Sample Cleaning Invoice Template for Easy Billing

Managing finances and ensuring timely payments is a crucial aspect of any service-based business. Having an organized and professional system for tracking payments helps maintain trust with clients while ensuring smooth cash flow. For providers in industries like residential and commercial maintenance, delivering clear, concise, and accurate documents is key to successful transactions.

Whether you’re offering regular upkeep or specialized tasks, the way you present charges can reflect your professionalism. A well-structured document not only specifies the services provided but also sets clear expectations regarding fees, payment terms, and due dates. Customizing such documents according to your business needs can simplify your administrative work and enhance your relationship with customers.

In this guide, we’ll explore various ways to create an efficient and adaptable billing system for your business. By understanding what information to include, how to format your paperwork, and the best practices for handling payments, you’ll be able to streamline your invoicing process and ensure your clients receive the best possible service.

Sample Cleaning Invoice Template Guide

When managing a service-based business, it’s essential to have a structured approach to documenting the work completed and the charges associated with it. A well-designed billing document ensures that both you and your clients are clear about the transaction, fostering trust and avoiding misunderstandings. This guide provides insights into creating a functional and professional billing document that meets the needs of both service providers and customers.

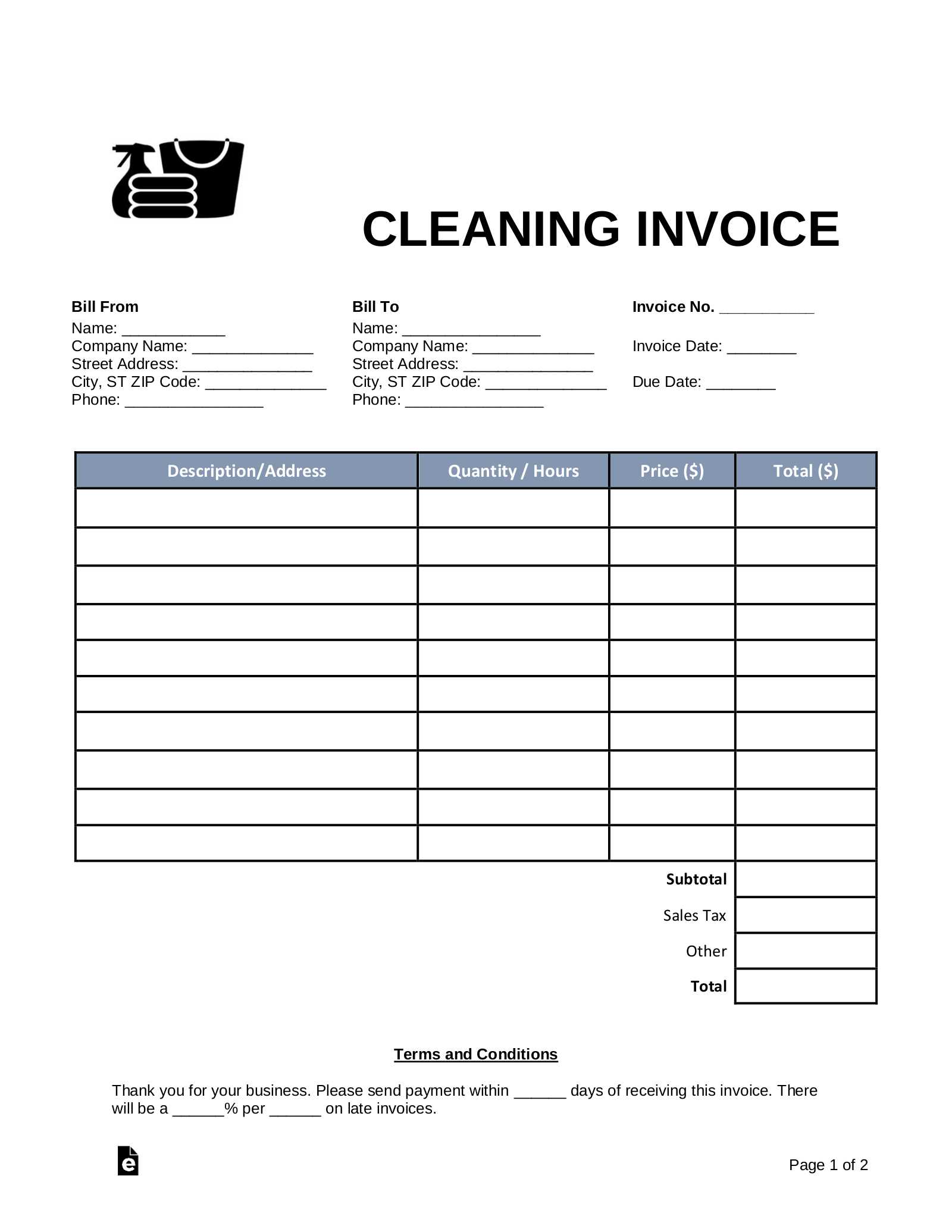

Key Elements to Include

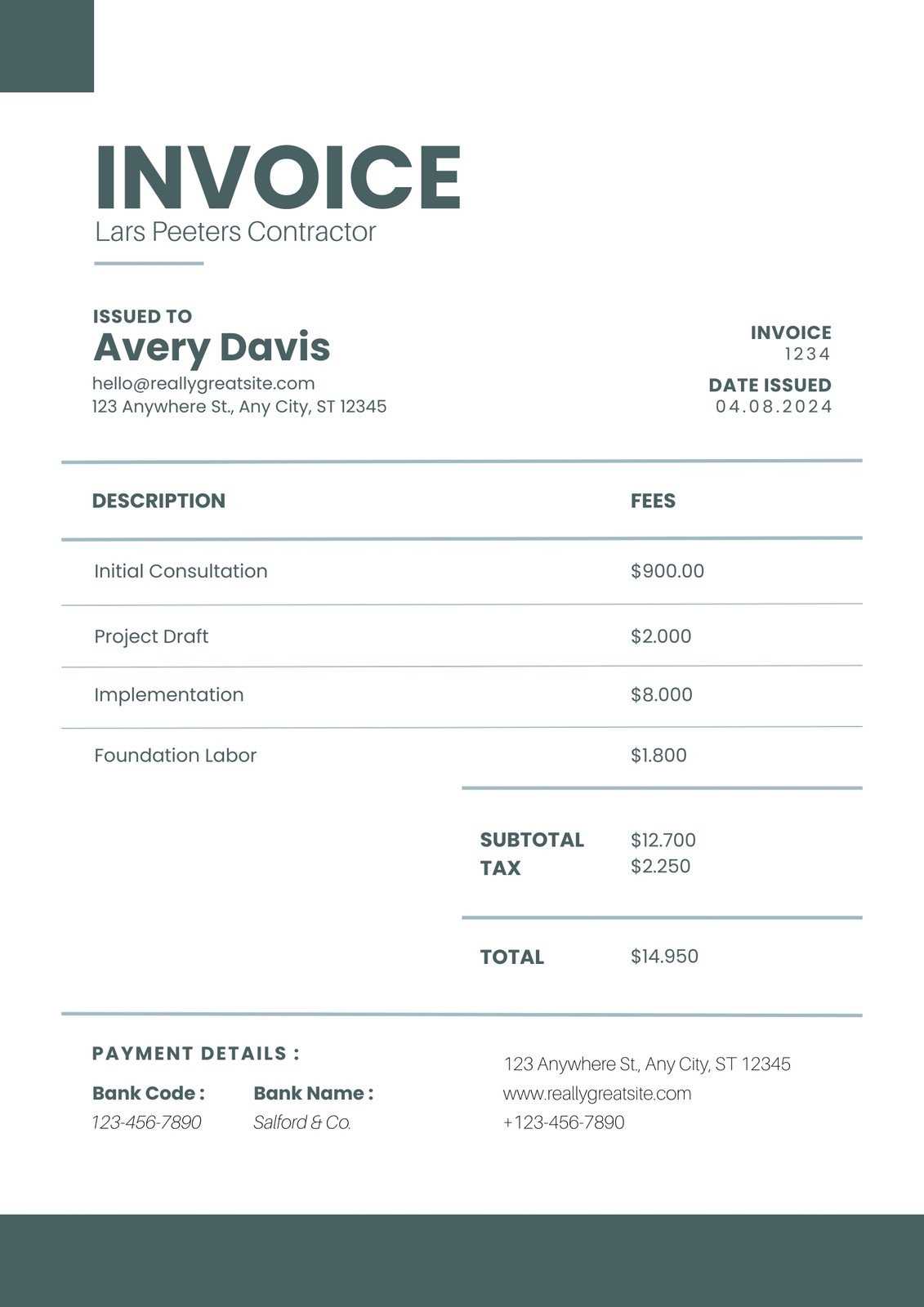

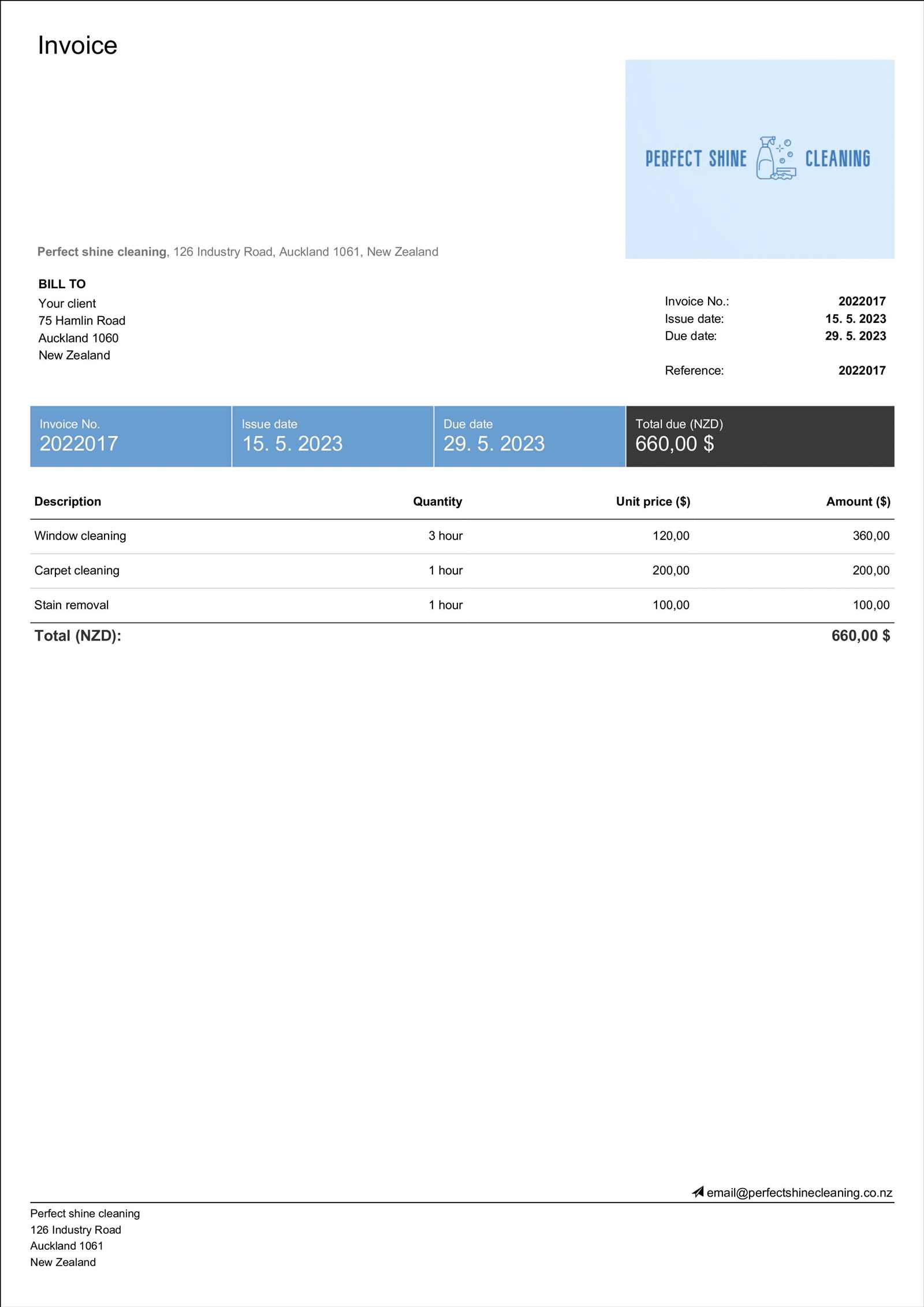

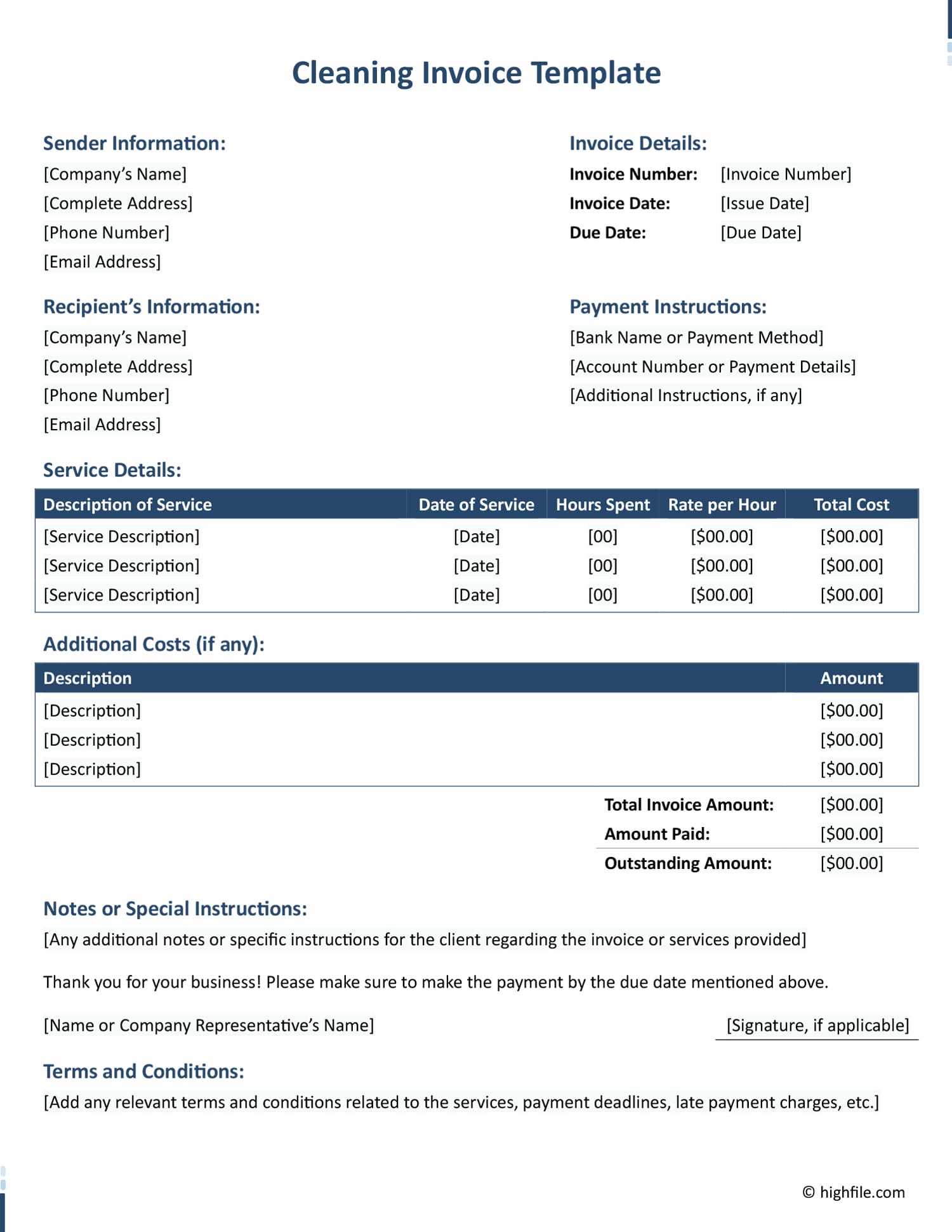

The core of any effective billing document lies in the information it contains. At a minimum, you should include service descriptions, cost breakdowns, and payment terms. Clearly outlining what was provided, when it was done, and how much is owed will make the entire transaction more transparent. Don’t forget to include your business details such as name, address, and contact information, as well as the client’s information to ensure accuracy.

Best Practices for Clarity and Professionalism

To present a polished and organized document, always keep the layout clean and simple. Use consistent fonts and formatting, and leave enough space between sections to make the document easy to read. Including clear payment instructions along with any late fees or discounts will help prevent confusion. Finally, consider offering clients different methods of payment to increase convenience and encourage prompt settlement.

Why Use a Cleaning Invoice Template

For service providers, having a standardized document for billing purposes is crucial in ensuring smooth transactions. Whether you’re managing a large-scale business or operating as an independent contractor, using a well-organized billing format can save time, reduce errors, and enhance professionalism. A consistent approach to documenting services and charges helps build trust with clients and makes the payment process clear and efficient.

Advantages of Using a Standardized Billing Document

- Time-saving: Pre-made structures allow you to quickly generate a new document without starting from scratch each time.

- Consistency: Using the same format ensures that all necessary details are included, making your billing process reliable.

- Professionalism: A clear and neat document enhances your credibility and reassures clients of your competence.

- Accuracy: With fields dedicated to specific information like service descriptions and costs, you reduce the likelihood of errors.

How It Benefits Your Business

By using a structured billing format, you not only streamline your administrative tasks but also improve communication with clients. A clear document sets expectations and avoids confusion about payment amounts, due dates, and services rendered. Additionally, it creates a record of transactions that can be referenced later for accounting or tax purposes. A well-organized approach ultimately contributes to more timely payments and satisfied customers.

Key Features of a Cleaning Invoice

An effective billing document is more than just a list of services and charges; it must be well-organized and detailed enough to avoid confusion for both the service provider and the client. Including the right elements ensures that the transaction is clear, professional, and easy to process. A well-structured document not only helps in tracking payments but also builds credibility with customers.

Some of the essential features of an effective billing record include:

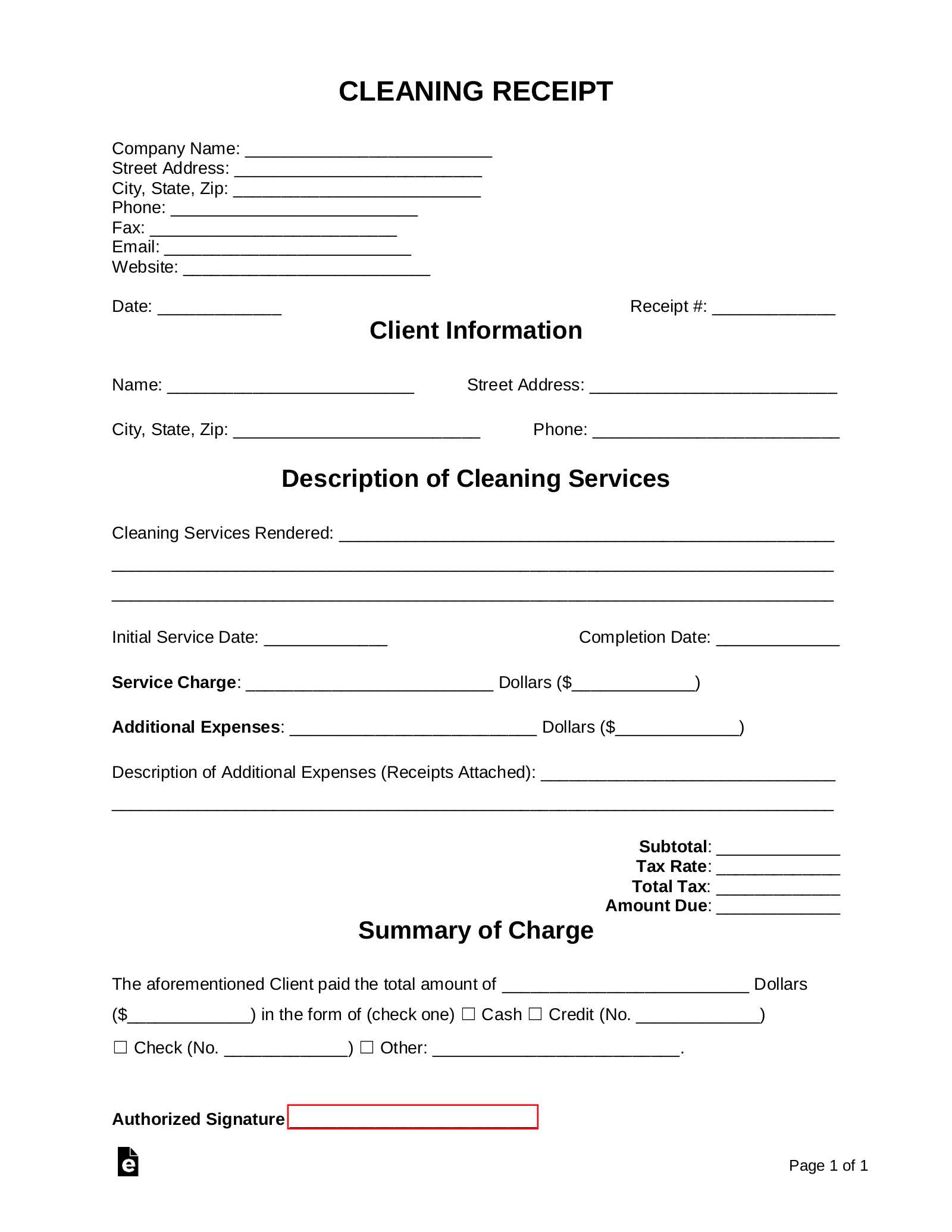

- Business and Client Information: Always include your company name, contact details, and the client’s information for easy reference.

- Service Description: Clearly outline the tasks performed with specific dates and times to provide transparency.

- Cost Breakdown: Show individual charges for each task or service, making it easier for clients to understand what they’re paying for.

- Payment Terms: Specify when the payment is due and any late fees that may apply. Include accepted payment methods for client convenience.

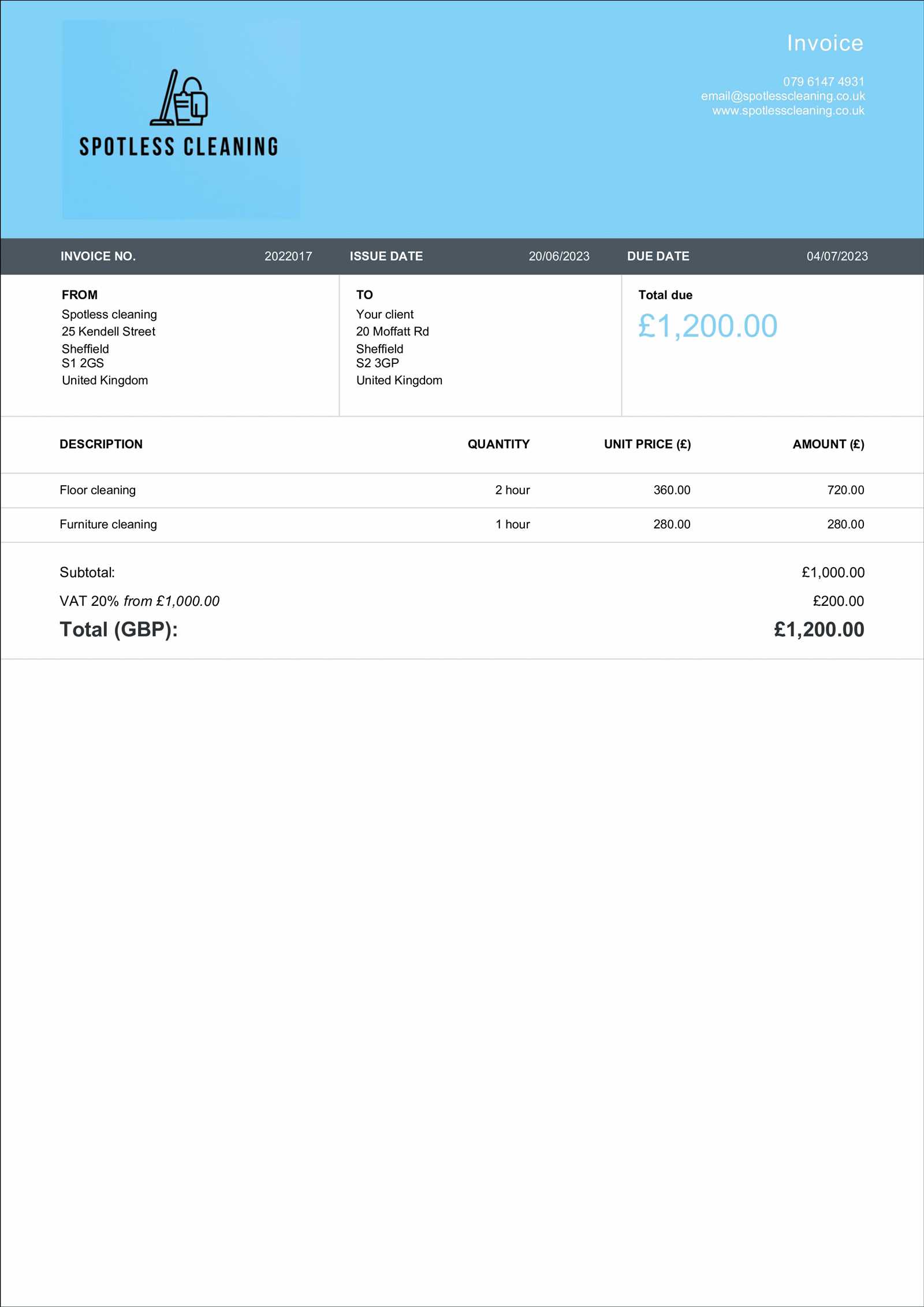

- Tax Information: If applicable, make sure to include the relevant tax rates and amounts to avoid misunderstandings.

- Unique Invoice Number: This helps with tracking and provides a reference for both parties in case of disputes or questions.

Including these elements ensures that both the client and the service provider are on the same page regarding the transaction, minimizing any potential confusion or conflict.

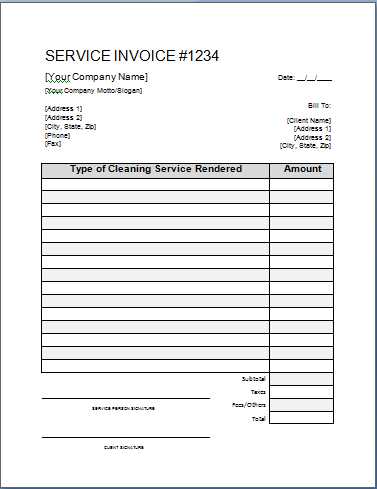

How to Customize a Cleaning Invoice

Personalizing your billing document allows you to tailor it to the unique needs of your business and clients. A customized format not only reflects your brand identity but also ensures that all relevant details are included in a way that’s easy for your clients to understand. Adjusting the structure and content of your document can improve its clarity and make the payment process smoother for both parties.

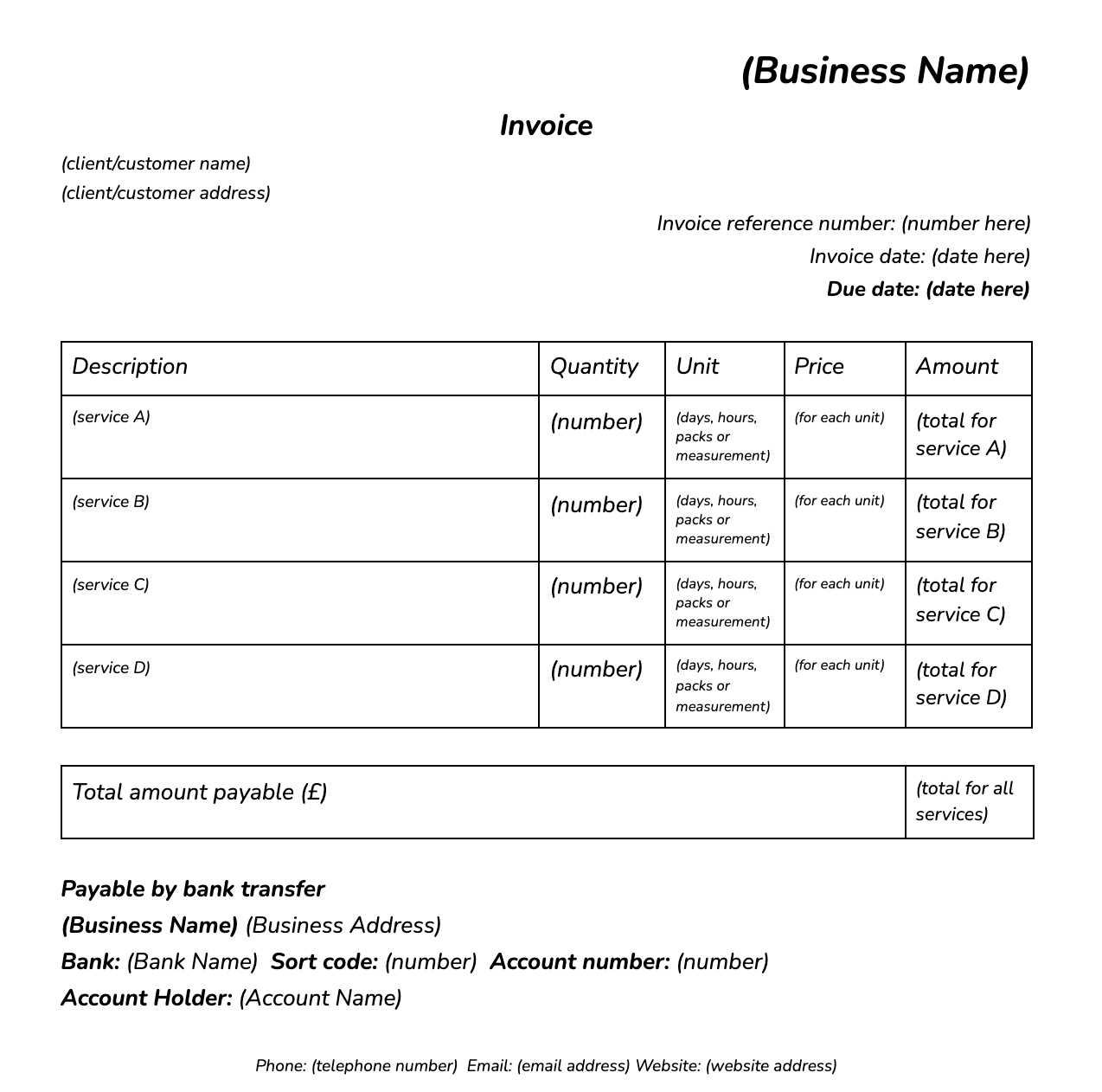

Choosing the Right Layout

The first step in customization is selecting an appropriate layout that suits your business style. You may choose a simple, straightforward design or a more detailed format, depending on the complexity of your services. Regardless of your choice, ensure that the sections are clearly divided, and the most important information is easily visible, such as service dates, amounts, and payment terms.

Adjusting the Content

- Service Details: Add a detailed description of each task performed, making it specific to the work you completed.

- Client-Specific Information: Customize the document by including the client’s name, contact details, and address for accurate record-keeping.

- Payment Options: Offer multiple payment methods or add a link to an online payment portal to increase convenience for clients.

- Business Branding: Include your logo, brand colors, and font styles to make your document visually consistent with your company’s identity.

By making these adjustments, you ensure that your document serves not only as a functional tool but also as a reflection of your professionalism and attention to detail.

Essential Information for Your Invoice

To ensure that both you and your client are on the same page, it’s important to include all necessary details in your billing document. These key pieces of information not only clarify the transaction but also protect both parties in case of disputes. Providing the correct data helps avoid confusion and speeds up the payment process.

What to Include in Every Document

- Your Business Information: Always include your company name, address, phone number, and email address. This allows your clients to contact you easily if needed.

- Client’s Information: Make sure to add the client’s name and address for accurate record-keeping and easy identification.

- Detailed Service Description: Clearly list the services provided with specific dates and hours worked. This helps your clients understand exactly what they’re being charged for.

- Charges and Fees: Itemize the costs for each service and include any additional charges, such as travel fees or taxes.

- Payment Terms: State the payment due date, any early payment discounts, and penalties for late payment. This keeps expectations clear.

- Unique Reference Number: Assign a unique identification number to each document for easier tracking and future reference.

Why This Information Matters

Including all these details ensures that there’s no ambiguity about the services provided or the amount owed. It also helps streamline your accounting processes, making it easier to manage financial records and track payments. By keeping everything clear and transparent, you build trust with your clients and avoid unnecessary delays in receiving payments.

Creating Professional Invoices for Clients

In any service-based business, presenting a polished and professional document is essential for maintaining a positive relationship with your clients. A well-crafted record not only reflects the quality of the service provided but also helps ensure that payments are processed smoothly and promptly. By paying attention to detail and structure, you can create a document that enhances your business image and sets clear expectations.

Here are some important steps to follow when crafting an effective billing document:

Maintain a Clean and Organized Layout

The design of your document should be simple, clear, and easy to read. Ensure that sections are well-spaced and information is logically grouped, such as contact details at the top, followed by a list of services rendered and corresponding charges. This makes it easier for clients to quickly review and understand the charges without feeling overwhelmed.

Ensure Accuracy and Transparency

Each billing statement should be precise and error-free. Double-check all calculations, dates, and client details before sending. Providing clear descriptions of the tasks performed, including the amount of time spent, adds transparency and helps clients feel confident that they’re being charged fairly. Additionally, outline your payment terms and due dates clearly to avoid confusion.

By focusing on these elements, you not only create a professional-looking document but also build trust and credibility with your clients, paving the way for smooth business operations.

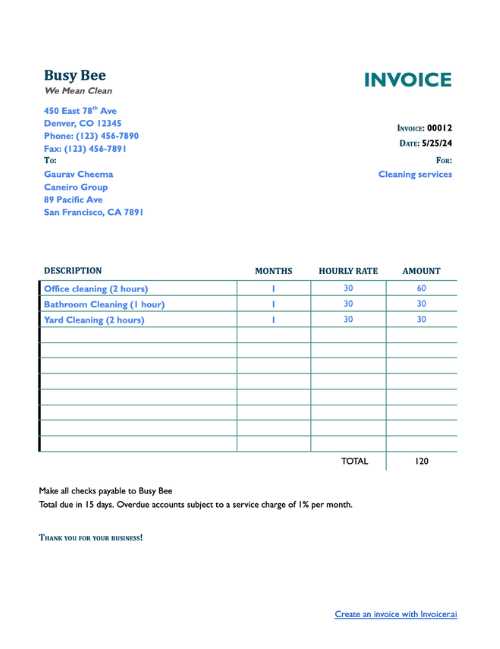

How to Add Payment Terms to Your Invoice

Setting clear payment terms in your billing document is essential for maintaining smooth financial transactions with clients. It ensures that both parties understand when the payment is due, what methods are acceptable, and what penalties or discounts may apply. Well-defined terms help avoid misunderstandings and encourage timely payments.

Key Components of Payment Terms

- Due Date: Clearly specify the date by which the payment must be made. This helps your client plan accordingly and ensures you receive payments on time.

- Late Fees: If applicable, mention any penalties for overdue payments. For example, a percentage fee for each day the payment is late can motivate clients to pay promptly.

- Accepted Payment Methods: List the payment options available, such as bank transfers, checks, or online platforms. This gives your client flexibility in choosing the most convenient method.

- Early Payment Discounts: Offer an incentive for clients who pay before the due date. For instance, a small discount can encourage quicker payments and improve cash flow.

Why Payment Terms Matter

Including specific payment instructions in your documents sets clear expectations for both you and your client, which helps prevent delays and confusion. By outlining payment methods, due dates, and penalties upfront, you not only make the process more transparent but also enhance your professional image. A well-structured payment policy contributes to smoother business operations and stronger client relationships.

Best Practices for Invoice Formatting

When creating a billing document, proper formatting is key to ensuring clarity, professionalism, and ease of use. A well-structured design not only enhances the document’s readability but also helps to convey important information efficiently. By following best practices for formatting, you can make sure your clients understand the details quickly and reduce the chances of errors or disputes.

Essential Formatting Guidelines

- Consistency: Use a consistent font style and size throughout the document to keep it looking professional. Choose fonts that are clear and easy to read, like Arial or Times New Roman.

- Logical Layout: Organize the document with clear headings, such as client information, services rendered, charges, and payment details. Keep sections well-spaced to make the document visually appealing.

- Highlight Key Information: Make important details stand out by using bold text or larger font sizes, such as due dates, payment terms, and total amounts.

Example of a Well-Formatted Billing Document

| Service Description | Hours Worked | Rate | Total |

|---|---|---|---|

| General cleaning of office space | 3 | $20/hour | $60 |

| Window cleaning | 1.5 | $25/hour | $37.50 |

| Total | $97.50 | ||

By following these formatting tips, you ensure that your billing document is both functional and visually appealing, which in turn reflects positively on your business.

Common Mistakes in Cleaning Invoices

Even small errors in billing documents can lead to confusion, delays in payments, or disputes with clients. It’s important to be aware of common mistakes to avoid, as they can affect both your professional reputation and your business operations. A carefully structured document can help maintain clarity and ensure smooth transactions.

Frequent Errors to Watch Out For

- Incorrect Client Information: Failing to include or incorrectly entering the client’s name, address, or contact details can cause confusion and delay communication regarding payment.

- Missing Service Descriptions: Not specifying the exact work done can lead to misunderstandings about what the client is being charged for. Always include a clear breakdown of tasks.

- Failure to List Payment Terms: Not including clear payment instructions or due dates can result in delayed payments. Be sure to outline when the payment is expected and any penalties for late payments.

- Errors in Pricing: Mistakes in calculating the total cost or missing out on additional fees can create friction with clients. Double-check all numbers before sending out the document.

- Omitting Tax Information: Not including the applicable taxes or failing to specify tax rates can lead to confusion and potential legal issues. Always include tax details where required.

How to Avoid These Pitfalls

To minimize errors, make sure to double-check all the information before sending the billing document. Using automated software or templates with built-in fields can also reduce the risk of mistakes. Clear communication with clients, including discussing terms and charges upfront, can further help prevent misunderstandings.

Choosing the Right Invoice Software

Selecting the right software for generating and managing billing documents is crucial for any business. The right tool can simplify the process, reduce errors, and help you stay organized. Whether you’re running a small operation or a larger business, the right software ensures that your financial documents are accurate, professional, and easy to track.

What to Look for in Billing Software

- User-Friendly Interface: The software should be easy to navigate, with a clean and intuitive design. You don’t want to spend more time figuring out how to use it than actually creating and sending documents.

- Customizability: Look for a solution that allows you to personalize the design, content, and structure of your billing documents. You should be able to add your business logo, adjust payment terms, and tailor the document according to your needs.

- Automation Features: Automated reminders for overdue payments, recurring billing options, and automatic calculations can save you significant time and reduce the chance of errors.

- Integration with Accounting Tools: A good invoicing tool should integrate seamlessly with your accounting software, allowing for easy tracking of payments and synchronization of financial data.

- Security and Compliance: Ensure the software is secure and compliant with relevant regulations, especially regarding data protection and tax reporting. Your client’s sensitive information should be protected at all times.

Popular Software Solutions

There are several popular tools that can streamline your billing process. From simple, free options to more robust paid software, the right choice depends on your business needs. Some of the best-rated tools include platforms like FreshBooks, QuickBooks, and Zoho Invoice. Many of these offer customizable features, reporting tools, and integrations that can fit the needs of small businesses and freelancers alike.

Choosing the right invoicing software can make a huge difference in how efficiently your business runs. By selecting a tool that aligns with your needs, you ensure that your billing process is not only professional but also effective and timely.

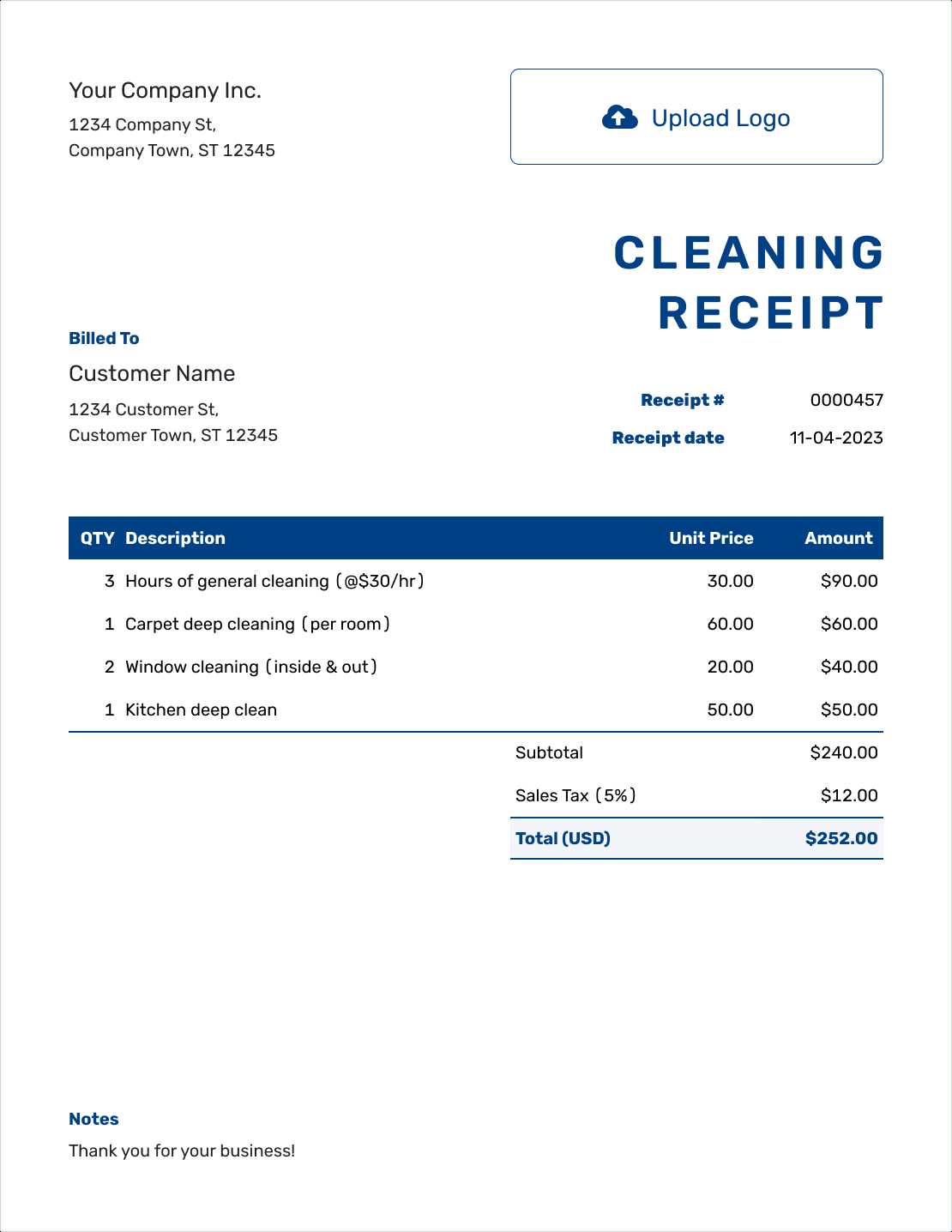

How to Calculate Cleaning Service Fees

Determining the appropriate fees for services rendered is crucial for ensuring profitability while maintaining client satisfaction. The process of calculating charges involves considering various factors such as time, labor, materials, and the complexity of the tasks performed. By carefully evaluating these elements, you can set fair and transparent rates that reflect the value of your work.

Factors to Consider When Setting Fees

- Hourly Rate: Many service providers charge by the hour. To determine your hourly rate, consider your expertise, industry standards, and the cost of running your business. It’s essential to account for overhead costs like equipment, insurance, and administrative expenses.

- Size of the Area: For services that involve cleaning large spaces, fees can be based on the square footage or the number of rooms being cleaned. Larger areas typically require more time and resources, so the price should reflect that.

- Service Complexity: The more detailed and specialized the tasks, the higher the cost. For example, deep cleaning or specialized treatments may justify a higher fee compared to standard maintenance services.

- Frequency of Service: Offering discounts for repeat or long-term clients can incentivize ongoing business. Regular contracts may allow for lower pricing per visit in exchange for steady work.

- Materials and Equipment: If special cleaning supplies or equipment are needed, these costs should be added to the overall price. Be sure to itemize these additional charges clearly.

Example Calculation

For instance, if you charge $25 per hour and a job takes 3 hours, the basic fee would be $75. If you need to use specialized cleaning products, such as eco-friendly solutions, and those materials cost $10, you would add that amount to the final total, bringing the total charge to $85.

By considering these factors, you can create fair and consistent pricing that accurately reflects the value of your services and meets both your financial goals and your clients’ expectations.

Importance of Clear Payment Instructions

Providing clear and straightforward payment instructions is essential for ensuring timely and accurate transactions. When clients understand exactly how to make payments, the process becomes smoother for both parties. Vague or incomplete instructions can lead to confusion, delayed payments, and frustration, which can ultimately affect your cash flow and business relationships.

Why Clarity is Crucial

- Avoiding Delays: Clear payment details, including due dates, accepted methods, and specific amounts, ensure that clients know what is expected of them, minimizing the risk of delayed payments.

- Building Trust: Transparency in your billing process reflects professionalism and builds trust with clients, which encourages prompt payment and long-term business relationships.

- Reducing Mistakes: When payment details are straightforward, the likelihood of errors such as overpayments, underpayments, or miscommunication is greatly reduced.

Key Elements to Include

- Due Date: Always include a specific date by which the payment should be made. This sets clear expectations for when funds should be received.

- Accepted Payment Methods: Specify the ways in which clients can pay, whether it’s through bank transfers, credit cards, online platforms, or checks. Offering multiple options can increase convenience and accelerate payment.

- Late Payment Terms: Clearly state any penalties or fees for overdue payments, such as interest rates or flat charges. This can motivate clients to pay on time and deter late payments.

By ensuring that your payment instructions are easy to follow and transparent, you create a more professional experience for your clients and improve your overall cash flow management.

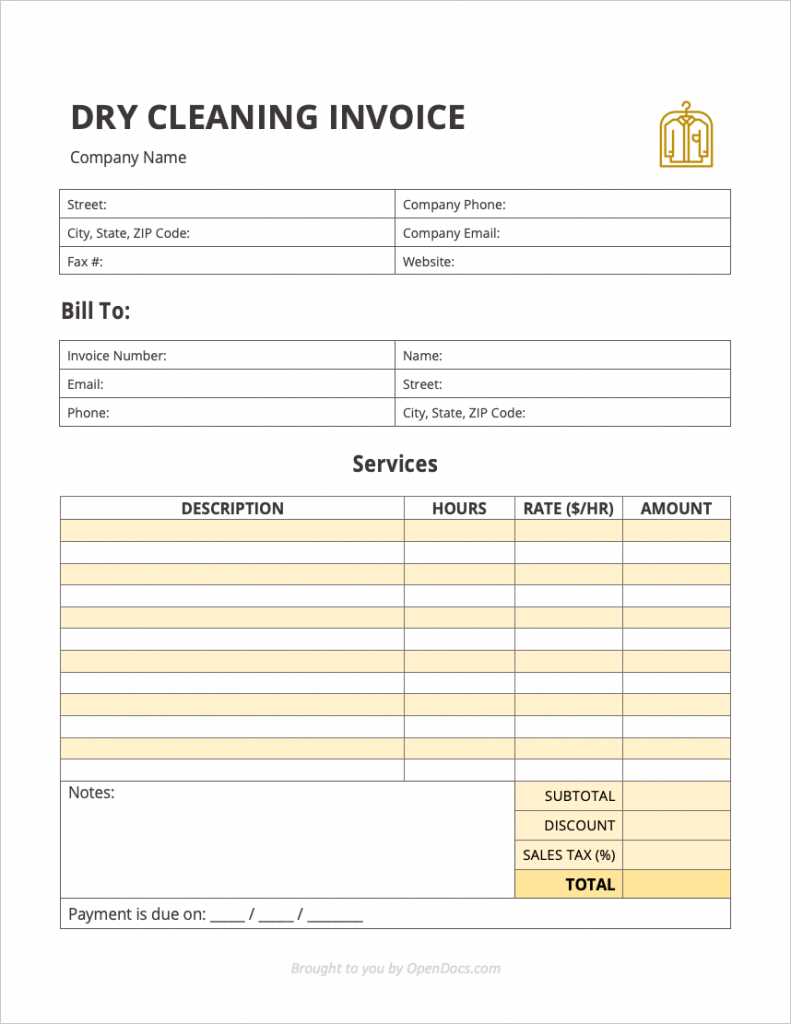

Invoice Templates for Different Cleaning Services

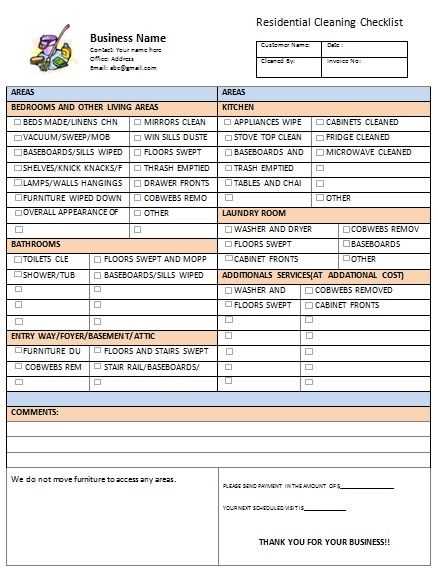

Each type of service may require a slightly different approach when it comes to generating billing documents. Tailoring the layout and details to match the nature of the work ensures that clients understand exactly what they are being charged for. Whether it’s for residential, commercial, or specialized services, customizing your billing documents helps maintain professionalism and clarity.

Residential Services

For household cleaning, billing documents typically include details such as the number of rooms cleaned, time spent, and any special tasks performed. These documents should emphasize the personalized nature of the service, and may include descriptions like “living room cleaning” or “bathroom sanitation.” By providing a clear breakdown of hours and tasks, you help clients see the value in what’s been provided.

Commercial and Specialized Services

For larger or more specialized jobs, such as office cleaning or post-construction cleanup, the billing documents might need to be more detailed. These may include factors like square footage, specialized equipment used, or a team of workers involved. Including the specific services rendered, along with any additional fees for equipment or materials, ensures that clients are fully aware of the costs associated with larger-scale projects.

By adapting your billing documents for each type of service, you not only clarify the charges but also demonstrate professionalism and transparency, building trust with your clients.

How to Include Taxes in Your Invoice

Including taxes in your billing documents is a necessary step to ensure compliance with local regulations and provide transparency to your clients. Properly accounting for taxes prevents misunderstandings and ensures you charge the correct amount. Whether you are applying sales tax, value-added tax (VAT), or other applicable charges, it’s essential to clearly list the tax rates and amounts in your documents.

Steps to Include Taxes

- Identify Applicable Tax Rates: First, determine the tax rate that applies to your services based on your location and the nature of your business. This could vary by state, country, or type of service provided.

- Calculate the Tax: Once you know the tax rate, multiply it by the total cost of the services provided. Ensure that the tax amount is calculated separately from the base amount to maintain clarity.

- Display the Tax Clearly: Include a separate line item for the tax on your billing document. This allows your client to see the exact amount being charged for taxes, which enhances transparency.

- Show Total Amount Due: Add the tax amount to the total cost of the services, and ensure the final amount due is clearly highlighted at the bottom of the document.

Example Breakdown with Tax

| Service Description | Amount |

|---|---|

| General Office Cleaning | $100.00 |

| Sales Tax (8%) | $8.00 |

| Total Due | $108.00 |

By following these steps and clearly indicating the tax breakdown, you help clients understand the charges and ensure they are properly paying the required taxes. This level of transparency not only promotes professionalism but also helps maintain legal c

Tips for Sending Cleaning Invoices on Time

Sending billing documents promptly is crucial for maintaining healthy cash flow and building strong client relationships. Timeliness in delivering your charges ensures that payments are made without unnecessary delays. Establishing a consistent schedule and streamlining your process can help avoid mistakes and ensure you meet deadlines without stress.

Effective Strategies for Timely Billing

- Set a Fixed Schedule: Create a routine for sending billing documents, such as issuing them on the last day of each month or immediately after completing a service. A set schedule helps avoid procrastination and ensures clients are consistently billed on time.

- Use Automated Tools: Leverage software that allows you to automate the creation and delivery of billing documents. Many tools enable you to set up recurring invoices and even send reminders to clients when payments are due.

- Prepare Documents in Advance: Don’t wait until the last minute to create and send your billing statements. Prepare the documents ahead of time and have them ready to go as soon as the service is completed.

- Keep Client Information Updated: Ensure that all client details, such as email addresses and contact numbers, are accurate. Incorrect or outdated information can delay the delivery of your billing documents and slow down payments.

Example of an Efficient Billing Process

| Step | Action | Timeframe | ||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Service Completion | Finish the job and gather all necessary details for billing. | Same day as service | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 2. Document Creation | Generate the billing document with clear breakdowns of services. | Within 24 hours of service | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 3. Sending Document | Email or mail the completed billing statement to the client. | Within 48 hours of service |

| Client | Amount Due | Due Date | Status | Next Action |

|---|---|---|---|---|

| Client A | $200.00 | October 15 | Outstanding | Send reminder email |

| Client B | $150.00 | October 5 | Overdue | Follow up via phone |

| Client C | $50.00 | October 12 | Paid | No action needed |

By implementing a clear and organized approach to tr

How to Handle Client Disputes Over Invoices

Disputes over billing can arise for various reasons, from misunderstandings about services rendered to disagreements over costs. When a client questions a charge, addressing the situation professionally and promptly is crucial for maintaining positive relationships. A well-handled dispute not only resolves the issue but can also reinforce trust and demonstrate your commitment to customer satisfaction.

Steps for Resolving Billing Disputes

- Stay Calm and Professional: The first step in managing a dispute is to approach the situation calmly. Reacting defensively can escalate the issue, whereas a patient, professional response helps defuse tension and shows that you are committed to finding a fair solution.

- Listen to the Client’s Concerns: Before making any assumptions or offering solutions, listen carefully to your client’s concerns. Understand exactly what they are disputing–whether it’s the amount, the services listed, or the payment terms.

- Review the Details: Go through the billing document, contract, and any related correspondence to ensure everything is accurate. If there’s a mistake on your part, take responsibility and correct it immediately. If the charge is justified, be prepared to explain the breakdown of costs clearly.

- Provide Clear Explanations: If the dispute is based on confusion about the services or charges, offer a clear and concise explanation. Provide itemized details and show how the amount was calculated. The more transparent you are, the more likely the client will feel reassured.

- Negotiate a Resolution: In some cases, a compromise might be necessary. Offering a discount or payment plan can help resolve the issue without damaging the relationship. Ensure that any agreed-upon changes are documented and confirmed in writing.

Example of Dispute Resolution Process

| Step | Action |

|---|---|

| 1. Acknowledge the Dispute | Listen to the client’s concern and confirm receipt of their complaint. |

| 2. Review the Document | Double-check the charges, services provided, and terms to identify any errors. |

| 3. Provide an Explanation | Clearly explain how the charges were calculated and the reasoning behind them. |

| 4. Offer a Resolution | If necessary, negotiate a fair solution, such as a partial refund or payment arrangement. |

| 5. Confirm the Outcome | Follow up in writing to confirm the agreed-upon resolution. |

Handling disputes over charges with care and attention can turn a potentially negative experience into an opportunity to strengthen your relationship with the client. By remaining transparent, flexible, and focused on finding solutions, you show professionalism and maintain trust, which ultimately benefits both parties.

When to Update Your Invoice Template

Regularly reviewing and updating your billing documents is essential for keeping your business operations smooth and compliant. As your services evolve or regulations change, your billing documents must reflect those updates to avoid confusion, errors, or missed opportunities. Knowing when to make changes ensures that all necessary information is captured accurately and that your clients are billed correctly.

Key Times to Update Your Billing Documents

- Changes in Service Offerings: If you expand or adjust the range of services you offer, it’s important to update your documents to reflect these changes. This may include adding new service categories, updating descriptions, or modifying pricing structures.

- Price Adjustments: When you increase or decrease your prices, you should update your billing documents to reflect the new rates. This ensures transparency and avoids any confusion when clients receive their bills.

- Regulatory or Tax Changes: Any changes in local, state, or federal tax rates or regulations may require you to update the format of your billing documents to comply with new laws, including revised tax rates or reporting requirements.

- Rebranding or Business Name Change: If your company undergoes rebranding or a name change, your documents should reflect the updated business name, logo, and contact information to maintain a consistent professional image.

- Technological Advancements: If you adopt new software or systems that improve your billing processes, it may be a good time to update your document format to incorporate features such as automation, better formatting, or integrations with payment systems.

When to Make Adjustments: A Quick Overview

| Scenario | Action | Timing |

|---|---|---|

| New Service or Product | Update your service categories and descriptions. | Immediately after adding the service. |

| Price Increase or Decrease | Revise pricing sections to reflect new rates. | Before applying new prices to any clients. |

| Changes in Tax Rates | Adjust tax fields and calculations as required. | As soon as tax changes are finalized. |

| Business Name or Branding Change | Update business name, logo, and contact info. | When the rebranding is officially completed. |

| Technology Upgrade | Incorporate new features and design elements. | As soon as the new system is set up. |

By regularly assessing and adjusting your billing documents to match the needs of your business, you ensure that they remain accurate, professional, and in compliance with relevant laws and regulations. Keeping your documents updated also helps to streamline your billing process and prevent future issues with clients.