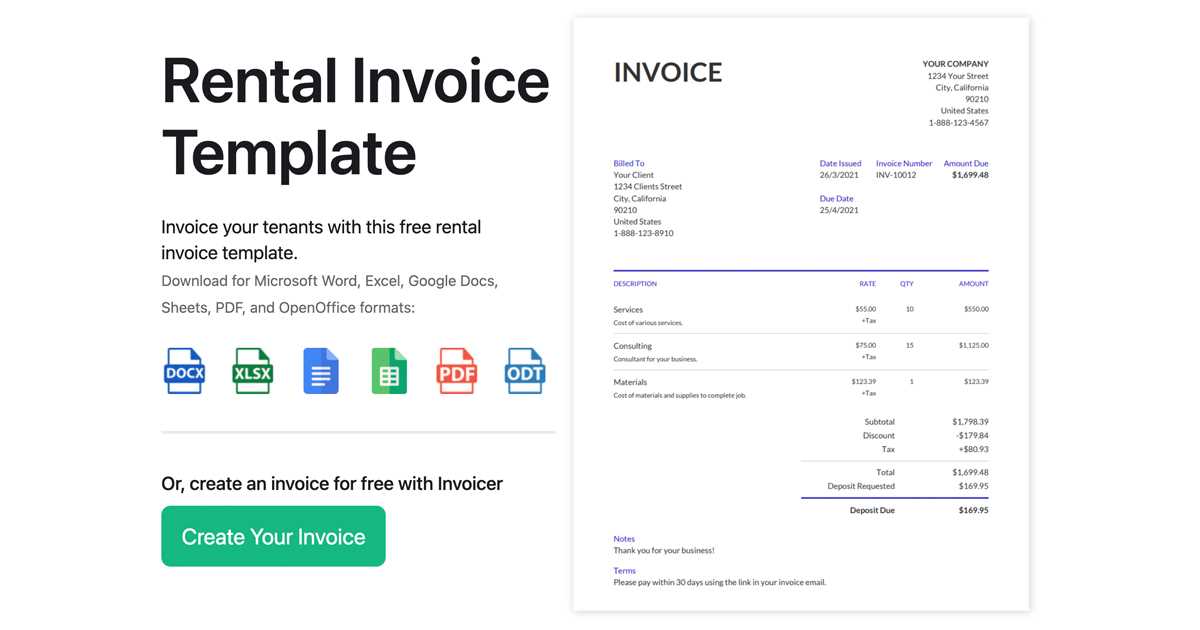

Short Term Rental Invoice Template for Efficient and Professional Billing

In the world of temporary accommodation, managing payments efficiently is crucial for both hosts and guests. One of the most important tasks for any property owner is ensuring that the financial transactions are clear, organized, and professional. A well-designed billing document plays a key role in this process, helping to avoid misunderstandings and providing a record of services rendered.

While creating such a document may seem like a simple task, it involves more than just listing charges. It requires attention to detail, clear itemization of costs, and the inclusion of essential information. Whether you are managing a few properties or a large portfolio, having a reliable system for generating these records is essential for maintaining a smooth operation and building trust with your guests.

In this guide, we will explore the components that make up an effective billing document, how to customize it for your needs, and the advantages of using a pre-designed format. By the end of this article, you will understand how to streamline your payment processes and ensure that your financial documentation is both professional and efficient.

Short Term Rental Invoice Template Guide

When managing temporary accommodations, having a structured document for billing is essential for maintaining clear financial records. This document ensures that both the property owner and the guest are on the same page regarding charges, payment terms, and services provided. It serves as a formal record of the transaction, offering transparency and professionalism to your business operations.

A well-organized billing document can save time, reduce errors, and prevent disputes. It outlines all relevant details such as the amount owed, due dates, and any additional charges or discounts. The goal is to create a clear, easy-to-understand document that makes the payment process smooth for all parties involved.

In this guide, we will walk you through the key elements to include in your billing record, how to customize it to fit your specific needs, and tips for creating one that will impress your clients. Whether you’re new to hosting or have been in the business for years, a solid approach to billing can streamline your workflow and improve your overall guest experience.

What is a Rental Invoice Template?

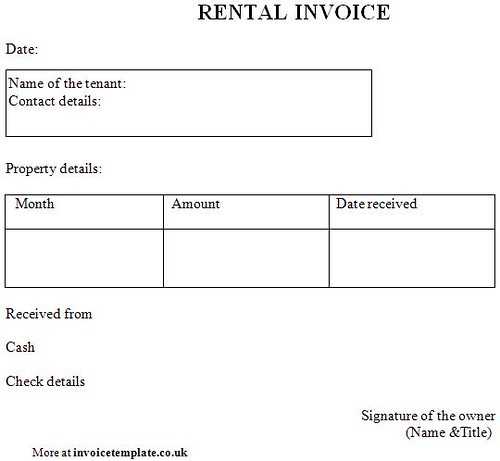

In the context of temporary property leasing, a billing document is a professional way of recording financial transactions between the property owner and the guest. It ensures transparency by listing all relevant charges, payment terms, and the services provided during the stay. This document is often used for tracking payments, providing receipts, and confirming the financial agreement between the two parties.

Key Features of a Billing Document

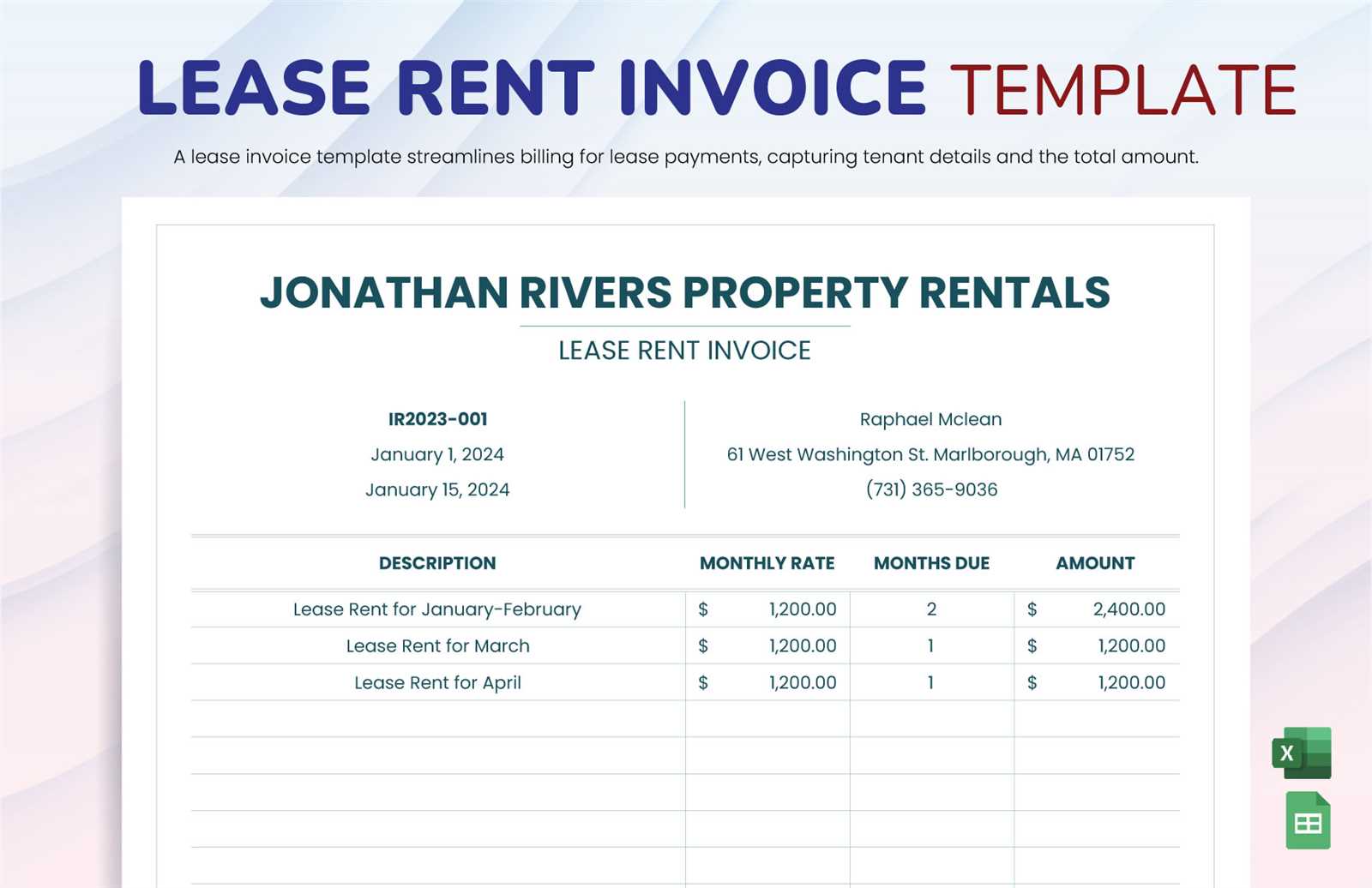

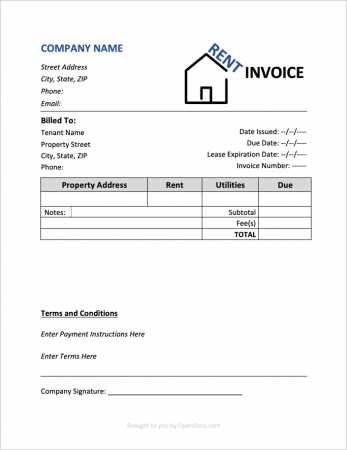

A well-constructed billing record includes essential details like the names of both the host and the guest, the accommodation dates, itemized fees, and the total amount due. It also specifies payment methods, due dates, and any applicable taxes or additional charges. The goal is to provide a clear, organized summary of the transaction that is easy to understand and reference.

Benefits of Using a Structured Billing Record

Using a pre-designed structure for these documents saves time and reduces the risk of mistakes. It allows hosts to quickly generate accurate records for each guest, ensuring consistency across multiple bookings. A structured approach also promotes professionalism, making your business operations look more organized and reliable in the eyes of your clients.

Why Use an Invoice Template for Rentals?

Utilizing a pre-designed billing document simplifies the process of managing financial transactions between hosts and guests. It ensures consistency and accuracy, helping property owners avoid errors while providing a professional and transparent record of all charges. A structured format is especially beneficial for those managing multiple properties or frequent bookings, as it saves time and reduces administrative workload.

Time-Saving and Efficiency

By using a standardized format, hosts can quickly generate accurate billing records without needing to manually create one from scratch for each guest. This eliminates the hassle of formatting and ensures that no important information is overlooked. Whether you’re dealing with a single booking or hundreds, this approach streamlines the financial process.

Professionalism and Trust

Providing a well-organized document builds trust with your guests and portrays your business as professional and reliable. Clear, itemized charges and payment terms reduce the chances of misunderstandings and disputes. A properly formatted document also gives guests a sense of security, knowing that the transaction is being handled transparently and in line with industry standards.

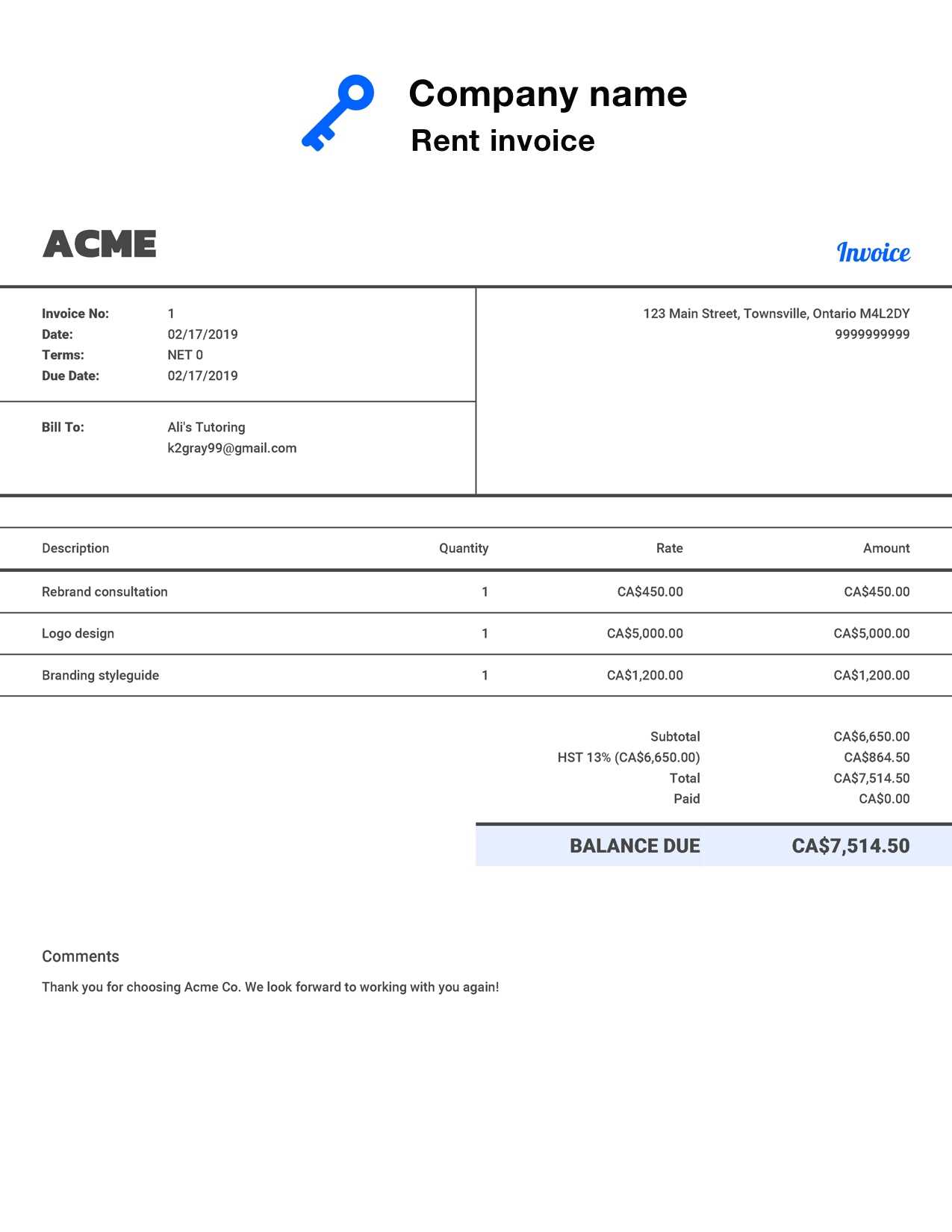

Key Elements of a Rental Invoice

Creating a comprehensive billing document involves including several key pieces of information that ensure clarity and accuracy for both the property owner and the guest. These essential elements help to define the transaction, outline the charges, and set clear expectations regarding payment terms. A well-structured document reduces the potential for misunderstandings and simplifies financial record-keeping.

Basic Information

The first step in any billing document is the inclusion of basic information, such as the names and contact details of both the host and the guest. This section ensures that the document is properly attributed and can be easily referenced in the future. The dates of the stay or service period should also be clearly stated, helping to define the timeframe for which the charges apply.

Itemized Charges and Payment Details

Itemization of charges is crucial for clarity. This includes breaking down all fees, such as accommodation costs, cleaning fees, taxes, and any additional services provided. Each charge should be listed separately, allowing the guest to understand what they are paying for. Additionally, clear payment terms, including the total amount due, payment method, and due date, should be highlighted to avoid confusion.

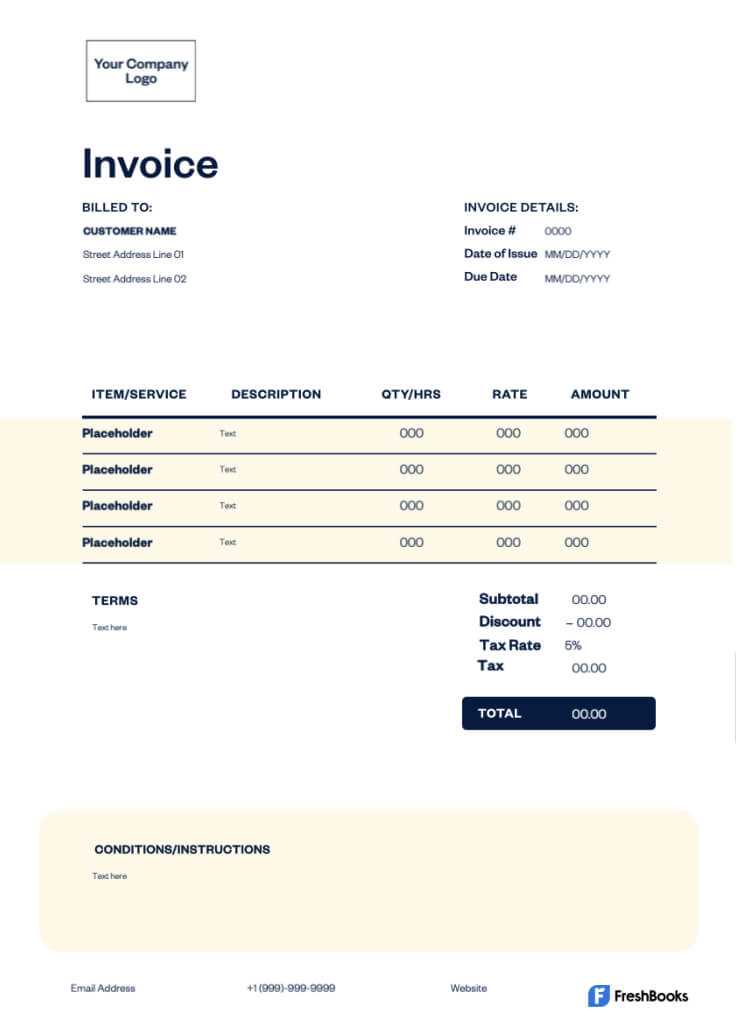

How to Create Your Own Invoice

Creating your own billing document can help you manage payments efficiently and maintain clear records of transactions. A personalized approach to structuring this document lets you address specific needs and details essential to your business interactions. Below are steps to design a professional and effective billing layout.

- Gather Basic Information: Include essential details such as your business name, contact information, and a unique document number for easy tracking.

- Define Client Details: Add the client’s name, contact information, and any additional identifiers relevant to your business relationship.

- Outline Products or Services Provided: Clearly list each product or service, accompanied by a brief description, quantity, and individual rate.

- Summarize Totals and Taxes: Add up the amounts, ensuring to itemize any tax

Benefits of Customizable Invoice Templates

Using adaptable billing formats offers flexibility and efficiency, helping businesses tailor documents to reflect their brand and meet specific needs. This approach enhances organization and ensures that each billing record aligns with the unique requirements of every transaction.

Key Advantages Include:

1. Brand Consistency: Customizable formats allow you to incorporate brand elements, such as logos and colors, creating a professional and cohesive look that reinforces your brand identity.

2. Improved Accuracy: With personalized fields, you can include only the details relevant to your business, reducing unnecessary information and minimizing errors in your billing records.

3. Time Efficiency: Tailored formats streamline the process, making it faster to generate documents that meet both your standards and your clients’ expectations.

4. Flexibility for Various Needs: Different transactions may re

Common Mistakes to Avoid in Invoices

Ensuring your billing documents are clear and accurate is essential for smooth business transactions. However, common errors can lead to misunderstandings, delays in payment, and can impact client trust. Here are some frequent pitfalls to be aware of and tips to prevent them.

1. Missing Essential Details

Common Mistakes to Avoid in Invoices

Ensuring your billing documents are clear and accurate is essential for smooth business transactions. However, common errors can lead to misunderstandings, delays in payment, and can impact client trust. Here are some frequent pitfalls to be aware of and tips to prevent them.

1. Missing Essential Details: Omitting important information, such as contact details, unique document numbers, or due dates, can cause confusion and delay payments. Double-check that all critical data is included.

2. Inaccurate Calculations: Incorrectly adding up totals or taxes can result in billing discrepancies, which may frustrate clients and require extra time to resolve. Ensure all calculations are accurate and verified.

3. Vague Descriptions: Providing unclear or overly general descriptions of products or services can make clients question charges. Use precise and concise descriptions to avoid any misunderstandings.

4. Inconsistent Format: A disorganized or inconsistent layout can appear unprofessional and make it difficult for clients to review the document. Use a structured format that is easy to read and visually organized.

5. Missing Payment Terms: Failing to specify payment methods and due dates may lead to payment delays. Always include clear payment instructions and deadlines to ensure timely transactions.

Avoiding these common mistakes helps make your billing documents more professional and reliable, leading to smoother transactions and improved client satisfaction.

Choosing the Right Invoice Format

Selecting the appropriate format for your billing document is crucial for ensuring clarity, professionalism, and efficiency in financial transactions. A well-organized layout can enhance the overall client experience and make it easier to process payments on time.

There are various options available, from simple designs with basic details to more complex formats that include additional features such as payment terms and tax breakdowns. The format you choose should align with the nature of your business, the type of transactions you handle, and your clients’ preferences.

For example, a straightforward approach may work best for small-scale transactions, while a more detailed structure is ideal for larger or ongoing agreements that involve multiple items or services. Consider whether you need to include space for discounts, late fees, or personalized notes, and select a format that accommodates these elements easily.

Ultimately, the goal is to choose a format that is both functional and aesthetically pleasing, providing a smooth and professional experience for both you and your clients.

How to Send Rental Invoices Professionally

Sending a billing document with professionalism and clarity ensures that payments are processed smoothly and your business is taken seriously. A well-crafted approach to delivering your financial statements not only improves client relations but also enhances your company’s reputation.

1. Use Clear Communication

Ensure your message is polite and direct when sending the billing document. Include a brief note that confirms the amount due, payment methods, and the due date. Always be courteous in your communication to maintain positive client interactions.

2. Choose the Right Delivery Method

Sending your billing statement via email or through a secure online platform is the most efficient method. Email allows for quick delivery and provides a digital record of the transaction. If you choose to send a hard copy, make sure it is well-packaged and promptly mailed to avoid delays.

By following these steps, you can ensure your billing process remains professional, organized, and clear, fostering trust and reliability with your clients.

Invoice Templates for Different Platforms

When managing business transactions across various online platforms, it’s important to adapt your billing documents to the specific requirements of each system. Different platforms may have their own standards, but the goal remains the same: to provide a clear, organized record that facilitates timely payments and professional communication.

1. E-Commerce and Online Marketplaces

For businesses operating on e-commerce platforms, it’s crucial to tailor your billing documents to match the platform’s format and expectations. Most e-commerce platforms allow you to generate customized receipts or statements directly from your account dashboard, but you may still need to ensure that they include all necessary details like item descriptions, quantities, and taxes. Customization options may include logos, color schemes, and personalized payment instructions to match your brand.

2. Freelance and Service-Based Platforms

Freelancers or service-based businesses using platforms like Upwork or Fiverr often rely on automated billing systems that generate documents for each project. However, customizing these documents can help ensure they reflect all relevant details, such as project milestones, hourly rates, or specific service charges. You may also need to adjust payment terms and deadlines based on client agreements.

By adjusting your billing approach for each platform, you ensure that your documents meet both your needs and the platform’s requirements, creating a seamless experience for both you and your clients.

How to Track Payments with Invoices

Tracking payments effectively is crucial for maintaining accurate financial records and ensuring that all transactions are properly settled. By organizing your billing documents with clear references to payment statuses, you can easily monitor outstanding balances and track which payments have been received.

1. Include Payment Status in Billing Records

When creating a billing document, be sure to include a section that clearly indicates whether the payment has been completed, is pending, or overdue. This can help you stay on top of payments and avoid confusion with clients.

2. Use a Payment Tracking Table

One of the best ways to track payments is by using a detailed table that records all payment information in one place. The table should include fields such as the payment date, amount, payment method, and outstanding balance. Below is an example format for tracking payments:

Payment Date Amount Payment Method Payment Status Balance Remaining 01/10/2024 $500 Credit Card Completed $0 15/10/2024 $300 Bank Transfer Pending $300 Legal Requirements for Rental Invoices

Ensuring your billing documents comply with local regulations is crucial for both legal and tax purposes. Properly structured records not only provide transparency in business dealings but also help protect both parties in the event of a dispute. Understanding the mandatory components and guidelines for your region ensures you stay compliant and avoid potential legal issues.

1. Required Information on Billing Documents

In many jurisdictions, there are specific details that must be included on all financial statements. These often include:

- Business Information: The legal name, address, and contact details of the business issuing the document.

- Client Information: The name and address of the recipient of the goods or services.

- Unique Document Number: A reference number for tracking purposes.

- Service or Product Details: Clear descriptions of the items provided, including quantities and prices.

- Tax Information: Any applicable taxes should be listed, with tax rates clearly identified.

2. Compliance with Tax Laws

Depending on your location, you may be required to collect and report taxes on certain transactions. It’s important to verify local tax regulations, including VAT (Value Added Tax), sales tax, or other region-specific charges, to ensure proper compliance. Failure to include the appropriate tax details can result in penalties or fines.

Adhering to these legal requirements helps ensure that your financial documents are valid, reducing the risk of disputes and ensuring a smoother business operation.

Integrating Invoices with Accounting Software

Connecting billing records with accounting software can streamline financial management, reduce manual work, and improve accuracy. Integrating these systems allows for a seamless flow of transaction data, simplifying record-keeping and enabling more efficient tracking of payments, expenses, and cash flow.

- Automatic Data Entry: When linked to accounting software, transaction details can be automatically recorded, eliminating the need for manual data entry and

How to Handle Invoice Disputes

Addressing disagreements over payment records requires a structured and professional approach to ensure a resolution that satisfies both parties. Disputes can arise due to misunderstandings, errors, or differing expectations, so clear communication and prompt action are essential to maintain positive relationships and avoid further complications.

1. Review the Details: Start by carefully examining all aspects of the transaction, including services provided, pricing, and terms. Verify that the information is accurate and consistent with what was agreed upon, as mistakes in documentation are a common cause of misunderstandings.

2. Communicate with the Client: Reach out to the client in a respectful manner to understand their concerns. Listening to their perspective can help clarify the issue and provide insights into how it can be

Free vs Paid Invoice Templates

When it comes to creating billing documents, individuals and businesses often face the choice between no-cost and premium options. Each category has its advantages and drawbacks, making it essential to evaluate your specific needs before deciding which route to take.

Advantages of Free Options

Free solutions provide an accessible way for users to get started without any financial commitment. These documents typically offer basic functionalities and can be easily customized to fit the user’s requirements. They are ideal for small operations or those just beginning their journey in managing financial transactions.

Benefits of Paid Solutions

On the other hand, premium offerings often come with advanced features, enhanced customization, and superior customer support. Investing in a paid option can lead to time savings and increased professionalism, which may result in improved cash flow and client satisfaction. Users can benefit from additional tools that help streamline the overall billing process, making it a worthwhile consideration for growing businesses.

Ultimately, the decision between free and paid options depends on individual circumstances, budget constraints, and the level of functionality required.

Best Practices for Rental Billing

Managing billing effectively is key to maintaining a smooth cash flow and fostering good relationships with clients. Adopting best practices in this area can help ensure transparency, reduce disputes, and streamline the payment process. The following guidelines will help you manage your financial transactions efficiently and professionally.

1. Be Clear and Detailed

Providing clear, concise, and detailed information is essential for both you and the client. Each document should include all relevant details such as dates, services provided, amounts due, and payment terms. Avoiding ambiguity can prevent misunderstandings and disputes down the line.

2. Set Clear Payment Terms

Establishing and communicating payment terms upfront is vital to avoiding confusion. Make sure your clients know the payment deadlines, accepted methods of payment, and any penalties for late payments. By setting clear expectations from the beginning, you can encourage timely payments and reduce the chances of overdue amounts.

3. Send Reminders Promptly

Sending friendly payment reminders as deadlines approach can help ensure payments are made on time. Timely follow-ups can encourage clients to settle any outstanding amounts quickly, maintaining good financial practices and preventing overdue accounts.

By following these best practices, you can ensure smooth financial operations and maintain positive relationships with clients throughout your business dealings.