Short Invoice Template for Quick and Easy Billing

In the world of business, efficiency is key. Having a streamlined method to request payments from clients is crucial for maintaining a smooth cash flow and a professional image. Many entrepreneurs, freelancers, and small business owners prefer using simplified documents to outline charges and payment details. These concise documents allow for quick and clear communication, reducing the chances of errors or confusion.

Using a straightforward format to request payments not only saves time but also ensures that clients understand exactly what services or products are being billed for. With fewer details to manage, this approach helps to keep the focus on the essentials–such as the total amount due and the payment deadline. Whether you’re just starting your business or looking to improve your current process, a minimalist payment request system can make a big difference in the way you handle transactions.

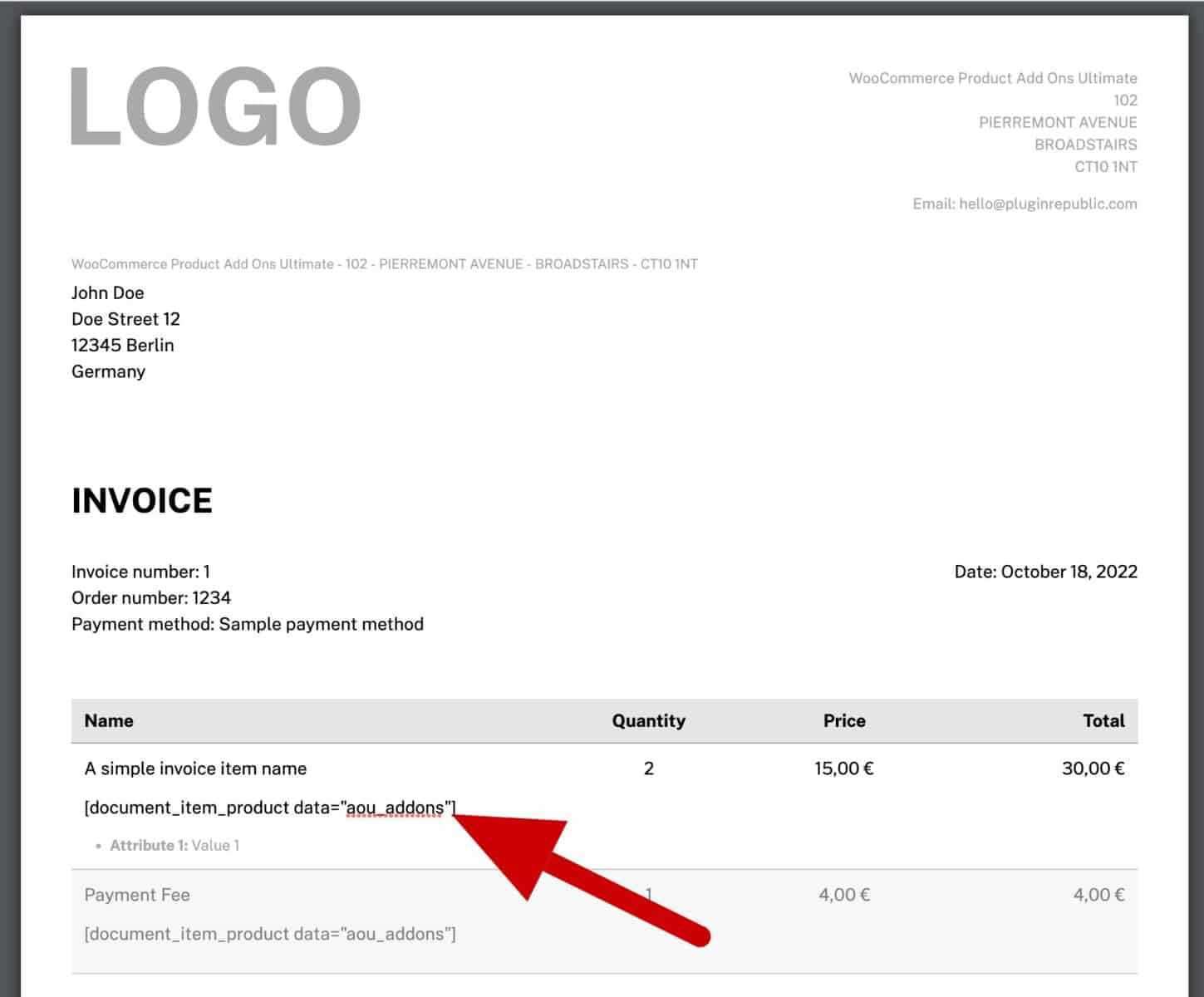

Customizing your own request form to meet specific needs is easy, and there are various tools available to help create professional-looking documents with minimal effort. From online services to downloadable formats, these documents are highly adaptable to different industries and payment requirements.

In this article, we’ll explore how you can create an effective payment request document that suits your business, and the benefits of using these simplified formats for managing finances efficiently.

Short Invoice Template Overview

In business transactions, clear and concise communication is essential. When requesting payment for services rendered or products delivered, using a simplified document helps both parties stay on the same page. A well-organized form that highlights the most important details of the transaction can significantly improve the billing process, saving time and reducing misunderstandings.

Key Features of a Simplified Payment Request

A minimalist payment request typically includes basic information such as the amount due, a brief description of the service or product, payment due date, and payment instructions. This approach focuses on clarity, offering clients just the essential details they need to process the payment quickly. By cutting out unnecessary sections, the request becomes more direct and easier to read.

Why This Approach Works

Opting for a simple design over a complex one can enhance professionalism and make the transaction process smoother for both parties. It allows you to maintain a polished image while ensuring that clients can easily navigate the document and promptly respond. The flexibility of a straightforward format also means it can be tailored to various industries and business sizes without much effort.

Using these types of documents can help streamline your accounting and administrative tasks, while also keeping your interactions with clients transparent and efficient. With a variety of customizable options available, creating a document that meets your business’s needs is easier than ever.

Why Use a Simple Billing Document

When it comes to requesting payments, simplicity often leads to greater efficiency. A streamlined document that includes only the essential details not only saves time but also minimizes confusion. By focusing on the most important aspects, such as the total amount due and the payment deadline, businesses can ensure a smooth and professional transaction process, with minimal effort from both parties.

Time-Saving Efficiency

Using a minimalistic format speeds up the process of creating and sending out payment requests. The less time spent on formatting and unnecessary details, the more time you have to focus on growing your business. A straightforward document reduces the chances of human error and ensures that all relevant information is presented clearly and concisely.

Improved Client Experience

A clean and simple document creates a better experience for your clients. They can quickly understand what is being billed, without having to sift through unnecessary information. This clarity fosters trust and makes it easier for clients to process payments on time. The less time they spend figuring out the details, the more likely they are to pay promptly.

Incorporating this approach into your business helps maintain a professional image, reduces administrative workload, and ensures that your clients can easily fulfill their financial obligations. With a variety of tools available to create such documents, there’s no reason not to streamline your billing process today.

Benefits of Simplified Billing Documents

Using a more streamlined approach to requesting payments offers several advantages that help businesses save time, reduce errors, and improve client satisfaction. By eliminating unnecessary details and focusing on the essentials, a simplified payment request allows for quicker processing and clearer communication, benefiting both the sender and the recipient.

Efficiency and Time Savings

One of the main advantages of simplifying your payment requests is the time saved in both creation and processing. With fewer elements to manage, you can quickly generate the necessary documents and send them to clients without delays. This reduction in complexity also allows for:

- Faster document preparation: Less time spent on design and formatting.

- Quick client understanding: Clients can immediately grasp the key details of the request, leading to faster payment processing.

- Reduced administrative burden: Less paperwork and fewer back-and-forth communications to clarify charges.

Improved Accuracy and Clarity

When payment requests are overly detailed or complex, there’s a greater chance of errors. By focusing on essential information only, you minimize the risk of mistakes that can lead to confusion or delayed payments. Key benefits include:

- Fewer chances for errors: With a clear, straightforward format, important details are less likely to be overlooked.

- Clear communication: Clients can easily understand the charges, reducing questions or disputes.

- Streamlined workflow: Both parties can process the request without unnecessary back-and-forth.

Incorporating this simplified approach into your business operations can increase efficiency, improve client relations, and reduce the time spent managing accounts. A clear and concise document can go a long way in maintaining a professional reputation and ensuring timely payments.

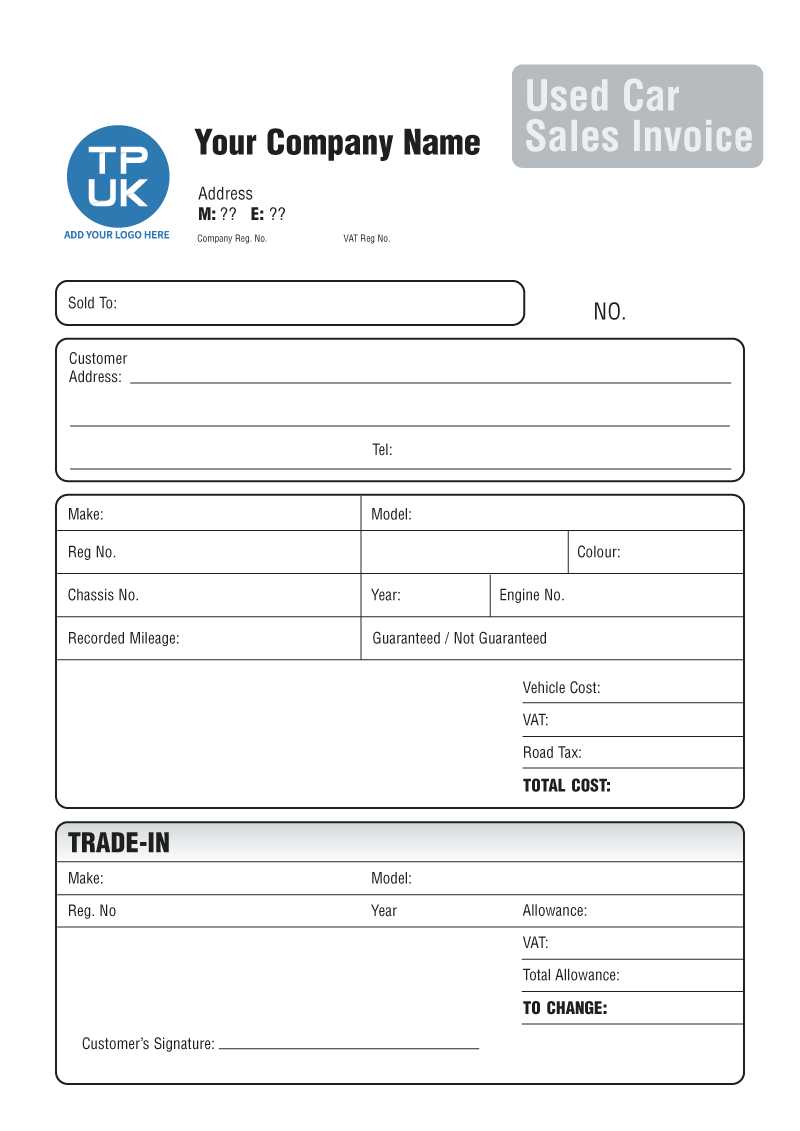

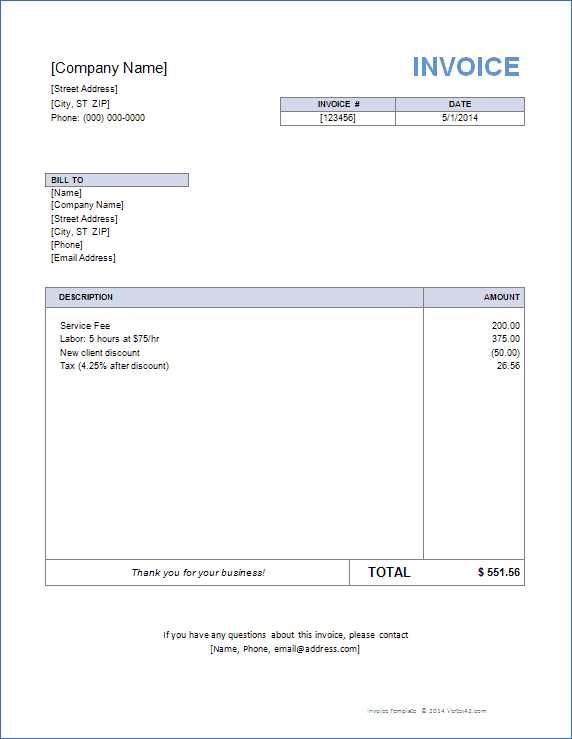

Key Components of a Simple Billing Document

When creating a document to request payment, it’s important to include only the essential details that allow the recipient to understand the charges and process the payment quickly. By focusing on the core elements, you ensure that the request is clear and straightforward, reducing the chances of confusion or delays.

Essential Elements for Clarity

A well-structured billing document should highlight the key information that both parties need to complete the transaction. The following elements are crucial for maintaining transparency and ensuring an efficient process:

- Business Information: Include the name, address, and contact details of the company or individual requesting payment.

- Client Information: Clearly state the name and contact details of the recipient to avoid any misunderstandings.

- Payment Due Date: Clearly specify the date by which payment must be made to avoid any confusion about deadlines.

- Amount Due: State the exact amount owed, including any applicable taxes or fees. Be specific to avoid ambiguity.

- Description of Goods/Services: Provide a brief, clear description of the product or service provided, making it easy for the recipient to recognize the charge.

- Payment Instructions: Include clear information about how the recipient can make the payment, such as bank details or online payment links.

Additional Features for Professionalism

While the essential elements are necessary for every payment request, certain optional features can enhance the professional appearance of the document and make the transaction smoother:

- Invoice Number: Including a unique reference number helps track payments and provides easy reference for both parties.

- Terms and Conditions: If applicable, include any terms regarding late fees, payment plans, or other important information.

- Notes or Special Instructions: Any additional comments or specific requests, such as a thank-you note, can help build client relationships.

Focusing on these key components ensures that the pa

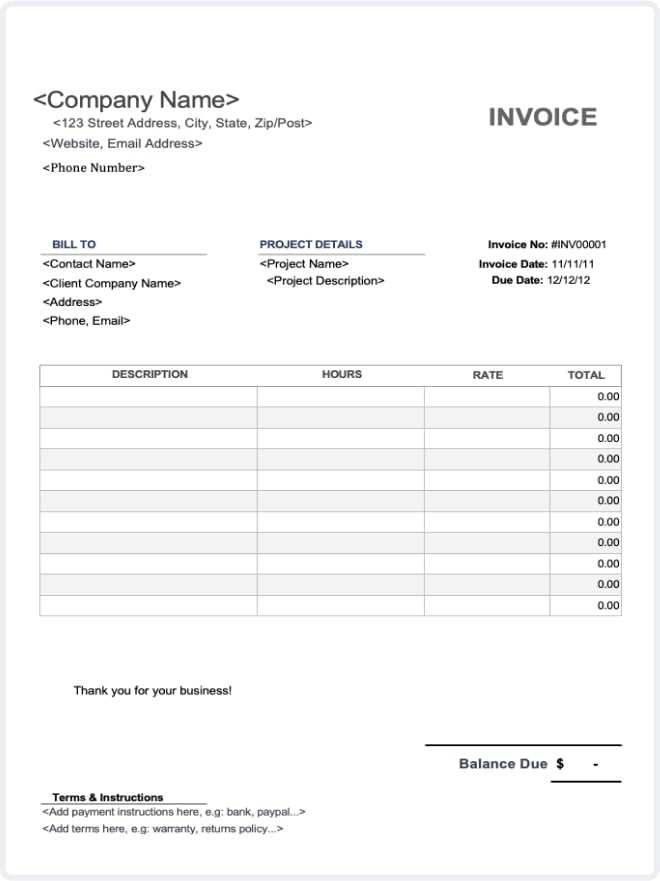

How to Create Your Own Payment Request

Creating a clear and professional document to request payment doesn’t have to be complicated. By following a few simple steps, you can easily generate a document that includes all the necessary information, ensuring smooth transactions with your clients. Whether you’re using a digital tool or doing it manually, the process remains straightforward and efficient.

Step 1: Gather Essential Information

The first step is to collect all the details you’ll need for the document. This includes both your business information and that of your client. Make sure you have the following:

- Your Business Details: Name, address, phone number, and email.

- Client Information: The client’s name, address, and contact details.

- Payment Amount: Be sure to specify the total amount due, including any taxes or fees.

- Description of Goods or Services: Briefly outline what the payment is for to ensure clarity.

- Payment Instructions: Provide clear details on how the client can pay (bank details, payment link, etc.).

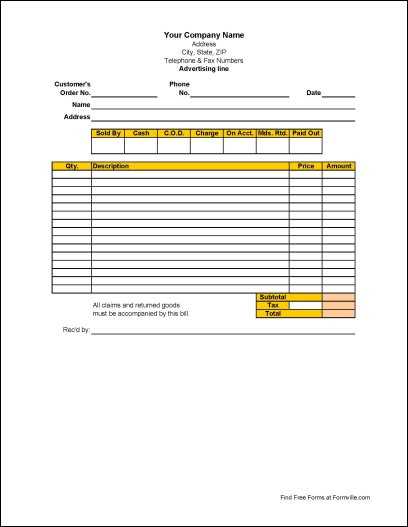

Step 2: Choose a Format and Add the Information

Once you’ve gathered all the necessary details, you can begin creating the document. Choose a format that works best for you–whether it’s a word processor, a spreadsheet, or an online tool. Start by adding the following sections:

- Header: Include your business name and the title of the document, such as “Payment Request” or “Receipt of Services.”

- Client and Business Information: Make sure the recipient’s details are clearly listed along with your own.

- Itemized Charges: List each item or service, the rate, and the total cost.

- Payment Terms: Include the due date and any late fee details if applicable.

- Final Amount Due: Ensure the total is clearly stated at the end of the document.

Once the document is complete, review it to ensure that all information is accurate and clear. This will minimize confusion and help ensure timely pa

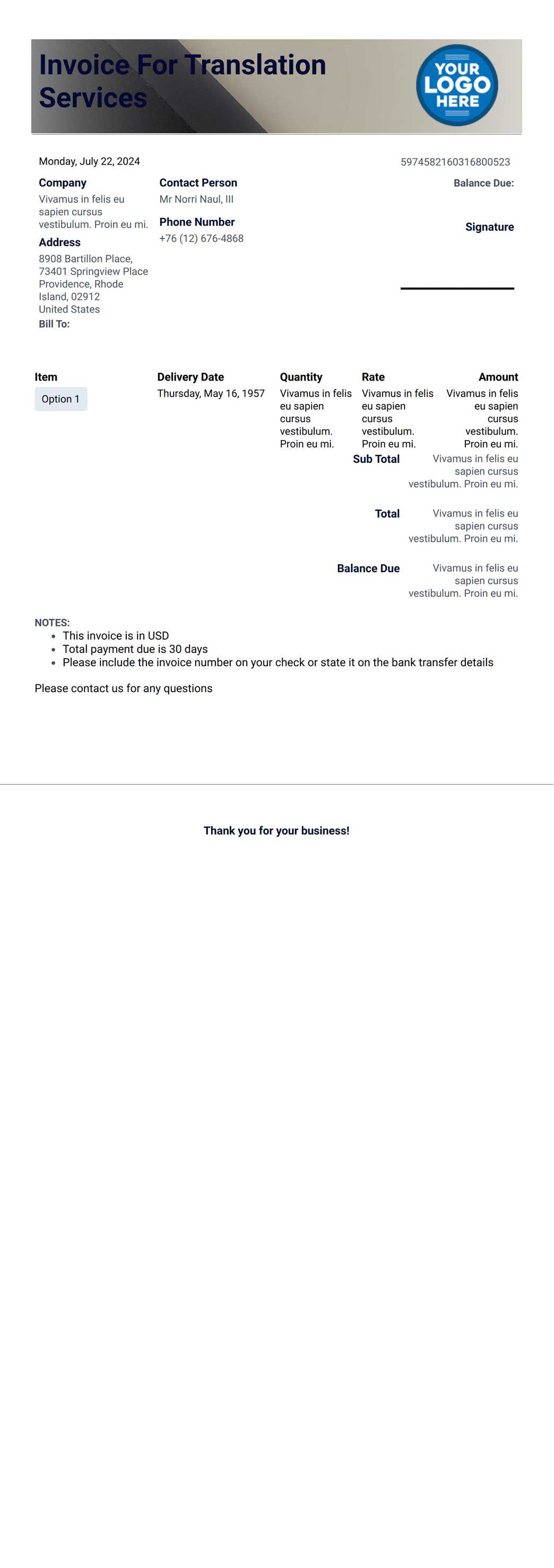

Top Software for Billing Document Creation

In today’s digital age, creating professional payment requests is easier than ever with the help of specialized software. These tools allow you to quickly generate documents that are both visually appealing and easy to understand. Whether you’re a freelancer, a small business owner, or part of a larger organization, using the right software can streamline your billing process and ensure accuracy in every transaction.

1. FreshBooks

FreshBooks is a popular choice among small business owners and freelancers. It offers an intuitive interface that allows you to create and send professional payment requests in minutes. With customizable fields, you can easily add details like item descriptions, taxes, and payment terms. FreshBooks also integrates with various payment platforms, making it simple for clients to pay directly from the document.

2. QuickBooks Online

QuickBooks Online is a comprehensive accounting solution that also excels in generating detailed billing requests. It allows you to create and customize invoices, track payments, and manage your finances all in one platform. The software is particularly helpful for businesses that need to stay on top of their accounting, offering features like automatic reminders for overdue payments and tax calculations.

3. Zoho Invoice

Zoho Invoice is a cloud-based tool that offers a wide range of customization options for creating payment documents. You can choose from various pre-built designs or create your own from scratch. The software supports recurring invoices, multi-currency transactions, and integrates with popular payment gateways. Zoho Invoice is ideal for businesses that need to manage clients across different countries.

4. Wave Accounting

Wave Accounting is a free solution for small businesses looking to create professional billing requests. Despite being a free tool, Wave offers a robust set of features, including customizable designs, automatic tax calculations, and the ability to accept online payments. Its simple interface makes it an excellent choice for users who want a quick, no-frills solution for their billing needs.

5. Invoicely

Invoicely provides a flexible platform for creating payment requests and tracking expenses. The software supports multiple languages and currencies, making it a good option for international businesses. Invoicely offers both free and premium plans, with the premium plans adding features like automatic payment reminders and the ability to create quotes and estimates.

Choosing the right tool depends on your business size, invoicing frequency, and specific needs. By selecting software that aligns with your workflow, you can streamline your bill

Choosing the Right Format for Payment Requests

Selecting the right structure for your payment documents is key to ensuring that the information is clear, professional, and easy for your clients to understand. The format you choose can affect how quickly payments are processed and how well your communication is received. Whether you’re opting for a simple design or a more detailed breakdown, it’s important to consider the needs of your business and your clients when making this decision.

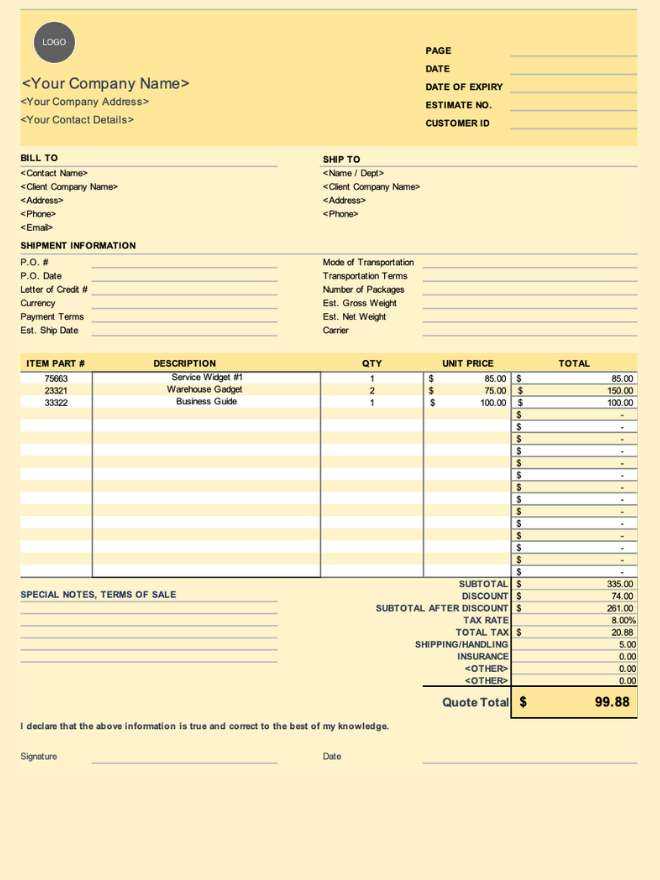

Simple vs. Detailed Formats

Depending on the complexity of the services or products you provide, you may need to decide between a simple or more detailed format. For smaller transactions or ongoing services, a minimalist format might be sufficient. This would include only the essential elements, such as the total amount due and a brief description of the work provided. On the other hand, more complex transactions or one-off projects might require a more detailed approach, which includes an itemized breakdown of services, quantities, and individual costs.

Digital vs. Paper Formats

Another consideration is whether you will create digital or printed documents. Digital formats, such as PDFs or documents generated through accounting software, are convenient for quick delivery via email and are often preferred for their ease of tracking and storage. However, in some industries or client relationships, printed formats may still be necessary, particularly if your client prefers hard copies or if the work involves formal contracts.

Ultimately, the format you choose should align with both your business needs and the expectations of your clients. A clear, professional-looking document will facilitate smoother transactions and enhance your business’s credibility.

Customizing Payment Request Documents

Personalizing your payment request documents can make a significant difference in how professional and unique your communication appears. Customization allows you to tailor the design and content to suit your business needs, making the document not only functional but also a reflection of your brand. With a few simple adjustments, you can create a document that aligns with your company’s identity and ensures clarity for your clients.

Adjusting the Layout and Design

The first step in customization is selecting a layout that best fits your business. Most digital tools allow you to choose from various designs, ranging from minimalistic to more detailed templates. You can modify the fonts, colors, and logos to match your branding. For example, adding your business logo at the top of the document can give it a professional touch, while adjusting font sizes and styles ensures readability and emphasis on key details.

Including Specific Business Information

In addition to design, it’s essential to customize the content to reflect the unique needs of your business. This includes:

- Business Name and Contact Info: Ensure that your company name, address, phone number, and email are clearly displayed.

- Payment Terms: Specify any special payment terms, such as discounts for early payments or penalties for late ones.

- Personalized Messages: Adding a thank-you note or a custom message can enhance your client relationships.

By customizing these elements, you make the document both functional and aligned with your business’s goals. Personalization not only adds a professional touch but also helps build trust with your clients, making them feel more confident in your services and their transactions.

How to Add Payment Terms

Including clear and specific payment terms in your billing documents is essential for managing expectations and ensuring timely payments. These terms outline when the payment is due, any discounts for early payment, and the penalties for late payments. Properly stating these conditions can prevent misunderstandings and help maintain a smooth business relationship with your clients.

Key Elements of Payment Terms

Payment terms typically cover the following details:

- Due Date: The date by which the client must pay the amount owed.

- Late Fees: The penalties that will be applied if payment is not received on time.

- Early Payment Discounts: Discounts offered to clients who pay before the due date.

- Accepted Payment Methods: Specify the ways in which the client can make the payment (bank transfer, online payment, cheque, etc.).

How to Format Payment Terms in Your Document

Once you’ve decided on the terms, it’s important to present them clearly in your billing request. Here’s an example of how to structure these terms:

| Payment Terms | Details | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Due Date | 30 days from the date of issue | ||||||||||||

| Late Fee | 2% per month after the due d

Common Mistakes in Billing Documents

Even with a simple and clear design, billing documents can sometimes lead to confusion or delayed payments if certain details are overlooked. These common errors can cause unnecessary back-and-forth with clients and slow down the payment process. Identifying and addressing these mistakes upfront can help ensure that your documents are both effective and professional. Missing or Incorrect Contact InformationOne of the most common mistakes is failing to include accurate or complete contact information. Without your business’s full address, phone number, or email, clients may struggle to get in touch with you for any questions or concerns. Additionally, if the client’s contact details are missing or incorrect, it can lead to misunderstandings or delayed payments. Always double-check that both your and your client’s information are up-to-date and correctly listed. Unclear Payment TermsAnother frequent issue arises when payment terms are not clearly outlined. This includes the absence of a due date, unclear late fees, or not specifying accepted payment methods. If a client is unsure about when and how to pay, they may delay the transaction or avoid paying altogether. It’s important to clearly state the payment due date, any penalties for late payments, and preferred payment methods to avoid confusion. By being mindful of these common mistakes, you can create more effective billing documents that promote timely payments and foster positive relationships with your clients. Ensuring clarity and accuracy in every detail will help you maintain a professional Simple Billing Document for FreelancersFor freelancers, creating a clear and professional payment request is essential for ensuring timely payments and maintaining a strong client relationship. A well-structured payment request not only helps you get paid on time but also reinforces your professionalism. Whether you’re offering design services, writing, or consulting, having a standardized yet flexible document can make the process smoother for both you and your client. Key Sections in a Freelancer’s Payment Request

While freelancers often work on a variety of projects, there are a few key components that should always be included in your billing document to ensure clarity:

Tips for Freelancers Creating Billing DocumentsTo make your payment requests as efficient and professional as possible, keep these tips in mind:

|