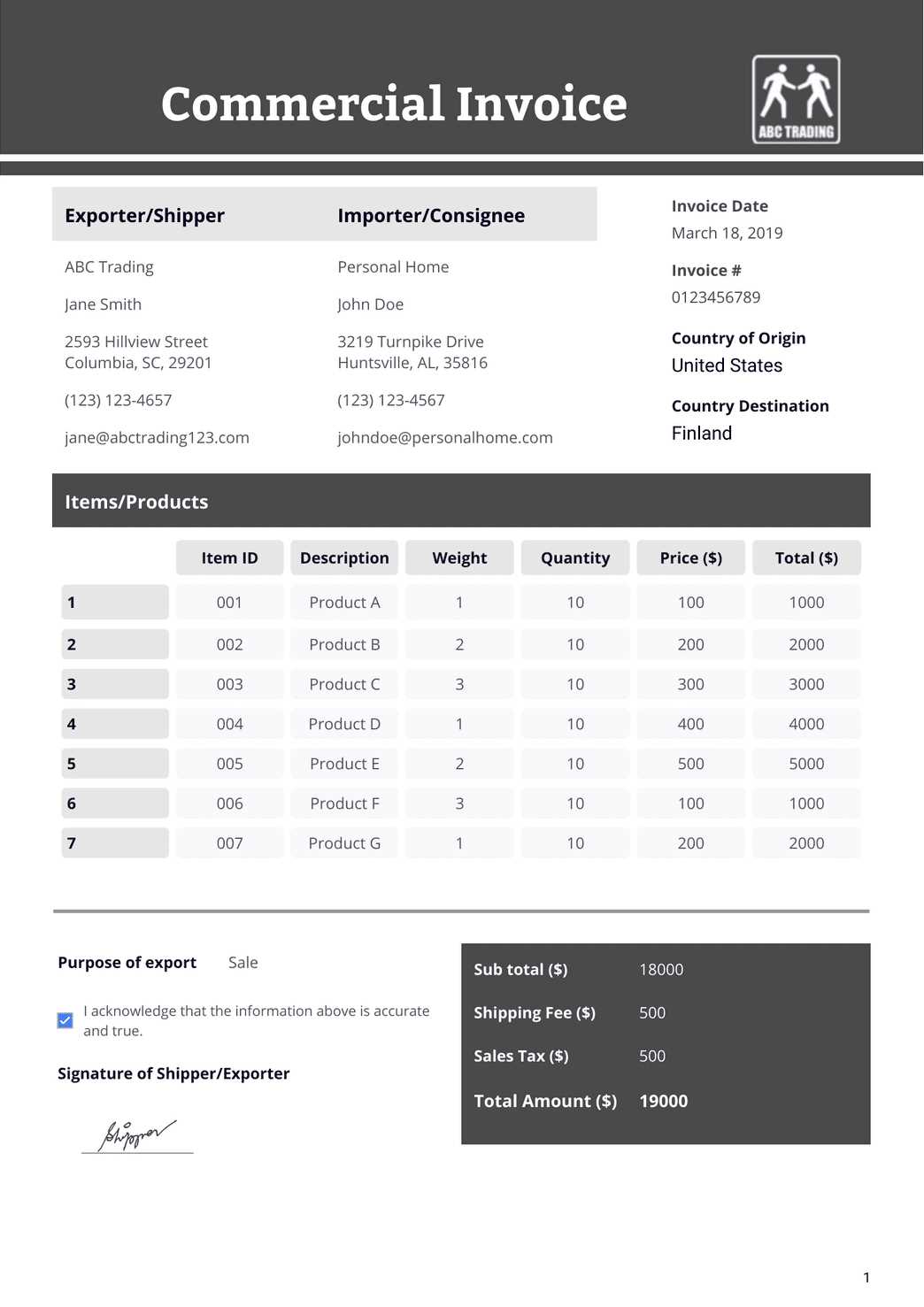

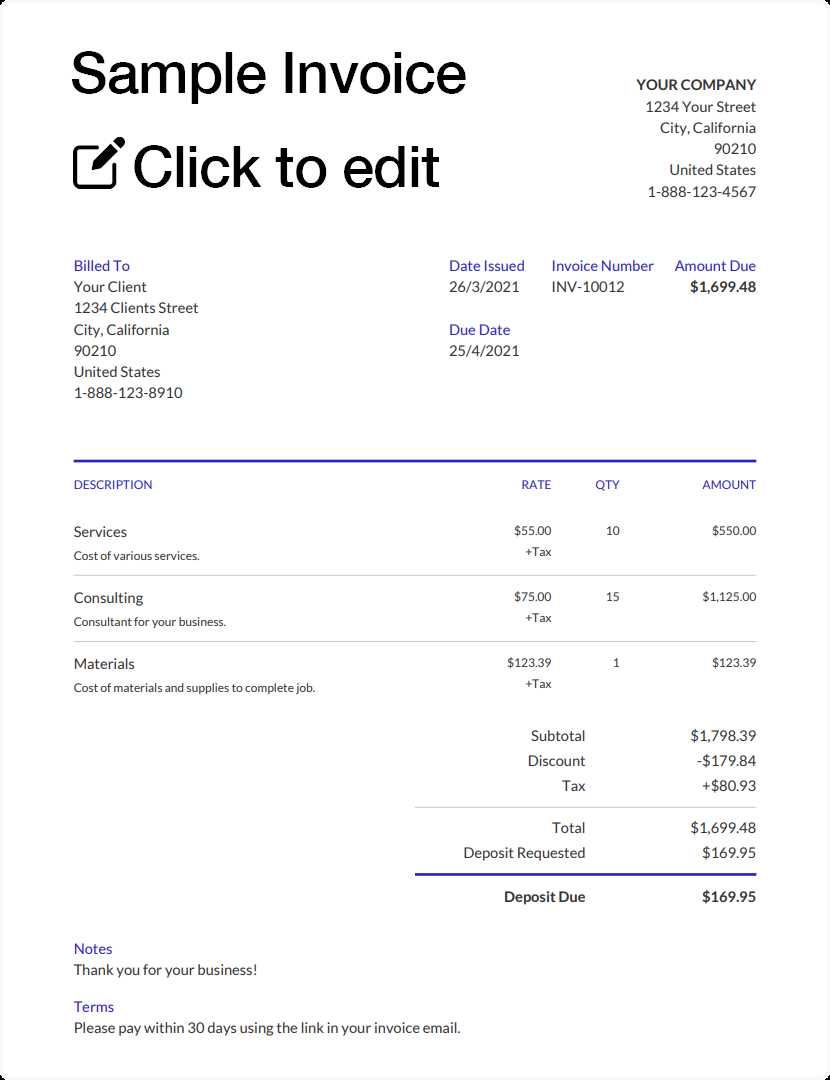

Free Sample Invoice Template for Quick and Easy Invoice Creation

When it comes to managing financial transactions, having a reliable and professional document format is essential for clear communication and smooth operations. Whether you’re a freelancer, a small business owner, or a large enterprise, using a structured format can help you maintain accuracy and consistency in all your dealings. These documents serve as official records that both parties can refer to, ensuring there is no confusion about amounts, due dates, or services rendered.

For anyone looking to streamline their administrative tasks, various editable designs are available to make document creation quick and hassle-free. With the right tools, you can easily generate personalized versions tailored to your specific needs, saving valuable time and reducing errors. Many of these options are accessible without any cost, allowing you to focus on your work rather than spending resources on expensive software.

In this guide, we explore several top-quality, customizable formats that can help you produce professional-grade paperwork in just a few clicks. Whether you need to track payments, outline terms, or clarify details, these resources offer a straightforward solution for businesses of any size.

Free Invoice Template Samples to Download

Having access to downloadable, ready-to-use document formats can significantly simplify the process of managing transactions. These resources allow individuals and businesses to generate professional-looking records with minimal effort, ensuring consistency and clarity in every deal. Whether you’re just starting out or looking to streamline your current workflow, the right design can make all the difference.

Numerous websites provide a variety of customizable options that can be downloaded and used instantly, catering to different industries and requirements. These resources are perfect for anyone looking to avoid the hassle of creating documents from scratch while still maintaining a professional appearance. By choosing the appropriate format, you can easily adjust details like payment terms, client information, and service descriptions to suit your needs.

The availability of these tools makes it easier than ever to stay organized and ensure that your business operations run smoothly. With just a few clicks, you can have a polished document that reflects your business’s professionalism, all without spending a dime on software or additional services.

Why You Need an Invoice Template

Having a structured document for billing is crucial for maintaining professionalism and clarity in financial transactions. It ensures that both parties involved have a clear understanding of the amounts due, payment terms, and services provided. Without a standardized approach, confusion or misunderstandings can arise, leading to delays or disputes.

By using a consistent format, you can streamline your accounting process, reduce errors, and save time. These pre-designed resources make it easy to fill in the necessary details, ensuring that you never miss important information. Whether you’re managing multiple clients or simply need a quick solution, such a format provides the organization and structure that are essential for smooth business operations.

Additionally, a well-crafted document can enhance your brand image and establish trust with clients. It reflects your attention to detail and commitment to professionalism, which can help strengthen business relationships over time.

How to Choose the Right Template

Selecting the right format for your financial documents is essential to ensure clarity, accuracy, and professionalism. The ideal choice depends on your specific needs, industry requirements, and the level of customization you require. By evaluating several key factors, you can choose a design that suits your business operations and saves you time.

Consider Your Business Needs

Think about the type of work you do and the level of detail required for each document. A freelancer may need a simpler design, while a larger business might require a more complex layout to accommodate various services and payment terms.

- For freelancers, opt for simple and clear formats with basic details.

- For small businesses, choose layouts that allow for the addition of taxes, discounts, and multiple items.

- For larger companies, consider advanced designs that support multiple sections and itemized breakdowns.

Look for Customization Options

The right layout should be flexible enough to allow for changes in text, logos, and payment instructions. Ensure that the design can easily be tailored to suit your brand’s identity, including your logo, color scheme, and font style.

- Ensure there is space for your logo and contact information.

- Check if the design supports fields for item descriptions, quantities, and unit prices.

- Confirm that payment terms and due dates are easy to adjust for each transaction.

By considering these factors, you can select a design that not only meets your practical needs but also enhances the professional image of your business.

Benefits of Using Free Invoice Templates

Utilizing ready-made document designs for billing and financial records offers a variety of advantages that can improve the efficiency of your business operations. These pre-built structures save time, reduce errors, and ensure consistency across all your transactions. Whether you’re just starting out or need to streamline your existing processes, these resources provide a simple, cost-effective solution.

- Time-saving: Ready-made formats eliminate the need to create documents from scratch, allowing you to focus on other important aspects of your business.

- Consistency: Using a standardized layout helps maintain uniformity in your records, ensuring a professional and cohesive look for all your communications.

- Cost-effective: These resources are often available at no cost, meaning you can maintain professionalism without having to invest in expensive software or design services.

Additionally, these tools often come with customizable features, enabling you to tailor each document to meet specific requirements. Whether you need to adjust payment terms, add services, or include client-specific details, these options make the process flexible and adaptable.

- Customization: You can easily adjust key elements like payment due dates, pricing, and client contact details.

- Professionalism: Pre-designed formats help ensure that your documents always appear polished and well-organized, reflecting the seriousness of your business.

Ultimately, using these pre-made designs allows for quick and efficient document generation, which can enhance your workflow and improve client satisfaction.

Top Sources for Free Invoice Templates

There are many online platforms offering ready-to-use designs for generating billing documents. These resources are perfect for individuals and businesses looking to streamline their financial record-keeping process. By choosing the right source, you can access a wide variety of layouts that suit your specific needs without the hassle of creating custom documents from scratch.

1. Online Business Tools

Several online business management platforms provide easy access to downloadable document layouts. These websites often allow you to customize fields like client names, services rendered, and payment terms, making them ideal for anyone who wants to stay organized without investing in software.

- Example platforms: Zoho, FreshBooks, and Wave

- These websites offer both basic and advanced formats tailored to different business needs.

- Many platforms also provide additional features like expense tracking, tax calculations, and client management.

2. Template Sharing Websites

Template sharing sites are another excellent option for finding various document designs. These sites usually provide a range of styles, from simple layouts to more complex ones with itemized breakdowns. Many are designed to be fully customizable to suit specific business models and industries.

- Popular options: Template.net, Vertex42, and Canva

- These platforms offer numerous formats for both personal and professional use.

- Templates from these sources are often easy to download and edit, ensuring you can quickly adapt them to your needs.

By exploring these sources, you can find the right format that suits your business requirements and improves your overall efficiency.

How to Customize Your Invoice Template

Customizing your billing documents is essential to reflect your brand, streamline your process, and ensure that all necessary details are included. Whether you’re adjusting layout elements or adding your own business information, personalizing the design can make your documents look more professional and tailored to your needs. This section covers key steps to easily customize pre-made layouts and adapt them to your specific requirements.

1. Add Your Business Details

The first step in customization is to incorporate your company’s essential information. This includes your business name, logo, contact details, and payment terms. Having this information at the top ensures that clients can easily identify who the document is from and how to get in touch.

- Logo: Place your logo at the top of the document to create a professional and cohesive look.

- Business name: Ensure that your company’s name is clearly visible and stands out.

- Contact details: Include phone numbers, email addresses, and website links for easy communication.

2. Modify Fields for Flexibility

Most layouts allow you to modify various fields such as services provided, quantities, pricing, and taxes. You can personalize these areas based on the specifics of each transaction, ensuring that no detail is missed and that all pricing is accurate.

- Item descriptions: Edit descriptions to suit the particular goods or services offered in the current transaction.

- Pricing: Adjust the unit price, quantity, and total cost for each item as needed.

- Payment terms: Specify payment deadlines, methods, or discounts offered to clients.

With these simple adjustments, your document becomes fully personalized and ready to send, enhancing both the clarity and professionalism of your billing process.

Common Mistakes in Invoice Creation

Creating accurate and clear billing documents is essential for smooth transactions and professional relationships with clients. However, there are several common mistakes that can lead to confusion, delayed payments, or even lost business. By being aware of these errors, you can ensure that your documents are always accurate and effective in conveying the necessary details.

1. Missing or Incorrect Contact Information

One of the most common errors is failing to include the correct contact details. If clients cannot easily reach you or identify who sent the document, it can delay payments or lead to misunderstandings.

- Ensure your business name, address, phone number, and email are clearly visible.

- Double-check that the recipient’s details are correct.

- Include multiple contact methods to make communication easy.

2. Overlooking Payment Terms

Clearly outlining payment terms is crucial. Without specifying due dates, late fees, or acceptable payment methods, clients may not prioritize payment or could be unsure of what is expected.

- Always specify a clear due date for payment.

- Clarify the payment method (e.g., bank transfer, PayPal, check).

- Include information about late fees or penalties for overdue payments.

By paying attention to these details, you can prevent delays, improve cash flow, and avoid unnecessary confusion in your billing process.

How to Add Payment Terms to an Invoice

Clearly stating payment terms in your financial documents is essential for maintaining a professional relationship with clients and ensuring timely payments. By defining the expectations upfront, you eliminate any ambiguity about when and how payments should be made. Here’s a guide on how to properly add payment conditions to your billing documents.

1. Specify the Payment Due Date

One of the first things to include is the due date. This lets your client know the exact time frame within which payment should be made. A clear deadline helps prevent confusion and ensures you are paid on time.

- Example: “Payment is due within 30 days from the date of issue.”

- Use specific dates: Instead of “due in 30 days,” you can specify the exact due date, such as “Due by December 15, 2024.”

2. List Accepted Payment Methods

Make it clear which methods of payment are acceptable, such as bank transfer, credit card, PayPal, or checks. This helps clients choose the most convenient option and reduces the chance of payment delays due to confusion about payment methods.

- Example: “Payments can be made via bank transfer, credit card, or PayPal.”

- Provide account details: If necessary, include your bank account number or PayPal information for easy reference.

3. Include Late Payment Fees

If you wish to enforce penalties for late payments, be sure to include this information upfront. Late fees act as a deterrent and encourage prompt payments.

- Example: “A late fee of 5% will be applied for payments received after the due date.”

- Clarify terms: Ensure the fee is calculated clearly (e.g., as a per

Best Practices for Invoicing Clients

Creating clear, professional billing documents is crucial for maintaining healthy cash flow and strong client relationships. By following best practices, you can ensure that your financial records are accurate, easy to understand, and encourage timely payments. The following guidelines can help you establish an efficient invoicing process that benefits both you and your clients.

1. Be Clear and Transparent

Ambiguity in your billing records can lead to confusion and delays. It’s important to clearly outline all the necessary details, including services provided, pricing, and payment terms. This will ensure that clients know exactly what they are paying for and when payment is due.

- Provide a detailed breakdown: List individual services, quantities, and rates so clients can see how the total amount was calculated.

- Specify payment deadlines: Make sure the payment due date is prominent, so clients know when to pay.

- Include clear payment terms: State the acceptable payment methods and any late fees for overdue payments.

2. Send Invoices Promptly

Timely submission of your billing documents helps ensure that clients can process payments on schedule. Sending invoices right after completing a project or delivering goods reduces the likelihood of delays and improves cash flow.

- Send invoices as soon as possible: Don’t wait too long after completing the work–this increases the chances of receiving prompt payment.

- Use automated reminders: Set up automated follow-up emails to remind clients when payment is approaching or overdue.

3. Maintain Consistency

Using a standardized format for your billing documents helps reinforce your brand and makes the process easier for both you and your clients. Consistency in layout, language, and terms ensures that clients can quickly understand the details of every document you send.

- Use the same format for each document: Whether you’re using a digital or printed format, make sure the layout remains consistent.

- Include your logo and branding: This helps maintain a professional appearance and promotes your business identity.

- Due Date: Clearly mention the deadline for payment to avoid delays.

- Payment Method: List the acceptable forms of payment, such as bank transfer, credit card, or PayPal.

- Late Fees: Include any penalties for overdue payments to encourage timely settlement.

- No additional expenses: Access templates without paying for premium design tools or subscriptions.

- Save on design services: Avoid the cost of hiring graphic designers or purchasing custom-built solutions.

- Quick customization: Easily adjust fields for pricing, services, or client details.

- Ready for use: Start using the layout immediately without spending time designing or formatting.

- Standardized layout: These designs follow industry best practices, ensuring your documents are well-organized.

- Customizable for branding: Easily incorporate your business logo, colors, and fonts to match your brand identity.

- Pre-set fields: With most templates, fields for dates, services, pricing, and contact information are already included.

- Simple updates: Modify quantities, descriptions, or amounts without altering the layout each time.

- Eliminate formatting issues: No need to worry about aligning text or images correctly every time.

- Save design time: With a standardized layout, you can quickly generate documents without redesigning them each time.

- Auto-fill options: Link your database to automatically input client information, reducing errors and time spent typing.

- Streamlined workflows: Set up automated wor

How to Convert Invoice Templates to PDF

Converting your billing documents into a universally accessible format, like PDF, ensures that your records are easy to share, view, and store without compromising on quality. This process also guarantees that the formatting remains intact, no matter what device or platform is used to open the document. Here’s how to quickly and efficiently convert your prepared records into a PDF format.

1. Using Built-in Export Options

Many document creation tools, including word processors and online platforms, offer built-in options to save or export your work as a PDF. This is often the easiest and most direct method.

- Microsoft Word or Google Docs: After entering your details, simply go to the “File” menu and choose “Save As” or “Download,” then select PDF as the format.

- Online platforms: If you’re using an online service, look for an “Export” or “Download” button, usually located at the top or bottom of the page. PDF will be one of the file format options.

2. Using Print-to-PDF Feature

If your document creation tool doesn’t have an export option, you can use the built-in “Print to PDF” feature, which is available on most operating systems.

- Windows: Open your document and select “Print.” Choose “Microsoft Print to PDF” as the printer. Once printed, it will ask you where to save the file.

- Mac: In the print dialog, click the “PDF” button at the bottom-left corner and select “Save as PDF.”

3. Using Online Conversion Tools

If you have a document in another format (like Word, Excel, or an image) and need to convert it into a PDF, there are numerous free online tools available for this task. These tools are easy to use and don’t require you to install any software.

- Search for online converters: Websites like Smallpdf, PDF2Go, or ILovePDF offer free PDF conversion services.

- Upload and convert: Simply upload your document, and the tool will automatically convert it to a PDF format, which you can then download to your device.

By following these methods, you can quickly convert your financial records into a PDF, ma

Free Invoice Templates for Different Industries

Businesses across various sectors have unique needs when it comes to financial documents. Whether you’re in consulting, retail, construction, or creative services, having the right format is essential for maintaining clarity and professionalism. Different industries often require specialized fields to capture the details of transactions accurately, and using the appropriate layout can save time and ensure accuracy. Below are some options tailored to specific industries that can help streamline the billing process.

1. Consulting and Professional Services

For consultants and other service-based professionals, it’s important to highlight the time spent or project phases completed. A simple, clean layout works best to break down billable hours or service milestones.

- Time-based billing: Include a section for tracking hours worked, hourly rates, and total due based on the time spent.

- Project milestones: If billing by project, create sections to indicate work completed by specific milestones or deliverables.

2. Retail and E-Commerce

Retail and online businesses often deal with product-based transactions. In this case, having fields for item descriptions, quantities, and unit prices is essential. The design should be simple to allow easy listing of products or services sold.

- Itemized list: Include a breakdown of each product or service, with descriptions, quantities, and individual prices.

- Shipping details: Ensure that shipping charges or handling fees are listed clearly, if applicable.

3. Construction and Contractors

In the construction industry, invoices often need to account for materials, labor, and other specific costs. The template should clearly distinguish between different types of charges and provide space for additional notes related to projects.

- Material costs: Include separate sections for labor and material costs, as well as any additional expenses incurred during the project.

- Work completion dates: Clearly indicate the scope of work completed and the dates on which the work was finished.

4. Creative Services (Design, Photography, etc.)

For creative professionals, such as photographers, graphic designers, or videographers, invoices often need to reflect specific project work with clear descriptions of services provided. These layouts may also include space for licensing terms or digital delivery notes.

- Project details: Include sections for sp

How to Track Payments Using Templates

Efficiently managing and tracking payments is crucial for maintaining a smooth cash flow in any business. By using structured documents, you can easily keep track of which clients have paid, which invoices are still pending, and any overdue balances. Organizing payment information within these documents helps reduce the risk of errors and improves your overall accounting processes. Below are several strategies for tracking payments using structured billing formats.

1. Include Payment Status Fields

One of the easiest ways to track payments is by adding a field specifically dedicated to tracking the payment status of each transaction. This field should be updated as soon as a payment is received, making it easy to see at a glance whether an invoice is paid, partially paid, or still outstanding.

- Paid: Mark this when the full amount has been received.

- Partially Paid: Use this if a client has made a partial payment but still owes a balance.

- Unpaid: Leave this status if no payment has been received by the due date.

2. Set Up Due Dates and Payment Deadlines

Setting clear due dates in your billing documents can help you track when payments are expected. This is especially important for keeping on top of overdue payments. You can use a simple reminder system to follow up with clients who have missed the deadline.

- Due Date: Include a field for the payment due date on each document.

- Late Fee Clause: If applicable, add a late fee to any overdue amounts to encourage timely payments.

3. Use Running Balance or Payment History

For clients with multiple transactions or ongoing services, maintaining a running balance or payment history is key. You can add columns or rows that show the previous balance, any payments made, and the current balance. This allows both you and the client to easily track how much has been paid and how much is still owed.

- When to Use Digital vs Printable Templates

- Easy Sharing: Digital records can be quickly emailed or shared via cloud storage services like Google Drive or Dropbox.

- Storage Efficiency: Digital formats take up less physical space and can be organized in folders, making it easier to manage large volumes of documents.

- Automated Tracking: When using digital formats, it’s easy to integrate your records with accounting software, helping automate processes like payment tracking and report generation.

- In-Person Transactions: If you are meeting clients in person, providing a printed copy of the document may feel more personal and professional.

- Legal or Tax Purposes: In some cases, printed copies may be required for legal documentation or for tax filing.

- Client Preference: Some clients may prefer receiving a hard copy for their own records, particularly if they are not comfortable with digital formats.

- PDF Files: Most PDF creation tools allow you to add a password before saving the document. This ensures that only those with the correct password can open or edit the document.

- Word Processors: Document editing tools like Microsoft Word or Google Docs also offer password protection features. Always set strong, unique passwords for sensitive files.

- Convert to PDF: Once you’ve completed the billing document, convert it into a PDF file before sending it to clients. This will prevent them from making any unwanted edits.

- Disable Editing: When creating a document in a word processor, disable the editing function or limit changes to only specific sections if necessary.

- Digital Signatures: Tools like Adobe Acrobat or DocuSign allow you to add a

Choosing between digital and printable formats for your financial records depends on several factors, including how you intend to share, store, and manage the documents. Each format has its advantages, and understanding when to use each one can help streamline your processes and ensure that your documents are both effective and professional. Below, we’ll explore the key situations in which you might choose one over the other.

1. When to Use Digital Formats

Digital formats are ideal for businesses that need to send, store, or manage documents electronically. They offer the flexibility of easy sharing, automatic filing, and quick access to records, making them the preferred choice for most modern businesses.

2. When to Use Printable Formats

Printable formats are beneficial when physical copies are needed for in-person transactions, legal requirements, or when clients specifically request paper documentation. Printed versions provide a tangible document that can be stored in physical files or handed directly to clients.

Ultimately, the decision to use a digital or printed format depends on your specific business needs and the preferences of your clients. Many businesses use both formats, offering digital records for convenience while printing hard copies for formal or legal purposes.

How to Protect Your Invoice Templates

Protecting your business documents is crucial to maintain confidentiality and prevent unauthorized access or alterations. Your billing forms are sensitive, containing important financial and client information, so securing them is essential for both privacy and compliance. Here are several strategies to help ensure that your financial documents are protected from unauthorized use or tampering.

1. Use Password Protection

Password protection is one of the simplest ways to secure your documents, especially when sharing them electronically. By encrypting your files with a password, you can ensure that only authorized individuals can access them.

2. Avoid Editable Formats

Another way to protect your records is by converting editable documents into a non-editable format, like a PDF. This reduces the risk of unauthorized changes to the content.

3. Use Digital Signatures

Digital signatures provide an additional layer of protection by ensuring that the document hasn’t been tampered with after it’s been signed. They also authenticate the sender, giving clients assurance that the document is legitimate.

Key Information to Include in Invoices

For any billing document to be effective, it must contain all the necessary details that allow both parties to understand the terms of the transaction. Clear and accurate information ensures timely payments and helps avoid confusion. The following sections outline the most important elements to include, so your financial records are both comprehensive and professional.

1. Business and Client Information

It’s essential to include clear contact details for both parties involved. This helps avoid confusion and ensures that the document reaches the correct person. Always double-check that the names, addresses, and contact information are correct.

Item Description Sender’s Information Business name, address, phone number, and email. Recipient’s Information Client’s name, company (if applicable), address, phone number, and email. 2. Details of Products or Services

Clearly listing the services rendered or products provided ensures transparency and reduces the chance of misunderstandings. Each item should be broken down with the appropriate quantity, rate, and description.

Item Description Quantity Unit Price Total Service Description or Product Number of units or hours Price per unit Total price for the item 3. Payment Terms and Deadlines

It’s critical to clearly state when and how the payment should be made. This includes specifying the due date, payment method, and any additional fees for late payments.

By ensuring that these key e

Why Free Templates Are Perfect for Small Businesses

For small businesses, keeping costs low while maintaining professionalism is crucial. Utilizing ready-made designs for your financial documents offers a cost-effective solution without sacrificing quality. These resources are simple to use, customizable, and provide all the essential elements to ensure your documents look polished and organized. Below are some reasons why these ready-made designs are ideal for small businesses.

1. Cost-Effective Solution

Small businesses often operate with limited budgets. Opting for pre-designed layouts eliminates the need to invest in expensive software or hire a designer. These tools are available at no cost, allowing you to allocate resources to other areas of your business.

2. Time-Saving and Easy to Use

Using a pre-made layout significantly reduces the time spent on creating documents from scratch. Many platforms offer user-friendly tools that allow you to quickly input your information and generate professional-looking records. This lets small business owners focus on core activities rather than administrative tasks.

3. Professional Appearance

Even with a tight budget, it’s important to present a professional image to your clients. Pre-made designs ensure that your documents look consistent, neat, and formal, which can help build trust and credibility with customers.

By using these ready-made solutions, small business owners can maintain a high level of professionalism without spending unnecessary time or money. Whether you’re just starting or trying to streamline operations, these resources offer the perfect balance of convenience and functionality.

How to Save Time with Invoice Templates

Managing your financial documentation can be time-consuming, especially when you need to create customized records for each transaction. However, by utilizing pre-designed structures, you can significantly reduce the time spent on creating and formatting these documents. Below, we’ll explore how using ready-made designs can streamline your billing process and make it more efficient.

1. Quick Customization

One of the biggest advantages of using pre-designed documents is the ability to customize them quickly. You don’t need to start from scratch each time, as most layouts allow you to input your business and client details in just a few simple steps. This process can be completed much faster than manually creating a document every time.

2. Consistent Formatting

Using ready-made structures ensures that your documents maintain a consistent look and feel, reducing the time spent formatting and adjusting design elements. Consistency across all your financial records is important for professionalism and saves you the hassle of starting over with each document.

3. Automation Tools and Integration

Many platforms offering pre-designed documents also integrate with other tools, such as accounting software or customer relationship management (CRM) systems. This integration allows you to automatically fill in client details, services, and pricing, reducing manual data entry and saving even more time.