How to Create and Use a Sage Accounts Invoice Template

Managing financial documents is crucial for smooth business operations. A well-organized system allows for faster transactions, better record-keeping, and professional communication with clients. Using the right structure for your payment requests can make a significant difference in how your business is perceived.

In this guide, we will explore how to design a professional billing format that fits your business needs. By understanding key features and customization options, you can create documents that not only meet legal requirements but also enhance the client experience. Streamlining this process can save time and reduce errors, ensuring payments are processed without delays.

Whether you are a freelancer or part of a larger organization, knowing how to efficiently manage financial paperwork is a skill that every professional should develop. Learn how to optimize your forms, from basic elements to advanced settings, for maximum productivity and clarity.

Complete Guide to Sage Accounts Invoice Template

Creating professional financial documents is essential for any business. A well-organized and easy-to-use structure helps you maintain accurate records, streamline payments, and enhance client trust. This guide will walk you through the process of setting up a billing system that is tailored to your specific needs, ensuring efficiency and clarity in every transaction.

Understanding Key Features for Effective Documents

The first step in creating an effective billing system is understanding the essential components of a proper document. Your form should clearly outline key details such as your business information, the client’s contact, the products or services provided, payment terms, and taxes if applicable. Customizing these elements will allow you to maintain control over your financial processes while also ensuring legal and professional compliance.

Steps to Design Your Financial Document

Once you understand the structure, the next step is customizing the content to suit your requirements. This means adjusting text fields, adding your business logo, and ensuring that all necessary sections are included for seamless transactions. The following table outlines common elements found in most business documents and their purpose:

| Element | Description |

|---|---|

| Business Information | Include your company name, address, and contact details. |

| Client Information | Clearly list the client’s name, address, and payment details. |

| Service/Product Description | A detailed breakdown of the services or products provided. |

| Payment Terms | Define when payments are due, including any late fees. |

| Taxes | Ensure tax amounts are calculated correctly and listed clearly. |

By paying attention to these key components, you will be able to create clear, professional documents that reduce errors and improve payment flow. This system not only ensures accuracy but also helps your business stand out as organized and trustworthy in the eyes of clients and partners.

What Is a Sage Accounts Invoice?

In any business, a formal document used to request payment for goods or services is essential for tracking transactions and ensuring proper record-keeping. This document typically outlines the terms of the sale, including what was sold, the price, and when payment is due. It serves as both a receipt for the buyer and a request for payment for the seller.

Key Elements of a Standard Payment Request

A well-structured billing document includes several essential components that allow both the seller and the buyer to understand the details of the transaction. These elements help ensure transparency and reduce confusion over payment expectations. Common components include:

- Seller Information: Business name, address, and contact details.

- Client Information: Name and address of the recipient.

- Itemized List: A breakdown of the services or goods provided, with quantities and individual prices.

- Total Amount: The final amount owed, including any applicable taxes or discounts.

- Payment Terms: Clear instructions on when the payment is due and any late fees that may apply.

- Unique Reference Number: A distinctive number for easy tracking and reference in future communications.

Why You Need This Type of Document

Creating and sending a formal request for payment helps ensure that both parties are on the same page regarding the transaction. It acts as proof of the agreement and can be referred to in case of disputes. Additionally, for businesses, it serves as an important tool for maintaining financial records and complying with accounting standards.

Whether you’re a small business owner or a large corporation, having a clear and concise document is critical for smooth financial operations. It helps streamline communication, ensures timely payments, and supports accurate accounting practices.

Benefits of Using a Template

Utilizing a pre-designed structure for your financial documents can save both time and effort. A ready-made layout ensures consistency, reduces the chance of errors, and simplifies the creation of accurate and professional forms. Whether you’re a freelancer, small business owner, or part of a larger company, using a structured format allows you to focus more on the content rather than designing each document from scratch.

Time Efficiency

By using a pre-made layout, you eliminate the need to manually design each document. This can significantly reduce the time spent on document creation, allowing you to focus on other important tasks. Some key time-saving benefits include:

- Quick Setup: Fill in the details quickly without having to worry about formatting or design.

- Reuse: Save and reuse the same structure for every transaction, ensuring consistency and efficiency.

- Automation: Some systems allow you to generate multiple forms at once, automating repetitive tasks.

Professionalism and Accuracy

A standardized form helps maintain a polished, professional appearance, which enhances your business reputation. In addition, using a structured format reduces human errors. Common benefits include:

- Consistent Design: Keep a uniform style across all documents, which strengthens brand identity.

- Accuracy: Pre-set fields ensure you don’t miss critical information, such as payment terms or item descriptions.

- Clear Communication: Well-organized documents help your clients understand the details of the transaction, leading to fewer disputes.

Improved Organization and Tracking

By using a reusable format, you can stay organized and ensure that all financial records are stored consistently. This also helps with tracking and reporting. Some organizational advantages include:

- Easy Record-Keeping: Store all documents in one place, easily accessible for future reference.

- Efficient Follow-Ups: Quickly review outstanding payments and follow up as needed, streamlining cash flow management.

- Reporting Made Simple: Organized data allows for easier integration with accounting systems for accurate reporting.

How to Create a Custom Invoice

Creating a personalized billing document allows you to maintain control over the details and presentation of your financial records. With a few simple steps, you can design a document that fits your business needs while ensuring all required information is included for clear communication and efficient payment processing.

Essential Components to Include

When designing your own financial form, it’s important to include several key elements that ensure clarity and legality. These elements help avoid confusion between you and your client and make it easier for both parties to track the transaction. The following table outlines the most common components to include in a custom billing document:

| Component | Description |

|---|---|

| Business Name and Details | Include your business name, address, and contact information for easy identification. |

| Client Information | Clearly list the client’s name, billing address, and contact details to avoid any mix-ups. |

| Itemized List | Detail the services or products provided, including quantities, unit prices, and any applicable discounts. |

| Total Amount Due | Specify the full amount owed, taking into account taxes and any additional charges. |

| Payment Terms | State the payment due date and any penalties for late payments to encourage timely settlement. |

| Unique Reference Number | Assign a unique number for easier tracking and future reference in communications. |

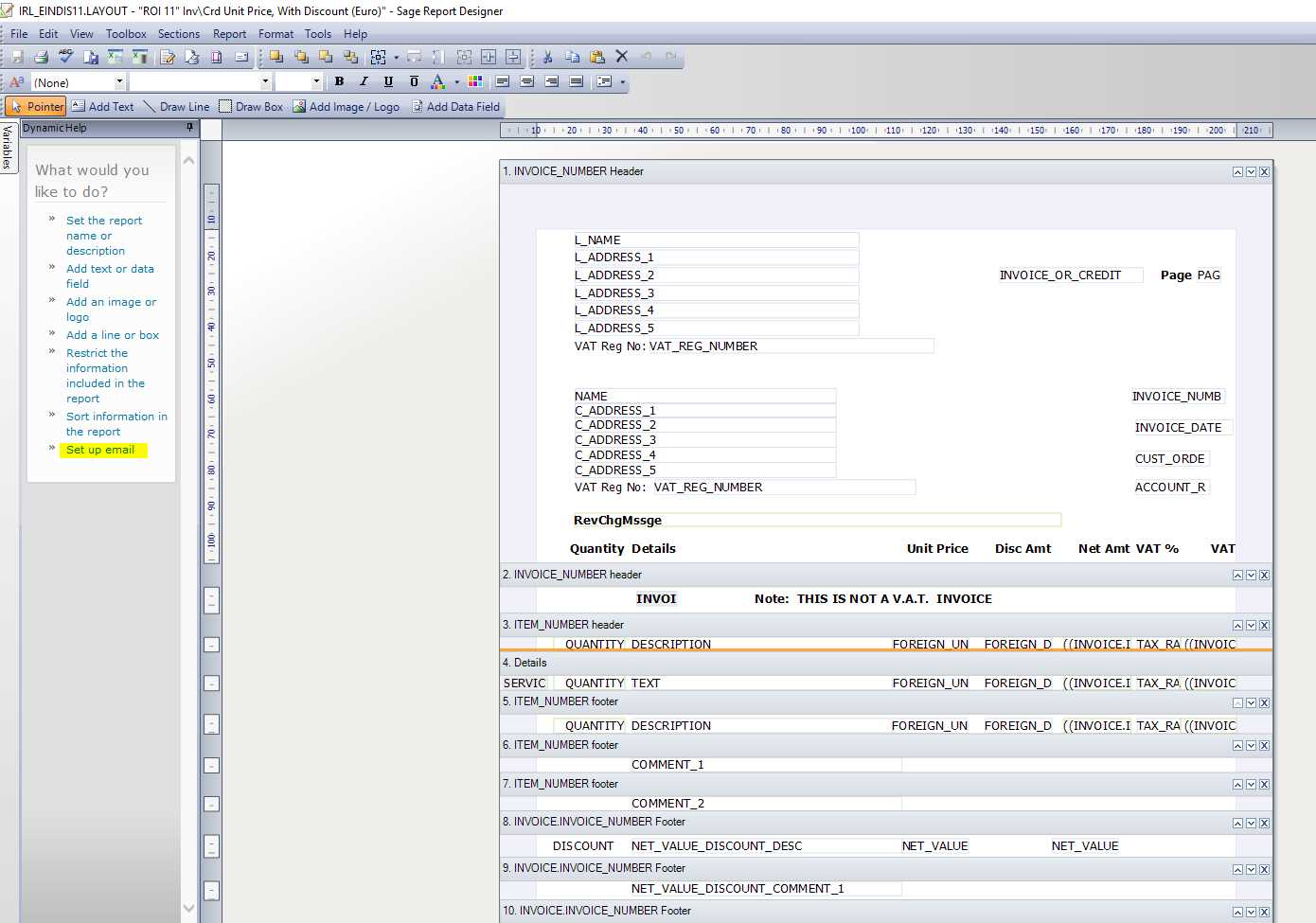

Designing the Document Layout

Once you’ve identified the necessary components, the next step is arranging them in a clear, visually appealing format. This can be done using either a word processor, spreadsheet software, or specialized financial software. Make sure to:

- Maintain a Clean Design: Avoid clutter by leaving space between sections and using headings to separate key elements.

- Highlight Important Information: Use bold or larger text for critical details like the total amount due, payment

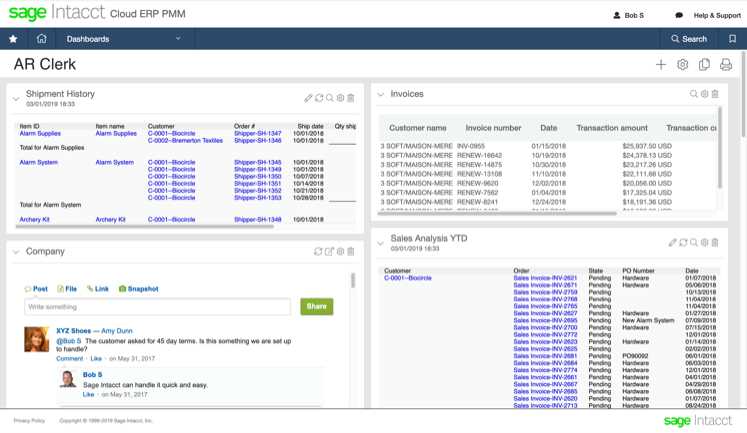

Understanding Sage Accounting Software Features

Modern financial software tools are designed to simplify and streamline the process of managing business finances. These systems offer a range of features that help users efficiently handle various aspects of their financial operations, from tracking sales to managing payments and expenses. By understanding the core features of accounting software, businesses can fully leverage its capabilities to improve productivity and maintain accurate records.

Key Functionalities for Efficient Financial Management

Accounting software comes with a variety of tools that allow users to easily manage their financial tasks. These features are tailored to improve accuracy, reduce manual work, and ensure compliance. Some of the most valuable functionalities include:

- Automated Calculations: Software can automatically calculate totals, taxes, and discounts, reducing human error.

- Recurring Transactions: Easily set up recurring bills or payments for regular services or products, saving time on data entry.

- Real-Time Updates: All financial information is updated in real-time, providing a clear and current overview of the business’s financial health.

- Integration with Banking Systems: Automatically import transactions from your bank, which helps with reconciliation and eliminates the need for manual input.

Customization and Reporting Tools

Another advantage of using accounting software is the ability to customize reports and documents to fit specific business needs. With built-in reporting tools, users can generate detailed financial statements, monitor cash flow, and track unpaid bills. Some key customizable features include:

- Customizable Documents: Adjust layout and content to match your business branding and specific reporting requirements.

- In-depth Financial Reports: Generate balance sheets, profit and loss statements, and tax reports with just a few clicks.

- Expense Tracking: Monitor business expenditures and categorize expenses for easier tax reporting and budgeting.

By understanding and utilizing these features, businesses can significantly improve their financial processes, ensuring smoother operations and greater control over their finances. With the right tools, managing financial records becomes a more efficient and less time-consuming task.

Setting Up Your Billing Document Format

Creating an efficient and professional document layout is essential for smooth business operations. Setting up your own customizable billing form allows you to standardize your financial communications, save time, and ensure all necessary details are included for every transaction. The process involves adjusting various elements, such as business information, payment terms, and product descriptions, to suit your specific needs.

Step-by-Step Process to Customize Your Layout

To set up a personalized billing document, follow these steps to ensure the form meets your business requirements and looks professional:

- Choose a Platform: Start by selecting the software or tool you’ll use to create and manage your forms. Whether it’s a spreadsheet, word processor, or accounting software, choose one that suits your business.

- Enter Your Business Information: Add your company’s name, address, contact details, and logo to the document. This ensures that every form you send represents your brand consistently.

- Add Client Details: Include fields for the client’s name, billing address, and contact information. This is critical for accurate record-keeping and future reference.

- List Products or Services: Clearly itemize the goods or services provided. Include quantities, unit prices, and any applicable discounts.

- Set Payment Terms: Specify the due date, acceptable payment methods, and any late fees. Clear terms help avoid misunderstandings and delays.

Finalizing and Saving Your Document

Once you have added all necessary elements, review the layout to ensure it is clean, clear, and easy to read. It’s important that the document looks professional and communicates all essential information effectively. After finalizing the design, save your form for future use, making it easier to create new documents for every transaction.

With these steps, you’ll have a personalized and professional document format that helps streamline your billing process, ensuring you get paid on time while maintaining a strong business reputation.

How to Add Your Business Logo

Incorporating your company logo into financial documents is a great way to maintain a professional appearance and enhance brand recognition. Adding a logo not only helps clients identify your business quickly, but it also gives your paperwork a polished and cohesive look. Below are simple steps to ensure your logo is seamlessly integrated into your forms.

Steps to Add Your Logo to Documents

Follow these easy steps to add your business logo to your financial documents, ensuring it appears clearly and professionally:

- Choose the Correct Format: Ensure your logo is in a high-quality image format, such as PNG or JPEG. PNG is preferred for a transparent background, allowing the logo to blend better with your document layout.

- Insert the Logo: Depending on the software you are using (word processor, spreadsheet, or financial software), look for an option to insert or add an image. Usually, this can be found under the “Insert” tab.

- Position the Logo: Place your logo in a prominent location, such as the top left or top center of the document. This placement ensures visibility and keeps your document organized.

- Resize for Clarity: Adjust the size of your logo to ensure it fits well within the layout. The logo should be large enough to be recognizable but not so large that it dominates the document.

Best Practices for Logo Placement

When placing your logo on financial documents, it’s important to consider readability and design balance. Here are some tips for the best results:

Position Considerations Top Left This is the most common and traditional position. It is easily visible while leaving space for other key document information, such as date and client details. Top Center This position makes the logo the focal point of the document and works well for branding purposes, especially in professional or creative industries. Top Right Customizing Document Fields for Your Needs

Each business has unique requirements when it comes to financial documents. Customizing the fields in your forms allows you to tailor the layout and content to better suit your specific needs, whether it’s adding extra information or adjusting how data is displayed. Personalizing these sections ensures that you capture the necessary details and present them in a way that reflects your brand and workflow.

Identifying Key Fields for Customization

When customizing a financial document, it’s essential to focus on the fields that hold the most important information. You can adjust existing fields or add new ones to capture additional details relevant to your business. Common fields to customize include:

- Client Information: Add extra contact details such as email, phone number, or a secondary address.

- Service Descriptions: Create custom fields for additional notes or specific product codes, making it easier to track and reference each transaction.

- Discounts and Coupons: If you offer promotions or discounts, adding fields for discount codes or percentage amounts will make these details clear to clients.

- Payment Methods: Include customizable options for different types of payments, such as credit card, PayPal, or bank transfer.

- Tax Details: Adjust tax rates or add additional fields for international customers, ensuring the correct tax calculations are shown based on location.

Steps to Modify Document Fields

Once you’ve identified which fields need customization, follow these steps to make adjustments:

- Open the Document Layout: Access the document creation tool or software you are using. Locate the section where you can edit the fields, either in a “Custom Fields” or “Advanced Settings” area.

- Add or Edit Fields: Depending on the software, you can either edit existing fields directly or add new ones. Ensure each field is labeled clearly and positioned logically within the layout.

- Test and Adjust: Once you’ve made the changes, generate a test document to check that everything looks correct and that all necessary fields are displayed properly.

- Save and Reuse: Save your customized document as a template so that you can easily use it for future transactions without repeating the customization process.

By adjusting the fields in your financial forms, you ensure that all necessary information is clearly captured and organized. This level of customization not only improves efficiency but also gives your

Incorporating Payment Terms in Document Layouts

Clearly outlining payment terms in your business documents is essential for establishing mutual understanding between you and your clients. By specifying the conditions under which payments are expected, you minimize confusion and create a clear framework for both parties. This ensures that payments are made on time and helps prevent disputes regarding the due dates and fees.

Key Payment Terms to Include

Including the right payment terms in your documents can streamline your financial processes and foster a sense of professionalism. Below are some key terms that should be incorporated into your business forms:

Payment Term Description Due Date The exact date by which payment should be made, often expressed as a specific date or a certain number of days from the document date. Late Payment Fees A specified percentage or flat fee charged if the payment is made after the due date. This incentivizes timely payments. Payment Methods Clear instructions on acceptable forms of payment, such as credit card, bank transfer, or online payment options. Discounts for Early Payment Offer a reduction in total cost if the payment is made before the due date, such as a 2% discount for payment within 10 days. Currency Specify the currency in which the payment should be made, especially if dealing with international clients. How to Effectively Incorporate Payment Terms

Once you’ve identified the payment terms that best suit your business, it’s essential to present them clearly in your document layout. Consider the following tips for effective incorporation:

- Highlight Key Information: Ensure that important details like the due date and late fees stand out by using bold text or a larger font size.

- Keep it Concise: Avoid overly complicated language. Keep the payment terms straightforward and easy to understand.

- Position Clearly: Place the payment terms near the bottom or at the end of the document, but make sure they are easy to find and not buried in the details.

- Use Standardized Phrasing: Standardize your payment terms across all documents to ensure consistency and avoid confusion.

Incorporating these payment terms into your documents allows for a smoother transaction process and helps both par

Integrating Tax Information into Billing Documents

Accurate tax information is a crucial component of any financial document, ensuring compliance with local laws and providing clarity for both businesses and clients. Including the correct tax details in your forms helps to avoid misunderstandings and ensures that both parties understand the total cost of the transaction. Properly integrating tax calculations allows you to stay organized and transparent, reducing the risk of errors during payment or audits.

Key Elements of Tax Information to Include

When adding tax details to your billing documents, several key pieces of information need to be included to ensure completeness and accuracy. Consider incorporating the following elements:

- Tax Rate: Clearly specify the applicable tax rate for the products or services being provided. This can vary depending on location or the type of goods or services.

- Taxable Amount: Ensure that the taxable amount is clearly stated, distinguishing between the subtotal (before tax) and the total (including tax).

- Tax Total: List the total amount of tax being applied. This should be based on the taxable amount and the applicable rate.

- Tax ID Number: If required, include your business’s tax identification number to comply with tax regulations and to provide proof of your tax status.

- Exemptions or Reductions: If any exemptions or special tax rates apply (e.g., nonprofit organizations or international sales), clearly state these on the document.

Steps for Correctly Adding Tax Information

Integrating tax details into your documents can be done easily by following these steps:

- Identify the Tax Jurisdiction: Determine the relevant tax jurisdiction (local, state, national) to ensure the correct tax rate is applied based on the customer’s location.

- Calculate the Tax: Apply the appropriate tax rate to the taxable amount. If your system supports automated calculations, it can help streamline this process.

- Display Tax Information Clearly: Make sure the tax details are easy to read and clearly separated from other amounts. This can include a breakdown of the subtotal, tax, and total cost.

- Review Compliance: Double-check your tax rates and calculations to ensure compliance with local tax laws and any applicable exemptions.

By following these steps, you can integrate tax information into your financial documents with ease, ensuring that your transactions are clear, accurate, and compliant with tax regulations.

Managing Multiple Billing Document Layouts

Managing various document formats is essential when you work with different clients or have diverse business needs. Having the ability to create and organize multiple layouts allows you to customize your forms based on specific requirements, such as client preferences, product types, or regional tax rules. Effectively handling multiple formats ensures consistency and professionalism across all your financial communications, no matter the situation.

Organizing and Managing Different Layouts

When handling multiple document formats, it’s important to keep them well-organized to avoid confusion and streamline your workflow. Here are a few tips for managing different layouts effectively:

- Use Descriptive Names: Give each document format a clear and descriptive name to help identify its purpose (e.g., “Standard Invoice,” “Pro Forma Invoice,” or “Service Bill”).

- Create Categories: If you use several formats for different purposes, categorize them based on client type, region, or service offered. This way, you can easily find the correct layout when needed.

- Standardize Fields: Ensure that key fields such as client name, address, and product details are consistent across all layouts to maintain a uniform look.

- Test Each Layout: Before using a new layout for client communication, test it by generating a sample document to ensure all fields are correctly displayed and all necessary information is included.

Best Practices for Switching Between Layouts

When working with multiple document formats, switching between them should be as smooth as possible. To do this effectively, follow these guidelines:

Action Considerations Selecting the Right Format Before generating a document, double-check that you have selected the correct format for the client, region, or type of transaction you are handling. Consistency in Layout While layouts may differ, maintain consistency in essential information like business name, contact info, and payment terms to ensure familiarity for clients. Updating Templates Keep your document formats up to date by reviewing them regularly and making any necessary adjustments based on client feedback or changes in business practices. By managing multiple formats effectively, you ensure that your business is prepared to handle a variety of transactions with

Tips for Organizing Your Billing System

Efficient management of your billing documents is crucial for maintaining smooth operations and ensuring timely payments. Organizing your financial documentation not only helps you stay on top of your business transactions but also reduces the chances of errors, missed payments, and confusion with clients. By implementing a well-structured system, you can easily access, track, and manage all your business records in a professional manner.

Key Tips for an Organized Billing System

To streamline your billing process and make it more efficient, consider the following strategies:

- Centralize Your Records: Keep all financial documents in one easily accessible location, whether it’s a digital file system or a physical filing cabinet. This minimizes the time spent searching for important information.

- Implement Clear Naming Conventions: Use clear, consistent naming conventions for your files (e.g., “ClientName_Date” or “InvoiceNumber_Client”). This helps you quickly locate specific documents and keeps everything in order.

- Set Up a Document Management System: Utilize document management software or tools that allow you to categorize and tag documents for easy retrieval. Cloud-based solutions can also provide secure access from anywhere.

- Establish a Regular Review Process: Set aside time to regularly review and update your financial documents. This ensures that all records are up-to-date and accurate.

Steps to Streamline the Billing Process

To improve the overall efficiency of your billing process, follow these steps to stay organized:

- Automate Where Possible: Take advantage of automation tools to streamline repetitive tasks like sending reminders, generating documents, and tracking payments. This will free up time and reduce human error.

- Organize by Client or Date: When storing or categorizing your documents, consider grouping them by client or date range. This will help you quickly reference historical data or follow up on past transactions.

- Maintain a Backup System: Always have backups of your important financial records, especially in case of digital failures. Store copies in secure locations, such as external hard drives or cloud services.

- Track Payment Status: Keep a detailed record of the payment status for each document. Whether paid, pending, or overdue, tracking this information will help you follow up on outstanding payments promptly.

By following these simple yet effective tips, you can ensure your billing system is organized, efficient, and capable of handling your business needs. A well-maintained system minimizes errors and delays while improving your financial workflow and client relationships.

How to Automate Billing Document Generation

Automating the creation of financial documents can significantly improve efficiency, reduce human error, and save valuable time for businesses. By setting up an automated system, you can generate and send documents to clients without manual input, ensuring that transactions are processed quickly and accurately. Automation helps streamline the entire process, from data entry to document distribution, allowing you to focus on other critical aspects of your business.

Steps to Automate the Process

Here’s how to implement automation in your document generation workflow:

- Choose the Right Software: Select a tool or platform that supports automation features for creating and sending financial documents. Many modern accounting and business management tools offer built-in automation options.

- Set Up Client Profiles: Create detailed client profiles within your system, including key information such as billing address, payment terms, and preferences. This ensures that all the necessary data is populated automatically when generating documents.

- Define Document Templates: Create standardized templates for various types of transactions. Ensure that all essential fields, such as client information and payment terms, are included in the templates, so they can be filled automatically with the relevant data.

- Enable Triggers for Automatic Generation: Set up triggers based on specific actions or dates (e.g., when a project is completed, or a service is rendered). These triggers will automatically generate the required documents, reducing the need for manual intervention.

- Review and Customize Automatically Generated Documents: While automation ensures speed, always review the generated documents for accuracy and ensure they reflect any specific terms or conditions unique to a client or service.

Benefits of Automation

Automating document generation offers numerous advantages for businesses:

- Time Efficiency: Automation speeds up the process, allowing you to generate and send documents in minutes rather than hours.

- Accuracy: Reduces the risk of human error in data entry, ensuring that all details, including client information and amounts, are accurate and consistent.

- Consistency: Automated systems ensure that your documents always follow a consistent format, improving your business’s professionalism and branding.

- Improved Cash Flow: With faster document generation and delivery, clients receive their records on time, helping to accelerate payments and improve cash flow.

By automating the creation of your financial documents, you can save time, reduce errors, and i

Tracking Payments Using Billing Documents

Accurately tracking payments is a crucial aspect of managing your business finances. By monitoring payment statuses in your documents, you ensure that all transactions are processed correctly and that any overdue payments are promptly addressed. A well-organized system for tracking payments helps improve cash flow, reduces administrative overhead, and ensures that both you and your clients are on the same page regarding financial obligations.

How to Track Payments Efficiently

To effectively manage payment tracking, follow these steps:

- Record Payment Status: Each financial document should clearly indicate whether it is paid, pending, or overdue. This helps you easily identify which documents require follow-up actions.

- Use Unique Identifiers: Assign a unique identifier (e.g., a number or code) to each document. This makes it easier to track payments and match them to the corresponding records in your system.

- Link Payments to Documents: When a payment is received, make sure to link it to the respective document in your system. This ensures accurate record-keeping and helps avoid confusion later on.

- Set Payment Reminders: Use automated reminders or notifications to prompt clients about upcoming or overdue payments. Timely reminders help ensure that payments are made promptly and reduce the likelihood of delays.

Best Practices for Monitoring Payment Progress

Monitoring and following up on payments requires consistency and attention to detail. Here are a few best practices to follow:

Action Best Practice Payment Status Updates Update payment statuses regularly (e.g., daily or weekly) to ensure that you have the latest information on the status of each document. Overdue Follow-Ups Set up automatic alerts for overdue payments and follow up promptly with clients to ensure that payments are made as soon as possible. Payment Method Documentation Record the payment method (e.g., bank transfer, credit card) for each transaction to maintain an accurate payment history and to avoid confusion in case of disputes. By incorporating these practices into your payment tracking process, you will be able to stay on top of outstanding balances, ensure smooth cash flow, and maintain strong financial relationships with your clients. Tracking payments is not only about keeping accurate records but also about fostering transparency and professionalism in your business operations.

Common Mistakes to Avoid in Billing Documents

When creating and using financial documents, it’s easy to overlook small details that can lead to significant issues down the road. Whether it’s missing information, incorrect formatting, or outdated terms, these mistakes can create confusion for both your business and your clients. By understanding the common errors and how to avoid them, you can ensure that your records are accurate, professional, and effective in communicating with your clients.

Common Errors in Document Creation

Here are some common mistakes to watch out for when setting up your financial documents:

- Leaving Out Key Information: One of the most frequent mistakes is omitting crucial details, such as client contact information, payment terms, or item descriptions. Ensure that all necessary fields are included and clearly visible on each document.

- Inconsistent Formatting: Using inconsistent fonts, colors, or styles can make your documents look unprofessional. Stick to a simple, uniform layout that is easy to read and reflects your business brand.

- Incorrect Dates or Numbers: Double-check dates, payment amounts, and any applicable taxes. Small errors can lead to confusion or disputes with clients, so it’s important to verify these details before sending documents.

- Failure to Include Payment Instructions: Always ensure that your documents clearly indicate how clients can make payments. Missing payment methods or account details can delay payments and cause frustration.

Tips for Avoiding Mistakes

To avoid these common pitfalls, consider the following tips:

- Review Your Documents: Always take a moment to review your documents before finalizing them. This helps you catch any errors or missing information before it reaches your client.

- Use Automated Tools: Leverage software that automatically populates key fields and checks for errors. Automation can reduce the chances of manual mistakes and save you time.

- Stay Consistent: Develop a standardized format for all your documents and ensure that it is applied consistently. This not only reduces errors but also creates a professional appearance across all communications.

- Test Your Documents: Before using your documents with clients, test them internally. Send a sample to a colleague or use a dummy client profile to see how the information appears in the final document.

By being mindful of these common mistakes and following best practices, you can create effective and professional billing records that keep your transactions smooth and hassle-free. Accurate, clear, and well-organized documents will not only help with client relationships but also streamline your business’s financial processes.

Exporting and Sharing Billing Documents

Efficiently exporting and sharing your financial records is essential for maintaining smooth communication with clients and colleagues. The ability to quickly send accurate documents ensures timely payments and fosters a professional image. Whether you’re sharing a document digitally or preparing it for physical distribution, understanding the best methods for exporting and sharing your records can save time and prevent errors.

How to Export Financial Documents

Exporting your financial records allows you to save and share them in a format that suits your needs. Here are the common steps to follow:

- Select the Correct Format: Most software systems allow you to export documents in various formats, such as PDF, Excel, or Word. PDFs are often preferred for their ability to preserve formatting and prevent alterations.

- Export with Key Information: Make sure that the exported document includes all relevant details, including client names, amounts, and payment terms. This will ensure that nothing is left out when sharing the document.

- Check for Accuracy: Before exporting, always double-check that all fields are filled correctly, and there are no missing details. Accuracy in the exported document is essential for maintaining professionalism and avoiding confusion.

- Batch Exporting: If you’re handling multiple documents, consider using batch exporting options to save time. Many systems allow you to export multiple records at once, streamlining the process.

Sharing Financial Records with Clients

Once your document is exported, it’s time to share it with your clients. The method you choose can impact how quickly the client receives and processes the document:

- Email Delivery: Sending financial records via email is one of the fastest and most efficient methods. Be sure to attach the correct file format and include a brief message outlining the contents of the document.

- Cloud Sharing: Cloud-based storage services, such as Google Drive, Dropbox, or OneDrive, allow you to store and share documents with clients securely. Simply upload the document and share the link with the client for easy access.

- Physical Copies: In some cases, clients may prefer physical copies. If this is the case, print the documents and send them via postal mail. Ensure that the printed copy is clear and legible.

Choosing the right export and sharing method for your financial records will depend on your client’s preferences and your business requirements. Regardless of the method, always ensure that the documents are easy to access and professional in appearance.

Why Choose This Tool Over Other Options

When it comes to managing financial processes, the right software can make a significant difference in terms of efficiency, accuracy, and ease of use. There are numerous tools available for handling business records, but choosing the right one depends on your specific needs. Some solutions may be more suitable for basic tasks, while others are better equipped to handle complex operations. Here, we explore why this particular tool stands out from the competition, offering advantages that other tools may lack.

Key Advantages of This Tool

- Comprehensive Features: Unlike many other options, this tool offers a wide range of integrated features designed to handle everything from basic data entry to complex financial tracking. It provides an all-in-one solution for various business tasks, reducing the need for multiple software tools.

- User-Friendly Interface: Many tools on the market can be complex and require a steep learning curve. This platform, however, is known for its intuitive design, making it easy for both beginners and experienced users to navigate and operate without extensive training.

- Customization Options: This software allows businesses to fully customize their documents, reports, and workflows to fit their specific needs. Whether you’re managing small-scale operations or a large enterprise, the tool can be tailored to meet your unique requirements.

- Automation Capabilities: With built-in automation features, this platform reduces the need for manual data entry and repetitive tasks, which saves time and minimizes human errors. It streamlines the process of generating and sending records, enhancing overall productivity.

- Reliable Customer Support: Excellent customer service is essential for resolving issues quickly. This tool is renowned for its responsive support team, offering assistance through various channels such as chat, email, and phone.

- Security and Compliance: Protecting sensitive financial data is a top priority. This tool offers robust security measures to ensure that your business data remains safe and complies with industry regulations, reducing the risk of data breaches and penalties.

Why Other Tools Fall Short

While there are many financial management tools available, they often lack the depth or flexibility offered by this platform. Some competitors may offer basic functionalities but fall short in areas like automation, customization, or integration with other business systems. Others may require additional plugins or third-party services to handle more complex tasks, which can increase costs and reduce efficiency.

Ultimately, choosing the right tool depends on your business needs, but for those looking for a comprehensive, flexible, and reliable solution, this tool provides a clear advantage over others in the market.

Updating and Maintaining Your Billing Documents

Keeping your financial records up to date and properly maintained is essential for the smooth operation of your business. As your business grows and changes, so too should your documents. Regularly reviewing and updating them ensures that they reflect any adjustments in business operations, tax laws, or client preferences. A well-maintained system helps to avoid errors, improves communication, and ensures consistency across all documents.

Steps for Regularly Updating Your Financial Records

To ensure that your documents remain accurate and effective, follow these simple steps:

- Review Key Information: Regularly check for outdated client details, payment terms, and item descriptions. This ensures that all information is accurate and relevant before sending it to clients.

- Stay Current with Legal and Tax Changes: Tax rates, legal requirements, and other regulations may change over time. Ensure that your documents are always in compliance by keeping up with these changes and adjusting accordingly.

- Update Branding Elements: As your business evolves, so should your branding. Keep your logo, color schemes, and design elements consistent with your latest marketing materials to present a professional, cohesive image to your clients.

- Ensure Consistency: It’s important that all your documents follow a consistent format, style, and tone. This consistency fosters trust with your clients and ensures your documents look professional and well-organized.

Best Practices for Maintaining Accuracy

Maintaining accurate and up-to-date records is an ongoing task. Here are some best practices to keep your system running smoothly:

- Automate Updates: Where possible, use automated tools that allow for easy updates to your financial documents. This can save time and reduce human error.

- Establish a Review Schedule: Set a regular schedule for reviewing your documents–whether quarterly or annually–to ensure everything remains current and accurate.

- Incorporate Client Feedback: Sometimes, clients may provide feedback on the clarity or structure of your documents. Be open to making adjustments based on this feedback to improve your documents’ effectiveness and client satisfaction.

- Test Changes: Before implementing major updates, test the changes to ensure they appear correctly across all versions of your documents, whether printed or digital.

By regularly updating and maintaining your billing documents, you can ensure that they continue to serve your business efficiently, maintain compliance with regulations, and foster strong professional relationships with your clients.