Service Invoice Template Excel for Efficient Billing

Managing payments and maintaining financial records can be a time-consuming task for any business or freelancer. However, using an organized system for tracking payments is essential for keeping things running smoothly. With the right tools, you can streamline this process and ensure that all transactions are properly documented.

Creating a structured document for tracking charges is one of the most effective ways to simplify the billing process. By using a customizable format, professionals can adapt the design to meet their specific needs and ensure accuracy every time a payment is requested.

Whether you are handling a few or numerous clients, having a reliable format allows for consistency in the way you manage finances. This not only saves time but also helps maintain clear communication with clients, preventing misunderstandings and ensuring smooth transactions.

Service Invoice Template Excel Overview

When managing payments for your business, having a reliable document to track transactions is crucial. A well-organized tool can help ensure that every charge is accurately recorded, making it easier to maintain proper financial records. This tool is designed to assist professionals in documenting their billing information efficiently and clearly.

Benefits of Using a Structured Document

By using a customized format, businesses can adapt the structure to suit their unique needs. This document allows you to track details such as client information, services rendered, payment amounts, and due dates. The simplicity of this approach reduces the chance for errors and helps streamline the billing process.

Key Features of an Effective Billing Document

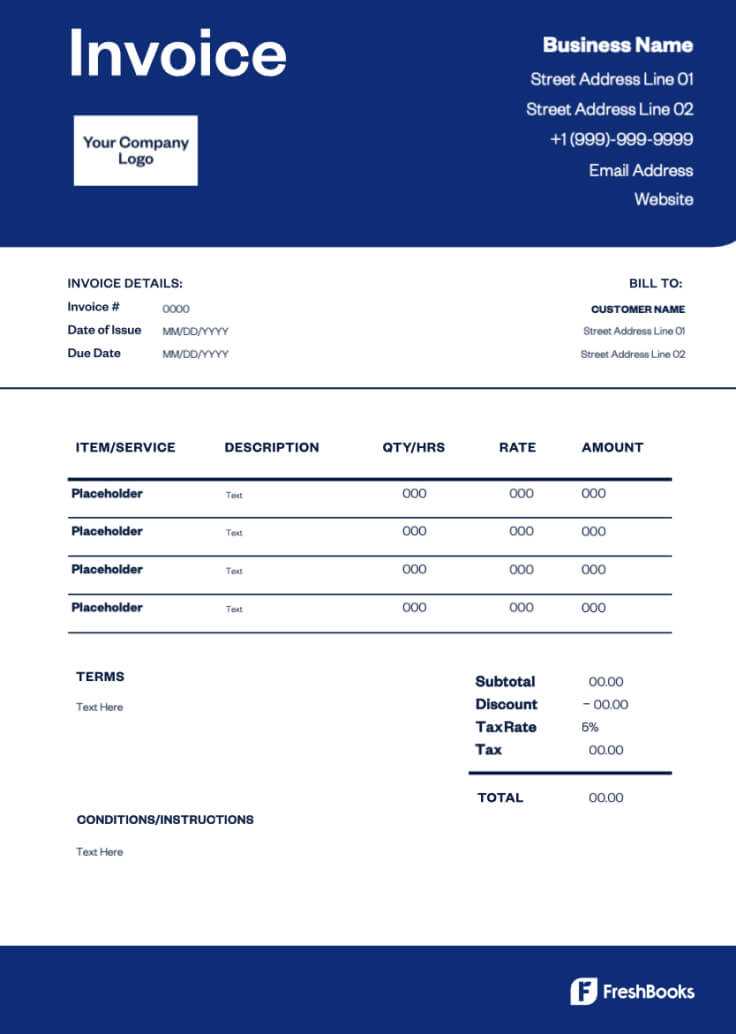

There are several essential components that make this tool effective. These include clear sections for entering client data, the ability to list charges, and options for calculating totals, taxes, and discounts. With a structured approach, it’s possible to ensure all necessary information is included while maintaining a professional appearance.

| Feature | Description |

|---|---|

| Client Information | Section to enter customer details such as name, address, and contact info. |

| Services Rendered | A detailed list of tasks or services provided to the client. |

| Payment Details | Includes payment terms, amounts, and due dates for clear financial tracking. |

| Tax and Discounts | Automatic calculation options for applying taxes and discounts. |

What is an Excel Service Invoice?

A billing document is an essential tool for businesses and professionals who need to request payment for their services. By organizing important financial information into a clear, structured format, this document ensures that all necessary details are included and easy to understand. It can be customized to meet the specific needs of the user, making it adaptable to a wide range of industries and businesses.

Key Components of a Billing Document

Each document typically includes several key sections to ensure that all transaction details are properly recorded. These include:

- Client’s contact information

- Details of the services provided

- Payment amounts and due dates

- Tax calculations and potential discounts

Why Use a Digital Format?

Using a digital document offers many advantages over paper-based billing methods. Here are a few key reasons to opt for an electronic version:

- Customization: Easily adjust the layout and content to suit specific needs.

- Automation: Quickly calculate totals, taxes, and discounts with built-in formulas.

- Accessibility: Store and share the document electronically, making it accessible from anywhere.

Benefits of Using Excel for Invoices

Utilizing a digital document for tracking payments offers significant advantages over traditional paper-based methods. With the right tool, managing billing becomes more efficient, organized, and error-free. A well-structured format allows for quick calculations and easy adjustments, making it a valuable resource for businesses of all sizes.

Key Advantages of Using a Digital Format

Here are some of the main benefits of using a digital document to manage payment requests:

- Efficiency: Automatically calculate totals, taxes, and discounts to reduce manual work.

- Customization: Easily modify fields and layouts to match your specific needs.

- Accuracy: Minimize the risk of errors by relying on built-in formulas and functions.

- Convenience: Quickly update and share the document with clients through email or cloud storage.

Cost-Effectiveness and Time-Saving

By using a digital document, businesses can save on printing and paper costs while also reducing the time spent on manual calculations. The ability to duplicate and adjust the structure for different clients ensures that a minimal amount of effort is required for each new transaction.

How to Customize Your Invoice Template

Personalizing your billing document allows you to tailor it to your specific needs, ensuring that all relevant details are clearly presented. Customization offers the flexibility to adjust the structure, add or remove sections, and incorporate features that enhance functionality and usability.

Start with the Basics: Begin by organizing the essential fields, such as client contact information, dates, and a list of services provided. Make sure the layout is simple and professional to avoid confusion. It’s important to include sections that allow for clear communication about payment terms, due dates, and the total amount due.

Use Calculations: Incorporate built-in formulas for automatic calculations of totals, taxes, and discounts. This reduces the risk of errors and saves time. For instance, you can use simple arithmetic functions to sum up amounts or apply tax rates directly within the document.

Flexibility is Key: If you regularly adjust the format for different clients or types of work, ensure your structure allows easy modifications. You might also want to include fields for additional information, such as payment methods, or options to add custom notes for clients.

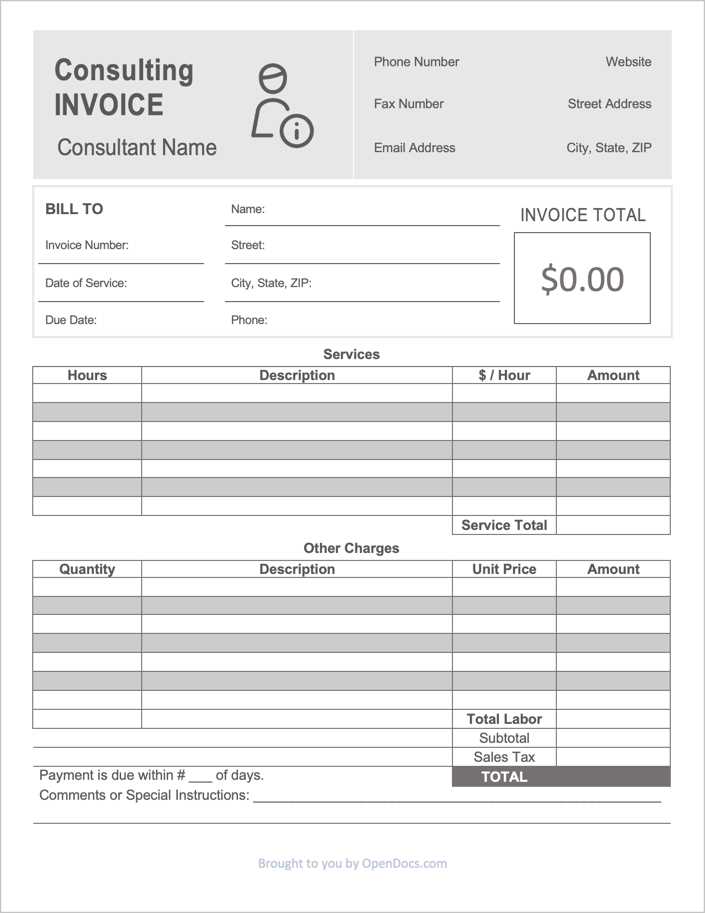

Step-by-Step Guide to Service Billing

Creating a clear and accurate billing document is an essential part of managing financial transactions with clients. Following a structured process ensures that all important details are included and that the client understands the charges. This guide walks you through the steps required to generate a professional billing document.

Step 1: Gather Client Information

Start by collecting all the necessary contact details for your client. This includes their name, address, and any relevant contact information. Make sure that the information is up-to-date and accurate to avoid any confusion later in the process.

Step 2: List Services or Products Provided

Clearly describe the services or products you have delivered. Be specific about each item or task and include quantities or time spent, if applicable. This transparency ensures that your client understands exactly what they are being charged for.

Step 3: Specify Payment Terms

Indicate the total amount due, the payment due date, and any other relevant terms. If applicable, include information about late fees, payment methods, or discounts. Setting clear expectations about when and how payments should be made helps avoid misunderstandings.

Step 4: Calculate Taxes and Totals

Use the appropriate tax rate to calculate any taxes that apply to the services or products. Ensure the total amount reflects any applicable discounts or adjustments. This step is crucial for maintaining accuracy in your financial records.

Step 5: Finalize and Send

Once all information is included and verified, review your document for accuracy. Ensure that all sections are clear and professional. After final checks, send the document to your client via email or any preferred method of communication.

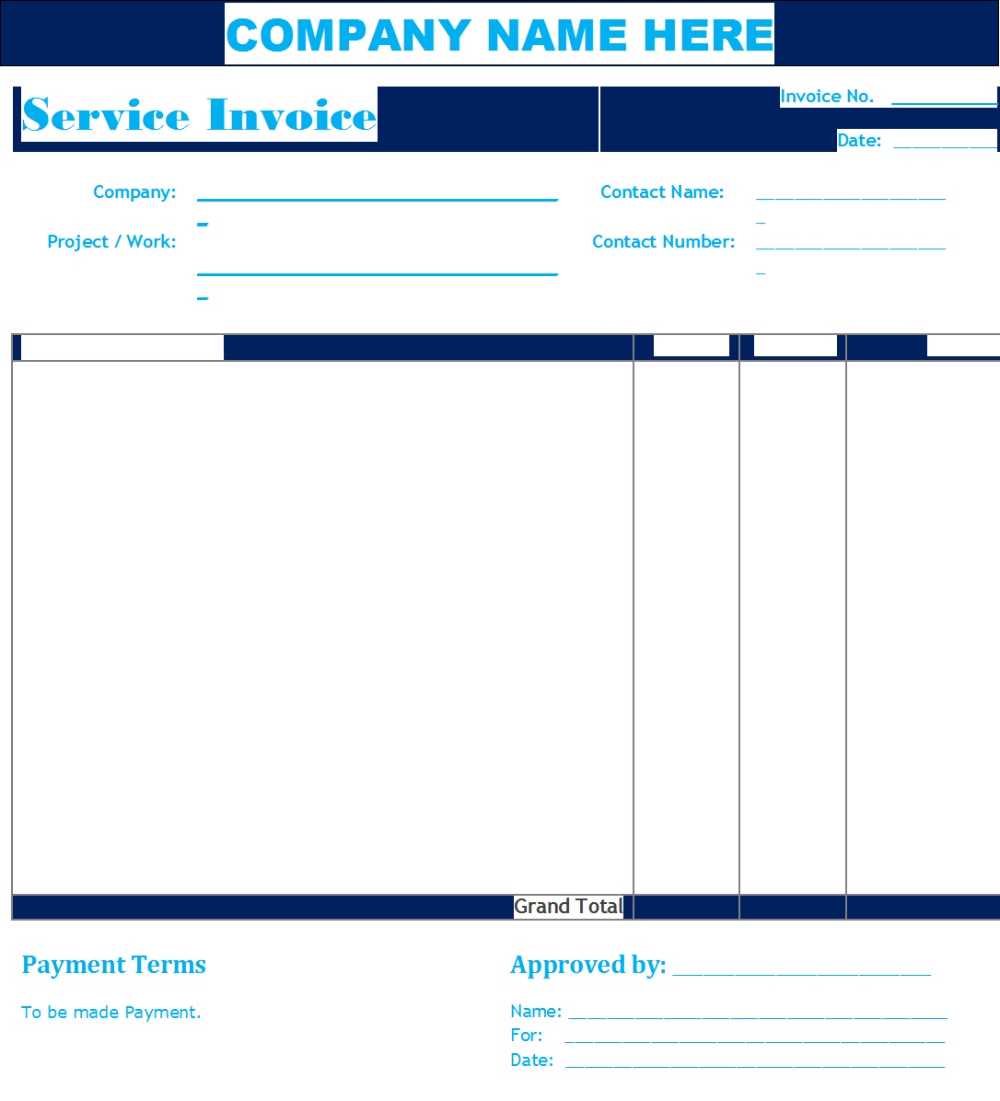

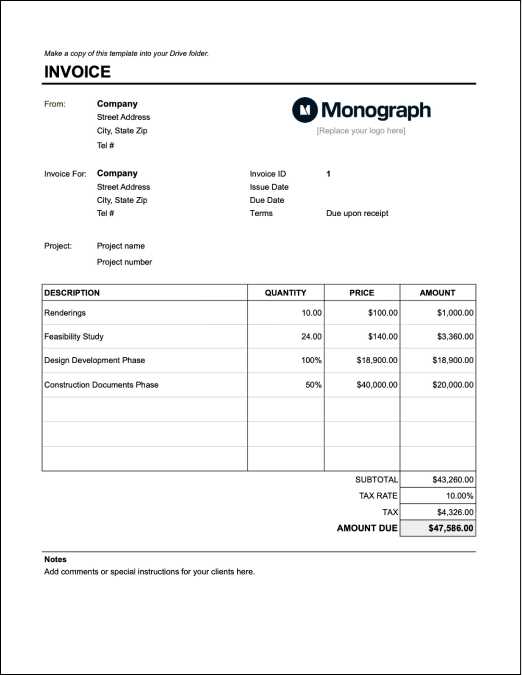

Key Features of a Good Invoice Template

An effective billing document should be easy to read, professional, and efficient in capturing all essential details of a transaction. The key to a well-designed document lies in its ability to communicate all necessary information while minimizing confusion. Here are some critical features that make a billing document truly effective.

Clear Client and Business Information:

The document should have clearly defined sections for the client’s contact information and your business details. This ensures that both parties can easily identify who is involved in the transaction and facilitates communication if necessary.

Itemized List of Charges:

A good document breaks down the services or products provided into individual line items. Each entry should include a detailed description, quantity, unit price, and total for full transparency.

Automatic Calculations:

A well-designed document allows for automatic calculations of totals, taxes, and discounts. This helps eliminate manual errors and saves time when preparing the billing document.

Clear Payment Terms:

Clearly state payment details, including the due date, accepted payment methods, and any late fees that may apply. This prevents misunderstandings and encourages prompt payment.

Professional Design:

The layout should be clean, with a professional appearance that reflects the business’s image. A well-structured document enhances the credibility of your brand and helps maintain a positive relationship with clients.

Common Mistakes to Avoid in Billing

When managing payments, it’s essential to ensure that all details are accurate and clear to avoid complications. Small mistakes in your billing process can lead to delays in payment or misunderstandings with clients. Recognizing and avoiding common errors can help maintain smooth business transactions and improve client relationships.

Typical Billing Errors

Here are some common mistakes to watch out for when creating your payment documents:

- Incorrect Client Information: Ensure that the client’s name, address, and contact details are accurate. Mistakes in this section can delay payments and create confusion.

- Missing or Inaccurate Item Details: Always list services or products with a clear description, quantity, and unit price. Vague or incorrect descriptions can lead to disputes.

- Overlooking Taxes or Discounts: Forgetting to calculate taxes or applying incorrect discount rates can result in financial discrepancies.

- Unclear Payment Terms: Not specifying due dates, accepted payment methods, or penalties for late payments can lead to misunderstandings with clients.

How to Avoid These Pitfalls

To avoid these mistakes, double-check all entries before sending the document. It’s also helpful to implement automated tools that handle calculations, ensuring accuracy. Clear communication is essential for maintaining a positive relationship with clients, so always be sure that your billing documents are thorough and precise.

How to Track Payments with Excel

Keeping track of payments is crucial for maintaining a healthy cash flow and ensuring that all financial transactions are accurately recorded. A well-organized document can simplify the process of monitoring payments, helping you stay on top of outstanding balances and due dates. With the right structure in place, you can easily manage and update payment information as needed.

Using a spreadsheet to track payments offers several advantages, including the ability to store large amounts of data, quickly update records, and automate calculations. Here’s how to set up a basic tracking system:

Steps to Track Payments

Follow these simple steps to set up an effective payment tracking system:

- Create Key Columns: Set up columns for relevant information, such as payment date, client name, amount due, amount paid, and balance remaining.

- Use Formulas: Implement simple formulas to automatically calculate outstanding balances, totals, and due dates.

- Track Payment Status: Add a column to indicate whether a payment has been received or is still pending.

- Filter and Sort: Utilize filtering and sorting features to quickly identify overdue payments or sort by client or due date.

Automating Updates: Set up your system to automatically update the balance when payments are made. This reduces the chance of human error and ensures that you always have up-to-date information.

Additional Tips

Consider using color-coding or conditional formatting to highlight overdue payments or high-priority accounts. This visual cue can make it easier to focus on urgent issues without having to manually search through the data.

How to Format Your Service Invoice

Formatting your billing document correctly ensures that all the relevant details are clearly visible and easy to understand. A well-organized layout not only enhances professionalism but also helps prevent errors or confusion when reviewing or processing the payment. A simple, clean format will also make it easier for clients to see exactly what they owe and by when.

Start with Clear Sections:

Your document should be divided into logical sections, including the sender’s and recipient’s information, the list of provided services, payment terms, and totals. This will make it easier for the client to review the details quickly and accurately.

Use a Logical Layout:

Place the most important information, such as your business and client contact details, at the top. Follow this with a detailed list of services or products, ensuring each item has a description, quantity, and price. Lastly, include the total amount due at the bottom along with payment instructions and deadlines.

Keep It Simple and Professional:

Use a clean, easy-to-read font and avoid unnecessary embellishments. The simpler and more direct the layout, the more professional it will appear. This can go a long way in making a positive impression on your clients.

Organize with Consistency:

Ensure that all similar information is formatted consistently throughout the document. For instance, if you use bullet points or numbered lists for the descriptions of services, keep the style the same throughout. This attention to detail demonstrates care and helps your clients navigate the document with ease.

Incorporating Taxes in Your Invoice

When creating a payment document, it’s important to account for taxes to ensure both legal compliance and transparency with your clients. Properly incorporating taxes not only helps maintain accuracy in financial records but also prevents misunderstandings or disputes later. Whether you are applying sales tax, VAT, or any other relevant charges, it’s crucial to make these additions clear and easy to understand for your clients.

How to Calculate Taxes

Calculating taxes can vary depending on the jurisdiction and type of service provided, but the basic principle is straightforward. Here’s how you can calculate taxes:

- Identify Applicable Tax Rates: Research the tax rates that apply to your business and the products or services you offer. Ensure that you are using the correct rate for your location and industry.

- Calculate Taxable Amount: Determine the total cost of the items or services being billed before tax is applied.

- Apply the Tax Rate: Multiply the taxable amount by the applicable tax rate to determine the tax amount. Add this figure to the total amount due.

Displaying Taxes in Your Document

Make sure to list taxes clearly so that your client can easily understand the total amount they are expected to pay. Typically, you should include a separate line for taxes in your document, as shown in the table below:

| Item Description | Amount |

|---|---|

| Product A | $100.00 |

| Sales Tax (10%) | $10.00 |

| Total Due | $110.00 |

Final Tips: Always ensure that tax rates are up-to-date and compliant with your local regulations. Display taxes in a clear and separate line item to avoid confusion. This will help your clients understand exactly what they are paying for and make the billing process more transparent.

Adding Discounts and Adjustments

In any billing document, offering discounts or making adjustments can be an important aspect of maintaining good customer relationships or accommodating special circumstances. Whether you are providing a promotional discount, correcting an error, or offering a price reduction based on volume, it’s essential to clearly reflect these changes in your documents. This ensures that the client understands the adjusted amount and that the financial records remain accurate.

Types of Discounts

There are various ways to apply discounts, depending on the nature of your transaction and agreement with the client. Some common types include:

- Percentage-Based Discounts: A discount based on a percentage of the total amount due. For example, a 10% reduction off the original price.

- Flat-Rate Discounts: A fixed amount deducted from the total bill. For example, a $50 discount off the total.

- Volume Discounts: Offering a reduction based on the quantity or size of the purchase, commonly used for bulk orders or large transactions.

How to Display Adjustments

When making adjustments or applying discounts, it is crucial to clearly itemize the change on your document. This helps to avoid confusion and ensures that your client knows exactly how much they are saving. Here’s how to display discounts and adjustments:

- List the Discount or Adjustment: Add a line item for the discount or adjustment in your document, indicating the type of discount and its value.

- Recalculate the Total: After applying the discount, ensure that the new total amount reflects the adjusted price. The discount should be subtracted from the original total.

- Clarify the Reason: Optionally, you can provide a brief description or reason for the discount or adjustment, especially if it is part of a special promotion or agreement.

Example: If you offer a 10% discount on a $200 charge, your document should show the original amount, the discount applied, and the new total due:

| Item Description | Amount |

|---|---|

| Product or Service | $200.00 |

| Discount (10%) | -$2

Best Practices for Service InvoicingEffective billing is essential for maintaining positive business relationships and ensuring timely payments. By following certain best practices, you can streamline the process, improve accuracy, and avoid common mistakes. These practices help to create clear, professional documents that both you and your clients can easily understand and reference. Key Elements to IncludeWhen creating a payment document, it’s important to ensure that all essential details are clearly presented. These elements include:

Timely and Consistent BillingAnother critical aspect of efficient billing is consistency and timing. Regular, timely billing helps to set expectations with your clients and can improve your cash flow. Here are some tips:

By following these best pract Automating Document Generation in ExcelStreamlining your financial processes can significantly enhance productivity and reduce errors. One way to achieve this is by automating the creation of payment records. By setting up automated systems within spreadsheet software, you can simplify the process of generating accurate documents, saving time and ensuring consistency in your records. Using Formulas to Automate CalculationsOne of the key benefits of automation in this context is the ability to use built-in formulas to calculate totals, taxes, discounts, and other charges. This eliminates manual input and reduces the risk of calculation errors. Some common formulas include:

Setting Up Automated FieldsBeyond simple formulas, you can also set up automated fields for recurring information such as client names, addresses, and payment terms. By creating a dynamic system where only the variable data needs to be updated, you can quickly generate new records with minimal effort. Some helpful features include:

Example: Suppose you need to generate a document for a recurring service. By setting up the client information, standard charges, and discounts in separate cells, all you need to do is input the service period and update any changes. The document will automatically adjust the amounts based on the pre-established formulas and fields. Note: Automating the document generation process can greatly increase your efficiency, allowing you to focus on growing your business while maintaining accurate financial records. Security Tips for Protecting Your DocumentEnsuring the safety of your financial records is crucial to prevent unauthorized access and protect sensitive information. With the increasing amount of digital transactions, taking the right measures to secure your documents is more important than ever. This section explores key strategies to safeguard your records and avoid potential security breaches. Use Strong Passwords and EncryptionOne of the most effective ways to protect your documents is by using strong passwords and encryption techniques. A secure password helps ensure that only authorized users can access the document. Additionally, encryption scrambles the file, making it unreadable without the proper decryption key.

Regular Backups and Secure StorageRegular backups are essential in case of data loss or corruption. Make sure to store your document securely and keep backups in multiple locations. This ensures that even if one storage device fails, your data remains protected.

Example: By regularly backing up your document to both the cloud and an offline device, you minimize the risk of losing important financial information due to technical failures. Note: Always ensure that your backup systems are also secure, with strong passwords and encryption in place, to prevent unauthorized access to your sensitive data. Saving and Sharing Your Document FilesProperly saving and sharing your financial records is essential for easy access, collaboration, and secure communication with clients. By following best practices for storage and file-sharing, you ensure that your data remains organized, accessible, and safe from unauthorized access. Best Practices for Saving Your FilesWhen saving your documents, it’s crucial to choose the right format and location. Whether you’re working on personal or business-related financial records, make sure your files are stored securely and in an organized manner.

How to Share Your Documents SecurelyWhen sharing your financial documents, it’s important to do so in a secure manner to protect sensitive information. Using trusted platforms and methods for sharing ensures that your files reach the intended recipient without compromising their security.

Note: Always verify the recipient’s identity and ensure they have the necessary permissions before sharing sensitive financial data. This helps avoid mistakes and ensures the safe transmission of your records. Integrating Document Formats with Accounting SoftwareIntegrating your financial record formats with accounting software can significantly streamline your billing process. By connecting your documents with your accounting system, you can automate tasks, minimize errors, and ensure smooth communication between your operations and financial tracking. When your financial documents are synced with accounting software, it enables seamless data entry, updating, and tracking. This integration allows you to easily manage your records, make calculations, and even track payments and taxes without needing to manually update the system. Benefits of Integration

How to Integrate Documents with Accounting SystemsIntegrating your records with accounting software typically involves linking your document formats (such as spreadsheets or PDFs) to the software through either built-in features or third-party tools. Follow these steps for smooth integration:

Note: Although integration can save time and reduce errors, it’s essential to periodically review your data to ensure everything is being transferred accurately. Frequently Asked Questions About Billing DocumentsWhen it comes to managing financial records and transactions, many individuals and businesses have common questions. Understanding the details of generating and managing financial documents can help you streamline your processes and avoid potential mistakes. Below are some of the most frequently asked questions regarding billing documents and their use. What Information Should Be Included in a Billing Document?A proper billing document typically contains essential details to ensure clarity and prevent disputes. The following information should always be included:

How Can I Ensure Accuracy in My Billing Documents?Ensuring the accuracy of your financial documents is crucial for both business operations and customer trust. Here are some tips to help:

Can I Modify Billing Documents After Sending Them?It is possible to modify billing documents after sendi |