Sales Invoice Template DOC for Simple and Professional Billing

Creating accurate and clear billing documents is essential for any business transaction. A well-designed billing document not only ensures smooth financial processes but also helps maintain professionalism and trust with clients. This guide will explore how to effectively design and utilize a document for recording sales and payments.

Whether you’re a freelancer, small business owner, or part of a larger enterprise, having a standardized approach to billing can save valuable time and reduce errors. By using a pre-formatted document that includes all the necessary fields and details, you can streamline your financial workflow and focus more on growing your business.

Understanding the key components of a billing document is crucial for ensuring that all important information is included and presented clearly. From the amount due to contact details and payment terms, each section plays an important role in making the document complete and legally sound.

Maximizing efficiency is another advantage of using a structured document, especially when you need to issue invoices quickly or regularly. By customizing the layout to fit your specific needs, you can create documents that reflect your brand while also meeting the requirements for legal and financial accuracy.

Sales Invoice Template DOC Guide

Creating a clear and professional document to record transactions is essential for any business. A well-structured document ensures that both the seller and the buyer have all the necessary information for a smooth financial exchange. This guide will help you understand how to design an effective form that meets your business needs and keeps transactions organized.

Key Elements to Include in Your Document

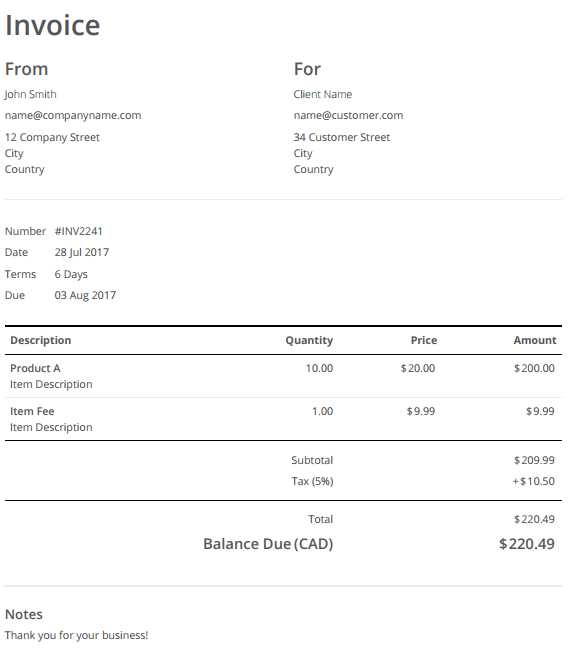

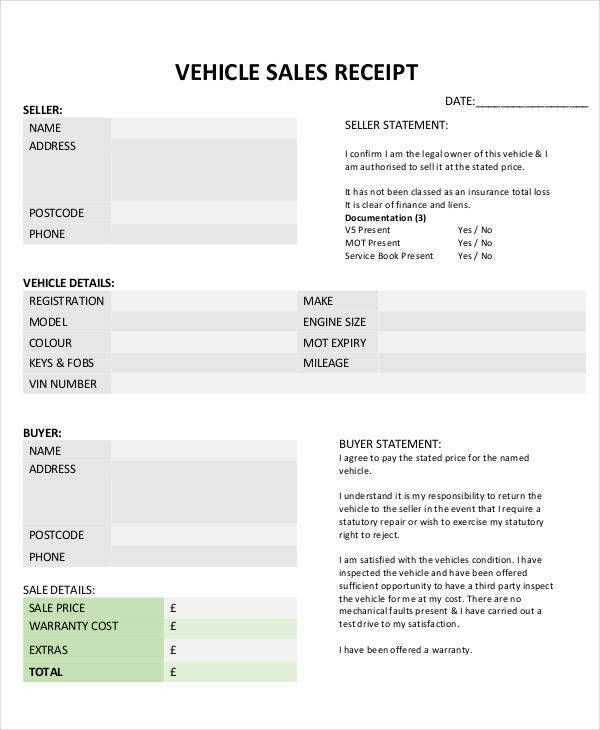

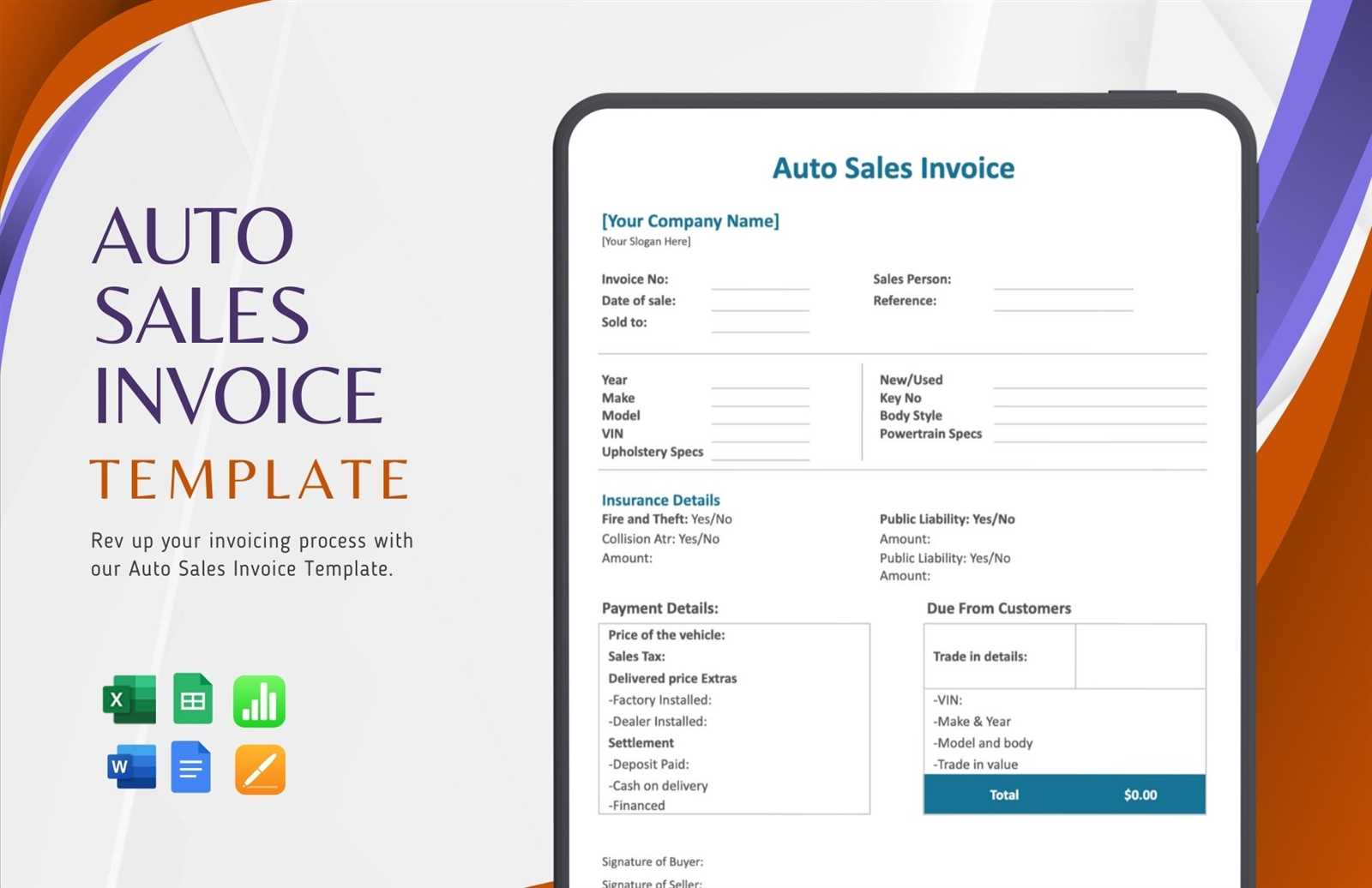

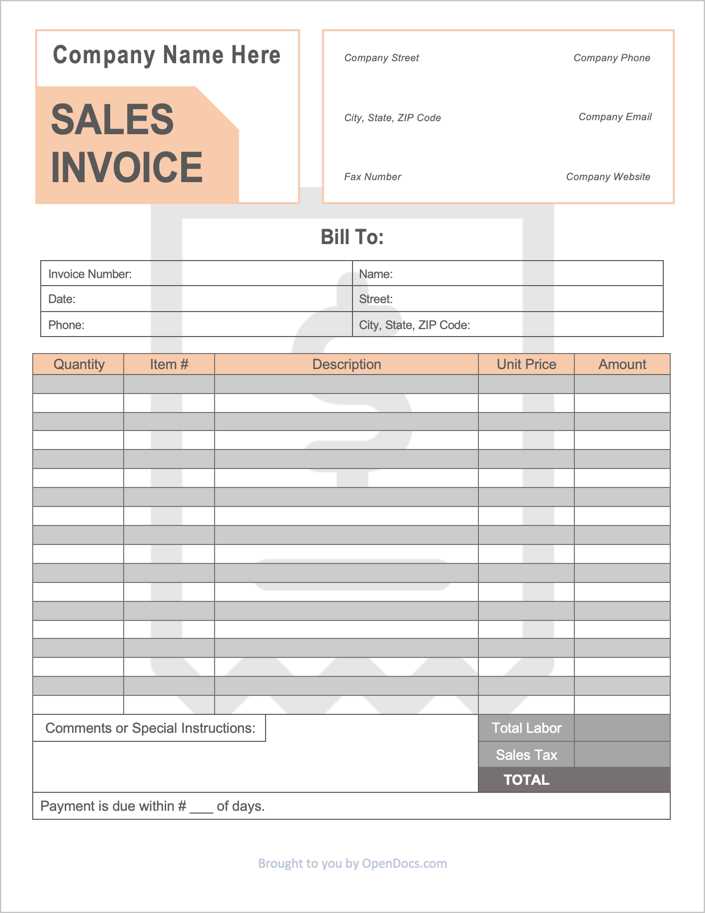

Each document should contain essential fields that make the transaction transparent and legally sound. Key sections typically include the name and contact details of both parties, the description of goods or services provided, the amount owed, and the terms of payment. By including these crucial elements, you ensure that your document is not only functional but also compliant with any necessary regulations.

Customizing Your Document for Efficiency

One of the advantages of using a pre-formatted document is the ability to customize it to suit your specific business requirements. You can adjust the layout, add or remove sections, and even include branding elements to reflect your company’s identity. This flexibility allows you to maintain a professional appearance while streamlining your billing process.

Maximizing Efficiency with a customizable document is particularly useful for businesses that require regular billing. The ability to quickly generate a document with consistent formatting and accurate details helps minimize errors and saves valuable time.

Legal Considerations should not be overlooked when creating these documents. Ensure that all necessary tax information is included and that your terms of payment are clear and concise to avoid misunderstandings with clients.

Why Use a Sales Invoice Template

Using a standardized form for documenting transactions offers numerous advantages for both businesses and clients. It ensures consistency, minimizes errors, and saves time in creating and managing payment records. With a pre-designed structure, businesses can focus on what matters most–delivering products or services–while maintaining professional and accurate documentation.

Here are several reasons why adopting a standardized form can be beneficial:

- Consistency: Using the same structure for each transaction helps maintain uniformity across all records, making them easier to track and manage.

- Time-saving: A ready-made structure eliminates the need to create new forms from scratch, speeding up the billing process.

- Accuracy: By including all the required fields and information, a predefined form reduces the risk of missing important details, such as payment terms or contact info.

- Professional Appearance: A well-structured document reflects positively on your business and helps build trust with clients.

- Legal Compliance: Many forms include standard fields that ensure legal requirements, such as tax details, are properly accounted for.

For businesses of any size, using such a form simplifies the process of creating, sending, and storing transaction records. This consistency helps ensure that your payment documentation is not only efficient but also legally sound and easy to reference when needed.

Benefits of DOC Format for Invoices

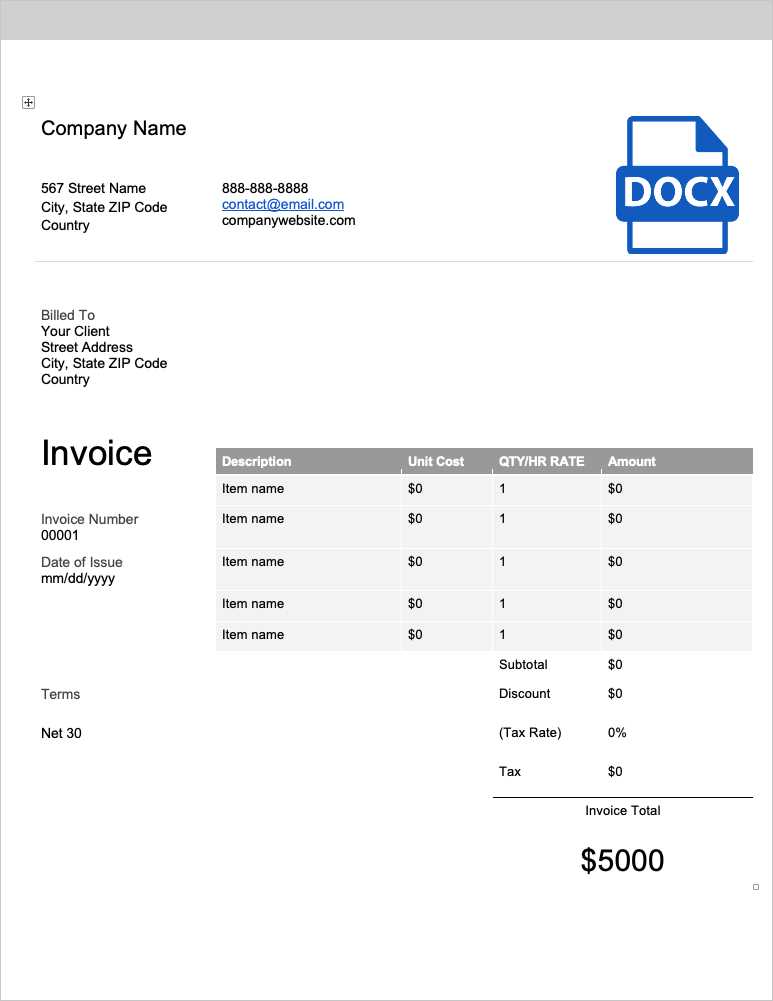

Choosing the right format for documenting financial transactions is crucial for ensuring flexibility, ease of use, and compatibility with different systems. One popular choice for creating professional and easily editable payment records is the DOC format. This format offers several advantages that can improve the efficiency of billing processes and enhance collaboration with clients and team members.

Easy Editing and Customization

The DOC format is widely recognized for its ability to be easily modified. Unlike other formats that may require specific software or technical expertise, DOC files can be quickly edited with common word processing software. This flexibility allows businesses to adjust the layout, change payment details, or add additional information as needed without hassle.

Wide Compatibility and Accessibility

Another significant benefit of using DOC format is its compatibility with a variety of devices and operating systems. Whether you are working on a PC, Mac, or mobile device, DOC files can be opened and edited using widely available applications, such as Microsoft Word or Google Docs. This accessibility ensures that businesses can manage their financial documentation from anywhere without worrying about technical barriers.

Professional Presentation is another reason why many businesses prefer this format. With the ability to include logos, tables, and formatted text, a DOC file allows for a polished, professional appearance that enhances client relationships and maintains the company’s image.

Storage and Sharing of documents in DOC format is also streamlined. Files are easy to save, organize, and send via email or cloud storage, which simplifies record-keeping and sharing across teams or with clients.

How to Customize a Sales Invoice

Customizing a document for recording transactions allows businesses to tailor it to their specific needs while maintaining professionalism and clarity. By adjusting various elements such as layout, content, and design, companies can create a document that reflects their branding and business practices while ensuring all necessary details are included. Below are steps to customize your document effectively.

Step-by-Step Customization Process

Customizing your document is a straightforward process, and it can be done by following these key steps:

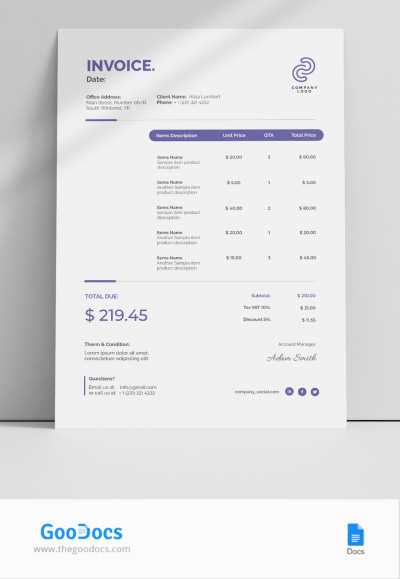

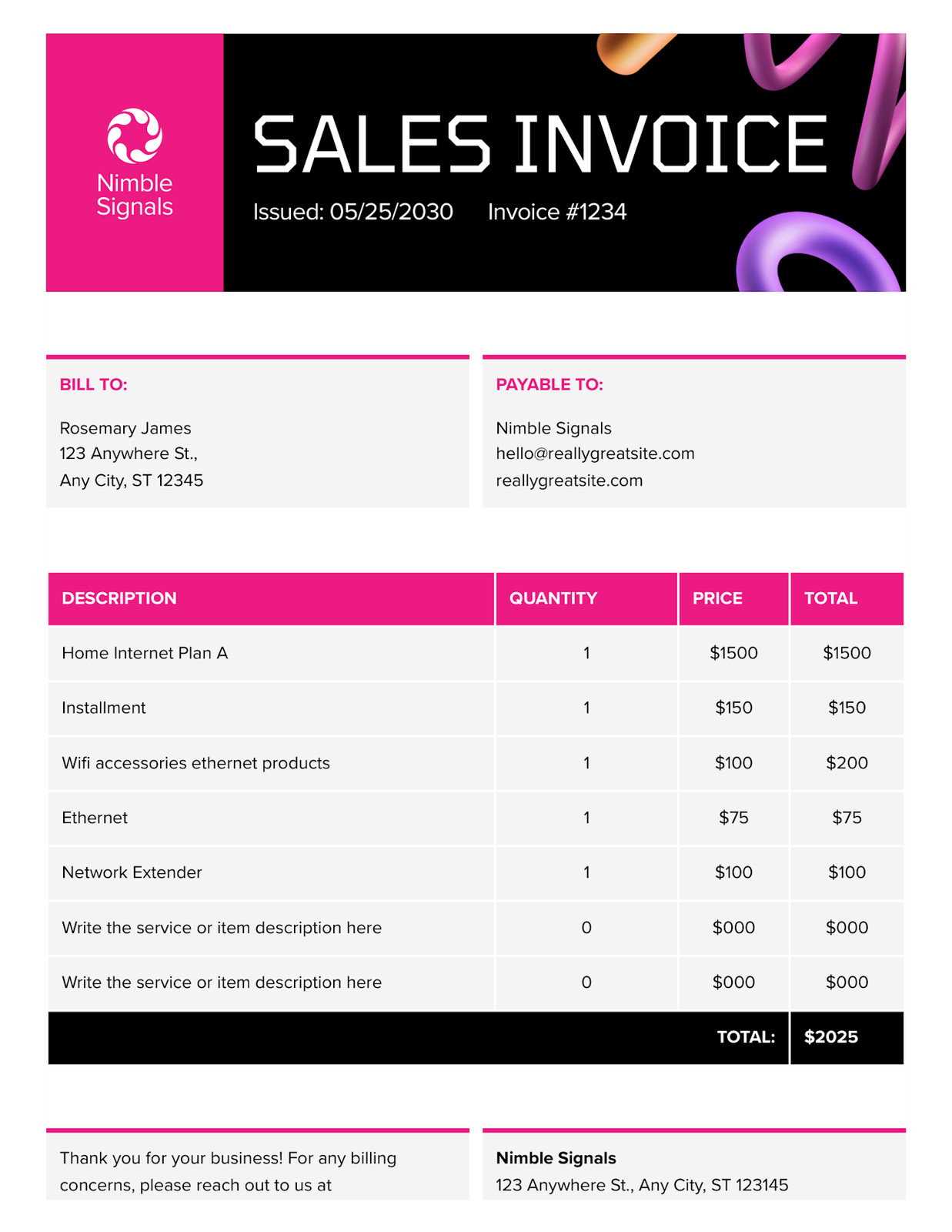

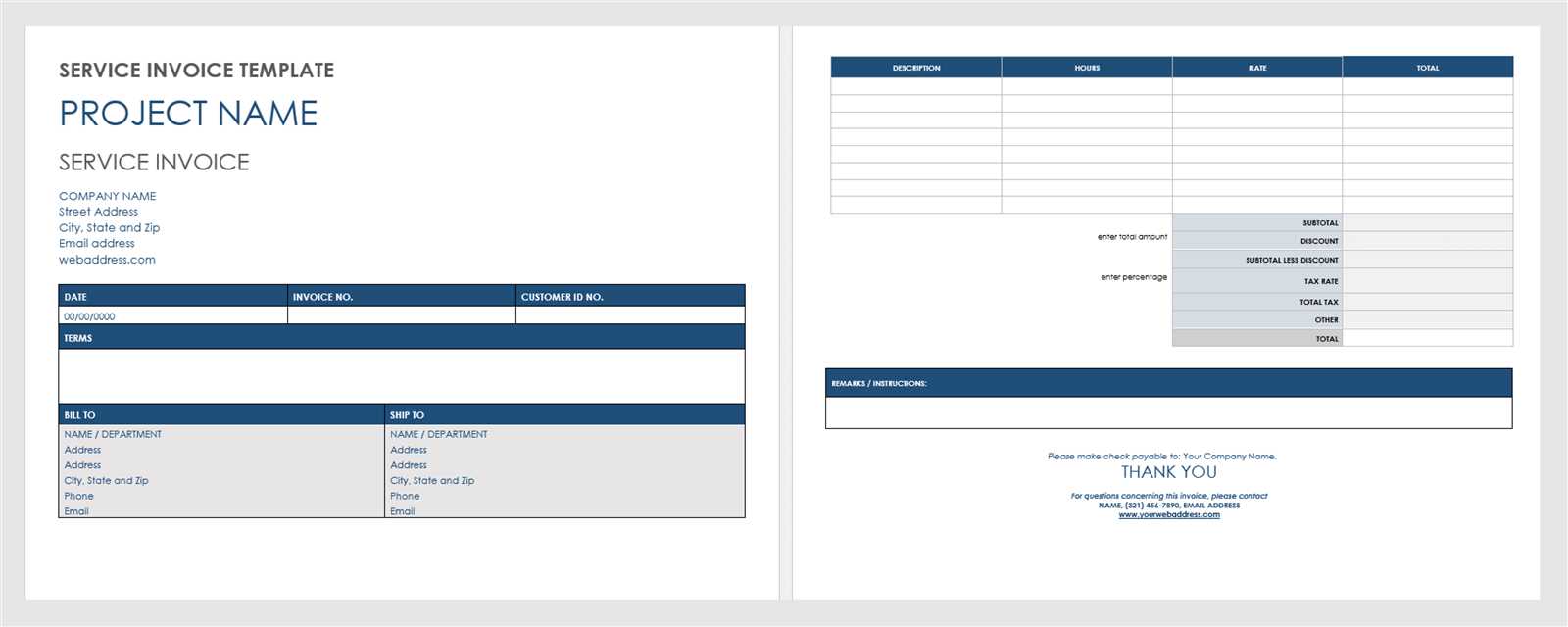

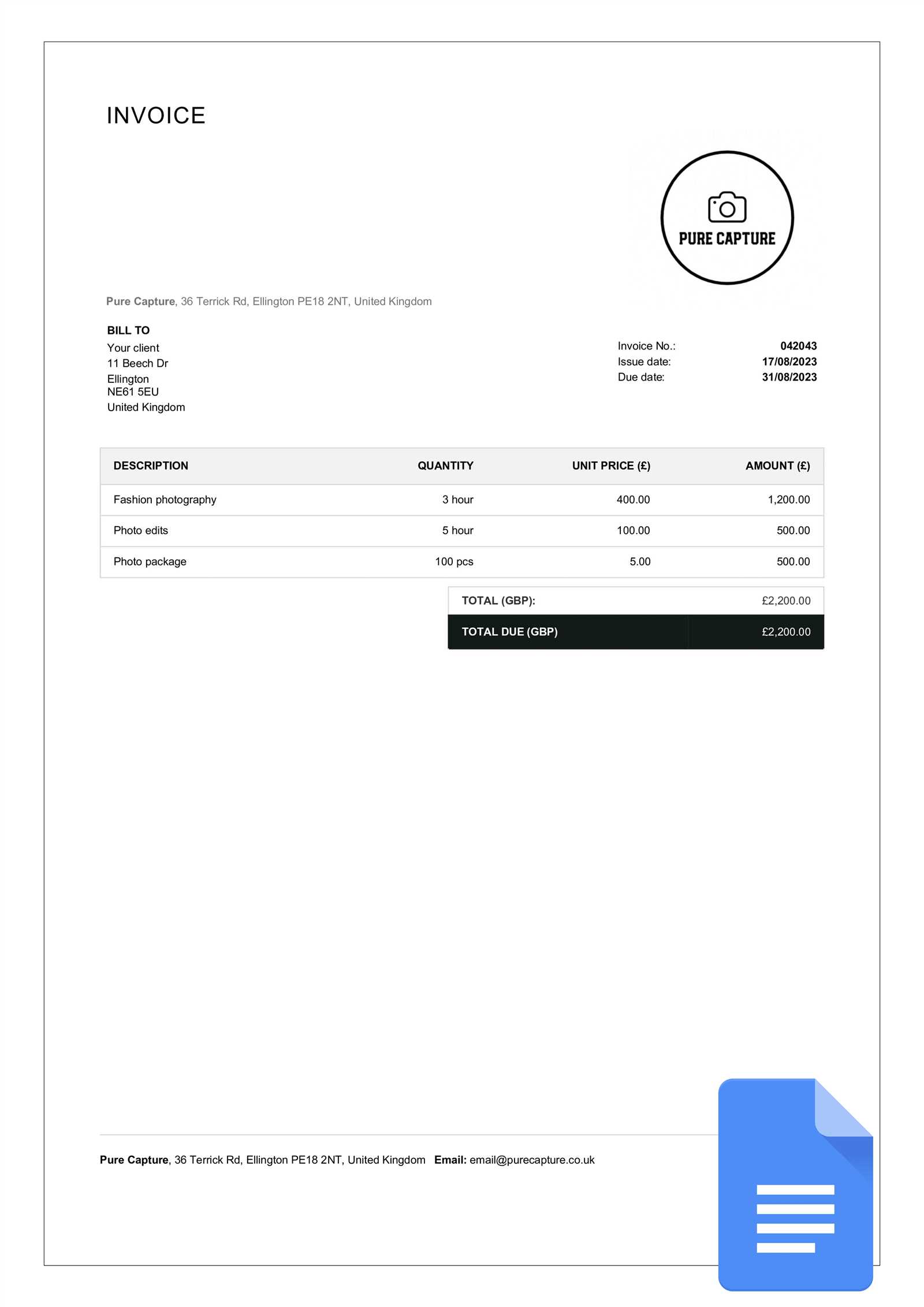

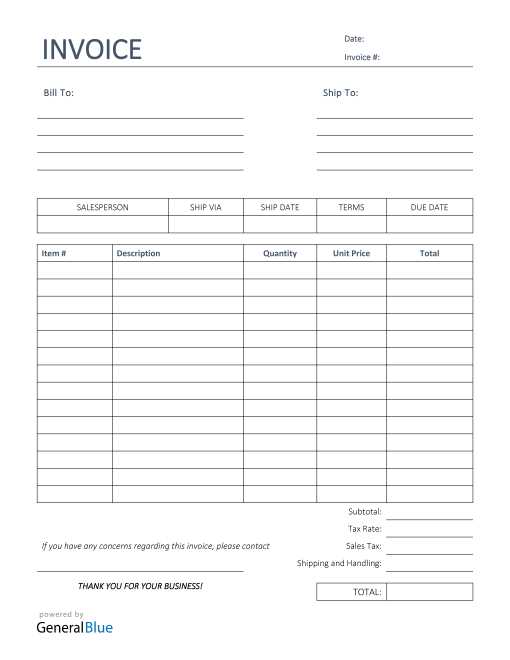

- Adjust the Header: Include your business logo, name, and contact information at the top of the document to personalize it and ensure it’s immediately recognizable.

- Modify Fields for Specific Needs: Depending on the nature of your business, you may need to add or remove fields. Common fields include the description of goods or services, quantity, unit price, and payment terms.

- Include Payment Terms: Clearly define payment methods, deadlines, and any late fees or discounts for early payment.

- Personalize the Footer: Add your company’s legal disclaimers, return policies, or thank-you notes to reinforce a professional image.

- Customize the Layout: Adjust margins, font sizes, and table formats to ensure readability and a clean appearance.

Design Tips for Better Presentation

In addition to functional adjustments, design plays a critical role in making your document stand out. Here are some design tips:

- Use Consistent Branding: Match the fonts, colors, and logo style to your company’s branding for a cohesive look.

- Organize Information Clearly: Use tables and bullet points to organize details like pricing, quantities, and payment terms, ensuring they are easy to understand.

- Avoid Clutter: Keep the document clean and simple, focusing on essential details without overwhelming the reader with excessive information.

Customizing your document in this way helps ensure that it’s not only functional but also aligns with your company’s identity and communicates professionalism to your clients.

Essential Fields in an Invoice Template

When creating a document to record a transaction, it’s important to include all necessary details to ensure clarity and avoid misunderstandings. Each section should contain specific information that makes the payment process transparent and legally sound. Below are the key components that should always be present in any transaction document.

Key Information to Include

Each document should feature several essential fields to ensure the transaction is properly documented and easy to understand. These include:

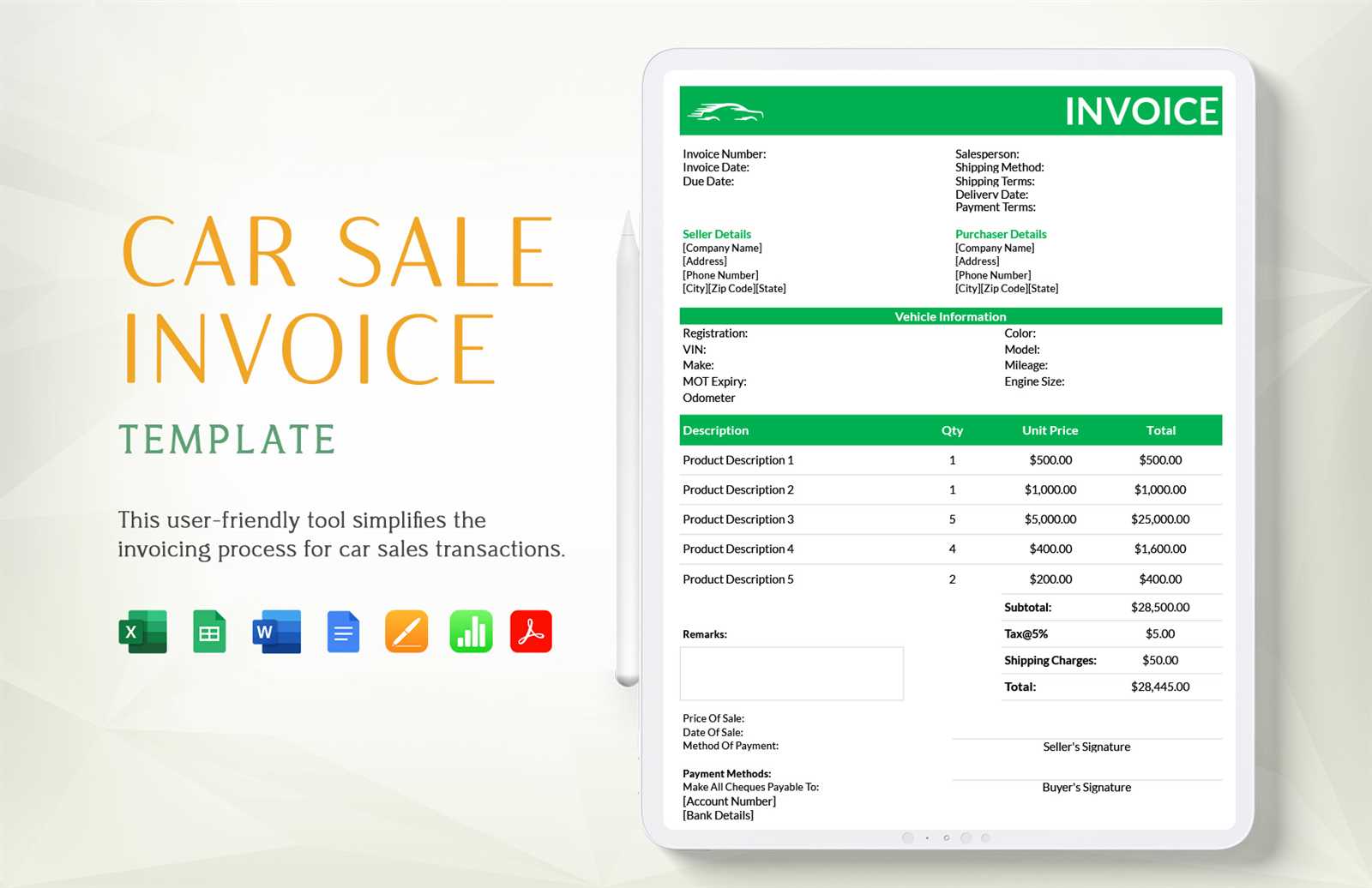

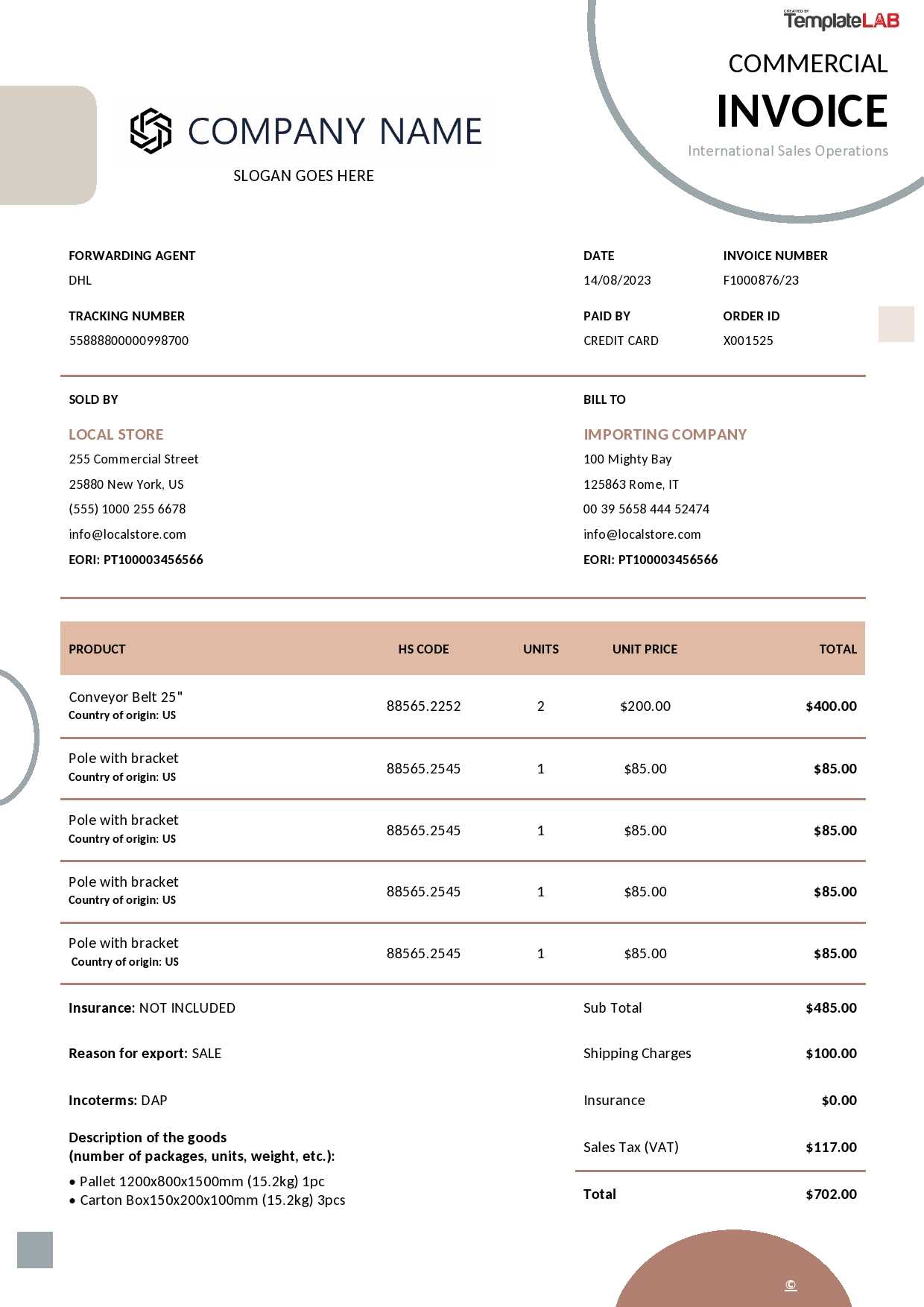

- Business and Client Information: Clearly display the names, addresses, and contact details of both parties involved in the transaction.

- Document Date: Include the date of issue to track the timing of the transaction and payment deadlines.

- Unique Identifier: A reference number or ID for the transaction helps both the business and the client track the payment and keep records organized.

- Goods or Services Description: Detail the items provided, including quantity, unit price, and a brief description to avoid confusion.

- Amount Due: Clearly display the total amount owed, including any applicable taxes, fees, or discounts.

- Payment Terms: Include payment deadlines, acceptable methods, and penalties for late payments if applicable.

Additional Optional Fields

In addition to the basic information, there are several optional fields that may be beneficial depending on the nature of your business:

- Tax Information: Ensure that applicable taxes are clearly itemized and that the tax rate is specified.

- Shipping Details: If applicable, include shipping costs, methods, and delivery dates.

- Notes or Comments: This section allows for personalized messages, such as thank-yous or reminders about payment terms.

By including these essential fields, you ensure that your transaction documents are complete, professional, and legally compliant.

Tips for Creating Professional Invoices

Creating a clear, concise, and professional document for financial transactions is essential for building trust and maintaining good relationships with clients. A well-designed record ensures that both parties have the necessary details to complete the payment process smoothly. Here are some practical tips to help you craft effective and professional documents for your business.

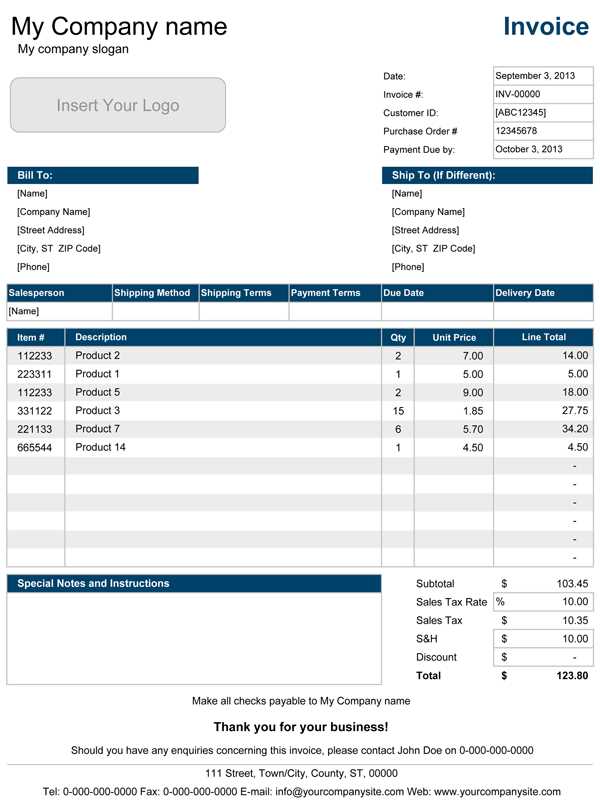

1. Use a Consistent Layout

Maintaining a uniform structure across all documents is important for brand consistency. Stick to a layout that is clean, well-organized, and easy to navigate. This not only helps clients find the information they need quickly but also projects a professional image of your business.

2. Include Clear Payment Instructions

Be specific about payment methods, due dates, and any late fees or discounts for early payments. Clear payment terms will reduce misunderstandings and encourage timely settlements.

3. Incorporate Your Branding

Your documents should reflect your business identity. Include your logo, company name, and contact information at the top. A personalized design reinforces your brand and makes the document more recognizable to clients.

4. Double-Check for Accuracy

Ensure that all information, such as client details, prices, and payment terms, is correct before sending out the document. Small errors can lead to confusion or delays in payment.

5. Maintain Professional Language

Use clear, polite, and professional language throughout the document. A well-worded record conveys respect and professionalism, reinforcing your company’s credibility.

6. Keep It Simple

While it’s important to include all relevant details, avoid overwhelming your clients with unnecessary information. A straightforward, easy-to-read document is more effective than one filled with excessive jargon or cluttered text.

By following these tips, you can create documents that are not only functional but also reinforce the professionalism of your business.

Common Mistakes to Avoid in Invoices

When creating a document for transaction records, small errors can lead to significant confusion and delays in payment. It’s important to be aware of common pitfalls that can affect both the clarity and professionalism of your documents. Below are some frequent mistakes that businesses should avoid to ensure smooth transactions and foster trust with clients.

Missing Key Details

One of the most common mistakes is failing to include essential information. Omitting critical fields can cause misunderstandings or delays in payment processing. Always ensure that the following are clearly listed:

- Client Information: Missing or incorrect client details can lead to confusion or incorrect billing.

- Payment Terms: Failure to specify payment deadlines or acceptable methods can lead to delayed payments.

- Accurate Amounts: Ensure the total amount, taxes, and discounts are correct to prevent disputes over charges.

Formatting Errors

Inconsistent formatting or poor organization can make a document difficult to read or appear unprofessional. Always aim for:

- Consistent Font and Style: Using too many fonts or varying font sizes can make the document appear disorganized.

- Clear Sectioning: Group related information together and use proper spacing to improve readability.

- Alignment: Make sure all elements are properly aligned, such as prices, dates, and client details, for a polished appearance.

Avoiding these mistakes will help ensure that your transaction documents are not only clear and precise but also project professionalism, making it easier for clients to process payments and for businesses to maintain positive relationships.

How to Organize Your Invoices Effectively

Proper organization of transaction records is essential for efficient financial management. By keeping these documents well-structured and easy to access, you can streamline your accounting process, reduce the risk of errors, and ensure timely payments. Below are some effective strategies to organize your records and maintain an orderly system.

1. Create a Centralized Filing System

Establish a central location, either physical or digital, where all transaction records can be stored. This will allow easy access to past documents when needed. You can organize these records by client, project, or date, depending on what suits your business best.

2. Label and Categorize Documents

Each document should be clearly labeled with a unique reference number, the client’s name, and the date. Organizing by categories such as completed transactions, outstanding payments, or archived documents will make it much easier to locate a specific file quickly.

3. Use Software or Tools

Consider using accounting software or online tools to automatically categorize and store your documents. Many tools offer features like automatic filing, customizable categories, and the ability to quickly generate reports, improving the overall efficiency of your organization process.

4. Maintain Consistent Naming Conventions

For digital records, adopt a consistent naming convention that includes relevant information such as the client name, document type, and date. This will make it easier to search and sort your files, saving you time when retrieving past records.

5. Regularly Review and Archive

Periodically review your records to ensure that all documents are correctly filed and up to date. Consider archiving old documents that are no longer needed for immediate reference but should still be stored for legal or accounting purposes.

By following these simple strategies, you can stay on top of your transaction records, reduce clutter, and maintain a highly efficient filing system.

Sales Invoice Template for Small Businesses

For small businesses, managing financial records effectively is key to maintaining smooth operations and ensuring timely payments. A well-structured document for transactions not only helps in keeping track of sales but also boosts professionalism. Here are some tips and features to look for when creating documents for your small business.

Key Features for Small Business Documents

When customizing your transaction record format, there are several crucial elements that should be included to make sure it meets your business needs:

- Client Information: Clearly list client details such as name, address, and contact information to avoid confusion.

- Transaction Date: Include the date of the sale or service to maintain a clear timeline for accounting purposes.

- Itemized List of Goods or Services: A detailed breakdown of what was sold, including quantity, unit price, and description, ensures transparency.

- Payment Terms: Specify payment deadlines, available methods, and late payment penalties to set clear expectations.

- Taxes and Fees: Make sure any applicable taxes or additional charges are clearly indicated and easy to understand.

Why It’s Important for Small Businesses

For small businesses, having a clear and organized document can make the difference in ensuring that payments are processed correctly and on time. It also serves as a valuable record for financial tracking, especially when filing taxes or preparing for audits. An organized transaction document helps avoid confusion, minimizes errors, and ensures consistency across all your sales.

By using a structured format tailored to your needs, small businesses can save time, improve cash flow, and maintain professionalism in their dealings with clients.

Using a Template for Quick Invoicing

For businesses that need to send out transaction records quickly and efficiently, having a pre-designed structure can save time and reduce errors. A ready-to-use format helps ensure that every document includes the necessary details while maintaining consistency. Using such a structure allows businesses to streamline the billing process and focus on core operations without worrying about creating documents from scratch each time.

Benefits of Using a Pre-Designed Structure

Utilizing a standardized format for transaction records provides several advantages, including:

- Time-Saving: With a ready-made structure, you can quickly fill in the required information and send out the document without delay.

- Consistency: Every document looks the same, ensuring uniformity across all your records and enhancing professionalism.

- Reduced Errors: By following a clear format, the chances of missing important details or making formatting mistakes are minimized.

- Easy Customization: Pre-designed formats allow you to easily adjust or update client information, pricing, or terms without starting over each time.

Key Sections to Include in a Pre-Designed Structure

When using a ready-made structure, it is important to include all the essential components of a transaction document. Below is an example of key sections you should have:

| Section | Description |

|---|---|

| Client Details | Include the client’s name, address, and contact information to ensure clarity. |

| Itemized List | Provide a detailed list of products or services sold, including quantities and prices. |

| Payment Terms | Clearly define the payment due date, available payment methods, and any late fees. |

| Total Amount | Summarize the total charges, including taxes or other applicable fees. |

Using a pre-designed structure can significantly reduce the time spent on administrative tasks and ensure that all necessary information is consistently presented, making the transaction process smoother for both businesses and clients.

Tracking Payments with Invoice Templates

Tracking payments efficiently is crucial for maintaining cash flow and ensuring that all transactions are properly accounted for. Using a structured format for recording payments helps businesses monitor due amounts, track overdue payments, and maintain financial clarity. By incorporating clear payment tracking methods within your transaction documents, you can easily identify which clients have paid, which are pending, and which require follow-up.

Essential Features for Payment Tracking

When setting up a system for tracking payments, make sure your document includes the following key features:

- Payment Due Date: Clearly state when the payment is expected to be received. This helps both parties stay on schedule and prevents delays.

- Paid Amount: Include a section where the payment amount is recorded once it has been received, allowing for easy reference later.

- Outstanding Balance: Make sure there is a section that shows the remaining balance, which can help clients and businesses stay on track.

- Payment Method: Specify the payment method used (e.g., credit card, bank transfer, cash) to keep accurate records of the transaction type.

How to Follow Up on Outstanding Payments

If payments are overdue, it is important to have a clear process in place for follow-up. A payment tracking system allows you to:

- Send Reminders: With a structured format, you can easily identify overdue payments and send gentle reminders to clients.

- Record Communication: Keep track of any conversations or agreements made regarding outstanding payments in the same document for future reference.

- Offer Payment Plans: In cases where clients are unable to pay in full, having a clear record allows you to negotiate payment terms and update the document accordingly.

By tracking payments through well-organized transaction documents, businesses can ensure that they stay on top of their financial responsibilities and maintain smooth client relationships.

How to Add Tax Information to Invoices

Including accurate tax details in your transaction records is essential for compliance and transparency. Whether it’s VAT, sales tax, or other applicable levies, properly documenting tax information ensures that both you and your clients understand the financial obligations. Adding these details can also prevent potential issues during audits or disputes, making it crucial to be precise when specifying tax rates and amounts.

Key Elements of Tax Information

When adding tax information to your transaction document, make sure to include the following elements:

- Tax Rate: Clearly state the tax rate applied to the goods or services. This should be displayed as a percentage (e.g., 10%, 20%) and should be based on the applicable local tax laws.

- Tax Amount: The total tax charged on the transaction. This should be calculated based on the tax rate and the total cost of the products or services provided.

- Tax Identification Number: Include your business’s tax ID number or VAT number, as required by your jurisdiction. This number verifies that your business is properly registered for tax purposes.

Where to Place Tax Information in Your Document

To ensure clarity and transparency, tax information should be placed in easily identifiable sections within your document:

- At the Top or Footer: Many businesses include the tax rate and tax amount at the top or footer of the document to make it easily visible to clients.

- Itemized Breakdown: If your transaction involves multiple items or services, provide a detailed breakdown of the tax for each individual item. This way, your client can see exactly how the tax was calculated.

By clearly adding tax details to your transaction records, you ensure both compliance with tax regulations and a transparent, professional interaction with your clients.

Creating Recurring Invoices with DOC

For businesses that provide ongoing services or products on a regular basis, automating the creation of recurring transaction records is a practical solution. Instead of manually generating new documents each period, you can create a template that allows for quick updates, ensuring consistency and accuracy. This approach saves time, reduces errors, and helps maintain a steady cash flow.

Steps to Set Up Recurring Billing

To streamline the process of generating recurring transactions, follow these simple steps:

- Create a Master Document: Begin by creating a base record that includes all necessary information for the recurring transactions, such as client details, services, and payment terms.

- Set the Recurrence Schedule: Define the frequency of the transaction, whether it’s monthly, quarterly, or annually. This will help you automatically prepare the document at the appropriate time.

- Update Payment Amounts: If there are any changes in pricing or taxes, ensure that each new document reflects the most up-to-date information.

Benefits of Automating Recurring Transactions

By setting up a system for recurring billing, businesses can enjoy numerous benefits:

- Time Savings: Automating the process means you don’t have to manually create documents each cycle, freeing up time for other important tasks.

- Consistency: Each transaction record will be uniform, reducing the risk of errors and maintaining professional appearance.

- Steady Revenue Stream: Recurring billing ensures predictable and timely payments, improving cash flow and financial planning.

By utilizing a well-organized system for recurring transactions, businesses can enhance operational efficiency and maintain strong relationships with clients through reliable and consistent billing practices.

Integrating Your Invoice Template with Accounting Tools

Integrating your transaction records with accounting software is an essential step for streamlining financial management. By connecting your billing documents to accounting platforms, you can automate data entry, reduce errors, and ensure consistency across your financial records. This integration helps maintain real-time tracking of payments, taxes, and overall financial performance, allowing for smoother operations and better decision-making.

Benefits of Integration

Integrating billing records with accounting tools offers several advantages:

- Time Efficiency: Automation of data transfer from your billing system to accounting software eliminates the need for manual data entry, saving time and reducing human errors.

- Consistency: Automated integration ensures that financial information is consistently updated across both systems, reducing discrepancies between your records and accounting reports.

- Improved Accuracy: With automated updates, there is less chance for mistakes in calculations or data entries, which is critical for maintaining financial integrity.

- Real-Time Financial Insights: By syncing data with accounting tools, you gain immediate access to financial reports, giving you a better understanding of cash flow and outstanding balances.

Steps to Integrate with Accounting Tools

To integrate your billing records with accounting software, follow these general steps:

- Select Compatible Software: Choose an accounting tool that is compatible with your billing system. Many popular platforms offer built-in integration features or API support.

- Set Up Data Mapping: Define how data from your transaction records should be mapped to categories within the accounting tool, such as tax rates, payment terms, and itemized charges.

- Automate Updates: Enable automatic synchronization so that any changes made to your billing documents are reflected in your accounting system in real-time.

- Review and Reconcile: Regularly review your integrated records to ensure that everything is aligned and reconcile any discrepancies between systems.

By integrating your billing system with accounting tools, you can create a seamless workflow that enhances accuracy, reduces administrative workload, and provides a clearer picture of your business’s financial health.

Legal Considerations When Issuing Invoices

When creating and sending payment requests, it’s essential to ensure that all legal requirements are met. Proper documentation not only facilitates the collection of payments but also helps protect both parties involved. Understanding the legal framework around billing practices can prevent potential disputes, reduce risks, and ensure that your business operates within the law.

Key Legal Aspects to Keep in Mind

There are several legal factors to consider when preparing and distributing payment documents:

- Accurate Information: Ensure that all details provided, such as the seller’s business name, address, and tax identification number, are accurate and up to date.

- Clear Payment Terms: Include clear terms regarding payment due dates, accepted methods of payment, and late fees, if applicable. This transparency helps avoid misunderstandings.

- Tax Compliance: Make sure that all applicable taxes are included in the total amount, and that tax rates and any exemptions are properly applied according to local regulations.

- Invoice Numbering: Consistent and sequential numbering of payment documents is often required by law to track transactions effectively and prevent fraud.

- Retaining Records: Legally, businesses must retain financial records for a set period (often several years), so it’s important to store payment requests and related documents securely for future reference and auditing purposes.

Legal Requirements in Different Jurisdictions

Legal obligations related to billing may vary depending on the country or region where the transaction occurs. Some important things to consider include:

- Tax Rates and Regulations: Different jurisdictions have different tax regulations, so it’s crucial to understand the specific rates that apply to your products or services in each area.

- Language and Currency: Some regions may require that financial documents be issued in a particular language or currency, particularly in international transactions.

- Electronic Invoicing Laws: In some countries, electronic payment documents must comply with specific standards, such as digital signatures, to be legally valid.

Staying informed about the legal requirements in your location and ensuring that your payment requests adhere to these laws helps protect your business and fosters trust with your clients.

Best Practices for Invoice Design

A well-designed payment request can enhance professionalism and ensure that all necessary details are easily accessible. Clear, organized, and visually appealing documents are not only easier for clients to understand but also help maintain consistency in your business communications. Following design best practices ensures that your documents serve their purpose effectively while reflecting your brand identity.

Key Design Elements

When designing payment requests, consider the following best practices to create documents that are both functional and professional:

- Clear Branding: Include your business logo, contact information, and brand colors to create a cohesive look that aligns with your company’s identity.

- Simple Layout: Keep the layout clean and uncluttered. Use white space strategically to prevent the document from looking overcrowded and ensure ease of reading.

- Readable Fonts: Choose legible fonts that are easy to read both on screen and in print. Avoid overly decorative fonts that can reduce readability.

- Logical Structure: Organize the content in a logical order. Key sections like customer details, payment terms, and amounts should be clearly separated to guide the reader’s eye.

- Highlight Important Information: Use bold, italics, or colored text to emphasize critical elements like the total amount due or the payment due date.

Using Tables for Clarity

Tables are particularly useful in organizing details like product descriptions, quantities, and prices. Properly formatted tables make it easier for clients to review and verify the information. Here’s an example of how a table can enhance the readability of your payment request:

| Item | Description | Unit Price | Quantity | Total |

|---|---|---|---|---|

| Product A | High-quality item | $50.00 | 2 | $100.00 |

| Service B | Consulting services | $75.00 | 1 | $75.00 |

| Total Due | $175.00 | |||

By following these design practices, your documents will be professional, easy to navigate, and effective in ensuring timely payments from your clients.

How to Save and Share Your Invoices

Once you’ve created your payment requests, it’s important to store and share them in a way that ensures they’re secure, easily accessible, and professionally presented. Properly saving and distributing these documents can improve your workflow, enhance client relationships, and help keep your financial records organized. Below are some key methods for effectively managing your payment documents.

Saving Your Documents

To maintain a clear and organized record of your transactions, follow these best practices when saving your payment documents:

- Choose the Right File Format: Save your documents in a widely used and easily accessible format such as PDF. This ensures that the recipient can open and view the file without issues, regardless of their device.

- Organize by Date or Client: Create folders that categorize your documents by either the date they were issued or the client they are associated with. This makes it easier to locate specific files later.

- Use Cloud Storage: Utilize cloud storage services such as Google Drive, Dropbox, or OneDrive. These platforms offer secure backup and easy access from any device.

- Backup Your Files: Always have a backup of your documents, either on an external hard drive or cloud-based system, to protect against potential data loss.

Sharing Your Documents

Sharing payment requests should be done securely and professionally. Here are some tips for distributing your documents:

- Email Attachments: The most common method for sending payment documents is through email. Attach the file to your email and include a brief, professional message. Ensure the file name is clear and concise.

- Shareable Links: If your documents are stored in a cloud service, create a shareable link to send to your client. This allows easy access without having to send large files directly.

- Online Payment Portals: Many payment platforms allow businesses to upload and share their payment documents directly within the system. This can simplify the process for both you and your clients.

- Physical Copies: While electronic methods are preferred, you can still print hard copies for clients who prefer paper documents. Ensure they are professionally formatted and sent via reliable mailing services.

By properly saving and sharing

Free Resources for Payment Request Templates

Finding high-quality resources to create your payment requests can save you both time and money. Whether you are just starting your business or need a quick way to generate professional documents, there are many free tools and platforms available to help you create customized forms. Below is a list of reliable, free resources that can assist you in generating your payment documents with ease.

Online Tools and Platforms

Several websites offer free access to customizable forms, which allow you to generate and download documents without any cost. Here are some popular options:

- Invoice Generator: A simple, easy-to-use online tool that lets you quickly create and download professional-looking forms in various formats like PDF and Excel.

- Wave: A cloud-based platform that provides free tools for creating, sending, and tracking payment documents. It also includes features for accounting and reporting.

- Zoho Invoice: Offers a free plan with customizable designs and automatic calculations, suitable for freelancers and small businesses.

- PayPal: Provides free customizable payment request generation, ideal for businesses that use PayPal as their primary payment method.

Downloadable Files and Open Source Options

If you prefer to work offline or with a specific program, there are numerous free downloadable resources available. These resources can be saved and edited according to your needs:

- Microsoft Office Templates: Offers free, pre-made forms in Word and Excel that can be customized to suit your business needs.

- Google Docs and Sheets: Templates available within the Google Docs suite allow for easy editing and sharing with clients directly from your Google account.

- OpenOffice Templates: A free, open-source office suite that offers a variety of customizable document templates compatible with Word and Excel formats.

Using these free resources, you can easily create customized payment documents that meet your business’s specific needs, without the need for expensive software or tools.