Service Billing Invoice Template for Streamlined Billing and Payment Tracking

Managing financial transactions efficiently is crucial for any business. By organizing payment requests through well-structured documents, you can streamline the process of tracking and collecting dues from clients. These records serve as essential tools for both businesses and clients, ensuring clarity and transparency in every financial exchange.

Customizing payment documents to fit specific needs and preferences helps improve professionalism and ensures that all necessary details are included. From client information to payment terms, having the right format can save time and reduce errors, benefiting both parties in the long run.

Whether you’re a freelancer, a small business owner, or part of a large company, creating and using an organized format for payment collection simplifies your workflow and enhances financial tracking. Tailoring these forms to suit your operational requirements can ensure that you maintain smooth transactions with every client, from start to finish.

Service Billing Invoice Template Overview

Organizing financial requests for services is essential for maintaining smooth transactions between businesses and clients. A structured document that outlines the work completed, payment amounts, and other relevant details helps ensure both parties are on the same page and reduces the risk of misunderstandings. Using a well-constructed format for these records can simplify the entire payment process, making it easier to track and manage financial dealings.

Key Features of Payment Request Documents

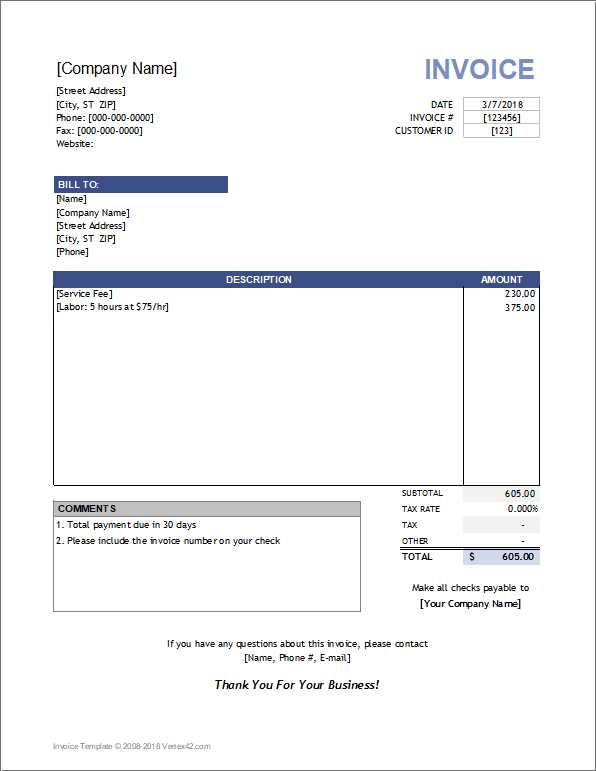

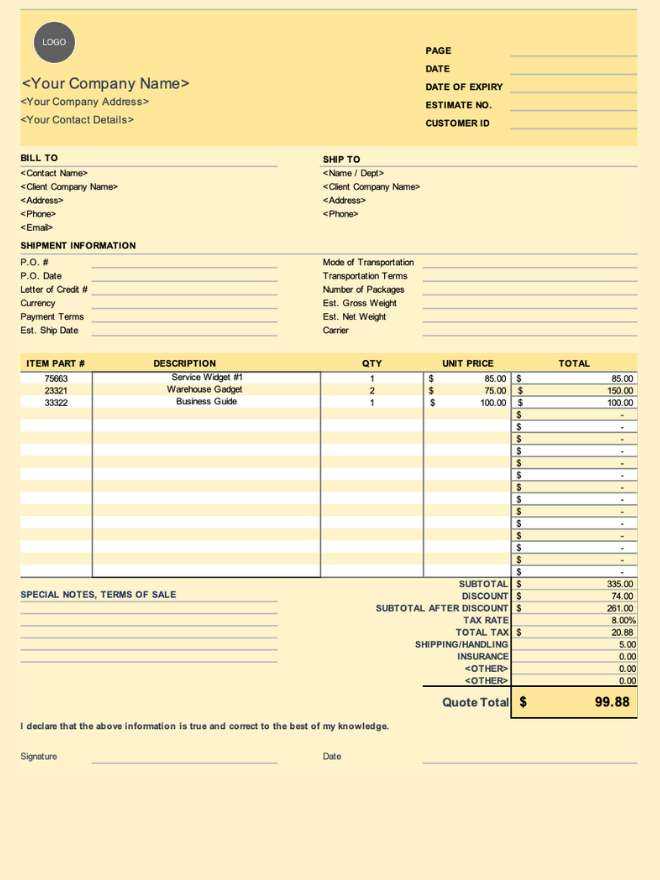

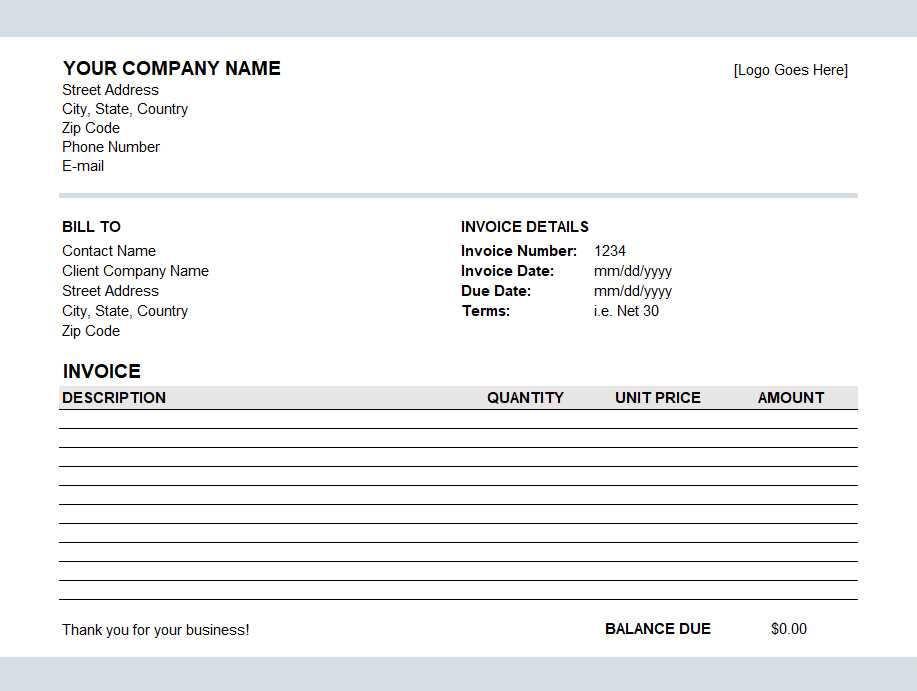

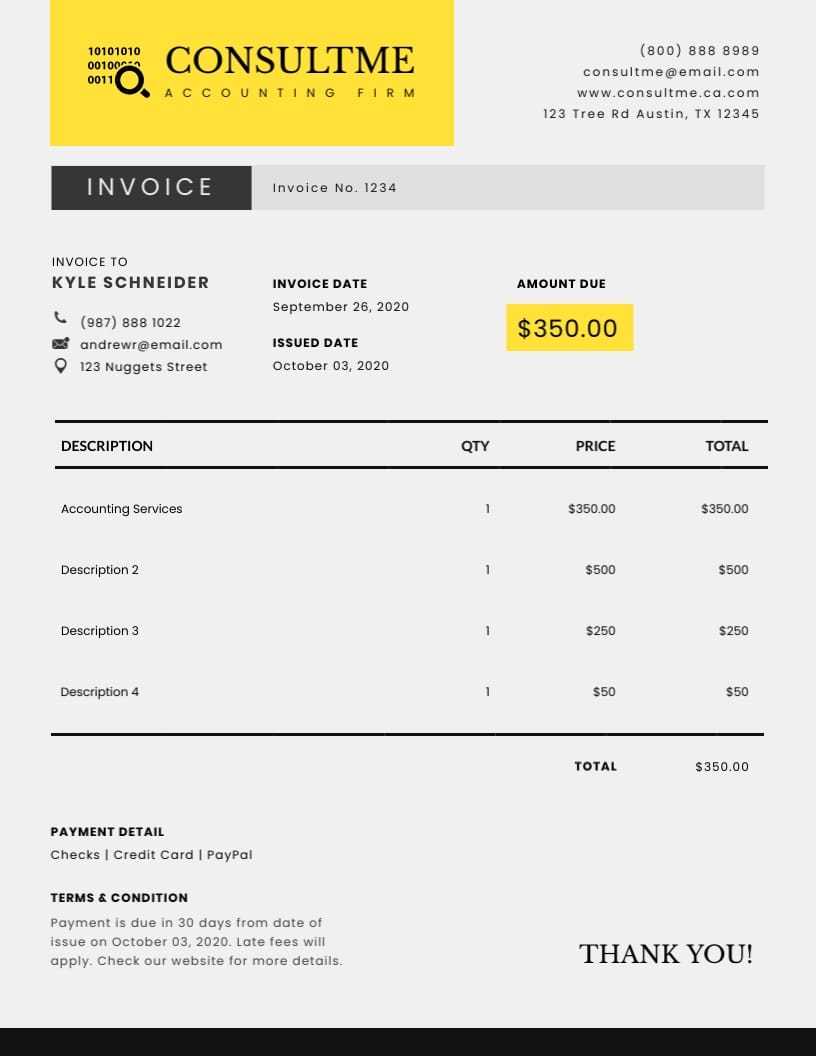

The main purpose of this document is to present all the necessary details related to a transaction. A well-organized format includes sections for client information, description of services, payment terms, and due dates. This structure ensures that all relevant information is readily available for both the service provider and the client, which helps in avoiding confusion and ensuring timely payments.

Benefits of Using a Structured Format

Having a standardized structure for financial requests offers several advantages. It saves time for the provider by reducing the need to manually input the same information for every transaction. Additionally, it offers a more professional appearance, which can improve client trust. Customization options allow businesses to tailor the document to suit their specific needs, improving both efficiency and clarity.

Benefits of Using a Billing Template

Adopting a structured format for financial documentation offers numerous advantages, particularly for businesses that handle frequent transactions. A well-designed document not only simplifies the process but also ensures that essential details are consistently included, leading to greater efficiency and professionalism. By utilizing a pre-designed format, companies can avoid errors and save valuable time on every transaction.

- Consistency: Using a predefined structure ensures that every financial record follows the same layout, reducing the chance of missing important details.

- Time-saving: With customizable sections, businesses can quickly input the necessary information without having to create a new document each time.

- Professionalism: A polished, organized format enhances the appearance of the document, which can help build trust with clients.

- Accuracy: A standardized document helps reduce errors by ensuring that all relevant fields are included, minimizing the risk of mistakes in calculations or missing data.

- Improved cash flow: Clear and structured documents can help ensure faster payments by making it easy for clients to understand the terms and due dates.

By integrating a structured document into your business processes, you can create an efficient system for tracking and managing financial transactions. Whether you’re managing a small or large volume of transactions, these benefits can improve both operational efficiency and client satisfaction.

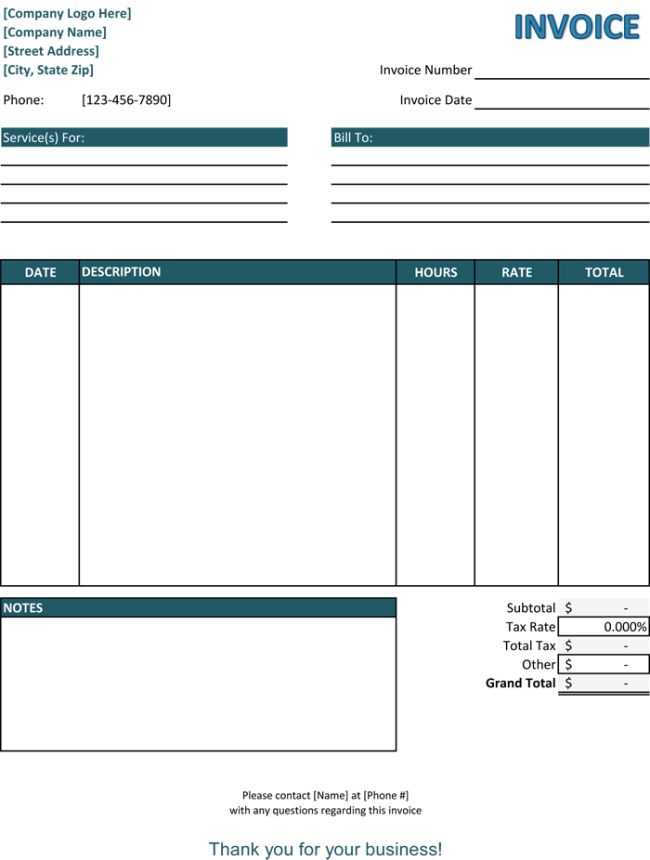

How to Create a Service Invoice

Creating a document for financial transactions requires careful attention to detail and proper structure. A well-crafted record should clearly outline the work completed, payment amounts, and any terms associated with the transaction. By following a few essential steps, you can ensure that your document is comprehensive, professional, and easy to understand for both parties involved.

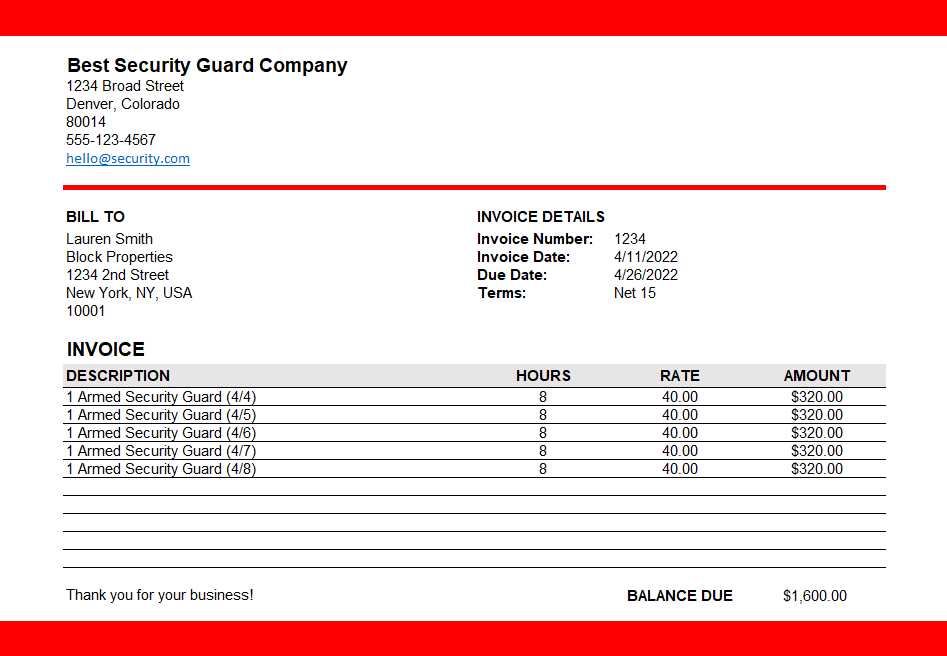

First, ensure that your document includes all the necessary contact information. This should consist of the provider’s name, address, and contact details, as well as the client’s information. Including these details not only helps identify both parties but also ensures that the document can be referenced easily in case of any issues.

Next, include a detailed description of the work completed. Break down the tasks or services provided in a clear and concise manner, outlining each charge or service separately. If applicable, include the number of hours worked, hourly rates, or other factors that affect the final amount due. This provides transparency and helps avoid any confusion or disputes later on.

Finally, be sure to include payment terms and due dates. This includes the total amount due, the payment methods accepted, and the deadline by which payment should be made. It is also helpful to add any late fees or penalties for delayed payments, ensuring that the terms are clear and enforceable.

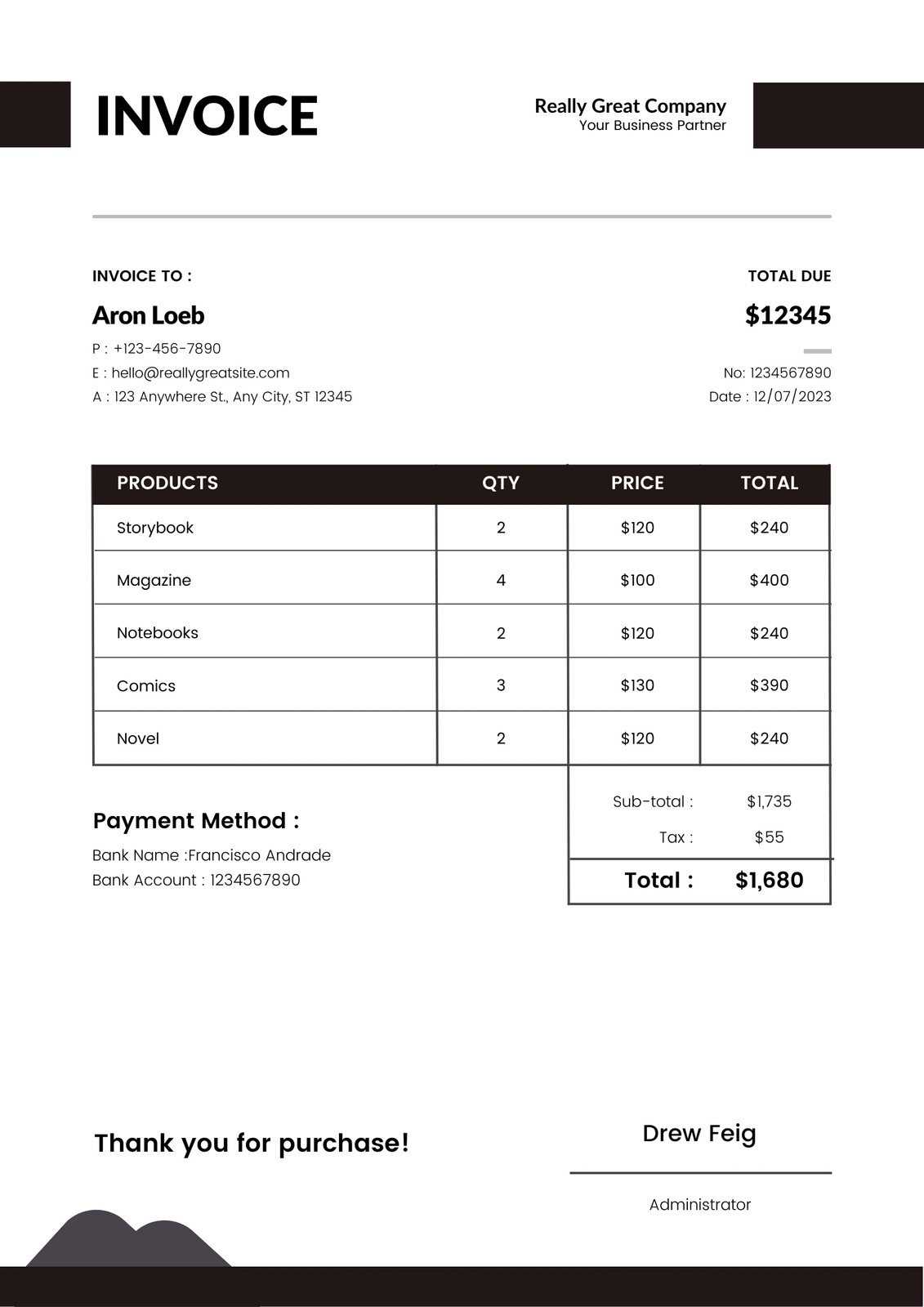

Key Elements of an Invoice

For any financial document, clarity and accuracy are crucial. A well-structured record not only ensures that all necessary details are covered but also reduces the chance of misunderstandings or disputes. By including the essential components, you can create a comprehensive and professional document that both parties can easily reference.

Essential Information for Identification

One of the first elements to include is the identification information for both the provider and the client. This section should contain the names, addresses, and contact details of both parties. Including these details makes it easier to identify the involved entities and enables smooth communication if necessary.

Clear Breakdown of Charges

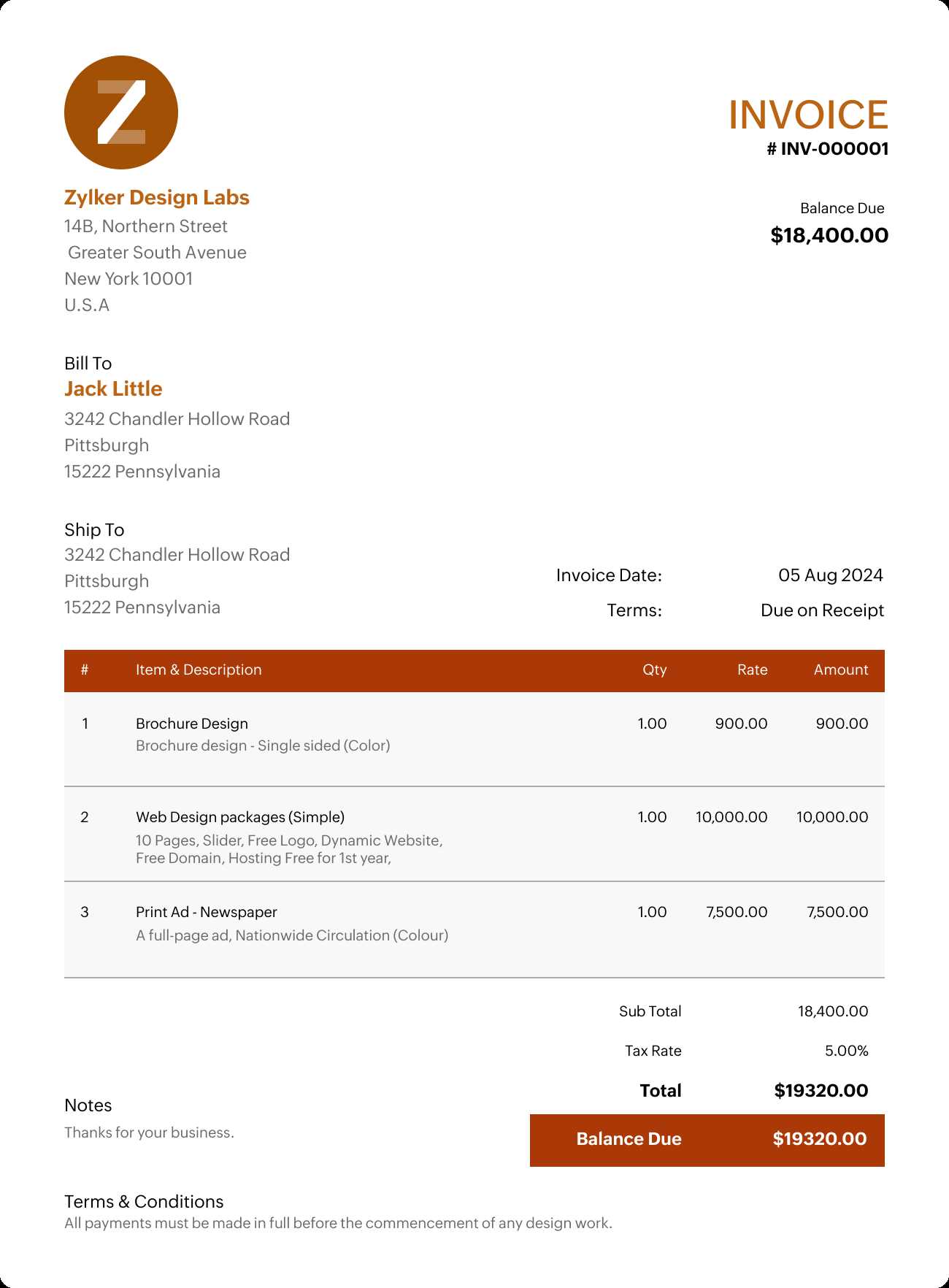

It is vital to provide a clear and detailed description of what has been provided in exchange for payment. This may include specific tasks completed, products delivered, or time worked. Each charge should be listed separately, with the corresponding cost next to it. Additionally, if applicable, taxes or discounts should be clearly stated to avoid confusion over the final total.

Including these key components ensures that the document is complete, transparent, and professionally presented, helping to foster trust and facilitate a smooth transaction process.

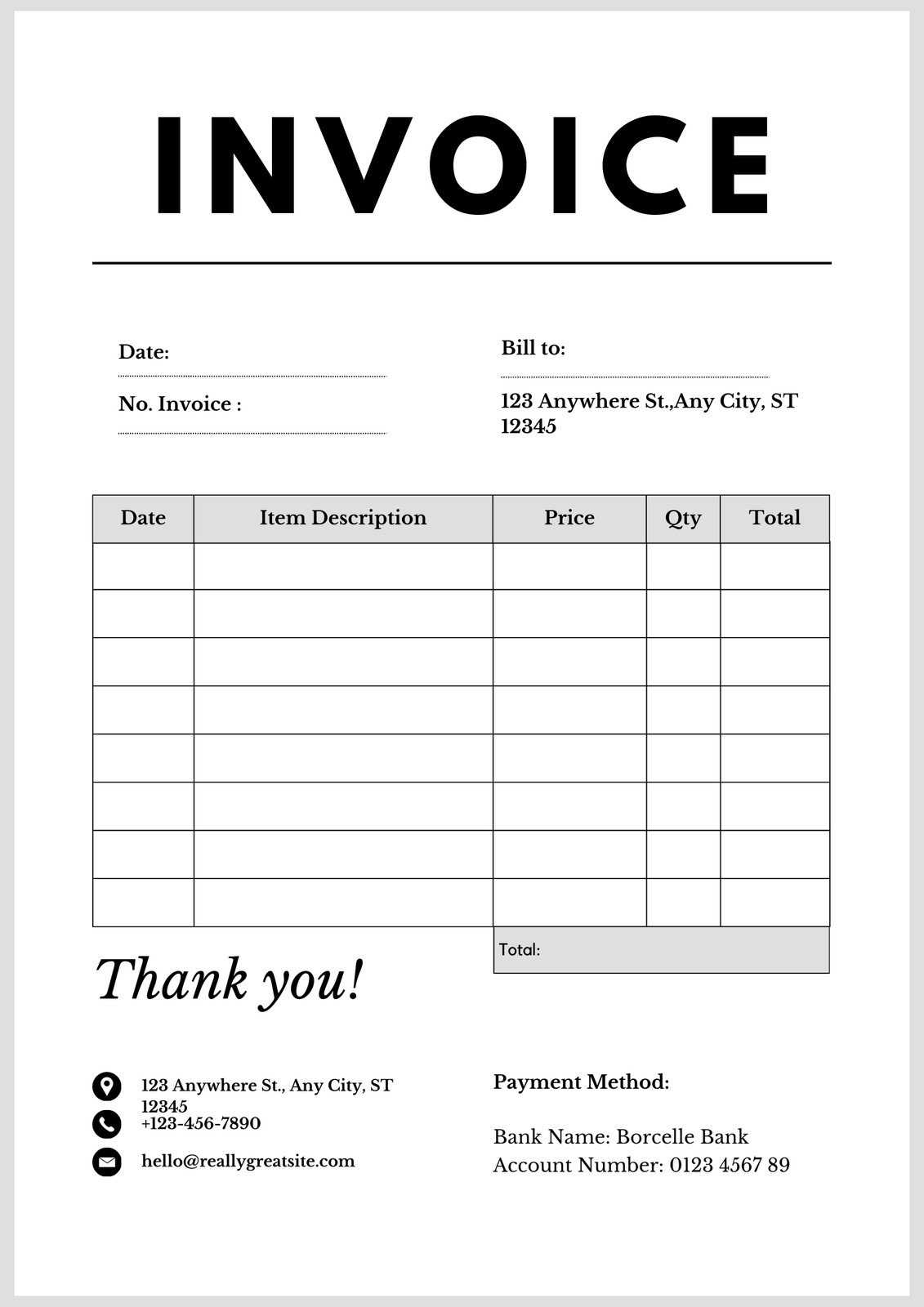

Choosing the Right Invoice Design

The design of a financial document plays an important role in its effectiveness. A clean, organized layout can make the content easier to understand, while a cluttered or confusing design can lead to mistakes or misinterpretations. The right layout not only reflects professionalism but also ensures that the important details are easy to find and interpret.

Importance of Simplicity and Clarity

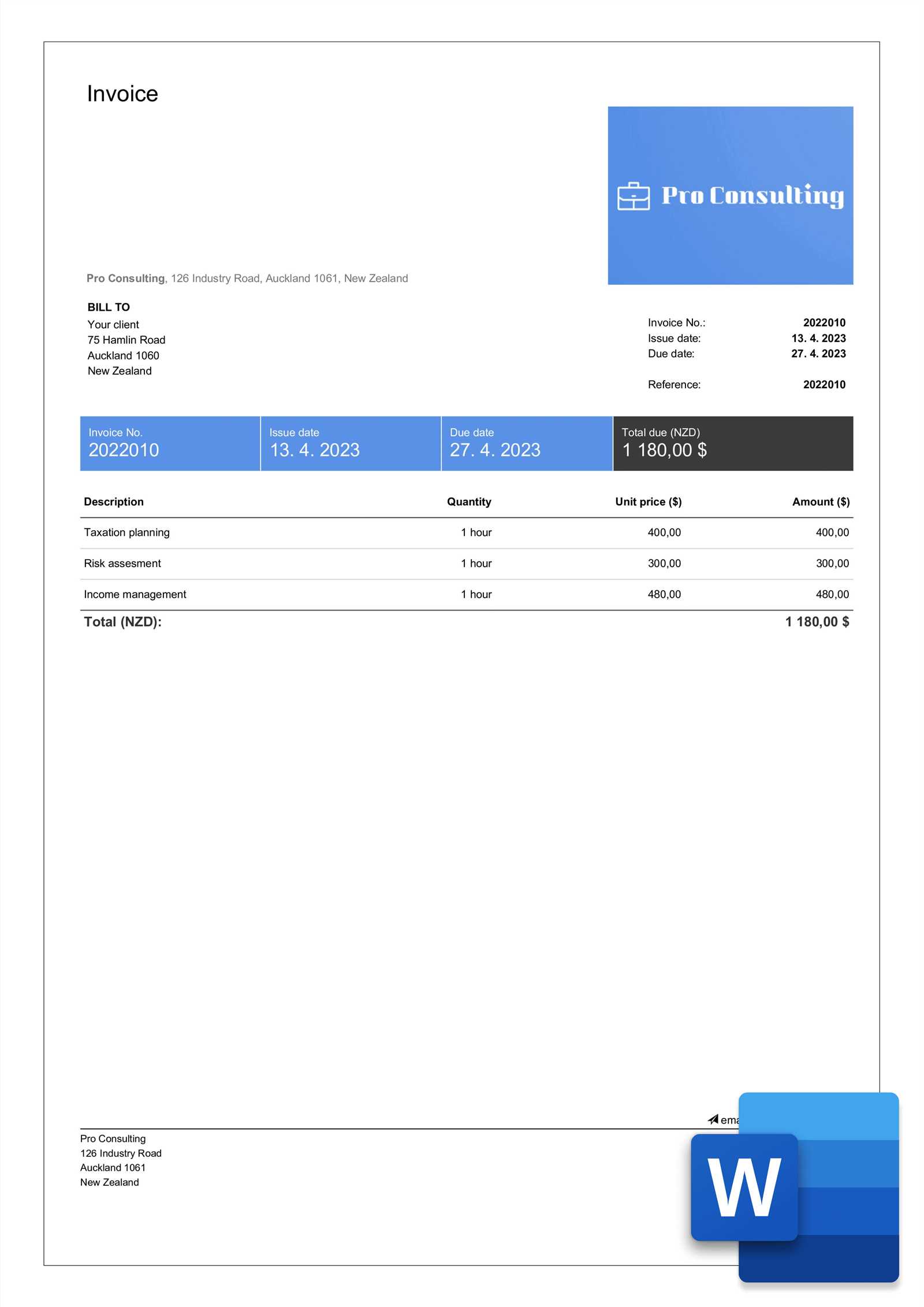

A well-designed document should prioritize simplicity. Too many elements or overly complex structures can overwhelm the recipient. A minimalist approach that clearly separates the different sections–such as client details, charges, and payment terms–helps readers quickly navigate the document without missing key information.

Branding and Customization Options

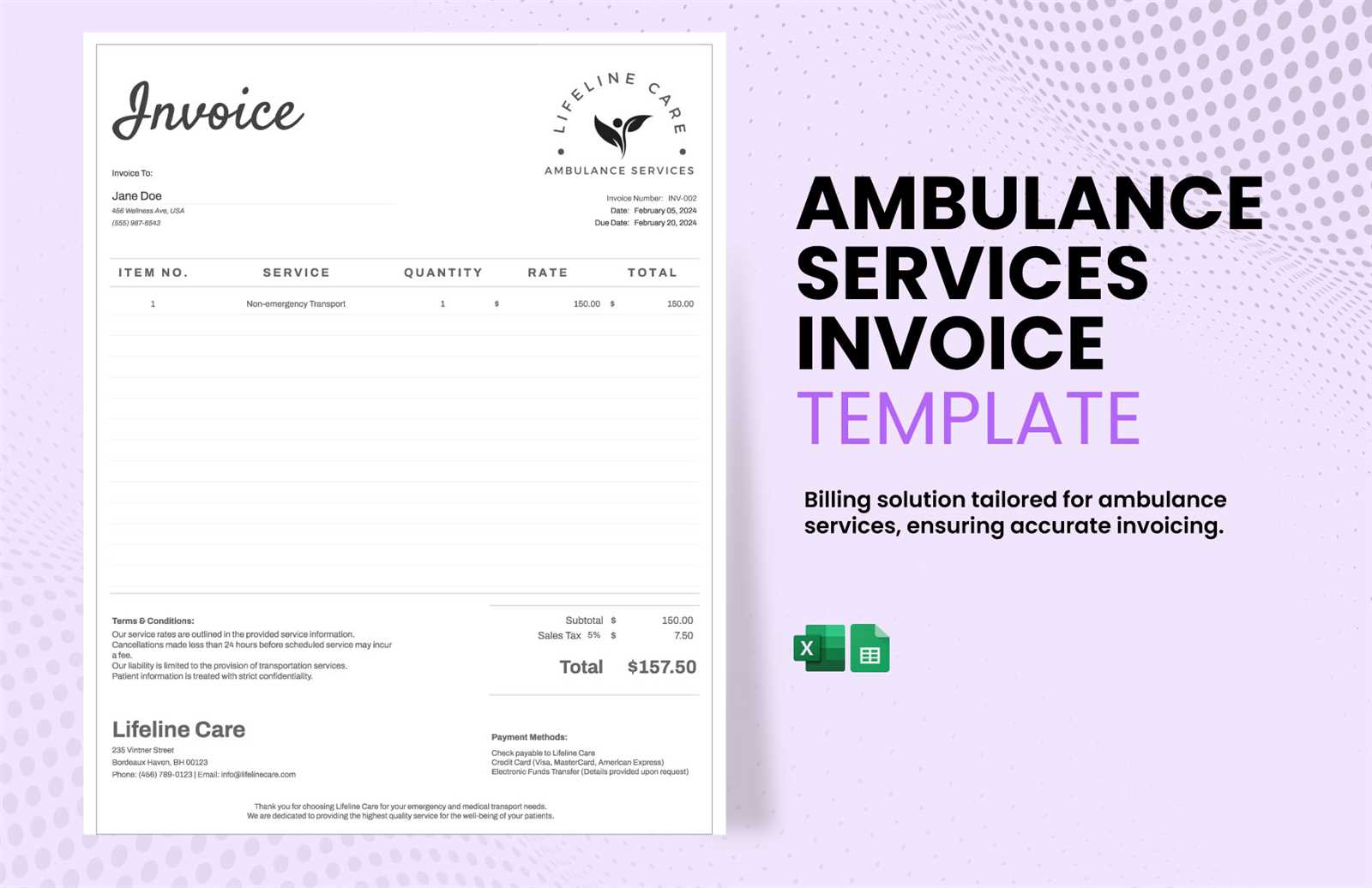

While clarity is essential, the design also provides an opportunity to reinforce your business’s identity. Incorporating your logo, brand colors, and fonts into the layout can make the document feel more personalized and professional. Additionally, customizable sections allow businesses to adjust the look and feel to suit their specific needs, giving each document a unique, tailored appearance.

Ultimately, the right design balances both functionality and aesthetics, ensuring that your document is both easy to read and aligned with your brand’s identity.

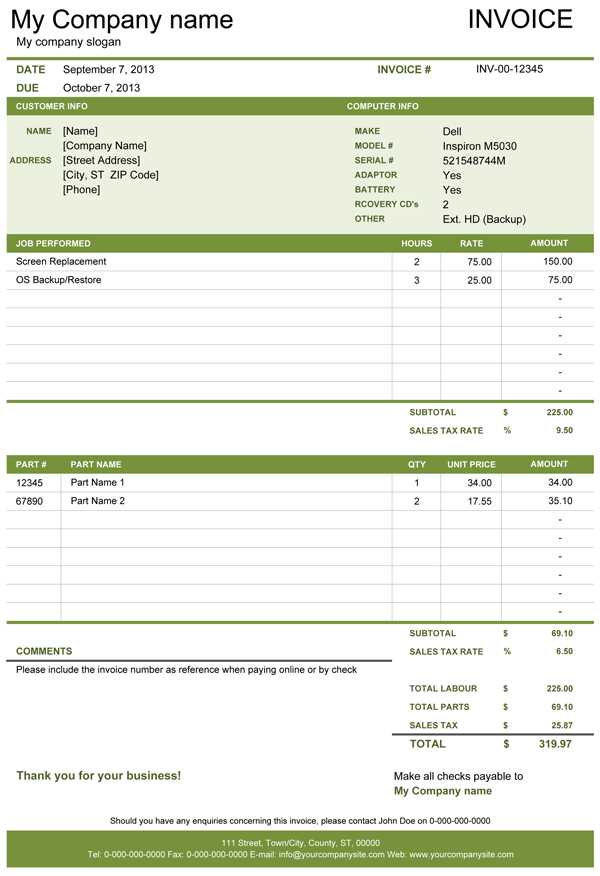

Customizing Your Service Invoice Template

Personalizing your financial document ensures it fits your specific needs and reflects your business style. A customizable layout allows you to adjust the design, structure, and details to suit different types of transactions and client preferences. This approach not only improves the presentation but also ensures that the document includes all the necessary elements to avoid confusion and facilitate smooth payments.

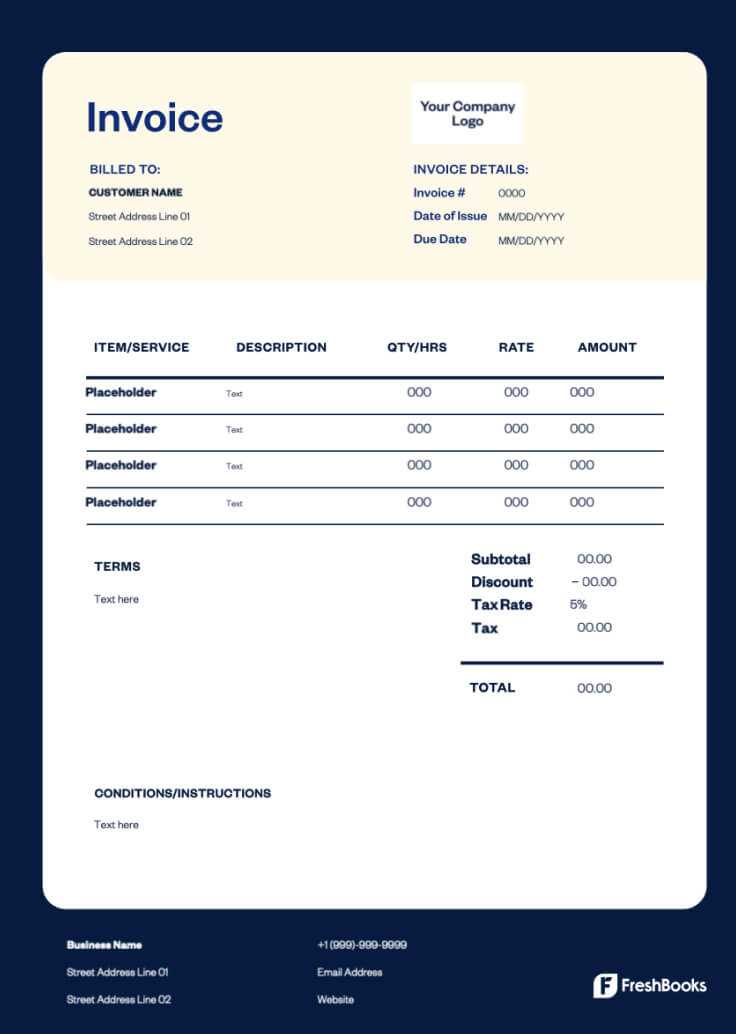

- Adjust the layout: Organize the sections based on the nature of your business. Whether you prioritize work descriptions, costs, or payment terms, make sure the most important elements are easy to find.

- Branding: Incorporate your business’s logo, colors, and fonts to give the document a professional and personalized look. This strengthens your brand identity and adds a cohesive touch to your communications.

- Flexible sections: Customize the fields for specific transaction details such as discounts, taxes, or additional notes. Tailor the document to address any particular requirements for different services or clients.

- Payment methods: Include a variety of payment options based on your business’s capabilities. Allow clients to choose from methods such as bank transfers, online payment platforms, or checks, and make sure these options are clearly outlined.

By customizing these aspects, you can create a more efficient and professional document that not only meets the needs of your business but also enhances the experience for your clients.

Common Mistakes to Avoid in Billing

When preparing financial records, small errors can lead to significant issues for both you and your clients. Ensuring accuracy and clarity in your documents is essential to avoid delays, misunderstandings, and payment disputes. By being aware of common pitfalls, you can maintain a smooth process and enhance your professional reputation.

- Incomplete or missing details: Always double-check that all necessary information is included, such as the client’s contact details, transaction descriptions, and payment terms. Omitting important information can lead to confusion and delays.

- Ambiguous payment terms: Be clear about when payments are due and include any late fees or penalties for overdue payments. Unclear terms can cause misunderstandings and make it difficult to enforce payment deadlines.

- Incorrect pricing: Ensure that the prices listed match your agreed-upon rates. Double-check for any calculation mistakes or discrepancies between the services provided and the charges listed.

- Failure to follow up: Not following up with clients who miss payments can delay cash flow and create unnecessary stress. Set up a system for timely reminders and follow-ups to keep everything on track.

- Overcomplicating the document: Avoid cluttering the document with unnecessary information or design elements. Keep the layout simple and easy to navigate to ensure clients can quickly find all the essential details.

By being mindful of these common errors, you can create more accurate, efficient, and professional documents that enhance your business operations and foster trust with your clients.

Integrating Payment Methods into Invoices

Including a variety of payment options in your financial documents can streamline the payment process, making it easier for clients to settle their dues. By offering multiple methods of payment, you increase the likelihood of timely transactions, enhance convenience for your clients, and reduce delays caused by payment method limitations.

Common Payment Methods to Include

When listing payment options, it’s important to provide clear instructions and the necessary details for each method. Some of the most common methods include:

- Bank Transfers: Provide your bank account number, the bank name, and any other relevant details like SWIFT/BIC codes for international transfers.

- Online Payment Systems: Platforms such as PayPal, Stripe, or Venmo allow for quick payments. Include the necessary links or payment instructions for easy access.

- Checks: If you accept checks, specify the payee’s name and the address where checks should be sent.

- Credit/Debit Cards: Many businesses now accept card payments directly through payment gateways. Clearly state the supported card types and any additional fees if applicable.

Important Considerations

While integrating payment options, it’s important to be transparent and straightforward. Be clear about any fees associated with certain methods, such as processing fees for credit cards or international bank transfers. Additionally, include clear instructions on how to complete the payment, as well as any due dates to ensure timely processing.

By making it easy for clients to pay through their preferred method, you not only improve cash flow but also enhance customer satisfaction and create a smoother transaction experience for all parties involved.

Setting Clear Payment Terms

Establishing clear and transparent payment terms is crucial for maintaining a smooth financial process between you and your clients. Clear terms not only set expectations but also help prevent misunderstandings and delays. When clients are aware of the conditions from the outset, they are more likely to make timely payments and adhere to agreed-upon deadlines.

Essential Payment Terms to Include

To ensure clarity and avoid any confusion, include the following key details in your financial agreements:

- Due Date: Clearly specify the exact date by which payment is expected. If there is flexibility, such as 30 or 60 days, make sure to state this explicitly.

- Accepted Payment Methods: List all the payment options available, such as bank transfers, credit cards, or online payment systems, and provide any necessary account or link details.

- Late Fees: Specify any additional charges that will apply if the payment is not received by the due date. This encourages clients to make payments promptly.

- Discounts for Early Payment: Offering a discount for early payments can incentivize clients to settle their bills sooner, improving cash flow.

- Currency: If working with international clients, always mention the currency in which payments should be made to avoid confusion or exchange rate issues.

Communicating Terms Effectively

Ensure that your payment terms are communicated clearly and are easily visible within your document. You can also send reminders as the due date approaches to help clients stay on track. The more transparent you are about payment expectations, the easier it will be to maintain a positive and professional relationship with your clients.

Tracking Payments with Invoice Templates

Monitoring payments is an essential part of managing financial transactions. A well-organized document helps keep track of whether payments have been made, the amounts received, and any outstanding balances. By incorporating clear tracking features, businesses can ensure timely follow-ups and maintain accurate records without the risk of missing important details.

Key Features for Payment Tracking

To effectively track payments, consider including these important features in your documents:

- Payment Status: Indicate whether a payment is pending, completed, or overdue. This helps both you and the client know exactly where the transaction stands.

- Amount Paid: Include a section to specify the amount that has been paid so far. This is particularly useful for partial payments or ongoing projects.

- Remaining Balance: Clearly show the amount left to be paid, making it easier to follow up on any outstanding amounts.

- Payment Due Dates: List due dates to provide a clear timeline for when the next payment is expected. This keeps clients aware of deadlines and encourages timely settlements.

Using Digital Tools for Tracking

Incorporating digital tools or software can streamline the tracking process, allowing for automatic updates when payments are received. These tools can also generate reports, send reminders to clients, and offer additional features such as payment history tracking. Using such systems can reduce the chances of human error and make the entire process more efficient.

By utilizing these tracking features, businesses can stay organized and ensure that all transactions are accounted for, ultimately improving cash flow management and reducing the time spent on follow-ups.

Best Practices for Invoice Management

Efficiently handling financial documents is crucial for maintaining a smooth cash flow and ensuring timely payments. Adopting a set of best practices can help prevent delays, avoid errors, and create a streamlined process for both you and your clients. Proper management ensures that all transactions are tracked, recorded accurately, and processed without unnecessary complications.

Key Practices for Effective Management

Here are some best practices to follow when managing your financial records:

- Consistency in Formatting: Use a standardized format for all your documents. This helps reduce confusion and ensures that all necessary details are included, making it easier for clients to understand and process the information.

- Timely Issuance: Send your records promptly after completing the agreed work or providing the product. Delaying the document can lead to delays in payment and disrupt your cash flow.

- Clear Payment Terms: Always define payment terms clearly, such as due dates and accepted methods. Make sure there are no ambiguities to avoid confusion later on.

- Automated Reminders: Use automated systems to send reminders to clients about upcoming or overdue payments. This ensures timely follow-ups without the need for manual intervention.

- Organized Record Keeping: Maintain organized records of all issued documents. Using cloud-based tools or accounting software can help you track payments, monitor outstanding amounts, and retrieve past records with ease.

Enhancing Efficiency with Technology

Leveraging digital tools can significantly improve your document management process. Many accounting and finance tools offer automation for issuing, tracking, and storing financial documents. These platforms also integrate with other business systems, allowing for seamless data entry and reducing human error.

By following these best practices, you can ensure that your financial record management is organized, efficient, and free from unnecessary delays, improving both your business operations and client relationships.

How to Handle Late Payments

Dealing with overdue payments can be frustrating, but it’s an inevitable part of running a business. A clear process for addressing late payments helps maintain professional relationships while ensuring that your cash flow is not disrupted. By handling late payments effectively, you can minimize delays, reduce stress, and keep your business operations running smoothly.

Steps to Address Late Payments

Here are some strategies to follow when dealing with overdue amounts:

- Send a Polite Reminder: Sometimes clients forget about due dates. A gentle reminder can be sent a few days after the payment is missed. Keep the tone professional and friendly.

- Communicate Clearly: If the payment remains overdue, reach out directly. Clearly state the outstanding amount, any late fees (if applicable), and the new due date for payment.

- Offer Payment Plans: In some cases, clients may be facing cash flow issues. Offering a payment installment plan can provide flexibility while ensuring that you still receive payment over time.

- Use Late Fees: Implementing a penalty for overdue payments can encourage clients to settle their debts on time. Be transparent about this policy from the start to avoid any surprises.

- Take Legal Action: If payment issues persist and the amount owed is significant, it might be necessary to take formal legal steps. This should always be a last resort, after all other methods have been exhausted.

Preventing Future Late Payments

While it’s important to have a strategy for dealing with overdue payments, prevention is always better. Clear payment terms, timely invoicing, and consistent follow-ups can help minimize the likelihood of delays in the future. Additionally, offering incentives for early payment can motivate clients to settle their bills promptly.

By following these practices, you can handle overdue payments professionally and maintain a positive relationship with your clients while ensuring your business stays financially stable.

Automating Your Billing Process

Automation can significantly streamline the financial aspects of your business, saving time and reducing errors. By automating repetitive tasks related to client transactions, you can focus on more strategic activities while ensuring accuracy and efficiency in your record-keeping. The right tools can help with everything from generating documents to processing payments automatically.

Benefits of Automation

Implementing automated systems offers several advantages for managing client transactions:

- Time-Saving: Automation eliminates the need for manual entry, reducing the time spent on administrative tasks. With the right software, most processes can be completed with just a few clicks.

- Consistency: Automated systems ensure consistency in formatting, details, and timing. This consistency leads to fewer mistakes and clearer communication with clients.

- Faster Payments: With automation, clients receive their documents promptly, and reminders can be sent automatically for overdue amounts. This leads to quicker payment processing.

- Accuracy: By reducing human involvement, automation minimizes the risk of errors, ensuring that amounts, dates, and details are correct every time.

Steps to Automate Your Process

To successfully automate your financial processes, consider these steps:

- Choose the Right Software: Look for a tool that integrates well with your other business systems and offers features like automatic document creation, payment reminders, and tracking.

- Set Up Recurring Transactions: If you have clients who make regular payments, automate recurring charges to ensure timely processing without manual intervention.

- Enable Online Payments: Make it easy for clients to pay by offering automated online payment options. This provides convenience and speeds up the payment cycle.

- Monitor and Adjust: Keep an eye on the performance of your automated system and make adjustments as needed to improve efficiency or address any issues that arise.

By automating your financial processes, you can improve efficiency, reduce administrative workload, and create a more professional experience for your clients. This allows you to focus on growing your business while maintaining control over your financial operations.

Legal Considerations for Service Invoices

When creating transaction records for your business, it is essential to ensure that they comply with legal standards. Accurate and legally compliant documentation not only helps prevent disputes but also protects your business from potential legal issues. Understanding the key legal aspects of these financial documents is crucial for maintaining transparency and safeguarding your interests.

Key Legal Elements

There are several important legal elements to include when creating transaction records:

- Correct Information: Always ensure that all relevant details such as business names, addresses, and tax identification numbers are accurately listed. This helps confirm the legitimacy of the document.

- Clear Terms and Conditions: Clearly outline the payment terms, including due dates, penalties for late payments, and any applicable discounts. These terms should be agreed upon by both parties.

- Tax Compliance: Verify that your documents include any applicable tax charges such as VAT or sales tax, and ensure they are compliant with local tax laws. This is essential for both business transparency and tax reporting.

- Legal Language: Use clear, professional language that avoids ambiguity. This helps prevent misunderstandings and supports legal enforceability if a dispute arises.

- Retention of Records: Maintain records of all transactions for a legally required period, which varies depending on jurisdiction. This helps in case of audits or legal actions.

Protecting Your Business

Incorporating the proper legal considerations into your documentation can protect you from future legal complications:

- Dispute Resolution: Include clauses that specify how disputes will be resolved, such as through mediation or arbitration, to avoid lengthy court processes.

- Late Payment Fees: Clearly outline the fees for late payments, including the percentage or fixed amount charged after the due date. Ensure that these charges are reasonable and legally enforceable.

- Intellectual Property: If applicable, include language about the ownership of intellectual property, ensuring that both parties understand their rights regarding any proprietary information involved in the transaction.

- Signatures: Ensure that both parties sign the document, either physically or digitally, to make the agreement legally binding.

By understanding and addressing these legal considerations, you can ensure that your transaction records are both effective and compliant with the law, minimizing the risk of disputes and protecting your business interests.

Importance of Accurate Billing Information

Having precise and up-to-date financial details is essential for any business that seeks to maintain professional relationships and ensure smooth transactions. Accurate data helps prevent misunderstandings and disputes, while also fostering trust between both parties. This is especially critical in situations where payments, due dates, and terms are involved. The clarity of financial records ensures that your business operates transparently and efficiently.

Key Reasons for Accuracy

Maintaining accuracy in your financial documents provides several significant benefits:

- Prevents Payment Delays: Accurate contact and payment details ensure that payments are processed without unnecessary delays. Missing or incorrect information can cause significant holdups in payment processing.

- Avoids Disputes: Clear and accurate data helps in preventing disputes between you and your clients. If both parties are on the same page about terms, amounts, and due dates, conflicts can be minimized.

- Improves Cash Flow: Timely and correct payments are crucial to maintaining a healthy cash flow. When payment information is accurate, you reduce the risk of payment errors and improve financial planning.

- Enhances Professional Image: Clear and error-free financial documents contribute to a more professional image, showing clients that you value their time and are committed to accuracy.

- Compliance with Regulations: Accurate details are vital for meeting legal and tax obligations. Incorrect records can lead to penalties, fines, or audits from regulatory authorities.

Best Practices for Ensuring Accuracy

Here are some best practices to maintain the precision of your financial documentation:

- Double-Check Information: Always verify customer details, amounts, and dates before finalizing any document. Small mistakes can lead to significant issues down the line.

- Use Software Tools: Utilize accounting or financial software that automatically checks and formats information for accuracy.

- Establish Clear Procedures: Set up internal processes to confirm the correctness of all transactions before sending out any paperwork to clients.

- Keep Records Updated: Regularly update your client contact details and payment terms to avoid any outdated or incorrect data from being used in future transactions.

By prioritizing accuracy, businesses can build stronger relationships with their clients, improve payment cycles, and reduce the risk of legal or financial complications.

How to Use Digital Invoices Effectively

In today’s digital age, managing financial documents electronically has become an essential practice for businesses seeking efficiency and accuracy. Using digital formats to handle transactions offers numerous benefits, including faster processing, easier storage, and the ability to track payments more effectively. However, to fully leverage these advantages, it’s important to understand how to use them in a way that optimizes workflow and minimizes errors.

Streamlining Your Processes

Digital records can save both time and resources, but only if you implement the right strategies:

- Automate Recurring Transactions: Set up automatic generation and sending of documents for regular clients or recurring payments. This eliminates manual entry and reduces the chance of mistakes.

- Use Reliable Software: Choose trusted tools and platforms that offer secure, professional designs and ensure proper tracking features for payments and dates.

- Organize and Categorize Files: Organize digital documents into clearly labeled folders or systems to quickly find records when needed. Categorizing invoices by client, date, or project ensures easy access.

Enhancing Client Communication

Effective use of digital records can also improve the interaction with clients:

- Provide Clear Details: Always include relevant information such as payment methods, terms, and contact details in an easy-to-read format. Clear documents help clients understand exactly what is due and when.

- Offer Multiple Payment Options: Digital formats allow you to integrate different payment methods such as bank transfers, credit cards, or even online payment gateways, making it easier for clients to pay promptly.

- Follow Up Efficiently: Use email or integrated messaging features to send reminders or updates. Automated notifications about upcoming due dates or outstanding balances can prompt quicker payments.

By leveraging digital systems for your financial records, you not only save time but also create a more efficient, professional experience for both your business and your clients. Implementing these best practices helps maintain accurate documentation and ensures that all transactions are handled swiftly and securely.

Improving Cash Flow with Invoices

Effective management of financial documents plays a crucial role in maintaining a steady cash flow for any business. Timely and accurate documentation of transactions ensures that payments are collected efficiently, which directly impacts the financial stability of a company. The way you create, send, and track your payment requests can significantly influence your ability to manage cash flow, reduce delays, and keep operations running smoothly.

Timely Submission for Faster Payments

One of the most effective ways to improve cash flow is by ensuring that payment requests are issued promptly and consistently. Here are some strategies to enhance this process:

- Send Requests Immediately: As soon as a product or service is delivered, send the documentation to your client. The quicker they receive the request, the faster they can process and make the payment.

- Automate Sending Processes: Use automated systems to generate and send payment requests as soon as a task is completed. This removes the delay caused by manual entry or oversight.

- Set Clear Payment Terms: Clearly outline the due dates and payment expectations in your documentation. This reduces confusion and makes it easier for clients to honor deadlines.

Tracking and Following Up on Payments

Tracking payments and following up on overdue accounts is essential for managing cash flow. By staying organized and proactive, you can reduce outstanding amounts and ensure steady income:

- Monitor Payment Status: Keep an organized record of when payments are due and when they are received. Digital tools can automatically update the status of each transaction, providing a clear picture of your cash flow.

- Send Gentle Reminders: For overdue accounts, automated reminders can help prompt clients to pay without the need for direct intervention. A gentle nudge can often speed up the payment process.

- Offer Flexible Payment Options: Providing different ways to settle payments can encourage clients to pay faster. Options like online transfers or credit card payments can streamline the transaction process.

By improving the efficiency of how payments are requested, tracked, and followed up on, businesses can see a significant improvement in their cash flow. Consistency, clarity, and automation are key factors in achieving better financial management.