Free DJ Invoice Template for Easy Billing

For any DJ, managing finances and maintaining a professional image is essential. Proper documentation of services provided helps in ensuring smooth transactions with clients. A well-structured billing system not only fosters trust but also simplifies the process of keeping track of payments, deadlines, and business relationships.

In this section, we’ll explore how to create clear, concise, and professional billing documents that will suit any DJ’s needs. With customizable features, these documents can be tailored to match specific services, payment terms, and event details, providing a seamless experience for both the DJ and their clients.

Adopting a clear approach to invoicing can save valuable time and prevent errors. By using an organized structure, DJs can ensure that their transactions are straightforward and transparent, making it easier for clients to understand the costs and terms associated with their services.

Essential Elements of a DJ Billing Document

When creating a financial document for services rendered, it’s important to include all the necessary details that reflect the agreement between the DJ and the client. A comprehensive record not only ensures clarity but also helps avoid misunderstandings about pricing, services, and payment expectations. Below are the key components that should always be present in a well-organized billing statement for a DJ performance.

| Component | Description |

|---|---|

| Client Information | Include the client’s full name, address, and contact details to ensure proper identification and communication. |

| Event Details | Clearly specify the event date, location, and type of service provided to avoid any confusion. |

| Service Breakdown | List all services rendered, including setup, performance time, and additional services like equipment rental or special requests. |

| Total Amount | State the total amount owed, ensuring all costs are clearly explained and justified. |

| Payment Terms | Specify the payment schedule, due dates, and acceptable payment methods. |

| Contact Information | Provide your own contact details for any queries or follow-ups regarding the payment. |

By includ

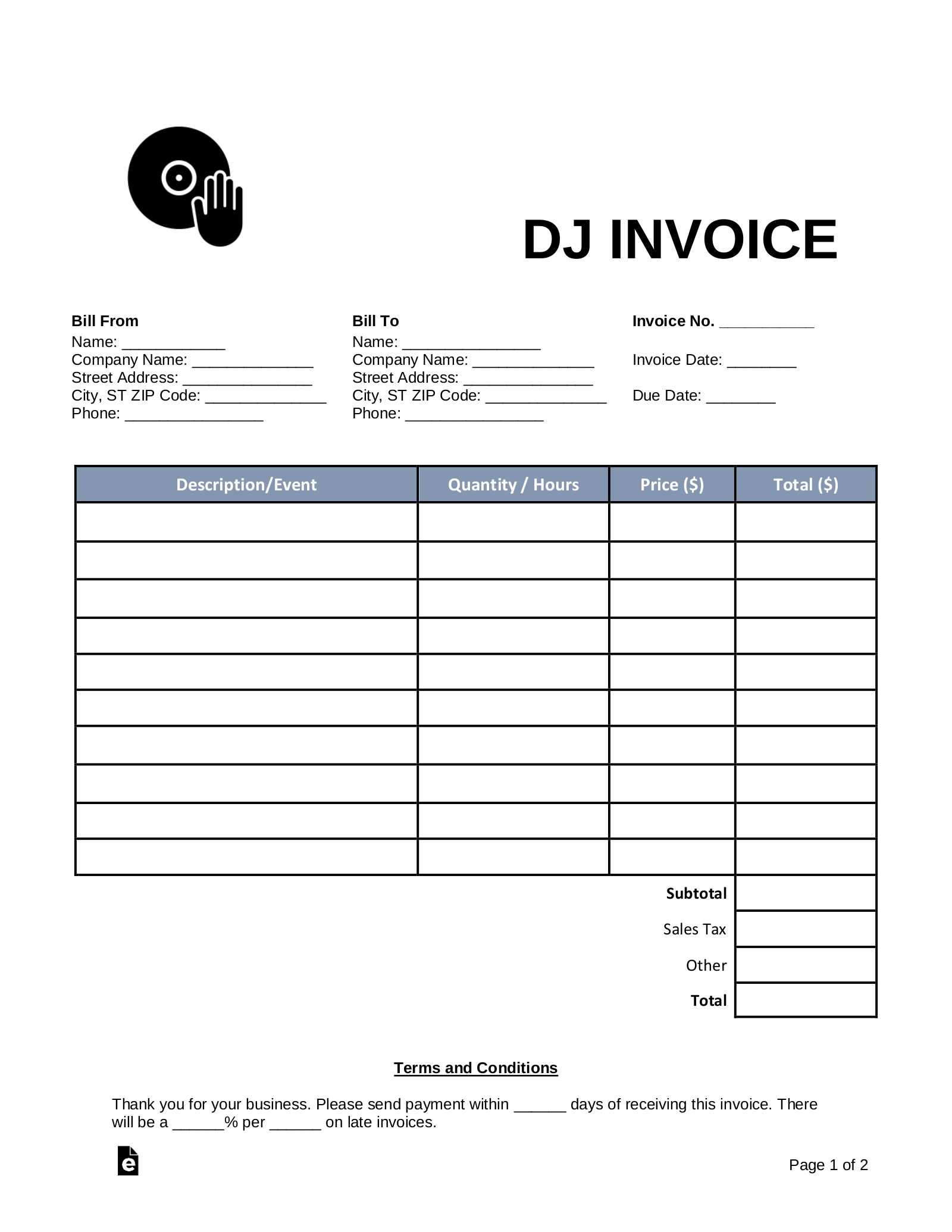

How to Create a Professional DJ Billing Document

Creating a professional billing document for your DJ services is crucial for establishing credibility and ensuring smooth financial transactions with your clients. A well-crafted statement clearly outlines the terms of the service, helping both you and the client stay organized and on track. To create an effective billing record, focus on clarity, accuracy, and organization.

Start by including all relevant details such as the client’s information, event specifics, and the breakdown of services provided. Be sure to list any additional costs or special requests separately, as this helps avoid confusion. Next, ensure the total amount is clear and precise, and specify the payment terms–such as due dates and accepted methods–so your clients understand when and how to make payments.

Finally, present the document in a neat, easy-to-read format. A professional layout with a clean design will not only make the document look polished but will also increase the likelihood of timely payments. Remember to keep a copy for your records and send the final document promptly after the event is completed.

Key Details to Include in Billing Documents

When preparing a financial document for your DJ services, it’s important to ensure that all relevant information is clearly stated. This not only helps avoid confusion but also sets expectations for payment and services rendered. Below are the essential components that should be included in every billing statement.

Client and Event Information

Start by including the client’s details, such as their full name, address, and contact information. It’s also vital to document the event specifics, such as the date, location, and type of service provided. This helps to prevent any misunderstandings regarding the event or the services you offered.

Breakdown of Services and Costs

Provide a detailed list of the services offered, including performance time, setup, and any additional charges for extra equipment or special requests. Make sure that each service is listed with its corresponding cost, allowing the client to clearly understand how the final amount is calculated.

Including these key details will make your billing documents clear, professional, and easy to follow, promoting trust and ensuring smooth transactions with your clients.

Benefits of Using a Billing Document Format

Utilizing a pre-designed structure for your financial records offers numerous advantages that can streamline your process and save you time. By adopting a standardized format, you ensure consistency and professionalism, making your work easier and more efficient. Here are some of the key benefits of using a structured approach for your billing needs.

Time Efficiency

One of the most significant advantages is the time saved in creating a new document from scratch. Instead of manually formatting each new statement, a consistent structure allows you to quickly input necessary details and generate a document in minutes.

- Fast setup: Pre-built layouts help you focus on the details rather than the design.

- Consistency: You maintain a uniform appearance for all your documents, creating a recognizable brand image.

- Reduced errors: Using an established format reduces the risk of forgetting important details.

Professional Appearance

Using a structured document not only saves time but also ensures that your bills look professional and are easy to read. Clients are more likely to view your services positively when the financial paperwork is clear, organized, and polished.

- Clear organization: A neat layout with clear sections and headings makes it easy for clients to navigate.

- Accurate details: With a structured format, important information like payment terms and service descriptions are easily outlined.

By adopting a professional, ready-to-use structure for your billing documents, you make the process smoother and more efficient, allowing you to focus on delivering exceptional services to your clients.

Customizing Your DJ Billing Document for Clients

Tailoring your financial records to meet the specific needs of each client can greatly improve the clarity of the transaction and enhance your professional image. By adjusting certain aspects of the document, you ensure that it reflects both the unique requirements of the event and the expectations of the client. Customization helps build a stronger relationship and encourages prompt payments.

Personalizing Client Information

Make sure to include detailed, accurate information about your client. This adds a personal touch and ensures the document is correctly addressed, avoiding any confusion later. Here’s what to focus on:

- Client’s full name: Always double-check the spelling and ensure it matches official records.

- Event location: Include specific details like venue name and address to clarify where the service was provided.

- Event date: Specify the exact date(s) the DJ service was rendered, as this helps track the work timeline.

Adjusting Service Details

Each event may have unique requirements, and your record should reflect that. You can modify the service section to include any special requests or additional tasks performed. This not only ensures clarity but also avoids any disputes over what was included in the original agreement.

- Hourly rates: If your pricing changes based on event length or type, clearly specify the rate and duration of services.

- Additional charges: If you provided extra services such as equipment rentals, include those details and costs.

- Custom services: Tailor the description of your services to reflect any special arrangements or requests from the client.

Customizing your billing records based on the client and event ensures a more personalized and professional approach. It demonstrates attention to detail, helping clients feel valued and promoting timely, hassle-free payments.

How to Format Your DJ Billing Document

Proper formatting is essential for creating a clear and professional financial document. A well-structured layout ensures that all information is easy to read and understand, helping to avoid confusion or errors. By following a logical order and maintaining consistency throughout, you create a document that is both visually appealing and functional.

Key Formatting Guidelines

Start with a clean, organized design that allows for easy navigation. The key is to balance simplicity with clarity, ensuring all necessary details are highlighted without overwhelming the reader. Here are some tips for formatting:

- Use headings: Divide the document into clear sections such as client information, services provided, and payment terms.

- Ensure consistency: Keep font styles, sizes, and colors consistent across the document for a professional look.

- Leave space: Use adequate spacing between sections and around text to avoid clutter.

Organizing the Content

Arrange the information in a logical flow, making it easy for clients to find what they need quickly. You can break down the content into well-defined blocks to ensure clarity.

- Header: Include your name or business name, address, and contact details at the top for easy identification.

- Client details: Ensure the client’s information is positioned next, followed by the event details.

- Services and costs: List the services provided along with associated costs in a separate section for transparency.

- Payment information: Clearly outline the total amount due, payment terms, and methods.

By following these formatting guidelines, you create a document that is both professional and easy to read, ensuring that all the i

Common Mistakes to Avoid in Billing Documents

When preparing a financial document for your DJ services, small errors can lead to confusion, delayed payments, and even strained relationships with clients. Avoiding common mistakes ensures that your documents are clear, professional, and easy to understand. By being mindful of these frequent pitfalls, you can maintain a smooth workflow and build trust with your clients.

Omitting Key Information

One of the most common mistakes is leaving out critical details that can lead to misunderstandings. Ensure that all essential information is included and easy to find.

- Missing client or event details: Failing to include the client’s full name, event date, or location can lead to confusion, especially if you’re working with multiple clients.

- Unclear service descriptions: If your services aren’t clearly outlined, clients may not fully understand what they are being charged for.

- Unspecified payment terms: Not specifying due dates or payment methods can lead to delays in payment and missed deadlines.

Formatting Errors

Another common mistake is poor formatting, which can make the document difficult to read and understand. A disorganized document can create frustration for both you and your client.

- Inconsistent layout: Using different fonts, sizes, or styles throughout the document can make it appear unprofessional.

- Lack of clear sections: If the document doesn’t have clear headings and sections, important information may be overlooked.

- Poor spacing: A cluttered or cramped layout makes it harder for the client to review the details of the document quickly.

Avoiding these mistakes will not only ensure that your financial documents are accurate and professional but will also foster a positive relationship with your clients, encouraging timely payments and repeat business.

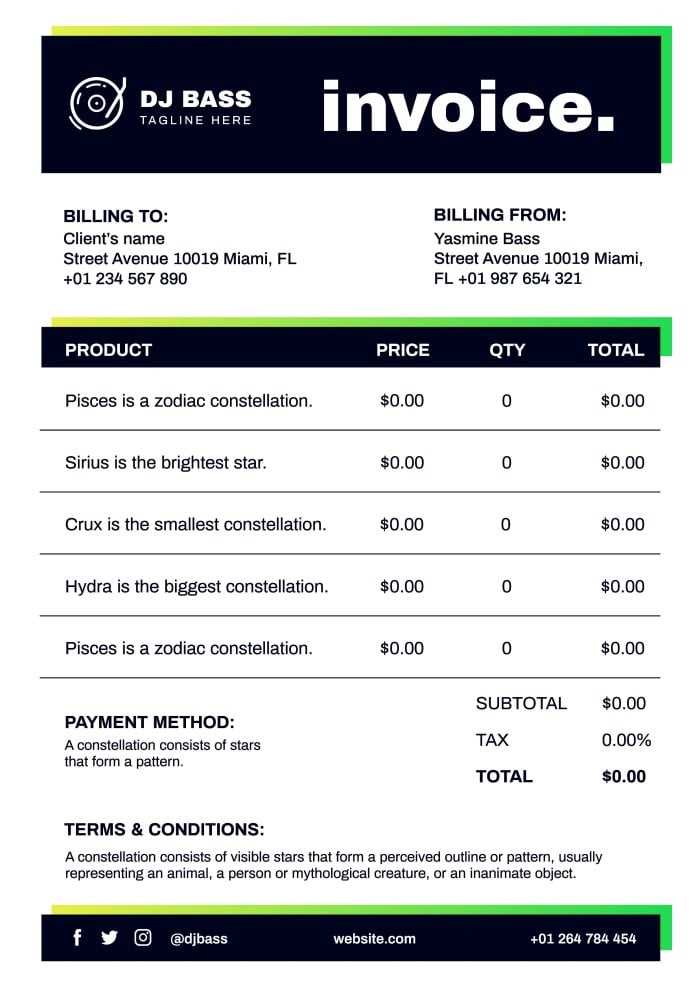

Best Practices for DJ Billing Document Design

Creating a visually appealing and easy-to-read financial document is crucial for maintaining a professional image and ensuring clarity. The design of your billing statement should reflect your brand while making it simple for your clients to understand the charges and payment details. By following a few key design principles, you can create a document that’s both functional and attractive.

1. Keep It Simple and Clean

Simplicity is key when it comes to designing your financial documents. Avoid clutter by using ample white space and focusing on essential details. A clean, minimalist design allows clients to easily read and digest the information without distractions.

2. Organize Information Clearly

Structure your document so that important information is easy to find. Use headings and subheadings to divide the content into logical sections. Make sure to include clear categories such as client details, event information, services rendered, and payment instructions.

3. Use Consistent Branding

Your billing document should reflect your unique style and branding. This means using your business logo, consistent fonts, and brand colors. A cohesive design helps reinforce your professional image and creates a lasting impression.

4. Highlight Key Details

Make the total amount due and payment due date stand out. This can be done by using bold or larger fonts to ensure that the client sees these key details at a glance. You want to make it as easy as possible for your client to take action on payment.

5. Include Clear Payment Instructions

Ensure that the payment terms and methods are explicitly stated. This includes information such as acceptable payment methods (credit card, bank transfer, etc.), payment deadlines, and any late fees or penalties.

By following these best practices, you can create a professional, organized, and user-friendly billing document that fosters trust with your clients and makes it easier for them to process payments. A well-designed document reflects the quality of your services and strengthens your reputation in the industry.

How to Set Payment Terms for DJs

Setting clear and fair payment terms is essential for ensuring smooth transactions and maintaining professional relationships with clients. By establishing specific expectations around payments, you protect yourself from potential delays and misunderstandings. Clear terms also help your clients understand when and how to pay, making the entire process easier for both parties.

Key Considerations for Setting Payment Terms

There are several factors to keep in mind when defining your payment terms. These will not only influence your cash flow but also set the tone for your business interactions.

- Payment Schedule: Decide if you want to require full payment upfront, a deposit before the event with the balance due after, or a post-event payment.

- Accepted Payment Methods: Be clear about which payment methods you accept, whether it’s bank transfer, cash, checks, or online payment platforms.

- Late Payment Fees: Specify any penalties for late payments to encourage clients to pay on time. This could be a percentage of the total fee for each day the payment is delayed.

Payment Deadlines and Clarity

It’s important to establish clear deadlines to ensure timely payments. Including this information upfront helps avoid confusion or delays after the event.

- Due Date: Specify the exact date when payment is due (e.g., “payment due within 30 days of the event date”).

- Deposit Requirements: If requiring a deposit, state the amount or percentage required and the date it should be paid to secure the booking.

- Final Payment Due: Clearly outline when the final balance is due, whether it’s before the event, after, or within a set number of days following the service.

By establishing well-defined payment terms, you help your clients understand the financial expectations, reducing the chances of late payments and ensuring smoother business operations. Clear communication is key to maintaining professional integrity and building trust with your clients.

Using Digital Tools for Billing Document Creation

In today’s digital age, creating professional financial documents has never been easier, thanks to various online tools designed to streamline the process. These tools can save time, reduce errors, and make managing your business finances more efficient. By using the right software, you can automate many tasks, ensuring consistency and professionalism in every document.

Advantages of Digital Tools

Digital solutions for creating financial statements offer numerous benefits over traditional paper-based methods.

- Time Efficiency: Automation features allow you to generate and send documents in just a few clicks, saving you valuable time.

- Customization Options: Many tools offer templates that can be easily tailored to your brand’s colors, logo, and design preferences.

- Error Reduction: Digital tools reduce the likelihood of human errors, such as incorrect calculations or missing information.

- Instant Delivery: With email integration, you can send your completed documents to clients instantly, speeding up the payment process.

Popular Digital Tools for DJs

There are many software options and online platforms available to help DJs manage their financial documentation effectively. Here are some of the most popular tools:

- QuickBooks: A comprehensive accounting tool that allows you to create, track, and manage all your financial records, including billing documents.

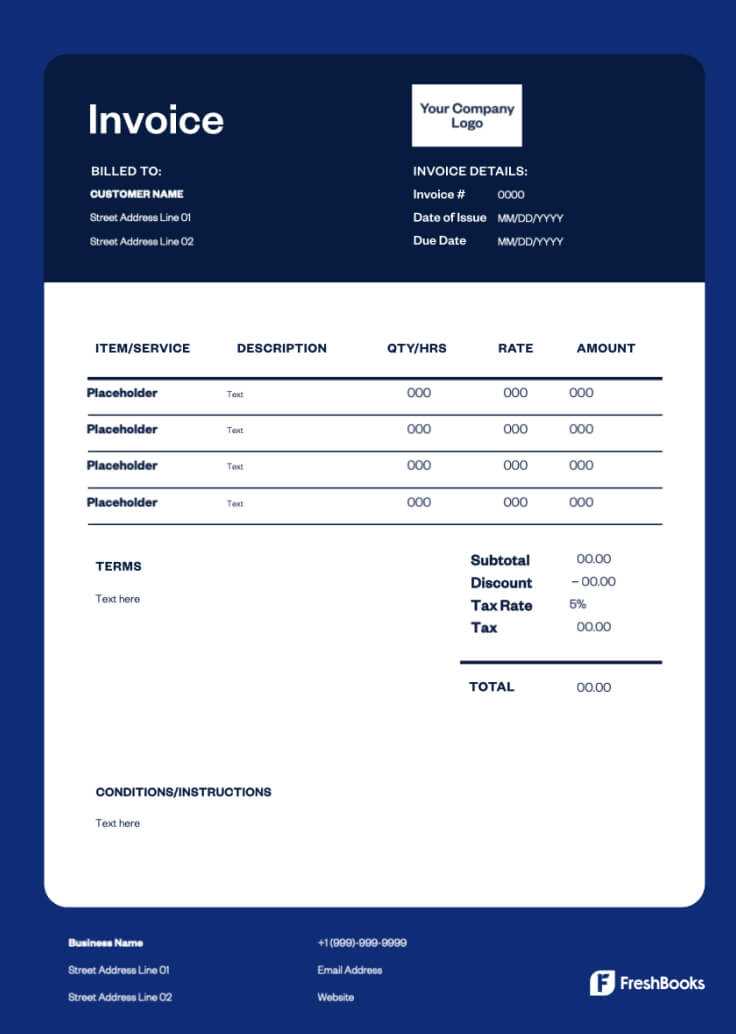

- Wave: A free, easy-to-use tool that offers invoicing, accounting, and receipt tracking for small businesses.

- FreshBooks: Known for its simple, user-friendly interface, FreshBooks helps streamline billing and includes time tracking and payment management features.

- Zoho Invoice: This tool offers robust customization options and integrates with other Zoho apps to manage your workflow and track payments.

By utilizing digital tools, DJs can create high-quality, professional documents more efficiently, leading to a better experience for both the business and clients. These tools not only simplify the billing process but also help you maintain better control over your finances and ensure that all your records are properly managed and easily accessible.

Why Accurate Billing Matters for DJs

For DJs, maintaining precise financial documentation is essential not only for business management but also for fostering trust with clients. When it comes to charging for services, accuracy ensures that both parties are on the same page regarding costs and payments. Discrepancies in billing can lead to misunderstandings, delayed payments, or even damage to your professional reputation.

Benefits of Accurate Billing

By ensuring that your financial documents are error-free and clearly outline all charges, you gain several advantages that help streamline your business operations:

- Professionalism: Consistently accurate records portray your business as organized and trustworthy, boosting your reputation in the industry.

- Cash Flow Management: Proper billing ensures that payments are tracked and collected on time, helping to maintain steady cash flow.

- Avoiding Disputes: Clear, correct statements help minimize conflicts with clients over unexpected fees or misunderstandings about payment amounts.

- Tax Compliance: Accurate financial records are essential when filing taxes, ensuring you have everything documented for audits or reporting purposes.

Consequences of Inaccurate Billing

On the flip side, poor billing practices can have serious consequences, some of which can directly impact your business.

- Client Dissatisfaction: Clients may feel frustrated or mistrustful if there are errors in the amount they owe or if charges seem unclear.

- Delays in Payments: Mistakes in billing can lead to delays in receiving payment, disrupting your financial planning.

- Reputational Damage: Frequent errors or misunderstandings related to payment can harm your credibility and result in a loss of future business.

- Legal Issues: Incorrect records can lead to disputes, which, in severe cases, may require legal intervention or damage your relationship with clients.

In short, accurate billing is not just about charging the right amount–it’s about building and maintaining positive relationships with clients, ensuring smooth business operations, and safeguarding your professional image. Taking the time to double-check all the details and ensure everything is clear and correct will set you up for long-term success.

Tracking Payments and Unpaid Invoices

Effective tracking of payments and outstanding amounts is crucial for DJs to maintain a healthy cash flow and ensure that they are paid for their services promptly. By staying on top of pending payments and monitoring completed transactions, you can prevent issues such as delayed payments or missed financial records. Having a clear system for tracking all transactions helps avoid confusion and strengthens client relationships.

Utilizing a structured approach to track payments can significantly reduce the risk of unpaid bills slipping through the cracks. Keeping a detailed record of all charges, payments made, and balances due ensures that you can follow up on overdue amounts and make sure nothing is overlooked. It’s important to have a system that allows you to view the status of each payment easily and take necessary action when needed.

There are various ways to manage and track payments effectively, from manual spreadsheets to dedicated accounting software. Regardless of the method you choose, consistency and accuracy are key to keeping everything organized and up-to-date. Whether you are handling a handful of clients or managing a large number of bookings, clear tracking will help you stay on top of your finances and minimize issues related to missed or delayed payments.

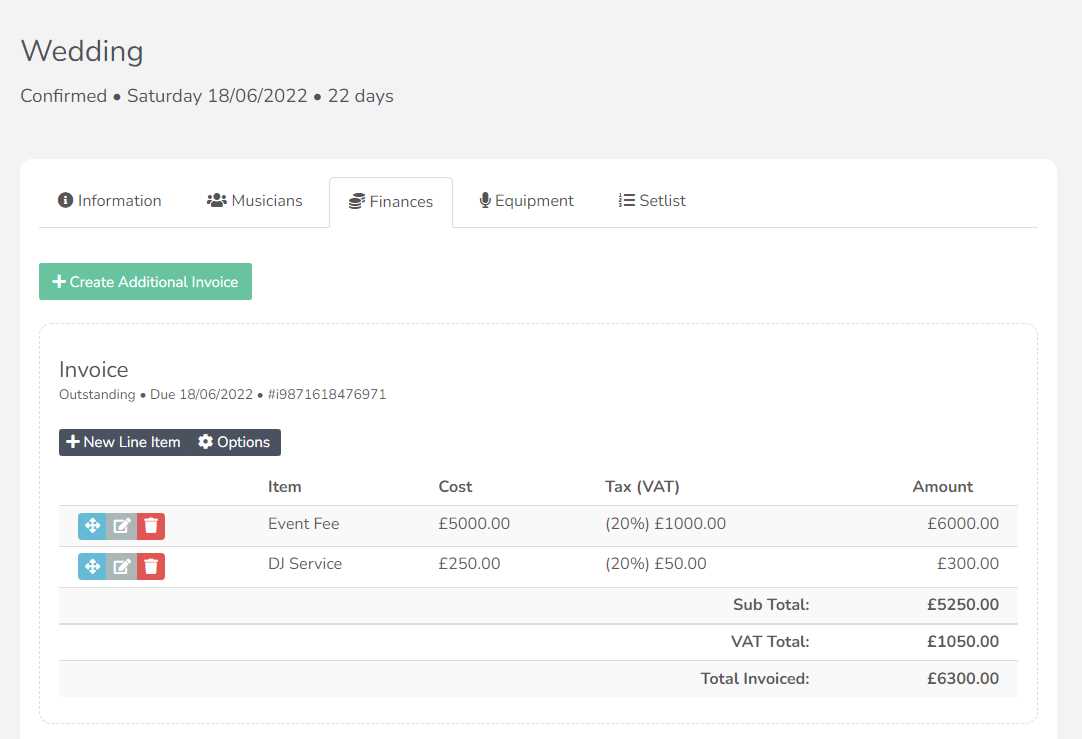

Incorporating Taxes in Your DJ Invoice

When working as a DJ, it’s important to factor in taxes as part of your overall billing process. Including taxes not only ensures compliance with local regulations but also helps avoid unexpected surprises for both you and your clients. Whether you’re operating as a freelancer or part of a larger company, understanding how to calculate and present taxes clearly can streamline the payment process and keep everything transparent.

Taxes can vary depending on your location, the type of service provided, and whether you are required to charge sales tax. In many regions, DJs may need to add a specific percentage of tax to the total fee, which must be clearly outlined in the billing document. Properly incorporating taxes into your charges allows you to collect the appropriate amounts and remit them to the tax authorities when necessary.

To ensure accuracy, make sure to clearly separate the base rate for services from any tax-related amounts. This distinction helps clients understand the breakdown of the total cost, making them more comfortable with the payment process. Additionally, keeping detailed records of taxes collected is crucial for your own financial management and for any potential audits or inquiries by tax authorities.

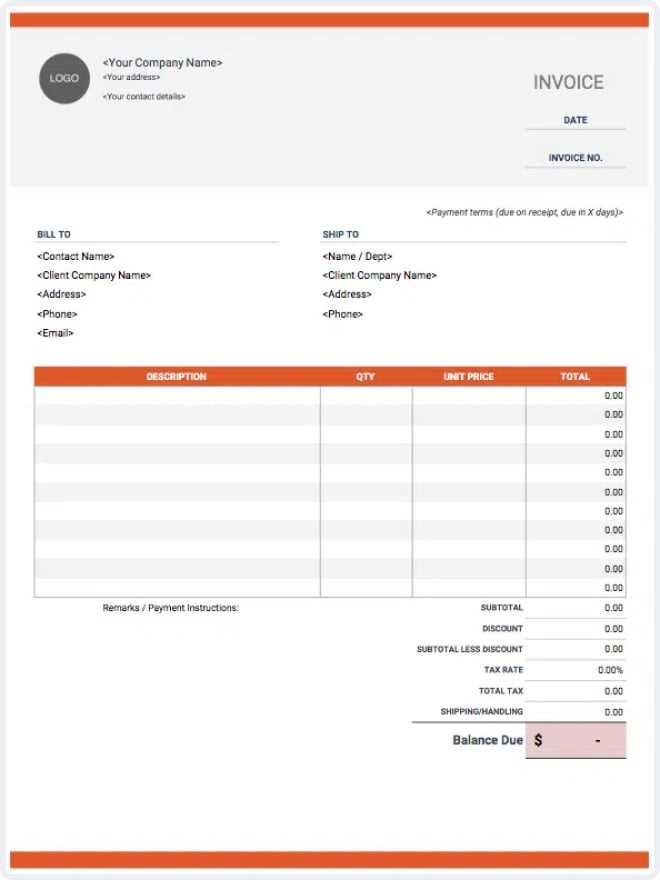

Creating a Professional Layout for Billing Documents

A well-structured billing document is essential for leaving a positive impression on clients and ensuring that all necessary information is easy to find. A professional layout should be clear, concise, and visually appealing, making it simple for your clients to understand the services provided and the amounts due. A neat and organized design will not only reflect your professionalism but also help maintain transparency and avoid confusion during the payment process.

When designing your billing document, it’s important to focus on key elements such as the itemization of services, payment terms, and tax details. These elements should be clearly separated and easy to read, allowing clients to quickly see the breakdown of charges. A logical flow of information and consistent formatting also contributes to a polished and trustworthy appearance.

Here is an example of a basic structure for a professional billing document layout:

| Service Description | Unit Price | Quantity | Total |

|---|---|---|---|

| DJ Performance for Event | $300 | 1 | $300 |

| Travel Fee | $50 | 1 | $50 |

| Subtotal | $350 | ||

| Sales Tax (8%) | $28 | ||

| Total Due | $378 | ||

By keeping your layout simple yet informative, you can ensure that your billing documents look professional and are easy for your clients to review and process.

Managing Multiple DJ Event Billing Documents

As a DJ, handling multiple events and clients can quickly become overwhelming without proper organization. It’s essential to manage each billing document efficiently to avoid mistakes and ensure timely payments. By keeping track of various bookings, payment due dates, and specific event details, you can streamline your financial process and maintain good relationships with your clients.

To manage multiple billing documents effectively, consider implementing a system that allows you to track each transaction individually while keeping all necessary information in one place. This approach can help you quickly reference past events, identify unpaid balances, and stay on top of your financial obligations.

Here are a few tips for managing multiple DJ event billing documents:

- Organize by Event: Keep each client’s billing information separate, and assign a unique reference number or code to each event for easier tracking.

- Use a Digital System: Use software or digital tools to create, store, and manage your billing documents. This can help prevent physical clutter and simplify record-keeping.

- Set Clear Payment Terms: Define clear payment deadlines for each event to avoid confusion and ensure that clients know when their payments are due.

- Track Payments: Maintain an up-to-date record of payments received, and follow up promptly with clients who have outstanding balances.

- Review for Accuracy: Always double-check the details of each billing document before sending it to ensure that all services, fees, and taxes are correctly accounted for.

By staying organized and keeping track of all necessary details, you’ll ensure that managing multiple billing documents becomes a smooth and efficient part of your business operations.

Free DJ Billing Documents You Can Use

As a DJ, having the right billing documents can make your business operations smoother and more professional. Thankfully, there are many free resources available that offer customizable forms tailored to the needs of DJs. These documents allow you to quickly generate accurate and professional records for each event, saving time and avoiding mistakes.

Using a pre-designed form can be especially useful for new DJs or those looking to streamline their administrative tasks. These free resources are often editable, making it easy to adapt the content to match the specifics of each event and client. Whether you prefer a simple layout or a more detailed breakdown of services, there’s an option that suits every style.

Here are some types of free resources you can explore:

- Simple Billing Forms: Basic and straightforward forms that include essential fields like event date, services provided, payment amount, and contact details.

- Detailed Billing Sheets: These provide additional spaces for itemized services, taxes, payment terms, and even discounts or special offers.

- Online Templates: Digital forms available for immediate use, often with features like automatic calculations and payment tracking, which can be filled out and sent electronically.

- PDF Fillable Forms: Easily downloadable and fillable PDFs, allowing you to input all relevant information without the need for specialized software.

By utilizing these free resources, you can maintain professionalism and efficiency in your business operations, ensuring that every transaction is well-documented and clearly communicated to your clients.