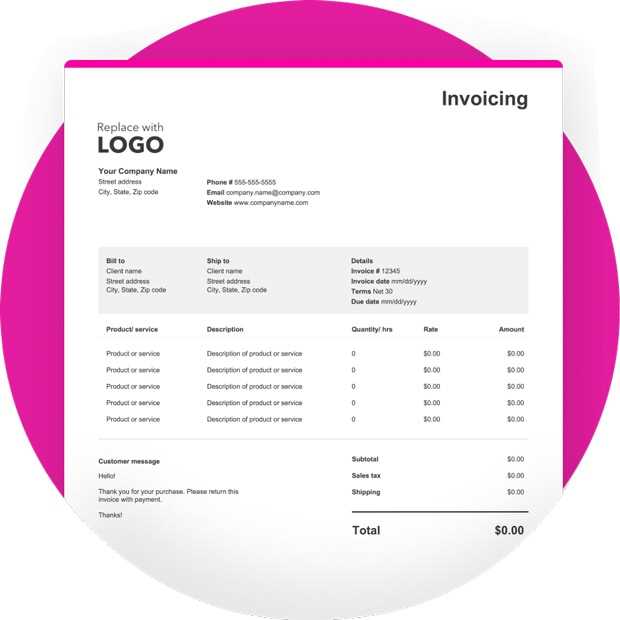

Sales Invoice Template for Easy Customization and Use

In any business, having a structured and organized approach to requesting payments is essential. Proper documentation not only ensures smooth financial transactions but also builds trust between you and your clients. A well-designed form for outlining goods or services provided and the corresponding charges is a crucial part of this process.

There are various ways to design such a document, but using a ready-made format can save time and reduce errors. These formats can be customized to meet the unique needs of your business while ensuring that all necessary details are included. Whether you’re a small startup or an established company, having a reliable system in place is key to maintaining clear financial records.

Customizable templates can be easily found and tailored to suit different business types, whether you’re offering products or services. By following a consistent structure, you make it easier for your clients to understand their obligations and for you to track payments and account balances.

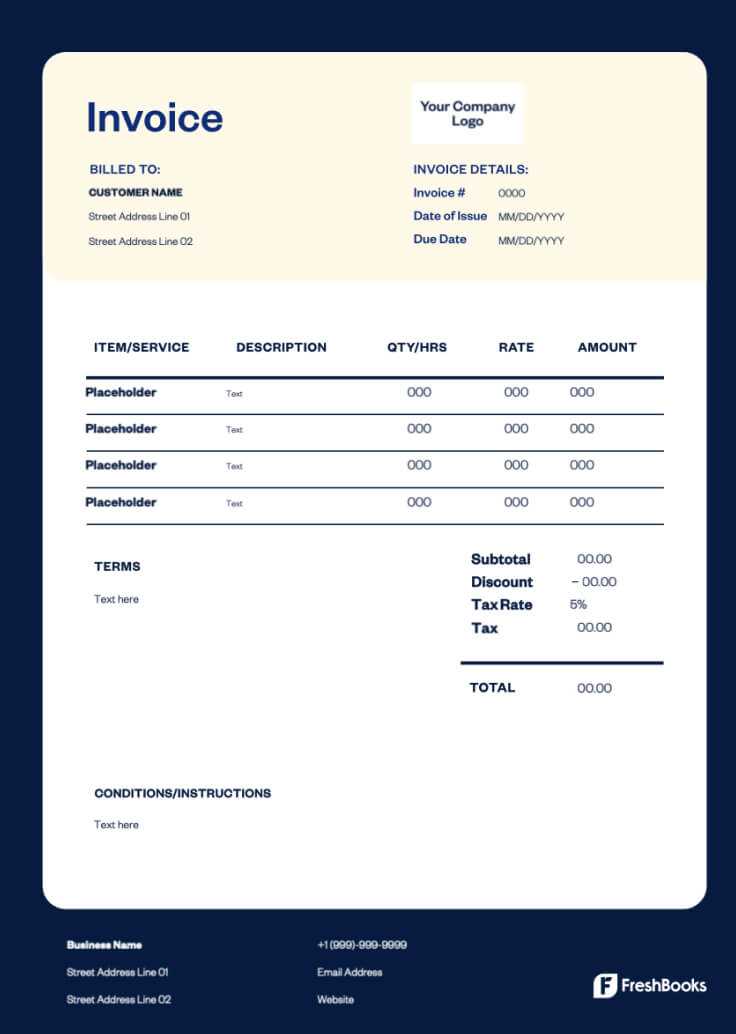

Sales Invoice Template Overview

When it comes to billing customers, having a clear and structured document is essential for both professionalism and financial accuracy. A well-organized form helps outline the details of the transaction, making it easier for both parties to understand the terms, products, and amounts due. Whether you’re working with a client for the first time or handling long-term business relationships, having a standard format for these documents simplifies the process.

Benefits of Using a Standardized Format

Using a uniform document for billing can save time and reduce the chances of errors. Below are some key advantages of utilizing a structured format:

- Consistency: A standard layout ensures that all necessary information is included, preventing missing or overlooked details.

- Professionalism: Presenting clients with a clean, organized document enhances your company’s reputation and credibility.

- Efficiency: With a pre-set structure, filling out details for each new transaction becomes faster, allowing for quicker processing and fewer mistakes.

- Easy Record Keeping: Maintaining consistent documentation simplifies financial tracking and helps with future audits or reports.

Key Components of the Document

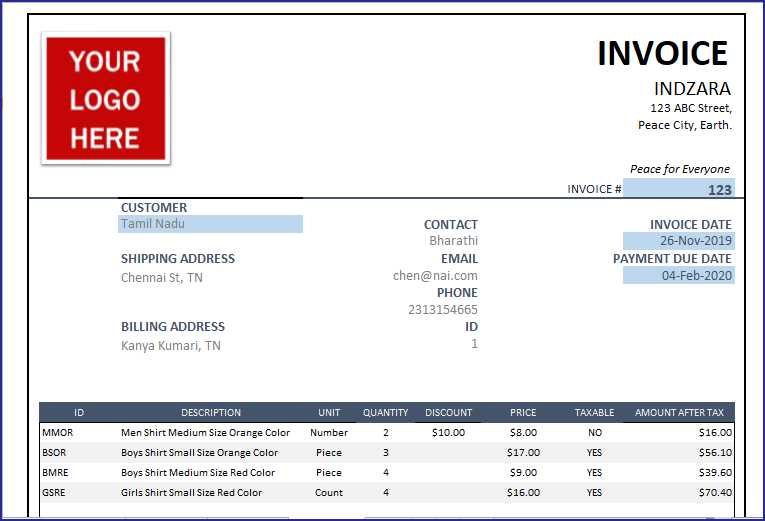

Every well-designed billing document should include several critical sections to ensure clarity and completeness. These are some of the most important components:

- Contact Information: Names, addresses, and communication details for both the issuer and the recipient.

- Itemized List: A detailed breakdown of products or services provided, including quantities, descriptions, and unit prices.

- Total Amount Due: A clear statement of the total balance, factoring in any taxes, discounts, or additional fees.

- Payment Terms: Information on payment deadlines, methods accepted, and any penalties for late payments.

By using a well-crafted format, you ensure that both parties have a transparent understanding of the transaction, which can help avoid potential disputes and confusion.

What is a Sales Invoice Template

In business transactions, creating a document that formally requests payment for goods or services rendered is an essential part of financial operations. This document outlines the transaction details, making it clear for the client what is owed and why. A structured format for this document ensures that all necessary information is included, saving time and reducing errors.

Understanding the Document’s Purpose

The primary goal of this document is to provide both the seller and the buyer with a clear record of the exchange, specifying the products or services provided, the costs associated, and the terms for payment. It acts as a formal request for payment and serves as an official record for accounting and tax purposes.

- Clarifies Details: It ensures that all transaction elements, such as quantities, prices, and descriptions, are documented in one place.

- Establishes Payment Terms: This document communicates when and how payments should be made, preventing confusion or delays.

- Provides Legal Protection: It serves as a legal record of the business transaction, which can be referenced in case of disputes or for tax reporting.

Key Features of a Standardized Format

Using a predefined structure for such a document can be beneficial for businesses of all sizes. Here are some of the essential elements commonly included:

- Contact Information: The names, addresses, and other relevant details of both parties involved.

- Detailed List of Products/Services: A breakdown of what was provided, including descriptions, quantities, and individual pricing.

- Total Amount: A final balance due, often broken down into subtotals, taxes, and discounts.

- Payment Instructions: How the payment should be made, including methods, deadlines, and late fees.

By utilizing this kind of structure, businesses can streamline their billing process and ensure both parties have a clear understanding of t

How to Create a Sales Invoice

Creating an accurate and professional document for requesting payment is a key aspect of running a successful business. This document serves as an official record of the goods or services provided, as well as the amount owed. To ensure the process runs smoothly, it’s important to follow a clear and consistent structure when designing this document.

Steps to Follow When Crafting the Document

To create a complete and effective billing document, follow these essential steps:

- Include Basic Information: Start by adding your company name, address, contact details, and any relevant identification numbers. Be sure to also include the recipient’s information for clarity.

- List of Items or Services: Provide a detailed description of the items or services delivered. Include quantities, unit prices, and any applicable discounts. This ensures transparency and helps avoid confusion.

- Payment Terms: Clearly outline when and how the payment should be made, including methods of payment and deadlines for submission. If there are any late fees or penalties, be sure to mention them here.

- Total Amount Due: Calculate the total due, including taxes, discounts, and any other additional charges. Be transparent with each element of the calculation to foster trust with your client.

Choosing the Right Method for Creation

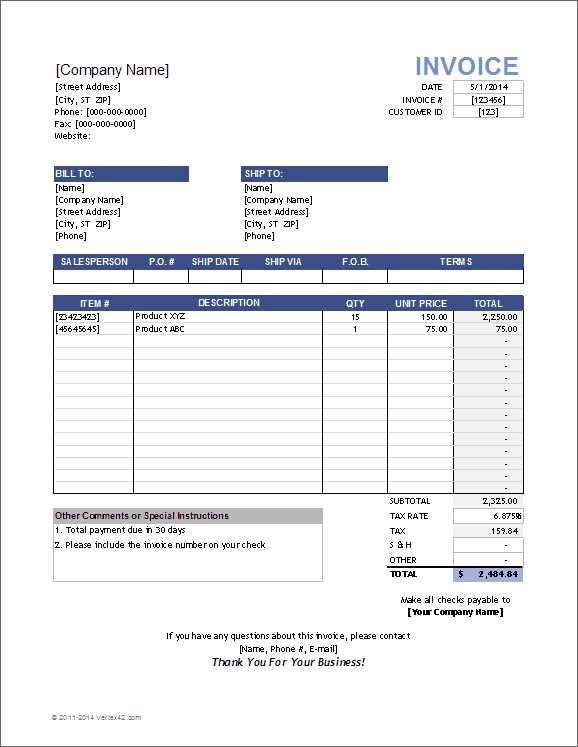

There are different ways to create this document. You can either design one manually using word processing software, use specialized accounting tools, or download a pre-designed format to save time. Regardless of the method, ensure that the layout is clean, professional, and easy to understand.

- Manual Creation: If you’re creating the document from scratch, focus on clarity and organization, making sure the most important details stand out.

- Software Tools: Accounting software often includes pre-built formats that can be easily customized for your specific needs.

- Pre-designed Formats: Downloading a ready-made structure is a quick and efficient option for businesses that need to issue these documents regularly.

By following these steps and paying attention to detail, you can create a comprehensive and professional document that ensures smooth transactions and helps maintain a strong business relationship.

Why Use a Sales Invoice Template

Using a structured format for creating payment requests brings several benefits that can improve efficiency, accuracy, and professionalism in your business operations. A predefined layout helps streamline the billing process, ensuring that every crucial detail is included without having to start from scratch each time. This approach not only saves time but also reduces the chances of costly errors.

Advantages of Using a Pre-designed Format

There are many reasons why businesses choose to adopt a consistent, standardized structure for their billing documents:

- Consistency: A uniform format ensures that every document includes the necessary elements, making it easier for clients to understand and for you to track.

- Time-saving: With a ready-made structure, you don’t need to create a new document from the ground up each time. This speeds up the billing process significantly.

- Reduces Errors: By using a pre-structured layout, you minimize the risk of forgetting important details, such as payment terms, tax rates, or product descriptions.

- Professional Appearance: A well-designed, polished document presents your business as organized and trustworthy, making a positive impression on your clients.

- Easy Customization: Many formats are easily customizable, allowing you to adapt them to your specific needs while still maintaining a clear, professional structure.

Improved Record Keeping and Tracking

Having a consistent format also helps with record-keeping. Whether for accounting purposes, tax reporting, or audits, a standard structure makes it easier to track payments and outstanding balances. You can quickly locate past transactions and ensure everything is accounted for accurately.

In conclusion, using a structured document format to request payments brings significant advantages in terms of efficiency, professionalism, and accuracy. It simplifies the process for both you and your clients, helping to build a smooth and transparent financial workflow.

Key Elements of a Sales Invoice

When creating a document to request payment, it’s important to ensure that all necessary information is clearly presented. A well-structured form will include key details that outline the transaction, establish payment terms, and help both parties understand their obligations. Each element plays a vital role in maintaining transparency and ensuring smooth business operations.

Essential Information to Include

There are several components that should be part of any payment request document. These elements not only ensure clarity but also help prevent misunderstandings between the buyer and seller.

- Header Information: This includes the name, address, and contact details of both parties. It’s important to have accurate, up-to-date information for proper communication.

- Unique Identifier: Assigning a reference number to each document makes it easier to track and manage records. This number also helps in referencing the document for future communications or disputes.

- Description of Products or Services: A detailed breakdown of the goods or services provided should be included. Each item should have a clear description, quantity, unit price, and total cost.

- Dates: Include both the date of the transaction and the due date for payment. This ensures that there is no confusion about when payment is expected.

- Total Amount: Clearly state the total amount due, including any taxes, discounts, or additional charges that may apply. This should be easy to locate and understand.

- Payment Instructions: Outline the accepted methods of payment, including bank account details, payment platforms, or other options. Additionally, specify any penalties or late fees for overdue payments.

Formatting and Clarity

Beyond the essential components, it’s important to present the information in a clear and organized manner. Use headings, bullet points, or tables to structure the document, making it easy for the recipient to review and understand the charges. A clean and professional layout ensures that all details stand out and minimizes the chances of errors or confusion.

By including these key elements, you ensure that your payment request is both complete and easy to process, helping to maintain smooth financial transactions and positive business relationships.

Common Mistakes in Sales Invoices

Even with a clear structure, mistakes can still occur when creating documents to request payment. These errors can lead to confusion, delayed payments, or strained relationships with clients. It’s important to recognize common mistakes so that you can avoid them and ensure that each transaction is documented accurately and professionally.

Frequent Errors to Avoid

Here are some of the most common mistakes made when preparing payment request documents:

- Incorrect or Missing Contact Details: Failing to include accurate information for both parties, such as names, addresses, or phone numbers, can lead to miscommunication or delays in payment.

- Omitting Dates: Not specifying the date of the transaction or the payment due date can create confusion about when the payment is expected.

- Unclear Descriptions of Goods or Services: Providing vague or incomplete descriptions of the products or services provided can lead to misunderstandings. Each item should be described thoroughly, including quantities and individual costs.

- Errors in Pricing or Calculations: Mistakes in calculating the total amount due, including taxes, discounts, or additional fees, can cause discrepancies between what is owed and what is billed. Always double-check the math to avoid errors.

- Failure to Include Payment Terms: Not specifying the payment methods or terms–such as due dates, penalties for late payments, or accepted forms of payment–can result in delays and disputes.

- Not Using a Unique Identifier: Using the same reference number for multiple requests or failing to include a unique identifier can make it difficult to track and reference specific transactions.

Impact of These Mistakes

While some errors may seem minor, they can lead to bigger problems down the line, such as late payments, client frustration, or even legal complications. Ensuring that each detail is accurate and clear helps build trust and ensures that payments are processed quickly and efficiently.

By being aware of these common pitfalls, you can take steps to avoid them and create accurate, professional document

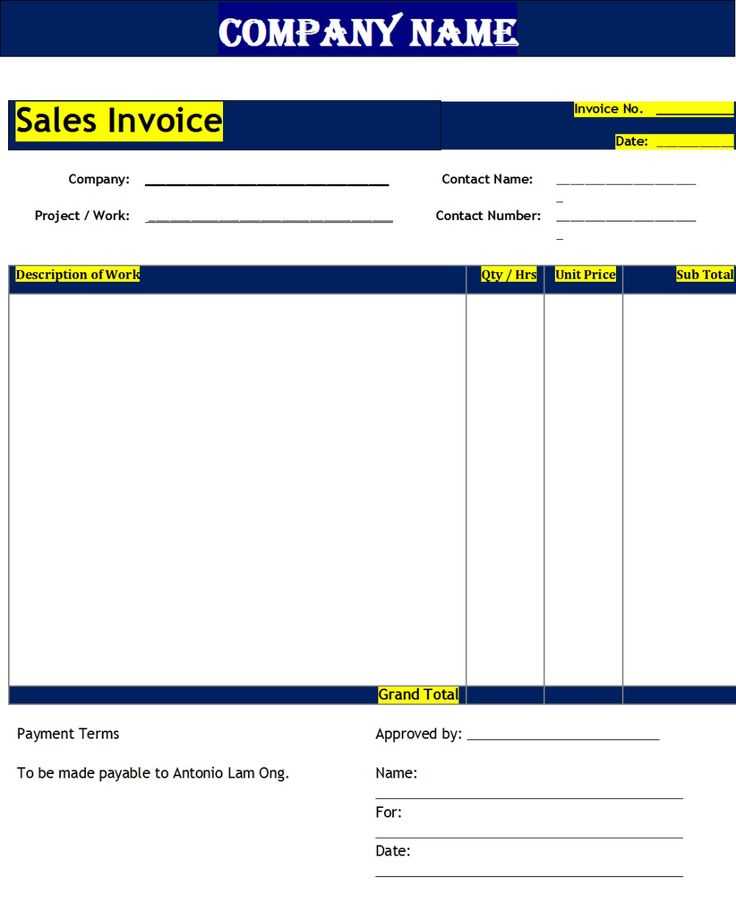

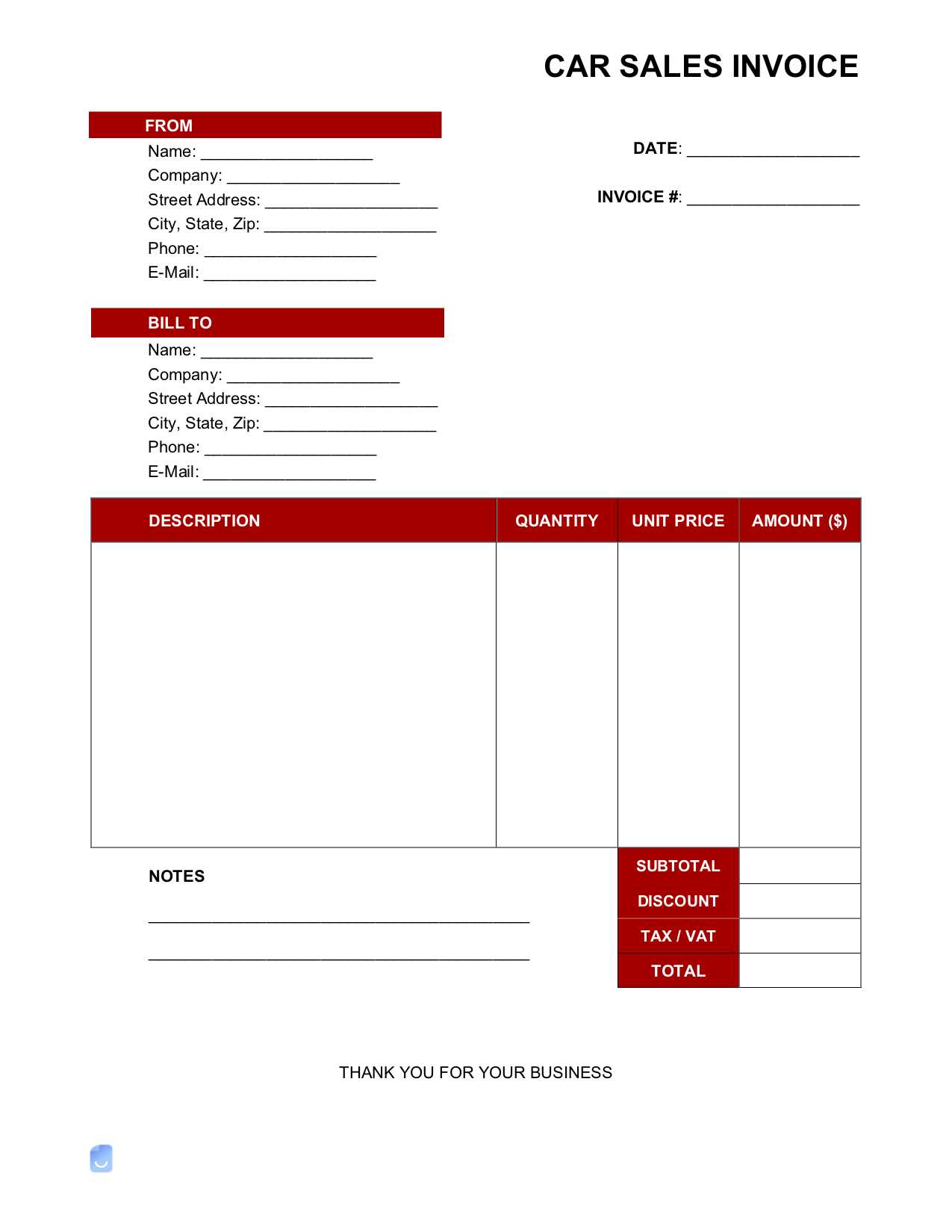

Choosing the Right Template for Your Business

Selecting the right structure for your billing documents is crucial for ensuring smooth financial operations. The layout you choose should reflect the nature of your business, the types of transactions you handle, and the needs of your clients. A well-suited format will help you maintain organization, streamline the payment process, and present a professional image to your customers.

Factors to Consider When Selecting a Format

When choosing a billing document structure, consider the following factors to ensure it meets your business requirements:

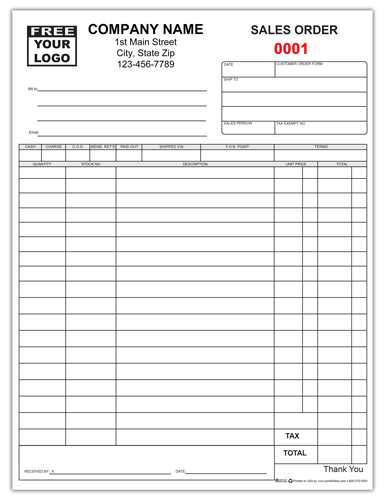

- Business Size: Smaller businesses may benefit from simpler formats, while larger organizations or those with more complex transactions may require detailed structures that can handle various product categories, multiple payment terms, or bulk pricing.

- Industry Type: The type of products or services you provide can influence the layout. For example, service-based businesses may need more space for time-tracking or hourly rates, while retail businesses may prioritize inventory lists and product codes.

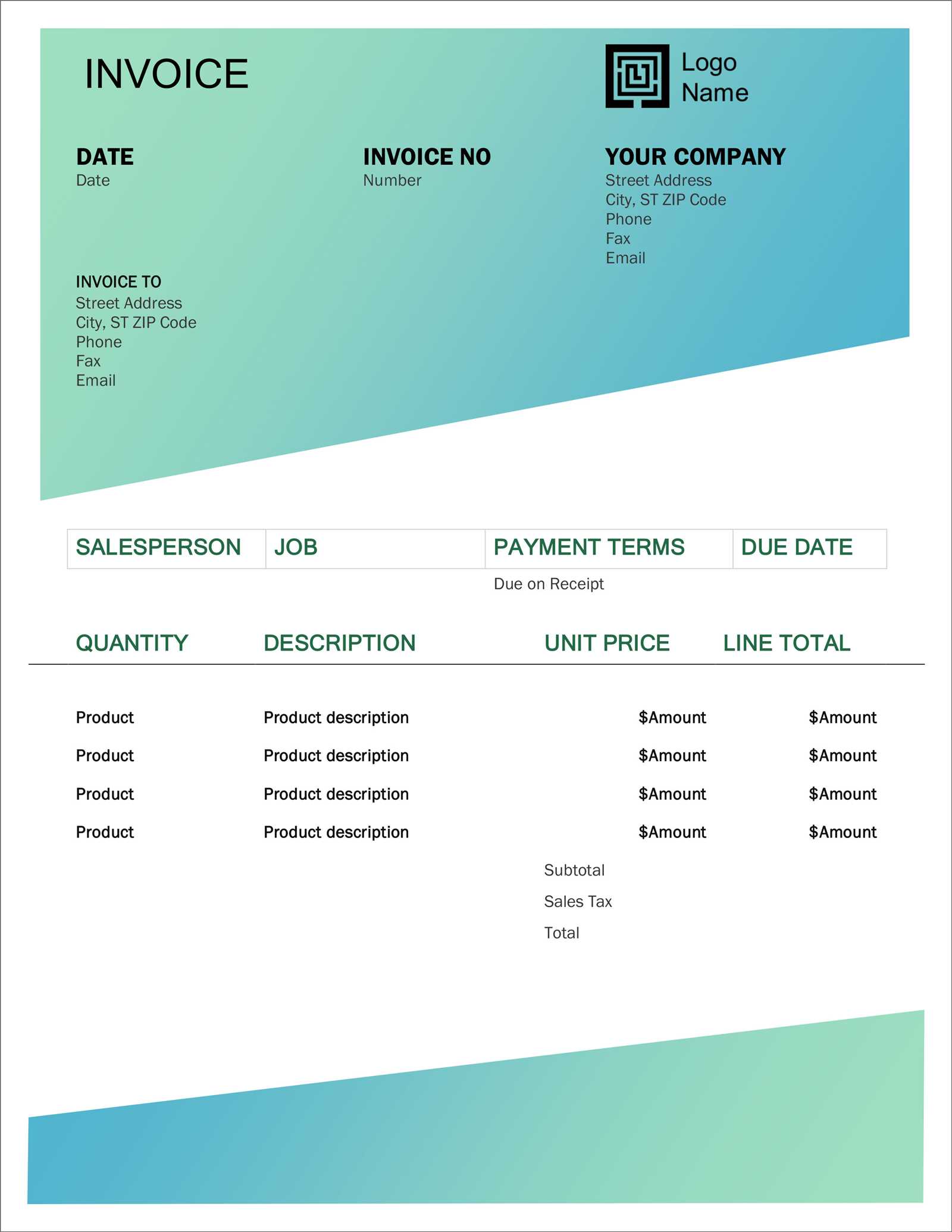

- Customization Needs: Depending on your branding or specific requirements, it may be important to choose a format that is easily customizable. Look for designs that allow you to add logos, adjust color schemes, or modify the layout as needed.

- Client Preferences: Some clients may prefer a simple document, while others may require more detailed breakdowns or specific legal language. Understanding your clients’ preferences can help you select the right format.

- Compliance with Regulations: Ensure that the chosen structure aligns with industry standards and any legal requirements, such as tax reporting or accounting practices. This is particularly important in highly regulated industries.

Different Types of Billing Documents

There are various formats available, each designed for different purposes. Some examples include:

- Simple Billing Documents: Best for small businesses or freelancers who need to quickly send a basic record of goods or services provided.

- Detailed Structured Formats: Ideal for businesses with complex transactions, such as those in retail or construction, which require extensive breakdowns, itemized lists, and multi

Customizing Your Sales Invoice Template

Customizing a billing document is an essential step for ensuring that it reflects your business’s unique branding, operational needs, and client requirements. A standardized structure is a great starting point, but personalizing the layout can make the document more professional, user-friendly, and tailored to your specific processes. Customization allows you to add specific details, such as company logos, payment terms, or specific item breakdowns, to better suit your business model.

Key Areas to Personalize

When adapting a format for your business, several key areas can be customized to improve both functionality and appearance:

- Branding Elements: Include your company logo, brand colors, and fonts to create a consistent look that reflects your brand identity. This helps maintain professionalism and strengthens brand recognition.

- Contact Information: Ensure that your business name, address, phone number, email, and website are clearly displayed, making it easy for clients to get in touch or find more information.

- Payment Terms and Instructions: Clearly outline the methods of payment accepted, deadlines, and any applicable late fees or discounts for early payments. Tailor the language to suit your company’s policies.

- Line Item Descriptions: Modify the way products or services are listed. Add additional columns for details like SKU numbers, discounts, or specific tax rates that apply to different categories of items.

Advanced Customization Options

For businesses with more complex needs, additional customization features can help streamline your billing process and ensure all necessary details are captured:

- Multi-currency or Tax Handling: If your business deals with international clients or operates in multiple regions, consider adding fields to manage different currencies or tax rates based on the client’s location.

- Automated Calculations: Some advanced layouts allow for automated totals, tax calculations, and discounts. This reduces the risk of human error and speeds up the process.

- Personalized Messages: Include a thank-you note or custom message to your clients. This pe

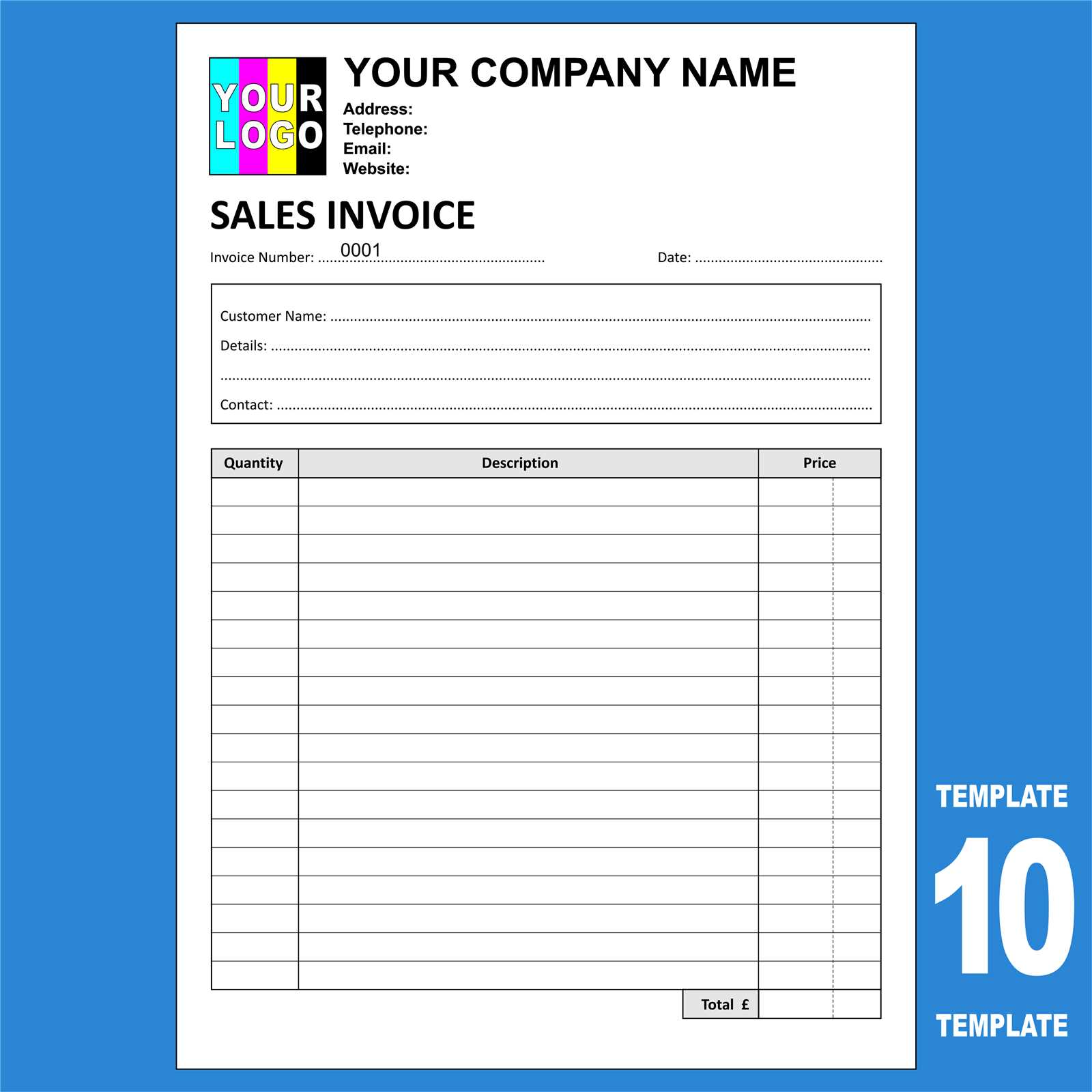

Free Sales Invoice Templates Online

For businesses looking to streamline their billing process, free document structures available online offer an easy and cost-effective solution. These pre-designed formats allow you to quickly create professional documents without needing specialized software or design expertise. Many platforms offer customizable options, giving you flexibility while keeping your costs low.

Advantages of Using Free Online Templates

Utilizing free structures from online sources comes with several key benefits:

- Cost-Effective: As the name suggests, these options are available at no cost, making them ideal for startups and small businesses working within tight budgets.

- Ease of Use: Most online options are user-friendly and require minimal setup. You can download a document and start using it right away, without complicated installations or tutorials.

- Time-Saving: Pre-designed formats save time, as they are already structured with all the essential fields, so you don’t have to worry about creating a new one from scratch.

- Customization Options: Even free formats often allow for basic customization, such as adding your logo, changing colors, or adjusting layout elements to fit your business needs.

Where to Find Free Document Formats

There are many reputable websites that offer free downloadable structures. Here are a few common sources:

- Online Accounting Platforms: Many accounting software providers offer free downloadable formats that integrate seamlessly with their tools, making invoicing even easier.

- Business Resource Websites: Websites dedicated to small business resources often feature a library of free downloadable formats for various business needs, including billing.

- Document Sharing Platforms: Platforms like Google Docs, Microsoft Office, or Canva often provide free access to customizable document formats, which can be edited online and shared directly with clients.

By taking advantage of these free online resources, businesses can create efficient and professional documents quickly, helping to ensure timely payments and maintain strong client relationships.

Best Practices for Issuing Invoices

Issuing payment requests effectively is essential for maintaining a smooth cash flow and a professional relationship with clients. Ensuring that your documents are clear, accurate, and timely can help prevent delays, disputes, and misunderstandings. By following best practices, you can streamline the billing process, improve client trust, and enhance the overall financial health of your business.

Key Best Practices to Follow

Here are some important guidelines to consider when issuing payment requests:

- Send Promptly: Always issue the document as soon as the work is completed or goods are delivered. Delays in sending payment requests can lead to delayed payments and negatively impact your cash flow.

- Be Clear and Detailed: Ensure that the request contains a comprehensive breakdown of the services provided or products delivered, including quantities, unit prices, taxes, and total amounts. Transparency reduces confusion and disputes.

- Use Professional Language: Maintain a professional tone in the document, even if the transaction is with a long-term client. Clear and respectful communication fosters good business relationships.

- Provide Multiple Payment Options: Offer your clients various payment methods, such as bank transfer, credit card, or online payment systems. The easier it is for clients to pay, the faster you are likely to receive the funds.

- Follow Up on Overdue Payments: Set clear terms for due dates and follow up promptly if the payment is not received on time. A polite reminder can often resolve the issue before it becomes more complicated.

Maintaining Consistency

To further streamline the process and improve your business operations, maintain consistency in your documents. This includes using a standardized layout, numbering system, and clearly defined payment terms. Regularly updating your system to reflect any changes in tax laws or company policies ensures that your documents are always compliant and accurate.

By adhering to these best practices, you can minimize errors, improve the efficiency of your billing cycle, and build trust with your clients, ensuring smoother transactions and stronger business relationships.

How to Track Sales with Invoices

Effectively monitoring and managing transactions is essential for any business. By using properly structured billing documents, you can easily keep track of your revenue, monitor outstanding payments, and analyze your financial performance. A clear and organized record of transactions helps ensure that your accounting process is accurate and up-to-date.

Steps to Track Transactions Efficiently

Here are some key strategies to help you track your transactions using billing documents:

- Assign Unique Identification Numbers: Each document should have a unique reference number. This helps to easily track and search for individual transactions in your records.

- Record Detailed Information: Include specific details such as product names, quantities, prices, and any applicable taxes or discounts. The more information you include, the easier it will be to track the items sold and monitor revenue accurately.

- Use Consistent Billing Periods: Align your records with consistent billing periods (e.g., weekly, monthly, quarterly). This helps you track payments and predict cash flow more effectively.

- Track Payment Status: Keep a record of whether the payment has been received, is pending, or is overdue. You can use a simple “Paid/Unpaid” status or integrate payment tracking features into your financial software.

- Monitor Outstanding Balances: Regularly check your records to identify any unpaid balances or overdue payments. This allows you to follow up with clients promptly and prevent financial discrepancies.

Using Software for Enhanced Tracking

For businesses with higher transaction volumes, using accounting or billing software can significantly improve the tracking process. These tools automate much of the tracking, allowing you to:

- Generate Reports: Software can automatically generate sales reports, helping you quickly assess revenue over specific periods or monitor trends in your business.

- Send Automated Reminders: Many software platforms allow you to set up automated reminders for overdue payments, reducing the need for manual follow-ups.

- Integrate Payment Gateways: If you use online payment systems, software can automatically update payment statuses once the funds are received, providing a more streamlined process.

By following these practices, you can ensure that your business has an accurate and organized record of all transactions. This not only helps with financial management but also provides

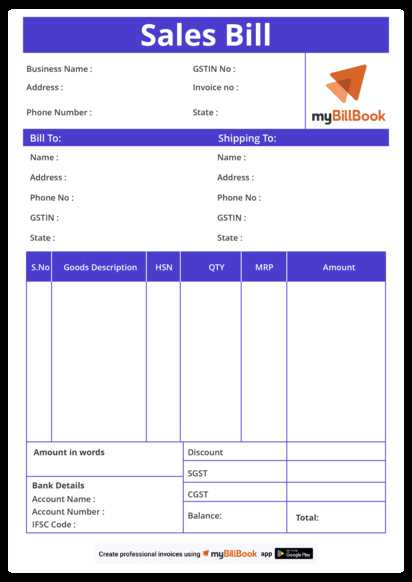

Legal Requirements for Sales Invoices

When issuing payment requests, it’s essential to ensure that your documents comply with local laws and regulations. Legal requirements can vary depending on your country, industry, and the nature of the transaction. However, some common elements are typically required to ensure that your records are valid for tax reporting, accounting purposes, and to avoid any potential legal disputes.

Essential Elements for Compliance

To ensure that your billing documents meet legal standards, make sure to include the following details:

- Business Identification: Include your business’s legal name, address, and contact information. Depending on your location, you may also need to provide your business registration number or tax identification number.

- Client Details: The document should list the name, address, and contact information of the customer. For business transactions, you may also need to include the client’s registration or tax ID number.

- Unique Identification Number: Each request should have a unique reference number, making it easier to track and reference in your records. This is often a legal requirement for tax purposes and accounting audits.

- Transaction Date: Clearly indicate the date the product or service was provided or the date of the transaction. This helps define the timeline for payment terms and tax reporting.

- Description of Goods or Services: Provide a detailed breakdown of what was sold, including quantities, unit prices, and a description of the products or services provided. This ensures transparency and prevents disputes over the charges.

- Amount and Payment Terms: Include the total amount due, any applicable taxes, and the payment due date. In many jurisdictions, businesses are required to state the tax rate applied and the total amount of tax charged.

- Payment Methods and Terms: Specify the accepted methods of payment (e.g., bank transfer, credit card) and any payment terms, such as early payment discounts or late payment penalties.

Additional Legal Considerations

In addition to the basic requirements, there are a few other considerations to be aware of:

- Tax Compliance: Make sure your

Automating Your Invoice Process

Automating the billing and payment request process can significantly improve efficiency, reduce errors, and save time. By integrating technology into your financial workflow, you can streamline repetitive tasks, ensure consistency, and allow your team to focus on more critical aspects of the business. Automation not only helps in generating payment requests but also tracks outstanding payments, sends reminders, and generates reports without manual intervention.

Benefits of Automating Your Billing Workflow

Implementing an automated system offers several key advantages for businesses of all sizes:

- Increased Efficiency: Automation eliminates the need for manual data entry, reducing the time spent creating and sending documents. This speeds up the process and improves turnaround times.

- Fewer Errors: Automation minimizes the risk of human errors, such as incorrect calculations or missing information. This helps ensure that your documents are accurate and compliant with regulations.

- Consistent Formatting: Automated systems ensure that every document follows a standardized format. This consistency enhances professionalism and reduces the likelihood of misunderstandings with clients.

- Improved Cash Flow: With automated reminders for overdue payments, you can reduce delays and ensure that your cash flow remains healthy. Timely follow-ups help avoid the need for manual intervention in collections.

- Better Insights: Many automated systems provide analytics and reporting features, which allow you to easily track outstanding payments, monitor revenue trends, and make more informed financial decisions.

How to Automate Your Billing Process

There are several tools and strategies you can use to automate your billing process effectively:

- Accounting Software: Many modern accounting platforms offer built-in automation features, such as recurring billing, automated reminders, and easy tracking of payment statuses. Popular solutions like QuickBooks, FreshBooks, or Xero can integrate directly with your financial systems.

- Customizable Billing Platforms: Specialized platforms like Zoho Invoice or Square allow you to set up recurring payment schedules, customize your document layouts, and automate payment notifications.

- Payment Gateways: Online payment gateways such as PayPal, Stripe, or Square not only handle transactions but can also send automated receipts and reminders to clients when payments are due.

- Integration with CRM: By integrating your billing system with your Customer Relationship Management (CRM) software, you can create a seamless process that automatically generates requests based on customer interactions and sales activities.

Automating your billing process not only saves time and resources but also ensures that your financial operations are more accurate an

How to Handle Payment Terms in Invoices

Setting clear payment terms is essential to ensure smooth financial transactions between your business and clients. Properly defining when and how payments are expected not only helps with cash flow management but also reduces the likelihood of misunderstandings. Establishing clear and agreed-upon terms fosters trust and ensures that both parties are on the same page regarding deadlines, amounts, and methods of payment.

Key Elements of Payment Terms

When outlining payment terms, make sure to include the following important details:

- Due Date: Clearly specify the date by which the payment should be made. This could be a specific date (e.g., “Due by May 1st”) or a number of days after the transaction (e.g., “Net 30,” meaning payment is due 30 days from the date of the transaction).

- Early Payment Discounts: Offering a discount for early payment can encourage clients to settle their accounts sooner. For example, “2% discount if paid within 10 days” can motivate timely payments.

- Late Payment Penalties: To discourage late payments, include a clause specifying any penalties for overdue amounts. This might include a flat fee or a percentage of the total amount due for each additional month the payment is delayed.

- Accepted Payment Methods: List the methods by which payments can be made, such as credit cards, bank transfers, checks, or online payment systems like PayPal or Stripe. The more options you offer, the easier it is for clients to pay promptly.

Communicating Payment Terms Effectively

Clear communication of payment terms is crucial to avoid confusion or disputes later on. Here are some best practices for handling payment terms in your billing documents:

- Be Transparent: Ensure that the payment terms are clearly stated on the document. Avoid any ambiguous language that could lead to misinterpretation. It’s best to make these terms easy to find, such as in the header or footer of the document.

- Discuss Terms Upfront: Before finalizing any agreement, discuss the payment terms with your client to ensure mutual understanding and agreement. This can be done in contracts, emails, or verbal agreements to avoid any surprises later on.

- Send Payment Reminders: If a payment is due soon, consider sending a reminder a few days in advance. If the payment is overdue, follow up with polite reminders that reference the agreed-upon terms.

Sales Invoice Template for Freelancers

For freelancers, managing payments efficiently is crucial to maintaining a steady cash flow and ensuring timely compensation for services rendered. A well-structured billing document is key to this process, as it outlines the specifics of the work performed, payment expectations, and terms in a professional manner. Having a consistent format helps freelancers streamline their business operations and ensures that clients understand exactly what they are being charged for and when payment is due.

Essential Components for Freelancers

When creating a payment request for freelance work, it’s important to include all the necessary details to ensure clarity and avoid any confusion. Key elements include:

- Your Information: Include your name, business name (if applicable), contact details, and tax identification number (if required). This ensures the document is properly attributed to you.

- Client’s Information: Include your client’s full name, company (if applicable), address, and contact information. Accurate details will help in case there’s a need for follow-up or disputes.

- Project or Service Description: Clearly outline the specific work or services you provided. Include details like hours worked, hourly rate, project milestones, and any other relevant deliverables.

- Payment Amount: Specify the total amount due, including any taxes, discounts, or additional charges. Be sure to break down the amount clearly to avoid confusion.

- Payment Terms: Define the payment method, due date, and any penalties for late payment. For example, you may set terms like “Net 30” (payment due within 30 days) or offer an early payment discount.

Why Having a Standardized Billing Document Matters

For freelancers, consistency in billing is not just about professionalism; it also helps in tracking payments, managing finances, and maintaining legal clarity. By using a standardized document for every project, you ensure that each transaction is clear and transparent. This can also help in case of disputes or audits, where a well-documented and professionally presented request can serve as evidence of the work completed and the agreed-upon terms.

In addition to improving payment tracking, having a consistent format for billing makes the entire process more efficient. Instead of creating a new document from scratch for every project, you can modify a pre-designed template to suit the specific project details, saving time and ensuring accuracy.

By adopting a clear and professional approach to payment requests, freelancers can enhance their reputation, minimize confusion, and ultimately b

Tips for Organizing Your Invoices

Keeping your billing documents organized is essential for smooth financial management. Proper organization not only helps you stay on top of payments and due dates but also simplifies tax reporting and financial audits. Whether you’re running a small business or working as a freelancer, having an efficient system for tracking and storing your payment records can save time and prevent costly mistakes.

Key Practices for Efficient Organization

To maintain order and ensure that your financial records are easily accessible, consider the following best practices:

- Create a Consistent Naming System: Use a standard format for naming your documents. This could include the client’s name, date of the transaction, or a unique reference number. For example, “ClientName_2024-05-01” or “Invoice_001_ClientName” makes it easier to search and locate specific files.

- Use Folder Structures: Organize your billing documents by client, project, or year. A well-structured folder system ensures you can quickly find what you’re looking for and keeps your digital or physical files neat and manageable.

- Maintain Both Digital and Physical Copies: While digital storage is convenient, it’s also wise to keep a backup in physical form for important documents. This provides extra security in case of technical issues with your devices.

- Track Payments and Due Dates: Use a spreadsheet or accounting software to track which documents have been paid and which are still outstanding. Adding a column for due dates and payment statuses can help you avoid missing deadlines and follow up when necessary.

- Automate Reminders: Set up automatic reminders for overdue payments. Many accounting tools and platforms allow you to send gentle reminders to clients, which helps you stay on top of late payments without additional manual effort.

Utilizing Accounting Software for Better Organization

Using accounting software can significantly improve the organization of your financial records. Many tools provide features such as automatic categorization, digital filing, and integrated payment tracking. Some platforms even allow you to customize your documents, generate reports, and sync your payment history, all in one place.

By implementing a solid organizational system, you not only ensure timely payments but also gain valuable insights into your financial status. Whether using manual methods or advanced software, keeping your billing records