Self Invoice Template for Quick and Easy Billing

For individuals and businesses that manage their own transactions, having a structured way to present payment requests is essential. Whether you’re a freelancer, contractor, or small business owner, having a reliable and consistent method for issuing payment reminders can save time and improve your professional image.

Designing a clear and organized billing document is key to ensuring smooth communication with clients and customers. A well-crafted form not only makes the payment process easier but also provides legal protection by detailing the terms of the transaction. Many choose to use pre-made formats that can be easily customized to meet specific needs, offering both efficiency and flexibility.

By utilizing such documents, you can ensure that all necessary information is included, from payment amounts to due dates, and present it in a manner that’s easy for recipients to understand. Whether you’re looking to create one from scratch or adapt an existing model, mastering this process is a vital skill for managing financial dealings professionally.

Self Invoice Template Basics

When managing payments and billing, it’s important to have a consistent and professional approach to document creation. A well-structured form not only ensures accuracy but also establishes trust with clients by clearly outlining the terms of the transaction. Understanding the essential components of such a document will help streamline the process, reduce errors, and make the entire payment procedure more efficient.

The core elements of a billing document include key details like the payer and payee information, payment amounts, services rendered, and the agreed-upon payment terms. These factors are essential for both parties to understand the expectations, reducing confusion and facilitating prompt processing of payments.

Designing a document that is both clear and flexible is crucial. You want it to be easily customizable to fit different transactions, while still maintaining a consistent format that ensures all necessary information is present. Whether you’re dealing with a one-time project or a recurring service, mastering the basics of creating these forms will help ensure smooth financial dealings every time.

Why You Need a Self Invoice Template

For any individual or business that regularly handles financial transactions, having a structured document to request payment is essential. It not only simplifies the process but also ensures that all relevant details are captured and communicated clearly. Without this, important information could be overlooked, leading to delays or misunderstandings.

Key Reasons for Using a Structured Billing Document

- Efficiency: With a pre-designed format, you don’t need to start from scratch each time. Simply fill in the necessary details, saving time and effort.

- Consistency: A standardized form ensures that every transaction is recorded and presented in the same manner, minimizing the risk of missing important details.

- Professionalism: Sending a well-organized request demonstrates to clients that you are serious and reliable, helping to build trust and improve your reputation.

- Legal Protection: A clearly outlined document can serve as a reference point in case of disputes, ensuring both parties are aware of the terms.

Benefits for Freelancers and Small Businesses

- Customizability: You can adjust the document to fit various services, rates, and payment conditions, providing flexibility for different clients or projects.

- Tax Compliance: A well-structured billing form allows you to accurately track and report earnings, making it easier when filing taxes.

- Record Keeping: Maintaining a set of well-organized payment requests helps with managing finances and staying on top of outstanding amounts.

In summary, using a professional, pre-made form can significantly streamline the billing process, allowing you to focus on growing your business while ensuring clear and timely payments.

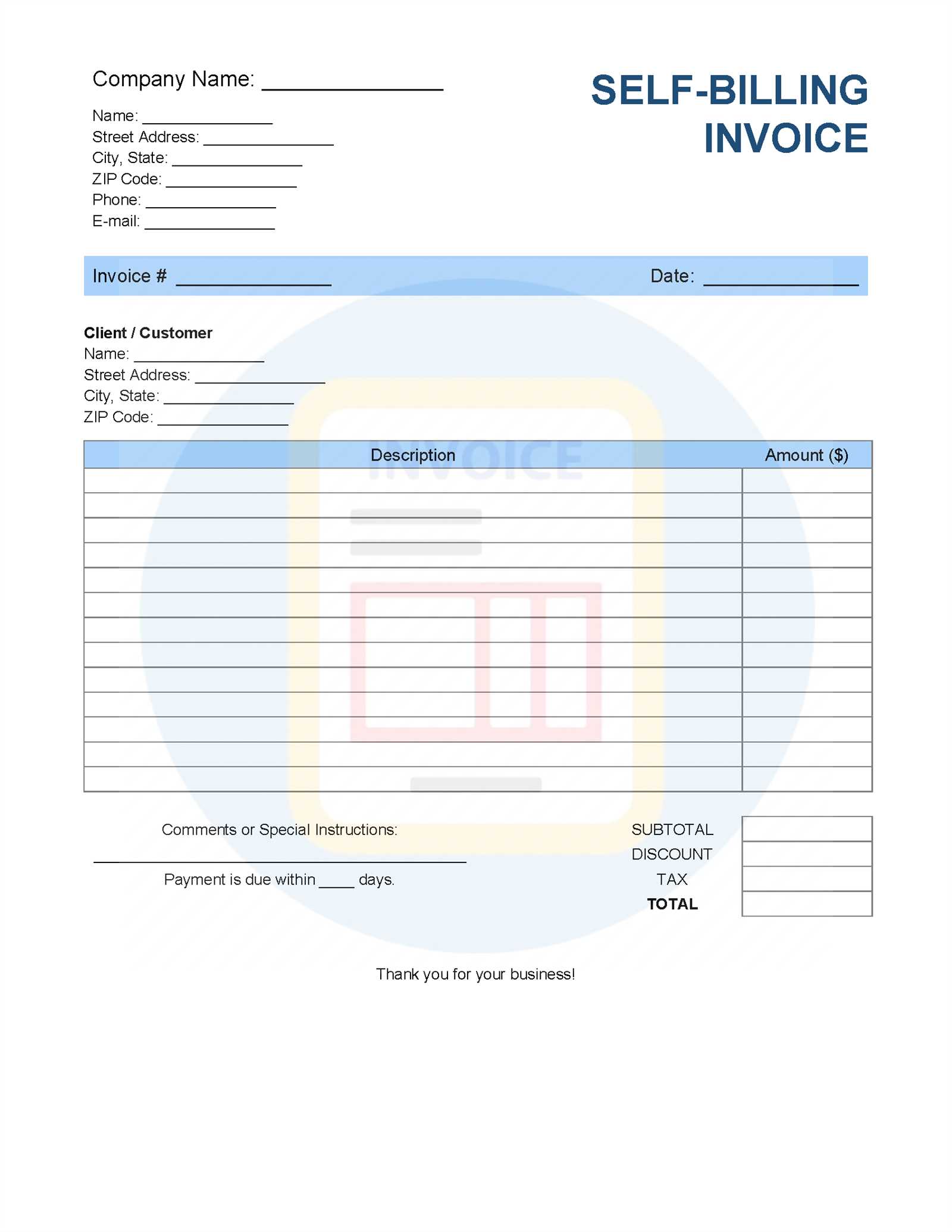

How to Create a Self Invoice

Creating a clear and professional payment request document is a crucial task for ensuring smooth financial transactions. Whether you’re offering a service or selling goods, having a well-structured document that includes all necessary details ensures that both parties are on the same page. Here’s a simple step-by-step guide on how to create such a document for any transaction.

Step-by-Step Guide

- Start with your business information: Include your name or company name, address, and contact details. This ensures that the recipient knows who is requesting the payment.

- Provide client information: Clearly state the name and contact details of the client or customer, as well as any relevant reference number for the project or contract.

- Include a unique reference number: This number helps track the payment request for both your records and the client’s. It’s helpful for both parties in case there are questions or disputes.

- List the services or products provided: Detail each item or service, including the quantity, description, and rate or price. Be clear and specific to avoid any confusion.

- Calculate the total amount: Add up the prices for all services or items, ensuring that the total matches the agreed amount. If applicable, include taxes or discounts here.

- Set a payment due date: Clearly specify the due date for the payment. This helps create a sense of urgency and sets expectations for when the funds should be transferred.

- Include payment methods: Specify the acceptable methods for payment (e.g., bank transfer, credit card, PayPal), as well as any necessary account details or instructions for completing the transaction.

- Note payment terms and conditions: Include any relevant terms, such as late fees, payment plans, or other important conditions that both parties should be aware of.

Formatting Tips for a Professional Look

- Keep it simple and organized: Use clear headings and bullet points to break down the information. This makes it easier for the recipient to understand the document quickly.

- Use a consistent font and layout: Choose a professional font and layout to make the document visually appealing and easy to read.

- Proofread for accuracy: Before sending the document, double-check all figures, names, and dates to avoid any mistakes that could delay payment or cause confusion.

By following these simple steps, you can create a professional and efficient document for every financial transaction, helping ensure that you receive payment promptly and without issues.

Key Elements of a Self Invoice

When preparing a document to request payment, it’s essential to include specific details that ensure the transaction is clear and complete. These components help avoid misunderstandings and provide both the payer and recipient with all the necessary information. Below are the fundamental elements that should be included in every billing document to make it effective and professional.

| Element | Description |

|---|---|

| Business Information | Include your name or company name, address, and contact details, ensuring the recipient knows who is requesting payment. |

| Client Information | Clearly state the client’s name, address, and contact details to ensure correct delivery of the payment request. |

| Document Reference Number | Assign a unique reference number to each payment request for easy tracking and future reference. |

| Details of Services or Products | List each item or service provided, including quantities, descriptions, and individual rates. |

| Total Amount Due | Clearly display the total cost for the services or products, including taxes or discounts if applicable. |

| Due Date | Specify when the payment is expected to be made, helping set clear expectations for the client. |

| Payment Methods | Indicate acceptable payment methods (bank transfer, credit card, etc.), including any necessary details like account numbers. |

| Terms and Conditions | Outline any terms, such as late fees, payment schedules, or specific instructions regarding the payment process. |

By including these key elements, you ensure that all necessary information is clearly presented, leading to smoother transactions and fewer potential disputes.

Customizing Your Self Invoice Template

Adapting a billing document to your specific needs allows for a more streamlined process and reflects your unique business style. Customization can help ensure that all necessary information is included while also allowing you to maintain a professional appearance. Tailoring the format and content will make the document not only functional but also aligned with your brand and business practices.

Key Areas for Customization

- Business Branding: Incorporate your logo, color scheme, and other branding elements to make the document visually cohesive with your business identity.

- Payment Terms: Adjust the payment terms to match your preferred policies. For example, you can specify discounts for early payments or introduce late fees.

- Service Descriptions: Customize the descriptions of services or products to reflect the specific terms of each transaction, ensuring clarity for your clients.

- Currency and Taxes: If you deal with international clients, ensure the currency is appropriate, and add any relevant tax information, such as VAT or sales tax, based on location.

- Due Date and Payment Methods: Adapt the due date format to fit your preferences and specify the payment methods that are most convenient for your clients, such as PayPal, bank transfer, or credit card.

Benefits of Customization

- Brand Identity: A customized document reinforces your brand’s professional image, helping clients associate it with quality and reliability.

- Flexibility: Tailoring the document to suit the needs of different clients or projects makes the billing process more adaptable and efficient.

- Clear Communication: When you adjust the template to reflect the specifics of each transaction, you reduce confusion and ensure that all terms are clearly stated.

By customizing your billing documents, you not only make the process more efficient but also enhance your client relationships by presenting a personalized and professional approach to financial matters.

Self Invoice vs. Standard Invoice

While both types of payment requests serve the same fundamental purpose–requesting payment for services or products–the format and use cases of each differ. Understanding the distinctions between these two types of documents will help you determine which is most appropriate for your needs and ensure smoother transactions with clients or customers.

| Aspect | Self Payment Request | Standard Payment Request |

|---|---|---|

| Initiator | The payer generates the request, typically when no formal contract or agreement is in place. | The seller or service provider typically issues the request after delivering goods or services. |

| Use Case | Commonly used by freelancers, contractors, or individuals who work without a formal employer or predefined billing schedule. | Used by businesses or service providers with regular, formal agreements and contracts in place with clients or customers. |

| Flexibility | Highly customizable, as it can be tailored to suit individual transactions and clients. | Generally follows a fixed format based on contractual agreements, with less flexibility in customization. |

| Legal Requirements | May not always include standard legal information required by tax authorities, depending on local regulations. | Typically includes all the necessary legal details, such as tax information, business identification, and payment terms. |

| Formality | More informal and suited for casual or one-off transactions. | More formal, reflecting professional business transactions with established terms and conditions. |

Both types of payment requests serve important functions, but the choice between the two depends on the nature of your work, your client relationship, and the level of formality required. Understanding these key differences will help ensure you choose the right approach for each transaction.

Benefits of Using Self Invoice Templates

Using pre-designed payment request documents can greatly simplify the billing process, making it more efficient and consistent. By leveraging ready-made formats, you can reduce the chances of errors, maintain a professional appearance, and save valuable time. Below are some key benefits of incorporating these customizable documents into your financial operations.

| Benefit | Description |

|---|---|

| Time Savings | Pre-made formats allow you to quickly fill in the necessary details, eliminating the need to start from scratch for each transaction. |

| Consistency | Using the same format for all billing requests ensures that you include all required details in a uniform manner, making your documents easy to read and understand. |

| Professional Appearance | A well-structured, clean document enhances your professional image, helping to build trust with clients and customers. |

| Reduced Errors | By using a pre-designed structure, you ensure that all necessary fields are included, reducing the chances of forgetting important details. |

| Flexibility | Customizable formats give you the flexibility to adjust the document based on the nature of each transaction, whether it’s a one-off project or a recurring service. |

| Legal and Tax Compliance | Many pre-designed formats include standard fields that help you stay compliant with local regulations, such as tax numbers, payment terms, and legal disclaimers. |

| Streamlined Record Keeping | Consistent use of a format makes it easier to track and organize your records, making it simpler to reference past transactions when needed. |

By utilizing these ready-made documents, you can simplify your billing process while maintaining professionalism, reducing errors, and ensuring compliance with legal requirements. This approach leads to greater efficiency and helps improve your overall workflow.

Common Mistakes to Avoid in Invoices

Even the most experienced business owners or freelancers can make mistakes when creating billing documents, which can lead to confusion, delayed payments, or strained client relationships. Recognizing and avoiding common errors is crucial for ensuring smooth transactions. Below are some of the most frequent pitfalls and tips on how to avoid them.

- Incorrect Client Information: Always double-check that the recipient’s name, address, and contact details are correct. Mistakes here can lead to delivery issues or misunderstandings.

- Missing or Incorrect Payment Details: Failing to clearly outline the total amount due, payment methods, or due date can cause confusion. Be precise in your calculations and ensure all necessary information is included.

- Vague Service Descriptions: It’s essential to clearly describe the work or products provided. Avoid using overly broad terms; be specific to prevent any ambiguity about what the payment is for.

- Omitting Tax Information: Failing to include tax rates or tax identification numbers can lead to legal issues, especially if you’re required to collect VAT or other taxes. Always ensure tax details are properly displayed.

- Overcomplicating the Layout: A cluttered, overly complex document can confuse the recipient. Keep your format clean and easy to read, with clear headings and sections for each piece of information.

- Not Setting Clear Payment Terms: If you don’t specify the due date or payment terms (such as late fees), it can lead to misunderstandings or delayed payments. Always include a clear due date and outline the payment expectations.

- Failing to Include a Unique Reference Number: Without a reference number, it’s difficult to track payments or resolve disputes. Make sure each document has a unique identifier for easy tracking.

By paying attention to these details and avoiding common mistakes, you can create professional, clear, and effective payment requests that minimize confusion and ensure timely payments.

Choosing the Right Invoice Format

Selecting the appropriate format for your payment request is essential for both clarity and efficiency. The right structure ensures that all necessary details are included while maintaining a professional appearance. It can also help avoid confusion and streamline the process for both you and your client. There are different formats available, and understanding their advantages will help you decide which one best suits your needs.

Consider the following factors when choosing a format:

- Transaction Type: The nature of your business and the type of work you do will influence the structure you need. For example, one-off services may require a simpler format, while ongoing contracts might need more detailed terms and conditions.

- Client Expectations: Some clients may have a preferred format based on their accounting system or internal processes. Be sure to inquire about their preferences to avoid any issues.

- Professional Appearance: Choose a format that looks polished and is easy to understand. A well-structured document helps establish credibility and encourages timely payments.

- Customization Needs: If your business offers a variety of products or services, you may need a format that allows for easy customization for each client. Look for a structure that lets you easily adjust quantities, descriptions, and prices.

- Legal and Tax Requirements: Make sure the format you select includes necessary details such as tax rates, business registration numbers, and any other legal information relevant to your location or industry.

Types of Formats to Consider:

- Simplified Format: Suitable for freelancers or small businesses with straightforward transactions, typically including just the essential details like service description, total amount, and due date.

- Detailed Format: Often used for larger businesses or complex projects, this format includes more in-depth information such as payment terms, itemized lists, and detailed tax calculations.

- Recurring Payment Format: Ideal for ongoing services or subscriptions, this structure includes fields for recurring billing cycles, payment schedules, and automatic renewal options.

Choosing the right format not only simplifies the process but also helps ensure that you meet your clients’ needs while maintaining professionalism. Whether you opt for a simple or more detailed structure, the key is to ensure that all necessary information is included and easily accessible.

Free vs Paid Self Invoice Templates

When it comes to choosing a payment request document format, many businesses and freelancers face the decision between using a free option or investing in a paid solution. Both have their benefits, but they also come with different levels of functionality and customization. Understanding the differences between free and paid formats will help you decide which option best suits your needs and budget.

Benefits of Free Formats

- Cost-Effective: The most obvious benefit is that free formats come at no cost, making them ideal for small businesses or freelancers just starting out.

- Quick and Easy to Use: Many free options are simple, easy-to-fill documents that require minimal setup, making them ideal for quick transactions.

- Basic Functionality: Free formats often cover essential needs, such as including business and client information, payment terms, and total amounts due.

- No Long-Term Commitment: Since they are free, there’s no obligation to continue using them once your needs evolve or if you decide to upgrade later on.

Drawbacks of Free Formats

- Limited Customization: Free options often lack the flexibility to customize the layout or design to match your brand, which can make your documents look generic.

- Basic Features: Free versions might lack advanced features like automatic calculations, tax settings, or integration with accounting systems.

- Possible Ads or Watermarks: Some free formats may include unwanted ads or watermarks, which can make your document appear unprofessional.

Advantages of Paid Formats

- Greater Customization: Paid formats often offer more design and layout options, allowing you to personalize the document with your branding and unique business requirements.

- Advanced Features: These can include automatic tax calculations, multiple currency options, recurring billing, and integration with accounting software.

- More Professional Look: A premium solution typically results in cleaner, more polished documents that can enhance your business’s image and credibility with clients.

- Customer Support: Paid formats often come with access to customer support, ensuring that you can get assistance if you run into any issues while using the format.

Drawbacks of Paid Formats

- How to Download a Self Invoice Template

- Search for Reliable Sources: Start by looking for trusted websites that offer downloadable payment request formats. Many websites provide both free and paid versions that can suit your specific requirements.

- Choose the Right Format: Depending on your needs, select a format that fits the type of business or services you provide. Ensure that it covers all the essential sections, such as service descriptions, pricing, and payment terms.

- Check Customization Options: Before downloading, verify if the format allows for easy customization. You may want to add your business logo, adjust the layout, or modify the content to match your branding.

- Download the Document: Once you’ve selected the appropriate format, look for the download button or link on the website. Most formats are available in PDF, Word, or Excel, but ensure that the file type is compatible with your software.

- Save the File: After downloading, save the file to a location on your computer where you can easily access it when needed. You may also want to organize your documents for future use, especially if you plan to reuse the format for multiple clients.

- Fill in the Necessary Details: Open the downloaded document and start filling in the required information, such as client details, service descriptions, amounts, and due dates.

- Clear Formatting: Ensure the layout is clean and easy to read. Use headings and sections to separate different types of information.

- Legal Disclaimers: Depending on your region, you may need to include certain legal terms or disclaimers to comply with local regulations.

- Personalization: Customize the document to fit your business’s branding by adding your logo, brand colors, and any other distinctive elements.

Downloading a ready-made payment request document is a straightforward process that can save you significant time and effort. Whether you need a basic structure or one with advanced features, there are various sources where you can obtain a suitable document. Below are the steps you can follow to easily download a format that meets your needs.

Steps to Download a Payment Request Format

By following these steps, you can quickly download a well-organized payment request document that simplifies your billing process and ensures that all the necessary details are included for a professional transaction.

Essential Information to Include in Self Invoices

To ensure your payment request documents are clear, professional, and legally compliant, it’s important to include all the necessary details. A complete and well-structured document not only facilitates quicker payments but also helps maintain a transparent relationship with your clients. Below are the key elements that should be present in any properly formatted billing document.

Key Components of a Payment Request

| Essential Information | Description |

|---|---|

| Your Business Information | Include your business name, address, and contact information to ensure the recipient knows who the request is from. |

| Client Information | Provide the full name or business name of the client, their address, and any other relevant contact details. |

| Unique Reference Number | Assign a unique number to each document for easy tracking and future reference. This is essential for record-keeping. |

| Date of Issue | The date the document is created should be clearly mentioned. This is important for tracking timelines and payment terms. |

| Description of Goods or Services | Provide a detailed description of the goods delivered or services rendered, including quantities, rates, and other specifics. |

| Total Amount Due | List the total amount to be paid, ensuring all taxes, discounts, or additional charges are clearly shown. |

| Payment Terms | Specify the payment due date, any applicable late fees, and accepted payment methods. |

| Tax Information | Include any applicable taxes (like VAT) and relevant tax identification numbers if required by law. |

| Signature or Authorization | In some cases, a signature or authorization from the client may be required for validity. |

Additional Considerations

By including all the necessary information and ensuring your document is clear and professional, you can streamline the payment process, avoid misunderstandings, and foster positive client relationships.

How to Calculate Taxes on Invoices

When preparing payment request documents, accurately calculating taxes is essential for compliance and transparency. The tax amount must be clearly stated to avoid confusion and ensure that both parties understand the total amount due. Understanding how to properly calculate taxes can help you stay organized and avoid potential issues with tax authorities.

Steps for Calculating Tax

The process of calculating taxes on a payment request document depends on the applicable tax rate and the type of product or service provided. Follow these steps to calculate the tax correctly:

- Identify the Applicable Tax Rate: The first step is to determine the tax rate that applies to the goods or services being provided. This rate can vary depending on the country, state, or type of service. For example, some products may be subject to sales tax, while others may require VAT.

- Calculate the Taxable Amount: Determine the amount that is subject to tax. This is usually the total value of the goods or services before tax is added. If there are discounts or other adjustments, apply them to reduce the taxable amount before calculating the tax.

- Apply the Tax Rate: Multiply the taxable amount by the applicable tax rate (expressed as a decimal). For example, if the tax rate is 10%, multiply the taxable amount by 0.10.

- Determine the Total Amount Due: Once the tax is calculated, add it to the taxable amount to determine the total amount due. This is the final amount the client will need to pay.

Example of Tax Calculation

Let’s consider an example where you are selling a service worth $500 and the applicable tax rate is 8%. Here’s how the tax calculation would work:

- Taxable Amount: $500

- Tax Rate: 8% (or 0.08)

- Tax Calculation: $500 × 0.08 = $40

- Total Amount Due: $500 + $40 = $540

By following these steps and using the appropriate tax rate, you can ensure that your payment requests are accurate and meet legal requirements. Always double-check your calculations to avoid errors and to maintain professionalism.

How to Send Your Self Invoice

Once your payment request document is complete, the next step is to send it to your client. Ensuring that it is delivered efficiently and securely is just as important as creating the document itself. Choosing the right method and ensuring that all necessary information is clear will help ensure prompt payment and avoid any misunderstandings.

Methods for Sending Your Payment Request

There are several ways to send a payment request document. Below are the most common methods, along with their benefits:

| Method | Benefits |

|---|---|

| Email is one of the fastest and most efficient ways to send a payment request. Attach the document in PDF, Word, or Excel format, and include a brief message in the body of the email explaining the details of the request. | |

| Online Billing Platforms | Platforms like PayPal, QuickBooks, or other invoicing software allow you to create, send, and track payment requests online. These platforms often offer automatic reminders and payment options directly within the document. |

| Postal Mail | Sending a physical copy of your payment request can be useful for clients who prefer hard copies. It also adds a level of professionalism, but it may take longer for the client to receive and process. |

| Fax | Though less common, some businesses still use fax machines for sending important documents. Ensure that your client has the ability to receive faxed documents before choosing this method. |

Tips for Sending Payment Requests

- Double-Check the Details: Before sending your document, review it carefully to ensure that all information is accurate, including the amounts, dates, and client details.

- Include Clear Payment Instructions: Make sure that your client understands how to make the payment. Include your payment methods, account details, and any necessary instructions for completing the transaction.

- Set a Clear Due Date: Mention the payment due date clearly within the document and ensure that your client is aware of any penalties for late payments.

- Follow Up: If the payment has not been made by the due date, send a polite reminder or follow-up email. Many invoicing platforms allow you to automate reminders, which can save you time.

By selecting the right method for sending your payment request and following these best practices, you can improve the chances

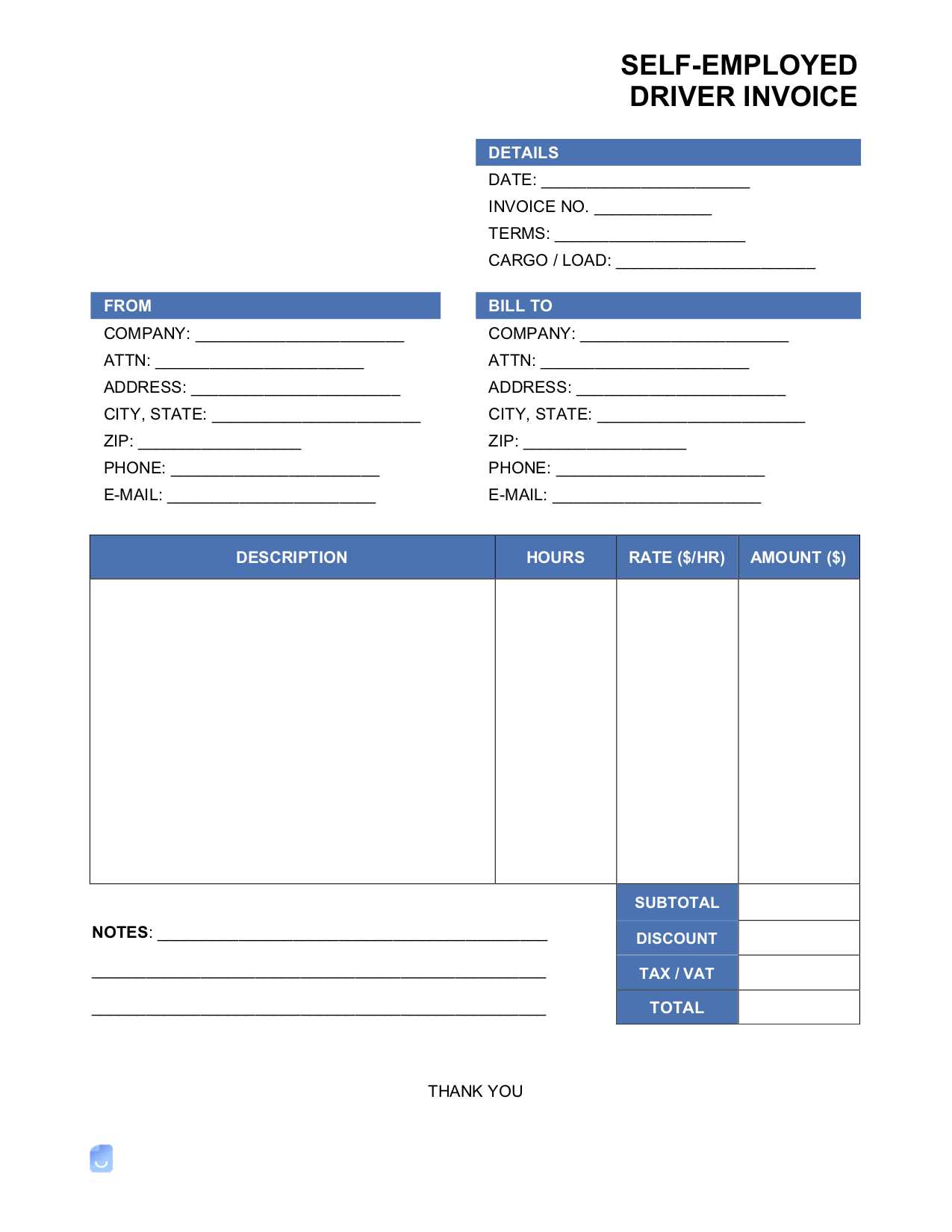

Self Invoice Template for Freelancers

Freelancers often need to create payment requests that clearly outline the work completed, the agreed-upon rates, and the payment terms. Having a well-structured document helps ensure that both parties understand the financial aspects of the project and that payment is processed smoothly. By using a dedicated document format, freelancers can maintain a professional image while keeping track of their earnings.

Why Freelancers Need a Structured Payment Document

For freelancers, clear and accurate billing is essential to avoid disputes and ensure timely payments. A structured document can streamline the invoicing process, allowing freelancers to focus on their work rather than administrative tasks. Additionally, it helps maintain financial records and provides a professional image when dealing with clients.

Key Sections for Freelance Payment Requests

Freelancers should include several key elements in their payment requests to ensure that all necessary information is communicated. These include:

- Client Information: The name, address, and contact details of the client should be listed to ensure that there is no confusion about who the payment is for.

- Freelancer Information: Include your name or business name, address, and any relevant contact details.

- Project Description: Provide a detailed explanation of the services or work completed, including hours worked or project milestones achieved.

- Payment Terms: Clearly state the agreed-upon amount and any applicable taxes. Additionally, include the due date and accepted payment methods.

- Invoice Number: Assign a unique number to each payment request for easy reference and record-keeping.

- Payment Due Date: Specify when the payment is expected to be made to avoid delays.

By including these key sections in your payment requests, you ensure that clients have all the necessary details to process payment promptly and accurately.

Improving Your Business with Invoicing Templates

Streamlining your billing process is essential for running a successful business. Using well-structured documents can help you save time, reduce errors, and present a more professional image to clients. By incorporating ready-made billing formats into your workflow, you ensure that your payment requests are consistent, accurate, and efficient, which ultimately improves cash flow and enhances client satisfaction.

Benefits of Using Billing Formats

- Time Efficiency: Pre-designed documents save time compared to creating a new one from scratch for each client or project.

- Professionalism: Well-organized payment requests enhance your reputation and create a more professional appearance for your business.

- Consistency: Using the same document structure for all clients ensures consistency in the way you present your services and fees.

- Reduced Errors: Templates help minimize mistakes in calculations, descriptions, and client information by providing clear sections to fill out.

- Better Record Keeping: Organized billing formats allow you to maintain a proper record of your transactions, which is valuable for accounting and tax purposes.

How Invoicing Formats Can Help Improve Cash Flow

Using standardized formats helps expedite the billing process, leading to quicker payments. With clear terms and easy-to-understand breakdowns of charges, clients are more likely to process payments promptly. This, in turn, reduces the time between service delivery and receiving compensation, helping to maintain a steady cash flow for your business.

By integrating effective billing formats into your routine, you can not only improve your operational efficiency but also build stronger, more transparent relationships with your clients.