Free Downloadable Excel Service Invoice Template

Managing financial transactions efficiently is essential for any business. Utilizing well-structured documents can significantly enhance the process of requesting payments from clients. These documents not only serve as records of services rendered but also reflect the professionalism of a business.

By using accessible tools, you can craft tailored documents that meet your specific needs. Customization allows for the inclusion of essential details such as pricing, payment terms, and company branding. This approach ensures that each request for payment is clear and concise, reducing misunderstandings and improving cash flow.

Exploring various options for document design can lead to discovering a wealth of resources available online. These resources often include various formats that cater to different business requirements, helping you to streamline your billing process. Embracing these tools will ultimately contribute to a more organized and efficient operation.

Comprehensive Guide to Invoice Templates

Effective billing is a cornerstone of financial management for any business. Well-structured documents that outline transactions help ensure clarity and accuracy, making it easier to track payments and maintain professional relationships. Understanding the different types of documents available and how to create them can enhance your billing process significantly.

Types of Billing Documents

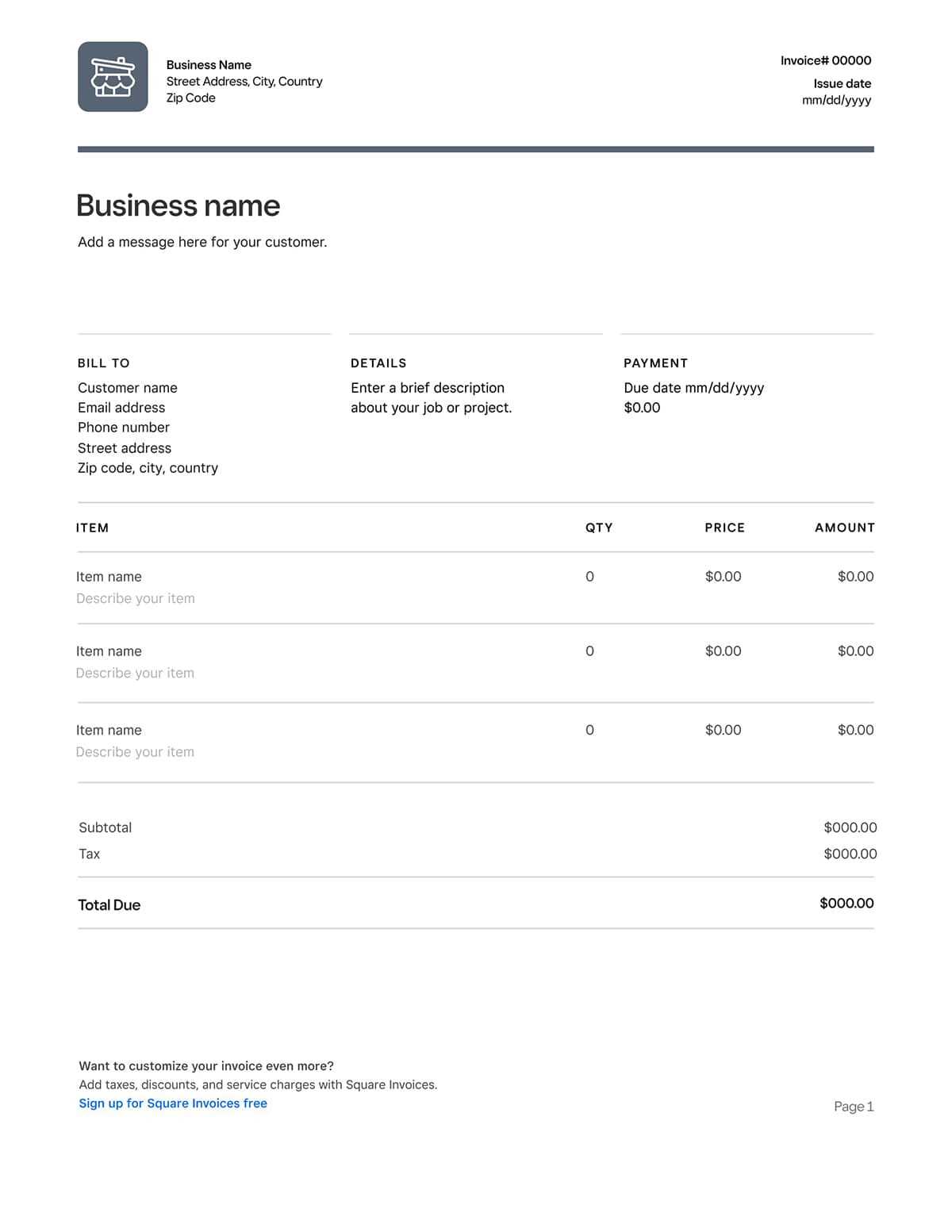

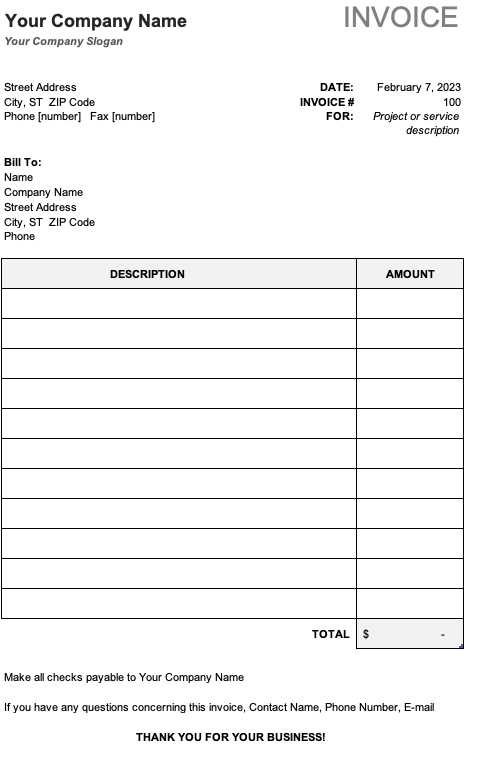

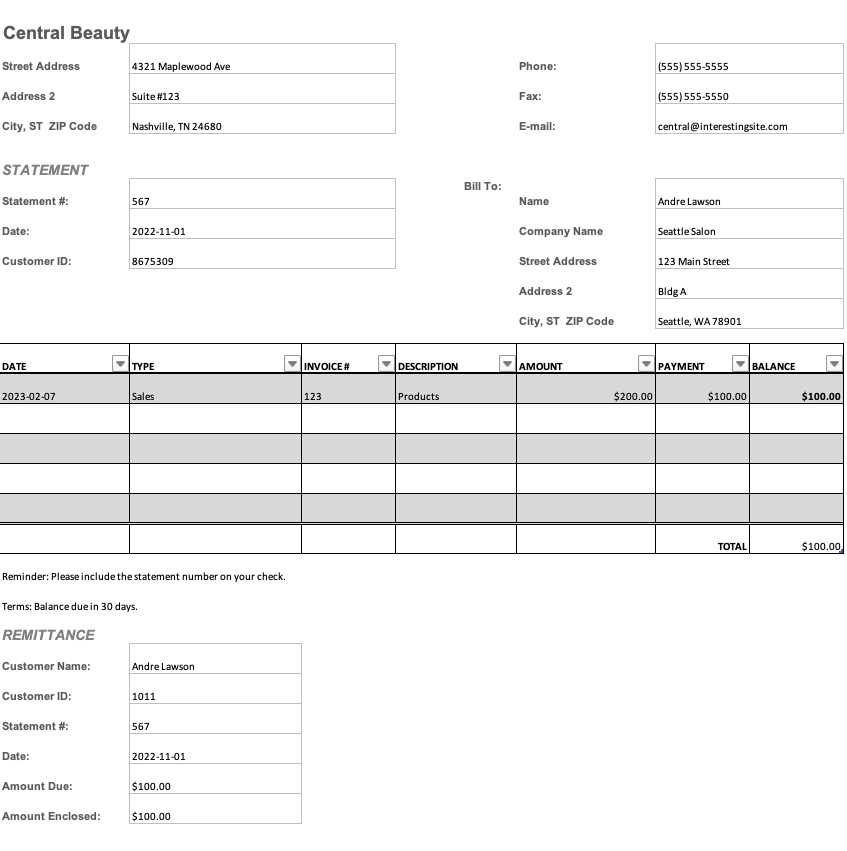

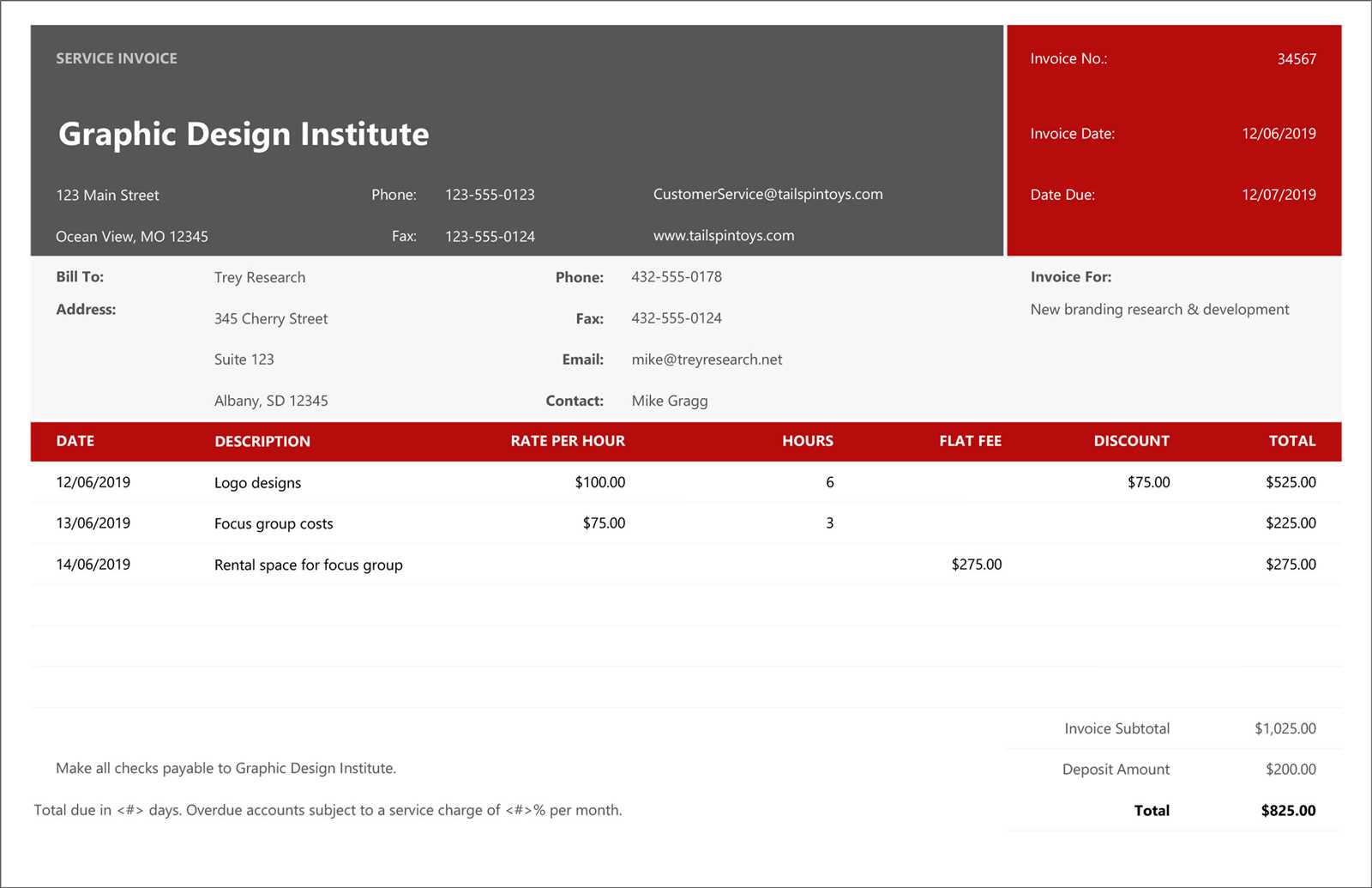

There are various formats to choose from, each designed to serve specific business needs. Some common formats include basic receipts, detailed statements, and custom documents tailored for specific services. Each type has unique features that can facilitate efficient communication with clients while providing necessary information regarding transactions.

Key Features to Consider

When creating billing documents, it is important to include key elements that enhance professionalism. Essential details such as your company name, contact information, service descriptions, pricing, and payment terms should be clearly presented. Additionally, incorporating branding elements can strengthen your business identity and improve recognition among clients.

Benefits of Using Excel Invoices

Employing spreadsheet software for creating billing documents offers numerous advantages that can simplify financial processes. The versatility and functionality of this tool enable users to manage their financial records efficiently, ensuring accuracy and organization. With the ability to customize layouts and calculations, businesses can enhance their billing practices significantly.

One of the primary benefits is the ability to automate calculations. By utilizing built-in functions, users can quickly generate totals and taxes, reducing the likelihood of errors that can occur with manual entry. This feature saves valuable time and increases overall efficiency, allowing businesses to focus on other essential tasks.

Additionally, the ease of customization allows for tailored documents that reflect a company’s branding and style. This personal touch can improve client relationships by presenting a professional image. Furthermore, the compatibility of spreadsheet files with various software means that sharing and collaborating with colleagues or clients is straightforward, promoting seamless communication and tracking.

How to Customize Your Invoice

Personalizing financial documents is essential for establishing a professional image and ensuring that all relevant details are communicated effectively. By modifying the layout and content, businesses can create documents that not only meet their specific needs but also resonate with their clients. Customization allows for a unique presentation that reflects the brand’s identity.

Selecting a Suitable Layout

The first step in the customization process is choosing an appropriate layout that aligns with your business style. Consider whether a simple design or a more elaborate format better suits your needs. Organizing information clearly will help clients understand the details at a glance, making the document both functional and appealing.

Incorporating Branding Elements

Including your company’s logo, color scheme, and font style is vital for creating a cohesive brand image. This not only enhances recognition but also builds trust with clients. Make sure to position these elements prominently, ensuring they are visible without overwhelming the essential information. Additionally, adding personalized messages or terms can foster a stronger connection with clients, making the transaction feel more engaging.

Essential Elements of Service Invoices

Creating comprehensive billing documents requires careful consideration of several key components to ensure clarity and effectiveness. Each element plays a crucial role in communicating important information to clients while establishing professionalism. Understanding these fundamental components can help streamline the billing process and enhance client relationships.

First and foremost, including accurate contact information for both the business and the client is essential. This ensures that there are no communication barriers and facilitates easy follow-up if needed. Additionally, a unique identification number for the document can help in tracking and referencing specific transactions.

Another critical element is a detailed description of the services provided. Clear and concise descriptions, along with corresponding charges, allow clients to understand what they are being billed for. Including the date of service and payment terms is also vital, as it informs clients about when payment is expected and any potential penalties for late payments.

Steps to Download Free Templates

Accessing customizable billing documents can greatly enhance your financial management process. There are several straightforward steps to acquire these resources, allowing you to start using them quickly and efficiently. Understanding the process can save time and ensure you find the right options that suit your business needs.

Finding Reliable Sources

The first step is to locate trustworthy websites that offer these resources. It is important to choose platforms that provide high-quality options. Look for user reviews or recommendations to gauge the reliability of the source.

Saving Your Desired Document

Once you find a suitable document, follow these steps to obtain it:

| Step | Description |

|---|---|

| 1 | Visit the chosen website and navigate to the section for billing documents. |

| 2 | Browse through the available options and select the one that meets your criteria. |

| 3 | Click on the download link or button, usually labeled clearly. |

| 4 | Choose a location on your device to save the file for easy access. |

| 5 | Open the document in your preferred software and begin customizing as needed. |

Comparing Different Invoice Formats

When it comes to financial documentation, various formats are available to suit different business needs. Each format offers unique features and advantages, which can impact how effectively you communicate with clients and manage your transactions. Understanding these differences can help you choose the most suitable option for your organization.

One common format is the basic document, which typically includes essential elements such as item descriptions, amounts, and payment terms. This straightforward approach is ideal for businesses that require simplicity and clarity without excessive detail.

Another popular choice is the detailed document, which provides a comprehensive breakdown of services rendered. This format allows for more thorough explanations, helping clients understand what they are being billed for, and can reduce disputes over charges.

Additionally, customized documents offer flexibility, allowing businesses to incorporate branding elements such as logos and color schemes. This personal touch can enhance brand recognition and present a professional image to clients.

Finally, digital formats, often designed for software applications, can include automated features like calculations and reminders. These options can streamline the billing process and improve efficiency by minimizing manual errors. Comparing these formats will help you determine the best fit for your billing requirements.

Common Mistakes in Invoicing

Managing financial documentation effectively is crucial for maintaining healthy client relationships and ensuring timely payments. However, there are several common pitfalls that businesses often encounter during this process. Recognizing these mistakes can help organizations avoid complications and enhance their billing practices.

Some frequent errors include:

- Incorrect Contact Information: Failing to provide accurate details can lead to communication issues and delays in payment.

- Ambiguous Descriptions: Using vague terms instead of clear item descriptions can confuse clients and result in disputes.

- Missing Payment Terms: Not specifying when payment is due can cause misunderstandings regarding deadlines.

- Neglecting to Number Documents: Omitting a unique identifier can complicate tracking and referencing past transactions.

- Ignoring Follow-Up: Failing to follow up on outstanding payments can lead to cash flow problems.

To improve your financial documentation process, consider the following best practices:

- Always verify contact details before sending documents.

- Provide thorough descriptions of all items and services.

- Clearly state payment terms to avoid misunderstandings.

- Utilize a numbering system for easy reference.

- Establish a follow-up routine for overdue payments.

Avoiding these common mistakes will help streamline your billing process and foster better relationships with clients.

How to Automate Invoice Generation

Streamlining the process of creating billing documents can save time and reduce errors in financial management. Automation allows businesses to efficiently generate documents with minimal manual intervention, leading to improved accuracy and faster turnaround times. By implementing the right tools and strategies, you can enhance your workflow significantly.

To automate your billing document creation, consider the following steps:

| Step | Description |

|---|---|

| 1 | Select appropriate software that supports automation features. |

| 2 | Set up templates that include all necessary elements such as item details and payment terms. |

| 3 | Integrate your software with accounting tools to synchronize data and reduce manual entry. |

| 4 | Establish triggers based on specific actions, such as project completion or time tracking, to initiate document creation. |

| 5 | Test the automated process to ensure accuracy and reliability before full implementation. |

By following these steps, you can create a more efficient billing process that not only saves time but also enhances the professionalism of your communications with clients.

Using Formulas in Excel Invoices

Incorporating calculations into your financial documents can greatly enhance efficiency and accuracy. By utilizing formulas, you can automate mathematical operations, ensuring that totals are always correct and that you save valuable time. This functionality allows for a seamless integration of data, enabling you to focus on other important aspects of your business.

Common applications of formulas in financial documentation include:

Calculating totals, taxes, and discounts automatically based on input values. For example, by using the SUM function, you can quickly total item costs without needing to add them manually. Implementing percentage calculations for tax or discounts allows for immediate adjustments to the final amount, reflecting any changes in pricing or offers.

Additionally, using conditional formulas can help in setting parameters for specific scenarios, such as applying different tax rates based on the type of service rendered. This flexibility enhances your ability to maintain accurate records while adapting to various client requirements.

By mastering the use of formulas, you can significantly improve the reliability of your financial documentation and streamline your overall workflow.

Tips for Accurate Billing Practices

Ensuring precise financial documentation is essential for maintaining healthy cash flow and fostering positive client relationships. Implementing effective practices can help minimize errors, reduce disputes, and streamline the overall billing process. Here are some essential strategies to enhance accuracy in your billing procedures.

| Tip | Description |

|---|---|

| 1 | Clearly itemize all charges to avoid confusion and provide transparency. |

| 2 | Double-check all calculations to ensure totals are correct and reflect the agreed-upon amounts. |

| 3 | Use consistent terminology and format across all financial documents for clarity. |

| 4 | Incorporate due dates and payment terms to encourage timely payments. |

| 5 | Keep detailed records of all communications with clients regarding charges and services rendered. |

| 6 | Regularly review and update your billing processes to align with best practices and changes in business needs. |

By adhering to these tips, you can enhance the reliability of your financial documentation, ultimately leading to improved client satisfaction and more efficient operations.

Maintaining Professional Invoice Design

Creating visually appealing and organized financial documents is crucial for leaving a positive impression on clients. A well-structured layout not only enhances readability but also reflects the professionalism of your business. Here are key aspects to consider when designing your billing statements.

Consistency in Layout

Maintaining a uniform structure across all documents helps build brand recognition. Consider the following elements:

- Use the same font type and size throughout the document.

- Employ a consistent color scheme that aligns with your brand identity.

- Ensure spacing and margins are uniform for a clean appearance.

Essential Components

Including specific elements can make your documents more functional and informative. Here are vital components to integrate:

- Your business name and logo for branding.

- Contact information, including email, phone number, and address.

- Clear headings for different sections to enhance navigation.

- A summary of services or products provided with clear descriptions.

- Payment instructions to guide clients on how to proceed.

By focusing on a cohesive design and incorporating essential components, you can ensure that your financial documents convey professionalism and clarity, fostering trust and reliability with your clients.

Tracking Payments with Excel Templates

Monitoring financial transactions is essential for any business. A systematic approach to tracking payments helps ensure that all amounts are received on time and discrepancies are promptly addressed. Utilizing organized spreadsheets can greatly enhance this process, making it simpler to maintain accurate records.

Benefits of Using Spreadsheets for Payment Tracking

Employing spreadsheets offers numerous advantages when managing payment records:

- Flexibility to customize fields based on specific business needs.

- Ability to perform calculations automatically, reducing manual errors.

- Easy to generate reports for financial analysis and forecasting.

- Visual representation of data through charts and graphs for better insight.

Key Features to Include in Your Payment Tracker

To effectively monitor transactions, consider integrating the following elements into your spreadsheet:

- Client details, including names and contact information.

- Description of services provided or products sold.

- Date of transaction for chronological tracking.

- Amount due and amount received to monitor outstanding balances.

- Status of payment (paid, pending, overdue) for quick reference.

By establishing a robust system for tracking payments, businesses can enhance their financial management processes, ensuring that cash flow remains stable and operations run smoothly.

Integrating Invoices with Accounting Software

Connecting financial documents with accounting systems can significantly streamline business operations. This integration allows for seamless data transfer, reducing manual entry errors and ensuring that financial records are always up-to-date. By leveraging technology, organizations can enhance efficiency and maintain accuracy in their financial reporting.

Advantages of Integration

Integrating financial records with accounting software offers numerous benefits:

- Improved accuracy by minimizing human errors during data entry.

- Time savings by automating repetitive tasks, such as data synchronization.

- Enhanced visibility of financial performance through real-time updates.

- Simplified reporting, making it easier to generate financial statements and analyses.

Steps to Successfully Integrate

To effectively connect your financial documents with accounting software, consider the following steps:

- Choose compatible accounting software that meets your business needs.

- Identify the data points to be transferred, such as amounts, dates, and client details.

- Utilize available integration tools or APIs provided by the software.

- Test the integration process to ensure accurate data transfer.

- Train staff on using the new system to maximize its potential.

By integrating financial documentation with accounting systems, businesses can create a more efficient workflow, ultimately leading to better financial management and decision-making capabilities.

Understanding Invoice Payment Terms

Grasping the conditions associated with payment for goods or services is crucial for maintaining healthy cash flow and fostering positive client relationships. Clear payment terms outline the expectations for both parties, including when payment is due and any potential penalties for late payments. Establishing these guidelines upfront can help avoid misunderstandings and disputes.

Here are some common payment terms you might encounter:

| Term | Description |

|---|---|

| Net 30 | Payment is due within 30 days from the date of the document. |

| Due on Receipt | Payment is expected immediately upon receiving the document. |

| 2/10 Net 30 | A 2% discount is offered if payment is made within 10 days; otherwise, the full amount is due in 30 days. |

| Monthly | Payments are collected on a monthly basis for ongoing services or products. |

| Prepayment | Full payment is required before the goods or services are provided. |

By clearly communicating payment conditions, businesses can help ensure prompt payment and reduce the likelihood of late fees or disputes.

Updating Your Invoice for Tax Compliance

Ensuring that your billing documents align with current tax regulations is essential for any business. Compliance not only helps in avoiding legal issues but also facilitates smoother transactions with clients and tax authorities. Regularly reviewing and updating your documentation to reflect any changes in tax laws can significantly reduce the risk of errors and penalties.

Here are key elements to consider when modifying your documents for tax compliance:

- Accurate Tax Rates: Always verify and apply the correct tax rates applicable to your products or services, as these may change based on jurisdiction or type of transaction.

- Clear Tax Identification: Include your tax identification number and any relevant tax codes to provide clarity and legitimacy.

- Proper Documentation: Maintain a clear record of all transactions, as well as any supporting documents that may be required during audits.

- Compliance with Local Laws: Be aware of specific requirements in your area, as tax obligations can vary significantly by location.

- Regular Updates: Schedule periodic reviews of your billing documents to ensure they reflect the latest tax requirements and practices.

By staying proactive about tax compliance, you can help safeguard your business’s financial health and maintain trust with your clients.

Client Communication and Invoicing

Effective communication with clients is a crucial aspect of managing financial transactions. Clear and transparent exchanges can enhance relationships, ensure timely payments, and reduce misunderstandings. When discussing financial documents, it’s essential to maintain professionalism while being approachable.

Key Aspects of Client Communication

Here are several important points to consider when communicating with clients regarding financial matters:

- Timeliness: Send reminders or updates about payments well in advance to avoid any surprises. This shows respect for the client’s time and budget.

- Clarity: Use simple and straightforward language. Ensure that all terms, due dates, and amounts are clearly stated to prevent confusion.

- Accessibility: Make it easy for clients to reach you with questions. Providing multiple contact methods can facilitate quicker resolutions to concerns.

- Follow-up: After sending financial documents, follow up to confirm receipt and address any potential issues. This proactive approach can lead to better client satisfaction.

Building Trust Through Communication

Maintaining an open line of communication can significantly enhance trust and foster a positive relationship. By being responsive and attentive to client needs, businesses can create a more favorable environment for discussions related to financial matters.

Resources for Further Invoice Management

Effective handling of financial documentation is essential for smooth operations and healthy cash flow. To enhance your skills and streamline processes, a variety of resources are available that can provide valuable insights and tools. These resources can help individuals and businesses manage their financial tasks more efficiently.

Recommended Books and Guides

- Accounting Principles: A comprehensive guide that covers fundamental concepts and practices in financial management.

- Cash Flow Management: This book offers strategies for maintaining a positive cash flow and understanding its importance for business sustainability.

- Billing and Payment Processes: A resource that details best practices for creating and managing payment systems.

Online Tools and Software

- Financial Management Software: Tools designed to assist with tracking expenses, generating reports, and facilitating financial planning.

- Templates and Spreadsheets: Many websites offer customizable documents that can aid in creating structured financial records.

- Webinars and Online Courses: Platforms that provide training on various aspects of financial management, enhancing your knowledge and skills.

Utilizing these resources can significantly improve your proficiency in managing financial documentation, ultimately leading to better business practices and increased efficiency.