Sample Attorney Invoice Template for Efficient Legal Billing

Managing billing in the legal profession can be complex, but using a well-structured document to outline charges and payment terms can simplify the process significantly. A clear, organized format helps both legal professionals and their clients understand financial obligations, ensuring smoother transactions and reducing the potential for misunderstandings.

By adopting a standardized method for detailing services rendered, time spent, and applicable fees, law firms can maintain consistency in their billing practices. This approach not only improves professionalism but also saves time, as it removes the need for creating invoices from scratch for every case.

Effective billing is an essential part of running a successful legal practice, and having the right format in place is key to ensuring that payments are processed efficiently and disputes are minimized. A well-crafted document will also reflect positively on a firm’s image, portraying it as organized and client-focused.

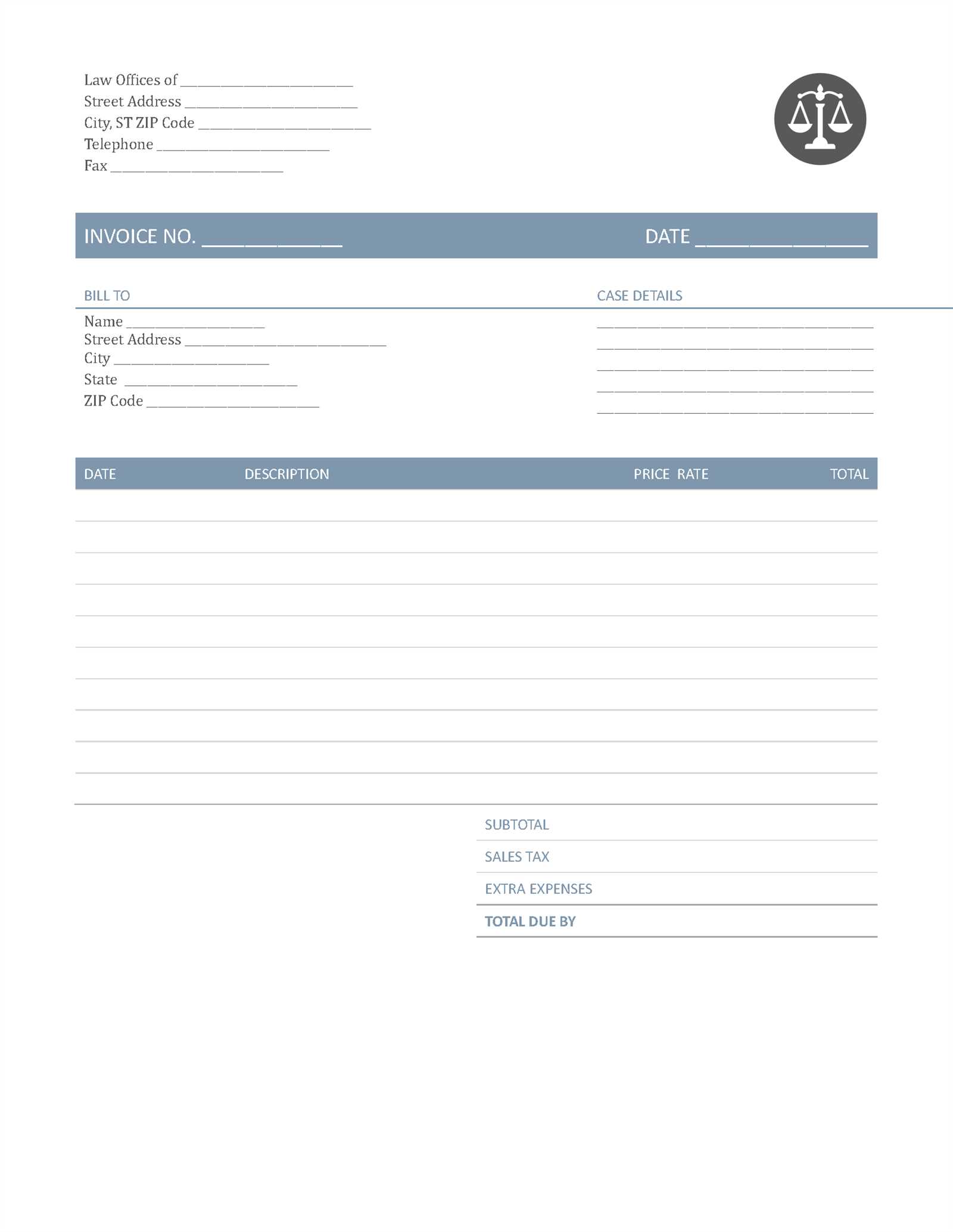

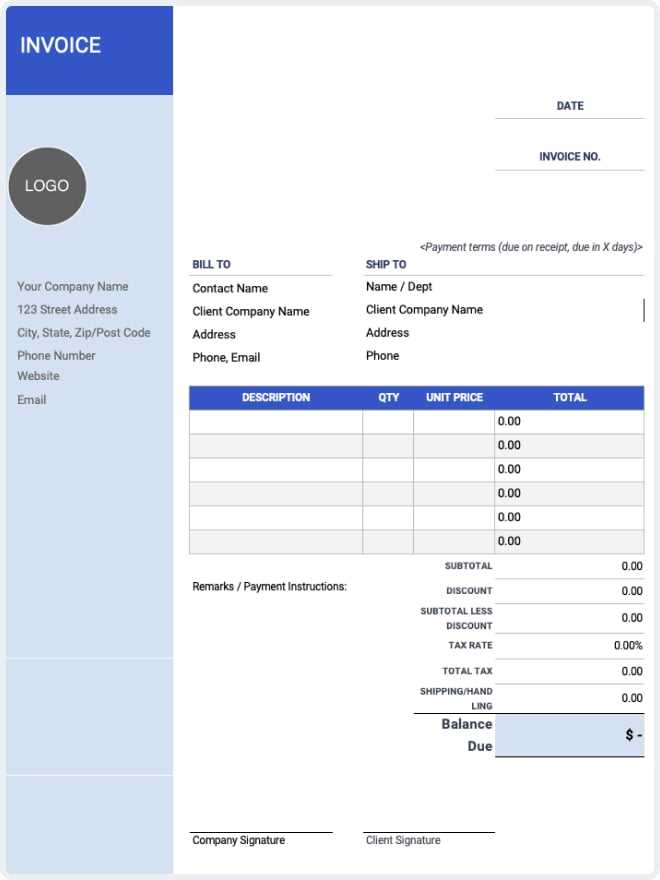

Sample Attorney Invoice Template Overview

Creating a professional billing document is a crucial part of any legal practice. It serves as a formal record of services provided and the corresponding fees, ensuring transparency and clarity between legal professionals and their clients. A well-organized billing format can help avoid confusion and disputes, allowing both parties to focus on the work at hand.

A properly designed billing document typically includes several key elements: client information, a breakdown of services rendered, the duration of each task, and a clear outline of payment terms. These components are essential for maintaining accuracy in charging clients and providing a reference point in case of future inquiries. In addition, the document should reflect the professional standards of the legal field, conveying trust and competence.

Efficiency is another major benefit of using a standardized structure. Instead of recreating a new document for every case, legal professionals can rely on a set format to streamline the billing process, saving time and ensuring consistency across all transactions. A well-organized layout also helps ensure that no fees are overlooked or omitted.

Why Use an Attorney Invoice Template

Utilizing a pre-designed billing document can save significant time and reduce errors when charging clients for legal services. A standardized format ensures that all essential information is included consistently, leading to more efficient administrative work and fewer billing disputes. By relying on a professional structure, legal practitioners can focus on their cases while ensuring that their financial transactions remain organized.

There are several key advantages to adopting a standardized billing format:

- Time efficiency: Using a pre-made format eliminates the need to create a new document for each case, speeding up the billing process.

- Accuracy: A consistent layout ensures that all relevant details, such as fees, hours worked, and terms of payment, are included correctly each time.

- Professionalism: A well-structured document reflects the professionalism of the practice, improving client trust and confidence in the services provided.

- Ease of use: Customizing a standard document to fit each specific case is quick and simple, reducing the effort needed to prepare invoices.

- Clarity: Clear, detailed billing documents help clients understand exactly what they are being charged for, minimizing confusion and potential disputes.

By using a consistent, reliable format for billing, legal professionals ensure that their financial transactions are handled smoothly and professionally, allowing them to focus on delivering excellent legal services.

Essential Components of an Attorney Invoice

To ensure that clients clearly understand the charges for legal services, every billing document must include several key elements. These components provide a detailed breakdown of the work performed, the time spent, and the corresponding fees. Including the necessary information helps to maintain transparency, avoid confusion, and establish trust between the legal professional and the client.

Key Information to Include

- Client details: Full name, address, and contact information of the client.

- Service provider details: The name, address, and contact information of the legal practice or professional.

- Case or matter reference: A description or reference number related to the specific legal matter or case.

- Date of service: The date when the service was rendered or the date range for ongoing work.

- Detailed breakdown of services: A clear listing of all tasks performed, including consultations, research, filings, and court appearances, along with time spent on each task.

- Hourly rates or fixed fees: The fee structure for services provided, whether billed by the hour, flat rates, or other billing arrangements.

- Expenses: Any additional costs incurred during the service, such as court fees, travel expenses, or administrative charges.

- Payment terms: Clear instructions on how and when payments are due, including late fees, discounts, or deposit requirements.

- Balance due: The total amount due, clearly stated at the bottom of the document.

Additional Optional Components

- Payment methods: Indication of acceptable payment options such as bank transfer, check, or online payment systems.

- Tax information: Any applicable taxes or VAT should be listed separately for clarity.

- Notes or disclaimers: Special terms, conditions, or other important information that may affect the charges or payment schedule.

Including these key elements ensures that the billing document is both comprehensive and professional, helping to prevent misunderstandings and ensuring smooth financial transactions.

How to Customize Your Invoice Template

Customizing your billing document allows you to tailor it to your specific needs while maintaining professionalism and clarity. By adjusting the format, content, and layout, you can ensure the document aligns with your practice’s requirements and the preferences of your clients. A personalized billing structure also helps streamline your workflow and makes the entire process more efficient.

Follow these steps to customize your billing document effectively:

- Choose the right layout: Decide whether you want a simple, minimalist design or a more detailed and structured layout. The layout should prioritize clarity and ease of use.

- Incorporate your branding: Add your logo, practice name, and other branding elements to make the document look professional and consistent with your other materials.

- Modify the header: Include important information at the top, such as your business address, contact details, and the client’s information. Make sure it’s easy to find.

- Adjust the billing sections: Depending on the services you offer, adjust the sections to include the correct services, rates, and payment terms. This may include listing hourly rates, flat fees, or other types of billing arrangements.

- Add or remove fields: Tailor the document to your specific needs by including additional fields for expenses, taxes, or payment methods. You may also want to leave out unnecessary sections.

- Personalize payment terms: Include your preferred payment methods, due dates, and penalties for late payments to ensure clear expectations with your clients.

- Save and reuse: After customizing the document, save it as a reusable template that you can modify for each case, saving you time on future billing.

By following these steps, you can ensure that your billing documents reflect your practice’s standards and streamline your financial transactions. Customizing the format to meet your needs will not only save time but also present a more professional image to your clients.

Common Billing Methods for Attorneys

Legal professionals have various options when it comes to charging clients for their services. The method chosen often depends on the type of work being done, the client’s preferences, and the specific arrangement made at the beginning of the legal relationship. Understanding the different billing methods can help ensure that both parties are clear about payment expectations and that the financial aspect of the case runs smoothly.

Here are some of the most commonly used billing methods in the legal field:

- Hourly rate: This is one of the most traditional methods, where clients are charged based on the amount of time spent on their case. Rates may vary depending on the experience of the professional or the complexity of the work.

- Flat fee: In this arrangement, a fixed amount is agreed upon for specific services, regardless of how long the task takes to complete. This is often used for simpler or routine legal matters.

- Contingency fee: This method is common for cases where the legal professional only gets paid if the client wins or settles the case. The fee is usually a percentage of the recovery amount.

- Retainer: Clients pay an upfront fee that is used to cover future legal services. The professional bills against this retainer as work is completed, and any unused funds are refunded once the case is closed.

- Value-based billing: In this model, the fee is determined by the value the legal service provides to the client rather than the time spent. It is often used for high-stakes or complex cases where the outcome is highly significant.

- Task-based billing: Clients are billed a set amount for each individual task or action taken, such as drafting a document or attending a court hearing. This can be combined with hourly rates for tasks that vary in time and complexity.

Each billing method has its advantages and is suited to different types of legal work. Choosing the right approach helps to foster a positive relationship with clients while ensuring that the legal professional is compensated fairly for their efforts.

Benefits of Using a Template for Legal Billing

Adopting a pre-designed structure for billing can significantly improve the efficiency and accuracy of the financial processes within a legal practice. A consistent and standardized approach helps ensure that all necessary details are included, reducing the likelihood of errors and misunderstandings. By relying on an established format, legal professionals can streamline administrative tasks and focus more on client work.

Here are some key advantages of using a pre-built structure for legal billing:

- Time-saving: With a consistent structure, there’s no need to start from scratch with each new client. Simply fill in the necessary details, which saves time and ensures uniformity across all transactions.

- Increased accuracy: A well-structured format reduces the risk of forgetting important information, such as billable hours, additional expenses, or payment terms, leading to fewer errors.

- Professionalism: A polished and organized document enhances the client’s perception of the legal practice, showcasing a level of professionalism and attention to detail.

- Consistency: Using the same format for all clients ensures that billing remains uniform, which simplifies accounting and record-keeping and reduces the chances of disputes over charges.

- Ease of customization: A standard structure can be easily adjusted to meet specific needs, whether it’s modifying payment terms or adding particular service categories, allowing flexibility while maintaining consistency.

- Improved cash flow management: Clear, professional documents make it easier to track payments, monitor outstanding balances, and follow up on overdue accounts, helping to maintain a steady cash flow.

Incorporating a standardized billing format not only boosts efficiency but also helps to maintain positive relationships with clients by presenting clear, transparent, and well-organized financial statements.

How to Calculate Attorney Fees Accurately

Accurately determining the fees for legal services is a critical aspect of managing a successful practice. Whether you charge by the hour, offer flat rates, or utilize a contingency arrangement, it’s important to ensure that the fees reflect the value of the services provided while also remaining fair and transparent for clients. Properly calculating fees ensures that you are compensated appropriately for your work and helps avoid potential disputes over billing.

Steps to Calculate Fees Correctly

- Determine the billing method: The first step is to decide which pricing model best suits the nature of the work. You may choose hourly rates, flat fees, or another method based on the case and client agreement.

- Track time accurately: If you are billing by the hour, ensure that every minute spent on a task is properly recorded. Use timekeeping tools or software to capture the exact time worked on each task to avoid overestimating or underestimating the charges.

- Review client agreements: Ensure that the terms agreed upon with the client, including rates and payment structures, are accurately reflected in your calculations. Double-check for any retainer amounts, fixed fees, or contingency arrangements that may apply.

- Include additional expenses: Any extra costs incurred while handling a case–such as court filing fees, travel expenses, or document copying–should be added to the total bill. Make sure these expenses are clearly outlined and agreed upon in advance with the client.

- Factor in complexity: If the work involved is particularly complex, requiring additional expertise or resources, consider adjusting your rates or adding surcharges. Ensure that these adjustments are communicated upfront to the client.

Tips for Accurate Calculations

- Keep detailed records: Maintain accurate logs of your time and any additional charges, as this helps to ensure that your calculations are precise and defensible if questioned.

- Use billing software: Consider using legal billing software to streamline the calculation process, which can help track time, expenses, and rates automatically.

- Communicate clearly with clients: Set clear expectations regarding fees, payment schedules, and any potential changes to the cost structure. Transparency at the start helps to avoid misunderstandings later on.

By following these steps and tips, you can ensure that your fees are calculated accurately, fairly, and in a way that maintains professionalism and transparency with your clients.

Incorporating Payment Terms in Invoices

Clearly outlining payment terms in a billing document is essential for ensuring that both the service provider and the client are on the same page regarding financial expectations. Well-defined payment terms help avoid misunderstandings and set clear guidelines for when and how payments are expected. Including these terms protects both parties and ensures smooth financial transactions.

Key Elements to Include in Payment Terms

- Due date: Clearly state when the payment is due. Whether it’s within 30 days, 60 days, or another timeframe, specifying this helps the client know when to make the payment.

- Late fees: Include any penalties for overdue payments. This could be a fixed fee or a percentage of the total amount due, and it should be mentioned upfront to avoid confusion later.

- Accepted payment methods: Specify the types of payments you accept, such as bank transfers, checks, credit cards, or online payment systems. This eliminates any ambiguity about how the client can pay.

- Payment installments: If the payment is to be made in installments, outline the amount due for each installment and the dates by which they must be paid.

- Discounts or early payment incentives: If you offer discounts for early payment, be sure to mention them in the payment terms. This encourages timely payments while offering value to the client.

Tips for Clear Payment Terms

- Be specific: Avoid vague terms like “due soon” or “as soon as possible.” Instead, use concrete language like “payment due within 30 days from the date of the document.”

- Communicate before sending: If any payment terms are unusual or different from a client’s expectations, it’s a good idea to discuss them beforehand to ensure there’s no confusion later.

- Keep terms visible: Ensure that the payment terms are easy to locate on the document, typically near the total amount due, so the client can review them quickly and easily.

By clearly outlining the payment terms in your billing documents, you ensure transparency and create an expectation for timely payments, reducing the likelihood of financial disputes and improving cash flow management.

Legal Billing Best Practices for Attorneys

Effective billing practices are essential for maintaining financial health and client satisfaction in the legal profession. Clear, transparent, and timely billing fosters trust with clients while ensuring that professionals are compensated fairly for their work. By adhering to best practices, legal practitioners can streamline the billing process, minimize disputes, and maintain long-term client relationships.

Here are some key best practices for legal billing:

- Be Transparent: Clearly communicate pricing structures and terms upfront. Discuss hourly rates, flat fees, and any additional charges before beginning work to ensure there are no surprises later.

- Track Time and Expenses Accurately: Record time spent on each task as soon as possible to avoid errors. Use time-tracking tools or software to log hours and capture every billable activity.

- Provide Detailed Breakdowns: Make it easy for clients to understand what they’re being charged for by providing a detailed breakdown of services, tasks, and expenses in your billing statements.

- Issue Invoices Promptly: Send invoices in a timely manner to maintain cash flow. Don’t wait too long after completing the work–issue invoices promptly, ideally within a few days of finishing the task or case.

- Set Clear Payment Terms: Include precise due dates, late fees, and acceptable payment methods. Establishing clear payment terms ensures that clients know when and how to pay.

- Be Consistent: Use a standard format for all your billing documents to ensure consistency across your practice. This helps with organization, record-keeping, and tracking payments.

- Offer Multiple Payment Options: Provide a variety of payment methods to make it easier for clients to settle their bills. Accepting credit cards, online payments, or bank transfers gives clients more flexibility and can lead to faster payments.

- Review for Accuracy: Double-check all billing statements before sending them. Look for any mistakes or missed charges that could cause confusion or delay payments.

- Be Professional and Courteous: Always maintain professionalism i

Understanding Hourly Rate Invoicing

Hourly rate billing is one of the most common methods used to charge for professional services. In this system, clients are billed based on the amount of time spent working on their case or project. This approach is particularly useful when the scope of work is uncertain or when tasks are highly variable. It ensures that professionals are compensated for every hour of their time, but also requires accurate tracking of time spent on each task.

How Hourly Rate Billing Works

Under an hourly rate system, the service provider charges a set amount for each hour worked. The total amount due is determined by multiplying the hourly rate by the number of hours spent on the case. For this to be effective, both parties must agree on the hourly rate in advance, and the service provider must track their time meticulously to ensure accurate billing.

- Set the hourly rate: The rate is typically determined by factors such as the professional’s experience, expertise, and the complexity of the work being done. Rates may vary depending on the nature of the service or the client’s needs.

- Track time carefully: Time must be recorded accurately, with clear documentation of how many hours were spent on each task. Many professionals use time tracking software to ensure precision and to avoid disputes over billing.

- Provide detailed breakdowns: Clients should be given a clear breakdown of how many hours were spent on each activity or task. This level of detail ensures transparency and can help prevent confusion or dissatisfaction with the charges.

Benefits and Challenges of Hourly Billing

Hourly billing offers both advantages and challenges for professionals and clients alike:

- Benefits:

- Flexibility: This method is ideal for work with uncertain timelines or when the scope of tasks is likely to change.

- Fair Compensation: Professionals are paid for every hour of work, ensuring they are compensated for the time invested in the case or project.

- Clear Documentation: With proper tracking, hourly rate billing provides an easy-to-understand record of services rendered, which can help clarify charges for clients.

- Challenges:

- Uncertainty: Clients may feel uneasy about the final cost, especially if the work takes longer than expected.

- Time Tracking: Accurate timekeeping is essential, and without it, the risk of overcharging or undercharging increases.

While hourly rate billing has its complexities, it remains a fair and transparent way to charge for services, provided that the time spent on tasks is accurately tracked and

Flat Fee Billing in Legal Services

Flat fee billing is a method in which a service provider charges a predetermined, fixed amount for a specific task or service, regardless of the time spent or the complexity involved. This pricing model offers both clients and professionals predictability and simplicity, as the cost is agreed upon upfront. It is often used for clearly defined and routine tasks where the scope and expected outcome are well understood in advance.

How Flat Fee Billing Works

Under a flat fee arrangement, the client pays a single, agreed-upon price for a particular service, such as preparing a legal document, representing a client in a straightforward case, or handling a routine transaction. This method is commonly used for services that have a standard scope and are unlikely to vary significantly in terms of time or effort. Once the fee is agreed upon, it covers the entire service, and no additional charges are added, unless otherwise specified.

- Set a fixed price: The professional sets a fixed price based on the expected time and effort required for the task. This amount is agreed upon before any work begins.

- Clear scope of work: Both the client and the service provider need to clearly define the scope of the work covered by the flat fee. This prevents confusion and ensures that both parties understand the expectations.

- Upfront agreement: The price is agreed upon before any work is started, offering clients certainty about the total cost.

Benefits and Considerations of Flat Fee Billing

While flat fee billing offers advantages, it also comes with some challenges that should be considered by both service providers and clients:

- Benefits:

- Predictability: Both parties know the exact cost from the outset, which helps with budgeting and financial planning.

- Simplicity: Flat fee billing reduces the need for complex calculations, as the agreed-upon price covers all aspects of the service.

- Incentive for efficiency: Since the fee is fixed, service providers may be incentivized to complete tasks efficiently, without dragging out the process unnecessarily.

- Considerations:

- Scope creep: If the task becomes more complex or time-consuming than initially anticipated, the professional may need to renegot

How to Handle Retainers in Invoices

When working with advance payments for services, it’s crucial to properly account for retainers in financial documents. A retainer is a sum of money paid upfront by a client to secure services, often used to cover future work. Properly handling retainers ensures both transparency and accuracy in billing, preventing any misunderstandings regarding outstanding balances or future charges.

How Retainers Are Applied in Billing

Retainers are typically applied against future work or hourly charges, with the balance used as the service provider works on the case or project. As the provider completes tasks, they deduct the appropriate amount from the retainer until it is either exhausted or the work is complete. If the retainer is fully used, the client may be required to replenish it or settle the remaining balance.

Retainer Amount Work Done Amount Deducted Remaining Balance $2,000 Initial Consultation, Research $500 $1,500 $1,500 Document Drafting $600 $900 $900 Court Filing, Representation $900 $0 Best Practices for Handling Retainers

- Clearly Define Terms: Specify how the retainer will be used, including which services it covers and whether it is refundable or non-refundable. Make sure both parties understand these terms before any work begins.

- Provide Regular Updates: Keep clients informed of how their retainer is being used by providing itemized breakdowns of charges and remaining balance at regular intervals.

Tracking Expenses on Billing Statements

Accurate tracking of additional costs is essential when preparing a billing statement for services. These expenses, which may include administrative fees, court filing fees, or other out-of-pocket costs, should be clearly documented and billed separately from professional fees. Transparent expense tracking not only helps ensure fair compensation but also builds trust with clients by clearly explaining what they are being charged for.

How to Track and Document Expenses

To ensure that additional costs are properly recorded and communicated, follow these best practices:

- Itemize Expenses: Break down each expense individually. For example, list the cost of copying documents, travel expenses, or any third-party services used. This helps clients understand the nature of each charge.

- Provide Receipts or Proof: Where possible, include receipts or proof of payment for the expenses incurred. This supports the legitimacy of the charges and increases transparency.

- Specify Payment Responsibility: Clarify whether certain expenses are included in the overall fee or if they are to be paid by the client separately. Make sure these details are clearly outlined in the agreement.

- Use Expense Categories: Categorize expenses to make it easier for both parties to understand what is being charged. Common categories include travel, research materials, court fees, and administrative costs.

- Maintain Consistent Records: Keep accurate records of all expenses as they occur. This will ensure that no costs are overlooked and helps avoid disputes over missing charges at the time of billing.

Best Practices for Reporting Expenses

- Clarity and Transparency: Provide a detailed breakdown of expenses in your billing statements. This will give your client a clear understanding of how the total amount was determined and prevent confusion about charges.

- Timely Updates: If new expenses arise during the course of providing services, inform the client promptly. This keeps the client in the loop and allows them to prepare for any additional charges.

- Separate Professional Fees from Expenses: Clearly distinguish between professional service charges and reimbursable expenses. This allows clients to see exactly what they are paying for in terms of labor versus out-of-pocket costs.

By carefully tracking and documenting expenses, professionals ensure that their billing statements are accurate, clear, and fair. Transparent reporting of these costs strengthens client relationships and reduces the risk of disputes over financial matters.

Managing Client Disputes Over Billing

Client disputes over charges are a common challenge for service providers, especially in industries where billing can be complex or vary based on the scope of work. Handling these disputes effectively is essential to maintaining positive client relationships while ensuring fair compensation for services rendered. Clear communication, detailed documentation, and a structured process for resolving conflicts can help prevent misunderstandings and lead to amicable solutions.

Steps to Address Billing Disputes

When a client disputes a charge, it’s important to address the issue professionally and systematically. Here are some steps to manage billing disputes effectively:

- Listen Actively: Begin by listening to the client’s concerns without interrupting. Acknowledge their frustration and demonstrate a willingness to resolve the issue amicably.

- Review the Billing Statement: Carefully review the disputed charges and ensure they are accurate. Verify that the services or expenses billed align with the agreed terms and the work completed.

- Clarify the Details: Provide a clear explanation of the charges, referencing the scope of work, contract terms, or any additional agreements. If necessary, break down the charges into smaller, understandable components.

- Offer Solutions: If the dispute is valid, offer to adjust the charges or find a compromise. If the charges are justified, explain the reasons clearly and respectfully. Offering flexibility, such as payment plans or discounts, may help resolve the situation.

- Document the Resolution: After resolving the issue, document the outcome in writing. Ensure that both parties agree to the resolution and confirm any adjustments or arrangements made.

Best Practices for Preventing Billing Disputes

While disputes are inevitable at times, adopting preventive measures can significantly reduce their occurrence. Here are some best practices to consider:

- Set Clear Expectations Upfront: Clearly outline pricing, payment terms, and services in the initial agreement or contract. Make sure the client understands what is included in the service and how they will be billed.

- Provide Detailed Billing Statements: Ensure all charges are itemized and include sufficient detail. The more transparent and specific the statement, the less likely the client will feel confused or misled.

- Maintain Open Communication: Keep the client informed throughout the process, especially if there are changes to the scope of work, unexpected costs, or delays. Regular communication helps prevent misunderstandings.

- Address Concerns Early: If you sense a potential issue arising with a client, address it promptly before it escalates. Early intervention can prevent a minor concern from turning into a major dispute.

By

Tips for Clear and Professional Billing Statements

Creating clear and professional billing statements is essential for maintaining transparency and trust with clients. A well-crafted document ensures that clients understand exactly what they are being charged for, helps avoid disputes, and reflects positively on the service provider’s reputation. To achieve this, it’s important to include all necessary details while keeping the layout simple and easy to understand.

Key Elements of a Professional Billing Statement

To create a billing document that is both clear and professional, consider incorporating the following elements:

- Clear Contact Information: Always include the full name, address, and contact details of both the client and the service provider. This ensures there is no confusion regarding who is responsible for payment.

- Itemized Charges: Break down each service or product provided, specifying the date and the cost associated with each. This helps clients understand the value of what they are paying for.

- Payment Terms: Clearly state when the payment is due, any late fees that may apply, and acceptable methods of payment. Transparency here reduces the chance of missed payments or misunderstandings.

- Unique Invoice Number: Assign a unique identifier to each billing statement. This helps both parties keep track of payments and avoids confusion if multiple documents are being processed simultaneously.

- Summary of Total Charges: Ensure that the total amount due is highlighted and easy to find. If any adjustments, discounts, or credits apply, show them separately and clearly.

Best Practices for Creating Professional Billing Documents

- Be Concise: Avoid unnecessary jargon or overly detailed descriptions. Keep the document straightforward and to the point while ensuring all important information is included.

- Use a Clean, Organized Layout: Organize the information logically. Group related items together, and use bullet points, headings, and tables for easy reading.

- Stay Consistent: Use a consistent format across all billing statements. This helps clients recognize your documents quickly and adds to the professionalism of your work.

- Include a Thank You or Acknowledgment: A simple line thanking the client for their business can leave a positive impression and reinforce good client relationships.

- Check for Accuracy: Before sending the document, double-check all numbers, dates, and details to ensure there are no errors. Accuracy helps avoid confusion or delays in payment.

By

Software Tools for Legal Billing

Using the right software tools can significantly streamline the billing process for legal professionals. These tools help ensure accurate tracking of time, expenses, and payments, while also simplifying the creation of detailed billing documents. By automating and organizing these tasks, legal service providers can save time, reduce errors, and improve client satisfaction.

Top Software Tools for Efficient Billing

There are several software solutions available that cater to the specific needs of legal professionals when it comes to billing. Below are some popular tools and their key features:

Software Tool Key Features Best For Clio Time tracking, expense management, customizable billing, trust accounting Small to medium-sized law firms looking for an all-in-one solution MyCase Integrated billing, time tracking, document management, client portal Solo practitioners and small law firms seeking an affordable option TimeSolv Advanced time tracking, expense logging, customizable billing templates, reports Firms with high volume billing or complex pricing structures Rocket Matter Cloud-based solution, time tracking, billing, document management Medium to large firms with a focus on productivity and client communication Bill4Time Time and expense tracking, reporting, invoicing, project management Small to mid-sized firms that require detailed reporting and tracking Benefits of Legal Billing Software

By implementing legal billing software, professionals can experience several benefits:

- Efficiency: Automates repetitive tasks such as time tracking, generating statements, and sending reminders, saving valuable time.

- Accuracy: Reduces human errors, ensuring that billing is precise and c

How to Stay Compliant with Legal Billing Rules

Maintaining compliance with legal billing regulations is crucial for ensuring that billing practices are transparent, ethical, and legally sound. Legal professionals must adhere to specific guidelines that govern how services are billed, what charges are permissible, and how fees should be disclosed. Staying compliant not only helps avoid legal disputes but also upholds the integrity of the practice.

Key Legal Billing Compliance Guidelines

To ensure that billing practices align with the applicable rules and regulations, legal service providers must consider the following compliance guidelines:

- Follow Jurisdictional Rules: Each jurisdiction may have its own set of rules for billing, particularly when it comes to trust account management, fee structures, and what can be included in a billing statement. Familiarize yourself with these rules to avoid violations.

- Transparent Fee Structures: Ensure that all fee arrangements, including hourly rates, flat fees, or contingency fees, are clearly outlined in the engagement letter or contract before starting work. Transparency prevents misunderstandings and protects both parties.

- Avoid Overbilling: Billing for services not rendered or inflating the amount of time spent on a task is unethical and illegal. Make sure to accurately record and charge only for the services that were actually provided.

- Disclose Billing Rates Upfront: Clients must be informed of billing rates in advance, including any changes in rates during the course of the representation. All rates should be documented and agreed upon in writing.

- Include Detailed Time Entries: Time should be billed in increments that are acceptable under the governing regulations, and each time entry should include a description of the work performed. Detailed entries help demonstrate the legitimacy of the charges.

Best Practices for Ensuring Compliance

In addition to following jurisdiction-specific rules, there are several best practices that can help maintain compliance and mitigate risk:

- Regularly Review Billing Policies: Continuously evaluate your billing practices to ensure they are in line with the latest regulations and ethical guidelines. This also includes reviewing any changes in fee structures or billing methodologies within your jurisdiction.

- Use a Trusted Billing System: Using software designed for legal billing can help ensure that your records are accurate, de

Improving Payment Collection with Billing Statements

Efficient payment collection is essential for maintaining a healthy cash flow and ensuring the sustainability of any business. By structuring billing statements in a way that is clear, timely, and professional, service providers can significantly reduce payment delays and improve their overall collection process. A well-designed statement not only helps clients understand what they owe but also encourages prompt payments.

Key Strategies for Effective Payment Collection

To streamline the payment collection process and reduce the risk of overdue balances, consider implementing the following strategies:

- Send Timely Statements: Send billing statements promptly after services are rendered. Delaying the issuance of bills can lead to confusion and a lack of urgency on the client’s part. The sooner clients receive their statements, the sooner they can settle their accounts.

- Be Clear and Transparent: Include a detailed breakdown of the services provided, the associated costs, and the total amount due. Clients are more likely to pay on time when they understand exactly what they are being charged for.

- Offer Multiple Payment Methods: Provide clients with various payment options, such as bank transfers, online payments, or credit cards. The more convenient you make the payment process, the more likely clients will pay promptly.

- Set Clear Payment Terms: Specify the payment due date, late fees, and any other terms upfront. Having clearly defined payment terms in place encourages clients to pay on time to avoid additional charges.

- Send Payment Reminders: If payments are overdue, send polite reminders. A gentle nudge can prompt clients to pay before the account becomes seriously delinquent.

Best Practices to Encourage Timely Payments

Incorporating the following best practices into your billing system can further improve your collection efforts:

- Automate Payment Reminders: Use automated systems to send reminders when a payment is due or overdue. This helps keep the payment process on track without requiring manual effort.

- Implement Early Payment Discounts: Offering small discounts for early payments can provide clients with an incentive to settle their accounts more quickly.

- Establish Clear Payment Schedules: For clients with larger outstanding balances, consider offering installment payment plans. Ensure these plans are clearly outlined in the agreement and reflected in the billing statement.

- Follow Up Consistently: Consistent follow-ups with clients who have not paid can improve collection ra

- Scope creep: If the task becomes more complex or time-consuming than initially anticipated, the professional may need to renegot