Free Sample Consulting Invoice Template for Easy Professional Billing

When working with clients, having a structured and organized system for requesting payments is essential for maintaining professionalism and ensuring timely compensation. A well-crafted billing document not only reflects your business’s attention to detail but also helps avoid misunderstandings or disputes regarding the terms of your work. Whether you’re a freelancer or running a consultancy, using a pre-designed document can save time and streamline the billing process.

Crafting a clear and concise bill ensures that both you and your clients are on the same page. It includes key details like the work performed, hours worked, and agreed-upon rates. These documents help keep everything transparent, making the transaction smoother for both parties. Furthermore, using a consistent format makes it easier to track payments and maintain a professional appearance across all your business dealings.

In this article, we’ll guide you through how to create an efficient and user-friendly billing document that you can customize to suit your needs. Whether you’re just starting out or looking to improve your current process, this approach will help you stay organized and ensure that you get paid on time for the services rendered.

Understanding the Importance of Consulting Invoices

When running a service-based business, the method by which you request payment is just as important as the service itself. A well-organized and professional billing system ensures that both you and your clients are clear about the terms of payment and prevents any confusion or disputes. It not only reflects your professionalism but also serves as a legal document that can be used for tracking financial transactions and resolving conflicts if they arise.

Here are some key reasons why using a structured billing document is crucial for your business:

- Clear Communication: A detailed document ensures that the scope of work, hours worked, and costs are all transparent, preventing misunderstandings.

- Timely Payments: Proper billing helps set expectations for payment deadlines and reduces the chances of delayed transactions.

- Financial Organization: Consistent use of well-structured documents aids in tracking payments, organizing records for tax purposes, and managing cash flow.

- Professional Image: A clear and polished payment request enhances your reputation and shows clients that you take your work seriously.

- Legal Protection: A correctly formatted document serves as evidence in case of disputes, providing clear terms that both parties have agreed upon.

In essence, using an efficient method to request compensation ensures smooth interactions and helps build trust between you and your clients. It’s an essential tool for maintaining a healthy and professional business relationship.

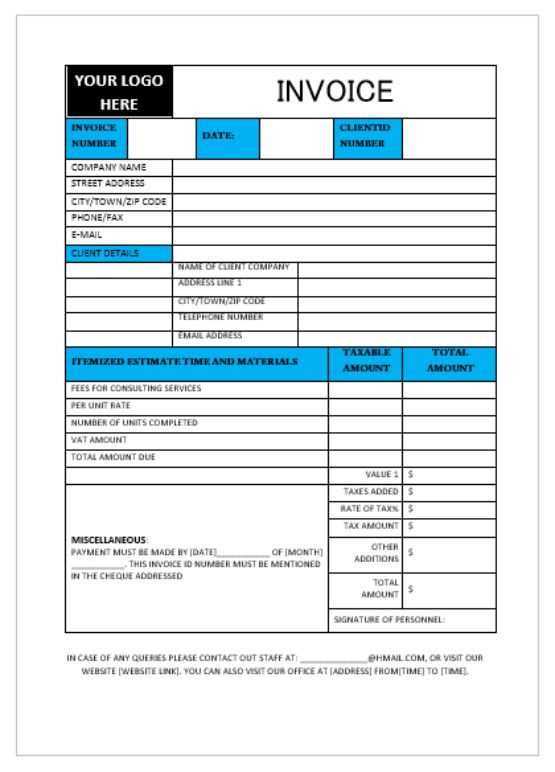

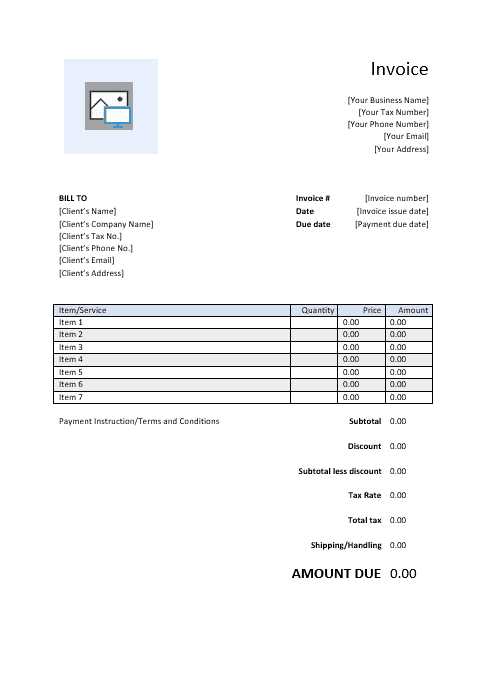

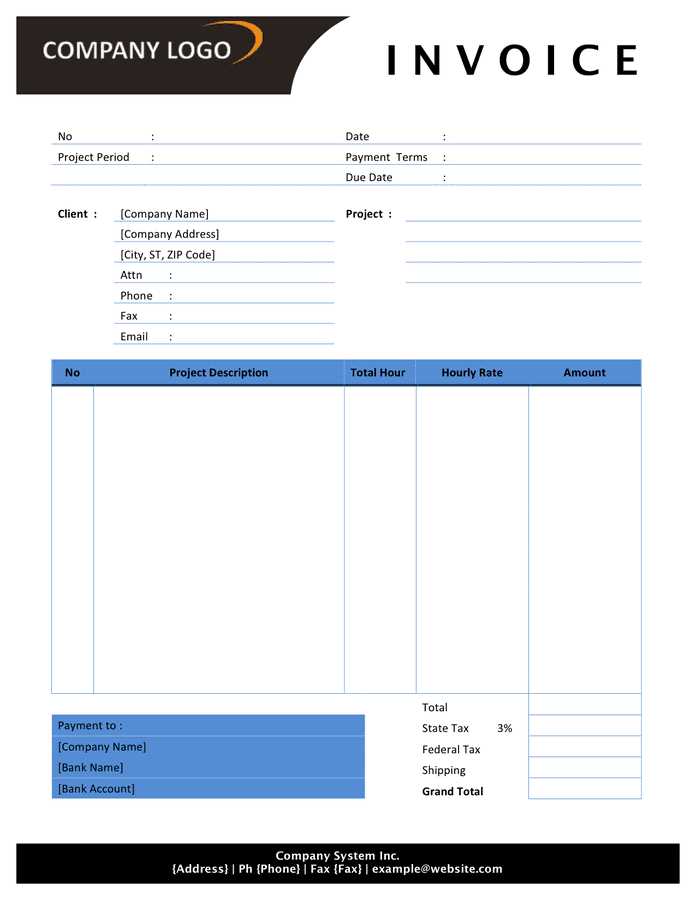

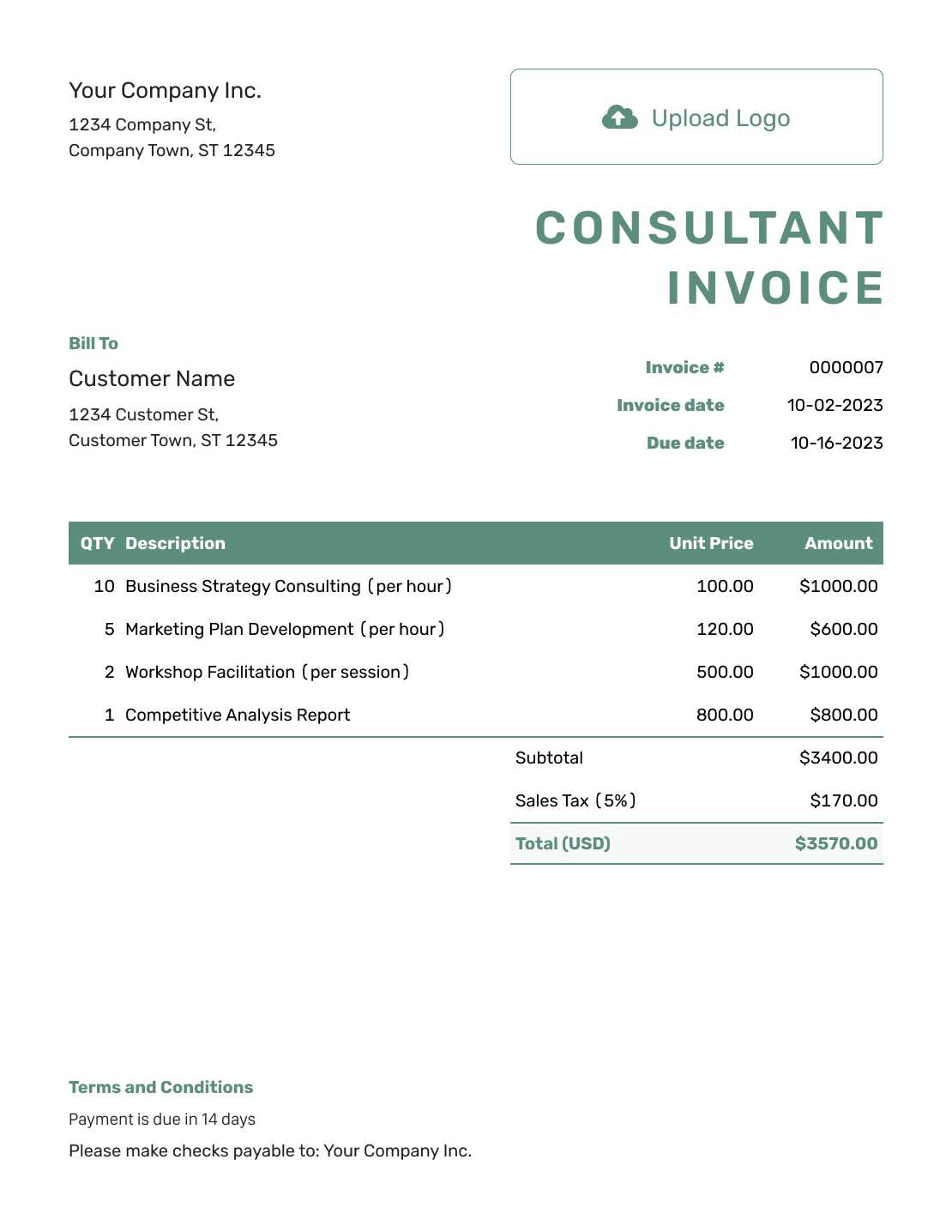

What is a Billing Document Layout

A billing document layout is a predefined structure designed to assist businesses in creating clear and organized payment requests for services rendered. This layout typically includes all the necessary sections that outline the work completed, the payment terms, and other essential information. By using such a layout, businesses can save time while ensuring that all key details are properly addressed and communicated to clients.

These layouts can be customized according to the specific needs of the business and the type of service provided. They ensure consistency and professionalism, making it easier to track payments and maintain accurate financial records. A well-constructed billing document can significantly improve the efficiency of the payment process and reduce errors.

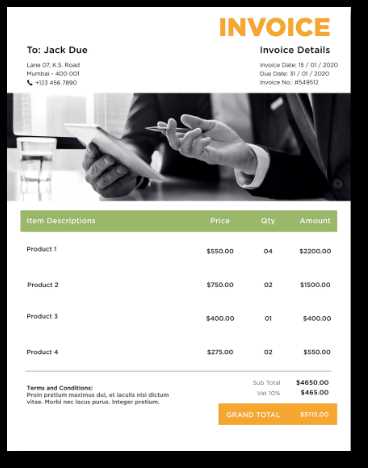

Here is a basic structure that is commonly included in such documents:

| Section | Description |

|---|---|

| Client Information | Details about the client, such as their name, address, and contact information. |

| Service Details | A breakdown of the services provided, including the scope, description, and hours worked. |

| Payment Terms | Clear instructions on how and when the payment should be made. |

| Total Amount | The final amount due, including any applicable taxes or additional fees. |

| Due Date | The specified date by which payment should be made. |

How to Create a Simple Billing Document

Creating a straightforward payment request document doesn’t have to be complicated. The key is to include all the necessary details in a clear and organized manner. A simple format will help you ensure that clients understand the charges and know exactly how to proceed with payment. Here’s a step-by-step guide to help you create an efficient and professional payment request.

1. Start with Your Business Information

At the top of the document, include your name, business name (if applicable), address, email, and phone number. This makes it easy for your client to reach out if needed.

2. Add Client Information

Next, add your client’s details, such as their name, business name, address, and contact information. This helps personalize the document and ensures that the right person is billed.

3. Specify the Services Provided

Clearly list the services you performed, including a brief description, the hours worked, and the rate charged. If applicable, you can also include any additional charges or discounts offered.

4. Include Payment Terms

Be clear about the payment methods you accept and any deadlines for payment. Specify if you require a deposit upfront or if payment is due upon receipt.

5. Total the Amount Due

Calculate the total amount due, including any taxes, fees, or additional charges. Make sure the final figure is easy to read and matches the calculations provided earlier in the document.

6. Add a Due Date

Indicate the due date for payment. Setting a deadline ensures both you and the client are aligned on when the tra

Key Components of a Billing Document

A well-structured payment request document includes several essential elements that ensure both clarity and professionalism. Each component plays a crucial role in making sure that all necessary information is communicated to the client in a clear and organized way. The following are the key parts that should be included in any payment request for services rendered.

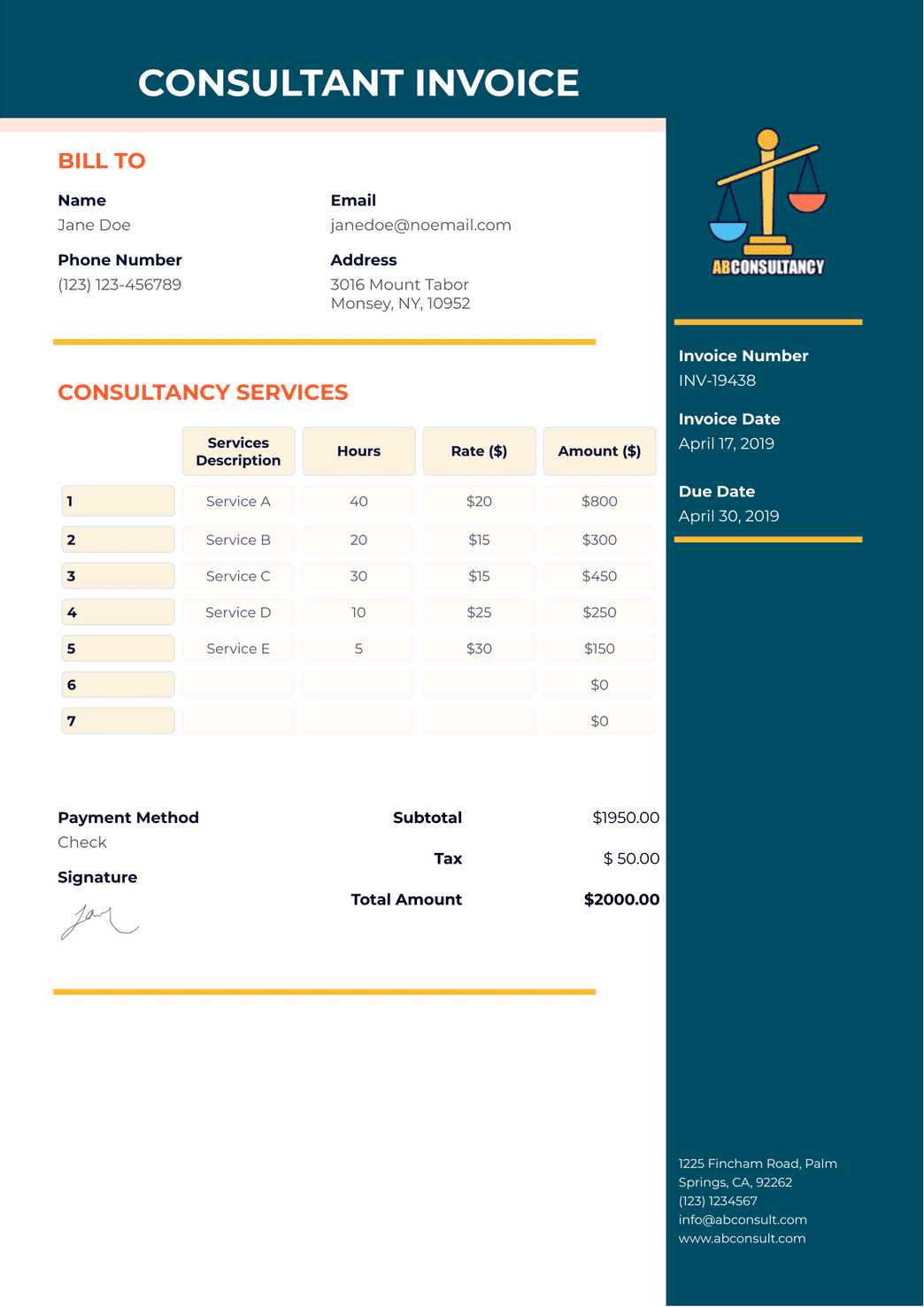

1. Business and Client Information

At the top of the document, list your business name, contact details, and the client’s information. This ensures that both parties know who is sending and receiving the payment request.

2. Unique Invoice Number

Each payment request should have a unique identifier, often referred to as the invoice number. This makes it easier for both you and the client to track and reference the document, especially for accounting purposes.

3. Service Description

Clearly describe the work you have completed. This section should include a breakdown of the tasks or services provided, the amount of time spent, and any other relevant details. Be as specific as possible to avoid confusion.

4. Payment Breakdown

Provide a detailed list of the charges for each service rendered. This breakdown should include the rate per hour or per service, the total cost, and any discounts or additional fees applied. Transparency in this section helps prevent disputes and ensures that both parties agree on the amounts.

5.

Why You Need a Professional Billing Layout

Having a predefined layout for payment requests is crucial for any business offering services. It not only helps ensure that all necessary information is included but also streamlines the process of creating and sending requests. With a consistent format, you save time, reduce errors, and present yourself as a professional to clients. Below are the key reasons why using a structured format is essential for your business.

- Consistency and Organization: A predefined layout ensures that every payment request follows the same structure, making it easier for both you and your clients to track payments and agreements.

- Professional Appearance: A polished and consistent format conveys professionalism, building trust and confidence with clients. It shows that you take your work and business seriously.

- Reduced Errors: By using a set layout, you reduce the likelihood of forgetting important details, such as rates, payment terms, or due dates, which could lead to confusion or delays.

- Time-Saving: Rather than creating a new document from scratch every time, a predefined structure allows you to simply fill in the details, saving you time and effort on every billing cycle.

- Legal Protection: A consistent payment request serves as a formal agreement, ensuring that both you and your client are clear on the terms of the work and payment. In case of any disputes, the document can act as evidence in resolving issues.

- Easy Tracking: Using a standard format makes it easier to maintain records of past transactions, track overdue payments, and stay on top of your financials.

In short, using a predefined layout for payment requests is a simple yet powerful way to streaml

Benefits of Using a Professional Payment Request

Utilizing a well-designed and structured payment request brings numerous advantages that can significantly improve the financial operations of your business. Whether you are a freelancer or managing a larger service-based enterprise, having a professional layout ensures clarity, accuracy, and efficiency. Below are some of the key benefits that come with using a professionally crafted document to request payment.

- Improved Clarity and Transparency: A well-organized request helps ensure that all relevant details, such as services provided, rates, and total costs, are clearly outlined. This transparency minimizes confusion and potential disputes between you and your clients.

- Increased Credibility: Sending a polished, professional request helps reinforce your reputation. Clients are more likely to take your business seriously and view you as an expert in your field when they see that you are meticulous in your billing process.

- Faster Payments: Clear and straightforward payment requests often lead to quicker payment processing. Clients are more likely to pay promptly when they understand the exact amount due and how to submit their payment.

- Better Financial Tracking: A standardized request helps you maintain organized records of all transactions. This makes it easier to track payments, manage outstanding balances, and handle your financial records efficiently.

- Reduced Errors: By following a consistent format for every payment request, you reduce the chance of forgetting important information or making calculation mistakes, ensuring the process remains smooth and hassle-free.

- Professional Appearance: A consistent, professional-looking request helps reinforce your business’s image. It communicates to clients that you take your work seriously and that you are reliable and organized.

- Legal Protection: In case of disputes, a properly formatted document serves as a legal reference, outlining agreed terms and conditions. This can be valuable if you need to resolve any conflicts about payment or services rendered.

Incorporating a professional approach to how you request payments not only simplifies the financial side of your business but also fosters trust and builds stronger client relationships. By focusing on clear communication and professionalism, you can ensure smoother transactions and a better overall business experience.

Customizing Your Billing Document Layout

Personalizing your payment request format is essential for reflecting your business’s unique identity and meeting your specific needs. A well-customized layout not only makes the document more professional but also helps you efficiently communicate key details to your clients. Customization allows you to tailor the document to suit different types of projects, services, or clients while maintaining consistency and clarity in your communication.

Key Customization Options

When adjusting your payment request format, there are several elements you can modify to better reflect your business and streamline your billing process:

| Element | Customization Options |

|---|---|

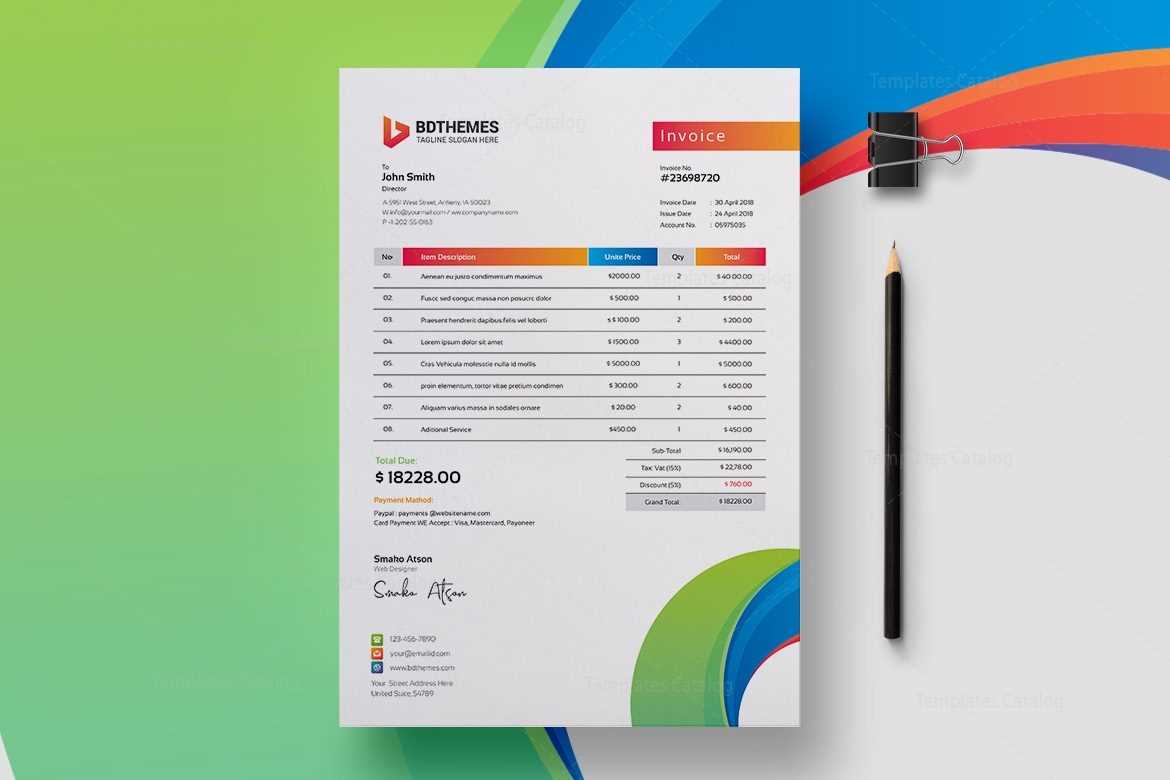

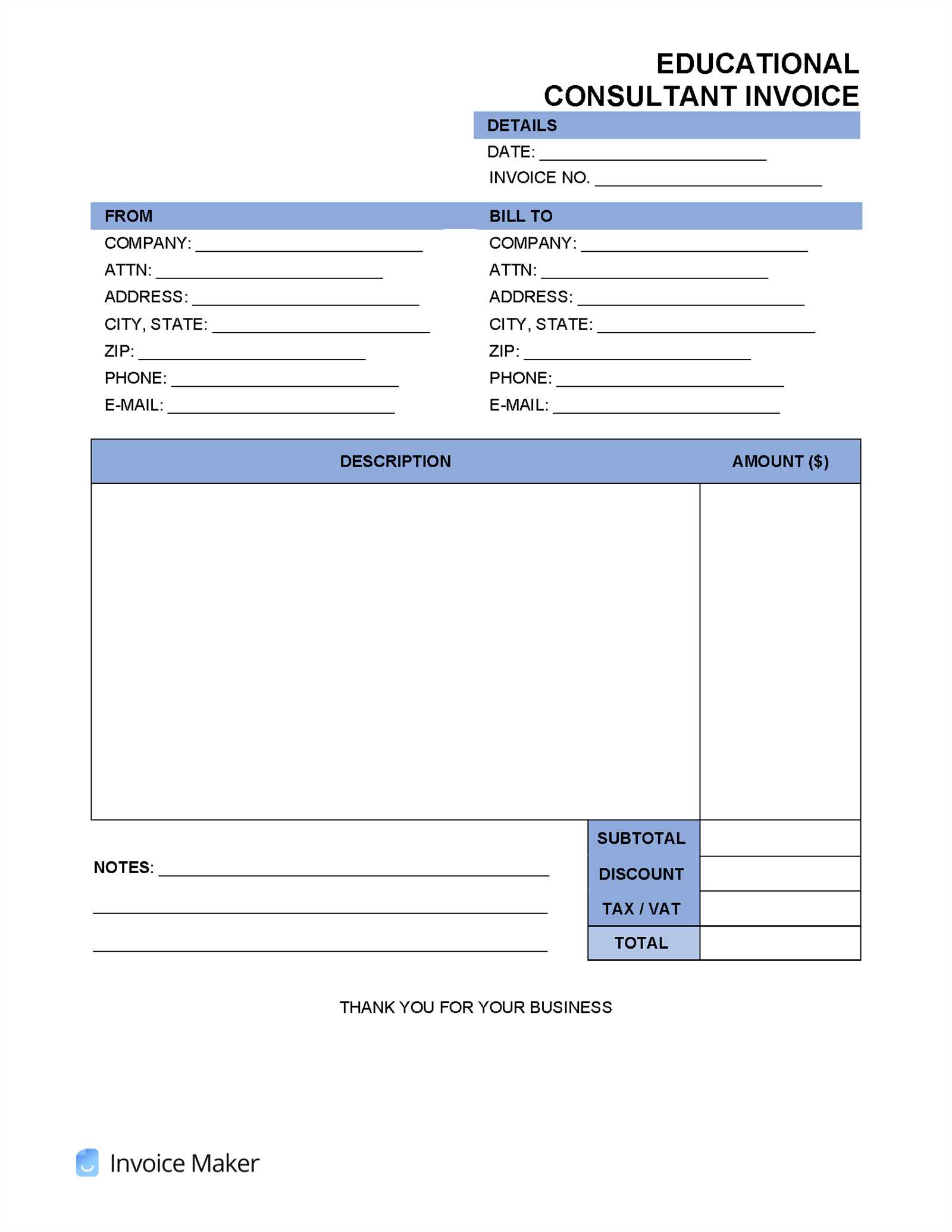

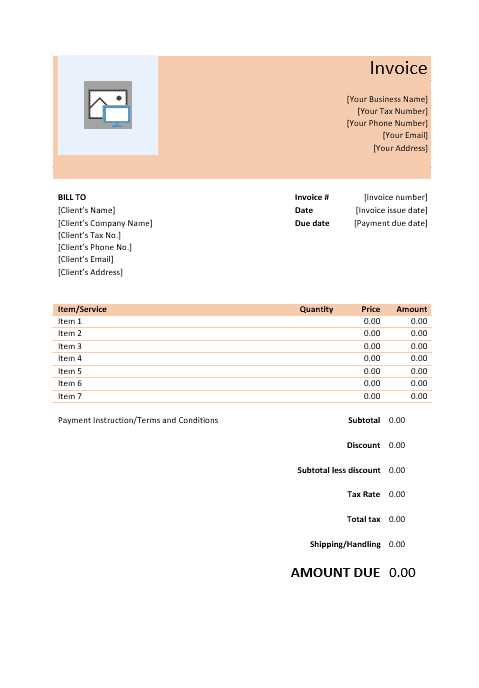

| Header | Add your logo, business name, and tagline to make your layout stand out and reinforce brand identity. |

| Client Details | Include custom fields for client-specific information such as project names, departments, or internal references. |

| Service Breakdown | Customize descriptions, hours, and rates based on the type of work or project. You can even include line items for recurring services or one-time charges. |

| Payment Methods | Adjust payment instructions to reflect the preferred methods for each client, whether bank transfer, credit card, or another payment gateway. |

| Footer | Include payment terms, notes, or links to your website or portfolio for additional services or terms. |

Why Customization Matters

Customizing your payment request format helps you address the specific needs of your clients while keeping the process efficient. It also reinforces your brand’s professionalism and attention to detail, making a positive impression. With these

Common Mistakes to Avoid in Payment Requests

While creating a payment request document might seem straightforward, there are several common errors that can lead to confusion, delayed payments, or even strained client relationships. Ensuring that your document is clear, complete, and accurate is essential for maintaining professionalism and efficiency in your billing process. Below are some of the most frequent mistakes to avoid when preparing a payment request.

1. Missing or Inaccurate Client Information

One of the most basic errors is neglecting to include or misrepresenting the client’s details. This includes incorrect business names, addresses, or contact information. If the information is wrong or incomplete, it can cause delays in processing the payment or confusion on the client’s part. Always double-check that the client’s details are accurate and up-to-date before sending the document.

2. Vague or Incomplete Service Descriptions

Another common mistake is providing insufficient or unclear descriptions of the work performed. A vague breakdown of services can leave clients unsure about what they are being charged for, leading to disputes or delays in payment. Make sure to clearly list the services, quantities, hours worked, and rates for each task or project item. The more specific and detailed your description, the better.

3. Failing to Include Payment Terms and Due Dates

Not specifying clear payment terms or omitting the due date is a mistake that can create confusion about when and how payment should be made. Always include the following:

- The payment methods you accept (e.g., bank transfer, credit card, check).

- The due date for payment to be completed.

- Any late fees or penalties for overdue payments, if applicable.

4. Incorrect Calculations and Totals

Errors in calculations are one of the most frustrating issues for both you and your clients. Whether it’s adding up rates incorrectly or miscalculating taxes or discounts, inaccu

How to Ensure Timely Payments from Clients

Getting paid on time is crucial for maintaining cash flow and running a successful business. However, many service providers face challenges when it comes to ensuring that clients pay promptly. To avoid delays, it’s essential to set clear expectations, communicate effectively, and maintain a professional approach to managing payments. Below are several strategies to help ensure timely payments from your clients.

1. Set Clear Payment Terms

Clearly outline your payment terms before beginning any project. This includes specifying when the payment is due, the accepted payment methods, and any late fees or penalties for overdue payments. By setting clear expectations upfront, you minimize the risk of confusion or misunderstandings later on.

2. Send Professional Payment Requests

Always send a well-organized and professional payment request that includes all necessary details, such as services provided, rates, total amount due, and the payment due date. A detailed document reduces the chances of disputes and helps clients understand exactly what they are paying for. Here’s an example of key information that should be included:

| Section | Details to Include | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client Information | Name, address, and contact details of the client. | ||||||||||||||||

| Service Details | Description of the work completed, hours worked, and agreed rates. | ||||||||||||||||

| Payment Terms | Accepted payment methods, payment due date, an

Essential Information to Include in Billing DocumentsWhen creating a billing document, it is important to include all the necessary details to ensure clarity and accuracy. A comprehensive and well-structured document not only helps clients understand the charges but also protects both parties by setting clear expectations. Below are the key elements that should always be included in a billing document to avoid confusion and maintain professionalism. 1. Contact Information

Start with the contact information for both you and your client. This ensures that both parties can easily reach out if there are any questions or concerns regarding the payment. Make sure the following details are included:

2. Detailed Service Description

Next, provide a detailed breakdown of the services rendered. This section should clearly outline what work has been done, how many hours were spent on each task, and the rate applied. Be specific to avoid any confusion about what the client is being charged for. This will also help in the event of a dispute or if the client requires clarification. Here’s what you should include: Tips for Streamlining Your Billing Process

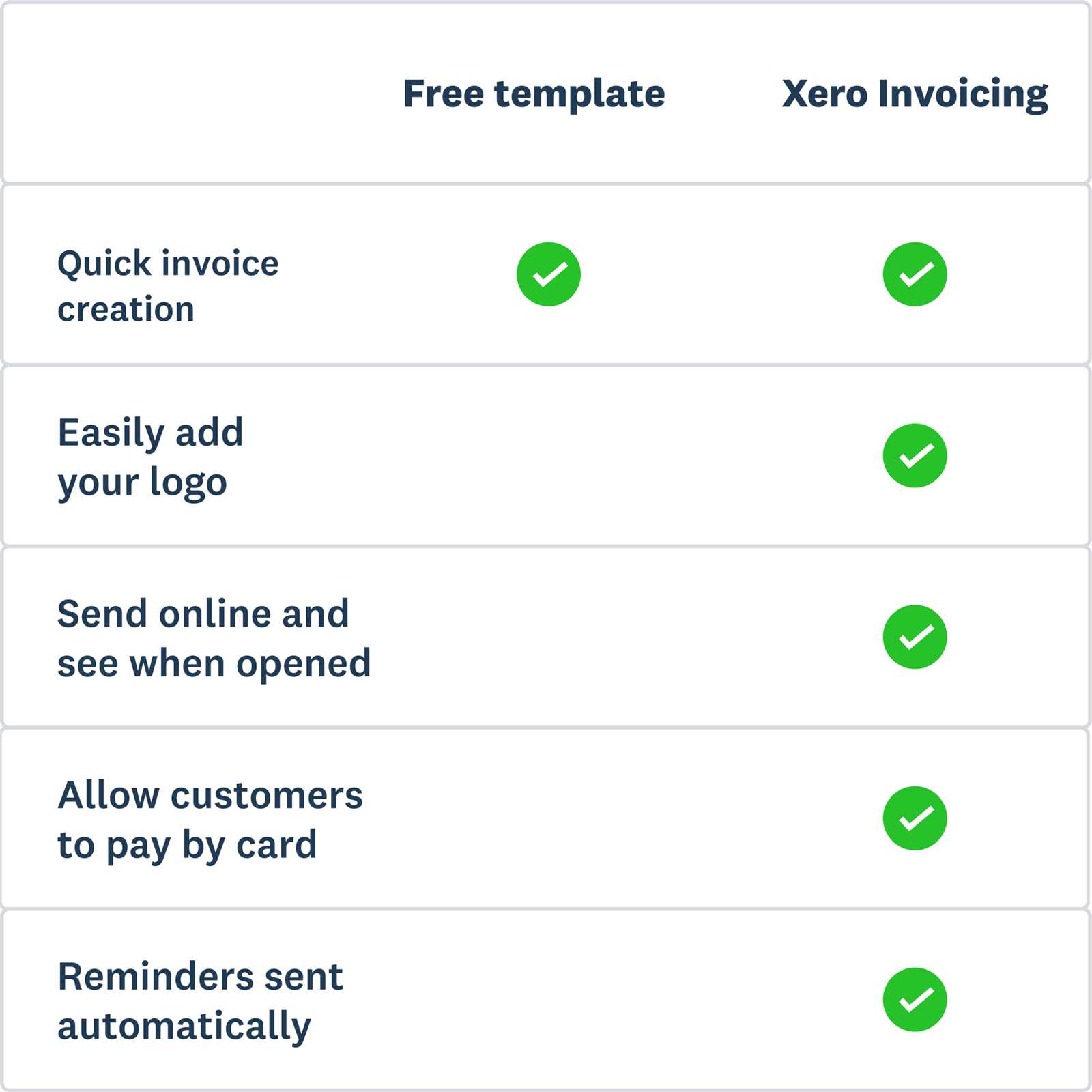

Efficient billing is crucial for maintaining smooth cash flow and avoiding delays in payments. A well-organized system not only saves time but also minimizes errors and reduces administrative work. Below are several tips to help you streamline your billing process, ensuring quicker and more reliable payment collection. 1. Automate the Billing WorkflowOne of the best ways to speed up your billing process is by automating it. Use software or online tools that can generate, send, and track payment requests. This eliminates the need for manual data entry, reduces the risk of errors, and speeds up the entire process. Many tools also offer features like automatic reminders for overdue payments, which can help keep your cash flow on track without constant follow-up. 2. Use Predefined FormatsUsing a consistent format for all your payment requests simplifies the process and saves time. Whether you create your own template or use specialized software, having a pre-designed structure ensures that you include all necessary details every time. You won’t have to worry about forgetting key information, and clients will appreciate the clarity and professionalism. 3. Set Clear Payment TermsTo avoid delays, make sure your payment terms are clearly stated in every request. Include the due date, accepted payment methods, and any penalties for late payments. Setting clear expectations from the start minimizes confusion and helps clients understand their responsibilities. This also encourages faster payments and reduces the need for follow-up emails or calls. 4. Track Payments Automatically

By keeping track of payments automatically, you can quickly identify overdue balances and take action without having to manually check your records. Many billing platforms allow you to track payments in real-time, which makes it easier to manage outstanding amounts and send reminders promptly. This also ensures that you maintain accurate records for tax and accounting purposes. 5. Offer Multiple Payment MethodsProviding clients with multiple payment options can help speed up the process. Whether it’s credit cards, online payment systems, or bank transfers, offering flexibility makes it easier for clients to pay on time. The more convenient you make it for them, the more likely they are to settle their balances promptly. 6. Consolidate Your Billing PerDifferent Formats for Billing DocumentsBilling documents can come in a variety of formats, each suited to different needs and preferences. Choosing the right format not only ensures that your document is easy for clients to understand but also streamlines the payment process. Whether you’re looking for simplicity, automation, or customization, understanding the available options will help you create the most effective document for your business. 1. Standard Text DocumentsOne of the simplest formats for billing is a plain text document, such as a Word or Google Docs file. This option allows you to create a custom layout from scratch or use a pre-made template. While this format offers flexibility, it requires more manual input, such as calculating totals and formatting, which can lead to errors if not carefully handled. However, it remains a popular choice for businesses that want complete control over the design and content of the document. 2. Spreadsheet Format

Spreadsheets, such as Microsoft Excel or Google Sheets, are another common format for billing documents. They allow for easy tracking of hours, rates, and totals, and many spreadsheet tools offer built-in formulas that automatically calculate the amounts. This format is particularly useful for businesses that need to manage multiple entries or generate detailed breakdowns. Additionally, spreadsheets are easily editable and can be customized to suit the unique needs of each client or project. 3. PDF FormatPDFs are a widely-used format for billing due to their universal compatibility and professional appearance. Once a document is created in another format (such as Word or Excel), it can be saved as a PDF for easy sharing. PDFs maintain their formatting, ensuring that the document looks the same on any device, and cannot be accidentally modified. This makes them ideal for businesses that want to ensure their billing documen Choosing the Right Billing Software for Consultants

For professionals who work independently or on a contract basis, selecting the right software to manage payment requests is crucial. The right tool can simplify the process, help track payments, and ensure that your documents are both accurate and professional. However, with so many options available, it can be difficult to know which one best suits your business needs. Below are key factors to consider when choosing billing software. 1. User-Friendly InterfaceWhen selecting a software solution, ease of use should be a top priority. The tool should have an intuitive interface that allows you to quickly create and send billing documents without requiring a steep learning curve. Look for software that simplifies tasks like entering client details, service Choosing the Right Billing Software for ConsultantsFor professionals who work independently or on a contract basis, selecting the right software to manage payment requests is crucial. The right tool can simplify the process, help track payments, and ensure that your documents are both accurate and professional. However, with so many options available, it can be difficult to know which one best suits your business needs. Below are key factors to consider when choosing billing software. 1. User-Friendly InterfaceWhen selecting a software solution, ease of use should be a top priority. The tool should have an intuitive interface that allows you to quickly create and send billing documents without requiring a steep learning curve. Look for software that simplifies tasks like entering client details, service descriptions, and calculating totals, so you can focus on your work rather than on the technicalities of the software. 2. Customization OptionsEvery business has its own unique needs, and the billing software you choose should be flexible enough to accommodate them. Look for tools that allow you to customize the layout and content of your documents, including your company logo, color scheme, and preferred terminology. This ensures that your documents not only meet your business’s specific requirements but also reflect your professional brand. 3. Payment Integration

One of the most important features of billing software is the ability to integrate with payment systems. Look for platforms that allow your clients to make payments directly from the document. Many billing tools integrate with popular payment gateways like PayPal, Stripe, or bank transfers, enabling your clients to pay in just a few clicks. This integration reduces friction and speeds up the payment process. 4. Invoice Tracking and RemindersTo ensure that you receive payments on time, it’s important to choose software that offers tracking and reminder functionality. The software should allow you to monitor the status of each payment, send automated reminders for overdue balances, and track your financial history. This feature is especially useful if you manage multiple clients or projects, as it helps you stay on top of all outstanding payments without having to manually check each one. 5. Reporting and AnalyticsEffective billing software should also provide insights into your financial health. Look for tools that offer reporting features, such as income tracking, tax calculations, and detailed analytics on your billing history. These reports can help you make better business decisions, optimize your workflow, and ensure that you’re keeping accurate financial records for tax purposes. 6. Cost-EffectivenessWhile there are many sophisticated software options available, not all of them are budget-friendly. It’s important to evaluate the cost of the software in relation to the features it offers. Many platforms offer a free tier with basic functionality, which may be sufficient for small businesses or freelancers just starting out. On the other hand, larger businesses or consultants with more complex needs may want to invest in a paid plan with advanced features. 7. Customer Support and ResourcesEven the best software can have a learning curve, and you may run into issues as you use it. Look for platforms that offer robust customer support, whether through email, phone, or live chat. Additionally, check if the software includes helpful resources, such as tutorials, FAQs, or user communities, to assist you when you need help or want to get the most out of the platform. By taking these factors into account, you can choose a billing solution that not only saves you time but also improves the professionalism and efficiency of your business operations. Selecting the right software allows you to streamline your payment collection process and focus more on delivering value to your clients. Using Billing Documents for Tax PurposesProperly documenting your financial transactions is essential for tax reporting and ensuring compliance with tax regulations. Having well-organized records not only helps you track earnings but also provides the necessary evidence in the event of an audit. Billing documents are a key tool in maintaining these records, as they detail your income and outline the services provided. By using these documents correctly, you can simplify your tax filing process and avoid potential tax-related issues. 1. Keeping Accurate Records of IncomeEach billing document you issue serves as a formal record of income earned. For tax purposes, it’s crucial to ensure that every service rendered and payment received is documented accurately. These records help you track your earnings throughout the year, making it easier to calculate your total taxable income when the time comes. It’s important to store these documents safely and keep them organized for easy retrieval during tax season. 2. Including Necessary Tax Information

For tax purposes, billing documents should include specific information to ensure that your income is properly reported. This includes details such as:

Having this information on each document helps ensure that you are calculating and reporting your taxes correctly. It also ensures that your clients have the right details for their own tax filings. 3. Deductions and ExpensesFor businesses or independent professionals, there are often various expenses that can be deducted from your taxable income. Billing documents can also serve as evidence when claiming deductions. For example, you may be able to deduct business-rel Free Resources for Billing Document Templates

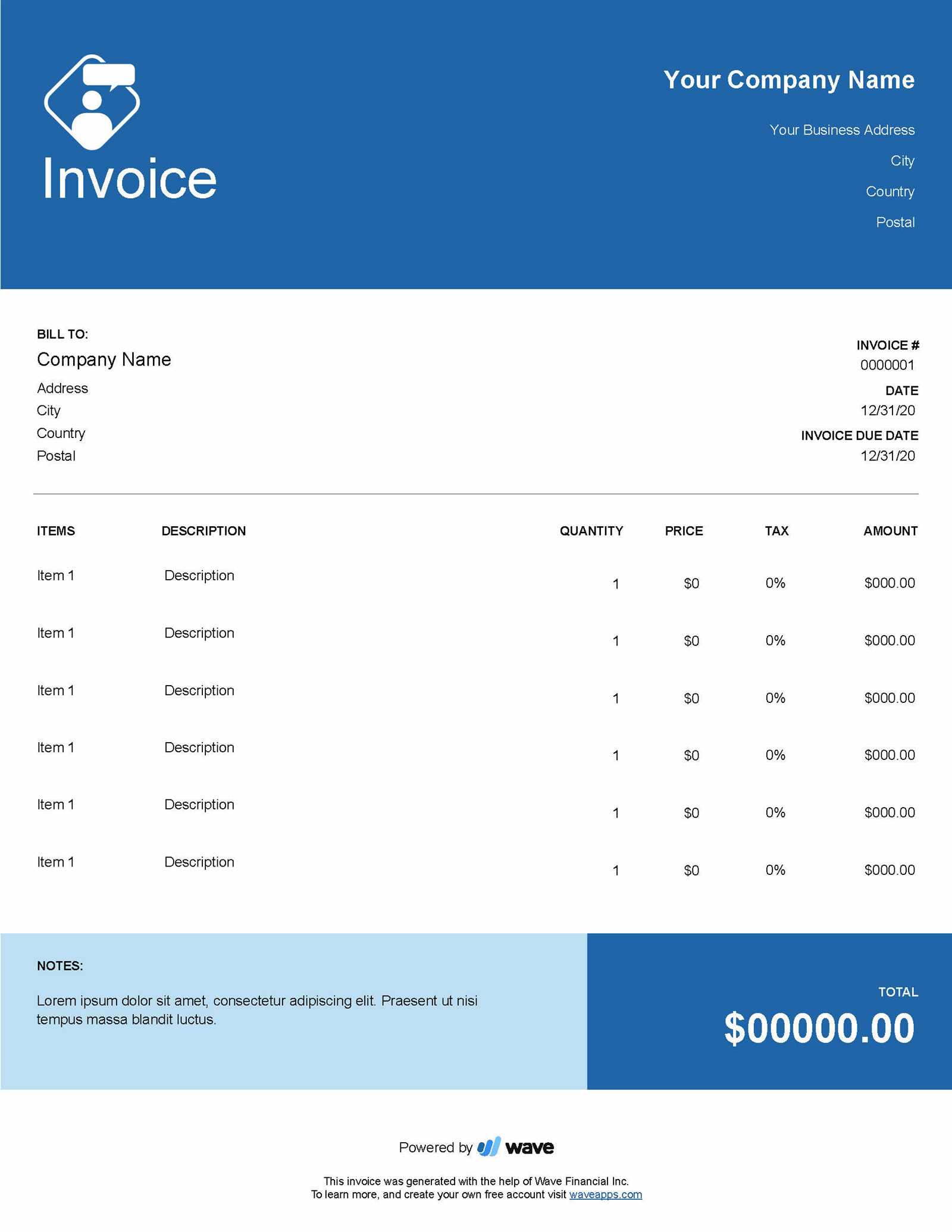

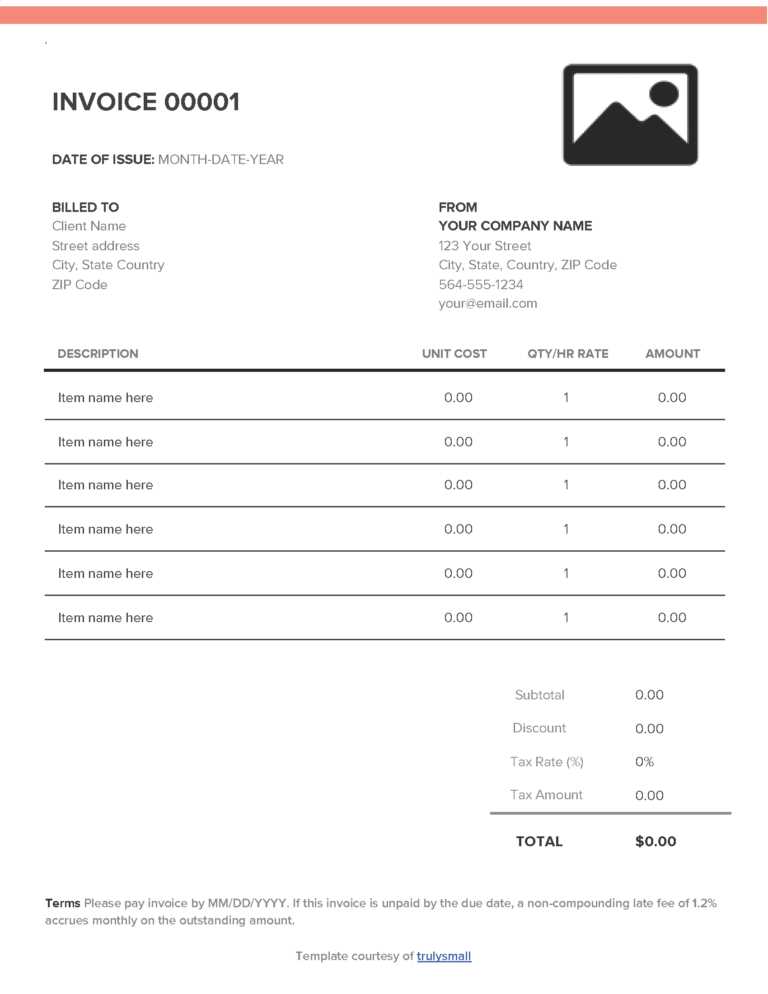

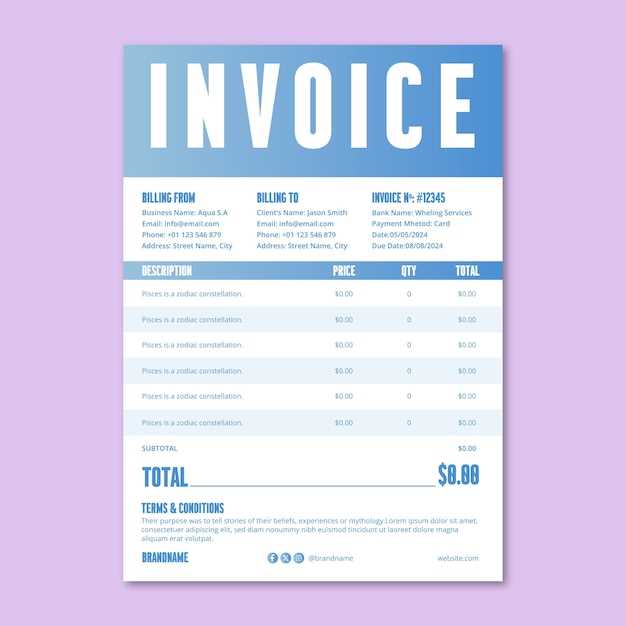

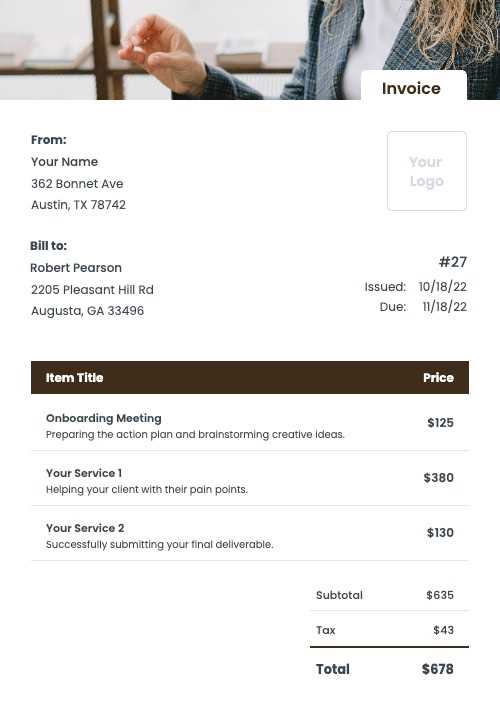

Creating billing documents can be a time-consuming task, especially if you’re starting from scratch. Fortunately, there are several free resources available online that offer customizable templates. These templates can save you time and effort by providing a professional structure for your documents, ensuring that all essential information is included. Whether you’re looking for a simple layout or a more detailed design, these resources offer a variety of options to suit your needs. 1. Online Template LibrariesThere are many websites that offer a wide range of free billing document templates. These templates are usually available in multiple formats, such as Word, Excel, or PDF, and can be easily customized to fit your specific needs. Some popular online libraries include:

2. Free Software ToolsMany free software tools also offer built-in templates that you can use to generate billing documents quickly. These tools often come with additional features, such as tracking payments or integrating with other financial tools. A few popular options include:

3. Downloadable Templates from Professional WebsitesMany professional organizations and blogs offer free downloadable templates. These templates are often tailored to specific industries or professions and can provide a great starting point for your documents. Some sites where you can find free resources include:

|