Best Sales Invoice Templates for Small Business and Freelancers

Effective financial documentation is crucial for maintaining clarity and professionalism in any business. Using structured formats for payment requests ensures both the sender and receiver understand the terms, amounts, and due dates without confusion. The right tool can make the process smoother, more organized, and reduce the risk of errors.

For small businesses and independent professionals, adopting a well-designed format for requesting payments not only helps save time but also enhances credibility. These documents serve as an official record of transactions and are essential for tracking finances and maintaining compliance with tax regulations.

In this guide, we will explore various options available for creating customized, easy-to-use formats that meet the needs of diverse industries. Whether you’re just starting or looking to improve your current workflow, you’ll find useful tips for designing and utilizing these crucial business tools.

Sales Invoice Templates Overview

When managing transactions, it’s essential to have a structured approach for documenting payments and services rendered. Using pre-designed formats helps streamline this process, ensuring consistency and professionalism. These standardized documents provide a clear outline of the agreed-upon details, such as the amount due, services provided, and payment terms.

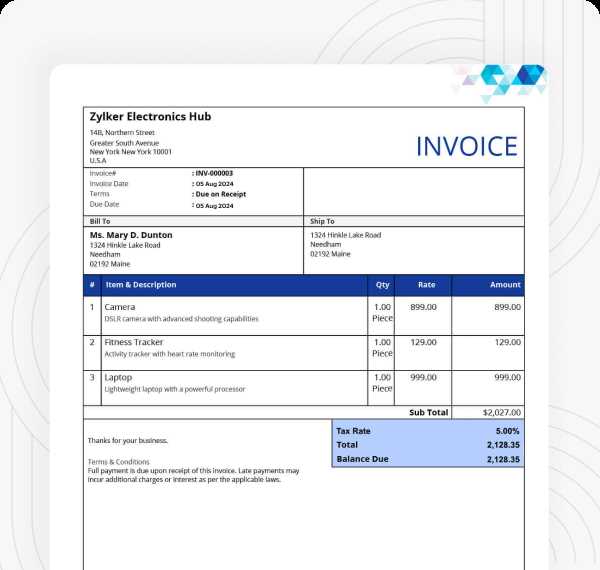

There are several types of documents that businesses can utilize to request payment, depending on their specific needs. These formats are often customizable, allowing for branding, specific payment terms, and additional details to be added. Key components typically include:

- Client and business contact details

- Description of services or goods provided

- Total amount due and payment deadlines

- Unique reference number for tracking

- Payment methods and instructions

Whether you’re a freelancer or managing a larger company, having access to these documents simplifies your billing process. They ensure that all necessary information is provided in a format that can easily be understood by both parties involved. Furthermore, these documents help in maintaining accurate records for accounting purposes, tax filings, and potential disputes.

Using ready-made formats can save you time and effort, especially if you’re not familiar with creating these records from scratch. There are various options available, from free downloadable versions to customizable solutions within accounting software. Selecting the right one for your business depends on factors such as your workflow, industry, and specific legal requirements.

What is a Sales Invoice Template

A structured document used to request payment for products or services is essential for ensuring clarity and professionalism in business transactions. This document outlines the terms of the exchange, including the agreed-upon amounts, due dates, and specifics about the transaction. A well-organized form helps both parties understand their obligations and provides a clear record for accounting purposes.

Key Features of This Document

At its core, a standard form for requesting payment includes several key elements:

- Client information – Details about the business or individual making the payment.

- Description of goods or services – Clear identification of what has been provided.

- Amount due – The total amount to be paid, including taxes or discounts.

- Payment instructions – Methods and terms for making the payment.

- Unique reference number – For tracking and identifying the document in your system.

Why It Is Important

This type of document is crucial for maintaining transparency and avoiding misunderstandings between businesses and their clients. By using a consistent format, businesses can ensure all necessary details are included, helping to prevent delays in payments or potential disputes. Moreover, it serves as an official record for both accounting and tax purposes.

Benefits of Using Invoice Templates

Adopting standardized formats for payment requests offers a range of advantages for businesses of all sizes. These pre-designed documents not only simplify the billing process but also ensure consistency and professionalism in every transaction. Whether you are a freelancer or managing a large company, using these documents can save time and reduce the likelihood of errors, improving overall efficiency.

Here are some key benefits of utilizing pre-built formats for requesting payments:

| Benefit | Description |

|---|---|

| Time Savings | Ready-to-use formats eliminate the need to start from scratch, allowing you to quickly generate payment requests. |

| Consistency | Using a standardized format ensures that all necessary information is included every time, minimizing the risk of missing key details. |

| Professionalism | A polished and clear payment request reflects well on your business and fosters trust with clients. |

| Accuracy | With pre-built formats, there’s less room for human error, reducing the chances of mistakes in calculations or information. |

| Easy Customization | Many options allow for easy modifications to suit your specific needs, whether you’re adjusting for tax rates or payment terms. |

| Record Keeping | These documents act as official records, simplifying the process of tracking payments and managing accounting tasks. |

By using a well-designed format, businesses can streamline their billing practices, increase their operational efficiency, and provide a clear, consistent experience for their clients.

Choosing the Right Template for Your Business

Selecting the appropriate format for requesting payment is an important decision that can impact your business’s efficiency and professionalism. The right choice not only streamlines your billing process but also reflects the values and style of your brand. Depending on the nature of your business and client base, different formats may be more suitable to meet your specific needs.

Consider Your Business Type

Each industry has its own set of requirements when it comes to documenting transactions. For example, freelancers may need a simpler layout that focuses on hourly rates and service descriptions, while a larger company might need a more comprehensive form that includes purchase orders, multiple line items, and taxes. Consider the following factors:

- Industry – Different sectors may require specific information or formatting.

- Client Demands – Some clients prefer more detailed documentation, while others may be satisfied with a simple request.

- Payment Methods – If you offer multiple payment options, ensure the document clearly outlines each choice.

Customization and Flexibility

Flexibility is another key factor when choosing a format. Your business may experience changes over time, whether in terms of services offered, pricing structure, or client base. The ability to easily modify the document allows you to adapt without starting from scratch. Look for options that offer:

- Editable Fields – Customize client names, dates, and service details with ease.

- Branding Options – Incorporate your logo and company colors to create a consistent brand identity.

- Legal and Tax Compliance – Ensure that the document includes the necessary sections to comply with local tax regulations.

Choosing the right format involves evaluating your business’s needs, client expectations, and the level of customization required. A well-selected document not only improves your workflow but also enhances your credibility and strengthens client relationships.

Customizing Your Sales Invoice Template

Personalizing your payment request document can significantly enhance its effectiveness and make it align better with your business needs. Customization not only allows you to add specific information relevant to your transactions but also helps reflect your brand’s identity, making the document more professional and recognizable to clients. Whether you’re adjusting the layout, adding details, or including legal disclaimers, tailoring the format ensures it serves your business well.

Adding Key Details

One of the most important steps in customizing your document is ensuring that all necessary fields are included and easy to modify. Consider adding the following elements:

- Business Information – Include your company name, logo, contact details, and business number for a more professional appearance.

- Payment Terms – Specify deadlines, late fees, and available payment methods to avoid misunderstandings.

- Service/Item Descriptions – Clearly outline what was provided, including quantities, unit prices, and totals for transparency.

Design and Branding

Branding is crucial in any document that represents your business. Customizing the design can make the request more appealing and align it with your overall brand identity. Pay attention to the following:

- Logo and Colors – Add your company’s logo and use your brand colors to make the document instantly recognizable.

- Typography – Choose professional and easy-to-read fonts that complement your brand style.

- Layout – Arrange the sections in a logical order, ensuring clarity and simplicity for both you and your client.

Customizing your document makes it more adaptable to your business’s needs while maintaining a polished and consistent presentation. A well-tailored format not only improves communication but also reinforces your professionalism in every transaction.

Free Sales Invoice Templates for Small Business

For small businesses, having access to cost-effective tools for documenting transactions can make a significant difference. Many entrepreneurs and freelancers face budget constraints, making it challenging to invest in expensive software or custom solutions. Fortunately, there are free resources available that offer fully functional, customizable formats for requesting payments. These free solutions provide an easy way to maintain professionalism and organization without additional costs.

Using no-cost options can help small business owners save both time and money. These documents often include all the essential elements required for a professional transaction record, such as contact details, service descriptions, and payment terms. Additionally, many free formats are customizable, allowing you to add your branding and adjust the structure to fit your specific needs.

Benefits of Free Resources:

- Zero Cost – You can download and start using them immediately without any financial commitment.

- Easy to Customize – Personalize the document with your business logo, colors, and specific terms to match your brand identity.

- Quick and Simple – Most options are easy to use, making the billing process faster and more efficient.

Whether you are just starting out or looking to improve your current billing practices, these free resources can provide all the tools you need to create clear, professional payment requests. By taking advantage of these options, small business owners can enhance their administrative tasks and focus on growing their operations.

How to Create Your Own Invoice Template

Creating your own payment request document can be a great way to ensure it meets your specific business needs. By designing a custom form, you have full control over the layout, content, and branding. This allows you to tailor it exactly to how you work, from the details you include to how the document looks. Whether you prefer a simple, minimalist design or a more comprehensive structure, creating your own format can streamline your billing process and reinforce your professional image.

Step 1: Identify Essential Information

The first step in creating your own document is to determine what key details must be included. A clear and comprehensive format should contain the following:

- Business and Client Information – Include your company name, contact details, and the client’s information for easy identification.

- Transaction Details – Provide a description of the goods or services provided, including quantities and rates.

- Total Amount Due – Clearly state the total amount owed, including any taxes, discounts, or fees.

- Payment Terms – Specify deadlines, late fees, and accepted payment methods to ensure clarity.

Step 2: Design Your Layout

Once you’ve identified the necessary details, it’s time to design the layout of your document. A clean, professional layout helps ensure that your clients can easily understand the information. Focus on the following:

- Easy-to-Read Fonts – Choose legible fonts that maintain a professional look and enhance readability.

- Logical Structure – Organize the document with clear headings, section breaks, and spacing for easy navigation.

- Branding – Add your company logo, colors, and other branding elements to personalize the document and make it unique to your business.

By taking the time to create your own payment request form, you can ensure it fully represents your brand while meeting all your functional needs. This approach gives you the flexibility to adapt the document over time, as your business evolves and your requirements change.

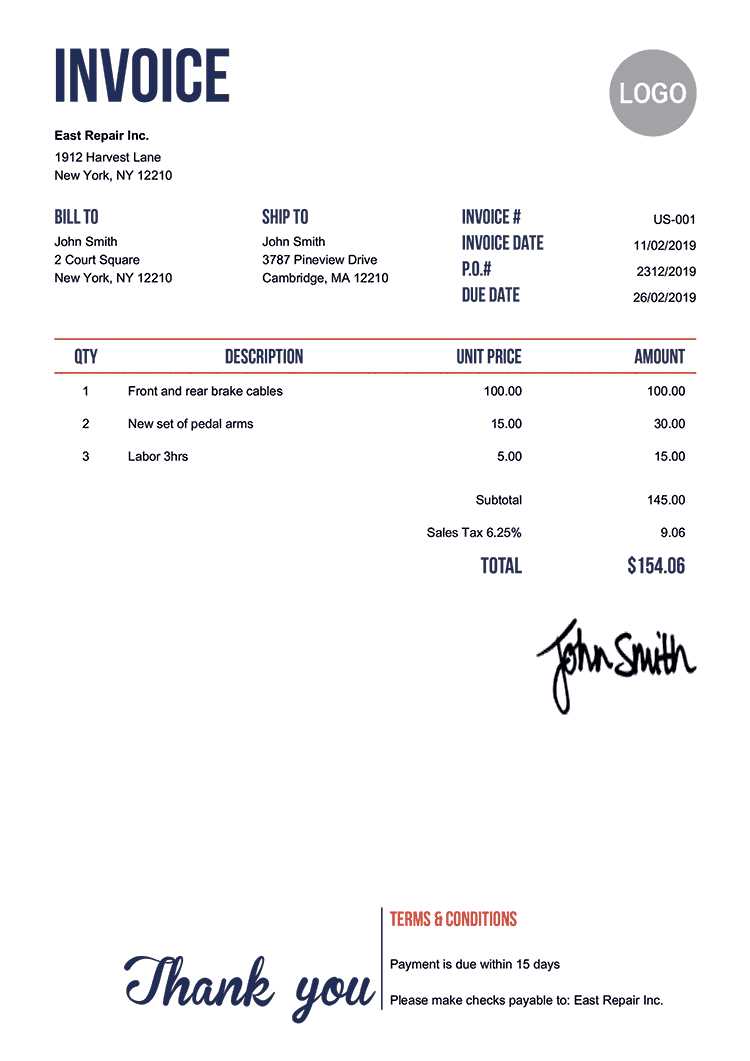

Invoice Template for Freelancers and Contractors

Freelancers and contractors often face unique challenges when it comes to managing their billing processes. Unlike full-time employees, they must create clear, detailed documentation for each project to ensure they get paid on time. Having a well-structured format for requesting payments is essential for keeping things organized, maintaining professionalism, and ensuring that all transaction details are captured accurately. This is especially important when managing multiple clients or projects simultaneously.

When creating a request for payment, freelancers and contractors should focus on certain key elements to ensure the document covers all necessary information:

- Client Details – Include the name and contact information of the client or business being billed.

- Project or Service Description – Provide a brief yet clear description of the work completed, including any deliverables or milestones achieved.

- Hourly Rates or Flat Fees – Clearly outline your charges, whether by the hour or a set price for the project or service.

- Payment Terms – Specify the payment due date, preferred payment methods, and any late fee charges.

- Unique Reference Number – Include a unique identifier for tracking purposes, particularly if you have multiple clients or projects.

Freelancers and contractors may also want to consider customizing the design of their documents to make them stand out and reflect their personal or business brand. Adding a logo, adjusting colors, and using professional fonts can help create a polished image that builds trust with clients.

Additionally, having a consistent and professional document can help avoid misunderstandings about terms and expectations, leading to smoother payment processes. By using a tailored format, freelancers can ensure that their billing is not only accurate but also aligned with the expectations of the client, making future transactions easier and more efficient.

Common Mistakes to Avoid in Invoices

When preparing a document to request payment, small errors can lead to delays, confusion, or even disputes. It’s crucial to pay close attention to detail to ensure that all necessary information is accurate and clearly presented. Avoiding common mistakes not only helps maintain a professional image but also speeds up the payment process and reduces the likelihood of miscommunication with clients.

Here are some of the most frequent mistakes made when creating payment request documents, along with tips on how to avoid them:

| Mistake | How to Avoid It |

|---|---|

| Missing or Incorrect Client Details | Always double-check client names, addresses, and contact information to ensure accuracy. |

| Unclear Description of Services | Be specific and detailed when describing the work completed or goods provided, including quantities and prices. |

| Incorrect or Omitted Payment Terms | Clearly state the payment due date, preferred methods, and any late fees to avoid confusion. |

| Not Including a Reference Number | Assign a unique reference number for each document to help with tracking and organization. |

| Mathematical Errors | Double-check all calculations, including totals, taxes, and discounts, to avoid mistakes that could cause payment delays. |

| Failure to Include Legal or Tax Information | Ensure your document complies with local tax laws and includes any required legal information, such as tax IDs or business registration numbers. |

By carefully reviewing each payment request, you can minimize mistakes that could slow down the payment process and maintain a smooth, professional relationship with your clients. Accuracy and clarity are key to getting paid on time and avoiding unnecessary back-and-forth communication.

Best Practices for Sales Invoices

Creating an effective payment request document involves more than just filling in the basic details of a transaction. To ensure that your clients understand the terms clearly and that the payment process runs smoothly, it’s important to follow certain best practices. These practices not only help avoid errors and delays but also contribute to a more professional and efficient workflow.

Here are some best practices to keep in mind when preparing a request for payment:

- Be Clear and Detailed – Always provide a thorough description of the services or products provided, including quantities, prices, and any relevant dates. This transparency helps avoid misunderstandings or disputes over the transaction.

- Double-Check Calculations – Ensure all numbers, including totals, taxes, and discounts, are accurate. Simple errors can lead to delays or confusion, which can hinder timely payment.

- Set Clear Payment Terms – Specify the payment due date, available payment methods, and any late fees that may apply. Clear terms set expectations for when and how payment should be made, reducing the chances of confusion later.

- Include a Unique Reference Number – Always assign a unique reference or number to each document. This helps with organization, tracking, and simplifies the process of resolving any issues that may arise.

- Maintain a Professional Layout – The design of your document should be clean and easy to follow. Use legible fonts, a logical structure, and enough spacing to ensure that key information stands out. A professional format not only helps clients read and understand your document but also reflects positively on your business.

- Provide Contact Information – Always include your business’s contact details, such as phone number and email address. This makes it easy for clients to reach out if they have questions or need clarification.

- Stay Consistent – Use the same format, style, and language for all your payment request documents. Consistency enhances professionalism and makes your documents more recognizable to clients.

By following these best practices, you’ll improve your overall billing process, ensuring that your clients are well-informed and that payments are processed efficiently. A well-crafted request not only promotes timely payment but also strengthens your business’s professional image.

Invoice Design Tips for Professionals

The design of your payment request document plays a significant role in how clients perceive your business. A clean, organized, and professional-looking document not only makes it easier for clients to understand but also helps reinforce your brand identity. A well-designed form ensures that all key information stands out, improving both the clarity and professionalism of your communications.

Focus on Clarity and Readability

When designing your payment request form, it’s essential to prioritize clarity and readability. Here are a few tips to help ensure your document is easy to read and understand:

- Use Simple Fonts – Choose fonts that are easy to read both digitally and in print. Stick with standard professional fonts like Arial, Calibri, or Times New Roman to maintain a clean and polished look.

- Clear Headings – Use bold or larger font sizes for section headings to make them stand out. This will help clients easily navigate the document and locate the necessary information quickly.

- Avoid Clutter – Leave enough space between sections, and don’t overcrowd the page with excessive text or unnecessary details. A minimalist design often leads to a more professional and digestible document.

Incorporate Your Branding

Integrating your brand’s visual identity into your payment request document strengthens your overall business image. Here’s how to make your document uniquely yours:

- Add Your Logo – Place your logo prominently at the top of the document. This makes your brand instantly recognizable and adds a professional touch.

- Use Brand Colors – If you have a color scheme for your business, incorporate it into the document’s design. This can help create a cohesive look across all your communications, making your brand more memorable.

- Consistency Across Documents – Ensure that your payment request form aligns with other business materials like contracts, business cards, or letterheads. Consistent design reinforces your brand’s professionalism and builds trust with clients.

By focusing on clear layout, readability, and integrating your brand identity, you create a more professional and polished document that reflects well on your business. A well-designed payment request not only facilitates communication but also enhances the overall client experience, encouraging prompt payments and strengthening client relationships.

How to Automate Your Invoicing Process

Automating your payment request system can save you time, reduce errors, and ensure a more consistent and efficient billing process. Instead of manually creating and sending each document, automation tools can generate, send, and track requests on your behalf. This allows you to focus more on growing your business while ensuring that clients are billed promptly and accurately.

Benefits of Automation

Automating your payment request process offers several advantages, from reducing administrative workload to improving cash flow management. Here are some key benefits:

| Benefit | Description |

|---|---|

| Time-Saving | Automated systems can generate payment requests instantly, reducing the time spent on manual tasks. |

| Accuracy | Automation minimizes human errors in calculations, reducing the chances of mistakes in amounts or client details. |

| Consistency | With automated systems, you can maintain a uniform format and structure, ensuring a professional appearance for every document. |

| Faster Payments | By automating reminders and deadlines, you increase the likelihood of clients paying on time. |

| Trackability | Automation allows you to easily track which payments have been made, which are outstanding, and when to follow up. |

How to Implement Automation

To start automating your payment request process, consider using invoicing software or tools that integrate with your accounting system. Here’s how to get started:

- Choose the Right Tool – Select a software solution that meets your business needs. Look for features such as recurring billing, customizable templates, and easy client management.

- Set Up Client Profiles – Input your client details, including payment terms and contact information, so the system can generate accurate and personalized documents.

- Schedule Automatic Reminders – Automate reminders to notify clients of upcoming payments or overdue balances, reducing the need for manual follow-ups.

- Track Payment Status – Use the software to track the status of each payment, ensuring that no transaction slips through the cracks.

By automating your billing process, you can streamline operations, reduce administrative burden, and maintain a professional image with minimal effort. With the right tools in place, invoicing becomes a seamless part of your workflow, allowing you to focus on what matters most: running and growing your business.

Legal Requirements for Sales Invoices

When creating a document to request payment, it’s essential to ensure that it complies with legal and tax regulations. Different regions and countries have specific rules regarding what information must be included in these documents, and failure to meet these requirements could result in penalties or delays in payment. Understanding the legal aspects of creating such documents helps you maintain proper records and avoids complications with tax authorities.

Key Information to Include

While the specific legal requirements vary by jurisdiction, most regulations mandate certain information be included in each payment request document. Below are the critical elements that should be included to ensure compliance:

| Required Information | Why It’s Important |

|---|---|

| Business Name and Contact Information | Helps identify the seller and provides clear contact details in case of questions or disputes. |

| Client Details | Ensures the document is properly addressed and helps clarify who is responsible for payment. |

| Description of Goods/Services Provided | Defines the scope of the transaction, avoiding misunderstandings and establishing the basis for payment. |

| Unique Document Number | Helps track and organize payment requests for record-keeping, auditing, and tax reporting. |

| Amount Due and Payment Terms | Clearly states how much is owed and the terms of payment, including due dates, penalties, and discounts. |

| Tax Identification Number | Required in many regions for tax reporting and compliance, especially for businesses that collect taxes on behalf of the government. |

Additional Legal Considerations

In addition to the basic requirements listed above, there are several other factors to consider depending on your business type and location:

- Tax Information – Depending on your location, you may need to include specific tax rates (e.g., VAT, GST) on the payment request document. Ensure that taxes are correctly calculated and clearly shown on the document.

- Payment Methods – Specify the payment methods you accept (e.g., bank transfer, credit card, online payments), as this may be a legal requirement for certain jurisdictions.

- Legal Terms and Conditions – In some cases, including terms related to late fees, returns, or warranties may be legally necessary to ensure transparency and protect both parties.

- Electronic Invoicing – Some regions now mandate or encourage electronic invoicing, especially for businesses above a certain threshold. Check your local regulations to ensure compliance with digital submission standards.

By understanding and implementing these legal requirements, you can protect your business and ensure smooth, compliant transactions with clients. Whether you’re a small business owner or a large corporation, maintaining proper documentation is essential for both legal and financial reasons.

How to Track Invoice Payments Effectively

Keeping track of payments is an essential part of managing your business’s cash flow. Ensuring that clients pay on time, and that you’re able to easily track and record all transactions, can significantly impact your financial stability. Without a clear tracking system, it becomes difficult to stay on top of outstanding balances, potentially leading to cash flow issues and administrative confusion.

Establish a Clear Tracking System

Having an organized system to monitor payment statuses helps prevent errors and ensures that no payment goes unnoticed. Here are a few strategies to help you track payments effectively:

- Use Accounting Software – Using specialized software can automate much of the tracking process. These systems often allow you to link payments directly to specific requests, reducing manual input and improving accuracy.

- Create a Payment Ledger – Maintain a detailed record of each payment request, noting when it was sent, when it was due, and when payment was received. This ledger can be kept digitally or in a spreadsheet for easy access.

- Set Payment Reminders – Use reminders and notifications to follow up with clients when payments are due or overdue. This ensures timely collection and avoids confusion.

Effective Payment Tracking Tools

In addition to manual systems, there are several tools and strategies that can help you manage payments more efficiently:

- Online Payment Systems – Platforms like PayPal, Stripe, or Square allow you to track payments in real time, giving you immediate updates when a payment has been made.

- Automated Reports – Many accounting systems generate regular reports that give an overview of payments, outstanding balances, and upcoming due dates. These reports help you stay proactive about your collections.

- Client Portals – Offering clients access to a secure online portal can streamline the payment process and allow them to track their own balances, while you maintain full visibility over their payment history.

By setting up an effective tracking system, you can manage your financial operations more efficiently, reduce the risk of missed payments, and maintain a healthy cash flow. Whether you choose to automate your tracking process or keep manual records, staying organized is key to running a successful business.

Invoice Templates for Different Industries

Different businesses have unique requirements when it comes to creating payment requests. Depending on the industry, the level of detail, the type of information required, and the format of the document can vary significantly. Understanding the specific needs of your industry is essential for creating a professional, compliant, and efficient payment request that aligns with your business operations.

Industry-Specific Considerations

Each industry has its own set of standards, regulations, and expectations regarding how payments should be documented. Here’s a breakdown of how different industries might approach their payment request documents:

- Freelancers and Consultants – For individuals offering services, payment documents typically include a breakdown of hours worked or project milestones, along with an hourly or project rate. Clear payment terms and deadlines are also critical for these professionals.

- Retailers – Retail businesses usually create payment documents that detail the purchased products, including quantities, unit prices, and applicable discounts. Taxes and shipping costs are also key components to include.

- Construction and Contractors – Contractors often require more detailed documents, specifying materials, labor costs, and payment schedules tied to project phases or deliverables. Payment terms may also include deposit requirements and milestone payments.

- Creative Agencies – Agencies providing creative services often break down the project into stages, with each stage having its own cost. Deliverables and deadlines are important to highlight, ensuring clients understand the scope of work and what is expected at each phase.

- Healthcare Providers – Medical service providers need to include detailed descriptions of the services provided, along with patient information and insurance details, if applicable. Payment terms may vary based on insurance claims and out-of-pocket costs.

Customizing Payment Documents for Your Industry

Regardless of the industry, ensuring that your payment request documents reflect your business’s professionalism and meet your clients’ expectations is crucial. Here are some ways to customize your document:

- Include Relevant Details – Make sure the document reflects the specific products, services, or tasks provided. The more detailed and accurate your description, the clearer the document will be for your clients.

- Comply with Industry Regulations – Some industries may require certain legal information or compliance with specific tax rules. For example, medical providers might need to include insurance codes, while contractors might need to list licensing numbers.

- Adjust Payment Terms Accordingly – Depending on the industry, your payment terms may vary. For instance, retailers might require immediate payment, while service providers like consultants may offer longer payment periods or installment options.

By tailoring your payment request documents to suit the unique needs of your industry, you ensure that your clients understand the terms and conditions and can process payments quickly and accurately. An industry-specific approach helps maintain professionalism and fosters trust in your business.

Digital vs Printable Sales Invoices

In today’s business world, there are two primary ways to manage payment requests: digital and printable documents. Both options offer distinct advantages and challenges, and the choice between the two often depends on the business’s specific needs, the preferences of clients, and the overall efficiency of operations. Understanding the differences between digital and printed formats is essential to deciding which method works best for your company.

Digital Payment Request Documents

Digital documents are created and sent electronically, typically through email or online platforms. These documents can be generated using specialized software or accounting tools, which automate much of the process. Digital formats are ideal for businesses that require speed, automation, and easy tracking of transactions.

- Advantages:

- Instant delivery to clients

- Easy to store and organize electronically

- Environmentally friendly, reducing paper waste

- Can be integrated with payment processing systems for faster transactions

- Disadvantages:

- May not be preferred by clients who need physical copies

- Could be seen as less formal or professional by certain industries

Printable Payment Request Documents

Printable documents are physical copies that can be printed out and mailed to clients. While this method is becoming less common in the digital age, it is still favored by some businesses for its tangible, formal appearance. Clients may prefer to receive printed documents for record-keeping or personal preference.

- Advantages:

- Often seen as more formal or professional

- Some clients prefer to keep physical copies for their records

- May be required by certain industries or for legal purposes

- Disadvantages:

- Slower delivery times due to mailing

- More costly due to printing and postage

- Requires physical storage space for record-keeping

Comparing Digital and Printable Documents

Below is a comparison of the key features of digital and printed documents:

| Feature | Digital | Printable |

|---|---|---|

| Speed of Delivery | Instant | Delayed (due to postal service) |

| Cost | Low (mostly software fees) | High (printing, paper, postage) |

| Record-Keeping | Easy to store electronically | Requires physical storage space |

| Client Preference | Preferred by many clients, especially tech-savvy ones | Preferred by clients who prefer hard copies |

| Environmental Impact | Eco-friendly | Less eco-friendly (paper waste) |

In conclusion, choosing between digital and printable documents depends on your specific business needs, the nature of your clients, and your operational preferences. Many businesses opt for a hybrid approach, using digital documents for speed and efficiency, while still offering printable options when necessary. Whichever method you choose, the most important factor is ensuring that your payment requests are clear, professional, a

Managing Sales Invoices in Accounting Software

Modern accounting software provides businesses with powerful tools to streamline financial operations, including the management of payment requests. By using these digital tools, businesses can automate the creation, tracking, and organization of their payment documents, reducing human error and saving valuable time. Accounting platforms offer features that make it easier to manage outstanding balances, monitor payment statuses, and integrate financial data with other business functions.

Benefits of Using Accounting Software

Accounting software offers a variety of benefits when it comes to managing payment documents. These tools provide businesses with greater control, efficiency, and accuracy. Some key advantages include:

- Automation: Accounting software can automate the creation of payment documents, ensuring accuracy and reducing the need for manual input. Users can set up recurring requests for regular clients or services.

- Real-Time Tracking: Businesses can easily track payment statuses, including pending, partially paid, or fully settled accounts. Notifications can be set up for overdue balances, helping businesses stay on top of collections.

- Integration: Many platforms integrate seamlessly with bank accounts, payment systems, and other business tools, allowing for direct payment updates and smoother financial management.

- Professional Customization: Accounting software often includes customizable fields, allowing businesses to tailor their payment requests to their specific needs or client preferences, such as adding discounts, taxes, or payment terms.

How to Manage Payment Requests in Accounting Software

Managing payment documents in accounting software is straightforward, but there are a few best practices to ensure efficient handling of all transactions. Below are key steps to follow:

- Set Up Client Information: Start by adding client details, including contact information, payment terms, and any special instructions. This allows for quicker document generation and a more personalized experience for clients.

- Create and Send Requests: Generate payment documents directly within the software, using pre-set templates or custom designs. These can be emailed or shared via online portals, reducing the need for manual printing and mailing.

- Track Payments and Set Reminders: Use the software’s tracking features to monitor the status of each payment. Set reminders for overdue payments to ensure timely follow-up with clients.

- Reconcile with Bank Accounts: After payments are made, reconcile them directly with your bank accounts within the software, allowing you to keep accurate financial records and avoid discrepancies.

- Generate Reports: Many accounting platforms offer reporting tools to provide insights into outstanding payments, revenue trends, and financial health. These reports can be used for strategic decision-making and budgeting.

By utilizing accounting software, businesses can improve the efficiency and accuracy of their payment processes, streamline their operations, and ensure a more professional approach to managing financial transactions. From automating payment requests to integrating with other business systems, these tools are essential for m

How to Handle Late Payments on Invoices

Late payments are a common challenge faced by businesses, regardless of their size or industry. When clients delay payments, it can disrupt cash flow, complicate financial planning, and create unnecessary stress. Knowing how to handle these situations professionally and effectively is crucial for maintaining positive client relationships while also protecting your business’s financial health.

Steps to Address Late Payments

When faced with overdue payments, there are several steps businesses can take to manage the situation and encourage timely settlements:

- Send Polite Reminders: Often, a late payment is simply an oversight. Begin by sending a polite reminder to the client, gently pointing out the overdue payment and asking for it to be processed as soon as possible.

- Offer Payment Flexibility: If the client is experiencing financial difficulties, offering flexible payment terms–such as an installment plan or an extended deadline–can help secure the payment while maintaining goodwill.

- Charge Late Fees: Clearly outline your late fee policy in advance and apply it when necessary. This can encourage clients to pay on time to avoid additional charges. Ensure the fee structure is transparent and communicated upfront.

- Review Contract Terms: In some cases, it may be necessary to revisit the terms of the agreement. If clients consistently miss payment deadlines, consider implementing stricter payment terms or requiring upfront deposits for future transactions.

Dealing with Persisting Delays

If payment delays continue despite your best efforts, it may be time to take more formal steps:

- Formal Letters: If reminders and flexibility have not worked, consider sending a formal demand letter outlining the overdue amount and your expectations for payment. This step is a clear signal that you are serious about collecting the outstanding balance.

- Engage a Collection Agency: For persistent non-payment, hiring a collection agency can be an effective way to recover funds. Agencies have expertise in handling overdue accounts and can often recover payments that might otherwise go unpaid.

- Legal Action: As a last resort, you may need to pursue legal action. This step can be costly and time-consuming, so it should only be considered when all other options have been exhausted. Consult a legal professional before proceeding with this route.

Preventing Future Late Payments

While addressing overdue payments is important, taking proactive measures to prevent them in the future can save time and effort. Consider the following strategies:

- Clear Payment Terms: Ensure your payment terms are clearly outlined from the start, including due dates, accepted payment methods, and any penalties for late payments.

- Incentives for Early Payments: Offering discounts or other incentives for early payments can motivate clients to settle t