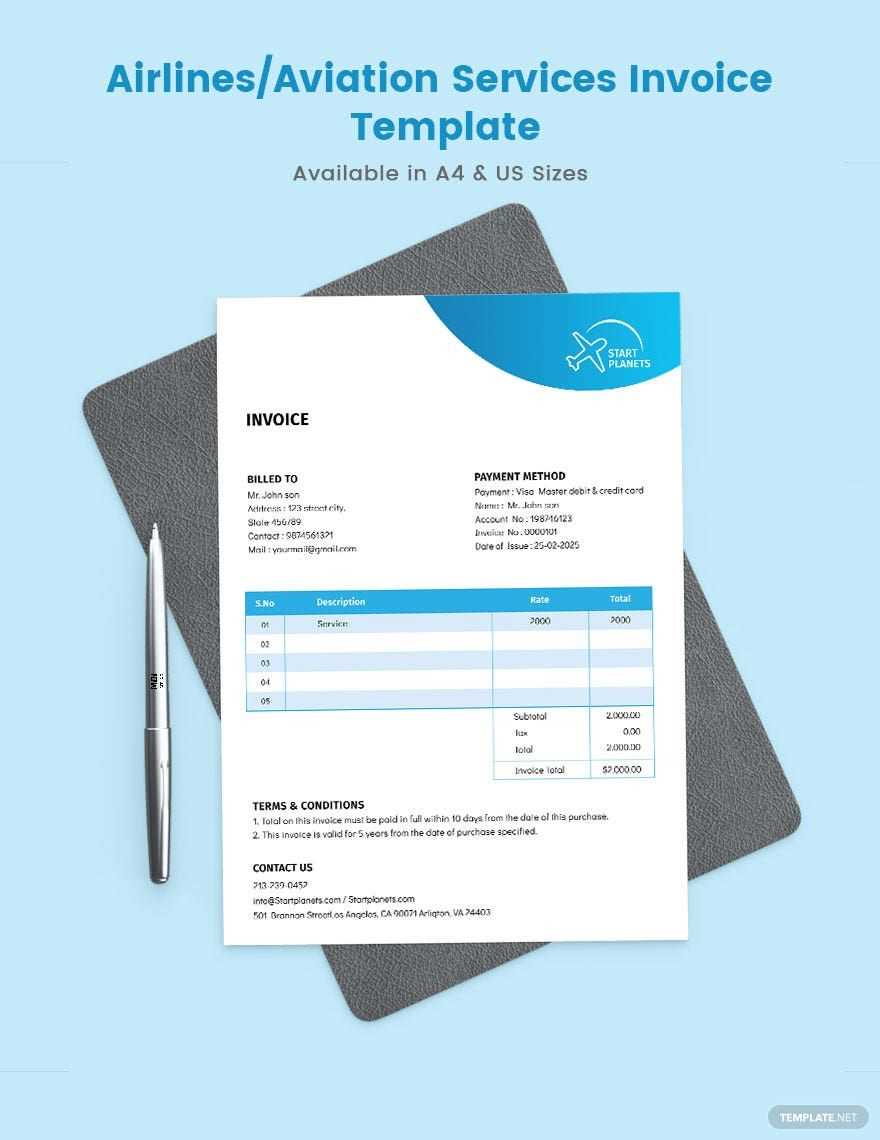

Essential Security Guard Invoice Template for Easy Billing

For any business offering on-site protection services, managing payments efficiently is key to maintaining smooth operations. One of the most important aspects of this process is having a well-organized billing system in place. The right tools can help ensure that transactions are accurate, timely, and professional, reducing misunderstandings and potential delays.

Using a well-designed document to request payment from clients allows you to clearly outline the services provided, hours worked, and the agreed-upon rates. This simple yet essential item helps to streamline the entire billing process, keeping your financials in order while presenting a professional image to your clients.

In this guide, we will explore the features of an effective billing document, discuss customization options, and provide tips on how to make the payment request process as smooth as possible. Whether you’re a small business owner or a larger provider, understanding the best practices for creating and managing these records is crucial for sustaining long-term success.

Security Guard Invoice Template Overview

When providing on-site protection services, it is essential to document and request payment in a clear and structured manner. A professionally designed document serves as a formal request for compensation, detailing the terms and breakdown of the services rendered. This ensures both parties are aligned regarding the amount owed and the expectations for payment.

In this section, we’ll outline the fundamental elements typically included in a well-organized billing document. These key components help maintain transparency and avoid confusion for both service providers and clients. Below is a general structure you can expect from a properly formatted payment request.

| Section | Description |

|---|---|

| Service Provider Details | Includes the name, address, and contact information of the business offering the services. |

| Client Information | Contains the client’s name, business name (if applicable), and contact details. |

| Service Description | A breakdown of the tasks performed, including time periods, locations, and any special instructions or requests. |

| Hours Worked | Details the total number of hours worked or shifts completed during the billing period. |

| Rates | Lists the hourly or flat rates applied to the services provided. |

| Subtotal | The total amount before taxes or discounts are applied. |

| Tax Calculation | Shows the applicable taxes based on the total amount. |

| Total Amount | The final amount due, including all fees, taxes, and adjustments. |

| Payment Terms | Includes the due date, payment methods, and any late payment penalties if applicable. |

By including these details in your billing documents, you can ensure a clear and professional payment request that both protects your business interests and fosters positive relationships with clients.

Why You Need an Invoice Template

Having a standardized document to request payment is essential for any business providing on-site services. This document ensures that both parties are clear on the terms of the transaction, reducing the chances of confusion or disputes. Without a proper format, billing can become disorganized and time-consuming, potentially affecting cash flow and client relationships.

Using a well-structured document allows you to outline all necessary details such as the scope of work, hours worked, and agreed-upon rates. This clarity makes the payment process smoother, helping clients understand exactly what they are paying for and when payments are due. It also provides a record for your own accounting, making it easier to track income and monitor overdue payments.

Additionally, relying on a consistent and professional-looking document enhances your business image. It signals reliability and attention to detail, which can improve client trust and encourage timely payments. Streamlining your billing process with a predefined structure not only saves time but also reduces errors, making it an indispensable tool for efficient financial management.

Key Elements of a Security Invoice

When requesting payment for on-site protection services, it is crucial to include all necessary details in the document. A well-crafted payment request not only ensures accuracy but also enhances professionalism. By providing a clear breakdown of services rendered and the corresponding fees, both the service provider and the client can avoid confusion and ensure smooth financial transactions.

The key elements of such a document help ensure transparency and clear communication. Below is an overview of the most important sections to include in a comprehensive payment request.

| Section | Description |

|---|---|

| Service Provider Information | Includes the business name, contact details, and any relevant identification numbers. |

| Client Information | Lists the client’s name, address, and contact details to ensure accurate identification. |

| Service Description | A detailed account of the work performed, including specific tasks, locations, and time periods. |

| Hours and Rates | Includes the total number of hours worked and the applicable hourly or flat rates for the services provided. |

| Subtotal | The total amount for services rendered before taxes or adjustments are applied. |

| Tax Details | Shows the amount of tax applicable to the subtotal, in accordance with local tax regulations. |

| Total Due | The final amount owed, including the subtotal and taxes. |

| Payment Terms | Specifies the due date, accepted payment methods, and any late fees for overdue payments. |

Including all these elements ensures that your payment request is both professional and clear, minimizing the potential for misunderstandings and ensuring that both parties are on the same page regarding the transaction details.

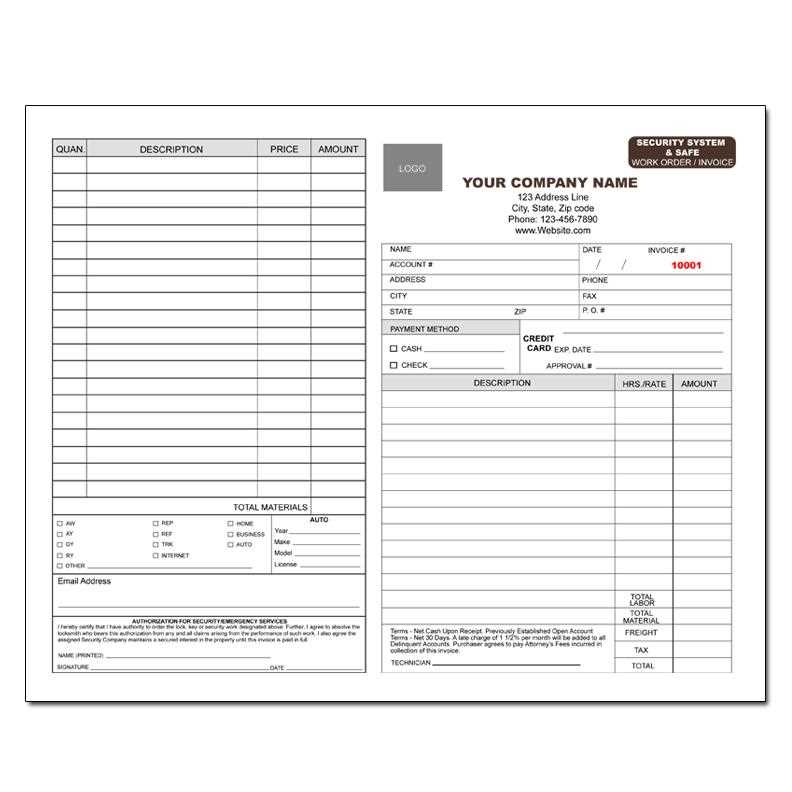

How to Customize Your Template

Customizing your payment request document ensures that it fits your specific business needs and aligns with your branding. A personalized format not only streamlines your billing process but also reinforces your professional image. By adjusting the layout and content, you can make sure all essential details are included and that the document clearly reflects the nature of the services provided.

Adjusting the Layout

The layout of your payment request should be clear and easy to follow. Begin by adjusting the header to include your company’s logo, name, and contact details. This helps clients quickly identify the source of the document. You can also modify the font, colors, and design elements to match your brand’s style guide. A clean, well-organized structure will make it easier for clients to understand the details and for you to maintain consistency across all documents.

Personalizing the Content

Next, tailor the content of your document to fit the services you provide. For instance, you may want to include specific fields that reflect the nature of the work, such as job site location or special instructions. You can also adjust the pricing sections to match your unique billing structure, whether it’s based on hourly rates, flat fees, or a combination of both. By customizing these details, you ensure that your payment request is not only accurate but also relevant to your business model.

Additional customizations may include adding client-specific notes or payment reminders. This personalized touch can improve communication and encourage timely payments.

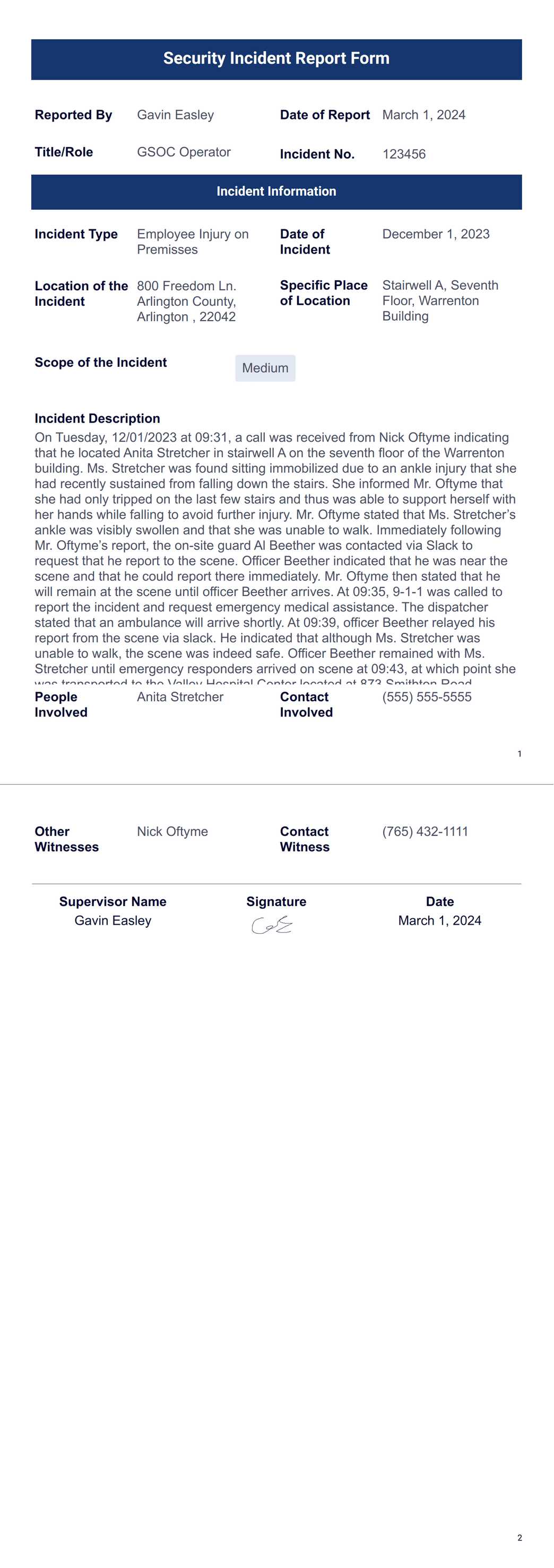

Common Errors in Security Invoices

Even a small mistake in a payment request document can lead to confusion or delays in receiving payment. Ensuring accuracy in every detail is essential to maintaining professionalism and preventing potential issues with clients. While most errors are easily avoidable, they can often go unnoticed until it’s too late, leading to costly misunderstandings or payment delays.

Missing or Incorrect Client Information

One of the most common mistakes is failing to include or incorrectly listing client details, such as the client’s name, address, or contact information. This can cause confusion and lead to the document being misplaced or misdirected. It’s essential to verify that the correct information is included for every transaction to ensure that the request reaches the right person and can be processed without delay.

Incorrectly Calculated Amounts

Another frequent error involves miscalculating the total amount owed. This may include incorrectly adding up the hours worked, applying the wrong rates, or forgetting to add taxes or discounts. Such mistakes can cause distrust or disputes with clients. It’s important to double-check all numerical calculations and ensure that the breakdown of services is accurate and consistent with the agreed-upon terms.

Additional errors may include omitting payment terms, neglecting to mention due dates, or failing to state the acceptable payment methods. These oversights can lead to confusion and delays, which are easily preventable with careful attention to detail.

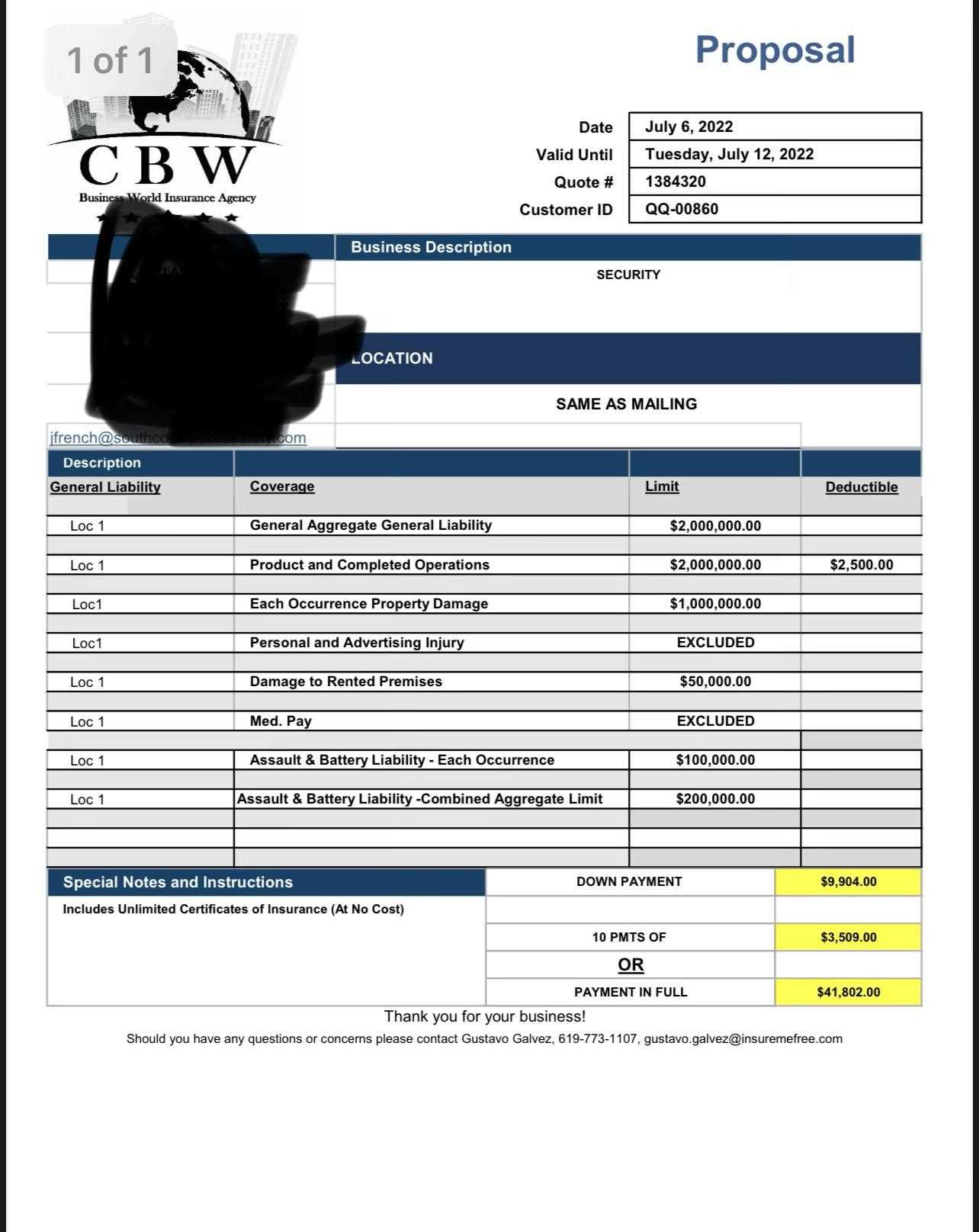

How to Calculate Security Guard Fees

Calculating the fees for on-site protection services requires taking into account several factors, such as the time spent on the job, the complexity of the tasks, and any additional expenses. Accurate fee calculation ensures that both the service provider and the client are in agreement on the compensation, avoiding disputes and ensuring fair payment for services rendered.

To properly calculate the cost of services, it’s important to consider the following factors:

| Factor | Explanation |

|---|---|

| Hourly Rate | Determine the agreed-upon hourly rate for services. This can vary depending on the level of expertise required and the location. |

| Hours Worked | Calculate the total number of hours worked, including breaks, travel time, or overtime, if applicable. |

| Flat Fees | If a flat fee is used for specific services (e.g., event security or emergency response), ensure that it is applied correctly. |

| Additional Costs | Include any extra costs incurred, such as equipment rental, travel expenses, or specialized uniforms, which may be added to the final total. |

| Tax | Ensure that applicable local or state taxes are calculated and added to the final amount due. |

By carefully considering these factors and accurately calculating the total cost, you can create a clear and fair payment request that reflects the value of the services provided.

How to Add Service Hours to Invoices

One of the key components of a payment request is the accurate documentation of the hours worked. Whether it’s for an hourly rate or a flat fee, detailing the amount of time spent on the job is essential for transparent billing. Properly adding service hours ensures that clients are charged fairly and that both parties agree on the time spent performing the services.

Here’s how you can properly document service hours in a billing request:

| Step | Action |

|---|---|

| Track Hours | Ensure accurate tracking of the hours worked, including start and end times for each shift or task. This can be done manually or with digital tools. |

| Breakdown of Time | Divide the total hours into specific tasks or shifts if applicable. This makes it easier for the client to understand what they are paying for. |

| Calculate Total Hours | Sum up all the hours worked for the given period, including overtime, if applicable. Ensure no time is left unaccounted for. |

| Apply Rates | Multiply the total hours by the agreed-upon hourly rate. If different rates apply for different types of work or shifts, ensure each section is billed separately. |

| List Hours Clearly | Display the total hours worked in a separate line or section of the request, breaking it down if necessary for clarity. |

By properly documenting and calculating the hours worked, you help ensure that both parties are clear on the charges and avoid misunderstandings related to the time spent on the project. Clear hour breakdowns also enhance professionalism and make your payment requests easier to review and approve.

Including Taxes in Security Invoices

When preparing a payment request for services, it is essential to correctly account for taxes in order to ensure compliance with local regulations and to prevent any issues with clients or tax authorities. Taxes can vary depending on the location and type of service provided, so it’s important to understand the rules that apply to your business and include them accurately in the billing document.

To include taxes correctly, follow these steps:

First, determine the applicable tax rate for the services you provide. This rate may differ depending on your location, whether you are required to charge sales tax, and what type of service is being offered. In many cases, the tax rate will be a fixed percentage that should be applied to the subtotal of the services provided.

Next, calculate the tax amount by multiplying the subtotal by the appropriate tax rate. Add this amount to the total due at the bottom of the payment request, clearly labeling it as “tax” or a similar term. It’s also a good idea to break down the calculation for transparency, showing the subtotal, tax rate, and total tax charged.

Finally, ensure that the tax is included in the final total amount due to the client, so they understand the full payment required. Be sure to verify that the tax amount is correctly calculated, as mistakes in tax calculations can cause delays or disputes.

Adding Payment Terms to Your Invoice

Including clear payment terms in your billing request is essential to ensure both parties understand the expectations regarding payment. Well-defined terms help avoid confusion, set deadlines, and establish the methods of payment accepted, all of which contribute to smoother financial transactions. Without clear terms, clients may delay payments or misunderstand the timing and process, which could affect your cash flow.

To add payment terms effectively, consider including the following key details:

- Due Date: Specify the exact date by which payment must be made. This helps clients know when the payment is expected and reduces the risk of late payments.

- Accepted Payment Methods: List all the payment methods you accept, such as bank transfer, credit card, or online payment platforms. This provides clarity and convenience for clients.

- Late Fees: Outline any penalties for late payments, such as an interest charge or a fixed late fee. This can encourage clients to pay on time and avoid delays.

- Discounts for Early Payment: If applicable, offer a discount for payments made before the due date. This can be an incentive for clients to pay sooner.

- Partial Payments: Clarify whether clients are allowed to make partial payments or if full payment is required at once. This is particularly useful for long-term projects or large service contracts.

By clearly stating payment terms, you set the stage for timely payments and reduce the likelihood of misunderstandings. Providing this information upfront ensures a professional and transparent relationship with your clients.

What to Include in the Invoice Header

The header of a payment request document plays a crucial role in providing essential information that helps identify both the service provider and the client. A well-organized header sets the tone for a professional document and ensures that the details are clear from the outset. Including the right information in the header helps streamline the process and ensures that both parties can easily refer to the document when needed.

Here are the key components to include in the header of your payment request:

| Component | Description |

|---|---|

| Business Name & Logo | Include your business name and logo at the top of the document to ensure your branding is clearly visible. This helps clients easily identify your company. |

| Contact Information | List your business address, phone number, and email address. This makes it easy for the client to get in touch with you if there are any questions or issues. |

| Client Details | Include the client’s name, company name (if applicable), address, and contact information to ensure the document is directed to the right recipient. |

| Invoice Number | Assign a unique reference number to each payment request. This makes it easier to track documents for both your records and the client’s. |

| Issue Date | Specify the date the payment request is issued. This is important for record-keeping and to determine when payments are due. |

| Due Date | Clearly state the due date by which payment must be received to avoid late fees or misunderstandings. |

Including these key details in the header of your payment request will make the document more professional and ensure that all critical information is readily available for both you and your client.

Creating Professional Invoice Design

A well-designed billing document not only ensures clarity and accuracy but also enhances the professionalism of your business. A clean and organized design helps your clients quickly understand the charges and terms, while also reflecting your brand’s identity. A visually appealing layout can make a lasting impression and foster trust in your services.

Key Design Elements

To create a professional design for your billing documents, focus on the following key elements:

- Logo and Branding: Incorporate your business logo and colors to make the document feel cohesive with your brand’s identity.

- Readable Fonts: Use clear, easy-to-read fonts that maintain a formal and professional look. Avoid using too many different fonts.

- Clear Layout: Organize the document into logical sections (e.g., client information, services rendered, totals) with adequate spacing for readability.

- Consistent Formatting: Ensure consistent font sizes and alignment throughout the document for a uniform and neat appearance.

- Subtle Design Elements: Use borders, shading, or lines sparingly to separate sections without overwhelming the viewer.

Best Practices for Presentation

Beyond the basic design elements, consider these additional practices to create a polished and effective document:

- Keep It Simple: Avoid clutter by limiting unnecessary graphics or text. A minimalist design often has the most impact.

- Mobile-Friendly: Ensure the design is adaptable for viewing on mobile devices, as clients may access documents on smartphones or tablets.

- Use Professional Colors: Stick to a neutral color palette with accents that match your brand’s aesthetic. Bright or distracting colors can make the document appear less professional.

- Include Payment Instructions: Clearly highlight the payment terms and methods, ensuring they stand out for easy reference.

A well-crafted document design helps communicate professionalism, making it easier for clients to process the payment request promptly. By investing time into your document’s appearance, you can enhance both the clarity and perception of your business.

Choosing the Right Invoice Software

Selecting the right software to manage your billing process can make a significant difference in the efficiency and accuracy of your financial operations. With the right tool, you can automate calculations, customize document layouts, track payments, and reduce human error. It’s important to choose software that suits your business needs, supports the complexity of your pricing structure, and integrates with your other financial systems.

Factors to Consider

When evaluating different software options, consider the following factors to ensure you choose the best one for your business:

| Factor | Description |

|---|---|

| Ease of Use | Choose software that is user-friendly and intuitive, allowing you to create and send payment requests without a steep learning curve. |

| Customization Options | Look for software that offers customizable templates and layout options so you can tailor the document to match your branding and business needs. |

| Integration with Other Tools | Ensure the software integrates seamlessly with your accounting, banking, and payment platforms, reducing the need for manual data entry and ensuring accuracy. |

| Automated Features | Many tools offer automation features, such as automatic tax calculations, recurring billing, and payment reminders. These can save time and reduce errors. |

| Security and Compliance | Make sure the software adheres to industry standards for data security and complies with relevant tax regulations, especially if you are handling sensitive client data. |

Popular Software Options

Here are some widely-used software options that can help streamline your payment management process:

- FreshBooks: Known for its ease of use and strong customer support, FreshBooks is ideal for small businesses looking for a simple yet feature-rich tool.

- QuickBooks: A well-established accounting software that includes invoicing features, QuickBooks is perfect for businesses that need comprehensive financial management tools.

- Zoho Invoice: Zoho offers customizable templates and advanced reporting features, making it a great option for growing businesses.

- Wave: A free invoicing software that is excellent for small businesses and freelancers, offering basic invoicing and payment tracking capabilities.

By carefully ev

How to Track Invoice Payments

Keeping track of payments for services rendered is essential for maintaining healthy cash flow and avoiding overdue payments. A solid tracking system ensures that you can easily identify outstanding balances, monitor payment history, and follow up with clients when necessary. Whether you are managing a few clients or a large customer base, having an organized method for tracking payments is crucial for your business’s financial health.

Methods for Tracking Payments

There are several ways to track payments, depending on the tools and resources you have at your disposal. Below are the most common methods used by businesses:

| Method | Description |

|---|---|

| Manual Recordkeeping | This method involves logging each payment by hand, either in a physical ledger or a spreadsheet. It’s a good option for small businesses, but it can be prone to errors and time-consuming. |

| Accounting Software | Many accounting platforms, like QuickBooks or FreshBooks, offer payment tracking features that automatically update your records when a payment is made. These tools save time and reduce human error. |

| Payment Processing Platforms | Platforms like PayPal, Stripe, or Square can help track payments made through their systems. These services often offer built-in payment tracking and reporting features that streamline the process. |

| Bank Statements | Reviewing your business bank statements can also help track payments. While this method is less automated, it can be useful for verifying large transactions or missed payments. |

Best Practices for Payment Tracking

To ensure you are effectively monitoring your payments, consider the following best practices:

- Record Payments Promptly: Update your records as soon as a payment is received, ensuring that the information is accurate and up-to-date.

- Use Payment References: Assign a unique reference number or code to each payment, making it easier to match payments with specific

Sending Invoices Electronically vs. Paper

When it comes to delivering payment requests to clients, businesses have the option to use traditional paper methods or take advantage of electronic formats. Both approaches have their pros and cons, and choosing the right method depends on factors such as efficiency, client preferences, and environmental considerations. Understanding the benefits and challenges of each can help you decide which option works best for your business operations.

Advantages of Electronic Delivery

Sending payment requests electronically has become the standard for many businesses due to the numerous benefits it offers. Here are some of the key advantages:

- Speed: Electronic payment requests can be delivered instantly, speeding up the time it takes for clients to receive and review the document. This can lead to quicker payments.

- Cost-Effective: There are no costs for paper, printing, or postage, making electronic delivery a more economical choice in the long run.

- Automation: Electronic systems often integrate with accounting software, allowing for automated tracking and reminders. This reduces the chance of missing payments.

- Convenience: Clients can receive, view, and pay their bills from anywhere at any time, which increases the likelihood of on-time payments.

- Environmentally Friendly: By reducing paper usage, electronic delivery helps lower your business’s environmental impact.

Advantages of Paper Delivery

While electronic methods are widely adopted, there are still situations where sending paper payment requests might be preferable. Below are some of the benefits of using paper:

- Personal Touch: A printed document can feel more formal and personal, and some clients may prefer receiving physical copies, especially in industries that value face-to-face communication.

- Legal Considerations: In some cases, paper documentation may be required for legal or contractual reasons, particularly in industries where contracts need to be signed in person.

- No Need for Technology: Some clients may not be comfortable with electronic payments or may lack the necessary technology, making paper an ideal alternative for them.

- Receipt Acknowledgment: Sending a paper bill via certified mail can ensure that the client acknowledges receipt, providing you with proof of delivery if necessary.

Ultimately, the choice between electronic and paper delivery depends on your business needs, client base, and the level of efficiency you aim to achieve. Many companies today opt for a hybrid approach, offering both methods to cater to different preferences.

Billing Document Format for Small Businesses

For small businesses, managing billing effectively is essential to ensure timely payments and maintain a healthy cash flow. A well-organized and clear billing document can help streamline the process of collecting payments for services provided. Having a consistent format not only saves time but also improves professionalism and client trust.

Creating a simple, customizable document for your billing needs is crucial for small business owners. A clear and straightforward layout ensures that clients can easily understand the charges, payment terms, and deadlines. Additionally, it helps reduce the risk of errors, miscommunications, and delays in payment.

Key Features of an Effective Billing Document:

- Clear Identification: Include your business name, contact information, and logo at the top to create a professional and consistent branding experience.

- Client Details: Make sure to include the client’s name, business name, and contact information to ensure that the payment is directed to the correct recipient.

- Service Description: Clearly outline the services provided, along with the dates and hours worked. This helps clients understand what they are being charged for.

- Payment Terms: State the due date, accepted payment methods, and any late fees to make sure both parties are clear on the expectations for payment.

- Total Amount Due: Break down the costs in a clear, itemized format and provide a total for easy reference.

For small businesses, simplicity and clarity are key when designing a billing document. By using a standard format, you can ensure that your clients always receive clear, professional requests for payment, helping to maintain smooth financial operations.

Benefits of Using a Template for Billing

Having a standardized format for your payment requests can significantly streamline the billing process and improve your overall efficiency. Whether you’re a small business owner or a freelancer, using a consistent structure for your financial documents ensures that important details are always included and organized. A well-designed format not only saves time but also promotes professionalism and reduces the risk of errors.

Advantages of Using a Standardized Format

Utilizing a pre-designed layout for your payment documents offers several key benefits:

Benefit Description Time Efficiency With a set structure, you can quickly generate and send billing documents without having to create them from scratch each time, reducing administrative work. Consistency A standard format ensures that all the necessary details are always included, making it easier for clients to review and process the payment request. Professional Appearance Using a polished, consistent format enhances your business’s image, making the payment documents appear more official and trustworthy. Accuracy A template minimizes the chances of missing critical information like payment terms or amounts, reducing errors and improving communication with clients. Customization Although you use a standardized format, templates can still be customized with your branding, allowing you to personalize the document for each client while maintaining consistency. How Templates Improve Workflow

Templates not only simplify the creation of financial documents, but they also improve your overall workflow by keeping everything organized. For example, having a pre-set layout for client information, services rendered, and totals ensures that each document follows a logical flow, reducing the chance of forgetting any key details. Additionally, using templates makes it easy to maintain records and retrieve past documents when needed.

Incorporating a pre-made structure into your billing routine offers both practical and professional benefits. It can lead to more timely payments, fewer mistakes, and a more streamlined administrative process for your business.

Free vs. Paid Billing Documents

When it comes to preparing payment requests, there are many options available, including both free and paid solutions. Each type has its advantages and drawbacks, and selecting the right one depends on factors like your business needs, budget, and desired features. While free options can be an attractive starting point for new businesses, paid versions often offer additional benefits that can help streamline your processes and elevate your professionalism.

Advantages of Free Billing Documents

Free billing formats can be a great choice for small businesses or individuals just getting started. They offer simplicity and no upfront cost, but may lack some advanced features. Below are some of the main benefits of using free options:

- No Cost: The biggest advantage is that these formats are completely free, making them an ideal option for businesses on a tight budget.

- Easy to Use: Most free documents are straightforward and simple, allowing you to create a payment request without much hassle.

- Basic Features: While they may lack advanced customization or automation, free formats typically cover all the essentials, such as itemized charges and due dates.

- Instant Access: Many free options are available online, so you can start using them immediately without needing to sign up for an account or subscription.

Advantages of Paid Billing Documents

Paid options often come with more advanced features and customization, making them a worthwhile investment for growing businesses. Here are some of the advantages:

- Advanced Features: Paid formats may include options for tracking payments, automated reminders, customizable layouts, and integration with accounting software.

- Customization: You can tailor the design, content, and structure to match your brand and specific business needs, offering a more professional appearance.

- Better Support: Paid services usually come with customer support, which can be a huge advantage if you run into technical issues or need help with setup.

- Enhanced Security: Some paid options offer secure cloud storage for your documents and encrypted payment processing features, giving you peace of mind when handling sensitive data.

While both free and paid solutions have their place, the choice ultimately depends on the size and scope of your business. If you’re just starting out and only need basic functionality, free formats may suffice. However, as your business grows and your needs become more complex, investing in a paid service

Ensuring Legal Compliance in Billing Documents

When preparing payment requests, it’s crucial to ensure that your documents comply with local laws and regulations. Legal compliance not only protects your business from potential disputes but also helps establish trust with your clients. Different countries and regions have specific rules regarding what needs to be included in payment requests, how taxes should be handled, and what language is required. Understanding these requirements and incorporating them into your documents is essential for maintaining proper business operations.

Key Considerations for Legal Compliance:

Requirement Description Business Information Your company’s name, address, and contact details should always be clearly displayed. This is often required by law for transparency and to ensure the document’s validity. Client Information Make sure to include the client’s full name and address. This helps to avoid confusion and ensures that the payment request is directed to the correct recipient. Tax Identification If applicable, include your tax ID number and the client’s. This is essential for businesses that are required to collect and remit sales tax or VAT. Clear Payment Terms Specify the due date, payment methods, and any penalties for late payments. Clearly defined payment terms are often a legal requirement and help avoid misunderstandings. Itemized List of Services Break down the services or products provided, with dates, quantities, and unit prices. An itemized list helps ensure that both parties are clear on what the charges relate to. Taxes and Fees If relevant, include details about taxes or additional fees applied. This ensures transparency and helps you comply with tax regulations. It’s important to regularly check for any changes in legal requirements in your region or industry. Failing to adhere to local regulations can result in fines or disputes with clients. By