Self Billing Invoice Template Excel for Easy and Accurate Invoicing

Managing payments and maintaining accurate financial records is a vital part of running any business. With the right tools, this process can be simplified, saving time and reducing errors. One of the most efficient ways to handle this is by using automated systems that allow for easy customization and consistency in every transaction. The right approach can significantly enhance your workflow, making it both faster and more reliable.

For businesses that need to generate regular statements, the key is to have a structured yet flexible method for creating these documents. Customizing a document to match specific needs can improve both organization and communication with clients. It ensures that all essential details are included and formatted properly, which leads to smoother processing of payments and fewer misunderstandings.

In this article, we’ll explore how to leverage a powerful tool that can be tailored to fit your unique requirements. With the ability to adapt and personalize your method of managing financial exchanges, you can ensure that all transactions are documented with precision and clarity.

Self Billing Invoice Template Excel Overview

In today’s fast-paced business environment, efficiency is key when it comes to managing financial transactions. A structured system that simplifies the process of generating payment documents can save significant time and reduce human error. With the right digital solution, companies can easily create accurate records that are tailored to their specific needs, ensuring smooth financial exchanges with clients and partners.

By using a customizable solution for creating payment documents, businesses can quickly adapt to various requirements, whether it’s for a one-time transaction or recurring payments. This streamlined method eliminates the need for manual calculations and formatting, reducing the likelihood of mistakes. Let’s explore how such a solution can be utilized and the key features it offers.

Key Benefits of Using This Solution

- Time-Saving: Automates the creation of financial documents, reducing the time spent on manual tasks.

- Consistency: Ensures all records are formatted according to a consistent structure, reducing errors.

- Customization: Allows for personalization of the document to match specific business requirements.

- Easy Tracking: Facilitates easy monitoring of payments and balances for better financial control.

How It Works

This solution works by offering a structured format where businesses can input key details such as client information, payment terms, and itemized charges. Once entered, the system calculates totals and provides an organized record that can be saved, shared, or printed. The flexibility of this tool means that businesses can adjust it to meet unique invoicing needs, ensuring all necessary information is captured accurately.

What is a Self Billing Invoice?

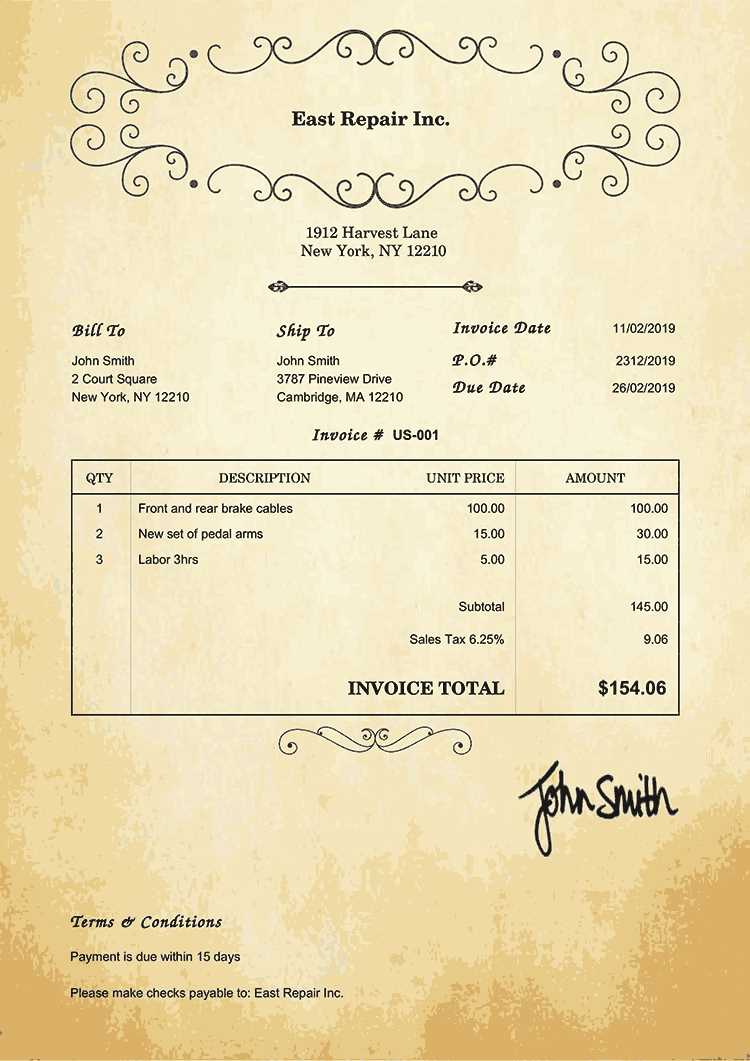

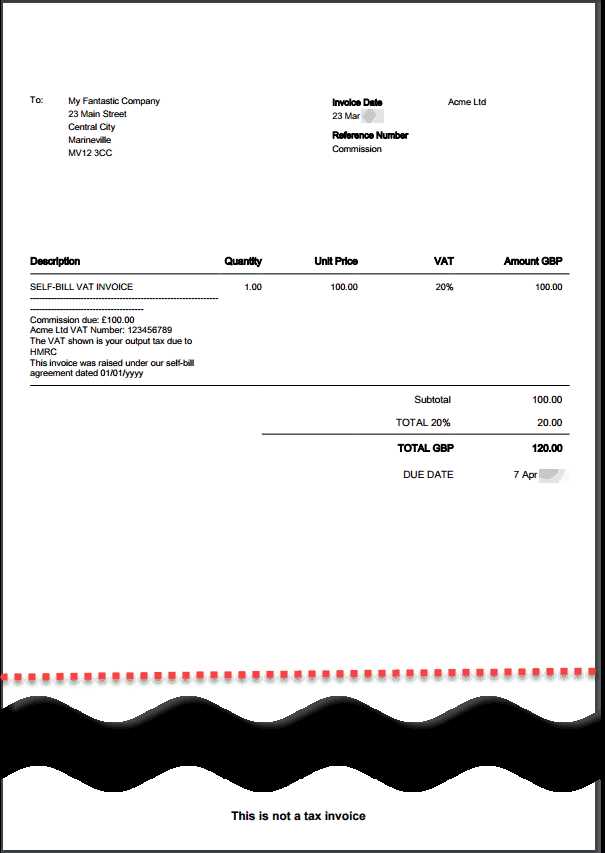

In business transactions, the method of documenting payments can vary depending on the relationship between the parties involved. One common approach is when the recipient of goods or services is responsible for preparing and sending the payment record. This system can significantly reduce administrative tasks for the provider, as they do not need to generate the document themselves. Instead, the buyer takes on this responsibility, ensuring that the terms are clearly outlined and that both sides are aligned on the details of the transaction.

This method offers several advantages, including reduced paperwork for suppliers and faster processing of payments. By allowing the customer to create the record, the need for multiple back-and-forth communications is minimized, which streamlines the entire process. The key aspect of this system is that it shifts the burden of generating the official document from the provider to the buyer while maintaining legal and financial accuracy.

Key Features:

- Transfer of document creation responsibility to the buyer

- Reduction in administrative workload for sellers

- Clear agreement on terms and payment amounts between both parties

This approach is commonly used in various industries where long-term or recurring transactions are involved, and both parties are familiar with the agreed-upon terms. It can be an effective way to streamline processes, save time, and ensure smooth financial operations.

Benefits of Using Excel for Invoicing

When it comes to managing financial records, using a digital tool can offer significant advantages over traditional paper-based methods. A powerful spreadsheet program allows businesses to create, modify, and track financial documents with ease, improving efficiency and reducing errors. With built-in functions and a flexible interface, this solution provides a streamlined way to handle payments and ensure accurate record-keeping.

Here are some of the key benefits of utilizing a spreadsheet application for generating payment records:

- Customization: Tailor the structure and design of the document to meet specific business needs, such as adding company logos, adjusting formatting, and including custom fields.

- Automation: Use built-in formulas to automatically calculate totals, taxes, and discounts, reducing the need for manual calculations and ensuring accuracy.

- Cost-Effective: Unlike specialized accounting software, this solution is often more affordable and accessible to businesses of all sizes.

- Data Organization: Easily store and categorize documents, allowing for quick retrieval of past records and improving overall data management.

- Easy Sharing: Save documents in common formats such as PDF or email them directly from the program, simplifying communication with clients and partners.

- Tracking and Monitoring: Keep track of due dates, outstanding amounts, and payment statuses by using simple filters and functions to organize records.

By utilizing a spreadsheet-based solution, businesses can maintain control over their financial transactions and streamline the entire process. Whether you’re a small business owner or a large corporation, this tool can be an essential part of your financial workflow.

How to Create an Invoice Template in Excel

Creating a structured document for payment tracking is a key task for any business. The process of building a custom form can be done quickly and efficiently using a digital tool that allows for easy formatting and organization. By setting up a reusable structure, you can ensure consistency in every transaction and reduce the time spent on document creation. This method offers a way to manage financial records while providing flexibility for any business need.

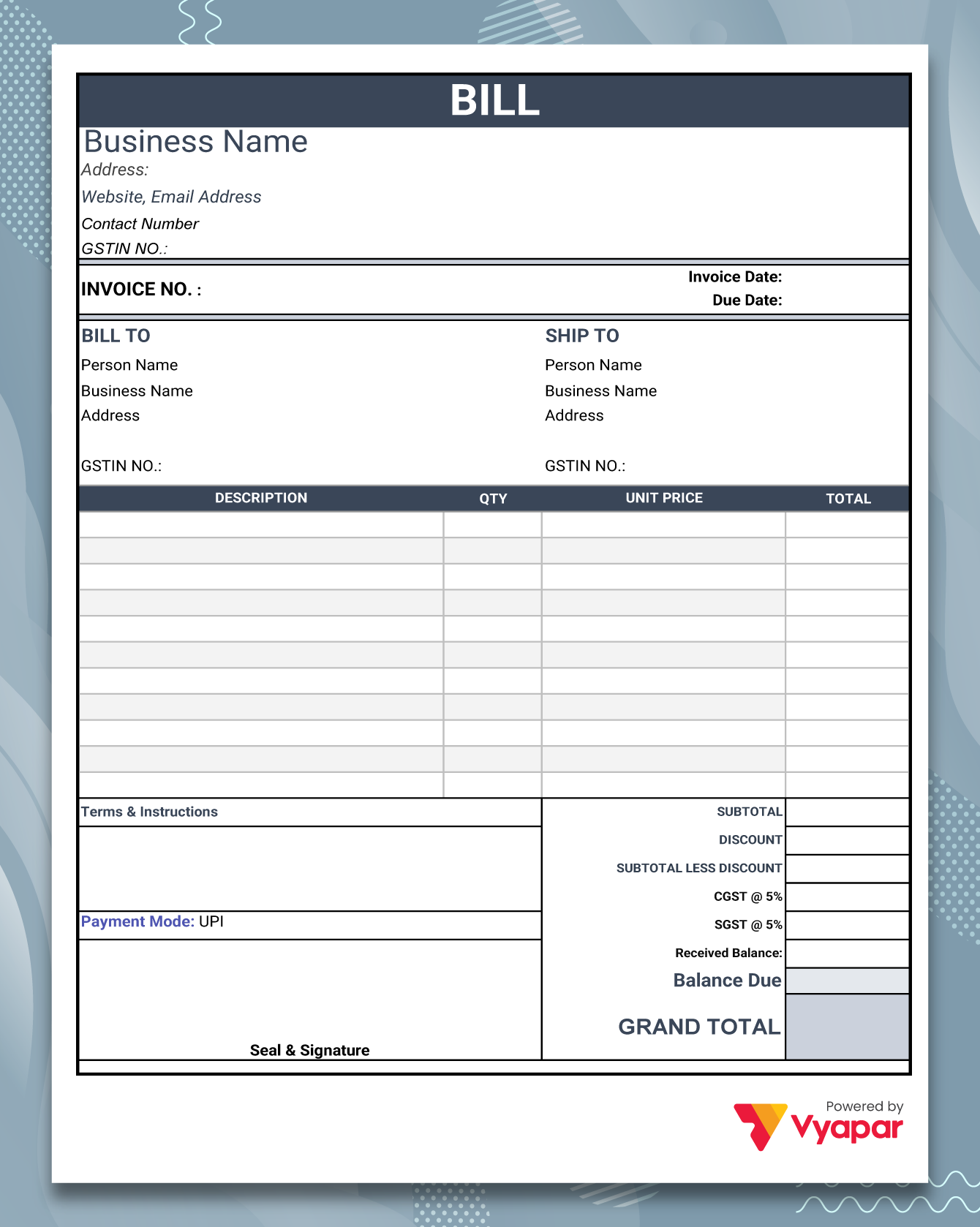

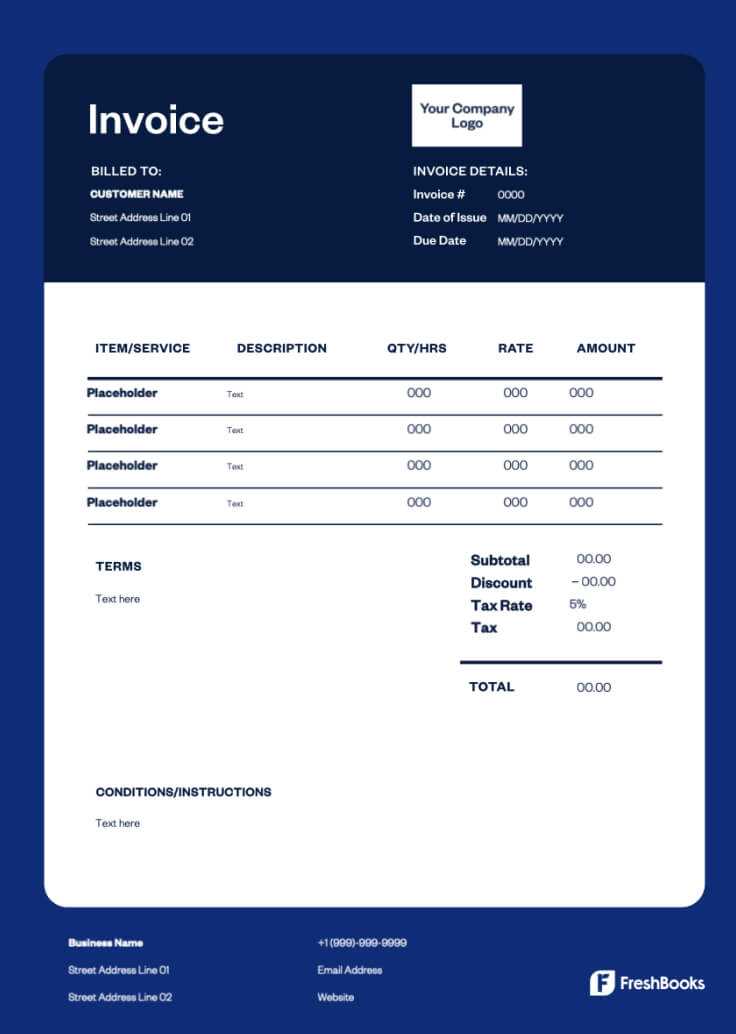

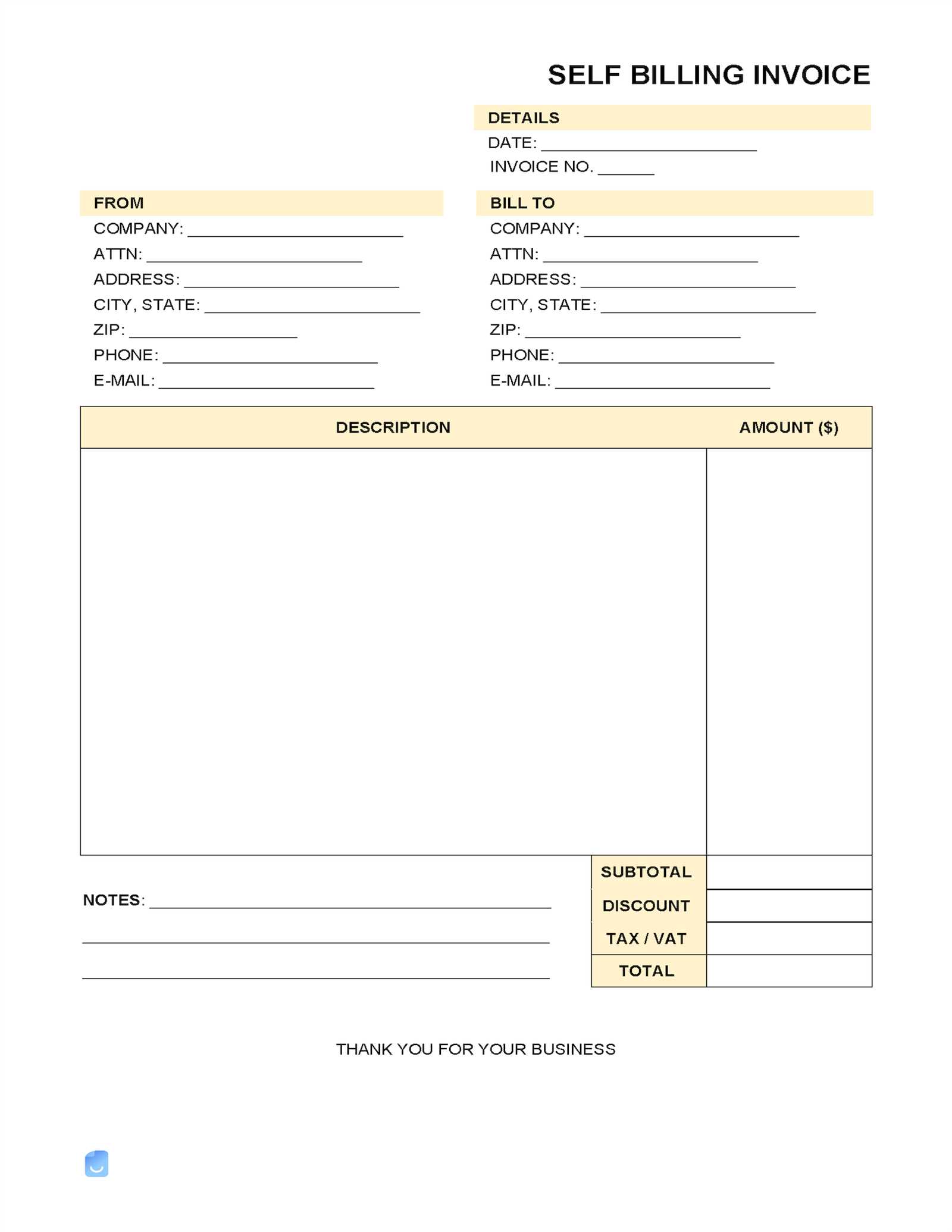

Here’s a step-by-step guide to building a professional document for billing purposes:

- Open a New File: Start by launching your spreadsheet program and opening a new blank file where you can begin building your structure.

- Set Up the Header: Include important company details at the top, such as your business name, logo, contact information, and the title of the document. Make sure the header is clearly visible.

- Define Key Fields: Create rows for necessary details like client information (name, address, and contact), payment terms, and the date of the transaction. Use separate columns for each piece of information for clarity.

- Itemize Charges: In the main body of the document, set up a table where you can list all products or services provided, including description, quantity, unit price, and total. Use formulas to automatically calculate totals.

- Calculate Totals: Utilize built-in functions to sum up item costs, apply taxes, and calculate the final amount due. This step helps ensure all calculations are accurate.

- Add Payment Information: Include fields for payment methods and instructions, as well as the due date for the payment. This helps ensure both parties are clear on the terms.

- Save and Reuse: Once the structure is complete, save the document as a template file so you can reuse it for future transactions. Simply update the specific details for each new billing cycle.

By following these simple steps, you can create a customized document that fits your needs. The beauty of this approach lies in its flexibility – you can adjust the layout, formulas, and design at any time to match the evolving needs of your business.

Key Features of Self Billing Invoices

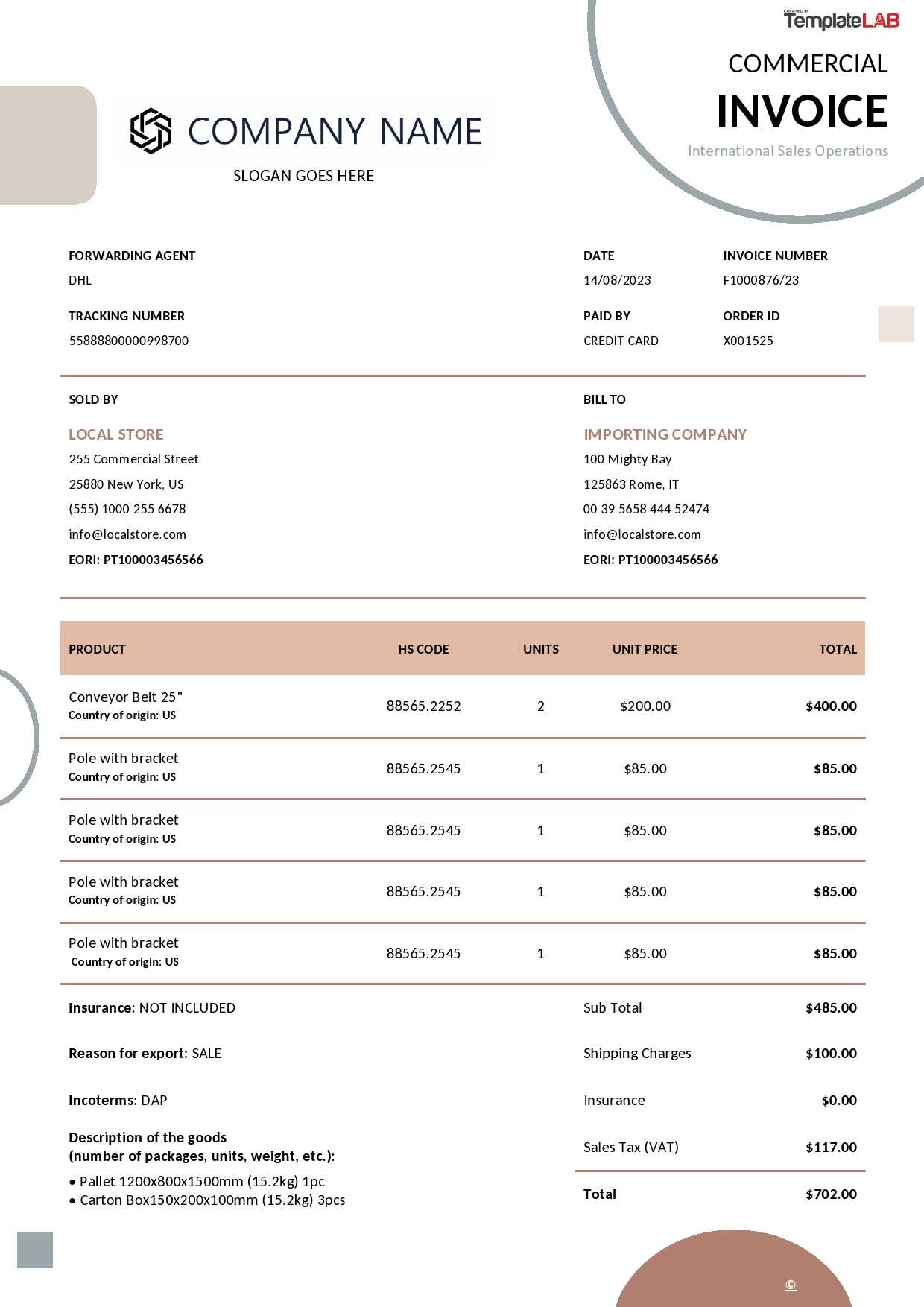

A well-structured document for tracking payments should include specific elements that ensure clarity, accuracy, and efficiency. These features help to streamline the process of documenting financial exchanges, ensuring both parties are on the same page regarding the transaction details. By incorporating the right elements, businesses can reduce errors, improve communication, and save time when handling multiple transactions.

Essential Components of a Payment Document

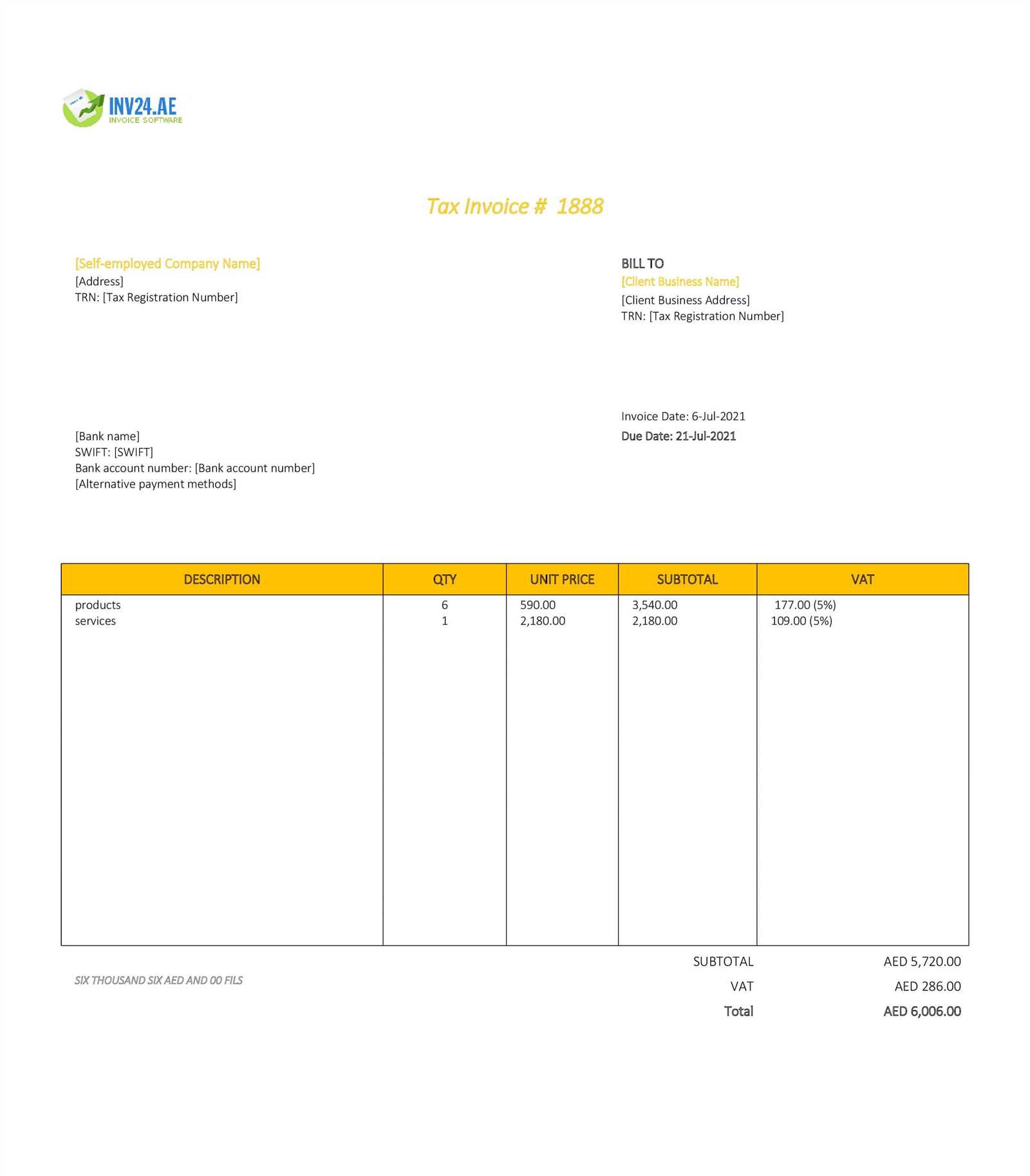

There are several important components to include in every document to ensure it is both effective and legally sound. These features cover all aspects of the transaction, from the date of issuance to payment instructions. Below is a summary of the most crucial elements:

| Component | Description |

|---|---|

| Document Header | Includes business name, logo, contact details, and document title for easy identification. |

| Client Information | Contains the client’s name, address, and contact details to ensure accurate communication. |

| Transaction Details | Lists services or products, including descriptions, quantities, prices, and subtotals for transparency. |

| Tax and Discounts | Calculates and applies taxes, discounts, or additional fees to provide an accurate total amount. |

| Payment Terms | Specifies payment methods, due dates, and any penalties for late payment. |

Additional Functionalities

In addition to the basic components, there are a few advanced features that enhance usability and tracking:

- Automatic Calculations: Built-in formulas that update totals and taxes automatically to avoid manual errors.

- Customizable Layout: The ability to change the document’s layout and design to suit business branding and preferences.

- Recurring Payment Setup: Option to set up repeating transactions for clients with ongoing agreements.

- Tracking and History: Store previous records and payment statuses for easy reference and follow-up.

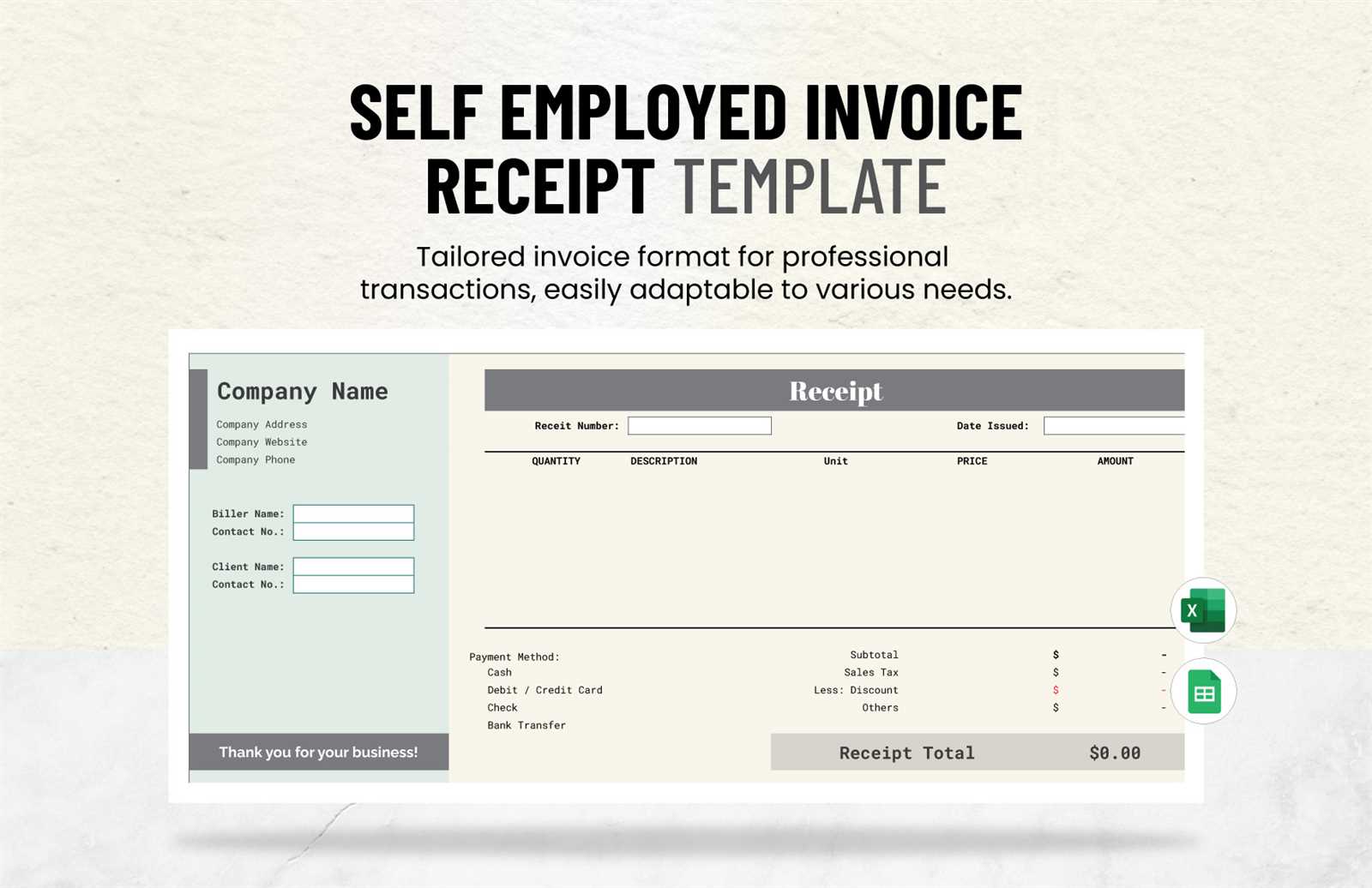

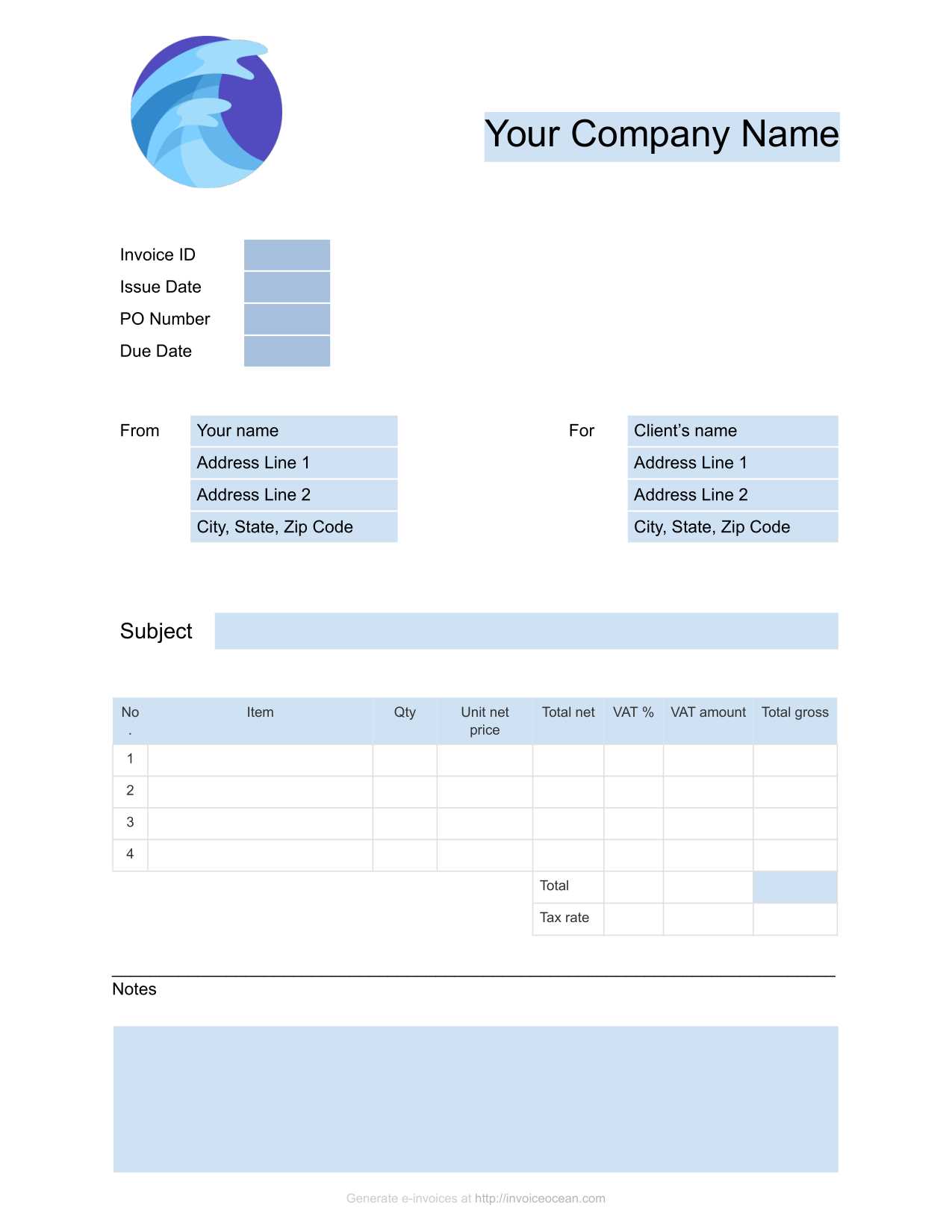

Customizing Your Excel Template for Business

Every business has unique needs when it comes to documenting financial transactions, and having the ability to adjust the structure of your payment documents is essential for efficiency and accuracy. Customizing your records allows you to align the document layout with your branding, include all necessary details, and streamline your process to meet specific business requirements. Whether you’re managing a small business or a larger enterprise, personalization ensures that every document reflects your company’s standards and operational needs.

Key Customization Options

There are several ways to adapt your documents to fit your business model and industry standards. From adjusting the design to adding relevant fields, the flexibility of digital solutions allows you to make changes that improve usability and ensure accuracy. Here are some common customizations:

- Branding: Incorporate your company logo, colors, and fonts to make your documents look professional and consistent with your brand identity.

- Custom Fields: Add fields specific to your business, such as project codes, delivery addresses, or order references, to capture all relevant information for each transaction.

- Flexible Layout: Adjust the placement of sections, such as client information, transaction details, and payment terms, to prioritize what matters most to your business.

- Payment Methods: Include a section detailing the various payment options available, such as bank transfers, credit cards, or digital payment systems, ensuring clarity for your clients.

Advanced Customization Techniques

For those looking to take customization further, there are advanced features that can automate and improve the document creation process:

- Automated Calculations: Use built-in formulas to automatically calculate totals, taxes, and discounts based on the entered data, minimizing manual errors and saving time.

- Dynamic Date Fields: Set the document to automatically update the date of issue or due date based on the transaction, ensuring consistency and timely follow-up.

- Recurring Transactions: If your business operates on a subscription or ongoing service model, you can set up recurring fields to simplify the process of managing regular payments.

By customizing your document layout and functionality, you can create a more efficient, professional, and user-friendly system that enhances your business operations and helps maintain consistency in your financial record-keeping.

Common Mistakes in Self Billing Invoices

Even with the best tools and systems in place, errors can still occur when creating financial documents. These mistakes can range from minor inaccuracies to more serious issues that affect the accuracy of the transaction or even lead to payment disputes. Recognizing and addressing common pitfalls is crucial to ensuring that your records are correct, professional, and legally compliant. Avoiding these mistakes can save time, reduce confusion, and help maintain positive relationships with clients.

Here are some of the most frequent mistakes that businesses make when preparing payment documents:

1. Missing or Inaccurate Details

One of the most common errors is leaving out essential information or entering it incorrectly. This can include missing client details, incorrect product descriptions, or inaccurate payment terms. These mistakes can lead to confusion, delays in payment, or disputes with clients.

- Ensure all client contact details, including addresses and payment information, are correct.

- Double-check the product or service descriptions, quantities, and prices.

- Verify the payment due dates and terms to avoid any misunderstandings.

2. Incorrect Calculations

Manual calculations are prone to human error. Whether it’s adding up totals, calculating taxes, or applying discounts, inaccuracies can result in incorrect amounts being billed, potentially causing frustration for both the business and the client.

- Use built-in formulas or automated tools to handle calculations accurately.

- Double-check the totals before sending the document to ensure correctness.

3. Lack of Consistent Formatting

Inconsistent formatting can make a financial document appear unprofessional and difficult to read. This includes issues such as varying font sizes, unaligned columns, or inconsistent headings. It can create confusion, making it harder for both you and your clients to understand the terms of the transaction.

- Keep the layout clean, consistent, and easy to follow.

- Ensure that columns, rows, and text are properly aligned for clarity.

4. Not Including Payment Instructions

Failing to provide clear payment instructions is another common issue. Without specific details on how to pay, clients may delay payments or ask for clarification, leading to unnecessary back-and-forth communication.

- Clearly specify the payment methods and options available (e.g., bank transfer, onli

How to Ensure Accuracy in Self Billing

Maintaining accuracy in financial documentation is essential to avoid errors that could lead to delayed payments, disputes, or legal issues. When creating records for transactions, it’s important to have a system in place that reduces human error and ensures all figures are correct. By implementing a few key strategies, you can significantly enhance the precision of your documents and streamline the entire process.

1. Use Automated Calculations

One of the easiest ways to ensure accuracy is by automating calculations. Manual calculations are prone to errors, especially when dealing with multiple items, taxes, or discounts. By using built-in functions or automated tools, you can ensure that totals, tax rates, and other financial figures are calculated correctly every time.

- Use formulas: Set up your system so that any additions, subtractions, or tax rates are automatically calculated.

- Double-check formulas: Ensure that all formulas are correctly inputted and tested before use.

- Validate totals: Compare the calculated totals with the expected amounts to confirm accuracy.

2. Standardize Your Document Structure

Consistency is key when generating financial records. A standardized format ensures that all necessary information is included every time, reducing the risk of omitting key details. Whether it’s a customer’s contact information, transaction date, or payment terms, a clear structure makes it easier to verify each section for accuracy.

- Set fixed fields: Ensure that each document follows a consistent format with standard fields for all required data.

- Use dropdowns or checkboxes: For repeating fields like payment methods or transaction categories, use predefined options to reduce mistakes.

- Review regularly: Periodically review your document templates to ensure all fields are still relevant and properly labeled.

3. Cross-Check Information

Even with automated systems in place, it’s still important to cross-check the data for accuracy before sending out any document. Verifying key pieces of information can prevent minor errors that could lead to confusion or payment issues.

- Verify client details: Ensure that the client’s name, address, and contact information are correct.

- Check transaction details: Review product descriptions, quanti

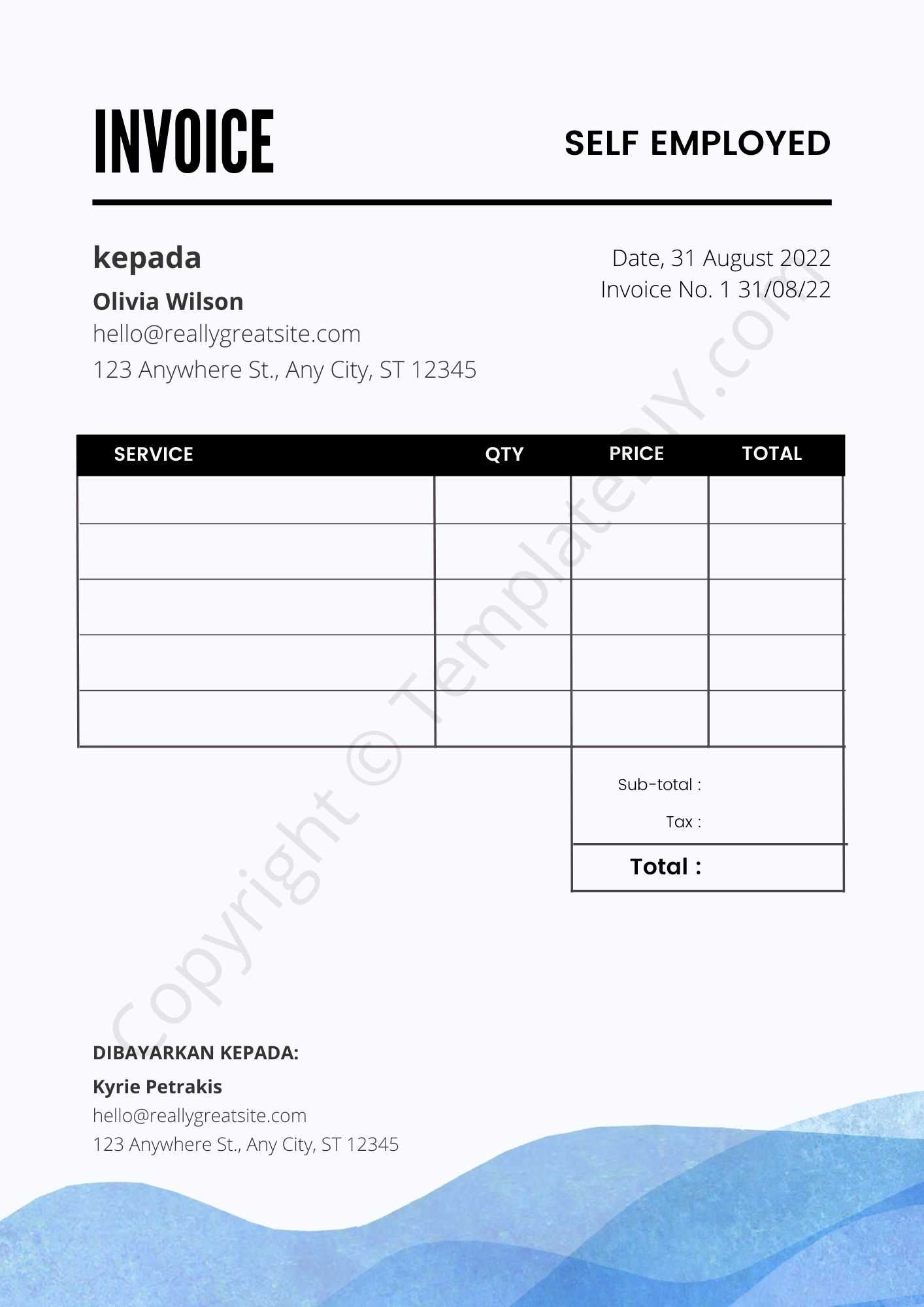

Free Templates for Self Billing Invoices

For businesses looking to streamline their payment documentation process, free tools and resources are available that can simplify the creation and management of financial records. These pre-designed structures offer flexibility and ease of use, making it possible to quickly generate accurate documents without the need for expensive software. By utilizing such resources, you can ensure that your records meet the necessary requirements while saving time and money.

Here are some benefits of using free resources for creating your payment records:

- Cost-effective: Free resources eliminate the need for expensive software or subscriptions, making them ideal for small businesses and startups.

- Ease of use: These documents are often user-friendly and come with pre-filled fields, so they can be customized quickly to suit your needs.

- Time-saving: With ready-to-use structures, you can focus on entering transaction details instead of starting from scratch.

Where to Find Free Resources

Several platforms offer free resources that you can download and use for creating payment records. These resources range from simple designs to more complex setups with built-in calculations and formatting options:

- Google Sheets: You can find free customizable files on the Google Sheets template gallery, with easy sharing options and cloud storage.

- Microsoft Office Templates: Microsoft offers free downloadable files for creating financial documents that you can adjust for your business needs.

- Third-Party Websites: Numerous websites specialize in offering free downloadable financial document resources. Just ensure they fit your business requirements before using them.

Customizing Free Resources

Even though these resources come pre-built, they still offer customization options to ensure they fit your unique business needs:

- Branding: Add your logo, company colors, and contact information to personalize the document.

- Fields and Sections: Modify or remove sections to match the specifics

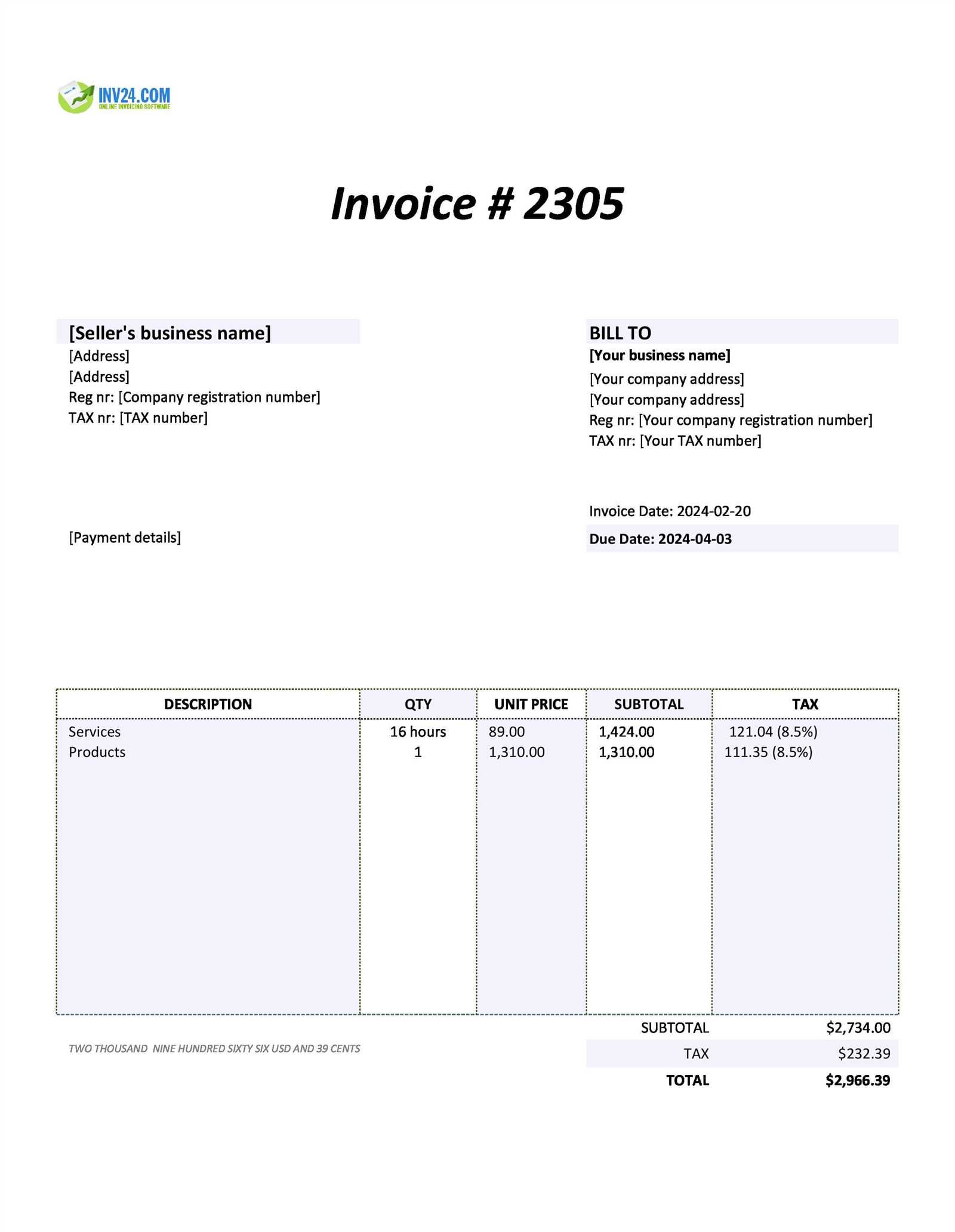

Tracking Payments with Excel Invoice Templates

Effectively tracking payments is crucial for managing cash flow and ensuring that your business receives timely compensation for goods or services. Having a reliable system to monitor outstanding balances and record payments can help avoid missed transactions and prevent errors. By using a well-organized document structure, you can easily track which payments have been received and which are still pending, improving both efficiency and financial accuracy.

Organizing Payment Data

A clear and consistent structure allows you to quickly access and manage payment information. For effective tracking, it’s essential to include key details such as the date of the transaction, amount due, payment status, and due date. This information helps you maintain an up-to-date record of all financial transactions and ensures nothing slips through the cracks.

- Transaction Date: Record the date when the payment was issued, so you can keep track of when payments are due or when they were received.

- Payment Amount: Always list the agreed amount due for the transaction, and update it if any adjustments (such as discounts) apply.

- Payment Status: Include a column to mark payments as “Paid,” “Pending,” or “Overdue,” so you can easily see the status of each transaction.

- Due Date: Track when payments are due to ensure timely follow-ups and avoid missed payments.

Using Formulas for Payment Tracking

To automate payment tracking and reduce manual errors, you can incorporate formulas to calculate totals and payment statuses. For example, you can use conditional formatting to highlight overdue payments or set up automatic calculations to update the balance once a payment is made. These built-in features not only save time but also ensure that all figures are accurate and up-to-date.

- Sum Function: Automatically calculate the total amount due for each transaction or for all outstanding payments in your records.

- Conditional Formatting: Highlight overdue payments in a specific color or flag unpaid transactions to draw attention to them.

- Balance Calculation: Use formulas to subtract payments made from the total amount due, giving you an updated balance with every new transaction.

With a structured approach and the right formulas, tracking payments becomes a seamless process, allowing you to stay on top of your finances and ensure timely cash flow

Best Practices for Invoice Management

Effective management of financial documents is essential for maintaining smooth business operations and ensuring timely payments. Whether you’re managing transactions for a small business or a large enterprise, implementing best practices for organizing and tracking payment records can help reduce errors, avoid delays, and maintain positive relationships with clients. By following certain guidelines, you can ensure that all payment documents are accurate, professional, and processed efficiently.

1. Organize Your Documents Consistently

Having a standardized system for organizing your financial records is crucial to avoid confusion and errors. By keeping your documents well-structured, you can easily track payments, due dates, and transaction details. This also helps in quick retrieval when needed for audits or client inquiries.

- Use Folders: Create separate folders for each client or project, making it easier to access related documents.

- Digital Solutions: Utilize cloud-based storage or software to keep all documents in one place, making it easy to access and share.

- Clear Naming Conventions: Name each document systematically (e.g., ClientName_Date_Transaction) to make it easy to identify and organize.

2. Keep Track of Payment Statuses

Tracking the status of each transaction is essential for timely follow-ups and managing cash flow. Knowing whether a payment has been received, is pending, or is overdue allows you to take action and prevent delays in your business’s finances.

- Use Status Columns: Include a column for tracking payment status (Paid, Pending, Overdue) in your document structure.

- Set Reminders: Use digital tools to set reminders for upcoming due dates or overdue payments.

- Regularly Update: Update payment statuses as soon as a payment is made to keep your records current.

3. Automate Where Possible

Automation tools can significantly reduce the time and effort involved in managing financial records. Automating calculations, reminders, and even document generation can save you time and prevent manual errors, ensuring that everything runs smoothly.

- Automate Calculations: Use formulas or built-in functions to automatically calculate totals, taxes, and other amounts.

- Set Up Recurring Reminders: Use software or calendar applications to automatic

How Self Billing Simplifies Accounting

Managing financial transactions can often be complex, especially when dealing with multiple clients, payment terms, and varying rates. A streamlined approach to recording and processing payments helps businesses save time, reduce errors, and maintain accurate records. By allowing one party to generate the payment documents, this process eliminates the need for back-and-forth communication and ensures everything is processed smoothly and efficiently. The result is a simpler, more organized way to handle accounting tasks.

1. Reduced Administrative Burden

When one party takes responsibility for creating payment documentation, it frees up time for the other to focus on their core tasks. This streamlined approach cuts down on manual entry, minimizes the chances of errors, and allows both parties to focus on their work without needing to reconcile discrepancies. The administrative burden is reduced significantly, leading to better efficiency in business operations.

- Less Time Spent on Documentation: Automating the generation of financial records saves valuable time for both parties.

- Fewer Mistakes: With fewer hands involved in creating the documents, the risk of errors is minimized.

- Quicker Payments: As the process becomes more efficient, payment cycles are often shortened.

2. Simplified Financial Tracking

Financial tracking becomes easier when the documentation process is centralized. With one party generating the records, it’s easier to keep a consistent format and structure across all transactions. This uniformity allows for quicker identification of overdue payments, outstanding balances, and any discrepancies that may arise. The simplified process also helps with financial forecasting and budgeting, as businesses can quickly access and analyze their financial data.

Transaction Date Amount Due Status Due Date 2024-10-01 $500 Paid 2024-10-10 2024-10-03 $750 Pending 2024-10-12 2024-10-05 $400 Excel Tips for Effective Invoice Creation Creating accurate and professional financial documents can be a time-consuming task, especially when there are many details to track. However, with the right tools and techniques, you can simplify the process and create documents that are both effective and efficient. Using spreadsheet software for this purpose offers numerous advantages, such as customizable fields, automated calculations, and easy formatting options. Below are some tips to help you optimize your workflow and ensure that your financial documents are accurate and professional.

1. Use Formulas for Automatic Calculations

One of the key advantages of using spreadsheet software is the ability to automate calculations. By incorporating basic formulas, you can quickly calculate totals, taxes, and discounts, reducing the chances of errors and speeding up the process.

- SUM Formula: Use the SUM function to automatically add up the amounts for each line item.

- Multiplication for Rates: Multiply quantities by unit prices to automatically calculate line totals.

- Tax Calculation: Use formulas to automatically calculate tax based on a percentage of the total amount.

2. Leverage Built-in Formatting Tools

Spreadsheets offer powerful formatting options that allow you to make your financial documents clear and professional-looking. By using colors, borders, and text formatting, you can make your documents easier to read and navigate.

- Bold Headers: Make the headers stand out by using bold fonts to differentiate important sections.

- Gridlines: Use borders or gridlines to clearly separate sections for easier reading.

- Conditional Formatting: Highlight overdue payments or unpaid amounts with different colors to draw attention to them.

3. Customize Templates for Your Business Needs

While starting from scratch is always an option, many businesses prefer to use predefined structures that can be easily customized. Customizing your documents helps save time and ensures that they are consistent with your branding and business requirements.

- Add Your Logo: Insert your company logo at the top to give your documents a professional and branded look.

- Personalize Contact Details: Include your business name, address, and contact information for easy reference.

- Adjust Layouts: Modify the layout to include any specific details that are relevant to your industry or business practices.

4. Use Drop-Down Lists for Consistency

Drop-down lists help reduce manual errors by offering predefined options. You can use these lists for recurring fields such as payment terms, currency types, or item categories.

- Payment Terms: Include a drop-down list with common payment terms (e.g., Net 30, Due on Receipt) for easy selection.

- Currency: If you work internationally, you can create a drop-down list for different currencies to avoid mistakes.

- Item Categories: Create a drop-down for categories of goods or services you provide, making it easier to select the right item.

5. Save Time with Pre-Defined Templates

If you regularly create financial records, using a predefined structure can save you significant time. Predefined formats ensure that all necessary information is included and properly arranged, re

Exporting and Sharing Your Excel Invoices

Once your financial documents are prepared and ready, it’s important to know how to export and share them efficiently. Whether you’re sending a document to a client, storing it for your records, or sharing it with your accounting team, ensuring that the document is in the right format and easily accessible is crucial for smooth business operations. Exporting files from a spreadsheet application allows you to save time and avoid complications when sharing or storing data.

1. Exporting to PDF for Professional Sharing

One of the most commonly used formats for sharing financial documents is PDF. Exporting your document to PDF ensures that the formatting remains intact and that it can be opened by any recipient without the need for specialized software. PDFs also prevent unauthorized edits, making them a secure and professional way to share financial records.

- Preserve Formatting: PDFs keep the layout, fonts, and styles the same regardless of the software the recipient uses.

- Easy to Read: PDF files are universally compatible and easy for recipients to view and print.

- Prevents Changes: Once exported, the file cannot be altered, ensuring the integrity of the information shared.

2. Sharing Files via Cloud Storage

Cloud storage services, such as Google Drive, Dropbox, or OneDrive, allow for quick sharing of financial documents without the need for email attachments. These services offer easy access, secure storage, and the ability to manage permissions, which is particularly useful when collaborating with team members or clients.

- Access Control: You can control who has access to the document by setting permissions such as “view-only” or “edit” access.

- Real-Time Collaboration: Multiple people can view or update the document at the same time, improving team collaboration.

- Easy Sharing: Simply generate a link and send it to the recipient, saving time on file uploads and downloads.

3. Sending via Email

For a more direct approach, you can attach your file to an email and send it directly to the intended recipient. While email attachments can be a quick way to share documents, it’s important to make sure that the file size is manageable and the format is compatible with the recipient’s system.

- File Size Limitations: Keep in mind that email systems often have limits on attachment si

How to Avoid Tax Errors in Self Billing

Accurate financial documentation is essential for businesses to ensure compliance with tax laws and avoid potential penalties. When generating payment records, it’s important to be meticulous with the calculation and reporting of taxes. Mistakes in tax reporting can lead to costly errors, audits, or missed opportunities for deductions. By following best practices and using the right tools, businesses can minimize tax-related mistakes and streamline the entire process.

1. Understand Tax Rates and Rules

One of the most common causes of tax errors is a lack of understanding of applicable tax rates and rules. Different regions, industries, or product types may have varying tax rates, exemptions, or special considerations. It’s essential to stay updated on local and national tax laws to avoid mistakes.

- Stay Informed: Regularly review tax laws or consult a tax professional to ensure compliance with changing rules.

- Use Correct Tax Rates: Apply the correct tax rate based on the location of the transaction or the type of service or product being sold.

- Consider Exemptions: Ensure that any eligible exemptions or deductions are applied where appropriate.

2. Implement Automated Tax Calculation

Manually calculating tax amounts is prone to error, especially when working with large datasets or multiple transactions. Implementing automated tax calculation tools can reduce the likelihood of mistakes and save time. Many financial tools and software solutions offer features that calculate taxes automatically based on current rates, ensuring accuracy.

- Use Tax Automation Software: Use built-in features in spreadsheet tools or dedicated tax software to calculate tax amounts automatically.

- Regularly Update Software: Ensure that any tax calculation tools you use are regularly updated to reflect the latest rates and rules.

- Double-Check Calculations: Even with automation, always verify tax calculations before finalizing the document.

3. Keep Detailed and Organized Records

Accurate record-keeping is essential for both tax reporting and business audits. It’s important to store detailed records of every transaction, including the tax amounts applied. By maintaining organized records, businesses can easily reference documents if they need to clarify any discrepancies or answer questions from tax authorities.

- Maintain Transaction Logs: Keep a log of all sales, purchases, and tax-related transactions, including the tax rates used.

- Store Supporting Documents: Retain receipts, contracts, and any other documentation that supports tax calculations.

- Regular Reconciliation: Regularly reconcile your records to ensure that tax amounts are correctly applied and consistent with invoices.

Ensuring Legal Compliance with Self Billing

Maintaining legal compliance in financial transactions is a crucial aspect of running a business. It is essential to ensure that all procedures, documentation, and records align with the tax laws and regulations of your region. Whether you’re managing payments, calculating taxes, or issuing financial records, following the correct legal framework is vital for avoiding penalties, disputes, or audits. Businesses need to be proactive about compliance to maintain good standing with tax authorities and ensure transparency in their operations.

1. Understand the Tax Regulations

Before issuing any financial documents, it is crucial to fully understand the tax laws relevant to your business operations. Different countries and regions have distinct rules regarding tax rates, exemptions, and reporting requirements. Failing to comply with these rules can result in fines or legal issues.

- Stay Updated: Tax laws are subject to change, so it’s essential to keep up with updates and revisions regularly.

- Know the Requirements: Ensure that your financial documentation meets the legal standards for your jurisdiction, including the proper display of tax amounts, registration numbers, and other required details.

- Consult Professionals: When in doubt, seek advice from tax experts or accountants who can help you navigate complex regulations.

2. Maintain Accurate Documentation

Proper documentation is one of the key components of ensuring legal compliance. Every transaction should be clearly recorded, with precise details about the products or services provided, payment terms, and the amounts involved. This helps protect your business in the event of an audit or dispute.

- Detailed Records: Keep comprehensive records that detail the products or services sold, the agreed-upon terms, and the taxes applied to each transaction.

- Legally Required Information: Be sure to include all legally required elements, such as your business name, address, tax identification number, and any other relevant details.

- Organized Storage: Store all records securely and in an organized manner, either digitally or physically, for easy access during audits or legal reviews.

3. Use Compliant Tools and Software

To ensure that all records are generated correctly and legally, it’s essential to use reliable tools and software. Many tools offer built-in compliance features that automatically calculate taxes, apply legal formatting, and provide reports that meet regulatory standards.

- Automation for Accuracy: Use software that automatically calculates tax amounts, applies relevant tax rates, and ensures that all required

How to Automate Invoice Generation in Excel

Automating the process of creating payment records is an essential time-saver for businesses, ensuring consistency, reducing human error, and improving efficiency. By using the right tools and techniques, businesses can streamline the creation of financial documents, making the entire process faster and more reliable. Automating tasks in spreadsheets allows for quick data input, automatic calculations, and standardized formatting without the need for manual intervention in each transaction.

To start automating the creation of payment records, you can take advantage of various features available within spreadsheet programs like formulas, macros, and data validation. Here’s how you can set up an automated workflow:

1. Set Up Your Data Fields

The first step in automation is to define the necessary fields for each payment record. These fields will typically include the customer’s name, transaction date, item description, unit price, quantity, and total amount. Setting up a clear structure for these fields ensures that all necessary information is captured correctly.

- Design a Clear Layout: Organize the fields into a logical layout to make it easy for users to fill in details.

- Identify Key Variables: Mark key data points that will require calculation, such as total amounts or tax.

- Include Payment Terms: Set fields for due dates, payment methods, and any applicable discounts or fees.

2. Use Formulas to Calculate Totals Automatically

One of the main advantages of using a spreadsheet is the ability to automatically calculate totals. By using formulas, you can ensure that the correct amounts are always computed based on the data entered.

- Use SUM for Totals: For calculating the total price, use the SUM formula to add up individual amounts.

- Apply Multiplication for Pricing: Use formulas like =UnitPrice * Quantity to calculate the total price for each item.

- Incorporate Tax Calculations: Add a formula to automatically apply the correct tax rate to the total, ensuring compliance with tax laws.

3. Implement Drop-Down Lists for Consistency

To make data entry more efficient and reduce errors, you can implement drop-down lists for fields that require consistent options, such as payment methods, pro

Integrating Self Billing with Other Tools

Integrating financial processes with other business tools can significantly improve workflow efficiency and ensure accuracy in operations. By connecting various software solutions, businesses can automate tasks, reduce manual data entry, and seamlessly sync important information across platforms. Whether you’re managing payments, tracking expenses, or generating reports, combining multiple tools helps create a streamlined and interconnected system.

1. Connecting with Accounting Software

Integrating payment documentation and management tools with accounting software can automate the transfer of transaction details, ensuring that all records are updated in real-time. This integration eliminates the need for duplicate data entry, reducing errors and saving time. Most accounting platforms allow users to import data from other systems, simplifying the process of tracking income, expenses, and taxes.

- Automated Data Entry: By connecting tools, transaction information is directly sent to your accounting system, ensuring all records are kept up to date.

- Real-Time Updates: Changes made in one tool will be reflected in the accounting system automatically, minimizing the risk of errors.

- Financial Reporting: With seamless data flow between systems, generating financial reports becomes more accurate and efficient.

2. Syncing with Payment Processing Platforms

Linking payment generation systems with payment processing platforms is another powerful integration that ensures faster transaction handling. Whether using credit cards, bank transfers, or other payment methods, integrating these tools allows businesses to track payments in real-time, verify transactions, and reconcile accounts with ease.

- Instant Payment Updates: Payments made by clients are automatically updated in your financial management tool, reducing the need for manual updates.

- Transaction Verification: Integration allows you to cross-check and verify payments, ensuring that no transactions are missed or inaccurately recorded.

- Easy Reconciliation: Matching payments with financial records becomes faster, as all data is synced across the tools.

By integrating various tools used for payment management, accounting, and transaction processing, businesses can reduce the likelihood of mistakes, automate time-consuming tasks, and ensure that all financial data remains consistent and accurate across platforms. This connectivity leads to improved efficiency, better decision-making, and a more organized workflow overall.