Sales Invoice Template for Philippines Businesses

In today’s fast-paced business environment, managing transactions efficiently is essential for growth and sustainability. One key aspect of ensuring smooth financial operations is creating clear and professional documentation for every sale or service rendered. Having a consistent and reliable system to outline payment details helps avoid confusion and fosters trust with clients.

Having the right tools in place can significantly reduce administrative burdens, making invoicing quicker and less prone to errors. By using a structured form for outlining costs, payment terms, and client information, businesses can stay organized while meeting both legal and professional standards.

For many entrepreneurs, especially in small and medium-sized enterprises, simplicity and accuracy are the top priorities. An effective method of invoicing ensures that payments are tracked easily and disputes are minimized. With the right format, businesses can maintain professionalism while focusing more on their core activities.

Sales Invoice Template Philippines Overview

For businesses, maintaining a well-organized record of every transaction is crucial. A structured document outlining the details of each sale ensures clarity and transparency for both the company and its clients. The format of this document plays a significant role in conveying important information such as amounts due, payment methods, and terms of agreement, which are vital for a smooth business operation.

In the local business landscape, using a standardized format for these records helps companies save time and reduce mistakes. This format is typically designed to be easily customized for various business types, offering flexibility while ensuring all necessary details are included. From small startups to larger enterprises, having access to an efficient method of documenting transactions is essential for financial accuracy and professional communication.

The following table highlights the key components typically found in a standard business transaction record:

| Component | Description |

|---|---|

| Document Number | A unique identifier for the transaction |

| Company Information | Details of the business issuing the document, such as name, address, and contact |

| Client Information | Name, address, and contact details of the customer |

| Transaction Date | The date the sale or service took place |

| Itemized List | A breakdown of goods or services provided along with their respective costs |

| Total Amount | The total cost for the transaction, including taxes or additional fees |

| Payment Terms | Details regarding when and how payment is due, including penalties for late payments |

This format not only ensures clarity for both parties but also contributes to maintaining a professional reputation. By having the right structure in place, businesses can focus on building relationships and growing their operations without worrying about the details of financial documentation.

Sales Invoice Template Philippines Overview

For businesses, maintaining a well-organized record of every transaction is crucial. A structured document outlining the details of each sale ensures clarity and transparency for both the company and its clients. The format of this document plays a significant role in conveying important information such as amounts due, payment methods, and terms of agreement, which are vital for a smooth business operation.

In the local business landscape, using a standardized format for these records helps companies save time and reduce mistakes. This format is typically designed to be easily customized for various business types, offering flexibility while ensuring all necessary details are included. From small startups to larger enterprises, having access to an efficient method of documenting transactions is essential for financial accuracy and professional communication.

The following table highlights the key components typically found in a standard business transaction record:

| Component | Description |

|---|---|

| Document Number | A unique identifier for the transaction |

| Company Information | Details of the business issuing the document, such as name, address, and contact |

| Client Information | Name, address, and contact details of the customer |

| Transaction Date | The date the sale or service took place |

| Itemized List | A breakdown of goods or services provided along with their respective costs |

| Total Amount | The total cost for the transaction, including taxes or additional fees |

| Payment Terms | Details regarding when and how payment is due, including penalties for late payments |

This format not only ensures clarity for both parties but also contributes to maintaining a professional reputation. By having the right structure in place, businesses can focus on building relationships and growing their operations without worrying about the details of financial documentation.

Essential Elements of a Sales Invoice

When creating a document to record a transaction, it’s important to include all relevant details that ensure both parties understand the terms and agreement clearly. A properly structured document not only serves as proof of the transaction but also outlines important information such as the costs, payment terms, and dates. These key elements ensure transparency and avoid future disputes between the seller and buyer.

Key Information for Accurate Documentation

Each document should include specific details to guarantee accuracy and professionalism. The following elements are essential to ensure that the record serves its intended purpose:

- Unique Identification Number: A unique reference number helps distinguish each record from others for easy tracking and future reference.

- Business Details: Include the name, address, and contact information of the seller’s company. This ensures the buyer knows who is responsible for the transaction.

- Client Information: The buyer’s details such as name, address, and contact should also be included to confirm who the goods or services are being provided to.

- Description of Products or Services: A clear list of the items or services provided, including quantities and prices, allows both parties to verify the details of the agreement.

- Total Amount: The total cost, including taxes or discounts, should be clearly displayed to avoid any confusion regarding the final amount due.

Additional Terms for Clarity

In addition to basic details, including payment terms and dates is crucial for proper financial tracking:

- Transaction Date: Clearly state the date the goods or services were provided or delivered.

- Payment Terms: Specify how and when the payment is expected, whether it’s immediately, on a certain date, or in installments.

- Late Fees: If applicable, include any penalties for late payments to encourage timely transactions.

By including these key elements, businesses can ensure their financial documentation is both professional and functional, minimizing confusion and enhancing the

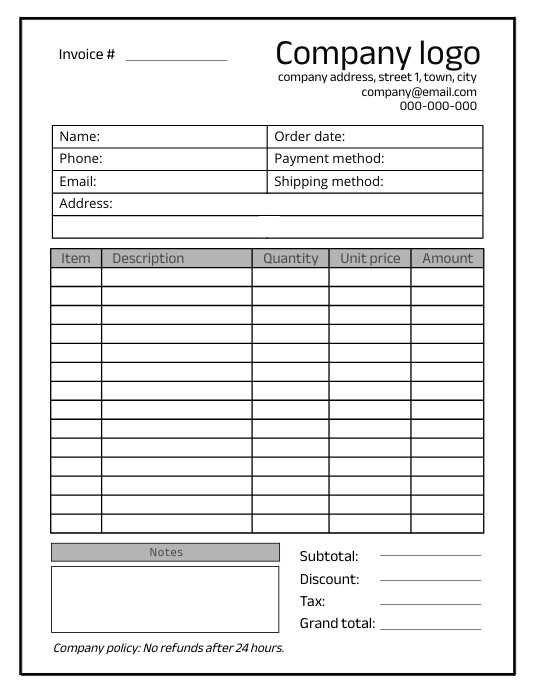

Free Sales Invoice Templates for Businesses

For businesses looking to streamline their billing process, finding a reliable and easy-to-use document format is essential. Free resources are available that allow entrepreneurs to quickly create professional records without the need for costly software or complicated tools. These templates can be customized to fit different business needs, saving both time and effort in managing transactions.

Many online platforms offer downloadable versions of these documents, which are designed to be simple yet comprehensive. By using a free format, businesses can avoid the expenses associated with custom-built solutions while still ensuring that all necessary information is clearly presented. Whether you’re a small startup or a growing enterprise, using a free and accessible method to manage your transactions is both practical and efficient.

These tools are particularly valuable for entrepreneurs with limited resources who need an easy solution to maintain organization and professionalism. They can be tailored for various industries, including retail, service providers, and freelancers, ensuring that each business type can use a relevant format that suits its specific needs.

How to Customize Your Invoice Template

Customizing your business documents is crucial for ensuring they reflect your brand identity and meet your specific needs. By adjusting a standard document format, you can include essential details tailored to your products, services, and client requirements. A personalized layout not only improves the professional appearance but also ensures that all necessary information is clearly communicated.

To begin with, it’s important to incorporate your company’s branding elements, such as your logo, colors, and fonts. This will help establish consistency across all your business materials and reinforce brand recognition. Additionally, you should update the header with your business name, contact details, and any relevant registration information, making it easier for clients to identify and reach you.

Another essential customization is modifying the itemized list of products or services. Include accurate descriptions, quantities, and pricing information for each item to avoid confusion. You can also add discounts or taxes if applicable, ensuring transparency in the final amount. Don’t forget to adjust the payment terms to reflect your preferred methods and timelines for transactions.

Lastly, review the footer section to ensure it includes any legal disclaimers or additional notes, such as late fees or payment instructions. With these simple adjustments, you can create a document that fits your business perfectly while presenting a polished and professional appearance to your clients.

Benefits of Digital Invoicing in the Philippines

Digital tools for managing business transactions have revolutionized the way companies handle their financial documentation. Moving away from paper-based records to electronic systems brings numerous advantages, particularly in terms of efficiency, accuracy, and environmental sustainability. By adopting digital solutions, businesses can simplify their processes and improve overall productivity.

One of the primary benefits of digital systems is the reduction of human errors. Manual entries and paper records can lead to mistakes, such as incorrect calculations or missing details. With automated processes, these errors are minimized, ensuring that all data is accurately captured and stored.

Another significant advantage is the time-saving aspect. Digital tools allow for quick generation and distribution of transaction records, eliminating the need for printing, manual filing, and physical delivery. This also speeds up the payment collection process, as customers can receive documents instantly via email or other online platforms.

Furthermore, digital systems offer better organization and accessibility. All records are stored in a centralized location, making it easier to retrieve and review past transactions. This organization improves record-keeping practices and simplifies auditing, ensuring that businesses comply with local regulations while maintaining transparency.

Lastly, the shift to digital methods aligns with the global trend toward sustainability. By reducing paper usage, businesses contribute to environmental conservation while also cutting costs associated with printing and storage. This not only benefits the company but also supports broader eco-friendly initiatives.

Common Invoice Mistakes to Avoid

When managing financial records, it’s essential to ensure that all documents are accurate and professional. Small errors can lead to confusion, delayed payments, or even legal issues. By understanding and avoiding the most common mistakes, businesses can maintain a smoother billing process and enhance their credibility with clients.

Key Mistakes to Watch Out For

While preparing financial documents, businesses should avoid some common pitfalls that can cause delays or misunderstandings. Here are a few of the most frequent mistakes:

| Mistake | Explanation |

|---|---|

| Incorrect Contact Information | Always double-check that the business and client details are accurate to ensure the document reaches the correct recipient. |

| Missing Payment Terms | Without clear payment terms, clients may delay payments or misunderstand when they are due. Specify payment deadlines and accepted methods. |

| Omitting Taxes and Fees | Be sure to include applicable taxes or additional charges to avoid confusion about the final amount owed. |

| Vague Descriptions of Products/Services | Provide clear, detailed descriptions of goods or services to ensure that both parties understand the terms of the transaction. |

| Not Including a Unique Identifier | Without a reference number, it becomes difficult to track and organize transactions efficiently. |

How to Prevent These Errors

To avoid these mistakes, it’s crucial to implement a systematic approach when preparing business records. Double-check all information, ensure that your format includes all necessary components, and set reminders for follow-up. By addressing these potential issues, busin

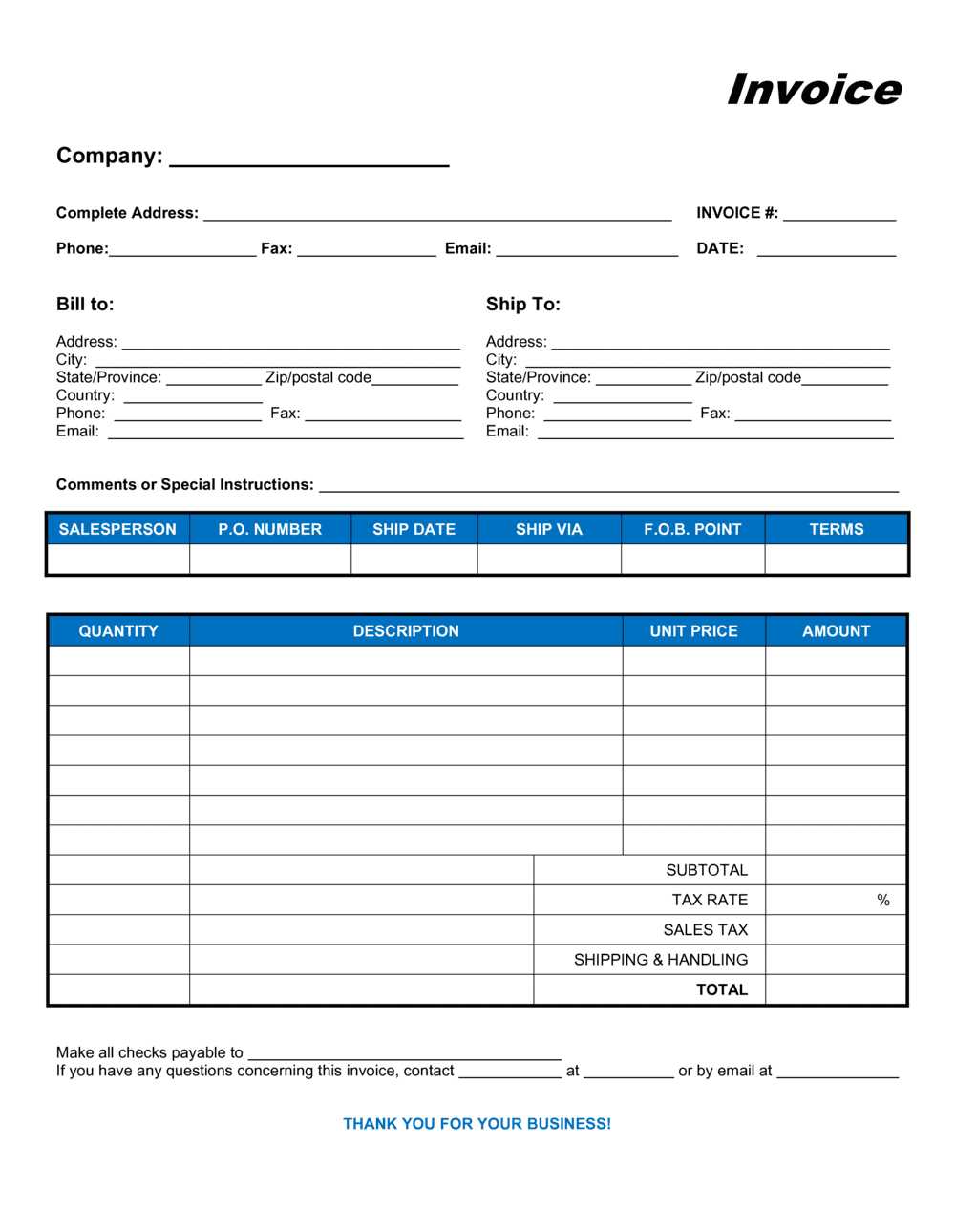

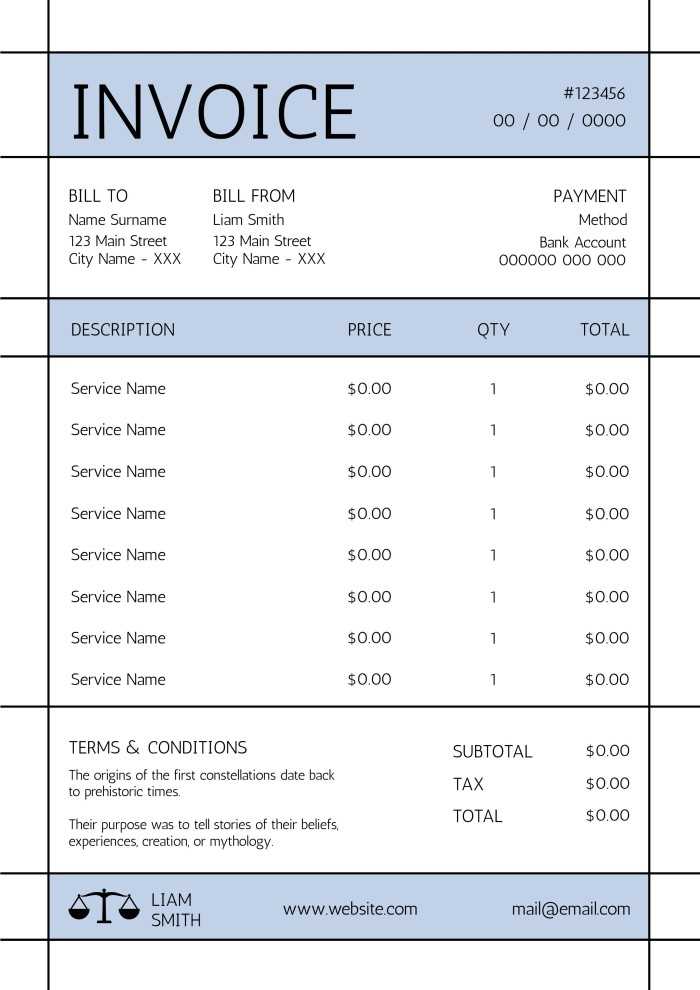

Invoice Templates for Different Business Types

Every business has its own unique needs when it comes to documenting transactions. Whether you’re in retail, providing professional services, or running a freelance operation, the structure of your transaction records should reflect your specific industry requirements. Customizing these documents ensures clarity, professionalism, and legal compliance while catering to the particularities of your business model.

For retail businesses, it’s important to have a detailed breakdown of each item sold, including quantities, unit prices, and any applicable taxes. A straightforward, itemized format is essential to keep track of each sale and make the process of issuing receipts quick and efficient. Similarly, businesses in services may require a different approach, often needing to specify hours worked, rates, and the nature of the service provided. The focus should be on transparency, ensuring the client understands what they are being charged for.

Freelancers and consultants also have unique needs. Their transaction records may involve variable rates based on project scope or hourly work. It’s important to ensure that payment terms, milestones, and deadlines are clearly defined. For manufacturers, on the other hand, a more complex breakdown may be required, with product specifications, bulk order details, and shipment information. These details help avoid disputes and ensure smooth operations when dealing with larger orders or long-term clients.

By tailoring your document format to fit your industry, you can maintain a higher level of professionalism, reduce misunderstandings, and enhance overall efficiency. Whether you are tracking products, services, or project-based work, ensuring that the correct fields are included will help streamline your financial processes.

Invoice Templates for Different Business Types

Every business has its own unique needs when it comes to documenting transactions. Whether you’re in retail, providing professional services, or running a freelance operation, the structure of your transaction records should reflect your specific industry requirements. Customizing these documents ensures clarity, professionalism, and legal compliance while catering to the particularities of your business model.

For retail businesses, it’s important to have a detailed breakdown of each item sold, including quantities, unit prices, and any applicable taxes. A straightforward, itemized format is essential to keep track of each sale and make the process of issuing receipts quick and efficient. Similarly, businesses in services may require a different approach, often needing to specify hours worked, rates, and the nature of the service provided. The focus should be on transparency, ensuring the client understands what they are being charged for.

Freelancers and consultants also have unique needs. Their transaction records may involve variable rates based on project scope or hourly work. It’s important to ensure that payment terms, milestones, and deadlines are clearly defined. For manufacturers, on the other hand, a more complex breakdown may be required, with product specifications, bulk order details, and shipment information. These details help avoid disputes and ensure smooth operations when dealing with larger orders or long-term clients.

By tailoring your document format to fit your industry, you can maintain a higher level of professionalism, reduce misunderstandings, and enhance overall efficiency. Whether you are tracking products, services, or project-based work, ensuring that the correct fields are included will help streamline your financial processes.

Creating a Professional Invoice in Minutes

Designing a professional document to record a transaction doesn’t have to be a time-consuming process. With the right tools, you can generate clear, concise, and accurate records in just a few minutes. A well-structured document helps maintain professionalism, ensures accurate payment processing, and fosters trust with clients. By following a simple approach, any business can create a polished and effective record without the need for complicated software or design skills.

The first step is to choose a suitable format that includes all the necessary details such as client information, itemized descriptions, and payment terms. Once the structure is set, entering the relevant data becomes a quick task. Here’s a simple breakdown of the key elements to include:

| Component | Description |

|---|---|

| Business Details | Include your company name, logo, and contact information for easy identification. |

| Client Information | Provide the recipient’s name, address, and contact details for accurate documentation. |

| Transaction Description | List the products or services provided, including quantities, unit prices, and applicable taxes. |

| Total Amount | Ensure the total amount due is clearly displayed, including any discounts or additional fees. |

| Payment Terms | Specify when and how the payment should be made, including any late fees or penalties for overdue payments. |

| Unique Reference Number | Assign a distinct number for easy tracking and future reference. |

By following these basic steps, you can create a professional document in minutes that is ready to be sent to your client. Whether you are using digital tools or simply a pre-designed format, focusing on clarity and completeness will ensure your transaction records are effective and trustworthy.

Tracking Payments with Invoice Templates

Efficiently tracking payments is a critical aspect of managing finances for any business. Without a reliable system to record and follow up on outstanding balances, it becomes difficult to maintain cash flow and ensure timely payments. A structured document format helps keep track of which transactions have been completed and which ones are still pending, allowing businesses to follow up and stay organized.

One of the key benefits of using a detailed format is that it provides a clear record of each transaction, including the total amount due, payment terms, and due dates. This allows businesses to easily monitor payment statuses and identify overdue amounts. With the right tracking system, businesses can avoid confusion and reduce the risk of overlooking payments.

To stay organized, it’s important to mark the payment status on each document. For example, using terms like “paid,” “pending,” or “overdue” helps quickly identify the status of a particular transaction. Additionally, tracking partial payments and updating the balance due is essential for keeping accurate financial records. Consistency in updating these records ensures that nothing slips through the cracks, even for long-term projects or recurring clients.

Moreover, digital systems often allow businesses to automatically update payment statuses and send reminders for overdue amounts. This automation saves time and reduces the chances of human error, making the payment tracking process much more efficient and accurate.

In conclusion, using a well-organized and clearly defined method for tracking payments is key to maintaining good financial health for your business. Whether through manual or automated systems, ensuring that each transaction is properly recorded and updated will help businesses stay on top of their finances and foster positive relationships with clients.

How to Include Tax Information on Invoices

When documenting business transactions, it’s essential to provide clear and accurate information about taxes. Including tax details not only ensures legal compliance but also helps both parties understand the full financial obligations. A well-structured document should specify the type of tax applied, the rate, and the total tax amount, giving the recipient a complete breakdown of the costs.

Steps for Including Tax Details

To properly incorporate tax information, start by identifying the relevant tax rates that apply to the transaction. This will depend on factors such as location, type of goods or services, and local tax laws. After determining the tax rate, it should be calculated based on the subtotal of the sale, and then clearly presented in the document.

| Component | Description |

|---|---|

| Tax Rate | Clearly state the percentage rate applied to the subtotal, such as 5%, 12%, or other applicable rates. |

| Tax Amount | List the amount of tax charged based on the subtotal and tax rate. |

| Subtotal | The total cost of the products or services before tax. |

| Total Amount | The full amount due after adding the tax to the subtotal. |

Common Tax Types to Include

Different regions and industries may apply various types of taxes. It’s important to note the specific taxes that are relevant to your business. Common examples include Value Added Tax (VAT), Sales Tax, or Service Tax. In some cases, there may be exemptions or special rates that apply to certain goods or services, so ensure these are reflected accurately in the document.

By properly including tax information, businesses can avoid potential disputes and ensure that clients fully understand their financial

Integrating Invoices with Accounting Software

Integrating transaction records with accounting software can streamline the financial management process for businesses. By linking these documents directly to your accounting system, you can automate much of the data entry, reduce the risk of errors, and gain real-time insights into your financial situation. This integration ensures that all your financial data is accurate, up-to-date, and easy to track, ultimately improving efficiency and making your financial operations more transparent.

Benefits of Integration

One of the major advantages of integrating your business records with accounting software is the elimination of manual data entry. When a transaction record is created, the details can automatically be transferred to your accounting software, reducing the chances of human error. This integration ensures that your accounts, balances, and taxes are always in sync with the most recent transactions, providing a more accurate financial picture.

Another key benefit is time savings. With the automation of invoicing and accounting processes, you no longer need to manually enter payment data or track outstanding balances. The software will do this for you, sending reminders for overdue payments and automatically updating records when payments are received. This frees up your time to focus on other critical areas of the business.

How to Set Up the Integration

To integrate transaction records with accounting software, start by choosing a platform that supports such integration. Many modern accounting tools offer seamless connections with popular invoicing systems, allowing automatic synchronization of financial data. Once the integration is set up, configure your accounting system to pull details such as client names, payment amounts, tax rates, and dates from your transaction records.

It’s important to ensure that both systems are configured to recognize and match the same data fields to avoid discrepancies. Regularly check for any updates or adjustments to the integration settings to maintain smooth synchronization. This setup not only simplifies your accounting process but also enhances accuracy and reporting capabilities.

By integrating your business transaction records with accounting software, you can make financial tracking and management much more efficient, allowing for better decision-making and increased productivity.

Using Invoice Templates for Small Businesses

For small businesses, managing financial records efficiently is crucial for maintaining smooth operations. One of the most effective ways to keep track of transactions is by using pre-designed document formats. These formats simplify the billing process, reduce administrative burden, and help business owners maintain a professional appearance without needing to invest in expensive software. With the right document structure, small business owners can save time and focus on growing their companies.

Why Small Businesses Need Structured Documents

For small businesses, it’s essential to maintain organization while ensuring that each transaction is clearly documented. Having a structured record makes it easier to manage accounts, follow up on payments, and ensure that all financial details are in order for tax purposes. A standardized document can save valuable time by eliminating the need to recreate records from scratch for each client. It also minimizes errors and inconsistencies, which are especially important when handling client payments and maintaining good relationships.

Key Features of Effective Business Documents

When using a pre-designed structure, small businesses should ensure that it includes all the necessary components. These typically include business and client details, a description of the products or services, the amount due, and clear payment terms. Additionally, including a section for tracking payment status is essential for follow-ups. Many small businesses also benefit from adding branding elements, such as logos and company colors, to maintain a professional appearance and reinforce brand identity.

By adopting these standardized records, small businesses can stay organized, reduce administrative tasks, and ensure that transactions are handled smoothly. Whether operating in retail, service industries, or freelancing, using structured documents helps improve efficiency and professionalism.

Automating Your Billing Process with Templates

Automating the billing process can save businesses valuable time and reduce human errors in financial documentation. By leveraging pre-structured formats, businesses can quickly generate accurate records for every transaction. Automation not only speeds up the process but also ensures consistency, helps with organization, and minimizes the risk of overlooking important details. This is especially crucial for businesses that handle frequent transactions or have recurring clients.

When you automate your billing system, you are essentially creating a seamless workflow where key details such as client information, amounts due, payment terms, and taxes are filled in automatically. This eliminates the need for manual input, reducing administrative work and the chances of errors. By integrating these formats with accounting software or online billing systems, the entire process can be made even more efficient.

| Benefit | Description |

|---|---|

| Speed and Efficiency | Automated systems allow you to quickly generate records, saving time and reducing delays in billing. |

| Accuracy | Eliminating manual data entry helps prevent errors and ensures consistent financial records. |

| Consistency | Every record follows the same format, making it easier to track transactions and maintain uniformity across all documents. |

| Integration with Accounting | Many automated systems integrate with accounting software, making it easier to track payments, taxes, and overall financial status. |

| Reduced Administrative Work | Automation frees up time for other tasks, reducing the need for manual administrative work and follow-ups. |

Incorporating automation into your billing workflow allows businesses to streamline operations, improve accuracy, and save significant time. Whether you run a small business or a larger enterprise, automating the process is an effective strategy to keep financial transactions organized and ensure that payments are processed in a timely manner.

Where to Find Sales Invoice Templates in the Philippines

For businesses looking to streamline their transaction documentation, finding a reliable and customizable document format is essential. These formats help ensure that all the necessary details are captured, reducing errors and promoting professionalism. Many platforms offer a variety of ready-to-use structures that can be easily customized to suit the specific needs of any business. Whether you’re just starting out or need a more advanced solution, there are numerous resources available to help you get the right format for your transactions.

Online Resources and Tools

There are several online platforms that provide customizable formats that can be downloaded or filled out directly within their systems. These platforms often offer both free and paid options, catering to businesses of all sizes. Some well-known websites provide a wide range of business documentation tools, including transaction records, which can be tailored to include specific fields such as product descriptions, taxes, and payment terms. Popular tools like Google Docs, Microsoft Word, and online invoicing services often have templates available that can be easily edited to fit your business needs.

Local Business Solutions

In addition to global platforms, many local providers in the country offer templates that are specifically designed to meet local regulations and tax requirements. These formats often include region-specific details, such as local tax rates and business regulations, ensuring that your records are compliant. Businesses can access these resources through local software companies or government websites, which may provide free downloadable forms or paid services with added features like automated calculations and integration with accounting software.

By using online resources or local solutions, businesses can easily access customizable formats to fit their unique needs, allowing them to stay organized and professional while ensuring compliance with local rules and regulations.