Effective Sending Invoice Email Template for Professional Communication

In any business relationship, clear and professional communication is key, especially when it comes to financial transactions. Properly structured messages for payment requests not only ensure clarity but also help maintain trust with clients. A well-crafted letter can set the right tone and prevent misunderstandings, making the process smoother for both parties involved.

When requesting payment, the way the message is framed matters just as much as the content itself. From the wording and layout to the tone and urgency, every detail counts. A well-formed request can encourage prompt settlement, while a poorly written one may delay payments and strain the professional relationship.

Mastering the art of crafting a payment request is crucial for maintaining financial stability in any business. Whether you’re a freelancer or managing a large organization, using a thoughtful and concise approach can significantly improve your payment collection process. In this guide, we’ll explore best practices and practical tips to help you craft the perfect message for requesting payment.

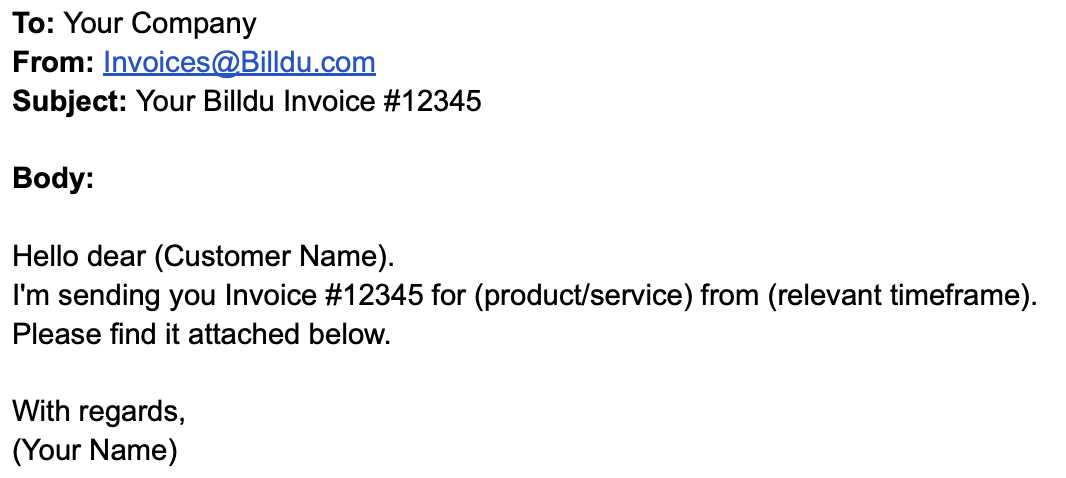

Creating a Professional Invoice Email

When it comes to requesting payment, presenting yourself professionally is essential for fostering trust and ensuring smooth financial transactions. The way you communicate payment requests can have a significant impact on how quickly and efficiently clients respond. A well-written message demonstrates your professionalism and helps avoid any confusion about the amount due, the deadline, and payment terms.

Key Elements of a Professional Message

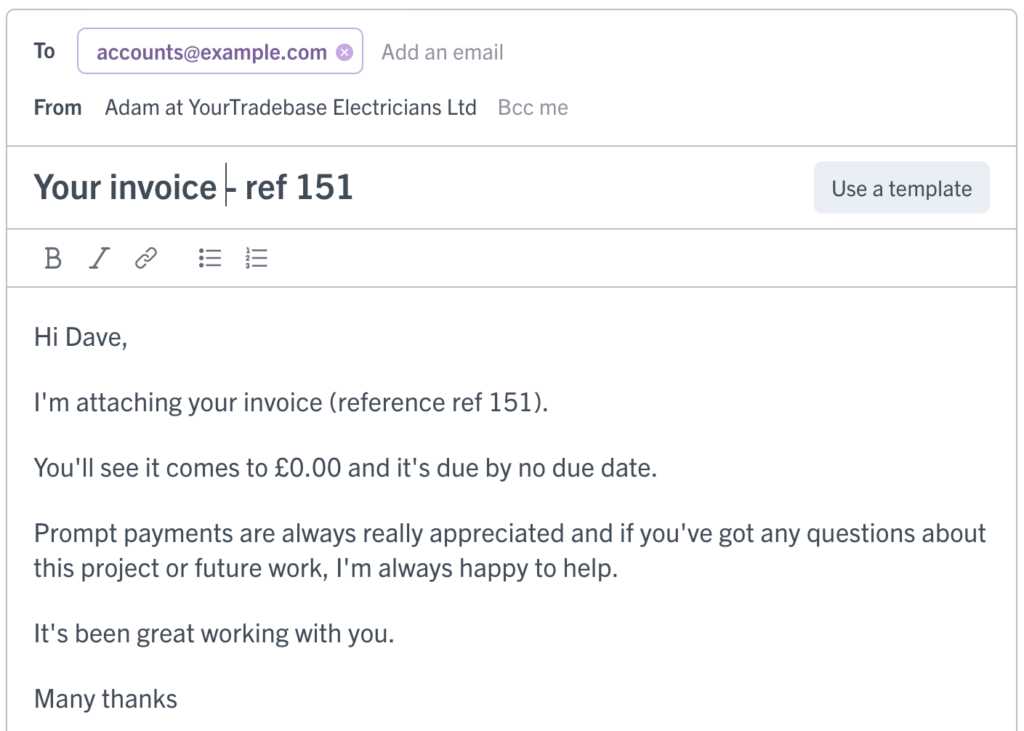

A polished request should be clear, concise, and polite. Begin with a formal greeting, addressing the client by name, and move into the details of the payment. It is crucial to be transparent about the amount due, the services provided, and the due date. Providing a brief summary of the work completed helps remind the client of the value received. Always make sure to include your preferred method of payment and any additional instructions if needed.

Crafting the Right Tone

The tone of your message should always reflect respect and professionalism. A firm yet courteous tone encourages prompt action while maintaining a positive relationship with the client. Avoid overly casual language or aggressive wording, as these can lead to misunderstandings or even damage the relationship. Politeness goes a long way, so phrases like “I appreciate your prompt attention to this matter” can reinforce the importance of timely payment without sounding demanding.

By following these steps and keeping your communication clear and respectful, you will create a message that not only looks professional but also sets the stage for a positive response. Maintaining this level of professionalism will help establish a trustworthy reputation with your clients, making future transactions smoother.

Why Your Invoice Email Matters

The way you communicate payment requests plays a crucial role in ensuring timely settlements and maintaining a professional image. A well-crafted message is not just a reminder of money owed; it’s also an opportunity to reinforce your brand’s professionalism and build stronger client relationships. In business, the details matter, and the tone and clarity of your communication can directly impact cash flow and future opportunities.

Impact on Client Relationships

A clear, well-written request can enhance the trust between you and your clients. On the other hand, poorly constructed or vague messages can create confusion, leading to delays or disputes. Here’s how effective communication can benefit your professional relationships:

- Promotes Transparency: A detailed breakdown of charges ensures that the client fully understands what they are paying for.

- Reduces Delays: Clear instructions and a concise format help eliminate misunderstandings that could cause delayed payments.

- Builds Trust: A polite and professional approach shows respect for the client, which in turn encourages timely payment.

Strengthening Your Business Image

Consistently sending professional payment requests helps build your brand’s reputation for reliability and attention to detail. Clients will feel more confident in doing business with you if they perceive you as organized and professional. Here are some ways in which your communication can reinforce your business image:

- Consistency: Regularly using a structured format builds familiarity, making clients more comfortable with your processes.

- Professionalism: Clear, respectful, and well-organized messages convey that you value both the client and the work completed.

- Timeliness: Promptly sending payment requests shows that you are on top of your financials and professional commitments.

In summary, a thoughtfully composed message not only helps ensure quicker payments but also plays a vital role in enhancing both client relationships and your overall business image. By prioritizing clear communication, you lay the foundation for smoother transactions and stronger partnerships in the future.

Essential Elements of an Invoice Email

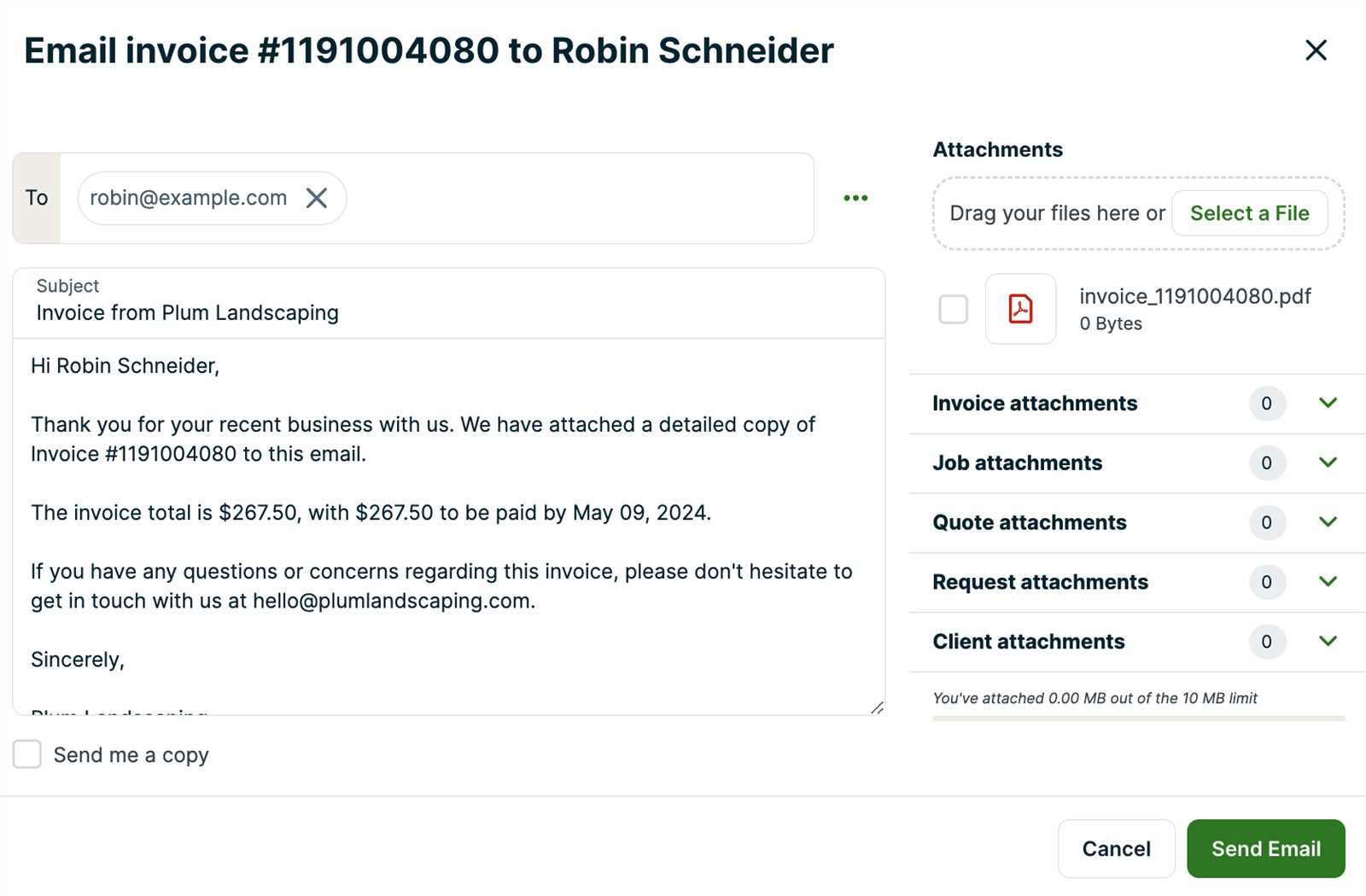

For a payment request to be effective, it must include all the necessary details in a clear and organized manner. The structure of your message is crucial to ensure that the recipient understands the request and can act on it promptly. An effective payment request contains not only the amount owed but also key information that clarifies the transaction and makes it easy for the client to complete the payment.

Key Information to Include

Every message should be concise yet thorough. Below are the most important elements to include in a payment request:

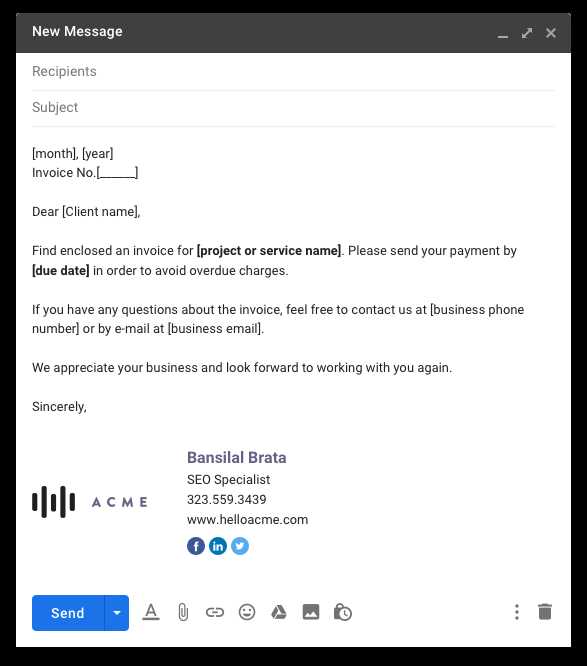

- Clear Subject Line: Ensure the subject line is direct, such as “Payment Due for [Service/Project Name]” or “Amount Due for [Month]”. This sets the tone and grabs attention immediately.

- Personalized Greeting: Address the client by name to add a personal touch and make the message feel more professional.

- Detailed Breakdown: Provide a clear list of services provided, the cost for each item, and any applicable taxes. This prevents confusion and reinforces transparency.

- Amount Due: Highlight the total amount owed and include a reminder of any payment terms, such as discounts for early payments or late fees for overdue amounts.

- Due Date: Specify the deadline by which the payment should be made, ensuring there is no ambiguity about the timeline.

- Payment Instructions: Include all necessary details, such as your preferred payment methods (bank transfer, credit card, etc.) and account information if needed.

- Professional Closing: Conclude with a polite, professional closing statement such as “Thank you for your business” or “Looking forward to your prompt payment.”

Formatting and Clarity

Beyond the content itself, how you present this information is just as important. Proper formatting ensures your message is easy to read and acts as a visual cue to guide the recipient through the details. Use bullet points, bold text, and clear paragraph breaks to separate different sections and highlight key points, such as the amount due and the payment deadline. This will make the request easier to understand and more likely to be acted upon swiftly.

By including these essential elements, you make it easier for your clients to process the payment and help ensure that your request is taken serio

How to Craft a Clear Invoice Message

Clear communication is essential when requesting payment. The recipient must quickly understand the amount owed, the services rendered, and the payment terms. By structuring your message logically and keeping it concise, you ensure that your client can process the request without confusion, making it more likely that payment will be made promptly.

Keep it Simple and Direct

A straightforward approach is always best. Start with a polite greeting and quickly move to the point of the message. Avoid unnecessary details or lengthy explanations. Focus on the key facts, such as the total amount due, the services provided, and the due date. This allows your client to focus on the essential elements and take immediate action.

- Start with a clear subject line: For example, “Payment Due for [Service/Project]” will immediately inform the recipient of the message’s purpose.

- State the amount due up front: Mention the total amount clearly at the beginning of the message, ensuring there’s no ambiguity.

- Be specific about the services: List the work completed, including dates and any applicable details, so the client knows exactly what they’re paying for.

- Include clear payment instructions: Make sure the client knows how to pay and by what method, providing all necessary details such as account numbers or payment links.

Avoid Ambiguity

One of the most common reasons for delayed payments is unclear communication. Avoid using vague phrases such as “please pay soon” or “the amount is due shortly.” Instead, use specific language like “Please pay by [date]” or “The amount of [total] is due for payment by [due date].” Additionally, outline any late fees or discounts clearly to avoid confusion later on.

Finally, always double-check for errors or omissions. A message free of mistakes or ambiguities reflects your professionalism and helps ensure a smooth payment process.

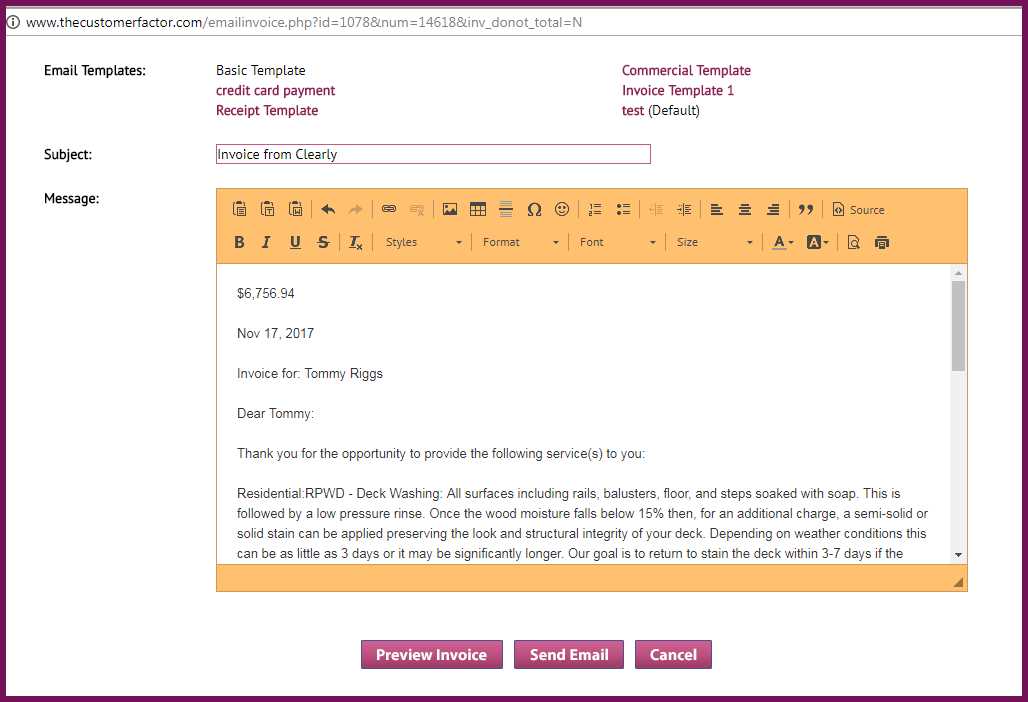

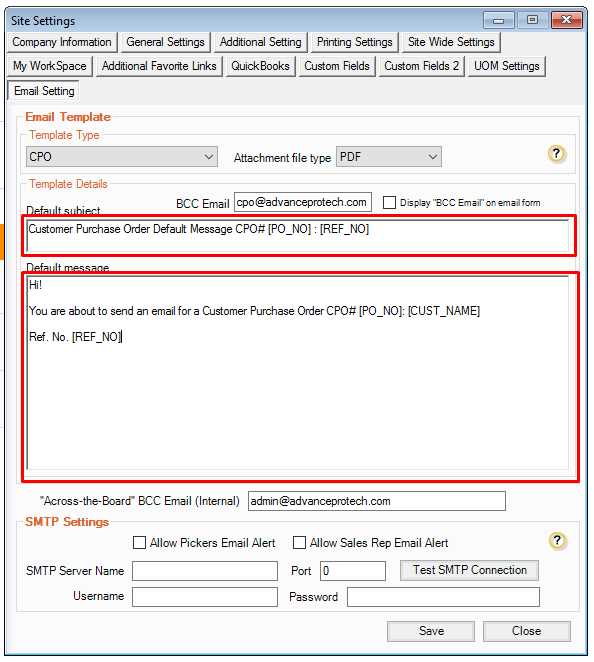

Customizing Your Invoice Email Template

Personalization plays a key role in making payment requests more effective and professional. By tailoring your message to reflect your brand and the specifics of each client, you can enhance your communication and make it stand out. Customizing your approach shows that you take the transaction seriously and are committed to maintaining a positive, professional relationship.

Key Aspects of Customization

There are several ways to adapt your request to suit the unique needs of each client while maintaining a consistent level of professionalism. Here are a few important elements to consider when customizing your communication:

- Personalized Greeting: Always address the recipient by name to create a more personal and professional tone.

- Customizing Payment Details: Tailor the payment breakdown to reflect the specific services or products provided, ensuring clarity for the client.

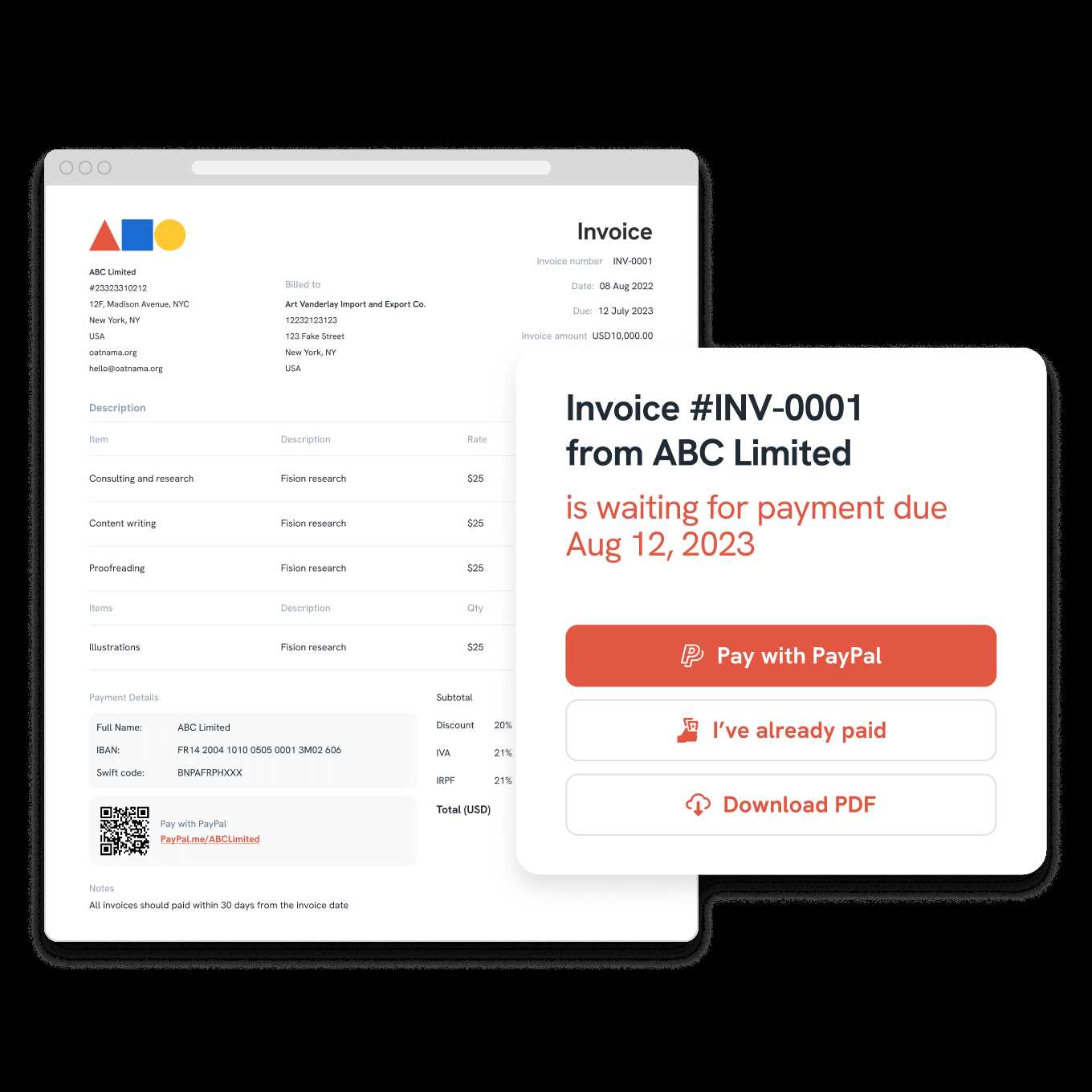

- Branding Your Message: Incorporate your company’s logo and branding elements (such as fonts and colors) to create a consistent and polished appearance.

Example of a Custom Payment Breakdown

Here’s an example of how you can structure the financial details in your message, ensuring it’s clear and easy to follow:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Web Design Services | 1 | $1,500 | $1,500 |

| Additional Revisions | 3 | $100 | $300 |

| Total | $1,800 |

By presenting the information in this clear format, your client can quickly understand the charges and what they are paying for. Customizing this table to fit your specific services or products ensures that each communication remains professional and relevant.

Customizing your payment requests not only helps to maintain professionalism but also allows you to build a stronger, more personal connection with your clients, encouraging timely and efficient payments.

Choosing the Right Tone for Invoice Emails

The tone of your payment request plays a significant role in how it is received by the client. A well-crafted message not only conveys the necessary information but also reflects your professionalism and the strength of your business relationships. The right tone ensures that your request is taken seriously, without coming across as too demanding or too casual.

Polite Yet Firm Approach

When composing a payment request, it is important to strike the balance between being courteous and assertive. You want to be clear about the amount due and the due date, while maintaining a level of politeness. A tone that is too passive may result in delayed payments, while a tone that is too harsh can damage relationships. Use phrasing that is respectful and confident, yet not overbearing.

- Respectful Language: Phrases like “We would appreciate your prompt payment” or “Please let us know if you need any further details” help maintain a positive tone.

- Clear Payment Expectations: Use direct but polite wording like “The total amount of $500 is due by [date]” to ensure the recipient understands the urgency without feeling pressured.

- Professional Courtesy: End with a courteous closing, such as “Thank you for your continued business” or “We look forward to working with you again.” This leaves the door open for future collaboration while maintaining respect.

Avoiding Aggressive or Casual Language

While it’s important to be firm, it’s equally crucial to avoid language that could be seen as aggressive or overly casual. A harsh tone could alienate your client and make it more difficult to resolve any issues that may arise. Similarly, a casual or overly friendly tone can make your request seem less important or urgent.

- Avoid Negative Phrasing: Instead of saying “Your payment is overdue, please pay now,” use “We kindly remind you that payment is due by [date].”

- Stay Professional: Even if you have a personal relationship with the client, it’s essential to keep the tone professional and focused on the matter at hand.

By choosing the right tone, you create an atmosphere of respect and professionalism, which encourages timely payment while preserving strong business relationships.

Best Practices for Sending Invoice Emails

When it comes to payment requests, the way you communicate with your clients can significantly impact your cash flow and business relationships. Following best practices ensures that your message is clear, professional, and effective, leading to timely payments and smoother transactions. By focusing on key elements such as timing, clarity, and politeness, you can improve the overall experience for both you and your clients.

Timing Is Key

Sending your payment requests at the right time is crucial for getting a quick response. Ideally, the message should be sent as soon as the work is completed or the billing period ends. However, follow-up reminders are also important for ensuring payments are not forgotten. Here are a few key timing guidelines:

- Send the first request promptly: Once the work or service is delivered, send the payment request within 24–48 hours.

- Follow up on overdue payments: If a payment is not received by the due date, send a polite reminder within a few days, including details about any late fees or penalties.

- Consider automated reminders: Set up automatic follow-ups that gently remind the client of the due date or past-due amount, reducing the need for manual tracking.

Clarity and Detail in Your Message

One of the best practices for any payment communication is to be as clear and detailed as possible. Clients should easily understand what is being requested and why. Here are some ways to ensure clarity:

- Be transparent about charges: Provide a clear breakdown of services, prices, taxes, and any other relevant details. This helps prevent disputes or confusion.

- Specify payment terms: Include payment due dates, methods of payment, and any late fees or discounts for early payments.

- Make your message easy to read: Use short paragraphs, bullet points, and bold text to highlight the key information, ensuring your message is quick to understand.

Maintain a Professional and Polite Tone

While you want to be firm in your payment requests, always remember to maintain professionalism and politeness. Even if the payment is overdue, keeping the tone respectful and courteous will help preserve a positive relationship with your clients. Consider phrases like:

- “We kindly remind you that payment is due by [date].”

- “Thank you for your prompt attention to this matter.”

- “We appreciate your business and look forward to continuing our partnership.”

By combining these best practices–timely communication, clear details, and a professional tone–you set yourself up for smoother transactions and stronger client relationships.

Avoiding Common Invoice Email Mistakes

When requesting payment, it’s easy to overlook certain details that could cause confusion or delay in processing. Small errors in communication can lead to misunderstandings, missed payments, or damaged relationships with clients. By being mindful of common mistakes and addressing them proactively, you can ensure that your payment requests are clear, professional, and effective.

Common Errors to Watch Out For

Here are some of the most frequent mistakes when composing a payment request and how to avoid them:

- Vague or Unclear Payment Terms: Not specifying the payment due date, amount, or method can lead to confusion. Always make sure to include all key details to avoid back-and-forth clarifications.

- Missing or Incorrect Client Information: Double-check that the recipient’s name, address, and contact details are accurate. Sending a request to the wrong person or using outdated contact information can cause unnecessary delays.

- Failure to Include a Breakdown of Charges: Clients may hesitate to pay if they don’t fully understand the charges. Providing a detailed breakdown of services and costs helps build trust and ensures transparency.

- Not Following Up on Overdue Payments: A polite reminder is essential if a payment isn’t received on time. Failing to follow up can lead to long-term delays or overdue amounts accumulating.

Formatting Issues and How to Fix Them

How you present your message is just as important as the content itself. Below are common formatting mistakes that can reduce the clarity and professionalism of your communication:

- Cluttered Layout: Avoid overwhelming your client with long paragraphs or dense blocks of text. Use clear headings, bullet points, and short, concise paragraphs for easy readability.

- Lack of Structure: A message without clear sections (e.g., payment breakdown, terms, and closing) can confuse the recipient. Organize your message logically, breaking it into distinct sections.

- Overuse of Complex Language: Keep the language simple and direct. Overly technical or complex terms can alienate the reader and make your message seem less approachable.

Example of a Well-Structured Payment Request

Here’s an example of how a payment breakdown should look to avoid confusion:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Web Development Services | 1 | $1,500 | $1,500 |

| Additional Revisions | 2 | $100 | $200 |

| Total Amount Due | $1,700 |

How to Request Payment in an Email

When it’s time to request payment for services rendered or products delivered, it’s important to communicate clearly and professionally. Crafting a direct and polite message increases the chances of receiving timely payments and ensures that your business maintains a positive reputation. The key is to include all the necessary details while keeping the tone respectful and concise.

Structure Your Message Clearly

A well-organized message is crucial for avoiding confusion. Begin with a polite greeting and then clearly state the purpose of your message: requesting payment. Provide all relevant details in a structured format, so the recipient knows exactly what is expected. Here’s how to approach it:

- Start with a clear subject line: Use a straightforward subject like “Payment Due for [Service/Product Name]” to make it clear what the email is about.

- Provide the total amount due: State the amount clearly and highlight it, so it stands out in the message.

- Include payment terms: Specify the due date, accepted payment methods, and any late fees or discounts that apply.

- Offer assistance: If there are any questions about the payment or the details provided, offer to help. A polite phrase such as “Please feel free to reach out if you need further clarification” can encourage communication and avoid misunderstandings.

Use a Polite and Professional Tone

While it’s essential to be clear and direct, the tone of your message should remain respectful and professional. Your goal is to remind the recipient of their obligation without sounding demanding. Use polite phrases like:

- “We kindly request your payment of [amount] by [due date].”

- “Please let us know if there are any issues or concerns with the payment details.”

- “Thank you for your prompt attention to this matter.”

By maintaining a polite tone, you reinforce your professionalism and increase the likelihood of a smooth transaction.

In conclusion, requesting payment in a message is all about clarity, professionalism, and politeness. Provide all necessary information in a well-organized manner, and be sure to express gratitude for the business relationship to foster positive ongoing communication.

What to Include in Your Invoice Subject Line

The subject line is the first thing your recipient sees, and it plays a critical role in ensuring that your payment request is opened and taken seriously. A well-crafted subject line sets the tone for the message and helps the recipient quickly understand the purpose of your communication. Including key details in this brief section can make a significant difference in how your request is received.

Key Elements of a Strong Subject Line

When composing the subject line for your payment request, it’s important to be clear, concise, and professional. Here are some key elements to include:

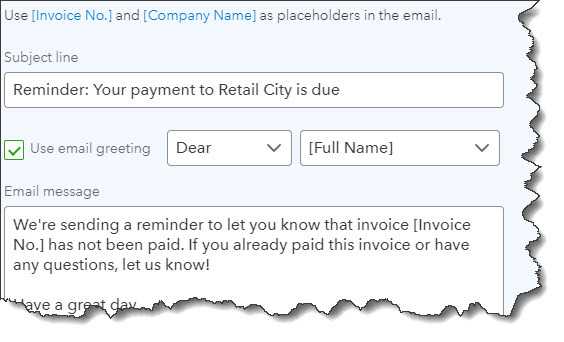

- Type of Request: Make it clear from the outset that this is a payment request. Phrases like “Payment Due,” “Amount Due,” or “Payment Reminder” quickly communicate the purpose.

- Specific Information: If applicable, mention the service or project related to the payment, such as “Payment Due for Web Design Services” or “Outstanding Balance for [Project Name].”

- Due Date: If relevant, including the due date in the subject line can add urgency. For example, “Payment Due by [Date] for [Service].”

- Amount (Optional): In some cases, including the total amount due can draw attention and help the recipient prioritize. For example, “$500 Payment Due for Consulting Services.”

Examples of Effective Subject Lines

Here are a few examples of well-crafted subject lines that incorporate the above elements:

- “Payment Due: $1,000 for Marketing Services – Due by [Date]”

- “Reminder: Outstanding Payment for Graphic Design – Due by [Date]”

- “Action Required: Payment for [Project Name] Due [Date]”

- “Final Notice: Payment for Web Development Services Due [Date]”

A clear and direct subject line not only grabs attention but also helps the recipient know exactly what the message is about before opening it. This small detail can make a big difference in ensuring that your payment request is handled in a timely manner.

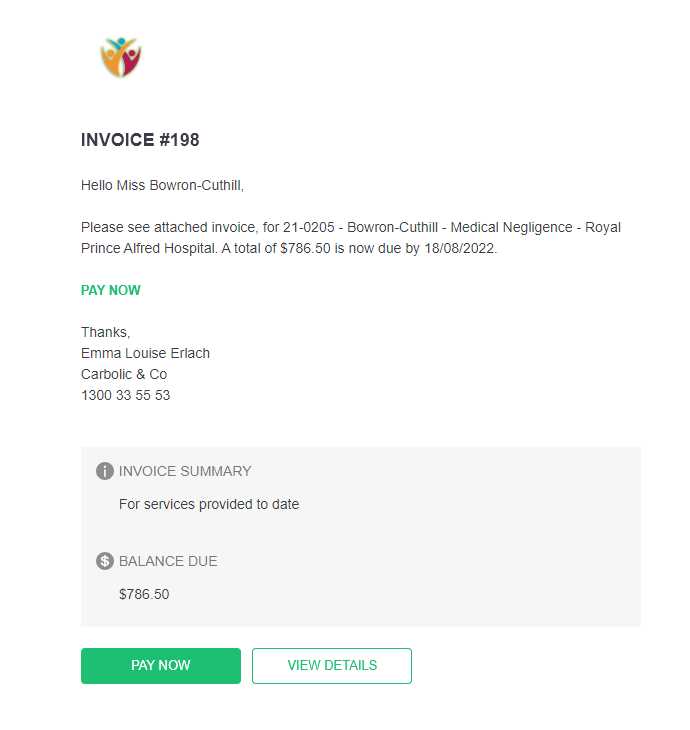

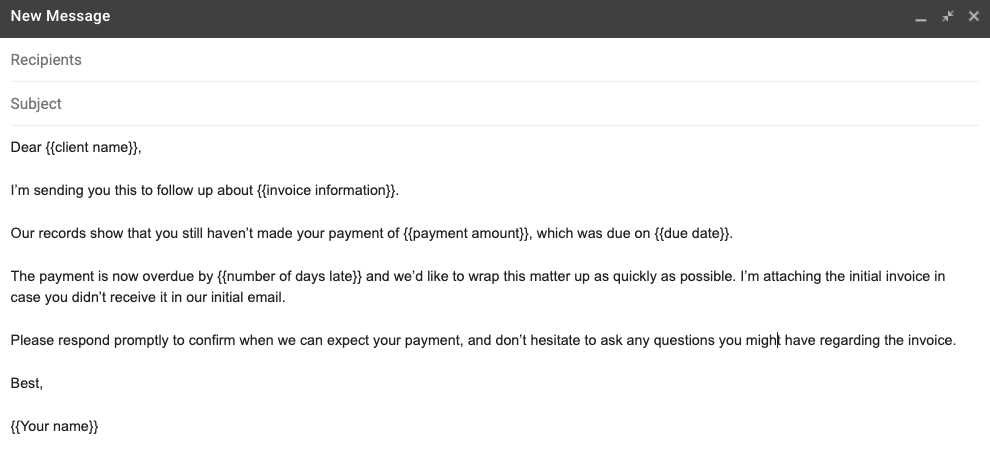

Follow-up Emails for Unpaid Invoices

Sometimes, payments get delayed due to various reasons, and it’s important to follow up with your clients in a professional and courteous manner. A well-crafted reminder can help you maintain a good relationship with your clients while ensuring that your business receives the funds it’s owed. Follow-up communication should be clear, polite, and provide all necessary details to avoid any confusion or further delays.

When to Send a Follow-up

Timing is crucial when following up on overdue payments. If you wait too long, it may appear unprofessional, while following up too soon might come across as overly aggressive. Here’s a general timeline for sending follow-up messages:

- First Follow-up: Send your first reminder a few days after the due date has passed. This should be a polite nudge, acknowledging that the payment might have been overlooked.

- Second Follow-up: If payment is still not received within a week or two, send a more direct follow-up. This can include a gentle reminder of the overdue amount and the consequences of further delay, such as late fees or interest.

- Final Reminder: After 30 days or more, if the payment has not been made, send a final reminder. In this message, include a firm but respectful request for immediate payment and remind the client of any late fees or the potential impact on future business.

Key Elements of a Follow-up Message

Each reminder should include a few key elements to ensure it’s effective and polite. Here’s what to include in a follow-up message:

- Clear Payment Information: Always reference the outstanding amount, due date, and any previous payment requests. Make it easy for the client to understand what is owed and why.

- Polite Tone: Keep the tone respectful, even if the payment is significantly overdue. Phrases like “We kindly remind you…” or “We would appreciate your prompt attention to this matter…” help maintain professionalism.

- Next Steps: Provide instructions on how the client can make the payment, and include any relevant payment details or links to make the process as easy as possible.

- Late Fees (If Applicable): If there are any penalties for overdue payments, remind the client of these fees in a polite and clear manner. This ensures there’s no confusion about the terms.

How to Format an Invoice Email Template

Proper formatting of a payment request message is key to ensuring that your communication is clear, professional, and easy to understand. A well-structured message not only presents the necessary information in an organized way, but it also helps the recipient process the request efficiently, leading to faster payments. By following a consistent format, you also reinforce your brand’s professionalism and attention to detail.

Structuring the Message for Clarity

The format of your payment request message should be clean and straightforward. Avoid cluttering the content with unnecessary details, and focus on the essentials that the recipient needs to know. Here are some guidelines on how to structure your message:

- Clear Subject Line: Make the purpose of the message immediately apparent with a direct subject like “Payment Due for [Service/Product]” or “Outstanding Balance for [Project Name].”

- Personalized Greeting: Start with a courteous greeting, using the client’s name to make the message more personal and engaging.

- Details of the Payment Request: Provide a summary of the amount due, due date, and any applicable terms (e.g., late fees or payment methods). This should be easy to read and understand at a glance.

- Call to Action: End with a polite, clear request for the payment to be made by the specified date, and offer assistance or clarification if necessary.

Including a Payment Breakdown

Providing a detailed breakdown of charges can prevent confusion and disputes, and make it easier for the client to understand what they are paying for. Below is an example of how to format a payment breakdown:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Services | 5 hours | $100 | $500 |

| Additional Research | 3 hours | $75 | $225 |

| Total Amount Due | $725 |

This format makes it easy for the recipient to see exactly what they are being charged for, which can reduce the chances of any confusion or delays in payment. After the breakdown, be sure to provide instructions on how to submit the payment, along with any necessary payment links or account details.

In conclusion, formatting your payment request in a clear and organized manner not only helps to communicate the necessary information efficiently but also enhances your professionalism. By following a simple structure and including all the relevant details, you ensure that your communication is both effective and courteous.

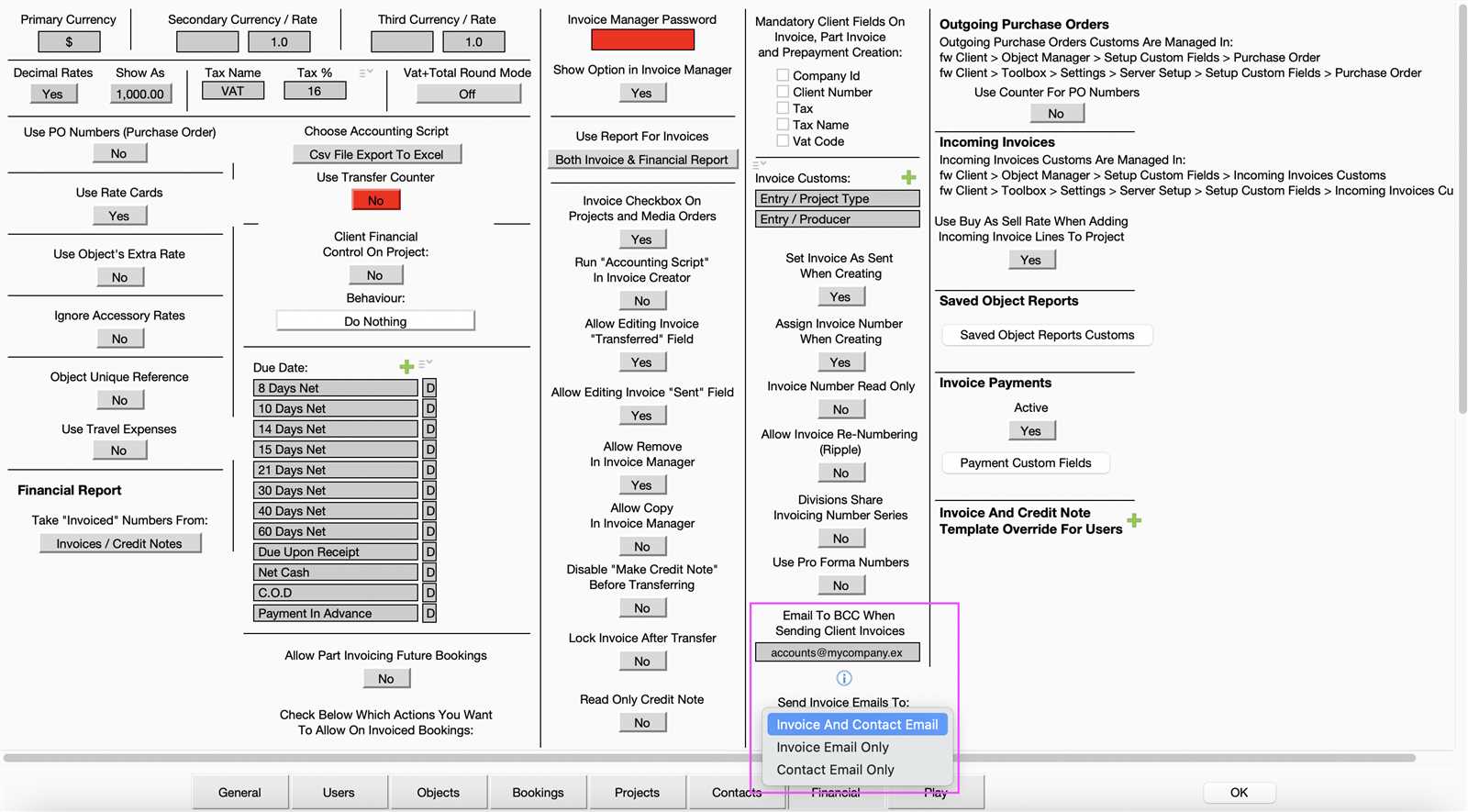

Sending Invoices to Multiple Recipients

When dealing with multiple clients or stakeholders, it’s important to ensure that each payment request is sent efficiently and correctly. Whether you are managing numerous projects or working with various departments, sending multiple payment requests can be a time-consuming task. However, with the right approach, you can streamline the process and ensure that each recipient receives their payment details in a timely and professional manner.

Organizing Your Recipients

The first step in sending payment requests to several recipients is organizing your contact list. Grouping clients or departments based on specific projects or categories can save time and reduce errors. You can also consider using email distribution lists or segmented mailing groups to target specific groups with relevant payment requests.

- Segment Recipients by Project or Department: This helps ensure that each recipient receives the correct payment details related to their specific work or project.

- Use Personalized Greetings: Even when sending to multiple people, personalizing each message (e.g., addressing them by name) can maintain a professional tone and encourage prompt action.

Efficient Tools for Mass Communication

There are several tools available to send payment requests to multiple recipients without compromising on professionalism. Using a bulk email platform or customer relationship management (CRM) software can help you manage and send personalized requests to a large group of clients. Many of these tools also allow you to track who has opened or responded to the payment request, giving you better insight into follow-up actions.

- Mail Merge Functionality: Many email platforms offer a mail merge feature, which allows you to send personalized messages to multiple recipients while maintaining a high level of customization.

- CRM Software: These tools not only allow for efficient communication but also track payment status, helping you stay organized and ensure that no payment request slips through the cracks.

By utilizing efficient systems and maintaining organization, you can successfully manage sending payment requests to multiple recipients without the process becoming overwhelming or error-prone. Streamlining this process also saves time and ensures consistency in your communication.

Tips for Professional Invoice Email Design

A well-designed payment request message not only conveys the necessary information but also enhances your brand’s credibility. The visual appeal and structure of your message can significantly impact how it’s perceived and whether it encourages prompt action. With the right design, you can make your request stand out and ensure clarity, which is crucial for a smooth transaction process.

1. Keep It Simple and Clean

When designing your message, it’s important to avoid clutter. A clean, simple layout ensures that the recipient can quickly understand the key details without feeling overwhelmed. Use ample white space to separate sections and create a balanced, easy-to-read format.

- Minimal Text: Avoid long paragraphs. Use short, concise sentences that communicate the necessary information clearly.

- Headings and Bullet Points: Use headings to separate sections (e.g., “Payment Due,” “Services Rendered,” “Amount Owed”) and bullet points to list items, making the content more digestible.

2. Choose a Professional Font and Colors

The choice of font and color scheme plays a major role in how your request is perceived. Stick to professional, easy-to-read fonts like Arial, Calibri, or Times New Roman, and ensure the font size is large enough to be legible on all devices. As for colors, use a simple, elegant palette that reflects your brand and doesn’t distract from the content.

- Font Size: Ensure the body text is at least 12pt for readability.

- Contrast: Choose high contrast between text and background (e.g., dark text on a light background) to enhance legibility.

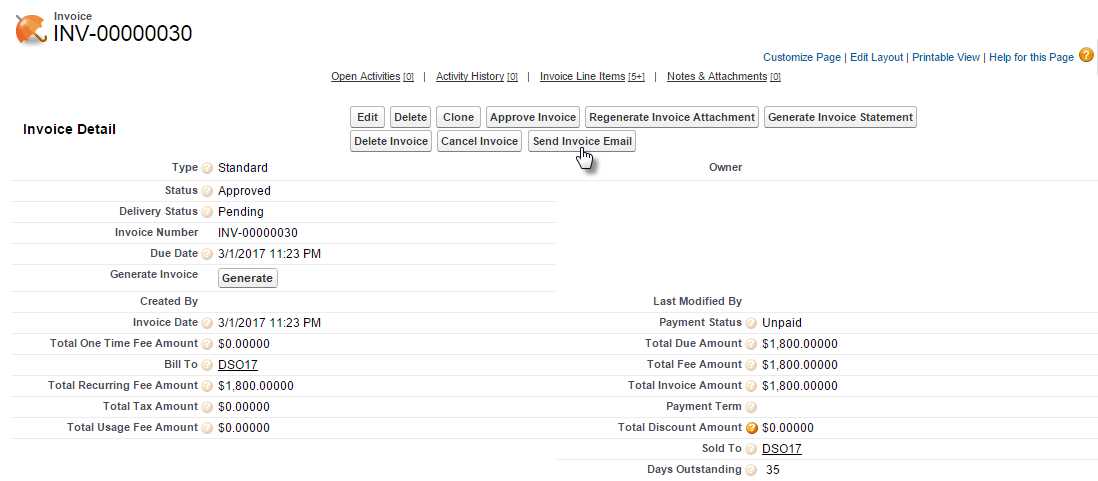

3. Include Clear Payment Details

Make sure the essential payment details stand out in the design. This includes the amount owed, payment due date, and any payment instructions or links. Presenting this information clearly will help avoid confusion and ensure that the recipient knows exactly what to do next.

- Use Bold for Key Information: Highlight the payment amount or due date in bold or a larger font size to make it easy to spot.

- Payment Methods: Clearly list the accepted payment methods and provide direct links or instructions for completing the transaction.

4. Add a Personal Touch

Even though the design should be professional, don’t overlook the importance of adding a per

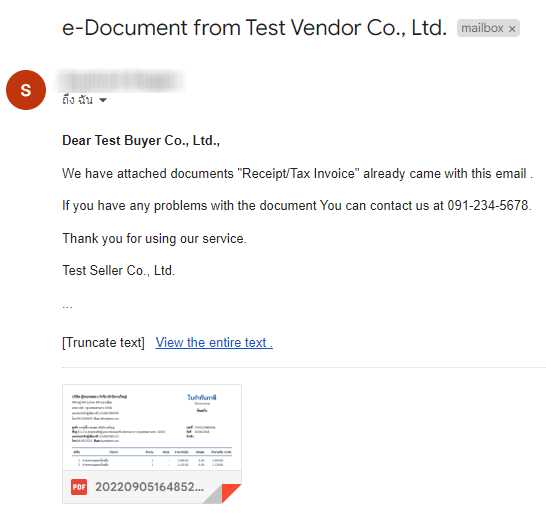

How to Automate Your Invoice Emails

Automating the process of sending payment requests can save you significant time and reduce human error. By setting up automated workflows, you can ensure that your clients receive payment reminders on time, without the need for manual intervention. This system also helps streamline your administrative processes and improves the consistency of your communication.

Using Automation Tools and Software

The first step to automating your payment reminders is to select the right software. Many invoicing platforms and customer relationship management (CRM) tools offer built-in automation features. These systems can automatically generate and send payment requests based on pre-set schedules, reducing the need for manual tracking.

- Cloud-Based Solutions: Platforms like QuickBooks, FreshBooks, and Zoho Invoice allow you to automate payment reminders based on the due dates of the outstanding amounts.

- CRM Integrations: CRMs like HubSpot and Salesforce can be configured to trigger automatic reminders based on the data you input into your system, helping you stay on top of overdue payments.

Setting Up Payment Reminders

Once you’ve chosen your automation tool, the next step is configuring the reminder sequence. It’s important to define the timing and frequency of the reminders to avoid overwhelming your clients with too many notifications. Here’s how you can set it up:

- Initial Reminder: Schedule the first reminder a few days after the due date has passed. This gentle nudge can encourage clients to take action without causing frustration.

- Follow-Up Reminder: Set a second reminder for a week or two after the first one. This should be more direct, yet still polite, and can include any additional fees or consequences for late payments.

- Final Notice: The final reminder should be sent after 30 days or more. At this point, the message should clearly state the importance of immediate payment to avoid further action.

Automation ensures that no reminder is overlooked, and that all clients are treated consistently. Once your system is set up, you’ll have a much easier time managing your payments, reducing manual effort and human error.

Handling Disputes in Invoice Emails

Disputes over payment requests can arise for a variety of reasons, including discrepancies in the amount owed, misunderstandings about terms, or issues with the quality of services rendered. Addressing these concerns promptly and professionally is essential for maintaining a positive relationship with clients while protecting your business interests. The way you handle disputes in your communication can make a significant difference in resolving issues efficiently and amicably.

1. Respond Promptly and Politely

When a dispute arises, it’s important to acknowledge the issue as soon as possible. Ignoring or delaying your response can escalate the situation, causing frustration and potentially damaging your relationship with the client. Always approach the dispute with a calm, professional tone and show empathy for their concerns.

- Thank the Client: Start by thanking the client for bringing the issue to your attention. This shows that you value their feedback and are willing to work with them to resolve the problem.

- Apologize When Necessary: If the dispute arises due to an error on your part, offer a sincere apology. Acknowledging your mistakes can go a long way in maintaining trust and goodwill.

2. Provide Clear Documentation

In order to resolve the dispute efficiently, it’s crucial to provide clear and organized documentation that supports your payment request. This can include itemized breakdowns, contract terms, or any previous correspondence related to the work. Transparency is key in resolving payment disputes.

- Breakdown of Charges: Include a detailed summary of the charges, including the services provided, rates, hours worked, and any other relevant information that clearly outlines how the amount was calculated.

- Supporting Documents: Attach or refer to any relevant documents, such as contracts, agreements, or signed work orders, to substantiate your claim and clarify misunderstandings.

3. Offer a Solution or Compromise

In some cases, offering a solution or compromise can help resolve the situation more smoothly. Whether it’s adjusting the amount due, providing additional clarification, or offering a payment plan, showing flexibility can often help in reaching a mutual agreement.

- Negotiate a Payment Plan: If the client has difficulty paying the full amoun