Self Employed Electrician Invoice Template for Easy Billing

Managing finances and ensuring timely payments is crucial for anyone offering professional services. For those in technical fields, it’s essential to have a streamlined system for documenting work completed, detailing costs, and tracking payments. A well-structured billing document can make all the difference, ensuring clear communication with clients and reducing the chances of payment delays or misunderstandings.

Creating an effective billing document can be overwhelming without the right tools. Whether you are just starting or have been operating for years, having a customizable format that fits your needs is key. The right layout and content can save time, prevent errors, and enhance your professional image.

In this guide, we’ll explore various aspects of crafting the perfect billing document, from the essential components to tips for customization. By the end, you’ll have a clear understanding of how to design a functional and professional billing system tailored to your services.

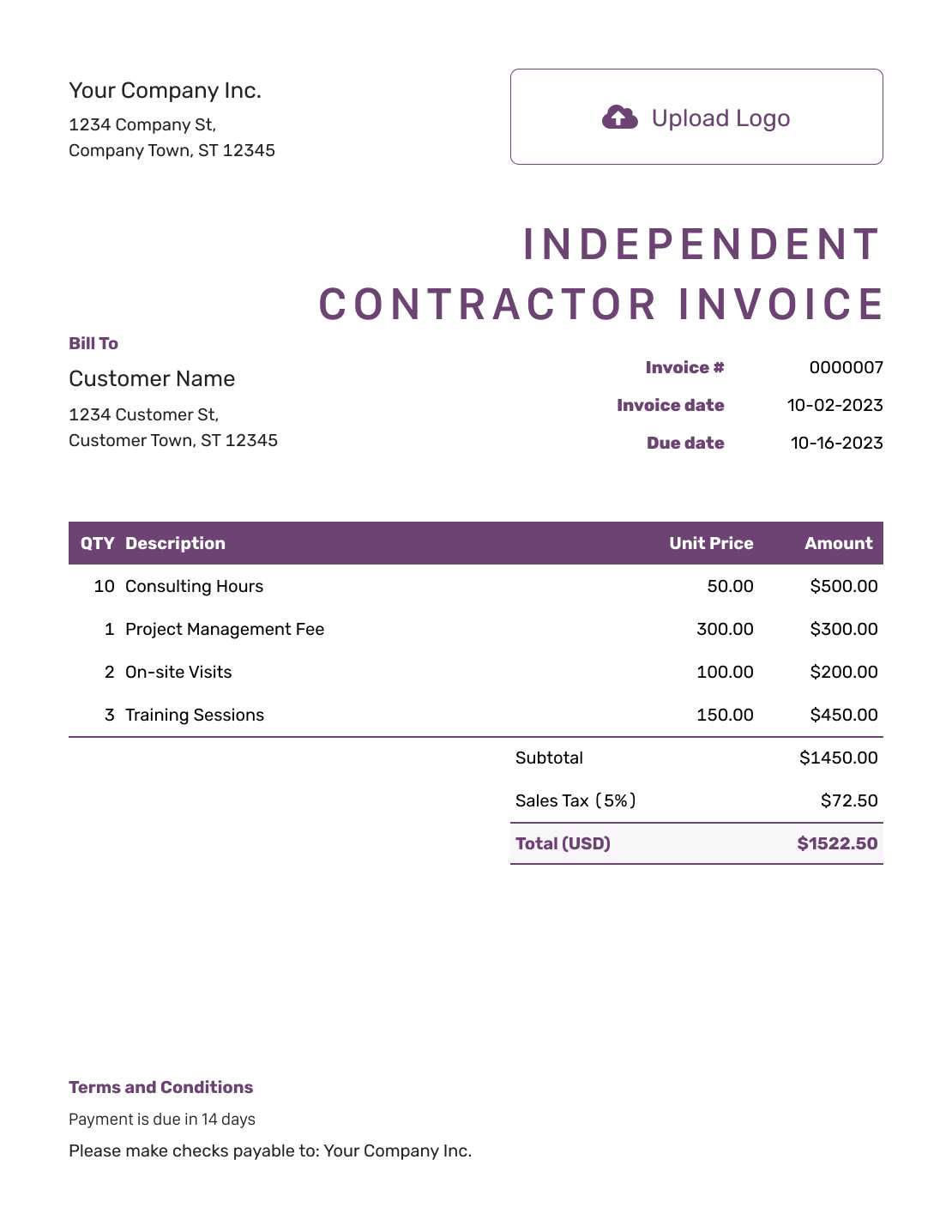

Billing Document for Independent Contractors

For those offering technical services, having a well-organized document for tracking work completed and requesting payments is essential. A structured approach to billing not only improves the efficiency of managing payments but also ensures that clients have all the necessary information to process them quickly. This document serves as both a record of the services provided and a formal request for compensation.

Creating a professional and clear billing format involves more than just listing charges. It should include detailed descriptions of tasks performed, applicable rates, payment terms, and contact information. With the right components, the process becomes seamless for both the service provider and the client, reducing confusion and the likelihood of disputes.

By customizing this document to fit specific business needs, individuals in skilled trades can maintain a professional image while simplifying their administrative tasks. This format can also serve as a useful reference for future projects, ensuring consistency and reducing the time spent on billing in the long run.

Why You Need an Invoice Template

Having a standardized document for requesting payment is vital for any independent contractor or freelancer. This document serves not only as a professional representation of your business but also as a legal record of the work completed and the amount due. Without a consistent format, billing can become confusing and time-consuming, leading to potential errors or delays in receiving compensation.

A pre-designed structure ensures that all necessary information is included, reducing the chances of overlooking important details such as rates, service descriptions, and payment deadlines. Additionally, it saves time by eliminating the need to create a new format for each client or project, allowing you to focus more on the work itself.

Furthermore, using a reliable billing format enhances your credibility and can foster trust with clients. A professional document demonstrates organization and transparency, which can lead to quicker payments and improved client relationships in the long run.

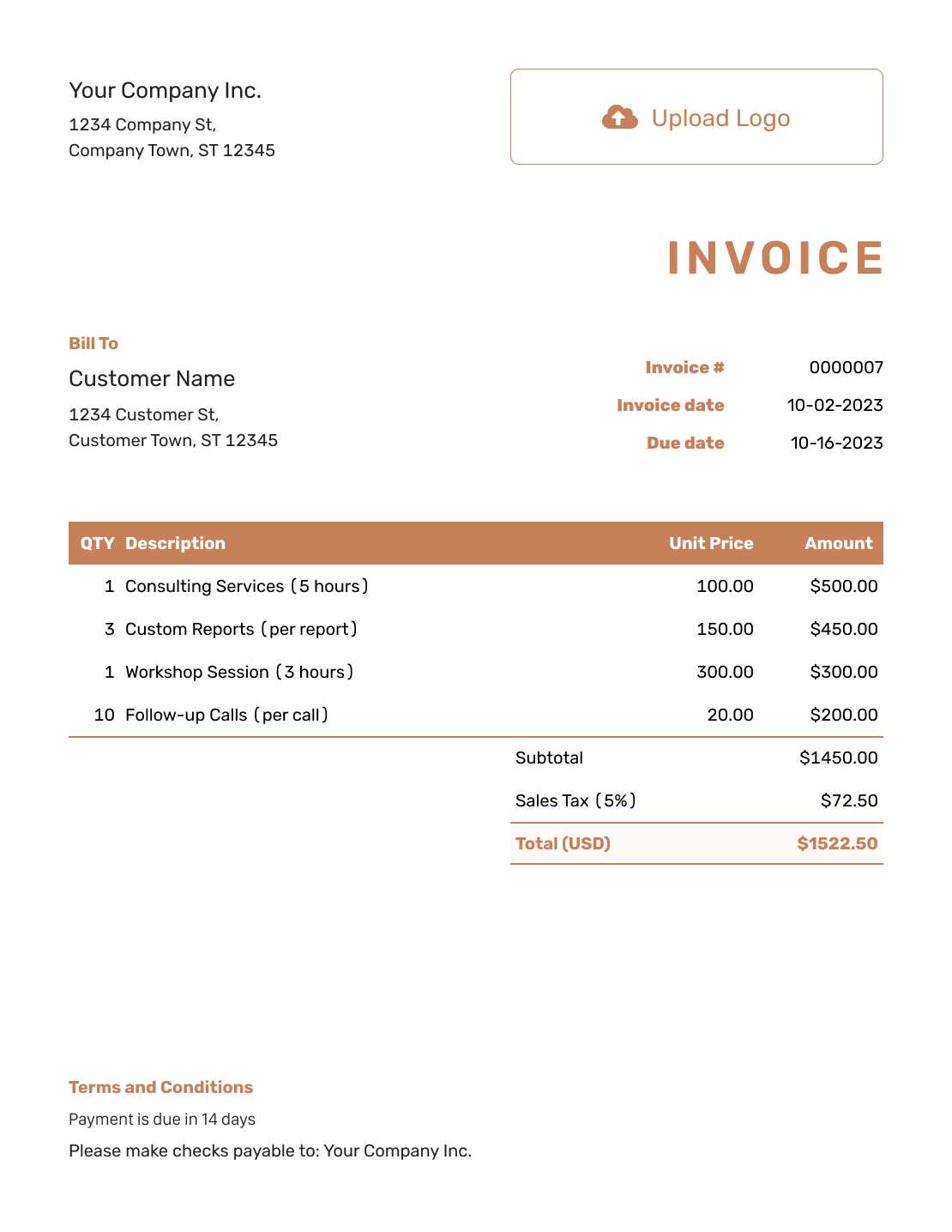

Essential Features of an Invoice Template

To ensure clear communication and smooth transactions, it’s crucial to include specific elements in any billing document. These essential features not only help to avoid misunderstandings but also streamline the process for both the service provider and the client. A comprehensive structure ensures that all necessary information is presented in an organized manner, making it easier to track payments and resolve any issues that may arise.

Key Elements to Include

- Contact Information: Both the service provider’s and the client’s names, addresses, and phone numbers should be clearly listed for reference.

- Service Description: A detailed breakdown of the work completed, including time spent and materials used, provides transparency.

- Rates and Pricing: Clear pricing details, including hourly rates or flat fees, should be included to avoid confusion.

- Payment Terms: Outline due dates, payment methods, and late fees if applicable.

- Unique Reference Number: Each document should have a unique number for tracking and organizational purposes.

Additional Considerations

- Taxes: Clearly state any taxes or VAT applied to the final amount.

- Notes or Special Instructions: Space for any additional information or terms that might be relevant to the transaction.

- Professional Design: A clean and easy-to-read layout contributes to the document’s professionalism.

Including these components in your billing document helps ensure that clients receive all the necessary details to process payments without delays. By being thorough and organized, you can maintain a professional image while simplifying the payment process.

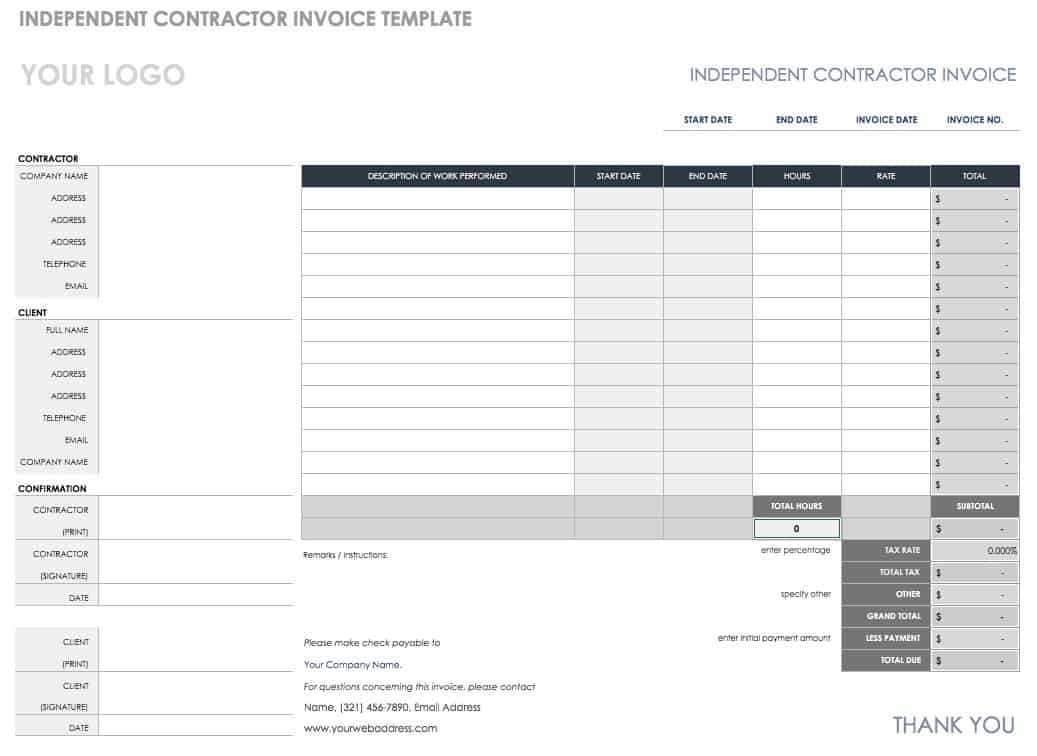

How to Create a Billing Document for Technicians

Creating a professional billing document is essential for anyone providing specialized services. The process involves gathering all the relevant information about the work performed, determining the payment terms, and organizing it in a clear and concise manner. A well-structured document ensures that clients understand the charges and can quickly process the payment without confusion.

Follow these steps to create a comprehensive billing document:

- Collect Client and Service Information: Start by including the contact details of both parties. Include the names, addresses, and phone numbers of both the contractor and the client. Additionally, add the date the work was completed.

- Describe the Services Provided: List all the tasks completed during the project. Be specific about the work performed to avoid misunderstandings. If applicable, include quantities of materials or hours worked.

- Breakdown the Pricing: Provide a clear breakdown of the costs. This could be based on hourly rates, flat fees, or material costs. Ensure that each item is listed separately for transparency.

- Specify Payment Terms: State the payment due date, acceptable payment methods, and any late fees or penalties. This helps set clear expectations regarding the timing of the payment.

- Add a Unique Reference Number: Each billing document should have a unique reference number for easy tracking and future reference.

By following these steps, you can create a detailed, professional billing document that ensures a smooth transaction for both you and your clients. A clear and well-organized format will not only improve payment efficiency but also contribute to building a positive reputation for your business.

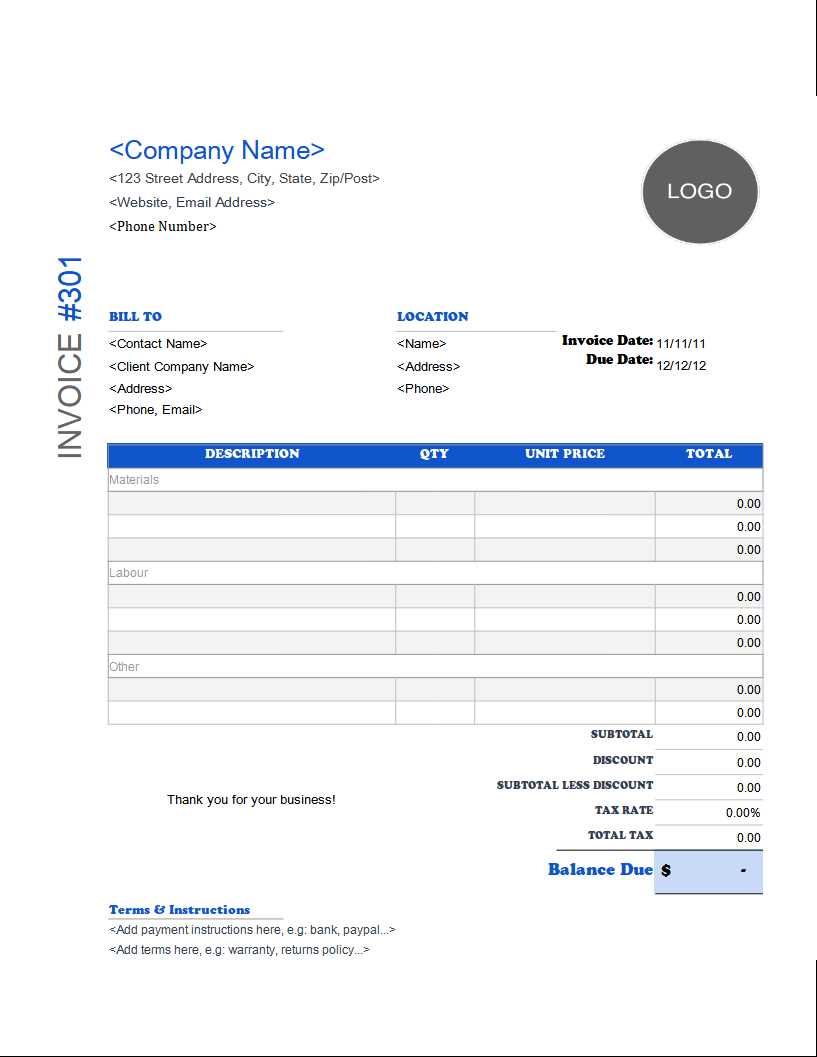

Customizing Your Billing Document

Tailoring your billing document to fit the specific needs of your business is essential for both professionalism and efficiency. Customization allows you to reflect your brand, make your billing process more streamlined, and ensure that all necessary information is included. By adjusting the format and layout, you can create a document that aligns with your unique services and client requirements.

Here are some key ways to personalize your billing document:

- Branding: Add your business logo, company name, and contact information at the top of the document to maintain a professional appearance.

- Tailored Service Descriptions: Customize the description section to reflect the specific types of work you perform. Use clear language that matches the services you provide.

- Flexible Pricing Structure: Include various pricing models, such as hourly rates, flat fees, or bundled packages, depending on the type of work you do. Be sure to specify how charges are calculated.

- Include Special Terms: Adjust the payment terms and conditions based on your business practices, such as offering discounts for early payment or outlining specific penalties for late payments.

- Additional Sections: Consider adding extra sections like “Materials Supplied” or “Notes” for more detailed billing. This can be particularly helpful for tracking extra costs or special instructions for the client.

Customizing your billing format ensures that you provide clients with exactly what they need while also representing your business in the best possible way. A personalized approach not only enhances clarity but also helps you stand out as a professional in your field.

Benefits of Using a Digital Billing Document

Switching to a digital format for your billing process offers a range of advantages over traditional paper-based methods. Not only does it increase efficiency, but it also provides greater flexibility, accuracy, and convenience for both the service provider and the client. Digital documents make it easier to track transactions, manage records, and speed up payment processing.

Efficiency and Convenience

- Faster Delivery: Digital billing can be sent instantly via email, reducing delays associated with postal mail.

- Access Anywhere: With digital documents, you can access your billing records from any device, whether you’re in the office, at home, or on the go.

- Easy Updates: It’s simple to edit or update digital files when necessary, allowing you to make corrections or adjustments quickly.

Improved Accuracy and Record-Keeping

- Minimized Errors: Automated tools can help reduce human errors in calculations or missing information, ensuring that your billing is accurate every time.

- Better Organization: Digital files can be easily stored, categorized, and retrieved, helping you maintain an organized record of all transactions for tax purposes and future reference.

- Integrated Payment Options: Digital documents can include integrated payment links, allowing clients to pay directly through online platforms, speeding up the process.

Adopting digital documents for billing not only simplifies administrative tasks but also enhances professionalism. By using electronic methods, you can streamline your operations, improve client satisfaction, and maintain a well-organized system for tracking payments and records.

Tips for Accurate Billing as a Technician

Ensuring the accuracy of your billing is crucial for maintaining healthy client relationships and a smooth financial workflow. Accurate charges not only prevent disputes but also help in building trust and professionalism. By following a few simple practices, you can avoid common billing mistakes and ensure that your clients receive clear and precise statements for your services.

Maintain Detailed Records

- Track Time and Materials: Keep a log of the time spent on each job and the materials used. This will ensure you can provide a thorough breakdown of the costs, which helps avoid confusion later on.

- Document Work Progress: Regularly update your records with specific details of tasks completed, so when it comes time to bill, you have a comprehensive history of the work done.

- Use Professional Tools: Using software or digital tools to track hours, materials, and services can significantly reduce errors and save you time in the billing process.

Double-Check Your Numbers

- Review Your Rates: Ensure that your hourly rates, flat fees, and charges for materials are consistent with your agreement with the client. Double-check any taxes or additional charges.

- Ensure Correct Calculations: Manually or automatically calculate your charges to ensure accuracy, especially when using complex pricing structures or multiple services.

- Revisit Payment Terms: Clarify payment due dates, penalties, or discounts before sending the document to the client to avoid confusion and potential delays in payment.

By staying organized, keeping accurate records, and reviewing every detail of your billing process, you can ensure that your documents reflect the true cost of the services provided. This helps create transparency and trust with clients while simplifying your overall administrative tasks.

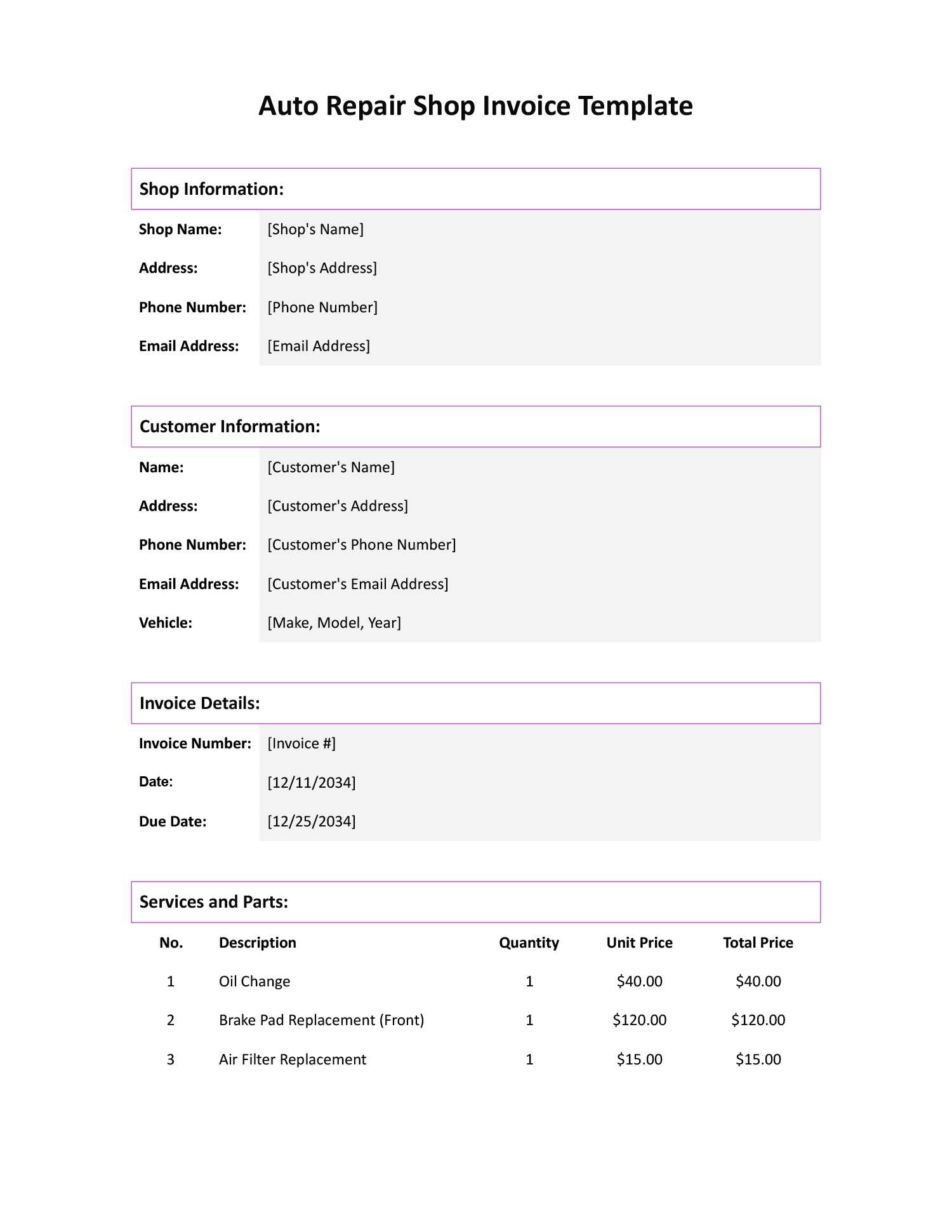

Free Billing Documents for Technicians

Finding the right tools to simplify your billing process can save you time and effort. There are many free resources available that offer customizable billing formats tailored to a variety of service providers. These documents help ensure that all necessary details are included, making the billing process more efficient and professional.

Free billing formats can be found in various styles and structures, depending on the nature of your work. Some are designed for simple services, while others may include more advanced features such as time tracking, material costs, or payment terms. These pre-designed documents often come with built-in fields, allowing you to easily input the specifics of your project and client.

Benefits of using free billing documents include:

- Cost-Effective: These resources are available at no charge, making them ideal for those just starting their business or those looking to reduce overhead costs.

- Customization Options: Many of these formats allow for easy customization, so you can add your logo, adjust the layout, or modify the content to suit your needs.

- Quick and Easy Setup: With a pre-made structure, you can start issuing bills immediately without spending time creating documents from scratch.

- Professional Appearance: Using a well-designed, structured document gives your business a professional look, which can help foster trust with clients.

Using free billing formats ensures that you maintain consistency and clarity in your financial transactions. By choosing the right tool, you can streamline your billing process and focus more on the work you do, rather than administrative tasks.

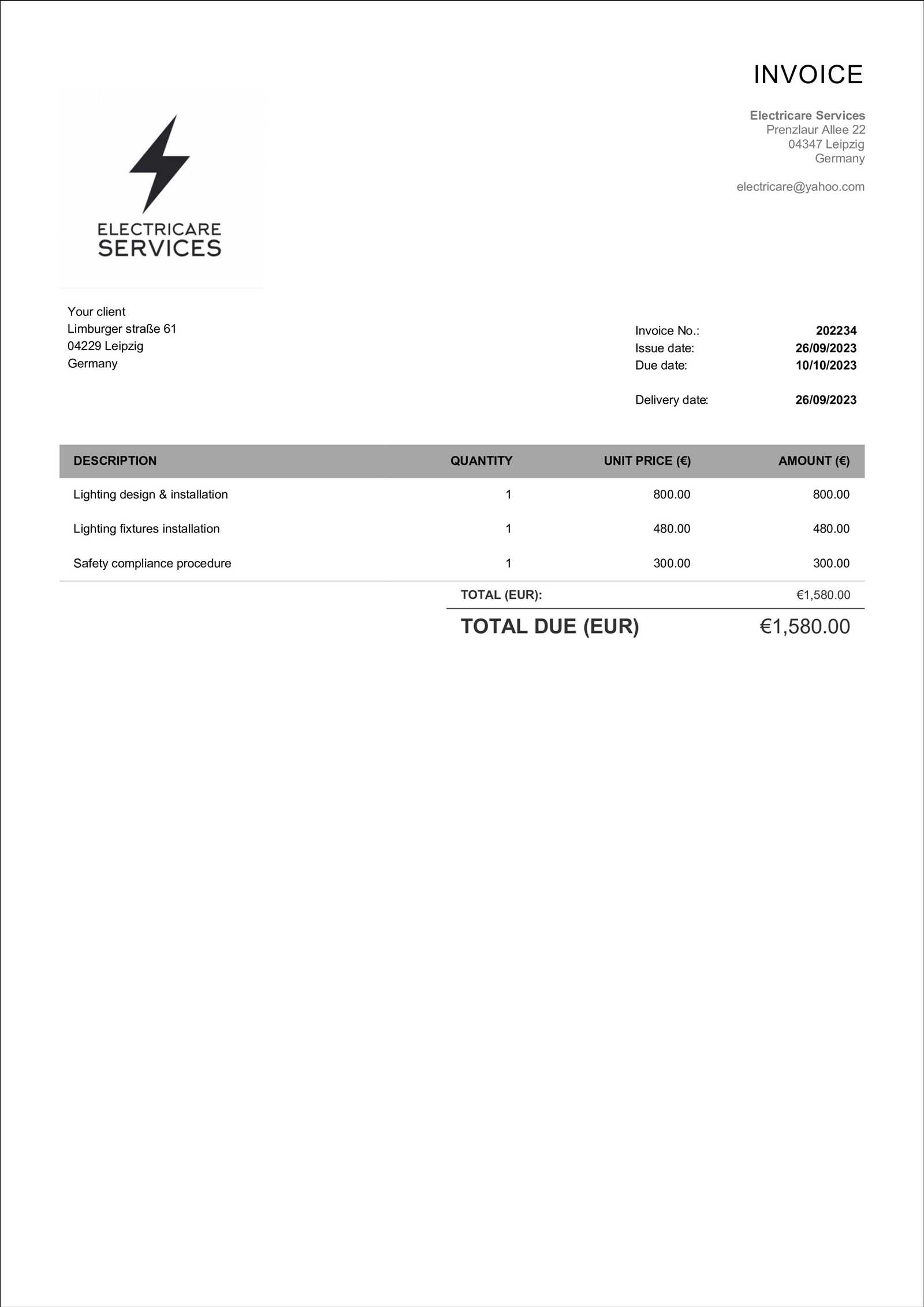

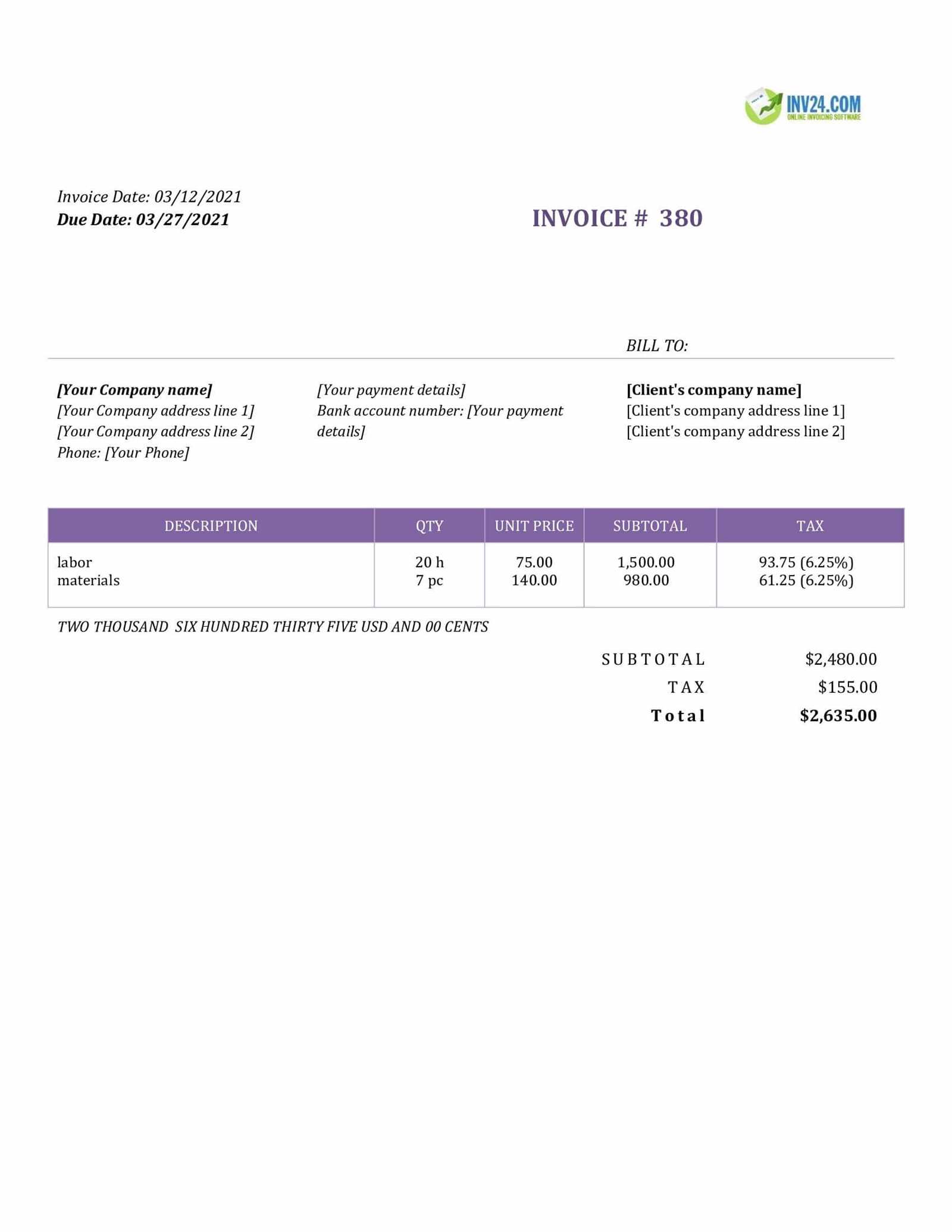

How to Include Taxes on Your Billing Document

Including taxes on your billing document is an essential step to ensure compliance with tax regulations and provide clients with a clear breakdown of the total amount due. Properly calculating and displaying taxes not only helps you avoid legal issues but also increases transparency with your clients. Different regions have varying tax rates, so it’s important to follow local rules to accurately reflect these charges.

Here are a few steps to properly include taxes:

- Identify the Applicable Tax Rate: Determine the correct tax rate for your location and the services you provide. This may vary depending on your region and the type of work being done.

- Calculate the Tax Amount: Multiply the taxable amount (such as service fees or materials) by the applicable tax rate to determine the total tax due.

- Separate Tax on the Document: It’s best to list taxes as a separate line item on your billing document. This makes it clear for clients how much they are being charged for taxes, separate from the services provided.

- Include Tax Registration Information: If required, include your tax identification number or registration details on the document to ensure transparency and compliance.

- Be Clear About Taxable and Non-Taxable Items: Not all goods and services may be subject to tax, so make sure to clarify which parts of your work are taxable and which are exempt, if applicable.

By correctly including taxes on your billing document, you ensure that your clients understand the total amount due and help keep your business compliant with local tax laws. This practice also demonstrates professionalism and helps avoid any future confusion regarding payment obligations.

Understanding Payment Terms in Billing Documents

Payment terms are a critical aspect of any billing document as they define the conditions under which a payment is expected. Clear and concise payment terms help both the service provider and the client understand when and how payment should be made, preventing misunderstandings and delays. By establishing these terms upfront, you can ensure a smoother transaction process and maintain a professional relationship with your clients.

Key Elements to Include in Payment Terms:

- Due Date: Specify the exact date by which payment is expected. This ensures clarity and avoids confusion regarding deadlines.

- Late Payment Fees: Clearly outline any penalties or interest charges that will apply if the payment is not made on time. This encourages clients to pay promptly and helps protect your cash flow.

- Accepted Payment Methods: Indicate which payment methods you accept, such as credit cards, bank transfers, or online payment platforms. Offering multiple options can make it easier for clients to pay.

- Early Payment Discounts: Some businesses offer discounts for clients who pay before the due date. If applicable, specify the percentage or amount of the discount to incentivize timely payments.

- Partial Payments: If you allow clients to pay in installments, outline the terms for these payments, including how often they are due and any amounts due at specific intervals.

Clearly defining payment terms ensures that both parties understand the expectations, which helps avoid disputes and delays. Having these terms written out in advance not only makes the billing process smoother but also enhances your credibility and professionalism in the eyes of your clients.

Designing Professional Billing Documents for Clients

Creating a well-designed billing document is essential for maintaining a professional image and fostering trust with your clients. A clean and organized document not only ensures that all important information is conveyed clearly, but it also helps streamline the payment process. A thoughtfully designed format can reflect the quality of your services and make a positive impact on your business reputation.

Key Elements of a Professional Billing Document:

- Clear Layout: Organize the document in a way that makes it easy to read. Use headers, bold text, and ample white space to break up sections and make the information digestible.

- Company Branding: Include your logo, business name, and contact details at the top of the document to create a consistent brand identity and enhance credibility.

- Simple and Precise Language: Avoid jargon or overly complex descriptions. Clearly state the services rendered, costs, and any other important details in simple terms.

- Itemized Breakdown: Provide a detailed list of the work completed, including hours worked, materials used, and the corresponding costs for each item. This transparency helps clients understand exactly what they are paying for.

- Payment Instructions: Include clear and concise payment terms, such as the due date, accepted methods, and any late fees or discounts for early payment.

Design Considerations:

- Consistent Fonts and Colors: Use easy-to-read fonts and a limited color palette that aligns with your brand’s aesthetic. Avoid cluttering the document with too many fonts or bright, distracting colors.

- Professional Structure: Organize the document logically, with sections for your contact details, the client’s information, a breakdown of services, payment terms, and any applicable taxes or fees.

- Customizable Fields: Ensure the design allows for c

How to Avoid Common Billing Mistakes

Billing mistakes can cause unnecessary confusion and delay payments, which can negatively impact your business’s cash flow. It’s essential to avoid errors in your billing documents to ensure timely payments and maintain a professional relationship with your clients. By following best practices and staying organized, you can minimize the risk of common billing errors and streamline your financial operations.

Common Billing Mistakes to Watch Out For

- Incorrect Information: Ensure that both your details and your client’s information are accurate. This includes addresses, phone numbers, and any project-related specifics. Mistakes in contact information can lead to missed payments or communication issues.

- Missing or Unclear Descriptions: Always provide clear descriptions of the services rendered or products supplied. Vague or incomplete descriptions can confuse your clients, leading to disputes or delayed payments.

- Forgetting to Include Taxes: Neglecting to include the correct tax rates or failing to list them separately can lead to complications with your client and tax authorities. Always make sure taxes are calculated accurately and displayed clearly.

- Errors in Pricing or Calculations: Double-check the figures for accuracy, especially when it comes to hourly rates, material costs, or discounts. Even small mistakes can add up and affect your payment.

- Not Setting Clear Payment Terms: Be explicit about when the payment is due, any penalties for late payments, and the acceptable methods of payment. Ambiguous payment terms can lead to misunderstandings and delays.

How to Avoid These Mistakes

- Use Billing Software: Using automated billing software can reduce human errors by calculating totals, taxes, and discounts automatically. It also allows for easy customization and consistent formatting.

- Review Every Detail: Before sending a document, take a moment to review all the details thoroughly. Double-check the figures, descriptions, and terms to ensure accuracy.

- Standardize Your Process: Establish a consistent billing process and format for all your documents. This makes it easier to spot errors and ensures uniformity in your records.

- Get Client Confirmation: If there is any uncertainty about the charges, it’s better to clarify with the client beforehand. This can help prevent disagreements later on.

By staying vigilant and following these tips, you can avoid common billing mistakes and ensure smoother financial transactions. This approach not only ensures accuracy but also reinforces professionalism and reliability in your business.

Integrating Payment Methods into Billing Documents

Incorporating various payment options into your billing documents is essential for facilitating fast and easy transactions. By offering multiple payment methods, you make it convenient for your clients to settle their bills, which can help speed up the payment process. Clearly listing these options in your billing statement helps avoid confusion and encourages timely payments, improving your cash flow.

Benefits of Integrating Payment Methods

- Client Convenience: Offering diverse payment methods allows clients to choose the option that suits them best, whether it’s online transfers, credit cards, or checks.

- Faster Payment Processing: Digital payment methods, like credit card payments or online platforms, typically offer quicker processing times, reducing delays.

- Improved Cash Flow: By giving clients more options, you increase the likelihood of receiving payments sooner, helping to keep your business running smoothly.

- Global Accessibility: Offering online payment options opens up the possibility of working with clients from different locations, allowing for international transactions with ease.

How to Include Payment Methods in Your Billing Document

- Provide Clear Payment Instructions: Clearly state the available methods for payment on the billing document, such as credit cards, bank transfers, checks, or digital wallets.

- Include Payment Links: For online payments, provide clickable links to payment platforms or include QR codes that clients can scan for instant payments.

- Highlight Payment Deadlines: Ensure that the due date for payment is clearly visible and linked to the available methods, so clients know exactly when and how they should pay.

- State Additional Fees: If certain payment methods incur additional fees, such as credit card processing charges, be transparent by including this information upfront.

- Offer Instructions for Complex Methods: For more complicated payment methods, such as international bank transfers or wire payments, include simple instructions on how to complete the transaction.

By integrating clear and diverse payment methods into your billing documents, you not only streamline the payment process but also enhance your professionalism and customer satisfaction. Offering flexibility in payment options helps reduce barriers for clients, making it easier for them to pay promptly.

How to Track Payments and Billing Documents

Efficiently tracking payments and billing documents is essential for maintaining a smooth cash flow and staying organized. By keeping a record of all payments and issued documents, you can easily monitor outstanding balances, identify late payments, and ensure that all transactions are accurately recorded. A reliable tracking system reduces the risk of errors and helps you stay on top of your financial operations.

Steps for Tracking Payments and Documents

- Create a Detailed Record System: Maintain a database or spreadsheet where you can log all issued documents, payment dates, amounts, and any relevant notes. This provides a quick reference for tracking both outstanding and paid balances.

- Mark Payments as Complete: Once a payment has been received, promptly update your records to reflect this. Include the payment method and any transaction details to maintain an accurate log.

- Track Due Dates: Keep an eye on due dates for all outstanding payments. Setting reminders or automatic notifications for upcoming deadlines helps prevent late payments.

- Use Payment Status Indicators: Clearly mark whether a payment is pending, partially paid, or completed. This visual aid makes it easy to assess the status of multiple transactions at a glance.

- Reconcile Records Regularly: Schedule regular checks to ensure that your payment records match your bank statements or payment platforms. This helps identify any discrepancies early on and ensures financial accuracy.

Tools for Tracking Payments

- Accounting Software: Automated tools such as QuickBooks, FreshBooks, or Wave can help streamline the tracking process by automatically updating payment statuses, generating reports, and sending reminders to clients.

- Spreadsheets: If you prefer a manual approach, spreadsheets can be an effective method for logging and tracking payments. Create columns for invoice numbers, payment amounts, and dates, and use formulas to calculate balances.

- Online Payment Platforms: Platforms like PayPal, Stripe, or Square allow you to track incoming payments, view transaction histories, and generate reports directly from the platform.

By adopting a consistent method for tracking payments and billing documents, you’ll reduce administrative burden, stay organized, and ensure that no payments slip through the cracks. Whether you prefer manual record-keeping or automated software, a reliable tracking system is key to managing your finances effectively.

Legal Considerations for Billing Documents

When creating billing documents, it’s crucial to understand the legal aspects involved to ensure that your business practices are compliant with the law. Properly formatted and accurate billing can protect both you and your clients in the event of disputes. Adhering to legal requirements not only helps avoid fines but also fosters trust and transparency with your customers.

Important Legal Aspects to Keep in Mind:

- Clear Payment Terms: Define payment deadlines and accepted payment methods explicitly. Setting clear expectations for when and how payments should be made reduces the likelihood of misunderstandings or delays.

- Tax Compliance: Ensure that you are correctly applying any relevant taxes (sales tax, VAT, etc.) based on your jurisdiction. Failure to include or report taxes properly can result in penalties.

- Itemized Charges: Always provide a detailed breakdown of services or goods supplied, including rates, hours worked, and materials used. This transparency protects both parties and can be used as evidence in case of disputes.

- Business Registration: Include your legal business name, address, and registration number if applicable. In some regions, this is required by law for formal transactions and can help verify your legitimacy.

- Late Payment Fees: If you plan to charge late fees, ensure they are clearly stated in your billing document. Check the laws in your area, as certain jurisdictions may have limits on how much can be charged for overdue payments.

- Dispute Resolution Clauses: Consider adding a clause for dispute resolution that outlines the steps both parties should take in the event of a disagreement, such as mediation or arbitration. This can provide a clear path for resolving issues without escalating to legal action.

Additional Considerations:

- Contracts and Agreements: In addition to billing documents, it’s often beneficial to have a contract in place with your clients. A contract sets the expectations for the scope of work, payment, and deadlines, providing legal protection for both parties.

- Record Keeping: Keep accurate records of all billing documents, including payments received, unpaid balances, and communication with clients. This documentation may be required for tax reporting or in case of legal disputes.

By paying attention to the legal aspects of your billing documents, you ensure that your business operates smoothly and in compliance with regulations. Taking the time to structure your documents properly can prevent costly mistakes and create a solid foundation for professional relationships with your clients.

How to Speed Up the Billing Process

Speeding up the billing process not only improves cash flow but also saves valuable time and reduces administrative workload. By streamlining the way you create and manage financial documents, you can quickly issue requests for payment and ensure that clients settle their accounts without unnecessary delays. Here are several strategies to help you accelerate this process while maintaining accuracy and professionalism.

Methods to Speed Up Billing

- Automate Billing: Utilize accounting software or billing platforms that allow you to automate the creation and sending of documents. This reduces manual input, minimizes errors, and allows you to quickly generate and distribute payment requests.

- Use Pre-built Formats: Rather than starting from scratch each time, create a standardized format for your billing documents. This way, you can simply update the necessary details (e.g., client name, amounts) and quickly send them out.

- Send Digital Bills: Opt for electronic delivery methods, such as email or online payment portals, instead of paper-based methods. Digital methods allow for instant delivery, reducing mailing time and offering your clients immediate access to the payment request.

- Set Clear Payment Terms: Define payment deadlines and terms clearly in your documents. By setting expectations upfront, you reduce the chances of delays due to confusion or misunderstandings.

- Offer Multiple Payment Methods: Providing clients with various payment options (e.g., credit card, bank transfer, online payment systems) can accelerate the payment process. The more ways your clients can pay, the faster they are likely to settle their balance.

Tips for Quick Payment Processing

- Invoice Promptly: Issue payment requests as soon as the work is completed or agreed milestones are reached. The quicker you bill, the quicker clients can process the payment.

- Set Up Payment Reminders: Use automated reminders for overdue payments. Set the system to notify clients a few days before or after the payment due date to keep them on track.

- Incorporate Clear Payment Instructions: Make sure your billing documents include easy-to-follow payment instructions. This removes any confusion about how to make payments and can speed up the process.

- Pre-Authorize Payments: For regular clients, you may want to set up pre-authorized payment methods, such as direct debit or credit card payments. This eliminates the need for invoicing altogether and ensures regular payments.

By implementing these techniques, you can significantly reduce the time it takes to create and collect payments, allowing you to focus more on your core business activities. A faster billing process not only enhances operational effici