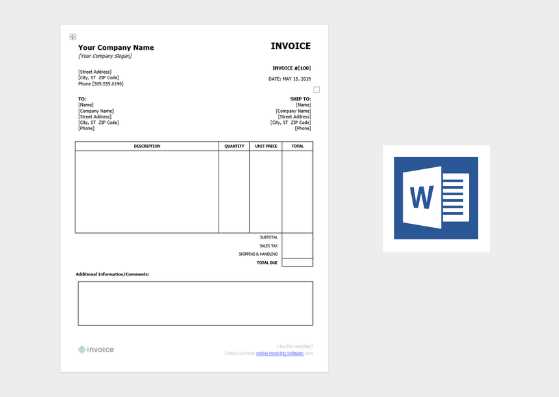

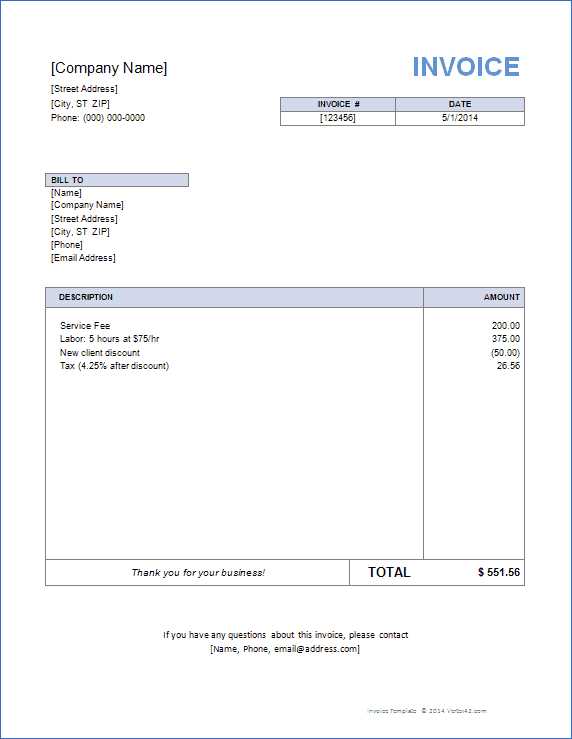

Sample Service Invoice Template for Word

Efficient billing is essential for any business. Having the right tools can streamline the payment process, ensuring clarity and professionalism when requesting compensation. Whether you’re a freelancer or a small business owner, managing financial transactions accurately and promptly is crucial for maintaining good client relationships and smooth operations.

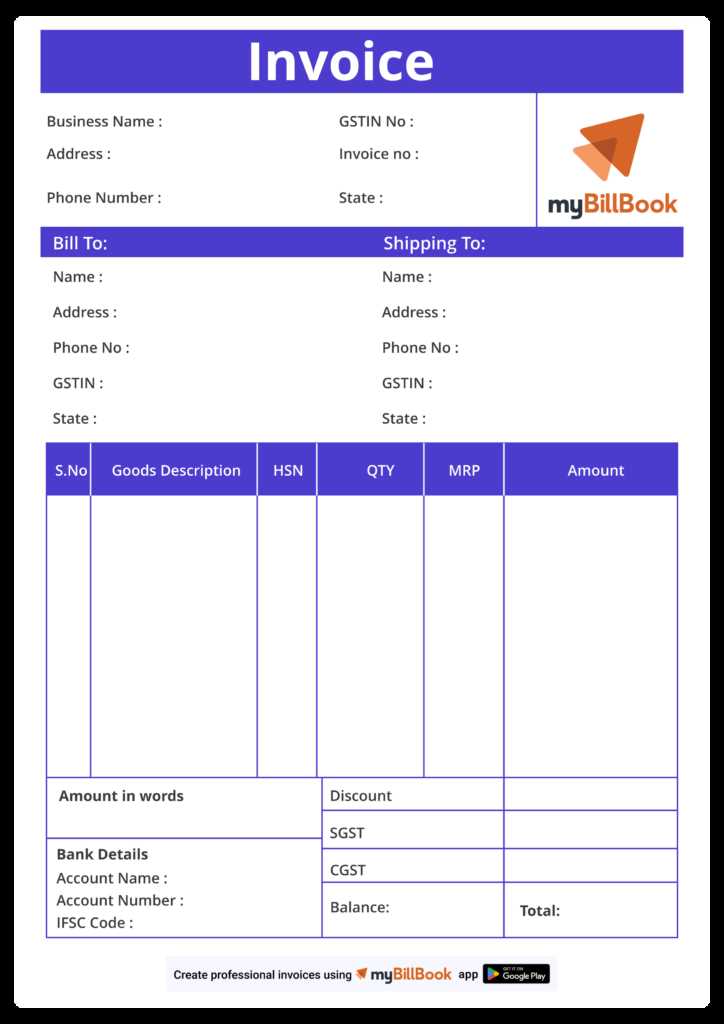

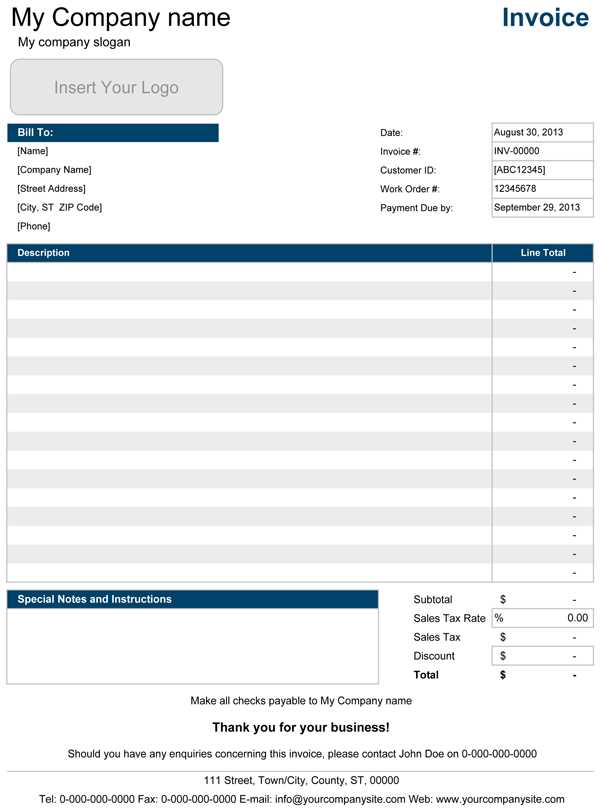

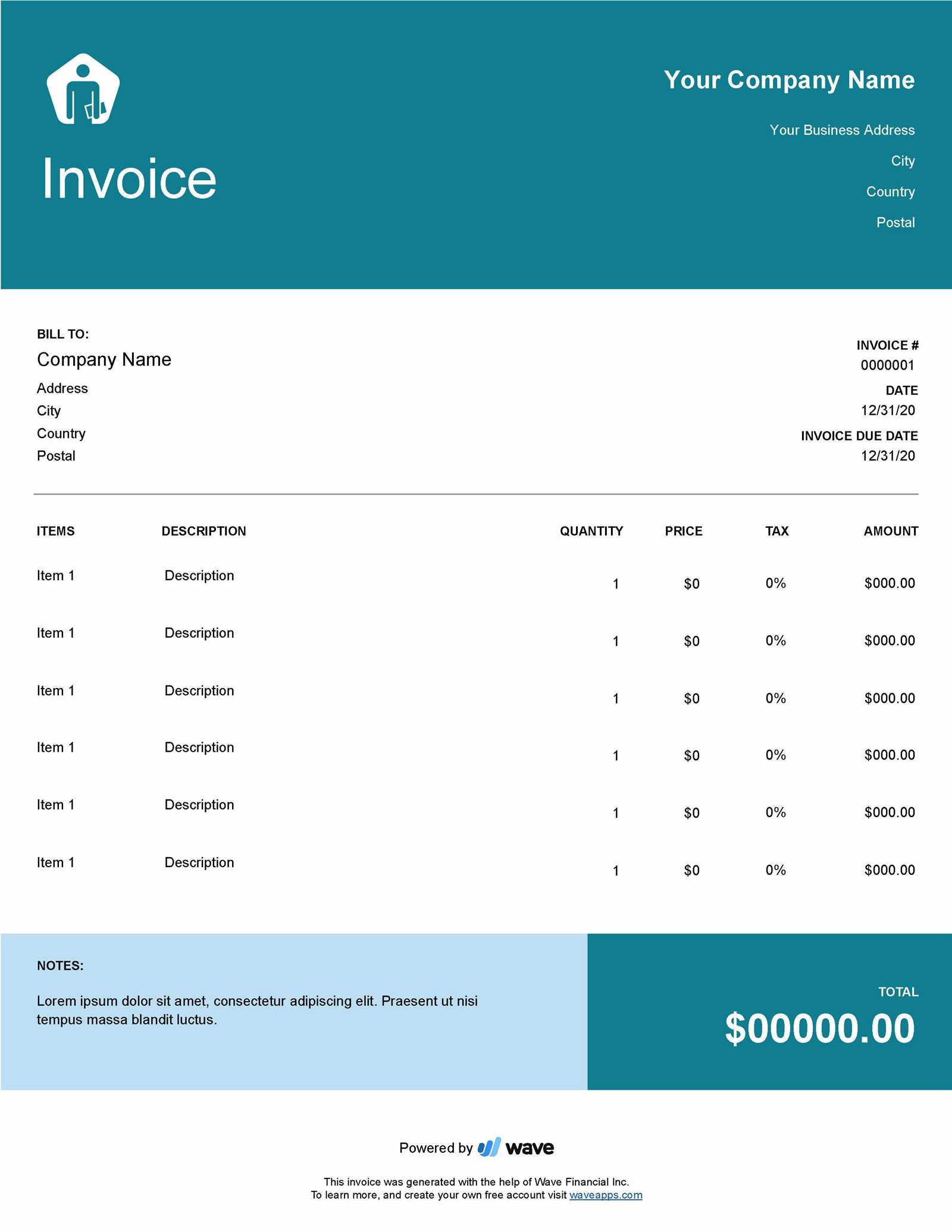

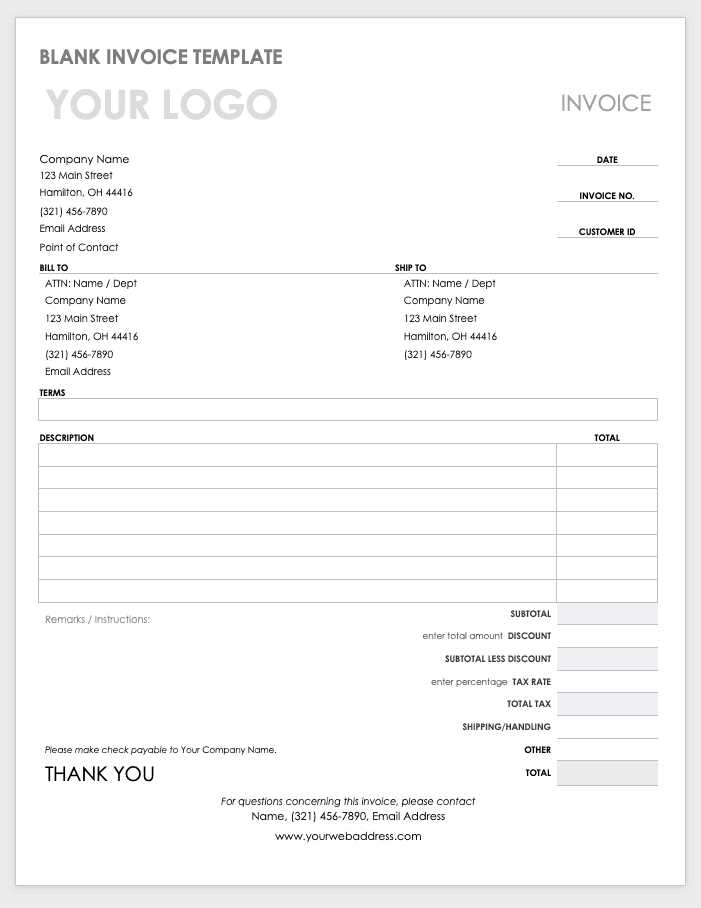

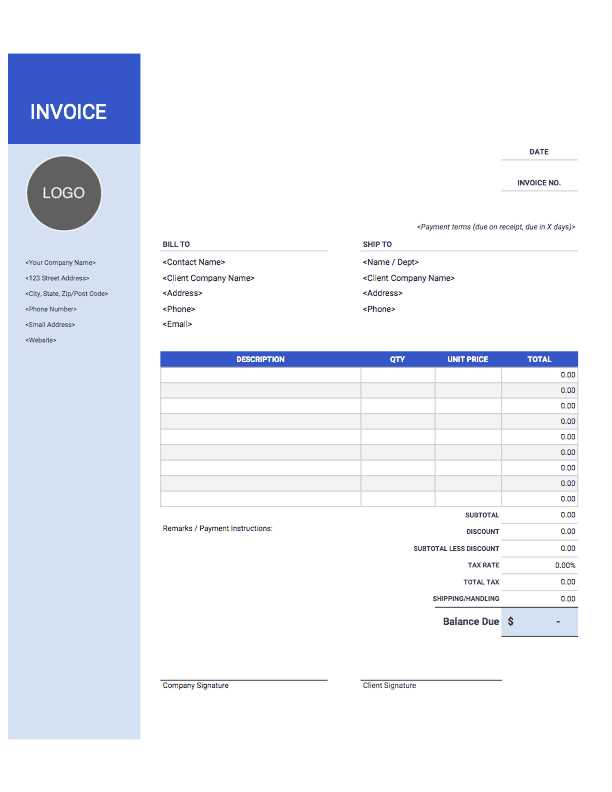

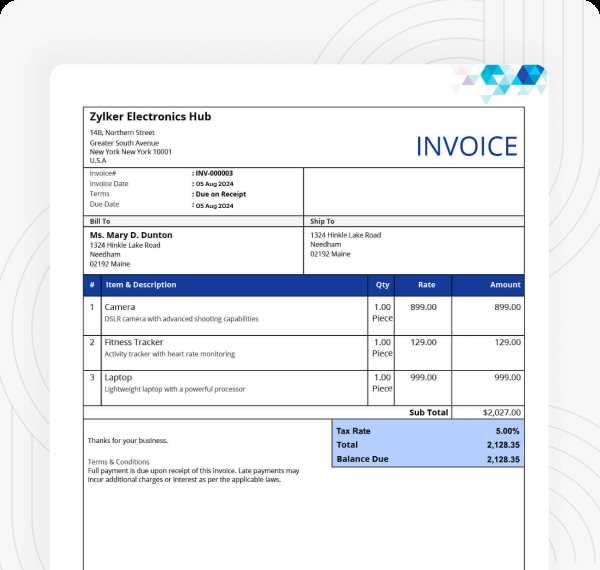

One effective way to handle this is by using pre-designed formats that can be customized to fit your specific needs. These formats help save time and reduce the likelihood of errors, all while giving your clients a clear and detailed record of services rendered and amounts due.

Customizable templates offer flexibility and convenience, allowing you to adapt the layout and content to suit different projects or client requirements. With a few simple adjustments, these ready-made documents can become a vital part of your business toolkit, providing both consistency and professionalism in every transaction.

Why Use a Billing Document Format

Managing financial transactions can be time-consuming, especially when it comes to creating documents from scratch for each client. By utilizing a pre-made structure, you can ensure that every important detail is included and organized in a professional manner. These ready-to-use forms are designed to save time, reduce mistakes, and present a polished image to clients.

Using a customized structure allows you to maintain consistency across all your transactions. It ensures that every bill follows the same format, with all necessary fields such as payment terms, due dates, and itemized services. This consistency not only looks professional but also helps clients quickly understand the details of their charges, making the payment process smoother.

Furthermore, relying on such a system helps streamline your workflow. You can quickly modify the layout to suit different situations, reducing the need for repetitive administrative tasks. Whether you’re working with a new client or issuing a recurring payment request, having a reliable framework simplifies the process, allowing you to focus on growing your business.

Benefits of Customizing Your Billing Document

Personalizing your billing documents can have a significant impact on both the professionalism and efficiency of your business. By tailoring the layout, design, and content to fit your specific needs, you create a more cohesive experience for your clients while maintaining consistency in your financial communications. Customization allows for greater flexibility in presenting information clearly and understandably, helping to avoid confusion and ensure accurate payments.

Enhance Brand Identity

Customizing your billing documents gives you the opportunity to incorporate your business’s branding elements. By adding your company logo, colors, and font styles, you create a consistent visual identity across all communications. This not only strengthens your brand but also makes your documents look more polished and professional, leaving a lasting impression on clients.

Increase Clarity and Accuracy

Customizable billing documents allow you to adjust the content to suit the specific needs of each transaction. You can easily modify sections such as payment terms, due dates, and itemized services to reflect any unique agreements or services provided. This level of detail reduces the chance of errors and ensures that both you and your clients are on the same page, resulting in smoother financial exchanges.

How to Download a Billing Document for Word

Downloading a ready-made document for billing is a quick and efficient way to get started with professional financial communication. These pre-designed formats are available from a variety of sources and can be customized to suit your needs. The process is simple and can save you time, enabling you to focus more on your business operations and less on administrative tasks.

Steps to Download a Document

Follow these easy steps to find and download a customizable billing format for your needs:

- Visit a trusted website offering free or paid document formats.

- Search for the billing layout that fits your requirements.

- Click on the download link to obtain the file.

- Save the document to your computer or cloud storage.

- Open the document with your preferred word processing software.

Choosing the Right Document

When selecting the right format for your business, consider the following factors:

- Compatibility: Ensure the document can be easily opened with your chosen software.

- Customization Options: Look for formats that allow easy adjustments to content such as payment terms, item details, and logos.

- Professional Design: Choose a layout that reflects your brand’s professionalism and helps maintain a consistent client experience.

Top Features of Billing Document Layouts

Using a pre-designed document structure for financial transactions offers several advantages that make the billing process easier and more organized. These ready-made formats come with built-in features that ensure accuracy, professionalism, and efficiency. By understanding these key features, you can select the best layout to suit your business needs and streamline your operations.

Customizable Fields and Layout

One of the main benefits of using a pre-designed layout is the flexibility it provides. You can easily modify fields such as client names, dates, item descriptions, and payment amounts. This allows you to tailor the document to reflect the specifics of each transaction, reducing the risk of errors and improving the overall clarity of the billing process.

Professional Design and Structure

These layouts often come with well-organized sections that present information in a clean and logical manner. With clearly defined areas for payment terms, due dates, and itemized lists, the document looks polished and ensures that clients understand the charges at a glance. A professionally designed document enhances your business’s image and builds trust with clients.

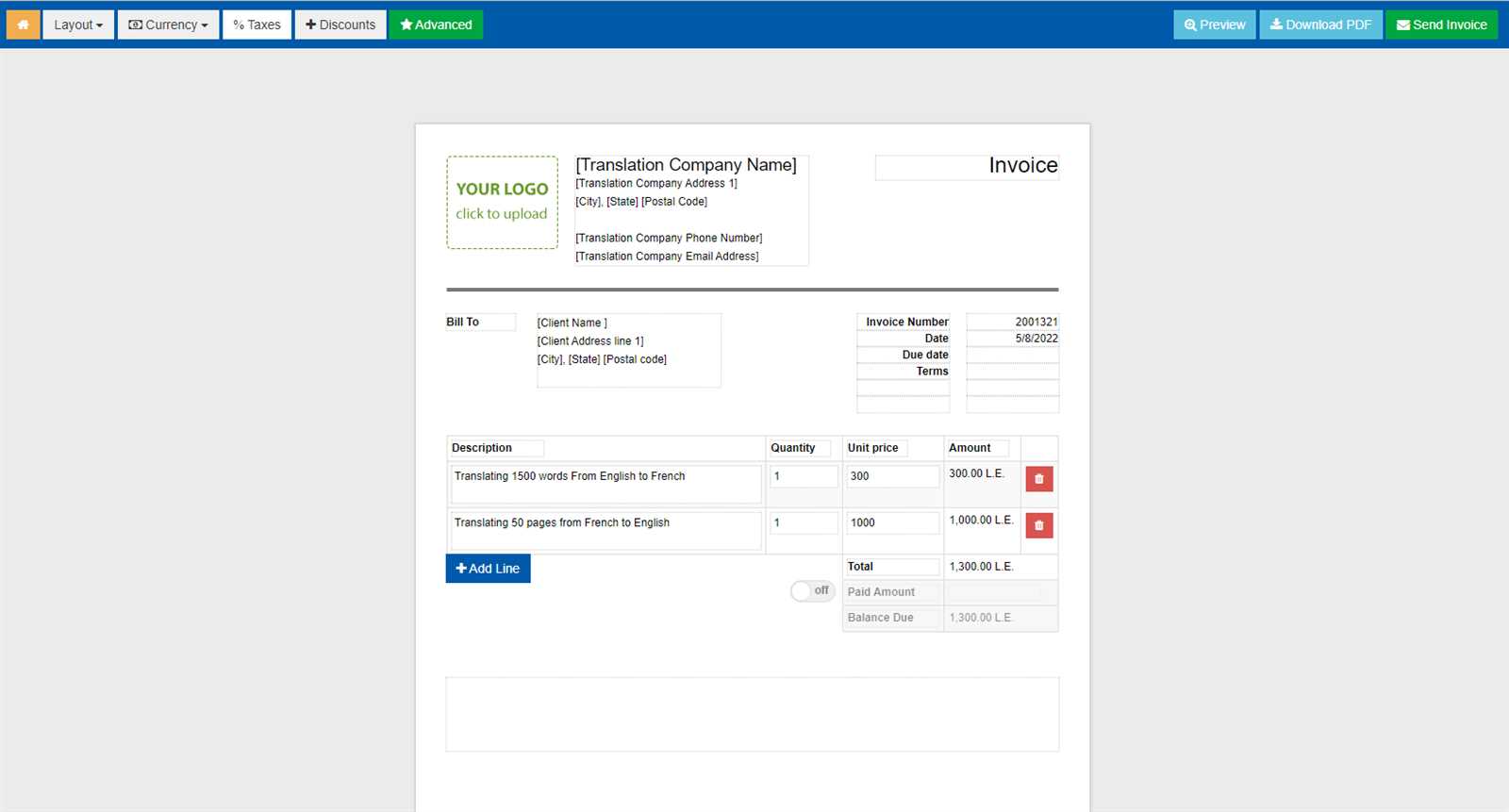

How to Edit the Billing Document in Your Text Editor

Editing a pre-designed billing document is simple and can be done quickly in your preferred text editing software. Customizing the layout allows you to tailor the content to match the specific details of each transaction. From adding your company logo to adjusting the payment terms, this flexibility ensures that every document reflects the exact information your client needs.

Step-by-Step Editing Process

To modify your document, follow these straightforward steps:

- Open the Document: Start by opening the downloaded layout in your text editing software.

- Modify Basic Information: Update essential fields like client names, dates, and invoice numbers.

- Customize the Layout: Adjust the design to include your business logo, contact details, and payment terms if necessary.

- Review and Save: After editing, ensure all details are correct before saving the final version.

Additional Customizations

In addition to basic editing, you can make more advanced adjustments to enhance the document:

- Add New Sections: Include extra fields for additional services, discounts, or special terms.

- Change Font Style: Modify the font and text sizes to align with your company’s branding guidelines.

- Incorporate Payment Instructions: Add any specific payment instructions to make the process smoother for clients.

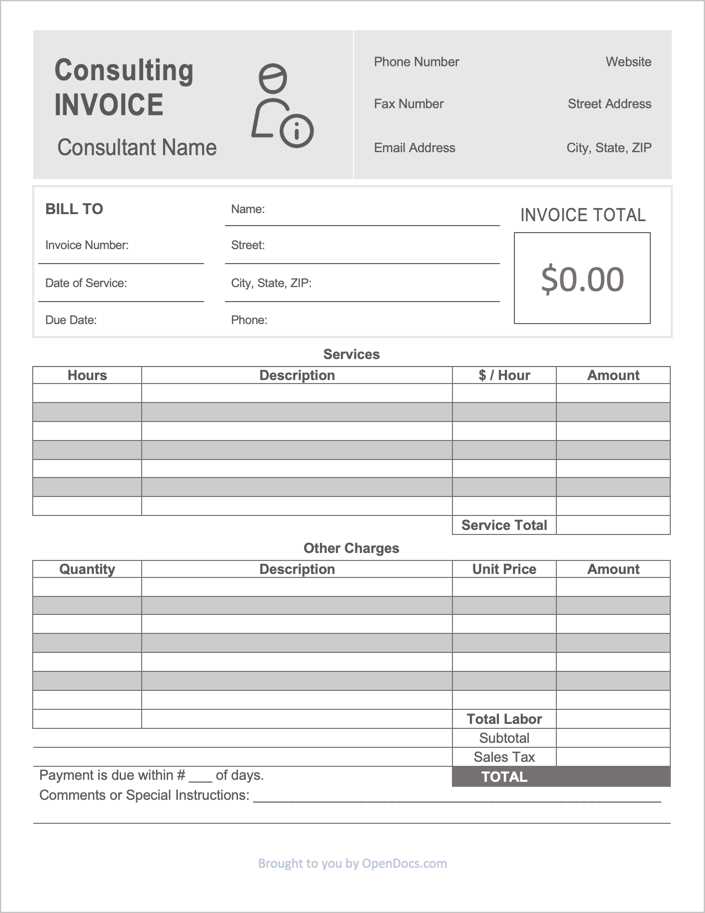

Essential Elements of a Billing Document

When creating a document to request payment for your services, it’s important to include specific details that ensure clarity and professionalism. A well-structured document helps both you and your client stay organized and avoid misunderstandings. Certain elements should always be present to ensure that the document is complete and effective.

Key Components to Include

Here are the essential elements to include in every billing document:

- Business Information: Include your company name, logo, contact details, and address.

- Client Details: Add the recipient’s name, address, and contact information to ensure proper delivery.

- Unique Identification Number: Assign a unique number for tracking and future reference.

- Detailed Description of Services: List the specific services or products provided, along with dates and quantities if applicable.

- Total Amount Due: Clearly state the total payment due, including taxes or any other fees.

- Payment Terms: Specify due dates, accepted payment methods, and any penalties for late payments.

Optional Sections for Clarity

While the core components are essential, you may also choose to add optional sections to further clarify the terms:

- Discounts: Include any applied discounts or special offers for the client.

- Additional Notes: Add any specific instructions, such as payment methods or instructions for disputing charges.

- Terms and Conditions: Provide any legal disclaimers or conditions related to the services rendered.

Tips for Professional Billing

Creating a polished and professional billing document not only ensures timely payments but also helps build a positive relationship with clients. Whether you’re a freelancer or running a small business, maintaining a high standard for your financial communications is key to conveying trustworthiness and efficiency. Here are some practical tips to improve your billing process and make a lasting impression.

Maintain Consistency

Consistency in the format and layout of your billing documents reflects well on your business. Ensure that each document follows the same structure and design, which makes it easier for clients to understand and process. A uniform approach will also enhance your brand identity, making your business more recognizable.

- Use the same fonts and colors for all documents.

- Ensure that the information is presented clearly and in a structured manner.

- Keep a consistent format for due dates, payment methods, and other key sections.

Be Clear and Transparent

Clarity in your billing documents is essential for avoiding confusion and ensuring a smooth transaction. Provide all necessary details in a straightforward and transparent manner to make it easier for clients to understand the charges and the payment process.

- Break down services or products into individual line items with descriptions.

- Clearly state the total amount due, including any taxes or additional charges.

- Specify payment terms, including deadlines and acceptable methods of payment.

How to Organize Your Billing System

Effective organization of your billing process is crucial for maintaining cash flow and ensuring that all financial transactions are tracked properly. A well-organized system reduces errors, improves client relationships, and makes it easier to manage your business finances. By implementing structured processes, you can ensure timely payments and better control over your accounting practices.

Steps to Set Up a System

Here are the essential steps to organize your billing system efficiently:

- Centralize All Financial Data: Keep all relevant information in one place to make tracking and accessing documents easier.

- Implement Consistent Numbering: Assign unique numbers to each document to avoid confusion and make it easier to reference past transactions.

- Set Clear Payment Terms: Define due dates, payment methods, and any applicable late fees clearly in each document.

- Use Software or Tools: Consider using invoicing software or templates to automate and simplify the process.

Tracking Payments and Due Dates

It’s important to have a clear system for monitoring payments and due dates to avoid missing any deadlines. Using a spreadsheet or tool to track the status of each transaction is essential for managing your cash flow.

| Invoice Number | Client Name | Amount Due | Due Date | Status | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 00123 | John Doe | $500 | 10/30/2024 | Paid | ||||||||||||||||

| 00124Free vs Premium Billing Document Layouts

When it comes to choosing a layout for your financial documents, there are two primary options: free and premium designs. Each has its benefits and limitations, depending on your business needs and the level of customization you require. Understanding the differences can help you make an informed decision about which option is best suited for your billing process. Comparing FeaturesBoth free and premium layouts serve the same basic function, but they differ in terms of design quality, customization options, and additional features. Below is a comparison to help you evaluate which type would work best for your business.

Which One Should You Choose?If you’re just starting out and need a simple, no-cost option, free layouts may be suff Best Practices for Service BillingEffective billing practices are essential for smooth transactions and maintaining good client relationships. Whether you’re an independent contractor or part of a larger business, ensuring that your financial documents are accurate, clear, and professionally presented will help foster trust and ensure timely payments. Below are some of the best practices to follow when managing your billing process. 1. Be Transparent with Charges Always provide clear breakdowns of the services rendered, including quantities, unit prices, and any applicable taxes or discounts. Transparency minimizes confusion and builds trust with clients. Make sure to state the total amount due clearly at the bottom of the document. 2. Set Clear Payment Terms Establish specific due dates and payment methods for every document. Indicate whether payments should be made via bank transfer, credit card, or another method. You should also include any penalties for late payments to ensure clients understand the consequences of missing the deadline. 3. Keep Records Organized Maintain organized records of all your transactions, including a copy of each document sent and received payments. This will help you keep track of outstanding balances and ensure that no payments are missed. Use either a digital tool or an organized filing system to store your records. 4. Be Consistent with Formatting Use a consistent format for all your billing documents. A uniform layout will make your records easier to read and ensure that no important information is overlooked. Keep your documents professional by using readable fonts, proper alignment, and clear headings for each section. 5. Send Bills Promptly Timely billing is crucial for maintaining cash flow. Avoid delays in sending out bills after services are rendered. Send them as soon as the work is completed to ensure you receive payment on time. By following these best practices, you will not only improve your billing process but also Common Mistakes in Billing DocumentsEven the most experienced professionals can make mistakes when creating financial documents. These errors can lead to confusion, delays in payments, and a lack of professionalism. Identifying and avoiding common mistakes is key to ensuring your transactions run smoothly. Below are some of the most frequent issues people face when preparing their billing records. Frequent Errors to Avoid

Here are some common mistakes that can cause problems in your billing process:

How to Prevent These Mistakes

Preventing these mistakes starts with attention to detail and using a consistent approach to your billing process. Double-check all the information, be transparent with your clients, and use tools or software to automate calculations and help with formatting. By eliminating common errors, you can ensure that your documents are accurate and professional. How to Include Payment Terms EffectivelyClear payment terms are essential for ensuring that clients understand when and how to pay for services rendered. Including these terms effectively in your financial documents helps avoid confusion and sets clear expectations. A well-structured agreement promotes timely payments and reduces the chance of disputes. Key Elements to IncludeWhen writing payment terms, consider these essential elements:

Communicating Payment Terms EffectivelyTo ensure clients fully understand your payment expectations, be sure to communicate the terms clearly both in writing and verbally if necessary. It’s also helpful to reference the payment terms in your agreements or contracts to reinforce the expectations and avoid misunderstandings. Including payment terms clearly and concisely helps create a smooth process, encourages timely payments, and protects both parties in the financial transaction. Understanding Numbering Systems for Billing DocumentsImplementing a clear and consistent numbering system for your financial records is crucial for organization and tracking. Proper numbering allows you to easily reference and manage each transaction, ensuring no document is overlooked or duplicated. It also adds a level of professionalism to your business operations. Why Numbering is ImportantHaving a structured numbering system helps in several ways:

How to Create an Effective Numbering SystemWhen setting up a numbering system for your records, keep the following tips in mind:

By adopting a logical and systematic approach to numberin Ensuring Legal Compliance with Billing DocumentsMaintaining legal compliance when preparing financial documents is essential for every business. Properly formatted records not only help avoid potential disputes but also ensure adherence to tax laws and regulations. Understanding the required elements for compliance can safeguard your company against legal issues and promote transparency in your transactions. Key Legal RequirementsTo ensure your billing documents are legally compliant, make sure to include the following details:

Compliance with Local Regulations

Different regions and countries have varying requirements when it comes to financial documentation. Be sure to familiarize yourself with the local laws and incorporate the necessary elements, such as legal disclaimers, licensing information, and applicable tax rates. If you’re unsure about what is legally required, consulting a legal expert or accountant is always a good practice. By adhering to legal standards, businesses not only avoid penalties but also build trust with clients by demonstrating professionalism and accountability in their financial operations. Integrating Billing Documents with Accounting SoftwareIntegrating financial records with accounting software streamlines the billing process, making it more efficient and reducing the risk of errors. By connecting your prepared documents to your accounting system, you can automate various tasks such as tracking payments, calculating taxes, and managing your financial reports. This integration simplifies your workflow and ensures accuracy across all aspects of your financial management. Benefits of Integration

How to Integrate Billing with Accounting Software

To successfully integrate your financial documentation with accounting software, follow these steps:

By integrating your billing documents with accounting tools, you not only increase productivity but also gain better insights into your financial health, helping your bu Improving Payment Follow-Ups with TemplatesEfficient follow-up on overdue payments is crucial for maintaining healthy cash flow in any business. By utilizing pre-made documents, you can streamline the process and ensure that clients are reminded in a timely and professional manner. Templates can help you maintain consistency in your communications, saving time while also improving the effectiveness of your reminders. These ready-to-use forms allow for quick customization, making it easier to track overdue payments and follow up accordingly. Key Benefits of Using Follow-Up Templates

Best Practices for Payment Follow-UpTo make the most of your follow-up documents, consider these strategies:

Example Follow-Up Template

|