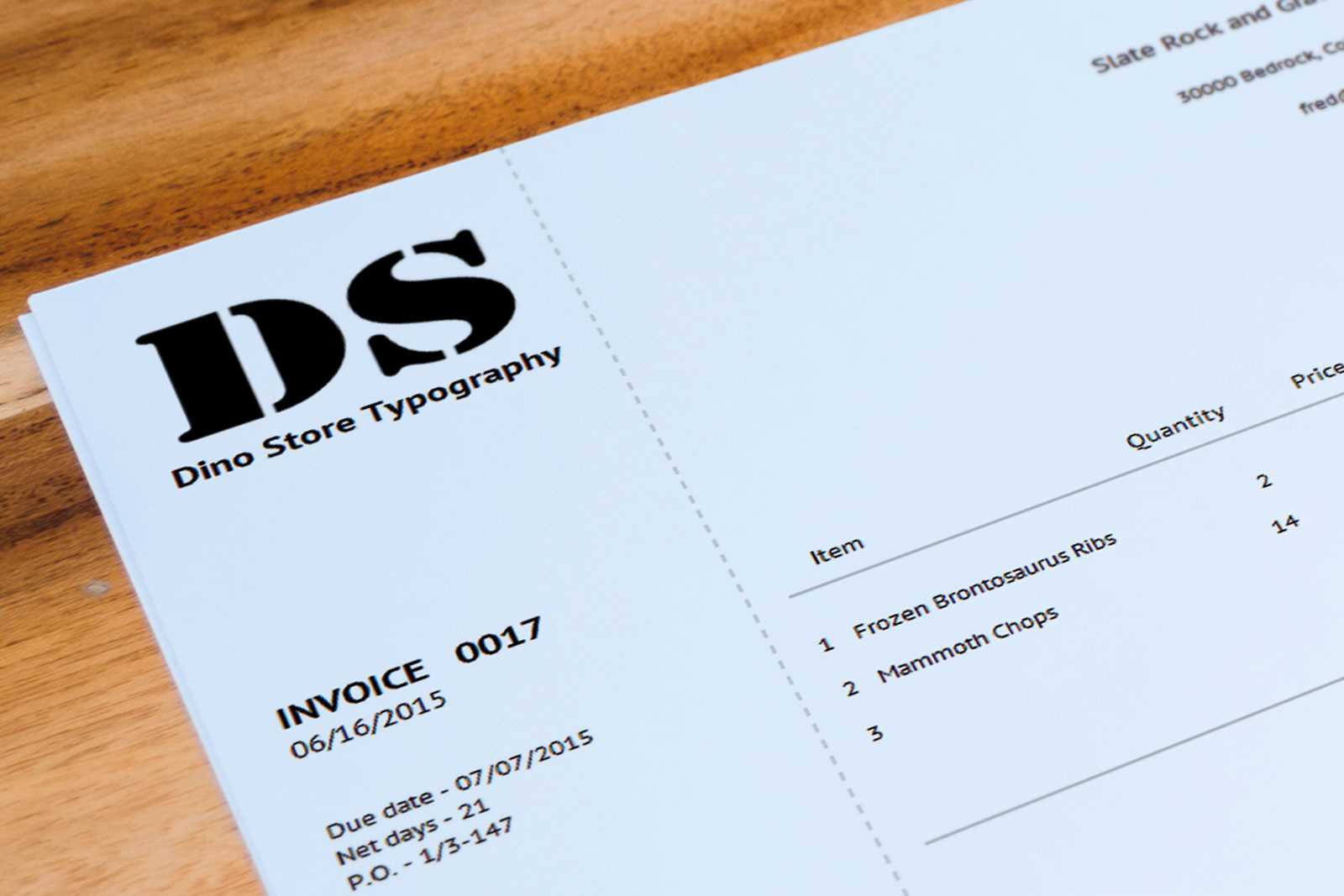

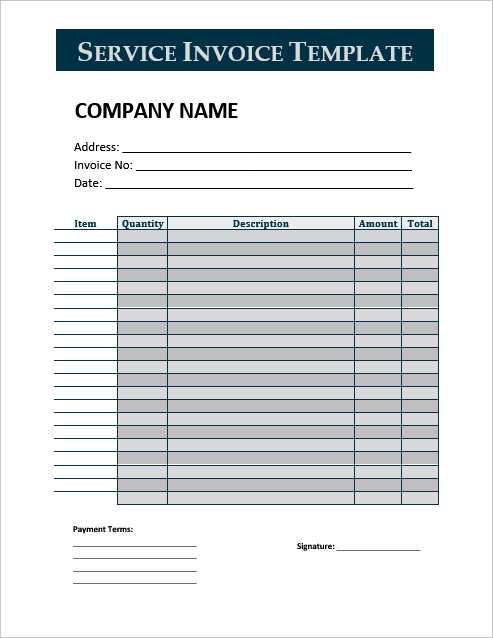

Steps to Create an Invoice from Scratch

Creating a billing document from the ground up may seem like a daunting task, but with the right structure and attention to detail, the process can be straightforward. The key is ensuring that all necessary elements are included and clearly presented. Here are the steps to build a professional statement that is both accurate and easy for clients to understand.

Step 1: Include Your Business Information

Start by listing your company’s details at the top of the page. This includes your business name, address, phone number, and email. These details help clients know where to send payments or reach out for any questions. Including your logo is also a great way to reinforce your brand identity.

Step 2: Add Client Information

Next, include your client’s name, address, and any relevant contact information. This helps ensure that the correct recipient receives the document and reduces the likelihood of confusion about who owes the payment.

Step 3: Assign a Unique Identification Number

Every statement should have a unique reference number. This makes it easier for both you and your client to track payments and manage records. If you have multiple clients, this number should be distinct for each document, ensuring clarity in your financial organization.

Step 4: List Products or Services

Provide a clear description of the items or services you are charging for. Be as detailed as possible, including quantities, rates, and any relevant terms. This helps prevent misunderstandings regarding the charges and gives clients a transparent breakdown of what they are paying for.

Step 5: Specify Payment Terms

Clearly state the total amount due and the payment terms, including the due date. It’s also helpful to include payment methods and any late fees that might apply if the payment is not made on time. These details help avoid confusion and set clear expectations.

Step 6: Review and Finalize

Before sending, double-check your document for any errors or missing information. Ensure that all numbers add up correctly and that all the fields are properly filled. A final review helps prevent mistakes that could delay payment or harm your professional image.

By following these steps, you can create an accurate and professional billing statement from scratch, ensuring that all your transactions are handled efficiently and with the necessary clarity.

Choosing the Right Invoice Format

Selecting the appropriate layout for your billing statements is crucial for ensuring clarity and professionalism. The format you choose will affect how your clients perceive your business and how easy it is for both parties to track and manage payments. The right structure should be simple, easy to read, and tailored to the type of work or services you provide.

There are several formats to consider, depending on your specific needs and preferences. Some businesses might require a more detailed breakdown of items, while others may prefer a cleaner, more streamlined approach. Below are some factors to consider when choosing the right format for your needs:

- Clarity: The layout should make it easy for your clients to quickly understand what they are being charged for and how much they owe.

- Customization: Choose a format that allows for easy customization, so you can adjust it for different clients, services, or payment terms.

- Branding: Ensure the format can incorporate your company logo and branding elements, as a professional appearance helps build trust.

- Legal Requirements: Depending on your location, there may be specific legal requirements for certain elements (like tax numbers or due dates) that must be included in the layout.

- Ease of Use: The format should be intuitive, allowing you to quickly fill out and send the statement without much hassle.

By considering these factors, you can choose a layout that fits your business needs and enhances your overall billing process, making it easier for both you and your clients to stay organized.

How a Blank Invoice Saves Time

Using a pre-structured billing document can significantly streamline the process of sending out statements, saving both time and effort. Instead of manually designing each document from scratch, you can simply fill in the relevant details, ensuring accuracy and consistency while cutting down on preparation time. This method allows you to focus more on core business activities, rather than getting bogged down with administrative tasks.

Quick Customization and Efficiency

When you have a ready-made structure, entering information becomes much faster. Fields such as client names, service descriptions, and amounts are already formatted and ready to be filled in. This eliminates the need for repetitive formatting or worrying about design elements each time a new statement is created. The result is a more efficient workflow and quicker turnaround on client billing.

- Standardized Format: A consistent layout ensures that every document looks professional and is easy to understand, reducing back-and-forth with clients.

- Less Error-Prone: Using a fixed format reduces the likelihood of mistakes that could delay payment or create confusion.

Reduced Administrative Workload

When you don’t have to reinvent the wheel each time you generate a new document, the administrative workload becomes lighter. This not only frees up time to focus on growing your business but also ensures that financial records remain organized and easy to access. With a structured document, keeping track of transactions becomes simpler, reducing the need for constant manual updates or corrections.

By adopting a pre-built layout, you can save valuable time, reduce mistakes, and maintain a smoother billing process that enhances both client satisfaction and business efficiency.

Best Software for Invoice Templates

Choosing the right software for creating and managing billing documents is essential for improving efficiency and maintaining a professional appearance. The right tools can help you quickly generate well-structured statements, customize them to suit your needs, and track payments effectively. With many options available, it’s important to select a solution that aligns with your business size, industry, and specific requirements.

Top Software for Small Businesses

For small business owners and freelancers, user-friendly platforms that offer customization options and affordable pricing are key. Here are some of the best options for generating billing documents:

- FreshBooks: Known for its intuitive interface, FreshBooks allows you to create professional records, track time, and send automated reminders for overdue payments.

- Wave: A free accounting software that includes customizable templates for billing, expense tracking, and financial reporting, perfect for small businesses on a budget.

- Zoho Invoice: With robust features for customization and automation, Zoho Invoice helps you manage clients, track payments, and create documents with ease.

Best Software for Larger Businesses

Larger enterprises or those needing more advanced features can benefit from platforms that offer more comprehensive financial management tools. These platforms typically include integrations for accounting, inventory, and payroll, making them well-suited for high-volume users.

- QuickBooks: A leading solution for businesses of all sizes, QuickBooks offers advanced billing options, detailed reports, and integrations with other business tools.

- Xero: Xero provides cloud-based accounting software with powerful invoicing capabilities, ideal for managing multiple clients and large teams.

By selecting the right software, you can not only save time in generating billing documents but also ensure your financial records are organized and easily accessible for future reference.

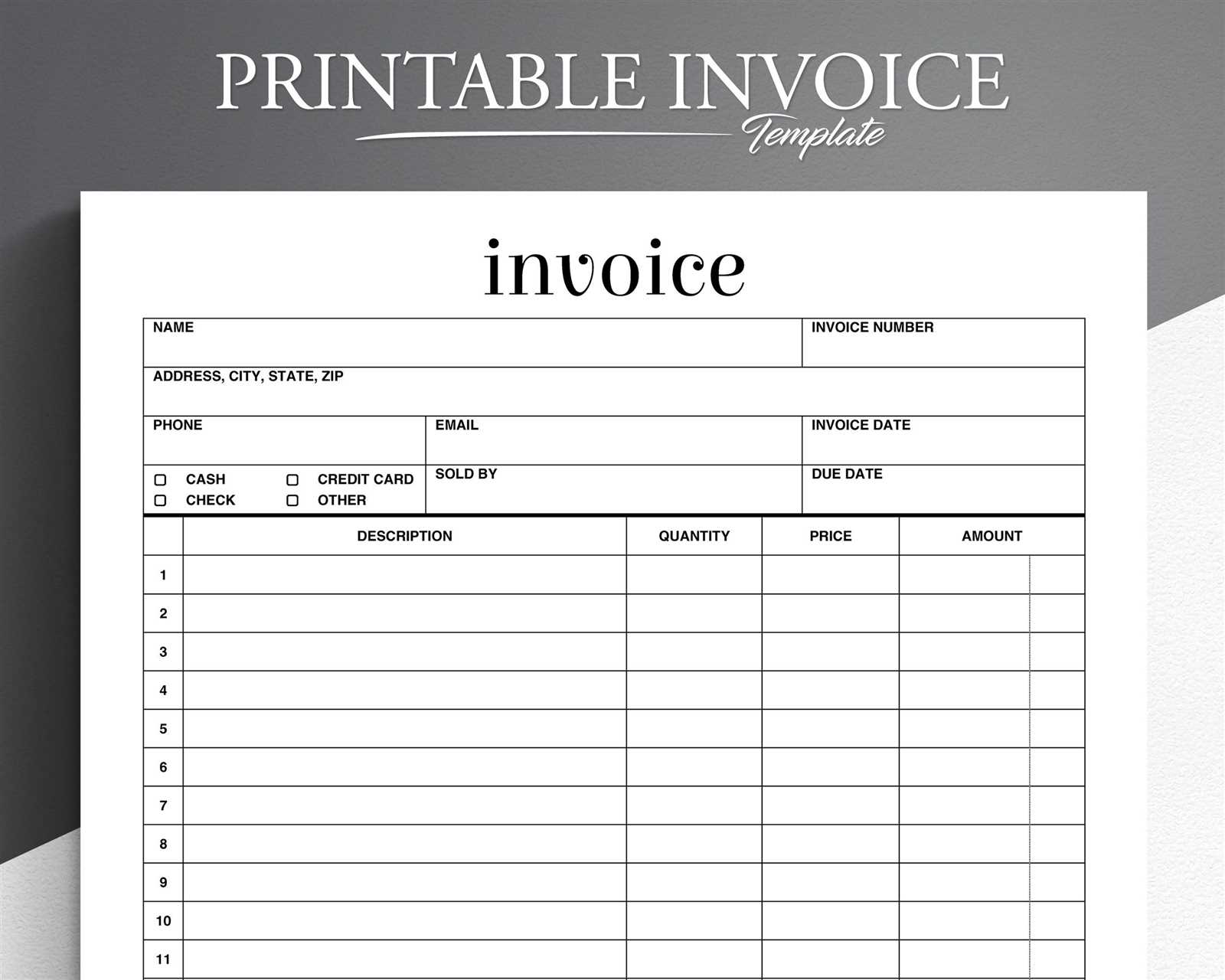

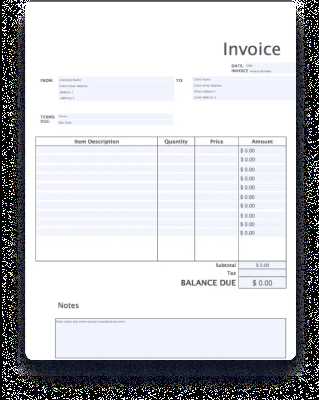

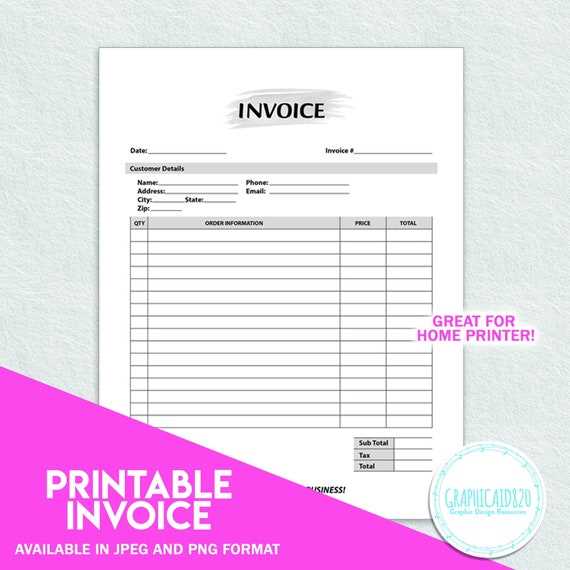

Printable Invoice Templates for Quick Billing

For businesses that need to quickly generate and send billing statements, having a printable document ready for customization is a game-changer. These ready-to-use formats allow you to rapidly fill in the required details, print the document, and send it to clients without any delay. Whether you are working from home or in a busy office, a printed version of a structured billing statement can streamline your workflow and ensure faster payment processing.

Printable formats are especially beneficial when you need to provide a physical copy to clients or when digital invoicing isn’t an option. They offer a straightforward solution that eliminates the need for complex software and enables quick adjustments. By using these customizable documents, businesses can maintain a professional appearance while minimizing the time spent on administrative tasks.

With the ability to instantly print your completed documents, you can easily manage both in-person transactions and remote clients. This feature helps reduce delays in processing payments, allowing you to keep your cash flow steady and ensure your business operations run smoothly.

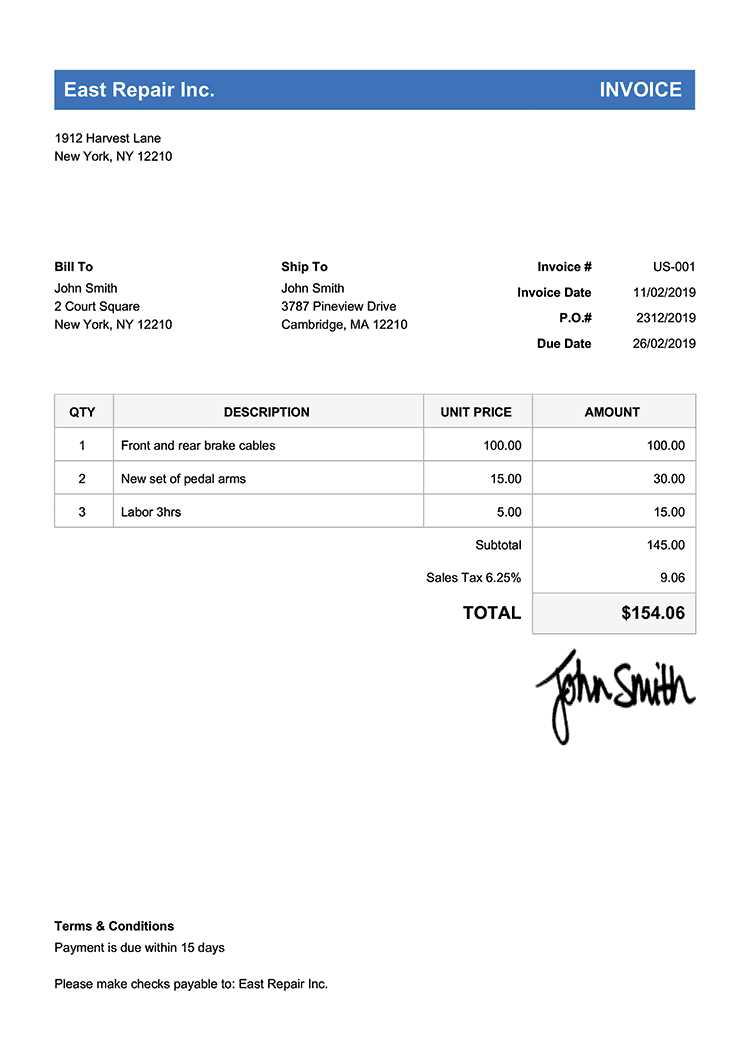

Common Invoice Mistakes to Avoid

While creating billing documents may seem straightforward, small mistakes can lead to confusion, delayed payments, or even lost revenue. Avoiding common errors is essential to ensure that your clients receive accurate, professional statements and that your business finances stay organized. Below are some of the most frequent mistakes to watch out for when preparing your billing documents.

Key Errors to Watch For

- Missing Contact Information: Failing to include the correct details for both your business and your client can lead to communication problems or delayed payments.

- Incorrect Payment Terms: Not clearly stating the payment due date or terms (e.g., late fees, discounts) can cause misunderstandings and missed deadlines.

- Unclear Descriptions of Goods/Services: Not providing a detailed list of items or services can result in confusion, especially if clients are unclear on what they’re being charged for.

- Calculations Errors: Double-check your math–miscalculations in total amounts, taxes, or discounts can damage your reputation and delay payments.

- Failure to Include a Unique Number: A missing reference number can make tracking payments difficult and lead to confusion when managing records.

Formatting and Presentation Mistakes

- Inconsistent Formatting: A cluttered or inconsistent layout can make your document difficult to read, leading to errors or confusion. Keep it neat and easy to follow.

- Not Keeping a Copy: Always retain a copy for your records. Failing to do so can complicate financial tracking and tax reporting.

- Omitting Payment Methods: If your client doesn’t know how to pay, they may delay or avoid payment. Make sure to clearly state the acceptable payment options.

By paying attention to these common mistakes and taking the time to double-check your work, you can maintain accurate, professional, and timely billing, helping to strengthen your business relationships and improve cash flow.

Tips for Making Invoices Look Professional

Creating well-designed billing documents is essential for leaving a positive impression on clients and ensuring clear communication. A professional appearance not only reflects your brand but also fosters trust and promotes prompt payments. Here are several tips to ensure your financial statements look polished and organized, helping you maintain a professional image in your business transactions.

Focus on Clean and Organized Layout

A cluttered or hard-to-read layout can make even the most straightforward billing statement difficult for clients to understand. To avoid this, keep the design simple and clear:

- Use Consistent Fonts: Stick to easy-to-read fonts and sizes. Limit the number of different fonts to maintain a clean look.

- Group Related Information: Organize your details logically, grouping similar information (like products or services) together, to make the document flow better.

- Leave White Space: Adequate spacing between sections and text makes your statement visually appealing and easier to navigate.

Include Essential Branding Elements

Adding your company logo, color scheme, and contact information helps reinforce your brand’s identity. This not only makes your statement more visually appealing but also enhances your business’s recognition and professionalism. Be sure to include:

- Your Business Logo: Place it at the top of the document to immediately showcase your brand.

- Contact Information: Make sure your business’s address, phone number, and email are clearly visible.

- Clear Terms: Include your payment terms and conditions in a prominent place, so your clients know exactly what to expect.

By focusing on a clean layout and integrating branding elements, your billing statements will not only look more professional but also foster trust with your clients, making them more likely to make timely payments and engage with your services again in the future.

What to Do After Sending an Invoice

Once you’ve sent your billing document, the process doesn’t end there. It’s important to follow up and ensure that payment is made promptly. Taking the right steps after dispatching the statement can help you maintain a smooth workflow and reduce the chances of delays or confusion. Here are the best practices to follow once your document is sent.

Track and Monitor Payment Status

After sending your statement, keep track of its status. This includes verifying whether the client has received it and if any payments are pending. Tools that allow you to monitor the payment progress can be helpful. You should:

- Set Reminders: Schedule reminders for yourself to follow up if the due date passes without receiving payment.

- Track the Payment: If you are using a payment system that allows online tracking, regularly check the payment status to see if it has been processed.

Send Payment Reminders if Necessary

If the payment has not been made by the due date, sending a polite reminder is crucial. A friendly yet firm follow-up message can encourage clients to take action without damaging your business relationship. When sending reminders:

- Be Professional: Keep your tone polite and professional, focusing on the terms rather than making it personal.

- Offer Payment Options: Remind clients of the various ways they can settle their balance, in case they’ve missed an option or are experiencing difficulties.

By staying organized and proactive after sending a statement, you can ensure that your business remains on track with minimal disruptions, fostering good client relationships while also securing timely payments.

Invoice Template for Freelancers

For freelancers, having a well-structured document for billing clients is essential to ensure timely payments and maintain a professional image. A clear and concise statement not only helps you track your work and earnings but also provides your clients with all the information they need to process payments efficiently. By using a ready-made layout, freelancers can save time and avoid confusion, creating a smooth financial process for both parties.

A suitable billing document for freelancers should include all the necessary details, such as the description of services rendered, payment terms, and deadlines. Additionally, it should feature sections for client information, the total amount due, and any applicable taxes or discounts. This ensures that your clients know exactly what they’re paying for and can make prompt payments without unnecessary delays.

- Personalized Information: Include your name or business name, contact details, and payment options. This helps your client recognize your brand and know how to contact you for questions.

- Service Descriptions: Be specific about the work you’ve done, with clear breakdowns for each task or project.

- Payment Terms: Clearly state when the payment is due, whether it’s upon receipt or after a certain period. Consider including late fees for overdue payments.

By having a structured billing document that includes all the necessary components, freelancers can present themselves as organized and professional, ensuring that their business operations run smoothly and they are compensated promptly.

How to Organize Your Invoices Effectively

Effective organization of your billing documents is crucial for maintaining smooth business operations. By keeping your financial records well-organized, you can quickly locate past statements, track payments, and reduce the risk of errors. Proper organization also helps ensure timely follow-ups, simplifies tax season, and improves your cash flow management. Below are some strategies to help you keep your records in order and stay on top of your finances.

Use Digital Tools for Easy Access

One of the best ways to keep your billing documents organized is by using digital tools. Cloud-based accounting platforms and apps allow you to store and categorize your records in a way that is easily accessible. Some key benefits include:

- Centralized Storage: Cloud solutions allow you to store all documents in one place, making it easier to find any document you need.

- Automatic Backup: By using online tools, your records are automatically backed up, reducing the risk of data loss.

- Real-Time Updates: Many platforms allow you to update or adjust your documents instantly, ensuring that the latest version is always available.

Implement a Clear Filing System

If you prefer to keep paper copies, organizing them in a clear, logical system is essential. Label folders by client or date, and use subfolders to separate different years or project types. This method makes it easy to track outstanding payments or locate specific transactions when needed.

- Client Folders: Keep separate folders for each client, ensuring that all related documents, such as contracts and statements, are together.

- Chronological Order: Organize by the date of issuance to easily track overdue payments and upcoming due dates.

By using a combination of digital tools and an efficient filing system, you can maintain a well-organized archive of your financial records, making it easier to manage your business’s cash flow and keep track of all transactions.