Self Employed Cleaner Invoice Template for Efficient Billing

Managing payments is a crucial aspect of any independent business. For those working in the cleaning industry or offering similar services, ensuring smooth transactions with clients can be challenging without the right tools. A well-structured billing document not only helps professionals keep track of earnings but also builds trust with customers by presenting a clear and professional image.

Creating a document that accurately reflects services rendered, payment terms, and any additional charges is essential. This ensures that all parties are on the same page and payments are processed efficiently. With the right approach, even the most straightforward tasks can be clearly communicated, reducing misunderstandings and delays.

By utilizing a customizable billing solution, independent workers can save time, avoid errors, and maintain an organized financial record. A properly formatted document serves as both a reminder for clients and a tool for professionals to track their income and expenses effectively.

How to Create an Invoice for Cleaners

Creating a professional billing document is essential for anyone offering services on a freelance basis. It helps ensure that both the service provider and the client are clear about the costs, payment terms, and any additional charges. A well-designed document not only facilitates smooth transactions but also enhances your credibility and fosters trust with clients.

Include Basic Information

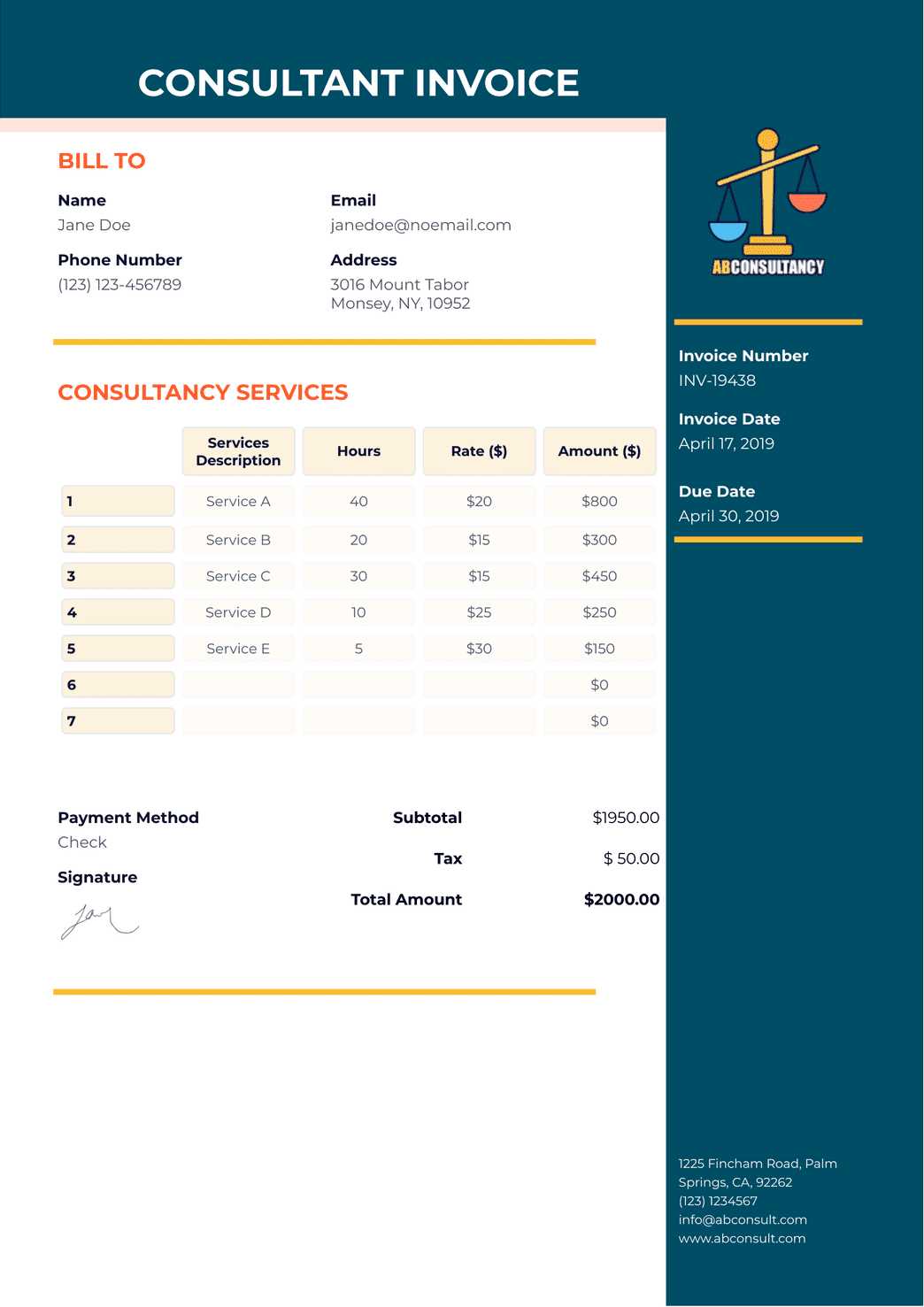

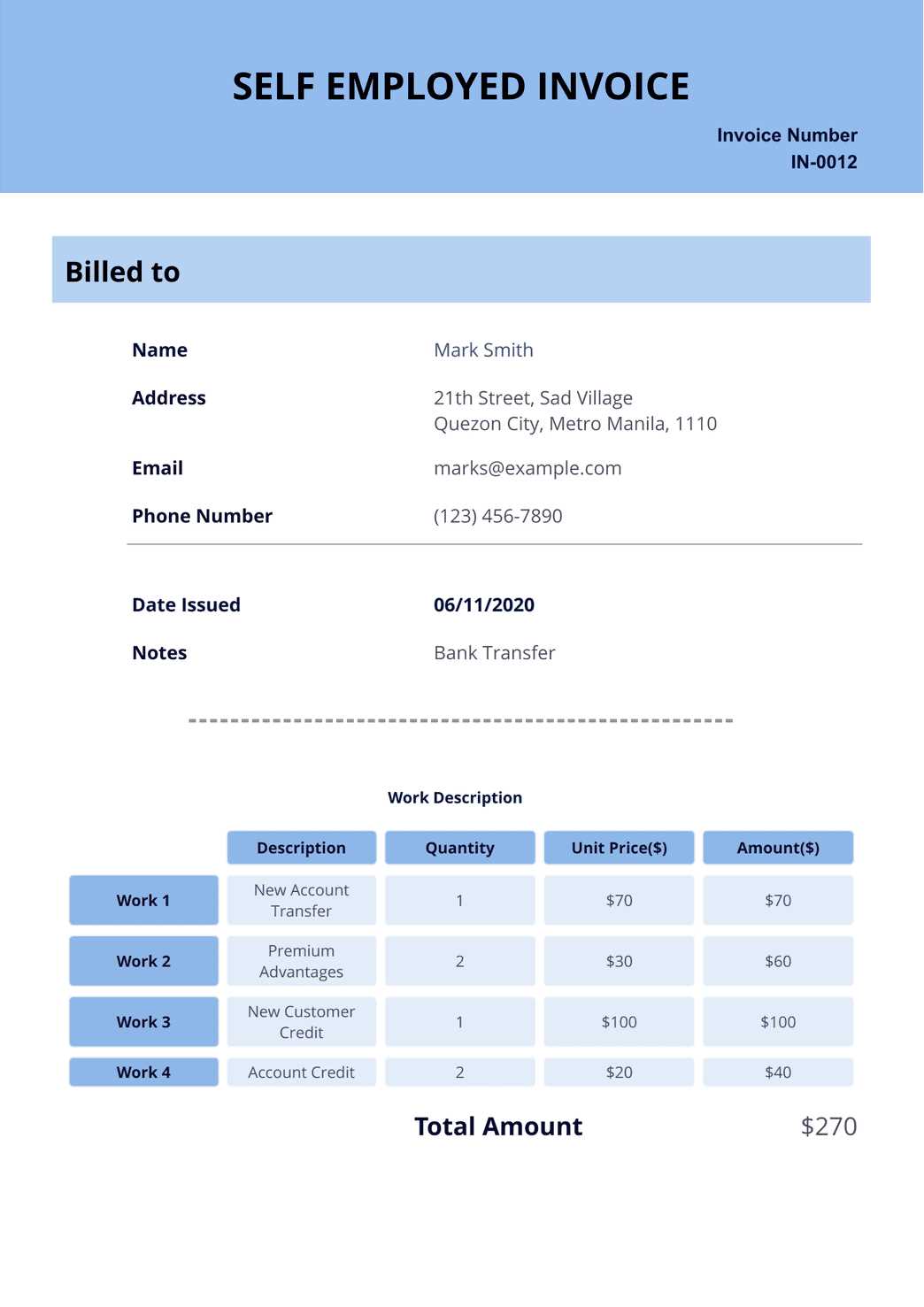

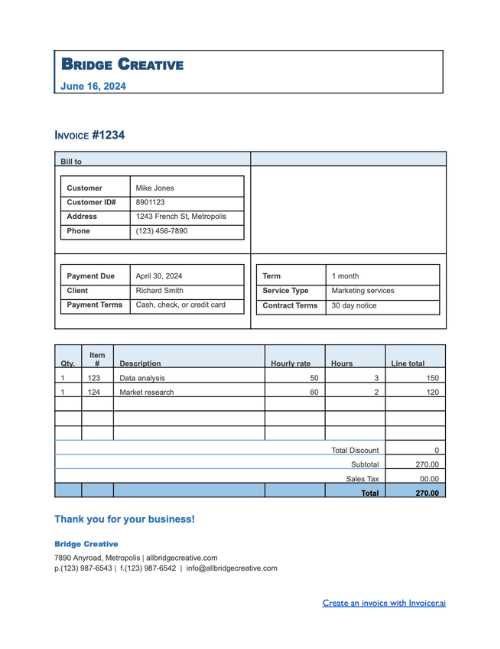

Start by adding essential details at the top of the document. This should include your name or business name, contact information, and a unique reference number for the billing record. It’s also important to include the client’s information and the date the service was completed. This allows for easy tracking and ensures that your client can quickly identify the document when reviewing their records.

Detail the Services Provided

Next, break down the tasks or services performed. List each job or task separately, including a brief description, the amount of time spent, and the agreed-upon rate. This transparency helps prevent any confusion and ensures that both parties are on the same page regarding the scope of the work.

Make sure to specify the total cost at the bottom of the document. You may also want to include payment terms, such as the due date or accepted payment methods. Clear terms will encourage timely payments and help avoid misunderstandings.

Tip: Keep a copy of each document for your records to help with accounting and future reference.

Why Cleaners Need an Invoice Template

For independent workers offering cleaning services, having a structured billing document is essential to maintain professionalism and streamline payment processes. This tool helps establish clear communication with clients regarding service costs and payment expectations. Without it, the payment process can become confusing, leading to delays or misunderstandings.

Here are a few key reasons why a well-organized billing document is necessary:

- Professionalism: A clearly formatted document shows clients that you are serious about your business and value transparent communication.

- Time-Saving: Pre-designed formats save time, allowing you to quickly generate and send accurate records without re-creating the layout from scratch.

- Legal Protection: A formal record of services rendered protects both parties in case of disputes, clearly outlining the agreed-upon work and payment terms.

- Financial Tracking: It helps you keep track of income, monitor payments, and stay organized, especially if you manage multiple clients.

- Tax Preparation: Proper records simplify tax filing by ensuring you have all the necessary details for reporting income and expenses.

Having a ready-to-use billing document is more than just a convenience; it’s a vital part of running a successful business. It minimizes confusion, ensures timely payments, and helps you maintain a positive relationship with clients.

Essential Elements of a Cleaning Invoice

Creating a comprehensive billing document is crucial for ensuring clear communication between service providers and clients. A well-organized record not only outlines the services provided but also sets expectations for payment. To ensure your document serves its purpose effectively, it’s important to include specific key components that help both parties stay organized and avoid confusion.

Basic Information

The first section of the document should include all relevant contact information. This includes your name or business name, your address, and your phone number or email. Similarly, the client’s details should also be included–this makes it easy for both parties to reference the document if needed. Additionally, each document should have a unique reference number for tracking purposes, as well as the date the service was completed.

Detailed Breakdown of Services

Clearly list the services that were provided, along with descriptions, quantities, and rates. For example, if you provided a one-time deep clean or routine maintenance, detail the areas cleaned and the time spent on each task. This helps avoid any confusion and assures clients that they are being charged fairly. It’s also a good practice to include any additional fees, such as transportation or supply charges, if applicable.

Important: Always provide a total amount due at the bottom of the document. This should include any applicable taxes or discounts, so clients can easily see the final amount they are expected to pay.

Tip: Including payment terms, such as due dates and accepted payment methods, ensures both parties are on the same page regarding when and how payment should be made.

Best Practices for Self-Employed Cleaners

Running an independent service business requires more than just performing quality work–it also involves managing the operational and administrative tasks that keep your business running smoothly. Adopting best practices can help you stay organized, build strong relationships with clients, and ensure financial stability. From clear communication to efficient billing, these strategies are crucial for long-term success.

Maintaining Clear Communication

Establishing open and professional communication with clients from the beginning sets the tone for a positive working relationship. Be clear about the services you offer, the pricing structure, and any specific terms. Regularly updating clients about scheduling, changes in rates, or special offers can also foster trust and help avoid misunderstandings. Always respond promptly to client inquiries and provide transparent answers to any questions.

Efficient Financial Management

Organizing your finances is one of the most important aspects of running an independent service business. Keep track of all transactions, whether it’s through a digital accounting system or a simple spreadsheet. Consistently sending clear and professional billing documents will help ensure timely payments and reduce the chances of errors. It’s also important to set aside money for taxes and savings, as irregular income can make financial planning more challenging.

Tip: Set up a payment schedule with clients to ensure you receive regular payments, and don’t hesitate to follow up if payments are overdue. Establishing payment terms upfront can help avoid delays.

Reminder: Keep records of all financial transactions, as this will help you at tax time and provide clarity if any disputes arise.

Choosing the Right Invoice Software

Selecting the right software for managing billing can greatly simplify the financial aspects of running an independent service business. With many options available, it’s important to choose a platform that suits your needs, whether you’re handling a few clients or a larger volume of work. The right tool can save you time, reduce errors, and help you maintain a professional image with your clients.

When evaluating software, consider the following features:

- User-Friendliness: Choose a platform that is easy to navigate, even if you don’t have a technical background. The simpler the interface, the more quickly you can generate accurate documents.

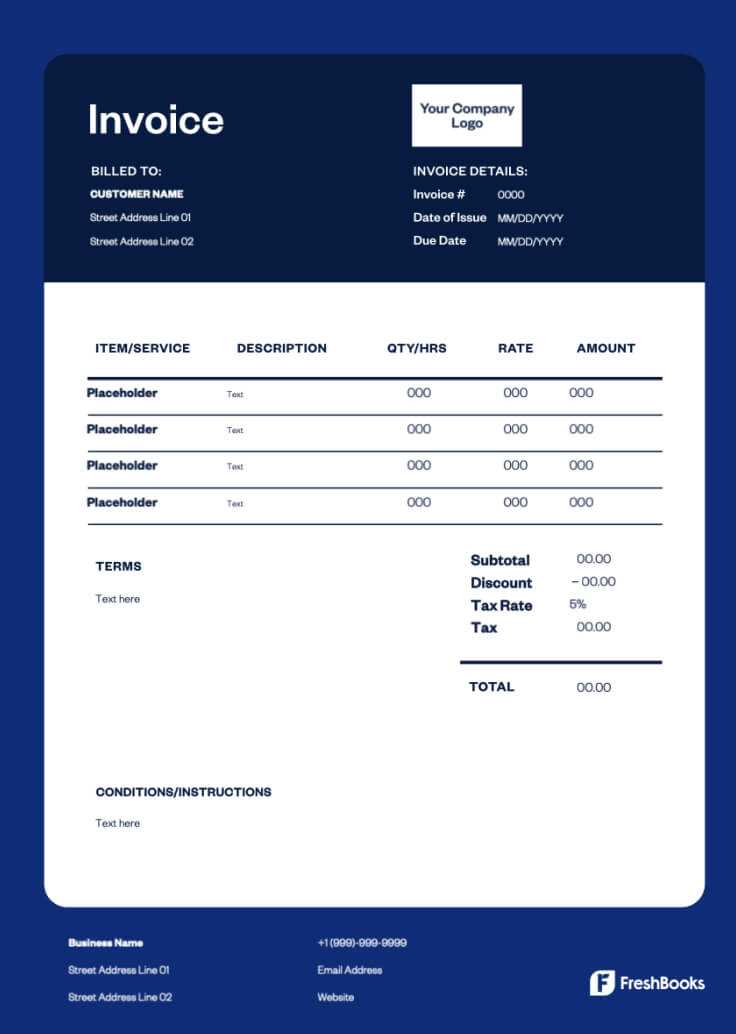

- Customization Options: Ensure that the software allows you to personalize billing documents with your business name, logo, and any specific details relevant to your services.

- Automation: Look for features that automate repetitive tasks, such as recurring billing, payment reminders, or tax calculations. This will reduce your administrative workload.

- Integration: Consider software that integrates well with other tools you use, such as accounting or scheduling platforms, to streamline your workflow.

- Mobile Access: If you often work on the go, a mobile-friendly solution can help you create and send documents directly from your phone or tablet.

Choosing the right software not only improves your efficiency but also ensures that your financial records are organized and easily accessible. Take the time to explore different options, read reviews, and even test out free trials before making a final decision. The right choice can make a significant difference in the way you manage your business finances.

Customizing Your Cleaner Invoice Template

Personalizing your billing documents allows you to create a professional and consistent image for your business. A customized record not only reflects your brand but also ensures that all necessary details are included to meet both your and your clients’ needs. Tailoring your format can make the billing process smoother, more efficient, and more aligned with your specific services.

When customizing your billing document, consider the following elements:

- Business Branding: Add your logo, business name, and contact information at the top of the document. This reinforces your brand identity and makes your records easily recognizable to clients.

- Service Descriptions: Include clear and concise descriptions of the services provided. Make sure each task is listed individually with its corresponding rate and time spent, if applicable.

- Payment Terms: Specify your payment methods, due dates, and any penalties for late payments. Clear terms reduce misunderstandings and encourage timely transactions.

- Client Details: Include the client’s name, address, and contact information, so both parties are clear about the services rendered and the amount owed.

- Additional Information: You might want to add extra notes such as promotional offers, service packages, or special instructions for future work, depending on your business model.

By making these customizations, your billing document becomes more than just a record of payment–it’s a professional tool that supports your business operations and helps you maintain organized financial records.

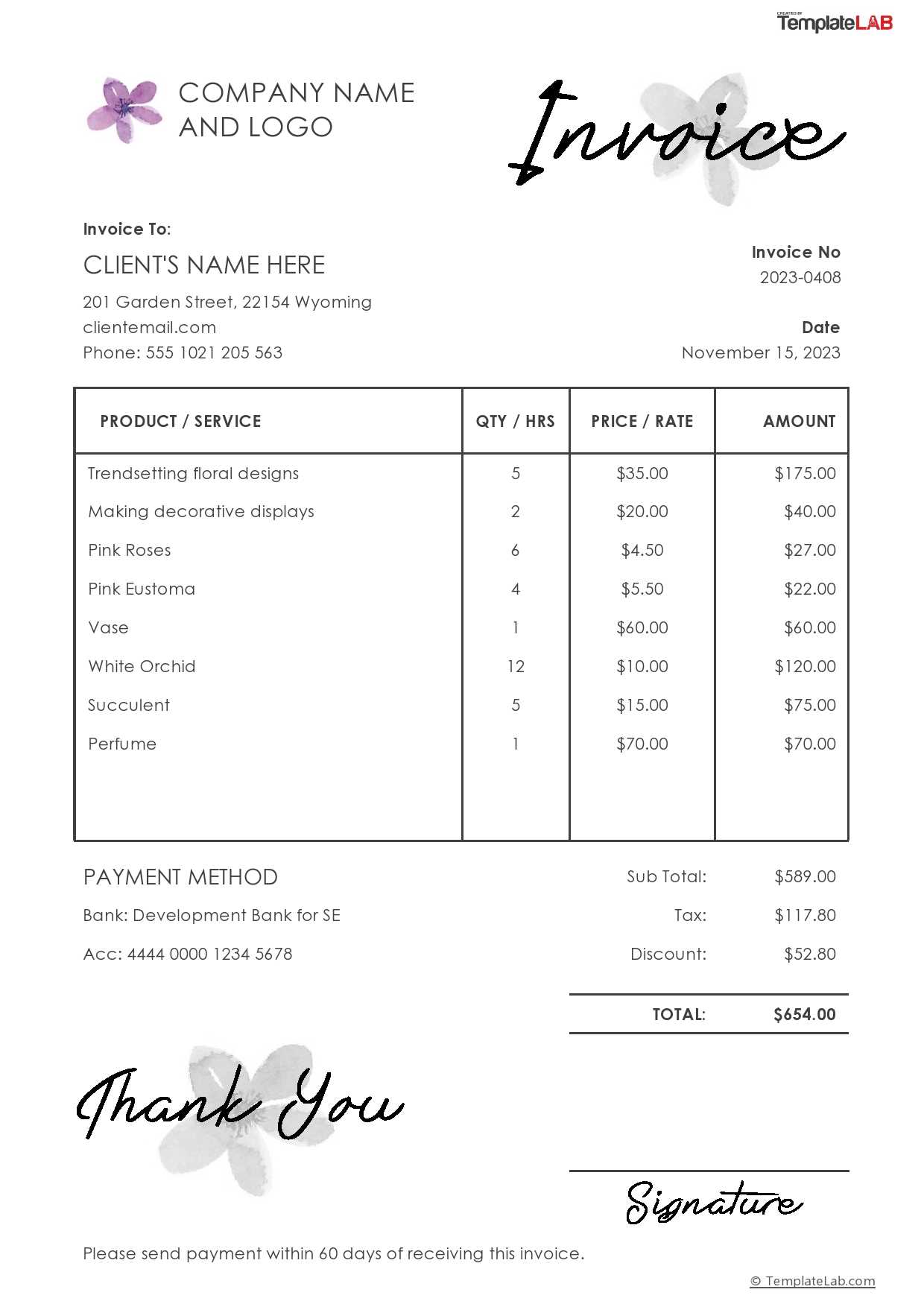

How to Itemize Cleaning Services

Breaking down the services you provide into clear, itemized details is essential for transparency and ensuring both you and your client are on the same page. Itemizing helps clarify the scope of work, sets expectations for the client, and allows you to accurately charge for the time and effort spent on each task. This practice also ensures that you are paid fairly for every service rendered.

To effectively itemize your services, follow these steps:

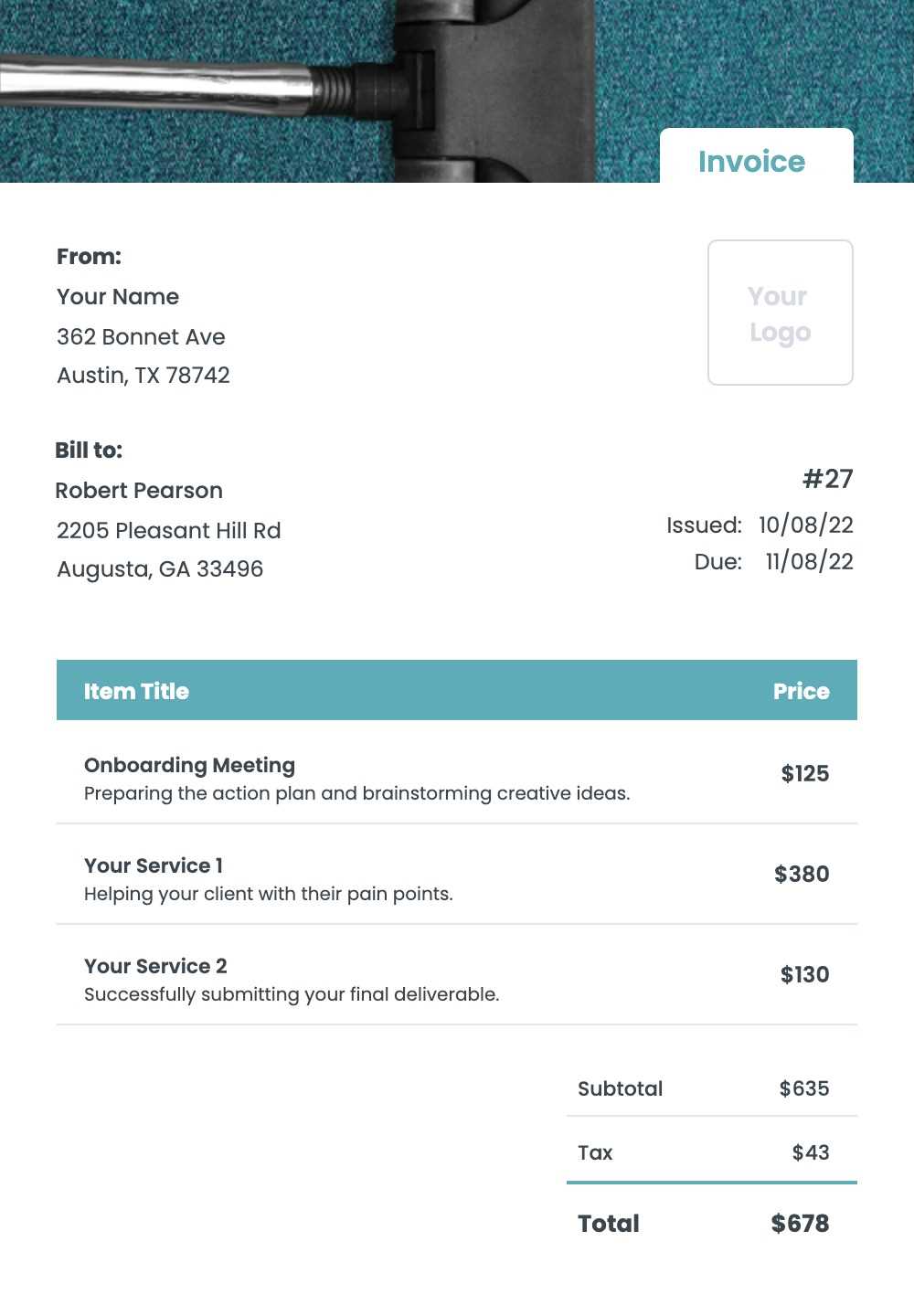

- List Each Service Separately: Break down the tasks you performed into individual line items. For example, “Living room dusting” or “Kitchen countertop sanitization.” This gives clients a clear understanding of what they are paying for.

- Include Time Spent: Indicate the amount of time spent on each task, especially if your rates are based on hourly work. This adds transparency and justifies the costs.

- Specify Rates: Clearly state the rate for each service, whether it’s hourly or flat-rate pricing. This helps prevent confusion and ensures both parties understand how charges are calculated.

- Additional Charges: If any extra costs apply, such as for specialized equipment or cleaning supplies, list these separately. Be sure to explain why these charges are being added, so clients can see that they are justified.

- Discounts or Promotions: If you are offering any discounts, be sure to include them on the bill, specifying the amount deducted and why. This can enhance client satisfaction and encourage repeat business.

By providing a detailed breakdown, you create a transparent and professional billing process. This not only helps avoid any misunderstandings but also improves your reputation as a trusted service provider.

Understanding Payment Terms in Invoices

Clearly defined payment terms are essential for ensuring smooth financial transactions between service providers and clients. By specifying when payments are due, how they should be made, and any penalties for late payments, both parties can avoid confusion and delays. Establishing these terms upfront helps set expectations and builds trust with your clients.

Key Payment Terms to Include

Here are some important payment terms that should be considered when drafting your billing document:

- Due Date: Always include a specific date by which payment is expected. This helps prevent delays and ensures that both parties are clear on the timeline for payment.

- Accepted Payment Methods: Specify which methods are acceptable (e.g., bank transfer, credit card, cash, or online payment platforms). This ensures clients know how to pay you easily.

- Late Fees: Outline any penalties for overdue payments, such as a flat fee or an interest rate. This incentivizes timely payment and compensates for potential delays.

- Discounts for Early Payment: Offering a small discount for early payments can encourage clients to settle their bills sooner. Be sure to clearly state the conditions for receiving the discount.

- Payment Plan: If applicable, consider offering clients a payment plan for larger amounts. Clearly outline the terms and deadlines for each installment.

Why Payment Terms Matter

Having clear and transparent payment terms not only helps prevent misunderstandings but also contributes to efficient cash flow management. When clients understand your expectations and the consequences of late payments, they are more likely to adhere to the agreed terms, which benefits your business’s financial health.

Common Mistakes to Avoid with Invoices

While creating billing documents may seem straightforward, there are several common errors that can lead to confusion, delayed payments, or even disputes with clients. Avoiding these mistakes is crucial for maintaining a professional image and ensuring that payments are received on time and without complications.

Here are some of the most common mistakes to watch out for:

| Mistake | Why It Matters | How to Avoid It |

|---|---|---|

| Missing Client Information | If the client’s name, address, or contact details are incorrect or missing, it can lead to confusion or delays in payment. | Always double-check client information before sending the document and ensure that all details are accurate and up to date. |

| Incorrect or Vague Descriptions of Services | Without clear descriptions, clients may be unsure of what they are paying for, leading to disputes or questions about charges. | Provide detailed descriptions of the work completed, including time spent and specific tasks performed. |

| Not Including a Payment Due Date | Failure to specify a due date can lead to late payments or clients delaying their response. | Always include a clear due date and consider adding a reminder for overdue payments. |

| Forgetting to Add Taxes or Additional Fees | Omitting taxes or extra charges can result in underpayment, creating financial problems. | Ensure that all applicable taxes, fees, and other charges are included in the total amount and clearly listed. |

| Using an Unprofessional Layout | An unorganized or poorly formatted billing document can appear unprofessional and may damage your reputation. | Use a clean, easy-to-read layout with consistent fonts, clear headings, and a logical structure for all the information. |

By being mindful of these common errors, you can ensure that your billing process runs smoothly and helps build strong, professional relationships with your clients.

How to Handle Late Payments

Late payments are a common challenge for independent service providers. While you can take steps to prevent delays by setting clear terms, occasionally clients may still miss payment deadlines. It’s important to address this issue professionally to maintain a good working relationship while ensuring your business remains financially stable.

Step 1: Send a Friendly Reminder

When a payment is overdue, the first step is to send a polite reminder. This should be a gentle nudge, acknowledging that sometimes things slip through the cracks. Be sure to include the original payment terms and clearly state the amount owed, along with the new due date. A friendly, non-confrontational tone is key in maintaining a positive relationship.

Tip: Many billing systems allow you to set up automated reminders, which can save time and ensure consistency in your communication.

Step 2: Follow Up with a Stronger Message

If a second reminder doesn’t yield results, you may need to take a firmer approach. Send a follow-up that reiterates the terms and conditions of your agreement, and make it clear that continued delays may result in late fees or suspension of services. Be firm but professional, keeping the focus on the need for timely payment.

Reminder: Make sure to give a reasonable deadline for the payment to be settled and state any late fees that will apply if payment is not received on time.

By addressing late payments professionally, you protect your business’s cash flow while preserving the client relationship. Timely follow-ups are essential to ensure that clients understand the importance of adhering to agreed payment schedules.

Legal Requirements for Cleaner Invoices

When creating billing documents, it is important to be aware of the legal requirements that apply to the information you include. These legal guidelines vary by country and jurisdiction but generally ensure that the transaction is properly documented and that both parties are protected. Understanding the essential elements required for compliance will help you avoid potential legal issues and ensure that your financial records meet regulatory standards.

Essential Information for Compliance

Depending on where you operate, there are several key details that must be included in your billing documents to meet legal standards:

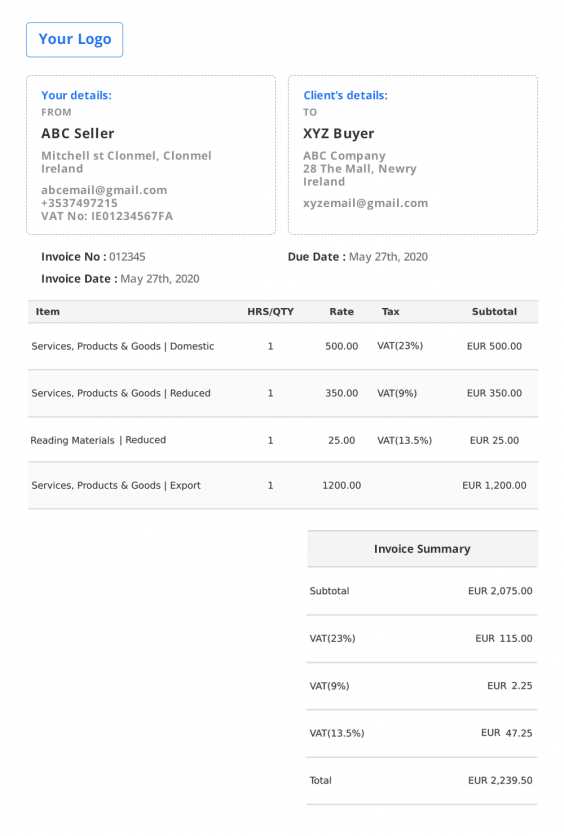

- Business Information: Always include your full business name, address, and contact details. This helps identify you as the service provider and makes the document legally valid.

- Client Information: It’s crucial to list the full name and address of the client receiving the services. This ensures both parties are clearly identified in case of any disputes.

- Unique Reference Number: Each document should have a unique reference number. This helps with tracking and organization for both you and the client.

- Clear Description of Services: Provide an accurate breakdown of the services rendered, including specific tasks, time spent, and rates charged. This adds clarity and helps avoid misunderstandings regarding the payment.

- Tax Identification Information: Depending on your location and income level, you may be required to include your tax ID number or VAT registration number. This is especially important for tax reporting purposes.

- Payment Terms: Clearly state the payment due date, methods of payment accepted, and any late fees or interest for overdue payments. This ensures that both parties understand when and how payments are to be made.

Tax and Reporting Considerations

In many countries, the amount you charge for services may be subject to taxes such as sales tax, VAT, or other local taxes. Be sure to clearly indicate the tax amount on the document, if applicable, and ensure that you are charging the correct tax rate for your services. Additionally, it’s essential to keep accurate records of all transactions for tax reporting purposes. Failing to comply with tax laws can result in fines or legal complications.

Tip: Consult with a local accountant or legal advisor to ensure your billing practices meet all relevant legal and tax requirements.

By including the necessary legal information in your billing documents, you can protect your business and maintain professional standards, ensuring that both you and your clients are on the same page legally and financially.

How to Include Taxes in Invoices

Including taxes correctly in your billing documents is a critical aspect of ensuring compliance with tax laws and providing transparency to your clients. Tax regulations vary depending on the country, region, or type of service, so it’s important to calculate and display taxes accurately. Clear tax inclusion helps avoid disputes and ensures that you charge the correct amount for the services provided.

Steps for Including Taxes

Follow these guidelines to properly include taxes in your billing documents:

- Identify the Applicable Tax Rate: Research the tax laws in your location to determine the correct tax rate to apply. This could be a general sales tax, VAT, or another type of tax depending on your jurisdiction and the nature of your services.

- Calculate the Tax Amount: Once you know the applicable rate, multiply the total cost of the services by the tax rate to determine the tax amount. For example, if the tax rate is 10% and your total before tax is $100, the tax amount would be $10.

- Clearly Label the Tax: On your billing document, show the tax amount separately from the service charge. List it as “Tax” or “Sales Tax” followed by the amount and the tax rate. This transparency ensures your client understands the breakdown of costs.

- Include Tax Registration Information: In many regions, businesses must include their tax identification number or VAT registration number on the billing document. Make sure this information is included to comply with local regulations.

Tips for Tax Compliance

To ensure that you’re following the correct tax procedures, consider these best practices:

- Stay Updated: Tax laws can change over time. Keep yourself informed about any updates to tax rates or regulations to ensure your documents remain accurate and compliant.

- Use Software: Many accounting and billing software tools can automatically calculate and include taxes for you. This reduces the risk of errors and ensures consistency across all your billing documents.

- Consult a Tax Professional: If you are unsure about how to calculate or apply taxes, seek advice from a tax professional to ensure compliance and avoid any potential penalties.

By properly including taxes in your billing documents, you not only stay compliant with the law but also foster trust with your clients by being transparent about the costs involved. Make sure to keep accurate records of all transactions for reporting purposes.

Benefits of Professional Invoices for Cleaners

Using professionally designed billing documents provides numerous advantages that go beyond simply requesting payment. A well-crafted document can help streamline your operations, build credibility with clients, and ensure timely payments. When your billing process is organized and clear, it not only reflects your attention to detail but also fosters stronger business relationships.

Here are some key benefits of using professional billing documents:

- Enhanced Professional Image: A polished and formal document helps position your business as trustworthy and professional. Clients are more likely to take you seriously when they see that you use organized, professional-looking paperwork.

- Faster Payments: When your documents are clear and include all the necessary details, clients are less likely to delay payments. A professional format can encourage clients to settle their bills promptly because they can easily see the total amount due and payment terms.

- Better Organization and Record-Keeping: Well-structured documents help you keep accurate records of your transactions, making it easier to track payments, manage finances, and file taxes. A consistent billing format ensures that nothing gets overlooked, providing a comprehensive financial overview.

- Clarity for Both Parties: A professional bill removes any ambiguity. It clearly details the services provided, the associated costs, payment terms, and due dates, leaving no room for confusion. This transparency can prevent disputes and foster trust with clients.

- Legal Protection: A properly formatted billing document serves as an official record of the transaction. It can be essential in case of a legal dispute, providing clear proof of the services rendered and agreed-upon terms.

By adopting a professional approach to your billing process, you not only ensure smoother transactions but also lay the foundation for a positive reputation and long-term success in your business.

Streamlining Your Billing Process

Efficient billing is crucial for maintaining smooth financial operations and ensuring timely payments. By simplifying and automating your billing practices, you can save valuable time, reduce errors, and improve cash flow. Streamlining this process not only enhances your productivity but also strengthens relationships with clients by providing a hassle-free payment experience.

Steps to Simplify Your Billing

Here are several strategies to make your billing process faster and more efficient:

- Automate with Software: Invest in billing or accounting software that can generate and send documents automatically. This eliminates the need to manually create each document, reducing the chances of errors and speeding up the process.

- Standardize Your Documents: Use a consistent format for all your billing documents. This ensures that all necessary information is included, reducing the risk of missing details and helping clients easily understand their charges.

- Set Clear Payment Terms: Define your payment terms in advance, including due dates and accepted methods of payment. This reduces confusion and helps ensure clients pay on time.

- Offer Multiple Payment Options: Make it easy for clients to pay by offering various payment methods such as bank transfer, credit card, or online payment systems. The more flexible you are, the faster you’re likely to receive payments.

- Send Reminders: Set up automated reminders for upcoming or overdue payments. Timely notifications can prompt clients to pay on time, reducing late fees or delays in your cash flow.

Benefits of a Streamlined Billing System

Streamlining your billing process brings a host of benefits, including:

- Time Savings: Automating and standardizing your billing reduces the time spent on administrative tasks, allowing you to focus on other aspects of your business.

- Improved Cash Flow: Faster billing and payments lead to better cash flow, which is essential for business growth and stability.

- Professional Image: A streamlined, efficient billing process enhances your business’s reputation and makes you appear more organized and reliable to clients.

- Reduced Errors: Automation minimizes the chance of mistakes in calculations or missing information, leading to more accurate transactions.

By adopting these strategies, you can optimize your billing process, save time, and enhance client satisfaction, ensuring a more efficient and profitable business operation.

Templates vs. Manual Invoices for Cleaners

When it comes to creating billing documents, there are two primary approaches: using pre-designed forms or creating each document from scratch. Both methods have their pros and cons, depending on the size and complexity of your business, as well as your preference for customization and efficiency. Understanding the differences between using automated forms and manually crafting your documents can help you decide which approach best suits your needs.

Advantages of Using Pre-Designed Forms

Pre-designed forms are a popular choice for many businesses due to their ease of use and consistency. Here are the benefits of using automated forms:

- Time Efficiency: With pre-designed forms, you can quickly fill in the necessary details and send out a document without starting from scratch. This significantly speeds up the process, especially when dealing with multiple clients.

- Consistency: A standardized format ensures that all the necessary information is included every time. This reduces the risk of forgetting important details like payment terms or tax rates.

- Professional Appearance: Pre-designed forms often come with clean, polished layouts, giving your documents a professional look that reflects well on your business.

- Automation: Many automated systems allow you to track payments, send reminders, and even integrate with accounting software, making financial management much simpler.

Advantages of Creating Manual Documents

Creating billing documents manually offers a more customized approach, allowing for greater flexibility in how you present your information. Some benefits of this method include:

- Full Customization: When creating documents by hand, you have complete control over their design and content. You can tailor every detail to suit your brand and the specific needs of each client.

- No Dependency on Software: If you prefer not to rely on software or digital tools, manually created documents offer a simpler, more hands-on approach without needing any technical knowledge.

- Flexibility: Manual creation allows you to make adjustments as needed without being restricted to a predefined template. You can alter the layout, add special notes, or change payment terms based on each transaction.

While manually crafted documents offer more flexibility, they can also be time-consuming and prone to human error. Using pre-designed forms, on the other hand, saves time and ensures consistency but may lack the personal touch of a custom document. The choice between the two methods largely depends on the nature of your business, the volume of transactions, and your preference for convenience versus customization.