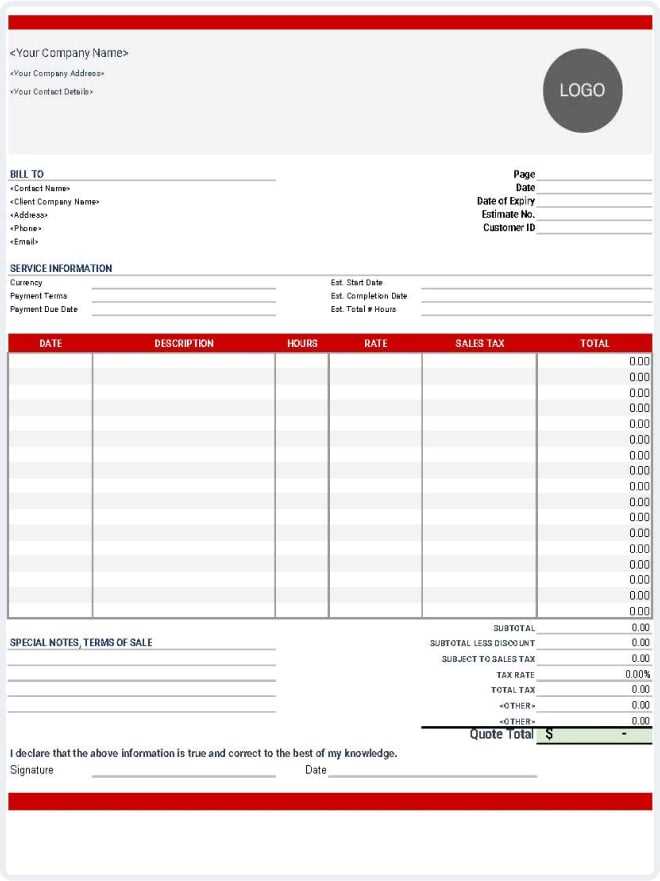

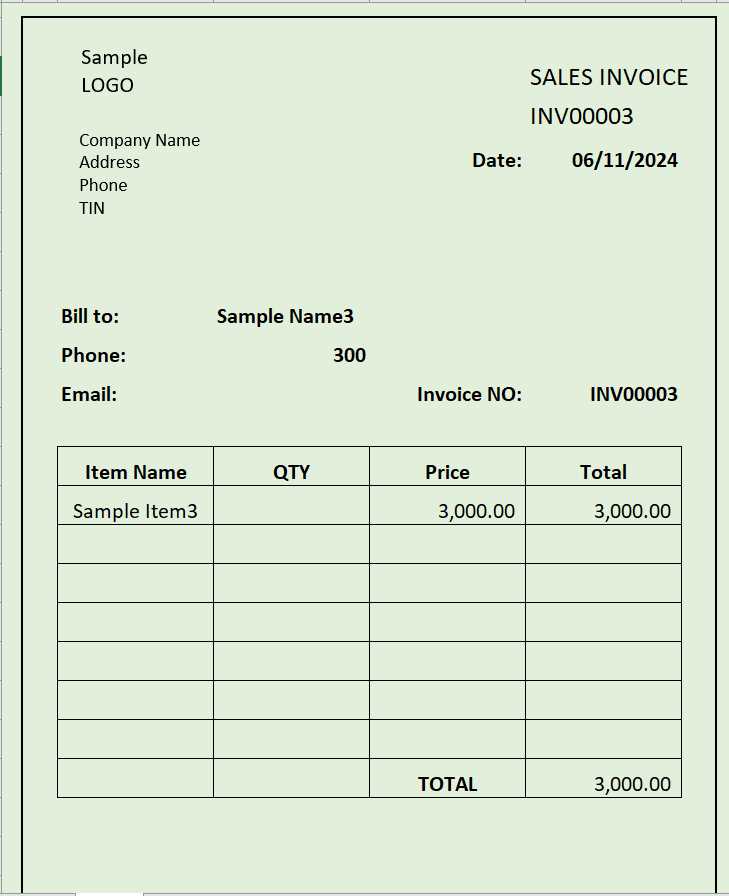

Sample Sales Invoice Template for Business Use

Creating an organized and effective billing system is crucial for any business. A well-structured document for requesting payment ensures clarity and professionalism while fostering smooth transactions between businesses and their clients.

By utilizing a customizable document, companies can streamline their billing process, avoid errors, and maintain consistency in their financial records. This guide will explore the key elements that make up such a document and how it can be tailored to meet specific needs.

Whether you’re a small business owner or part of a large organization, mastering the creation and usage of these essential tools is vital for maintaining a reliable and efficient payment system.

Sample Sales Invoice Template Overview

A well-designed billing document is essential for businesses to manage financial transactions effectively. It serves as a clear record of what has been purchased, the agreed-upon price, and the terms of payment. Having a pre-structured document format can simplify this process and ensure that important details are consistently included.

This section provides an overview of a typical billing document structure, offering insight into its components and how each part contributes to clear and professional communication between a business and its client. Using a consistent format helps avoid confusion and makes the transaction process more efficient.

Key Elements of a Billing Document

| Element | Description |

|---|---|

| Business Information | Includes the name, address, and contact details of the issuing company. |

| Client Information | Contains the name and address of the client receiving the bill. |

| Itemized List | Details of products or services provided, including quantity and individual prices. |

| Total Amount | The final price due, including applicable taxes or discounts. |

| Payment Terms | Specifies the due date and any payment instructions or conditions. |

Why Use a Pre-Formatted Document

By utilizing a pre-designed structure, businesses can ensure that all relevant information is captured accurately and presented in a professional manner. This approach not only saves time but also reduces the likelihood of errors, leading to smoother transactions and better financial management.

Key Elements of a Billing Document

An effective billing document contains specific elements that ensure clarity and accuracy. These components help both the issuer and the recipient to understand the transaction details, facilitating smooth financial operations. Each part plays a role in confirming what has been delivered, the cost associated with it, and the payment terms.

Understanding these key elements is essential for creating a professional and reliable document. Below are the primary components that make up a typical billing document.

| Component | Description |

|---|---|

| Business Information | Includes the name, address, phone number, and other contact details of the business issuing the document. |

| Client Details | Contains the name, address, and contact information of the recipient of the goods or services. |

| Itemized Description | A breakdown of the products or services provided, including quantity, unit price, and a brief description. |

| Total Due | The final amount payable, which may include discounts, taxes, and additional charges. |

| Payment Terms | Specifies the payment due date, payment methods accepted, and any penalties or interest for late payments. |

How to Customize Your Billing Document

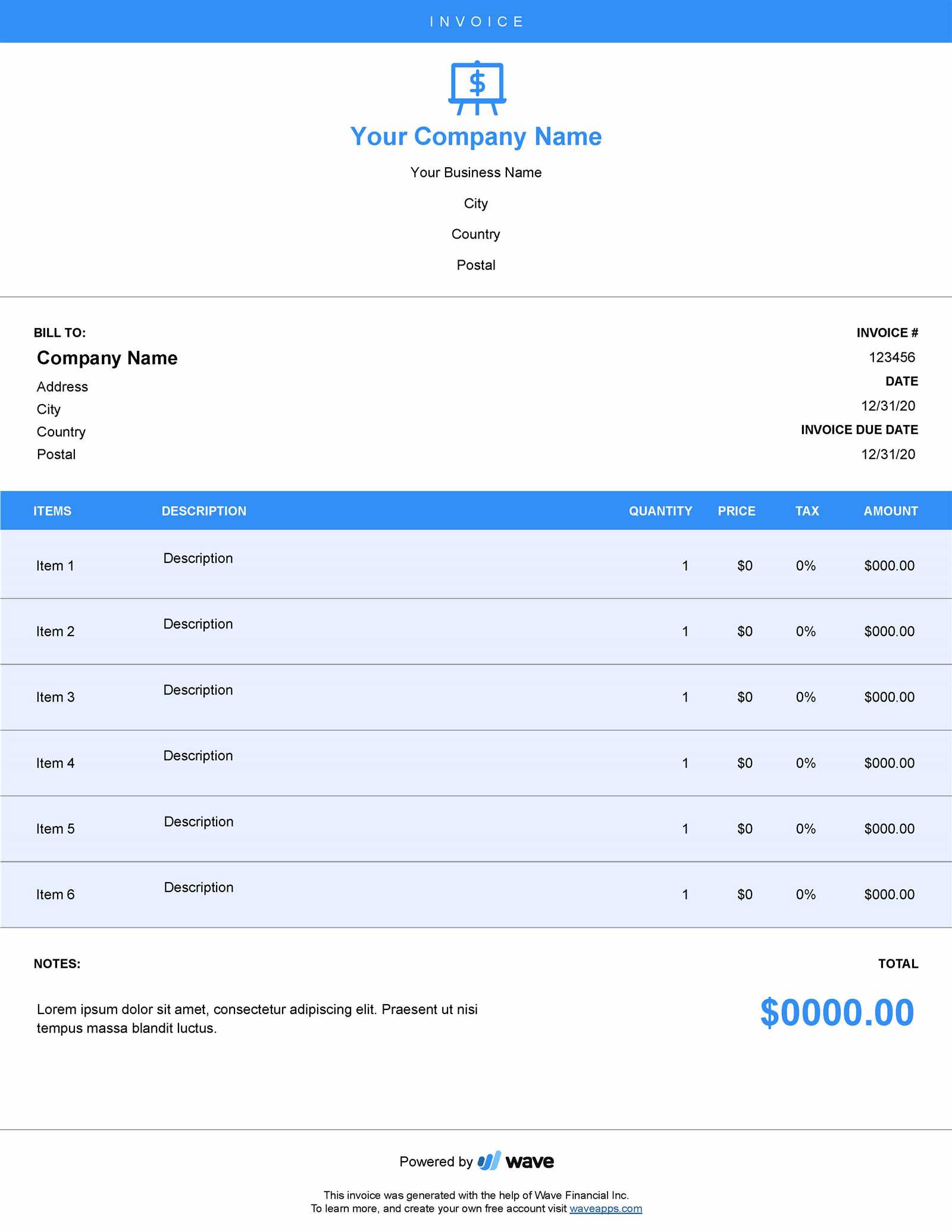

Customizing a billing document allows you to tailor it to your specific business needs and reflect your brand’s identity. A personalized format helps to create a professional impression and ensures that all necessary details are captured in a consistent way. Customization can involve changing the layout, adding specific fields, or incorporating branding elements.

Steps to Personalize Your Document

- Branding: Include your company’s logo, color scheme, and fonts to align with your business identity.

- Adjust Fields: Add or remove sections depending on the type of transaction, such as payment methods, order numbers, or client references.

- Legal Requirements: Ensure all necessary legal information is included, such as tax identification numbers or terms and conditions.

- Terms & Conditions: Customize payment terms and conditions that suit your business, such as late fees or early payment discounts.

Benefits of Customizing Your Document

- Enhances professionalism and client trust.

- Ensures all relevant details are included for smooth transactions.

- Improves consistency in your billing process.

Benefits of Using a Billing Document Format

Utilizing a pre-designed billing structure offers several advantages for businesses, from saving time to ensuring accuracy in every transaction. These ready-made layouts help streamline the process by providing a consistent and professional approach to documenting sales, simplifying the way businesses handle financial records.

Time Efficiency

One of the key benefits of using a structured format is the time it saves. Instead of creating a new document from scratch for every transaction, businesses can quickly fill in the required details, significantly reducing administrative effort.

Professionalism and Consistency

By adopting a consistent format, businesses present a more professional image to clients. This consistency helps avoid errors and ensures that all necessary information is included, making the billing process more reliable and transparent.

Essential Information to Include on Invoices

For a billing document to be effective, it must contain certain key details that ensure clarity and facilitate smooth transactions. Including the right information helps both the business and the client understand the terms of the agreement, preventing misunderstandings and ensuring timely payments.

Below are the critical elements that should always be present in a billing document:

- Business Information: Include your company’s name, address, and contact details. This provides clear identification for the recipient.

- Client Information: Clearly state the client’s name and address to avoid any confusion regarding the intended recipient of the bill.

- Unique Document Number: Each billing document should have a unique identifier for easy reference and tracking of transactions.

- Itemized List: A detailed description of the products or services provided, including quantities, individual prices, and total amounts.

- Payment Terms: Specify the payment due date, any discounts for early payment, or penalties for late payments.

- Total Amount Due: Clearly state the total amount the client owes, including any taxes, shipping fees, or additional charges.

By ensuring all these components are included, businesses can maintain professionalism and keep their financial records organized and transparent.

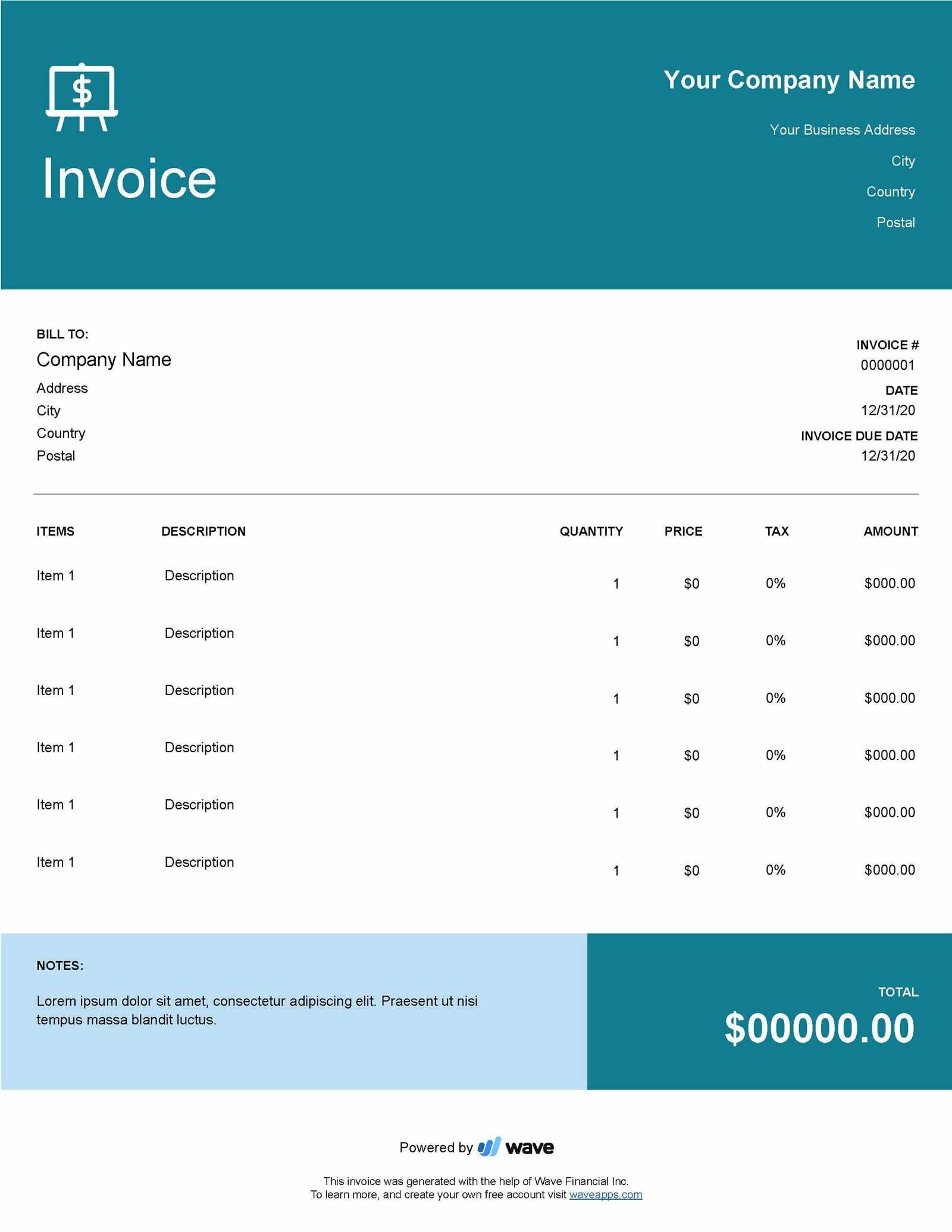

Different Types of Billing Document Formats

There are various formats available for creating a billing document, each suited to different business needs and transaction types. Choosing the right structure is important as it ensures that all relevant details are communicated clearly and efficiently. The format can impact how quickly payments are processed and how easily information can be tracked.

Below are some common formats used for billing documents:

- Standard Format: The most common structure, typically including fields for business and client details, itemized charges, and total amount due. This format is simple and widely recognized.

- Pro Forma Format: Used for preliminary billing before the actual transaction occurs. This format outlines expected charges and is often used for quoting prices or outlining future services.

- Credit Note Format: Issued when an adjustment is made to a previous billing document, such as a return or discount. This format allows businesses to correct any errors or discrepancies.

- Recurring Billing Format: Ideal for subscription-based businesses, this format is used to automatically bill clients on a regular schedule, such as monthly or annually.

- Electronic Format: A digital version of a billing document that can be sent via email or processed through accounting software. It often includes built-in automation for calculation and tracking.

Selecting the appropriate format based on the nature of the transaction and business requirements helps streamline the billing process and maintain clear records.

Choosing the Right Document Format for Your Business

Selecting the appropriate document format is essential for ensuring that all necessary details are captured and presented clearly. A well-suited structure can improve workflow, save time, and enhance the professionalism of your financial transactions. The right choice depends on the nature of your business, the types of transactions you handle, and the level of customization you require.

Below are key factors to consider when choosing the best format for your business:

| Factor | Considerations |

|---|---|

| Business Type | Determine whether your business deals with one-time transactions or recurring payments, as this will affect your document format choice. |

| Customization Needs | Consider how much customization you require. If you need to add specific fields or branding, choose a format that allows for easy edits. |

| Automation Requirements | If your business requires automated calculations or tracking, an electronic or digital format may be the most efficient option. |

| Client Preferences | Some clients may prefer electronic documents while others might prefer printed formats. Take your client base into account when choosing a format. |

| Compliance Needs | Ensure the format you choose meets any legal or regulatory requirements specific to your industry. |

By considering these factors, you can select the most appropriate format that meets your business needs, enhances efficiency, and ensures consistency across your financial transactions.

How to Create a Professional Billing Document

Creating a well-structured and professional document is essential for maintaining clear communication with clients and ensuring timely payments. A polished and accurate document reflects your business’s credibility and helps avoid misunderstandings. Crafting a professional document involves including the right elements, using proper formatting, and presenting the information in a clean and organized manner.

Step 1: Include Key Information

Start by incorporating the necessary details that identify your business, the client, and the transaction. This includes your company’s name, contact information, the client’s details, a unique reference number, and a detailed list of goods or services provided.

Step 2: Use a Clear Layout

Design the document with easy-to-read sections and a logical flow. Group related information together, such as payment terms and pricing details, and ensure that the overall layout is simple yet professional. This helps clients quickly locate the information they need.

Tip: Keep your document clean and avoid clutter by using enough white space. This enhances readability and creates a professional appearance.

Common Mistakes to Avoid in Billing Documents

Creating accurate and clear billing documents is crucial for smooth business operations and maintaining strong client relationships. However, mistakes in these documents can lead to confusion, delayed payments, or even legal issues. To ensure your documents are professional and effective, it’s important to avoid common errors that can undermine their purpose.

Common Errors to Avoid

- Missing or Incorrect Contact Information: Ensure that both your company’s and the client’s contact details are correct and clearly listed. Errors here can delay communication and payments.

- Inaccurate or Omitted Item Descriptions: Always provide detailed descriptions of goods or services provided, including quantities and unit prices. Failing to do so can lead to misunderstandings or disputes.

- Failure to Include Payment Terms: Be sure to clearly state the payment terms, such as the due date and any late fees or discounts for early payments. This helps prevent confusion and sets expectations.

- Incorrect Total Calculations: Double-check all calculations to ensure that totals are accurate, including taxes, shipping costs, and discounts. Mistakes in math can harm your credibility and cause delays.

- Not Using a Unique Reference Number: Always assign a unique identifier to each document for easy tracking and reference. Without this, managing records can become difficult.

- Not Following Legal Requirements: Ensure that all necessary legal information, such as tax identification numbers, is included, especially if you’re required to comply with local regulations.

By avoiding these mistakes, you can create clear, accurate, and professional documents that help streamline the billing process and maintain positive relationships with clients.

Importance of Accurate Billing Information

Providing precise billing information is essential for maintaining smooth financial transactions between a business and its clients. Accurate details not only ensure that payments are processed without delay, but also help build trust and credibility with your customers. Any discrepancies or mistakes in billing can lead to confusion, missed payments, and potential legal or financial issues.

Prevents Delays in Payments

When the information on a billing document is incorrect or unclear, clients may struggle to understand the charges or need additional clarification. This can lead to delays in payment processing as clients wait for the correct details to be provided. By ensuring accuracy upfront, you help avoid unnecessary back-and-forth communication and speed up the payment cycle.

Maintains Professionalism and Trust

Accurate billing reflects professionalism and attention to detail, which helps maintain a positive relationship with your clients. Consistently providing error-free documents demonstrates that you value your clients and are serious about conducting business. This trust is essential for long-term success and repeat business.

In summary, having the right information on your billing documents is not just about completing a transaction; it’s about fostering strong, transparent, and reliable relationships with your clients, which ultimately benefits your business.

How to Include Taxes on Billing Documents

Accurately including taxes in billing documents is essential for both legal compliance and clear communication with clients. Taxes vary depending on the region, the type of goods or services, and the specific tax rates applicable. Properly displaying tax amounts ensures that both you and your clients understand the final cost and prevents any confusion about the total amount due.

Determine the Correct Tax Rate

Before including taxes, you must first determine the appropriate tax rate for the goods or services you are selling. The rate may vary depending on the local jurisdiction or product category. Be sure to research and apply the correct percentage to avoid legal issues. In many cases, tax rates are provided by local government authorities.

Clearly Display the Tax Information

Once the correct tax rate is applied, it should be clearly listed on the document. Include a separate line item for taxes, showing the rate applied and the amount charged. This allows the client to easily see how the tax was calculated. You should also include any additional tax information, such as tax ID numbers, if required by law.

Tip: If multiple taxes apply, such as state and federal, list them separately to maintain transparency and ensure clarity.

By including taxes properly, you ensure that your documents comply with tax regulations and help maintain a transparent relationship with your clients.

Payment Terms and Due Dates Explained

Clearly defining payment terms and due dates is crucial for managing cash flow and ensuring that clients understand when payments are expected. These terms set expectations on how and when payment should be made, helping to avoid delays and misunderstandings. Properly communicated payment terms also establish a professional tone and protect the business from potential late fees or disputes.

What Are Payment Terms?

Payment terms outline the conditions under which payment is expected for goods or services rendered. They specify the time frame in which the client should pay, any available discounts for early payment, and penalties for late payment. Common payment terms include “net 30,” which means payment is due within 30 days of the transaction, or “due on receipt,” meaning payment is expected immediately upon receiving the document.

Understanding Due Dates

The due date is the specific day by which the payment must be made. It’s crucial to set a clear and unambiguous due date to avoid confusion and help manage your cash flow. Some businesses may offer flexibility, such as allowing clients to pay within 30, 60, or 90 days, while others may request immediate payment. Including a precise due date also helps businesses track overdue payments and send reminders when necessary.

Tip: Be sure to communicate payment terms clearly on all documents to ensure that your clients understand the expectations and avoid delays in receiving payments.

How to Manage Multiple Billing Documents

Managing multiple billing documents can become overwhelming without a structured system in place. Whether you’re handling a few transactions or hundreds, staying organized is key to ensuring smooth financial operations and timely payments. Implementing efficient tracking and record-keeping practices can help avoid errors, missed payments, and confusion across different clients.

Establish a Clear Organization System

First and foremost, creating a well-organized system is essential. This could be digital or paper-based, depending on your preference. Some tips for managing multiple documents include:

- Use sequential numbering: Assign a unique number to each document to easily track and reference them.

- Group by client: Organize documents by customer to keep their records together and accessible.

- Maintain separate folders: Keep different folders for unpaid, paid, and overdue transactions to quickly find and address any issues.

Automate Tracking and Reminders

Automation tools can greatly simplify the management of numerous documents. With software that tracks payment statuses and sends reminders, you can:

- Track due dates: Set automatic alerts for upcoming due dates to prevent late payments.

- Generate reports: Create regular reports on outstanding payments to stay on top of your financials.

- Send reminders: Automate follow-up emails for overdue payments, reducing the need for manual intervention.

By organizing and automating key processes, you can manage a large number of documents efficiently while reducing the risk of mistakes and delays.

Digital vs Printable Billing Documents

When managing your financial records, choosing between digital and printable versions of billing documents is essential for streamlining your workflow and ensuring proper documentation. Both options offer distinct advantages depending on the needs of your business, client preferences, and long-term goals. Understanding the differences between the two can help you decide which method best suits your operational requirements.

Advantages of Digital Documents

Digital billing records are increasingly popular due to their ease of use, accessibility, and environmental benefits. Some key benefits include:

- Convenience: Digital records can be accessed from anywhere, allowing you to send and manage them instantly, without the need for physical storage.

- Automation: Software tools can automatically track payments, generate reports, and send reminders to clients, reducing administrative time.

- Cost-effective: Since there’s no need for paper, ink, or postage, digital records are more affordable in the long run.

Advantages of Printable Documents

While digital records are on the rise, printable versions still have their place, especially in industries where physical copies are required. Key advantages include:

- Physical Record: Some businesses prefer to have a tangible record of transactions for filing or legal reasons.

- Client Preferences: Certain clients may prefer paper billing for personal or accounting purposes, so providing a printed copy can improve client satisfaction.

- Professionalism: A well-formatted, printed document can leave a positive impression, particularly for high-end clients or formal industries.

Ultimately, the choice between digital and printable documents depends on your specific needs, but both options provide valuable ways to manage billing information efficiently.

Incorporating Branding into Your Billing Documents

Incorporating your company’s branding into billing documents is an effective way to reinforce your identity and leave a professional impression. By customizing the layout and design to reflect your brand’s values, colors, and visual style, you can create a cohesive experience that extends beyond your products or services. This attention to detail helps establish credibility, trust, and recognition among your clients.

Key Branding Elements to Include

When integrating your brand into billing documents, consider the following elements:

- Logo: Including your logo at the top of the document ensures that your brand is instantly recognizable.

- Brand Colors: Use your company’s color scheme to create a consistent look that aligns with your other marketing materials.

- Typography: Choose fonts that match your brand’s style and convey the appropriate tone, whether formal, modern, or friendly.

- Tagline or Slogan: If appropriate, adding a short tagline can remind customers of your business values or unique sell

How to Use Billing Document Formats in Accounting Software

Using pre-designed formats within accounting software can significantly simplify the process of creating and managing billing documents. These formats allow you to quickly generate accurate, professional-looking records without having to start from scratch each time. With just a few clicks, you can customize these layouts to fit your business needs and automate repetitive tasks, saving both time and effort.

Many accounting software solutions offer a variety of customizable formats that can be tailored to match your business’s specific requirements. These include options for adjusting layouts, adding company logos, setting tax rates, and including payment terms. By using these integrated tools, you can ensure that your billing documents are consistent, accurate, and aligned with your financial practices.

Steps to Use Formats in Accounting Software

- Choose the Right Software: Select accounting software that provides customizable billing document formats and fits your business needs.

- Set Up Your Business Information: Input your company details such as name, address, logo, and contact info into the software settings.

- Customize the Layout: Use the software’s design features to add or remove sections, adjust fonts, colors, and positions to match your brand.

- Save and Automate: Once you’ve set up your document, save the customized format for future use and automate its generation for recurring transactions.

Advantages of Using Built-In Formats

- Consistency: Automated generation ensures every document follows the same format, enhancing professionalism and clarity.

- Efficiency: Pre-designed formats save time, especially for businesses with frequent transactions.

- Accuracy: Built-in calculations for taxes, discounts, and totals reduce the risk of human error.

Incorporating these features into your workflow not only streamlines your billing process but also ensures that all your financial documents meet legal and professional standards.

When to Update Your Billing Document Layout

Keeping your billing documents up-to-date is essential for ensuring they remain effective, professional, and compliant with changing regulations. Over time, you may encounter situations where updating the format or design becomes necessary. Whether it’s adapting to new legal requirements or refining the appearance to align with your evolving business needs, regularly reviewing and updating your document layouts can prevent errors and improve your overall workflow.

It’s important to recognize when changes in your business or industry might require an update. Key factors like shifting tax laws, rebranding, or adding new services to your offerings could all affect the details and structure of your billing documents. Below are some common scenarios when you should consider revising your layout:

Common Reasons to Update Your Billing Document

- Change in Business Information: If your company undergoes rebranding, changes its name, address, or logo, updating your billing documents ensures consistency across all business materials.

- Tax Rate Adjustments: When tax laws or rates change, it’s crucial to reflect those updates in your billing documents to stay compliant and avoid errors.

- Service or Product Additions: New offerings might require additional fields, descriptions, or categories on your documents to ensure all transactions are accurately recorded.

- Technological Advancements: As your business grows and adopts new technologies, incorporating these into your billing processes might involve adding new payment options or data fields.

- Legal or Regulatory Changes: Changes in local, national, or international laws could require you to include specific information on your billing documents to stay compliant.

When to Review Your Layout

- Annually: A yearly review allows you to assess whether your documents are still up-to-date with your business practices and legal requirements.

- After Major Business Changes: Any significant shift in your business model, pricing structure, or branding should trigger a review of your billing format.

- After Receiving Customer Feedback: If clients mention issues with the clarity or professionalism of your documents, it might be time to update the layout to enhance user experience.

By regularly updating your billing documents, you can maintain professionalism, improve accuracy, and ensure that your company’s financial records are always in line with the current standards.