Consulting Services Invoice Template to Streamline Your Billing

Managing financial documentation is essential in establishing trust and professionalism in client relations. A well-structured document makes it simple to outline completed tasks, specify rates, and establish clear expectations regarding payment. This approach helps both parties maintain transparency, avoiding potential misunderstandings and ensuring a seamless exchange of services.

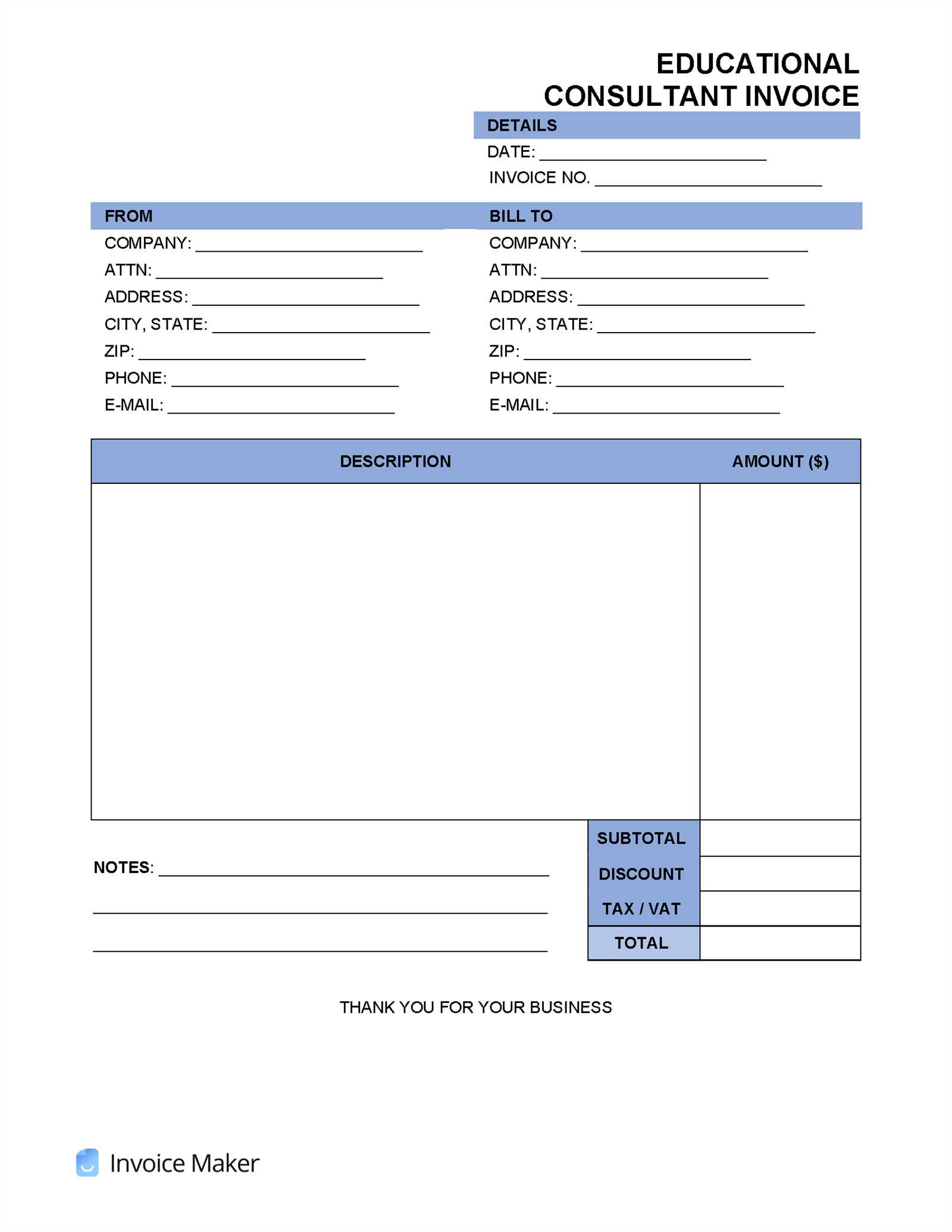

Professionals in the advisory field often have unique billing requirements due to the varied nature of their work. With customized documents tailored to these needs, professionals can highlight individual services, add detailed descriptions, and adjust pricing to reflect the scope and complexity of each project. This format ensures that each document is easy to understand, fully aligning with client expectations and industry standards.

Utilizing a tailored financial structure not only streamlines administrative tasks but also enhances a brand’s image by demonstrating thoroughness and reliability. By implementing adaptable, clear layouts, service

Professional Invoice Solutions for Consultants

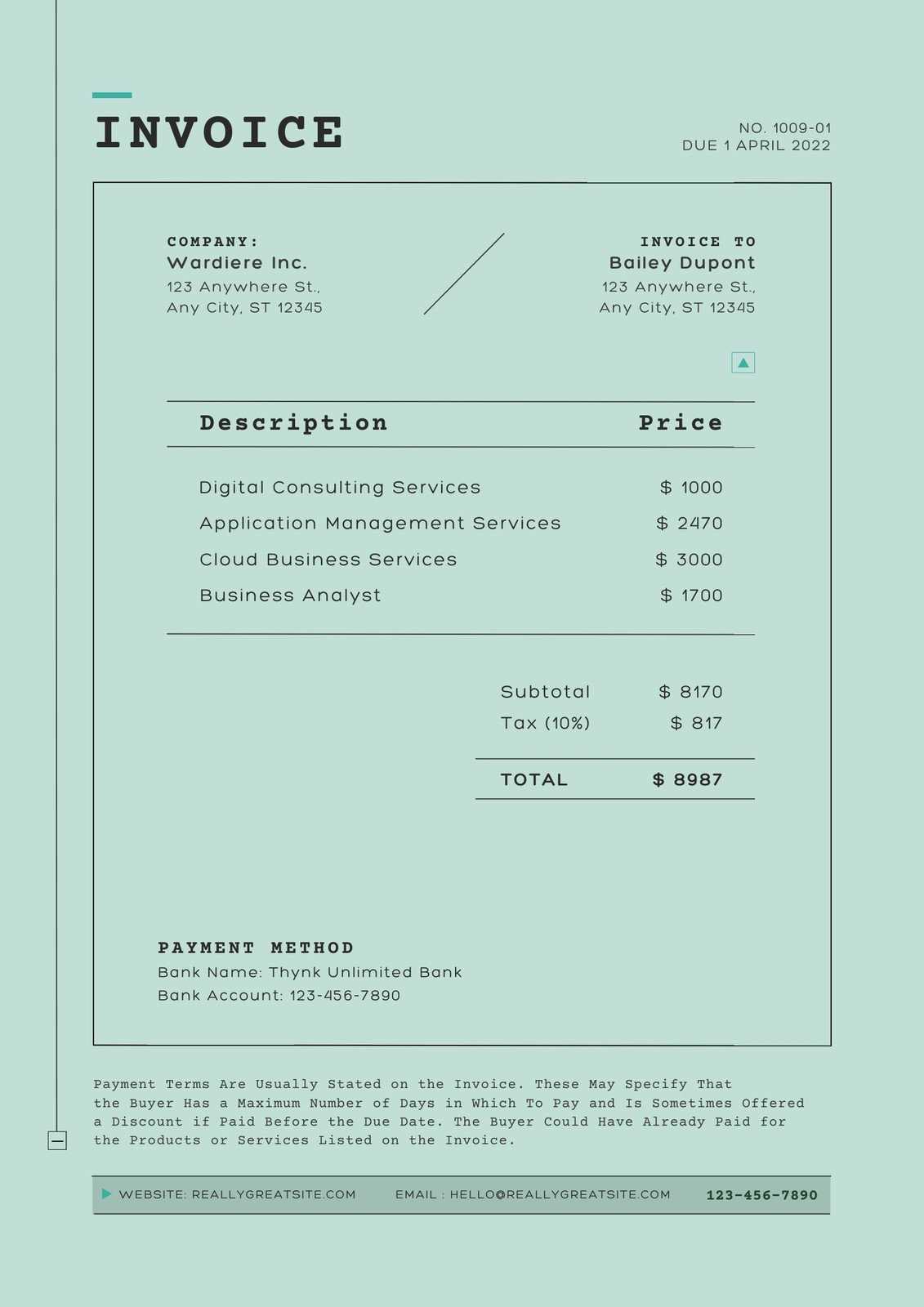

In the advisory field, having a tailored financial record-keeping process ensures clarity and consistency in every transaction. Such solutions allow advisors to maintain transparent communication with clients, specifying key details like project descriptions, charges, and payment schedules. This section explores essential components and best practices for structured financial documents that simplify interactions and enhance the professionalism of a brand.

Key Components of Structured Financial Documents

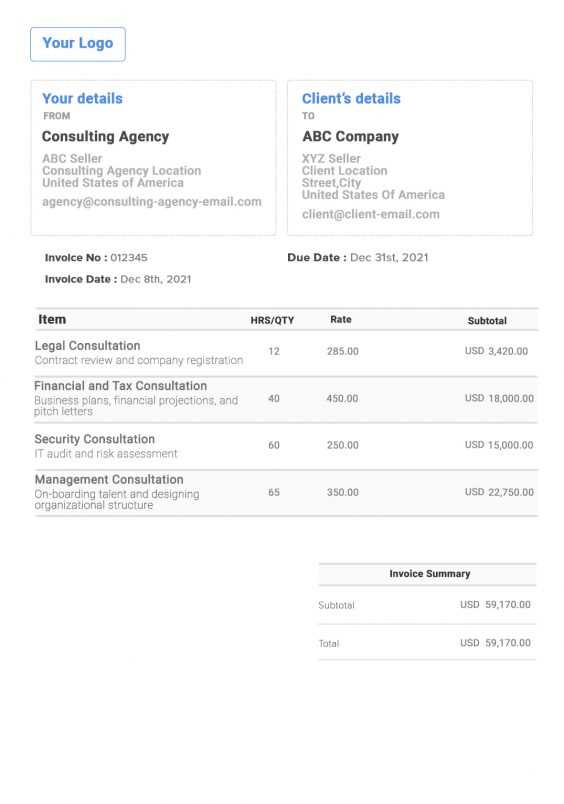

For any advisor, organizing information in a straightforward format can greatly impact how clients perceive their business. Essential elements to include range from project summaries and detailed service descriptions to clear calculations for rates and any applicable fees. Arranging these components logically helps both parties keep track of work progress and understand payment expectations.

| Component | Description | ||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client Details | Includes the client’s name, contact information, and any relevant project identifiers, ensuring that all records are accurately associated with the correct individual or organization. | ||||||||||||||||||||||||||||||||||||||||||

| Service Breakdown | Outlines

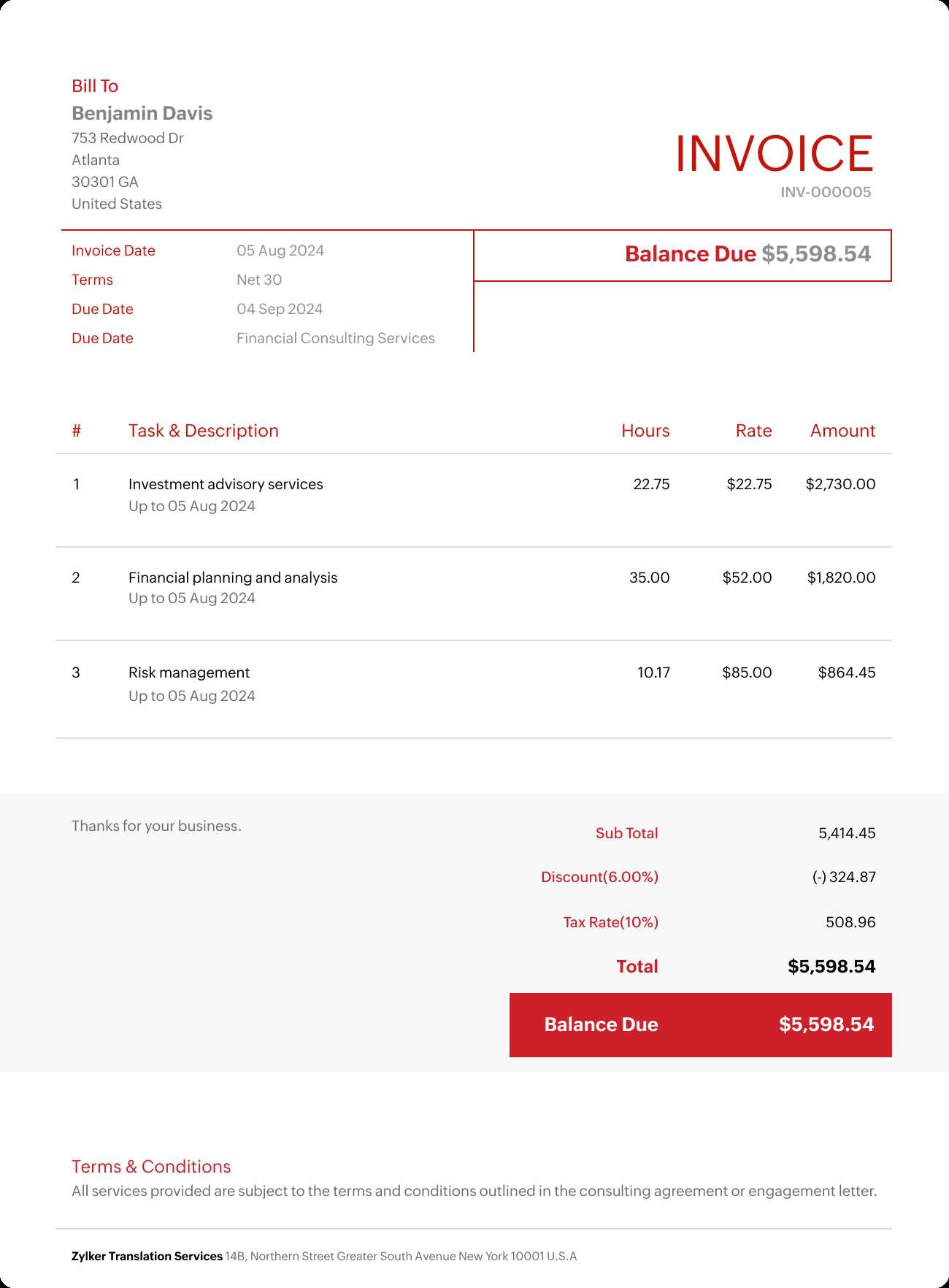

Creating Clear and Concise Client InvoicesPresenting a well-organized billing document is essential in building trust and ensuring a smooth payment process. By focusing on clarity and simplicity, advisors can avoid misunderstandings and facilitate prompt payments. Streamlined documentation also reflects a professional image, making it easier for clients to review and understand all the key details of the transaction. Structuring Information for Maximum ClarityOrganizing a billing document starts with an easy-to-read format. Each section should flow logically, with clear headers and brief descriptions that guide the client through the details of the completed work. Avoiding excessive technical language and using straightforward terms allows clients to quickly assess the information, reducing the chances of confusion or questions about the specifics. Highlighting Essential Details EffectivelyEach document should in Essential Elements of a Consulting InvoiceA successful billing document requires certain core elements to communicate all relevant details clearly and concisely. By including specific sections, advisors ensure transparency, making it easy for clients to understand the nature of the services provided, associated costs, and payment expectations. This structure minimizes the potential for misunderstandings and fosters a professional relationship between both parties. Key Client and Project Information

To begin, each document should feature clear client identification details, including the name, address, and contact information. Adding specific project details, such as a unique project name or code, can also help both the client and advisor quickly recognize the transaction. This information establishes the document’s legitimacy and serves as a record for future reference. Service Descriptions and Cost BreakdownA complete breakdown of each task performed provides clients with transparency regarding the services they are being billed for. This section should include short descriptions of each service, along with Effective Layouts for Service-Based BillingAn organized layout is key to creating a straightforward and efficient billing document. By arranging information logically, advisors can guide clients through each section effortlessly, enhancing clarity and reducing the time needed to process payments. Well-structured layouts not only ensure readability but also convey professionalism and attention to detail, essential in maintaining client trust. Key Sections for Clarity and TransparencyIncluding essential sections in a logical order is crucial for an easy-to-read billing document. The following components provide a clear roadmap for clients:

|