Easy Salary Invoice Template in Excel for Efficient Payroll Management

Organizing and tracking employee compensation can be a challenging task for businesses of all sizes. It’s essential to have a structured approach that simplifies the process, reduces errors, and saves valuable time. Using a well-designed tool can streamline these operations, ensuring that everything from wages to deductions is accurately calculated and documented.

With the right system, it’s possible to automate calculations, maintain transparency, and generate detailed reports that meet both business and legal requirements. In this section, we will explore how to effectively manage payment records, offering practical guidance on setting up a system that works for your company’s needs.

Whether you are a small business owner or a large enterprise, having a reliable method to manage financial transactions related to compensation is crucial for maintaining smooth operations. Embracing digital solutions can help you keep track of payments, minimize mistakes, and stay organized.

Salary Invoice Template Excel for Beginners

For those new to managing employee payments, getting started can seem overwhelming. Having a clear and straightforward system is crucial to ensure accuracy and efficiency. This section will guide you through the basics of setting up a document that tracks earnings, deductions, and other relevant information without requiring advanced skills or software knowledge.

At its core, the goal is to create a record that can easily calculate wages, organize essential data, and generate reports as needed. It’s a practical solution that helps beginners maintain control over financial processes and avoid common errors.

Here are the key steps to follow for beginners:

- Choose the Right Platform: Select a user-friendly software that allows for easy customization and data entry.

- Input Basic Information: Start by entering the employee’s details such as name, position, and payment period.

- Set Up Calculation Fields: Create simple formulas that automatically calculate earnings based on hourly rates or fixed salaries.

- Track Deductions and Taxes: Ensure you include sections for any mandatory deductions or contributions to avoid errors.

- Format for Clarity: Organize the document with clear labels and headings to make it easy to read and understand.

By following these basic steps, beginners can create a reliable system for managing payments that is both efficient and easy to use. It’s an essential skill for any business looking to keep financial processes smooth and error-free.

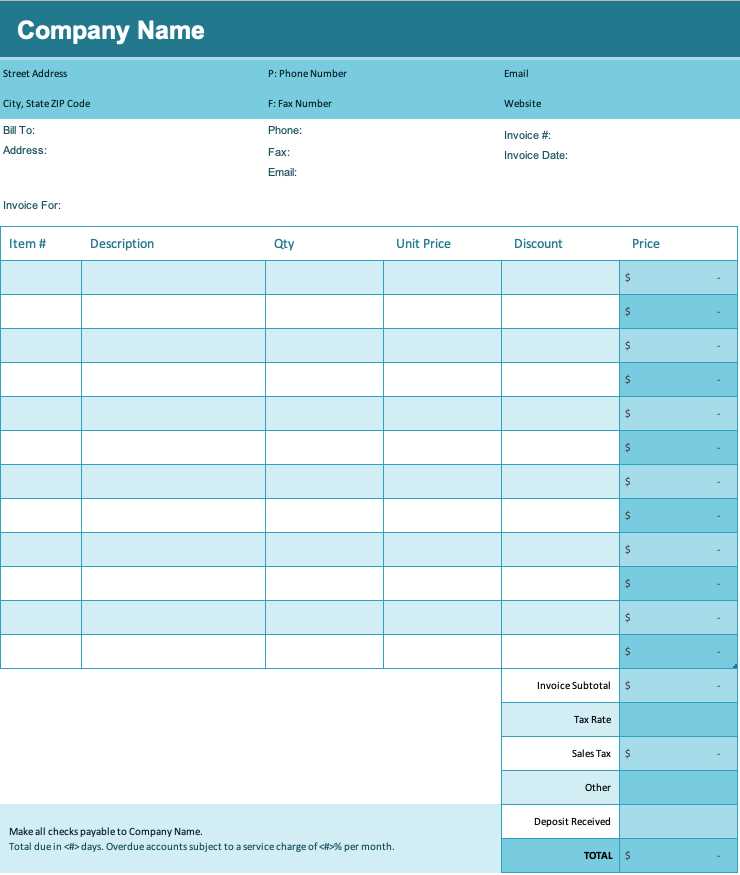

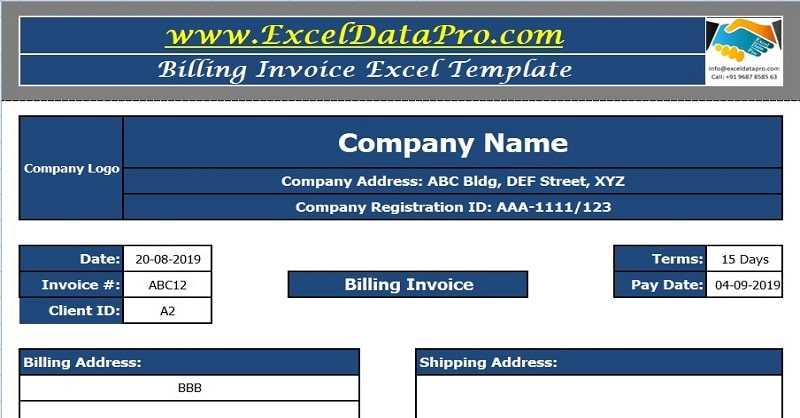

How to Customize an Excel Template

Customizing a document for tracking employee payments is essential to match your specific business needs. A pre-built structure is a great starting point, but tailoring it ensures that it works perfectly for your company. Whether it’s adding new fields, adjusting calculations, or changing the layout, customizing allows you to optimize the document to fit your workflow and requirements.

Adjusting Layout and Structure

The first step in customization is adjusting the layout to make the document more readable and functional. You can change column widths, add or remove sections, and rearrange elements to suit your needs. For example, you might want to add space for bonuses or overtime, or change the headers to reflect your company’s specific terminology.

Adding Formulas and Automating Calculations

One of the key benefits of using a digital system is the ability to automate calculations. You can set up formulas to automatically calculate total earnings, deductions, and taxes based on the data entered. This not only saves time but also reduces the chances of errors in the calculation process. Excel’s built-in functions, such as SUM, IF, and VLOOKUP, can help you easily customize the document to calculate totals and generate reports.

By customizing the document in this way, you’ll have a more efficient and accurate system that suits your specific needs. It’s an important step to make sure the tool fits your business processes perfectly.

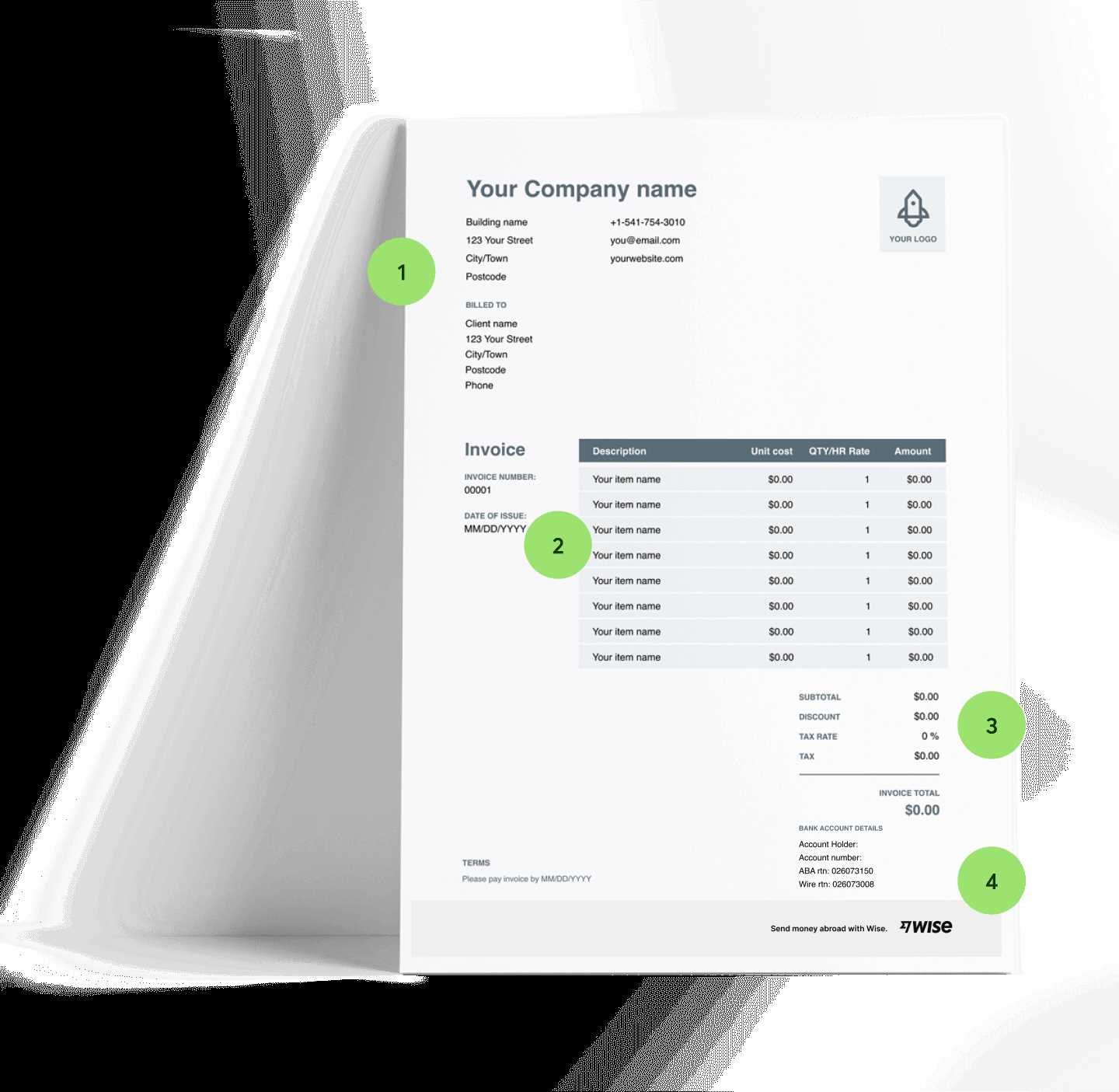

Step-by-Step Guide to Salary Invoicing

Creating a structured document for employee payments is a critical task for maintaining financial accuracy and organization. This guide will walk you through the essential steps needed to set up and manage a payment record system from start to finish. By following these steps, you’ll ensure that all necessary information is captured, calculated correctly, and ready for use.

Here is a step-by-step guide to help you get started:

- Step 1: Gather Employee Information

- Collect basic details such as employee name, position, and pay period.

- Ensure you have any other relevant information like bonuses, allowances, or deductions.

- Step 2: Set Up Payment Details

- Decide whether the payments are hourly or fixed rates.

- Input rates, hours worked, or flat amounts in the appropriate fields.

- Step 3: Add Deductions and Taxes

- Include sections for mandatory deductions such as taxes, insurance, or pension contributions.

- Make sure that each deduction is calculated correctly based on the relevant rates or percentages.

- Step 4: Automate Calculations

- Use basic functions to automate the calculation of total earnings and deductions.

- Ensure that your system updates totals automatically when any changes are made to the input data.

- Step 5: Finalize and Review

- Double-check all details for accuracy.

- Review the document to make sure everything is clear and properly formatted.

By following these steps, you’ll have a well-organized system for managing payments that is easy to update, track, and use for reporting purposes.

Key Features of Excel Salary Templates

When it comes to managing employee payments, a well-structured document can significantly improve efficiency and reduce errors. The ability to customize and automate certain processes makes digital systems invaluable for businesses of any size. In this section, we will explore the essential features that make these payment management systems both effective and user-friendly.

Automatic Calculations and Formulas

One of the most important aspects of any payment tracking system is the ability to automatically calculate totals. This feature ensures accuracy and saves time by eliminating the need for manual calculations. Commonly used functions include:

- SUM: Automatically totals earnings, deductions, or any other column of numbers.

- IF: Enables conditional calculations, such as determining different tax rates based on income.

- VLOOKUP: Helps retrieve data from other sections of the document, such as employee rates or deductions.

Customizable Fields and Layout

Another key feature is the flexibility to customize the layout and fields according to your needs. This allows for adjustments based on the type of employees or specific requirements for your company. You can add sections for:

- Overtime or bonuses

- Tax calculations

- Employee benefits

- Additional allowances or deductions

This level of customization ensures that all relevant data is captured and displayed clearly, making it easier to manage and track payments accurately.

Benefits of Using Excel for Invoices

Utilizing digital tools for managing employee payments provides businesses with a number of advantages. These tools can simplify the process of organizing and calculating financial information, ultimately improving accuracy and efficiency. With flexible and customizable options, spreadsheets are a great solution for those looking to streamline their payment management system.

Efficiency and Time-Saving

One of the primary benefits of using spreadsheets for managing payments is the efficiency it brings. By automating calculations, businesses save time that would otherwise be spent on manual data entry and math. Automatic calculations for totals, deductions, and taxes make the entire process quicker and less prone to error, allowing your team to focus on more critical tasks.

Cost-Effective and Accessible

Another significant advantage is the affordability of these tools. Unlike specialized software, most spreadsheet programs are widely available and come at little or no cost. This makes them an excellent option for small businesses or startups with limited budgets. Additionally, spreadsheets can be easily accessed, updated, and shared across teams, making them a convenient solution for managing financial records remotely.

Overall, using spreadsheets for financial management offers a powerful way to stay organized, improve accuracy, and save time–all without breaking the bank.

Common Mistakes in Salary Invoice Creation

While managing employee payments may seem straightforward, there are several common mistakes that can lead to errors in financial records and potential issues down the line. Understanding these pitfalls is crucial for ensuring that your payment management process runs smoothly and efficiently. By addressing these errors, you can improve the accuracy and reliability of your system.

Incorrect Calculations

One of the most frequent mistakes is improper calculations. Whether it’s the total amount, taxes, or deductions, errors in math can cause significant discrepancies. These mistakes often arise when formulas aren’t set up properly or when data is entered incorrectly. To avoid this, ensure that your formulas are tested and reviewed regularly to ensure accurate computations for earnings and deductions.

Missing or Incomplete Information

Another common issue is missing or incomplete data. Omitting important details such as employee hours, pay rates, or deduction amounts can lead to confusion or inaccuracies. It’s essential to ensure that all required fields are completed and updated regularly. Double-checking the information before finalizing the document can help avoid any oversight.

By being aware of these common mistakes, you can streamline the process and ensure that your payment management system remains accurate and efficient.

Top Excel Functions for Payroll Templates

Utilizing the right functions can significantly improve the effectiveness of your payment management system. When handling employee compensation, it’s crucial to automate calculations to ensure accuracy and efficiency. The right set of tools can help streamline the entire process, from computing earnings to calculating deductions and taxes.

SUM Function

The SUM function is one of the most widely used features in payment management. It allows you to quickly add up all values in a specific range, which is especially useful for calculating total earnings or the sum of deductions. For example, you can use it to sum up hourly rates for different employees or to calculate total deductions over a specific period.

IF Function

The IF function is essential for making conditional calculations. It can be used to determine whether certain criteria are met, such as whether an employee qualifies for a bonus or a tax break. This function allows you to set up a system where certain actions are taken based on the data you input, ensuring your system adapts to different payment conditions.

These functions, along with others like VLOOKUP and ROUND, can help create a more automated and accurate system for managing payments. By integrating these features, you can ensure your records are precise and up to date with minimal manual effort.

Top Excel Functions for Payroll Templates

Utilizing the right functions can significantly improve the effectiveness of your payment management system. When handling employee compensation, it’s crucial to automate calculations to ensure accuracy and efficiency. The right set of tools can help streamline the entire process, from computing earnings to calculating deductions and taxes.

SUM Function

The SUM function is one of the most widely used features in payment management. It allows you to quickly add up all values in a specific range, which is especially useful for calculating total earnings or the sum of deductions. For example, you can use it to sum up hourly rates for different employees or to calculate total deductions over a specific period.

IF Function

The IF function is essential for making conditional calculations. It can be used to determine whether certain criteria are met, such as whether an employee qualifies for a bonus or a tax break. This function allows you to set up a system where certain actions are taken based on the data you input, ensuring your system adapts to different payment conditions.

These functions, along with others like VLOOKUP and ROUND, can help create a more automated and accurate system for managing payments. By integrating these features, you can ensure your records are precise and up to date with minimal manual effort.

Formatting Your Payment Record in Excel

Properly formatting your payment record is essential for clarity and ease of use. A well-structured document not only looks professional but also ensures that all relevant information is easily accessible and readable. In this section, we will explore key tips for formatting your financial record in a way that improves both functionality and presentation.

- Organize Data into Columns: Ensure that your data is neatly organized into columns for each specific category (e.g., employee name, payment period, hours worked, rate, total payment, etc.). This helps in easy navigation and quick data entry.

- Use Clear Headings: Label each column clearly, using bold or colored text to distinguish them. This makes it easier for anyone reviewing the document to understand the information at a glance.

- Apply Number Formatting: Use number formatting to display monetary values correctly. You can apply currency formatting to ensure that all amounts are displayed with the correct symbols and decimal places.

- Highlight Key Data: Use background shading or bold text for important figures, such as total payment or deductions, to make them stand out in the document.

- Implement Conditional Formatting: Conditional formatting can be used to highlight cells based on specific criteria, such as overdue payments or discrepancies in data. This helps draw attention to any issues that may need to be addressed.

By following these formatting tips, you will create a clean and easy-to-understand financial document that ensures accuracy and professionalism in managing payments. The cleaner your records, the easier it will be to track and review the details as needed.

Adding Tax Calculations to Salary Templates

Including tax calculations in your payment management system is essential for ensuring compliance and accuracy. Properly accounting for taxes helps avoid errors and ensures that employees’ paychecks reflect the correct deductions. In this section, we will discuss how to seamlessly incorporate tax calculations into your financial records to streamline the process.

1. Understanding Tax Rates

The first step is to understand the tax rates applicable to the employees. These can vary based on location, income level, and other factors. Be sure to gather all necessary tax information to accurately calculate the amount to be deducted.

2. Implementing Tax Calculation Formulas

Once the tax rates are known, you can apply formulas to calculate the tax amounts. For example, if the tax rate is a percentage of total earnings, you can use the following formula:

=Total Earnings * Tax Rate

By incorporating this simple formula into your system, you can automatically calculate the tax amount to be deducted for each employee.

3. Handling Multiple Tax Deductions

In some cases, employees may have multiple types of deductions (e.g., federal, state, local taxes). It is important to track these deductions separately and apply the correct rates to each category. You can create different columns for each tax type and use appropriate formulas to ensure accuracy.

4. Reviewing the Results

After the calculations are applied, review the deductions to ensure everything is correct. Double-check that the tax rates align with current regulations and that the formulas are correctly applied to all relevant data points.

By adding tax calculations into your payment records, you can automate deductions and ensure that all necessary taxes are accounted for in a timely and accurate manner.

Automating Salary Calculations in Excel

Automating calculations can save significant time and reduce human error when managing compensation. By setting up formulas and functions, you can ensure that your financial records are accurate, up-to-date, and processed efficiently. In this section, we’ll show you how to streamline the calculation process and set up an automated system for managing earnings and deductions.

Using Formulas to Calculate Total Earnings

One of the most basic and effective ways to automate salary calculations is by using simple formulas. For example, you can calculate the total compensation for an employee by multiplying the number of hours worked by their hourly rate. This can be done by setting up the following formula:

=Hours Worked * Hourly Rate

This formula can be copied across multiple rows to automatically calculate the total earnings for each employee without needing to input the calculation manually.

Setting Up Automatic Deduction Calculations

In addition to calculating total earnings, you can also automate deduction calculations, such as taxes or benefits. By setting up conditional formulas, you can apply different tax rates or deduction percentages based on the amount an employee earns. For example:

=IF(Total Earnings > 5000, Total Earnings * 0.15, Total Earnings * 0.10)

This formula checks whether an employee’s total earnings exceed a specific threshold and applies the correct deduction rate accordingly. By using this method, deductions are automatically adjusted based on the input data.

| Employee Name | Hours Worked | Hourly Rate | Total Earnings | Tax Deduction | Net Pay |

|---|---|---|---|---|---|

| John Doe | 160 | $20 | $3200 | $320 | $2880 |

| Jane Smith | 170 | $22 | $3740 | $374 | $3366 |

As demonstrated in the table above, by using automated formulas, the total earnings, tax deductions, and net pay are calculated automatically, streamlining the entire process and reducing the risk of errors.

How to Protect Your Payment Records

When managing financial data, it’s crucial to ensure that your documents remain secure from unauthorized access or accidental alterations. Protecting your payment records not only safeguards sensitive information but also helps maintain the integrity of your calculations and records. In this section, we will explore several methods to secure your payment management documents and prevent tampering.

- Set a Password for Your Document: One of the most effective ways to protect your document is by setting a password. This ensures that only authorized individuals can access or modify the data. To do this, go to the file settings and enable password protection before saving your file.

- Restrict Editing Permissions: You can restrict who can edit specific sections of your document while allowing others to view it. This is useful when sharing documents with multiple team members. Use the “Protect Sheet” feature to prevent others from changing important cells or formulas.

- Enable File Encryption: For added security, you can enable encryption on your document. This ensures that the file is not only password-protected but also encrypted, making it unreadable without the proper decryption key.

- Use Digital Signatures: Adding a digital signature to your file helps verify its authenticity. This feature provides a secure way to ensure that the document has not been altered since it was signed, offering an additional layer of trust and protection.

- Back Up Your Data: Regularly back up your file to ensure that you have a copy in case of accidental loss or corruption. Cloud storage services and external drives offer a convenient way to store backups securely.

By applying these methods, you can significantly reduce the risk of unauthorized access or accidental data loss, keeping your financial records secure and trustworthy. Regularly updating your protection settings ensures ongoing security as your documents evolve.

Best Practices for Document Design

Designing a well-organized document for managing financial data is essential for ensuring clarity, ease of use, and efficiency. A well-structured sheet allows users to input data, perform calculations, and track information with minimal errors and maximum ease. In this section, we will highlight best practices for creating an efficient document that facilitates accurate record-keeping and improves overall workflow.

Keep It Simple and Clean

One of the key principles in designing any functional document is simplicity. Over-complicating the layout can create confusion and increase the likelihood of errors. Here are some tips to keep your design clean:

- Limit the number of columns and rows: Include only the necessary fields to minimize clutter and focus on essential data.

- Use consistent formatting: Maintain uniform fonts, cell sizes, and colors throughout the document for a professional look and ease of reading.

- Avoid excessive use of colors: Stick to a limited color palette that highlights important information, such as totals or key sections, without overwhelming the user.

Enhance Usability with Automation

Automating calculations and processes can significantly reduce the chances of human error and make data entry more efficient. Follow these guidelines to automate tasks:

- Use formulas: Incorporate built-in functions like SUM, AVERAGE, and IF to automate calculations and ensure accuracy.

- Apply conditional formatting: Set up automatic highlighting to draw attention to specific data, such as overdue payments or exceeded limits.

- Lock important cells: Protect cells with formulas or vital information to prevent accidental modifications.

By following these best practices, you can create a functional, easy-to-use document that simplifies financial tracking and enhances productivity. The goal is to design a tool that is not only efficient but also user-friendly for anyone handling the data.

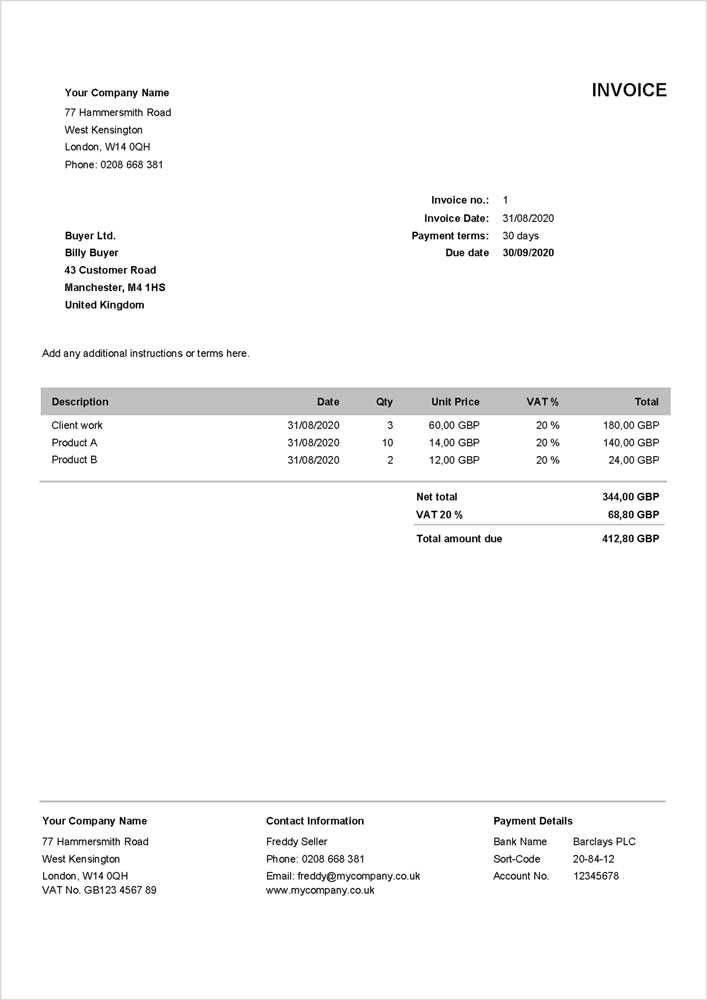

How to Create a Professional Payment Record

Creating a professional document for financial transactions is essential for maintaining clear and organized records. Such a document serves not only as a proof of the agreement but also helps in tracking payments, terms, and overall financial management. In this section, we will guide you through the steps to create a polished, well-structured record that meets professional standards and ensures accuracy.

Include Essential Information

The first step to creating a professional document is ensuring it contains all necessary details. These include both the payer’s and recipient’s information, the terms of payment, and the amount due. A comprehensive record typically includes:

- Contact details: Include the names, addresses, and contact numbers of both parties involved.

- Document number: Assign a unique reference number to each record for easy tracking and record-keeping.

- Date of issue: Clearly state when the document was created and when the payment is due.

- Description of services or products: Include a brief breakdown of the services or goods provided, ensuring clarity on what the payment covers.

- Amount due: State the total sum to be paid, along with any applicable taxes or discounts.

Ensure Clear and Professional Formatting

After gathering all the necessary information, focus on presenting it in a clear, readable format. The layout should reflect a professional tone and be easy to navigate. Here are a few tips for clean formatting:

- Use headings and subheadings: Organize your document with clearly defined sections to guide the reader easily through the information.

- Align text and figures properly: Ensure that numbers and text are aligned correctly to improve readability.

- Keep the design simple: Avoid clutter by using a straightforward design with minimal colors and fonts. Stick to a clean, easy-to-read format.

By including the necessary information and following clear, professional formatting guidelines, you can ensure that your financial records are organized, accurate, and presentable to any recipient.

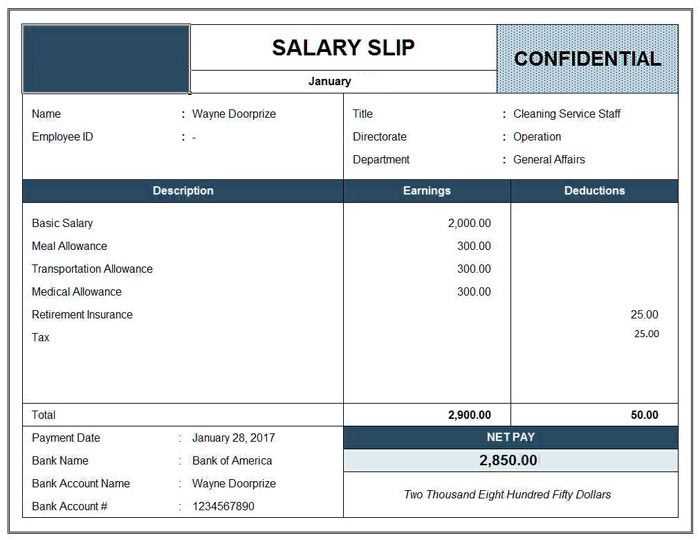

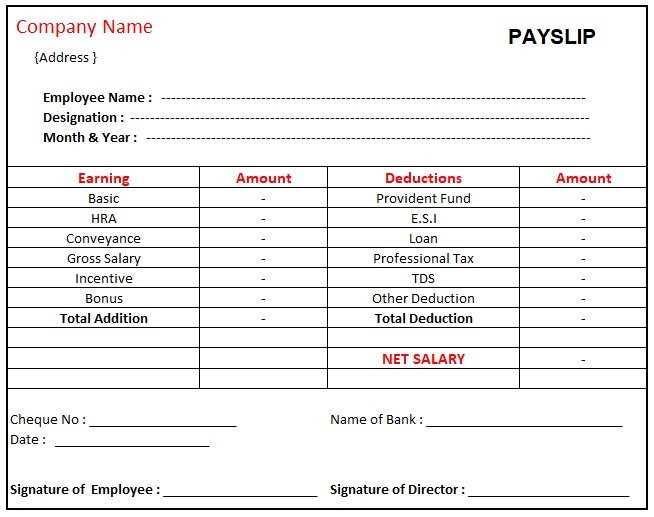

Customizing the Record for Different Roles

When preparing a financial document, it’s important to tailor it according to the specific roles of both the issuer and the recipient. Different professions and industries have varying requirements, which means the layout and content may need to be adjusted to fit the context. Customization allows for a more precise and relevant document, ensuring that it meets the expectations of the parties involved.

Adjusting for Different Job Functions

The roles of the individuals involved can significantly impact what details should be highlighted in the document. For example, a contractor’s payment record might prioritize a breakdown of hours worked and the associated rates, while a consultant may require a clear description of the services provided. Here’s how you can adjust the content for different job functions:

- Freelancers and Contractors: Include hourly rates, project milestones, and deliverables. Be sure to specify deadlines and payment schedules.

- Consultants: Focus on detailing the specific services rendered, the hours of consultation, and any materials or advice provided.

- Full-time Employees: If creating a record for employees, ensure that the base pay, bonuses, taxes, and deductions are clearly outlined in a structured manner.

Key Elements to Modify

The following sections should be customized depending on the role and nature of the work:

| Section | Customization Tips |

|---|---|

| Amount Due | For freelancers and contractors, specify hourly or project rates. For employees, include base salary and deductions. |

| Itemized List | Contractors may have a list of tasks or projects completed. Consultants should include services provided, while employees need only a summary of hours worked or salary earned. |

| Payment Terms | Adjust according to payment schedules: for contractors, it could be upon completion of milestones; for employees, it may be bi-weekly or monthly. |

Customizing the financial document for different roles ensures clarity and accuracy, helping both parties easily understand the breakdown of payments and services rendered.

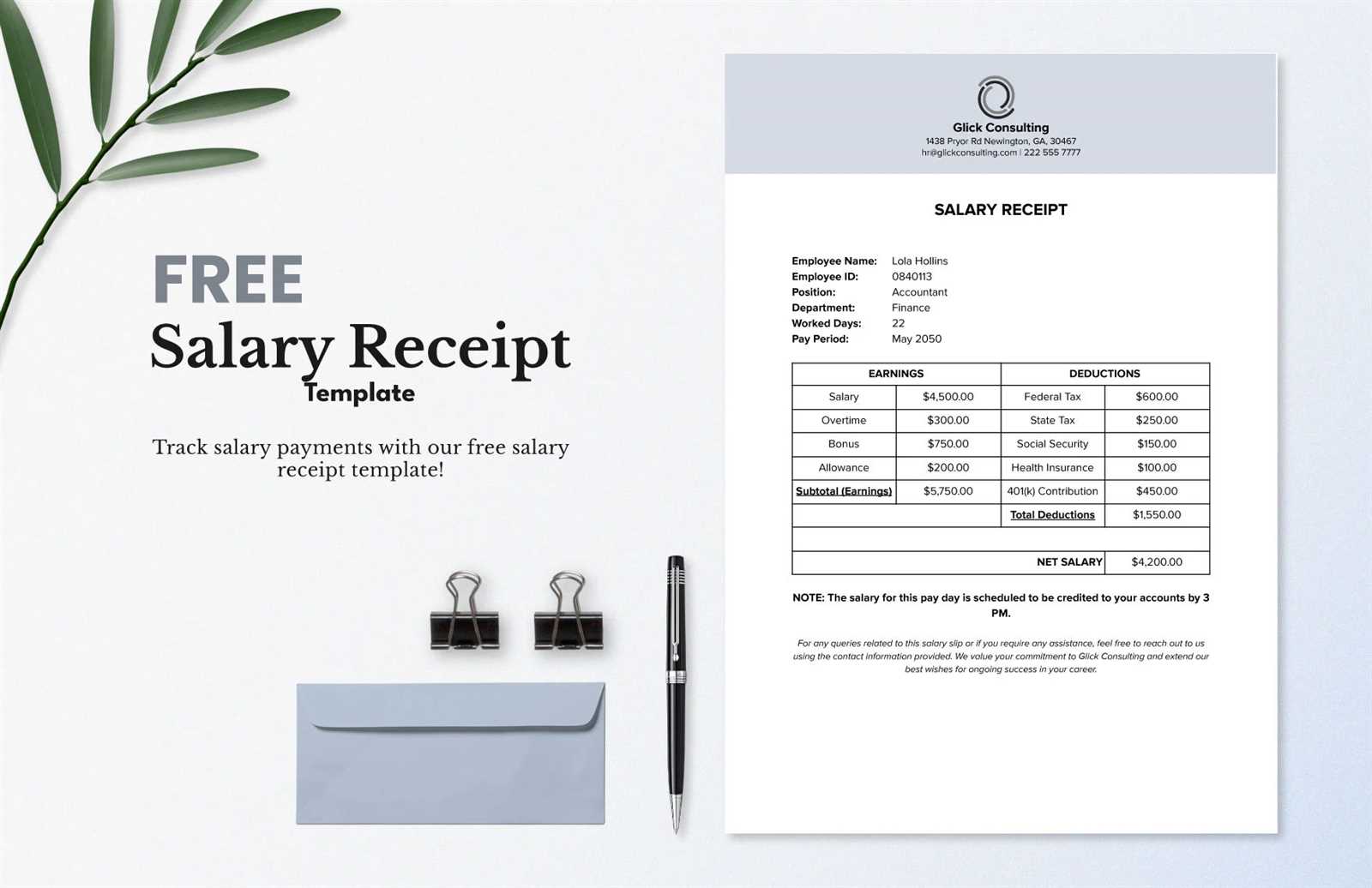

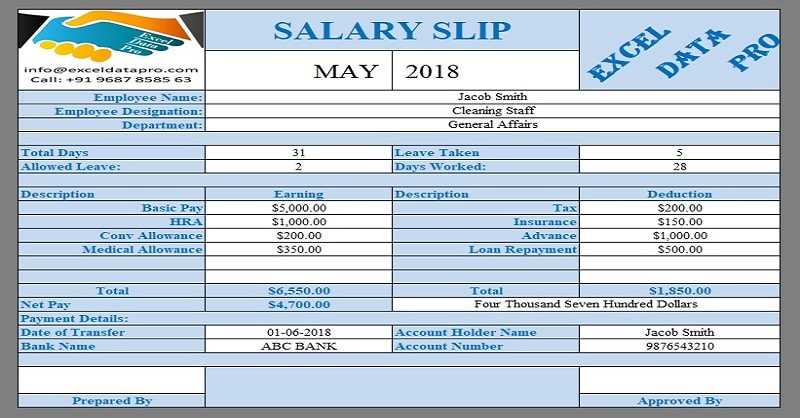

Free Resources for Payment Record Layouts

If you’re looking for convenient and cost-effective ways to manage financial documents, there are many free resources available online. These platforms provide a variety of pre-designed files that can easily be customized to fit your specific needs. Whether you are an independent contractor, a small business owner, or a manager, you can find ready-to-use formats that streamline the process of preparing financial documents.

Many websites offer these documents for free, allowing you to save time and effort while ensuring accuracy. These resources often include different designs and structures, catering to diverse industries and professional roles. Customization is simple, and most of these layouts can be adapted to reflect hourly rates, project-based payments, or even monthly salaries.

Top Sources for Free Payment Record Layouts

- Google Sheets: Offers simple and easy-to-use templates that can be modified with basic formulas to calculate amounts, taxes, and deductions.

- Microsoft Office Templates: A variety of customizable documents designed for business owners, freelancers, and employees.

- Template.net: A website that provides an array of free downloadable formats for various professional fields, including freelancers, consultants, and more.

- Zoho Invoice: Free plan options available, offering templates that integrate with invoicing and payment systems.

- Canva: A graphic design platform that offers visually appealing templates that can be customized to meet payment documentation needs.

By utilizing these free resources, you can ensure that your payment records are both professional and easy to manage. These tools make it simpler to stay organized, track payments, and maintain consistency across multiple transactions.