Self Employed Hours Invoice Template for Efficient Time Tracking and Billing

For independent professionals, keeping track of work completed and ensuring timely compensation is crucial to maintaining a smooth business operation. Organizing your billing process not only saves time but also reduces the risk of payment disputes. Properly documenting the services provided allows both parties to stay on the same page and ensures transparent financial transactions.

Designing a clear and professional record of your services is a key step in the business process. It simplifies the communication between you and your clients, making sure that all the details are documented and agreed upon. By using a well-structured format, you can streamline this aspect of your work and focus more on delivering quality results.

Whether you’re working on short-term projects or long-term contracts, having an easy-to-use system for listing your work hours and rates can make a significant difference. This approach eliminates confusion, improves trust, and helps you get paid faster and more accurately.

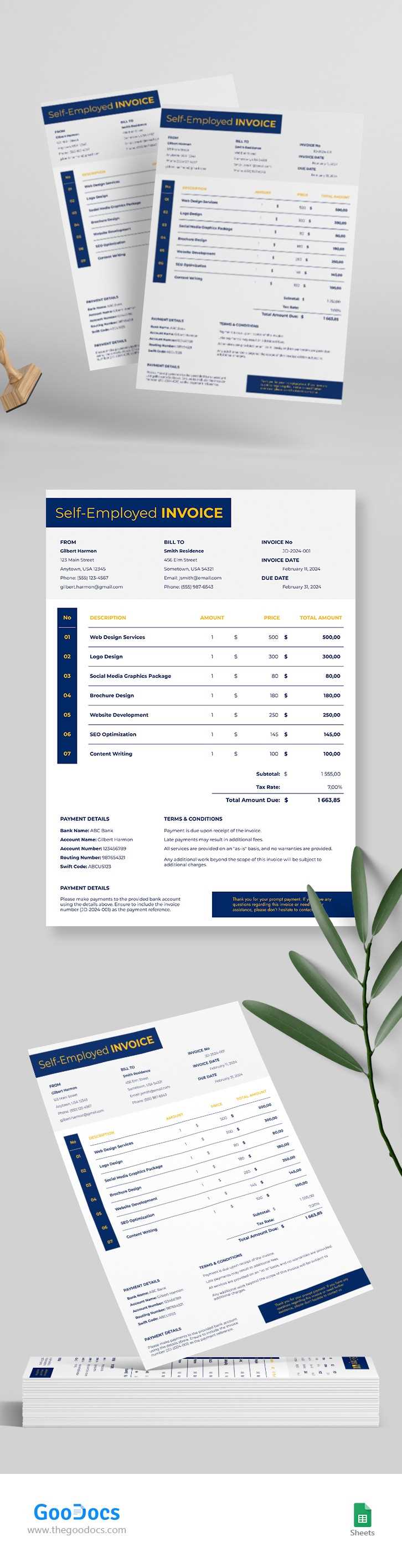

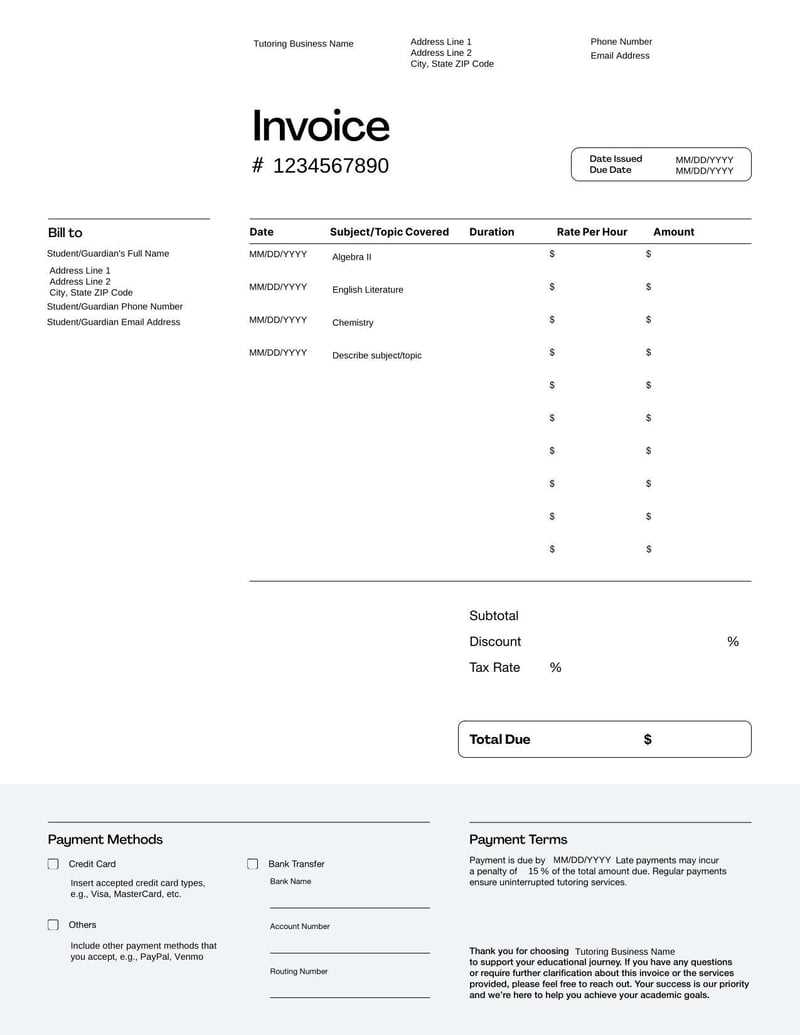

Self Employed Hours Invoice Template

When working independently, it’s essential to have a well-organized method for documenting the services rendered and tracking compensation. A professional document that outlines your work and rates ensures both you and your clients are aligned on expectations. It serves as a clear record, reducing misunderstandings and improving payment accuracy.

Having a reliable system in place allows you to present your work clearly and efficiently, showcasing the time spent and the value provided. The structure of this document should be simple yet comprehensive, covering key details such as the tasks performed, the time invested, and the agreed-upon rates. This helps streamline the process, making it easier to submit for payment and track ongoing work.

By utilizing an organized format, you can enhance communication with clients and avoid unnecessary delays in payment. A well-crafted document serves as both a professional tool and a protective measure, ensuring that all parties involved are on the same page regarding the services provided and compensation owed.

Why Use an Invoice Template

Having a consistent and structured way to document services and payments offers numerous advantages for independent professionals. It allows for clear communication with clients and ensures that all necessary details are included, reducing the likelihood of errors or misunderstandings. The use of a pre-designed format can save time and effort, letting you focus more on your work rather than the administrative side of things.

Efficiency and Time-Saving

Creating an organized record from scratch for each project can be time-consuming. A standardized structure helps streamline the process, enabling you to quickly fill in the necessary details without starting from scratch every time. This not only saves time but also ensures consistency in the way you document your work.

Improved Professionalism and Accuracy

By using a professionally designed document, you present yourself as organized and reliable. Clear, accurate records build trust with clients and demonstrate your commitment to transparency. An easy-to-read layout with all key information helps avoid confusion and makes it simpler for your clients to process payments without delay.

Key Benefits of Tracking Work Hours

Accurately documenting the time spent on various tasks provides a number of advantages for independent professionals. It helps maintain control over your workflow and ensures that all efforts are properly accounted for, leading to fair compensation. By tracking time, you can gain valuable insights into your productivity, identify areas for improvement, and avoid potential issues with clients regarding payment or expectations.

Better Time Management

When you monitor your time closely, you can assess how much effort is being allocated to each task or project. This visibility allows you to prioritize more effectively and allocate resources where they are needed most. By understanding where your time goes, you can improve your overall efficiency and avoid unnecessary delays.

Ensuring Fair Compensation

For independent workers, being able to provide a detailed account of the time spent on each project ensures that you’re paid accurately for the work completed. Precise tracking helps eliminate disputes and confirms the value of the services you’ve delivered. By documenting your time, you create a transparent record that both you and your clients can rely on.

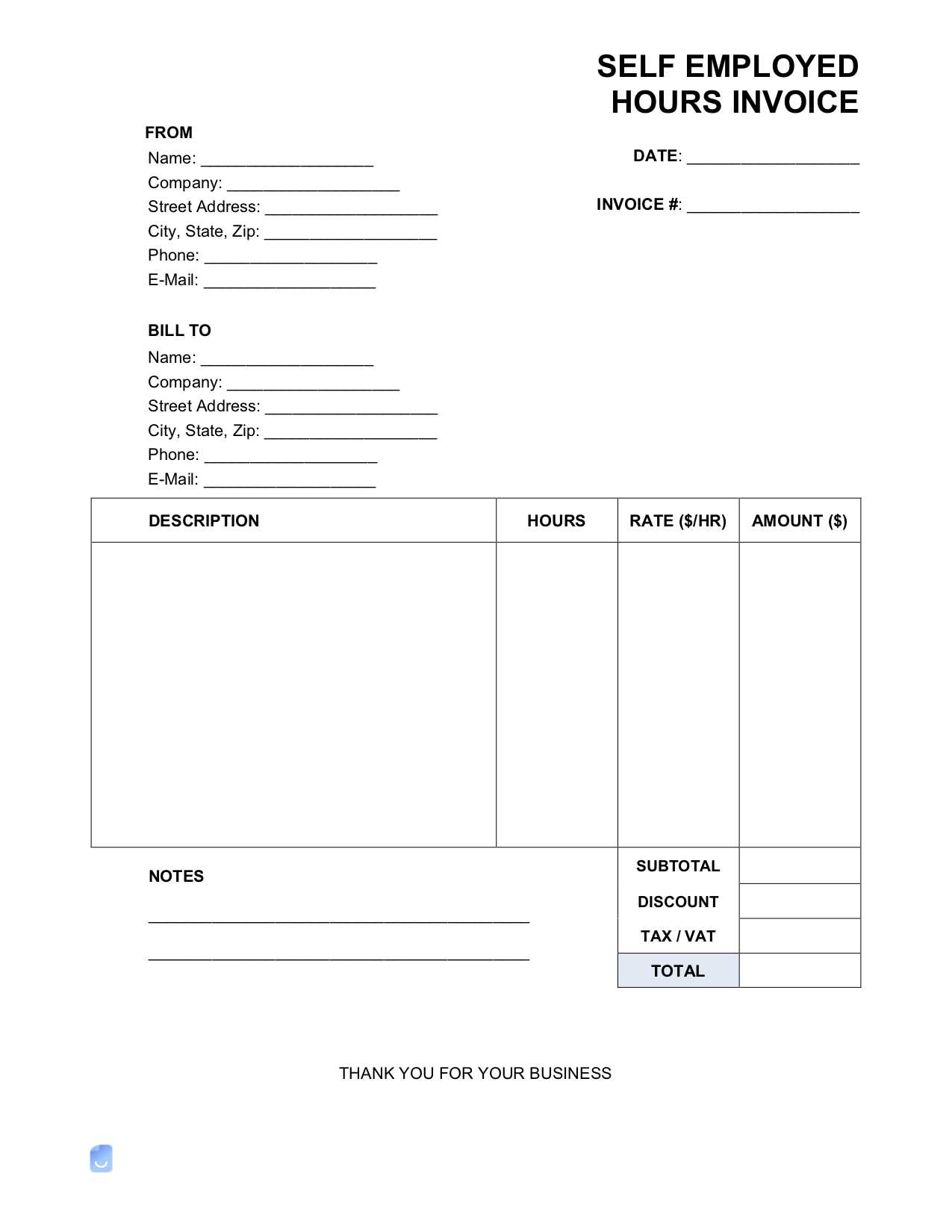

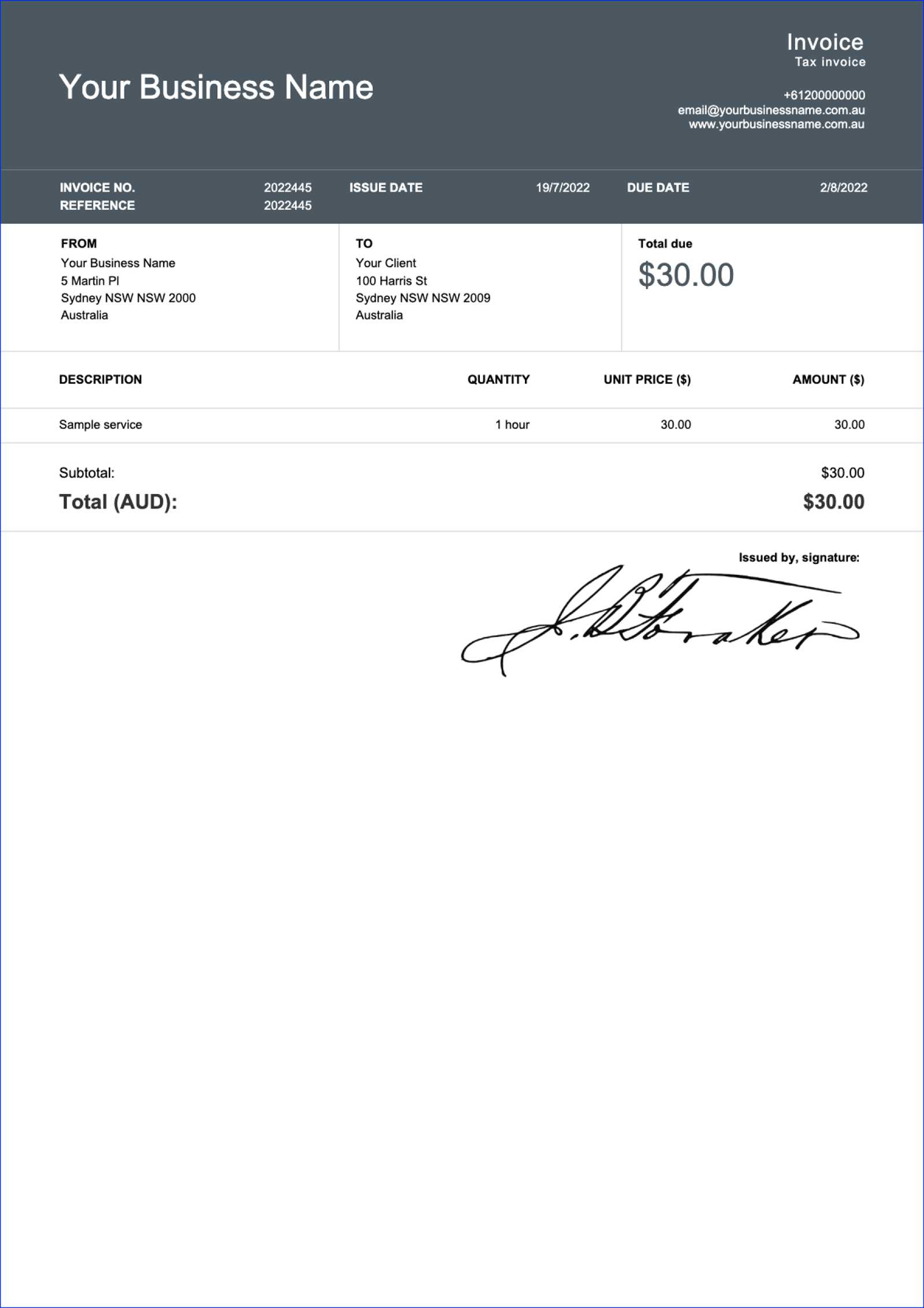

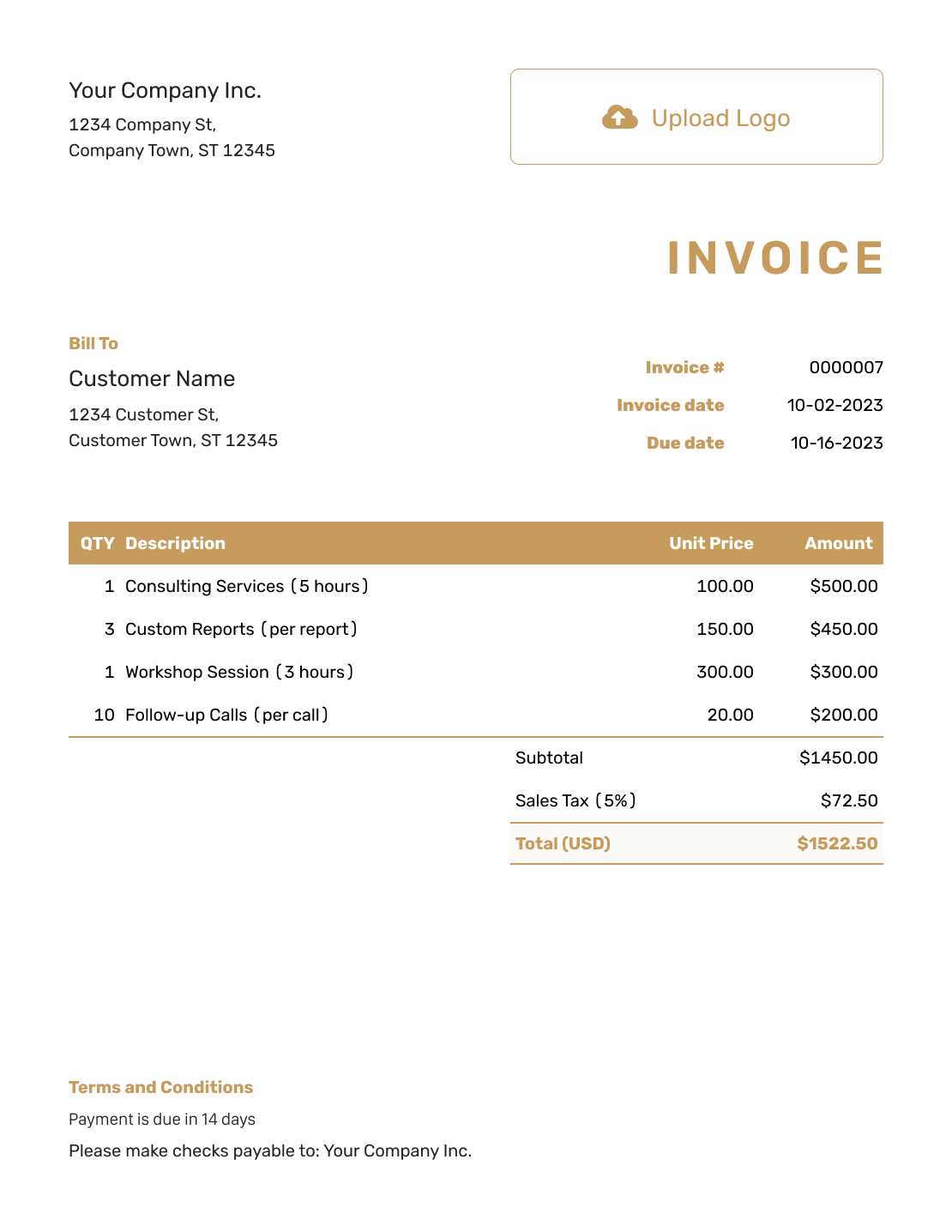

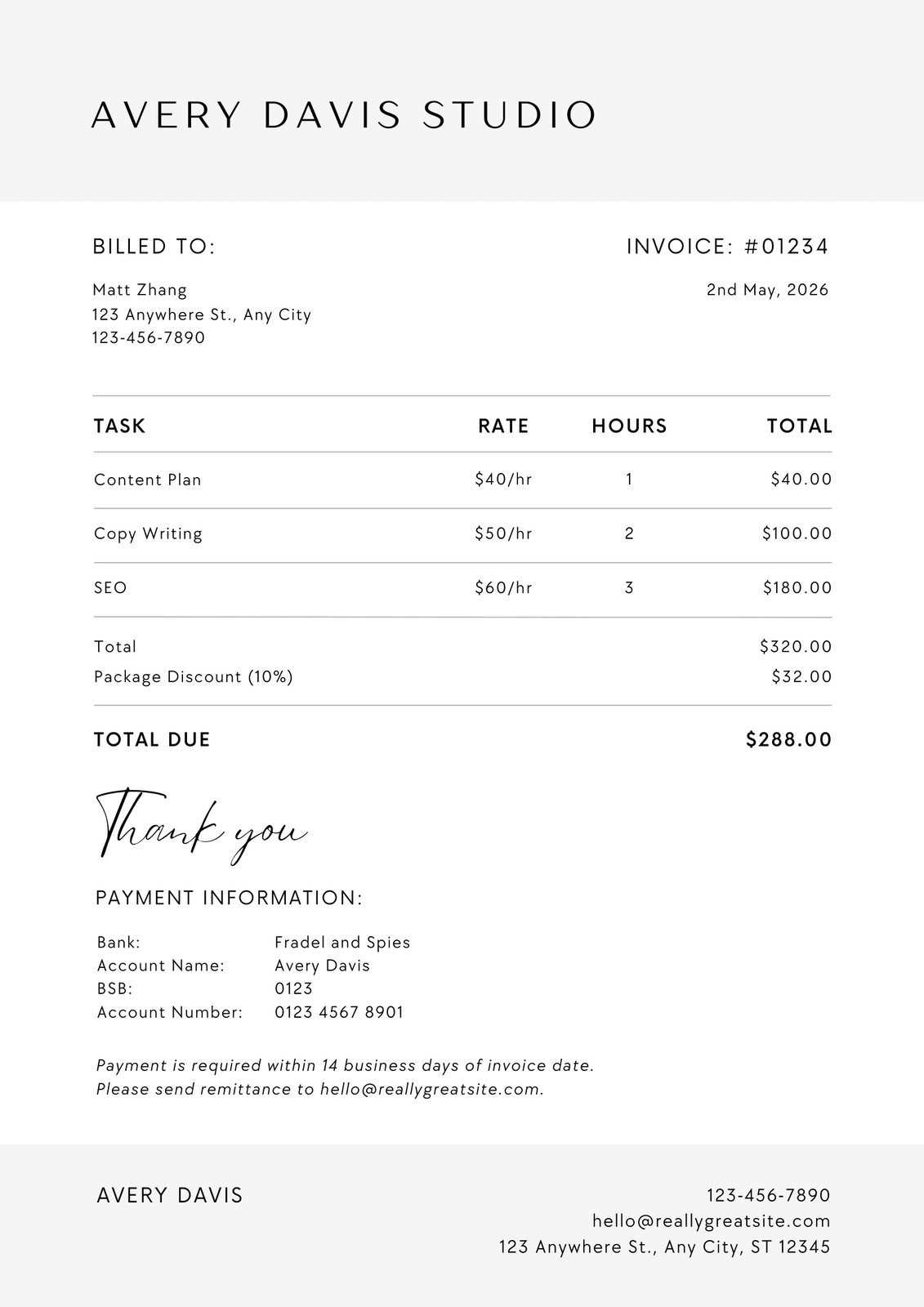

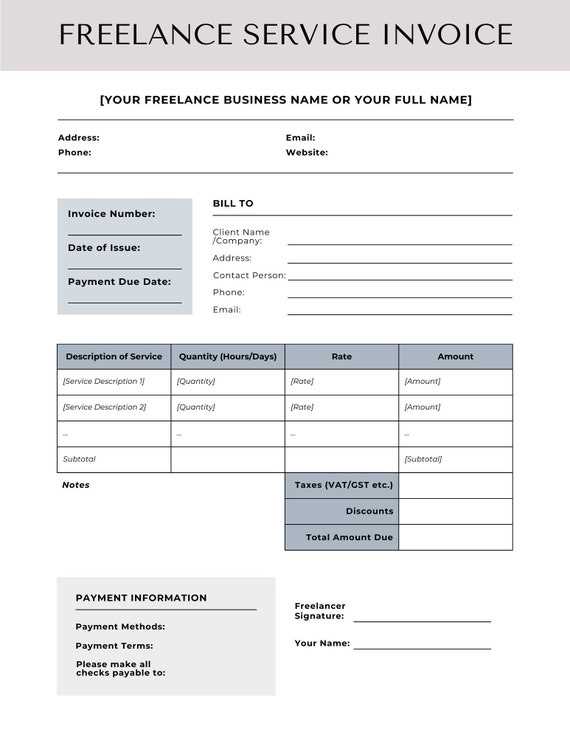

How to Create an Invoice for Freelancers

Creating a clear and professional record of work completed is essential for freelancers. This document not only outlines the services rendered but also ensures that compensation is processed correctly and on time. By structuring the record effectively, you can avoid confusion and ensure both parties are aligned on the terms of the agreement.

Steps to Create a Professional Record

To create a well-organized document, follow these key steps:

- Start with Your Information: Include your name, business name (if applicable), address, and contact details. This ensures that your client knows exactly who the bill is coming from.

- Client’s Details: Make sure to include your client’s name, company (if applicable), and contact information. This establishes the relationship and helps in case of future communication.

- List of Services Rendered: Clearly describe the work done, including the specific tasks or projects completed. Be as detailed as possible to avoid any ambiguity.

- Time Spent or Rates: Whether you’re charging by the hour, per project, or based on a flat rate, make sure to specify how the total was calculated.

- Payment Terms: Specify the due date, acceptable payment methods, and any late fees if applicable. Clear terms help avoid delays in payments.

- Total Amount Due: Clearly state the total amount to be paid. Include any taxes or additional fees if necessary.

Tips for a Clean and Professional Look

- Keep it Simple: Use a clear, easy-to-read font and format to make the record look professional.

- Use a Numbered System: Assign each document a unique number to keep your records organized.

- Include Payment Instructions: Ensure the payment methods and instructions are straightforward to minimize confusion.

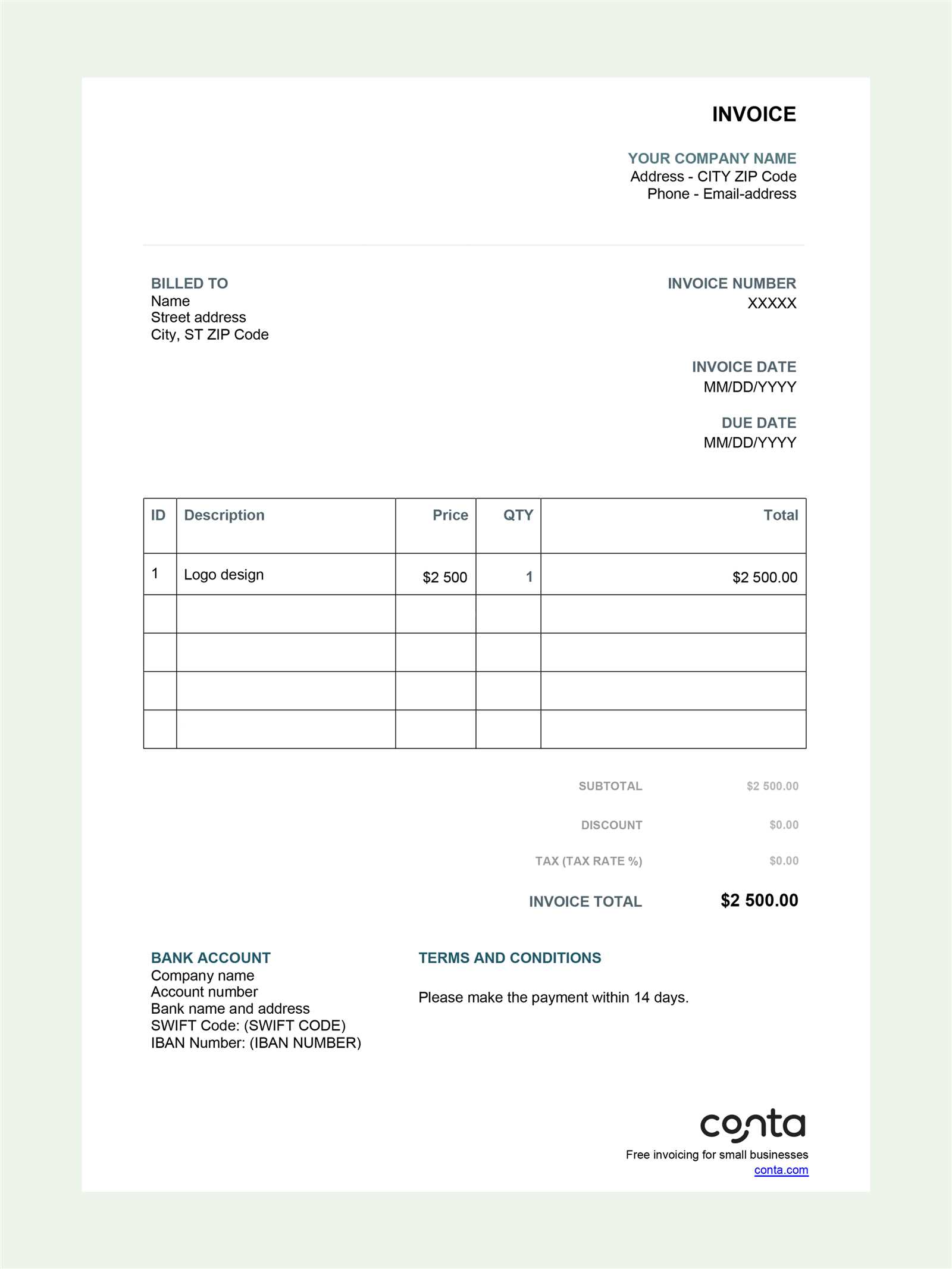

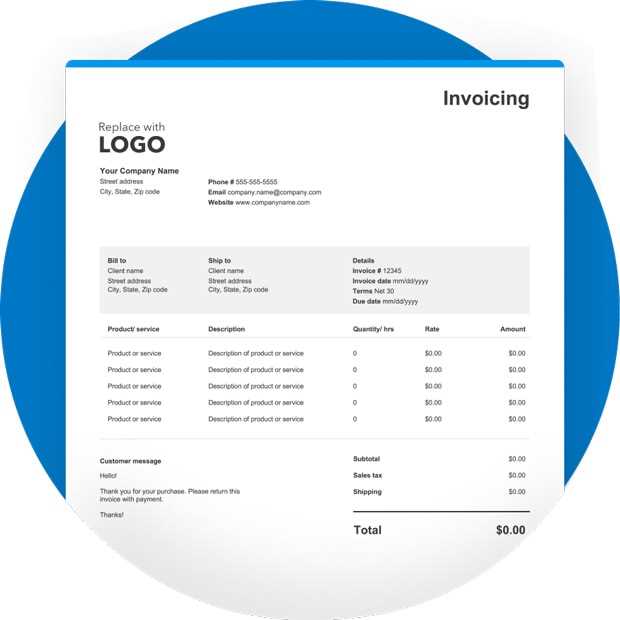

Essential Elements of an Invoice Template

Creating a well-structured document for billing purposes requires certain key details that ensure clarity, professionalism, and ease of understanding for both the service provider and the client. These crucial components help to avoid confusion and streamline the process of payment processing. Every bill should be designed to deliver all necessary information in an organized manner, guaranteeing that all parties involved are on the same page.

Key Information to Include

- Identification Information: The document should clearly state both the service provider’s and client’s names and contact details. This helps to avoid any ambiguity in identifying the entities involved.

- Unique Reference Number: A unique code or reference helps track and differentiate each transaction for easy reference in the future.

- Clear Description of Services or Products: A detailed description of what has been provided, including the scope of the work or list of items delivered, ensures transparency.

- Date of Issue and Due Date: Clearly state when the document is generated and when payment is due. This helps set clear expectations for both parties.

- Payment Terms: Specify the payment method, any discounts for early payment, or penalties for late payments to avoid misunderstandings.

Additional Details for Professional Presentation

- Price Breakdown: List the cost of each item or service, including any applicable taxes or additional fees, to make the total amount easily understandable.

- Company Branding: Including a logo or brand elements can enhance the professional look of the document, reinforcing the company’s identity.

- Legal Considerations: Depending on the location and industry, including terms and conditions, tax IDs, or legal disclaimers may be necessary for compliance purposes.

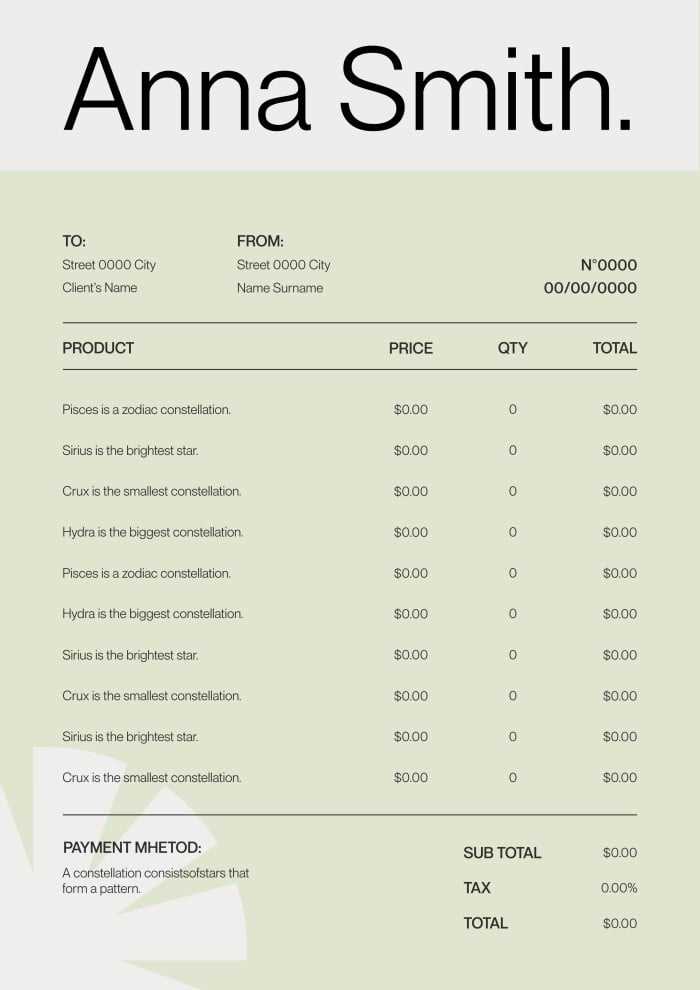

Customizing Your Invoice for Clients

Adapting your billing documents to suit the specific needs of your clients is essential for maintaining a positive professional relationship. Personalizing each statement ensures that it reflects both the nature of the service provided and the preferences of the recipient. A well-tailored billing statement can improve client satisfaction, reduce errors, and facilitate faster payments.

Personalizing Key Information

- Client-Specific Details: Always include the client’s correct name, address, and contact information. If your client prefers to receive communications at a specific address or email, make sure to adjust this accordingly.

- Customized Descriptions: Modify the description of the services to match the specific requirements or terms agreed upon with the client. This helps avoid any confusion about what is being billed.

- Payment Instructions: If a client has a preferred method of payment (e.g., bank transfer, online payment system), ensure these details are clearly listed. Also, if there are any special instructions or references they need to use when paying, include that information clearly.

Adjusting Visual Design and Branding

- Incorporate Client’s Branding: When appropriate, include your client’s branding elements, such as their logo or preferred color scheme, to create a more personalized feel. This can enhance the relationship and show that you are paying attention to their specific business culture.

- Document Formatting: Adapt the layout or structure to suit your client’s preferences, especially if they have specific requirements for the way the document is presented (e.g., a more formal style, inclusion of specific fields, etc.).

How to Calculate Hourly Rates

Determining an appropriate fee for the time spent providing services is a critical aspect of any professional relationship. The process involves considering multiple factors such as experience, market demand, and overhead costs to arrive at a fair and sustainable rate. Accurately calculating your rate ensures that you are compensated adequately for the value you provide, while also remaining competitive within your industry.

Start by calculating your annual or monthly income goals. Divide this by the number of hours you plan to work in a year or month, factoring in time for breaks, vacations, and any non-billable tasks. Additionally, assess any overhead costs like equipment, software, or office space that need to be covered. The final figure should reflect both your personal needs and the value of your expertise in the market.

Common Mistakes to Avoid in Invoicing

Managing billing documents with accuracy is crucial for ensuring timely payments and maintaining professional relationships. Small errors can lead to delays, misunderstandings, or even disputes, which can negatively affect cash flow and reputation. Being aware of the most common pitfalls and taking steps to avoid them will help keep your financial transactions smooth and efficient.

Frequent Errors to Watch Out For

- Missing or Incorrect Contact Information: Double-check the contact details for both yourself and your client. Mistakes here can lead to delayed payments or miscommunication.

- Unclear Payment Terms: Always specify when payment is due and what methods are acceptable. Ambiguity in this area can lead to confusion or delayed payments.

- Not Including a Unique Reference: Every document should have a unique reference number to avoid mix-ups. This helps both you and the client track payments more easily.

- Omitting Detailed Descriptions: Failing to clearly describe the services provided or products delivered can create confusion. Always provide enough detail so your client understands exactly what they are paying for.

Issues That Can Lead to Payment Delays

- Failure to Account for Taxes: Ensure that taxes are properly calculated and included in the total amount due, especially if you operate in regions with varying tax rates.

- Inaccurate Totals: Always double-check your calculations. Simple math errors can affect the final amount, leading to delays or disputes.

- Lack of Payment Instructions: Be sure to clearly state how you expect to be paid. Include account details, online payment links, or other necessary instructions to avoid confusion.

Time Tracking Tools for Independent Professionals

For professionals managing their own business, keeping track of the time spent on various projects is essential for both productivity and accurate billing. Efficiently logging time ensures that all tasks are accounted for and that clients are billed fairly for the work done. The right time tracking tools can help streamline this process, reduce errors, and provide valuable insights into how time is allocated across different activities.

Popular Tools for Tracking Work

- Toggle: A simple and user-friendly tool that allows users to track time by creating different projects and tasks. Its intuitive interface helps avoid any confusion about time spent on each job.

- Harvest: Known for its robust reporting features, Harvest not only helps track time but also allows professionals to generate detailed reports for clients, offering insight into the time and resources allocated to specific projects.

- Toggl Track: This tool offers features like easy one-click time tracking, detailed reports, and integrations with other apps like project management systems. It’s great for individuals who want a quick and effective way to monitor their work.

Choosing the Right Tool for Your Needs

- Consider Your Workflow: Choose a tool that fits seamlessly with your daily tasks. If you prefer a simple solution, basic apps like Toggl might work best. For more complex projects, consider tools like Harvest that offer in-depth features.

- Evaluate Reporting Capabilities: A tool with strong reporting features allows you to easily generate summaries and share them with clients or teams, saving time when preparing statements.

- Look for Mobile Access: If you’re constantly on the move, choose a time tracking app that offers a mobile version, so you can log your work from anywhere, at any time.

How to Improve Payment Accuracy

Ensuring the correct payment amount is one of the most crucial aspects of managing your finances. Small mistakes in calculations or unclear terms can lead to disputes, delays, or even non-payment. By taking proactive steps to improve the accuracy of your payment processes, you can avoid these issues and foster smoother business relationships.

Best Practices for Accurate Billing

- Double-check Calculations: Always verify that your calculations are correct, including the cost of services rendered, any applicable taxes, and discounts. Even a small error can lead to discrepancies.

- Clear Payment Terms: Make sure your terms are easy to understand and leave no room for confusion. Clearly state due dates, payment methods, and any penalties for late payments.

- Consistent Formats: Use a consistent format for all your documents to ensure that the information is easy to follow. Include all necessary details such as job descriptions, totals, and payment instructions in a clear, structured way.

Using Tools to Enhance Accuracy

Many businesses use software or online tools to automate and verify payment processes, helping to reduce the risk of errors. Below is a comparison of key features in popular payment management tools:

| Tool | Key Features | Benefits |

|---|---|---|

| QuickBooks | Automated billing, tax calculations, customizable templates | Prevents calculation errors, saves time, ensures compliance |

| FreshBooks | Recurring billing, time tracking integration, automated reminders | Improves accuracy, reduces late payments, tracks hours efficiently |

| Wave | Free invoicing, financial reporting, integration with payment processors | Affordable for small businesses, simplifies financial tracking, minimizes mistakes |

Using these tools, or similar ones, can help ensure that your payment process is streamlined and accurate, reducing errors and improving cash flow management.

Automating Invoice Creation and Sending

Streamlining the process of creating and sending billing statements is key to saving time and reducing human error. Automating these tasks not only ensures consistency but also speeds up the entire process, allowing professionals to focus on more strategic activities. With the right tools, you can create personalized documents and send them to clients without having to manually enter information each time.

Benefits of Automation

- Time Efficiency: Automating the creation and distribution of billing statements eliminates the need for repetitive tasks, freeing up valuable time for other business operations.

- Reduced Errors: By using automated systems, the chances of mistakes in calculations or missing details are significantly minimized, ensuring accurate records every time.

- Consistency: Automation ensures that all statements follow the same format and include all necessary information, promoting professionalism and clarity.

- Faster Payments: Automated reminders and easy access to statements help speed up payment cycles by ensuring clients receive their documents promptly and on schedule.

How to Automate the Process

To automate the creation and sending of your billing statements, consider using specialized software or tools that offer the following features:

- Pre-built Templates: Many tools come with customizable templates that can be filled in automatically with client and transaction details.

- Recurring Billing: For ongoing services, set up recurring billing cycles so that statements are generated and sent at regular intervals without manual input.

- Payment Reminders: Automated systems can send reminders to clients before and after the due date, reducing the need for follow-up communication.

- Integration with Payment Systems: Connect your automation tool with payment processors to allow clients to pay directly through the document, making the entire process seamless.

By adopting these automated solutions, you can simplify your financial workflows, enhance your productivity, and maintain better cash flow management.

Best Practices for Organizing Your Invoices

Maintaining an organized system for tracking billing documents is essential for smooth financial management and timely payments. A well-structured approach to storing and managing your statements allows you to quickly locate past records, stay on top of overdue payments, and ensure that all necessary information is readily accessible when needed. Here are some key practices to help you stay organized.

Effective Organization Strategies

- Use Clear Naming Conventions: Adopt a consistent naming format for each document, such as using a unique reference number or client name along with the date. This makes it easier to find specific records when needed.

- Sort by Date: Organizing your documents chronologically ensures that older statements are filed correctly and that you can easily track overdue payments.

- Segment by Client or Project: If you work with multiple clients or on various projects, consider keeping separate folders for each. This allows you to quickly locate documents specific to a client or job.

- Cloud Storage: Use cloud-based storage solutions to keep your documents secure, accessible, and easy to share. This also ensures that your records are backed up and protected from data loss.

Automation for Organization

- Set Up Automatic Categorization: Many digital tools allow you to set up automatic categorization of your documents based on pre-defined rules. This can save you time and reduce the risk of misplacing important records.

- Integrate with Accounting Software: Use software that automatically imports and categorizes documents as they are created, helping you track payments and outstanding balances without manual entry.

- Implement Reminders and Alerts: Set up alerts to notify you of overdue payments or when a document is due for sending. This helps you stay proactive and avoid delays.

By following these best practices, you can ensure that your billing documents are well-organized, easy to manage, and ready to use whenever necessary, making your financial management process more efficient and less stressful.

Legal Considerations for Freelance Invoices

When preparing billing documents, freelancers must ensure that they comply with relevant legal requirements to protect both themselves and their clients. Inaccurate or incomplete information can lead to disputes, delayed payments, or even legal issues. It’s important to understand the legal aspects of creating such documents, including necessary terms, tax obligations, and compliance with local regulations.

Key Legal Elements to Include

- Business Identification: Always include your full legal name or business name, along with your tax identification number (TIN) or VAT number (if applicable). This ensures that your client knows they are working with a registered entity.

- Payment Terms: Clearly outline payment expectations, such as due dates, late fees, and interest charges for overdue payments. These terms help establish a clear understanding of the financial arrangements between you and the client.

- Tax Compliance: Depending on your location and the type of services provided, you may need to include sales tax or VAT on your billing documents. It’s essential to ensure that the tax is correctly calculated and displayed.

- Confidentiality Clauses: If your work involves sensitive information, including confidentiality clauses in your agreements or billing statements may be necessary to safeguard your client’s data.

Understanding Your Tax Obligations

It’s essential to understand the tax rules that apply to your services. In many countries, freelancers are required to pay taxes on their income, and some may also need to charge VAT or sales tax on services provided. Below is a comparison of tax considerations for freelancers in different regions:

| Region | Tax Requirements | Additional Considerations |

|---|---|---|

| United States | Freelancers must report income to the IRS using Schedule C, and pay self-employment tax. | Self-employment tax covers Social Security and Medicare. Consider quarterly estimated payments. |

| European Union | VAT may apply, depending on the country and the type of service. Freelancers must register for VAT if their revenue exceeds a certain threshold. | Some countries offer reduced VAT rates for specific services. Research local regulations for your field. |

| United Kingdom | Freelancers must register as a sole trader or limited company and may be required to charge VAT based on their annual turnover. | Income tax is based on annual earnings, and freelancers can claim allowable business expenses to reduce their taxable income. |

By ensuring that your billing documents are legally sound and compliant with applicable tax rules, you can minimize risks and establish trust with your clients. Always stay informed about changes in tax laws and local regulations to keep your business practices in line with legal requirements.

How to Handle Late Payments Effectively

Late payments can create significant challenges for individuals offering services on a freelance or contract basis. Managing overdue accounts requires a combination of tact, clear communication, and well-defined procedures. Taking proactive steps to address delays can help maintain professional relationships while ensuring timely compensation for work completed. By implementing effective strategies, you can reduce the likelihood of delays and recover owed amounts in a structured and respectful manner.

Start by setting clear expectations from the outset. Whether it’s through formal agreements or friendly discussions, it’s important to outline payment terms upfront. Clear deadlines and consequences for non-payment should be communicated early on. Additionally, offering multiple payment options can make it easier for clients to settle their debts promptly.

If a payment becomes overdue, initiate contact in a polite and professional manner. A gentle reminder, whether through email or phone call, can often resolve the issue without conflict. Keep your tone neutral and positive, emphasizing your desire to maintain a good working relationship. In your communication, be specific about the amount owed and the agreed-upon deadline. If the payment remains unsettled, follow up with more frequent reminders, ensuring each communication is documented for reference.

For clients who consistently delay payments, consider implementing late fees or interest charges as part of your agreements. This can serve as a deterrent to future delays and encourage quicker action on outstanding amounts. It’s essential to be transparent about these policies before work begins to ensure your client is aware of the potential consequences.

If late payments persist despite these efforts, you may need to explore more formal methods of collection. This could include sending a formal demand letter or engaging a collection agency. However, these steps should be taken cautiously, as they can strain professional relationships. In some cases, you might decide that the cost of collection outweighs the value of the debt, so always assess each situation carefully.

Ultimately, handling overdue payments is about balance–being firm but fair, and taking appropriate steps to protect your business while maintaining a positive professional reputation.

How to Use Excel for Invoices

Excel is a powerful tool for managing financial documents, and creating professional statements for services rendered is no exception. It offers a flexible and customizable platform to track payments, manage records, and ensure accuracy when requesting compensation. Using this software effectively allows for easy updates, calculations, and the ability to quickly generate clear and organized documentation.

Setting Up Your Document

To begin, you need to structure your document in a way that captures all the necessary details while remaining clean and easy to read. Start by creating columns for each essential element. The following categories are typically required:

- Client Name and Contact Information

- Description of the Service or Work Provided

- Payment Due Date

- Total Amount Due

- Payment Terms

- Unique Reference or ID Number

Once you have defined these sections, use Excel’s grid layout to neatly organize the data. This structure not only ensures that all important information is present but also helps prevent errors when entering values.

Automating Calculations

One of the main advantages of using Excel is the ability to automate certain tasks. You can set up formulas to automatically calculate totals, taxes, or discounts based on entered values. This minimizes the risk of mistakes and saves you time. For example, you can create a formula to multiply the rate by the quantity of work done, and it will instantly provide the total.

- Use the SUM function to add up totals across different rows or columns.

- Set up percentage-based formulas for taxes or discounts to automatically adjust the final amount due.

- Apply conditional formatting to highlight overdue payments or discounts.

By leveraging Excel’s built-in formulas, you ensure that the numbers are always accurate and up-to-date, making your financial documentation much more efficient.

Excel can be an invaluable tool for managing financial records and generating statements. By setting up a clear structure and utilizing automation features, you can create professional documents that reflect the work completed and facilitate smooth transactions.

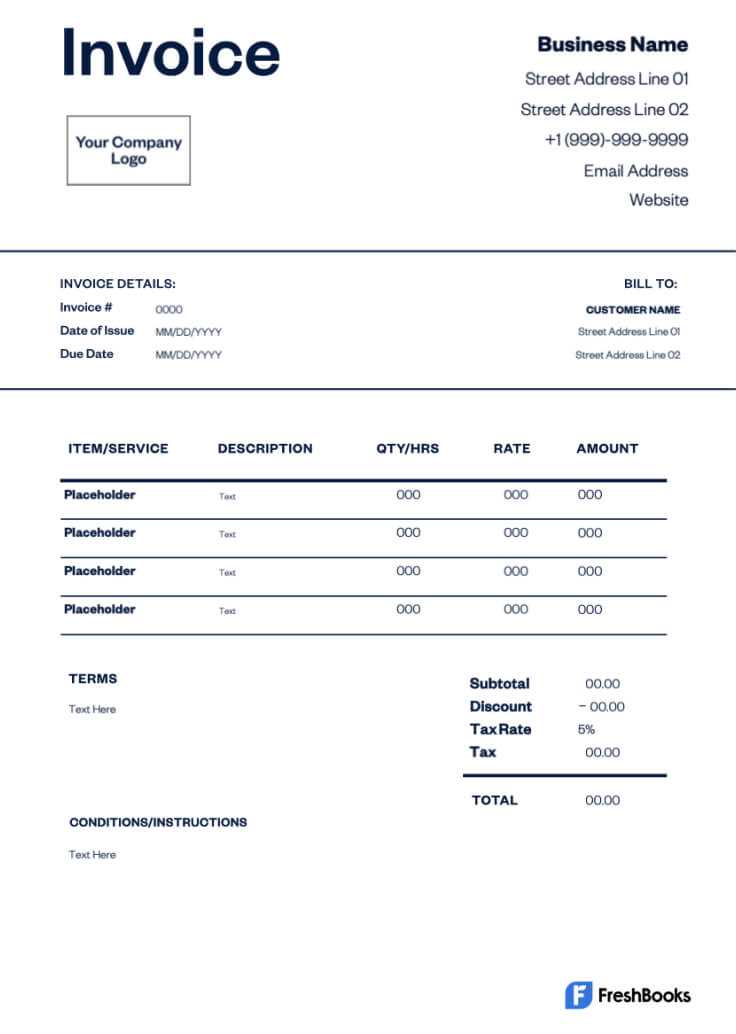

Free Resources for Invoice Templates

When managing financial transactions, having access to professional and customizable documents can simplify the process significantly. Fortunately, there are numerous free resources available online that provide ready-made layouts for creating billing statements. These resources not only save time but also ensure that your records are consistent, organized, and meet industry standards. Below are some of the top platforms offering free options for generating such documents.

1. Microsoft Office Templates

Microsoft Office offers a variety of free, editable documents that can be customized according to your needs. You can access these resources directly from Excel, Word, or the Office website. With simple customization options, you can modify the design, layout, and fields to suit your specific requirements.

- Easy to use with pre-set calculations in Excel options.

- Wide variety of designs for different industries.

- Downloadable directly to your device for quick access.

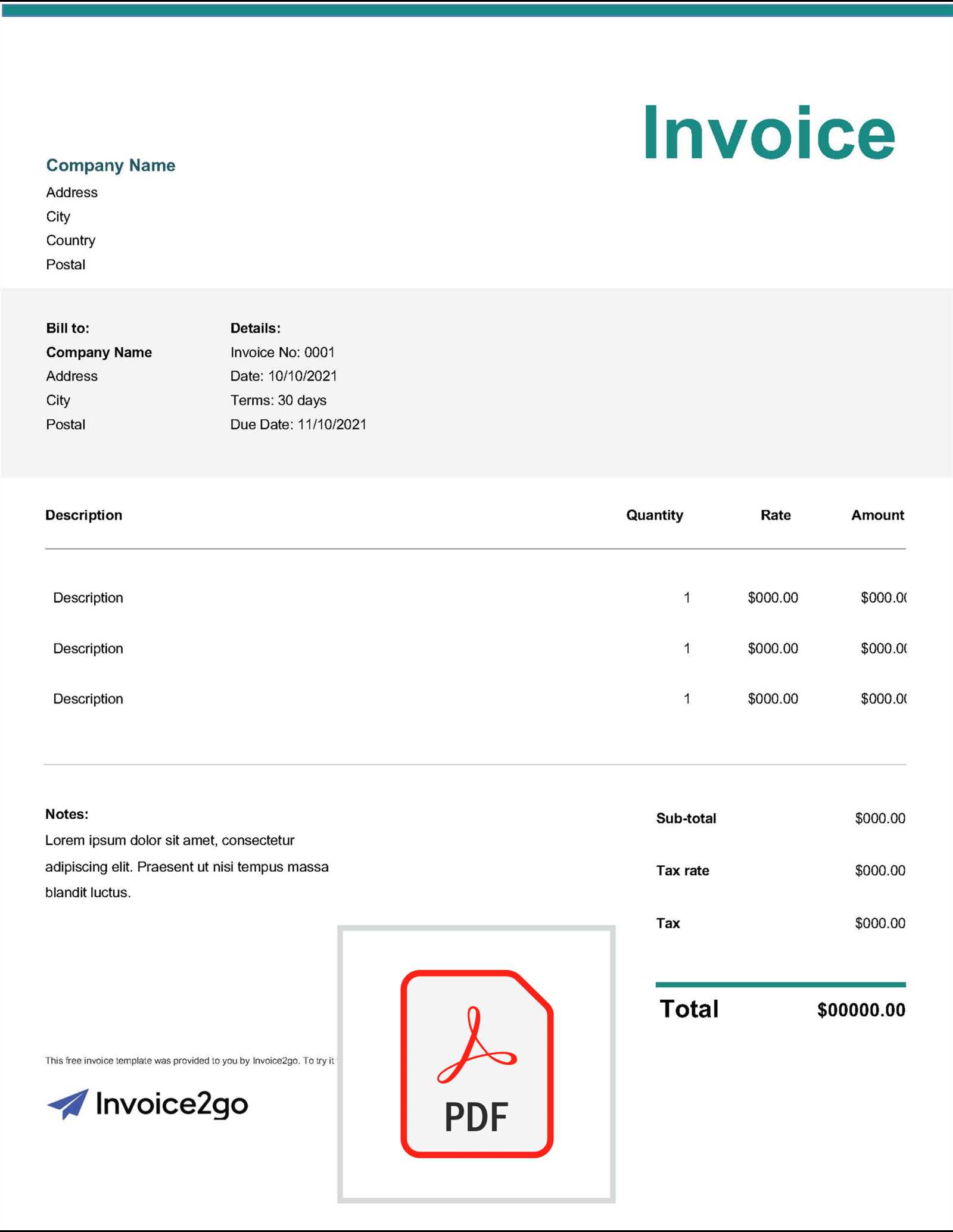

2. Google Docs and Sheets

Google provides several free templates through its Docs and Sheets platforms. These templates are cloud-based, meaning you can access and edit them from any device with an internet connection. They’re particularly useful for users who need to share or collaborate on documents in real time.

- Cloud-based, accessible from any device with internet.

- Customizable and easy to share with clients or team members.

- Free with a Google account.

3. Online Platforms for Customizable Documents

There are numerous websites dedicated to offering free layouts for financial statements. These platforms often allow for easy customization, and some even provide the ability to download your documents in various formats such as PDF or Word. Some examples include:

- Zoho Invoice – Provides free templates for small business owners.

- Invoice Generator – Simple to use with no sign-up required.

- Wave – A free service offering customizable billing formats along with accounting tools.

4. Design Websites with Free Layouts

Some design-focused platforms offer attractive and professional layouts for those looking to create visually appealing documents. Websites such as Canva and Adobe Spark provide templates that are easy to customize and can be downloaded or shared directly with clients.

- Canva – Offers a variety of creative, customizable designs.

- Adobe Spark – Allows for detailed design with branding options.

- Free to use with optional premium upgrades for additional features.

With these free resources, you can streamline the process of creating professional documents, saving time and ensuring that your financial records remain accurate and consistent. Whether you need simple layouts or highly customizable designs, these platforms offer everything you need to get started without any cost.