Self Employed Independent Contractor Invoice Template for Freelancers

When running your own business, managing finances effectively is crucial. One of the most important aspects of financial organization is ensuring that you can clearly communicate payment details to clients. This means having an efficient way to outline the work completed, the agreed-upon rates, and the expected payments in a format that is both professional and easy to understand.

For those working on their own, designing a reliable billing system is essential to avoid confusion or delays in receiving payments. Having a consistent structure for your financial documents not only improves your professionalism but also simplifies the process of keeping track of payments and expenses. A well-crafted document can serve as a clear record for both parties involved, protecting both you and your clients.

In this article, we will explore how to create a streamlined billing form that ensures accuracy and clarity. You’ll learn about the key elements to include and how to personalize your documents to suit the nature of your business and your clients’ needs. By the end of this guide, you will have a tool that helps you stay organized and maintain a positive relationship with your clients.

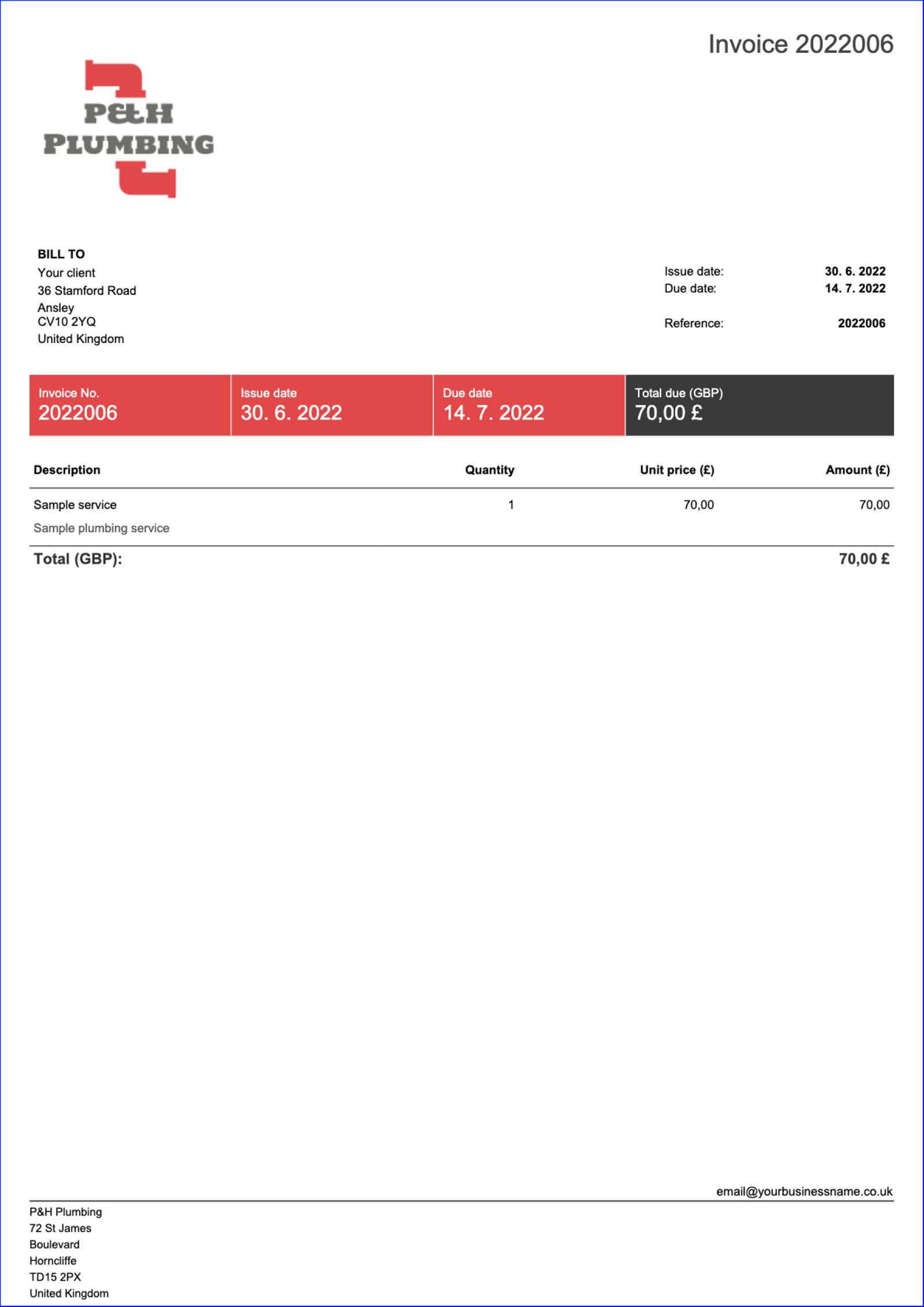

Self Employed Independent Contractor Invoice Template

For anyone managing their own business or working with clients on a freelance basis, creating a clear and professional billing document is essential. It helps to ensure that both parties are aligned on the work completed, the pricing structure, and the terms of payment. A structured document can also serve as an official record for tax purposes and for keeping track of financial transactions over time.

Key Elements to Include

To create a functional billing form, certain elements are necessary to provide clarity and avoid misunderstandings. At a minimum, the document should include the following details:

- Your contact details (name, address, phone number, and email)

- Client’s information (name, address, and contact details)

- Description of services provided (include the project name or specific tasks completed)

- Payment terms (due date, late fees, and accepted payment methods)

- Amount due (include the total sum and break it down if necessary)

- Unique identification number for tracking purposes

Customization Tips

While the basic structure remains the same, it’s important to tailor your documents to suit the nature of your business. For example, you might want to include a section for discounts or recurring payments if that applies to your work. Additionally, using a professional design can help make the document more visually appealing and ensure it aligns with your brand identity. Remember, the clearer and more organized the document is, the better the chances of smooth, timely payments.

Why You Need an Invoice Template

For any individual or business managing their own projects, having a consistent and professional way to document payment details is essential. Clear, well-structured billing documents help avoid confusion and ensure that clients are fully informed of the costs and payment terms. A well-prepared statement not only aids in receiving payments on time but also serves as a useful reference for both you and your clients.

Streamlining the Billing Process

Creating a standard format for every transaction saves time and reduces the chances of errors. Instead of having to draft a new document from scratch each time you work with a client, you can simply fill in the necessary details–such as the amount, the services rendered, and the due date. This consistency ensures that every billing statement is professional and easy to understand, which increases the likelihood of prompt payment.

Maintaining Organization and Record Keeping

Having a standardized document also helps keep your records in order. By using the same layout for each transaction, you can easily track past payments, monitor outstanding balances, and quickly generate reports when needed. This is especially useful during tax season or if you need to review your financial situation for planning purposes. An organized system simplifies your accounting and keeps everything running smoothly.

Key Features of a Professional Invoice

A well-designed billing document not only ensures that payment terms are clearly communicated but also conveys professionalism and credibility. To achieve this, certain elements must be included to create a polished and effective document. A professional statement should be comprehensive yet easy to read, ensuring both you and your client are on the same page regarding expectations and payment details.

The most important features include clear contact information, detailed descriptions of services provided, and a well-organized layout. Additionally, it’s essential to include payment terms, deadlines, and a unique reference number for tracking purposes. By incorporating these elements, you can create a document that not only helps with smooth transactions but also builds trust with your clients.

How to Customize Your Invoice Template

Personalizing your billing document is an important step in making sure it aligns with your business style and the needs of your clients. A customized layout not only reflects your brand but also makes the document more tailored and professional. Whether you choose a simple or more elaborate design, there are key elements that you can adjust to create a unique and functional tool for managing your financial transactions.

Adjusting Layout and Design

The design of your document plays a big role in how it is perceived. Start by selecting a clean, easy-to-read format that suits your industry. Consider using your business’s logo, choosing a color scheme that reflects your brand, and selecting fonts that are professional and legible. While a minimalist design is often effective, feel free to include subtle details that align with your personal or company identity.

Adding Custom Sections

Depending on the services you offer, you might need to add specific sections to your document. For example, if you offer discounts, payment plans, or recurring services, you can include dedicated areas to specify this information. Additionally, creating space for a brief description of the work completed, or for adding custom notes for the client, can make the document more informative and tailored to your specific transaction.

Essential Information to Include on an Invoice

To ensure smooth transactions and avoid any confusion, it’s important to include specific details in every billing document. A well-constructed statement should clearly outline the terms of payment, services rendered, and the agreed-upon amounts. By including all the necessary information, you create a transparent record that both you and your clients can reference at any time.

At a minimum, every document should contain the following elements: the names and contact information of both parties, a unique identification number for tracking, a detailed description of the work completed, and the agreed-upon payment amount. Additionally, including clear payment terms, such as due dates and accepted methods of payment, ensures that both sides understand the expectations and deadlines. This transparency helps build trust and reduces the risk of disputes.

Understanding Invoice Numbering System

A proper numbering system for your billing documents is crucial for maintaining organization and ensuring you can track payments efficiently. Each document should have a unique reference number that helps both you and your clients easily identify and reference specific transactions. This not only helps with record-keeping but also adds a level of professionalism to your process.

Why a Numbering System Matters

Using a consistent numbering system can significantly simplify managing your financial records. It provides a clear and systematic way to track payments and monitor outstanding balances. Here’s why it’s important:

- Improved organization: A unique number for each document makes it easy to search for and identify specific transactions.

- Prevents confusion: Sequential numbers reduce the risk of duplicate entries or confusion between different clients or projects.

- Professionalism: A well-structured system creates a more polished and organized impression on your clients.

Best Practices for Numbering

To create an effective numbering system, follow these guidelines:

- Use sequential numbers: Start with 001 or 1001 and increase by one with each new document to keep things in order.

- Incorporate dates or project codes: For easier identification, you might consider adding a year or project code to the numbering system (e.g., 2024-001 or P123-001).

- Stay consistent: Once you decide on a system, stick with it across all your documents for simplicity and clarity.

Choosing the Right Payment Terms for Your Clients

Setting clear and fair payment terms is an essential part of managing your business relationships. The terms you agree on with clients should reflect the nature of the work, the project timeline, and your financial needs. Properly defined conditions not only ensure timely payments but also set clear expectations, helping to avoid disputes or misunderstandings down the line.

When determining payment terms, consider factors such as the scope of work, your cash flow needs, and industry standards. It’s important to balance being flexible with ensuring that you’re compensated fairly and on time. Whether you opt for a fixed price, hourly rate, or installment plan, clearly stating these conditions on your billing document will help avoid confusion and improve the client experience.

Common payment terms include:

- Net 30 or Net 60: Payment due 30 or 60 days from the date of issue. Common for larger projects or clients with longer payment cycles.

- 50% upfront: Asking for an initial deposit before starting work, with the remaining balance due upon completion.

- Early payment discounts: Offering a small discount for clients who pay before the due date, which can encourage quicker payments.

How to Set Clear Payment Due Dates

Establishing clear and precise payment due dates is crucial to ensure timely compensation for the work you complete. Without a clearly defined deadline, both you and your clients may have different expectations, which can lead to confusion and delays. By specifying when payments are due, you set a professional tone and reduce the likelihood of late payments.

Factors to Consider When Setting Due Dates

When deciding on payment due dates, there are several factors to consider. You need to account for the size and complexity of the project, your cash flow needs, and your client’s payment practices. Setting realistic timelines while ensuring prompt payment is key to maintaining a good working relationship.

| Project Type | Suggested Payment Due Date |

|---|---|

| Small or One-Time Projects | Within 15-30 days after completion |

| Ongoing or Retainer-Based Work | On a monthly or quarterly basis, depending on the agreement |

| Large-Scale Projects | Installments based on project milestones or 30-60 days after final delivery |

Communicating Payment Due Dates Clearly

Once you’ve established the due date, make sure to communicate it clearly in all billing documents and agreements. Highlight the payment due date in a prominent position on the document, and be sure to outline any late fees or penalties for missed payments. By doing so, you set clear expectations and avoid any misunderstandings.

Common Invoice Mistakes to Avoid

Creating accurate and professional billing documents is essential for ensuring timely payments and maintaining good client relationships. However, there are several common mistakes that can lead to confusion, delayed payments, or even disputes. By understanding these errors and taking steps to avoid them, you can streamline your payment process and present a more professional image to your clients.

Frequent Errors to Watch Out For

Many of the mistakes people make when creating billing documents can be easily avoided with a little attention to detail. Here are some of the most common pitfalls:

- Missing or incorrect contact details: Always double-check the client’s information and your own to avoid confusion or delays in communication.

- Omitting important payment terms: Be sure to include the due date, accepted payment methods, and any late fees. This helps set clear expectations.

- Not including a unique reference number: Every transaction should have its own unique identifier to avoid confusion with other payments.

- Unclear descriptions of services: Always provide a clear breakdown of the work completed to prevent any misunderstandings about what the client is being charged for.

- Not following up on overdue payments: Failing to track overdue payments can result in cash flow issues. Set reminders or follow-up procedures to stay on top of payments.

Tips for Avoiding These Mistakes

To prevent errors and ensure smooth transactions, consider the following best practices:

- Use a standardized format: Having a consistent layout for each document reduces the chance of leaving out important details.

- Proofread before sending: Always review your documents for accuracy, checking for spelling errors or missing information.

- Track all payments: Maintain a system for tracking issued documents and received payments to ensure nothing slips through the cracks.

Digital vs. Paper Invoices: Which is Better?

When it comes to sending billing documents, the decision between using digital or paper formats can have a significant impact on your workflow, efficiency, and the client’s experience. Both methods have their advantages, but one may be more suitable depending on your business needs, client preferences, and overall convenience. Understanding the pros and cons of each option will help you make an informed choice.

Advantages of Digital Billing

Digital documents are becoming increasingly popular due to their speed, ease of use, and environmental benefits. Here are some reasons why you might choose to send your billing documents electronically:

- Speed: Digital documents can be delivered instantly, reducing the time between completing a project and receiving payment.

- Convenience: You can create, send, and store digital files from anywhere, making it easier to manage multiple clients and projects.

- Cost-effectiveness: There are no printing or mailing costs associated with digital documents, helping to save money in the long run.

- Easy tracking: Digital records can be easily organized and stored, making it simpler to keep track of payments and outstanding balances.

- Environmentally friendly: By reducing paper usage, digital documents contribute to a more sustainable business practice.

Benefits of Paper Billing

Despite the rise of digital options, some businesses and clients still prefer physical copies. Here are some of the reasons why paper documents may still be valuable:

- Personal touch: For certain clients, receiving a physical document can feel more personal and formal, which may enhance your business relationship.

- Legal or contractual preferences: Some industries or clients may prefer to keep hard copies for record-keeping or legal purposes.

- Less risk of technical issues: With paper documents, you avoid issues like email delivery failures or digital file corruption.

Choosing the Right Option for Your Business

Ultimately, the decision between digital and paper documents depends on your clients’ preferences and your own business needs. If your clients are tech-savvy and prefer convenience, digital might be the better choice. However, if you work with clients who value a more traditional approach, or if you need physical documentation for your records, paper may still be the preferred option.

How to Track Payments from Clients

Keeping track of payments is essential for maintaining financial stability and ensuring that no payments are missed or overlooked. By implementing a system to monitor client payments, you can stay organized, avoid cash flow problems, and quickly identify any overdue balances. Whether you manage a few clients or many, having an efficient tracking method is key to staying on top of your finances.

One of the simplest ways to track payments is through a payment log. This can be a manual or digital record that lists each transaction, including the amount paid, the date of payment, and the client’s details. An organized record not only helps you stay on top of payments but also makes it easier to spot any discrepancies or delays.

| Client Name | Amount Due | Amount Paid | Payment Date | Balance Remaining |

|---|---|---|---|---|

| Client A | $500 | $500 | 2024-10-01 | $0 |

| Client B | $750 | $500 | 2024-10-05 | $250 |

| Client C | $400 | $400 | 2024-10-10 | $0 |

By regularly updating this log and cross-referencing with payment receipts or confirmations, you can easily keep track of outstanding balances and ensure that your clients are paying according to the agreed terms. Additionally, using accounting software or spreadsheets can automate much of this process, making it even more efficient.

Adding Tax Information to Your Invoice

Including tax details in your billing documents is essential for compliance and transparency. Whether you’re required to charge sales tax, value-added tax (VAT), or other taxes, it is important that the amounts are clearly indicated. This not only helps ensure that you are fulfilling legal obligations, but also provides your clients with a complete breakdown of costs, fostering trust and clarity in your transactions.

When adding tax information, make sure to include the tax rate applied, the total tax amount, and any relevant registration numbers or tax IDs if applicable. It is also helpful to separate the taxable amount from the total, so clients can easily see how the tax was calculated. This ensures both accuracy and clarity, preventing potential misunderstandings or disputes later on.

Here are some key tax details to include:

- Tax Rate: Specify the rate at which the tax is charged (e.g., 10%, 20%, etc.).

- Tax Amount: Clearly list the total amount of tax added to the original cost of services or goods.

- Tax Identification Number: If required by law, include your tax registration number or VAT ID to verify your tax status.

- Breakdown of Costs: Separate the original cost and the tax amount to avoid confusion.

By including accurate tax information on each billing document, you not only stay compliant with local regulations but also build credibility with your clients by demonstrating professionalism and attention to detail.

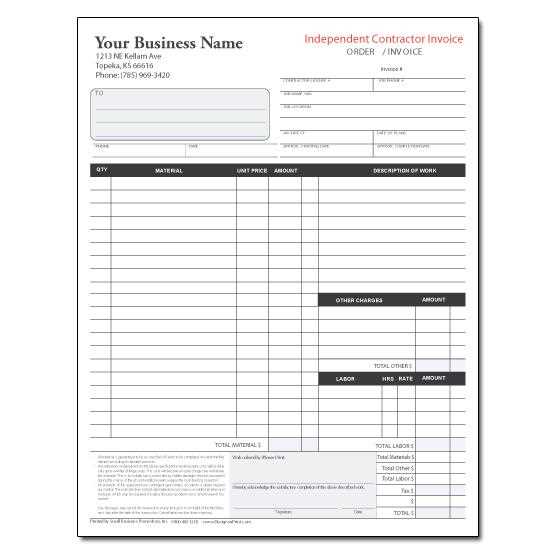

How to Invoice for Different Services

When providing a variety of services, it’s important to tailor your billing process to reflect the specifics of each project. Different types of work may require different methods of charging, whether it’s an hourly rate, a flat fee, or a per-project cost. Understanding how to accurately charge for each type of service ensures you are paid fairly while keeping the process transparent for your clients.

Billing for Hourly Services

For work billed by the hour, it’s crucial to keep detailed records of the time spent on each task. Here’s how you can structure these billing documents:

- Track Hours: Log your working hours accurately and include a breakdown of the time spent on each part of the task.

- Hourly Rate: Clearly state the rate you charge per hour and the total number of hours worked.

- Service Details: Describe the services provided, ensuring clients understand how the time was spent.

- Total Amount: Multiply the hours worked by your hourly rate to calculate the total due.

Billing for Fixed-Price Projects

For projects with a predetermined cost, you’ll need to provide a detailed estimate upfront and set clear terms for payment. When billing for fixed-price work, consider the following:

- Project Description: Offer a thorough description of the services or deliverables included in the project scope.

- Set Fee: State the agreed-upon flat rate for the entire project, and specify the payment schedule if applicable (e.g., a deposit or installment payments).

- Milestone Payments: If the project involves multiple phases, break down the total cost by milestones and outline the payments due at each stage.

Billing for Retainer-Based Services

For ongoing work or monthly services, a retainer fee is often used. Here’s how to structure your billing for this type of agreement:

- Monthly Fee: Define a fixed monthly amount that covers a set number of hours or services.

- Service Limitations: Clarify what’s included within the monthly retainer and any additional fees for services beyond the agreed scope.

- Payment Due Date: Set a regular, recurring payment date (e.g., the 1st of every month) for retainer-based work.

By customizing your billing approach for each type of service, you can maintain clarity and professionalism while ensuring that clients understand exactly what they are being charged for.

Free Invoice Templates for Independent Contractors

When managing your billing process, using a ready-made form can save you time and effort, ensuring that all necessary details are included. Free billing forms are widely available online, allowing you to easily customize them to suit the specific needs of your business. These tools can help you maintain a professional appearance and streamline your administrative tasks, from tracking services provided to ensuring timely payments.

There are several free options available that cater to various business models, offering flexibility in how you charge for your services. Below is a comparison of some common types of billing forms you can find for no cost:

| Type of Billing Document | Best For | Key Features |

|---|---|---|

| Basic Form | Simple one-time projects | Includes space for work details, amount due, and payment terms |

| Hourly Billing Form | Time-based services | Allows for tracking hours worked, hourly rate, and total amount due |

| Fixed-Rate Form | Flat-fee projects | Predefined price for a project or service, with a detailed breakdown of tasks |

| Recurring Billing Form | Ongoing services | Setup for monthly or recurring payments, with space for service details and due dates |

By using a free form, you ensure that you don’t miss critical billing details, like contact information, payment due dates, or service descriptions. Many templates are compatible with spreadsheet software or can be easily downloaded as PDFs, making them convenient to work with and share with clients.

Make sure to check the template carefully to ensure that it fits your specific business needs and that all necessary information is included. A well-crafted billing document not only helps you get paid on time but also reinforces the professionalism of your work.

How to Format Your Invoice for Clarity

Formatting your billing document properly is key to ensuring that your clients understand the details of the transaction. A clear, well-organized document not only helps avoid confusion but also reflects your professionalism. By presenting all necessary information in a straightforward and logical manner, you ensure that both parties are on the same page regarding the services provided and the amounts due.

Use a Clean Layout

Start with a clean, organized layout that makes it easy for your client to follow. Keep important information visible and group related details together. Here’s how you can format your document for maximum clarity:

- Company or Personal Details: Place your contact information at the top of the page, including your name, business name (if applicable), phone number, and email. This makes it easy for clients to reach you if needed.

- Invoice Number and Date: Clearly list the invoice number and issue date near the top of the page. These identifiers help both you and your client track the payment history.

- Service Description: Break down each service provided in a clear, bullet-pointed list or table. Include dates, hours worked (if applicable), and the agreed-upon price for each item.

- Tax and Additional Charges: Separate taxes or additional charges to avoid confusion. Clearly state the tax rate, total tax amount, and any other fees applied.

- Total Amount Due: Highlight the final amount due, and ensure it stands out from the rest of the information. This is the most important figure for your client to see at a glance.

Use Clear, Easy-to-Read Fonts and Spacing

Choose legible fonts and use appropriate spacing to enhance readability. Too much text crammed into one section can be overwhelming, so space out your information to allow the client to absorb the details easily. Large, bold headers for each section help to separate the key components, while simple fonts like Arial or Times New Roman maintain a professional tone.

By following these formatting tips, you can ensure that your billing documents are easy to understand, reducing the likelihood of mistakes or confusion that could delay payments. A clean, well-organized document reflects well on your professionalism and can lead to smoother transactions with your clients.

Best Practices for Invoice Delivery

Delivering your billing documents efficiently and professionally is as important as the content of the document itself. Ensuring that your clients receive their billing statements on time and through the right channels can improve the speed of payment and reduce misunderstandings. The method of delivery should be clear, secure, and convenient for both parties involved.

Here are some best practices for delivering your billing statements to clients:

- Choose the Right Delivery Method: Email is the most common and efficient way to send billing documents. It allows for quick delivery and ensures that the client can easily access and review the document. However, if a client prefers physical mail, be sure to send the document via certified mail or another trackable service to ensure its receipt.

- Confirm Receipt: After sending the billing document, follow up with the client to confirm that they received it. This helps prevent any delays due to lost documents or misunderstandings.

- Set a Clear Delivery Schedule: Send your documents on a regular schedule–whether it’s weekly, monthly, or based on the completion of a specific project. Consistent timing can help your clients expect and prioritize payments.

- Use Professional Email Practices: When emailing billing documents, always use a professional subject line, such as “Billing Statement for [Month/Project Name]”. Attach the document in PDF format, which preserves the formatting and is universally accessible.

- Secure Sensitive Information: If your billing documents contain sensitive information, consider using password protection or secure file-sharing services to safeguard your client’s details. This can build trust and ensure privacy.

By following these practices, you create a smooth and professional process for delivering your billing documents, which not only helps ensure timely payments but also fosters a positive business relationship with your clients.

What to Do if a Client Doesn’t Pay

Dealing with non-payment is an unfortunate but common challenge in business. When clients fail to pay on time, it can disrupt your cash flow and create unnecessary stress. However, it’s important to approach the situation with professionalism and a clear strategy to resolve the issue effectively while maintaining a positive business relationship.

Here’s what you can do if a client doesn’t pay:

- Review the Terms: Before taking any action, review the agreed-upon payment terms. Ensure that the payment deadline has passed and that the client is truly overdue. Sometimes, delays occur due to simple misunderstandings or technical issues.

- Send a Polite Reminder: Contact the client through email or phone with a friendly reminder that payment is due. Sometimes clients forget, and a gentle nudge is all that’s needed. Be sure to include all relevant details, such as the amount owed and the due date.

- Offer Payment Options: If the client is experiencing financial difficulty, consider offering flexible payment terms. This could include a payment plan, a small extension, or splitting the total into installments. Showing flexibility can encourage the client to pay and demonstrate that you’re willing to work with them.

- Send a Formal Payment Request: If the friendly reminder doesn’t work, send a formal payment request. This should include a clear breakdown of the amount due, the original terms, and any late fees (if applicable). It’s a more serious communication that may prompt the client to act.

- Consider Late Fees: If your payment terms include penalties for late payments, make sure to enforce them. Politely but firmly remind the client that these fees apply and explain that they are part of the agreed-upon conditions for working with you.

- Escalate to Legal Action: As a last resort, if the client refuses to pay or ignore your attempts at resolution, consider involving a collection agency or pursuing legal action. This step can be costly and time-consuming, but it may be necessary if the debt is substantial.

Ultimately, how you respond to a late payment depends on the severity of the situation and the relationship you wish to maintain with the client. Always remain professional and respectful throughout the process, as this will help you preserve your reputation and minimize conflict.

Legal Considerations for Billing Documents

When creating and sending billing documents, it is essential to ensure that they comply with legal requirements. Properly structured documents not only help maintain professionalism but also protect your business interests. Depending on your location and the nature of the services you provide, there are several important legal aspects to consider when drafting your payment requests.

Here are key legal considerations to keep in mind when preparing billing statements:

- Business Identification: Always include your business name and any required registration numbers (such as a VAT number or business license number). This provides legitimacy to your documents and ensures compliance with local business laws.

- Clear Payment Terms: Outline payment terms clearly on your billing statements. Specify the due date, accepted payment methods, and any late fees or penalties for overdue payments. Having well-defined terms helps avoid disputes down the road.

- Tax Information: If you are required to collect taxes, be sure to include the appropriate tax rate and total tax amount on the document. This is crucial for both your business records and your client’s accounting purposes. Ensure that your tax practices align with local regulations.

- Contractual Obligations: If you’ve agreed to specific terms with your client regarding payment (such as deposits or milestone payments), make sure these are referenced on the billing document. This helps clarify what has been agreed upon and can serve as a legal reference in case of disputes.

- Clear Descriptions of Services: Provide a detailed description of the services provided, including dates, quantities, rates, and any other relevant information. This ensures there are no misunderstandings regarding what was delivered and helps prevent future legal issues.

- Legal Language and Disclaimers: Depending on the nature of your business, you may need to include specific disclaimers or legal language on your billing documents. For example, if you work in a regulated industry, you may need to specify compliance with certain standards or laws.

- Record Keeping: Keep copies of all your billing documents for a specified period as required by law. This is important for tax purposes and in case of any future disputes. Be sure to follow any local laws regarding the retention of business records.

By ensuring that your billing documents are legally compliant, you protect both yourself and your clients. This helps to avoid potential disputes, delays in payments, and ensures that your business runs smoothly within the confines of the law. Always stay informed about local regulations and update your practices accordingly.