Sales Invoice Template for Open Office Free Download

Managing payments and keeping track of transactions can be time-consuming, especially when doing it manually. To simplify this task, many businesses turn to ready-made documents that can be easily customized for each client or order. These tools help create professional-looking records and ensure that important details are not overlooked.

Whether you are a freelancer, small business owner, or managing a larger company, using a structured format for charging clients can save you time and effort. With the right software, creating these documents becomes an efficient and straightforward process. Customization options allow you to tailor each record according to your needs, making sure you always include the correct information.

Adopting such a system not only improves your workflow but also enhances your business image, ensuring your clients receive clear, well-organized documents. As you explore these options, you’ll discover that setting up templates for repeated use can increase productivity and reduce the chances of errors.

Whether you’re looking to generate one-off bills or recurring ones, the right set of tools can streamline your entire accounting process.

Sales Invoice Template for Open Office

For any business, having a reliable system to document transactions is crucial. These structured documents serve as proof of agreements between parties and help track payments, product deliveries, or services rendered. With the right tools, you can generate these documents quickly, ensuring all necessary details are included and properly formatted.

Using software like Open Office allows you to create and customize these documents according to your business needs. The flexibility of such programs ensures that you can modify fields, add logos, or change the layout to match your branding or specific requirements.

Why Use a Pre-built Format

- Time-saving: Ready-made structures eliminate the need to create a document from scratch.

- Consistency: Maintain a uniform style across all client communications.

- Accuracy: Minimize the risk of errors with a standardized format.

How to Customize Your Document

- Open the pre-configured file in your software.

- Modify fields such as client information, product details, and pricing.

- Adjust the layout to match your company’s design or personal preference.

- Save and use the document for each transaction or project.

By using such systems, you can ensure that every document you create is clear, professional, and tailored to your business needs. The ability to edit and save these formats also helps you handle recurring billing or new agreements with ease.

Why Use an Invoice Template

Using a structured format for financial records simplifies the process of documenting transactions and ensures consistency in your communications. Instead of creating each document from scratch, having a pre-designed layout can save time, reduce errors, and maintain professionalism. By relying on a template, you can focus more on your business operations rather than on administrative tasks.

Advantages of Using a Pre-designed Layout

- Efficiency: Quickly generate documents without starting from zero every time.

- Consistency: Keep a uniform style for all client records, making your business look more organized and trustworthy.

- Accuracy: Reduce the chance of missing important information or making errors with a well-structured format.

- Customization: Easily modify the document to suit each transaction or client, ensuring relevance to each case.

How a Layout Improves Client Communication

- Clear presentation of details such as products, prices, and terms.

- Predefined sections for important information reduce the risk of confusion.

- Helps build trust with clients by providing transparent and professional documentation.

Overall, using such systems helps streamline your workflow, freeing up time to focus on growing your business while ensuring that every document you send is professional and clear.

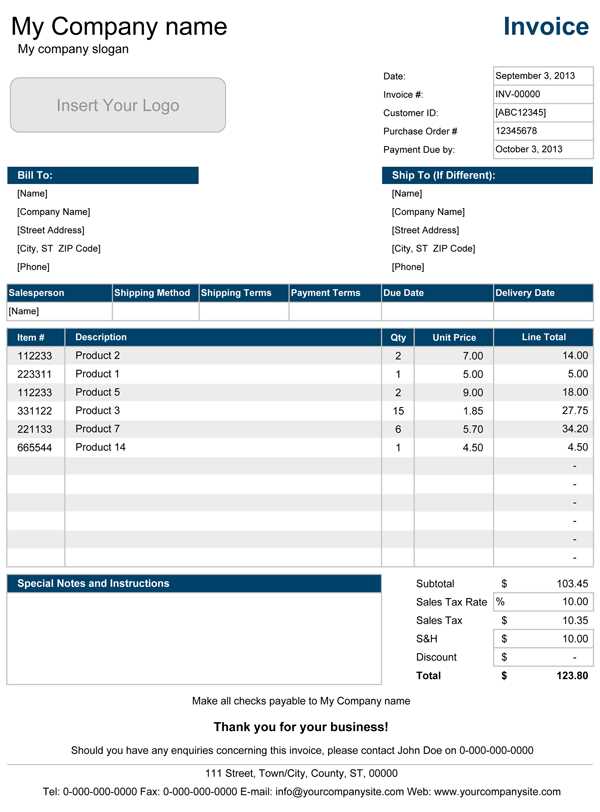

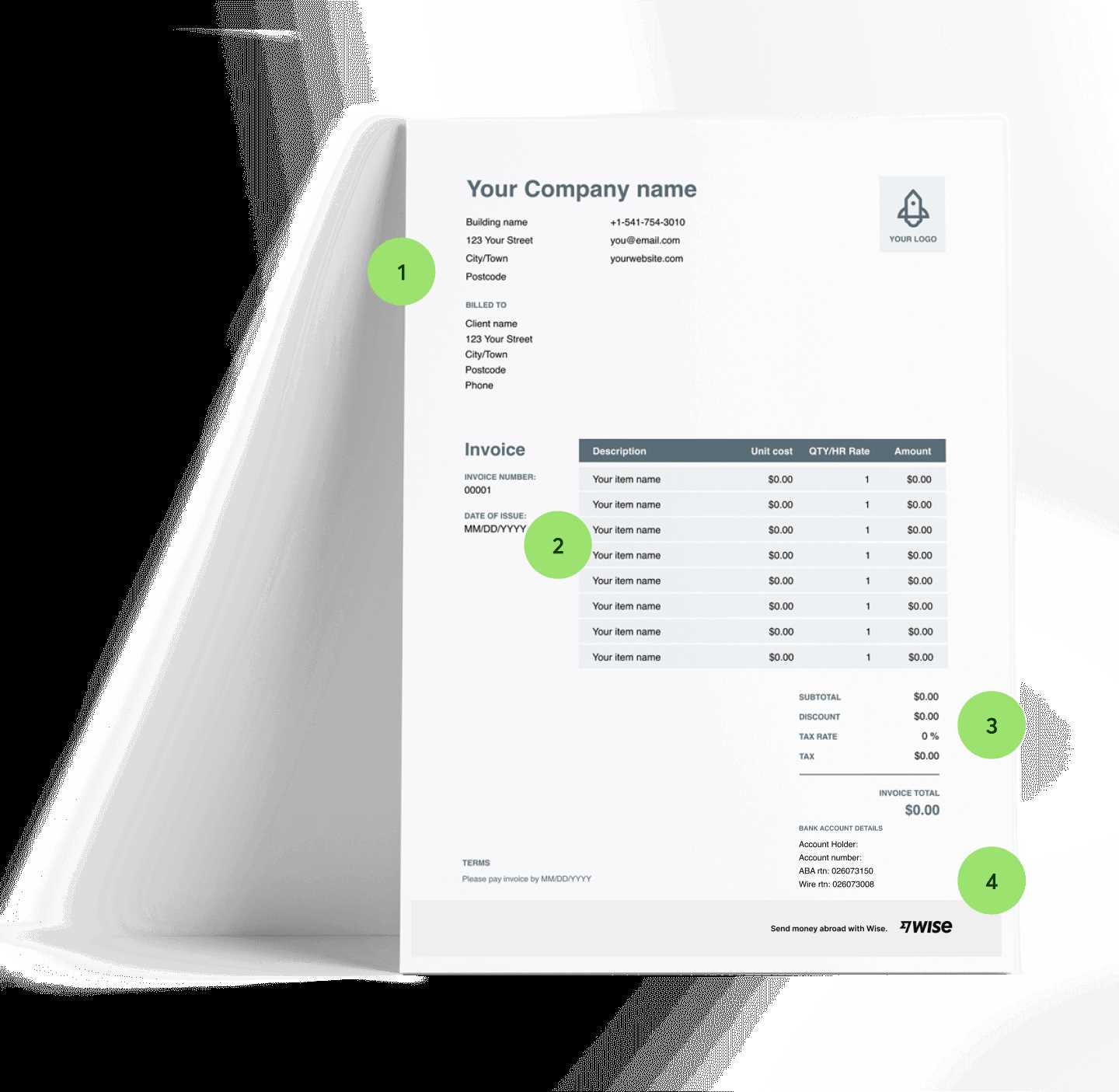

How to Customize Your Invoice

When creating documents for client transactions, it’s essential to tailor them to fit both your business needs and your clients’ expectations. Customization allows you to add or remove sections, adjust the layout, and include specific details that reflect your brand and services. By modifying the design and structure, you can create a more personalized and professional experience for your clients.

Steps to Personalize Your Document

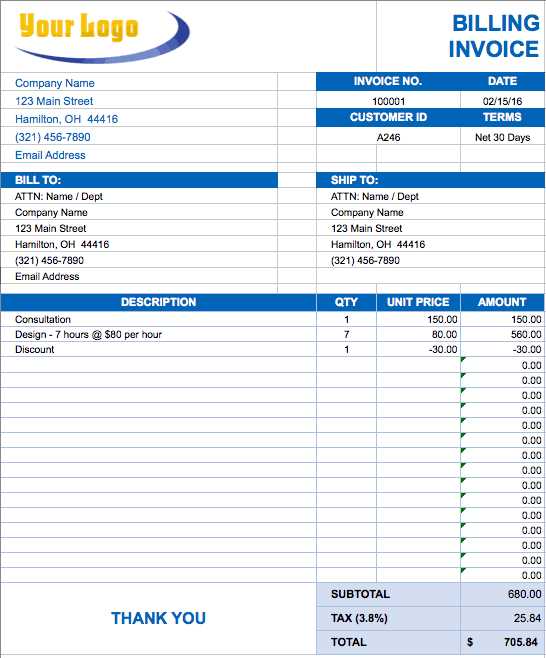

- Edit Company Information: Replace the placeholder details with your business name, logo, and contact information.

- Adjust Client Fields: Make sure to enter accurate client information such as their name, address, and any specific billing instructions.

- Modify Product or Service Descriptions: Customize the description of what you’re providing, including quantities, prices, and special terms.

- Include Payment Instructions: Clearly specify how clients can pay, including bank account details or online payment options.

Designing for Clarity and Impact

- Change Fonts and Colors: Adjust the font styles and colors to match your company’s branding, while keeping it easy to read.

- Rearrange Sections: Rearrange the layout to prioritize the most important information, such as payment terms or due dates.

- Highlight Important Details: Use bold or italicized text to emphasize key information like discounts, deadlines, or special conditions.

By making these adjustments, you can create a document that not only meets the needs of your business but also leaves a lasting impression on your clients. Customizing your records ensures that they are both functional and reflective of your brand’s identity.

Key Features of Open Office Invoices

When creating financial documents using software, it’s essential to have access to key features that allow for customization, accuracy, and ease of use. With the right set of tools, generating clear, professional records becomes a streamlined process. These tools provide a range of functionalities that help users tailor documents according to their needs, improving both efficiency and presentation.

Essential Functions for Creating Effective Documents

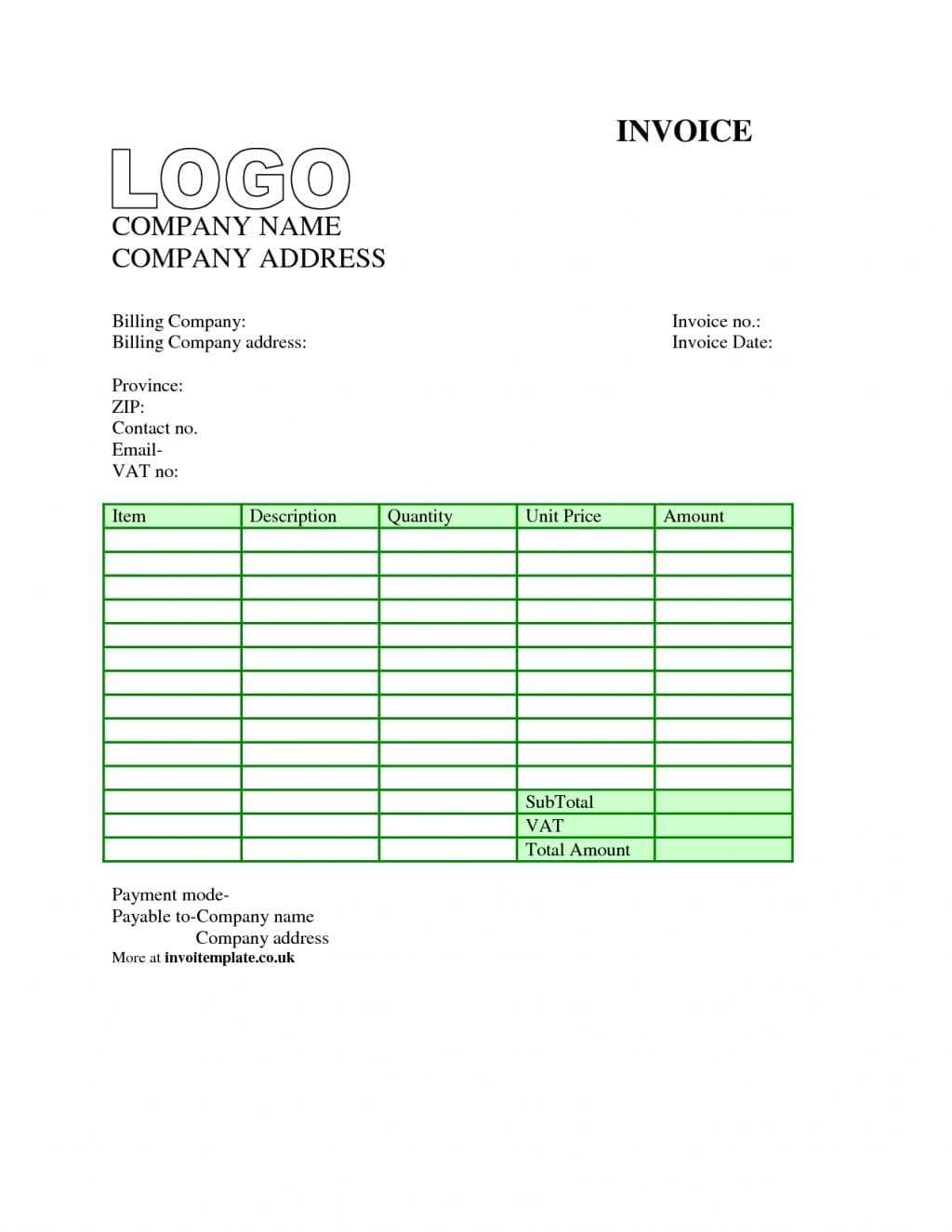

- Predefined Layouts: Ready-to-use designs that allow users to quickly input relevant information without starting from scratch.

- Editable Fields: Ability to easily modify text and sections, including product details, pricing, and client information.

- Flexible Formatting Options: Customize fonts, text sizes, and colors to align with your business’s branding and make key details stand out.

- Automatic Calculations: Built-in formulas that automatically compute totals, taxes, and discounts to reduce the risk of errors.

Additional Benefits for Streamlining Workflows

- Multi-Page Capability: Handle large documents with ease, splitting them into multiple pages while keeping everything properly formatted.

- Customizable Headers and Footers: Add your logo, contact details, or other business-specific information to make each document unique.

- Integration with Other Files: Easily link data from other documents or spreadsheets to automatically update numbers or client details.

These features make it easier for businesses of all sizes to manage and issue financial records efficiently, while also ensuring that each document looks professional and is fully customized to meet specific needs.

Benefits of Using Open Office for Billing

Using a versatile software suite to manage financial records offers significant advantages, especially for businesses looking to streamline their processes. By providing powerful tools and flexible features, the right program can simplify the task of generating, customizing, and tracking billing documents, making the entire process more efficient and accurate. Leveraging such tools enhances productivity while ensuring professionalism in client communications.

Key Advantages for Businesses

- Cost-Effective Solution: Unlike other paid software, this program is free to use, making it an ideal choice for small businesses or freelancers.

- Easy to Learn and Use: The intuitive interface ensures that even those with limited technical skills can quickly create and manage documents.

- Cross-Platform Compatibility: It works across multiple operating systems, ensuring flexibility for businesses regardless of their setup.

- Customizable Features: The software allows easy adjustments to document layouts and designs, letting you tailor each record to fit your specific needs.

Improved Accuracy and Time Savings

- Automated Calculations: Built-in features handle calculations for totals, taxes, and discounts, reducing human error.

- Predefined Formats: Ready-made structures speed up document creation, allowing you to focus on content rather than design.

- Storage and Retrieval: Save your work in an easily accessible format, making it quick to retrieve previous documents and track payments.

By integrating this software into your workflow, you can not only save time but also enhance the accuracy and professionalism of your financial documents. This flexibility and efficiency are key to improving your overall billing and accounting processes.

Step-by-Step Guide to Editing Templates

Editing pre-designed documents is a straightforward process that allows you to personalize content according to your business needs. Whether you’re updating client information, modifying item descriptions, or adjusting the layout, customization can be done quickly and efficiently. With the right tools, you can create professional-looking records tailored to each transaction.

Getting Started with Document Customization

- Open the File: Launch the software and open the pre-designed document you want to modify.

- Edit Text Fields: Click on the text boxes to enter or update details such as client name, product descriptions, pricing, and payment terms.

- Adjust Layout: You can move sections around, resize elements, or add new ones to suit your needs.

- Insert Logo or Branding: Add your company’s logo or change the header to reflect your brand’s identity.

Refining Your Document

- Format Text: Adjust fonts, sizes, and colors to ensure readability and alignment with your brand style.

- Update Calculation Fields: If the document includes totals or taxes, ensure that the necessary fields are updated and correctly linked.

- Save Changes: Once all edits are made, save the document in your preferred format, and it’s ready to use for the next transaction.

Following these simple steps ensures that each document reflects your business’s unique style and needs. Customization not only helps in maintaining consistency but also improves the overall professional presentation of your records.

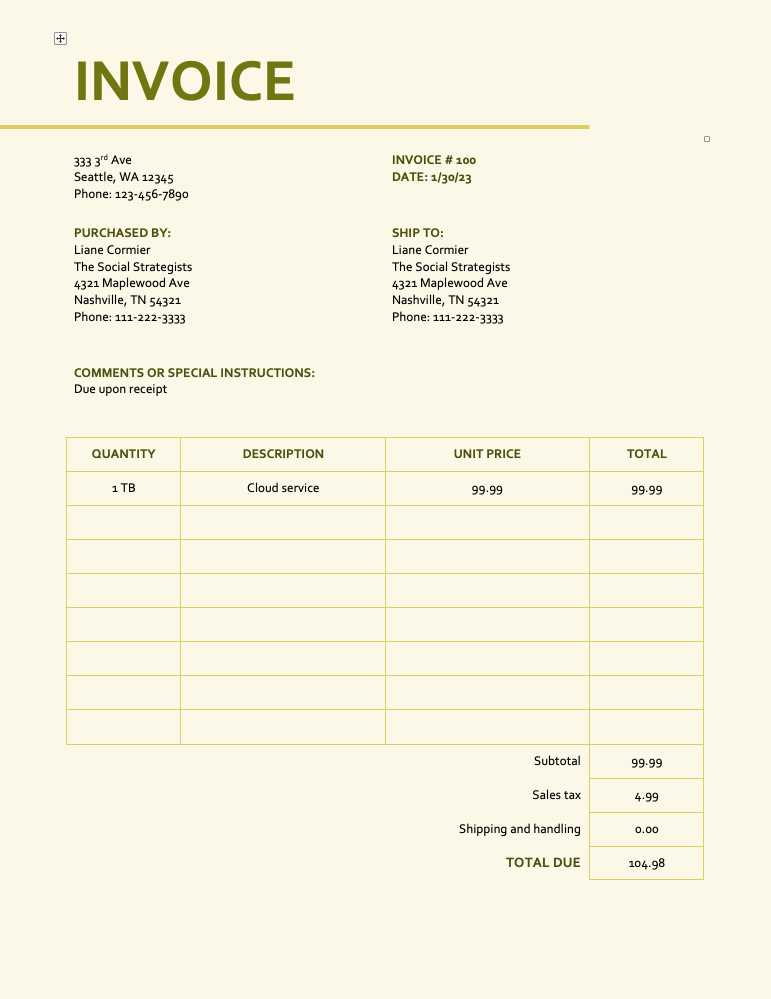

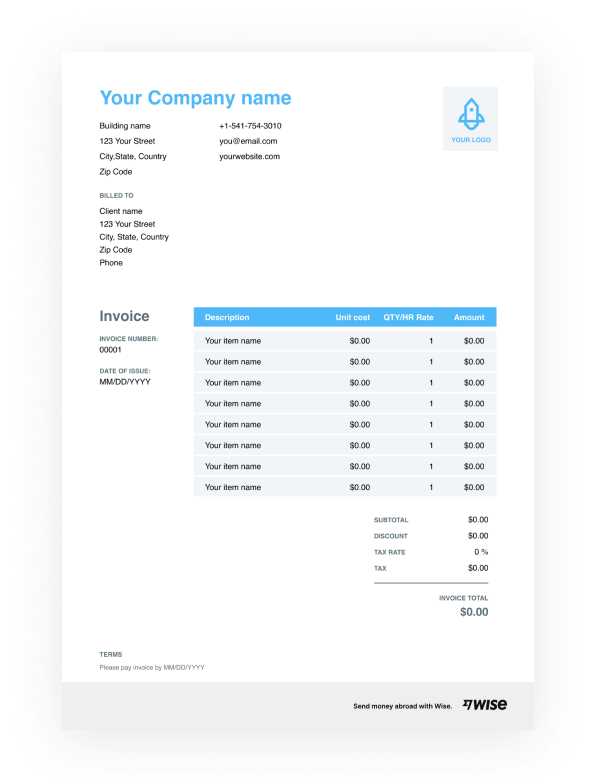

Choosing the Right Template Style

Selecting the appropriate style for your billing or transaction documents is crucial for both functionality and presentation. The design should not only reflect your brand’s identity but also ensure that the information is easy to read and understand. By choosing the right layout, you can make the document more professional and user-friendly, which enhances your client’s experience.

Factors to Consider When Choosing a Design

- Business Type: The style of the document should align with the nature of your business. For example, a creative agency might choose a more modern, colorful design, while a law firm may prefer a clean, formal style.

- Client Expectations: Think about your client’s preferences and the industry standards. A more formal tone might be necessary for corporate clients, while smaller businesses or freelancers may benefit from a more personalized style.

- Document Clarity: Choose a design that clearly organizes information, such as payment terms, amounts, and due dates. The easier it is for your clients to navigate the document, the better.

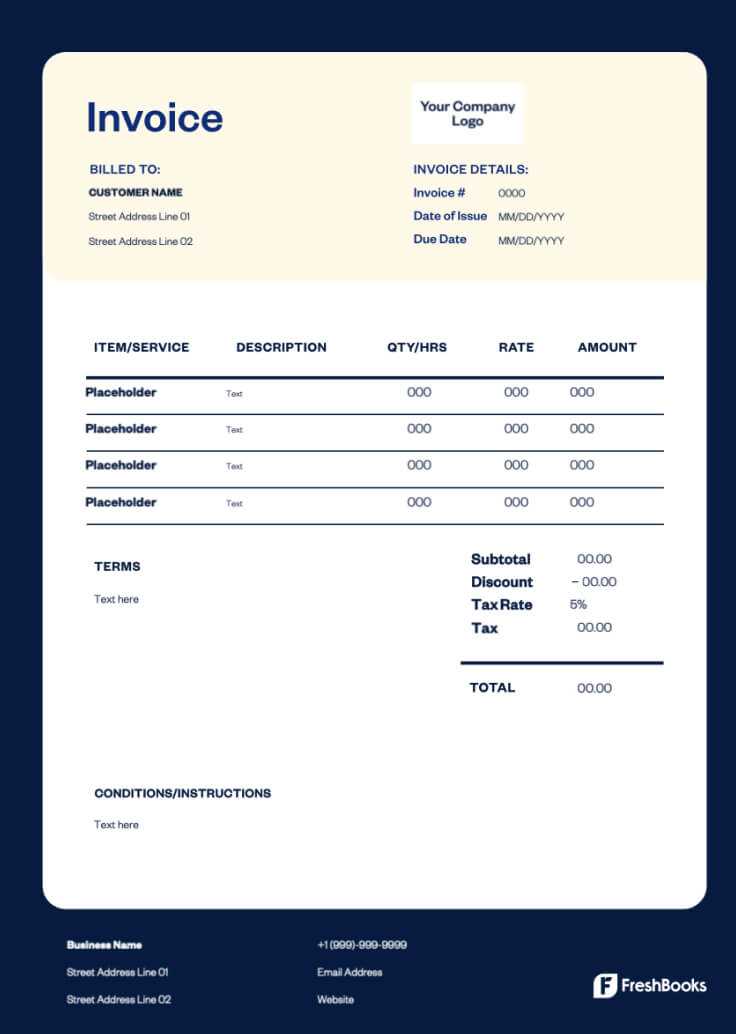

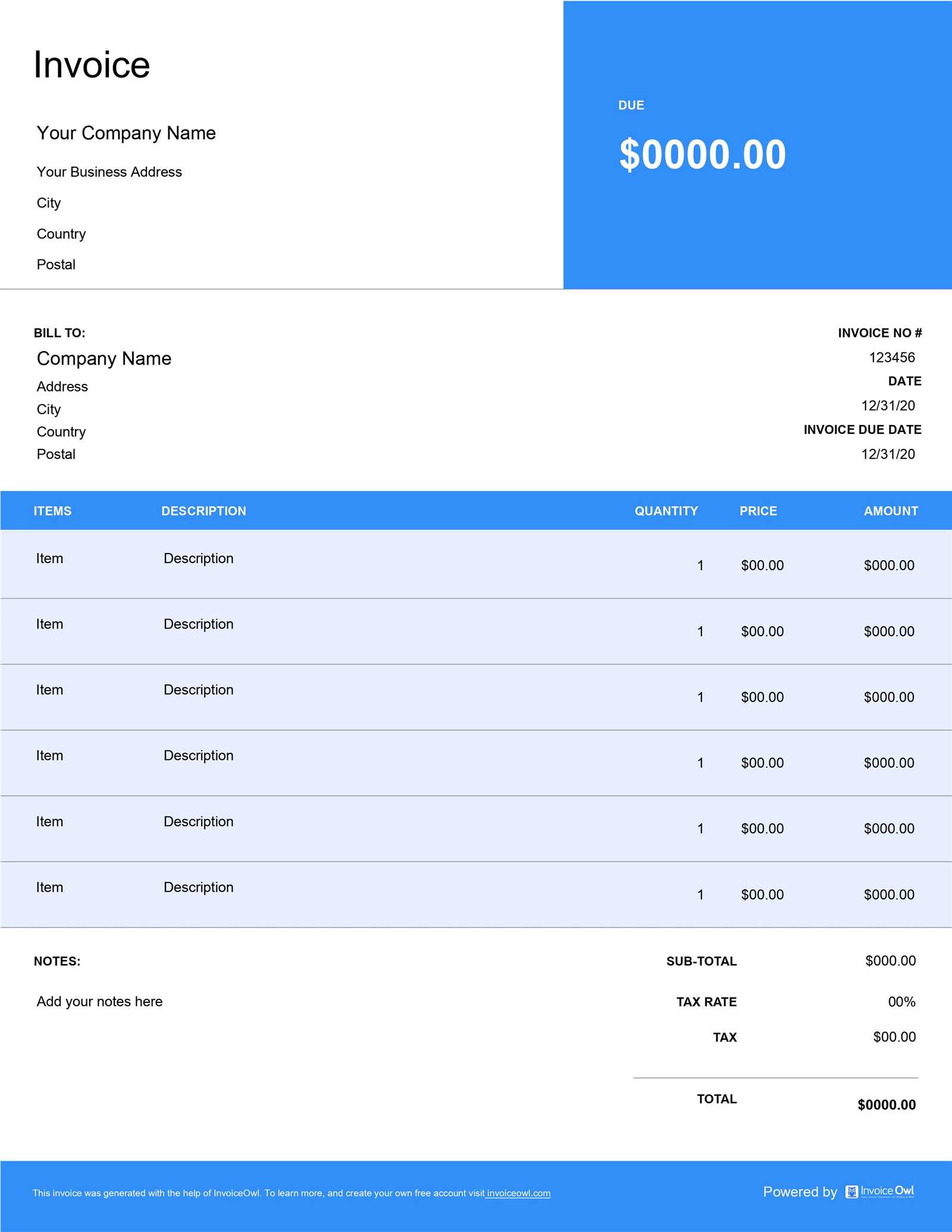

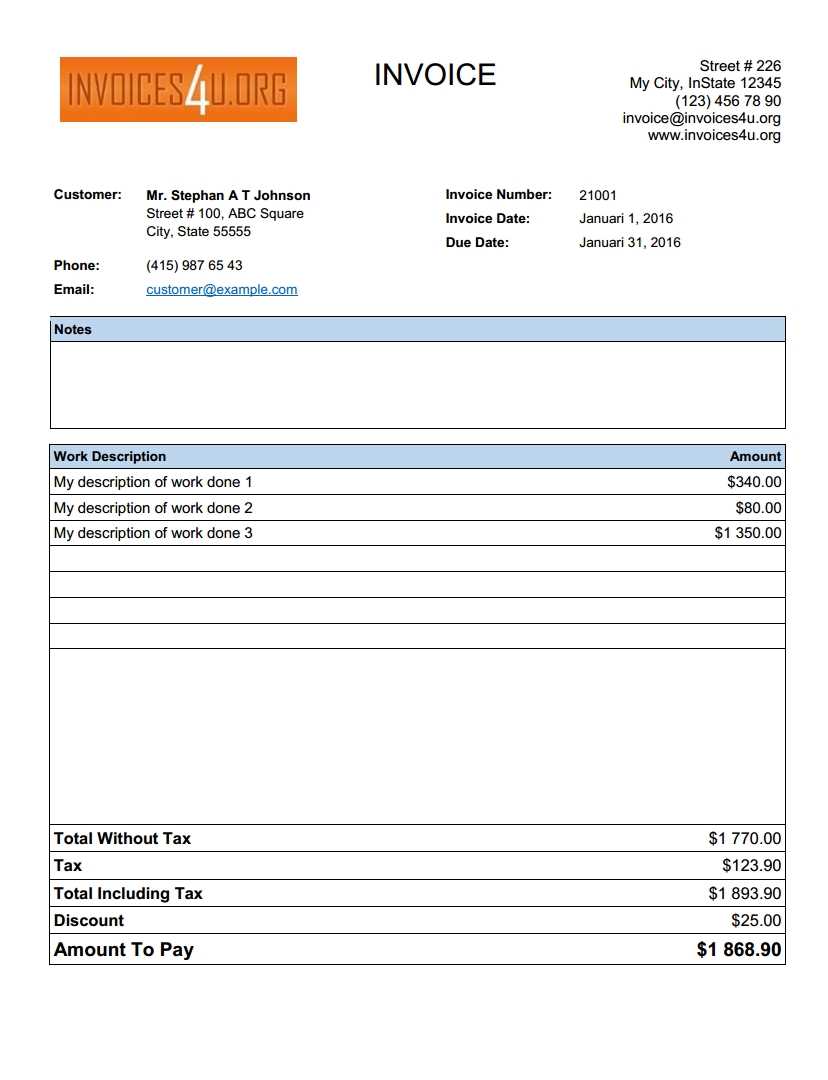

Popular Design Options

- Minimalistic Design: A clean, simple layout that focuses on essential information. Ideal for businesses looking for a professional, straightforward presentation.

- Modern and Creative: Incorporates bold colors, custom logos, and dynamic elements. Suitable for industries like design, marketing, and entertainment.

- Formal and Classic: A more traditional design with clear sections and a conservative color scheme. Perfect for industries such as legal, financial, or consulting services.

By considering the factors mentioned above, you can select a style that not only reflects your business identity but also makes your documents clear and professional, improving your overall client communication.

Common Billing Mistakes to Avoid

Creating clear and accurate financial documents is essential for maintaining a professional relationship with clients. However, there are several common errors that can occur during the process, leading to confusion, delays in payments, or even damaged trust. Being aware of these mistakes can help you avoid them and ensure that each document you send is both accurate and effective.

Frequent Mistakes and How to Fix Them

- Incorrect Client Details: Always double-check the client’s name, address, and contact information before finalizing the document. Mistakes here can delay payment or cause misunderstandings.

- Missing or Incorrect Dates: Ensure that the issue date and payment due date are clearly stated. Forgetting to include these or using incorrect dates can lead to confusion about deadlines.

- Unclear Payment Terms: Clearly define how and when payments should be made. Ambiguity in payment methods or deadlines can cause delays and frustration.

- Omitted or Incorrect Amounts: Double-check the listed prices, quantities, and totals. An incorrect amount can lead to disputes or delayed payments.

How to Ensure Accuracy

- Review All Details: Always proofread the document carefully to ensure that no information is missing or incorrect.

- Use Automatic Calculations: Many programs offer built-in formulas that can automatically calculate totals, taxes, and discounts. This reduces the risk of errors.

- Maintain Consistent Formatting: Clear and consistent formatting helps prevent misinterpretation. Make sure that all numbers, dates, and terms are easy to read.

By taking the time to review your documents for these common errors, you can ensure that every transaction is handled smoothly and professionally. Avoiding these mistakes helps maintain client trust and keeps your billing process running efficiently.

How to Save Your Invoice in Open Office

Once you’ve customized your billing document, it’s important to save it correctly to ensure easy access for future use and sharing with clients. Saving your file in the right format not only preserves your work but also makes it easy to retrieve, edit, or send whenever needed. Different saving options offer flexibility, whether you want to keep the document editable or ready for distribution.

Steps to Save Your Document

- Click on ‘File’: In the top menu bar, locate and click the ‘File’ option.

- Select ‘Save As’: This will allow you to choose the location and format for your document.

- Name the File: Choose a clear and recognizable name for your document, such as the client’s name or project number, for easy reference.

- Choose a Format: Select your preferred file format, such as .odt for editable versions or .pdf for a non-editable, easily shareable version.

Saving for Different Purposes

- Edit Later: Save the document in the default format (e.g., .odt) so you can make future edits or reuse the layout for other transactions.

- For Sharing: If you plan to send the document to a client, save it as a PDF to prevent unauthorized changes and ensure consistent formatting across devices.

- Backup Your Work: Keep a copy of the document in a secure location, such as cloud storage or an external hard drive, to ensure it’s easily recoverable.

By following these simple steps, you can efficiently save your document in a way that suits your needs, whether for future edits or secure sharing with clients. Proper file management ensures that your documents are always organized and easily accessible.

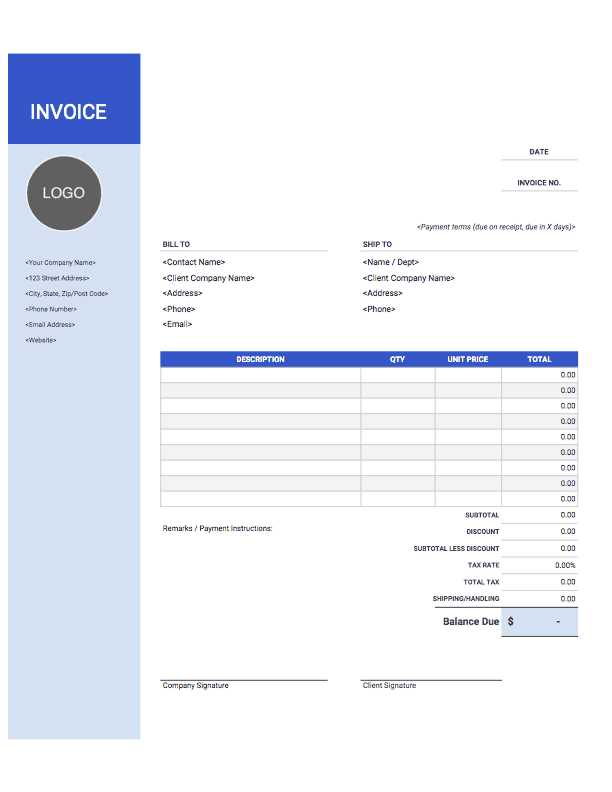

How to Add Company Branding to Your Invoice

Adding your company’s branding to financial documents helps create a professional and cohesive look that reflects your business identity. This not only strengthens your brand’s presence but also enhances the credibility of your communications. By incorporating your logo, color scheme, and other design elements, you make your documents instantly recognizable and aligned with your company’s image.

Steps to Integrate Branding Elements

- Insert Your Logo: Place your company’s logo at the top of the document, usually in the header section. This makes it visible and establishes your brand from the first glance.

- Use Brand Colors: Adjust the text colors, background, or borders to match your company’s color palette. Consistency in colors helps reinforce brand recognition.

- Choose Brand Fonts: Select fonts that reflect your company’s style, whether it’s modern, professional, or creative. Stick to one or two complementary fonts to maintain clarity and avoid visual clutter.

Additional Design Tips

- Custom Header/Footer: Add your company name, contact information, and website in the header or footer to make it easy for clients to reach you.

- Incorporate Taglines or Slogans: If applicable, consider adding a tagline or slogan that reflects your business values or services.

- Ensure Consistent Layout: Keep the layout simple and professional, ensuring all branding elements are balanced and not overwhelming the core content of the document.

By adding these elements to your documents, you not only make them look more professional but also reinforce your business identity, making every transaction feel more personalized and trustworthy to your clients.

Integrating Payment Terms in Your Template

Clear and concise payment terms are a vital part of any financial document. Including them ensures both you and your client are on the same page regarding expectations for when and how payments should be made. By clearly outlining payment due dates, accepted methods, and any penalties for late payments, you can prevent confusion and ensure a smooth transaction process.

Steps to Include Payment Terms

- Specify the Due Date: Clearly state the payment deadline, whether it’s a specific date or a number of days after the document is issued (e.g., “Due within 30 days”).

- Include Payment Methods: List all the payment options available, such as bank transfer, credit card, or online payment systems. Be clear about how clients can pay and provide the necessary details for each method.

- State Late Payment Fees: If applicable, mention any fees or interest charged on overdue payments. This encourages timely payment and protects your cash flow.

- Offer Early Payment Discounts: If you offer discounts for early payment, clearly indicate the percentage and conditions (e.g., “2% discount if paid within 10 days”).

Best Practices for Payment Terms

- Be Clear and Concise: Avoid complicated wording or legal jargon. Use simple language to ensure your client understands the terms easily.

- Highlight Important Information: Make key terms like the due date and late fees stand out by using bold text or a separate section of the document.

- Consistency Across Documents: Ensure that payment terms are consistent across all your documents to avoid confusion and ensure a professional appearance.

Including these payment terms in your financial documents not only sets clear expectations but also helps protect your business from delayed or missed payments. A well-structured and transparent payment section ensures that both parties understand the agreement and can proceed smoothly.

Using Multiple Invoice Templates Effectively

Managing various types of documents for different purposes or clients can become a challenge, but using multiple designs can help streamline the process and improve efficiency. Whether you’re handling various payment structures, services, or industries, having a variety of document formats ready to use ensures that each situation is addressed with the right structure and style. This flexibility allows you to cater to specific needs without reinventing the wheel each time.

How to Organize and Use Multiple Formats

- Identify Your Needs: Start by categorizing the different types of documents you need. For instance, you might require different formats for services, products, or project-based work. Tailoring each document for the right situation ensures relevance and clarity.

- Create Consistent Designs: Even though you’re using multiple designs, ensure there is consistency in the layout, branding, and terminology. This helps maintain a professional and unified look across all your materials.

- Maintain Flexibility: Use adaptable elements in your designs that allow for easy updates and modifications. This way, you can quickly tweak sections like pricing or terms without having to start from scratch each time.

When to Use Different Layouts

- Project-Based Work: For contracts or long-term projects, you may want a more detailed document that outlines milestones, deliverables, and payment schedules.

- Recurring Services: For ongoing work or subscriptions, a simplified document that focuses on the recurring nature of the payments might be more suitable.

- Product-Based Sales: When selling physical products, a straightforward document with a clear list of items and prices works best.

Using multiple designs allows you to adapt your documents to the specific needs of each client or situation, improving clarity and professionalism. With the right strategy in place, you can keep everything organized and ensure that each document serves its intended purpose effectively.

Printing and Sharing Your Sales Invoice

Once you’ve created and customized your financial document, the next step is to print or share it with your clients. This process involves ensuring that the file is in the right format for either printing a hard copy or sending electronically. Whether you’re opting for physical delivery or sharing digitally, it’s essential to maintain the integrity of your design and ensure that all the information is clear and accessible.

How to Print Your Document

- Check Layout and Margins: Before printing, review the document’s layout to ensure that all information is within the printable area. Adjust the margins or text size if necessary.

- Choose the Right Printer Settings: Select the appropriate printer and paper size, ensuring the printout matches the document’s original layout.

- Preview Before Printing: Always preview your document to make sure it appears correctly. This helps avoid wasting paper or ink due to formatting issues.

- Print a Test Copy: Print a sample page to confirm the quality of the print, especially if you’re using color elements or complex layouts.

Sharing Your Document Digitally

- Save as PDF: Save the file as a PDF for easy sharing. This format preserves the layout and ensures the recipient sees the document exactly as you intended.

- Send via Email: Attach the PDF to an email and include a brief message explaining the document. Make sure to verify the recipient’s email address before sending.

- Use Cloud Storage: For larger documents or when sharing with multiple recipients, use cloud storage platforms such as Google Drive or Dropbox. Share the link for easy access and secure delivery.

Considerations for Efficient Sharing

| Method | Advantages | Considerations | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Printing | Ideal for physical deliveries, professional appearance | Requi

Security Tips for Sending InvoicesWhen sending financial documents to clients, security is a top priority. Ensuring that sensitive information such as payment details, client addresses, and pricing remains confidential is crucial. There are several precautions you can take to protect both your business and your clients from potential fraud or data breaches during the process of sharing documents. Protecting Sensitive Information

Best Practices for Safe Sending

By following these security practices, you minimize the risk of exposing confidential information. Protecting both your business and your clients helps build trust and ensures smooth, secure transactions every time. Creating Recurring Invoices in Open OfficeFor businesses that offer ongoing services or subscription-based products, generating recurring billing documents is essential. Automating the process of creating these documents can save time and ensure consistency, allowing you to focus on other aspects of your business. By setting up a structured system, you can easily replicate and modify documents for each billing cycle without having to start from scratch. Steps to Set Up Recurring Documents

Managing Recurring Documents Efficiently

With these steps, you can create recurring billing documents that are not only efficient but also easy to manage. By setting up a solid structure and automating where possible, you ensure that every cycle runs smoothly, keeping your business operations organized and professional. Optimizing Sales Invoices for Client ClarityClear and concise billing documents are essential for maintaining positive relationships with your clients. When clients can easily understand the details of the charges and payment terms, they are more likely to make timely payments and have fewer disputes. By focusing on clarity in the design and content of your documents, you ensure transparency, which is key to building trust and professionalism in any business transaction. Key Elements for Clear Documentation

Tips for Layout and Design

By focusing on these strategies, you can create financial documents that are not only professional but also easy for clients to understand. The result is improved communication, smoother transactions, and stronger business relationships. |