How to Send an Invoice to Client Email with a Professional Template

Clear and professional correspondence plays a crucial role in maintaining smooth business operations. When it comes to collecting payments for goods or services, how you present your request can significantly impact the speed and ease of the transaction. Crafting a concise and well-structured message not only ensures your client understands the details but also fosters trust and professionalism.

Using the right structure and tone can help streamline the process, reducing confusion or delays. A carefully written message that includes all necessary information, such as amounts owed, deadlines, and payment methods, will facilitate quicker responses. With the right approach, you can minimize misunderstandings and enhance your business relationships.

Whether you’re reaching out for the first time or following up on an outstanding balance, clear communication is key. By ensuring your request is both polite and direct, you set the stage for a positive outcome and continued collaboration.

How to Write a Professional Invoice Email

Crafting a well-written message when requesting payment is essential for maintaining professionalism and ensuring timely transactions. A clear, polite, and concise request helps avoid misunderstandings and fosters a positive relationship with your business partners. It’s important to strike the right tone while providing all necessary details to make it easy for the recipient to process the payment.

Key Components of a Payment Request

When composing your message, there are several key elements you should include to ensure clarity and avoid confusion. These components will help you stay organized and professional:

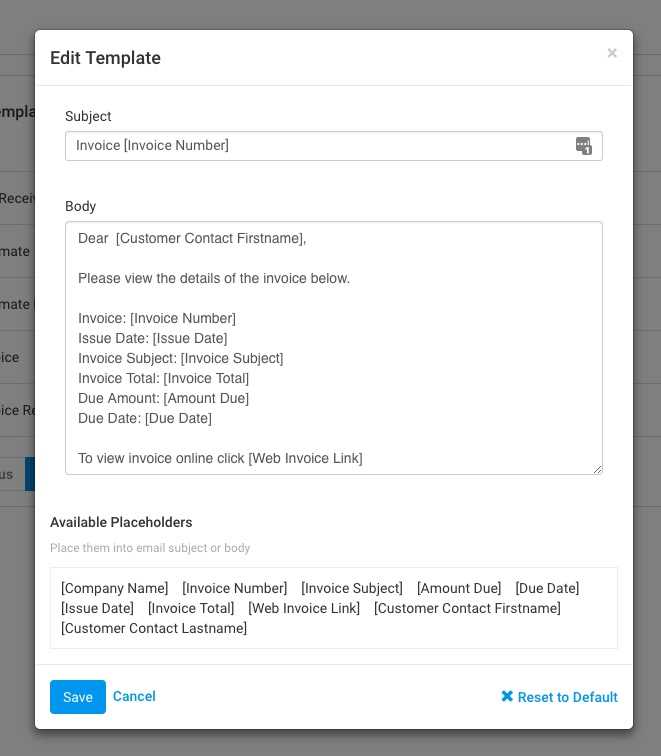

- Subject Line: Keep it clear and specific to the purpose, such as “Payment Due for Services Rendered” or “Balance Reminder for Recent Purchase”.

- Greeting: Always address the recipient politely, using their proper title or name if known.

- Invoice Details: Briefly mention the amount due, the date of the transaction, and any payment terms agreed upon.

- Payment Instructions: Include clear directions on how to complete the payment, such as bank details or links to payment portals.

- Closing Remarks: Politely encourage the recipient to reach out if they have any questions and thank them for their business.

Tips for Writing a Professional Message

To ensure your message is professional and effective, keep the following tips in mind:

- Be Clear and Concise: Stick to the point and avoid unnecessary details. The recipient should easily understand what is expected of them.

- Use a Polite Tone: Even if the payment is overdue, always remain courteous. A friendly tone encourages cooperation.

- Proofread: Before sending, make sure your message is free of errors. Typos or grammatical mistakes can undermine your professionalism.

- Customize Your Approach: Tailor your language to suit the relationship with the recipient. A more formal tone may be appropriate for business clients, while a casual approach works better for smaller transactions or less formal partnerships.

Importance of Clear Invoice Communication

Effective communication when requesting payment is crucial for maintaining smooth business transactions. When the details of a financial request are conveyed clearly, it reduces the likelihood of confusion and ensures the recipient understands exactly what is required. Clear messaging not only expedites the payment process but also fosters trust and professionalism in business relationships.

Transparency is a key element in financial communication. By providing all necessary details in a straightforward manner, you help the recipient quickly assess what they owe, when it’s due, and how to complete the transaction. This clarity leads to fewer questions, faster processing, and minimizes the risk of delays or disputes.

Timely and clear communication also helps to build a positive reputation. Clients appreciate clear expectations, and this encourages long-term partnerships. A well-structured request shows your organization is professional and values efficiency, which can enhance your business credibility.

Best Practices for Invoice Email Formatting

Proper formatting of a payment request message ensures that all essential details are easy to read and understand. A well-organized structure not only improves the recipient’s experience but also increases the likelihood of prompt and accurate payment processing. Effective formatting helps create a professional appearance and reduces the chance of errors or confusion.

Clear Subject Line: Start with a concise and direct subject that reflects the purpose of the message, such as “Payment Due for Services” or “Balance Reminder for Recent Transaction.” This sets the right expectations from the moment the recipient sees the message.

Organized Body Content: Break the message into easily digestible sections. Use short paragraphs or bullet points to highlight important information like the amount due, payment methods, and due dates. This allows the recipient to quickly scan for key details.

Professional Tone and Politeness: Even if the payment is overdue, maintain a courteous and respectful tone. A professional approach helps keep the business relationship positive and reduces the chances of any misunderstandings.

Consistent Formatting: Use consistent fonts, font sizes, and alignment throughout the message to enhance readability. Avoid using too many different styles or colors, as this can make the message appear cluttered or unprofessional.

Effective formatting is about clarity. By ensuring that every element of the message is easy to follow, you make it easier for the recipient to take action swiftly and without confusion, leading to faster responses and smoother transactions.

Choosing the Right Subject Line for Invoices

The subject line is the first thing the recipient sees and plays a crucial role in ensuring your message is opened and addressed promptly. A well-crafted subject line clearly conveys the purpose of the message and sets the tone for the communication. It should be brief, informative, and encourage the recipient to take immediate action.

Characteristics of an Effective Subject Line

An ideal subject line should be clear, specific, and professional. It needs to highlight the most important information without being overly complex or vague. Here are some key features of an effective subject line:

| Quality | Description |

|---|---|

| Clarity | Clearly state the purpose of the message so the recipient knows what to expect. |

| Conciseness | Avoid long or convoluted phrasing. Stick to the essentials to grab attention quickly. |

| Professionalism | Use formal and respectful language to maintain a businesslike tone. |

| Urgency | If payment is due soon, consider using a polite but urgent tone to encourage prompt action. |

Examples of Effective Subject Lines

Here are some examples of subject lines that effectively convey the message and prompt action:

- “Outstanding Balance for Recent Purchase – Due Date Approaching”

- “Reminder: Payment Due for Services Rendered on [Date]”

- “Action Required: Payment Due for [Company Name]’s Recent Invoice”

- “Balance Due for [Project Name] – Please Review and Pay”

By keeping the subject line straightforward and clear, you increase the chances of your message being opened and addressed without delay. A thoughtful subject sets the stage for smooth, efficient communication and successful transaction completion.

Essential Information to Include in Your Invoice

When requesting payment for goods or services, it’s crucial to provide all necessary details in a clear and structured manner. Including the right information helps ensure that the recipient understands the specifics of the request, can easily process the payment, and avoids confusion or delays. The more comprehensive and organized the information is, the smoother the transaction will be.

Key Details to Include

Here are the essential elements that should be included to make sure your request is complete and transparent:

- Business Information: Include your business name, address, and contact details to ensure the recipient knows where to reach you if needed.

- Recipient Details: Make sure to mention the name and address of the person or organization you’re requesting payment from.

- Description of Products/Services: Clearly outline the goods or services provided, including quantities and any relevant dates. This ensures that the recipient knows exactly what they are paying for.

- Amount Due: Clearly state the total amount due, including any applicable taxes, fees, or discounts.

- Payment Terms: Specify payment methods, due dates, and any penalties for late payments. This helps set expectations for both parties.

- Unique Reference Number: A unique reference number (e.g., invoice or order number) will help both you and the recipient track the transaction efficiently.

- Bank or Payment Details: Provide the necessary information for making the payment, whether it’s bank account details or a payment link.

Why These Details Matter

Clear communication is key when requesting payments. By providing these crucial details, you ensure that both parties are aligned on the terms of the transaction. This helps prevent errors, misunderstandings, and delays, ensuring a smooth and efficient process from start to finish.

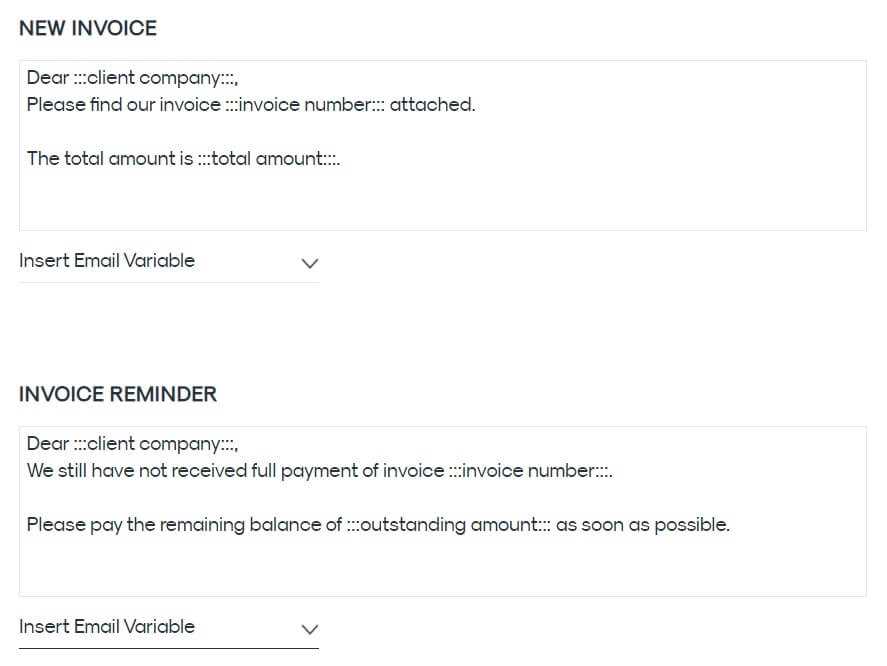

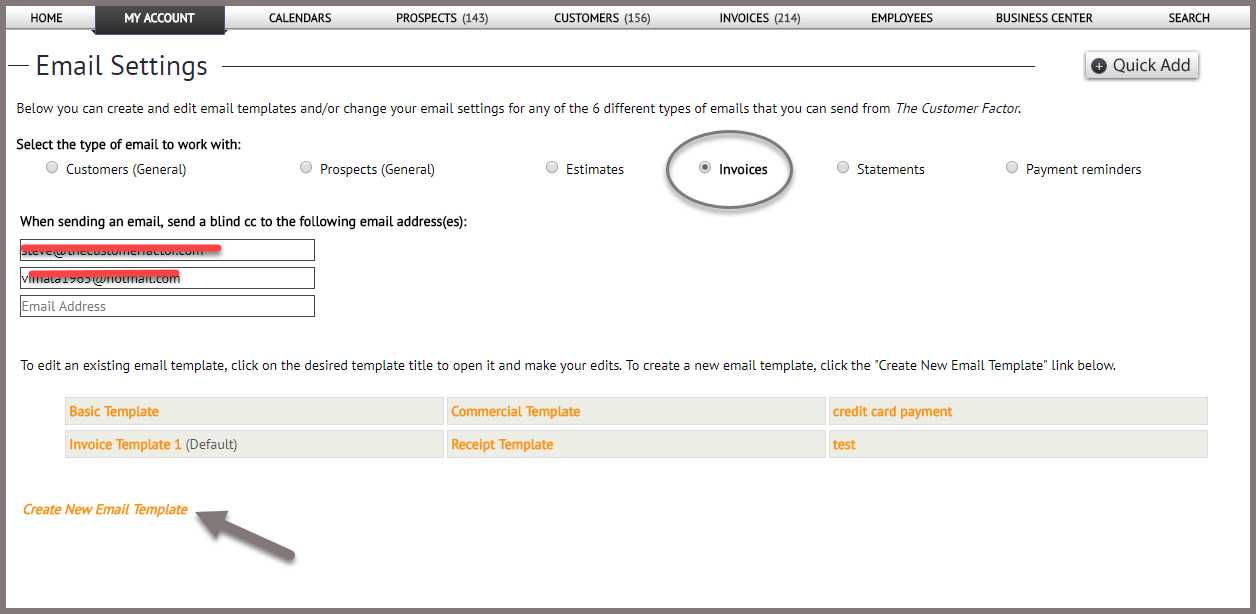

Customizing Invoice Email Templates for Clients

Personalizing your payment request messages can significantly enhance the recipient’s experience and improve the likelihood of a prompt response. Customization allows you to adapt the message to suit the specific needs of each transaction or business relationship. By tailoring your correspondence, you demonstrate attention to detail and professionalism, which fosters trust and encourages timely payments.

Why Personalization Matters

When you personalize a payment request, it shows the recipient that you are attentive to their unique situation. A customized message can also create a more positive interaction, as it makes the recipient feel valued and understood. Personalization might include addressing the person by name, referencing specific details of the transaction, or adjusting the tone based on your relationship with the recipient.

How to Customize Your Payment Request

Here are some strategies to effectively tailor your message:

- Use the Recipient’s Name: Always use the recipient’s name in the greeting to create a more personalized and direct message.

- Reference Specific Transactions: Mention the details of the specific goods or services provided. This makes it clear what the payment is for and ensures transparency.

- Adjust the Tone: If you’re working with a long-term partner, a more casual tone may be appropriate. For a formal relationship, stick to a professional and respectful approach.

- Include Personalized Payment Details: If you’re offering different payment methods or options for specific clients, customize this section to suit their preferences.

- Custom Sign-Off: End the message with a friendly or formal sign-off, depending on your relationship with the recipient. A personal thank-you note can also leave a positive impression.

Customizing your communication can have a significant impact on how your payment request is received. By making your message more relevant and specific, you not only improve clarity but also build a stronger relationship with your business partners.

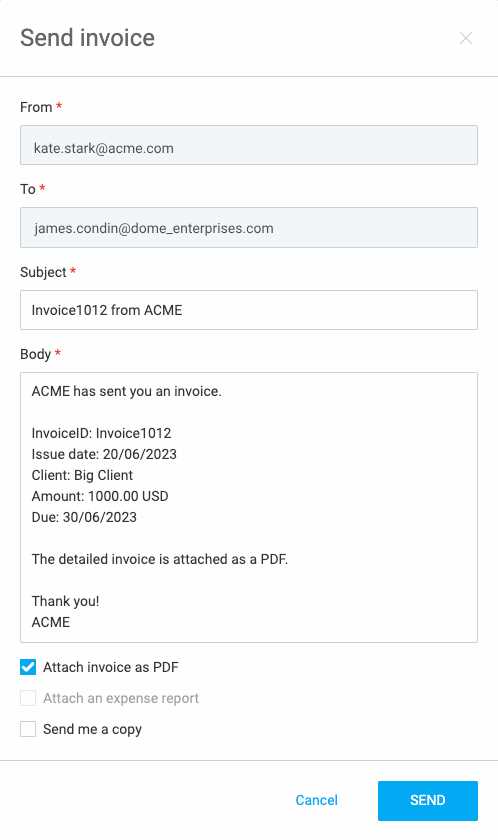

How to Attach Invoices Correctly in Emails

Attaching files properly to your messages is a crucial step in ensuring your payment request is clear and professional. A well-attached document makes it easy for the recipient to access, review, and process the necessary details. Improper attachments or file handling can cause confusion or delays in payment processing, so it’s important to follow best practices to ensure smooth communication.

Choosing the Right File Format

The format of the document you attach plays a vital role in ensuring compatibility and ease of access for the recipient. The most commonly used and widely accepted formats are:

- PDF: This is the most professional and secure file format, ensuring that the layout and content appear exactly as intended on any device.

- Word Document: While editable, Word files can be used if the recipient prefers to make changes or add notes. However, PDF is generally recommended for formal requests.

- Excel: If you need to provide detailed financial breakdowns or spreadsheets, an Excel file can be a good choice. Just be sure the recipient is expecting it and can open the file easily.

How to Attach Files Effectively

To avoid common mistakes, follow these tips when attaching your documents:

- Check File Size: Ensure the document isn’t too large to send. If necessary, compress the file or use cloud storage links to share large documents.

- Properly Name Your File: Use a clear and professional naming convention, such as “Payment Request for [Service Name] – [Date]”. This makes it easy for the recipient to identify the document and file it correctly.

- Double-Check Attachment: Before clicking “Send,” confirm that the correct file is attached. It’s easy to forget, especially when handling multiple documents.

- Include a Brief Reference in the Message: In the body of the message, remind the recipient that the document is attached and briefly describe its contents. This ensures they know what to expect when opening the file.

Properly attaching documents not only ensures that the payment request is delivered effectively but also enhances the professionalism of your communication. By following these guidelines, you make it easier for the recipient to access the details and take prompt action.

Polite Phrases for Requesting Payment

When requesting payment, it’s essential to maintain a polite and professional tone. Clear communication, combined with courteous language, helps to ensure that the message is well-received and that the recipient feels respected. A polite approach not only encourages timely payment but also strengthens your business relationships. The right words can make all the difference, especially when the request concerns outstanding balances.

Key Phrases for Polite Payment Requests

Below are some examples of polite phrases you can use when asking for payment. These phrases are crafted to maintain a respectful tone while still conveying the urgency of the request:

| Phrase | Context |

|---|---|

| “We kindly request payment for the recent services provided.” | Use this when you are following up on a recent transaction. |

| “This is a gentle reminder that payment is due by [Date].” | Polite reminder for upcoming or overdue payments. |

| “Please let us know if you need any additional information to process the payment.” | Encourages the recipient to reach out if they require clarification. |

| “We appreciate your prompt attention to this matter.” | A polite way to express appreciation for timely action. |

| “Thank you for your business, and we look forward to your payment by [Date].” | A positive and respectful way to encourage timely payment. |

Additional Polite Reminders for Follow-Up

When following up on overdue payments, it’s important to remain polite and professional, even if the payment has been delayed. Here are a few more polite phrases that help you maintain goodwill while requesting payment:

- “We hope everything is well and just wanted to follow up on the outstanding balance.”

- “Could you kindly confirm when we can expect the payment?”

- “We would greatly appreciate your prompt settlement of the amount due.”

- “If there are any issues with the payment, please let us know, and we will be happy to assist.”

Using polite phrases ensures that your payment requests are respectful and professional, fostering positive communication and facilitating smoother financial transactions.

Common Mistakes to Avoid in Invoice Emails

When requesting payment through written correspondence, certain errors can lead to confusion, delays, or even strained business relationships. Even seemingly minor mistakes can affect how the message is perceived and how quickly the recipient acts. Ensuring that your communication is clear, accurate, and professional is key to a smooth payment process. Below are some of the most common pitfalls to avoid when drafting your payment request.

1. Incorrect or Missing Payment Information

Providing incomplete or incorrect payment details can cause significant delays in processing. Ensure that all necessary information–such as payment methods, due amounts, and any reference numbers–are included and accurate. Omitting or mistyping this information could lead to confusion or a delayed response, prolonging the time it takes to settle the balance.

2. Using an Unclear or Vague Subject Line

A vague or unclear subject line can result in your message being overlooked or misunderstood. Always use a clear, direct subject that accurately reflects the content of the message. For instance, “Payment Due for Recent Services” is much more effective than a generic subject like “Important Information Inside.” This ensures your message is opened promptly and the recipient understands the urgency of the request.

3. Overly Casual or Unprofessional Tone

While friendliness is important, an overly casual tone can come across as unprofessional, especially when dealing with business transactions. It’s important to maintain a respectful and formal tone, even if you have an established relationship with the recipient. Keep the language polite and courteous to ensure that the request is taken seriously.

4. Failing to Include Key Details

Not providing enough context or details can lead to confusion or delays. Always include essential information, such as the amount due, the due date, and a brief description of the services or goods provided. If there are any special terms or conditions, mention them upfront to avoid misunderstandings.

5. Poor Formatting or Spelling Errors

Errors in spelling, grammar, or formatting can undermine your professionalism and make the message harder to read. Always proofread your message before sending it, and ensure that the format is neat and organized. This will help the recipient understand your request more clearly and reflect positively on your business.

6. Not Following Up When Necessary

Neglecting to follow up can result in delays or forgotten payments. If the payment is overdue or if you haven’t received a response within a reasonable timeframe, it’s important to send a polite reminder. However, make sure to avoid being too pushy or aggressive, as this can damage the relationship.

Avoiding these common mistakes will help you present a more professional, clear, and effective payment request, ensuring that your communication is taken seriously

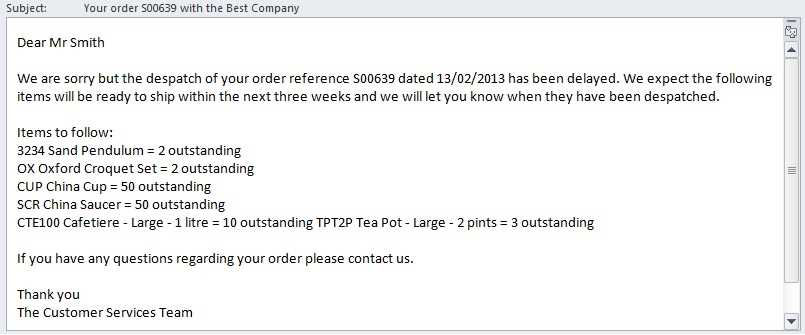

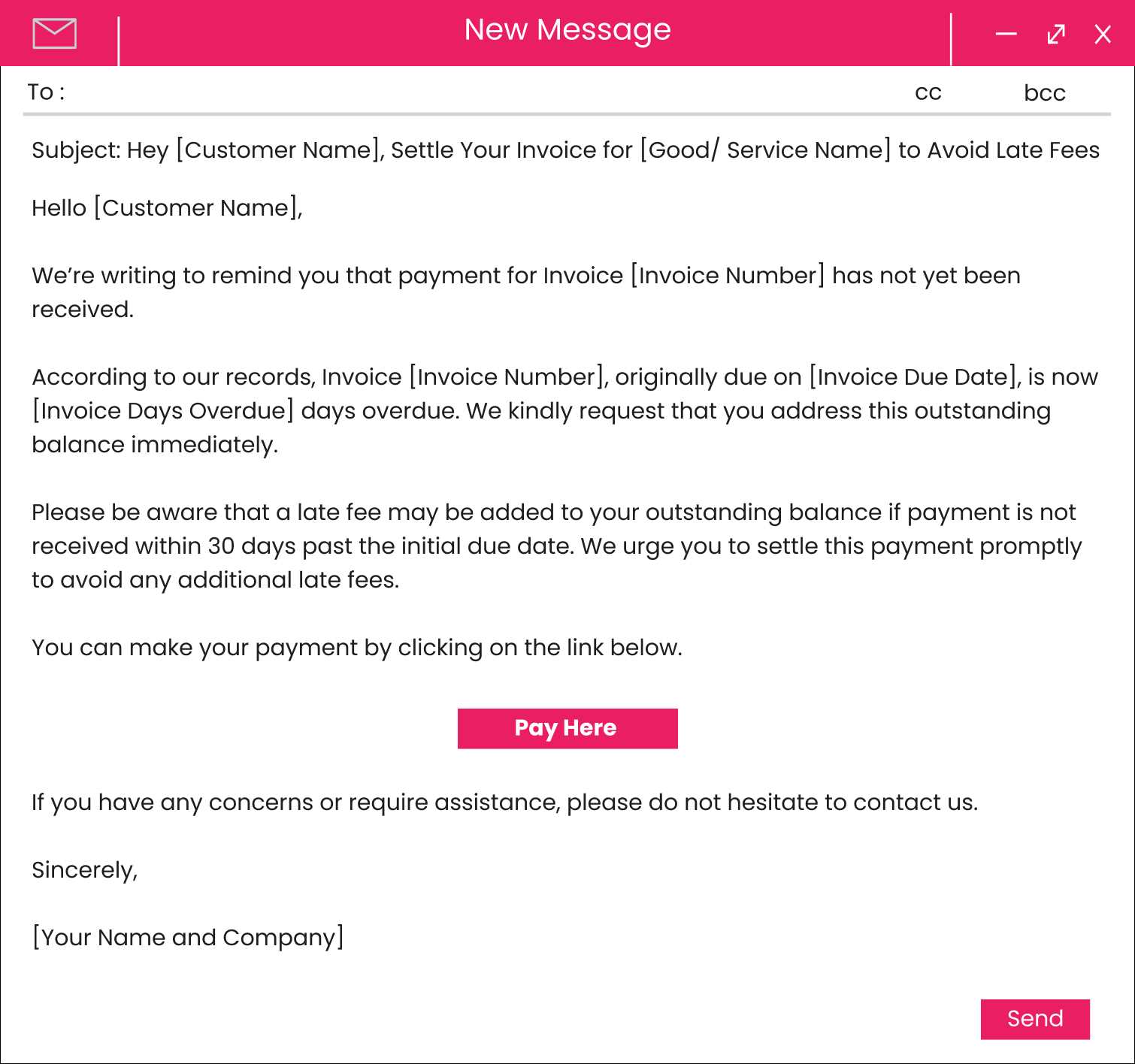

Creating a Follow-Up Email for Unpaid Invoices

Following up on outstanding payments is a delicate task that requires professionalism and tact. While it is important to ensure timely payment, how you communicate the request can significantly impact your relationship with the recipient. A well-crafted follow-up message encourages prompt payment while maintaining goodwill and professionalism. In this section, we will explore how to create an effective follow-up message that strikes the right balance between polite reminders and clear urgency.

Key Elements of a Follow-Up Message

A follow-up message should be polite but firm, respectful of the recipient while clearly stating the need for action. Below are the key components to include:

- Subject Line: Be clear and direct, for example, “Payment Reminder for Outstanding Balance” or “Second Reminder: Payment Due for [Service/Product].” This sets the right expectation and increases the chances of the message being opened promptly.

- Polite Greeting: Always begin with a friendly and courteous greeting, using the recipient’s name if possible. A positive tone helps maintain a professional relationship.

- Reference Previous Communication: If this isn’t the first time you’re reaching out, briefly reference any previous conversations or requests. For instance, “As mentioned in our previous correspondence” or “This is a gentle reminder regarding our outstanding balance.”

- State the Amount Due and Due Date: Clearly state the outstanding amount and the due date, especially if the payment is now overdue. Be specific and avoid ambiguity to prevent confusion.

- Provide Payment Details: Include the necessary information on how the recipient can make the payment. If there are multiple options, list them clearly and concisely.

- Offer Assistance: Politely offer to assist with any issues regarding payment processing. For example, “If you have any questions or need assistance with processing the payment, please feel free to reach out.”

- Friendly Closing: End the message on a positive note, expressing your appreciation for their attention to the matter and your expectation of prompt resolution.

Example of a Follow-Up Message

Here is an example of how to structure a polite but firm follow-up message:

Subject: Payment Reminder for Outstanding Balance

Dear [Recipient Name],

I hope this message finds you well. I am writing to follow up on the balance due for [Service/Product] provided on [Date]. As of today, we have not yet received payment for the amount of [Amount Due], which was due on [Due Date].

We kindly request that you process the payment at your earliest convenience. Please find the payment details below:

- Payment Method: [Payment Method]

- Amount Due: [Amount]

- Due Date: [Due Date]

If you have any questions or need assistance with the

Setting Payment Terms in Your Email

Clearly outlining payment expectations in your written communication is essential for avoiding misunderstandings and ensuring smooth transactions. By specifying payment terms upfront, you establish clear guidelines for the recipient regarding when and how to make the payment. This not only helps you get paid on time but also maintains a professional relationship with the other party.

Key Elements of Payment Terms

When setting payment terms in your communication, it’s important to cover all essential details to ensure clarity. Here are the key components to include:

- Due Date: Always specify the exact date by which payment should be made. This removes any ambiguity and sets a clear deadline for action.

- Late Fees: If applicable, mention any penalties for overdue payments. This serves as a gentle reminder of the consequences of not meeting the deadline.

- Payment Methods: Clearly list the available methods for completing the payment, such as bank transfer, credit card, or online payment platforms. This ensures the recipient knows how to proceed.

- Discounts for Early Payments: If you offer any discounts for early payment, be sure to include this information as an incentive for the recipient to pay ahead of the due date.

- Currency and Amount: Clearly state the amount due and the currency to avoid confusion, especially if dealing with international transactions.

Example of Payment Terms in a Message

Here’s how you might include payment terms in your message:

Dear [Recipient Name],

We hope you’re satisfied with the [goods/services] provided. As agreed, the amount of [Amount Due] is due for payment by [Due Date]. Please find the payment details below:

- Amount Due: [Amount Due]

- Due Date: [Due Date]

- Late Fee: A late fee of [Late Fee Amount] will apply for payments received after [Due Date].

- Payment Methods: You can make the payment via [Payment Method 1], [Payment Method 2], or [Payment Method 3].

- Early Payment Discount: A [X]% discount will be applied if the payment is received before [Early Payment Deadline].

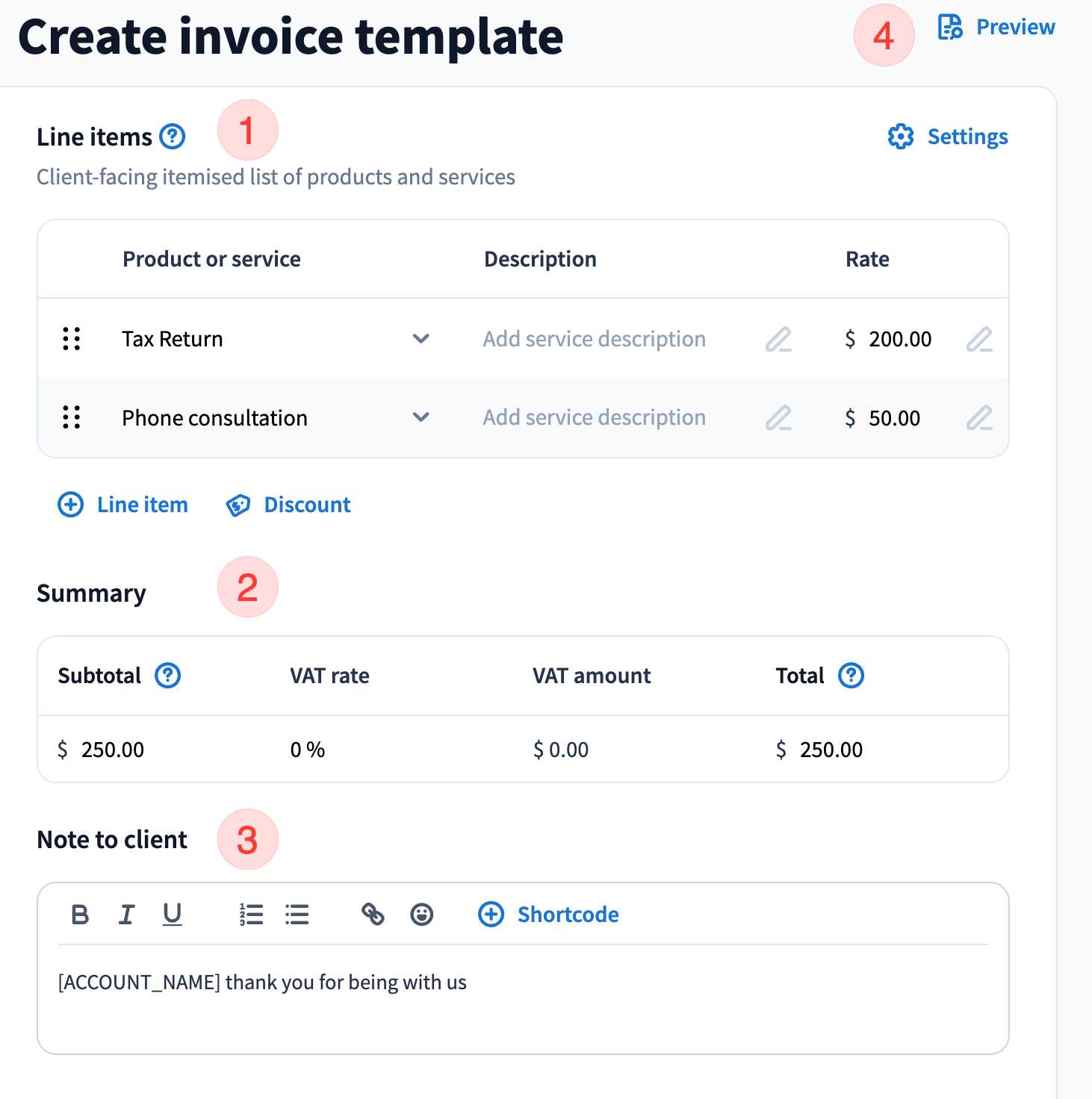

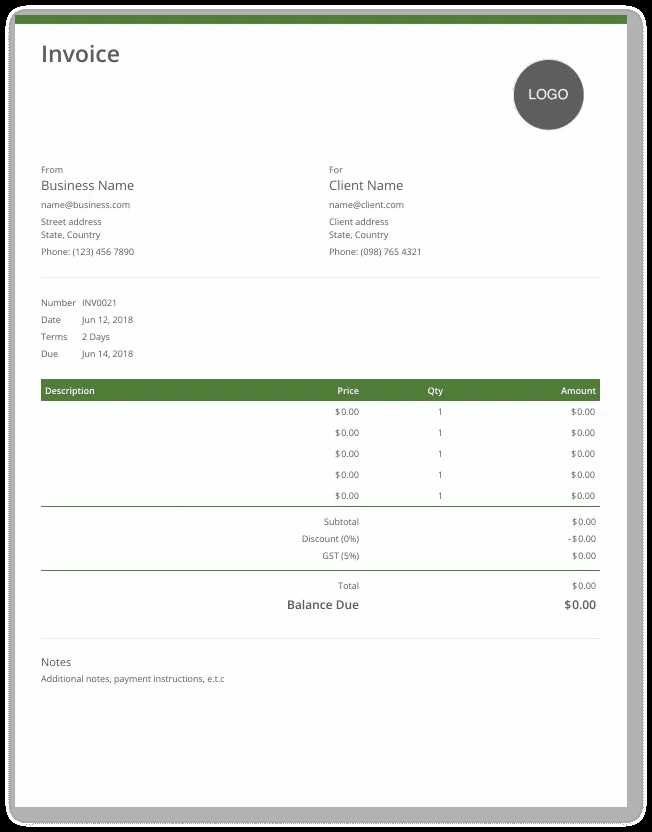

- Your Business Information: Include your company name, address, and contact information at the top of the document to ensure the recipient knows where the request is coming from.

- Recipient Information: Clearly list the recipient’s name and contact details, so they know exactly who the document pertains to.

- Unique Reference Number: Assigning a unique reference number to each document helps with tracking and future reference, especially if there are multiple requests being processed at the same time.

- Detailed Description of Products/Services: Include a clear and itemized list of the goods or services provided, along with the corresponding costs for each item. This allows the recipient to see exactly what they are paying for.

- Total Amount Due: Clearly highlight the total amount due, ensuring it stands out on the page to avoid any confusion.

- Payment Terms and Due Date: Include the due date and any specific payment terms such as late fees or discounts for early payment. This sets clear expectations and encourages timely action.

- Payment Instructions: Provide clear instructions on how to make the payment, including accepted payment methods and bank details if necessary.

- Use Clear Fonts: Choose easy-to-read fonts such as Arial or Times New Roman, and ensure that the font size is large enough for easy reading. Avoid using decorative fonts that can make the document difficult to read.

- Organize Information in Sections: Structure the document in clear sections, such as “Business Information,” “Recipient Information,” “Details,” and “Total Amount Due.” This will help the reader quickly locate the information they need.

- Include White Space: Don’t overcrowd the document with too much text. Allow for plenty of white space around the text to make it more readable and less overwhelming.

- Use Tables for Itemization: A table is an effective way to display detailed information, such as a list of services or items with their respective costs. This makes it easy for the recipient to understand the breakdown of the total amount due.

- Add Your Brand Elements: Incorporating your company’s logo, colors, and design elements can help reinforce your brand and make the document look more professional.

- Time Savings: Automated systems handle repetitive tasks such as composing and sending payment reminders, freeing up time for you and your team to focus on higher-value activities.

- Consistency: Automated reminders ensure that each message is sent in a timely manner, with consistent wording and format, reducing the risk of missed or late payments.

- Improved Accuracy: Automation minimizes the risk of human error, such as forgetting to send a reminder or inputting incorrect payment details.

- Reduced Administrative Burden: Once the automation is set up, it runs without ongoing manual intervention, making the process more efficient and less labor-intensive.

- Better Cash Flow Management: With reminders being sent automatically, payments are more likely to be received on time, helping maintain a steady cash flow for your business.

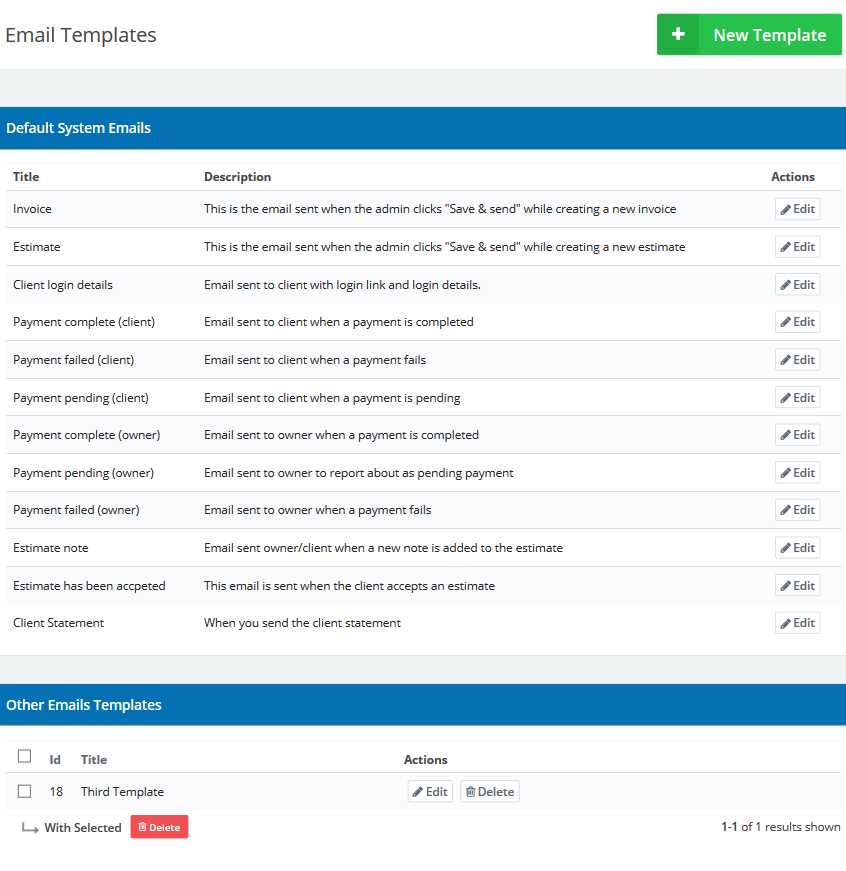

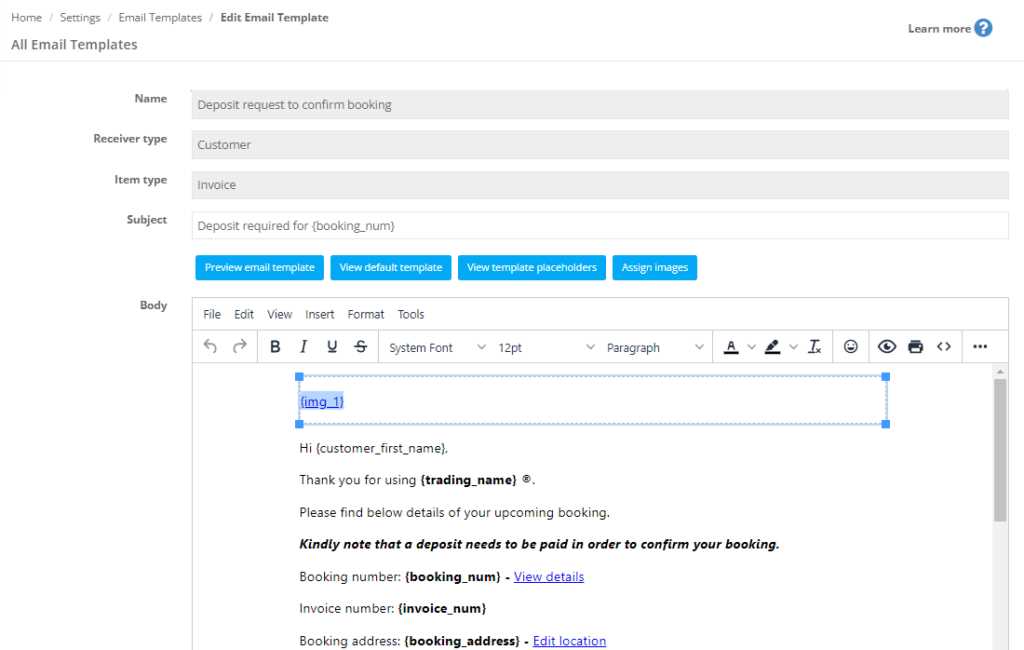

- Choose the Right Software: Select a tool that integrates with your payment system and offers automation features such as automatic reminders, payment tracking, and customizable messaging.

- Set Payment Reminders: Schedule automated messages to be sent at specified intervals–such as a few days before the due date, on the due date, and a few days after. Customize the timing based on your business needs.

- Personalize the Messages: Ensure that the automated messages are personalized with the recipient’s name, due amount, and relevant details. Most automation platforms allow for dynamic fields that can pull in this information automatically.

- Include Payment Instructions: Make sure the automated message includes clear instructions on how the recipient can make the payment, including acceptable payment methods, account details, and due dates.

- Test the Process: Before fully automating the process, conduct a few test runs to ensure everything works as expected and that the messages are being sent correctly.

- Payment Terms: Clearly state when payment is due and whether there are any grace periods or extensions. Include the method of payment and any specific instructions to avoid confusion.

- Late Fees and Penalties: If you plan to charge a late fee for overdue payments, specify the amount or percentage that will be charged and the conditions under which it will apply.

- Refund Policies: If applicable, outline any refund or return policies to avoid legal conflicts in case the recipient is dissatisfied with the product or service.

- Tax Regulations: Make sure that your payment request complies with the tax laws of your region. This may include the correct application of value-added tax (VAT) or sales tax, as well as including the appropriate tax identification numbers.

- Data Privacy Laws: Be mindful of data privacy regulations such as the GDPR in Europe or CCPA in California. Ensure that personal information shared between you and the recipient is handled in compliance with these laws.

- Cross-border Transactions: If dealing with international clients, familiarize yourself with the laws and regulations that govern cross-border payments and contracts to avoid complications.

- Written Contracts: Whenever possible, have a written contract that outlines the terms of the transaction. This document can help avoid confusion and protect both parties if there is a legal dispute later on.

- Proof of Delivery: If sending physical documents, use tracked delivery services to have proof of receipt. For elec

Tips for Ensuring Timely Payments

Securing prompt payments is essential for maintaining healthy cash flow and ensuring the smooth operation of your business. However, delays in payment can be a common challenge. Implementing proactive strategies can help reduce the likelihood of late payments and ensure that you get paid on time. In this section, we will discuss several effective techniques to encourage timely payments and avoid unnecessary follow-ups.

Set Clear Payment Terms

One of the most important steps in ensuring on-time payments is to clearly define your payment terms from the outset. When both parties know the expectations, it’s easier to manage the process and avoid misunderstandings.

- Define Payment Deadlines: Specify a clear due date on all documents, including any relevant payment terms, such as net 30, net 60, or early payment discounts.

- Specify Payment Methods: Be sure to list acceptable payment methods, such as bank transfer, credit card, or online payment platforms, to avoid confusion and speed up the process.

- Clarify Penalties for Late Payments: If you charge interest or late fees, make sure these terms are communicated in advance to encourage timely payments.

Maintain Consistent Communication

Staying in touch with your customers throughout the payment process can help ensure that they don’t forget or delay their payment. Regular communication builds trust and can encourage recipients to prioritize settling their balances.

- Send Reminders Before the Due Date: A friendly reminder a few days before the due date can nudge the recipient to make the payment on time.

- Send Timely Follow-ups: If payment is missed, follow up quickly with a polite reminder, ideally within a few days after the due date. A prompt follow-up is more likely to result in a quick payment.

- Offer Multiple Contact Points: Ensure recipients know how to reach you in case of questions or concerns regarding the payment process. This can help resolve issues quickly and prevent delays.

Setting clear expectations and staying in touch are key steps in ensuring that payments are made promptly. By being proactive in your communication and outlining precise terms, you can minimize delays and keep your business finances on track.

How to Handle Client Disputes Over Invoices

Disputes over payment requests can occur for various reasons, ranging from misunderstandings about the terms of the agreement to issues with the quality of the provided goods or services. It’s important to address these concerns promptly and professionally to maintain a good working relationship with the other party while protecting your business interests. In this section, we will explore effective strategies for handling disputes in a calm, constructive manner.

1. Listen Carefully and Understand the Issue

The first step in resolving any dispute is to carefully listen to the other party’s concerns. Whether the issue lies in the details of the transaction, a perceived error, or dissatisfaction with the service, understanding the root cause is essential. Approach the conversation with empathy and be open to their perspective. This not only helps defuse any tension but also helps you determine if the dispute is valid and how to address it effectively.

2. Review the Documentation

Once you have understood the other party’s concerns, carefully review all related documentation. This includes contracts, payment terms, communications, and any records of the transaction. Ensure that the payment request aligns with the original agreement. If there was an error or misunderstanding on your part, address it honestly and propose a solution to correct the issue.

3. Communicate Clearly and Professionally

When responding to a dispute, always maintain a professional tone. Clearly explain your position while also being open to compromise if the situation warrants it. Provide any necessary evidence, such as agreements or correspondence, to back up your stance. If a mistake was made on your end, apologize and offer to rectify the situation. If the dispute is not valid, politely explain why and offer possible solutions or alternatives.

4. Offer a Fair Resolution

When possible, aim to find a mutually beneficial resolution. This could involve offering a partial refund, a discount, or an extension of the payment deadline. If the dispute arises from a misunderstanding, providing clarification or correcting the error might resolve the issue. In cases where a compromise is not possible, be clear about your terms and the potential consequences of non-payment.

5. Document Everything

Throughout the dispute resolution process, it’s crucial to keep detailed records of all communications. This documentation can serve as a reference in case the dispute escalates or requires legal action. It also helps ensure that you and the other party are on the same page and that any agreed-upon changes are documented clearly.

6. Know When to Seek Legal Help

If the dispute cannot be resolved through direct communication and negotiation, and if the other party refuses to make payment without a valid reason, it may be necessary to seek legal assistance. Consult with a legal professional to explore your options and determine the next steps for resolving the situation effectively and protecting your business interests.

By handling disputes professionally and constructively, you can maintain strong relationships while ensuring that your business remains protected and that payment issues are resolved in a fair manner. Effective communication, documentation, and a willingness to find common ground are key to successfully navigating any payment-related conflicts.

Improving Client Relationships Through Invoice Emails

Payment requests are an essential part of any business transaction, but they can also play a significant role in building and maintaining strong relationships with the people you work with. When handled properly, these communications can demonstrate professionalism, transparency, and trustworthiness. By approaching payment requests in a thoughtful and client-centric way, you can turn routine financial communications into an opportunity for strengthening bonds with your partners. In this section, we will discuss strategies for using payment requests as a tool to improve relationships.

1. Personalize Your Communication

One of the simplest ways to improve relationships is by making your payment requests feel personal. Address the recipient by name, acknowledge their business or the ongoing relationship, and express appreciation for their partnership. A personalized approach can help the recipient feel valued and respected, rather than just another transaction.

2. Be Clear and Transparent

Clear communication is key to avoiding misunderstandings and fostering trust. Ensure that your request clearly outlines the amount due, the due date, and any terms or conditions related to payment. Transparency not only helps the other party understand what is expected but also shows that your business is open and honest in its dealings. This can greatly enhance your reputation and strengthen the professional relationship.

3. Offer Flexibility and Support

Flexibility in your approach to payment requests can go a long way in nurturing positive relationships. If a partner is experiencing financial difficulties or needs additional time, offering extensions or flexible payment options can show empathy and understanding. By demonstrating that you are willing to work with them, you build goodwill and show that your relationship is about more than just financial transactions.

4. Keep Communication Professional Yet Friendly

Maintaining a balance between professionalism and friendliness is crucial. Be polite, respectful, and courteous in your tone, while also remaining professional. A friendly yet professional tone helps create a positive environment for resolving any issues that may arise and ensures that the recipient feels comfortable communicating with you in the future.

5. Use Positive Reinforcement

Incorporating positive reinforcement into your payment requests can encourage future collaboration. Express your appreciation for past business and mention how much you look forward to continuing the partnership. A small note of gratitude can leave a lasting positive impression and remind the recipient that your business relationship is a valued one.

6. Follow-Up with Respect

If a payment is delayed, be sure to follow up in a way that is courteous and understanding. A gentle reminder can often resolve the issue without causing unnecessary tension. By maintaining respect and professionalism throughout the follow-up process, you reinforce that your relationship is based on mutual respect and collaboration, rather than confrontation.

Incorporating these strategies into your payment communications not only helps ensure timely payments but also strengthens the trust and loyalty of those you work with. By approaching payment requests as an opportunity to reinforce

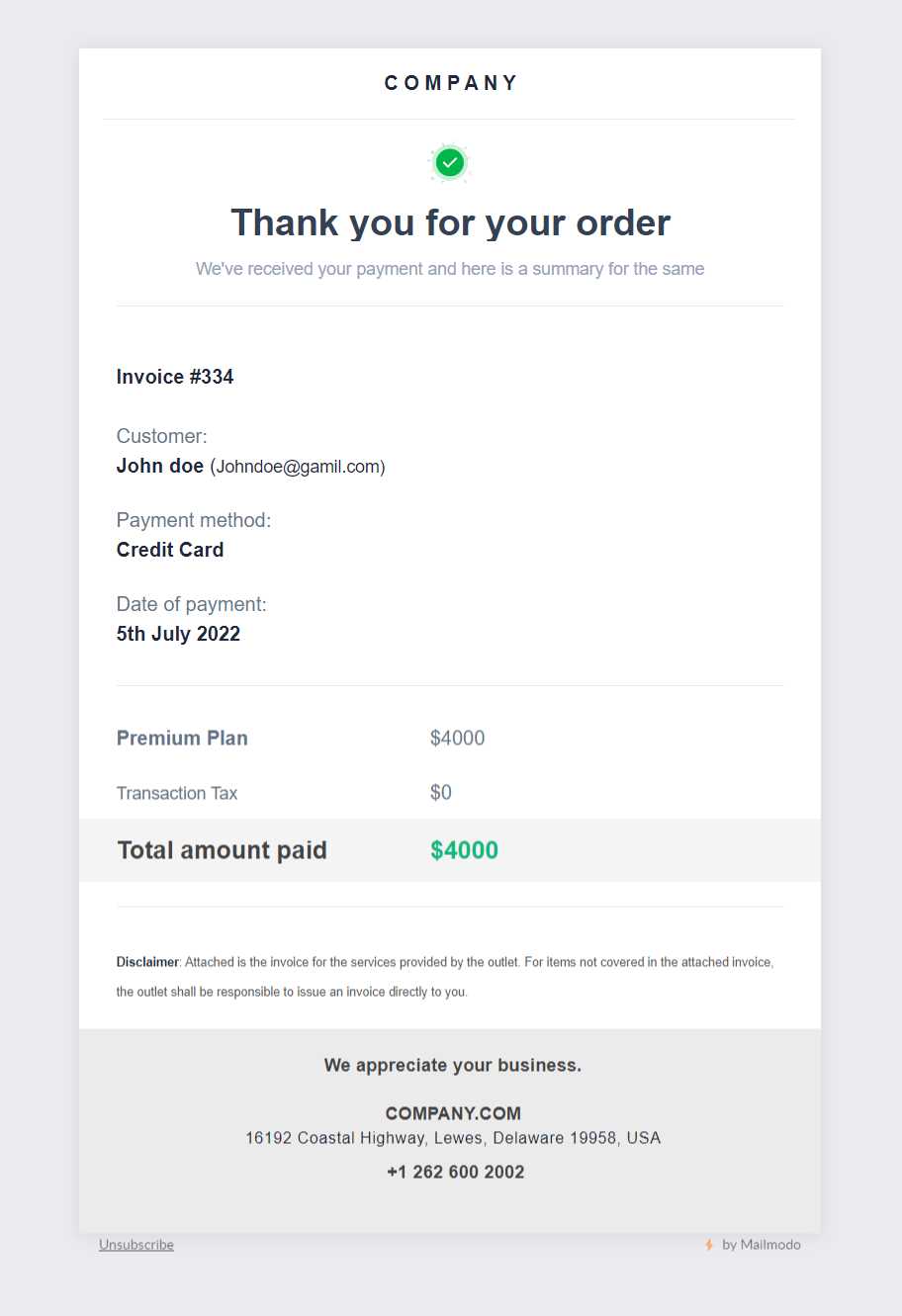

Designing an Invoice Template for Clients

Creating a well-organized and professional document for payment requests is crucial for maintaining clear communication with the recipient. A well-designed payment request form not only looks professional but also ensures that the recipient can easily access and understand the important details. The structure and appearance of the document can have a direct impact on how quickly and smoothly the payment process unfolds. In this section, we will explore how to design an effective payment request form that is both visually appealing and functional.

Key Elements to Include in a Payment Request

When designing your payment request form, it’s important to ensure that it includes all the necessary details in a clear and easy-to-read format. Here are the essential elements to include:

Design Tips for Clarity and Professionalism

While the content of the document is important, the design plays a crucial role in ensuring the recipient can easily read and understand the information. Here are some design tips to keep in mind:

Designing a clear, professional payment request document that is easy to read and visually appealing can help ensure that the recipient understands the details and takes prompt action. By including all necessary information in a well-structured format, you increase the likelihood of a smooth and efficien

Automating Invoice Emails for Efficiency

In today’s fast-paced business environment, streamlining routine tasks is essential for maximizing productivity. Automating your payment requests can save valuable time, reduce human error, and ensure consistency in communication. By setting up automatic processes, you can focus on more strategic tasks while ensuring that recipients consistently receive timely, professional reminders. In this section, we will explore how automating payment requests can improve efficiency and simplify your workflow.

Benefits of Automation

Automating payment reminders brings several advantages that can enhance both operational efficiency and customer experience:

How to Set Up Automated Payment Requests

Setting up automated payment reminders is easier than it seems. Many accounting software platforms and customer relationship management (CRM) systems offer built-in automation features that allow you to create and schedule payment requests. Here are the key steps to follow:

Automating payment requests not only saves time but also improves communication efficiency and reduces the likelihood of missed payments. By implementing automated reminders, businesses can ensure smoother operations, maintain a steady cash flow, and avoid the administrative burdens that come with man

Legal Considerations When Sending Invoices

When requesting payment for goods or services provided, it’s essential to ensure that all communications and documents are legally sound. The way you structure your payment requests can have significant legal implications if not handled correctly. It is important to understand the legal framework that governs these transactions, ensuring that you are compliant with relevant laws and regulations. In this section, we will discuss the key legal considerations that businesses should keep in mind when preparing and dispatching payment requests.

Clear Terms and Conditions

One of the most crucial legal aspects of any payment request is clarity. It’s essential to clearly outline the terms of the transaction, including payment deadlines, late fees, and any other conditions that apply to the business agreement. Without clear terms, there may be confusion or disputes that can lead to legal complications.

Complying with Local and International Laws

When drafting and dispatching payment requests, it’s important to ensure that you are compliant with both local and international regulations, especially if you deal with clients across different regions. Different countries have different rules regarding contracts, payments, and data protection. Ignoring these can result in legal issues, including fines or disputes.

Documenting Agreements and Communications

To avoid misunderstandings or disputes, it is advisable to keep thorough records of all communications, agreements, and payment requests. This documentation can serve as evidence in case of legal disputes and will help protect your business interests.