Download Free Salary Invoice Template for Word to Simplify Payroll

In any business, ensuring accurate and timely payments to employees is crucial for smooth operations and maintaining trust. One of the best ways to streamline this process is by using well-organized documents designed for payment tracking. These tools help businesses maintain clear records, reduce errors, and save time when handling compensation details.

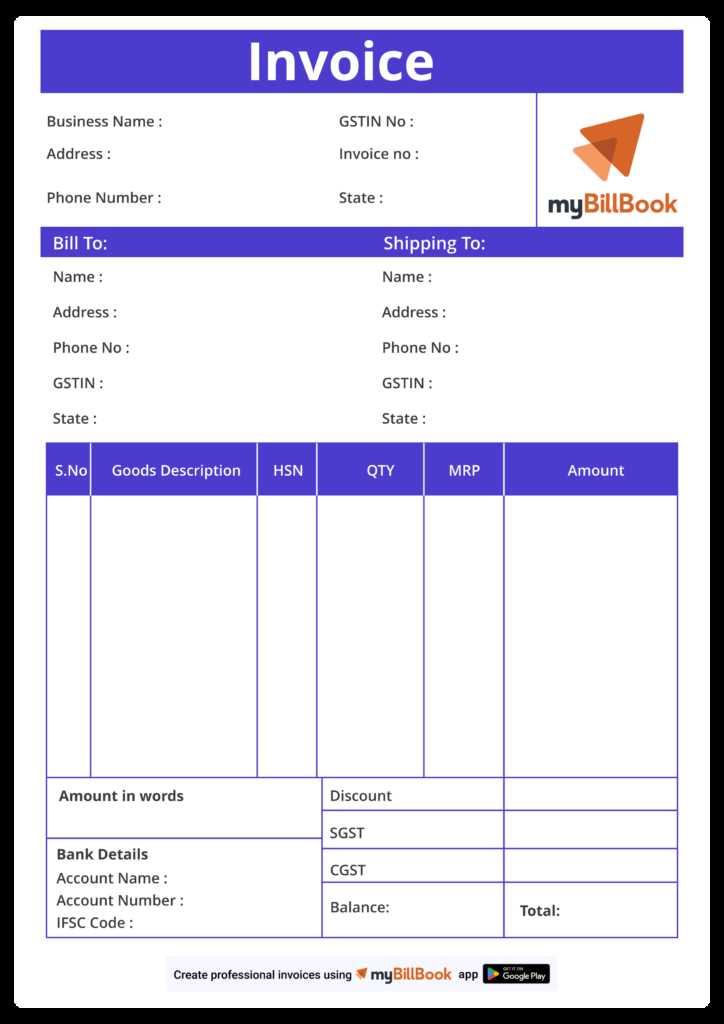

For businesses looking to simplify the process of documenting and sharing employee earnings, customizable solutions offer the flexibility to meet specific needs. By using a structured format, employers can include all essential information such as hours worked, rates, deductions, and final amounts, ensuring full transparency and compliance with regulations.

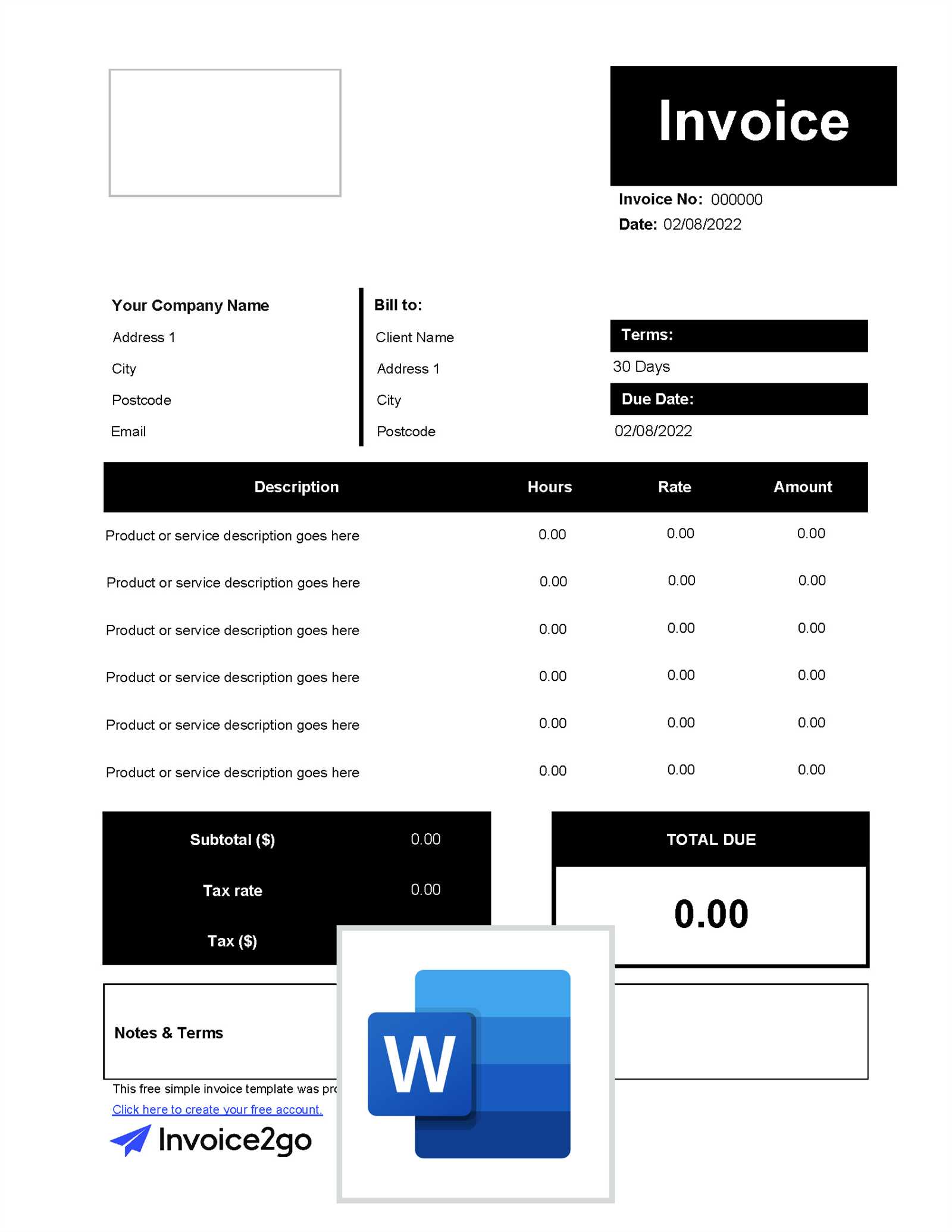

With modern software options, creating these records has never been easier. Whether for small teams or large enterprises, having a predefined structure allows for quick adaptation, ensuring every payout is accurately documented. These documents are easily shareable, editable, and can be kept secure for future reference, making them a vital resource for payroll management.

Salary Invoice Template Word: An Overview

When managing employee compensation, having a consistent and clear format for documenting payments is essential. Such documents not only ensure accuracy but also serve as proof of transactions. With the right structure, businesses can easily track and report payment details, which is crucial for both accounting and legal purposes. A pre-designed system helps save time, reduce errors, and maintain professionalism in all business communications.

One of the most effective ways to organize compensation records is by using a ready-made solution that can be tailored to your specific needs. These formats are available in various software tools, offering flexibility for users to adjust fields and sections to fit their business style and payroll requirements. They are particularly helpful for small and medium-sized businesses that need an easy, efficient way to document payments regularly.

Benefits of Using a Predefined Document System

- Consistency: Helps maintain uniformity in the way compensation records are created.

- Efficiency: Saves time by eliminating the need to create records from scratch.

- Accuracy: Minimizes the risk of errors that could occur with manual record-keeping.

- Legal Compliance: Ensures all essential information is included for tax and reporting purposes.

Customization Options for Your Business

While predefined formats offer convenience, they also allow for customization to suit the specific needs of different businesses. Some options include:

- Adjustable fields for employee details, payment periods, and deduction information.

- The ability to incorporate your company logo, colors, and other branding elements.

- Options to add custom calculations, such as overtime, bonuses, or deductions.

By choosing the right solution, businesses can easily adapt the document to their unique workflow while ensuring a professional presentation each time.

Why Use a Salary Invoice Template

Having a well-structured document for recording employee payments is essential for maintaining accurate financial records. Such tools streamline the process of documenting and calculating compensation, saving time and ensuring no important details are overlooked. By using a standardized format, businesses can efficiently manage employee earnings and maintain consistency across all records.

Utilizing a predefined format helps businesses avoid the common errors associated with manual calculations and inconsistent reporting. It also ensures that the key elements required for tax and regulatory purposes are always included, making the process easier for both employers and employees. Additionally, these solutions make the exchange of payment details more professional and transparent.

| Benefits | Description |

|---|---|

| Accuracy | Reduces the risk of human error in payment calculations and document creation. |

| Efficiency | Saves time by providing a ready-to-use structure for creating payment records. |

| Consistency | Ensures that all records follow the same format, making them easier to manage and track. |

| Professionalism | Gives a polished, formal look to your documents, enhancing trust with employees. |

| Compliance | Helps ensure that all necessary information is included for legal and tax purposes. |

By using a structured document, businesses can streamline their payroll processes and ensure that all required information is included each time. This organized approach leads to smoother operations, greater employee satisfaction, and easier financial management.

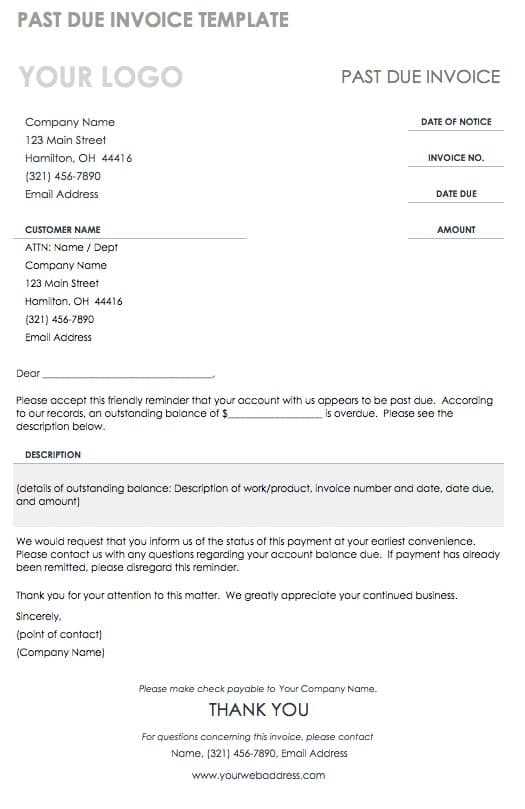

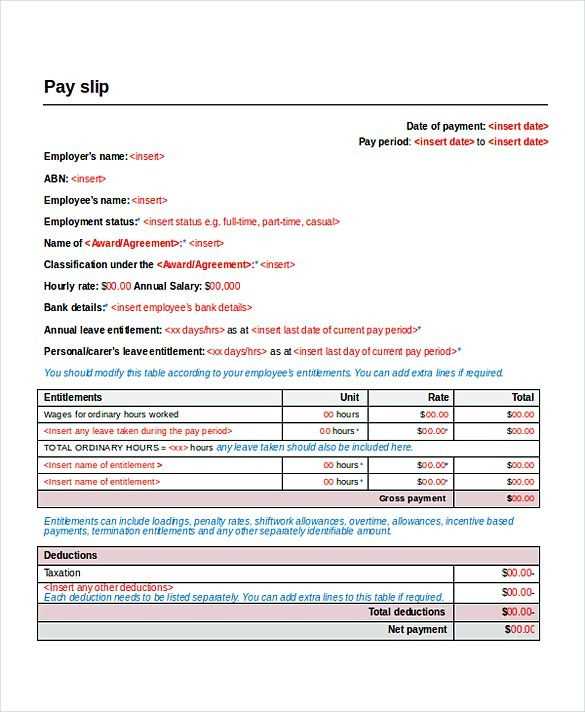

How to Customize a Salary Invoice

Customizing a payment document to fit your business needs is a simple yet essential task for ensuring accurate and professional compensation records. Whether you need to adjust fields for additional employee information or include specific deductions and bonuses, tailoring the format to your business requirements makes it more effective and efficient. The ability to modify key sections of the document ensures that it meets both legal requirements and your internal accounting procedures.

Personalizing these documents also allows businesses to align them with their branding, making them look polished and professional when shared with employees. Customization can be done easily in most office software, allowing you to add or remove sections, change fonts, and update layout designs.

Steps to Modify a Payment Document

- Update Employee Information: Ensure that all fields for employee details, such as name, position, and department, are correct and easy to fill out.

- Adjust Payment Breakdown: Add or modify sections for hourly rates, overtime, bonuses, and deductions to reflect the specific terms of your payroll system.

- Incorporate Company Branding: Include your company logo, contact information, and any other elements that will give the document a professional look.

- Ensure Legal Compliance: Double-check that required information, such as tax details and payment terms, is included and accurate.

Advanced Customization Tips

- Use Formulas: If you’re working with a document that allows calculations, use formulas to automatically compute totals, taxes, and deductions.

- Make Fields Editable: Ensure that certain sections are editable, so each payment document can be updated for different employees or periods.

- Save as a Template: Once you’ve made the necessary adjustments, save the document as a reusable format for future use.

By following these steps, businesses can create a customized document that suits their needs, while maintaining accuracy, clarity, and professionalism in every record. Customization ensures that your payment processes remain efficient and tailored to your unique requirements.

Benefits of Using Word Templates

Utilizing pre-designed document formats for managing employee compensation can significantly enhance efficiency and accuracy in your payroll processes. By having a structured layout ready for customization, businesses can save time, reduce the likelihood of errors, and maintain consistency across all records. This approach also simplifies the task of documenting financial transactions, making it easier to focus on core business activities.

Pre-designed formats offer several advantages, especially when used in popular software tools that are easy to access and modify. These formats can be tailored to fit any business model, allowing for quick adjustments to suit specific needs while maintaining a professional appearance.

Key Advantages of Pre-Designed Documents

- Time-Saving: Ready-made structures eliminate the need to create documents from scratch, speeding up the payroll process.

- Accuracy: Minimizes the risk of mistakes by providing predefined fields and formulas for calculations.

- Professional Look: Documents maintain a clean, formal layout that can be customized to reflect your brand’s identity.

- Consistency: Ensures all records follow the same format, making it easier to manage and track payments.

- Flexibility: Easily editable to fit different business requirements, from adding new sections to adjusting existing ones.

Why Choose Popular Office Software?

- Ease of Use: Most businesses already use familiar software tools, making it simple to implement without additional training.

- Compatibility: These formats are easily shared, making collaboration or external review seamless.

- Customizable Features: Features such as automated calculations or customizable fields allow for a more personalized document without requiring technical expertise.

Incorporating these formats into your workflow offers an efficient, reliable, and professional way to handle employee payments while reducing administrative burdens and ensuring compliance with business regulations.

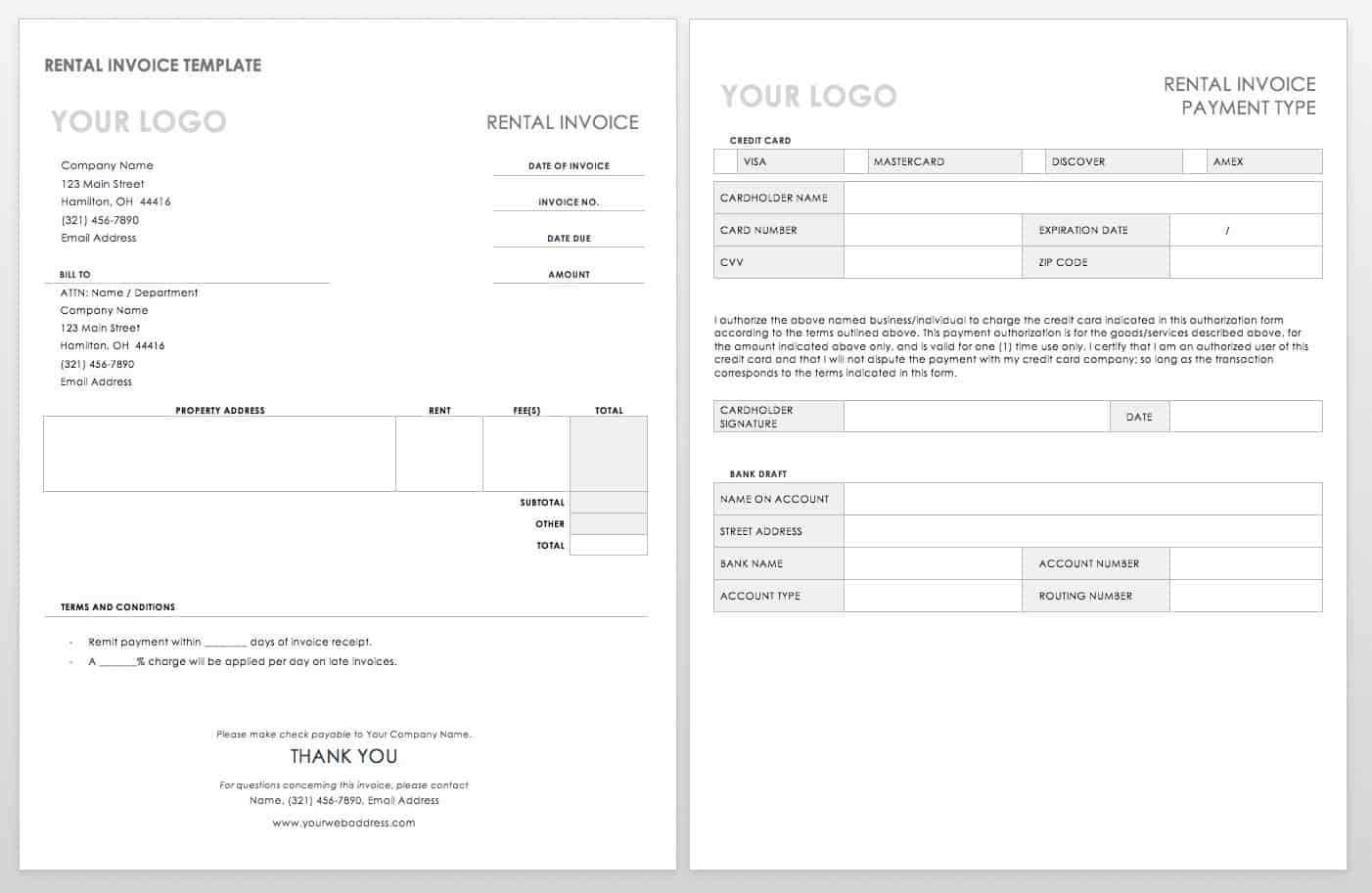

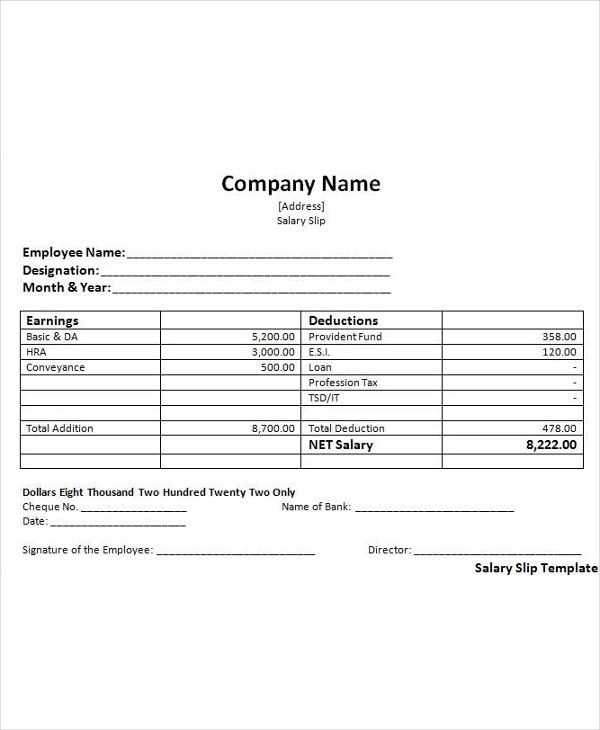

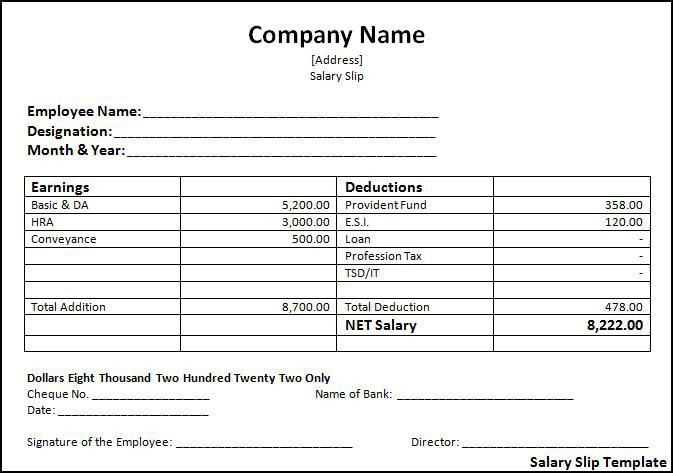

Key Elements of a Salary Invoice

To ensure clarity and accuracy when documenting employee compensation, it is crucial to include all necessary details in the payment record. A well-organized document should provide a comprehensive breakdown of earnings, deductions, and other relevant information. Each section should be clearly defined to avoid confusion and ensure both the employer and employee are on the same page.

Here are the essential elements that should be included in every compensation document to ensure it is complete and professional:

- Employee Information: This includes the full name, position, department, and employee ID if applicable. It’s important to have accurate details to avoid mistakes.

- Payment Period: Specify the date range that the payment covers, whether it’s for a weekly, bi-weekly, or monthly period.

- Hours Worked: Clearly list the number of hours worked during the period. This section can also include overtime or shift details if applicable.

- Rate of Pay: Specify the employee’s pay rate (e.g., hourly wage, daily rate, or salary). If overtime is applicable, include the overtime rate.

- Gross Earnings: This is the total before any deductions. It should be calculated by multiplying the number of hours worked by the rate of pay or showing the full salary for the period.

- Deductions: List any deductions such as taxes, insurance premiums, retirement contributions, or other benefits. It’s important to be transparent in this section.

- Net Pay: The amount the employee will actually receive after deductions. This is the “take-home” pay.

- Payment Method: Indicate how the payment will be made, whether by bank transfer, check, or another method.

- Employer Information: Include the company name, address, and contact information, as well as any relevant company identification numbers (e.g., tax ID).

- Additional Notes: This section can include special remarks, such as bonuses, commissions, or any other information relevant to the payment.

By including all of these key elements in each payment document, businesses can maintain clear, consistent, and professional records. This transparency ensures employees understand the breakdown of their earnings, while also making it easier for the company to stay compliant with tax and labor laws.

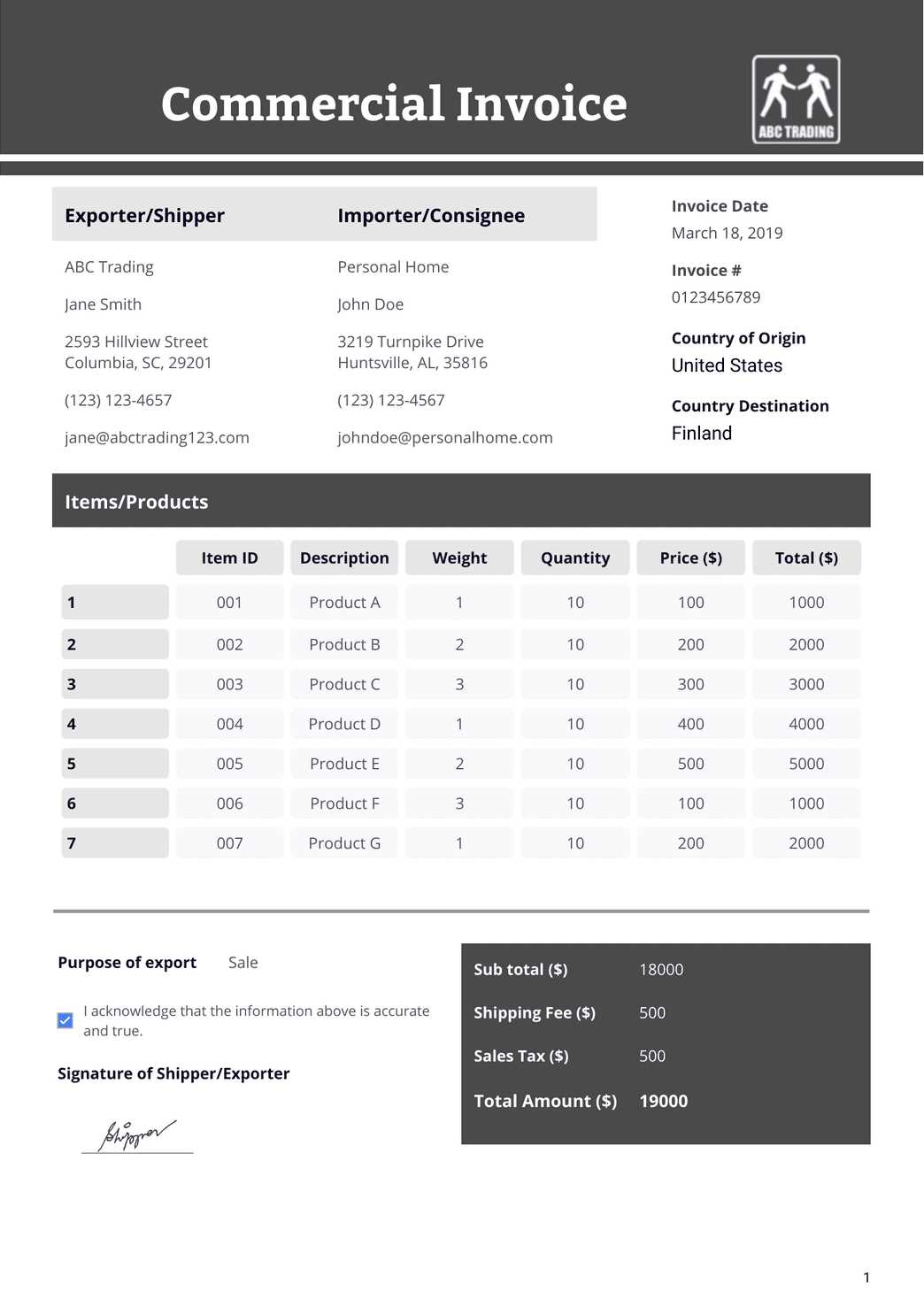

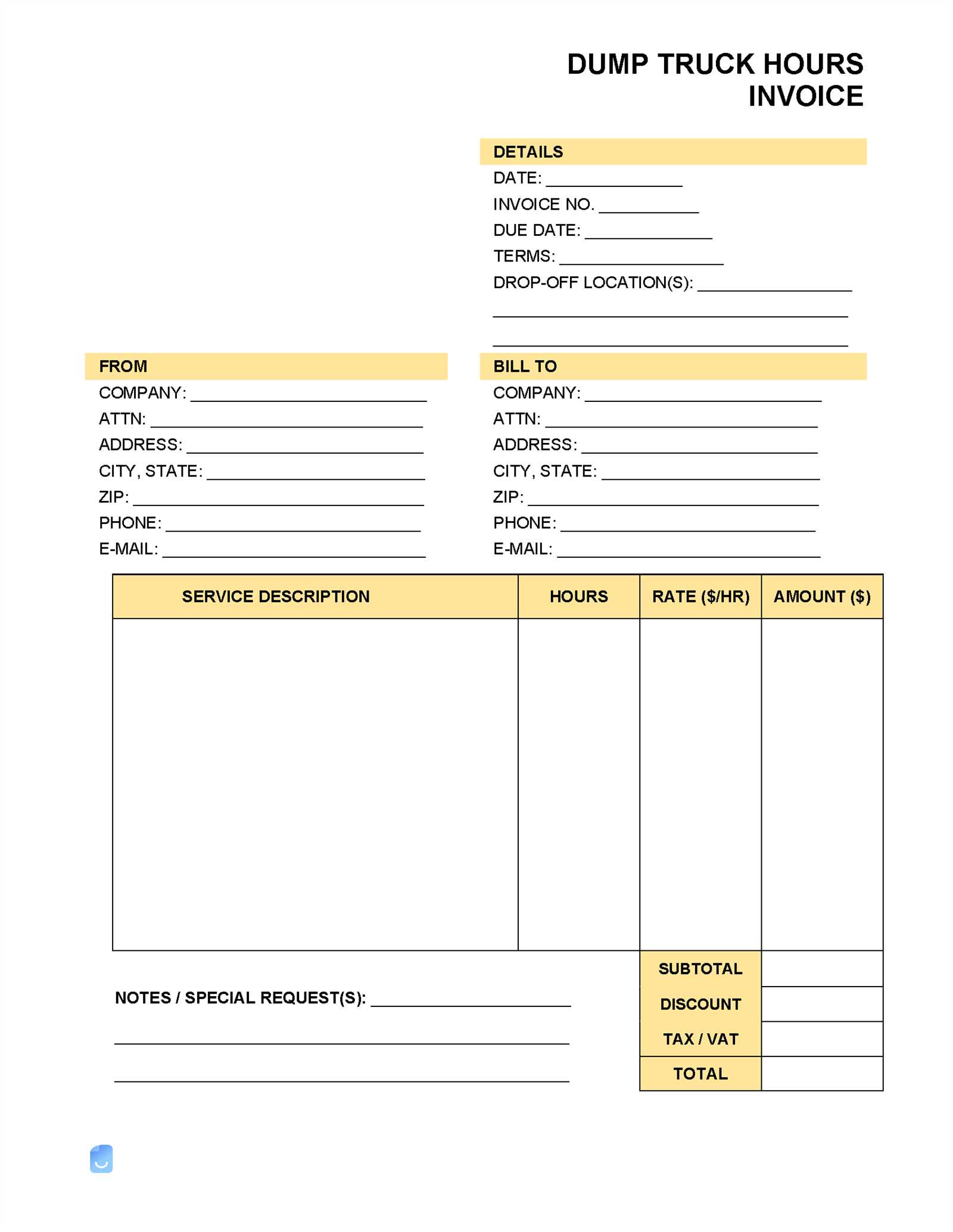

Step-by-Step Guide to Creating Invoices

Creating a detailed and organized payment record is essential for ensuring smooth payroll processing. Whether you’re preparing a document for a single employee or an entire team, having a clear step-by-step approach will help you cover all necessary details. This guide outlines the process of designing a comprehensive document that tracks employee earnings, deductions, and other important information.

Follow these simple steps to create a professional and accurate payment document each time:

Step 1: Gather All Required Information

Before creating the document, collect all the essential details, including:

- Employee name and identification number

- Payment period (start and end dates)

- Hours worked or monthly salary

- Applicable tax and benefit deductions

- Employer contact details

Step 2: Organize the Layout

Next, arrange the information in a clear, logical format. The document should include the following sections:

| Section | Description |

|---|---|

| Employee Information | Details such as name, position, and department |

| Payment Details | Hours worked, pay rate, and overtime, if applicable |

| Deductions | Taxes, insurance, and other withholdings |

| Gross and Net Pay | Total earnings before and after deductions |

| Employer Information | Company name, address, and contact details |

Once the sections are organized, input the relevant data into the corresponding fields, ensuring accuracy in every entry.

Step 3: Finalize and Review

After entering the information, double-check the document for errors or missing details. Ensure that calculations are correct and all mandatory fields are filled. It’s also a good idea to add a

Common Mistakes in Salary Invoices

Even with the best intentions, it’s easy to make mistakes when creating documents that track employee earnings and deductions. These errors can lead to confusion, delays in payments, and even legal issues. Whether it’s incorrect calculations or missing information, small mistakes can have a big impact on both the employee and employer. Being aware of the most common pitfalls can help prevent these issues and ensure your records are accurate and professional.

Here are some of the most frequent mistakes made when preparing payment documents:

- Incorrect Calculation of Total Earnings: One of the most common errors is failing to accurately calculate the total amount due. This could include miscalculating hours worked or incorrectly applying the pay rate, resulting in either overpaying or underpaying employees.

- Missing or Incomplete Information: Leaving out important details, such as the payment period, employee name, or company contact details, can lead to confusion. Always ensure that all fields are filled out completely.

- Not Accounting for Deductions: Forgetting to include deductions like taxes, insurance premiums, or retirement contributions can lead to incorrect net pay amounts. Always verify that deductions are properly subtracted from the gross pay.

- Failure to Update Employee Information: Using outdated employee details, such as old addresses, incorrect bank account numbers, or former pay rates, can cause delivery issues or payment mistakes. Regularly update your records to reflect any changes.

- Ignoring Legal and Tax Requirements: Inaccurate or missing information related to tax withholdings and benefits can lead to legal complications. Ensure your document meets all local tax regulations and company policies regarding employee compensation.

- Inconsistent Formatting: Disorganized or poorly formatted documents can make it difficult for both the employer and employee to quickly review key information. Consistency in layout and structure is important for clarity and professionalism.

By recognizing these common mistakes, businesses can ensure greater accuracy and consistency in their employee compensation records, ultimately improving the efficiency of payroll processes and reducing the risk of errors in future payments.

How Salary Templates Save Time

Managing employee compensation efficiently is a critical part of any business’s payroll system. One of the best ways to streamline this process is by using pre-designed documents that are easy to customize and fill out. These ready-made structures can save businesses valuable time by eliminating the need to create new records from scratch each pay period. By using a consistent format, you can quickly update the necessary details, ensuring that each payment is documented accurately and professionally.

The use of such tools allows payroll managers to focus on other important tasks while minimizing the time spent on document preparation. Automation features like pre-calculated fields for taxes, deductions, and net pay further accelerate the process, allowing for quick adjustments without the risk of manual errors.

Speeding Up Document Creation

Using a pre-designed system speeds up the creation of compensation documents in several ways:

- Pre-filled Information: Basic employee data, such as name and department, can be saved and automatically filled in, reducing the time it takes to create each document.

- Standardized Layouts: Having a consistent structure means less time spent organizing and formatting documents, ensuring that everything is in the right place.

- Calculations Done for You: Many tools allow for automatic calculation of taxes, deductions, and gross pay, eliminating the need for manual math and reducing the chance of errors.

Improved Efficiency for Payroll Teams

By using these systems, payroll teams can handle a higher volume of records in less time. The streamlined process leads to faster payment processing, reducing delays and improving employee satisfaction. Additionally, the time saved can be reinvested in more complex tasks, such as resolving discrepancies or improving payroll systems further.

Ultimately, the use of efficient, customizable tools is an essential part of a business’s effort to optimize its payroll process, reduce administrative overhead, and ensure timely, accurate payments.

Free vs Paid Salary Invoice Templates

When it comes to choosing a document format for tracking employee earnings and payments, businesses are often faced with the decision between free and paid options. Both choices come with their own set of advantages and limitations, depending on the specific needs of the business. While free formats are often accessible and easy to use, paid options may offer more advanced features and customization options. Understanding the differences can help you choose the right solution for your business.

Here’s a breakdown of the key differences between free and paid formats for creating employee compensation records:

Advantages of Free Formats

- Cost-Effective: The most obvious benefit is that free formats come at no cost, making them an attractive option for small businesses or startups with limited budgets.

- Ease of Access: Free formats are widely available online and can often be downloaded immediately without the need for a subscription or payment.

- Basic Features: These options typically cover the fundamental information required for creating compensation records, such as employee details, hours worked, and pay rates.

Limitations of Free Formats

- Limited Customization: Free formats may lack advanced customization options, limiting your ability to tailor them to your specific business needs.

- Basic Design: The design and layout of free formats are often minimal and may not provide the level of professionalism or branding that some businesses require.

- Lack of Advanced Features: Free options may not include helpful features like automated calculations, integration with accounting systems, or recurring billing setups.

Advantages of Paid Formats

- Advanced Customization: Paid options often allow for a higher degree of customization, enabling you to tailor the document layout, add specific fields, and incorporate your company branding.

- Professional Design: These formats typically come with polished, business-ready designs that present a professional appearance to employees.

- Additional Features: Paid solutions often include advanced features such as automated calculations, integration with payroll systems, and ongoing support.

Limitations of Paid Formats

- Cost: Paid formats typically come with a one-time or subscription fee, which may not be suitable for businesses on a tight budget.

- Learning Curve: Some paid options may have a steeper learning curve or require additional software, which could require extra time and resources to master.

Ultimately, the choice between free and paid formats depends on your business’s needs

Best Practices for Salary Invoice Formatting

Properly formatting compensation records is essential for clarity, professionalism, and accuracy. A well-organized document not only makes it easier for employees to understand their earnings but also ensures that important details are clearly communicated. Whether you are preparing a single record or processing multiple documents, adhering to a set of best practices can improve the overall quality and consistency of your payroll process.

Below are some key guidelines for effectively formatting compensation records that are both professional and easy to navigate:

1. Consistent Layout and Structure

Having a consistent and predictable layout helps both employers and employees quickly locate important information. Use the same structure for each document, including sections for employee details, payment breakdown, deductions, and final amount. This ensures that all necessary elements are present and easy to find.

- Use clear headings to separate each section, such as “Employee Details,” “Payment Breakdown,” and “Deductions.”

- Maintain alignment throughout the document. Keep all numbers, dates, and text aligned for easy reading.

2. Ensure Readability and Legibility

Readability is essential for any business document. The goal is for employees to easily review their compensation details without confusion. Choose clear, legible fonts and appropriate font sizes, making sure the document is easy to read both on screen and in print.

- Choose simple fonts like Arial, Helvetica, or Calibri for a clean, professional look.

- Use adequate font size (10–12 pt) for the body text to ensure readability.

- Avoid clutter by leaving enough white space between sections, making the document easy to navigate.

3. Include Accurate and Detailed Information

Accuracy is key when creating compensation documents. Ensure all fields, from employee name to payment totals, are filled out correctly. Include comprehensive details for the period, hourly rates, overtime, and any applicable deductions.

- Provide detailed breakdowns of gross pay, deductions, and net pay.

- Verify all calculations for accuracy, particularly for overtime and bonus pay, to prevent errors.

- List all deductions separately, showing taxes, benefits, and other withholdings clearly.

4. Use Clear and Simple Language

Keep the language simple and professional. Avoid jargon or overly technical terms that could confuse the reader. The goal is to ensure that every employee can easily understand their payment record.

- Avoid complex terms and use plain language whenever possible.

- Be transparent about the payment process and clearly explain any deductions or adjustments made.

5. Incorporate Your Company Branding

Including your company logo, contact details, and other branding e

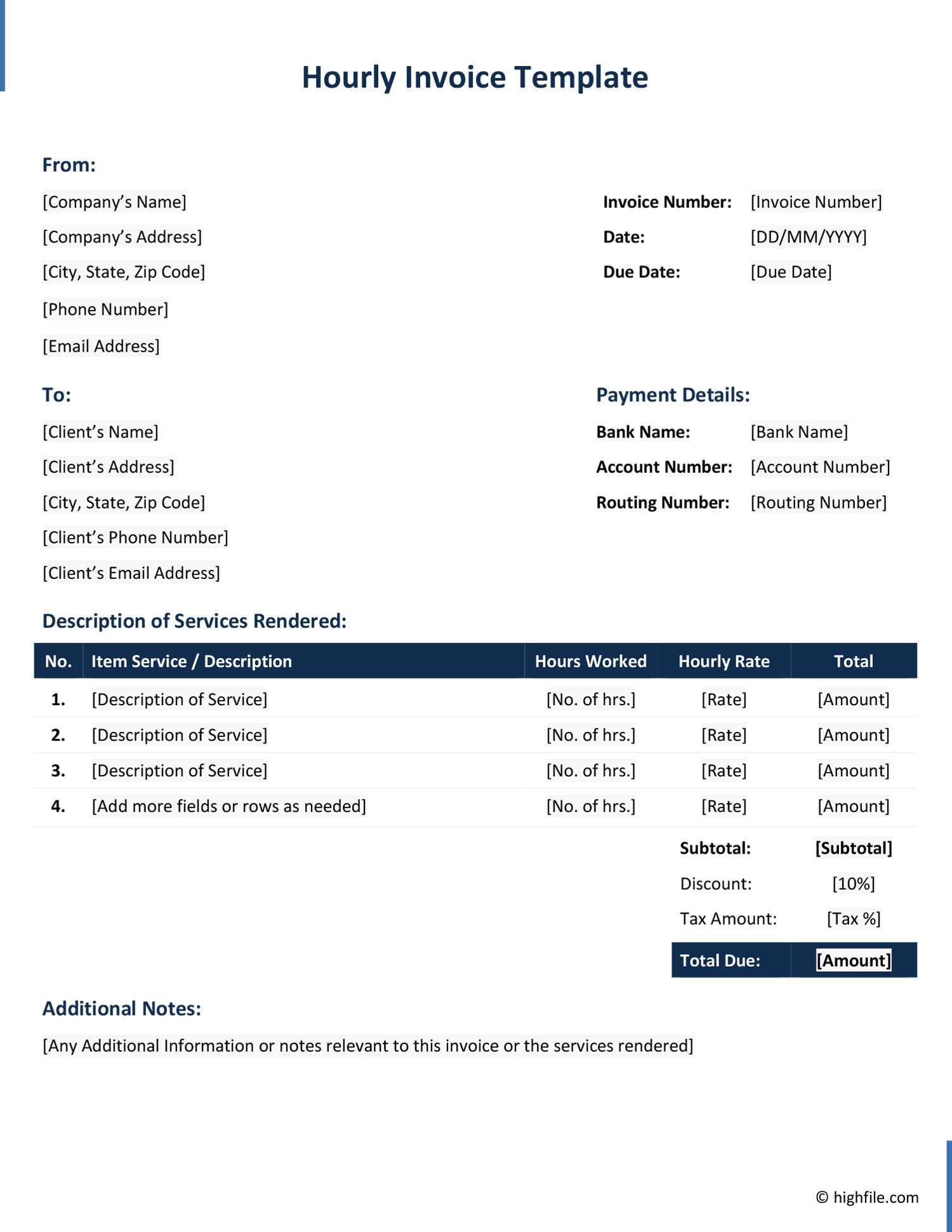

How to Calculate Employee Salary in Word

Calculating employee compensation accurately is crucial for businesses to ensure timely and correct payments. When preparing records manually, you may need to use specific formulas and data to determine an employee’s earnings. With the right tools and structure, the calculation process can be simplified, allowing for quick updates and transparency. In this section, we’ll walk through how to calculate employee compensation using a document editor, ensuring all details are accurately presented.

Step 1: Gather Necessary Information

Before you can start calculating the total payment, it is important to collect all relevant data. The key pieces of information you’ll need include:

- Hourly rate or fixed salary: Determine whether the employee is paid hourly or on a fixed salary basis.

- Hours worked: For hourly workers, calculate the total number of hours worked in the pay period.

- Overtime (if applicable): If the employee worked overtime, ensure to calculate the additional hours and the overtime rate.

- Deductions: List any applicable deductions, such as taxes, benefits, or retirement contributions.

Step 2: Use Basic Formulas for Calculation

Once you have all the necessary details, you can calculate the total earnings. If the employee is hourly, use the following formula:

Total Earnings = Hourly Rate × Hours Worked

For employees on a fixed salary, you’ll calculate the salary based on the payment period:

Total Earnings = Monthly Salary (or agreed pay rate) for the period

If there are overtime hours, use this formula to calculate the additional pay:

Overtime Pay = Overtime Rate × Overtime Hours Worked

Finally, calculate the deductions and subtract them from the total earnings:

Net Pay = Total Earnings – Deductions

Step 3: Input Calculations into a Document

Once the calculations are made, input them into the compensation record. For easy tracking and clarity, it’s best to separate the following sections:

- Gross Pay: Display the total amount earned before any deductions.

- Deductions: List all deductions clearly, such as taxes, insurance, or retirement contributions.

- Net Pay: Show the final amount the employee will receive after deductions.

By using a document editor with structured fields and formulas, you can quickly calculate and update compensation records with minimal effort, ensuring accuracy every time.

Maintaining Professionalism in Invoices

Creating accurate and professional records of employee compensation is essential for maintaining transparency, trust, and clarity between employers and employees. The way you present these documents reflects the organization’s attention to detail and commitment to professionalism. A well-organized document not only provides important payment information but also enhances your company’s reputation. Ensuring that these records are consistently formatted and easy to read is key to demonstrating a high level of professionalism.

Key Principles for Professional Documents

There are several principles to follow in order to ensure that compensation records maintain a professional appearance and meet all necessary standards:

- Accuracy: All calculations and details must be precise, including hours worked, rates, deductions, and total payment. Double-check numbers to avoid errors.

- Clarity: Make sure that the document is easy to read, with clear section titles, legible fonts, and consistent formatting. Avoid cluttering the document with excessive text or unnecessary information.

- Consistency: Use the same layout and style for every document, ensuring that employees know exactly where to find the information they need. Consistent design adds to the professionalism of the document.

Best Practices for Formatting and Design

Design plays a critical role in maintaining professionalism in compensation records. The visual layout should be clean, organized, and easy to navigate. Here are some key practices to follow:

- Simple and Clear Design: Use a simple, readable font like Arial or Calibri. Avoid overly decorative fonts that can distract from the content.

- Effective Use of Headings: Use headings to break the document into logical sections, such as employee details, payment breakdown, deductions, and final payment.

- Professional Branding: If applicable, include your company logo, address, and contact details. This adds a personal and professional touch to each document.

Maintaining Confidentiality

Maintaining the confidentiality of the information within these documents is crucial. Ensure that sensitive details, such as personal employee information and financial data, are protected. Documents should be shared only with authorized personnel, and secure methods should be used for electronic distribution.

By following these practices, businesses can ensure that their compensation records are not only accurate and reliable but also reflect a high standard of professionalism that instills confidence in employees.

Integrating Payroll Data into Templates

Efficiently managing employee compensation requires a seamless process that integrates all necessary payroll data into the final payment records. By automating data entry and embedding key information directly into structured documents, businesses can streamline the entire payroll process, ensuring accuracy and reducing the chances of human error. Integrating payroll data into pre-designed structures not only saves time but also improves the consistency of payment reports, making it easier for both employers and employees to understand compensation details.

One of the most effective ways to integrate payroll data is by utilizing customizable formats that can automatically populate with real-time information. Here’s how you can integrate payroll data into these formats efficiently:

1. Use Dynamic Fields for Data Integration

Many payroll systems allow the automatic export of data into various document formats. This means that employee-specific information, such as name, hours worked, pay rate, and deductions, can be imported directly into the payment record. By using dynamic fields, businesses can ensure that each document is populated with the latest payroll information without needing to manually enter data each time.

For example, you can have a document that automatically pulls data from your payroll system, such as:

| Field | Example Data |

|---|---|

| Employee Name | John Doe |

| Hours Worked | 160 |

| Pay Rate | $20/hr |

| Gross Pay | $3,200 |

| Deductions | $400 |

| Net Pay | $2,800 |

2. Automate Calculations for Efficiency

Instead of manually calculating pay, deductions, or overtime, you can automate these calculations directly within your structure. For example, when an employee’s hourly rate and hours worked are input, the system can automatically calculate the gross pay. Similarly, deductions for taxes, benefits, and other withholdings can be automatically deducted based on predefined rules.

- Gross Pay Calculation: Hourly Rate × Hours Worked

- Deductions: Taxes, insurance, retirement contributions, etc.

- Net Pay: Gross Pay – Deductions

3. Ensure Accurate Data Synchronization

When integrating payroll data, it’s essential that the information is synchronized accurately between the payroll system and the document. Any errors in data synchronization can result in discrepancies that affect the payment process. Regularly updating payroll data and ensuring compatibility between systems can help mitigate this risk.

By leveraging these automated data integration strategies, businesses can create streamlined, accurate, and professional compensation records with minimal manual effort. This not only saves time but also improves the accuracy and reliability of payment documentation.

Legal Requirements for Salary Invoices

When preparing compensation records for employees, it is crucial to ensure that they comply with legal regulations. These documents are not just a formality; they serve as official records that can be used for tax purposes, dispute resolution, and compliance with labor laws. Employers must follow specific guidelines to ensure that the information provided is accurate, transparent, and meets the legal standards set by authorities. Failing to meet these requirements could lead to legal complications or penalties.

Here are the key legal considerations when preparing compensation records:

1. Employee Identification Details

One of the first pieces of information required by law is the employee’s identification details. This ensures that the document is uniquely tied to the individual and can be referenced easily in case of audits or disputes. Employers must include:

- Employee Name: Full legal name of the employee.

- Employee Address: Residential address or the address associated with employment.

- Tax Identification Number (TIN): A unique number that links the employee to the tax system.

2. Accurate Payment Details

Employers must clearly indicate the compensation the employee is entitled to. This includes both the gross and net amounts, as well as any deductions that apply. Legal guidelines require transparency about how the final amount is calculated. Key details include:

- Payment Period: The start and end dates for the period in which the payment was earned.

- Gross Pay: The total amount earned before any deductions.

- Deductions: A breakdown of taxes, benefits, and other withholdings that have been applied.

- Net Pay: The final amount the employee will receive after deductions.

3. Compliance with Minimum Wage Laws

Employers must ensure that compensation meets the minimum wage laws for their jurisdiction. These laws vary depending on the location of the business, the employee’s role, and whether the worker is classified as exempt or non-exempt. It is important to review both federal and local wage regulations to avoid legal issues.

4. Overtime and Special Pay Rules

For employees eligible for overtime or special pay rates, it is necessary to comply with the relevant labor laws. Compensation records should include:

- Overtime Pay: Clearly state the number of overtime hours worked and the corresponding pay rate, which is often higher than the standard hourly rate.

- Bonuses or Commission: Any bonuses, commissions, or special incentives should be listed separately with their corresponding amounts.

5. Deductions and Withholdings

Deductions such as taxes, social security contributions, and health benefits must be clearly shown and justified in the document. Employees have the legal right to understand how their compensation is being adjusted and what is being withheld from their earnings. It’s essential to itemize these deductions for transparency.

6. Record Keeping and Access to Information

Employers are legally required to maintain records of employee compensation for a set number of years, depending on the jurisdiction. In some countries, these records must be kept for a minimum of three to seven years. Employees also have the right to access their compensation records upon request.

Ensuring that compensation records are properly formatted and comply with legal requirements helps to protect both t

Editing and Sharing Salary Invoices

Once employee compensation records are generated, it is important to ensure that they are easily editable and shareable while maintaining accuracy and confidentiality. Modifications to these records may be necessary for various reasons, such as correcting errors, updating payment details, or incorporating last-minute changes. Additionally, sharing these documents securely is crucial for protecting sensitive employee information. This section will explore how to efficiently edit and distribute compensation records, ensuring they remain professional and secure.

Editing Compensation Records

When changes are needed, it is essential to make sure that the document reflects the most current and accurate information. Here are some best practices for editing:

- Check for Accuracy: Always verify that the employee’s details (name, pay rate, hours worked, etc.) are correct before making any changes.

- Update Payment Information: If there are adjustments to be made (e.g., overtime hours, deductions), ensure that all relevant fields are updated with the correct amounts.

- Keep a Revision History: It’s important to track changes to documents for transparency. Use version control if possible, so that you can reference previous versions if needed.

- Clear Formatting: When editing, ensure that the document remains well-organized and readable. Avoid cluttering the document with too much text or confusing formats.

Sharing Compensation Records

Once the document has been finalized, securely sharing the compensation details with the employee is the next important step. Here’s how to do so effectively:

- Email Securely: When sending compensation records via email, use encrypted emails or password-protected documents to ensure the data remains confidential.

- Cloud Storage: If sharing through cloud services (e.g., Google Drive, Dropbox), ensure that proper access controls are in place to limit who can view or edit the document.

- Printed Copies: If providing printed copies, make sure the document is stored securely and distributed directly to the employee to avoid unauthorized access.

- Digital Signatures: For added security, consider using digital signatures to verify the authenticity of the document and prevent unauthorized changes.

Legal Considerations for Sharing

In addition to securing the document, employers must be aware of legal requirements related to sharing compensation details. These requirements may vary by jurisdiction, but generally, it is necessary to:

- Maintain Confidentiality: Never share compensation records with unauthorized individuals or external parties.

- Provide Access on Request: Employees may request a copy of their compensation records. Employers should ensure that these requests are fulfilled promptly and accurately.

By following these best practices for editing and securely sharing employee compensation records, businesses can ensure that all necessary adjustments are made efficiently while protecting sensitive information. This approach not only fosters trust but also ensures compliance with relevant legal and organizational standards.

How to Secure Salary Invoice Documents

Securing compensation records is a critical aspect of managing employee information. These documents contain sensitive personal and financial data that must be protected to prevent unauthorized access and potential misuse. Whether these records are stored electronically or in physical form, implementing effective security measures is essential for safeguarding employee privacy and maintaining compliance with legal regulations. This section will cover best practices for securing these documents and ensuring that they are only accessible to authorized personnel.

1. Secure Storage of Digital Files

When storing compensation records electronically, it is crucial to use secure systems that offer encryption and access control. Here are some strategies for securing digital files:

- Use Encryption: Encrypt files both when they are stored and when they are transmitted over the internet. This ensures that even if the files are intercepted, the data will remain unreadable without the proper decryption key.

- Secure Cloud Storage: If using cloud storage solutions, choose a provider that offers strong encryption and allows you to control who can access the documents. Always enable two-factor authentication (2FA) for added security.

- Password Protection: Use complex passwords and password-protect sensitive files before sharing them electronically. Ensure that only authorized personnel have access to the passwords.

- Regular Backups: Regularly back up digital files to secure servers or external drives. In case of data loss or corruption, backups ensure you can recover documents safely.

2. Secure Sharing of Documents

Sharing employee compensation records requires special attention to ensure that sensitive information is not exposed to unauthorized individuals. Here are some tips for securely sharing these documents:

- Use Encrypted Email: When sending documents via email, use encrypted email services or tools that allow for secure transmission. Avoid sending sensitive information in plain text emails.

- Restrict Access: If sharing through cloud platforms, set permissions so that only specific individuals or groups can view or edit the documents. Regularly review and update access permissions to ensure they are still appropriate.

- Digital Signatures: To verify the authenticity of the document and ensure it has not been tampered with, consider using digital signatures. These verify the origin and integrity of the document during transmission.

3. Secure Physical Copies

If compensation records are maintained in physical form, additional precautions must be taken to prevent unauthorized access. Consider the following measures for securing paper records:

- Locked Storage: Store physical copies of compensation records in locked cabinets or secure rooms with restricted access. Only authorized personnel should have the keys or access codes.

- Limit Physical Access: Restrict access to paper documents to those who absolutely need to view them. Regularly audit who has access to these records.

- Shredding Documents: If documents are no longer needed, shred them securely. This ensures that sensitive information is not discarded carelessly and cannot be reconstructed by unauthorized parties.

4. Employee Awareness and Training

One of the most effective ways to secure compensation records is by ensuring that all employees understand the importance of data security and the steps they can take to protect sensitive information. Provide regular training on how to handl

Top Resources for Salary Templates

When managing employee compensation documentation, it is essential to have access to reliable and customizable resources that simplify the creation of accurate records. Various tools and platforms are available to assist employers in generating professional and compliant documents quickly. These resources can help automate calculations, provide structure, and ensure consistency across all records, ultimately saving time and reducing errors.

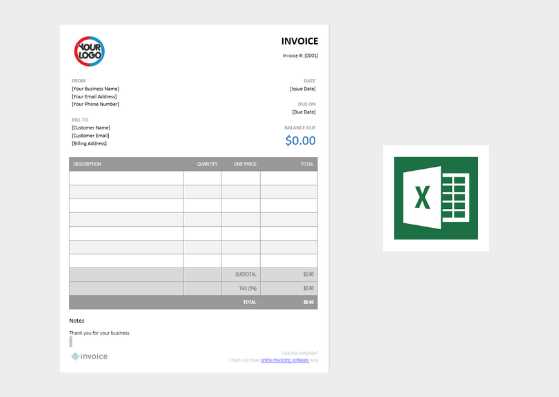

1. Microsoft Office Templates

Microsoft Office offers a wide range of free and premium document creation tools that can be tailored to your specific needs. With built-in templates for generating compensation records, users can quickly select a format and start filling in the necessary details. Microsoft Office allows for easy editing and customization to ensure that documents meet company standards.

- Flexibility: Easily modify templates to suit different compensation structures and roles.

- Integration: Seamlessly integrate with other Microsoft tools, such as Excel for calculation and data management.

- User-Friendly: Simple and intuitive interface for quick document creation.

2. Google Docs Templates

Google Docs offers a range of free online templates for creating employee compensation records. With the added benefit of cloud storage, Google Docs allows users to work from anywhere and collaborate in real time. It’s an excellent resource for businesses that require remote access and need to share documents with team members instantly.

- Cloud Access: Store documents in the cloud for easy access across multiple devices.

- Collaboration: Share documents with others and collaborate in real time to make necessary updates.

- Customizable: Google Docs templates can be fully customized to match company branding and format requirements.

3. Online Compensation Management Tools

Specialized software platforms designed for payroll and compensation management provide robust resources for creating and managing compensation records. These tools often offer built-in templates, auto-calculation features, and compliance checks to ensure that all documents are accurate and meet legal standards.

- Automation: Automatically calculate payments, deductions, and benefits based on employee data.

- Legal Compliance: Ensure documents are in line with local, state, and federal compensation laws.

- Centralized Data: Store employee compensation records in one secure, easily accessible platform.

4. Template Marketplaces

If you’re looking for professionally designed and customizable compensation record templates, online marketplaces can be an excellent resource. Websites such as Template.net and Envato Elements provide a variety of options for businesses looking for premium templates designed by experts.

- High-Quality Designs: Access professionally designed templates tailored to business needs.

- Variety: Choose from a wide range of designs that suit different business industries and compensation structures.

- Customization: Templates are easy to edit and can be tailored to specific organizational requirements.

5. Freelance Platforms

If you prefe