Sample Photography Invoice Template for Easy and Professional Billing

When running a business, keeping track of payments and ensuring timely compensation for your services is essential. One of the most important tasks for freelancers and professionals is crafting clear and detailed documents that outline the work completed and the amounts due. These documents not only serve as proof of agreement but also help maintain a professional image with clients.

Having a ready-to-use structure for these financial records can save time and avoid mistakes. With the right format, you can easily customize the information, manage your transactions efficiently, and ensure that everything is clear for both parties. Whether you’re a newcomer or an experienced professional, using a well-structured document will simplify the billing process.

Understanding how to properly create and manage these forms can make a significant difference in how your business operates. Clear communication regarding payment expectations, due dates, and services provided is key to maintaining smooth client relations and timely payments. In this guide, you’ll learn how to develop and use the most effective formats for your business needs.

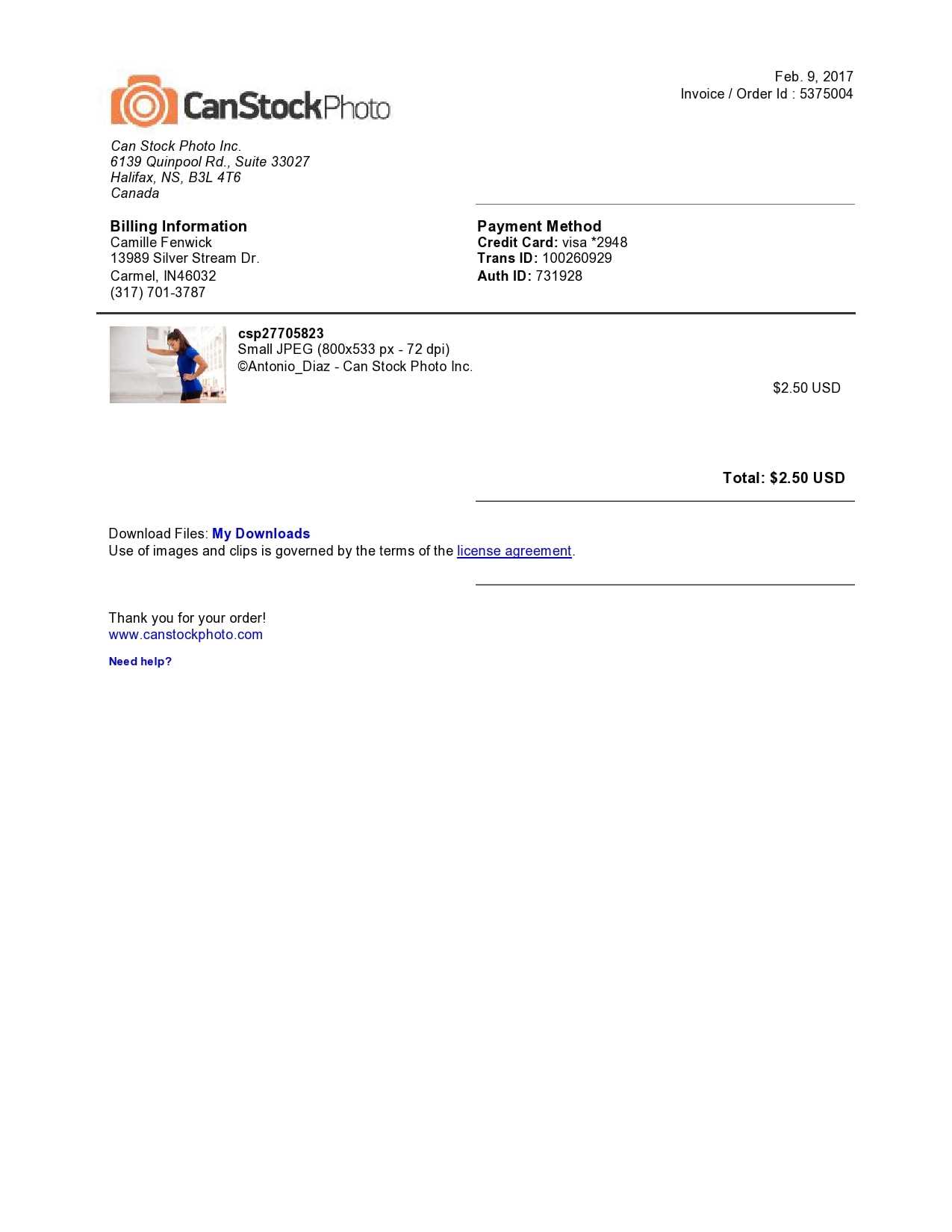

Sample Photography Invoice Template for Photographers

Creating a professional document for billing clients is essential for any visual artist. These documents help outline the work completed, the agreed-upon prices, and payment terms, ensuring both parties have a clear understanding of their financial agreement. A structured approach to billing not only saves time but also adds a level of professionalism to your business.

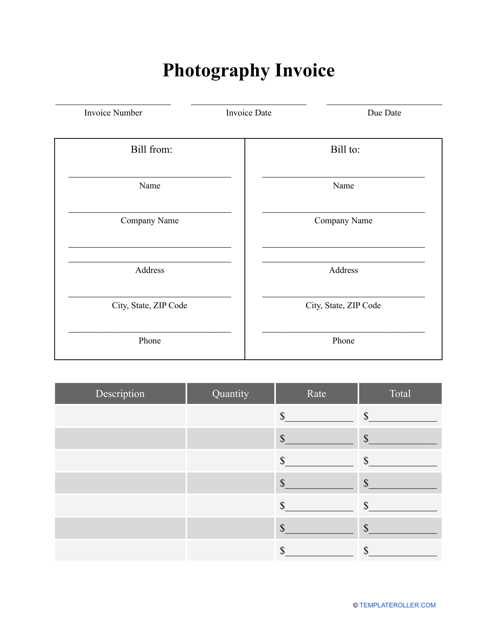

Key Elements to Include

To ensure your billing document is complete and effective, it should contain the following key sections:

- Client Information: Include the full name, business name (if applicable), address, and contact details of your client.

- Your Information: Include your full name, business name, contact details, and payment information.

- Service Description: Clearly outline the services provided, including the date, time, and specific tasks completed.

- Pricing: List the rates for your services, any applicable discounts, and the total cost.

- Payment Terms: Specify when payment is due and acceptable payment methods (e.g., bank transfer, online payments).

- Tax Details: Include any applicable taxes or fees based on your location and the nature of your services.

- Notes: Any special terms or additional instructions for the client regarding payment or services.

Customizing Your Document

Customizing your billing document can make it more personalized and professional. You can adjust the layout to match your brand, include your logo, or modify the sections according to the needs of each project. Some other considerations include:

- Branding: Add your logo and choose fonts and colors that match your business identity.

- Payment Deadlines: Be specific about when payment is due and any late fees that may apply.

-

Why You Need an Invoice Template

For any professional offering services, creating detailed and organized documents for payments is a key element of business operations. These documents not only ensure proper record-keeping but also help establish clear terms with clients, reducing the potential for confusion or disputes. Without a standardized format, tracking payments and managing multiple projects becomes increasingly challenging.

Having a pre-designed structure for your payment requests provides several benefits:

- Time Efficiency: Pre-designed formats save time by eliminating the need to create a new document for each client or project.

- Consistency: A consistent layout ensures that all essential information is included every time, preventing errors.

- Professionalism: A polished document helps build trust with clients and positions you as a serious business.

- Easy Customization: Customizing a structured format for each project or client is simple, whether you need to add specific terms or pricing details.

- Legal Protection: Clear documentation can serve as legal proof of services rendered and agreed-upon terms.

For a clearer understanding of the importance, here’s a breakdown of what a well-organized document can include:

Feature Benefit Client and business information Ensures both parties are correctly identified and establishes transparency. Service details and description Clearly defines what was delivered and when, reducing the chance of disputes. Price breakdown Helps the client understand exactly what they are being charged for each service. Payment terms Establishes when payment is due and what methods are acceptable, aiding in cash flow management. In summary, having a consistent and customizable document for billing is a practical tool that saves time, ensures accuracy, and enhances your professionalism, all while maintaining clarity with your clients.

How to Create a Photography Invoice

Creating a detailed billing document is essential for any professional in the visual arts. This document not only outlines the agreed-upon services and fees but also helps establish a clear financial record. By following a simple process, you can create a professional document that is both accurate and easy to understand for your clients.

Follow these steps to create a comprehensive billing record:

- Step 1: Gather Client Information

- Collect the client’s full name, business name (if applicable), and contact details.

- Ensure the client’s billing address and email address are accurate for communication and future reference.

- Step 2: List Your Services

- Clearly describe the services you provided, including the date, location, and duration of each session or service.

- Break down any additional services (e.g., editing, prints, extra sessions) if applicable.

- Step 3: Set Your Prices

- State your rate for each service, whether it’s hourly, per project, or

Key Elements of a Photography Invoice

To ensure your billing documents are clear and effective, it is essential to include certain key components. These elements not only help to avoid misunderstandings but also create a professional appearance that reflects well on your business. A well-structured financial record should contain specific details that allow both you and your client to easily review the work and payment expectations.

Here are the critical elements that should be included:

- Client Information: Include the client’s full name, company name (if applicable), contact number, and address. This helps personalize the document and avoids any confusion about who is being billed.

- Your Information: Clearly list your name or business name, address, and contact details. Adding your logo or branding can further professionalize the document.

- Service Description: Provide a clear, detailed breakdown of the services rendered. Include dates, locations, and specific tasks completed to avoid ambiguity and ensure both parties are on the same page.

- Pricing and Fees: List the cost of each service or product provided. Be sure to include any applicable taxes, discounts, or additional charges. This should be broken down in a way that’s easy for the client to understand.

- Payment Terms: Specify when payment is due, accepted payment methods, and any late fees or penalties for overdue payments. This ensures there is no confusion about when and how the client should pay.

- Reference Number: Adding a unique reference number helps both you and the client track the billing record. It’s especially useful if you have multiple clients or projects.

- Notes or Special Terms: If there are any specific terms, such as usage rights for images or delivery timelines, they should be clearly outlined. This helps avoid future misunderstandings and ensures both parties know exactly what was agreed upon.

Including these key details makes your billing document more than just a request for payment; it serves as a professional record of the transaction that protects both you and your client. A well-structured document helps build trust and keeps the workflow smooth.

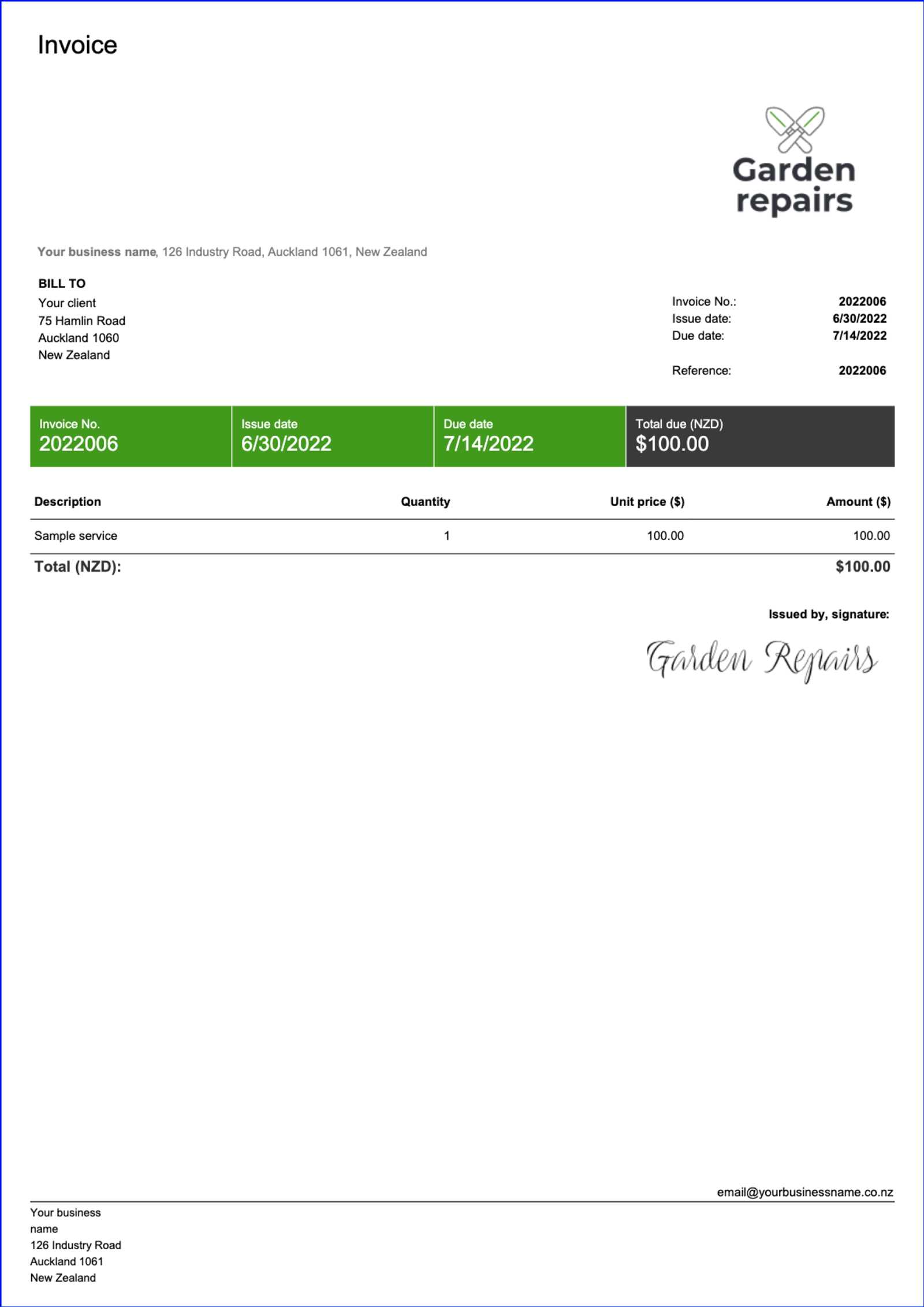

Customizing Your Photography Invoice Template

Personalizing your billing document is an important step in establishing your brand identity and ensuring clarity for your clients. By tailoring the layout and content, you can create a more professional and consistent experience that aligns with your business style and specific client needs. Customization allows you to adjust the design, language, and structure to reflect your unique service offering while maintaining an easy-to-understand format.

Personalizing the Layout and Design

One of the first things you can adjust is the design of the document. A well-designed document enhances professionalism and can help make a lasting impression. Here are a few elements you can personalize:

- Logo and Branding: Adding your business logo and choosing colors that align with your brand creates a cohesive look that reflects your style.

- Fonts and Typography: Select fonts that are readable yet distinct to reflect your business personality. Consistency is key to keeping things professional.

- Header and Footer: Customize these sections with your business name, tagline, or website, ensuring your contact information is easily visible for quick reference.

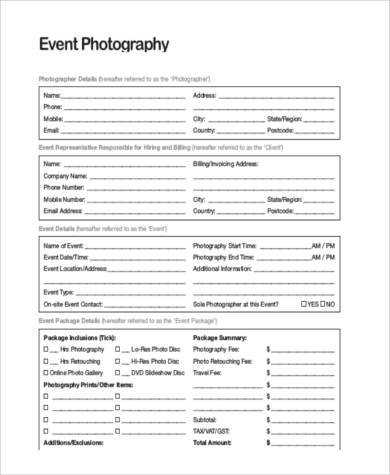

Adjusting the Content to Suit Your Services

Beyond design, it’s important to customize the information included in the document. Tailoring the content ensures it accurately represents your work and meets the client’s needs. Consider adjusting the following:

- Service Descriptions: Detail the specific services provided to each client. Whether it’s event coverage, editing, or product shots, make sure to list everything included in the agreement.

- Pricing Breakdown: Be transparent with your fees. You can include itemized costs for each service or product, which helps build trust and avoids confusion.

- Terms and Conditions: If you have special payment terms or policies, such as deposits or image usage rights, make sure these are clearly outlined in the document.

Customizing these elements makes your document not only more personalized but also more organized and professional. You can use various online tools or software to adjust these details with ease, ensuring every billing document aligns with your brand while maintaining clarity and accuracy.

Example of Customizable Elements

Element Customization Options Logo Add your business logo in the header or footer for brand recognition. Fonts Choose fonts that match your brand style–professional but easy to read. Service List Adjust the descriptions of services to be specific to the client’s needs, such as event type or package. Payment Terms Modify due dates, deposit requirements, and late fees based on your business model. By making these adjustments, you ensure that every billing document is a reflection of your business professionalism and unique offerings. Customization allows you to stand out while keeping your process organized and efficient.

Choosing the Right Format for Invoices

Selecting the proper structure for your billing documents is crucial for ensuring clarity and professionalism. The format you choose affects how easily the client can understand the details, how effectively you can manage your finances, and how smoothly payments are processed. There are various formats available, and understanding which one suits your business needs is essential for streamlining your workflow and maintaining accurate records.

When deciding on a format, consider factors such as simplicity, accessibility, and the type of services you offer. The format should allow you to easily update or modify details, track payments, and maintain a consistent presentation. Below are the most common formats you can use, each with its own set of advantages:

Format Advantages Best For Word Processor (e.g., Word, Google Docs) Easy to customize, highly flexible, familiar tools for many users. Freelancers or small businesses who need simple, editable documents. Spreadsheet (e.g., Excel, Google Sheets) Efficient for calculations, automatic sum totals, easy tracking of payments. Businesses that handle many transactions or require detailed calculations. Online Tools (e.g., FreshBooks, QuickBooks) Professional templates, automatic calculations, integrated payment systems. Small businesses or professionals looking for automation and accounting integration. PDF (Portable Document Format) Universally accessible, easy to share, maintains formatting across devices. Professionals looking for a secure, consistent format to send to clients. Each format serves a different purpose, and the choice depends on your specific needs. If you prefer more control over design and layout, a word processor might be your best bet. For those who need to track multiple payments or offer a variety of services, spreadsheets or online tools may offer added value. PDF is the go-to format whe

Free Photography Invoice Templates Online

Finding pre-made structures for billing can save you a lot of time and effort, especially if you’re just starting out or looking to streamline your workflow. Many online platforms offer free, customizable documents that allow you to quickly generate a professional record for each client. These resources make it easy to create polished, accurate billing forms without needing advanced design skills or specialized software.

Free online resources offer a wide variety of options, ranging from basic formats to more sophisticated designs with automated features. The best part is that most of these tools allow for quick customization, ensuring that the document matches your business needs. Here are some popular platforms that provide free templates:

Platform Features Best For Invoice Generator Simple, fast, customizable, no registration required. Freelancers who need a quick and easy solution without extra features. Canva Design-focused with numerous templates, customization options, and free download. Business owners looking for visually appealing and customizable documents. Zoho Invoice Free invoicing software with professional templates, integrated payment systems. Small businesses needing additional accounting features and automation. Wave Accounting Comprehensive invoicing tool with automated reminders and easy-to-use design. Freelancers and small businesses looking for free accounting and invoicing features. These platforms make the billing process simpler by offering easy-to-edit templates, automatic calculations, and the ability to store client data for future use. Whether you’re looking for a minimalist design or a more complex layout, these resources provide flexible solutions for professionals who want to save time and maintain a consistent, professional appearance across all client interactions.

By using free online tools, you not only create effective and professional documents but also streamline your workflow without the need for expensive software. Most importantly, these resources give you more time to focus on the creative aspects of your business while ensuring your financial records are accurate and well-organized.

Common Mistakes to Avoid on Invoices

Even the most experienced professionals can make simple errors when creating financial documents. These mistakes can lead to confusion, delays in payments, or even disputes with clients. It’s crucial to double-check every detail to ensure accuracy and clarity. Understanding and avoiding these common pitfalls will help you maintain a smooth, professional billing process and avoid unnecessary setbacks.

Here are some of the most frequent mistakes people make when creating billing documents:

Mistake Consequence How to Avoid Missing or incorrect client information Delays in communication, payment issues, and confusion. Double-check contact details and ensure the client’s full name and address are accurate. Unclear service descriptions Confusion about what was delivered, leading to disputes or misunderstandings. Provide specific details of services provided, including dates, locations, and tasks completed. Incorrect pricing or totals Overcharging or undercharging, leading to financial discrepancies. Carefully review all pricing and calculate totals accurately, considering any taxes or discounts. Not including payment terms Delays in payment or clients not understanding when and how to pay. Always specify payment deadlines, accepted payment methods, and any late fees. Not using a unique reference number Difficulty in tracking payments or matching payments to specific clients or projects. Use a reference number or code for each billing record to make it easy to track and manage payments. Omitting tax or additional fees Unexpected costs for the client, leading to dissatisfaction or disputes. Clearly list all taxes, fees, or additional costs upfront to avoid surprises. By paying attention to these common errors and taking extra care to review your financial documents, you can reduce the risk of misunderstandings and ensure timely, hassle-free payments. A well-organized and accurate document not only helps maintain good client relationships but also reflects the professionalism of your business.

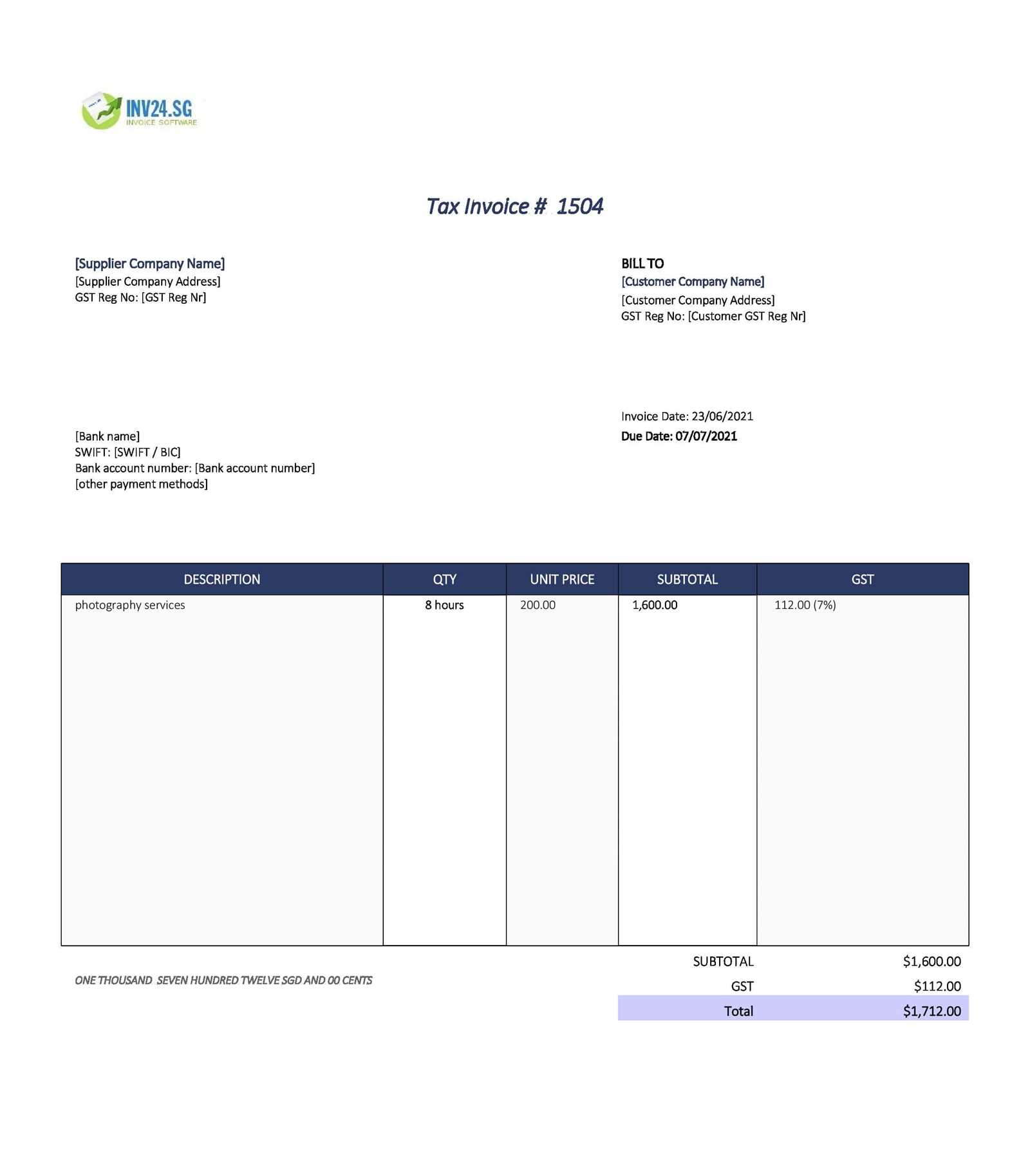

How to Add Taxes to Photography Invoices

Adding taxes to your billing documents is an important step to ensure compliance with local tax laws and to avoid any future legal issues. When charging clients for services, it’s crucial to include the appropriate tax rate based on the jurisdiction in which the services were provided. Properly calculating and displaying taxes not only keeps your business in good standing but also helps maintain transparency with your clients.

To accurately add taxes to your billing records, follow these steps:

- Step 1: Understand the Tax Rate

Different regions have different tax rates, and some may require specific types of taxes (sales tax, VAT, etc.). Make sure you are familiar with the tax laws in your area or the area in which the services were rendered. - Step 2: Calculate the Tax Amount

Multiply the total amount for the services by the tax rate. For example, if your total charge is $500 and the tax rate is 10%, the tax would be $50 (500 x 0.10 = 50). Add this tax amount to the total due on the billing record. - Step 3: Clearly Display the Tax Information

Ensure the tax is clearly outlined on the document. Include a separate line for the tax amount, labeled appropriately, so that the client can easily see the breakdown of costs. For example, list the “Service Total” and then below it, “Tax” with the applicable rate and amount. - Step 4: Include Your Tax ID Number (if required)

In some regions, it may be necessary to include your business’s tax identification number (TIN) or VAT number on the document. This is especially important for businesses that are registered for tax purposes or working internationally.

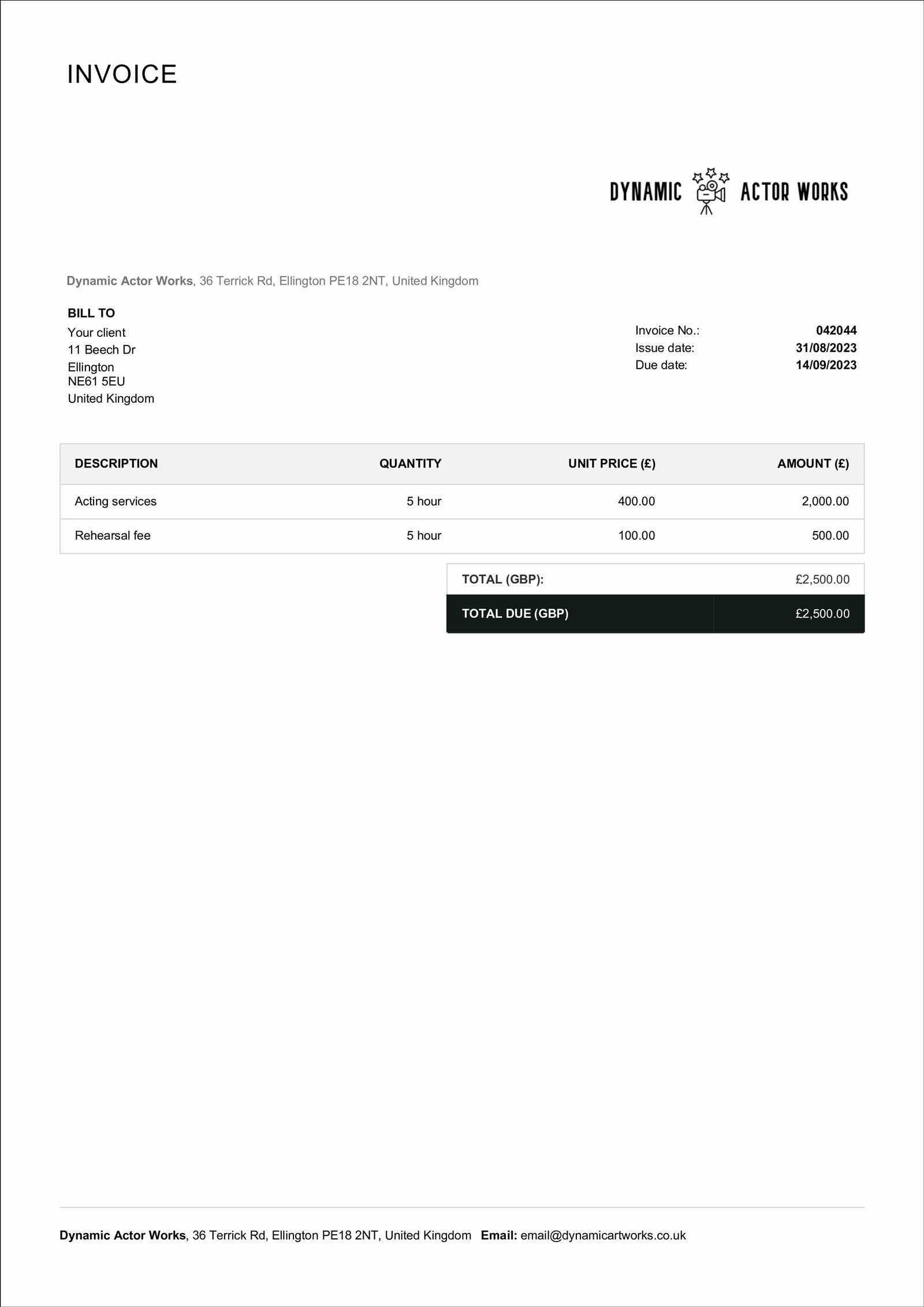

Here is an example of how your final billing document might look when including taxes:

Description Amount Service Total $500 Tax (10%) $50 Total Due $550 By following these steps and ensuring that the tax is correctly applied and displayed, you can provide clarity to your clients while staying compliant with tax regulations. This approach also demonstrates professionalism and transparency, which are key to maintaining po

How to Include Payment Terms Effectively

Clearly defined payment terms are crucial for maintaining a smooth and professional relationship with clients. These terms outline the expectations regarding when and how payments are made, helping to avoid misunderstandings or delays. Properly communicating payment terms ensures that both parties are on the same page and can prevent future disputes or confusion.

Key Elements to Include in Payment Terms

When drafting payment terms, make sure to include the following key elements to avoid any ambiguity:

- Due Date: Clearly specify the exact date by which payment should be made. This removes any confusion and sets clear expectations.

- Accepted Payment Methods: Indicate which payment methods are acceptable, whether it’s credit card, bank transfer, PayPal, or another option. This ensures the client knows how they can pay.

- Late Fees: If applicable, include information about any penalties or interest charged for overdue payments. This motivates clients to pay on time and prevents delays.

- Deposit Requirements: If you require a deposit upfront, clearly state the percentage or fixed amount, as well as when it’s due. This helps manage cash flow and secures your time and services.

- Installments (if applicable): If payments are to be made in installments, specify the amount and dates for each payment. This can be especially useful for larger projects or packages.

Best Practices for Writing Payment Terms

While it’s important to be clear and direct with payment terms, it’s equally essential to keep the language professional and friendly. Here are some best practices:

- Be specific: Avoid vague terms like “ASAP” or “soon.” Use concrete dates and amounts to eliminate uncertainty.

- Be fair: Set reasonable payment timelines and fees that reflect the nature of the work and the client relationship.

- Be transparent: Make sure all payment-related information is easy to find on the document. This reduces the chances of the client overlooking or forgetting important details.

- Use a polite tone: While it’s important to be firm about payment expectations, always maintain a professional, courteous tone to preserve good relationships with clients.

By effectively including these terms in your billing documents, you help create a framework that guides both you and your client through the payment process. This promotes professionalism and fos

Incorporating Your Branding in Invoices

Incorporating your branding into your billing documents is an effective way to create a consistent and professional image for your business. By aligning your billing statements with your brand’s identity, you reinforce your visual presence, build trust, and ensure a cohesive experience for your clients. Customizing your documents with your brand’s colors, logo, and font choices creates a more personalized and polished interaction, making a lasting impression.

Key Elements to Include for Strong Branding

When customizing your billing documents, focus on integrating the following key elements of your branding:

- Logo: Placing your logo at the top of the document helps with immediate brand recognition. Make sure it’s clear and appropriately sized to fit the document layout.

- Brand Colors: Using your brand’s color scheme for text, borders, or accents reinforces your identity. Choose colors that are easy to read and visually appealing.

- Typography: Use fonts that align with your brand’s style. Whether you prefer a modern, minimalist font or a more classic one, consistency in typography is key.

- Tagline or Slogan: If applicable, include your tagline or slogan near your logo. This can be a powerful reminder of what your business represents.

Designing a Branded Billing Document

Creating a well-designed billing document is a reflection of your business’s professionalism. Below is an example of how to incorporate branding elements into a simple layout:

Element Customization Option Header Place your logo at the top along with your business name, contact information, and tagline. Color Scheme Use brand colors for headings, borders, and accent sections to create a visually appealing document. Typography Select fonts that reflect your business personality. Use one primary font for headings and another for body text to maintain clarity. Footer Include your website, social media handles, or any other contact information, ensuring clients can easily reach you. Best Software for Photography Invoices

Choosing the right software to manage your billing process can streamline your workflow, reduce human error, and ensure that your financial records are accurate and professional. With the right tools, creating, sending, and tracking client payments becomes more efficient, allowing you to focus more on your creative work. Various software options are available, each offering different features suited to a range of business needs.

Top Software for Managing Billing Documents

The following tools are among the best when it comes to creating and managing your billing documents. They provide user-friendly interfaces, customizable features, and the ability to easily track payments and expenses:

- FreshBooks: A cloud-based solution with customizable templates, easy expense tracking, and automatic reminders. Ideal for freelancers and small businesses.

- QuickBooks: A comprehensive accounting tool that offers invoicing as part of its suite of features. It’s excellent for those who need both billing and accounting in one platform.

- Wave: A free, easy-to-use software perfect for small businesses and freelancers. It includes invoicing, accounting, and receipt scanning features.

- Zoho Invoice: Offers a simple interface with advanced features like automated billing, multi-currency support, and detailed reporting. Great for businesses with international clients.

- HoneyBook: This software is designed specifically for creative professionals. It offers contract management, project tracking, and integrated payment options.

Key Features to Look For

When selecting the right software for your business, it’s essential to consider the following features:

- Customization: Ensure that the software allows you to customize your billing documents with your branding, including logos, colors, and payment terms.

- Automation: Look for tools that automate repetitive tasks such as sending reminders for overdue payments or generating recurring bills.

- Client Management: Some software offers integrated client management systems, helping you track customer details and communication history in one place.

- Payment Integration:

Automating Photography Invoicing with Tools

Managing the billing process manually can be time-consuming and prone to errors, especially for those juggling multiple clients and projects. By automating this process, you can save valuable time, ensure consistency, and focus more on your creative work. Automation tools are designed to streamline the creation, delivery, and tracking of financial documents, reducing the administrative burden and improving overall efficiency.

Using the right tools to automate your billing tasks allows you to create and send invoices with just a few clicks. These tools can also help with recurring payments, automatic reminders, and tracking outstanding balances, making the entire process more seamless and less stressful.

Benefits of Automating Your Billing Process

Automation offers several advantages for freelancers and small businesses looking to streamline their financial operations:

- Time-Saving: Once set up, automated tools handle the creation and delivery of billing documents, freeing up time to focus on other aspects of the business.

- Consistency: Automated systems reduce the risk of human error, ensuring that each client receives an accurate and professional document every time.

- Recurring Payments: For ongoing projects or retainer clients, automation can set up recurring billing schedules, ensuring payments are received on time without manual intervention.

- Automatic Reminders: Many tools send reminders to clients about upcoming or overdue payments, helping to reduce late fees and improve cash flow.

- Data Tracking: Automation tools often include built-in tracking, allowing you to monitor the status of payments, track your revenue, and generate detailed financial reports.

Tools to Consider for Automating Billing

There are several tools available that can help automate your billing and financial processes. Here are some popular options:

- FreshBooks: A cloud-based tool that automates invoicing, expense tracking, and recurring payments. It’s easy to use and highly customizable for different business needs.

- QuickBooks: This widely-used tool integrates invoicing with comprehensive accounting features, making it a great option for businesses looking for a complete financial management solution.

- Wave: A free tool that automates billing, expense tracking, and provides invoicing templates. It’s an excellent choice for freelancers or small businesses on a budget.

- Zoho Invoice: Offers automated invoicing with features like multi-currency support, recurring invoices, and automatic payment reminders, ideal for businesses with international clients.

- HoneyBook: A tool tailored for creative professionals, HoneyBook allows you to automate invoices, contracts, and client communications all in one platform.

By integrating automation tools into your billing process, you can save time, reduce errors, and improve your overall workflow. These tools allow you to stay organized and ensure timely payments, ultimately enhancing your client relationships and business efficiency.

How to Send Photography Invoices to Clients

Sending clear, professional billing documents to your clients is an essential part of maintaining a smooth business operation. Whether you’re a freelancer or a small business owner, ensuring that clients receive accurate and timely financial documents helps you get paid on time and strengthens your professional image. The method you choose to send these documents can influence how quickly clients process payments and how easily you manage your records.

Best Methods for Sending Billing Documents

There are several effective ways to deliver your billing documents to clients. The best method depends on client preferences and your business processes. Below are some common methods:

- Email: The most common and convenient way to send financial documents. You can attach the billing document as a PDF and send it directly to your client’s email inbox.

- Online Billing Systems: Many tools, such as FreshBooks or QuickBooks, allow you to send invoices directly from their platform. These systems often include built-in tracking, allowing you to see when a client has viewed or paid their bill.

- Postal Mail: For clients who prefer physical copies, mailing your documents can still be a valid option. Be sure to use clear, well-organized documentation and send it via tracked mail to ensure it reaches your client safely.

- Client Portals: Some businesses set up secure client portals where clients can log in, view their bills, and make payments. This method is often used by larger companies and can be integrated with your CRM or financial software.

How to Ensure Effective Delivery

Regardless of the method you use, it’s important to follow these steps to ensure your client receives their document without issues:

- Double-check the details: Before sending, verify that all the details on the billing document are correct, including client information, amounts, dates, and payment terms.

- Attach the document properly: Always send billing documents in a universally accessible format, such as PDF. This ensures that your client can open and read the file without difficulty.

- Provide clear instructions: Include clear instructions on how to make payments, especially if you are using online payment platforms. Include payment links when possible.

- Fo

Tracking Payments for Photography Services

Keeping track of payments is a vital aspect of managing any creative business. Accurate tracking ensures you stay on top of your finances, can easily follow up on overdue amounts, and maintain a healthy cash flow. A systematic approach to payment tracking helps you avoid errors, ensures transparency with clients, and provides insight into your overall financial health.

Methods for Tracking Payments

There are several ways to effectively track payments for your services. Whether you prefer using software or manual methods, it’s essential to have a clear system in place. Below are some common approaches:

- Payment Tracking Software: Using accounting or invoicing tools, such as QuickBooks, FreshBooks, or Wave, allows you to automatically track payments in real-time. These systems help you monitor outstanding amounts and generate reports easily.

- Spreadsheets: For those who prefer a more manual approach, spreadsheets are an effective tool. You can create custom columns to track client names, amounts due, payment dates, and outstanding balances.

- Client Portals: Some invoicing systems offer client portals where payments can be tracked directly. These portals allow clients to view their payment status and make payments securely online.

- Bank Statements: Regularly reviewing your bank statements and reconciling them with your records can ensure that all payments are accounted for and no amounts are overlooked.

Creating a Payment Tracking System

To help streamline your payment tracking, consider creating a simple table that can be updated as payments are received. Below is an example of how to structure this system:

Client Name Amount Due Payment Received Payment Date Balance John Doe $500 $500 01/10/2024 $0 Jane Smith $300 $150 01/11/2024 $150 Michael Lee $600 $600 05/11/2024 $0 By creating and maintaining a clear payment tracking system, you ensure that you are aware of which clients have paid, which payments are still pending, and when you can expect to receive payment. This transparency helps avoid misunderstand

When to Send Your Photography Invoice

Knowing the right time to send a billing document is crucial for maintaining positive client relationships and ensuring timely payments. The timing of your financial request can impact how quickly you get paid, as well as how clients perceive your professionalism. It is important to consider the nature of the work, the client’s expectations, and your payment terms when determining the optimal moment to send a payment request.

Sending a billing document too early may confuse your client or cause unnecessary delays in processing, while waiting too long could result in missed payments and financial strain. The key is to find a balance that aligns with both your business needs and your client’s workflow.

Key Considerations for Sending Billing Documents

- Project Completion: It’s often best to send the billing request once the work is completed and delivered. This ensures that the client has everything they need and is more likely to pay promptly.

- Payment Terms: If you have a set payment schedule, such as 30 days from the delivery date, make sure to send the billing document in accordance with these terms. Clearly specify the payment deadline to avoid confusion.

- Milestone-Based Billing: For larger projects, you may want to send partial billing requests after key milestones are achieved. This ensures you receive payments at various stages rather than waiting until the end.

- Client Agreement: Consider any agreements or industry standards that affect when a client expects to receive a payment request. Some clients prefer to receive billing documents immediately after the service is rendered, while others may have a set billing cycle.

- After Deliverables: Once any final images, videos, or other assets are delivered to the client, it’s a good time to send the financial document. Ensure that all deliverables meet the client’s satisfaction before invoicing.

By carefully timing when you send your billing request, you can enhance client satisfaction while ensuring that your business remains financially stable. A clear, timely request for payment builds trust and ensures that your professional services are valued and compensated on schedule.

- State your rate for each service, whether it’s hourly, per project, or