Self Employment Invoice Template for UK Freelancers and Contractors

Managing payments and keeping track of work completed is a crucial aspect of running an independent business. For professionals offering services, creating clear and professional billing documents is an essential step in ensuring timely and accurate compensation. Having a structured format for requesting payments not only helps you stay organized but also projects a professional image to clients.

Whether you’re a freelancer, consultant, or contractor in the UK, knowing how to structure your financial documents correctly is vital. These documents must contain all the necessary details to avoid confusion and facilitate smooth transactions. With the right approach, the process of invoicing can be simplified, allowing you to focus more on delivering quality work.

In this guide, we will explore how to craft a billing document that aligns with UK regulations and best practices, ensuring you remain compliant while optimizing your payment process. From basic requirements to design elements, we will cover everything you need to know to enhance your business transactions.

Understanding Billing Documents for Freelancers and Contractors in the UK

For independent professionals working in the UK, issuing clear and accurate requests for payment is crucial for maintaining a smooth workflow and ensuring timely compensation. These financial documents serve as formal requests for payment, outlining the services provided, the amounts due, and the payment terms. Understanding the structure and content of these documents helps freelancers and contractors manage their finances efficiently while meeting legal and tax obligations.

Key Elements of a Billing Document

When creating a financial document, it is essential to include specific details to ensure both clarity and accuracy. A well-structured request for payment should contain basic information that both the service provider and client can refer to in case of any queries or disputes. Below is a table outlining the essential components of a proper financial document:

| Section | Description |

|---|---|

| Service Description | Details of the work performed or services rendered, including dates and specific tasks. |

| Total Amount | The full amount due for the services, including any additional charges like VAT. |

| Payment Terms | Clarification of when payment is due, including any late fees or early payment discounts. |

| Contact Information | Details of both the client and the service provider, such as names, addresses, and phone numbers. |

| Invoice Number | A unique reference number to help identify and track the request for payment. |

Why Proper Documentation Matters

Properly drafted billing documents ensure that both the freelancer and client are on the same page, reducing the likelihood of payment delays or misunderstandings. They also play a crucial role in financial record-keeping, making it easier for independent professionals to manage their income, file taxes, and comply with regulatory requirements. By using a well-organized approach, independent workers can build trust with clients and establish a reputation for professionalism in their business dealings.

Why Freelancers Need an Organized Billing Document

For freelancers and independent contractors, having a consistent and professional method for requesting payment is essential to maintaining a healthy cash flow and keeping business operations running smoothly. Without a standardized approach, it becomes difficult to manage multiple clients, track payments, and ensure timely compensation. Using an organized format for billing allows for clarity and precision, reducing the chance of errors or misunderstandings between the service provider and client.

Additionally, relying on a predefined structure can help freelancers save time and effort. Instead of creating a new document from scratch for each client, a reusable format ensures that important details are never overlooked. This not only simplifies the billing process but also contributes to a more streamlined workflow, enabling freelancers to focus on their work rather than administrative tasks.

Moreover, using a clear and consistent structure for requests enhances professionalism and helps freelancers build trust with clients. By presenting well-organized, easy-to-read financial documents, freelancers can establish themselves as reliable and credible business partners, which can ultimately lead to more opportunities and long-term client relationships.

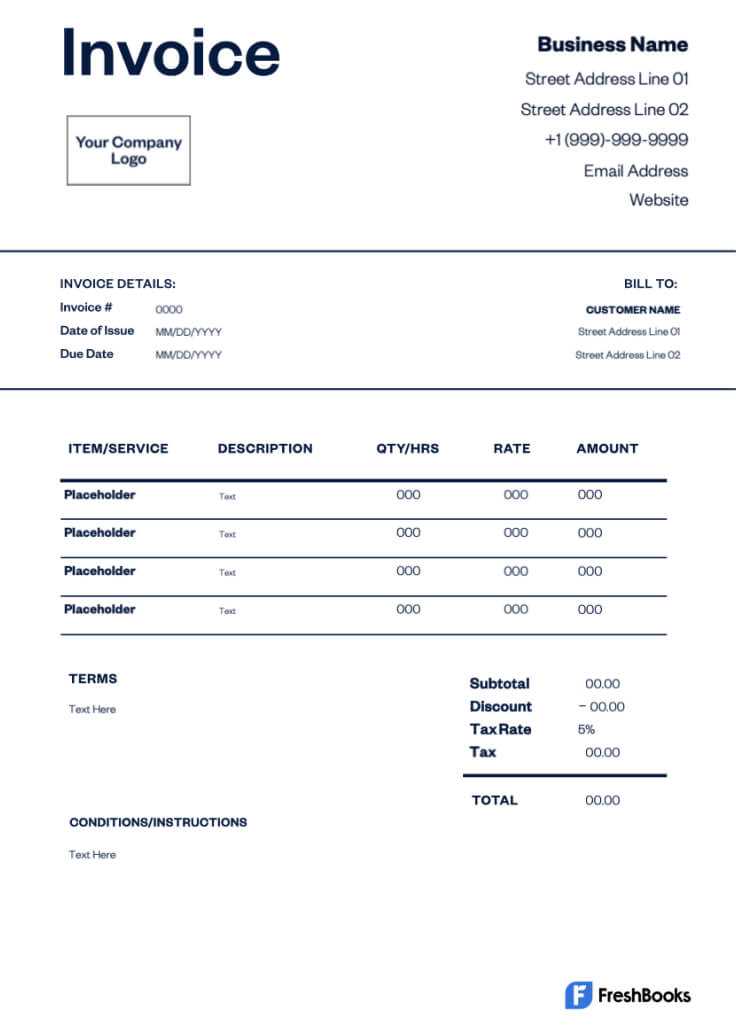

Key Information to Include on a Billing Document

When requesting payment for services rendered, it’s essential to include specific details that ensure both parties are clear on the terms and expectations. A well-structured document not only helps prevent misunderstandings but also ensures that payment is processed smoothly and promptly. Below are the key elements that must be included in any billing document for freelancers or contractors in the UK:

- Client Information: The full name, company name (if applicable), and contact details of the client should be clearly stated to avoid any confusion.

- Service Provider Details: Include your full name, business name (if you have one), address, and contact information to ensure the client knows who the bill is coming from.

- Unique Reference Number: Assign a unique number to each document to make it easy for both you and your client to track and reference.

- Description of Services: Provide a detailed list of the work completed or the services provided. Be specific about the nature of the tasks and the time frame in which they were performed.

- Amount Due: Clearly state the total amount owed, including any additional costs such as VAT or expenses, and break it down by individual services if needed.

- Payment Terms: Specify the due date for payment, including any late fees or discounts for early payment, to set clear expectations on both sides.

- Payment Methods: Clearly list the methods of payment you accept, such as bank transfer, PayPal, or cheque, along with relevant account details or instructions.

- Tax Information: If applicable, include any VAT charges and ensure they are calculated correctly according to UK tax laws.

- Notes or Additional Information: Any additional terms, conditions, or clarifications that may be necessary to avoid confusion can be added here.

Ensuring all these elements are included in your billing document will help you maintain professionalism, stay organized, and make the payment process as smooth as possible for both you and your clients.

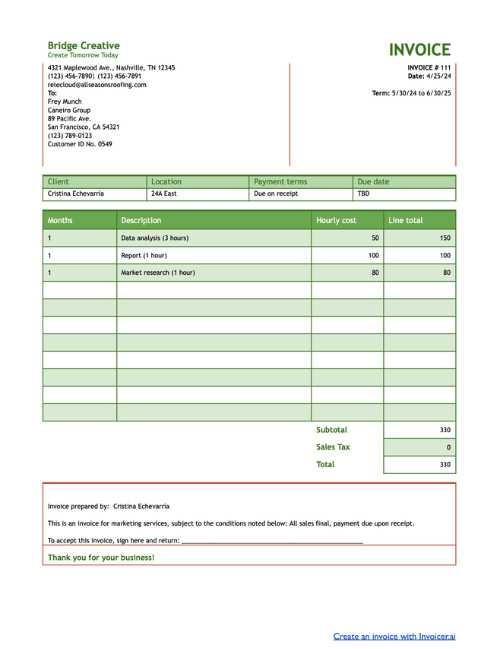

How to Create a Billing Document for Freelancers and Contractors

Creating a professional billing document is an important step for any independent worker looking to request payment for services rendered. A well-organized document ensures clarity, reduces the risk of payment delays, and helps establish a reliable reputation with clients. While the process might seem straightforward, it’s important to follow a few key steps to ensure your document is both legally compliant and easy for clients to understand.

Follow these steps to create an effective billing document:

- Start with Your Information: Include your full name or business name, address, phone number, and email. This allows the client to quickly identify the document and contact you if needed.

- Include Client Details: Add your client’s name, business name (if applicable), and contact details. This helps avoid confusion and ensures the document is directed to the correct recipient.

- Assign a Unique Reference Number: Every document should have a unique number for tracking purposes. This will help both you and your client reference the payment easily in future communications.

- Describe the Services Provided: Detail the work or services you have completed. Include dates, hours worked, and any other relevant information, such as project milestones or deliverables.

- Specify the Total Amount Due: Clearly state the total amount that is owed. If applicable, break down the cost by service, adding any extra charges like VAT or materials used.

- Outline Payment Terms: Include payment instructions, such as the due date, any early payment discounts, and the penalties for late payment. Be specific about the payment method(s) you accept.

- Provide Payment Details: Include your bank details or the relevant payment information needed for the client to make the payment. For online payments, you may include PayPal or other digital payment methods.

Once you’ve included all the necessary details, double-check your document for accuracy. A clean, professional format will help present you as a reliable and trustworthy freelancer. After making sure everything is correct, send the document to your client and follow up if needed to ensure timely payment.

Common Mistakes to Avoid in Invoicing

Creating a financial document for services rendered is a task that requires attention to detail. Mistakes in this process can lead to delayed payments, confusion, or even disputes with clients. It’s important to be thorough and precise to maintain professionalism and ensure timely compensation for your work. Here are some common errors to watch out for when preparing such documents.

1. Missing or Incorrect Contact Information

- Always double-check that both your details and your client’s are accurate.

- Include a correct business name, address, and contact information.

- Ensure that all data is up-to-date to avoid confusion or non-delivery of documents.

2. Not Defining Payment Terms Clearly

- Specify the due date for payment and any penalties for late payments.

- Clearly state the accepted payment methods and bank details if applicable.

- Be explicit about any discounts or terms for early payment to avoid misunderstandings.

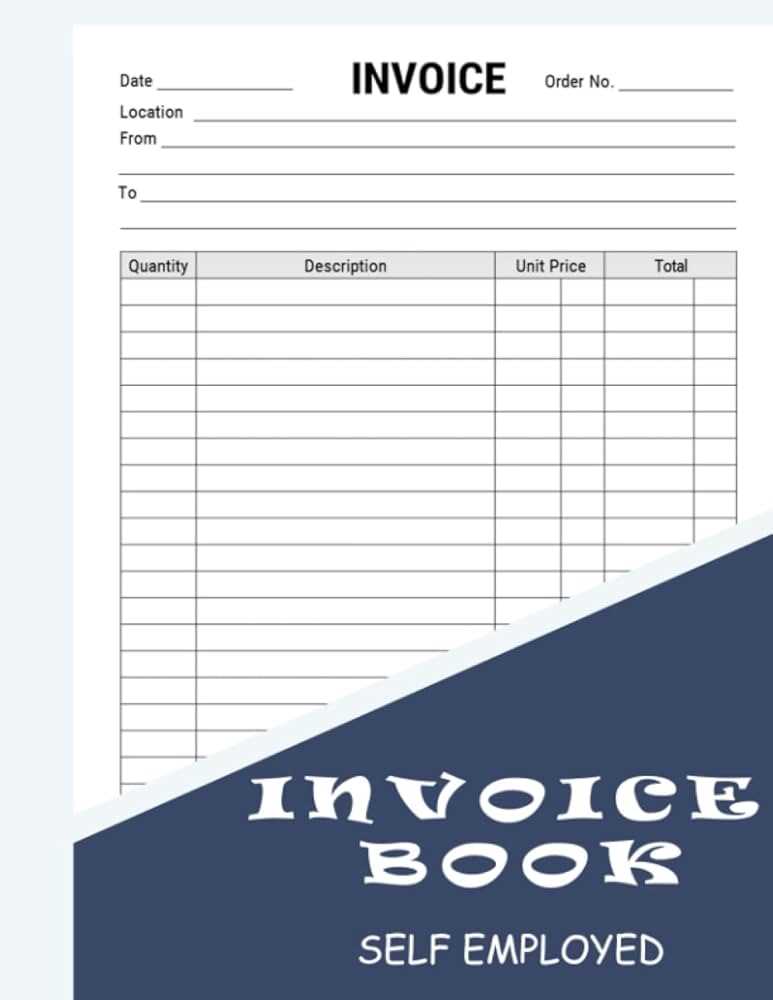

Free Self Employment Invoice Templates for UK Workers

For those working as independent contractors or freelancers in the UK, having a professionally designed document for requesting payment is essential. There are several free options available online that allow you to create these documents quickly and easily. Using a well-structured format ensures you present yourself as a professional and avoid any confusion regarding payments.

1. Benefits of Using Free Document Formats

- Time-saving – Ready-made formats save you the trouble of starting from scratch.

- Professional Appearance – These designs help you create clear and organized records, which can boost your credibility with clients.

- Customization – Most free formats are customizable, so you can tailor them to suit your specific business needs.

2. Where to Find Free Options

- Websites such as Invoicely and FreeAgent offer free, downloadable formats that are easy to use.

- Google Docs and Microsoft Word also provide templates with the option to add custom branding or fields.

- Check out free resources on platforms like Canva, where you can personalize the document with your own logo and style.

Best Tools for Invoice Creation in the UK

For independent workers and contractors in the UK, using the right tools to create professional payment requests can make a significant difference in managing finances efficiently. These tools help streamline the process, ensuring accuracy and timely payments. Whether you are looking for simple, user-friendly solutions or more advanced features, there are several platforms available to meet various needs.

1. QuickBooks

QuickBooks is one of the most popular accounting tools, widely used by freelancers and small businesses alike. It offers easy-to-use features for generating detailed payment requests, tracking expenses, and managing taxes. With customizable fields and automated reminders, it can save a lot of time for business owners.

2. Xero

Xero is another robust accounting software that allows users to create, send, and track payment documents efficiently. It provides a range of templates, integrates with bank accounts, and offers an easy-to-navigate dashboard. Ideal for businesses of all sizes, Xero also includes features for managing cash flow and payroll.

3. Wave

Wave is a free online tool with a straightforward interface, perfect for small businesses and freelancers just starting out. It allows users to create and send documents, track payments, and even manage receipts. Though the platform is free, it offers premium services for additional features such as accounting and payroll.

4. FreeAgent

FreeAgent is a comprehensive solution designed specifically for small business owners and freelancers. It simplifies tax filing and document management while allowing you to create professional payment requests quickly. The tool includes options for automatic tax calculations, expense tracking, and reporting.

Best Tools for Invoice Creation in the UK

For independent workers and contractors in the UK, using the right tools to create professional payment requests can make a significant difference in managing finances efficiently. These tools help streamline the process, ensuring accuracy and timely payments. Whether you are looking for simple, user-friendly solutions or more advanced features, there are several platforms available to meet various needs.

1. QuickBooks

QuickBooks is one of the most popular accounting tools, widely used by freelancers and small businesses alike. It offers easy-to-use features for generating detailed payment requests, tracking expenses, and managing taxes. With customizable fields and automated reminders, it can save a lot of time for business owners.

2. Xero

Xero is another robust accounting software that allows users to create, send, and track payment documents efficiently. It provides a range of templates, integrates with bank accounts, and offers an easy-to-navigate dashboard. Ideal for businesses of all sizes, Xero also includes features for managing cash flow and payroll.

3. Wave

Wave is a free online tool with a straightforward interface, perfect for small businesses and freelancers just starting out. It allows users to create and send documents, track payments, and even manage receipts. Though the platform is free, it offers premium services for additional features such as accounting and payroll.

4. FreeAgent

FreeAgent is a comprehensive solution designed specifically for small business owners and freelancers. It simplifies tax filing and document management while allowing you to create professional payment requests quickly. The tool includes options for automatic tax calculations, expense tracking, and reporting.

When to Send an Invoice for Payment

Timing plays a crucial role in ensuring smooth financial transactions between you and your clients. Knowing when to issue a formal request for payment can help you avoid delays and ensure that you receive compensation promptly. The right timing depends on the nature of the work, the agreement with your client, and your business needs.

1. Upon Completion of the Project

- If the work is project-based, it’s common to send a request as soon as the project is completed or the agreed-upon milestones are achieved.

- This ensures you are paid promptly after delivering your services.

2. After Reaching a Payment Milestone

- For long-term or ongoing projects, it’s standard to set payment milestones, such as after the completion of certain phases of the work.

- By doing so, you maintain cash flow and reduce the risk of non-payment.

3. According to Agreed Payment Terms

- If your client has set specific terms, such as paying at the end of the month or after 30 days, be sure to adhere to those timelines.

- In some cases, it’s beneficial to send a reminder a few days before the payment is due to avoid delays.

4. For Recurring Services

- For clients on a subscription or retainer basis, it’s common to send a payment request at regular intervals, such as weekly or monthly.

- Make sure to send these requests on the agreed-upon dates to maintain a smooth cash flow.

When to Send an Invoice for Payment

Timing plays a crucial role in ensuring smooth financial transactions between you and your clients. Knowing when to issue a formal request for payment can help you avoid delays and ensure that you receive compensation promptly. The right timing depends on the nature of the work, the agreement with your client, and your business needs.

1. Upon Completion of the Project

- If the work is project-based, it’s common to send a request as soon as the project is completed or the agreed-upon milestones are achieved.

- This ensures you are paid promptly after delivering your services.

2. After Reaching a Payment Milestone

- For long-term or ongoing projects, it’s standard to set payment milestones, such as after the completion of certain phases of the work.

- By doing so, you maintain cash flow and reduce the risk of non-payment.

3. According to Agreed Payment Terms

- If your client has set specific terms, such as paying at the end of the month or after 30 days, be sure to adhere to those timelines.

- In some cases, it’s beneficial to send a reminder a few days before the payment is due to avoid delays.

4. For Recurring Services

- For clients on a subscription or retainer basis, it’s common to send a payment request at regular intervals, such as weekly or monthly.

- Make sure to send these requests on the agreed-upon dates to maintain a smooth cash flow.

Setting Payment Terms for Your Invoices

Establishing clear payment terms is vital for maintaining a healthy cash flow and avoiding misunderstandings with clients. The terms outline when and how payments are to be made and can help prevent delayed or missed payments. Setting these terms at the start of a project creates transparency and sets expectations for both parties.

1. Specify Payment Due Dates

- Clearly define when the payment is expected, such as “within 14 days” or “30 days from the date of the request.”

- Consider offering different terms for repeat clients or large projects, such as longer payment windows for significant work.

2. Set Late Payment Fees

- To encourage timely payments, include a clause that specifies a late fee if payment is not received by the due date.

- For example, a percentage of the outstanding amount can be added for each day or week past the due date.

- Make sure to communicate these terms upfront to avoid surprises for your clients.

3. Define Accepted Payment Methods

- Be clear about the methods you accept for payment, such as bank transfer, PayPal, or cheque.

- Ensure that your client understands the process for making payments using their preferred method.

How to Personalize Your Invoice Template

Customizing your payment request document not only makes it look more professional but also adds a personal touch that can help strengthen your brand identity. Personalization allows you to stand out and build stronger connections with clients. There are several key elements you can adjust to make the document uniquely yours while ensuring it remains functional and clear.

1. Add Your Branding

- Incorporate your logo at the top of the document to make it instantly recognizable.

- Use your brand colors and fonts to create a cohesive look that matches your overall marketing materials.

- Including a professional business name and tagline can also help reinforce your brand message.

2. Include Detailed Contact Information

- Make sure to provide your business address, phone number, and email at the top or bottom of the document.

- Consider adding links to your website or social media profiles if relevant to your business.

3. Customize the Payment Terms

- Personalize the payment terms section to match your preferred methods, whether that’s via bank transfer, credit card, or other online platforms.

- Clearly specify due dates, late fees, or discounts for early payment to avoid confusion and ensure timely payment.

4. Use Descriptive Itemization

- When listing services or products, include clear descriptions to avoid ambiguity and make it easier for clients to understand what they are paying for.

- Personalize the description to reflect the nature of your business and provide additional details, such as the number of hours worked or the specific tasks completed.

How to Personalize Your Invoice Template

Customizing your payment request document not only makes it look more professional but also adds a personal touch that can help strengthen your brand identity. Personalization allows you to stand out and build stronger connections with clients. There are several key elements you can adjust to make the document uniquely yours while ensuring it remains functional and clear.

1. Add Your Branding

- Incorporate your logo at the top of the document to make it instantly recognizable.

- Use your brand colors and fonts to create a cohesive look that matches your overall marketing materials.

- Including a professional business name and tagline can also help reinforce your brand message.

2. Include Detailed Contact Information

- Make sure to provide your business address, phone number, and email at the top or bottom of the document.

- Consider adding links to your website or social media profiles if relevant to your business.

3. Customize the Payment Terms

- Personalize the payment terms section to match your preferred methods, whether that’s via bank transfer, credit card, or other online platforms.

- Clearly specify due dates, late fees, or discounts for early payment to avoid confusion and ensure timely payment.

4. Use Descriptive Itemization

- When listing services or products, include clear descriptions to avoid ambiguity and make it easier for clients to understand what they are paying for.

- Personalize the description to reflect the nature of your business and provide additional details, such as the number of hours worked or the specific tasks completed.

How to Personalize Your Invoice Template

Customizing your payment request document not only makes it look more professional but also adds a personal touch that can help strengthen your brand identity. Personalization allows you to stand out and build stronger connections with clients. There are several key elements you can adjust to make the document uniquely yours while ensuring it remains functional and clear.

1. Add Your Branding

- Incorporate your logo at the top of the document to make it instantly recognizable.

- Use your brand colors and fonts to create a cohesive look that matches your overall marketing materials.

- Including a professional business name and tagline can also help reinforce your brand message.

2. Include Detailed Contact Information

- Make sure to provide your business address, phone number, and email at the top or bottom of the document.

- Consider adding links to your website or social media profiles if relevant to your business.

3. Customize the Payment Terms

- Personalize the payment terms section to match your preferred methods, whether that’s via bank transfer, credit card, or other online platforms.

- Clearly specify due dates, late fees, or discounts for early payment to avoid confusion and ensure timely payment.

4. Use Descriptive Itemization

- When listing services or products, include clear descriptions to avoid ambiguity and make it easier for clients to understand what they are paying for.

- Personalize the description to reflect the nature of your business and provide additional details, such as the number of hours worked or the specific tasks completed.

What to Do if a Client Disputes an Invoice

Disputes over payment requests can occur for various reasons, including misunderstandings, discrepancies, or even errors. It’s important to handle these situations professionally to maintain good client relationships and protect your business. Taking the right steps early on can help resolve the issue quickly and efficiently.

1. Stay Calm and Professional

- Remain composed and avoid getting defensive, even if you believe the dispute is unjustified.

- Approach the situation with an open mind and a willingness to understand your client’s perspective.

2. Review the Original Agreement

- Check your initial contract or terms of service to confirm the scope of work, agreed-upon fees, and payment schedules.

- Ensure that the details of the request align with what was previously agreed upon to identify any potential discrepancies.

3. Communicate Clearly

- Reach out to your client to discuss the issue, ideally via email or phone, to clarify any confusion or concerns.

- Provide any supporting documents, such as signed agreements or a detailed breakdown of services, to help resolve the situation.

4. Offer Solutions

- If the dispute stems from a minor error on your part, such as incorrect pricing or missing items, offer to make corrections promptly.

- If the disagreement is about the quality or scope of the work, discuss how you can address the client’s concerns to reach a satisfactory resolution.

5. Keep a Record of Correspondence

- Document all communications related to the dispute, including emails, calls, and any agreements or resolutions made.

- Having a clear record of the process can protect you in case the dispute escalates or needs to be revisited later.

What to Do if a Client Disputes an Invoice

Disputes over payment requests can occur for various reasons, including misunderstandings, discrepancies, or even errors. It’s important to handle these situations professionally to maintain good client relationships and protect your business. Taking the right steps early on can help resolve the issue quickly and efficiently.

1. Stay Calm and Professional

- Remain composed and avoid getting defensive, even if you believe the dispute is unjustified.

- Approach the situation with an open mind and a willingness to understand your client’s perspective.

2. Review the Original Agreement

- Check your initial contract or terms of service to confirm the scope of work, agreed-upon fees, and payment schedules.

- Ensure that the details of the request align with what was previously agreed upon to identify any potential discrepancies.

3. Communicate Clearly

- Reach out to your client to discuss the issue, ideally via email or phone, to clarify any confusion or concerns.

- Provide any supporting documents, such as signed agreements or a detailed breakdown of services, to help resolve the situation.

4. Offer Solutions

- If the dispute stems from a minor error on your part, such as incorrect pricing or missing items, offer to make corrections promptly.

- If the disagreement is about the quality or scope of the work, discuss how you can address the client’s concerns to reach a satisfactory resolution.

5. Keep a Record of Correspondence

- Document all communications related to the dispute, including emails, calls, and any agreements or resolutions made.

- Having a clear record of the process can protect you in case the dispute escalates or needs to be revisited later.

What to Do if a Client Disputes an Invoice

Disputes over payment requests can occur for various reasons, including misunderstandings, discrepancies, or even errors. It’s important to handle these situations professionally to maintain good client relationships and protect your business. Taking the right steps early on can help resolve the issue quickly and efficiently.

1. Stay Calm and Professional

- Remain composed and avoid getting defensive, even if you believe the dispute is unjustified.

- Approach the situation with an open mind and a willingness to understand your client’s perspective.

2. Review the Original Agreement

- Check your initial contract or terms of service to confirm the scope of work, agreed-upon fees, and payment schedules.

- Ensure that the details of the request align with what was previously agreed upon to identify any potential discrepancies.

3. Communicate Clearly

- Reach out to your client to discuss the issue, ideally via email or phone, to clarify any confusion or concerns.

- Provide any supporting documents, such as signed agreements or a detailed breakdown of services, to help resolve the situation.

4. Offer Solutions

- If the dispute stems from a minor error on your part, such as incorrect pricing or missing items, offer to make corrections promptly.

- If the disagreement is about the quality or scope of the work, discuss how you can address the client’s concerns to reach a satisfactory resolution.

5. Keep a Record of Correspondence

- Document all communications related to the dispute, including emails, calls, and any agreements or resolutions made.

- Having a clear record of the process can protect you in case the dispute escalates or needs to be revisited later.