Sage One Invoice Templates for Effortless Billing

In today’s fast-paced business world, managing finances efficiently is crucial for success. Whether you’re a freelancer or a small business owner, ensuring that your billing system is both professional and easy to manage can save time and reduce errors. Customizing documents to meet your needs is an essential part of this process, helping you maintain accuracy while keeping your brand consistent.

By utilizing well-designed billing documents, you can simplify tracking payments, reducing administrative tasks. These customizable files allow for seamless integration with other financial tools, providing an organized and efficient solution. With just a few simple adjustments, you can create clear, professional records that enhance your business image and streamline your operations.

Optimizing your billing documents with the right tools not only boosts productivity but also ensures that you maintain a smooth cash flow. Whether you are issuing receipts or managing multiple clients, having an efficient system in place is key to staying on top of your financial responsibilities. Embracing modern solutions makes these tasks less time-consuming and more effective.

What Are Sage One Invoice Templates

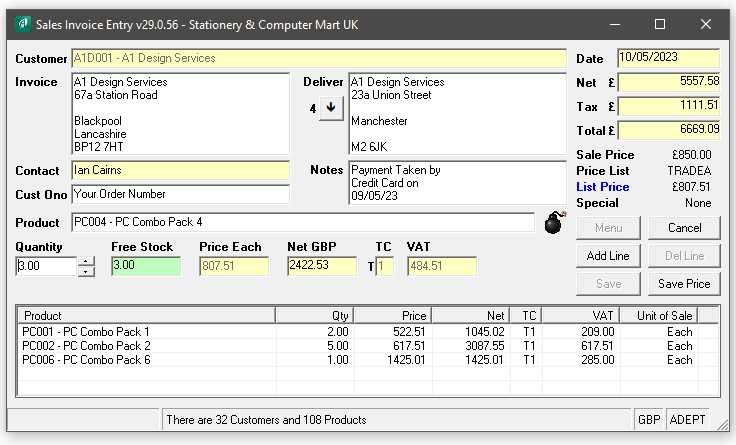

Customized billing documents are essential tools for businesses that aim to keep track of transactions efficiently while maintaining a professional appearance. These specialized files allow you to easily manage client payments and ensure all necessary details are included. With the right set of customizable options, you can create personalized records that reflect your business’s unique style and branding.

These ready-made solutions are designed to simplify the billing process. They provide predefined structures, helping you quickly create accurate documents that contain all the necessary information for both your clients and accounting system. By using such documents, businesses can ensure consistency and avoid common errors in manual billing.

Key Features of These Billing Documents

These documents typically include several important fields and sections, such as client details, service descriptions, payment terms, and totals. The ability to adjust or add these fields makes them versatile and adaptable for various business needs.

| Feature | Description | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client Information | Personalized space for customer details like name, address, and contact info. | |||||||||||||||||||||||

| Itemized List | Breakdown of services or products provided with associated costs. | |||||||||||||||||||||||

| Terms and Conditions | Space for payment terms, including due dates and late fees. | |||||||||||||||||||||||

| Total Calculation | Automatic calculation of total amount based on services/products provided. |

| Factor | Considerations | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Business Type | Choose a layout that suits the nature of your products or services. For example, service-based businesses may prefer a more detailed breakdown, while product-based businesses may focus on quantity and item descriptions. | |||||||||||||||||||||||

| Client Preferences | Consider if your clients have specific expectations for the format. Some industries may prefer simpler designs, while others may expect more detailed documentation. | |||||||||||||||||||||||

| Usability | Ensure that the document is easy to edit, especially if you need to make frequent updates or adjustments. The easier the system is to navigate, the faster you can issue and track payments. | |||||||||||||||||||||||

| Customization Options |

| Tip | Description |

|---|---|

| Automate Recurring Bills | Set up automated billing for clients with regular payments. This reduces the time spent creating invoices manually and ensures payments are made on time. |

| Use Pre-Designed Documents | Utilize pre-made, customizable layouts to save time. This reduces the need for repetitive formatting and ensures consistency across all documents. |

| Track Payments in Real Time | Implement systems that allow you to monitor payment statuses in real-time. This helps you quickly identify overdue payments and follow up accordingly. |

| Clearly Define Payment Terms | Make sure your payment terms are clearly outlined in every document. This prevents confusion and helps ensure clients understand when and how to pay. |

| Offer Multiple Payment Methods | Providing various payment options, such as credit cards, bank transfers, or online payment services, can speed up the payment process and improve client satisfaction. |

By applying these strategies, you can reduce the time spent on billing t

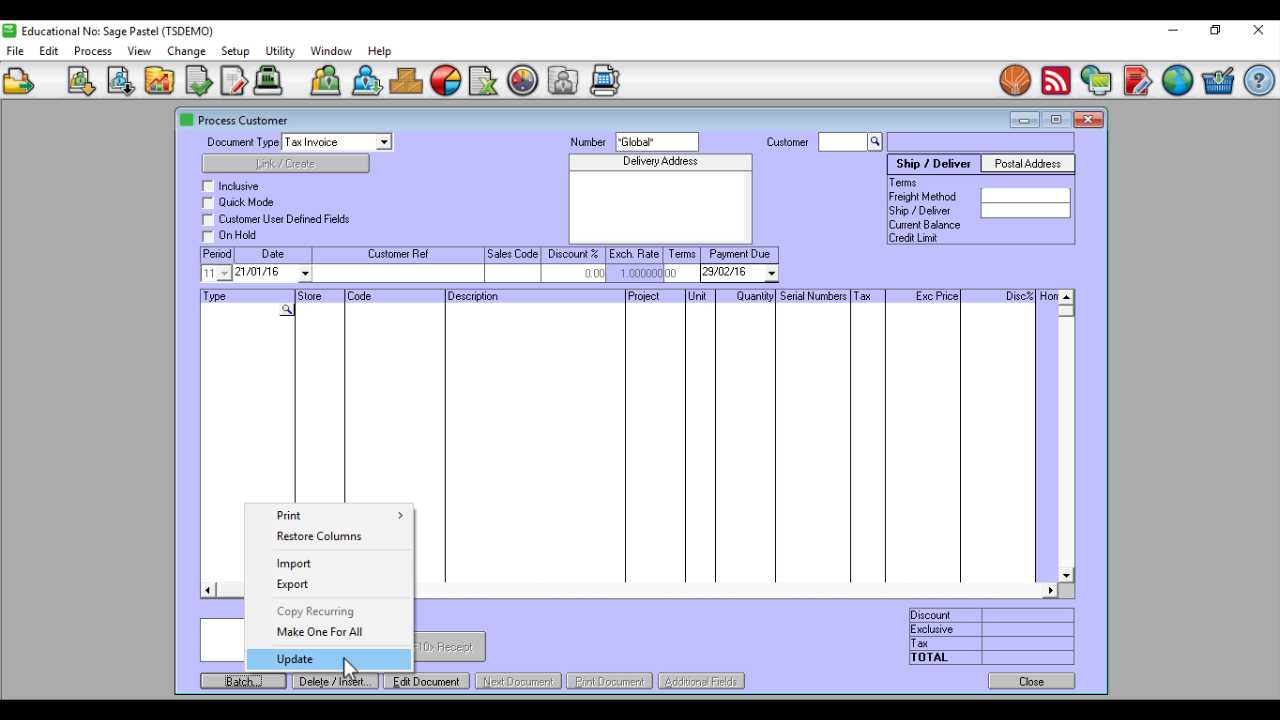

Integrating Sage One with Other Tools

Integrating your financial management system with other tools can significantly enhance your workflow and improve efficiency. By connecting your billing platform with various applications, you can automate tasks, sync data in real time, and eliminate manual errors. These integrations provide a seamless experience, allowing businesses to manage multiple aspects of their operations from one central hub.

Key Benefits of Integration

Connecting your financial software to other business tools offers several advantages:

- Time-saving Automation: By automating data syncing between systems, you reduce the need for manual data entry, which saves time and minimizes errors.

- Improved Accuracy: Integrating with accounting, CRM, and other systems ensures that all data is consistent across platforms, reducing discrepancies.

- Better Financial Insights: Integration allows for real-time tracking of financial performance, providing accurate and up-to-date insights into cash flow, expenses, and revenue.

Common Tools for Integration

There are several popular tools that can integrate with your financial system to streamline your operations:

- CRM Systems: Integration with customer relationship management software allows you to easily track client information, communication history, and outstanding payments.

- Payment Gateways: Connecting to online payment platforms ensures payments are processed quickly, and data is automatically recorded in your financial system.

- Accounting Software: Syncing with accounting platforms helps streamline your financial reporting and ensures accurate records for tax

Managing Payments with Sage One Templates

Efficient payment management is crucial to maintaining smooth business operations. By using a customized billing system, you can easily track payments, monitor overdue balances, and ensure that your records are accurate. With the right tools in place, managing payments becomes a straightforward process, allowing you to stay on top of your cash flow and focus on growing your business.

Tracking Payments

One of the key features of a well-designed billing system is the ability to track payments efficiently. You can easily monitor the status of each transaction and quickly identify any outstanding balances. Here are some key steps to managing payments effectively:

- Record Payment Dates: Always note the date of payment when you receive it, so you can easily verify when the transaction occurred and when the next payment is due.

- Monitor Payment Methods: Track the payment method used by your clients, whether it’s via bank transfer, credit card, or online platforms. This allows you to keep records organized and reconcile payments quickly.

- Generate Payment Reminders: Set up automatic reminders for clients with outstanding balances. This ensures timely follow-ups and helps reduce late payments.

- Maintain Accurate Records: Ensure all payments are logged correctly and linked to the corresponding billing document to avoid discrepancies.

Handling Overdue Payments

Late payments can disrupt your business’s cash flow, so it’s important to handle overdue balances promptly. Here are some tips for managing overdue payments:

- Send Polite Reminders: If a payment is overdue, send a polite reminder to the client with the payment details, including the amount owed and the original due date.

- Implement Late Fees: Consider adding a late fee policy for overdue payments. This can encourage clients to pay on time and ensure you’re compensated for the delay.

- Offer Payment Plans: For clients facing financial difficulties, consider offering flexible payment plans. This can help maintain the business relationship and ensure that you receive payments over time.

By organizing and tracking payments effectively, you can streamline your accounting process and avoid delays in receiving funds. A clear and efficient payment management system ensures that you maintain a healthy cash flow, which is essential for the success of any business.

Tracking Outstanding Invoices in Sage One

Efficiently tracking unpaid balances is crucial for maintaining healthy cash flow and ensuring timely payments. By keeping a close eye on overdue amounts, you can follow up with clients promptly and take necessary actions to avoid delays. A reliable system allows you to stay on top of outstanding transactions and reduce the risk of financial discrepancies.

Setting Up Payment Reminders

One effective way to track unpaid balances is by setting up automatic payment reminders. By doing so, you can receive notifications when a payment is overdue, helping you avoid any potential lapses in communication. Most billing systems allow you to schedule reminders that can be sent directly to clients, making it easier to stay on top of accounts receivable.

Using Reports to Monitor Unpaid Balances

Regularly reviewing reports that detail outstanding balances is another essential strategy. These reports typically include key information such as the client name, amount due, original due date, and the current status of payment. By monitoring these reports, you can prioritize follow-ups with clients who have the highest overdue amounts, ensuring that your collections process is efficient and organized.

In addition to reminders and reports, it’s also important to maintain a consistent approach to addressing overdue payments. Promptly following up with clients and keeping accurate records will help minimize the risk of financial mismanagement and keep your business’s finances on track.

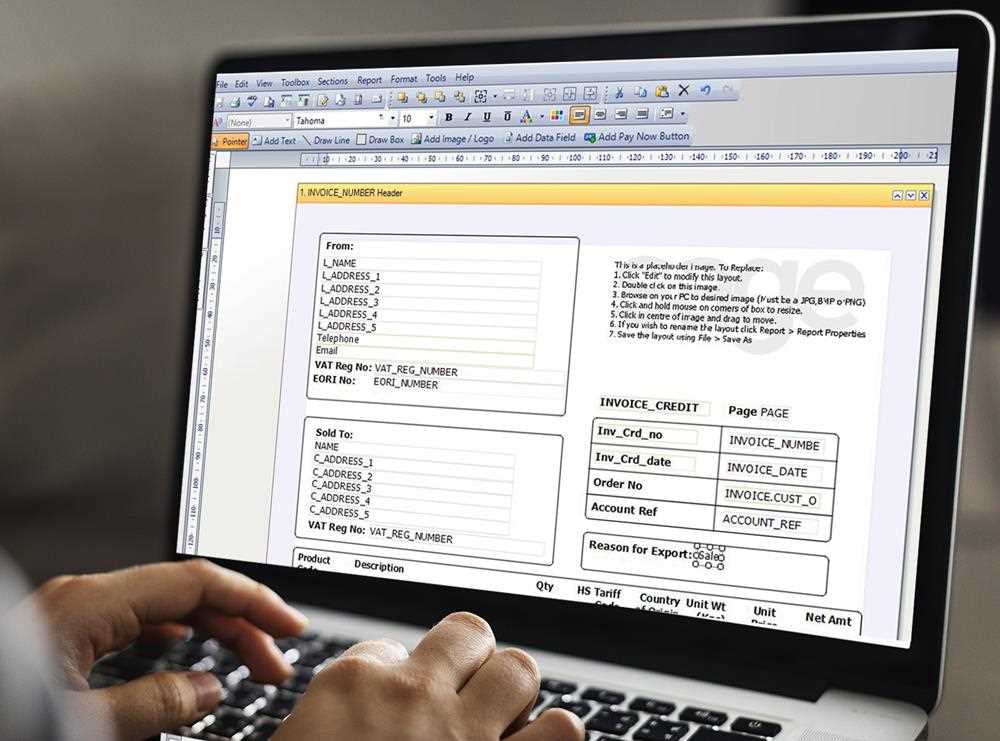

Exporting Documents to PDF

Converting billing records into PDF format is a useful feature that ensures your documents are both professional and easy to share. PDFs are universally accepted, making them ideal for email communication, official record-keeping, and storage. This process allows you to preserve the layout, formatting, and content of your financial records while keeping them secure and easily accessible.

Steps to Export Documents

Most billing systems offer a straightforward method to export records into PDF. Here’s how to do it:

- Finalize the Document: Ensure all details, including client information, amounts, and payment terms, are correct before exporting.

- Select the Export Option: Within the software, look for the option to export or download the document. This is typically found under the “File” or “Actions” menu.

- Choose PDF Format: When prompted, select PDF as the desired file format. Most platforms will automatically generate a PDF version of the document.

- Save the PDF: Choose a location on your computer or cloud storage to save the PDF file, making it easy to access and share when needed.

Why Export to PDF?

Exporting your records to PDF format offers several advantages:

- Consistency: The PDF format ensures that your document looks the same across all devices, preserving your layout and design choices.

- Security: PDFs can be password-protected, ensuring sensitive financial information remains secure during transmission.

- Professional Presentation: PDFs maintain a high-quality format that looks polished and ready for professi

How to Handle Multiple Clients

Managing multiple clients effectively requires an organized approach to tracking their individual needs, transactions, and communications. Whether you’re handling a few or dozens of clients, it’s essential to maintain clear records and streamlined processes for billing and follow-ups. By setting up an efficient system, you can ensure that each client’s details are correctly recorded and easily accessible, leading to better service and fewer errors.

Organizing Client Data

To manage several clients at once, it’s important to have a structured database for their contact information, payment history, and any relevant notes. A well-organized system allows you to quickly locate client records and ensure that billing information is accurate and up-to-date.

- Create Unique Client Profiles: Ensure each client has a dedicated profile with their personal and business details. This will help you tailor your communications and billing accurately.

- Track Client History: Keep a record of all past transactions, outstanding balances, and payment terms. This allows you to monitor clients’ financial activities and easily identify any overdue payments.

- Use Categorization: Categorize clients based on criteria such as industry, location, or account status. This helps you segment your client base for more effective communication and follow-ups.

Streamlining the Billing Process for Multiple Clients

Managing payments and documents for several clients can become cumbersome if not handled properly. Here are a few strategies to streamline your process:

- Automate Recurring Transactions: Set up automated billing for clients with regular payment schedules. This saves you time and ensures that payments are never missed.

- Consolidate Statements: If clients have multiple transactions, consider consolidating them into a single document or statement. This makes it easier for both you and the client to track payments.

- Use Batch Processing: Process several clients’ transactions at once by grouping them based on payment terms or due dates. This simplifies record-keeping and reduces the risk of errors.

By organizing client data and streamlining your workflo

Improving Cash Flow with Effective Billing

Maintaining a healthy cash flow is crucial for the stability and growth of any business. Efficient billing and timely payment collection play a significant role in ensuring that your business has the liquidity to cover operating costs and invest in opportunities. By optimizing your payment processes, you can reduce delays and ensure that you receive the funds needed to keep your operations running smoothly.

Strategy Description Implement Clear Payment Terms Clearly define payment terms upfront with your clients, including due dates, late fees, and acceptable payment methods. This minimizes confusion and sets expectations for both parties. Offer Multiple Payment Methods Provide clients with various ways to pay, such as credit cards, online payments, or bank transfers. The more convenient you make it for clients to pay, the faster you’ll receive funds. Automate Payment Reminders Set up automated reminders to notify clients when a payment is due or overdue. This reduces the need for manual follow-ups and encourages timely payments. Follow Up on Overdue Payments Be proactive in following up with clients who have outstanding balances. Consistent communication can prevent payments from becoming further delayed. Offer Early Payment Discounts Incentivize clients to pay early by offering a discount on early settlement. This can improve cash flow by encouraging faster payments. By implementing these strategies, you can effectively improve your cash flow, reduce the risk of late payments, and ensure that your business operates without financial interruptions. Streamlining your billing process and maintaining clear communication with clients will not only improve your financial position but also enhance client satisfaction and loyalty.

How to Automate Payment Reminders

Automating payment reminders is a key step in ensuring timely collections and maintaining a steady cash flow for your business. By setting up automated notifications, you can reduce the manual effort involved in tracking overdue payments and increase the likelihood of prompt settlements. Automated reminders allow you to stay organized and consistent with follow-ups, ensuring clients are always aware of their upcoming or overdue payments.

Setting Up Automatic Reminders

Most modern accounting and billing platforms offer easy-to-use features for automating payment reminders. Here’s how you can set them up:

- Choose a Reminder Frequency: Decide how often you want reminders to be sent–whether a few days before the due date or a set number of days after the payment is overdue. You can set this frequency based on your preferences and client payment behavior.

- Customize Reminder Messages: Personalize the reminder emails or messages to reflect your business tone and include necessary payment details. A clear, polite reminder can improve client relationships while encouraging faster payments.

- Set Up a Reminder Schedule: Create a schedule for when the reminders will be sent. You can automate a first reminder on the due date, a second reminder after a week, and a final notice if the payment remains unpaid for a longer period.

- Integrate with Payment Systems: Ensure that your automated reminder system integrates with your payment processing platform. This will allow clients to pay directly from the reminder message, making it as easy as possible for them to settle their accounts.

Benefits of Automating Payment Reminders

Automating reminders offers several advantages for businesses:

- Consistency: Automated reminders ensure that every client receives the same level of attention without the need for manual tracking and sending. This consistency helps prevent missed payments.

- Time-Saving: By automating the reminder process, you free up time that can be used for other business-critical tasks, improving overall productivity.

- Reduced Late Payments: Automated reminders help ensure that clients a

Common Problems with Billing Document Designs

While using billing document designs is essential for maintaining professional standards, there are common issues that businesses encounter when utilizing these tools. These challenges can range from technical glitches to issues with customization and compatibility. Understanding these problems can help you troubleshoot and optimize the use of your billing solutions to ensure smooth operations and avoid potential delays.

Technical Glitches and Errors

One of the most common issues when working with billing document systems is encountering technical errors. These can manifest as problems with generating documents, saving data, or exporting files in the desired format. Such issues may arise due to software bugs, system crashes, or compatibility problems with your device or browser. It’s crucial to regularly update your billing software and check for any patches or fixes that address known issues.

- Document Formatting Issues: Sometimes, after generating a document, the layout may appear misaligned or the fonts may not display correctly. This can result from compatibility problems between the software and your system settings.

- Exporting Errors: You might experience difficulties when exporting documents to formats like PDF or Excel. Files may not render correctly, or data may be lost during the conversion process.

- Missing Data: In some cases, data fields may be left blank or not populated as expected. This could occur due to improper configuration of the system or data entry errors.

Customization Challenges

Another frequent issue is the difficulty in customizing billing documents to meet specific business needs. Many businesses require personalized fields, branding, or unique payment terms to be included in their documents. Customizing templates often involves navigating through complex settings or using specific coding functions, which can be challenging for those without technical expertise.

- Limited Customization Options: Some billing