Free Sales Invoice Excel Templates for Effortless Billing

Managing financial transactions is crucial for any business, and having a well-organized system for documenting payments is key. Whether you’re a freelancer, small business owner, or part of a larger enterprise, keeping track of charges and receipts can quickly become overwhelming without the right tools. Fortunately, there are efficient solutions available that simplify this process, allowing you to maintain professionalism and accuracy with minimal effort.

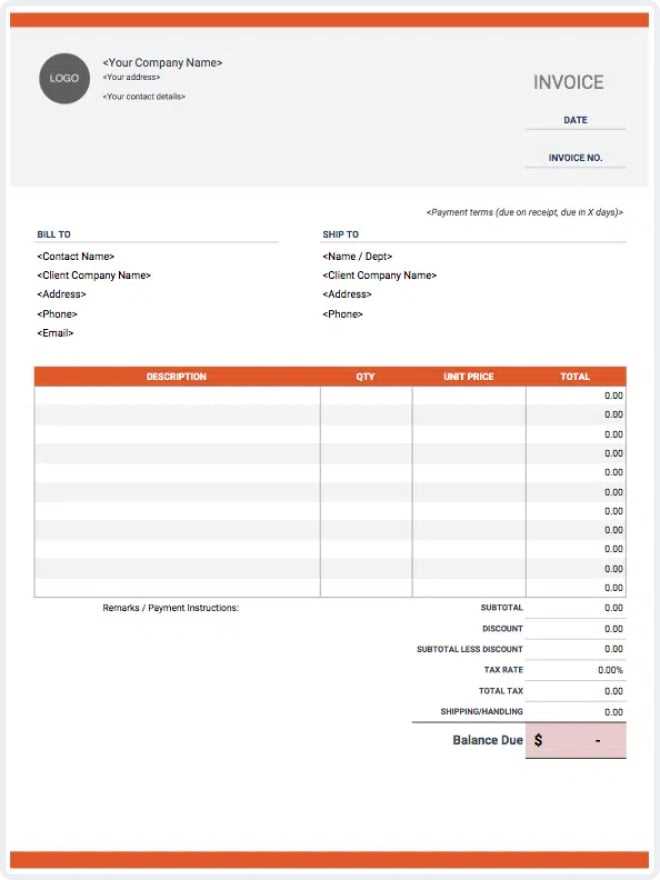

Customizable options for creating professional-looking records have become more accessible than ever. These tools enable users to easily generate detailed statements with all the necessary information, from itemized charges to tax calculations. No matter your level of expertise with spreadsheets, a basic knowledge can help you create documents that are both practical and visually appealing.

With these resources, you can streamline your accounting processes, reduce the chance of errors, and save valuable time. The best part is that many of these resources require little to no investment, allowing you to start organizing your finances without additional costs or steep learning curves. Whether you’re looking to track transactions for a single project or manage a series of ongoing payments, these solutions offer a straightforward way to keep your financial records in order.

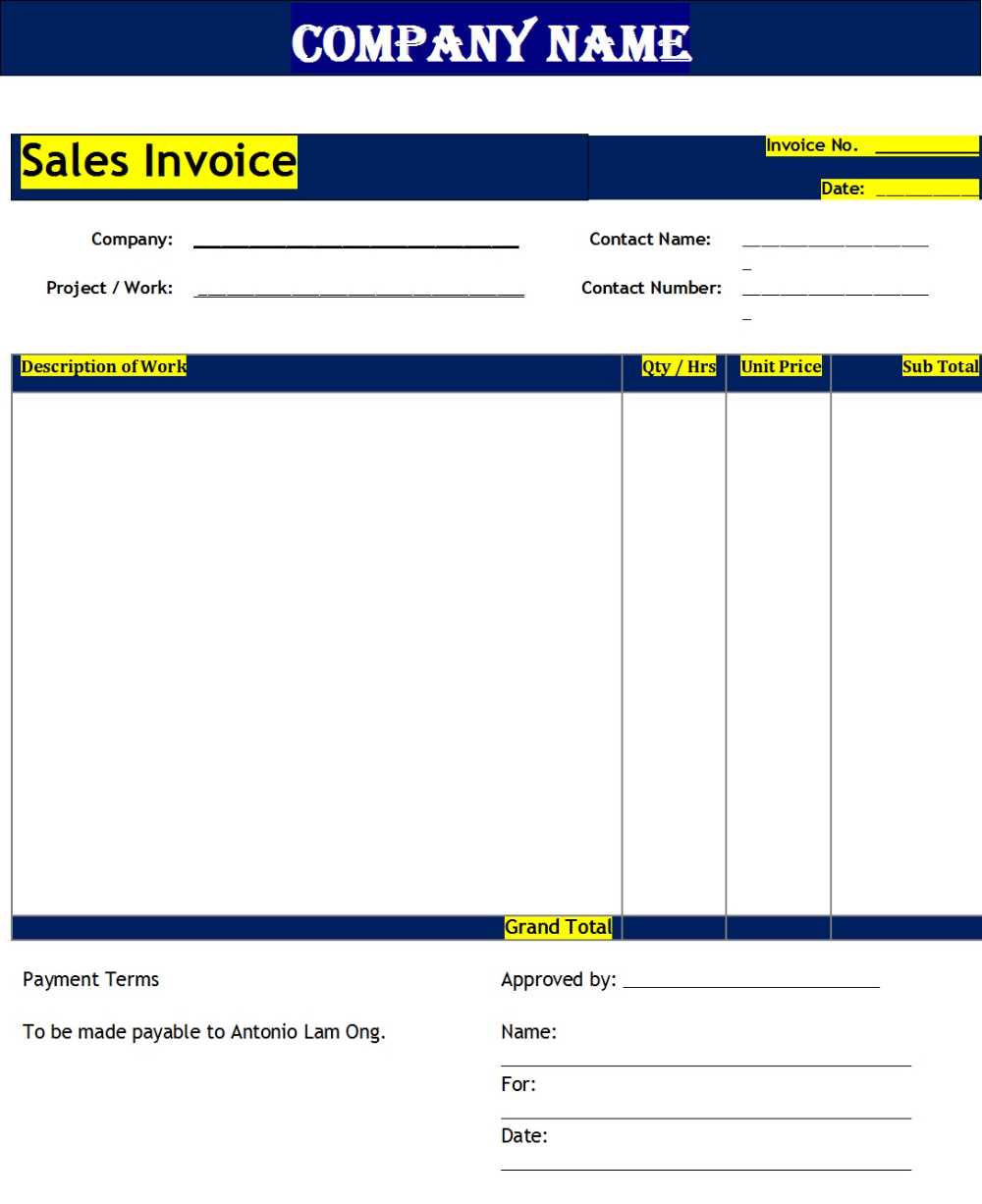

Free Sales Invoice Templates for Excel

When managing payments and transactions, it’s essential to have a tool that simplifies the creation of detailed and accurate records. There are several accessible solutions that help you quickly generate billing documents, organize information, and ensure that everything is presented professionally. These tools can be customized to suit your specific needs and are ideal for individuals or businesses looking to streamline their financial processes without complex software.

Many platforms offer these resources at no cost, giving users the opportunity to get started with minimal investment. With basic spreadsheet skills, anyone can create a comprehensive and polished document that meets the requirements for tracking purchases, payments, and other financial details. The best part is that these solutions are easy to modify and can be adjusted as your business or needs evolve.

Here are some key features you can expect from these accessible solutions:

- Customizable Fields: Tailor the document to include all necessary details, such as product descriptions, pricing, quantities, taxes, and more.

- Easy Calculations: Automatically calculate totals, taxes, and discounts with simple formulas.

- Professional Design: Generate clear and attractive documents that enhance your brand’s image.

- Quick Setup: Pre-built structures allow you to fill in your specific details without the need to start from scratch.

- Time-saving Features: Save time by reusing the same layout for multiple transactions and adjusting as needed.

These solutions are particularly helpful for small businesses or independent contractors who need to quickly produce well-organized records for their clients or internal accounting. By using the right tools, you can ensure that your financial documentation is accurate, professional, and easy to manage, all while minimizing the amount of time spent on administrative tasks.

Why Use Excel for Sales Invoices

Using a spreadsheet program for creating payment documents offers numerous advantages, making it an ideal choice for many businesses and professionals. With its user-friendly interface and flexibility, you can efficiently design and manage records without the need for specialized software. A spreadsheet provides both simplicity and powerful features, allowing you to organize and calculate information seamlessly. Whether you’re a small business owner or a freelancer, these tools help you maintain accuracy and professionalism with minimal effort.

Ease of Customization

One of the main benefits of using a spreadsheet application for payment documents is the ability to fully customize the layout to your specific needs. From adjusting columns for different types of data to adding your own branding elements, you can ensure that each document aligns with your business style and requirements. Modifying fields such as descriptions, quantities, and pricing is simple and quick, allowing you to adapt the document for various types of transactions.

Automation and Calculation

Another significant advantage is the ability to automate calculations. Using built-in formulas, you can instantly calculate totals, taxes, discounts, and more, reducing the risk of errors and saving valuable time. Spreadsheets can easily update the final figures whenever you adjust the data, ensuring that your documents remain accurate and consistent. With these automated features, you can create efficient, error-free records with little manual effort.

Benefits of Free Invoice Templates

Utilizing pre-designed tools for creating billing documents offers numerous advantages, especially for small businesses and freelancers. These ready-made solutions allow users to quickly generate professional records without the need for specialized software or extensive technical knowledge. The ability to download and use these resources without a financial investment makes them an accessible choice for anyone looking to simplify their billing process.

One of the key benefits is the time saved in setting up and organizing financial documents. Instead of starting from scratch, users can instantly access structured formats that only need a few modifications to fit specific needs. This streamlined approach reduces administrative burdens and allows business owners to focus on other areas of their operations.

Moreover, these ready-to-use resources ensure that all necessary fields are included and properly arranged. From itemized lists to tax calculations, these documents ensure consistency and help users avoid common errors. Additionally, many of these tools come with automated features, allowing for quick updates and reducing the chances of manual mistakes in the final documents.

How to Customize Sales Invoice Templates

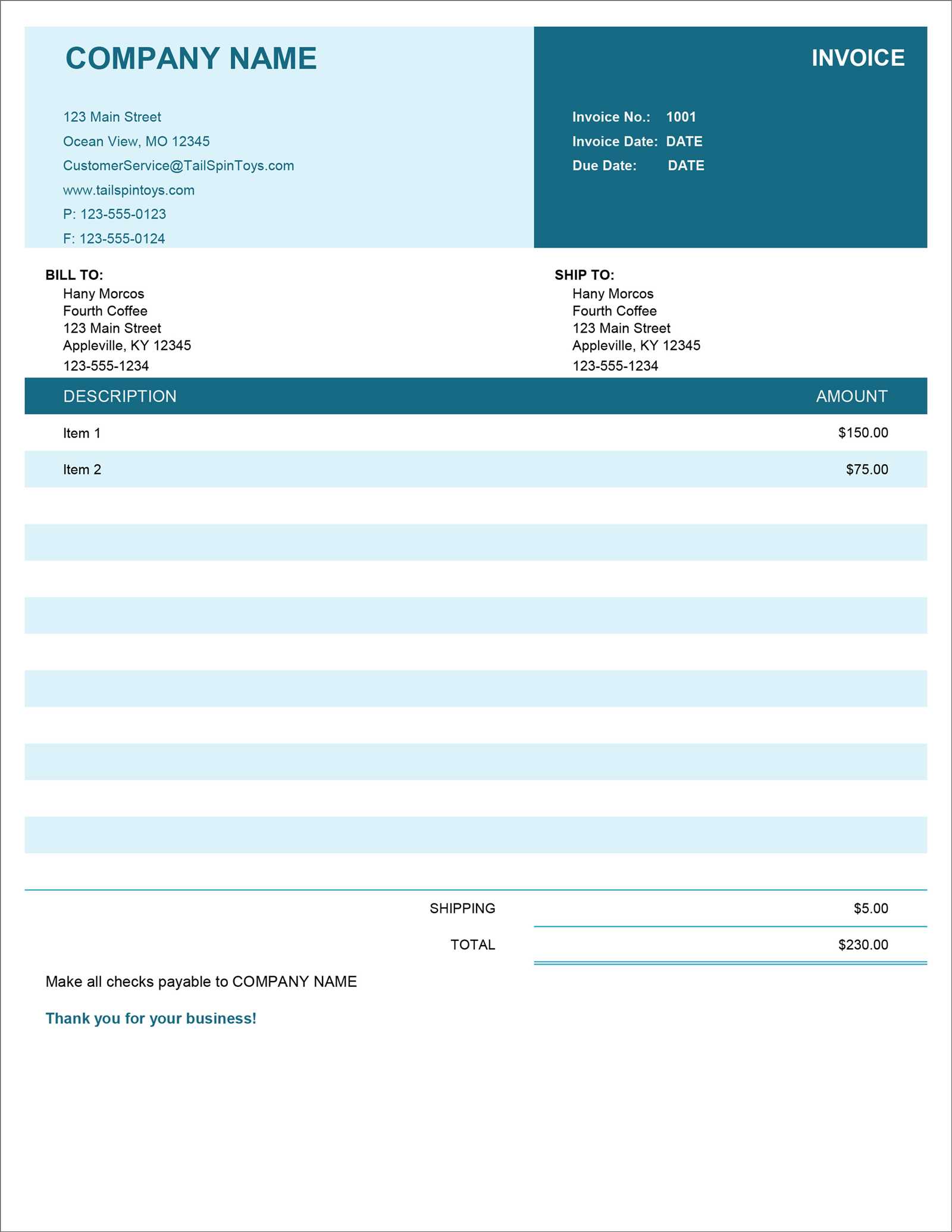

Customizing billing documents is essential for tailoring them to your business needs and creating a professional impression. By modifying the structure and content of a pre-made document, you can ensure that all the necessary details are included while maintaining a unique style. Customization options are often easy to implement, allowing you to add or remove sections, adjust formatting, and even incorporate branding elements like logos and colors.

Step-by-Step Customization Process

Here’s how you can personalize a standard payment record layout for your business:

- Modify Header Information: Add your business name, logo, and contact details at the top of the document for branding consistency.

- Adjust Field Layout: Rearrange sections to highlight the most important information, such as pricing, descriptions, and totals.

- Include Payment Terms: Customize the payment due date, methods, and other terms that are specific to your business practices.

- Add Custom Calculations: If needed, update formulas to reflect discounts, taxes, or other calculations that apply to your transactions.

Design and Formatting Adjustments

After adjusting the structure, consider modifying the design for a more polished look:

- Font Choices: Choose professional fonts that are easy to read and match your brand identity.

- Color Scheme: Use your brand’s colors for headers, borders, and other accents to make the document visually consistent with your other materials.

- Table Layouts: Adjust row heights, column widths, and borders to create a clean, organized look that’s easy for clients to follow.

By following these steps, you can easily transform a standard billing document into one that fully reflects your business’s style and operational needs, ensuring clarity and professionalism in every transaction.

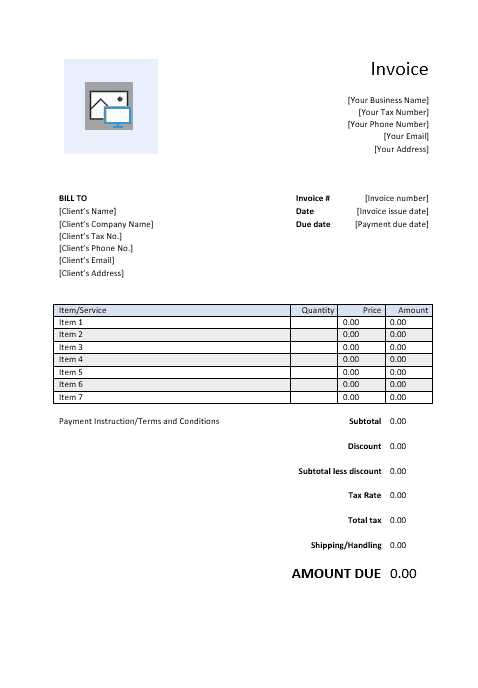

Top Features of Excel Invoice Templates

When choosing a tool for creating billing documents, it’s important to select one that offers a combination of flexibility, automation, and ease of use. The best solutions come with a range of built-in features designed to streamline the document creation process, improve accuracy, and save time. These features make it easier to manage transactions, track payments, and produce professional records consistently.

Here are some of the most useful features you can expect from a high-quality tool for generating billing documents:

- Automatic Calculations: Built-in formulas for adding up totals, applying taxes, and calculating discounts make it easy to get accurate results without manual calculations.

- Customizable Layout: You can adjust columns, rows, and fields to better suit your specific needs, such as adding new product categories or modifying descriptions.

- Itemized Entries: The ability to break down each charge clearly helps both the issuer and the recipient understand the details of the transaction.

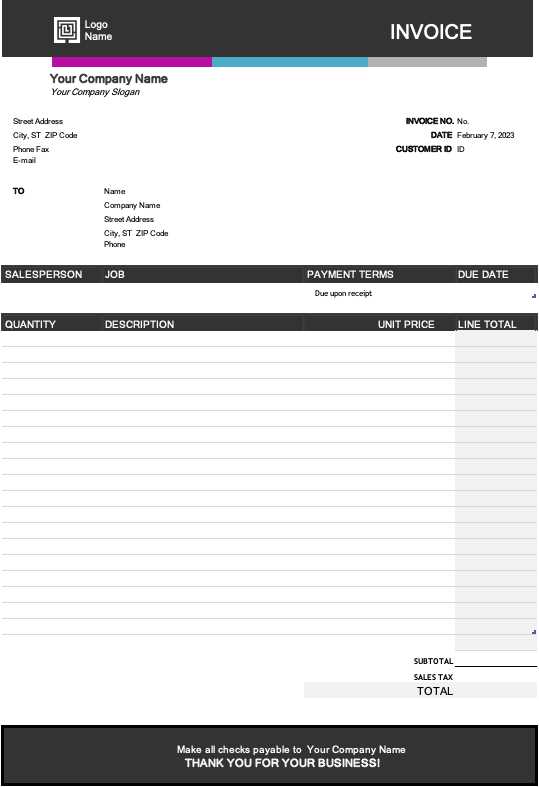

- Professional Design: Pre-designed structures with clean layouts and attention to detail help you create documents that look polished and are easy to read.

- Tracking Capabilities: Some tools include features to track payments, due dates, and outstanding balances, helping you stay on top of financial records.

- Multiple Currency Support: If your business operates internationally, many solutions allow for easy adjustments in currency format and conversion rates.

With these powerful features, you can create billing documents that are not only professional but also efficient, ensuring that your transactions are processed smoothly and with minimal effort.

How to Save Time with Templates

Using pre-made document layouts can significantly reduce the time spent on repetitive administrative tasks. Instead of starting from scratch each time you need to create a record, a ready-to-use structure allows you to fill in only the necessary details. This streamlined approach helps you focus on more important aspects of your business, while maintaining accuracy and professionalism in your documentation.

Here are a few ways you can save time by utilizing these ready-made solutions:

- Pre-filled Fields: Most document layouts come with pre-defined sections for essential information such as product descriptions, quantities, and prices. All you need to do is input the specific details for each transaction.

- Automated Calculations: Built-in formulas automatically calculate totals, taxes, and discounts, eliminating the need for manual math and reducing the chance of errors.

- Reusability: Once you’ve customized a document for your business, you can reuse the same structure for future records, saving time on formatting and setup.

- Consistent Structure: With a consistent layout, you don’t have to worry about rearranging information or forgetting important details. The layout ensures that everything is included every time, reducing the risk of missed elements.

By automating and simplifying the document creation process, these solutions allow you to focus on more important tasks and get your work done faster, with greater efficiency.

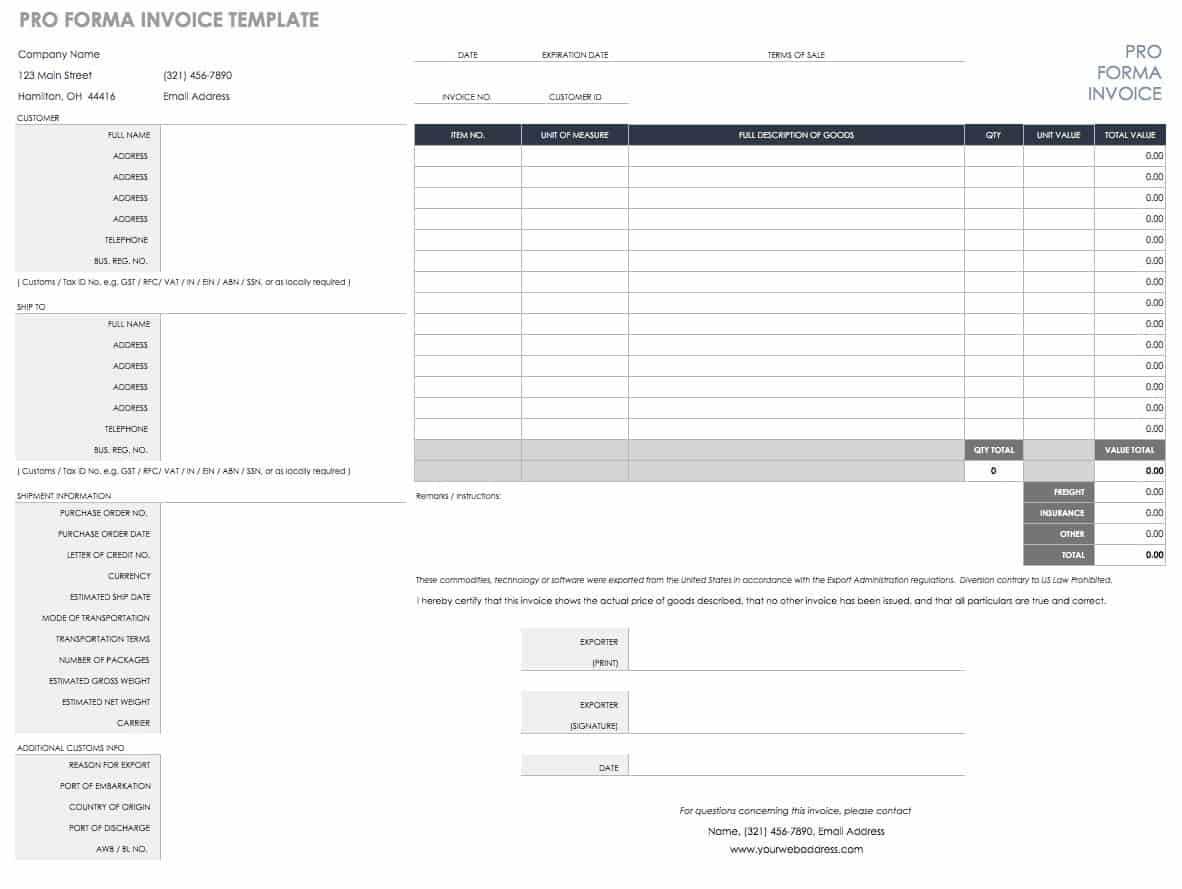

Choosing the Right Invoice Template

Selecting the right format for creating billing records is crucial to ensure that your documents are not only accurate but also professional and easy to understand. The right structure should meet both your business’s operational needs and the expectations of your clients. A good document layout allows for easy customization, clear presentation, and efficient tracking of transactions.

When deciding which layout to use, consider the following factors:

- Business Type: Different industries may require different document formats. For example, a service-based business might need a simple structure, while a product-based business could require detailed product descriptions and quantities.

- Design and Readability: Opt for a clean, organized layout that presents all the essential information in a logical and easy-to-read manner. This helps your clients quickly understand the details of the transaction.

- Customization Options: Choose a layout that can be easily adjusted to fit your specific needs. This includes adding fields for discounts, taxes, and payment terms, or adjusting the appearance to reflect your brand’s identity.

- Automation Features: Some layouts come with built-in formulas that automatically calculate totals, taxes, and other variables. These features can save you time and reduce the chance of errors.

- Compatibility: Ensure that the chosen format works well with the software you’re using and can be easily shared with clients, either in digital or print form.

By carefully considering these aspects, you can choose a layout that not only fits your business’s needs but also enhances the clarity and professionalism of your financial documentation.

Organizing Sales Data in Excel

Effectively managing transaction records is essential for any business, as it helps you keep track of financial activities and ensure accurate reporting. With the right approach, organizing your data can become a streamlined process, allowing you to quickly access and analyze key information. Proper organization also enables you to stay on top of payments, identify trends, and maintain up-to-date records without unnecessary effort.

Here are some useful tips for organizing your financial data efficiently:

- Use Clear Categories: Break your data into logical sections such as dates, client names, product/service details, and amounts. This makes it easier to track individual transactions and quickly locate specific information.

- Consistent Formatting: Ensure that data entries are uniform, whether it’s the way you list products or format prices. Consistent structure helps avoid confusion and errors when reviewing your records.

- Leverage Sorting and Filtering: Utilize built-in sorting and filtering tools to organize your data by specific criteria, such as due dates or payment status. This allows you to quickly find what you need without manually sifting through rows of information.

- Track Outstanding Payments: Create a section to monitor unpaid amounts and deadlines. Highlight or color-code overdue items to stay on top of accounts that need attention.

- Regularly Update Your Records: Make it a habit to update your data after each transaction to ensure your records reflect the most current status, reducing the risk of missing critical details.

By following these guidelines, you can maintain a well-organized financial system that saves you time, reduces errors, and improves your overall efficiency in managing business transactions.

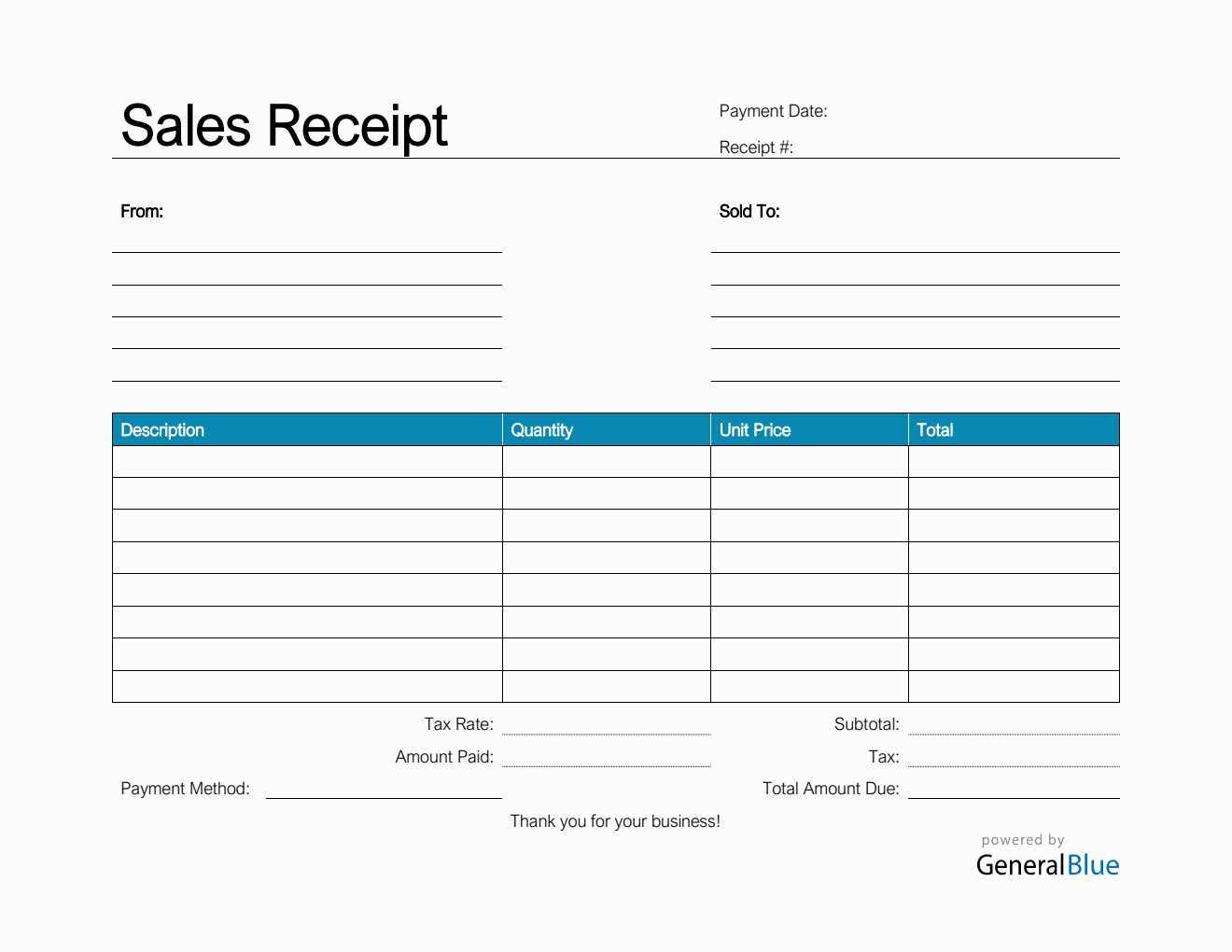

How to Add Tax Calculations to Invoices

Incorporating tax calculations into billing documents is essential for ensuring compliance and accuracy. Whether you’re dealing with sales tax, VAT, or other applicable taxes, it’s important to include the correct figures in your financial records. The right approach not only simplifies the calculation process but also ensures that your customers receive accurate statements, which helps maintain transparency and trust.

Here’s a step-by-step guide on how to add tax calculations to your billing records:

- Identify the Tax Rate: Determine the applicable tax rate based on your location and the type of goods or services you’re offering. For instance, some regions may have different rates for different categories, so it’s important to know which tax applies.

- Calculate the Tax Amount: Multiply the total price of the items by the tax rate. For example, if the total is $100 and the tax rate is 10%, the tax amount would be $10.

- Add a Tax Line: Insert a row or section in your document to show the tax amount separately. This helps maintain clarity and allows both you and the client to see exactly how much tax is being applied.

- Calculate the Total: Add the tax amount to the subtotal to arrive at the final total. For example, if your subtotal is $100 and the tax is $10, the total amount due would be $110.

- Ensure Accuracy: Double-check your calculations to avoid errors. Many tools come with built-in formulas to automatically calculate taxes based on the entered subtotal, so it’s important to set up these formulas correctly from the start.

By following these simple steps, you can easily incorporate tax calculations into your records, ensuring that your financial documents are both accurate and compliant with local regulations.

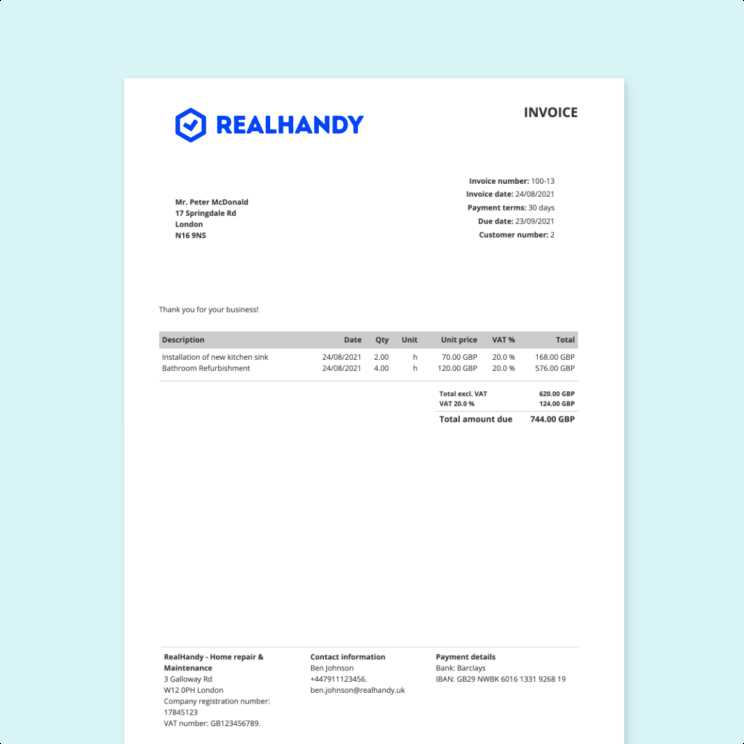

Design Tips for Professional Invoices

The design of your billing documents plays a critical role in creating a professional image and ensuring clarity for your clients. A well-structured and visually appealing record not only helps communicate essential information but also builds trust and confidence in your business. Whether you’re creating a simple document or one with more complex details, following a few design principles can elevate the quality of your work.

Keep It Simple and Organized

Cluttered and disorganized documents can confuse clients and cause unnecessary delays in payment. To avoid this, keep the layout clean and straightforward. Use clear headings, consistent fonts, and ample spacing to separate sections. Prioritize important details, such as transaction amounts, payment due dates, and client information, by making them stand out visually.

- Limit the number of fonts: Stick to one or two fonts to avoid distractions. Use bold or italics to highlight key information like totals or dates.

- Use bullet points or tables: Breaking down charges into easy-to-read lists or tables improves readability and reduces confusion.

- Leave room for notes: A small space for additional comments or terms can be useful without cluttering the document.

Incorporate Branding and Visual Appeal

Incorporating your brand’s identity into your billing documents can help reinforce professionalism and create a consistent image across all your communications. Adding your company logo, using brand colors, and choosing a visually pleasing layout can make your document stand out and align with your overall business presentation.

- Use brand colors: Incorporating your company’s primary colors can make your document visually cohesive and strengthen brand recognition.

- Include your logo: Position your logo in the header or footer for easy visibility, ensuring clients associate the document with your business.

- Make use of lines and borders: Simple lines or borders can help organize the sections of your document and make it look neat.

By focusing on simplicity, organization, and branding, you can create documents that are not only functional but also professional and polished, leaving a lasting positive impression on your clients.

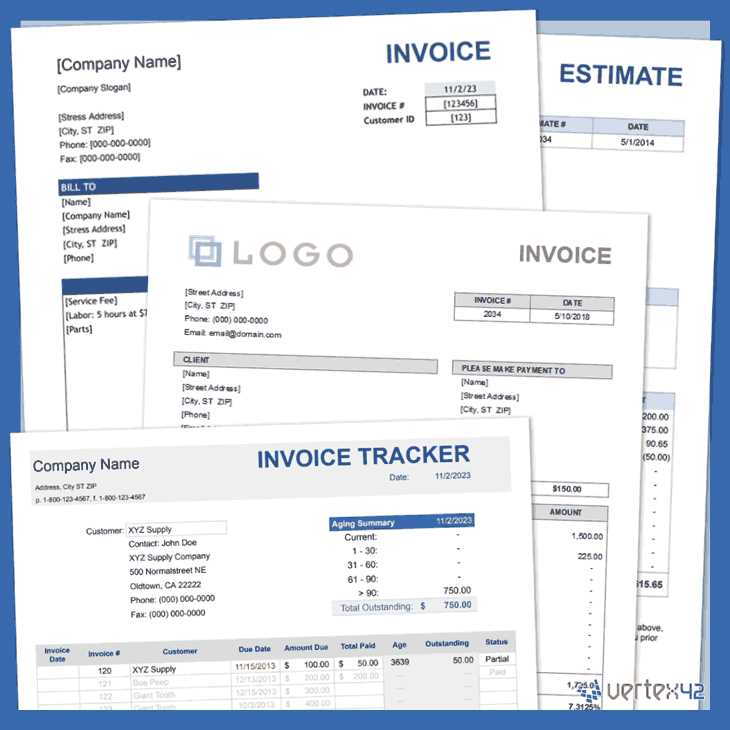

Tracking Payments with Excel Templates

Keeping track of payments is a crucial aspect of financial management for any business. Having an organized system to monitor which clients have paid, which are overdue, and how much is left to be collected helps maintain cash flow and prevents mistakes. With the right structure in place, this process becomes straightforward and efficient, ensuring you stay on top of your financial obligations and client payments.

Using a pre-designed tool for tracking payments can save you time and effort. Here’s how you can efficiently monitor payment statuses with such tools:

- Payment Status Column: Add a column to track whether a payment has been received, is pending, or is overdue. This simple update helps you immediately identify which transactions need follow-up.

- Due Dates and Reminders: Include a section for due dates and automate reminders for upcoming payments. This ensures you never miss a payment deadline and can reach out to clients in a timely manner.

- Payment Amounts: Keep a detailed record of the amounts paid versus the total owed. This helps you quickly calculate outstanding balances for clients and ensures accuracy in your financial reporting.

- Filtering and Sorting: Use the built-in filtering and sorting options to organize your data by payment status, due date, or amount. This makes it easier to follow up on overdue payments or review completed transactions.

- Automated Calculations: Set up formulas to automatically calculate outstanding balances or display totals, saving time and ensuring accuracy in your records.

By incorporating these features into your tracking system, you can streamline the payment management process, avoid confusion, and ensure that all transactions are properly accounted for.

Common Mistakes to Avoid in Invoices

Creating accurate and professional billing documents is essential for maintaining a good relationship with clients and ensuring smooth financial transactions. However, even experienced business owners can make simple mistakes when preparing these documents. These errors can lead to confusion, delayed payments, and even damage your business reputation. By understanding the most common mistakes and learning how to avoid them, you can ensure that your records are clear, precise, and reliable.

1. Missing or Incorrect Information

One of the most common mistakes is leaving out important details or making errors in the provided information. This can lead to confusion and delays, as clients may not know exactly what they are being charged for or when the payment is due.

- Client Details: Always double-check the accuracy of your client’s contact details, including name, address, and email. Incorrect information can lead to communication problems.

- Product/Service Descriptions: Ensure each item is listed clearly with detailed descriptions to avoid misunderstandings. Ambiguous or vague descriptions can cause disputes.

- Due Dates: Clearly state the payment due date. Ambiguous deadlines can result in late payments.

2. Calculation Errors

Errors in adding totals, applying taxes, or calculating discounts can result in overcharging or undercharging clients, which can harm your credibility and lead to payment issues.

- Manual Calculations: Double-check any manual calculations. Using automated tools can reduce the risk of human error.

- Tax Calculations: Make sure you apply the correct tax rate for your region and type of goods/services. Mistakes here can lead to compliance issues.

- Discounts and Fees: Ensure that any discounts or additional fees are clearly listed and calculated accurately. Failing to mention these can cause confusion.

3. Lack of Professional Formatting

A cluttered or disorganized document can make it difficult for clients to read and understand the charges. Poor formatting can create a negative impression and may even lead to delayed payments.

- Cluttered Layout: Keep your document simple and easy to read. Avoid overcrowding the page with too much information or unnecessary details.

- Unclear Totals: Ensure the final amount due is clearly highlighted and easy to spot. This makes it simple for clients to know how much to pay.

By being mindful of these common mistakes and taking care to avoid them, you can create clear, professional, and error-free billing records that reflect positively on your business and ensure smooth transactions.

How to Share Invoices with Clients

Once you’ve prepared and finalized your billing documents, it’s essential to ensure that they reach your clients in a timely and professional manner. The method you choose to share these documents can impact how quickly you receive payment and how your business is perceived. It’s important to select a sharing method that is secure, easy to use, and preferred by your clients.

1. Emailing Documents

Email is one of the most common and efficient methods for sending billing statements. It allows for quick delivery and easy access for your clients. When sending via email, consider the following:

- Attach a PDF: Converting your document into a PDF format ensures that the layout remains consistent and easily viewable across different devices and operating systems.

- Clear Subject Line: Use a subject line that clearly indicates the purpose of the email, such as “Invoice for [Service/Product] – [Month/Date]”. This helps your client quickly identify the content of the email.

- Include a Brief Message: Always add a brief message in the body of the email, thanking the client and stating the payment due date.

2. Using Cloud Storage or File-Sharing Platforms

If your document is too large to send via email, or if you prefer not to send attachments, using cloud storage or a file-sharing platform is a great option. Services such as Google Drive, Dropbox, or OneDrive allow you to upload the document and share a secure link with your client.

- Upload to a Cloud Storage Service: Save the billing document to your preferred platform and generate a shareable link.

- Set Permissions: Ensure that the permissions for the file are set to “view only” to prevent unauthorized editing. If necessary, password-protect the file for added security.

- Include a Personalized Message: When sending the link, include a polite message with the link to the document, ensuring the client knows how to access and download it.

By selecting the right method for sharing your billing records, you can make it easy for clients to receive, review, and pay their bills, ultimately improving cash flow and ensuring professional communication.

Updating and Modifying Your Templates

Over time, you may need to adjust or enhance your billing documents to reflect changes in your business, tax laws, or client requirements. Regular updates ensure that your records remain accurate, professional, and aligned with your current business practices. Whether you’re adding new sections, adjusting for tax changes, or simply redesigning for a more polished look, the ability to modify your documents is essential for maintaining efficiency and consistency.

1. Keeping Information Up-to-Date

As your business evolves, it’s important to ensure that all details on your documents remain relevant and accurate. This includes your company name, contact information, and payment terms. Additionally, if you’re offering new services or products, be sure to add these to your record layouts.

- Update Company Details: Double-check that your business name, address, phone number, and email are current to avoid any confusion.

- Modify Payment Terms: Adjust payment due dates, late fees, or other payment-related information to reflect any policy changes in your business.

- Reflect New Services/Products: Add or remove product/service descriptions and adjust prices as necessary to match your current offerings.

2. Improving Design and Functionality

As you gain more experience, you may want to refine the design or functionality of your records. This could involve making the layout cleaner, adding new features, or automating certain calculations. Making these adjustments ensures that your billing documents not only look professional but also work efficiently for both you and your clients.

- Enhance Layout: Organize sections better, use consistent fonts, and employ visual hierarchy to make your records easy to read and navigate.

- Add New Fields: If you need to track additional information, such as purchase order numbers or payment references, simply add new columns or rows to your documents.

- Automate Calculations: Modify formulas to automatically calculate totals, taxes, or discounts based on updated rates or changes in your billing process.

By regularly updating and modifying your records, you ensure that your business operations run smoothly and that your documents always reflect the most accurate and professional information for your clients.

Free Excel Templates for Small Businesses

For small businesses, managing administrative tasks efficiently is key to maintaining smooth operations. One of the most common challenges faced is keeping track of financial records, especially when it comes to managing payments, orders, and client transactions. Using pre-built tools can save time and reduce errors, allowing you to focus on running your business. With readily available, customizable tools, even the smallest enterprises can maintain a professional approach to their financial record-keeping without having to invest in expensive software.

There are many options available for small businesses looking to streamline their financial processes. These tools allow you to track key information, automate calculations, and maintain a clean record of transactions without needing extensive accounting knowledge. Below are a few key benefits of using such tools:

- Cost-Effective: Many of these tools are available at no cost, providing a budget-friendly option for business owners who don’t want to invest in complex accounting software.

- Easy to Use: Pre-designed structures are often simple to navigate, even for individuals with minimal experience in accounting or financial management.

- Customizable: These documents can be tailored to your specific needs, from adjusting fields to adding new features that better suit your business requirements.

By taking advantage of these resources, small businesses can stay organized, avoid costly mistakes, and ensure that their financial processes remain efficient and accurate.

Protecting Your Invoice Data in Excel

When managing sensitive financial information, it’s essential to take steps to protect your data from unauthorized access and potential loss. Whether you’re storing billing records, payment details, or client information, ensuring the security of your documents is crucial for safeguarding both your business and your clients. Inadequate protection can lead to data breaches, fraud, or accidental loss, which can severely impact your operations.

Fortunately, there are several ways to protect your documents, even when using simple tools like spreadsheets. Below are some strategies to secure your financial records and ensure that they remain safe and accessible only to authorized individuals:

- Password Protection: One of the most effective ways to secure your document is by setting a password for access. Most spreadsheet programs offer an option to encrypt and require a password to open the file, ensuring that only those with the correct credentials can view or edit the information.

- Restricted Access: When sharing your document, ensure that permissions are limited to viewing only, preventing any unauthorized editing or alterations. If possible, use a cloud platform with advanced access control settings to regulate who can access your records.

- Backup Regularly: Losing your data due to accidental deletion or technical failure can be disastrous. Make regular backups of your documents, either on an external drive or in the cloud, to prevent any irreversible loss of important information.

- Use Version History: Many cloud storage services offer version control, which allows you to track and revert to earlier versions of your documents. This is especially useful in case of errors or accidental changes that need to be undone.

- Data Encryption: For added security, consider encrypting sensitive information within your documents. Encryption ensures that even if someone gains access to the file, they won’t be able to read or understand the data without the decryption key.

By implementing these security measures, you can minimize the risk of unauthorized access or data loss, ensuring that your financial records remain safe and secure.

How to Automate Invoice Generation

Automating the creation of billing records can significantly streamline your business operations, saving time and reducing the risk of errors. Instead of manually entering client details, product information, and payment terms for each transaction, automated processes allow you to generate accurate documents with minimal effort. This is especially useful for businesses that deal with frequent transactions or need to send recurring billing statements. By leveraging available tools, you can enhance productivity and maintain a consistent, professional approach to financial management.

There are several methods to set up automation for your billing documents. These approaches can help reduce the time spent on repetitive tasks while improving accuracy and organization. Below are a few strategies you can implement to automate the process:

- Using Spreadsheet Formulas: If you’re working with spreadsheet software, you can set up automatic calculations using formulas. For example, once you input product prices and quantities, formulas can automatically calculate totals, taxes, and discounts. This ensures consistency and accuracy in each document without the need for manual updates.

- Incorporating Macros: For advanced users, macros can be created to automate repetitive tasks, such as filling in client details, updating billing terms, or even generating a full document based on predefined data. This can save considerable time, especially when creating multiple documents for similar transactions.

- Using Third-Party Tools: Several third-party software options offer automatic document creation based on client records and previous transactions. These tools can integrate with your customer database, allowing you to generate detailed billing documents with just a few clicks. Many of these tools also offer features such as recurring billing, email reminders, and payment tracking.

- Cloud-Based Solutions: Cloud platforms like Google Sheets or Microsoft OneDrive offer automation through add-ons or built-in features. These services often allow you to set triggers, such as automatically generating a new billing document when a payment is received or when a service is completed.

By automating your billing process, you free up time to focus on other aspects of your business while ensuring that every document is accurate, timely, and professional. Additionally, this approach minimizes human error and simplifies the overall process of financial recordkeeping.

Where to Find Free Invoice Templates

For small businesses or freelancers just starting, it’s essential to have access to ready-made tools that can help streamline the billing process. Many resources offer customizable document formats that can save time and ensure professional-looking records. Instead of creating everything from scratch, you can find a wide variety of templates online, many of which are available at no cost. These templates are designed to be flexible, so you can tailor them to your specific needs, whether you’re tracking services rendered or products sold.

Here are some places where you can find free resources to create your billing documents:

- Office Software Providers: Popular office software suites such as Microsoft Office and Google Workspace often offer a selection of pre-designed documents. These platforms have templates for almost any business need, including billing records, and they allow easy customization to match your branding and specific requirements.

- Online Template Websites: Numerous websites specialize in offering a variety of free documents. Sites like Template.net, Vertex42, or Invoice Generator offer collections of easy-to-use options for businesses. Many of these sites allow you to download the documents directly or work on them in the cloud for real-time edits.

- Freelancer and Small Business Platforms: Many freelancer platforms and small business websites, such as FreshBooks, QuickBooks, or Wave, offer free document resources, even if you don’t use their full service. They often provide downloadable files that are already formatted for your convenience.

- Public Document Repositories: Some online repositories, like GitHub or OpenOffice, host a wealth of resources uploaded by other users. These platforms typically allow you to search for specific types of documents and download them for use on your computer or in the cloud.

- Social Media and Online Communities: Platforms like Reddit, forums for small businesses, or even Facebook groups dedicated to business support are often great places to find free tools shared by others. Many small business owners and freelancers share their own custom formats, which can often be downloaded and modified to fit your needs.

By exploring these sources, you can easily find high-quality, ready-to-use documents that meet your business’s needs and help you stay organized without having to invest in costly software or spend time creating your own formats.