Free Self Employed Invoice Template Download for Easy Billing

Managing payments can be a daunting task for freelancers and independent workers. The process often involves tracking hours, calculating amounts, and ensuring that clients pay on time. With the right tools, this can be simplified, allowing you to focus more on your work and less on administrative tasks.

Streamlined documentation plays a crucial role in maintaining a smooth workflow and avoiding delays. By using a structured document for billing, you can present your services in a professional manner while keeping your financial records organized. This not only helps with clarity but also supports better cash flow management.

In this guide, we’ll explore how easy-to-use resources can assist you in creating polished, accurate bills for your clients. These tools are designed to save time, reduce errors, and ensure that your billing process is efficient and hassle-free, no matter your field of work.

Free Invoice Template for Self Employed

For independent professionals, managing financial transactions is a key aspect of running a successful business. An organized billing system not only helps track payments but also presents a professional image to clients. Having a reliable tool to create accurate documents for services rendered can simplify this process significantly.

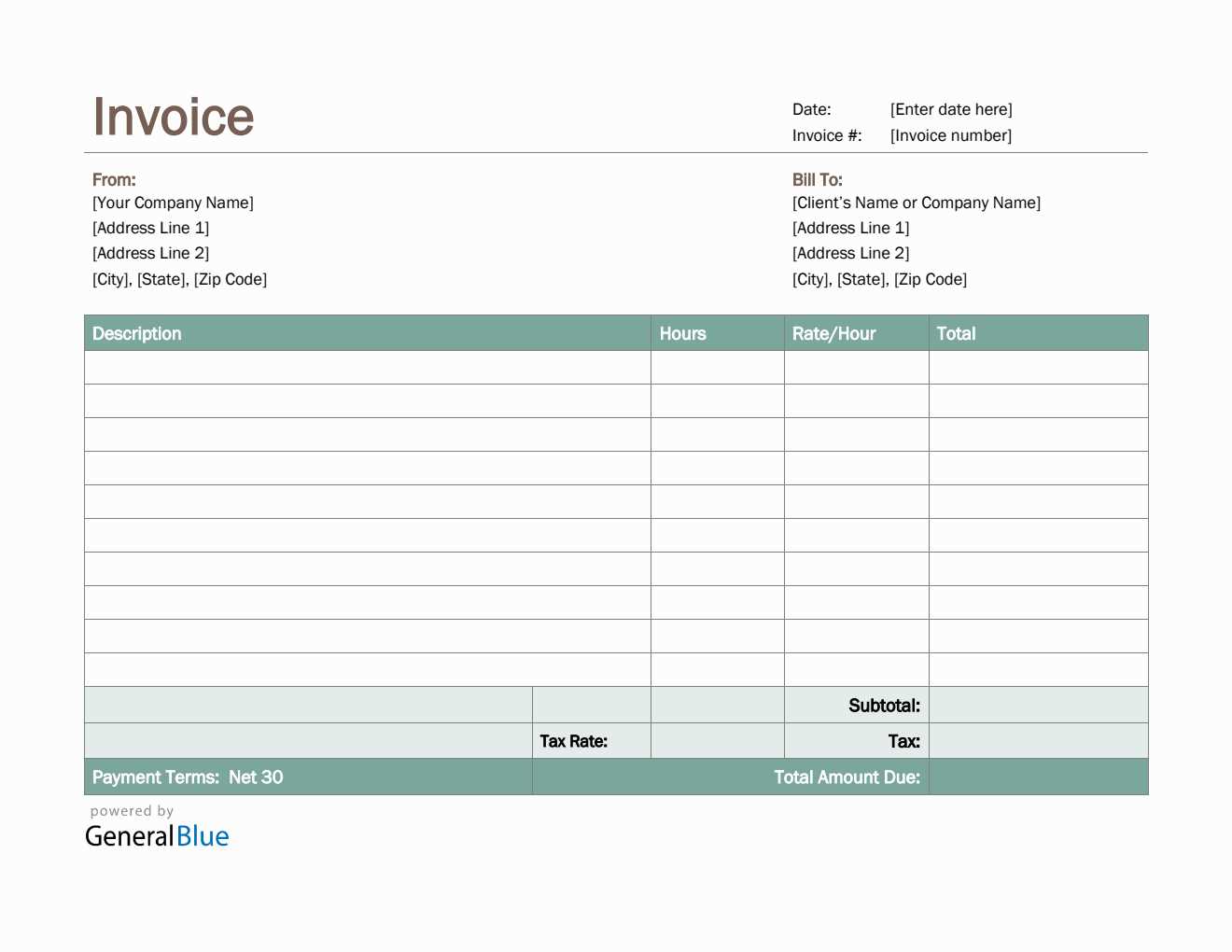

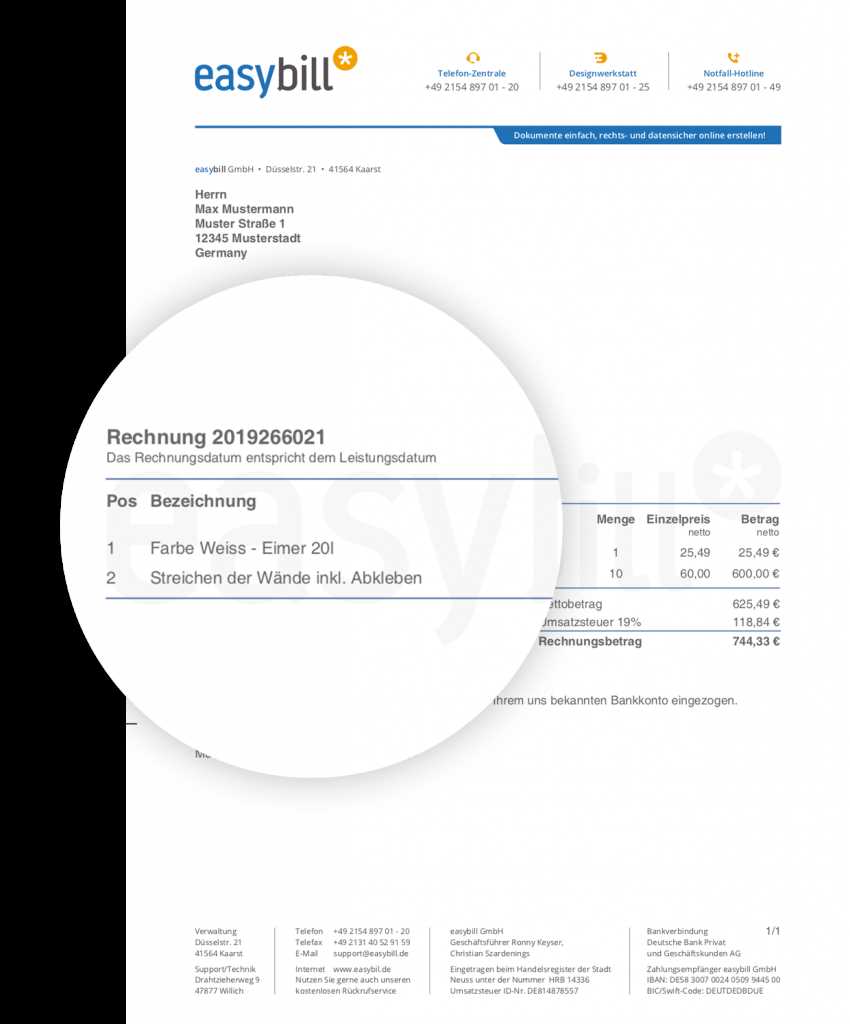

When you don’t need to create a billing document from scratch, the time spent on invoicing is minimized. By using a pre-designed solution, you can quickly input your details and generate a polished statement ready for clients. This ensures consistency across your transactions and eliminates common errors that may arise from manual calculations or formatting.

Why Use a Structured Billing Document

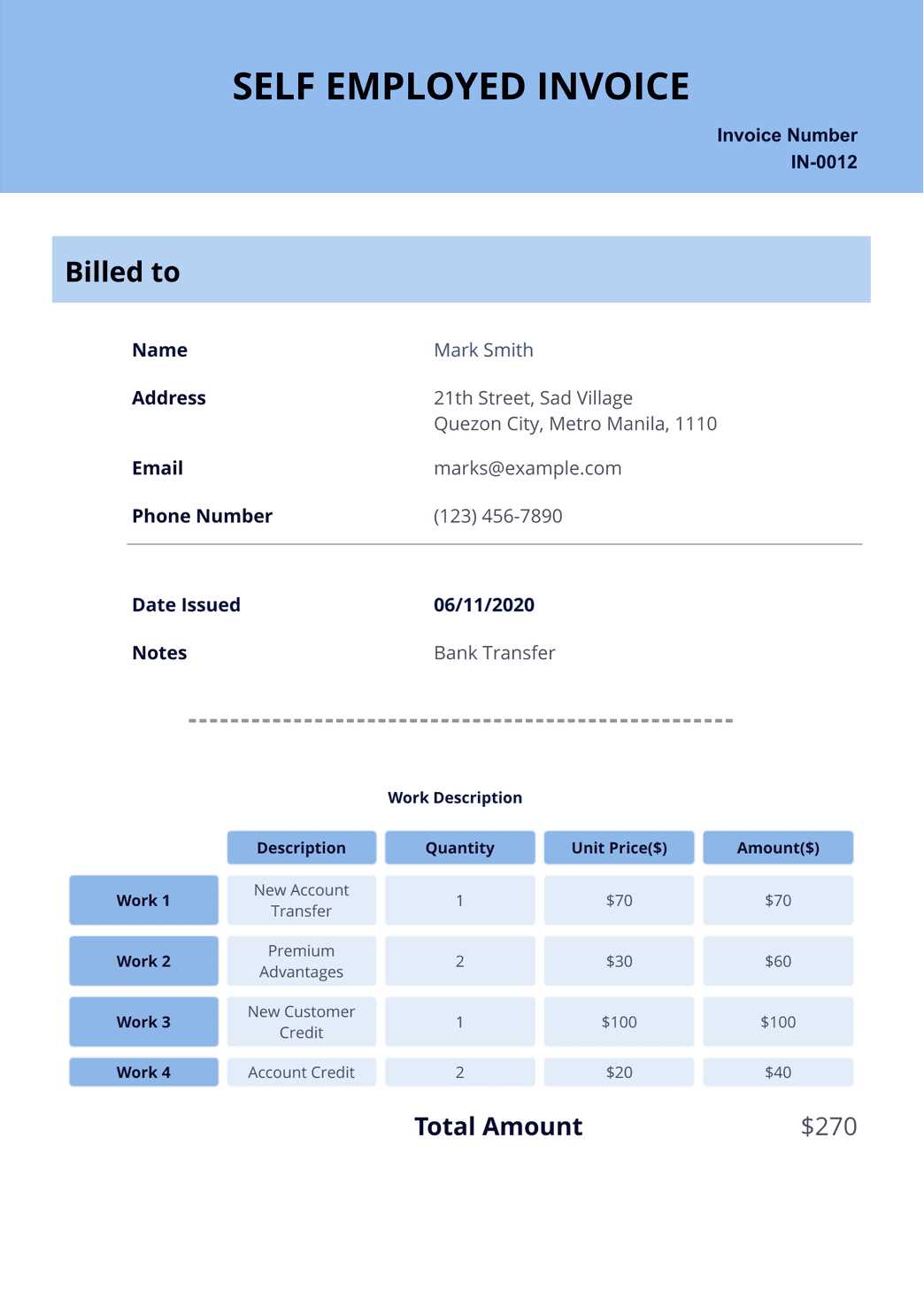

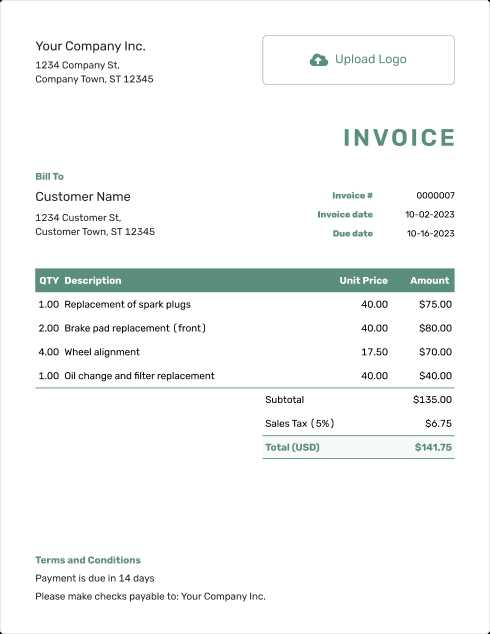

Using a ready-made document ensures that you include all the necessary information in the correct format. These documents typically have sections for client details, a breakdown of services provided, payment terms, and due dates. By adhering to a clear structure, you can avoid confusion and make sure both parties are aligned on expectations.

Where to Find Reliable Billing Resources

Many online platforms offer easy-to-use tools for generating professional financial documents. These resources are especially helpful for individuals just starting out or those who prefer not to spend time creating paperwork from scratch. In many cases, these tools are available at no cost, making them a practical choice for independent workers.

Why Use an Invoice Template

Creating professional-looking documents for billing can be a time-consuming and tedious task. However, using a structured document simplifies the process, ensuring accuracy and saving time. Whether you’re a freelancer or run a small business, utilizing a pre-designed solution streamlines your workflow, helping you focus on what matters most: your work.

Key Benefits of Using a Structured Document

- Consistency: A predefined format ensures that every billing statement is uniform, reducing the chances of missing important details or making formatting mistakes.

- Time-saving: Instead of starting from scratch each time, a ready-to-use document allows you to fill in essential information quickly and easily.

- Professional appearance: Presenting a well-organized statement builds trust with clients, showing them that you are thorough and reliable in your business practices.

- Legal compliance: Many billing solutions are designed to include the necessary legal elements, such as payment terms and tax information, which helps ensure that your documents meet regulatory requirements.

- Error reduction: By using an established format, the chances of human error in calculations or data entry are minimized.

How It Helps with Financial Organization

- Clear tracking: Having a consistent structure makes it easier to keep track of outstanding payments and monitor your financial records.

- Easy updates: With a saved version, you can make changes as needed, adapting to different clients or services without creating a whole new document.

- Client communication: By including all the necessary information in a readable and clear format, it improves communication with clients, reducing confusion about due dates, amounts, or services provided.

Benefits of Free Invoice Templates

For independent professionals and small business owners, using a ready-made solution for billing offers numerous advantages. Accessing a pre-designed document removes the need for creating one from scratch, simplifying the task of managing financial records. With no cost involved, these resources allow you to maintain a professional appearance without straining your budget.

Key Advantages of Using Pre-Designed Billing Documents

- Cost-effective: Many billing solutions are available at no charge, providing a practical option for those on a tight budget or just starting their business.

- Time-saving: With a ready-to-use document, you can quickly fill in your details and generate a clean, professional statement without spending time on design or formatting.

- Ease of use: Pre-designed resources often include simple instructions, making it easy for even those with little experience to create accurate and clear billing documents.

- Instant accessibility: Most platforms offer immediate access to these resources, allowing you to begin creating professional documents right away, without any waiting period.

Additional Benefits for Small Businesses

- Consistency: Using a uniform structure for all your statements ensures your branding and presentation remain consistent across all documents, which builds client trust.

- Customization: Many free solutions allow for minor adjustments to suit your specific needs, such as adding your logo or adjusting payment terms.

- Professional impression: Presenting a polished, well-organized statement shows your clients that you are reliable and thorough in your business dealings.

- Record-keeping: With templates, you can easily maintain an organized archive of your transactions, helping you stay on top of overdue payments and taxes.

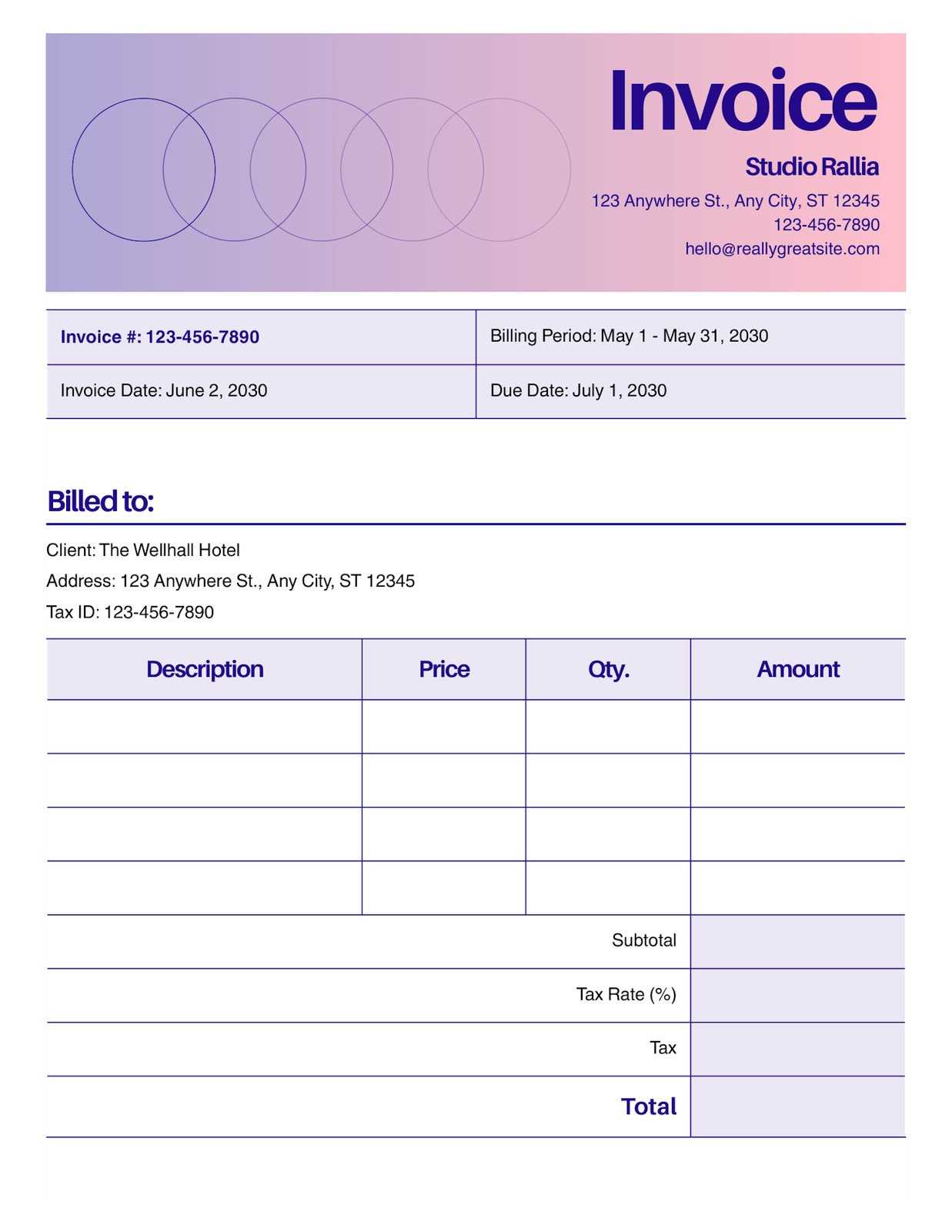

How to Customize Your Invoice

Personalizing your billing documents is essential for creating a professional impression and ensuring that they meet the specific needs of your business. Customization allows you to add relevant details such as branding elements, payment instructions, and service descriptions. By making a few adjustments to a pre-designed structure, you can make your financial statements more aligned with your business identity and the expectations of your clients.

Steps to Personalize Your Billing Document

- Add Your Branding: Include your business logo, colors, and contact information at the top of the document to ensure it represents your brand consistently.

- Adjust the Layout: Modify the layout to suit your preferences or the type of services you provide. For example, you can add additional sections for service descriptions or payment terms.

- Specify Payment Terms: Customize the payment terms, including due dates, late fees, or any discounts offered for early payments, to make sure both you and the client are clear on the expectations.

- Include Personal Details: Tailor the sections for client information to match the specifics of each transaction. Include their name, address, and contact details to ensure accurate records.

Other Customization Tips

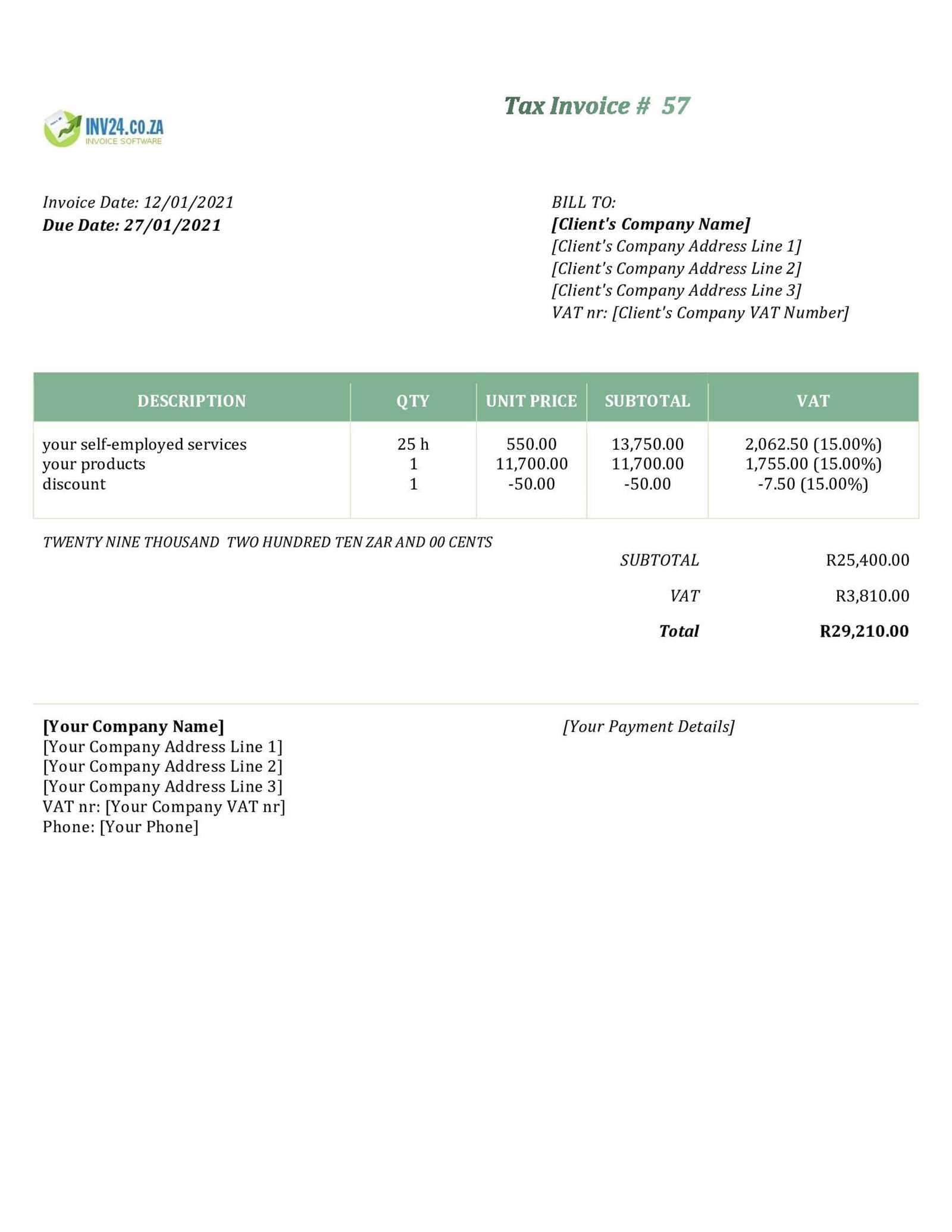

- Tax Information: Add fields for applicable taxes to make sure your documents are compliant with local tax regulations.

- Additional Notes: Include a personalized message or additional instructions for your client, such as thanking them for their business or providing details about your next availability.

- Payment Methods: Specify the types of payments you accept (e.g., bank transfers, credit cards, PayPal) and provide relevant details such as account numbers or links to payment portals.

Common Mistakes in Self Employed Invoices

Creating clear and accurate billing statements is crucial for maintaining professionalism and ensuring timely payments. However, even experienced professionals can make errors when preparing financial documents. These mistakes can lead to confusion, delayed payments, or even legal issues. Understanding the most common pitfalls can help you avoid them and ensure your transactions are smooth and efficient.

Key Errors to Avoid in Billing Statements

- Missing Contact Information: Failing to include your full contact details, including your business name, phone number, and email address, can make it difficult for clients to reach you if there are any issues with the payment.

- Incorrect Payment Terms: Not specifying clear payment terms, such as due dates or late fees, can lead to misunderstandings and delayed payments. Make sure to outline exactly when the payment is expected and any penalties for overdue amounts.

- Not Itemizing Services: Lack of detail in the services provided can lead to confusion for the client. Always break down the tasks performed, including the quantity, description, and cost for each service, to provide full transparency.

- Omitting Tax Information: Depending on your location, tax rates may need to be included in your billing. Omitting this information can create complications, especially if clients need to submit the statement for reimbursement or accounting purposes.

- Wrong Calculations: Simple math errors can have a major impact on your reputation and cash flow. Double-check your calculations for totals, tax, and discounts to ensure accuracy before sending the document.

Additional Pitfalls to Watch Out For

- Not Using a Consistent Format: A lack of consistency in your documents can make them look unprofessional. Using a uniform

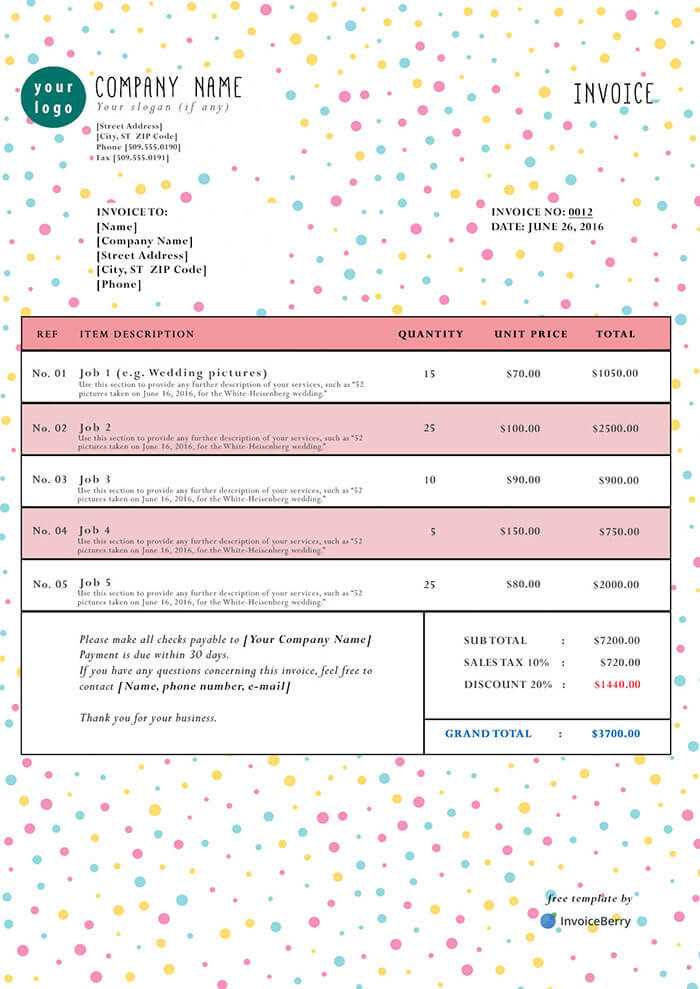

Essential Information to Include in Invoices

To ensure smooth and professional transactions, it’s important to include all the necessary details in your billing documents. This helps both you and your client stay on the same page regarding the services rendered and the payment terms. A well-organized statement not only facilitates quicker payments but also serves as an official record of the transaction.

Key Details to Include in Billing Documents

- Your Business Information: Make sure to include your full business name, address, phone number, and email. This allows your client to easily contact you with any questions regarding the bill.

- Client Information: List the client’s name, address, and contact details so there is no confusion about who the payment is for.

- Unique Reference Number: Assign a unique number to each document. This helps both you and the client keep track of the transaction and is essential for accounting purposes.

- Description of Services: Provide a detailed breakdown of the services you performed, including the quantity, rate, and any additional costs. This ensures transparency and avoids any misunderstandings.

- Total Amount Due: Clearly state the total amount owed, including any taxes or additional charges. Make sure this is easy to find on the document so your client knows the exact amount to pay.

Additional Important Information

- Payment Terms: Specify the payment due date, as well as any late fees or discounts for early payment. This helps set expectations and encourages timely payments.

- Accepted Payment Methods: List the methods of payment you accept (e.g., bank transfer, credit card, PayPal), and include any relevant details like account numbers or links.

- Tax Information: If applicable, include the tax rates and total tax amount to mak

How to Save Time with Templates

Managing billing documents can be a time-consuming task, especially when you have multiple clients and projects to handle. However, using a pre-designed solution can significantly reduce the amount of time spent on paperwork. By streamlining the creation process, you can focus more on your core work rather than spending hours formatting and calculating each statement from scratch.

Efficiency Through Ready-Made Solutions

One of the key benefits of using a pre-structured document is that it eliminates the need to start from zero with every new project. Instead of manually creating a new layout for every client, you can use a saved format, making minor adjustments as necessary. This approach speeds up the billing process and ensures consistency across all your statements.

- Quick Updates: Simply input the new project details–such as client information, service description, and amount due–and you’re ready to send it off.

- Standardized Layout: A consistent design makes it easier to track documents and manage financial records. It also ensures that you never forget to include essential information, like payment terms or due dates.

- Automated Calculations: Many pre-made solutions include built-in features to automatically calculate totals, taxes, and discounts, reducing the chances of errors and saving time on math.

How to Maximize Your Time Savings

- Save Custom Versions: Once you’ve customized your document, save it with specific details for different clients or services. This allows you to quickly adjust for future projects without redoing the entire setup.

- Use Digital Formats: Working with digital versions means you can easily make updates, save templates to your devices, and send them instantly, cutting down on paper and postal delays.

- Batch Processing: If you have multiple clients to bill, prepare all documents in one sitting. With ready-made designs, you can complete the process much faster.

Where to Find Free Invoice Templates

There are numerous resources available online where you can find ready-made billing documents to suit your business needs. These platforms offer a variety of options, allowing you to choose the one that best fits your specific requirements. Whether you’re looking for a simple layout or a more advanced design, these sources make it easy to find a solution at no cost.

Online Platforms Offering Ready-to-Use Solutions

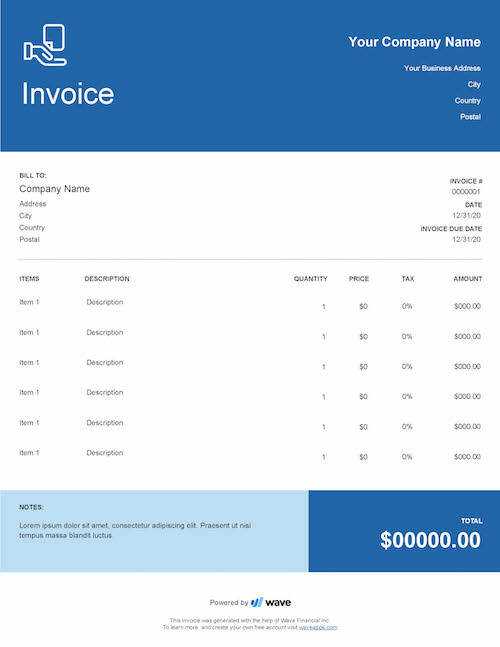

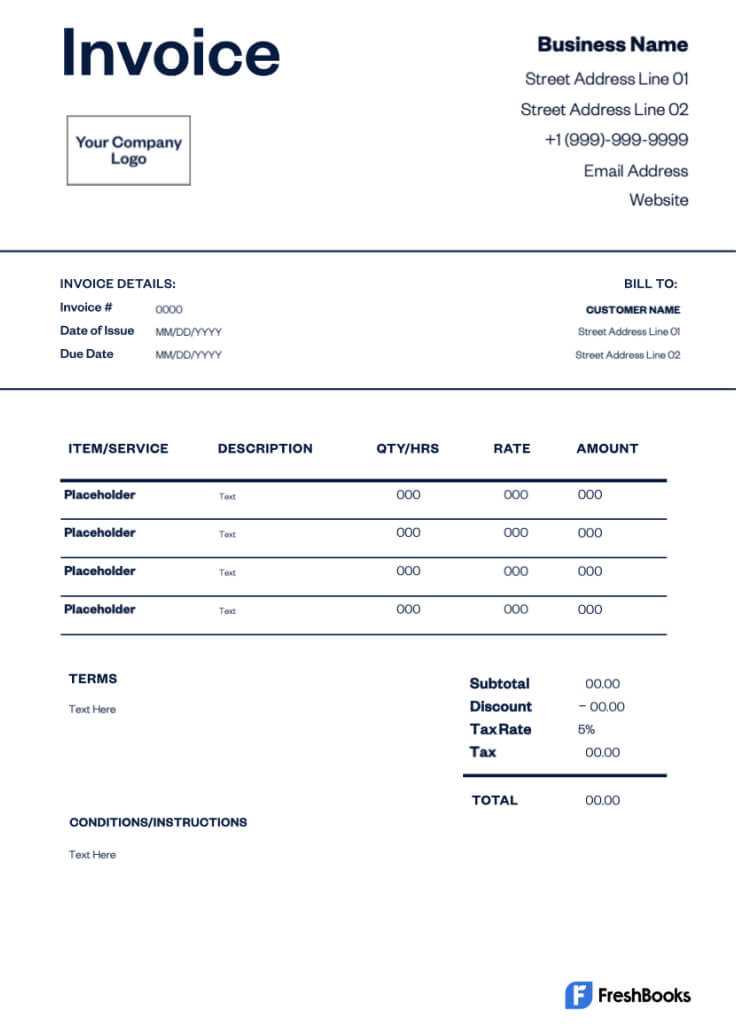

Many websites provide downloadable billing documents that can be customized for your use. Some of these platforms offer a range of designs and formats, including Word documents, PDFs, and Excel spreadsheets, making it easy to choose the format you’re most comfortable working with.

Platform Types of Formats Customization Options Microsoft Office Word, Excel Basic customization, logo, payment terms Google Docs Google Docs, Sheets Customizable for branding and details Canva PDF, Image formats Advanced design options, full branding Invoicing Websites Online Formatted Bills Automated calculations, invoice numbers Additional Tips for Finding the Best Resource

- Search for Reviews: Look for user reviews and ratings to ensure the platform is

How to Download and Use a Template

Accessing and utilizing a pre-designed billing document can significantly simplify the process of creating professional statements. The process is straightforward and requires only a few steps to start using the solution for your business. Once you’ve selected a suitable format, you can customize it to fit your specific needs and begin sending out your statements with minimal effort.

To get started, find a platform that offers the type of document you’re looking for, whether it’s a Word file, Excel sheet, or an online tool. Many of these resources allow you to either fill in fields directly or download them to your computer for offline use. After acquiring the document, make any necessary adjustments such as adding your branding, payment details, and itemizing the services you provided.

Choosing the Right Template for Your Business

Selecting the right billing document for your business is crucial to maintaining a professional image and ensuring clarity in transactions. The format you choose should reflect the nature of your services, be easy to understand for your clients, and contain all the necessary details for smooth payment processing. Whether you’re a freelancer or run a small business, the right structure will save you time and reduce errors.

Factors to Consider When Choosing a Format

- Industry-Specific Needs: Different industries may require different information on a billing document. For example, a consultant might need to detail hourly rates and project milestones, while a product-based business will need to list itemized products and quantities.

- Ease of Use: Choose a solution that is easy for you to fill out quickly. Look for formats that are user-friendly and customizable, allowing you to add or remove sections as needed.

- Professional Appearance: The design of your document should align with your brand image. A clean, simple layout often works best, but you can customize it with your logo, business colors, or other branding elements for added impact.

- Flexibility: Pick a format that can accommodate different payment terms, such as late fees, discounts, or payment plans. This ensures that the document remains versatile for various types of transactions.

Types of Billing Documents for Different Businesses

- Freelancers: Look for a simple, easy-to-use structure that allows you to list services, hourly rates, and project details, along with clear payment terms.

- Product-Based Businesses: Choose a format that includes space for item descriptions, quantities, unit prices, and total costs to give a f

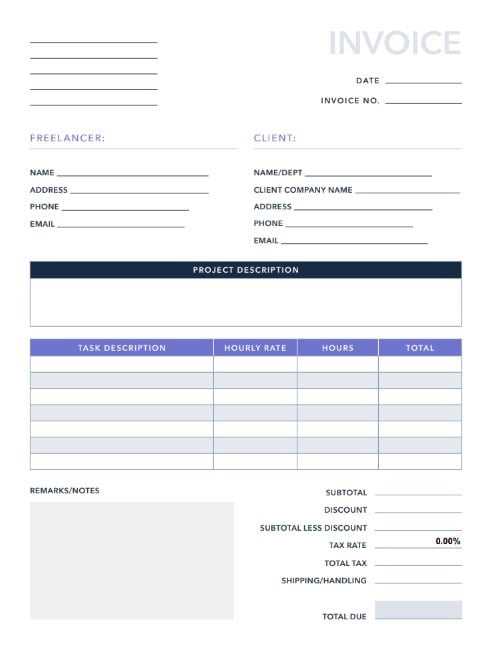

Invoice Formatting Tips for Self Employed

Proper formatting is key to creating clear, professional billing documents. A well-structured statement ensures that all necessary information is easy to find, which can speed up payments and prevent misunderstandings. Whether you’re a freelancer or run a small business, following a few formatting guidelines can help you maintain consistency and professionalism in your financial communications.

Key Formatting Guidelines to Follow

- Clear Section Headings: Make sure each section of the document is clearly labeled. Use headings such as “Client Details,” “Services Provided,” “Payment Terms,” and “Total Due” to organize the information and make it easy to navigate.

- Readable Font and Size: Use a clean, professional font like Arial, Calibri, or Times New Roman. The font size should be large enough to be easily readable, typically between 10pt and 12pt.

- Avoid Clutter: Keep the layout simple and organized. Too many elements or excessive text can make the document look chaotic. Stick to essential information and leave white space to make the document look more inviting.

- Consistent Alignment: Align text consistently throughout the document. Use left alignment for most text and right alignment for numbers and totals. This creates a neat, orderly look that is easier to read.

Additional Tips for a Professional Layout

- Include a Unique Reference Number: Always assign a unique number to each statement to keep track of your records. This number should be clearly visible at the top of the document.

- Itemize Charges: Break down services or products by listing them individually with corresponding rates and quantities. This provides transparency and helps avoid confusion for the client.

- Highlight Key Information: Make the total amount due, due date, and payment instructions stand out by using bold text or a larger font size.

- Double-Check Alignment: Ensure that all amounts, such as the total due and subtotals, are aligned properly in columns. This not only improves readability but also make

Managing Payments with Invoice Templates

Efficient payment management is crucial for maintaining a healthy cash flow in any business. By using a well-structured billing document, you can clearly communicate payment terms, due dates, and expectations to clients, which helps streamline the payment process. A consistent approach to managing payments not only reduces errors but also builds trust and professionalism with clients.

How Billing Documents Help with Payment Tracking

A well-designed document can serve as both a reminder and a reference point for both you and your client. By including all necessary details, such as payment due dates, terms, and instructions, you create a clear pathway for clients to follow when processing payments. This eliminates confusion and ensures that both parties are on the same page.

- Clear Payment Terms: Specify the exact amount due, due date, and any late fees or discounts. This helps prevent delays and encourages timely payments.

- Detailed Payment Instructions: Provide instructions on how clients can pay you, whether it’s through bank transfer, credit card, or other methods. This removes ambiguity and makes it easier for clients to act.

- Tracking Outstanding Payments: By keeping detailed records of each transaction, you can easily track which payments are pending and follow up with clients as needed.

Additional Tips for Streamlining Payment Processes

- Include Payment Reference Numbers: Assigning a unique reference number to each statement helps both you and the client easily identify and track payments in case of any issues.

- Automate Reminders: If you are using invoicing software or digital tools, set up automated reminders for clients when payments are approaching or overdue. This keeps the process on track and reduces manual follow-ups.

- Offer Multiple Payment Metho

Creating Professional Invoices Quickly

Generating clear and professional billing documents doesn’t have to be a time-consuming task. By utilizing efficient tools and following a streamlined process, you can create polished statements in minutes. Whether you’re handling multiple clients or managing a single project, simplifying the process can help ensure that you meet deadlines and maintain consistent cash flow.

Steps to Speed Up the Billing Process

With the right approach, you can prepare and send billing documents with minimal effort. Below are the essential steps for quickly creating professional statements:

- Use a Pre-Formatted Layout: Start with a pre-structured format that includes all the necessary fields. This allows you to simply input client details, services provided, and amounts due without having to worry about formatting.

- Automate Calculations: Utilize tools or software that automatically calculate totals, taxes, and discounts. This saves time and reduces the risk of errors.

- Pre-Set Payment Terms: Create standard payment terms that you can reuse across all documents, including due dates, payment methods, and late fees.

- Store Client Information: Keep a record of client names, addresses, and other details that can be quickly inserted into any document without needing to re-enter them each time.

Essential Elements to Include for Quick Creation

Even when you’re in a rush, make sure to include all the important information in your billing document. Below is a table of key elements that should always be present in any statement:

Element Pur How to Track Paid and Unpaid Invoices

Tracking payments efficiently is essential for maintaining a healthy cash flow and ensuring that no outstanding balances are overlooked. Whether you’re a freelancer or run a small business, keeping track of which transactions have been settled and which are still pending will help you manage finances, follow up with clients in a timely manner, and avoid late payment issues.

Strategies for Tracking Outstanding Payments

To stay on top of your financial records, it’s important to have a clear system in place to differentiate between paid and unpaid balances. Here are some effective ways to keep track of these payments:

- Use a Payment Log: Maintain a spreadsheet or software tool that records every transaction. Include columns for the amount due, date issued, payment date, and payment status (paid or unpaid). This provides a clear overview of outstanding balances.

- Set Up Payment Reminders: Many invoicing systems allow you to set reminders for upcoming or overdue payments. This ensures you can follow up promptly without having to manually track each transaction.

- Highlight Paid Transactions: Color-code or mark paid transactions to quickly identify cleared payments. This makes it easier to focus on the outstanding ones and follow up accordingly.

- Use Accounting Software: Accounting tools and apps often come with built-in features to track payments. These systems can automatically mark payments as received and even send reminders for overdue amounts, saving you time and effort.

Keeping Clients Informed

Maintaining transparency with your clients is key to ensuring smooth transactions. Here’s how you can keep clients informed about their payment status:

- Include Payment Terms: Clearly state when payments are due and any penalties for late payments. This helps set expectations from the outset and reduces the chance of confusion later on.

- Send Regular Statements: If a payment is overdue, send periodic reminders or statements to inform clients of their outstanding balance. This can encourage them to settle

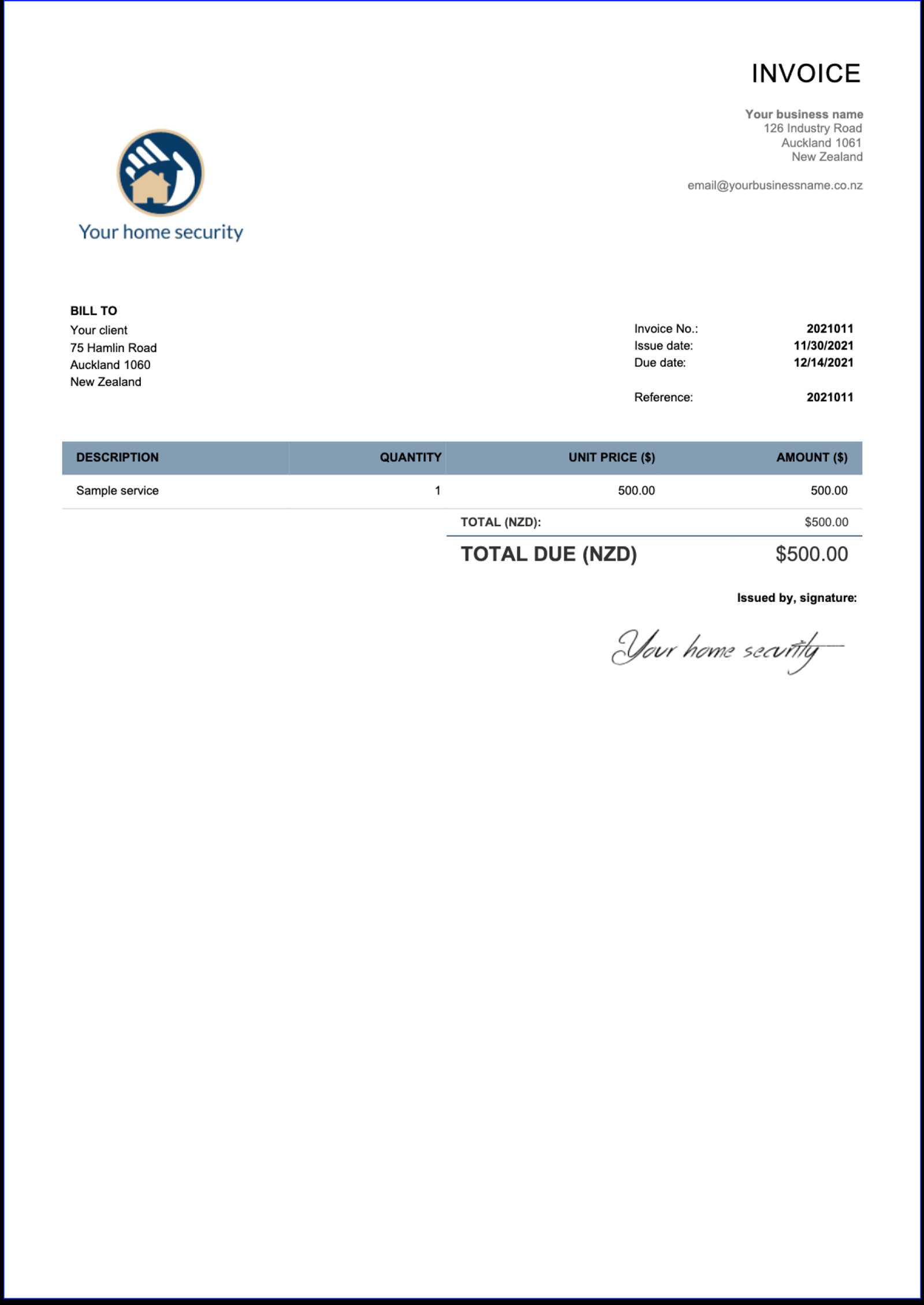

Legal Requirements for Self Employed Invoices

When managing payments and transactions, it’s important to ensure that all necessary legal information is included in billing documents. Complying with legal requirements not only helps avoid potential disputes but also ensures that your business practices are transparent and professionally documented. Depending on the country or region where you operate, there are specific details that must be included to meet regulatory standards.

Key Information Required for Compliance

There are several essential pieces of information that must be present in any billing document to meet legal requirements. Missing these details could result in delays or complications with tax authorities or clients. Below is a table of the key elements that are typically required:

Element Explanation Business Information Include your full business name, registered address, and tax identification number (TIN) or VAT number, if applicable. This identifies your business legally and ensures compliance with tax regulations. Client Information Clearly state the name and address of the client receiving the billing document. This ensures that there is no confusion about the parties involved in the transaction. Unique Reference Number A unique reference or identification number should be assigned to each document for tracking purposes. This helps both you and your client keep organized records and avoid confusion. Date of Issue Include the date the billing document was created or issued. This is important for establishing payment deadlines and avoiding disputes over when the payment was due. Detailed Description of Goods/Services Provide a clear breakdown of the products or services provided, including quantities, unit prices, and any applicable discounts. This ensures transparency and helps in case of any disputes or queries. Total Amount Due The final amount to be paid should be clearly stated, including taxes, fees, or other adjustments. This eliminates any confusion regarding the total payment expected. Payment Terms Specify the due date, payment methods accepted, and any penalties for late payment. This ensures that both you and your client understand the payment expectations and any associated consequences. Additional Legal Considerations

- Taxes: Depending on your location and business type, you may need to include the appropriate tax rates (such as VAT) on your documents. Make sure you are aware of the tax laws in your region to avoid fines or penalties.

- Record-Keeping: It’s important to maintain accurate records of all transactions, including payment dates and amounts. This will help you during tax season and in the event of any legal audits or disputes.

- Dispute Resolution: Include any necessary information regarding dispute resolution procedures, such as mediation or arbitration, to clarify how disagreements should be handled.

By ensuring these legal elements are included in your billing documents, you can maintain compliance with regulations and provide clear, accurate records for both you and your clients.

Digital vs Paper Invoices for Freelancers

When it comes to managing payments, freelancers have the option of using either digital or paper documents for their billing. Each method has its own set of benefits and drawbacks, depending on factors such as convenience, cost, and speed. Understanding the pros and cons of both options can help you decide which is best suited to your business needs.

Advantages of Digital Billing

Digital documents are becoming the preferred choice for many freelancers due to their speed and convenience. Below are some key reasons why you might choose to go digital:

- Faster Processing: Digital documents can be sent instantly to clients via email or payment platforms, reducing the time it takes for payments to be processed.

- Environmentally Friendly: By eliminating the need for paper, you contribute to sustainability and reduce waste.

- Easy Tracking: Digital records are easier to organize and manage, allowing you to quickly track outstanding payments and past transactions.

- Automation: Many digital tools allow you to automate calculations, tax inclusion, and due dates, saving you time and reducing the risk of errors.

- Accessibility: Digital documents can be accessed and stored securely in cloud-based platforms, making them easy to retrieve from anywhere at any time.

Benefits of Paper Billing

While digital billing is increasingly popular, some freelancers may still prefer paper-based methods. Here are a few reasons why paper documents might be the right choice:

- Personal Touch: Some clients may appreciate the formality and personal touch that comes with receiving a physical statement in the mail, especially in more traditional industries.

- How Invoice Templates Improve Cash Flow

Effective management of cash flow is crucial for maintaining a stable business. One of the most important tools for improving cash flow is the proper creation and management of billing documents. When you use structured and consistent billing formats, you ensure that payments are requested in a timely, clear, and professional manner, which can significantly enhance cash flow. Properly formatted records reduce errors, speed up payment processing, and help avoid misunderstandings with clients.

When billing documents are easy to understand and include all necessary details, clients are more likely to make payments promptly. Furthermore, by having a consistent approach to creating these documents, freelancers and small business owners can reduce the time spent on administrative tasks and focus more on their work, resulting in improved operational efficiency. Below are a few ways that organized billing formats can positively impact your business’s financial flow:

- Faster Payment Processing: When all relevant information is clearly laid out, clients can quickly understand the total amount due and make payments without delay.

- Reduced Errors: Pre-designed formats help eliminate mistakes that might cause confusion or delay payments. By avoiding discrepancies, you reduce the risk of disputes and extended payment cycles.

- Consistency and Professionalism: A standard structure gives your business a professional image, which increases client trust and their willingness to pay on time.

- Clear Payment Terms: Clearly defined payment expectations, including due dates and accepted payment methods, help clients manage their payments more effectively, reducing the chances of overdue balances.

By using well-structured billing formats, you can streamline your payment process and ensure that your business receives payments more quickly and consistently. This, in turn, contributes to better cash flow management and a healthier financial outlook for your business.