Download Free Sage Invoice Template in Word Format

Creating professional and accurate payment documents is essential for any business. The ability to efficiently generate clear and well-organized statements can save time and reduce errors, ensuring smooth transactions with clients. Using a pre-designed document that can be easily customized to fit your needs is an effective way to simplify the entire process.

With the right tools, you can quickly create personalized receipts that include essential details like services provided, amounts due, and payment terms. Such documents can be easily modified and reused, allowing for consistency across all your financial interactions. By choosing a flexible and widely-used format, you can ensure compatibility and ease of use across various devices and platforms.

In this guide, we’ll explore how to make the most of customizable document formats that allow you to quickly create, manage, and send professional payment statements. Whether you’re a freelancer, small business owner, or managing a larger enterprise, the ability to effortlessly prepare these documents is key to maintaining financial accuracy and professionalism.

Benefits of Using Sage Invoice Template

Utilizing a pre-designed format for generating billing statements brings numerous advantages to businesses of all sizes. A well-structured document helps streamline financial processes, ensuring that all necessary information is included while maintaining a professional appearance. This consistency reduces errors, saves time, and enhances overall workflow efficiency, making it a valuable tool for both small businesses and larger enterprises.

Time Efficiency and Consistency

One of the key benefits is the significant amount of time saved. By using a ready-made format, you can quickly create accurate documents without the need to start from scratch each time. This allows you to focus on other critical tasks, such as client communication or business development. Additionally, using a consistent layout ensures that your documents maintain a professional look and feel with minimal effort, contributing to a stronger brand image.

Customization and Flexibility

The flexibility to tailor the document according to your specific needs is another significant advantage. You can easily modify sections such as pricing, terms, and payment details, ensuring that each statement reflects the unique aspects of the transaction. This adaptability not only saves time but also helps keep your records organized and in line with your business’s requirements.

Overall, incorporating a customizable and easy-to-use format into your billing process brings a range of benefits, from improved accuracy and time savings to enhanced professionalism and flexibility.

How to Download Sage Invoice Template

Obtaining a ready-made document for creating billing statements is a straightforward process that can significantly ease your accounting tasks. With just a few simple steps, you can download a professionally designed format that is ready to use and customize to fit your specific business needs. Whether you’re a freelancer or managing a larger organization, this downloadable resource is an essential tool for maintaining organized and efficient financial records.

Step-by-Step Guide to Download

To begin, visit the official website or a trusted platform offering downloadable billing formats. Look for the section dedicated to free or customizable documents. Once you locate the correct section, choose the version that suits your needs based on the features it offers, such as customizable fields for payment terms, client details, and service descriptions. Click on the download link, and the file will be saved to your computer in a compatible format.

Editing and Customizing Your Document

After downloading, open the document in any word processing software. You’ll be able to modify essential details, including business information, service descriptions, and pricing. This flexibility ensures that each billing statement reflects the unique needs of your business, without the hassle of creating a new one from scratch each time.

By following these simple steps, you can quickly acquire a customizable billing document, saving time and improving the accuracy of your financial statements.

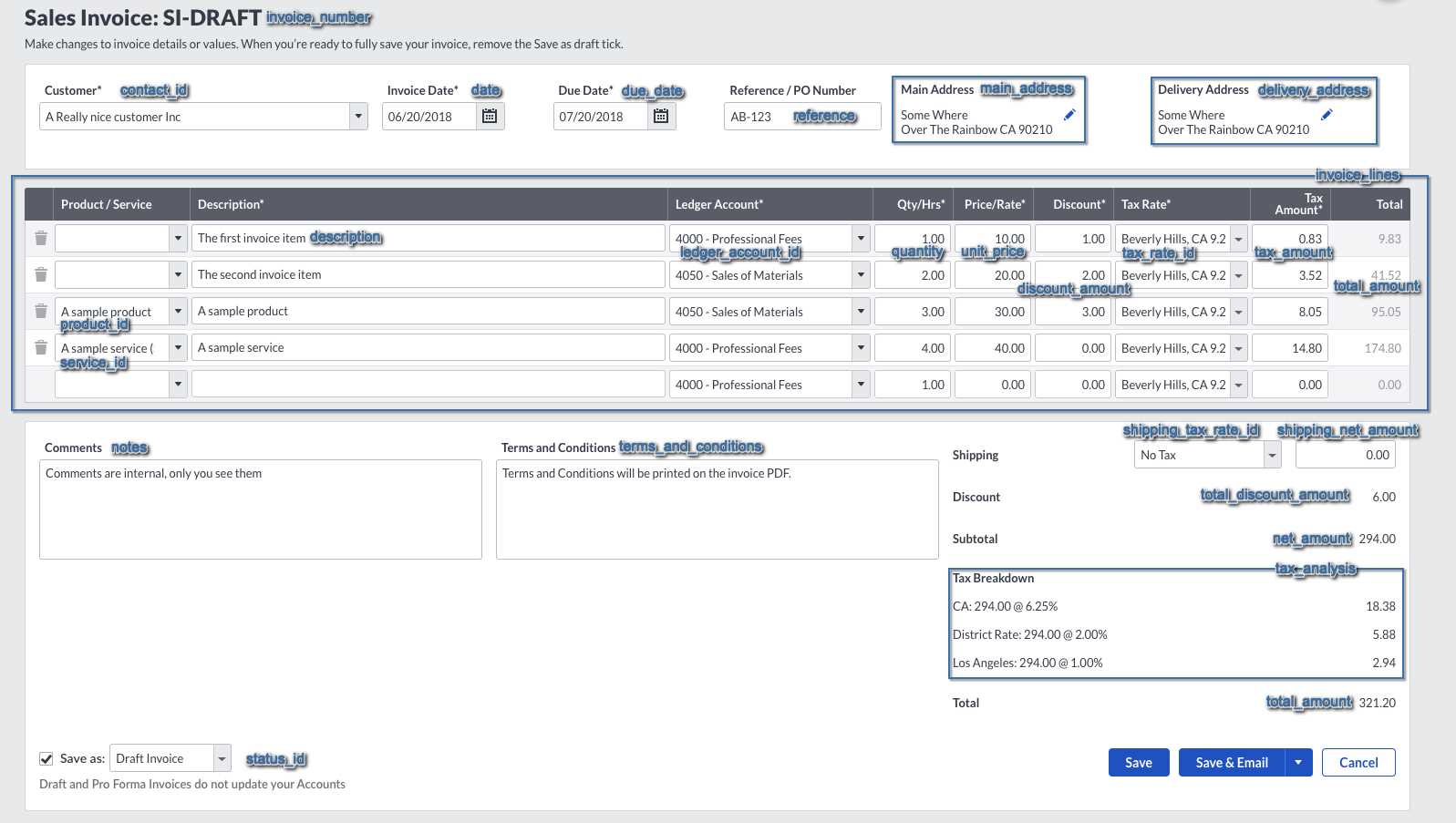

Customizing Your Sage Invoice in Word

Personalizing your billing documents to match your business’s needs is essential for creating professional and accurate statements. Customization allows you to adjust key details such as company information, payment terms, and service descriptions, ensuring that every document you send reflects your brand and business model. The process is quick and easy, offering flexibility to tailor the document each time you need to generate a new statement.

Steps to Personalize Your Document

Follow these simple steps to customize your billing form:

| Step | Action |

|---|---|

| 1 | Open the downloaded file in a compatible software. |

| 2 | Replace the default business name and contact information with your own details. |

| 3 | Modify the payment terms, due dates, and any applicable taxes as per your business requirements. |

| 4 | Adjust the service or product descriptions, including pricing and quantities if necessary. |

| 5 | Save the customized document for future use or immediate sending to clients. |

Enhancing Your Document’s Professional Appeal

To make your document stand out, consider adding your business logo and adjusting the layout to match your branding. You can modify fonts, colors, and other design elements to ensure the document aligns with your company’s visual identity. With these customizations, your financial statements will not only be functional but also contribute to reinforcing your brand image.

By personalizing each document, you maintain a high level of professionalism and ensure that all necessary information is presented clearly and accurately to your clients.

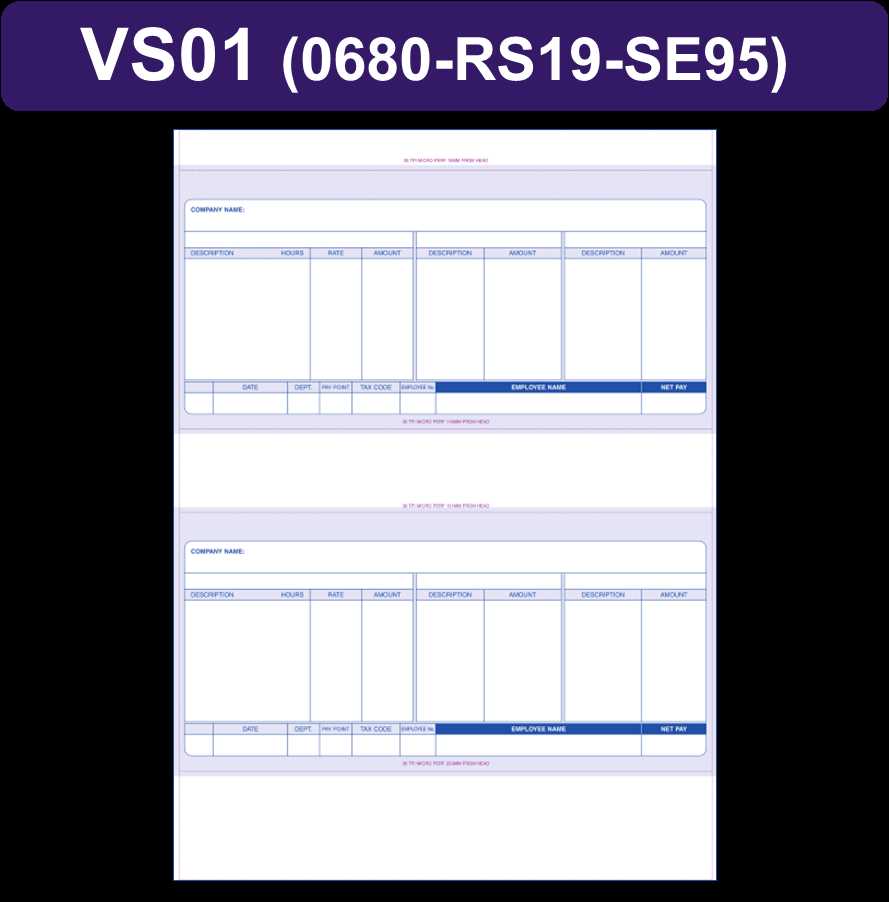

Top Features of Sage Invoice Templates

Pre-designed billing documents offer a range of features that make managing payments and generating statements easier and more efficient. These customizable forms come with built-in tools and functionalities that streamline the process, reduce errors, and ensure all necessary information is included in every statement. Here are some of the top features that make these formats an essential tool for businesses of all sizes.

Easy Customization Options

One of the most valuable aspects of these ready-made formats is their flexibility. You can quickly adjust fields to include your company’s name, contact details, and logo. Additionally, payment terms, prices, and service descriptions can be tailored to fit each transaction. This ensures that every document is unique to your business needs, while maintaining consistency in style and format.

Automatic Calculations

Automatic calculations are a key feature that simplifies the billing process. The document can be set to automatically calculate totals, taxes, and discounts based on the input data, saving you time and reducing the risk of human error. This ensures that your financial records are accurate and up-to-date without having to manually adjust figures for each transaction.

Professional Design

With a clean and polished design, these forms present a professional appearance to your clients. The layout is structured to highlight important details such as payment terms, itemized lists of services, and due dates, making it easy for clients to understand the charges and take action. This attention to design helps build trust with your clients and enhances the overall customer experience.

Multi-Client Management

Managing multiple clients becomes simpler with customizable forms that allow you to create and save specific profiles for each customer. You can adjust the document for recurring clients, ensuring consistent communication and minimizing the time spent on document creation. This feature is particularly useful for businesses that deal with numerous clients or projects.

Compatibility with Other Software

Another important feature is the compatibility of these forms with other business tools and software. Whether you use accounting platforms or customer relationship management (CRM) systems, the ability to integrate with other tools ensures a seamless flow of data, reducing the need for manual input and enhancing overall efficiency.

These features make the billing process much more efficient, helping businesses save time, reduce errors, and present a more professional image to clients. By leveraging these pre-designed formats, companies can ensure smooth and accurate transactions while focusing on growth and customer satisfaction.

Why Choose Word for Sage Invoices

When managing business documents, flexibility and ease of customization are crucial. Using a popular word processing tool for generating business records allows for efficient editing, quick formatting, and personalized designs. The widespread familiarity with this software makes it an excellent choice for creating professional, well-structured documents tailored to any specific need.

Benefits of Using a Familiar Document Editor

One of the main reasons to choose a familiar word processor for generating business records is its user-friendly interface. Most individuals are already accustomed to the layout and features, which significantly reduces the learning curve. This tool offers a wide range of formatting options that allow you to easily adapt the design of documents to meet company standards. Moreover, the ability to integrate tables, logos, and other elements ensures consistency across all your files.

Customizability and Versatility

This tool provides greater control over the structure and design of your documents. You can create tailored sections, add dynamic fields, and adjust layouts to reflect the specific needs of your business. Whether you need to generate simple or complex records, this software supports flexibility in adding details such as payment terms, itemized lists, and tax calculations. The ability to save and reuse customized layouts makes it a practical solution for recurring tasks.

| Feature | Benefit |

|---|---|

| Ease of Use | Familiar interface, quick editing |

| Design Control | Customizable layout and styling options |

| Consistency | Ability to create uniform designs across documents |

| Integration | Option to add logos, tables, and more |

Setting Up Payment Terms in Sage Invoice

Establishing clear payment expectations with clients is essential for maintaining a healthy cash flow. By specifying payment deadlines and conditions in business documents, both parties have a mutual understanding of when and how payments should be made. Setting precise terms not only helps avoid confusion but also encourages prompt settlement of balances.

Defining Payment Deadlines

To ensure timely payments, it is important to define when a payment is due. This can be done by specifying a fixed date or a period after the document is issued, such as “Due in 30 days.” For example, a simple “Net 30” term means the full amount must be paid within 30 days. Additionally, you can outline any late fees or interest charges that will apply if the payment is not made within the agreed period.

Including Discount Terms for Early Payments

Another effective strategy for encouraging quicker payments is to offer discounts for early settlement. For instance, “2% discount if paid within 10 days” can motivate clients to pay faster, benefiting both parties. It’s important to ensure these terms are clearly stated on the document to avoid misunderstandings and ensure the client is aware of the available incentives.

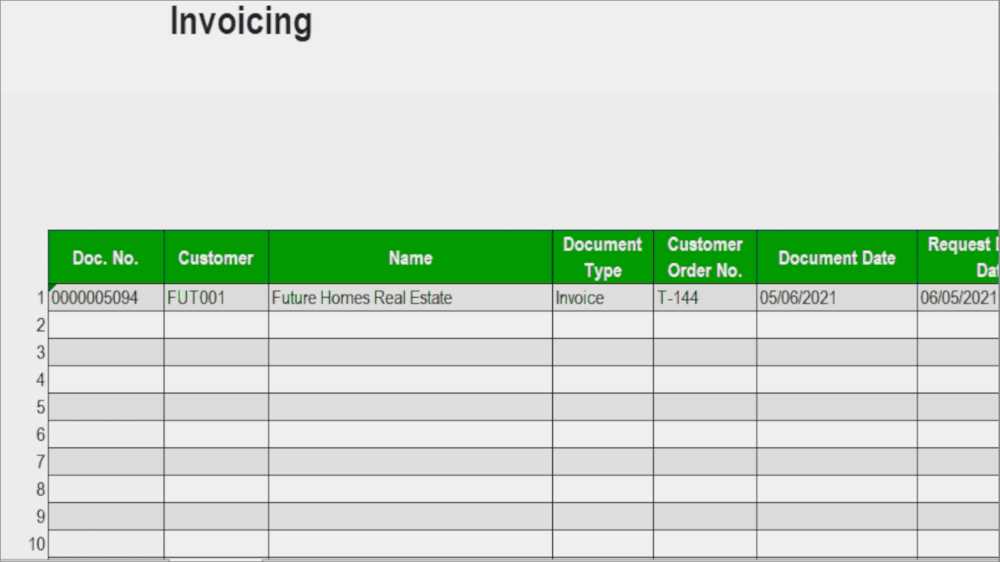

Managing Multiple Clients with Sage Template

When handling a diverse group of clients, it is crucial to stay organized and maintain consistency across all business documents. Using a customizable document layout allows for the efficient management of client-specific details, such as billing information, payment terms, and service descriptions. This approach ensures each client receives a personalized yet professional record, streamlining administrative tasks and reducing errors.

Personalizing Client Information

One of the key advantages of using a flexible document tool is the ability to easily personalize each file. By creating a consistent structure and incorporating client-specific fields, such as names, addresses, and unique terms, you can avoid repetitive work. For instance, a unique client ID or service history can be automatically included, ensuring every document reflects the most accurate and up-to-date information.

Tracking Multiple Accounts Efficiently

Another benefit of a customizable system is the ability to track multiple client records in an organized manner. By grouping related information in tables or using dynamic fields, you can quickly reference outstanding balances, service dates, and payment schedules. This simplifies follow-up tasks, helping you stay on top of different clients and ensure nothing is overlooked.

Common Mistakes to Avoid in Invoices

Creating business documents requires precision and attention to detail. Small errors can lead to misunderstandings, delayed payments, and unnecessary confusion. It’s essential to ensure every record is accurate and clear, as this helps maintain a professional image and promotes smooth transactions with clients.

Missing or Incorrect Payment Terms

One of the most common mistakes is failing to specify the payment conditions clearly. Omitting important details, such as due dates or applicable discounts for early payments, can result in delays. Always include clear deadlines and specify the agreed terms, such as “Net 30” or “Due on Receipt”, to avoid confusion and ensure timely settlement.

Inaccurate or Incomplete Details

Another frequent issue is incomplete or inaccurate client information. This can range from incorrect billing addresses to missing item descriptions or quantities. Double-check that all data, including client names, addresses, and product details, are correct. Even small errors can complicate matters, leading to disputes or delays in payment.

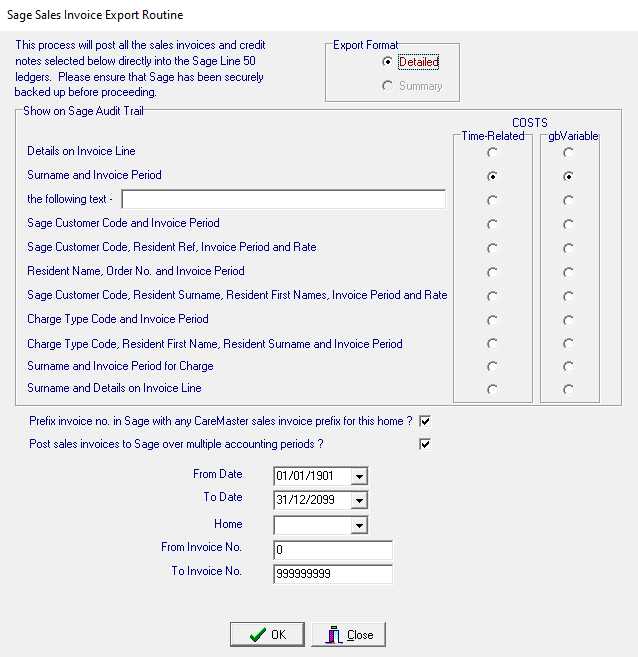

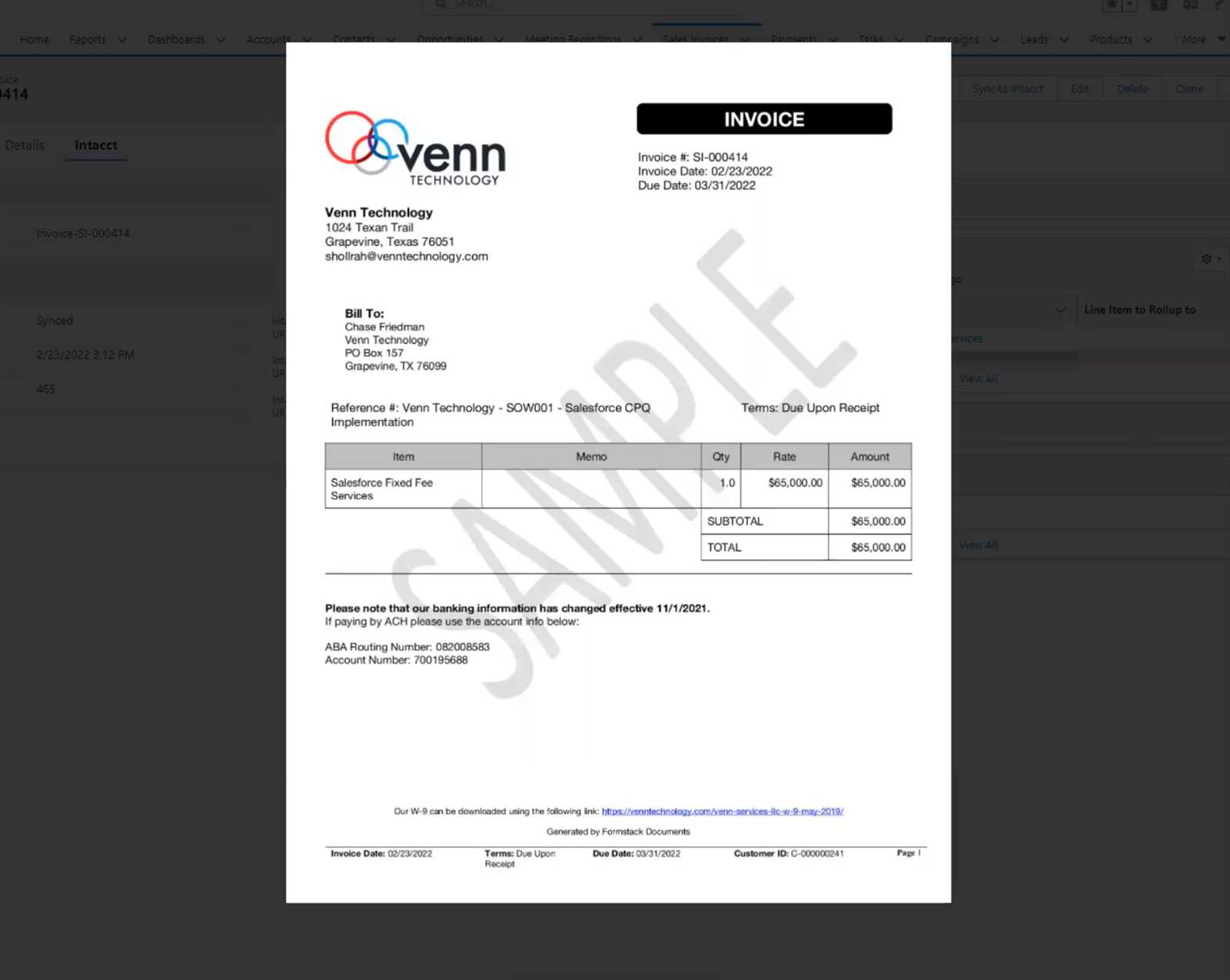

Integrating Sage Invoice with Accounting Software

Streamlining business processes is essential for maintaining efficiency, especially when managing financial records. By linking your business documents with accounting software, you can automate data entry, reduce the risk of errors, and enhance overall accuracy. Integration ensures that all financial data is aligned and consistent across platforms, making it easier to track payments, manage balances, and generate reports.

Benefits of Integration

Integrating business document generation tools with accounting systems offers numerous advantages. With seamless data flow between platforms, you can eliminate the need for manual entry of figures, saving time and reducing human error. This integration helps maintain up-to-date financial records, making it easier to reconcile accounts, process payments, and track the financial health of your business in real-time.

How Integration Works

By connecting your document creation system to accounting software, key details such as amounts, tax calculations, and payment dates can automatically transfer between platforms. This allows for faster invoicing and more accurate bookkeeping. Additionally, integration often enables automatic updates of client information, so there’s no need to enter the same details repeatedly.

| Feature | Benefit |

|---|---|

| Automated Data Entry | Reduces errors and saves time |

| Real-Time Updates | Ensures up-to-date financial records |

| Client Information Sync | Prevents repeated data entry |

| Easy Reconciliation | Improves accuracy and simplifies reporting |

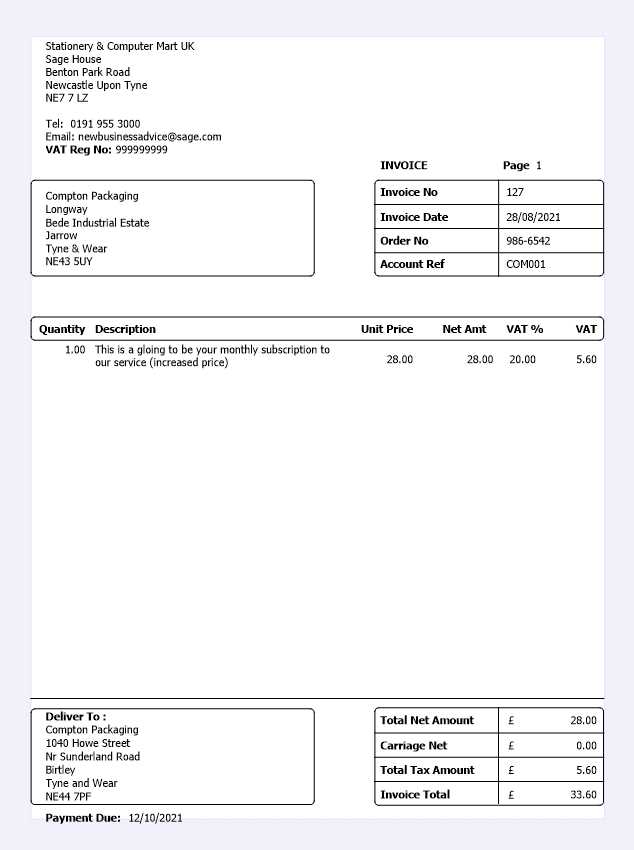

How to Add Tax Information in Sage Invoice

Including tax details in financial documents is an essential part of ensuring compliance and providing transparency to clients. Properly accounting for taxes not only helps maintain accuracy but also simplifies record-keeping for tax purposes. Whether you’re applying sales tax or VAT, it’s important to clearly outline the applicable tax rates and amounts to avoid confusion and potential disputes.

Steps for Including Tax Information

When preparing a business document, you need to include the tax rate applicable to each item or service provided. Depending on the jurisdiction, this may involve listing multiple tax rates or categories. Ensure that each item has the correct tax applied, and clearly specify the total tax amount at the end of the document. This makes it easy for the client to understand the final amount due, including the tax.

Organizing Tax Information in the Document

To ensure clarity, create a dedicated section at the bottom of the document for the tax breakdown. This section should show the subtotal of the goods or services, the individual tax rates applied, and the total tax amount. By doing so, clients can easily verify how their payment is calculated and avoid any misunderstandings.

| Item/Service | Price | Tax Rate | Tax Amount |

|---|---|---|---|

| Product A | $100 | 5% | $5 |

| Product B | $50 | 5% | $2.50 |

| Total | $150 | $7.50 |

Tracking Payments with Sage Invoice Template

Efficiently tracking payments is crucial for maintaining accurate financial records and ensuring timely cash flow. By incorporating payment tracking features into your business documents, you can easily monitor outstanding balances, payment statuses, and due dates. This method not only helps with organization but also minimizes the risk of missed payments or discrepancies in financial reporting.

Adding Payment Status to Your Document

To track payments effectively, it’s essential to include a section for payment status on each document. Clearly marking whether a payment is pending, partially paid, or paid in full helps keep both parties informed. Including this information ensures that you can quickly identify outstanding amounts and follow up accordingly, reducing the chances of overdue payments.

Using a Payment History Table

A payment history table is a practical tool for recording each payment received. By listing the dates, amounts, and payment methods, you can create a detailed overview of a client’s payment behavior. This also provides a clear record that can be referenced in case of any future disputes or inquiries regarding payment history.

| Date | Amount Paid | Payment Method | Balance Remaining |

|---|---|---|---|

| 01/10/2024 | $100 | Credit Card | $400 |

| 15/10/2024 | $150 | Bank Transfer | $250 |

| Total | $250 | $250 |

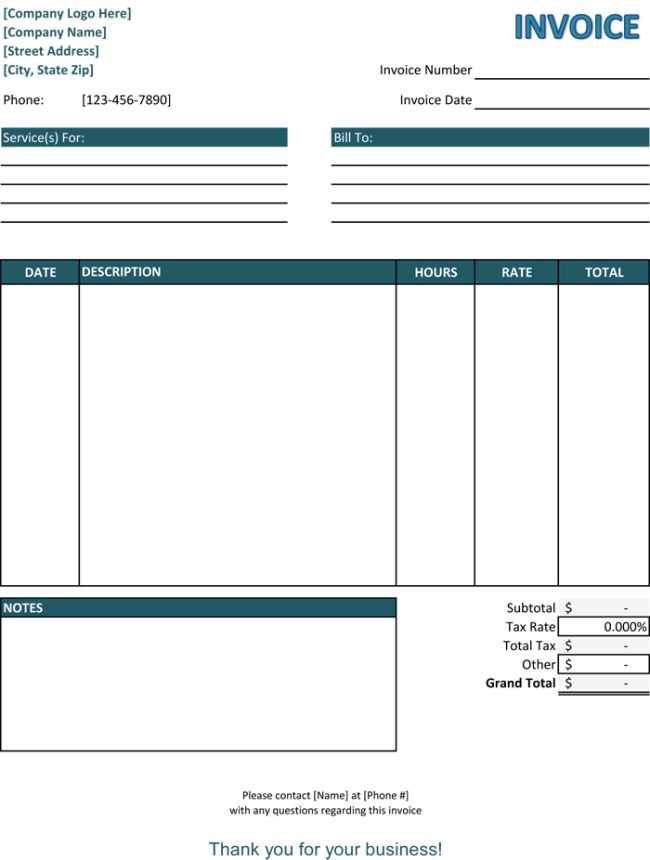

Creating Professional Invoices with Sage

Crafting polished and professional business documents is crucial for establishing a reputable brand image. A well-structured and clear document not only ensures that clients understand the details of the transaction but also reinforces the credibility of your business. By using an intuitive design, you can create documents that are visually appealing, easy to navigate, and consistent in their presentation.

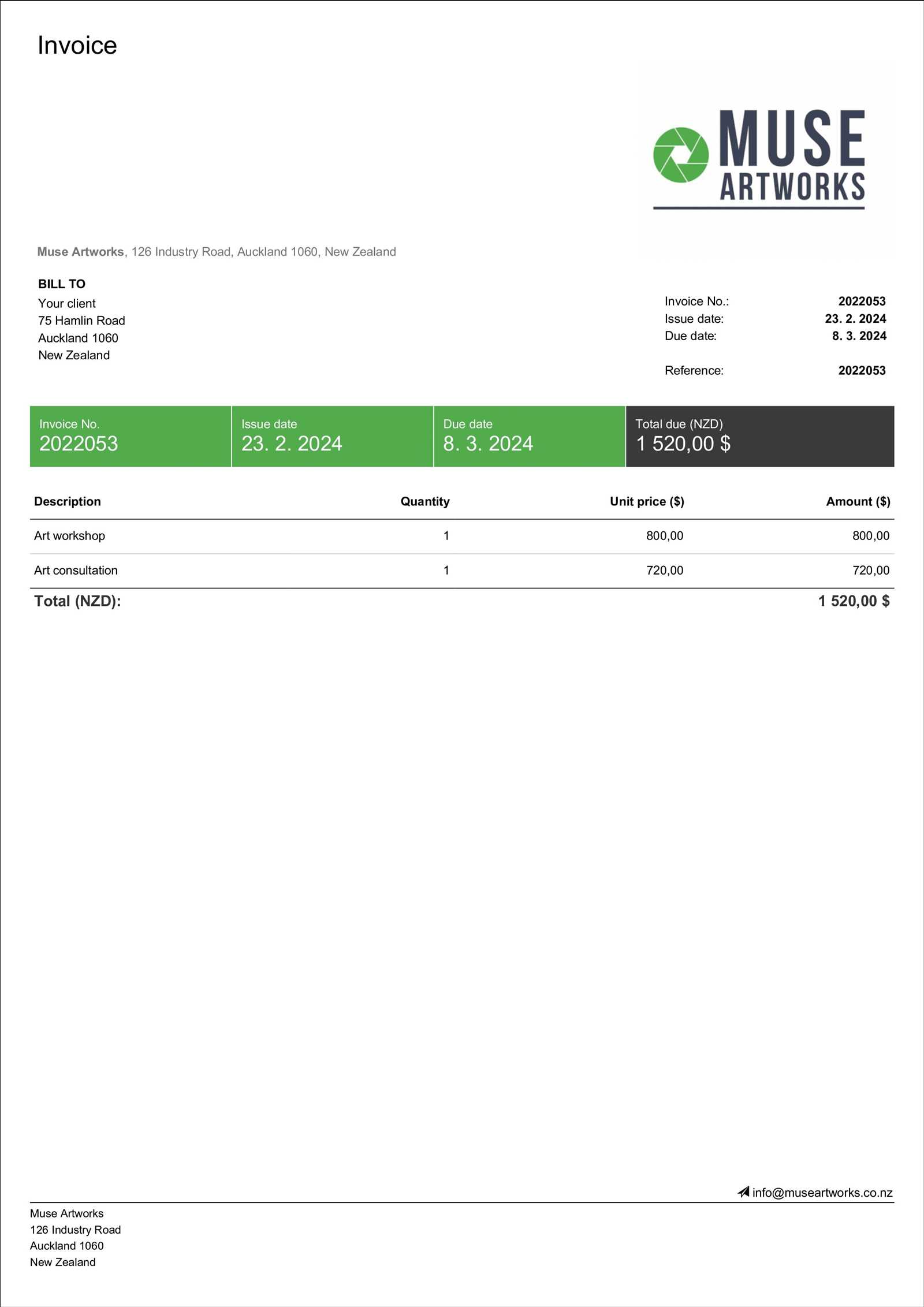

Key Elements of a Professional Document

To create a document that reflects professionalism, it’s essential to include certain key components. These should include clear client information, an itemized list of products or services, and a total amount due. Organizing the details in a logical manner and using easy-to-read fonts and formatting will help ensure that clients can quickly understand the charges and terms. The addition of your business logo and contact information further strengthens your brand’s identity.

Structuring the Document for Clarity

Consistency is important when structuring your business documents. Use headings and tables to clearly separate different sections, such as item descriptions, taxes, and payment terms. A well-organized layout not only makes it easier for clients to read but also helps you avoid errors when entering data. Additionally, incorporating a space for tracking payment status can help you manage outstanding balances efficiently.

| Item/Service | Description | Price | Total |

|---|---|---|---|

| Consulting Service | One-hour session | $100 | $100 |

| Web Design | Design for client website | $500 | $500 |

| Total | $600 |

Legal Requirements for Invoices in Word

In business transactions, it’s crucial that all financial documents meet legal standards to avoid potential disputes or complications. Ensuring that your records include the necessary legal details is essential for compliance with tax laws and financial regulations. A well-structured document not only ensures transparency with clients but also provides you with a reliable record in case of audits or legal review.

Essential Information to Include

To comply with legal requirements, certain details must always be present on business documents. These include accurate information about both the seller and the buyer, a unique reference number, a clear description of the products or services provided, and the date of the transaction. It’s also important to include the tax rate applied, total amounts, and payment terms. Missing or incomplete information can lead to complications, especially in legal or financial contexts.

Keeping Records for Compliance

Proper record-keeping is another key component of legal compliance. Keeping accurate and detailed records not only protects your business in the event of a dispute but also ensures you meet tax reporting requirements. Storing these records in an organized manner allows for easier retrieval during audits or when reporting to authorities.

| Required Detail | Purpose |

|---|---|

| Unique Reference Number | Helps identify and track the document |

| Seller and Buyer Information | Ensures proper identification of both parties |

| Description of Products/Services | Clarifies the goods or services provided |

| Tax Rate and Total | Ensures compliance with tax laws |

| Payment Terms | Sets clear expectations for payment deadlines |

Updating Your Sage Invoice Template Regularly

To keep your business communications consistent and professional, it’s essential to periodically refresh your documentation formats. Regular updates allow you to adjust for branding changes, pricing modifications, and the inclusion of any necessary legal details or new information relevant to clients. Reviewing these details consistently ensures your documentation remains clear and accurate.

Benefits of Regular Template Updates

Frequent updates offer several advantages. For one, they keep your documents aligned with current branding elements, which helps reinforce your brand’s image. Additionally, adjustments to formats allow you to enhance readability, making it easier for clients to understand key information at a glance. Regular updates also offer an opportunity to add any necessary terms or policies that may have changed over time, ensuring your documents always reflect

How Sage Templates Save Time and Effort

Utilizing predefined document formats streamlines your workflow by reducing repetitive tasks and minimizing the chance for errors. These ready-made layouts allow you to quickly input essential information, making the creation process faster and more efficient. With a well-structured format in place, you can dedicate more focus to critical business tasks rather than building documents from scratch.

Below is an overview of the specific ways these formats can enhance efficiency:

| Benefit | Description |

|---|---|

| Quick Setup | Pre-designed structures simplify the setup process, allowing you to create polished documents in less time. |

| Consistency | Ensures |