Self Employed Invoice Template for Canada

When running your own business or working on a freelance basis, managing finances effectively is key to long-term success. One of the most important aspects of this process is issuing clear and accurate billing statements to clients. A well-structured document ensures that both parties are aligned on the terms of payment, reducing confusion and improving cash flow.

By using a structured format for your charges, you not only maintain professionalism but also comply with local financial regulations. This approach helps you stay organized, track payments, and avoid any miscommunication with clients. Regardless of the nature of your services, having a reliable method for documenting transactions is essential for smooth business operations.

In this guide, we’ll explore the necessary components of an efficient billing system, share best practices, and show you how to create a personalized document that suits your needs. Whether you’re a consultant, contractor, or small business owner, understanding the fundamentals will ensure you handle payments seamlessly.

Understanding Billing Documents for Independent Workers

For those working on their own, preparing proper documentation for services rendered is crucial to maintaining professionalism and ensuring timely payment. A well-prepared statement clearly communicates the details of the transaction and provides a transparent overview of services, fees, and payment terms. This is essential for both freelancers and small business owners who handle their own finances.

Key Elements to Include in Your Billing Document

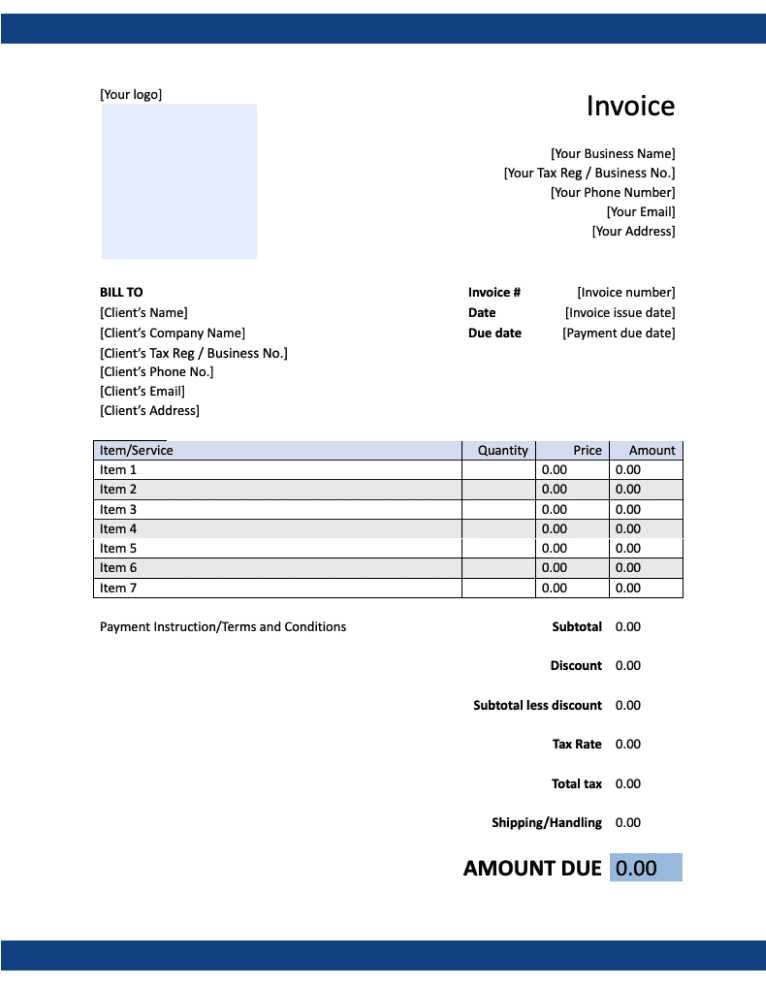

There are several key components that should always be included in a billing document to ensure it is complete and accurate. These elements help prevent misunderstandings and ensure smooth financial transactions. The following are the most important items to incorporate:

- Contact Information: Include your full name or business name, address, phone number, and email. This allows clients to reach out if needed.

- Client Details: Include your client’s name, business name (if applicable), and contact information.

- Description of Services: Provide a detailed breakdown of the work performed, hours worked, and any other relevant details.

- Charges and Rates: List the agreed-upon rates for services rendered, including any taxes or additional fees.

- Payment Terms: Clearly outline when payment is due and the acceptable methods of payment.

Why Proper Documentation is Essential

Having a properly structured document benefits both the service provider and the client. It minimizes the chances of disputes by offering clarity about what was agreed upon. Furthermore, it helps with managing finances, tracking payments, and staying compliant with local tax regulations. Regular use of accurate billing statements fosters trust and ensures a smooth business relationship.

By consistently issuing professional and transparent documents, independent workers can streamline their business practices, keep organized records, and focus more on delivering high-quality services to their clients.

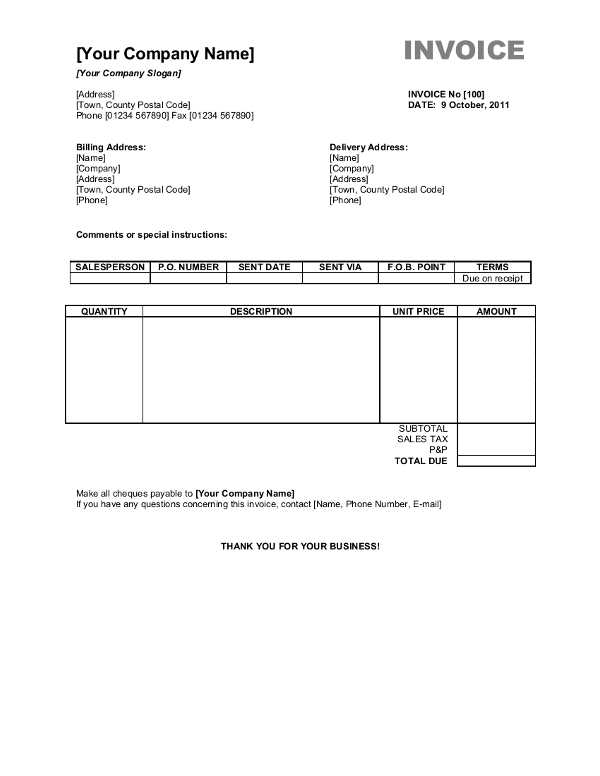

Why You Need an Invoice Template

When you manage your own business or work independently, organizing and documenting transactions is essential for both clarity and professionalism. Having a ready-made structure for creating billing documents helps save time, reduce errors, and ensure that all necessary information is included. Without this tool, there’s a risk of forgetting key details or providing inconsistent documentation, which could lead to payment delays or disputes.

Time-Saving Benefits

Creating a document from scratch for each client can be a lengthy process, especially if you’re juggling multiple projects. By using a pre-designed structure, you can quickly generate new records by simply filling in the relevant details. This eliminates the need to format everything manually each time, freeing up more time to focus on the work itself.

Consistency and Professionalism

Maintaining consistency across all your transactions is vital for building credibility with your clients. A well-designed structure ensures that every record looks professional, reflects the same format, and includes all necessary elements. Clients are more likely to trust a structured, easy-to-read document, which in turn encourages prompt payments.

In addition, using a standard format allows you to comply with industry practices and local regulations more easily. It ensures that all legal requirements, such as tax information or payment terms, are clearly outlined. This consistency not only simplifies your record-keeping but also helps establish a reliable and professional business image.

Key Elements of an Invoice

When creating a billing document for your services, it is important to include certain critical details to ensure clarity, accuracy, and prompt payment. Each document should be complete and easy to understand, both for you and for the client. By including the necessary components, you can avoid confusion and maintain a professional business relationship.

Essential Information to Include

While the specific details may vary depending on the nature of the services, there are several key elements that should always be included in any billing record:

- Contact Information: Always list your name or business name, address, phone number, and email. This allows clients to reach out if there are any questions regarding the payment.

- Client Details: Include the full name or business name of your client along with their contact information to ensure clarity and avoid any confusion about the recipient of the document.

- Description of Services: Clearly outline the work performed, hours spent, and any other relevant details. This helps the client understand exactly what they are paying for.

- Amounts and Charges: Provide a detailed breakdown of the costs associated with the work, including any additional fees, taxes, or discounts. Specify the agreed-upon rate for each service.

- Payment Terms: Outline the payment due date and acceptable methods of payment. Clearly state the terms to avoid delays in receiving funds.

- Unique Reference Number: Use a unique identifier for each document to help track payments and simplify record-keeping. This is especially helpful for both parties when referencing past transactions.

Why These Elements Matter

Including these elements not only ensures that the billing document is legally compliant and clear, but it also improves the likelihood of receiving payment on time. When clients can easily review the charges and understand the terms, they are more likely to pay promptly and without dispute. Clear communication fosters trust and helps establish a positive working relationship.

Customizing Your Billing Document for Canada

When working with clients in a specific region, it is important to adjust your payment records to reflect local regulations and standards. In the case of Canada, this means ensuring that your financial documents include the necessary tax information, compliance with local laws, and clear language that is familiar to Canadian clients. Customizing your billing documents helps you avoid confusion and ensures that both you and your clients are on the same page regarding fees, taxes, and payment terms.

To meet local requirements, there are several key aspects that need to be considered when tailoring your document for clients in Canada:

- Tax Information: In Canada, you must account for Goods and Services Tax (GST) or the Harmonized Sales Tax (HST), depending on your province. Make sure to include the applicable tax rate and clearly specify any tax amounts.

- Currency: Use Canadian dollars (CAD) as the currency for all amounts listed. This will help ensure clarity for clients and avoid confusion with international billing.

- Business Number: If you are registered for GST/HST, include your Business Number (BN) on the document. This is a requirement for tax purposes and ensures that your client can properly claim the taxes paid on their end.

- Payment Terms: Ensure that your payment terms reflect standard Canadian practices. Specify due dates clearly, and include any late fees or interest rates for overdue payments if applicable.

By customizing your payment documents in line with local practices and legal requirements, you can build trust with Canadian clients and demonstrate professionalism. It also makes your transactions more transparent, helping to avoid potential issues down the line.

Best Free Billing Documents for Independent Workers

For independent workers looking to streamline their financial processes, using a ready-made structure can save both time and effort. There are many free options available that provide professional-looking layouts, ensuring that your records are accurate, clear, and easy to manage. Choosing the right document format can help you stay organized, enhance your professionalism, and ensure all essential details are included.

Top Free Resources for Billing Documents

Many websites offer free, downloadable formats that you can easily customize for your business needs. Here are some of the best options for independent workers:

- Google Docs: Google Docs offers simple, editable templates that can be customized with your business details. It’s easy to access and share, and it integrates well with other Google tools.

- Microsoft Word: Microsoft provides a variety of free downloadable billing document formats that can be quickly personalized. These templates are easy to edit and work well for those who prefer offline tools.

- Invoiced: Invoiced offers a free, user-friendly platform where independent workers can create and send professional documents directly from the website.

- Zoho Invoice: Zoho offers a free version of its online software that includes templates and customizable features, perfect for managing multiple client records in one place.

- Canva: Canva provides visually appealing and highly customizable options, especially for those who want a more creative or branded look for their documents.

Why Choose a Free Resource?

Using free tools to create your billing documents allows you to maintain professionalism without the cost of expensive software. These resources are easy to use, customizable, and provide all the essential features for generating clear, accurate billing statements. Many of these options also allow for the storage and sharing of documents, helping you keep track of payments with minimal effort.

Choosing the best free option depends on your specific needs, whether you require simple functionality or more advanced customization. These resources help independent workers stay organized and maintain strong client relationships with professional-looking records.

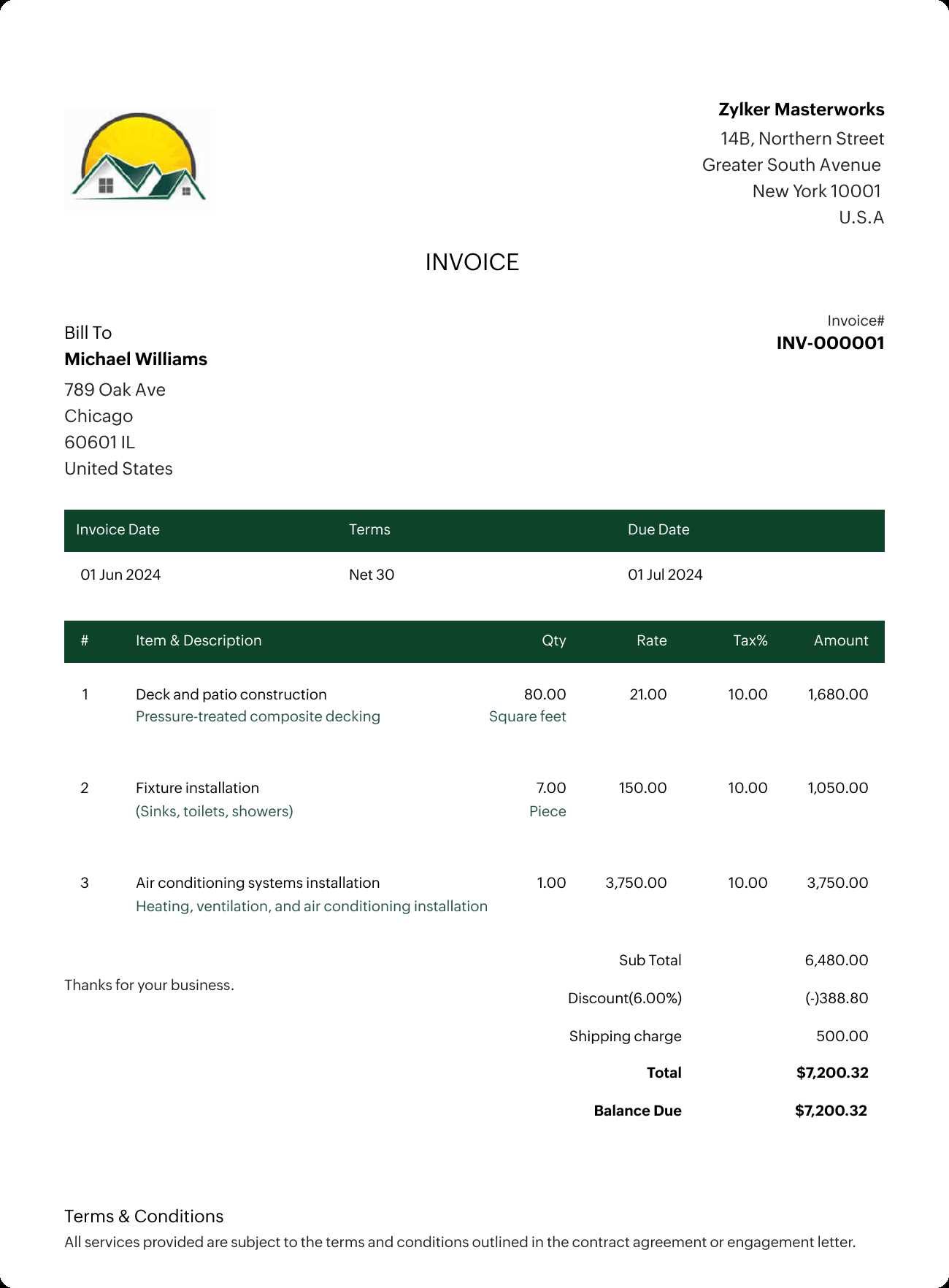

How to Add Tax Information to Billing Documents

Including tax details in your financial records is essential for compliance and transparency. When working with clients, it is crucial to outline the applicable tax amounts, rates, and provide clear information about how these are calculated. Properly incorporating tax information ensures you meet legal requirements and helps your clients understand the total amount due.

Steps to Include Tax Details

To ensure that you are correctly adding tax information, follow these steps when creating your payment document:

- Determine the Appropriate Tax Rate: Depending on your location and the type of services you offer, you will need to apply the correct tax rate. In many regions, this includes sales taxes such as the Goods and Services Tax (GST) or Harmonized Sales Tax (HST).

- Break Down Tax Separately: Clearly separate the tax amount from the total charges for your services. This allows clients to see exactly what they are paying in taxes.

- Provide Tax Identification Number: If required, include your business number or tax identification number (TIN) for clients to reference when filing their own taxes or claiming deductions.

- Include Total Amount Due: After adding tax, clearly indicate the total amount due, including both service charges and tax amounts.

Example Breakdown

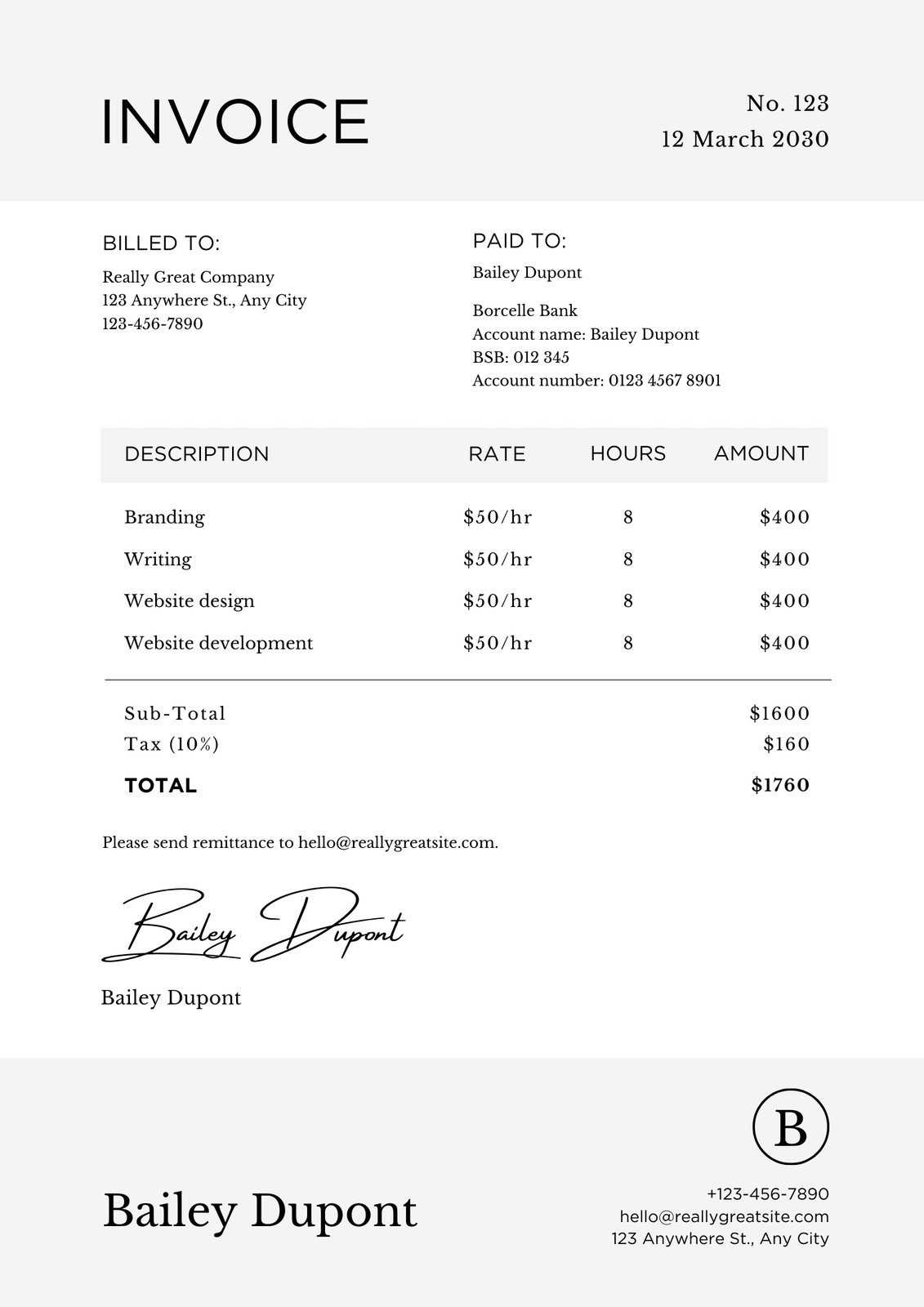

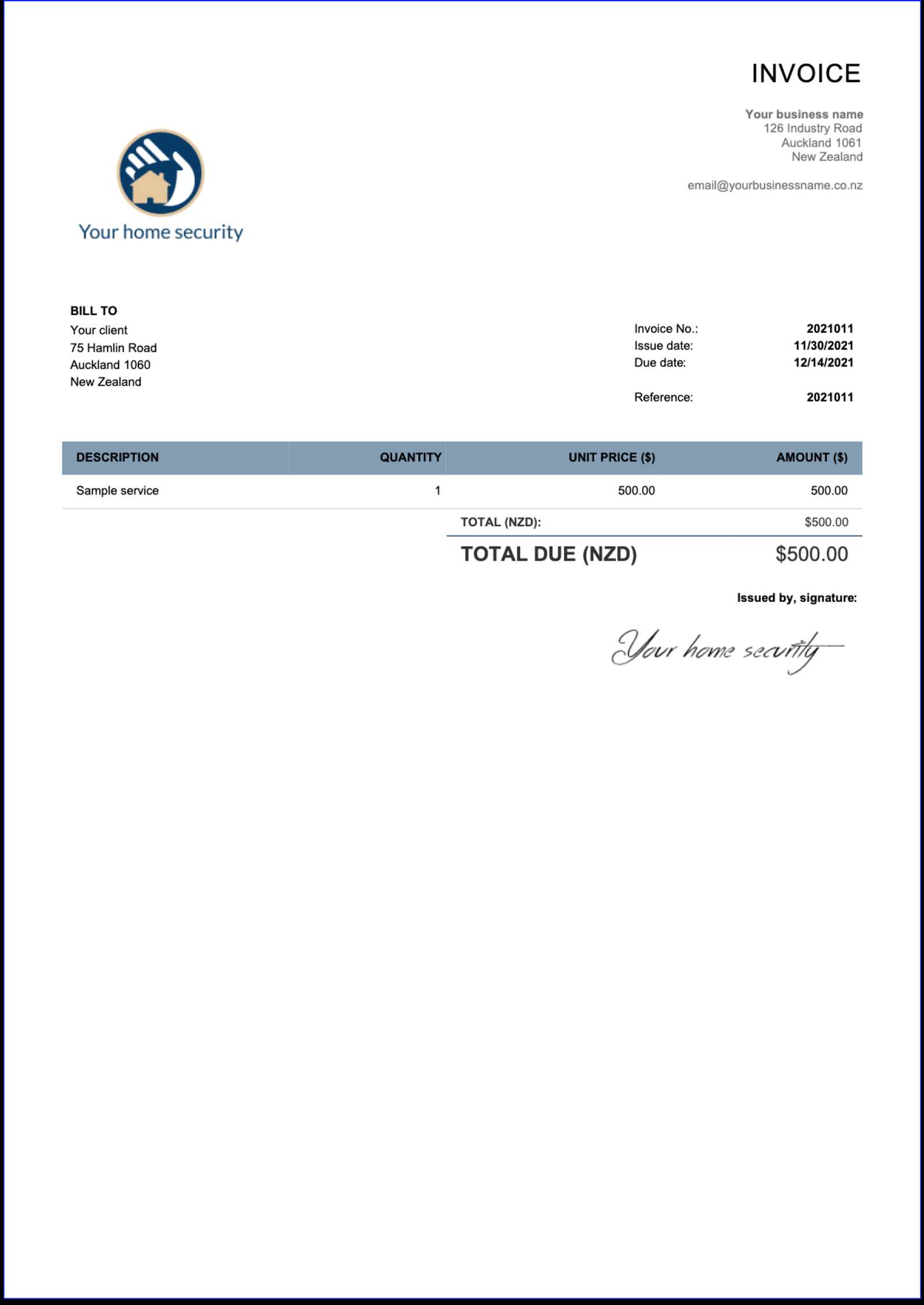

The following table shows how to break down a transaction with taxes included:

| Description | Amount |

|---|---|

| Service Fee | $500.00 |

| Sales Tax (GST @ 5%) | $25.00 |

| Total Amount Due | $525.00 |

By clearly displaying the service charge and tax amounts, you create a transparent and professional document that helps avoid confusion and ensures timely payment. Including tax information is not only a best practice but also a legal requirement in many regions.

Including Payment Terms in Your Billing Document

Clear payment terms are a crucial part of any transaction agreement. By outlining when and how you expect to be paid, you help set expectations for both you and your client. This ensures that payments are made on time and avoids confusion or disputes regarding due dates, late fees, or payment methods. Properly communicating payment terms can strengthen your professional relationships and keep your business running smoothly.

Key Elements of Payment Terms

Including the right details in the payment terms section of your billing document is essential for clarity. The following aspects should always be outlined:

- Due Date: Specify the exact date by which payment should be made. This helps avoid delays and provides a clear timeline for the client.

- Accepted Payment Methods: List the types of payments you accept, such as bank transfer, credit card, cheque, or digital payment platforms like PayPal or Venmo.

- Late Payment Fees: If applicable, indicate the interest rate or flat fee for late payments. This can serve as an incentive for clients to pay promptly.

- Discounts for Early Payment: If you offer discounts for early settlement, be sure to specify the amount or percentage, and the time frame in which it applies.

Example Payment Terms

Here is an example of how to structure the payment terms section in your billing document:

| Description | Details |

|---|---|

| Payment Due Date | Within 30 days of the billing date |

| Accepted Payment Methods | Bank Transfer, PayPal, Credit Card |

| Late Payment Fee | 2% interest per month on overdue balances |

| Early Payment Discount | 5% discount if paid within 10 days |

By including detailed payment terms, you ensure that your clients understand when and how to make payments, which helps to avoid delays and potential issues. Being clear about expectations benefits both parties and helps maintain a smooth, professional working relationship.

What to Do When Clients Don’t Pay

Non-payment is a common issue that many independent workers face, and it can be frustrating when clients fail to settle their bills on time. It’s important to take a systematic approach to resolve the situation while maintaining professionalism. Knowing how to handle late payments can help preserve your cash flow and protect your business from financial strain.

Steps to Take When Payment is Delayed

If a client hasn’t paid by the due date, it’s essential to act promptly. Here are the steps you should follow to address late payments:

- Review the Agreement: Before reaching out to the client, double-check the agreed-upon payment terms. Ensure that the due date has passed and there are no discrepancies in the charges.

- Send a Friendly Reminder: A polite email or message can be the first step in addressing the issue. Remind the client of the outstanding balance, providing all the necessary details, such as the original due date and payment method.

- Follow Up with a Formal Request: If the initial reminder does not prompt payment, send a more formal notice. Include a clear statement of the amount due and the consequences of continued non-payment.

- Offer Payment Plans: If the client is struggling with payment, offer the possibility of a payment plan. This can help ensure you eventually receive payment while being flexible to the client’s situation.

- Charge Late Fees: If your payment terms include late fees, now is the time to apply them. Be sure to clearly communicate the additional charges and the updated amount due.

- Consider Legal Action: As a last resort, if all attempts to recover the payment fail, you may need to consider legal action. Consulting with a lawyer or using a collection agency may be necessary for larger sums or repeated offenses.

Best Practices to Prevent Late Payments

While dealing with overdue payments is sometimes unavoidable, there are steps you can take to minimize the risk of non-payment in the future:

- Clear Payment Terms: Always set clear payment expectations upfront, including due dates and penalties for late payments. Having these details in writing helps both parties avoid misunderstandings.

- Request Deposits: For larger projects, request a deposit before starting the work. This ensures that you receive some payment upfront, reducing the risk of non-payment.

- Use Payment Reminders: Send gentle reminders a few days before the payment is due to prompt clients to make arrangements on time.

- Offer Multiple Payment Methods: Make it as easy as possible for clients to pay by offering various payment methods such as bank transfer, credit card, or online payment systems.

By following these steps, you can address late payments professionally and reduce the impact they have on your business. Having a clear, structured approach to overdue payments will not only help protect your income but also reinforce your reputation as a reliable business partner.

Common Mistakes to Avoid on Billing Documents

When preparing a document for payment, it’s easy to overlook important details or make small errors that can lead to confusion or delays. Mistakes in billing records can lead to misunderstandings with clients, and can even delay payments or affect the professional image of your business. Being aware of these common mistakes and avoiding them can help ensure that your financial transactions run smoothly and efficiently.

Frequent Errors to Watch Out For

Here are some of the most common mistakes to avoid when creating payment records:

- Incorrect or Missing Contact Information: Always ensure that your contact details, as well as the client’s information, are correct. Missing or inaccurate details can lead to confusion about who the payment is for and delay the processing of the payment.

- Unclear Service Descriptions: A vague or incomplete description of the work performed can cause confusion. Clearly outline the services provided, including the hours worked and any specific tasks completed. This transparency helps avoid disputes.

- Not Including a Payment Due Date: Failing to specify when payment is due can lead to delays or misunderstandings. Always include a clear and specific due date to set expectations for timely payment.

- Forgetting to Apply Taxes: Depending on your location and the nature of the services, taxes like sales tax or VAT may be required. Make sure to apply the correct tax rate and specify it separately in the document to ensure proper compliance.

- Inconsistent Formatting: A messy or inconsistent layout can make your billing document look unprofessional and harder to read. Stick to a clean, organized format with clearly labeled sections for charges, taxes, and total amounts.

- Not Including Payment Methods: It’s crucial to specify how clients can pay, whether through bank transfer, credit card, or other methods. Leaving this out can delay payment or cause confusion.

How to Avoid These Mistakes

By paying attention to detail and following a consistent process, you can avoid these errors. Here are a few tips:

- Double-Check Information: Always double-check the contact information, service descriptions, and payment terms before sending the document.

- Use a Structured Format: Whether you create your own or use a template, ensure that the structure is consistent and easy to follow. Use headings, bullet points, and clear section labels.

- Get Familiar with Local Tax Rules: Be aware of local tax regulations and ensure that the correct rates are applied. This will help avoid any legal issues or miscalculations.

- Send Regular Reminders: To avoid late payments, include payment due dates clearly and send reminders a few days before the due date.

By avoiding these common mistakes, you can ensure that your billing documents are accurate, clear, and professional. This not only helps to maintain good relationships with clients but also contributes to smoother cash flow and fewer payment delays.

How to Track Payment Receipts

Keeping track of payments is a crucial aspect of managing your business finances. By monitoring which payments have been made and which are still outstanding, you can ensure that your cash flow remains steady and that you stay on top of any overdue amounts. Proper tracking helps prevent missed payments, ensures accuracy in your financial records, and allows you to address issues quickly if payments are delayed.

There are various methods to track payments effectively, and choosing the right system depends on the size and complexity of your business. Whether you manage a few transactions per month or deal with multiple clients, it’s essential to have a reliable way to monitor the status of each payment.

Methods for Tracking Payments

Here are some common methods for keeping an eye on incoming payments:

- Manual Tracking: Using a simple spreadsheet or paper ledger to record each payment as it comes in. While this method is straightforward, it can become time-consuming and error-prone as your business grows.

- Accounting Software: Many accounting tools and platforms (such as QuickBooks, FreshBooks, or Xero) allow you to track payments automatically. These programs often integrate with your bank account and payment systems, making it easier to see the status of payments in real time.

- Payment Gateway Reports: If you accept payments through an online platform or payment gateway, such as PayPal or Stripe, you can track incoming payments directly from the reporting features within these services. They often offer detailed transaction logs, showing the date, amount, and method of each payment.

- Bank Statements: For those who primarily receive payments through direct bank transfers, regularly reviewing your bank statements is essential for identifying incoming payments. Setting up alerts for incoming payments can also help you stay on top of cash flow.

Tips for Effective Payment Tracking

Regardless of the method you use, consider these tips to make payment tracking more efficient:

- Set Clear Payment Terms: Ensure that your clients know when payments are due and how to make them. Clear terms help you identify when payments are late and reduce confusion.

- Record Payments Promptly: As soon as a payment is received, update your records. The sooner you log the transaction, the easier it will be to track your finances and avoid missing any payments.

- Regularly Review Your Accounts: Even if you use automated software, it’s important to review your payment records periodically. This helps catch any discrepancies and ensures that all payments are properly recorded.

- Communicate with Clients: If a payment is overdue, don’t hesitate to reach out to your client promptly. A polite reminder can help avoid further delays and ensure your cash flow remains stable.

By using the right tools and strategies, tracking payments becomes a more manageable task, allowing you to focus on growing your business and maintaining strong client relationships.

Understanding GST/HST on Billing Documents

In many regions, sales tax is a crucial component of business transactions, and knowing how to apply these taxes correctly is important for both compliance and transparency. Goods and Services Tax (GST) and Harmonized Sales Tax (HST) are types of taxes that may be applicable when selling goods or services. Understanding how to incorporate these taxes into your billing records ensures that you charge the correct amount and stay within legal requirements.

These taxes are typically calculated as a percentage of the total amount for services or goods provided. How and when you charge them depends on your location, your client’s location, and the type of services you offer. It’s essential to be clear about how these taxes are presented on your financial records to avoid confusion or errors.

When to Charge GST/HST

Knowing when and how to charge GST/HST is essential for maintaining accurate financial documents:

- Registered Businesses: If your business is registered for GST/HST, you are required to charge these taxes on eligible transactions. Make sure you have your GST/HST registration number on your billing records.

- Threshold for Registration: Businesses with taxable revenues exceeding a certain amount may be required to register for GST/HST. Ensure that your earnings align with local regulations to determine your tax obligations.

- Exempt or Zero-Rated Goods: Some products and services may be exempt from GST/HST, or they may be taxed at a zero rate. Always check the tax guidelines relevant to the goods or services you provide.

- Location-Specific Rates: Depending on the region where the transaction takes place, different rates may apply. GST is typically charged in some provinces, while HST is charged in others. Understanding your client’s location is crucial for applying the right rate.

How to Present GST/HST on Financial Records

When including GST/HST in your records, clarity is key. Make sure the tax amounts are listed separately from the total charges. This breakdown ensures that both you and your client understand how the final amount was calculated. Here’s how to present it:

- Tax Rate: Clearly state the applicable tax rate, such as “GST (5%)” or “HST (13%)” depending on the region and service.

- Tax Amount: Include a line showing the amount of tax being charged. This helps the client see the exact value of the tax applied.

- Total Due: After including the tax, present the total amount due, ensuring that the taxes are added to the total charge clearly.

By following these guidelines and properly understanding when and how to charge GST/HST, you can ensure your billing documents are compliant with local tax laws, which will help maintain your business’s financial accuracy and professionalism.

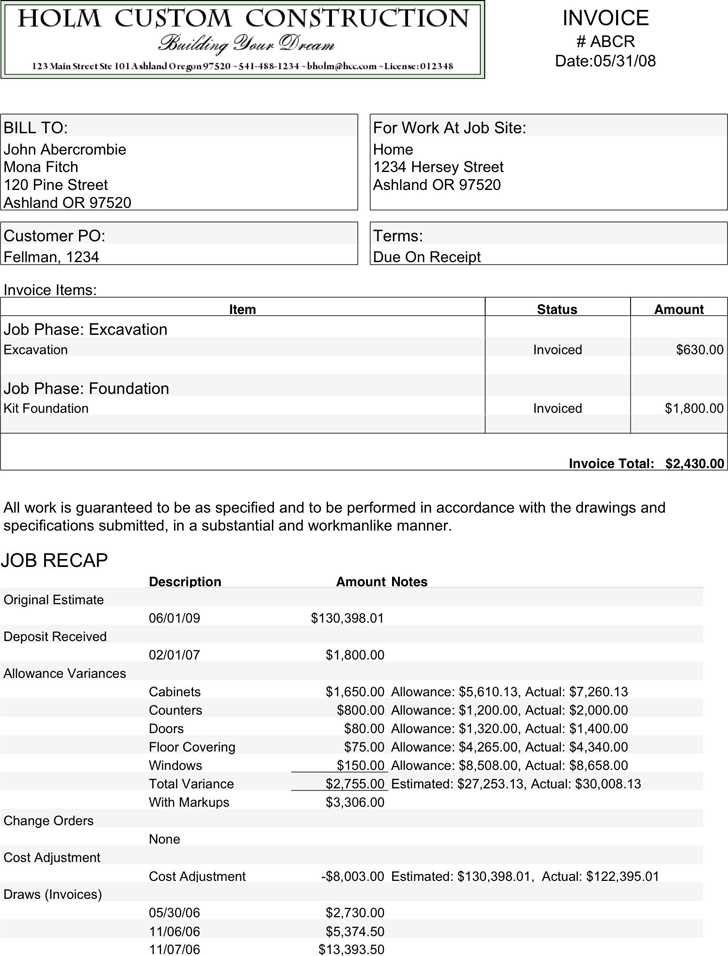

Invoicing for Different Types of Services

When providing various types of services, the way you structure your billing document can vary depending on the nature of the work. Each service type may require a different approach to how charges are calculated, how time is tracked, or how specific materials or resources are accounted for. Understanding how to tailor your billing for different services ensures transparency and helps clients understand the breakdown of costs clearly.

Whether you’re offering consulting, design work, technical services, or any other professional service, adapting your billing format to suit the service type can help ensure smooth transactions and foster positive relationships with clients.

Service-Based Billing Approaches

Here are common billing methods used for various services:

- Hourly Billing: For services where the amount of time spent is the primary factor in the charge, such as consulting or freelance work, an hourly rate is often applied. In this case, track the number of hours worked and clearly specify the rate per hour on the billing document.

- Project-Based Billing: For larger or one-time projects, such as web design or event planning, a flat fee for the entire project is typically charged. This requires clear communication regarding the scope of work and deliverables to avoid misunderstandings.

- Retainer Billing: Professionals like attorneys or consultants often use a retainer model, where clients pay a set amount upfront for ongoing services. The payment is usually for a set number of hours or tasks over a specific period.

- Milestone Billing: For long-term projects, invoicing can be done in phases based on specific milestones. For example, web developers may invoice after completing the initial design, after the development phase, and upon final delivery.

- Subscription Billing: For recurring services, such as maintenance contracts or software as a service (SaaS), a regular billing cycle (monthly, quarterly, etc.) is used, with a fixed amount charged at each interval.

Details to Include for Service-Based Work

When structuring a billing document for any service, it’s important to include relevant details to ensure accuracy and avoid confusion. Key items to include are:

- Service Description: Provide a detailed description of the work performed, including the scope and any deliverables. For example, a design service might list tasks like “Website layout design” or “Logo creation”.

- Time Spent or Units Used: For services billed by the hour or by units (such as per consultation or per session), clearly outline the number of hours worked or units used. If applicable, include the hourly rate or unit price.

- Payment Terms: Always include clear terms on when payments are due, including the specific payment date and any late fees or discounts for early payment.

- Additional Costs: If your service requires additional materials, expenses, or travel, make sure to itemize these costs separately to avoid any misunderstandings.

By adjusting your billing structure to match the type of service you offer, you can ensure that clients fully understand the charges and make th

How to Send Billing Documents Efficiently

Sending billing documents in a timely and organized manner is essential for maintaining a smooth cash flow and ensuring that clients are well-informed about their payments. The more efficient your process, the quicker you can receive compensation for your work, avoid delays, and minimize administrative time. A streamlined process not only saves you time but also ensures that your clients have all the information they need to process the payment without confusion.

Whether you’re sending billing records via email, physical mail, or using an online payment platform, efficiency and accuracy are key to getting paid quickly and avoiding unnecessary follow-ups.

Methods for Sending Billing Documents

There are several methods available for sending payment requests. Each has its own advantages depending on the size of your business, the preferences of your clients, and the tools you have at your disposal:

- Email: Sending billing records through email is one of the most efficient methods. You can easily attach a digital copy of the document, track responses, and make updates as necessary. Be sure to include clear instructions on how clients can make payments, as well as any important payment terms.

- Online Payment Platforms: Services such as PayPal, Stripe, or FreshBooks allow you to send professional billing documents directly through their platforms. These tools can automatically track payments and send reminders to clients who are late, saving you time on follow-ups.

- Postal Mail: While this method is less common in today’s digital age, sending paper records may be required for certain clients, especially those who are not comfortable with digital transactions. Be sure to allow sufficient time for delivery and include a return envelope or payment instructions to expedite the process.

Best Practices for Efficient Billing

To make the process even more efficient, follow these best practices when sending your billing records:

- Use Professional Software: Accounting software can automate many aspects of your billing, including creating and sending documents, tracking payments, and reminding clients about overdue balances. This can significantly reduce manual effort and increase accuracy.

- Set Up Reminders: Automating reminders for overdue payments can help keep clients on track and reduce the need for personal follow-ups. Many invoicing platforms allow you to schedule reminders, so you don’t have to worry about forgetting.

- Include Clear Payment Instructions: Always provide your clients with clear, concise instructions on how to pay. This could include your payment methods, account details, or links to online payment platforms. The easier you make it for clients to pay, the faster the payment process will be.

- Send Invoices Promptly: Ensure that you send your billing documents as soon as possible after completing work. The sooner clients receive the document, the sooner they can process the payment. Sending them promptly also reflects professionalism.

- Follow Up Regularly: If payments aren’t made on time, follow up with clients in a polite but firm manner. A gentle reminder via email or phone call can prompt them to take action. You can also automate follow-ups wit

Legal Requirements for Billing Documents in Canada

When conducting business in any country, it’s essential to follow the legal guidelines regarding the creation and distribution of financial documents. In Canada, there are specific requirements that must be adhered to when generating official records for goods and services provided. These regulations ensure that businesses remain compliant with tax laws and provide transparency in transactions. Understanding these requirements is important for avoiding penalties and ensuring that your financial documents are legally valid.

There are key elements that must be included in your financial records in order to comply with Canadian law. Failure to meet these standards can lead to complications with tax reporting or delays in payments.

Key Legal Elements for Billing Documents

The following elements are legally required for billing documents in Canada:

- Unique Identifier: Each record must include a unique number that identifies the transaction. This number helps both the business and the client track and reference the record easily. Sequential numbering is often recommended for organization.

- Business Information: The document must clearly display the name, address, and contact details of the business issuing the record. If applicable, the GST/HST registration number must also be included.

- Client Information: The name and address of the client receiving the goods or services must be listed on the document. This ensures that there is no confusion about the recipient of the charges.

- Description of Goods or Services: A detailed description of the goods or services provided, including the quantity and price, must be included. This helps to avoid any disputes about what was agreed upon.

- Dates: The document should clearly state the date the goods or services were provided, as well as the date the record was issued. Additionally, the payment due date should be specified to set expectations for when the payment should be made.

- GST/HST Amount: If applicable, the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) must be listed separately. This includes showing the tax rate and the total amount of tax charged on the transaction.

- Total Amount Due: The final amount payable, including both the cost of the goods/services and any applicable taxes, should be clearly stated.

Additional Considerations for Compliance

In addition to the key legal elements, there are several other considerations businesses should be mindful of when creating financial records:

- Digital and Paper Formats: Businesses must ensure that both digital and physical records comply with the same standards. If you’re issuing electronic documents, ensure that they are properly formatted and can be easily accessed by the client.

- Payment Terms: Include clear payment terms, such as due dates, late fees, and accepted payment methods. This transparency helps prevent misunderstandings and ensures timely payments.

- Record Retention: Businesses are required to retain financial records for a certain period, typically at least six years, for tax and audit purposes. Keeping organized and accurate records will make this process easier.

By adhering to these legal requirements, businesses can ensure that their billing documents are compliant with Canadian tax laws and other regulations. Proper documentation will not only protect the business but als

Using Accounting Software for Billing

In today’s fast-paced business environment, relying on manual methods for financial record-keeping and client billing can be time-consuming and prone to errors. Accounting software provides an efficient way to streamline the entire process, from generating financial documents to tracking payments and managing tax obligations. By integrating accounting tools into your workflow, you can save valuable time, reduce mistakes, and maintain a more organized financial system.

With the right accounting software, businesses can automate many aspects of their billing process, making it easier to issue accurate records, manage finances, and stay compliant with tax laws. This section explores how using accounting software can enhance your billing operations.

Benefits of Using Accounting Software

Accounting software offers several advantages that can simplify your financial processes and improve efficiency:

- Automated Record Generation: Once set up, accounting software allows you to generate financial documents automatically, ensuring consistency and accuracy with minimal effort. Templates and preset formats help you create clear and professional documents quickly.

- Tracking and Reporting: Accounting tools can help you monitor payments, generate reports on outstanding balances, and track cash flow. This makes it easier to stay on top of unpaid balances and manage your business’s finances effectively.

- Time Savings: Automated calculations, record-keeping, and reminders save you time, allowing you to focus more on other aspects of your business. Additionally, some tools integrate with other software like time-tracking apps, further automating the process.

- Tax Management: Many accounting platforms offer features that automatically calculate tax rates based on your location and the services provided. This helps ensure that you’re correctly applying taxes to your billing documents, which can save you from costly mistakes when filing taxes.

- Client Communication: With accounting software, you can quickly send billing records to clients, including due dates and payment methods. Automated payment reminders can also be set to ensure clients are notified about upcoming or overdue payments.

Key Features to Look for in Accounting Software

When selecting accounting software for billing purposes, it’s important to consider certain features that will enhance your experience and meet your business needs:

- Customizable Templates: Choose software that allows you to create billing records that suit your business, with the flexibility to add specific details such as your company’s logo, service descriptions, or custom payment terms.

- Multi-Device Access: Software that can be accessed from both desktop and mobile devices ensures you can manage your finances on the go. This is especially useful for business owners who work remotely or travel frequently.

- Integration with Payment Systems: Look for software that integrates with popular payment systems like PayPal, Stripe, or bank transfers. This simplifies the payment process for clients and can help speed up collections.

- Multi-Currency Support: If your business works internationally, consider software that supports multiple currencies and language options. This is particularly helpful for managing transactions with clients in different countries.

- Invoicing Reminders and Notifications: Automated reminders