Self Employed Invoice Template UK for Easy and Professional Invoicing

For anyone managing their own business or offering services independently, it’s essential to keep track of payments and ensure smooth financial transactions with clients. A well-structured document that outlines the details of the work done and the amount due plays a crucial role in maintaining clear communication and professionalism. Having a standardized format helps avoid confusion and ensures that both parties are on the same page.

In the UK, there are certain requirements that need to be followed when preparing such documents. From including the correct business details to adhering to tax regulations, it’s important to make sure that every aspect is addressed properly. Whether you’re just starting out or have been in the business for years, having a reliable way to create these records is vital for managing your finances efficiently.

Using a pre-designed format can save valuable time and reduce the chance of making mistakes. With the right framework, you can focus more on your work while ensuring that your financial transactions are well-documented and legally sound. This article will guide you through the key components of these important records and how to make the most of available resources in the UK.

Self Employed Invoice Template UK

For freelancers and independent contractors in the UK, creating clear and professional financial documents is a key part of doing business. These documents outline the work provided, the payment due, and any other important details, ensuring that both parties have a mutual understanding of the terms. Using a structured and reliable format allows you to maintain professionalism and keep your finances organized.

Key Features of a Professional Financial Record

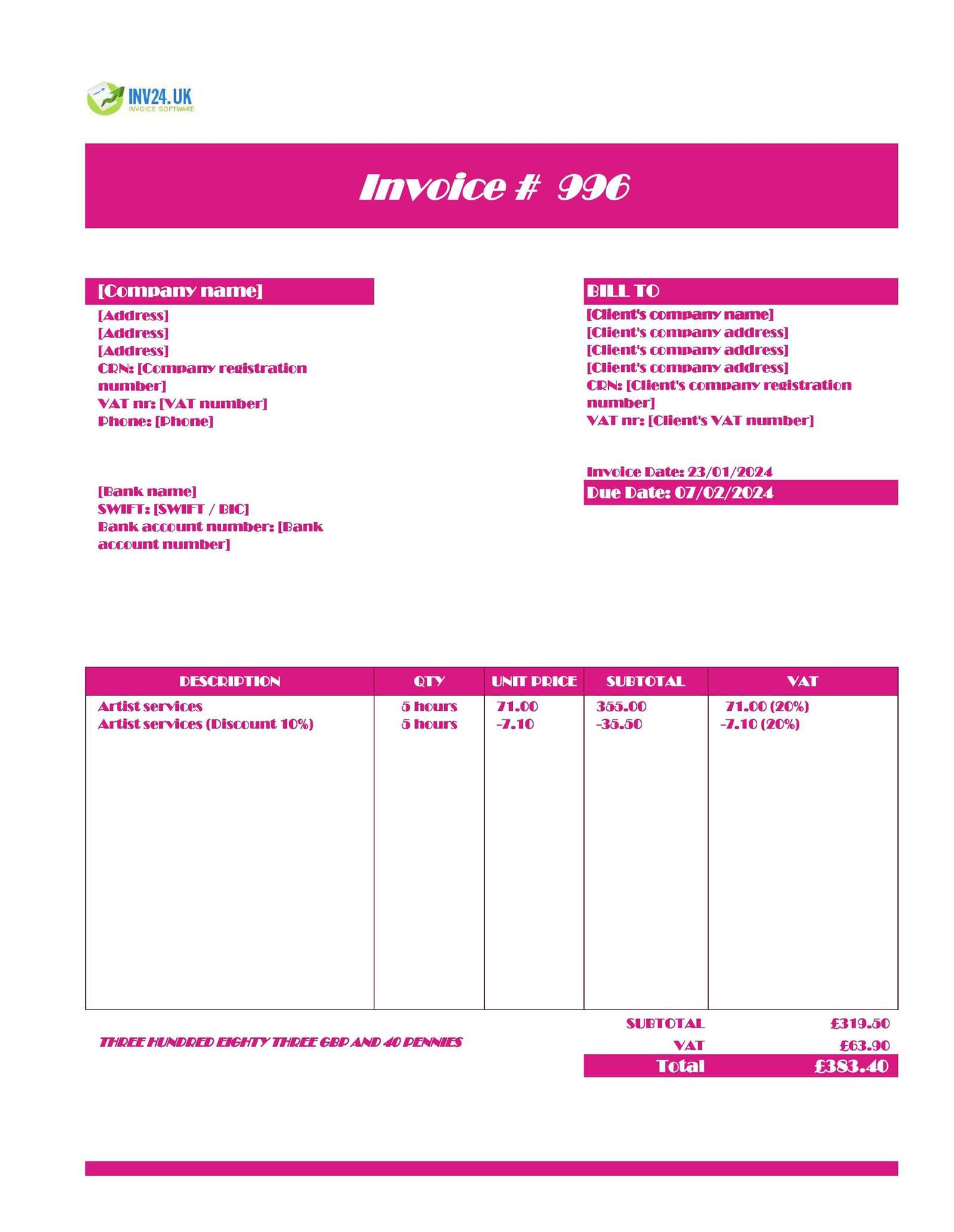

When crafting these essential documents, it’s important to include specific details that ensure accuracy and compliance. A well-organized record should have the following elements:

- Business Information: Include your name, address, and contact details, along with your client’s information.

- Service Description: Clearly explain the services or products provided, including any relevant dates or timeframes.

- Payment Terms: State the amount due, due date, and any terms for late payment or early settlement discounts.

- Tax Information: Ensure compliance by including any applicable tax rates, such as VAT, if required.

How to Create the Document Effectively

Using an organized structure not only ensures accuracy but also saves time. You can easily find a variety of pre-designed layouts available online, many of which are customizable for your specific needs. Consider these steps when creating your own:

- Choose a simple, clear format that is easy to read and understand.

- Input the necessary details, including payment instructions and any relevant tax rates.

- Double-check the document for any errors or missing information before sending it to the client.

By using a reliable structure, you can ensure that your financial records are professional, clear, and legally compliant, helping you build trust with clients and stay on top of your business finances.

Why Use an Invoice Template

When managing a business or freelance work, having a reliable method to document transactions is essential for maintaining order and professionalism. Using a consistent structure for your financial records ensures that all the necessary information is included and reduces the risk of errors. This approach not only helps keep your business running smoothly but also builds credibility with clients.

Standardized formats allow for quick and easy creation of essential documents, saving you time and effort. With a pre-designed layout, you don’t need to worry about forgetting key details or making mistakes. These structures help ensure that every record is accurate, compliant with regulations, and easy to read. Additionally, using a standardized approach helps establish trust with clients, as they will recognize a professional and consistent method of communication.

Furthermore, using a customizable framework offers flexibility, allowing you to tailor your documents to meet specific needs. Whether you’re adding payment terms, adjusting for tax rates, or including unique service descriptions, a good framework gives you the tools to create documents that suit your business model while adhering to industry standards.

Benefits of Customizing Your Invoice

Personalizing your financial records not only makes them more relevant to your business but also enhances your professional image. Customization allows you to tailor each document to reflect your brand, specific services, and unique terms. By doing so, you ensure that all necessary details are included while maintaining a clear and consistent presentation.

Align with Your Business Identity

Customizing your financial documents helps create a cohesive image for your business. You can add your logo, use specific colors, and incorporate a consistent design, all of which contribute to a professional and recognizable brand presence. This helps build trust and credibility with your clients, as they will associate your documents with a polished and organized approach to business.

Increase Clarity and Reduce Errors

Personalized documents make it easier to include the exact details your clients need, reducing the likelihood of confusion. By modifying the layout and content, you can ensure that the most relevant information is highlighted, such as payment terms, service descriptions, and tax calculations. This clarity not only benefits your clients but also helps you avoid mistakes and potential disputes.

Customizing your financial records provides the flexibility to meet your specific needs, helping you stay organized and efficient. It gives you full control over the appearance and content, making sure every document is tailored to your business’s requirements.

Key Elements of a UK Invoice

When creating a financial document for your business in the UK, it’s important to include all necessary components to ensure clarity, accuracy, and legal compliance. A well-structured record ensures that both you and your client understand the terms, payment due, and other essential details. The following elements are crucial to making sure your document is complete and professional.

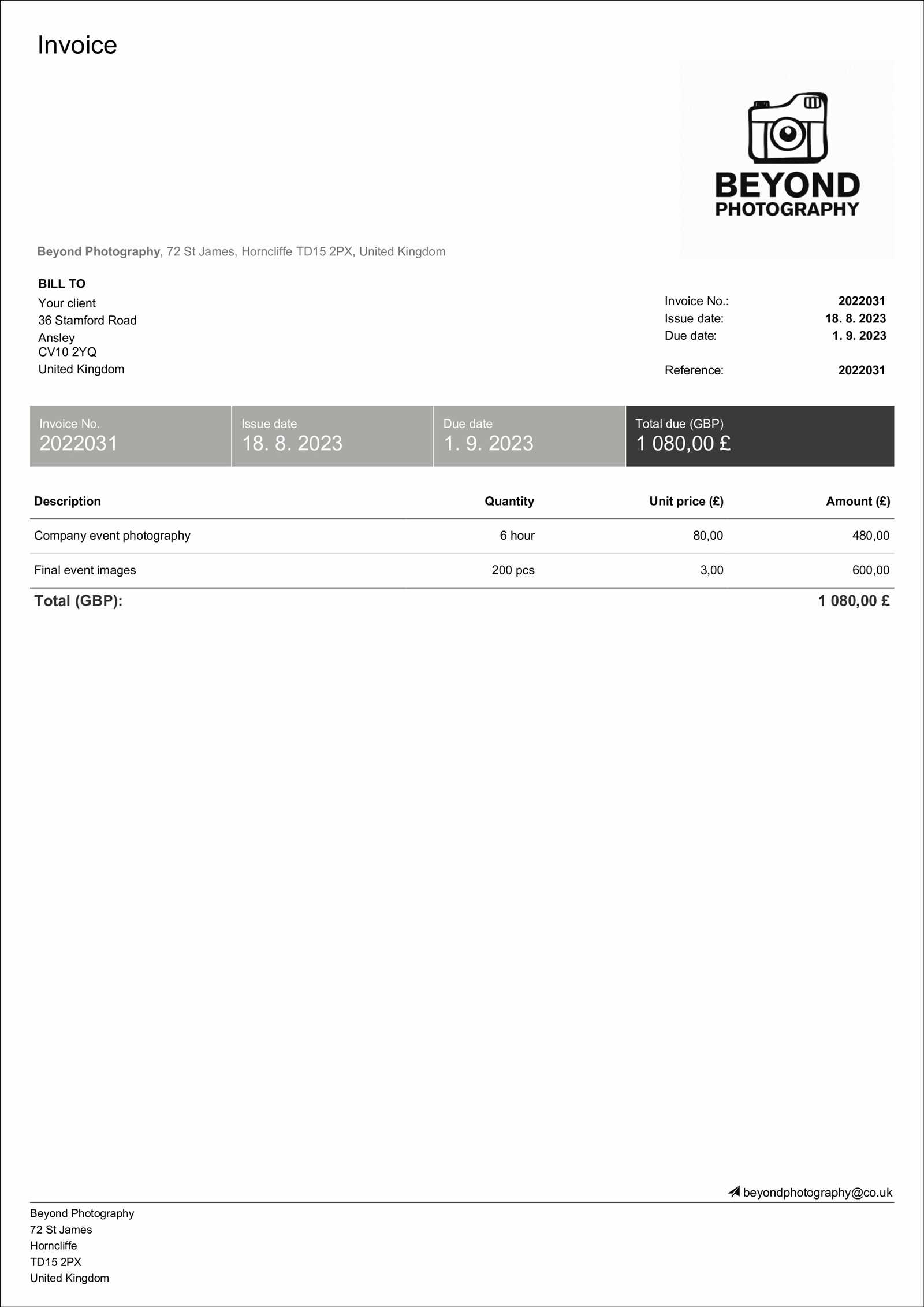

Business Information: Always include your name, business name (if applicable), address, phone number, and email. This provides transparency and ensures the recipient knows who the document is from. Your client’s details should also be listed to avoid any confusion.

Unique Reference Number: Every document should have a distinct reference number for easy identification and record-keeping. This helps track payments and correspondence with clients, especially when dealing with multiple transactions.

Description of Goods or Services: Clearly state the services provided or products delivered, along with relevant dates or time periods. This detail ensures that both parties understand exactly what is being paid for.

Payment Terms: Specify the amount due, payment methods accepted, and the due date. If applicable, include any late fees or discounts for early payment. Clear payment terms help avoid confusion and streamline the transaction process.

Tax Information: If VAT or any other taxes apply, include the tax rate and total amount to be paid. This ensures compliance with UK tax laws and avoids potential legal issues. Always check the current VAT rules to ensure accuracy.

Total Amount Due: The final total should include all costs, taxes, and any additional charges. This gives your client a clear picture of the full amount they need to pay and avoids misunderstandings.

By ensuring that all these key elements are included in your documents, you create clear, professional, and legally sound financial records for your business in the UK.

How to Create a Professional Invoice

Creating a polished financial document is essential for maintaining professionalism and ensuring smooth transactions with clients. A well-crafted record not only helps you get paid on time but also reinforces your credibility as a business owner. The process of building a professional document requires attention to detail, accuracy, and a clear structure. Here’s a guide to help you create a professional financial record that meets all the necessary requirements.

Follow these steps to ensure your document is both comprehensive and clear:

| Step | Description |

|---|---|

| 1. Include Your Details | Begin with your full name, business name (if applicable), address, and contact information. This establishes your identity and provides transparency. |

| 2. Add Client Information | Include your client’s name, company name, and their address or contact details for easy identification and communication. |

| 3. Assign a Unique Reference Number | Each record should have a unique reference number for tracking and organizational purposes. This helps both you and the client keep records straight. |

| 4. List the Work or Products Provided | Clearly describe the services performed or products supplied, including the date of delivery or time period for the services rendered. |

| 5. Specify the Total Amount | State the total payment due, including taxes and any additional charges. Break it down clearly for full transparency. |

| 6. Set Payment Terms | Clearly mention the due date, any payment methods accepted, and any late fees or discounts for early payment. |

| 7. Ensure Tax Compliance | If applicable, include VAT or other taxes as required by UK law, making sure they are calculated correctly. |

By following these steps and ensuring all key information is included, you can create a clear, professional, and legally compliant financial document that supports smoo

Best Free Invoice Templates for UK

For independent contractors and small business owners in the UK, using a well-designed financial document can save time and improve professionalism. There are several free resources available online that offer customizable layouts, enabling you to create clear and accurate records for each transaction. Choosing the right design helps ensure you meet legal requirements while maintaining a polished appearance.

Top Resources for Free Financial Document Layouts

Here are some of the best free options for creating your own financial records:

- Microsoft Word – Provides a variety of easy-to-use, customizable designs suitable for any business.

- Google Docs – A great cloud-based solution with free templates that are easy to edit and share with clients.

- Canva – Offers visually appealing, professional designs with customizable fields for your business details.

- Zoho Invoice – Free and fully customizable, with templates that are simple and perfect for small businesses.

- Invoice Simple – Provides easy-to-use layouts, free for basic usage, that include all necessary fields for UK businesses.

How to Choose the Right Design

When selecting a free resource, consider the following:

- Ease of Use: Choose a platform that is simple to navigate, especially if you are new to creating these records.

- Customizability: Ensure the layout allows you to add or remove fields as needed for your business’s specific requirements.

- Compliance: Make sure the design supports all the required details, such as tax rates and business information, for UK regulations.

By selecting the right tool, you can create professional and legally-compliant records that save time and help maintain a streamlined financial process for your business.

Understanding UK VAT Requirements on Invoices

In the UK, businesses that are VAT-registered must ensure their financial records meet specific requirements. These records not only serve as proof of transactions but also need to comply with tax regulations, which include correctly displaying VAT details. For business owners, understanding these requirements is essential to ensure both legal compliance and accurate reporting of taxes.

What VAT Details Must Be Included

When preparing a record for your business, certain information must be included to meet VAT regulations:

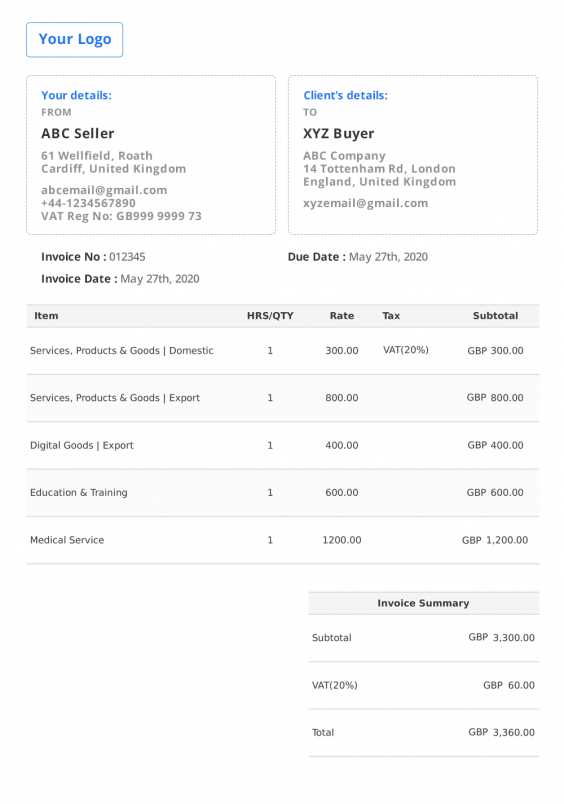

- VAT Registration Number: If your business is VAT-registered, you must display your VAT registration number on each financial document.

- VAT Rate Applied: Indicate the VAT rate used for the products or services provided. The standard rate is currently 20%, but there are reduced rates for certain goods and services.

- Total VAT Charged: Include the total amount of VAT charged on each item, ensuring that the tax calculation is accurate and clearly displayed.

- Business Details: Ensure that your business name, address, and contact details are included, as well as the customer’s information to confirm the transaction.

Common Mistakes to Avoid

While VAT may seem straightforward, there are common errors that can lead to problems down the line:

- Omitting VAT Numbers: Failing to include your VAT registration number can result in non-compliance and potential penalties.

- Incorrect VAT Rates: Applying the wrong rate of tax can lead to undercharging or overcharging, which may require you to correct the mistake later.

- Missing VAT Breakdown: Not providing a breakdown of VAT applied on each item can confuse your client and make it harder for you to track tax payments.

By ensuring that these details are accurately reflected in your records, you not only comply with UK VAT regulations but also present a professional and transparent approach to your clients.

How to Include Your Business Details

For any professional financial record, it is crucial to ensure that your business information is clear and easily identifiable. This helps establish credibility, makes it easier for clients to contact you, and ensures compliance with legal and tax regulations. Including the necessary details in the right way is essential to presenting a professional image and maintaining smooth business operations.

1. Business Name and Address: Always start with the full name of your business or your own name if you’re a sole trader. Below that, include your registered business address or the address from which you operate. This information is essential for identification and for official correspondence.

2. Contact Information: Providing multiple ways for your client to reach you is important. Include your phone number, email address, and any other relevant contact details. This ensures that your client can easily communicate with you for any questions or payment-related issues.

3. VAT Registration Number: If your business is VAT-registered, be sure to include your VAT number on all financial documents. This is a legal requirement for businesses that are VAT-registered and ensures that the transactions are recorded properly for tax purposes.

4. Website and Social Media Links: If applicable, include your website and social media handles. This allows your clients to easily access your online presence and stay connected with updates or services you may offer.

5. Additional Legal Information: Depending on your business type, you may also need to include other legal information, such as your company registration number or the name of the person responsible for the business. This is especially relevant for limited companies.

By ensuring that these details are present and accurate, you not only make it easier for your clients to reach you but also maintain transparency and professionalism in your financial documents.

Including Payment Terms in Your Invoice

Clear payment terms are essential for maintaining smooth financial transactions between you and your clients. By specifying the expectations regarding payment deadlines, methods, and any associated late fees, you protect both parties and minimize misunderstandings. Clearly outlined terms help ensure that you receive timely payments and that clients are aware of their obligations.

Key Elements to Include in Payment Terms

When outlining your payment conditions, consider the following details:

- Due Date: Specify the exact date by which the payment should be made. This gives your client a clear timeline to follow.

- Accepted Payment Methods: List the methods of payment you accept, such as bank transfers, credit cards, or online payment systems.

- Late Fees: If you charge a penalty for late payments, state the fee clearly, such as a percentage of the total amount or a fixed amount after a specific period.

- Early Payment Discounts: If you offer discounts for early payment, make sure to mention this in your terms, along with the conditions to qualify for the discount.

Why Clear Payment Terms Matter

Having clear payment conditions not only ensures that you are paid on time, but it also sets professional expectations. It reduces the need for constant reminders and helps avoid disputes. Clients are more likely to respect your terms when they are clearly communicated, and it can also help to foster trust between you and your customers.

By including precise payment terms, you protect your business’s cash flow and create a transparent environment for all transactions.

Choosing the Right Format for Your Invoices

Selecting the appropriate layout for your financial documents is essential for ensuring clarity, professionalism, and efficiency. The format you choose impacts not only how information is presented but also how easily your clients can process and pay your bills. Different formats serve various needs, and understanding the best fit for your business helps streamline your operations.

Factors to Consider When Choosing a Format

When deciding on a layout, consider the following factors:

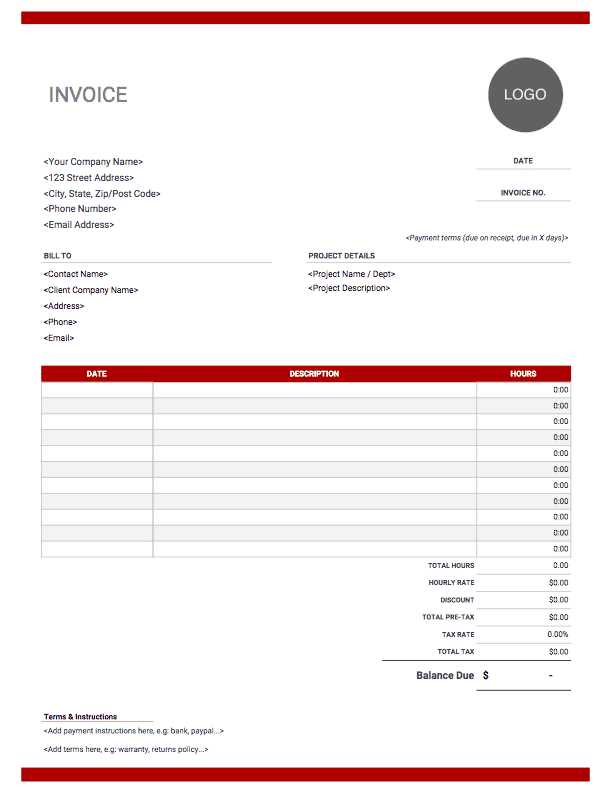

- Clarity and Simplicity: A clean and simple design helps ensure that all details are easily readable. Avoid cluttered layouts, which can confuse the recipient.

- Customization Options: Select a format that allows you to add or remove fields as needed to suit your specific business needs. This ensures that all required information is included.

- Professional Appearance: Choose a format that reflects the professionalism of your business. A well-organized design can leave a positive impression on your clients.

- File Compatibility: Make sure the format you choose is compatible with the software or tools you use. Formats like PDFs or Word documents are often the most widely accepted.

Popular Formats to Consider

Here are some of the most common formats businesses use for their financial documents:

- Digital (PDF): Ideal for businesses that need to email their records. It’s easy to create and ensures that the layout stays consistent across different devices.

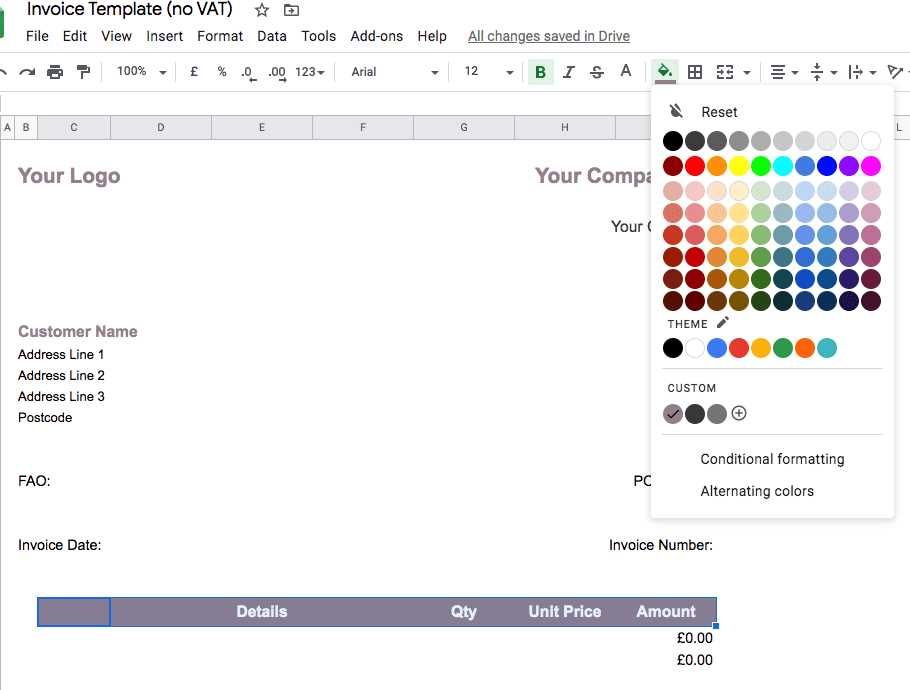

- Spreadsheet (Excel/Google Sheets): Useful for those who want to track and calculate transactions within the same document, offering flexibility and easy editing.

- Word Documents: A good choice for those who need a customizable format that can be easily edited and formatted for different clients.

- Online Invoice Generators: These tools offer easy-to-use online platforms with pre-designed formats, providing instant customization and the ability to send records directly to clients.

The right format

How to Calculate and Add Taxes

Accurately calculating and adding taxes to your financial records is essential for maintaining compliance with regulations and ensuring that your clients understand the total amount due. Taxes can vary depending on the type of goods or services provided, and the correct tax rates must be applied to avoid discrepancies. This section explains how to determine the correct tax amount and how to present it clearly in your billing documents.

Steps to Calculate Taxes

Follow these steps to calculate the tax accurately:

- Identify Applicable Tax Rate: Determine the correct tax rate for your business based on the region or country in which you operate. In the UK, this is typically VAT (Value Added Tax), but rates may vary depending on the service or product type.

- Calculate Taxable Amount: The taxable amount is the total cost of goods or services before tax. For example, if you are charging for a service, this is the fee before any VAT is applied.

- Apply the Tax Rate: Multiply the taxable amount by the applicable tax rate. For example, if the tax rate is 20% and the taxable amount is £100, the tax would be £20 (100 * 0.20).

Adding Taxes to Your Total

Once you have calculated the tax, it’s essential to include it in your total amount due in a transparent manner:

- Break Down the Tax: Clearly show the tax amount on your records, making it easy for your clients to see how much they are being charged for taxes separately from the product or service cost.

- Include the Total Amount: Add the calculated tax to the taxable amount to get

Ensuring Legal Compliance for Invoices

Maintaining legal compliance when preparing financial records is crucial for any business. Accurate documentation not only helps you meet regulatory requirements but also ensures that you avoid any legal issues or penalties. In this section, we will discuss the key factors to consider when preparing billing statements to ensure they align with legal standards.

Key Legal Requirements to Include

To stay compliant, it’s important to include specific information in your billing documents. Here are the critical elements:

- Tax Identification Number: In many jurisdictions, including the UK, businesses must provide their tax ID number. This helps tax authorities track transactions and ensures that the business is registered for tax purposes.

- Client Details: Ensure that the recipient’s full name, business name (if applicable), and address are clearly stated on the document.

- Clear Breakdown of Goods or Services: Provide a detailed description of the products or services supplied, including quantities, prices, and any applicable tax rates.

- Legal Tax Rate: In the UK, VAT is a common tax applied to goods and services. Ensure that the correct VAT rate is used and displayed clearly on the document.

Adhering to Tax Regulations

Tax regulations can be complex, and failure to comply can result in penalties. Here are some best practices to follow:

- Follow Local Tax Laws: Be sure to apply the correct tax rate based on the nature of your goods or services, and ensure your business is VAT-registered if necessary.

- Timely Filing: Maintain accurate records and submit them on time to avoid late penalties.

- Ensure Transparency: Provide a clear and transparent breakdown of any taxes applied, including VAT and other charges.

By following these steps and including the required details in your documents, you can ensure that your business remains legally compliant and avoids unnecessary complications.

Top Mistakes to Avoid in Invoices

When preparing billing statements, it’s important to be meticulous and avoid common errors that could lead to confusion or delays in payment. Small mistakes can lead to misunderstandings with clients, missed payments, or even legal issues. In this section, we’ll explore some of the most frequent mistakes businesses make and how to avoid them to ensure smooth transactions.

Common Mistakes to Avoid

Mistake Explanation How to Avoid Incorrect Billing Information Missing or incorrect client details can lead to confusion or incorrect payments. Ensure that all client details are up to date and accurate before issuing any document. Missing Tax Information Failure to include the correct tax rate or applicable taxes can lead to issues with compliance. Always check that tax rates are applied correctly, and display tax information clearly. Unclear Payment Terms Ambiguous or missing payment terms can cause delays in receiving payments. Clearly specify the due date, accepted payment methods, and any late payment fees. Failure to Include an Invoice Number Without a unique number, it can be difficult to track payments or resolve disputes. Assign a unique reference number to each document to ensure proper tracking. Not Including a Description of Products/Services Vague descriptions can lead to confusion about what was provided. Provide a detailed description of the goods or services, including quantities, prices, and dates. Additional Tips for Success

To further improve your billing process, make sure to:

- Double-check for Errors: Before sending any document, review all details carefully to avoid mistakes.

- Keep Records Organized: Store all financial records, including transactions and related documents, for easy reference.

- Stay Professional: Use clear, professional language and a consistent format in all billing statements.

- Manual Record-Keeping: Keeping a written or spreadsheet log of due and overdue payments is one simple approach. Regularly update the list as payments come in.

- Accounting Software: Using specialized software allows automatic tracking of amounts owed and alerts for overdue payments, helping you stay organized.

- Customer Relationship Management (CRM) Tools: Some CRM platforms include payment tracking features that allow businesses to integrate payment schedules with customer data for a more streamlined approach.

- Cloud-Based Solutions: Cloud platforms can provide real-time tracking and easy access from multiple devices, which is particularly useful for remote workers or teams.

- Set Clear Payment Terms: Make sure your clients understand the payment expectations from the start, including the timeline for payment and any late fees.

- Regular Reminders: Send polite reminders when payments are approaching or have passed their due date. Set up automatic reminders if possible to reduce manual work.

- Follow-Up Communication: If a payment is overdue, contact the client with a professional and firm tone, outlining the outstanding balance and possible consequences for further delays.

- Offer Flexible Payment Options: Sometimes offering alternative payment methods or installment plans can encourage timely settlement of dues.

- Automation: Software can automate many aspects of the process, such as generating documents, sending reminders, and updating payment statuses, saving you significant time.

- Accuracy: Using digital tools reduces the likelihood of errors, ensuring that all calculations and details are correct and up to date.

- Centralized Record-Keeping: Everything is stored in one place, making it easier to access historical records and track the progress of payments at any time.

- Professional Appearance: Software typically allows you to create clean, professional documents that can be sent directly to clients, enhancing your business’s image.

- Customizability: Many tools let you customize documents according to your branding or legal needs, ensuring that the paperwork reflects your business style and meets all relevant standards.

- QuickBooks: Known for its comprehensive accounting features, QuickBooks helps businesses manage financial documents, track expenses, and handle payments seamlessly.

- Xero: A cloud-based platform offering tools for invoicing, expense tracking, and reporting, Xero is ideal for small businesses seeking an efficient solution.

- FreshBooks: This software specializes in helping freelancers and small business owners automate billing, payments, and financial reporting.

- Zoho Books: Zoho Books offers robust tools for accounting, billing, and reporting, with an easy-to-use interface and integration with various other business tools.

- Set a realistic payment deadline: Ensure that your deadlines are reasonable and allow enough time for your client to make the payment.

- Include a late fee policy: Specify any fees that will be applied if payments are not received on time.

- Offer multiple payment options: Providing clients with various payment methods can encourage timely payments and reduce delays.

- First reminder: Send an email or message as soon as the payment is overdue, politely reminding the client of their outstanding balance.

- Second reminder: If the payment remains unpaid, follow up with a more urgent reminder, emphasizing the importance of clearing the balance promptly.

- Phone call: In cases where reminders go unanswered, a personal call can help resolve the issue and maintain the relationship.

- Automatic creation: Set up your system to generate bills on a recurring schedule, automatically including all necessary details such as items, quantities, and prices.

- Quick updates: Whenever you make changes to services or pricing, the system can instantly reflect these updates in future documents, ensuring consistency and accuracy.

- Batch processing: Automated systems allow for multiple records to be processed at once, significantly speeding up the entire workflow.

- Pre-set templates: Use standardized layouts that automatically fill in information, reducing the risk of mistakes.

- Automatic calculations: No need to manually tally up totals–automated systems calculate taxes, discounts, and subtotals for you.

- Automated reminders: Set up the system to send notifications to clients when payment is overdue, helping ensure timely receipts.

- Instant updates: As soon as a payment is made, the system can automatically update your records, saving you the trouble of manually tracking down payments.

- Email: Sending files via email is the most common method, as it’s fast and cost-effective. You can attach your document as a PDF or send it as part of the message itself.

- Postal Services: For clients who prefer physical copies, or if a printed document is required for legal reasons, using a postal service is an option. Make sure to use a reliable service to avoid delays.

- Online Platforms: Some businesses opt for online payment platforms or client portals where clients can access and pay their bills securely. This method often includes features like automated reminders and record keeping.

- File Format: PDFs are widely accepted as they preserve the formatting and are easy to view on any device.

- Clear Details: Include all relevant information such as the amount due, due date, and payment methods. Double-check the spelling of client details, as this reflects professionalism.

- Personalized Message: Always include a polite and professional message, thanking your client for their business and providing any extra payment instructions or terms.

- Set Payment Deadlines: Be clear about when you expect payment and specify the consequences of late payments, such as interest fees or suspension of services.

- Reminder Notices: If payment is not received by the due date, send a polite reminder to the client. You can use email, online pla

How to Track Outstanding Invoices

Keeping track of unpaid amounts is essential for maintaining a healthy cash flow and ensuring timely payments. Without a clear system for monitoring outstanding sums, businesses risk losing revenue or missing deadlines. In this section, we’ll discuss effective methods for tracking amounts due and how to manage overdue accounts efficiently.

Methods to Track Unpaid Amounts

There are several tools and techniques available to keep a close eye on overdue payments:

Best Practices for Tracking and Follow-Ups

Once you have a system in place, there are a few best practices to ensure prompt payment:

By maintaining a diligent and proactive approach to tracking unpaid amounts, you can reduce the likelihood of overdue payments and maintain a smoother cash flow for your business.

Using Software for Invoice Management

Managing payments and outstanding amounts can be time-consuming and complex. With the growing need for efficiency and accuracy, utilizing specialized software tools for organizing, tracking, and processing financial documents has become a standard practice. These tools not only streamline the entire process but also help ensure compliance and eliminate the risk of human error.

Advantages of Using Software for Financial Tracking

There are numerous benefits to adopting software for payment management and related tasks:

Popular Software Options for Payment Management

There are various software options available, each catering to different needs and budgets. Some popular choices include:

By integrating payment management software into your workflow, you can not only save time but also improve accuracy and professionalize your business operations.

How to Handle Late Payments Effectively

Late payments can disrupt cash flow and cause unnecessary stress for any business. Managing overdue payments efficiently is crucial to maintaining smooth operations and ensuring financial stability. A well-organized approach to addressing delays can help foster positive relationships with clients while safeguarding your income.

Establish Clear Payment Terms

One of the most effective ways to avoid delays is by setting clear payment terms from the outset. Make sure your clients are fully aware of your expectations regarding payment deadlines, late fees, and accepted payment methods. This transparency helps prevent misunderstandings and ensures both parties are on the same page.

Send Friendly Reminders

If payment becomes overdue, sending a polite reminder can be an effective first step. Many clients simply forget or overlook payment due dates, so a gentle nudge is often all that’s needed. Be sure to stay professional and courteous in your communication.

Consider Payment Plans

For clients facing financial difficulties, offering a payment plan can be an effective way to collect payments without damag

Saving Time with Automated Invoicing

In today’s fast-paced business environment, efficiency is key. Automating certain tasks, such as billing, can save valuable time and reduce the potential for human error. With the help of automated systems, businesses can streamline their payment processes, ensuring that clients are billed promptly while also allowing business owners to focus on other essential tasks.

Streamlining the Billing Process

One of the major benefits of using automated tools is the ability to streamline the entire billing process. Instead of manually creating and sending documents, automated software can generate accurate records based on pre-set criteria, saving hours of work each week.

Improving Accuracy and Reducing Errors

Manual billing can lead to errors, whether it’s a typo in the price, a missed client detail, or an incorrect calculation. Automation helps eliminate these issues by relying on standardized templates and algorithms that perform calculations with precision.

Enhancing Cash Flow Management

Automated systems can also help manage your cash flow by sending reminders for outstanding balances. Late payments can affect your financial stability, but automation ensures that clients are reminded promptly and consistently.

By implementing automation into your billing process, you can save time, improve accuracy, and ensure a smoother experience for both you and your clients.

How to Send Documents to Clients

Sending billing documents to clients is a crucial step in the payment process. Ensuring that these documents are delivered correctly, in a timely manner, and in a professional format is essential for maintaining positive client relationships and facilitating quick payments. Whether you’re sending digital files or printed copies, there are several best practices to follow when sharing these important records.

Choosing the Right Method of Delivery

There are multiple ways to send billing documents, each with its own advantages. It’s important to choose the method that suits both your business and the preferences of your clients.

Formatting and Personalizing the Document

When preparing your document, ensure that it’s clearly formatted and includes all the necessary details for your client to make payment without confusion.

Following Up on Unpaid Bills

Once you’ve sent the billing documents, it’s important to monitor payments and follow up if needed. Implementing a follow-up process can help you track outstanding balances and maintain good communication with your clients.