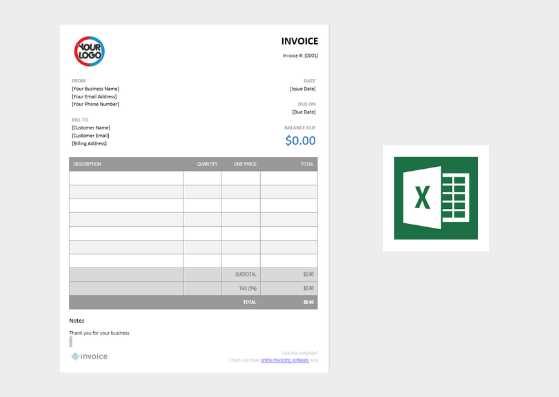

Sample Excel Invoice Template for Simple and Effective Billing

Managing financial transactions is a critical task for any business, and having the right tools can streamline the process significantly. A well-organized method for creating and tracking client payments ensures you stay on top of your finances. Whether you’re running a small startup or handling multiple accounts, simplifying invoicing can save time and reduce errors.

One effective approach is to use a customizable document that allows you to quickly generate professional payment requests. These files are designed to be flexible, enabling you to input the necessary details without complicated software. With the right setup, you can easily adapt them to fit your business needs, making the whole process more efficient.

By incorporating key features such as automatic calculations, clear formatting, and consistent structure, you can ensure that each billing statement is accurate and polished. The ability to modify these files on the go also offers a level of convenience, allowing you to maintain control over your invoicing even as your business evolves.

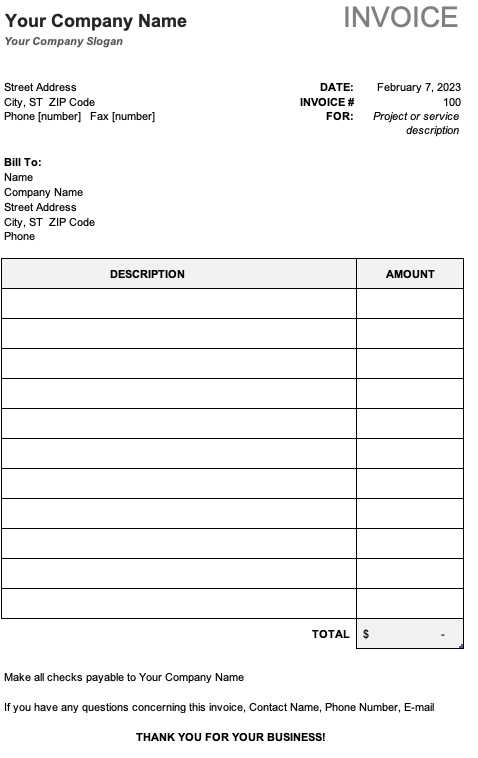

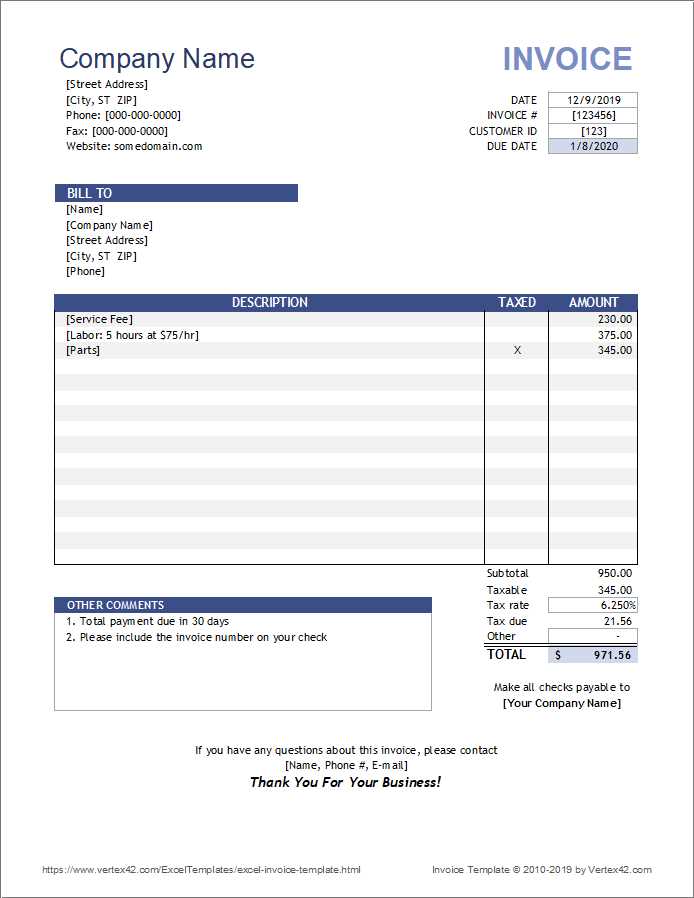

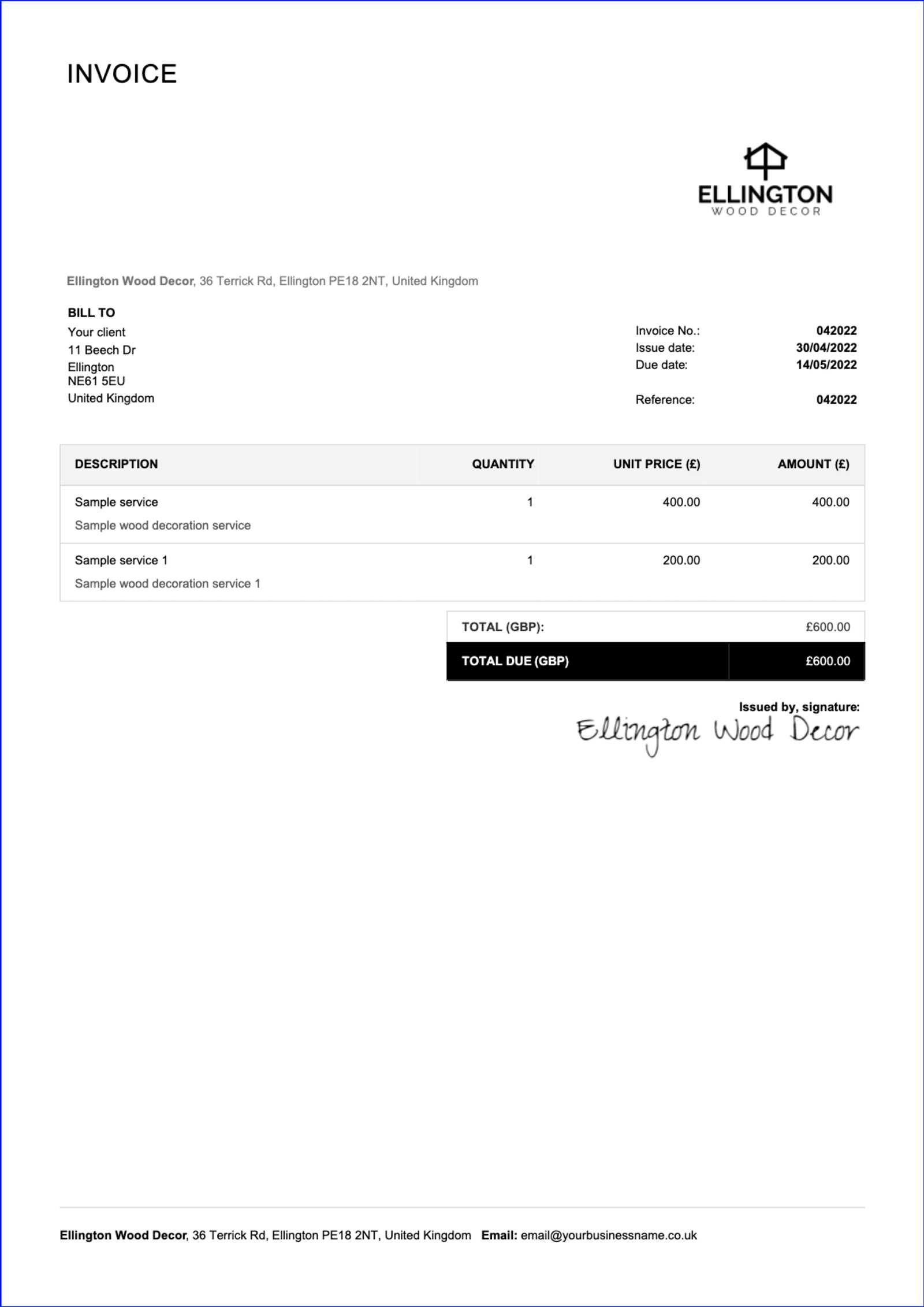

Sample Excel Invoice Template for Beginners

For those just starting their business journey or looking to improve their billing process, creating clear and professional payment requests can seem overwhelming. Fortunately, there are simple, customizable tools that can assist with this task. These tools enable users to generate accurate financial documents without the need for advanced software or extensive experience in accounting.

The key to success in this area is understanding how to create a straightforward and easy-to-use system. By focusing on basic elements such as client details, services provided, and payment terms, even beginners can efficiently produce the necessary documents for smooth transactions.

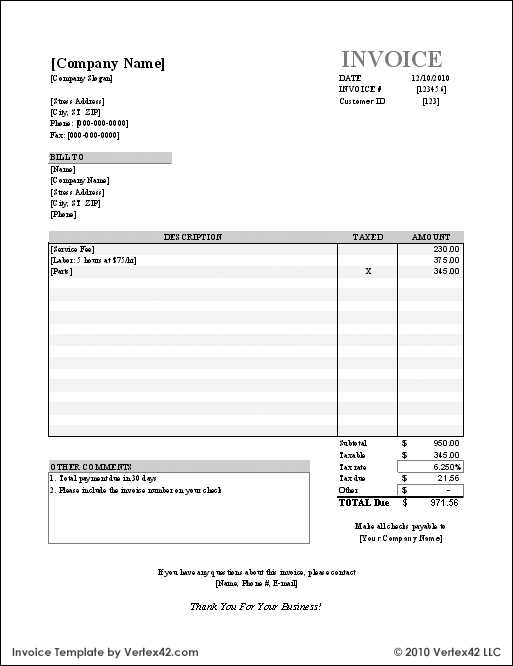

Basic Structure of a Billing Document

Here is a simple outline of what to include when setting up a basic billing form:

| Section | Details to Include |

|---|---|

| Header | Your business name, contact information, and invoice number |

| Client Information | Client’s name, address, and contact details |

| Service Description | List of products/services provided with quantities and pricing |

| Payment Terms | Due date, payment methods accepted, and late fees (if applicable) |

Creating Your Own Document

Once you have a general understanding of what should be included, the next step is to set up your file. Start with a clean, organized layout that is easy to modify. Most people new to the process find it helpful to begin with a pre-built structure that can be adjusted to fit specific needs. By using the right software, you can easily make changes as your business grows or as payment structures change.

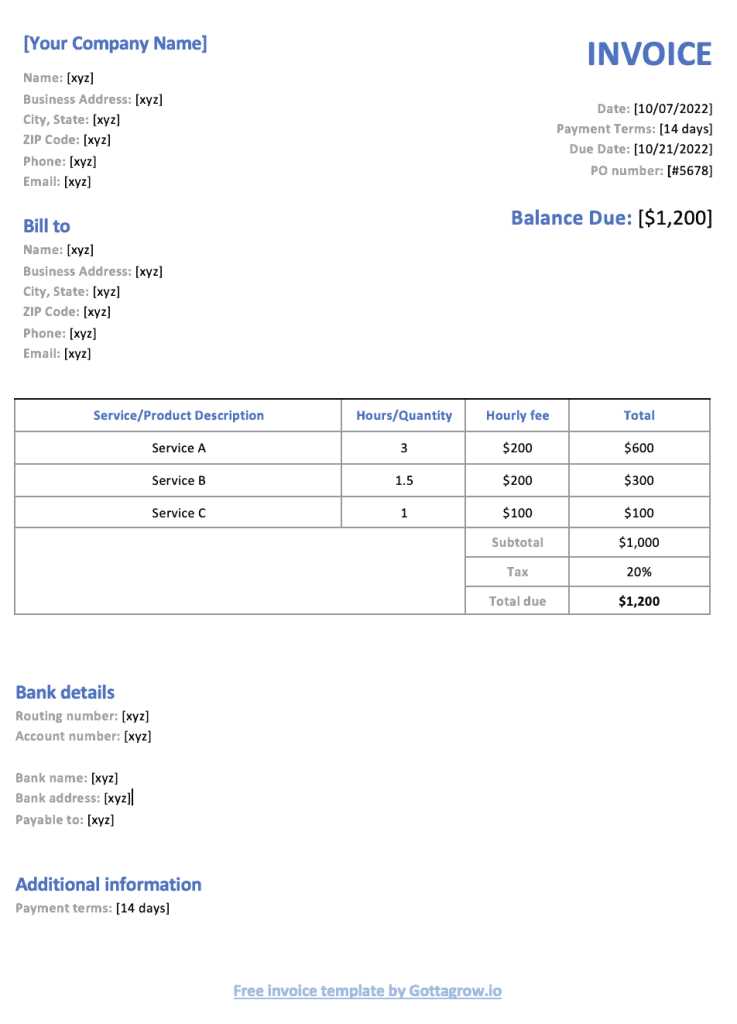

How to Use an Excel Invoice Template

For businesses looking to streamline their billing process, using a pre-designed file for generating payment requests can save time and reduce errors. These tools are designed to be user-friendly and customizable, allowing users to quickly fill in necessary details and produce professional-looking documents. Learning how to effectively utilize such a system can make managing payments simpler and more efficient.

To begin, open the file and start by entering your company’s information, such as your name, address, and contact details. This will ensure that all communication related to the payment is clear and consistent. Once this is set up, you can move on to adding client-specific information, including their name, address, and any relevant payment terms.

The next step is to detail the products or services provided. In most cases, you will need to list each item, its quantity, and the price. These documents often feature built-in calculation fields, making it easier to automatically calculate totals and apply taxes or discounts. This reduces the chances of errors and helps to ensure accurate final amounts.

Once the document is filled in, review all sections to make sure everything is correct. The final step is to save the document and send it to the client. You can either email it as an attachment or print it for physical delivery. With a few simple steps, you can create a clear, professional billing statement that will help you manage payments smoothly.

Why Choose Excel for Invoicing

When it comes to creating financial documents, simplicity and flexibility are key. For many small businesses and freelancers, using a spreadsheet program to generate billing statements offers a range of benefits that make the process faster and more efficient. These tools are accessible, easy to customize, and provide powerful features that can help ensure accuracy in each transaction.

One of the main advantages is the ability to automate calculations. A well-structured file can automatically add totals, apply taxes, and even calculate discounts, saving you from manual entry and reducing the likelihood of errors. This is especially useful when working with multiple clients or a high volume of transactions, as it allows for quick updates and changes.

Another reason to choose this method is the flexibility it offers. Unlike specialized invoicing software, which may have a set structure or require a subscription, spreadsheet programs give you the freedom to design your own layout, add or remove fields, and adjust formulas as needed. This makes it an ideal solution for businesses of all sizes and industries.

Additionally, spreadsheet files are easy to share and store. You can save them on your computer, email them to clients, or even store them in the cloud for access anywhere. This level of convenience is unmatched by traditional paper billing or more complex software, making it an excellent choice for businesses looking to streamline their accounting process.

Step-by-Step Guide to Customizing Templates

Customizing a billing document allows you to tailor it to your specific needs and preferences. Whether you’re adapting a pre-designed file or creating one from scratch, the process is straightforward and helps ensure that all the necessary information is included. With a few simple steps, you can create a professional-looking payment request that aligns with your brand and business requirements.

First, open the file you plan to customize. The basic structure should already be in place, with sections for your business information, client details, and line items. Start by updating your business name, logo, and contact information in the header. This will ensure your clients always know how to reach you if they have any questions or concerns regarding the payment.

Next, update the client’s details in the appropriate fields. Be sure to enter their full name, address, and contact information. This will ensure that the document is personalized for each client and helps avoid any confusion in case the payment is delayed or there are issues with the transaction.

Afterward, move on to adding the specific products or services provided. For each item, list the quantity, price, and any relevant descriptions. Most billing systems allow you to add tax calculations and apply discounts automatically, which will make the process even easier. Make sure all line items are accurate and reflect the work you’ve done or the products you’ve sold.

Once all the data is entered, review the document for any errors. Check the totals, confirm that taxes are applied correctly, and ensure that payment terms are clear. You can adjust the layout and formatting to suit your preferences, such as changing font sizes or adding color for better readability. When you’re satisfied with the results, save the file and it’s ready to be sent to your client.

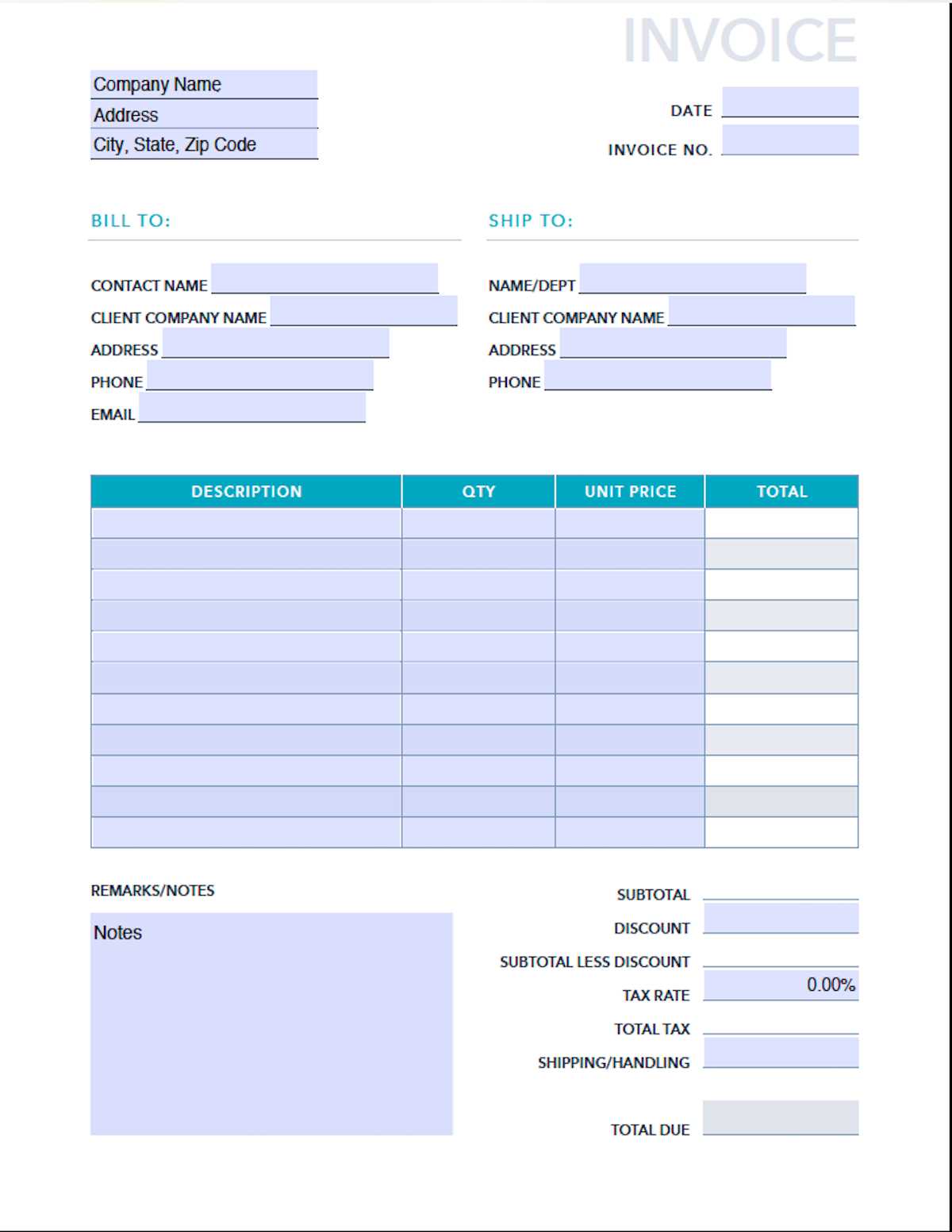

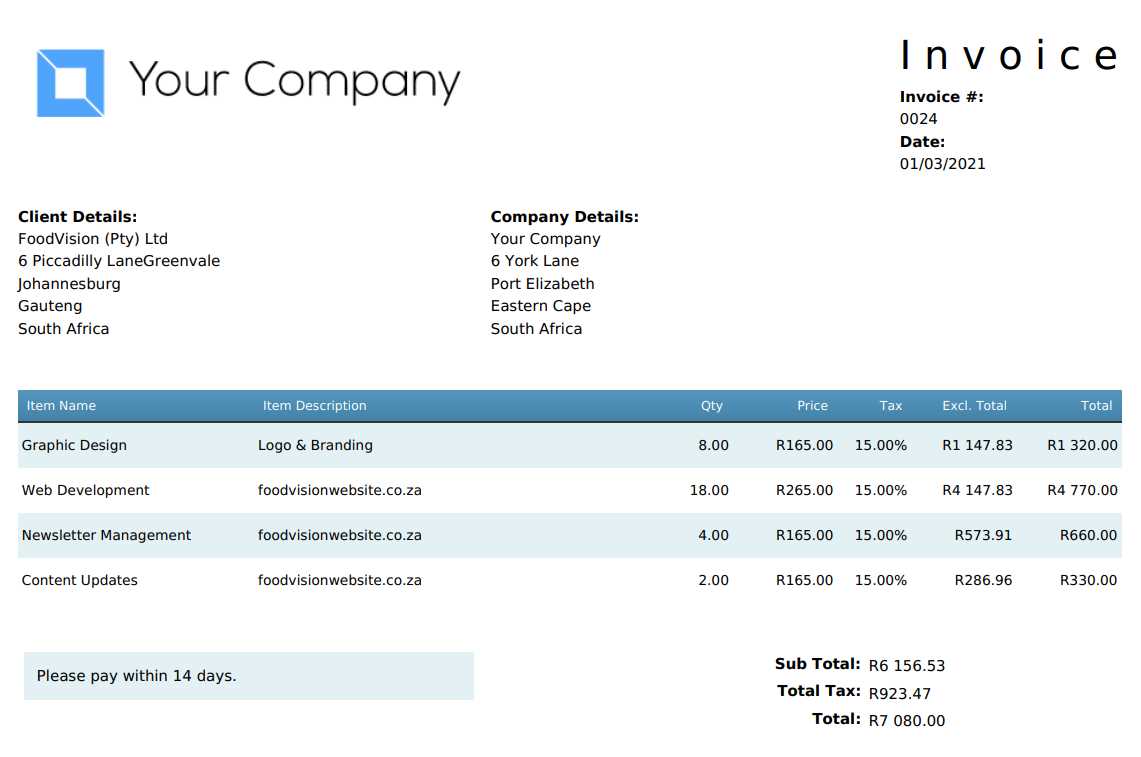

Essential Features in an Invoice Template

When creating a payment document, certain elements are crucial for ensuring clarity, accuracy, and professionalism. A well-structured document helps avoid confusion and provides both the sender and recipient with all the necessary details to process a transaction smoothly. Whether you’re using a ready-made file or building one from scratch, understanding the essential features can help you design an effective and comprehensive bill.

The first important feature is the inclusion of your business information, such as your name, address, and contact details. This section helps establish your identity and makes it easy for the recipient to reach you if any questions arise about the payment. Additionally, ensure that your document has a unique reference number for easy tracking and record-keeping.

Another key component is the section for client information. You should include the recipient’s full name, address, and contact details to avoid any confusion. Having accurate details ensures that the payment is directed to the right person and can help with any follow-up communications.

One of the most critical aspects is the breakdown of goods or services provided. Each item should be listed with a brief description, quantity, unit price, and the total amount for each line. This section needs to be clear and concise to avoid misunderstandings about the charges. Additionally, incorporating automatic calculations for totals and taxes will save time and reduce the chances of errors.

Lastly, make sure to include payment terms, such as the due date, acceptable payment methods, and any late fees or penalties that might apply. This sets clear expectations and helps ensure timely payments. By including these essential features, your document will be organized, professional, and easy to process for both parties involved.

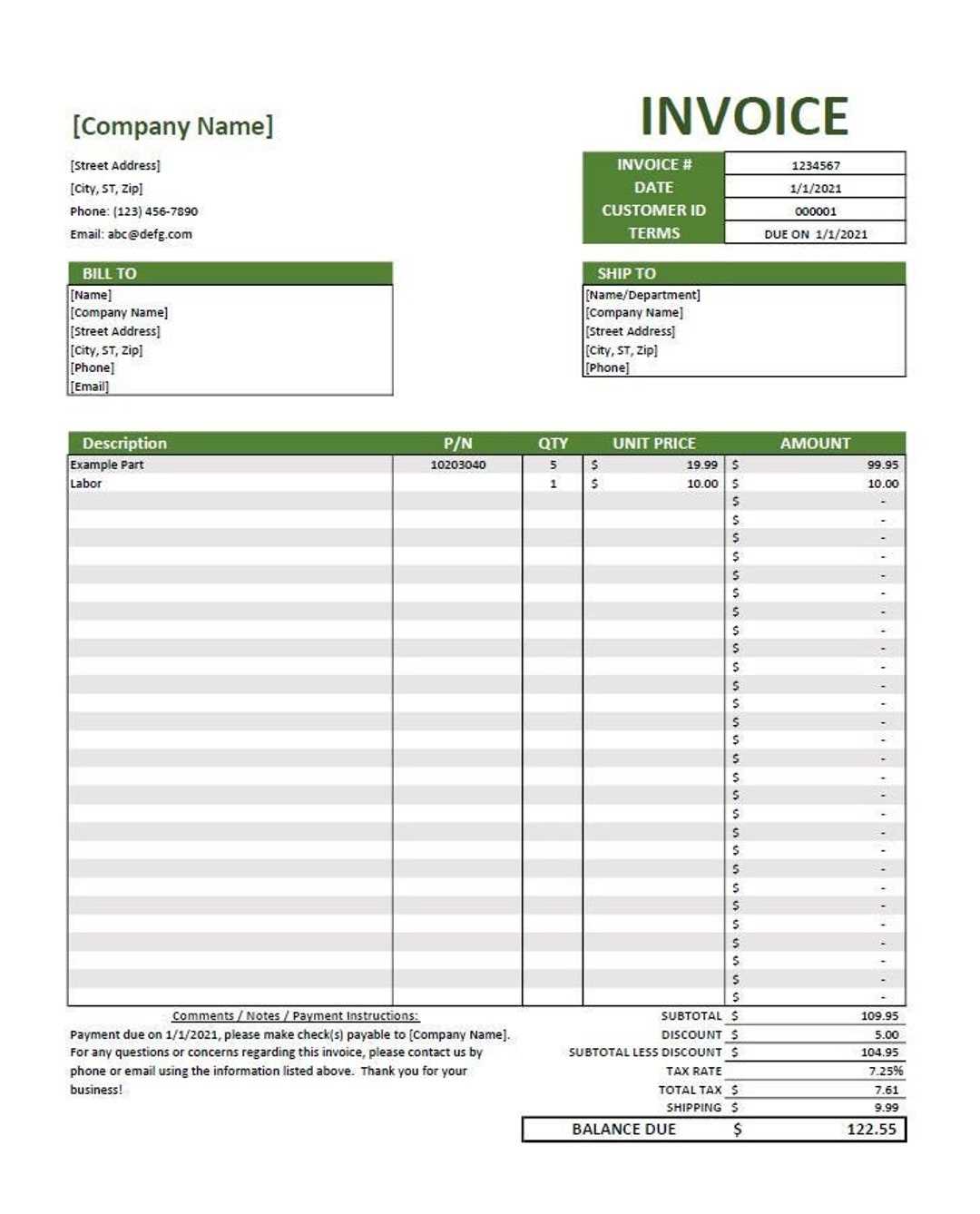

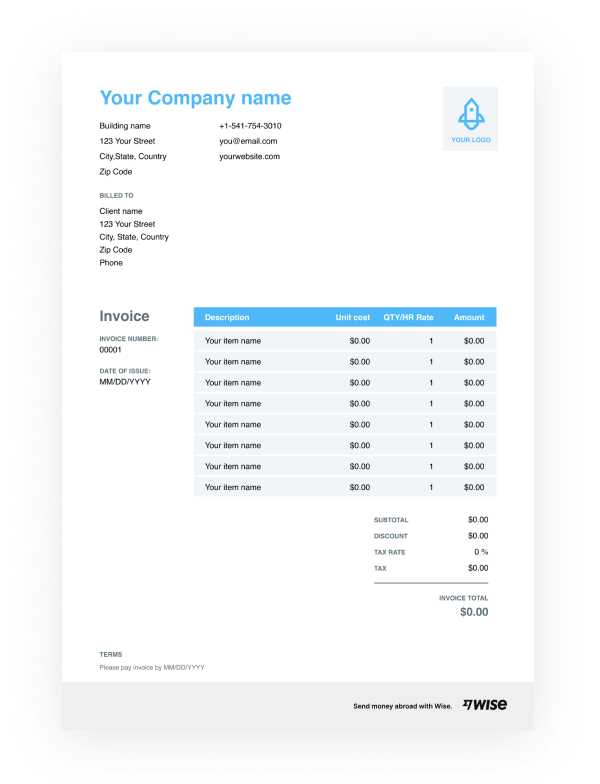

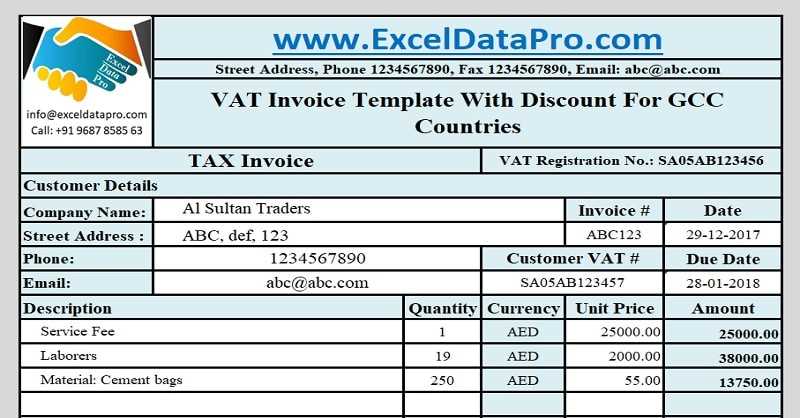

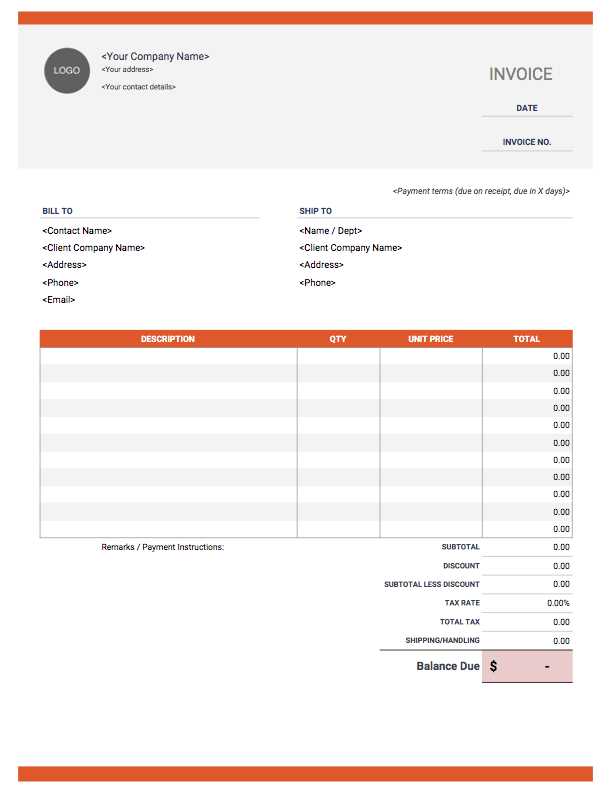

Free Excel Invoice Templates Available Online

For those looking to simplify the billing process, there are many resources available online that offer customizable files for creating payment requests. These documents come in various formats and designs, allowing businesses of all sizes to find a style that best suits their needs. Whether you’re a freelancer or a small business owner, these free options can help you generate professional billing statements without the need for complex software or a steep learning curve.

Most online platforms offer a wide range of designs, each with built-in calculations and organized fields that allow for quick adjustments. You can easily download and modify these files to reflect your business details, client information, and the specifics of your transactions. This can save you both time and money while ensuring that your bills are accurate and consistent.

Here are some common types of files you can find online:

| Type | Features |

|---|---|

| Simple Billing Form | Basic layout with fields for item descriptions, quantities, and prices |

| Detailed Invoice | Includes sections for taxes, discounts, and payment terms |

| Professional Design | Stylized formats with advanced layout options for businesses |

| Freelancer-Specific | Includes hourly rates, project breakdown, and total calculations |

By downloading these free resources, you can create well-organized, error-free payment documents in no time. This option is especially valuable for businesses that want to avoid the costs of expensive software while still maintaining a professional appearance in their financial communications.

How to Automate Invoice Creation in Excel

Automating the process of creating billing statements can significantly reduce the time spent on manual data entry and help ensure accuracy. By setting up automated calculations and templates, you can generate consistent and professional payment requests with minimal effort. This is particularly useful when dealing with recurring clients or orders, where many of the details remain the same from one transaction to the next.

One of the key elements of automating this process is setting up formulas for totals, taxes, and discounts. These formulas can be used to calculate the final amount due based on the quantities and prices you input. Once set up, you only need to enter the relevant product or service details for each client, and the document will update automatically.

Setting Up Formulas for Automated Calculations

To automate calculations, start by using basic formulas like SUM and multiplication. For example, in the “Quantity” column, enter the number of items, and in the “Price” column, input the cost of each item. In the next column, you can multiply these values to get the total for that line item. Then, use a SUM formula to add up all the totals for an overall sum.

Adding Tax and Discount Calculations

To add tax, simply input a formula that multiplies the subtotal by the applicable tax rate. For discounts, you can create a conditional formula that applies a percentage discount based on certain criteria, such as a specific order value or promotional offer. Once these formulas are set up, the document will automatically adjust for taxes and discounts, making it much easier to handle changing rates or promotions.

By leveraging these basic functions, you can fully automate the creation of billing statements, saving time and reducing errors. This makes the entire invoicing process faster and more efficient, while ensuring that each document is accurate and consistent.

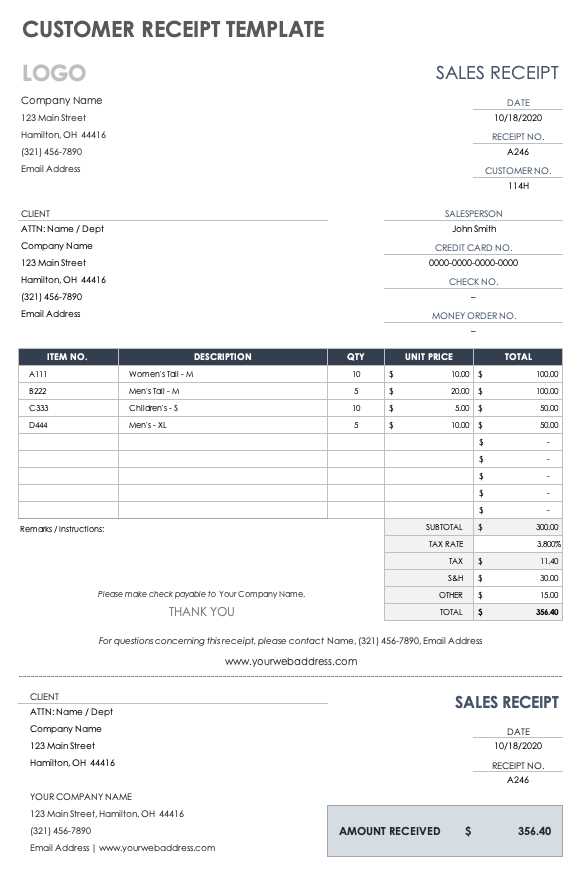

Best Practices for Designing Invoices

Creating a professional and clear payment request is essential for maintaining good business relationships and ensuring timely payments. Well-designed documents not only help with clarity but also enhance your brand’s image. When designing these financial documents, it’s important to follow best practices that ensure both functionality and aesthetic appeal, making the billing process smooth and efficient.

Clear Layout and Readability

The design of your document should prioritize clarity. Keep the layout simple and organized, with easily distinguishable sections for client information, services or products provided, and payment details. Use bold headers and sufficient spacing between sections to ensure that the document is easy to read. A clean, minimalist design is often more effective than a cluttered one, as it helps clients quickly find the necessary information.

Consistency and Branding

Maintaining consistency in design is crucial for professionalism. Ensure that your document includes your company’s logo, name, and contact information at the top. Use the same fonts, colors, and styling across all your financial documents to create a cohesive look. Incorporating your brand’s colors or fonts can help reinforce your business identity and make the document feel more personalized.

Additionally, ensure that your payment terms and due dates are easy to find and understand. This prevents misunderstandings and encourages timely payments. A well-structured document not only ensures that the client has all the necessary information but also reflects your attention to detail and professionalism.

Tracking Payments with Excel Invoices

Effectively managing payments is crucial for maintaining a healthy cash flow and ensuring that all transactions are accounted for. Using digital billing systems can make tracking payments much easier, especially when you include features that automatically update payment statuses. By setting up your financial documents with tracking capabilities, you can quickly identify which transactions are paid, pending, or overdue.

One way to track payments is by adding a “Status” column to your document. In this column, you can mark each transaction as “Paid,” “Pending,” or “Overdue.” This allows you to keep an organized record of each client’s payment history. Additionally, by including payment due dates and the actual payment date, you can track whether clients are adhering to agreed timelines.

To further automate the process, you can set up conditional formatting rules that highlight overdue payments in red, making them easily visible at a glance. You can also calculate the outstanding balance for each client by subtracting the payment amount from the total due, helping you keep track of which invoices need follow-up.

By utilizing these simple features, you can create a system that not only simplifies payment tracking but also helps you stay on top of your financials, making the invoicing process more efficient and less prone to errors.

How to Save Time with Templates

One of the biggest challenges for businesses is finding ways to streamline repetitive tasks, such as creating billing statements. With the right setup, you can drastically reduce the time spent on these tasks and ensure that each document is accurate and professional. By using pre-designed files that can be quickly adjusted, you can create and send financial documents in a fraction of the time it would take to start from scratch each time.

Pre-built files come with a basic structure in place, allowing you to simply fill in the necessary details, such as client names, service descriptions, and amounts. This eliminates the need to format every document individually or manually calculate totals and taxes. The result is faster, more efficient billing that allows you to focus on other areas of your business.

Key Time-Saving Features

Here are some features that can save you time when using these files:

| Feature | Time-Saving Benefit |

|---|---|

| Pre-filled Fields | Quickly enter details for clients, services, and pricing |

| Automatic Calculations | Instantly calculate totals, taxes, and discounts without manual effort |

| Customizable Design | Save time by using a format that suits your business without redesigning each document |

How to Maximize Efficiency

To fully capitalize on these time-saving features, it’s important to set up a system where you can easily store and access these files. Keep a library of standard documents that you can update with new client information or details specific to each transaction. By doing so, you’ll minimize the need for recreating files from scratch, and your billing process will become faster and more consistent.

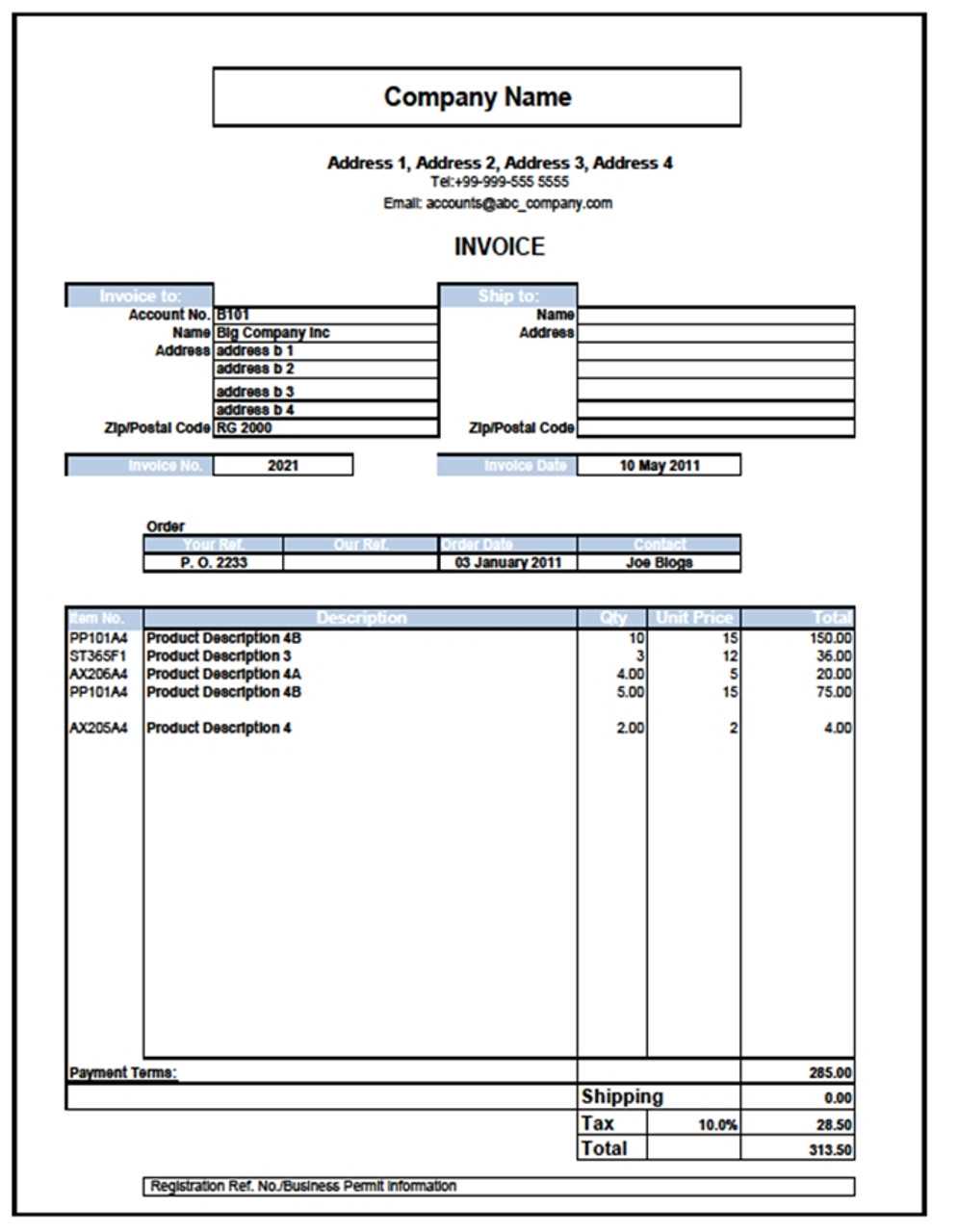

Customizing Invoice Layouts in Excel

When creating billing statements, having a layout that reflects your business style and is easy to navigate is essential. A well-organized structure ensures that all important details are clearly visible, making it easier for your clients to understand the charges and terms. Customizing the layout allows you to tailor each document to your specific needs, giving you full control over the design and functionality.

The first step in customizing a layout is choosing a clean and organized design. Start by defining the sections you need, such as your business information, client details, and line items. You can then adjust the width of columns, align text, and use borders to clearly separate different sections, making the document more visually appealing and easy to read.

Adjusting Columns and Rows

Begin by adjusting the column widths to ensure that all your content fits neatly without overcrowding the document. For example, the “Description” column should be wider than the “Quantity” or “Price” columns. This allows you to provide more details for each item or service. You can also merge cells for headings or section titles to create a more structured look.

Incorporating Branding Elements

To make the document align with your company’s brand, consider adding your business logo, adjusting the color scheme to match your brand colors, and choosing fonts that reflect your business identity. This customization not only enhances the professional appearance but also helps establish a recognizable visual style for your financial documents. You can also highlight key sections, such as the total amount due, by using bold text or a different background color to draw attention to critical information.

Once you have set the structure and branding, save the layout for future use. You can create a template that you can quickly update for each new client or project, saving you time while maintaining a consistent professional appearance.

Top Benefits of Using Excel for Billing

Using a spreadsheet program to manage financial documents offers a range of advantages, making it an appealing choice for businesses of all sizes. With the ability to organize and automate calculations, spreadsheets provide an efficient way to create billing records quickly while maintaining accuracy. This tool is particularly useful for small business owners, freelancers, and anyone seeking an affordable and flexible solution for managing payments.

Key Advantages

- Cost-Effective: Unlike specialized software that often requires expensive subscriptions, spreadsheet programs are widely available and inexpensive, making them a budget-friendly option for managing billing tasks.

- Customizable Layout: Spreadsheets allow full customization of the document’s layout. You can easily adjust fonts, colors, and sections to match your branding and ensure a professional presentation for each payment request.

- Automated Calculations: Built-in functions allow for automatic calculations of totals, taxes, and discounts, reducing the chance of human error and speeding up the billing process.

- Flexibility: You can modify existing documents to meet specific client needs or business requirements. Adding new fields or formulas is quick and easy, allowing you to tailor the document for any type of transaction.

- Easy Storage and Access: Digital files can be stored on your computer or cloud storage, making them easy to access and share with clients. No more worrying about lost paperwork or misplaced receipts.

How It Helps with Efficiency

- Quick Setup: Start with a basic document and customize it for each client. No need to rebuild from scratch every time.

- Instant Updates: Any changes to pricing, tax rates, or discount policies can be updated in minutes, and the entire billing process is adjusted automatically.

- Record Keeping: Maintain an organized archive of all transactions for easy retrieval when needed, simplifying financial reporting and audits.

These benefits make spreadsheets a powerful and efficient tool for managing billing, allowing businesses to focus more on growth and less on administrative tasks.

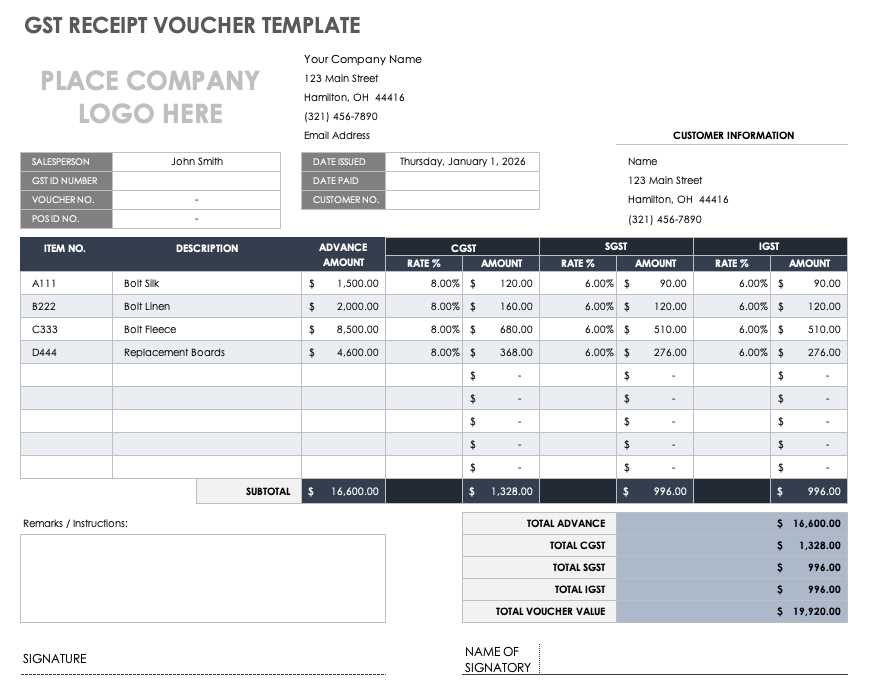

How to Include Taxes in Your Invoice

Including taxes in your payment documents is a critical aspect of ensuring accuracy and compliance with local regulations. Properly calculating and displaying taxes helps both you and your clients understand the total amount due. It also keeps your business organized and ready for any financial audits or reporting requirements. Adding taxes to your payment request may seem complicated, but with the right approach, it can be a straightforward process.

Steps to Include Taxes

- Identify the Applicable Tax Rate: Depending on your location and the type of product or service provided, the tax rate may vary. Ensure you know the correct rate for your region and the specific items being billed.

- Apply the Tax Rate: Once you have the correct tax rate, you can calculate the tax for each item by multiplying the price by the tax rate. For example, if your product costs $100 and the tax rate is 10%, the tax will be $10.

- Include a Tax Section: Create a separate section on your payment request for taxes. Clearly label it to avoid confusion, and ensure that both the subtotal and the final total are displayed with and without the tax included.

- Consider Multiple Tax Types: In some cases, multiple taxes may apply, such as state, federal, or local taxes. If this is the case, break down each tax type separately so the client can see exactly what they are being charged for each tax.

Best Practices for Tax Inclusion

- Clearly Separate the Tax: Ensure that taxes are listed separately from the product or service total. This helps clients see exactly what portion of the payment is due to taxes.

- Include Tax Details: If your tax rate is based on location, include a note about where the tax is being applied or provide a tax ID number if required.

- Double-Check Calculations: Always double-check the tax calculations to ensure accuracy. Mistakes can lead to legal and financial issues down the line.

- Stay Updated on Tax Rates: Tax rates can change over time, so make sure you stay informed about any updates to local tax laws or regulations to avoid billing errors.

By following these steps and practices, you can easily integrate taxes into your financial documents and keep everything transparent and compliant with tax regulations.

Managing Multiple Clients with Excel Templates

When managing a large number of clients, staying organized and efficient is crucial to maintaining a smooth workflow. One of the best ways to handle multiple client accounts is by using organized, customizable files. These documents can help you track all relevant information, from payments to service details, ensuring that each client’s records are easily accessible and up to date. By leveraging the right structure, you can quickly adapt the document for each new client while keeping everything consistent and professional.

Efficient Client Management

- Centralized Information: Store all client data, including names, contact information, and billing histories, in a single file. This allows you to access everything you need in one place, avoiding the hassle of searching through multiple documents.

- Customizable Fields: Create specific fields tailored to your business needs. For example, you could add columns for due dates, payment terms, or project descriptions, making it easy to track the status of each transaction.

- Consistency Across Documents: Use the same structure for each client, which ensures that every document looks uniform and professional. This consistency also reduces the time spent creating new files, as you only need to update the relevant details.

- Track Payment Status: Include a “status” field to indicate whether a payment is pending, completed, or overdue. This feature helps you monitor outstanding balances and identify which clients may need a follow-up.

Best Practices for Managing Multiple Accounts

- Use Separate Sheets: For clients with multiple projects or transactions, consider creating separate sheets within the same file. This keeps all client data organized and makes it easier to navigate.

- Sort and Filter Data: Use sorting and filtering features to quickly find specific clients or transactions based on various criteria, such as payment status or due dates.

- Automate Calculations: Leverage built-in formulas to automatically calculate totals, taxes, and any discounts. This ensures that every document is accurate and up to date, without the need for manual adjustments.

- Save and Reuse: Save your layout as a reusable format, so you can quickly duplicate it for new clients. This minimizes the time spent on administrative tasks and keeps your workflow efficient.

By implementing these strategies, you can simplify the management of multiple client accounts and ensure that all billing and record-keeping tasks are handled seamlessly.

Common Mistakes When Using Invoice Templates

While using pre-designed documents for billing can greatly simplify the process, there are common errors that can occur if you’re not careful. These mistakes often lead to confusion, payment delays, or even legal issues if not addressed. It’s important to be aware of these potential pitfalls so you can avoid them and ensure your financial documents are accurate and professional.

Common Errors to Watch For

- Missing Client Information: One of the most basic mistakes is failing to include the client’s full name, address, or contact details. Incomplete client information can lead to miscommunication and delays in payment.

- Incorrect Payment Terms: Always double-check the payment due date and terms. Failing to clearly state whether payment is due upon receipt or within a specific number of days can lead to misunderstandings.

- Not Including a Unique Reference Number: Each billing document should have a unique reference number to make tracking payments and handling disputes easier. Neglecting this step can result in confusion when searching for past transactions.

- Errors in Calculations: One of the most common mistakes is incorrect math. Failing to properly calculate the subtotal, taxes, or discounts can result in overcharging or undercharging your client.

- Neglecting Taxes or Additional Fees: If taxes or extra charges are applicable to the transaction, be sure to include them clearly in the breakdown. Forgetting to do this can create confusion or lead to underreporting income.

How to Avoid These Mistakes

- Double-Check Details: Always verify that all client information, including addresses, payment terms, and contact information, is correct before sending the document.

- Use Formulas: Set up automatic calculations within your document to ensure accurate totals, taxes, and discounts. This reduces the chance of manual errors.

- Proofread Before Sending: Take a moment to review your document for any missing or incorrect details. A quick proofread can save you from costly mistakes.

- Include All Required Information: Ensure that you include all necessary elements, such as a unique reference number, item descriptions, and payment instructions. This makes the billing process smoother for both you and your client.

- Keep a Record: Maintain an organized system of all issued billing statements to easily reference past transactions. This will help you stay on top of payments and avoid disputes in the future.

By being aware of these common mistakes and taking the proper precautions, you can ensure that your financial documents are accurate, clear, and professional, helping you maintain strong client relationships and a smooth billing process.

Exporting and Sharing Excel Invoices Effectively

Once your billing documents are complete, it’s important to know how to share them efficiently with your clients. Exporting and sharing files in a professional and secure manner ensures that both you and your clients have access to the necessary information without complications. Understanding the best formats and methods for sharing financial documents can save you time and avoid confusion, while maintaining confidentiality and data integrity.

Best Ways to Export and Share Documents

- Use PDF Format: Converting your financial documents into a PDF format is one of the most common and secure ways to share them. PDFs preserve the formatting of the document, ensuring it looks professional and remains unchanged, even when opened on different devices.

- Leverage Cloud Storage: Cloud storage services like Google Drive, Dropbox, or OneDrive provide an easy way to share documents securely. By uploading your billing statements to the cloud, you can generate a shareable link and send it to your client. This method allows clients to access the document at any time without having to email large attachments.

- Email Attachments: If you prefer to send documents directly via email, attaching the file in PDF format is a reliable option. Ensure that the email subject and message body are clear, concise, and professional, so your client knows exactly what to expect when opening the attachment.

- Ensure Security: When sharing financial documents, always prioritize security. Use password protection on sensitive files if necessary, and avoid sending sensitive information over unprotected channels. For extra protection, consider encrypting your PDF or using secure cloud sharing services with access permissions.

Example of Exported Document Sharing Flow

| Step | Action | Tool/Method |

|---|---|---|

| 1 | Complete the document with all relevant details | Spreadsheet application |

| 2 | Convert to a secure, universal format | PDF conversion tool |

| 3 | Upload the document to a cloud storage service | Google Drive, Dropbox, or OneDrive |

| 4 | Generate a shareable link or attach the document to an email | Email, secure link sharing |

| 5 | Send the document with a professional message |