Sample Simple Invoice Template for Efficient Billing

When managing finances, clear and accurate documentation is crucial. A well-structured billing document helps ensure that payments are tracked properly and that both parties are on the same page. It simplifies the process of requesting payment for services or goods provided, making it easy for clients to understand the charges and for businesses to maintain organized records.

Designing an efficient and easy-to-use format for these records can save time and reduce errors. With the right structure, anyone can create professional-looking statements that cover all essential details. This approach not only speeds up the payment process but also boosts credibility with clients and partners.

Whether you’re a freelancer, a small business owner, or part of a larger organization, having a clear and consistent way to request payments is essential. By choosing an adaptable and straightforward method, you can focus on providing value while keeping your financial records in order.

Sample Simple Invoice Template Overview

Creating a well-organized document for billing is a key aspect of managing financial transactions. These documents play a crucial role in ensuring that services or products rendered are accurately reflected and that clients have clear instructions for payment. An effective billing document can streamline the payment process and enhance communication between businesses and their customers.

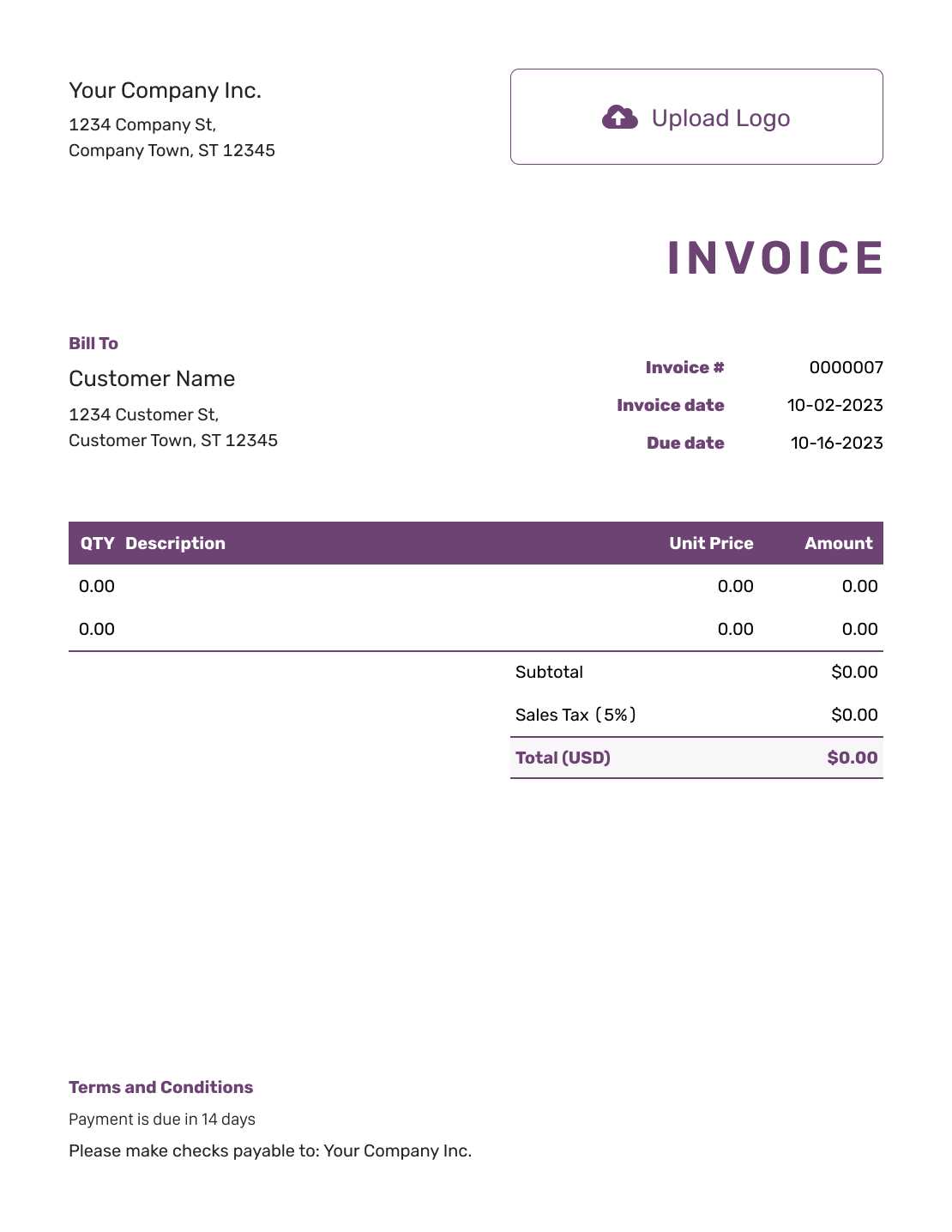

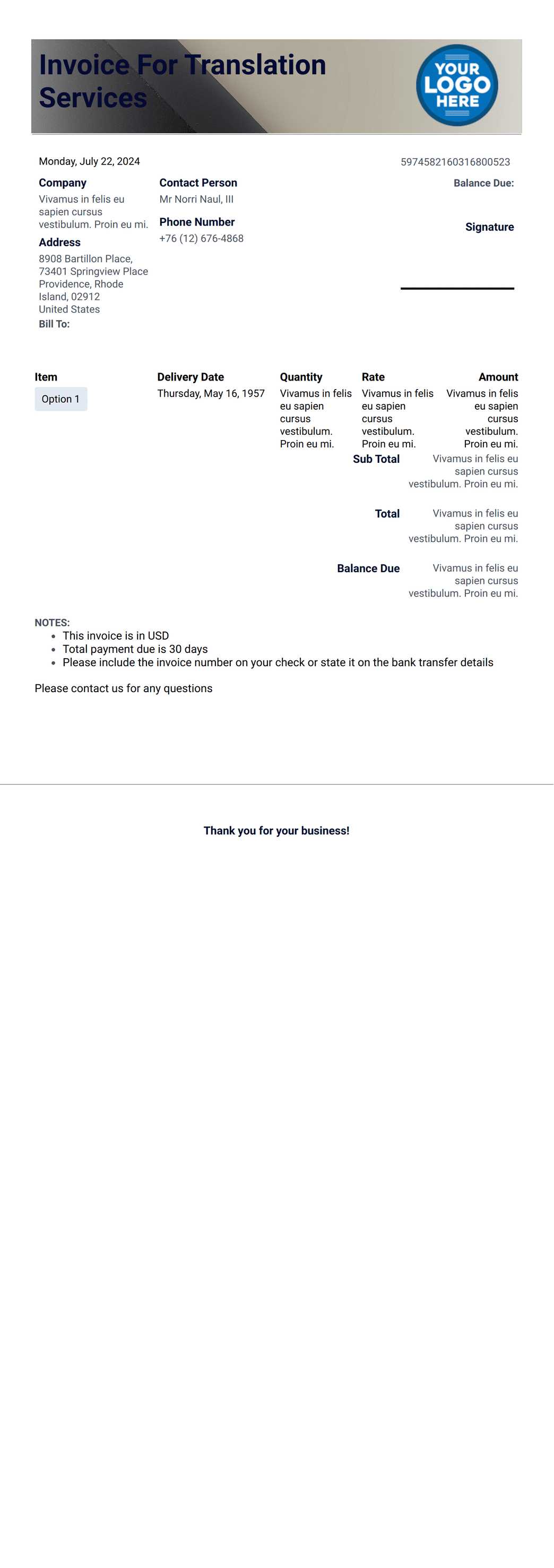

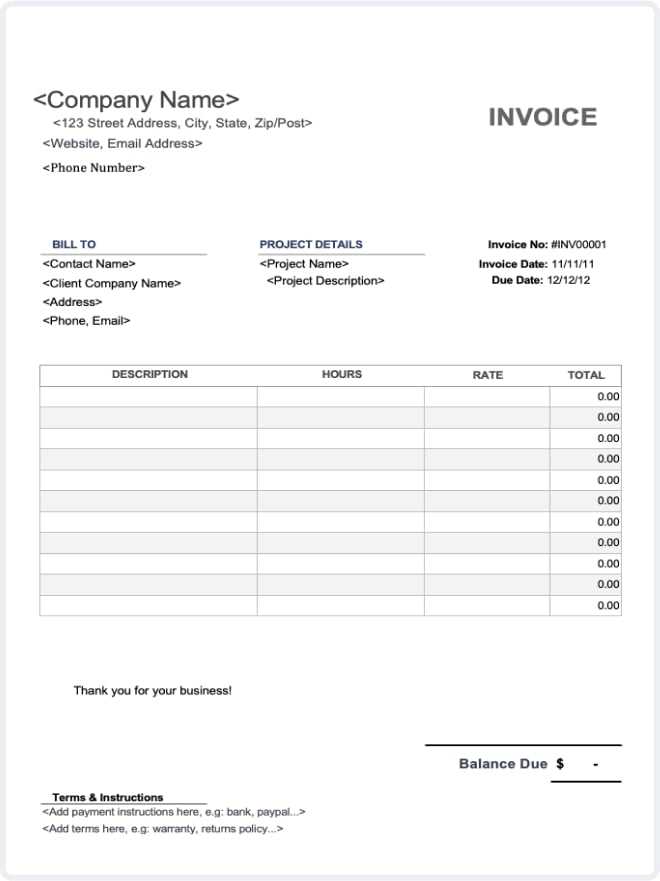

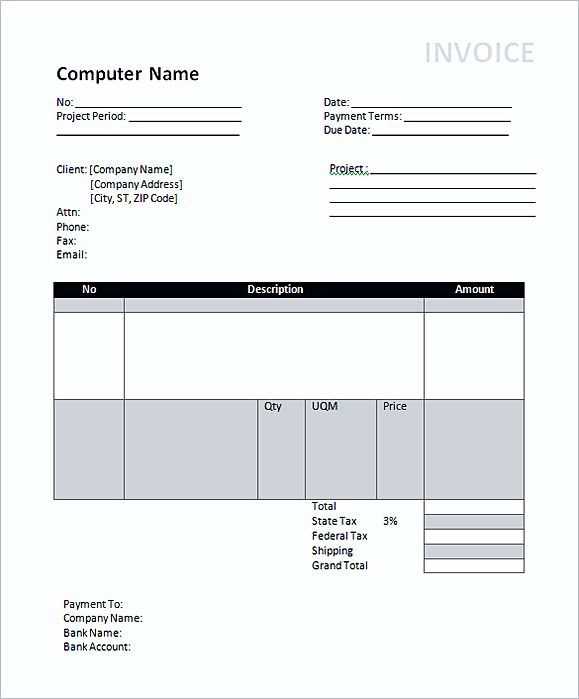

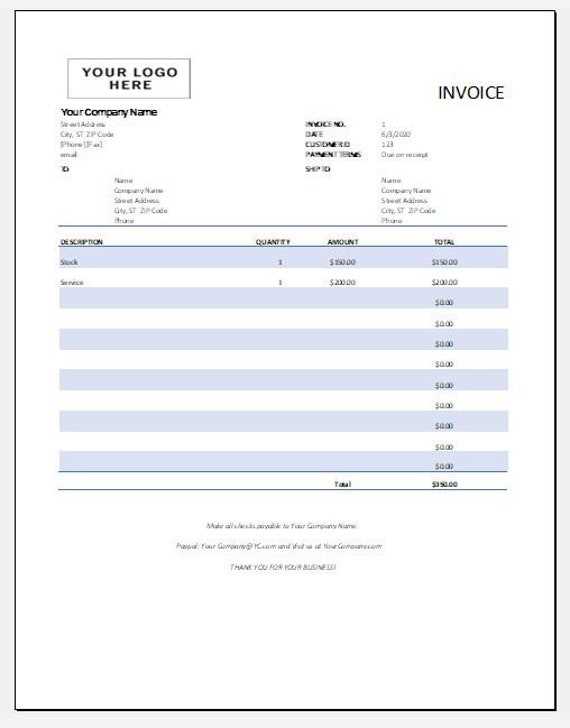

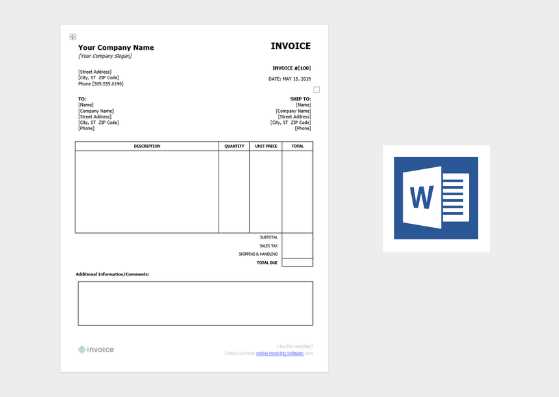

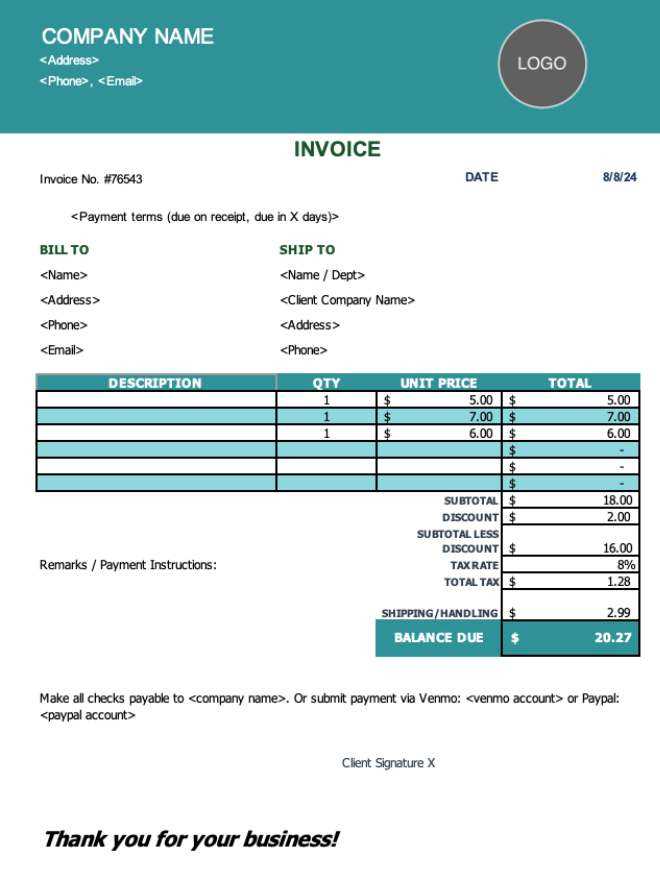

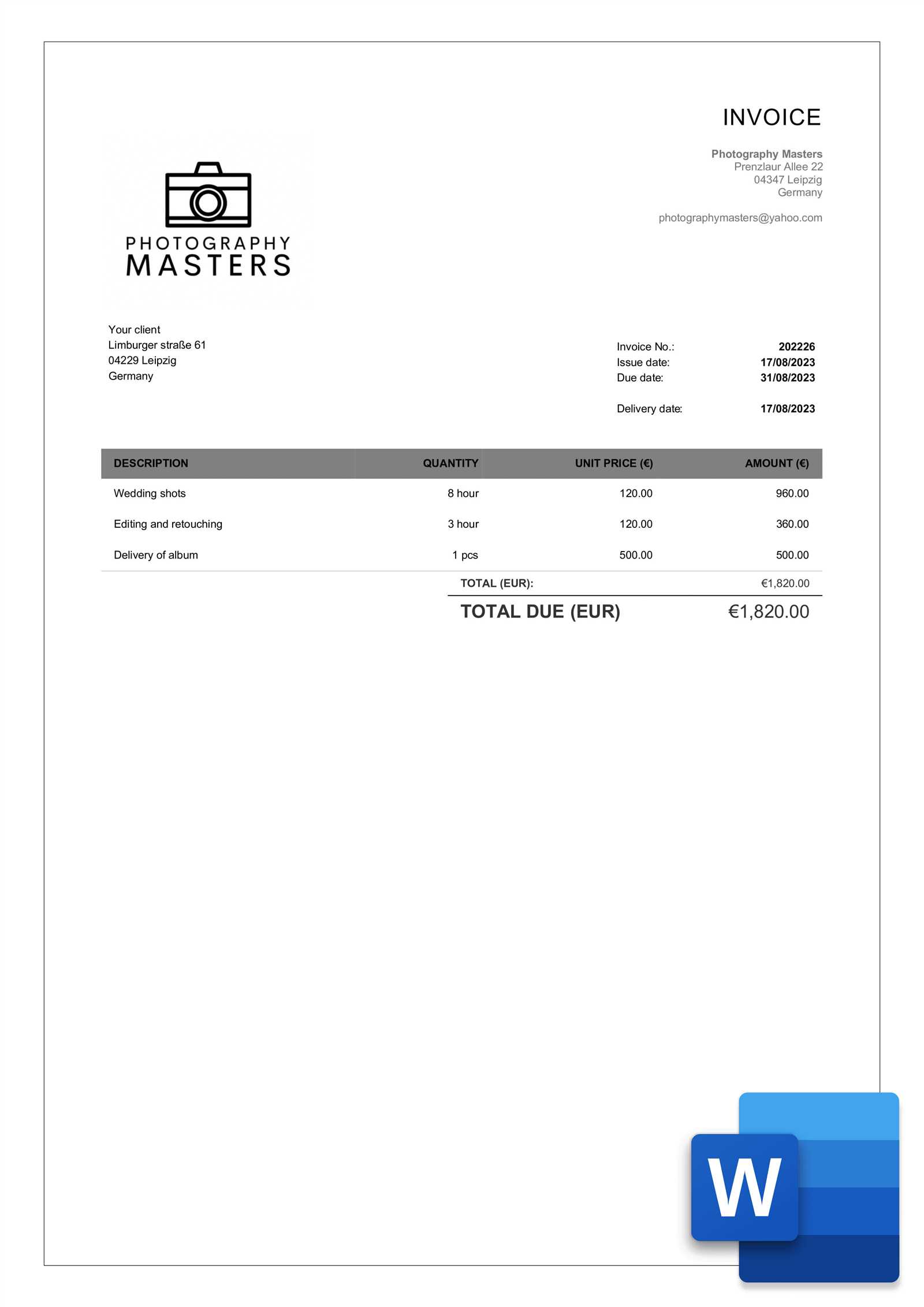

For those looking for an easy and flexible way to generate such documents, there are various pre-designed formats available. These formats offer essential fields that can be quickly filled in, saving time while ensuring consistency. They help in presenting the necessary details, such as the payment amount, service description, and due date, in a professional manner.

Key Features to Include

When designing a billing document, certain elements should always be present. Key information like the business name, client details, and a breakdown of services or goods delivered is essential. In addition, payment terms, due dates, and any applicable taxes should be clearly stated to avoid misunderstandings. A straightforward structure ensures that both the sender and the recipient are aligned on expectations.

How to Use These Documents Effectively

Once you have the format, customizing it to suit your needs is simple. By adjusting the content for each transaction, you can create a tailored record that fits the specifics of every client interaction. With these adaptable formats, business owners can maintain consistency and professionalism while reducing the time spent on creating each document.

Why Use a Simple Invoice

Opting for a straightforward billing document brings numerous benefits to both businesses and clients. By removing unnecessary complexity, it becomes easier to focus on the core information, ensuring that the transaction details are clear and accessible. A clean and concise format improves communication and minimizes the chances of errors or misunderstandings, allowing for a smoother payment process.

For businesses, using a basic document format can save time and reduce the administrative burden. Instead of spending hours creating a custom design for each client, an uncomplicated structure allows for quick adjustments to suit each transaction. This simplicity also enhances the overall professional appearance, as clients are more likely to appreciate a document that gets straight to the point.

For clients, receiving a clear and easy-to-read document makes understanding the charges and payment expectations effortless. When details like service descriptions, payment amounts, and due dates are presented in a well-organized manner, there is little room for confusion. This clarity builds trust and ensures that clients feel confident about making timely payments.

Benefits of Customizable Invoice Templates

Having the ability to personalize your billing documents brings great flexibility and efficiency to the payment process. Customizable formats allow businesses to adjust the content and structure to match their specific needs, ensuring that every transaction is represented accurately and professionally. This adaptability is especially useful for businesses of various sizes, as it helps maintain consistency while accommodating the unique details of each client or service.

One of the primary advantages of these adaptable formats is that they can be tailored to reflect the branding and tone of the business. From including logos to adjusting color schemes, every aspect can be customized to align with the company’s identity. This personalization not only makes the document look more professional but also enhances the customer experience by making it easier for them to recognize and relate to the business.

Key Advantages of Customization

Customizable billing formats offer several key benefits:

| Benefit | Description |

|---|---|

| Brand Consistency | Tailor the document to match your business’s brand and visual identity. |

| Efficiency | Quickly adjust the content for different clients or projects, saving time on each new transaction. |

| Clarity | Ensure all essential details are clearly communicated and easily understood by clients. |

| Flexibility | Adapt the layout and information as needed for different services, payments, or industries. |

How Customization Improves Client Relations

By offering a personalized document, you create a more professional and tailored experience for your clients. This not only fosters trust but also increases the likelihood of timely payments. Clients appreciate receiving documents that reflect the uniqueness of the service provided, and the ease of understanding the payment details encourages smooth transactions.

How to Create an Invoice Template

Designing a billing document from scratch requires attention to detail and clarity. A well-structured format ensures that all essential information is included and easily understood by the recipient. Creating an effective document involves setting up specific sections for details such as the sender’s and recipient’s information, the list of products or services, payment terms, and the total amount due.

Here’s a step-by-step guide to help you create a clear and professional billing record:

- Start with Basic Information: Begin by including the sender’s details, such as the business name, contact information, and address. Then, add the recipient’s information, ensuring accuracy in their name and address.

- List the Products or Services: Provide a clear description of each item or service being charged. Include the quantity, unit price, and total for each line item.

- Include Dates: The document should feature the date the goods or services were provided, as well as the payment due date.

- Specify Payment Terms: Make sure to clarify payment methods and due dates, including any late fees or discounts for early payments.

- Summarize the Total Amount: Conclude by clearly stating the total amount due, including taxes and any other relevant charges.

Once you’ve included these sections, you can adjust the layout to suit your preferences or branding. Keep in mind that clarity and simplicity are key to ensuring that the document is both functional and professional.

After creating the document format, you can save it for future use. This will allow you to quickly generate new billing records without the need to start from scratch each time. Many businesses also find it useful to automate the generation of such documents through various software tools, streamlining the entire process.

Key Elements of a Simple Invoice

When creating a billing document, it’s important to include specific details that ensure both clarity and professionalism. A well-structured document helps both the business and the client stay organized and aligned on the terms of payment. These key elements are essential to make sure the recipient understands what is being charged and how to proceed with payment.

Basic Information

The most crucial details of any billing document include the business and client information. This includes:

- Sender’s Name and Contact Info: Clearly display your business name, address, and contact details.

- Recipient’s Name and Contact Info: Include the client’s full name, company (if applicable), and address to ensure accuracy.

Transaction Details

The core of the document includes the transaction details, which should outline the following:

- Product/Service Description: A brief and clear explanation of what was provided, including quantities and any relevant unit prices.

- Dates: The date when the goods or services were delivered and the payment due date.

- Payment Terms: Information about acceptable payment methods, due dates, and any late fees or discounts for early payments.

In addition to these fundamental sections, the total amount due, including any applicable taxes and fees, should be clearly outlined at the end of the document. This ensures that the client understands exactly what they owe and how to settle the amount promptly.

Invoice Template Design Tips

Creating an effective billing document goes beyond just including the necessary details. The design plays a crucial role in ensuring that the information is not only clear but also visually appealing. A well-organized layout makes it easier for the client to quickly understand the charges and payment terms, fostering better communication and a more professional appearance.

Layout and Structure

A clean and logical layout helps guide the reader’s eye to the most important information. Consider the following design tips:

- Use Clear Headings: Each section should be clearly labeled, such as “Services Provided,” “Total Amount Due,” and “Payment Terms.” This improves readability.

- Logical Flow: Arrange the details in a logical order, starting with business and client information, followed by a description of services or goods, and ending with the total amount due.

- Spacing and Margins: Use adequate white space to avoid a cluttered appearance. Proper margins and line spacing ensure that the content doesn’t feel cramped.

Table Layout for Clarity

Tables are an excellent way to present the details of the services or goods provided. Organizing the information in columns makes it easier for the client to understand each line item, its cost, and the total amount.

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Service A | 1 | $50.00 | $50.00 |

| Service B | 2 | $30.00 | $60.00 |

| Total Due | $110.00 | ||

By using tables and clear sections, you create a document that is both visually organized and easy to read, reducing the chances of confusion and ensuring that clients have all the necessary information to make a payment.

Common Invoice Mistakes to Avoid

Creating a billing document may seem straightforward, but there are several common mistakes that can cause confusion or delays in payment. These errors can range from missing information to formatting issues, and they often lead to frustration for both the business and the client. By being aware of these common pitfalls, you can ensure a smooth and professional transaction process every time.

Missing or Incorrect Information

One of the most frequent mistakes is omitting crucial details or providing inaccurate information. This includes:

- Incorrect Business or Client Details: Double-check names, addresses, and contact information to ensure accuracy.

- Missing Payment Terms: Clearly state the payment due date, methods accepted, and any applicable late fees or discounts.

- Omitted Tax Information: If applicable, be sure to include the relevant tax rate and total tax amount.

Formatting Issues

While clarity is important, poor formatting can lead to misinterpretation of the information. Avoid these mistakes:

- Cluttered Layout: Ensure that the layout is clean, with sufficient white space to make the document easy to read.

- Poorly Organized Sections: Follow a logical structure, grouping similar information together (e.g., business details at the top, followed by services provided, and total due at the bottom).

- Unclear Descriptions: Provide clear and concise descriptions of services or products to avoid confusion regarding what the client is being charged for.

By avoiding these mistakes, you can ensure that your billing documents are accurate, professional, and easy to understand, ultimately fostering better client relationships and facilitating prompt payments.

Choosing the Right Template Format

Selecting the appropriate document layout is essential for clarity and efficiency. Different formats cater to different business needs, and it’s important to choose one that matches your workflow, branding, and the complexity of the transactions. Whether you’re looking for simplicity or a more detailed breakdown, the right structure can streamline your process and make the document more professional.

Consider Your Business Needs

Before deciding on a format, take a moment to assess the specific needs of your business:

- Small or Large Transactions: For simple or one-off transactions, a basic format may suffice, while recurring or complex services might require more detailed layouts.

- Branding and Design: A customized format with your logo and business colors can add a personal touch and reinforce your brand identity.

- Client Preferences: Some clients may prefer a more traditional format, while others might appreciate a digital, automated approach. Understanding your audience can help guide your decision.

Choose the Right File Type

Another important consideration is the file format in which the document will be saved and sent. Each file type offers unique benefits:

- PDF: Ideal for preserving formatting across devices, ensuring that the recipient sees exactly what you intended.

- Word or Excel: These formats are more flexible and easier to edit if you need to make adjustments quickly.

- Online Tools: Some businesses prefer cloud-based tools that allow for real-time updates and easy sharing with clients.

By carefully considering the format that best suits your needs, you can create a more effective and user-friendly billing document that enhances your workflow and client satisfaction.

How to Save Time with Templates

Utilizing pre-designed documents can significantly reduce the time spent on creating repetitive paperwork. By using a standardized layout, businesses can avoid starting from scratch with every transaction, allowing for faster processing and a more efficient workflow. This approach not only saves time but also ensures consistency across all communications.

Efficiency in Document Creation: When you have a pre-designed structure, you only need to fill in the relevant details, such as client names, services provided, and payment amounts. This eliminates the need for manual formatting and minimizes the risk of errors. The more templates you have for different scenarios, the less time you spend customizing each one.

Streamlining Communication: Consistent use of the same layout also helps create a professional and recognizable format for your clients. By saving time on document creation, you can focus more on maintaining client relationships, following up on payments, or handling other important tasks, rather than spending excessive time on document preparation.

Automation Potential: Many businesses now use software tools that allow you to automate filling in specific fields, making the process even faster. With these automated tools, you can instantly generate a new document with the required information pre-filled based on prior entries or templates, further speeding up the process.

By adopting a consistent approach to document preparation, businesses can save time, improve accuracy, and ensure that every client receives professional, uniform communications without delays.

Free Invoice Templates vs Premium Options

When choosing a document layout for billing purposes, businesses often face the decision between using free resources or opting for a paid version. While both options have their advantages, the right choice largely depends on the complexity of your needs, the level of customization required, and the budget available. In this section, we compare the benefits and limitations of both free and premium options to help you make an informed decision.

Free Options

Free layouts are an excellent choice for startups and small businesses with basic needs. These documents can be found easily online and offer essential features for generating billing paperwork. However, free options typically come with some limitations:

- Basic Functionality: Free options usually offer only the most basic fields, such as client information, item descriptions, and totals.

- Limited Customization: Customization options might be minimal, making it difficult to tailor the document to your specific business branding.

- Lack of Advanced Features: Advanced features like automated calculations, recurring billing, or integration with accounting software are generally absent in free resources.

Premium Options

Premium layouts offer a more robust solution with additional features that can streamline your billing process and improve the professionalism of your documents. These options often come with the following benefits:

- Advanced Customization: Premium options allow you to add personalized branding, such as logos, custom fonts, and color schemes.

- Enhanced Functionality: With premium versions, you can often automate calculations, include tax calculations, and even link the document to accounting software for easier management.

- Professional Design: Premium options tend to have a more polished and refined layout, which can enhance your business’s image and help maintain a consistent professional look across all communications.

| Feature | Free Layout | Premium Layout |

|---|---|---|

| Customization | Limited | Highly Customizable |

| Functionality | Basic | Advanced Features |

| Professional Design | Basic | Polished |

| Integration | None | Software Integration Available |

Ultimately, choosing between fr

How to Edit and Customize Your Template

Personalizing your document layout can help tailor it to your business needs and reflect your brand identity. Editing a pre-designed layout is straightforward, and with the right tools, you can easily adjust it to include your unique information, logo, and branding. This customization process ensures that your documents are not only functional but also professional and aligned with your company’s image.

Start by selecting the document you want to modify. Most software tools, such as word processors or spreadsheet programs, allow you to edit text fields, fonts, colors, and logos. Begin by replacing the default company name and address with your own, followed by adjusting the layout to match your business’s preferred format.

Next, customize the fields relevant to your services. Whether it’s changing item descriptions, adding additional sections for tax breakdowns, or adjusting the payment terms, these details can be easily updated. Ensure that your contact information and payment instructions are clear and accessible, so clients can easily follow them.

For added professionalism, consider adjusting the color scheme and fonts to match your brand style. Many software tools allow you to select from a variety of fonts and color palettes to ensure consistency across your documents. If you want a more polished look, consider including your company logo and a watermark in the background to make your document instantly recognizable.

Lastly, save the customized version in your preferred format for future use. Whether you choose to store it in a cloud service, a local folder, or directly within your accounting software, having a personalized and editable document at your fingertips can save you valuable time in the long run.

Tracking Payments with an Invoice Template

Monitoring payments is a crucial part of managing any business’s finances. Using a structured document layout can help you efficiently track payments, ensuring that you stay organized and keep accurate records of all transactions. By incorporating key payment details into your layout, you can easily mark off which payments have been received and which are still outstanding.

Include Payment Status: One of the simplest ways to track payments is by including a “Payment Status” field on your document. This field allows you to quickly note whether the payment is pending, completed, or overdue. You can update this status manually or use software that automatically tracks it based on payment dates.

Record Payment Dates: Make sure to include a section where you can note the date of payment receipt. This helps establish a clear timeline for when payments were made and allows you to quickly reference the payment history in case of any disputes or questions from clients.

Highlight Outstanding Amounts: Another essential part of tracking payments is clearly marking any remaining balances. For unpaid amounts, ensure the outstanding balance is visible on the document, so both you and the client know exactly how much is left to be paid. This transparency helps prevent confusion and ensures timely follow-ups for unpaid invoices.

Use Software for Automatic Tracking: Many accounting tools and software platforms now integrate with your documents to automatically track payments. These tools can pull in transaction data and update the payment status in real-time, reducing the need for manual tracking and offering a more seamless payment management process.

By making these simple adjustments to your billing documents, you can stay on top of your payments and improve your financial record-keeping. Whether manually or through automation, tracking payments ensures that nothing slips through the cracks and that you maintain healthy cash flow.

Using Invoice Templates for Small Businesses

For small businesses, managing finances can be time-consuming and challenging. One of the most effective ways to streamline the billing process is by using pre-designed layouts. These ready-to-use documents can save valuable time, reduce errors, and help maintain professionalism in business dealings.

When small business owners utilize a structured format for their financial transactions, they can focus more on growing their business instead of getting bogged down by paperwork. Here are some key advantages:

- Time Efficiency: By using a standardized document, small business owners don’t need to create new layouts from scratch each time. This speeds up the invoicing process significantly.

- Consistency and Professionalism: Consistency in the design of your financial documents reinforces your brand image and makes you appear more professional to clients.

- Accuracy: Templates reduce the chances of making mistakes, such as forgetting important payment details or miscalculating totals, which can be costly for small businesses.

- Organization: Keeping track of payments and outstanding balances becomes easier when using consistent formats that include all relevant information in a clear and structured way.

With these benefits, small businesses can improve efficiency and reduce administrative workload. Instead of manually crafting each billing document, owners can easily fill in the necessary fields and maintain accurate, uniform records that contribute to a smooth operation.

Incorporating a consistent document format also simplifies tax reporting and helps avoid errors when filing returns. Plus, by keeping everything organized, small businesses can quickly access payment histories when needed, making financial management less stressful and more effective.

Printable vs Digital Invoice Templates

When it comes to managing financial transactions, businesses often face the decision of choosing between printed or electronic billing formats. Both methods have their unique advantages, and the choice largely depends on the business’s specific needs, client preferences, and operational processes.

Printed Documents: Physical copies offer a traditional approach to invoicing. Businesses may prefer printed formats for clients who are accustomed to receiving hard copies. In some industries, physical documentation is necessary for record-keeping or legal purposes. Additionally, printed invoices can be mailed or handed over in person, allowing for greater flexibility in client interactions.

Advantages of Printed Documents:

- Client Preference: Some clients prefer tangible, physical documents for record-keeping or as part of their payment process.

- Legality and Formality: Certain transactions may require printed documentation for compliance or tax purposes.

- Customizable for Branding: Printed invoices can be designed to align with physical branding materials, like letterheads or business cards.

Digital Documents: On the other hand, electronic formats are becoming increasingly popular due to their convenience and speed. Digital documents can be quickly sent via email or uploaded to client portals, making them a more efficient choice for businesses that handle large volumes of transactions. These formats are also easy to store, reducing the need for physical file storage and minimizing the risk of losing important documents.

Advantages of Digital Documents:

- Speed and Convenience: Sending invoices electronically allows for immediate delivery, which is especially beneficial for time-sensitive transactions.

- Cost-Effective: Digital invoicing eliminates the need for paper, ink, and postage, leading to reduced operational costs.

- Easy Tracking and Storage: Electronic documents can be easily stored, searched, and organized within digital systems, helping businesses track payments and keep better records.

Choosing between printable and digital formats comes down to the specific needs of the business and the expectations of the clients. While printed documents may still hold value in certain contexts, digital formats are becoming the preferred choice for many due to their efficiency and cost-saving potential.

Ensuring Accuracy in Invoice Information

Ensuring the precision of financial documentation is crucial for maintaining professionalism and avoiding potential disputes. Accurate records not only streamline the billing process but also ensure that both parties are aligned on the terms of the transaction. Whether you are a small business owner or a freelancer, providing clear and correct details is key to a smooth and reliable financial process.

Key Elements to Double-Check:

- Client Information: Ensure the recipient’s name, address, and contact details are correct. Errors in this section can lead to miscommunication or delayed payments.

- Payment Details: Carefully list the amounts due, any applicable taxes, and the total owed. Double-check the calculation to avoid discrepancies.

- Payment Terms: Include clear instructions regarding due dates, accepted payment methods, and any late fees that may apply.

- Itemized List: Provide a detailed breakdown of goods or services provided. This ensures transparency and helps resolve any questions about the charges.

Accurate financial records not only help ensure that payments are processed promptly but also prevent misunderstandings that could damage relationships with clients. By taking the time to verify each element of the document, businesses demonstrate reliability and attention to detail. This process fosters trust and increases the likelihood of timely payment.

Additionally, utilizing a consistent format or structure can help reduce errors. Having a standard way of organizing and presenting financial information makes it easier to spot mistakes before they become a problem. Regular checks and attention to detail are essential to maintaining accuracy and professionalism in every transaction.

Automating Your Invoicing Process

Automating financial record creation can significantly streamline your business operations. By reducing manual tasks, you not only save valuable time but also reduce the risk of errors that can arise from human oversight. Setting up an automated system ensures that invoices are consistently generated and delivered on time, helping to maintain smooth cash flow and improve overall efficiency.

Why Automation is Beneficial

Consistency: Automation ensures that all financial documents follow the same structure and content, reducing the chance of discrepancies between different records. This consistency helps reinforce professionalism in your communications.

Time Efficiency: Rather than creating each document from scratch, automated systems can quickly generate multiple records based on predefined templates, saving time and effort. This allows you to focus on other important tasks that require more attention.

How to Automate Your Financial Process

There are several tools available that can help streamline this process. Many cloud-based platforms offer invoicing solutions that can be customized to suit your needs. These platforms can integrate with your accounting system, track payment statuses, and even send reminders to clients. Here’s how to get started:

- Choose an Automation Tool: Select a software or online service that suits your business model. Look for features like recurring billing, integration with payment processors, and customizable design options.

- Set Up Templates: Customize templates with your business details, branding, and common charges to ensure uniformity across all records.

- Automate Reminders: Set up automatic payment reminders to notify clients when payment is due or overdue, helping to reduce late payments.

By automating your financial documentation process, you can ensure greater accuracy, timely delivery, and fewer administrative headaches. As your business grows, these systems will scale with you, making the entire process much more manageable.

Common Questions About Invoice Templates

When it comes to creating and using financial documents for your business, many questions often arise regarding the design, structure, and best practices. This section aims to address some of the most frequently asked queries to help streamline the process and ensure that you are using your financial forms effectively.

Frequently Asked Questions

Here are some of the common questions business owners have when it comes to designing and using their billing documents:

| Question | Answer |

|---|---|

| What information should be included? | The document should include basic details such as your business name, contact information, the client’s details, a breakdown of products or services provided, payment terms, and the total amount due. |

| How do I make it look professional? | Use clean, organized formatting with clear sections. Include your logo, use consistent fonts, and ensure there is enough white space for readability. A professional appearance can foster trust with clients. |

| Should I use a pre-designed format or create my own? | It depends on your needs. Pre-designed formats can save time and offer standard features, but creating a custom design tailored to your brand allows for more flexibility and personalization. |

| Can I automate the process of generating these documents? | Yes, many online tools and software allow for automation, reducing manual work by automatically filling in details and sending reminders for due payments. |

Additional Tips

Make sure to regularly update your form to reflect any changes in your business details or service offerings. Additionally, always double-check for accuracy before sending out financial documents to avoid confusion and potential disputes.