Simple and Free Service Invoice Template for Open Office

When managing a business, having a structured method for documenting payments and transactions is essential. Crafting clear and well-organized billing documents helps ensure smooth financial operations and fosters professionalism with clients. These documents provide both parties with a clear record of services rendered and agreed-upon amounts, streamlining payment processes and reducing misunderstandings.

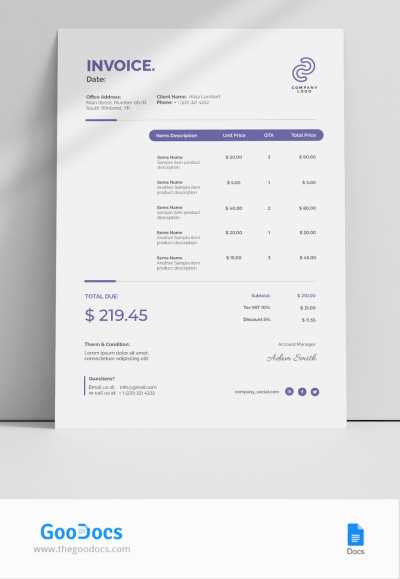

With the right tools, generating these documents becomes a simple task. Customizable formats allow you to adapt the layout to suit your business needs, from adding personalized information to ensuring a clean, easy-to-read structure. Using user-friendly software ensures efficiency and consistency in all your records, allowing you to focus more on growing your business.

By utilizing ready-made formats, you can quickly create professional billing papers, saving time while maintaining quality. Whether you’re a freelancer or run a small business, having access to the right resources can significantly improve your workflow and overall client experience. Start creating your billing documents today and experience the benefits of a well-organized financial system.

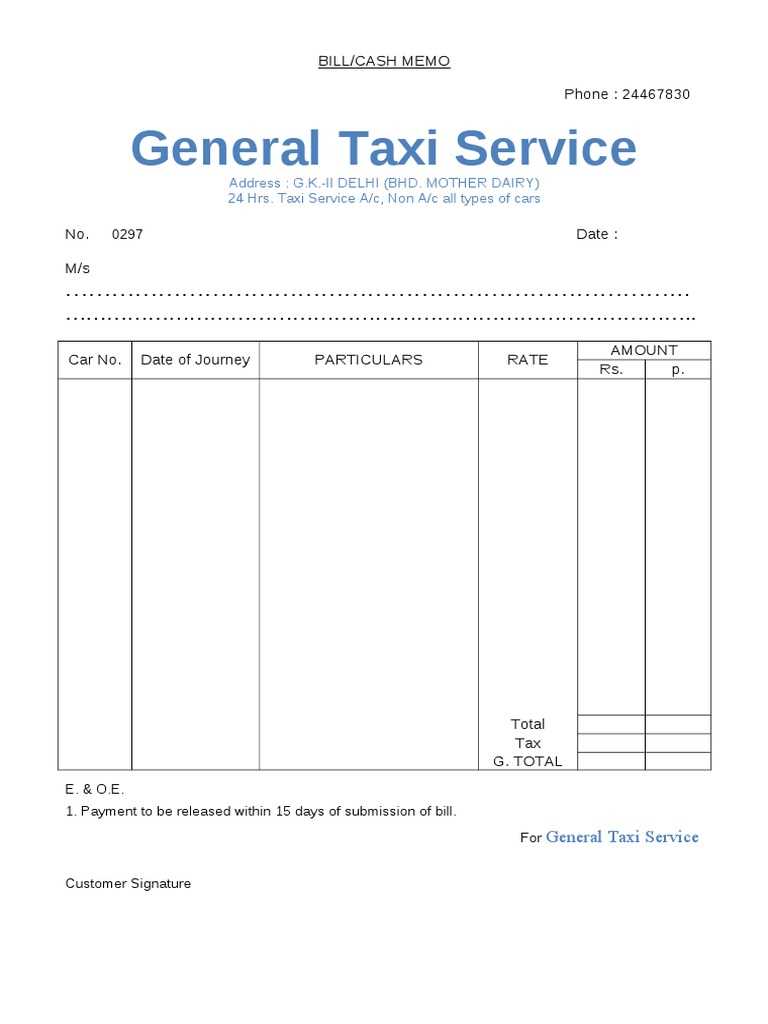

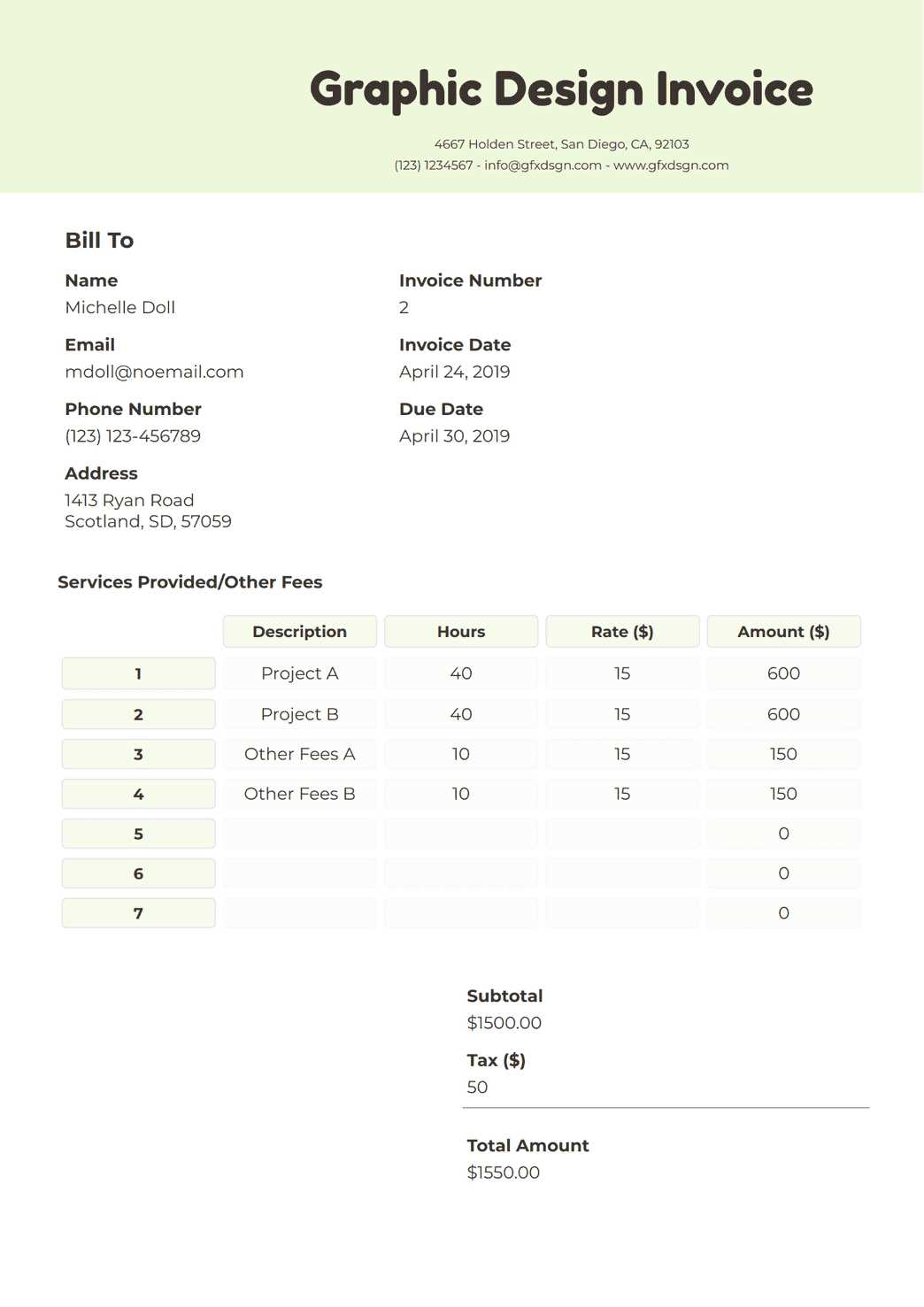

Free Billing Document for Service Providers

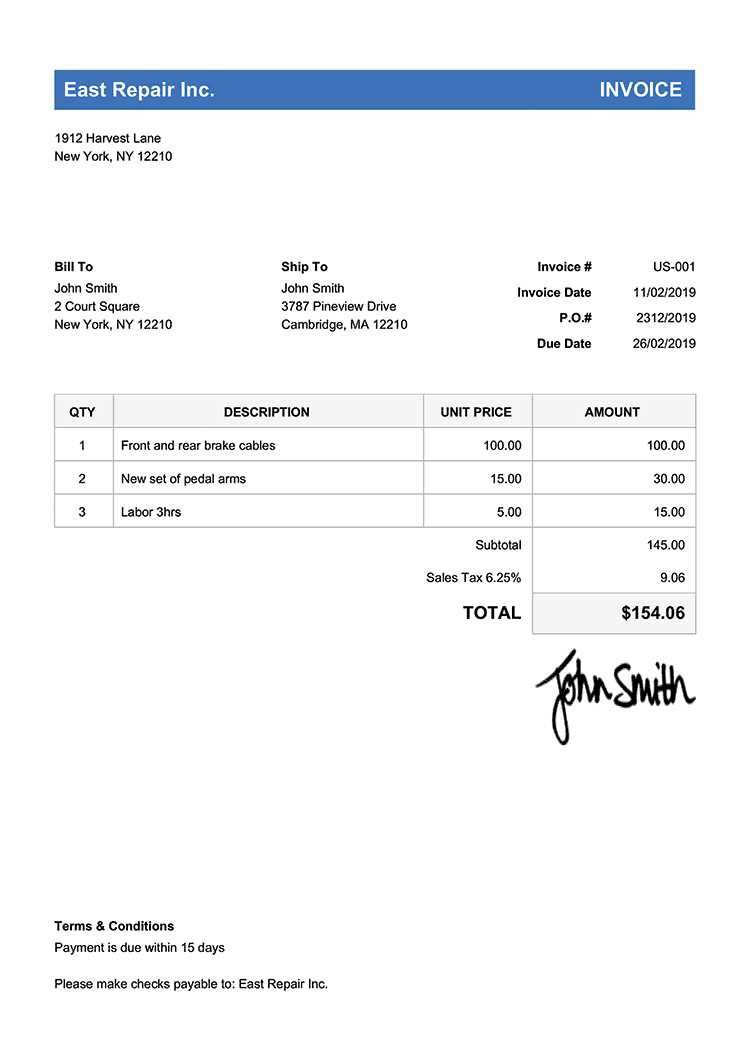

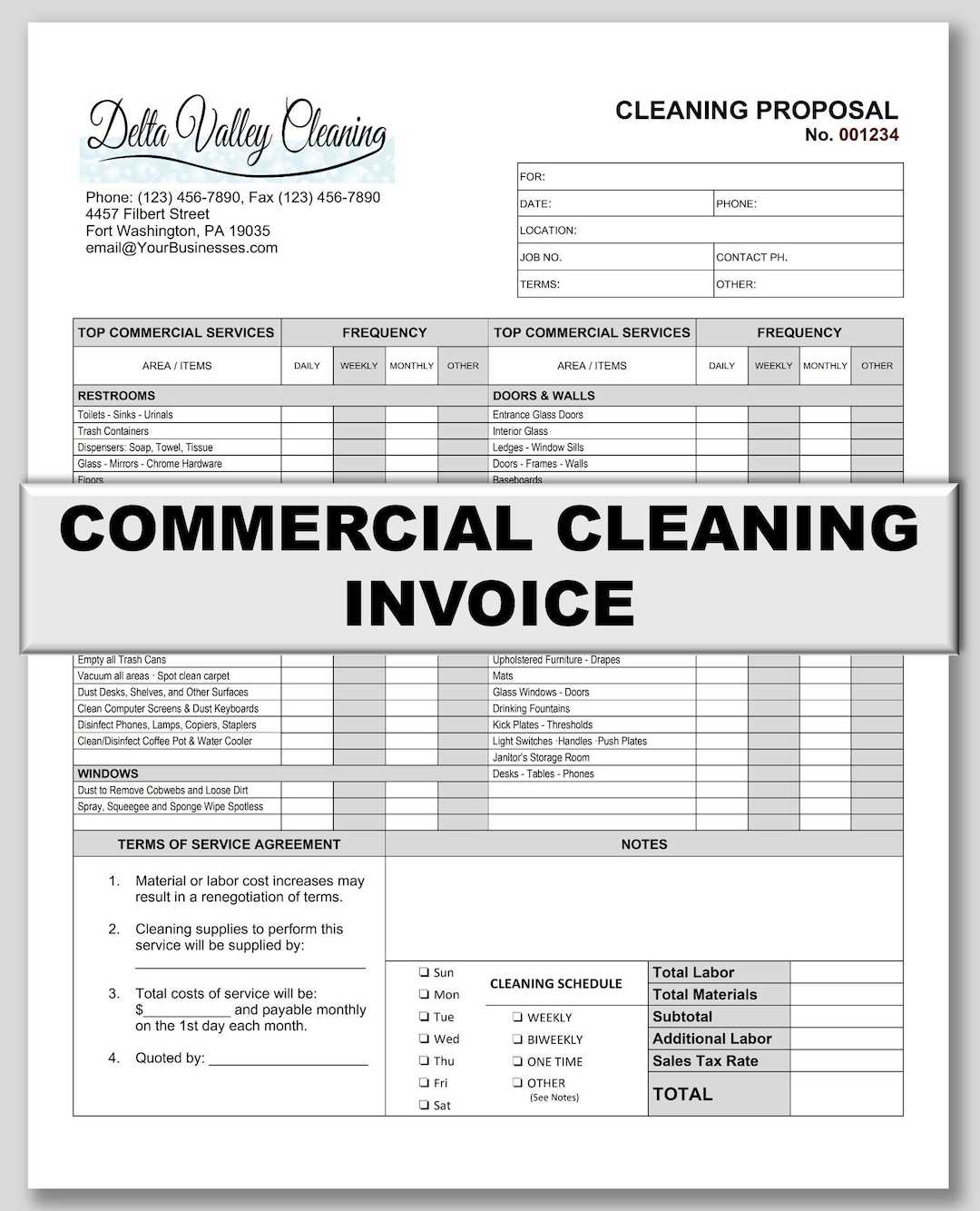

For any business that requires documentation of completed tasks or rendered assistance, having a clear and professional way to request payment is crucial. With a free billing solution, service providers can easily create structured documents to ensure clients understand what they are being charged for and the amounts due. These documents should be simple yet informative, allowing both the provider and the client to keep track of work completed and payments owed.

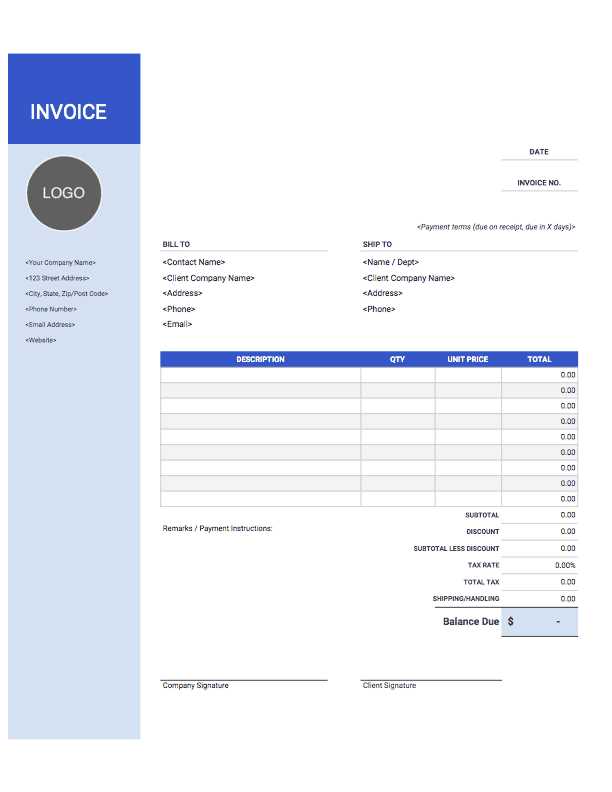

By using a free billing system, you can save time on paperwork while maintaining professionalism. Below is an example of a basic layout that service providers can use for this purpose:

| Item | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| Task 1 | Web Development | 10 hours | $50/hour | $500 |

| Task 2 | Consultation | 2 hours | $100/hour | $200 |

| Total Due | $700 | |||

With this structure, service providers can easily adapt it for different types of work and adjust pricing accordingly. A well-organized document not only helps to clarify charges but also ensures prompt payment.

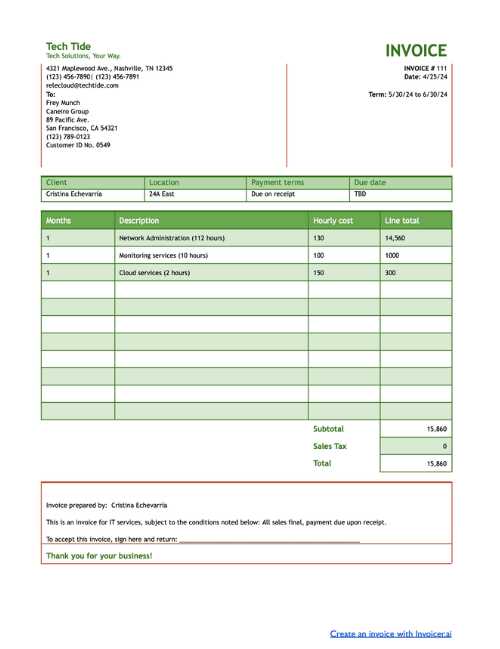

How to Create a Billing Document in Open Office

Creating a clear and well-organized record for your completed tasks or services is essential for smooth financial transactions. With the right software, this process can be both simple and efficient. By using an intuitive program, you can design a document that outlines the details of work provided and the payment required, making it easy to manage finances and maintain professionalism.

Follow these steps to create a comprehensive billing document:

- Open the Software: Start by opening the program where you will design your document. Select a blank sheet to begin creating from scratch.

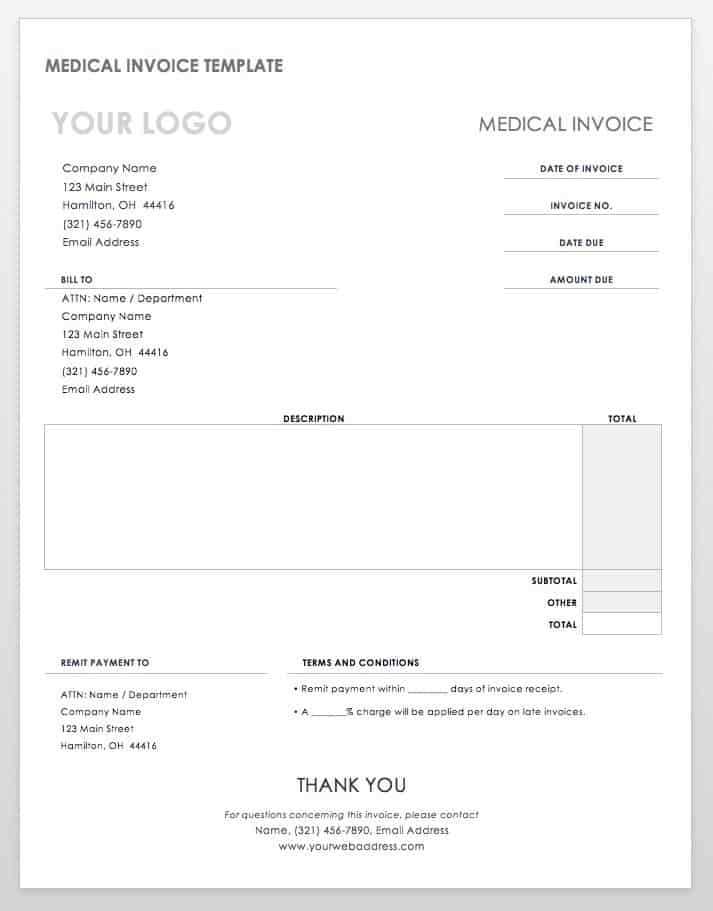

- Add Your Business Information: In the top section, include your name, business name, contact details, and payment terms. This gives the document a personalized touch and ensures your clients know how to reach you.

- List the Work Completed: In a table format, describe the tasks completed, including a brief description, the quantity, the rate charged, and the total cost. This helps to keep everything clear and easily understandable.

- Set the Total Amount Due: At the bottom of your document, calculate and display the total amount due. This should include any applicable taxes or discounts to make the payment process straightforward.

- Save the Document: Once completed, save the file in your preferred format, whether PDF or the default document type, so it can be shared with your clients efficiently.

Creating a document in this manner ensures that all necessary details are covered, and both you and your clients have a clear understanding of the payment expectations.

Benefits of Using Open Office for Billing

Managing financial documents efficiently is essential for any business, and having the right software can make the process smoother. Using a free and versatile program for generating documents provides numerous advantages, including cost-effectiveness, flexibility, and easy customization. These benefits ensure that business owners can create professional documents without any hassle.

Here are some key reasons why this software is ideal for creating billing records:

- Cost-Free and Accessible: The software is free to download and use, providing a low-cost solution for businesses of all sizes. It allows you to create, edit, and save your records without the need for a paid subscription.

- Customizable Layouts: You can fully customize the structure and design of your documents to reflect your brand’s identity, making it easy to tailor them to different client needs.

- Compatibility: The program works with a variety of file formats, ensuring compatibility across different devices and platforms. This makes it easy to share your documents with clients in various formats.

- User-Friendly Interface: The simple and intuitive interface makes it easy for users, even those with minimal technical knowledge, to create accurate and professional records without frustration.

By using such a tool, businesses can save time while maintaining a high level of professionalism and consistency in their financial records.

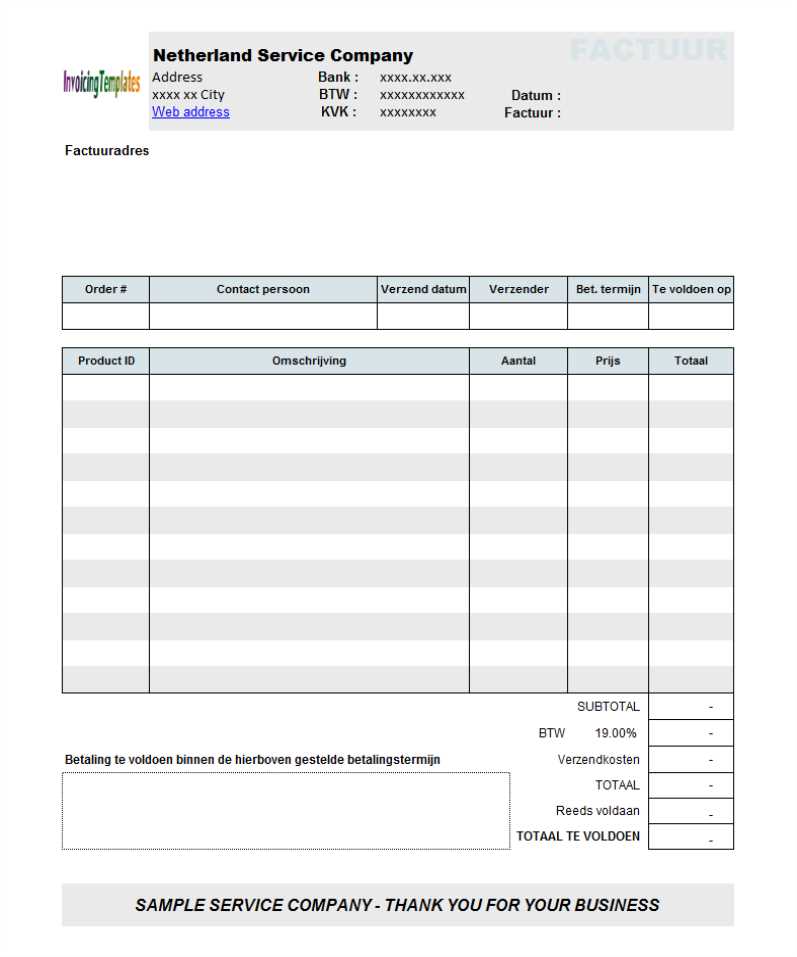

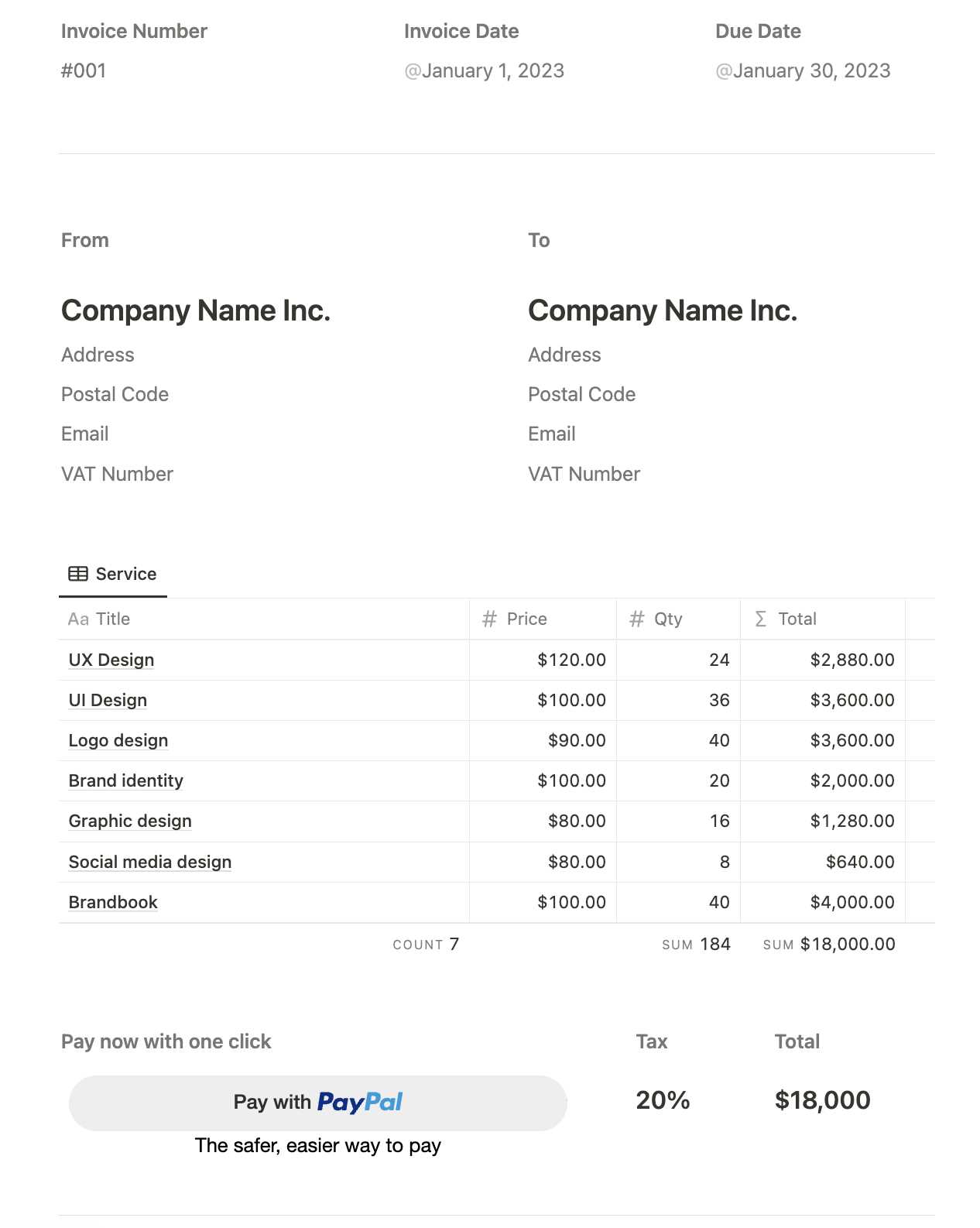

Example Layout:

| Item | Description | Hours | Rate | Total |

|---|---|---|---|---|

| Consultation | Business Strategy Session | 3 | $75/hour | $225 |

| Development | Website Build | 10 | $50/hour | $500 |

| Total Amount Due | $725 | |||

| Transaction Date | Description | Amount Due | Amount Paid | Payment Status |

|---|---|---|---|---|

| 2024-11-01 | Consulting Services | $500.00 | $500.00 | Paid |

| 2024-11-05 | Web Development | $1,200.00 | $0.00 | Pending |

| 2024-11-10 | Graphic Design | $300.00 | $300.00 | Paid |

By incorporating a tracking system like the one above, you can easily monitor your income and follow up on unpaid amounts. This level of organization not only improves your financial oversight but also enhances your professionalism in dealings with clients.

Saving and Sharing Billing Documents Efficiently

Efficient management of financial documents is crucial for maintaining a smooth workflow and ensuring timely payments. Properly saving and sharing these documents not only enhances accessibility but also supports effective communication with clients. Adopting best practices in document handling can streamline your processes and improve your overall productivity.

To begin with, consider organizing your documents in a structured file system on your computer or cloud storage. This allows you to quickly locate specific records when needed. Using clear naming conventions for your files, such as including the client’s name and date, can further enhance this organization.

When it comes to sharing, digital formats are the most efficient. Exporting your documents as PDF files ensures that the formatting remains consistent across different devices and operating systems. This format is widely accepted and provides a professional appearance. To share documents effectively, utilize email or cloud storage services, which allow for easy access and collaboration.

In addition, consider implementing a version control system if you frequently update documents. This helps to track changes and maintain a record of previous versions, ensuring that you and your clients always refer to the most current information.

By following these strategies for saving and sharing your billing documents, you can enhance your operational efficiency and foster better relationships with your clients.

Common Mistakes in Billing Documents to Avoid

Creating accurate and professional financial documents is essential for any business. However, several common errors can undermine the effectiveness of these records, leading to confusion and potential payment delays. Recognizing and avoiding these pitfalls is key to maintaining smooth transactions with clients.

Neglecting Details

One of the most frequent mistakes is overlooking essential details such as the date, payment terms, and client information. Missing or incorrect data can result in misunderstandings and disputes. Always double-check to ensure that all relevant information is clearly presented and accurate.

Unclear Pricing Structure

Another common issue arises from vague descriptions of products or services provided. Clients need to understand exactly what they are being charged for. Providing a clear breakdown of costs, including any additional fees or discounts, can help avoid confusion and enhance transparency.

By being mindful of these common errors, businesses can enhance the quality of their financial documents, ensuring better communication and prompt payments.

Why Open Office is Ideal for Billing Documents

This software suite provides a flexible and user-friendly environment for creating financial documents. Its robust features and compatibility with various file formats make it an excellent choice for managing business records efficiently. By leveraging its capabilities, users can streamline their documentation processes and enhance their professionalism.

Key Features

- Cost-Effective: As a free alternative to many commercial options, this software allows businesses to save on expenses while still obtaining high-quality tools.

- User-Friendly Interface: The intuitive design facilitates easy navigation, making it accessible for users of all skill levels.

- Versatile Formats: It supports multiple file formats, enabling seamless sharing and compatibility with clients who may use different software.

Customization Options

With various templates and design options available, users can easily tailor their documents to reflect their brand identity. This customization enhances the visual appeal and professionalism of the records.

By utilizing this software, businesses can effectively create and manage their billing documents, ultimately improving their financial operations and client relationships.

Updating Your Billing Document Regularly

Maintaining up-to-date records is crucial for any business. Regularly revising your financial documentation ensures compliance with current standards and reflects any changes in your services or pricing structure. Staying current not only helps in avoiding mistakes but also enhances professionalism in your interactions with clients.

Benefits of Regular Updates

- Accuracy: Regular reviews help ensure that all information, such as rates and services offered, is accurate and reflects your current business practices.

- Compliance: Keeping documents updated aids in adhering to any new legal or regulatory requirements, thereby protecting your business from potential issues.

- Improved Branding: An updated design and layout can better showcase your brand identity, making your records more appealing and professional.

Best Practices for Updating

- Set a schedule to review your documents regularly, such as quarterly or bi-annually.

- Gather feedback from clients regarding the clarity and usability of your records.

- Stay informed about industry trends and adjust your documentation to meet evolving standards.

By prioritizing regular updates, businesses can ensure that their financial documents remain relevant, professional, and aligned with their operational goals.

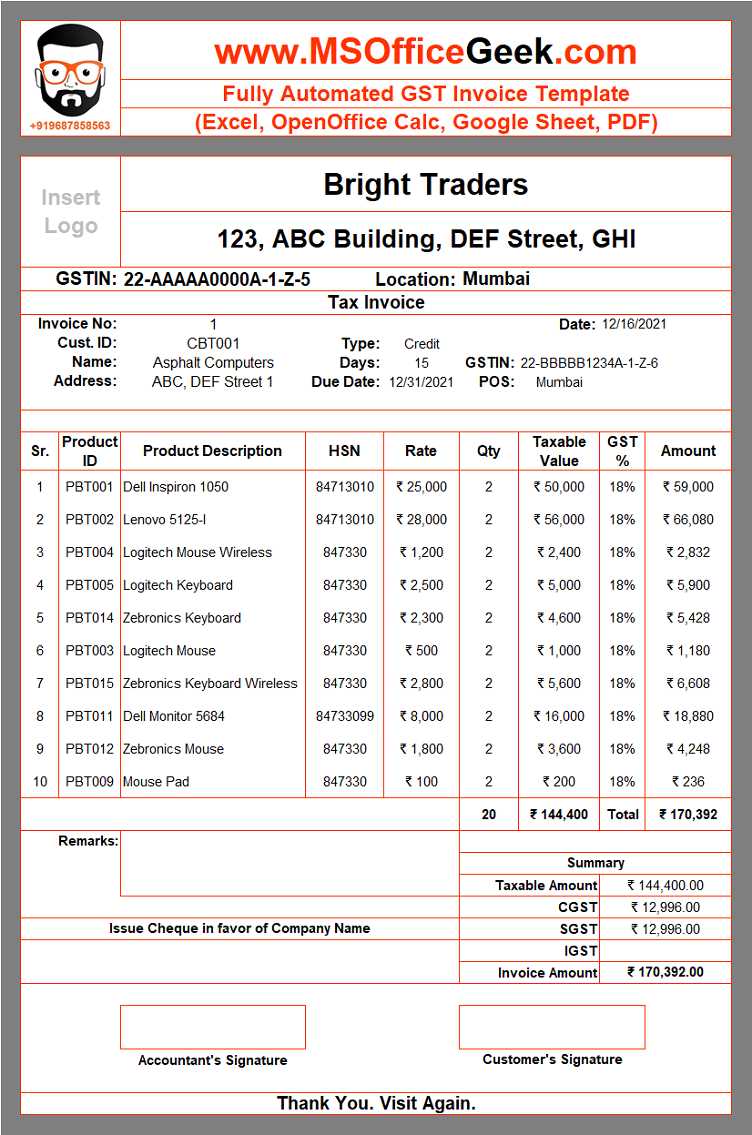

Adding Discounts and Taxes to Invoices

Incorporating adjustments like price reductions and applicable levies into your financial documents is essential for accurate billing. These elements not only affect the total amount due but also play a significant role in maintaining transparent and fair transactions with your clients. Properly managing these aspects can enhance customer satisfaction and streamline your accounting processes.

Incorporating Discounts

Offering price reductions can be a strategic move to attract and retain customers. When applying discounts, ensure you clearly indicate the original price alongside the reduced amount. This transparency helps clients understand the value they are receiving.

Calculating Taxes

Taxes can vary depending on your location and the type of goods or services provided. It’s important to calculate the correct tax percentage and clearly display this information in your financial documentation. Including a breakdown of the tax applied helps clients see exactly how their total is calculated, promoting trust and clarity.

By effectively managing discounts and taxes, you can create precise and professional billing documents that reflect your business practices and meet regulatory requirements.

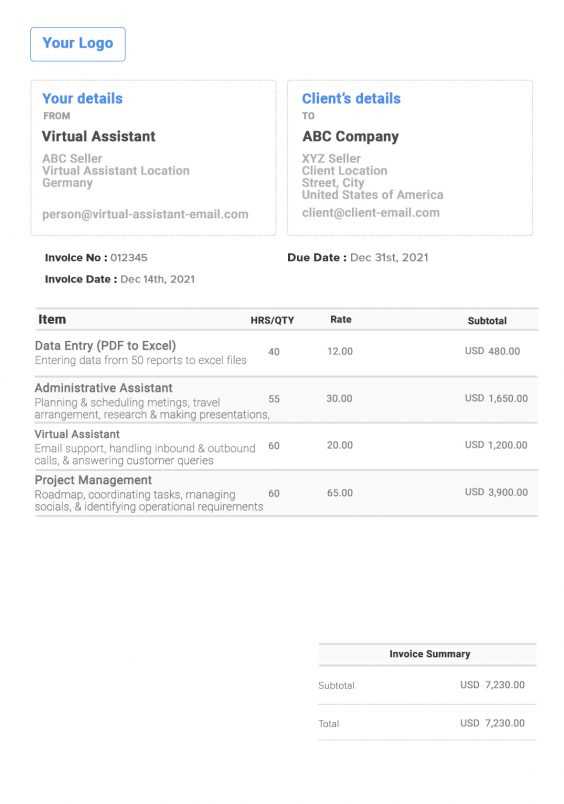

Managing Multiple Clients with One Template

Handling numerous clients efficiently can be challenging, but utilizing a single customizable format for billing can streamline the process significantly. This approach not only saves time but also ensures consistency across all financial documents. By tailoring specific details for each client, you can maintain professionalism while simplifying your workflow.

Benefits of Using a Unified Format

- Time Efficiency: Create one comprehensive layout that can be easily adjusted for different clients, reducing the need to start from scratch each time.

- Consistency: A uniform structure enhances your brand image, making your documents recognizable and professional.

- Ease of Management: Centralizing your billing process allows for easier tracking of transactions and payments across all clients.

Customizing for Individual Needs

While a single format serves as a foundation, personalizing it for each client is crucial. Include specific details such as:

- Client name and contact information

- Unique pricing structures or agreements

- Tailored notes or terms based on the client’s preferences

By balancing a unified format with personalized elements, you can effectively manage multiple clients without compromising on quality or professionalism.

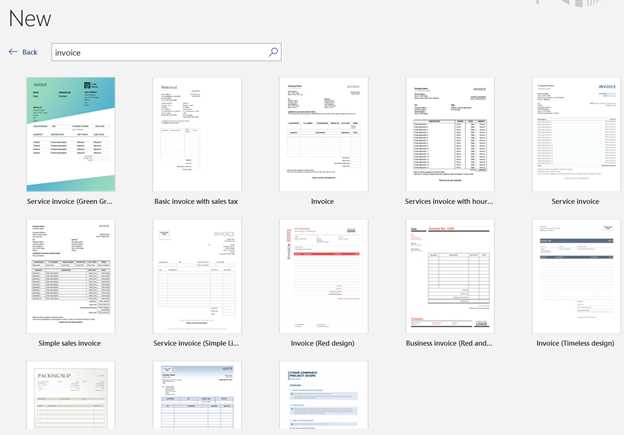

Free Resources for Open Office Templates

Finding quality resources to create professional documents can enhance your workflow and save time. Various platforms offer complimentary materials that cater to different business needs. Utilizing these resources not only streamlines your processes but also helps maintain a polished image for your communications.

Here are some valuable sources where you can access free materials:

- OpenOffice.org: The official site provides a variety of resources and samples that can be downloaded and customized for your specific requirements.

- Template.net: This site offers a wide selection of no-cost options for various document types, suitable for different sectors and styles.

- Vertex42: Known for its user-friendly formats, Vertex42 provides numerous free files that cater to diverse business scenarios.

- Google Docs: While primarily associated with Google, many users share their creations that can be adapted for use in alternative software like OpenOffice.

By leveraging these free resources, you can enhance your documentation process and ensure your materials are both effective and visually appealing.

How to Keep Your Invoices Organized

Maintaining a systematic approach to managing your financial documents is crucial for efficiency and accuracy. An organized method not only facilitates easy retrieval but also aids in tracking payments and ensuring timely follow-ups. Implementing a few strategies can greatly improve your document management process.

Strategies for Organization

- Create a Filing System: Develop a consistent method for categorizing your documents. You can organize them by date, client name, or project type to simplify access.

- Utilize Digital Tools: Consider using software designed for document management. Many applications offer features that allow you to store, retrieve, and sort your files efficiently.

- Regularly Update Records: Set aside time each week or month to review and update your documents. This practice helps prevent backlog and ensures everything remains current.

- Back-Up Your Files: Always have a backup of your documents, whether on an external drive or cloud storage, to protect against data loss.

Best Practices

- Label Clearly: Ensure that all files are labeled with relevant information, making it easier to identify their contents at a glance.

- Use Consistent Naming Conventions: Adopt a standard format for naming your files, which can include the date, client name, and document type.

- Review and Purge: Periodically go through your documents to remove outdated or unnecessary files, keeping your system clean and efficient.

By adopting these practices, you can significantly improve the organization of your financial documents, leading to better management and reduced stress.

Making Invoices Simple and Easy to Read

Creating financial documents that are straightforward and clear is essential for effective communication with clients. A well-structured document not only enhances professionalism but also reduces the chances of misunderstandings regarding charges. By focusing on simplicity and readability, you can ensure that your clients easily grasp the necessary details.

Key Elements for Clarity

When designing your financial documents, consider the following components to improve clarity:

| Element | Description |

|---|---|

| Consistent Formatting | Use uniform fonts, colors, and layout throughout to create a cohesive look. |

| Clear Headings | Include distinct headings to categorize sections such as services provided, total amount due, and payment terms. |

| Bullet Points | Utilize bullet points for listing items or services to enhance readability and make it easier for clients to follow. |

| Whitespace | Incorporate adequate whitespace to prevent overcrowding, making the document more inviting to read. |

Additional Tips

To further improve the accessibility of your financial documents, keep these suggestions in mind:

- Use simple language and avoid jargon to ensure that clients of all backgrounds can understand.

- Highlight important information, such as due dates and total amounts, using bold text or a larger font size.

- Regularly review your documents for clarity and make updates as needed based on client feedback.

By prioritizing simplicity and readability, you can foster positive client relationships and enhance the effectiveness of your financial communications.