Download Self-Employed Invoice Template for Easy Billing

Managing finances as an independent worker requires organization and professionalism, especially when it comes to receiving payments. A well-structured document for requesting compensation not only ensures smooth transactions but also helps maintain clear records for future reference. Having the right format in place can make a significant difference in the efficiency and professionalism of your business operations.

Creating a customizable form for financial requests allows for flexibility in presenting your services, payments due, and due dates. By using a pre-designed structure, you can save time, reduce errors, and create a consistent appearance for your business. With the right structure, you can ensure that every client receives the information they need, and you can track payments effectively.

In this guide, we’ll explore how to choose and use the best tools for creating and managing these essential documents, ensuring that you can streamline your workflow and focus on what matters most–growing your business.

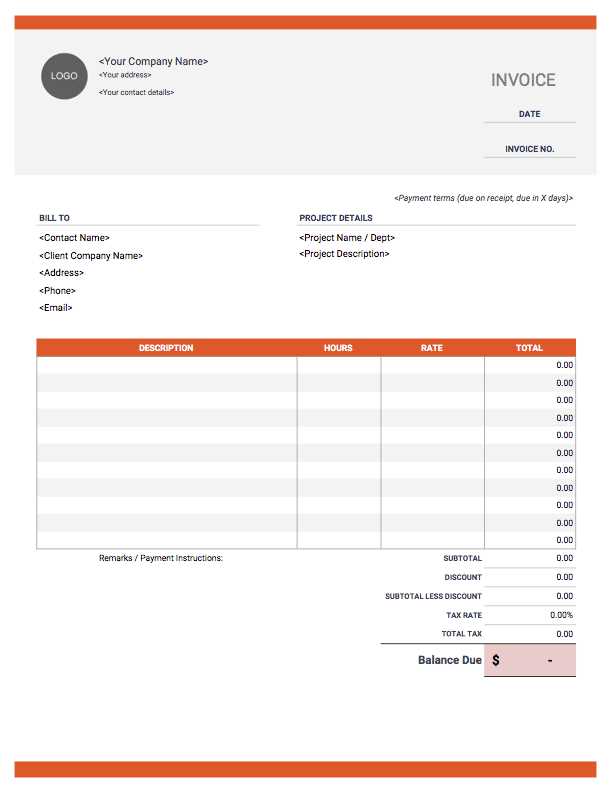

Self-Employed Invoice Template Download

When it comes to managing your freelance business, creating professional financial documents is essential for clear communication with clients and timely payments. Having a pre-designed format for requesting payments can save valuable time and ensure consistency in your billing process. This section will guide you through the importance of having the right documents and where to find resources for generating them quickly and efficiently.

Why You Need a Ready-Made Document

Using a structured format for billing not only simplifies the process but also enhances your credibility with clients. A well-organized request for payment provides all the necessary details in one place, reducing the likelihood of errors or misunderstandings. It ensures that both you and your clients are clear about the services rendered, the amount due, and the payment terms.

Where to Find Useful Resources

There are several online platforms that offer ready-to-use forms that can be easily customized to suit your specific needs. These resources often provide both free and premium options, allowing you to choose a style that aligns with your brand and business requirements. Whether you’re looking for basic or more advanced features, you can find the perfect solution to streamline your financial documentation process.

Why Use an Invoice Template

Having a pre-structured document for requesting payments offers a variety of benefits that help make the billing process more efficient and professional. By using a set format, you ensure consistency in all your transactions, save time on manual creation, and reduce the risk of making errors. This streamlined approach not only simplifies your workflow but also builds trust with clients by presenting clear and organized payment requests.

Here are some key advantages of using a standardized format:

| Benefit | Description |

|---|---|

| Time-Saving | Ready-made structures allow you to quickly fill in details, eliminating the need to design a new document from scratch each time. |

| Professional Appearance | A clean and organized format presents you as a serious business owner and enhances your brand image. |

| Accuracy | Using a structured layout ensures all necessary details are included, reducing the risk of missing important information. |

| Consistency | By using the same format for each payment request, you ensure that all clients receive the same level of clarity and professionalism. |

| Customizability | Many resources allow you to personalize the document according to your business’s needs while maintaining a professional layout. |

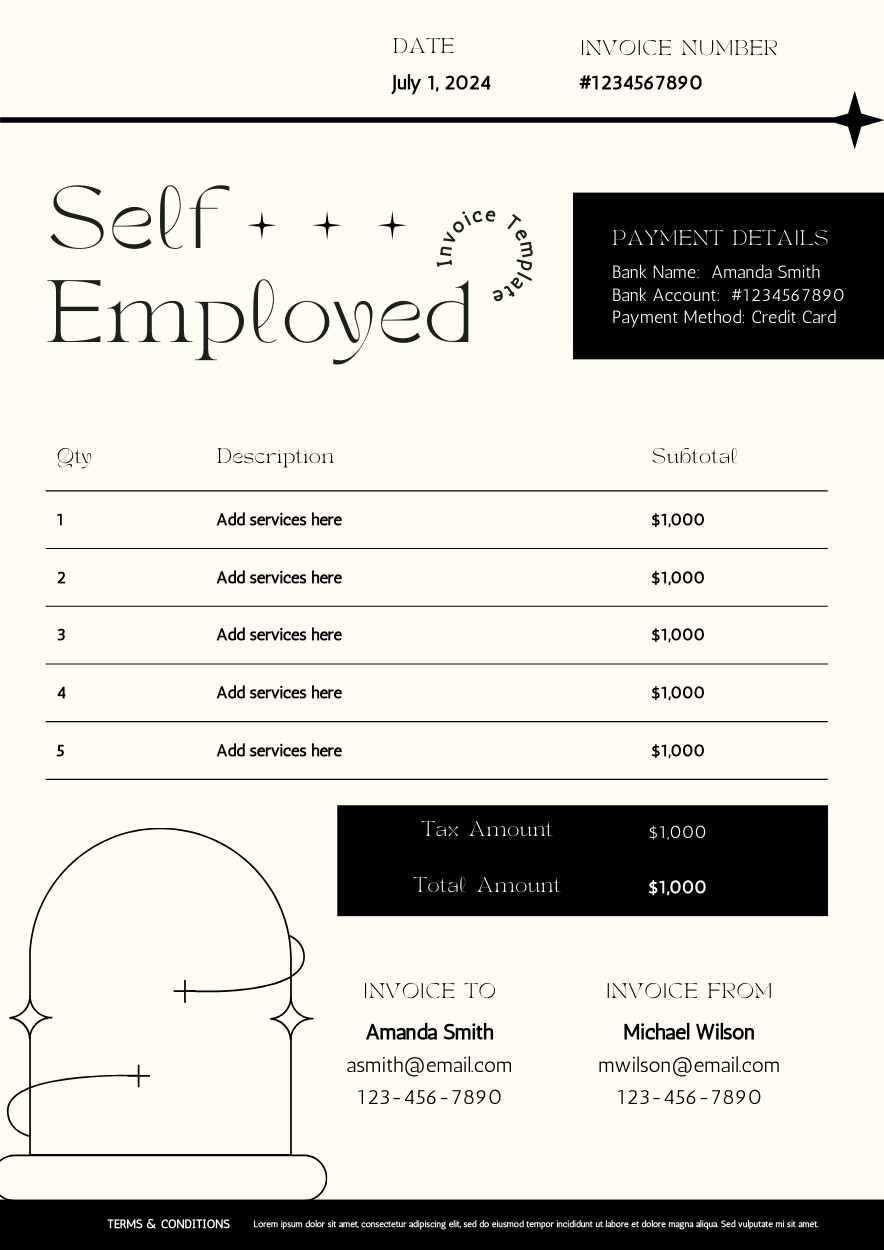

Benefits of Customizing Your Invoice

Personalizing your payment request document can bring several advantages that go beyond basic functionality. By tailoring the layout, details, and overall design, you can align your financial requests with your brand identity, make the document easier to understand, and create a professional image that fosters trust. Customization also allows you to highlight key information that suits your unique business needs, making your process more efficient and clear for both you and your clients.

Here are some key reasons why customization is important:

- Brand Consistency: Customizing the design and layout ensures that your document aligns with your overall brand aesthetic, from fonts to colors. This creates a cohesive experience for your clients and reinforces your professional image.

- Improved Clarity: By including only the most relevant details for your business, you help your clients easily understand the payment terms, services provided, and total amounts due. This reduces confusion and potential disputes.

- Efficient Workflow: Tailoring the structure allows you to streamline your internal processes, adding specific fields or sections that you regularly need, making it quicker to fill out each time.

- Professionalism: A customized request can demonstrate attention to detail and professionalism, which enhances your reputation and increases the likelihood of prompt payment.

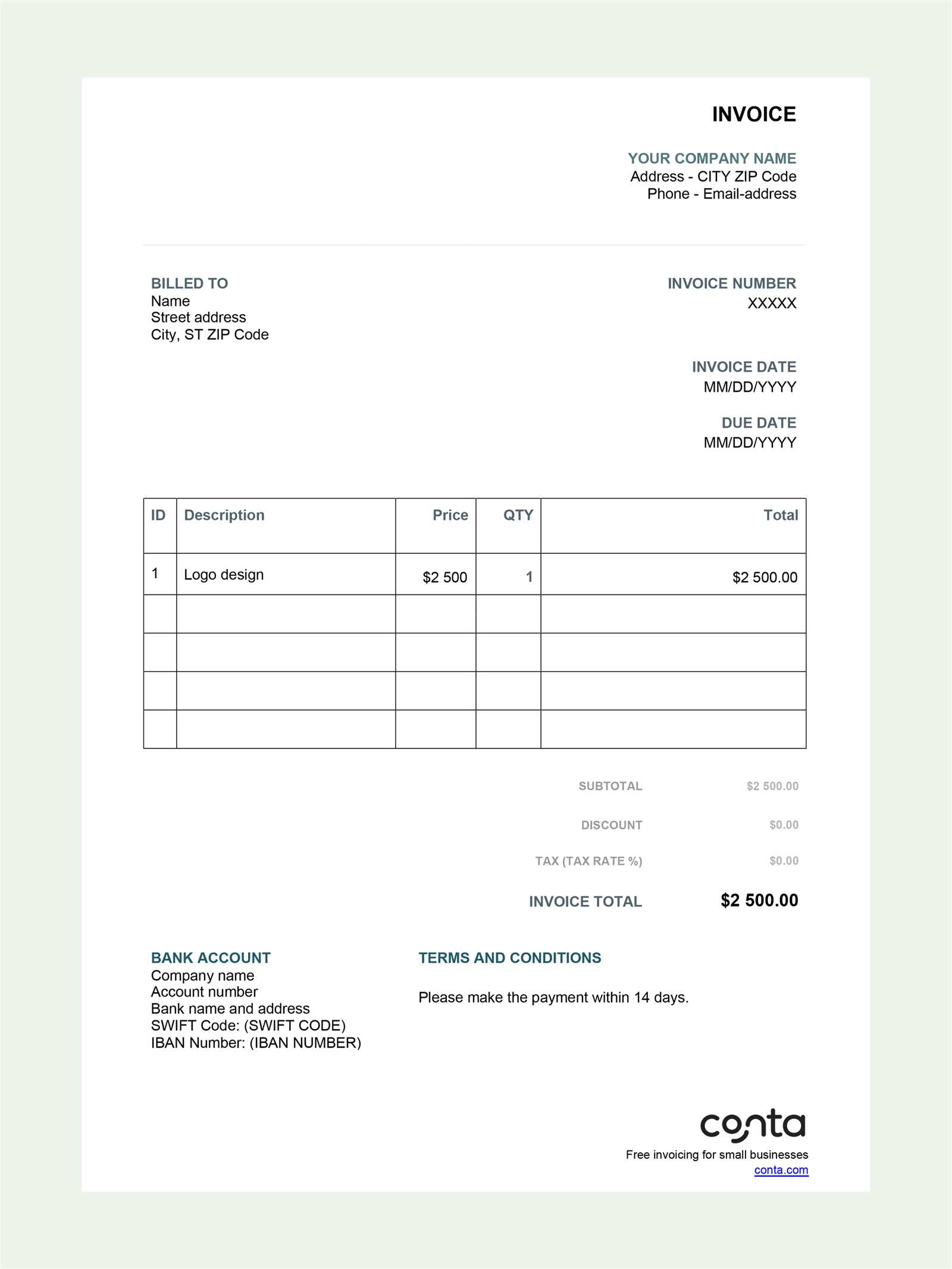

How to Create a Professional Invoice

Designing a polished payment request is essential for maintaining a professional image and ensuring smooth transactions with your clients. A well-structured document not only provides clarity but also demonstrates attention to detail and organization. When creating this important business tool, it’s crucial to include all relevant information in a clean, concise manner, making it easy for clients to understand and process your request efficiently.

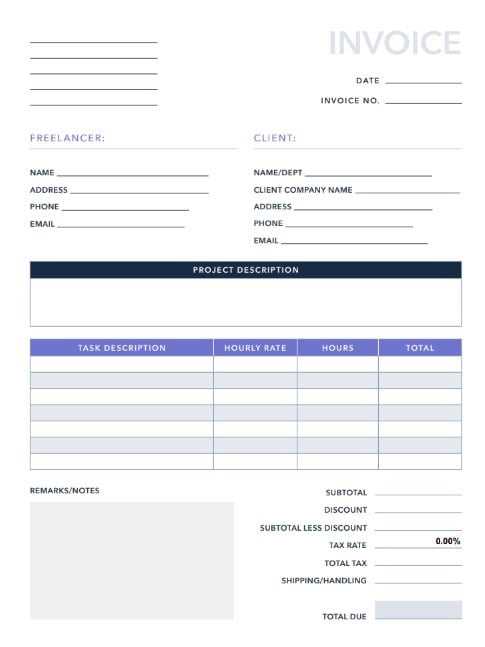

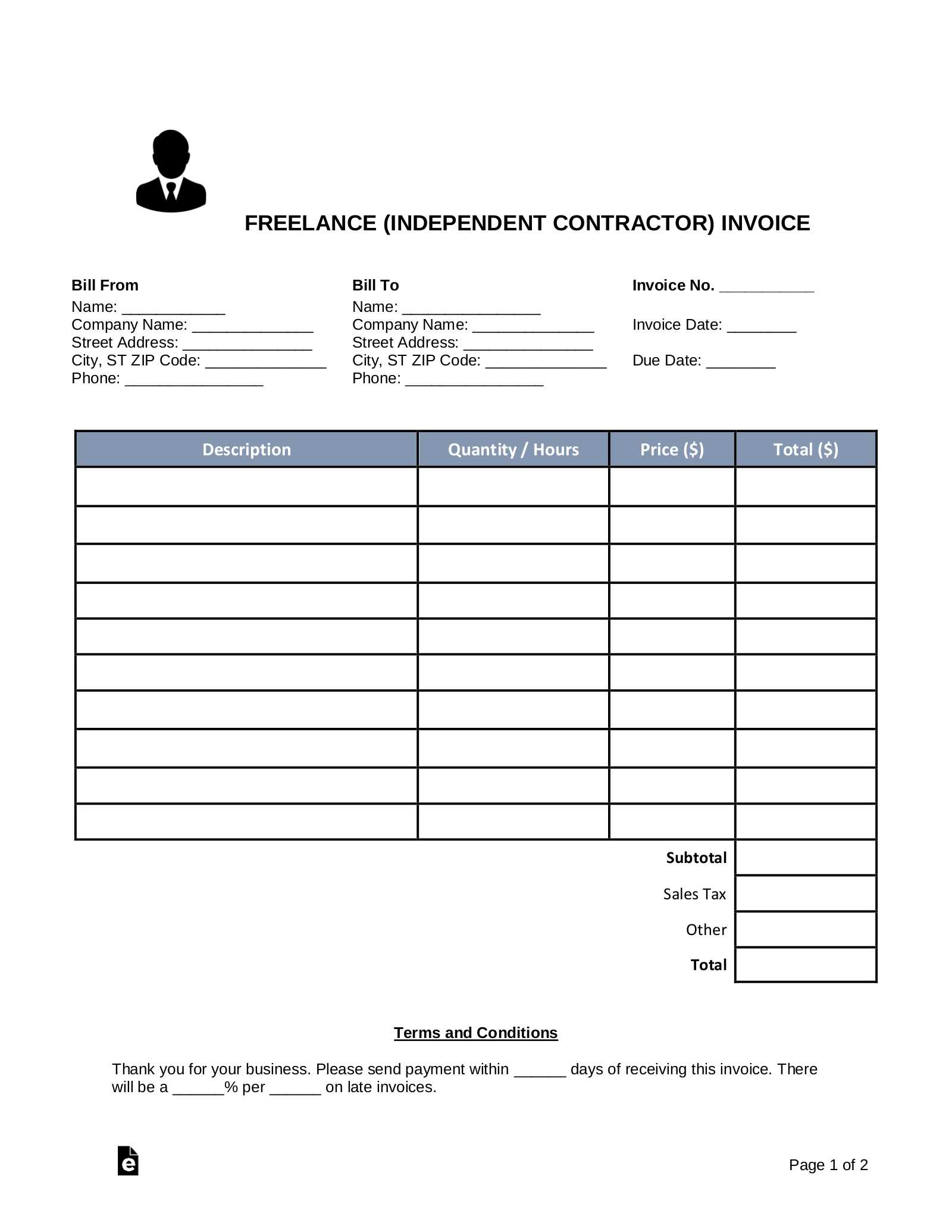

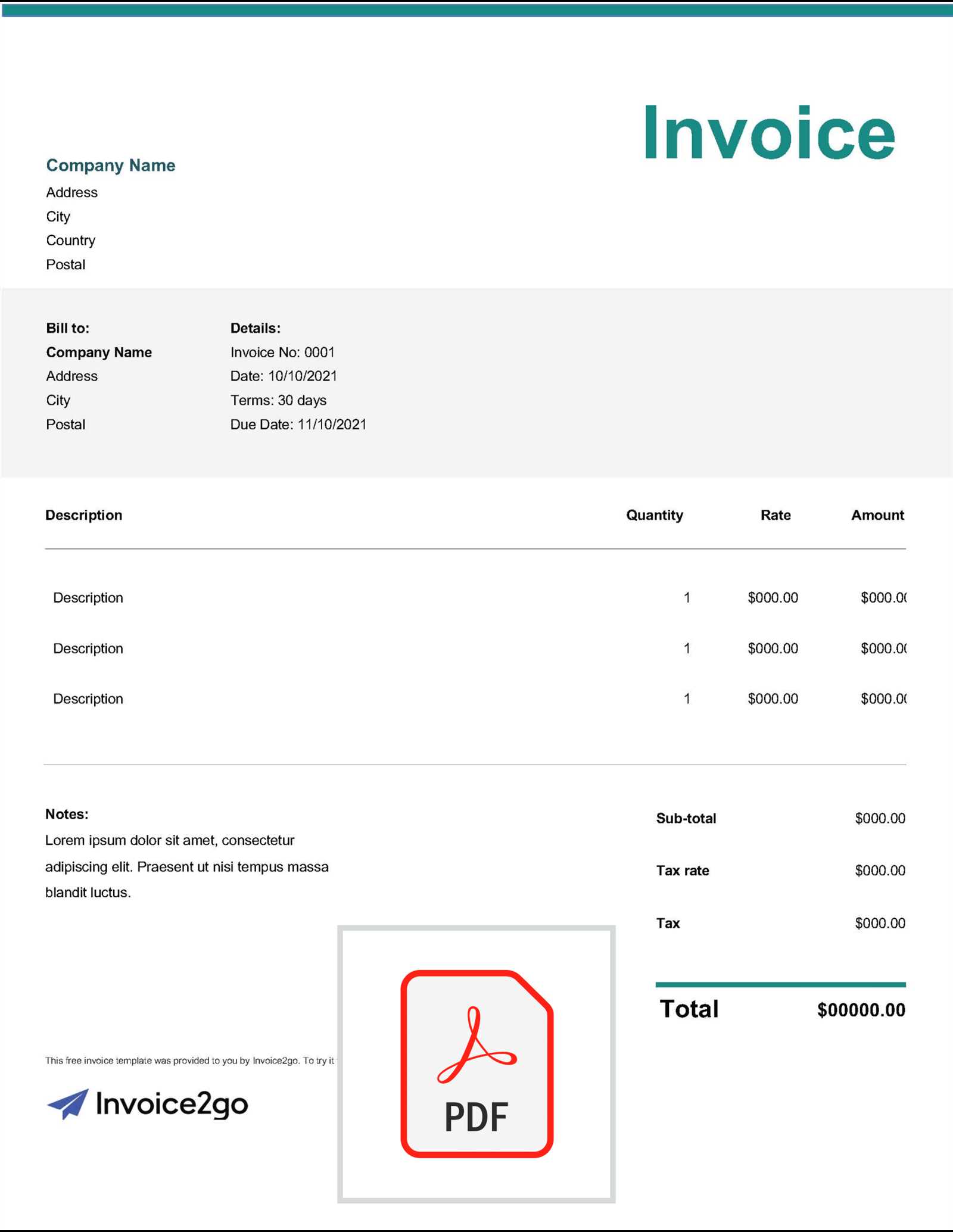

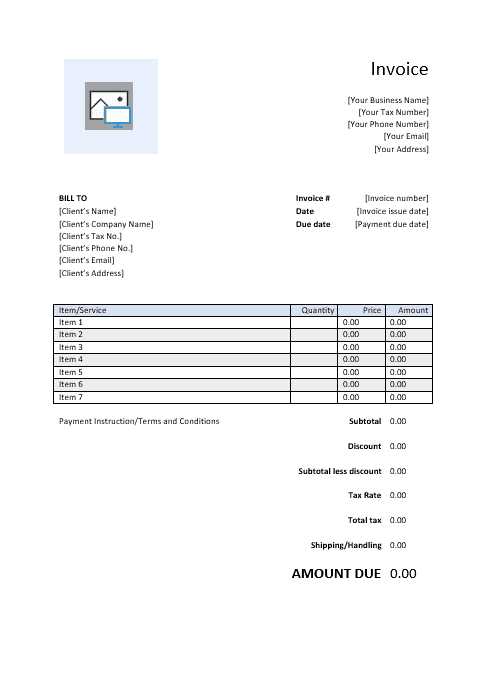

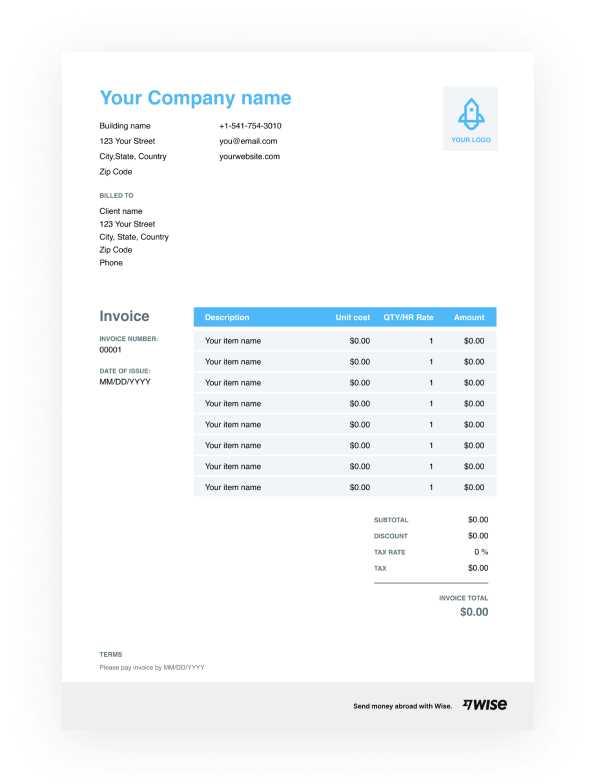

Here are the key elements to include in your payment request to ensure it looks professional and contains all necessary details:

| Component | Description |

|---|---|

| Your Contact Information | Include your name, business name, address, phone number, and email. This makes it easy for clients to reach you with questions or concerns. |

| Client’s Details | Make sure to list the client’s full name or company name, address, and contact information to ensure proper identification and billing. |

| Unique Reference Number | Assign a unique number to each request to easily track payments and keep records organized. This also helps with accountability. |

| Service Description | Provide a clear breakdown of the services or products provided, including any relevant dates, hours worked, or quantities sold. |

| Payment Terms | Clearly state the payment due date, accepted methods of payment, and any late fees or penalties for overdue amounts. |

| Total Amount Due | Include the total amount the client owes, making sure to itemize any taxes or additional fees that are applicable. |

By incorporating these essential components, you ensure that your payment requests are not only professional but also clear, helping to foster better relationships with your clients and streamline your business operations.

Essential Information for Invoices

When creating a document to request payment, it’s important to include all necessary details to ensure clarity and avoid confusion. This not only helps clients understand what they are being charged for, but also ensures that your records are complete for accounting and tax purposes. Including the right information is key to maintaining a professional and efficient billing process.

Key Elements to Include

Here’s a list of the essential details you should always include in a payment request document:

- Your Contact Information: Always include your full name (or business name), address, phone number, and email for easy communication.

- Client’s Information: Make sure to add the client’s name or company name and their contact details. This ensures there is no confusion about who the request is for.

- Unique Reference Number: Assign a unique number to each request for easy tracking and reference in your accounting records.

- Description of Services/Products: Clearly outline the services or products provided, including dates, hours worked, or quantities delivered. This helps your client understand exactly what they are paying for.

- Payment Terms: State the payment due date, preferred payment methods, and any late fees or penalties for overdue payments.

- Total Amount Due: Clearly show the amount due, breaking it down into individual costs and any applicable taxes or fees.

Additional Information to Consider

Depending on your business type and the relationship with your clients, you may also want to include the following:

- Discounts or Promotions: If applicable, provide information about any discounts or special offers that apply to the payment.

- Payment Instructions: Include specific instructions on how the payment should be made (bank details, online payment links, etc.).

- Notes or Comments: If needed, you can include any additional comments or clarifications related to the services or agreement.

By including all of these elements, you ensure that your financial documents are thorough, easy to understand, and professional, leading to smoother transactions with your clients.

Choosing the Right Invoice Format

Selecting the proper layout for your payment request is crucial to ensuring clarity and professionalism. A well-organized document not only helps you present your services or products in a straightforward way but also streamlines the process of collecting payments. The format you choose should align with your business needs, be easy for clients to understand, and facilitate smooth transactions.

Factors to Consider When Choosing a Layout

When deciding on a structure for your payment request, consider the following aspects:

- Business Type: The nature of your business plays a significant role in determining the complexity of your document. A simple layout may be sufficient for smaller, less complicated services, while more detailed formats might be necessary for projects involving multiple services or items.

- Branding: A consistent visual identity is important for your business. Choose a format that reflects your branding–whether that means adding your logo, specific fonts, or colors to create a cohesive look that matches your professional style.

- Client Preferences: Consider the preferences of your clients. Some clients may prefer a more straightforward, minimalist layout, while others might expect a more detailed breakdown of charges.

- Ease of Use: The format should be easy for you to update and for clients to read. Avoid clutter or excessive information, and ensure that all key sections are easy to locate, such as payment terms and amounts due.

Common Layout Options

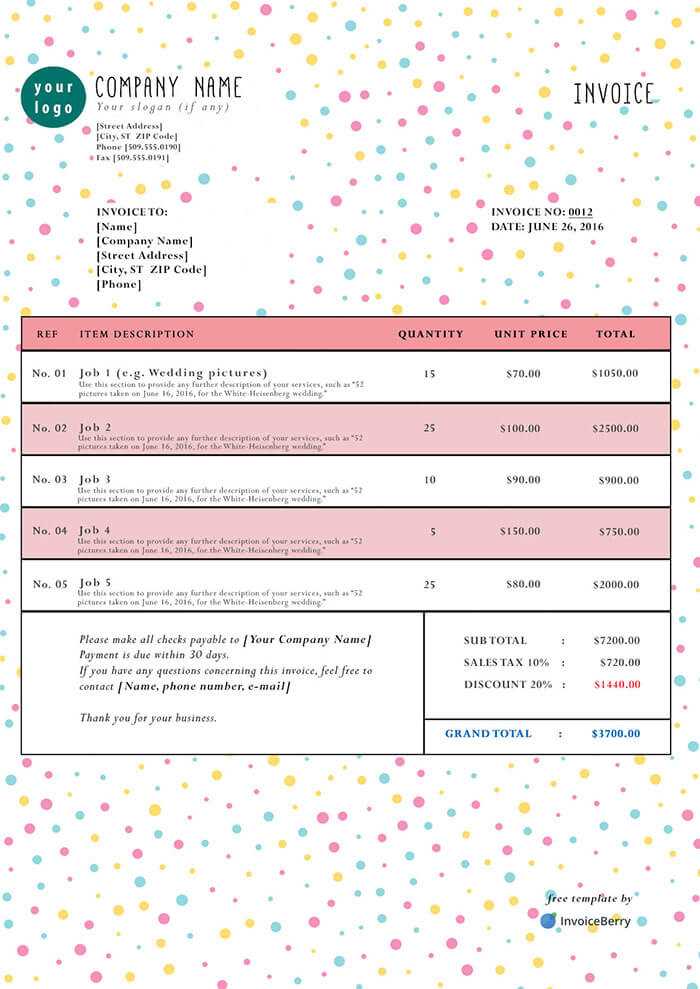

Here are some common formats to choose from, depending on your needs:

- Basic Format: A simple layout with essential details like the service description, amounts, and due date. Ideal for small projects or clients who prefer minimalism.

- Itemized Format: Best suited for businesses that provide a variety of services or products. This format includes a detailed breakdown of each item or service, with individual costs and total amounts for each line.

- Detailed Format: A more comprehensive layout that includes additional sections such as payment instructions, taxes, discounts, and specific terms and conditions. This format is often used for larger, more complex projects.

Choosing the right structure ensures that your payment request is professional, easy to understand, and well-received by your clients, ultimately helping you maintain efficient and organized financial operations.

Free Invoice Templates vs Paid Options

When it comes to creating a professional payment request, there are a variety of resources available to choose from. Some offer free solutions, while others come with a cost. Understanding the differences between free and paid options can help you determine which choice is best suited for your business. Both options have their own benefits and limitations, so it’s important to weigh the factors that matter most to you, such as ease of use, customization, and additional features.

Advantages of Free Resources

Free formats are a popular choice for small businesses or independent workers who are just starting out. These resources can be a great way to get up and running without any initial investment. Here are some benefits of using free options:

- Cost-Effective: As the name suggests, free resources don’t require any financial commitment, making them a good option for businesses on a tight budget.

- Quick Setup: Many free options are simple and easy to use, allowing you to quickly create and send requests without spending much time on customization.

- Basic Functionality: For businesses with straightforward billing needs, free formats often provide all the necessary components like contact information, services, and amounts due.

Benefits of Paid Solutions

Paid options typically offer more advanced features and greater flexibility in terms of design and functionality. While there is a cost involved, many find that the additional investment is worth it. Some key advantages include:

- Customization: Paid resources often provide a higher level of customization, allowing you to design a document that matches your brand identity and includes any unique fields that are important for your business.

- Advanced Features: Many premium options come with additional features, such as automatic calculations, integrated payment links, and customizable templates, which can save time and reduce errors.

- Professional Support: Paid solutions often come with customer service or technical support, offering assistance if you encounter any issues or need help with customization.

Ultimately, the decision between free and paid options depends on your business’s specific needs. If you require a simple, no-frills solution, free resources might be sufficient. However, if you need advanced features or a more polished, branded look, investing in a paid service could be the better option.

Understanding Invoice Numbers for Freelancers

When managing financial transactions, assigning a unique identifier to each payment request is an essential practice for freelancers. This system not only helps you keep track of your billing history but also improves organization and professionalism. A well-structured numbering system makes it easier to monitor outstanding payments, track progress, and maintain accurate records for tax and accounting purposes.

Why Use Unique Numbers?

Unique numbers for each payment request serve multiple purposes in the billing process. Here’s why they’re important:

- Tracking Payments: Assigning a distinct number to each request allows you to easily monitor whether clients have paid or if any payments are overdue.

- Professionalism: Using a numbering system demonstrates that you have an organized approach to your business operations, which can enhance your professional image.

- Easy Record-Keeping: Invoice numbers help you organize your financial documents chronologically, making it easier to find past records when needed for audits or tax filings.

Best Practices for Creating Invoice Numbers

There are several ways to structure your numbering system. Consider these tips for creating an effective approach:

- Start Simple: Begin with a basic sequential numbering system (e.g., 001, 002, 003) and increase the number with each new request.

- Incorporate Dates: To make your system more intuitive, consider including the year or month in the number (e.g., 2024-001 for the first request of the year).

- Use Prefixes or Suffixes: If you work with different clients or projects, you might want to add client codes or project names as part of the number (e.g., CLIENTA-001, CLIENTB-001).

- Stay Consistent: Whichever system you choose, keep it consistent across all requests to maintain organization and reduce the risk of confusion.

By implementing a well-thought-out numbering system, you can greatly improve the efficiency of your billing process, ensuring clear communication with clients and better management of your finances.

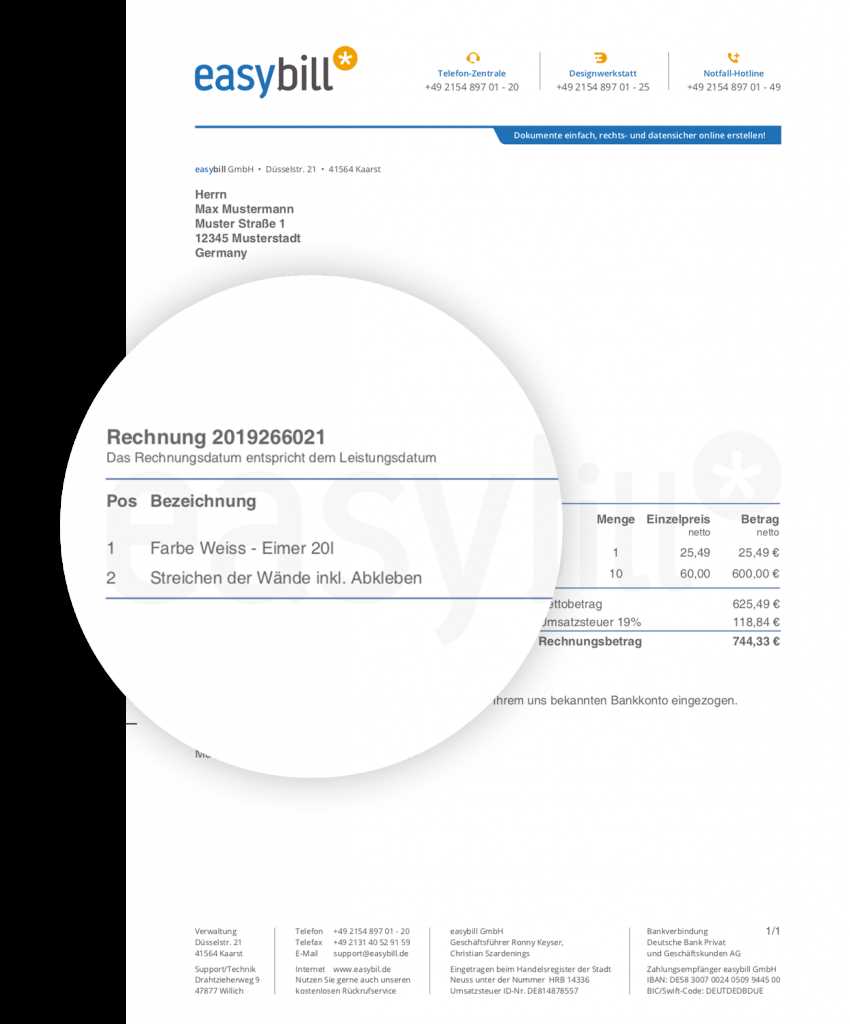

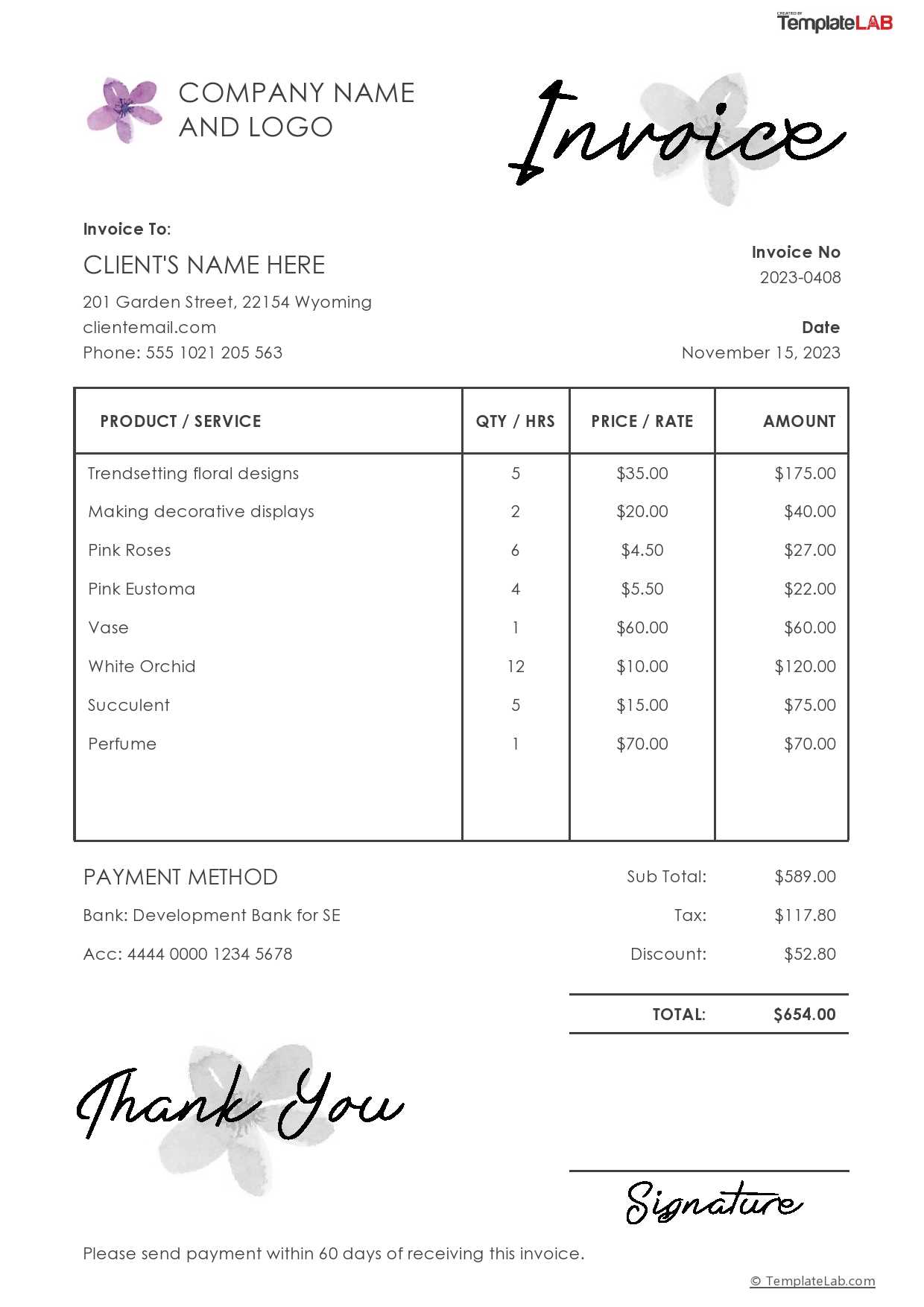

How to Add Taxes to Your Invoice

When charging clients for your services or products, it’s essential to account for applicable taxes. Including taxes properly ensures that you’re complying with local tax regulations while providing clarity to your clients about the total amount they owe. Adding taxes to your payment request document might seem complex, but with the right approach, it can be a simple and transparent process that benefits both parties.

Steps to Add Taxes

Here’s a straightforward guide to correctly adding taxes to your payment request:

- Identify Applicable Taxes: First, determine which taxes apply to your services or products. This could include sales tax, VAT (Value Added Tax), or other region-specific levies. The tax rate varies depending on your location and the type of service provided.

- Calculate the Tax Amount: To calculate the tax, multiply the total amount of the service or product by the tax rate. For example, if your service costs $100 and the tax rate is 10%, the tax amount would be $10.

- Add the Tax to the Total: Once you have the tax amount, add it to the original total of the service or product. The final amount will be the sum of the original price and the tax amount.

- Clearly Display the Tax on the Document: Make sure the tax amount is clearly listed on your payment request, along with the base price, the tax rate, and the total amount due. This ensures transparency and avoids confusion.

Example

Let’s say you provided a service that costs $150, and the applicable tax rate is 8%. The calculation would be as follows:

- Service Cost: $150

- Tax Rate: 8%

- Tax Amount: $150 * 0.08 = $12

- Total Amount Due: $150 + $12 = $162

Ensure that both the original cost and tax are clearly listed, along with the total amount due, so your client can easily see how the final amount was calculated.

By following these steps, you’ll ensure that your payment requests are accurate, transparent, and compliant with tax regulations, while also maintaining professionalism in your financial dealings with clients.

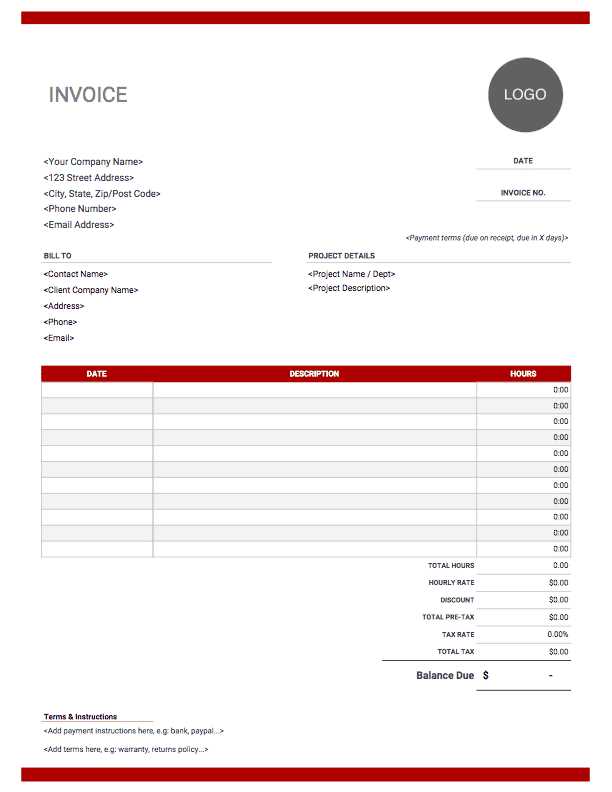

Common Mistakes in Self-Employed Invoices

Creating a clear and accurate payment request is crucial for maintaining professionalism and ensuring timely payments. However, there are several common mistakes that many independent workers make when preparing these documents. These errors can lead to confusion, delayed payments, and potential disputes with clients. Understanding and avoiding these mistakes can help you maintain smooth financial operations and build better client relationships.

Here are some of the most frequent mistakes to watch out for:

| Mistake | Impact | How to Avoid |

|---|---|---|

| Missing Client Details | Without accurate contact information, clients may not know who the payment request is for or how to contact you for clarification. | Always ensure that both your and your client’s contact information are correctly listed. |

| Incorrect Payment Amounts | Errors in the total cost or missing calculations can lead to delays in payment and disputes over charges. | Double-check all calculations and ensure that taxes, discounts, and fees are included correctly. |

| Unclear Payment Terms | Without clear payment terms, clients may be confused about the due date, accepted payment methods, or any late fees. | Clearly state payment due dates, methods of payment, and any applicable late fees or penalties. |

| Lack of Unique Reference Numbers | Without unique identifiers, tracking payments and maintaining accurate records becomes difficult, especially when managing multiple clients. | Assign a unique reference number to each request to facilitate tracking and organization. |

| Failure to Include Tax Information | Not listing taxes can lead to legal issues or confusion about the final amount due, especially if you’re required to charge tax. | Ensure that any taxes are included, with clear descriptions and the correct rates applied. |

| Not Following a Consistent Format | Inconsistent formatting can make your payment requests look unprofessional and difficult to read. | Use a consistent layout and clear headings for each section of the document. |

By avoiding these common errors, you can ensure that your payment requests are professional, clear, and accurate, leading to smoother transactions and improved client satisfaction.

Best Tools for Generating Invoices

Creating accurate and professional payment requests doesn’t have to be time-consuming. Today, there are a variety of tools available that can help you quickly generate documents, automate calculations, and even send them directly to your clients. Whether you’re looking for simplicity or more advanced features, the right tool can save you valuable time and ensure your records are always in order.

Here are some of the best tools for creating detailed payment requests:

1. FreshBooks

FreshBooks is an easy-to-use accounting tool designed for small businesses and independent contractors. It offers customizable templates that you can personalize with your business logo and client details. The tool also integrates with payment gateways to accept online payments directly from the document.

2. QuickBooks

QuickBooks is a popular option for freelancers and businesses alike. It provides comprehensive invoicing features, including automated billing, recurring requests, and detailed reports. With QuickBooks, you can also track expenses and taxes, making it a great all-in-one accounting solution.

3. Zoho Invoice

Zoho Invoice is a versatile platform that offers a variety of templates and customization options. It allows users to manage multiple clients and projects, making it an ideal choice for freelancers with diverse services. Zoho also provides useful tools for tracking time and expenses, which can be incorporated into your payment requests.

4. PayPal

PayPal offers a simple yet effective tool for generating payment requests. While it may not offer as many customization features as other options, it’s convenient for freelancers who want to quickly send requests and receive payments through the platform. It’s also a popular choice among clients, making it easy to accept payments worldwide.

5. Wave

Wave is a free accounting software that provides easy-to-use invoicing features. It allows you to customize your documents and track your earnings and expenses. Since it’s free, it’s especially beneficial for freelancers who are just starting out and need basic but reliable tools for their billing needs.

Choosing the right tool depends on the level of customization you need, your budget, and whether you need additional accounting features. These tools offer a range of solutions, from simple to comprehensive, to help you streamline the billing process and ensure that your financial transactions are always accurate and professional.

How to Save Time with Templates

For freelancers and small business owners, efficiency is key to managing workloads and staying organized. One of the best ways to save time when preparing payment requests is by using pre-made documents that can be quickly filled out and sent to clients. By relying on ready-to-use formats, you can eliminate the need to start from scratch each time, allowing you to focus on delivering quality services and maintaining smooth client relationships.

Here are some ways that using structured documents can help you streamline the billing process:

1. Consistent Formatting

Pre-designed formats provide a consistent layout that ensures all the necessary details are included and properly organized. You won’t need to spend time figuring out the structure each time, as everything will already be in place. This consistency also promotes professionalism and makes it easier for clients to review and process payments.

2. Reduced Error Rates

Using pre-built documents can significantly reduce the chances of making mistakes. Since the fields and sections are already set up, you’re less likely to forget important details, such as payment terms, tax information, or contact details. This also minimizes the need for revisions and clarifications, saving you valuable time and ensuring your requests are accurate.

3. Customizable for Your Needs

Many pre-made documents are fully customizable, allowing you to tailor them to your specific business needs. You can easily add your business logo, adjust the design, and modify sections such as descriptions, rates, and payment terms. This flexibility ensures you can personalize the document without having to start from scratch each time.

4. Quick Updates for Repeat Clients

For recurring clients or projects, pre-designed formats make it easy to quickly update and reuse previous documents. Instead of creating a new document each time, you can simply adjust the details (like the service provided and the amount) and send it out with minimal effort. This is particularly helpful when managing multiple clients or projects simultaneously.

By leveraging pre-made formats, you can save time, reduce errors, and maintain a professional workflow. With minimal effort, you can send out accurate and organized payment requests, giving you more time to focus on what you do best–serving your clients and growing your business.

Understanding Payment Terms in Invoices

Clear and precise payment terms are essential for ensuring that both parties–service providers and clients–are on the same page regarding expectations for payments. These terms outline when payments are due, how they should be made, and any penalties for late payments. By specifying these details in your payment requests, you can help prevent misunderstandings and ensure that your business operations run smoothly.

Key Components of Payment Terms

Payment terms typically include several important elements, each designed to make the transaction process clearer and more organized. Here are the key components:

- Due Date: This is the date by which payment must be made. It’s essential to be specific, as vague terms like “net 30” or “upon receipt” can lead to confusion.

- Accepted Payment Methods: Specify the methods of payment you accept, such as bank transfers, credit card payments, or digital payment platforms like PayPal.

- Late Fees: If payments are not made by the due date, late fees should be outlined. This encourages timely payment and helps offset the inconvenience of delays.

- Discounts for Early Payment: Offering discounts for early payments can incentivize clients to pay sooner, improving cash flow for your business.

Common Payment Terms Used in Business

Different businesses may use different payment terms depending on their preferences or industry standards. Here are a few common options:

- Net 30: Payment is due within 30 days of the service completion date.

- Net 15: Payment is due within 15 days of the invoice date.

- Upon Receipt: The payment is expected as soon as the client receives the payment request.

- Due on Receipt: Payment is due immediately when the client receives the document.

- COD (Cash on Delivery): Payment is made at the time of service delivery, often used for tangible goods.

By clearly outlining your payment terms, you can avoid delays and confusion while encouraging timely payments from clients. This also helps maintain a professional and transparent relationship with your clients, contributing to better cash flow management.

Legal Requirements for Self-Employed Invoices

When preparing payment requests as a freelancer or independent contractor, it’s essential to ensure that your documents meet legal requirements. Different regions have specific laws governing what must be included in such documents to ensure both parties are protected. Failing to meet these requirements can lead to delays in payments, legal issues, or even fines. Understanding and adhering to the legal guidelines helps protect your business and ensures compliance with local regulations.

Key Legal Elements to Include

There are several critical components that must be present in a valid payment request, depending on your jurisdiction. Below are the key elements you should include to ensure that your document meets legal standards:

- Your Full Business Name and Contact Information: You must include your full legal name or the name of your business, along with your address, phone number, and email. This ensures that your client can easily identify you and contact you if needed.

- Client Information: Include your client’s full name or business name, address, and contact details. This is important for legal purposes and ensures that the request is properly directed to the right party.

- Unique Document Number: Each payment request must have a unique identification number for tracking purposes. This helps both you and your client manage and reference past transactions.

- Clear Description of Goods/Services: A detailed breakdown of the services or products provided, along with the associated costs. This is crucial for transparency and avoids any misunderstandings between you and your client.

- Applicable Tax Information: If you are required to charge taxes, you must clearly list the tax rate and the amount being charged. This ensures you comply with local tax laws and provide your clients with all the information they need for their own records.

- Payment Terms and Due Date: Specify when the payment is due, accepted payment methods, and any penalties for late payments. This provides clear expectations and protects your business interests.

Additional Considerations

In some regions, you may also need to include other details, such as your business registration number or VAT ID, especially if you are dealing with clients from different countries. It’s also advisable to keep a record of each payment request for tax purposes and to help resolve any disputes that may arise.

By understanding and following these legal requirements, you can avoid potential issues and ensure that your payment requests are legitimate, clear, and enforceable. This not only promotes professionalism but also helps protect your bu

How to Manage Multiple Clients’ Invoices

When juggling several clients, keeping track of financial transactions can quickly become overwhelming. Ensuring that each payment request is correctly generated, sent, and followed up on requires organization and consistency. Effective management techniques help prevent errors, reduce confusion, and ensure that payments are received on time. Here are strategies to help you streamline the process and stay on top of multiple clients’ financial needs.

1. Use a Centralized System

One of the best ways to manage several clients’ financial records is to use a centralized system. Whether it’s an accounting software, spreadsheet, or project management tool, having all your payment details in one place can save time and reduce the chances of missing important deadlines. By centralizing all data, you can easily access and update client information, service details, and due dates.

2. Organize by Client

For efficient tracking, organize your records by client. You can either create separate folders for each client or use client-specific codes to track their payments. This way, you’ll always know where to find the details you need and ensure that you can quickly reference past transactions when necessary. Be sure to include essential information like the service provided, the agreed amount, and payment status for each client.

Additionally, it’s helpful to set up reminders or automated alerts for each client’s payment due dates. This ensures you never miss a deadline, making it easier to follow up with clients if necessary.

3. Automate Recurring Transactions

If you have long-term or recurring clients, consider setting up automatic payment requests. Many software solutions allow you to automate billing for regular services, reducing the administrative work and ensuring you’re paid on time. This is especially helpful for clients on subscription-based services or those with long-term contracts.

4. Keep Detailed Records

Thorough record-keeping is essential when managing multiple clients. By maintaining clear, detailed records of each payment request, including the services provided, payment terms, and communications, you can prevent misunderstandings and disputes. These records also come in handy when preparing financial statements or tax returns, ensuring that you have all the necessary information at your fingertips.

By using these strategies, you can effectively manage multiple clients’ financial transactions, ensuring smooth operations and on-time payments for your business. Staying organized not only helps you reduce stress but also enhances professionalism and client satisfaction.

How to Edit and Update Your Invoice

Maintaining accurate and up-to-date payment requests is essential for effective financial management. Sometimes, you may need to make adjustments or updates to previously issued documents. Whether it’s correcting an error, adding new services, or revising payment terms, knowing how to properly edit and update your requests ensures that both you and your clients have the correct information. Below are key steps to help you manage these changes efficiently.

1. Review the Original Document

Before making any changes, carefully review the original document to ensure that you understand the context of the transaction. This includes checking the services or products listed, the payment terms, and any previously agreed-upon amounts. It’s also essential to verify client information, such as their contact details and billing address, to ensure accuracy.

2. Make Necessary Edits

Once you’ve reviewed the original request, you can begin making necessary edits. Common updates include:

- Adjusting the Amount: If there was an error in the pricing or if additional services have been added, update the total amount accordingly.

- Correcting Dates: If the due date or the date of service needs to be changed, update these fields to reflect the new terms.

- Changing Payment Terms: If your payment terms have changed, or if you’re offering a discount or new payment method, update the relevant sections to reflect these modifications.

- Adding Additional Services: If new services or products were provided after the original request was sent, be sure to include them with appropriate descriptions and pricing.

3. Issue an Updated Document

After making the necessary edits, it’s crucial to ensure that the updated document is clearly marked as an amended or revised version. If you’re sending the updated payment request to your client, consider including a note explaining the changes made. For example, you can mention that the new version reflects an additional service or a corrected amount. This transparency helps avoid confusion.

4. Keep Track of Changes

Whenever you make changes to a payment request, it’s important to keep a record of the modifications. Whether through software or a simple document log, tracking updates allows you to refer back to past versions if necessary. This is especially important for tax purposes or when dealing with multiple revisions for a single client.

By following these steps and maintaining a systematic approach, you can ensure that your financial documents remain accurate, professional, and up-to-date–reducing the risk of misunderstandings and ensuring smooth business operations.

Where to Find Professional Payment Request Forms

Finding the right forms for creating payment requests is essential for any business. These documents help maintain professionalism and ensure that all important details are included. Fortunately, there are several reliable sources where you can access customizable documents, either free or for a fee. The following options provide a range of solutions, from simple forms to comprehensive tools designed for more complex billing needs.

1. Free Online Resources

There are numerous websites offering free customizable forms for creating payment requests. These sites often allow you to download basic documents that you can quickly personalize with your details. While the free versions may have limited features, they can be sufficient for basic needs.

| Website | Features | Cost |

|---|---|---|

| Invoice Generator | Simple and quick; customizable fields | Free |

| Zoho Invoice | Customizable with basic features | Free for up to 5 clients |

| PayPal | Integrated with PayPal payments | Free |

2. Paid Solutions for Advanced Features

If you need more advanced features such as automatic reminders, recurring billing, or additional payment tracking options, paid solutions may be the best choice. These platforms often offer greater customization, templates for specific industries, and integration with accounting software.

| Website | Features | Cost |

|---|---|---|

| QuickBooks | Comprehensive billing, tax calculations, and reporting | Subscription-based |

| FreshBooks | Time tracking, project management, and invoicing | Monthly subscription |

| Wave Accounting | Free with paid features for advanced invoicing | Free and paid options |

Whether you are a freelancer, contractor, or small business owner, finding the right tool to create and manage payment requests is crucial for smooth operations. Free resources work well for straightforward needs, but paid platforms can provide additional functionalities for more complex billing structures. Choose the option that best fits your requirements and budget to ensure professional and efficient financial management.