Service Invoice Template for Professional Billing

Efficiently managing financial transactions is essential for businesses of all sizes. Proper documentation ensures clear communication between service providers and clients while maintaining professionalism. Customizing these documents can streamline the process and reduce errors, making billing smoother for both parties.

Understanding the key elements of these documents helps you create accurate records that cover all necessary details, such as amounts, services rendered, and payment terms. Having a ready-made structure can save time and reduce the chances of missing crucial information.

Whether you’re a freelancer, small business owner, or part of a larger company, learning how to create effective billing forms can lead to more organized and professional transactions. With the right approach, you’ll find that handling payments becomes a seamless part of your workflow.

Understanding Service Invoice Templates

Efficient documentation for transactions is essential for businesses to ensure clarity in financial exchanges. These documents not only help keep track of the services provided but also serve as a formal request for payment. Having a clear and professional structure can prevent confusion and ensure smooth business operations.

Essential Components of a Billing Document

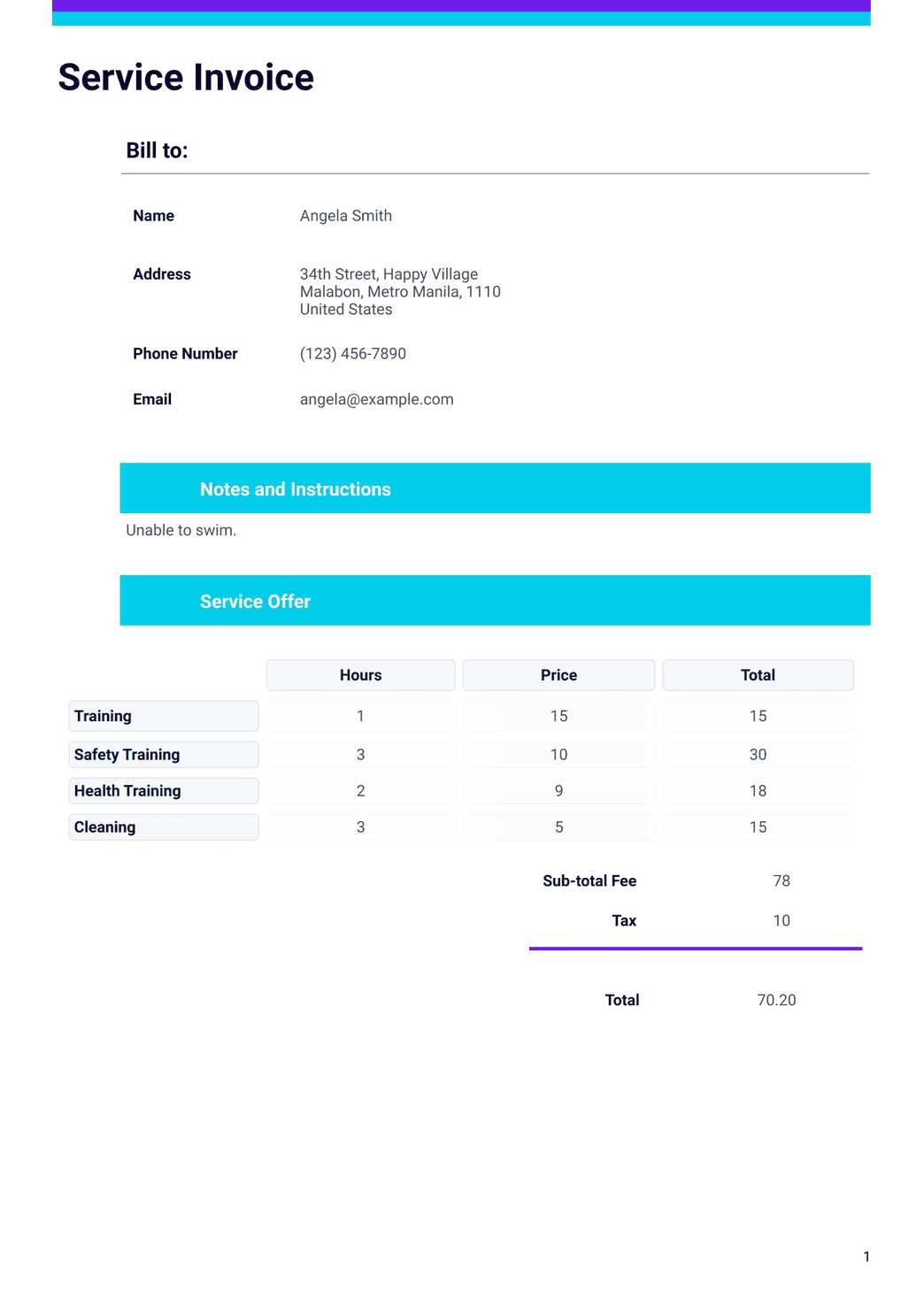

Each record should include key details such as the recipient’s contact information, a breakdown of charges, the date of service, and terms for payment. These elements help both parties stay informed and can act as a reference for any future questions or disputes.

Benefits of Using a Pre-Formatted Structure

Utilizing a pre-designed structure simplifies the creation of financial documents. It saves time, ensures all necessary information is included, and minimizes the risk of missing important details. Customizable formats can be adjusted to fit the unique needs of any business while maintaining consistency across all transactions.

Why Use a Service Invoice Template

Having a standardized document for billing purposes offers significant advantages for both businesses and clients. It ensures consistency, reduces errors, and saves time in the financial process. By using a well-structured format, you can quickly create accurate records that meet professional standards.

A pre-structured format helps avoid missing crucial details such as amounts, payment deadlines, and service descriptions. It also fosters trust and professionalism, as clients are more likely to respond positively to clearly organized and detailed requests for payment. Additionally, using such a framework makes it easier to track transactions and maintain a clear financial record for accounting purposes.

Key Features of Service Invoices

Properly structured financial documents contain essential elements that help ensure accuracy and clarity. These features not only make the document complete but also help both parties understand the terms of payment and the details of the transaction. When these components are included, the process becomes more efficient and professional.

| Feature | Description |

|---|---|

| Contact Information | Includes the names, addresses, and contact details of both the provider and recipient. |

| Service Description | A clear breakdown of the services or products provided, with relevant details. |

| Payment Terms | Specifies the payment amount, due date, and accepted methods of payment. |

| Unique Number | A unique reference number helps track the document for future reference and accounting. |

| Date of Issue | The date the document was created to establish when the request for payment was made. |

How to Customize Your Invoice

Customizing your billing document allows you to tailor it to the specific needs of your business and clients. Personalizing the layout and content can help present a professional appearance while ensuring all necessary information is included. The following steps outline how to adjust your document to fit your unique requirements.

- Choose a Layout: Select a format that suits your style and is easy to read, with sections clearly separated for each type of information.

- Include Your Branding: Add your logo, business name, and color scheme to maintain a consistent brand identity.

- Adjust the Contact Information: Ensure that both your and your client’s contact details are clearly visible, and include email addresses for easy communication.

- Specify Payment Terms: Clearly state the due date, any discounts, and penalties for late payments to avoid confusion.

- Detail Services Provided: List each service or product provided, with a brief description, the quantity, and the price for transparency.

By customizing these elements, you can create a document that not only meets legal requirements but also helps maintain a professional relationship with your clients.

Benefits of Digital Service Invoices

Digital billing documents offer numerous advantages over traditional paper-based methods. By switching to electronic formats, businesses can save time, reduce errors, and improve overall efficiency. Here are some of the key benefits of using digital records for financial transactions.

- Faster Processing: Digital documents can be created, sent, and processed much more quickly than paper versions, allowing for faster payments.

- Cost-Effective: Eliminating the need for paper, ink, and postage reduces operational costs over time.

- Environmentally Friendly: By going paperless, you contribute to sustainability efforts and reduce waste.

- Easy to Track: Digital documents can be easily stored, searched, and retrieved, helping with record-keeping and audits.

- Reduced Errors: Automated calculations and pre-filled data reduce the chances of human error, ensuring accuracy.

- Improved Client Experience: Clients appreciate the convenience of receiving electronic documents, which can be paid quickly and securely online.

Switching to digital billing can streamline business operations, improve client satisfaction, and help businesses stay ahead in an increasingly digital world.

Common Mistakes to Avoid in Invoicing

When creating billing documents, it’s important to be mindful of common errors that can lead to confusion or delays in payment. Even small mistakes can create issues for both businesses and clients, affecting cash flow and professional relationships. Here are some of the most frequent mistakes to avoid when preparing your financial records.

- Missing or Incorrect Contact Information: Always double-check that both your and the client’s contact details are accurate and complete.

- Failure to Include Clear Payment Terms: Specify the due date, any discounts, and penalties for late payments to avoid misunderstandings.

- Unclear Descriptions: Be precise in describing the products or services provided, including quantities and prices to ensure transparency.

- Not Using Unique Reference Numbers: Each document should have a unique identifier for easy tracking and future reference.

- Forgetting to Double-Check Calculations: Ensure all amounts are calculated correctly and reviewed before sending the document.

- Not Sending in a Timely Manner: Delaying the submission of a billing document can cause payment delays and disrupt cash flow.

- Failure to Track Sent Documents: Keep a record of all sent documents to monitor their status and follow up if necessary.

Avoiding these errors can help maintain professionalism and streamline the payment process, ensuring that your business operations run smoothly.

Essential Information for Service Invoices

To ensure clarity and avoid any confusion, it’s crucial to include all the necessary details in your billing documents. Providing comprehensive and accurate information helps establish trust with clients and ensures smooth transactions. The following elements should be included in every document to make it complete and professional.

- Business Details: Include your company name, address, and contact information to make it easy for clients to reach you.

- Client Information: List the client’s name, company (if applicable), and their contact details for accurate record-keeping.

- Document Number: Use a unique reference number for each document to help both parties track and manage transactions.

- Detailed Description of Work: Include a clear and concise description of the products or services provided, including quantity and unit price.

- Total Amount Due: Ensure the final amount is clearly stated, along with any applicable taxes, discounts, or additional fees.

- Payment Terms: Clearly specify the due date, accepted payment methods, and any late payment penalties.

- Invoice Date: Include the date the document is issued to help track payment schedules.

Including all of these details not only ensures a smooth transaction process but also helps avoid disputes and delays in payment.

How to Track Payments Efficiently

Tracking payments is an essential part of managing your business’s financial health. By keeping accurate records of all transactions, you can ensure timely collections, avoid errors, and maintain a steady cash flow. Here are some effective strategies to monitor and track payments efficiently.

Utilize Payment Management Software

Investing in a reliable payment tracking system can simplify the process of managing your financial transactions. Many software tools provide automatic updates, reminders, and reporting features to help you stay organized.

- Automated Reminders: Set up automated payment reminders for clients to reduce the chances of missed payments.

- Real-Time Updates: Track payments as they are made to ensure your records are always up to date.

- Detailed Reporting: Generate reports to analyze your cash flow and assess any outstanding payments.

Manual Tracking Methods

For smaller businesses, manual tracking can still be effective. Using spreadsheets or a simple ledger allows you to keep an eye on payments without investing in complex software.

- Spreadsheet Tracking: Create a spreadsheet to record each payment’s date, amount, and status. This helps identify overdue accounts.

- Payment Logs: Maintain a physical or digital logbook where you can track payments as they come in.

Whether using digital tools or manual methods, consistent tracking ensures that payments are recorded promptly, helping to prevent delays and maintain financial stability.

Using Invoice Templates for Freelancers

For freelancers, having a streamlined way to request payment from clients is essential for maintaining a professional image and ensuring smooth financial operations. A well-organized billing document can save time, reduce errors, and ensure that all necessary details are included. Here’s how using pre-designed forms can benefit freelancers.

- Consistency: Using a standard form for each project ensures uniformity in the information you provide, making your requests for payment look professional and organized.

- Time-Saving: Instead of creating a new document from scratch each time, you can simply fill in the required details and send it quickly, saving valuable time.

- Easy Customization: Pre-made forms are often customizable, allowing freelancers to add their specific branding, payment terms, and relevant information.

- Error Reduction: With a predefined structure, the chances of omitting critical information are minimized, reducing mistakes and confusion with clients.

- Client Trust: A well-structured payment request reinforces your professionalism and builds trust with clients, making them more likely to pay on time.

By using ready-made forms, freelancers can ensure that their payment requests are consistent, clear, and efficient, allowing them to focus more on their work and less on administrative tasks.

Creating an Invoice from Scratch

When you’re managing your own business or freelancing, sometimes it’s necessary to create a payment request from the ground up. This process involves including all the essential details that ensure clarity and professionalism in your financial transactions. Below are the key steps to follow when drafting your own billing document.

Include Key Details

To create a comprehensive and clear document, include the following essential elements:

- Header Information: Your business or personal details, including name, address, and contact information.

- Client Information: Include the name, address, and any relevant contact details of the client.

- Unique Identifier: Assign a unique number or code for tracking the document.

- Description of Work: Clearly outline the services or products provided, including dates and any specific terms.

- Amount Due: Specify the total amount, breaking down the charges if necessary.

- Payment Terms: Include details on due dates, late fees, and acceptable methods of payment.

Ensure Professional Formatting

The layout of your document is just as important as the content. Keep the structure clean and easy to follow to present a polished and organized look. Use clear headings, appropriate spacing, and easy-to-read fonts. This helps clients navigate through the payment details with ease.

By following these steps, you can create a well-organized document that serves its purpose efficiently and fosters trust between you and your clients.

Free vs Paid Invoice Template Options

When it comes to creating professional billing documents, there are numerous options available, each with its own set of advantages. The decision between using a free option or investing in a paid solution depends on various factors such as customization, features, and the level of support needed. Below is a comparison of both choices to help you determine which best suits your needs.

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Limited; may require manual adjustments | High; allows full customization and branding |

| Design | Basic, often with fewer layout choices | Advanced, professional design options |

| Support | Minimal or no customer support | Priority support and customer service |

| Updates | Occasional updates, if any | Regular updates with new features |

| Cost | Free | Subscription or one-time payment required |

While free options might be suitable for small businesses or individuals with simple needs, paid solutions offer greater flexibility, design options, and long-term benefits for those looking for a more professional and efficient approach. Choose the option that aligns with your business size, budget, and specific requirements.

How to Add Taxes and Fees

When creating billing documents, it’s crucial to include all relevant taxes and fees to ensure that your totals are accurate and comply with regulations. These additional charges are important for both legal compliance and transparency with your clients. Here are the key steps to include them effectively:

- Identify Applicable Taxes: Research the specific tax rates that apply to your product or service in your location or the client’s jurisdiction. Different regions may have varying tax laws.

- Calculate Taxes Correctly: Ensure that taxes are calculated on the right amount (usually the subtotal), and apply the correct rate based on local tax regulations.

- Include Additional Fees: If you are charging extra fees, such as delivery or handling charges, ensure that they are clearly listed separately from the product or service total.

- Itemize Charges: Provide a breakdown of all taxes and fees to make it clear to your client how the total was calculated. This improves transparency and avoids confusion.

- Review and Adjust: Double-check all the calculations before finalizing the document. A mistake in tax rates or fees could lead to problems or disputes.

By following these guidelines, you can ensure that all necessary taxes and additional charges are added correctly, making your billing process more professional and compliant with legal requirements.

Importance of Professional Invoice Design

Having a well-organized and visually appealing billing document is essential for leaving a lasting impression on clients. A professional design not only enhances the credibility of your business but also ensures that important information is easy to understand and navigate. Proper layout, structure, and clarity can help avoid misunderstandings and reflect the professionalism of your company.

First Impressions Matter

A clean, professional design can make a positive first impression on your clients. When they receive a document that is organized and clear, it shows that you value their business and that you are detail-oriented. This can increase the likelihood of timely payments and strengthen your business relationships.

Key Elements of Good Design

- Clarity: Clear, legible fonts and well-structured information make the document easy to read and understand at a glance.

- Brand Consistency: A design that matches your brand’s color scheme and logo creates a cohesive look and reinforces brand identity.

- Logical Layout: Organizing the document with clear sections, such as service details, charges, and totals, improves the readability and flow of information.

- Professional Appearance: A polished design can help elevate your business in the eyes of clients, showing that you take your operations seriously.

Incorporating these elements into your billing documents can improve both your image and your clients’ experience, leading to greater trust and efficiency in the transaction process.

Setting Payment Terms and Conditions

Establishing clear and concise payment terms and conditions is crucial for ensuring smooth transactions and maintaining healthy business relationships. When both parties know when and how payments are expected, it helps avoid misunderstandings and potential disputes. Clearly defined terms also contribute to more efficient cash flow management and overall business stability.

Key Aspects to Include

- Due Date: Specify when the payment is expected, whether it’s within a set number of days after the agreement or upon completion of the work.

- Accepted Payment Methods: List the payment methods you accept, such as bank transfers, credit cards, or online payment platforms.

- Late Payment Fees: Outline any penalties for overdue payments to encourage timely settlement and cover any administrative costs associated with delays.

- Discounts for Early Payment: If applicable, offer a discount for early payment as an incentive for clients to settle their balances ahead of schedule.

Why These Terms Matter

Clearly defined payment terms reduce ambiguity, set expectations, and help ensure both parties are on the same page. They protect your business by encouraging prompt payments, while also providing clients with the transparency they need. Setting these conditions upfront helps build trust and fosters a professional relationship.

Integrating Documents with Accounting Software

Efficiently managing financial transactions is essential for maintaining accurate records and ensuring smooth business operations. By integrating billing documents with accounting software, businesses can automate processes, track payments, and maintain up-to-date financial data. This integration eliminates manual data entry, reduces errors, and provides better insight into overall financial health.

Key Benefits of Integration

- Automation: Automatically sync transaction details between billing documents and your accounting system, saving time and effort.

- Real-Time Updates: Ensure your financial records are always current, with updates made as soon as payments are processed.

- Error Reduction: Minimize the risk of mistakes that occur during manual data entry, ensuring accuracy in both records and reports.

- Streamlined Reporting: Easily generate financial reports that reflect the latest transactions, simplifying tax preparation and financial analysis.

How to Set Up Integration

Setting up integration between billing documents and accounting software typically involves selecting compatible tools and ensuring proper synchronization. Many accounting platforms offer integration features, which can be easily configured through third-party apps or native connections. Once set up, your documents will seamlessly communicate with your financial records, providing you with a streamlined workflow.

How to Send and Manage Billing Documents

Efficiently sending and managing billing documents is crucial for maintaining healthy cash flow and ensuring timely payments. A clear, systematic approach helps prevent delays and confusion, making the entire process smoother for both businesses and clients. From creating professional records to tracking their status, there are several steps you can follow to streamline these tasks.

Steps to Send Billing Documents

- Choose the Right Format: Select a format that is easy for your clients to read and access, such as PDFs or digital invoices.

- Include Necessary Details: Ensure all key elements, such as payment terms, due dates, and descriptions of charges, are clearly included in the document.

- Send Promptly: Timeliness is important–send the document as soon as the work or product is delivered to ensure quick payment processing.

- Use an Email or Billing Platform: Sending via email or using a dedicated platform ensures that documents are delivered securely and received by the client without delays.

Effective Management Tips

- Track Payments: Use a system to monitor which documents have been paid and which are still outstanding, helping you stay on top of accounts.

- Set Reminders: For unpaid or overdue amounts, schedule automatic reminders to clients, keeping the communication professional and polite.

- Keep Records Organized: Organize your documents by client or date to make future reference easier and prevent any lost records.

- Review for Accuracy: Before sending, always double-check the document to ensure all charges and terms are correct to avoid disputes.