How Sage Accounting Invoice Templates Can Simplify Your Business Invoicing

Efficient financial management is a cornerstone of any successful business. A key part of this process is ensuring that your payment requests are clear, professional, and easy to manage. With the right tools, businesses can automate much of their billing process, saving valuable time and reducing human error.

By adopting well-structured solutions for generating payment requests, companies can enhance both their productivity and client relationships. These systems not only provide a polished, consistent appearance but also allow for flexibility, customization, and error-free transactions. Properly designed forms are essential for smooth operations, helping to maintain accurate records and improve cash flow.

With a range of digital tools available today, tailoring financial documents to meet specific needs has never been simpler. Whether you’re running a small startup or a large enterprise, implementing such tools can make a significant difference in the overall efficiency of your financial operations.

Why Choose Sage for Invoicing

When it comes to managing payment requests, selecting the right tool can drastically improve business operations. A reliable system that simplifies the billing process while offering customization, accuracy, and integration is essential for ensuring smooth financial workflows. Here’s why this solution stands out among the many options available.

- Efficiency: Automating routine tasks reduces the time spent on manual entries, allowing businesses to focus on more critical areas of growth.

- Customization: The system offers flexibility to tailor forms to specific business needs, from adding custom fields to adjusting the layout to match company branding.

- Accuracy: By minimizing human error, it helps ensure that financial records are precise, preventing costly mistakes that could affect cash flow.

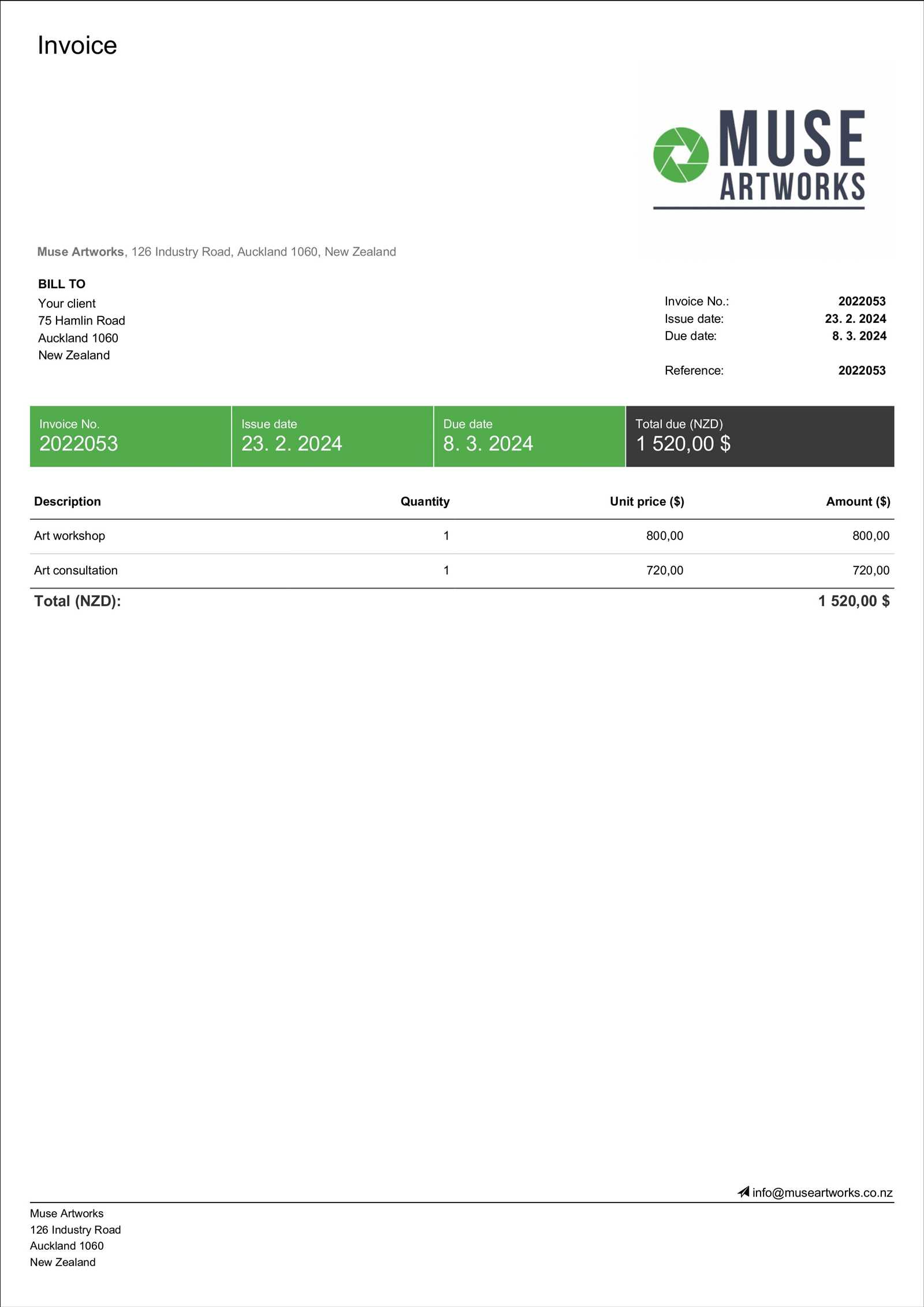

- Professional Appearance: With polished and consistent designs, businesses can present their requests in a way that enhances their reputation with clients and partners.

- Integration: The solution seamlessly integrates with other business tools, streamlining processes and offering a unified view of operations.

Incorporating such a tool into your operations not only saves time but also ensures that every transaction is handled with the utmost efficiency and professionalism. Whether you’re a small business or a larger enterprise, this approach is crucial for managing finances effectively and growing your business.

Key Features of Sage Templates

Effective financial documentation relies on well-designed tools that offer both functionality and flexibility. A comprehensive solution provides users with a range of features that simplify the creation and management of payment requests, ensuring accuracy, professionalism, and ease of use. Below are some of the key attributes that make this solution a powerful choice for businesses.

- Customizable Layouts: Users can easily modify the structure and design to match their company’s branding, creating a cohesive look across all documents.

- Predefined Fields: Essential data fields are built-in, streamlining data entry while reducing the risk of omissions or errors.

- Automation: Automatic calculations, such as tax or discounts, save time and ensure precision with every document generated.

- Professional Designs: A range of clean, polished layouts gives businesses a professional edge when presenting financial documents to clients.

- Integration with Other Tools: Seamless integration with various business systems allows for easy data transfer and synchronization, improving overall workflow.

- Multiple Currency and Language Support: Businesses with international clients can easily manage financial documents in different languages and currencies, broadening their global reach.

These features not only improve the efficiency of generating financial documents but also enhance the overall user experience, making it an indispensable tool for businesses of all sizes.

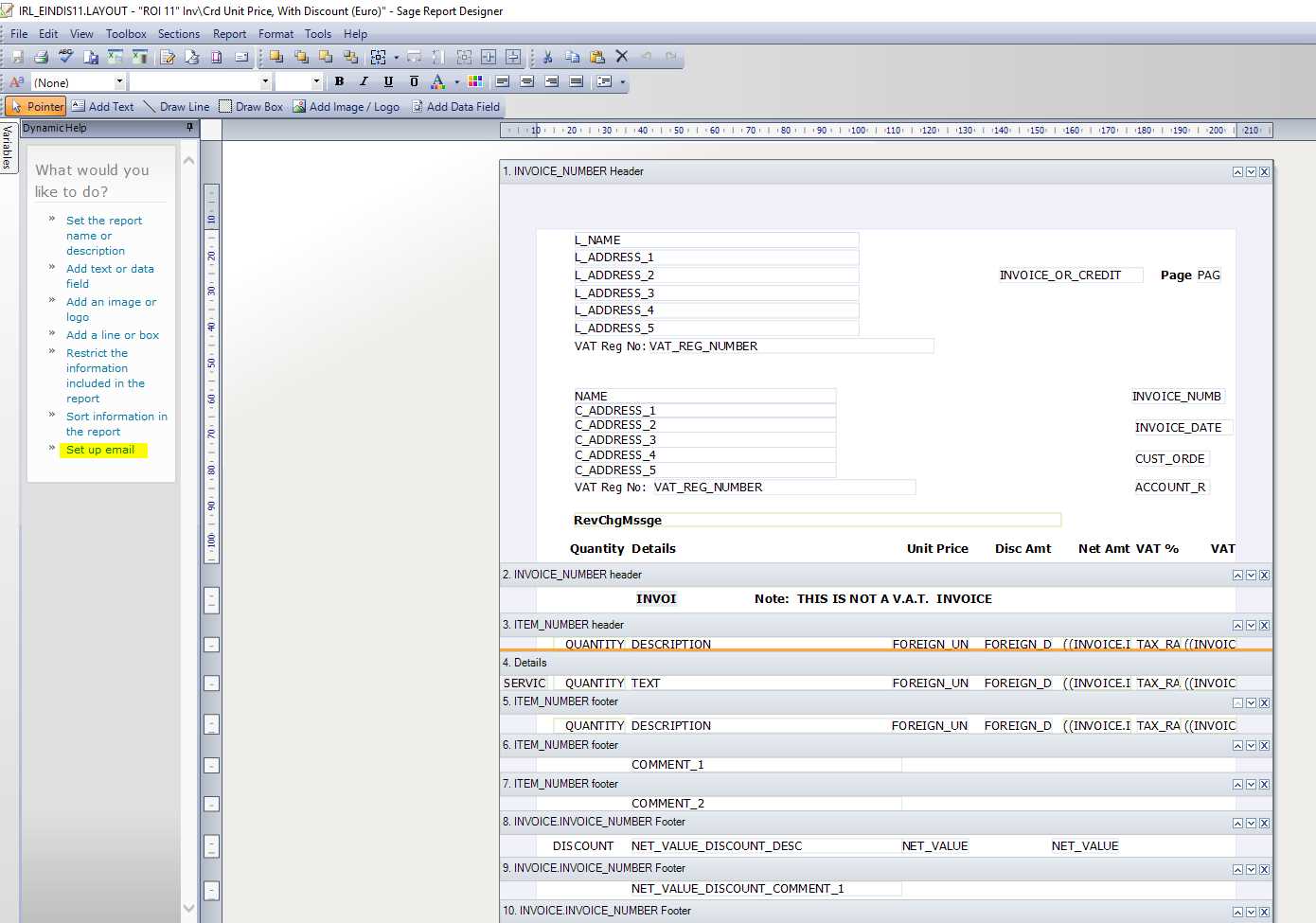

How to Customize Invoice Layouts

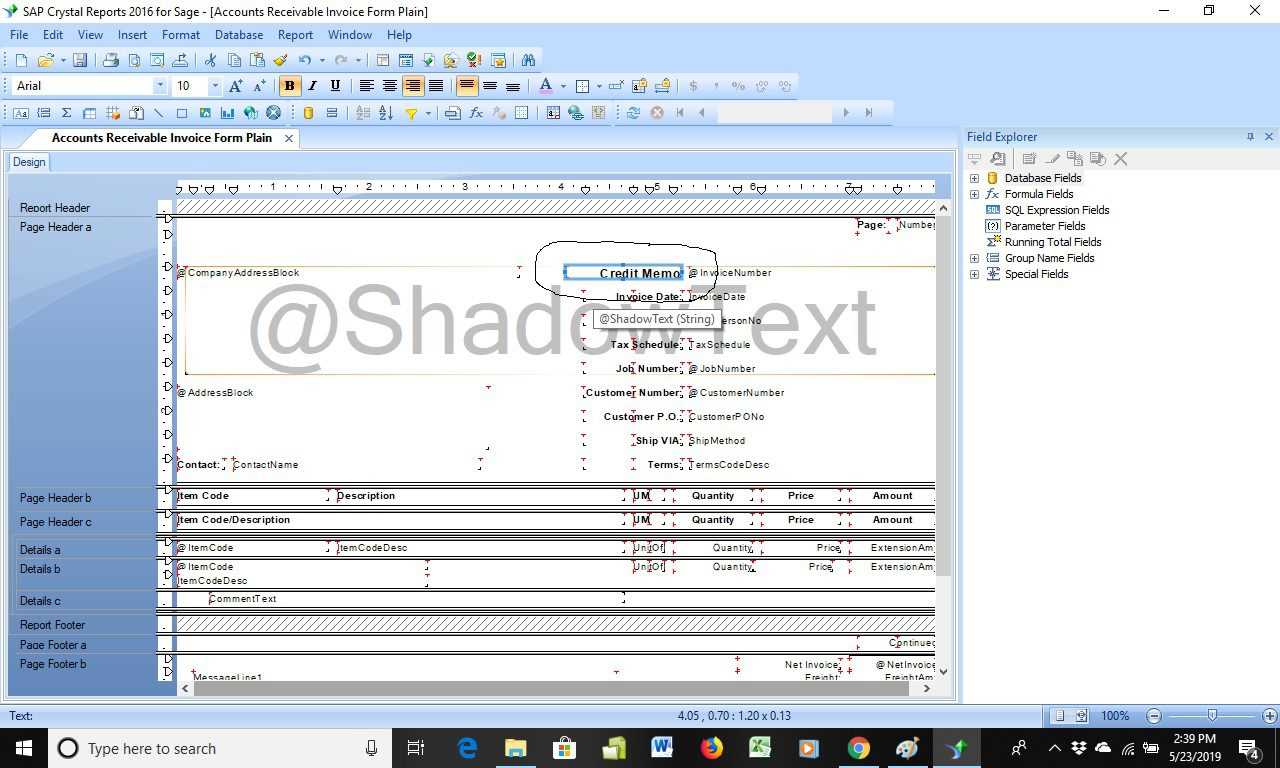

Personalizing the appearance and structure of your financial documents is crucial for maintaining a consistent brand image. Customization options allow you to adjust various elements to suit your business needs and ensure that your documents reflect your company’s style and professionalism. Below are some easy steps to help you tailor the layout of your financial records.

Adjusting the Basic Layout

To start, you can modify the general structure of the document. Common adjustments include altering the position of logos, headers, and contact information. This helps create a clean, organized format that enhances readability.

- Header Customization: Position your logo, company name, and contact details to make them prominent and aligned with your branding.

- Footer Information: Include important legal details or payment instructions in the footer section for easy access.

- Fonts and Colors: Choose fonts and color schemes that reflect your company’s identity while ensuring clarity and readability.

Adding Custom Fields and Sections

Next, add or remove sections to include specific data relevant to your business. Custom fields can be particularly useful for including additional details like project numbers, client references, or special notes.

- Custom Data Fields: Include fields such as order numbers or shipping details to make the document more comprehensive.

- Notes and Terms: Add terms and conditions or special instructions directly on the document for easy reference.

- Item Descriptions: Customize the layout of item descriptions and prices to match the level of detail required for your products or services.

These steps will ensure that your financial documents are not only professional but also tailored to meet the specific needs of your business and clients.

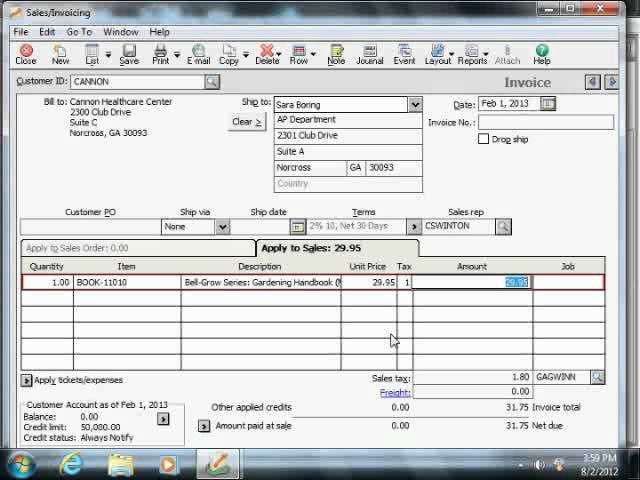

Streamlining Billing with Sage Tools

Efficient billing systems are essential for maintaining smooth financial operations. By automating and simplifying various steps in the payment request process, businesses can ensure faster transactions, reduce errors, and improve client satisfaction. Advanced tools designed to streamline these processes are key to enhancing overall workflow.

- Automated Calculations: These systems can automatically calculate taxes, discounts, and totals, eliminating manual errors and saving time.

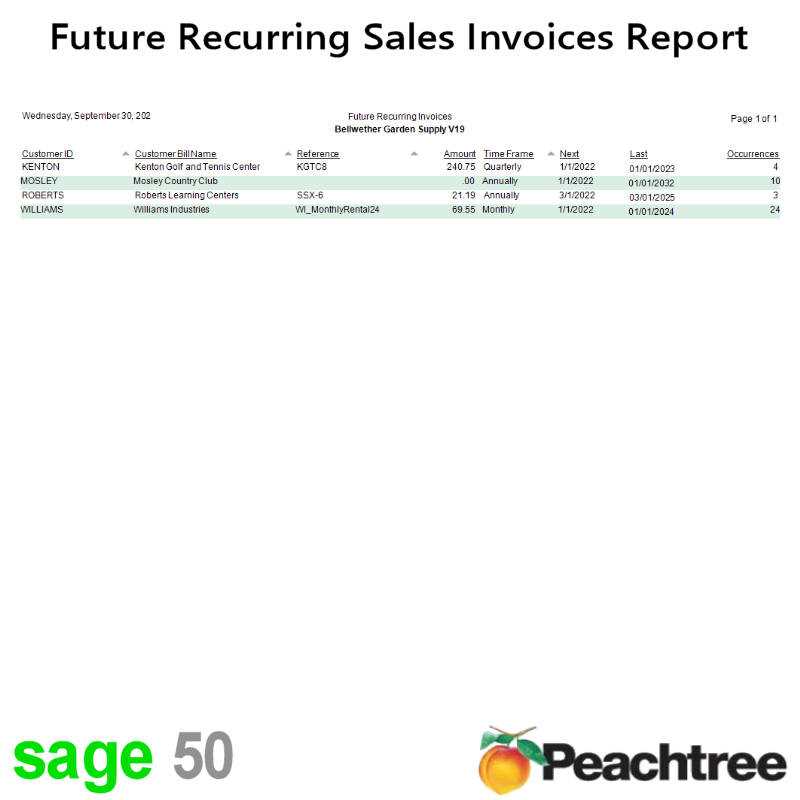

- Recurring Billing: Set up automatic, recurring payment requests for regular clients, ensuring consistent cash flow without the need for constant manual intervention.

- Instant Generation: Quickly create and send documents with pre-filled information, drastically reducing time spent on administrative tasks.

- Payment Tracking: Easily track outstanding amounts, view payment history, and send reminders, all in one place, for better financial control.

- Integration with Other Systems: Seamlessly integrate billing tools with accounting software and customer management systems for a unified approach to financial operations.

By leveraging these tools, businesses can not only save time and effort but also improve the accuracy and professionalism of their billing process. These streamlined systems create more efficient workflows, freeing up time for other critical tasks while keeping financial records organized and up to date.

Benefits of Sage Invoice Automation

Automating the billing process brings a wealth of advantages for businesses, ranging from time savings to enhanced accuracy. By leveraging automation tools, companies can streamline the entire process, reducing manual tasks while ensuring consistency and reliability in every transaction. The following benefits highlight why automation is a smart choice for any organization.

- Time Efficiency: Automated systems can quickly generate and send documents, allowing businesses to focus on other critical tasks without being bogged down by manual administrative work.

- Reduced Errors: With automatic calculations and pre-filled information, the likelihood of human error is minimized, ensuring accurate records and reducing costly mistakes.

- Faster Payments: Automation speeds up the process of creating and sending requests, leading to faster responses and quicker payment cycles, ultimately improving cash flow.

- Consistency: Automated processes ensure that all documents are formatted consistently, maintaining a professional appearance and ensuring uniformity across all transactions.

- Improved Client Experience: Clients receive prompt, clear, and accurate documentation, which enhances trust and satisfaction in your business dealings.

- Cost Savings: By reducing manual labor, automation cuts down on overhead costs, enabling businesses to allocate resources more effectively.

Overall, automating the payment request process provides significant operational advantages, offering a more efficient, accurate, and professional approach to managing financial transactions.

Integrating Sage with Other Software

Integrating business management tools with other software solutions can significantly enhance workflow efficiency and data accuracy. By connecting various systems, businesses can create a seamless exchange of information, reducing manual data entry and ensuring consistency across platforms. Below are some key advantages of integrating financial tools with other essential business software.

- Streamlined Data Flow: Integration allows automatic data transfer between systems, ensuring that information is updated in real-time across all platforms without manual input.

- Eliminating Redundancies: When systems are connected, duplicate entries are avoided, reducing the risk of errors and saving valuable time.

- Improved Reporting: Integration enables the consolidation of data from different sources, providing more accurate and comprehensive financial reports.

- Enhanced Collaboration: Teams working across different platforms can easily access and share critical information, improving overall collaboration and decision-making.

- Increased Efficiency: Automated data synchronization between tools minimizes the need for manual updates, allowing businesses to focus on core activities and improve productivity.

- Better Client Insights: Integrating customer relationship management (CRM) systems with financial platforms helps businesses better understand customer behavior and tailor offerings to their needs.

By integrating these systems, businesses not only improve operational efficiency but also unlock new opportunities for growth, collaboration, and improved client satisfaction.

Understanding Sage Invoice Templates

Financial documentation plays a crucial role in business operations, and having a well-structured system for creating these records can make a significant difference. Customized forms are essential for accurately presenting transaction details, ensuring consistency, and facilitating smoother interactions with clients. Understanding how to effectively use these forms can help businesses maintain professionalism while streamlining their billing process.

What Are These Forms?

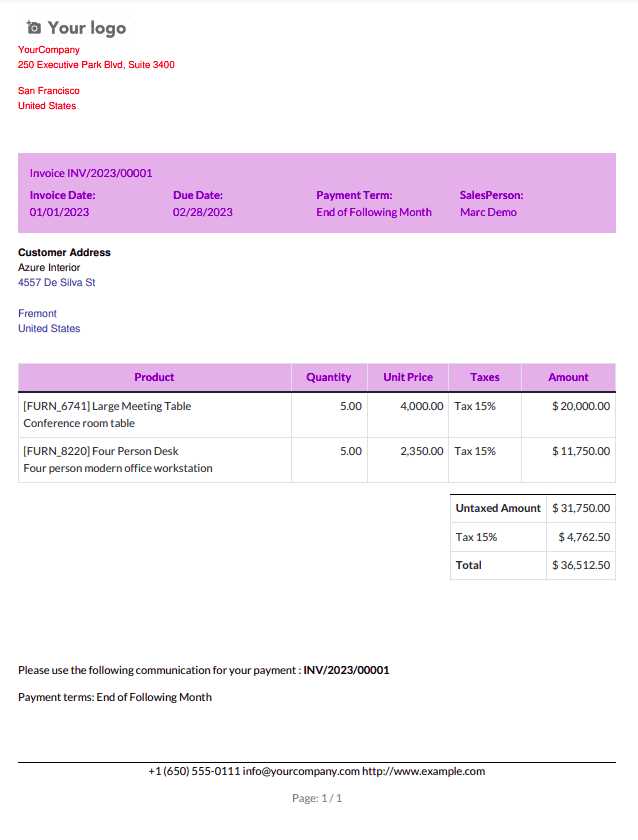

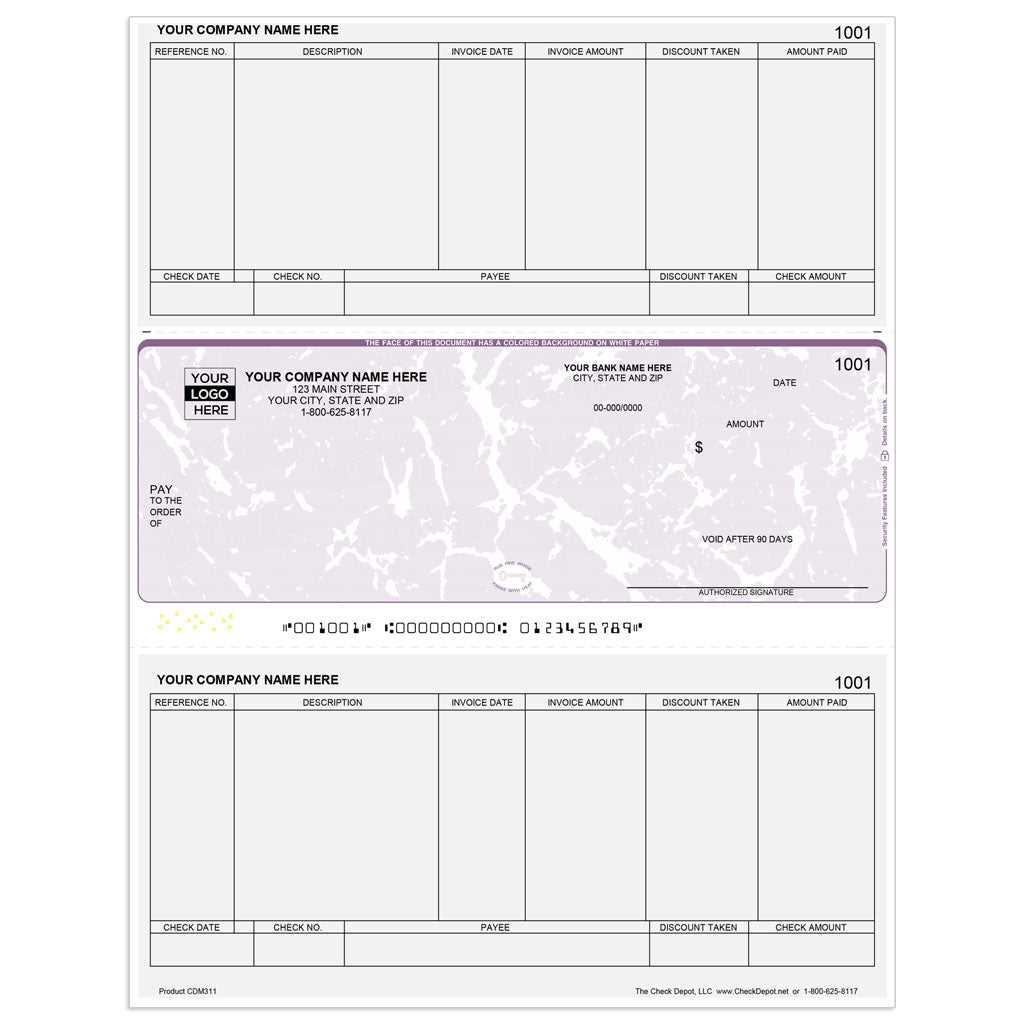

These documents are pre-designed layouts that enable businesses to quickly input necessary information and generate accurate financial records. They typically include fields for company details, client information, transaction amounts, and payment terms. Customizable elements allow businesses to adjust the layout according to their needs, ensuring a personalized and consistent presentation.

- Standardized Structure: Predefined fields help businesses maintain consistency in each document, reducing the chances of missing critical information.

- Easy Customization: Businesses can personalize the forms to reflect their branding by adjusting logos, color schemes, and field placements.

- Efficiency: By having a ready-to-use structure, users can quickly generate the necessary paperwork without spending excessive time on formatting or layout adjustments.

How They Benefit Your Business

These forms are more than just convenient tools–they play a key role in enhancing the overall efficiency of business processes. By automating the generation of essential financial documents, businesses can reduce human error, save time, and create a more professional experience for clients.

- Consistency in Branding: Customizable options ensure that all financial records maintain a cohesive look aligned with your company’s image.

- Time-Saving: With an easy-to-use layout, businesses can quickly create and send documents, accelerating the entire transaction process.

- Accurate Data: Automatic calculations and predefined fields reduce the chances of errors, ensuring that each record is accurate and reliable.

By fully understanding how to leverage these customizable forms, businesses can streamline their financial operations, improve client relations, and maintain high standards of professionalism.

How to Save Time on Invoicing

Time management is crucial when it comes to financial paperwork. Streamlining the process of generating and sending payment requests can free up valuable hours for more important tasks. By implementing a few smart strategies and using the right tools, businesses can significantly reduce the time spent on these routine activities.

Automate Repetitive Tasks

One of the most effective ways to save time is by automating recurring tasks. Many software solutions allow you to set up automatic generation of documents for regular clients, recurring payments, or subscription-based services. This way, businesses can avoid manually creating documents each time and ensure that nothing is forgotten.

- Recurring Billing: Automatically generate payment requests at regular intervals, whether weekly, monthly, or annually, saving time on repetitive entries.

- Pre-filled Information: Use pre-filled client details, payment terms, and other relevant data, ensuring faster document creation.

- Scheduled Reminders: Set up reminders for outstanding payments, allowing you to focus on other tasks while ensuring follow-ups are timely.

Leverage Pre-designed Layouts

Using pre-designed structures can drastically reduce the time spent on formatting and organizing the necessary details. With ready-to-use layouts, businesses can quickly insert the required information without worrying about design or structure. This can be especially helpful for businesses handling large volumes of transactions.

- Customizable Fields: Use flexible fields to adjust the document layout for specific needs without starting from scratch each time.

- Standardized Format: Maintain a consistent look across all documents, saving time and ensuring professionalism.

- Batch Processing: Generate multiple documents at once when needed, cutting down on manual effort.

By automating routine tasks and taking advantage of time-saving tools, businesses can ensure smoother operations, faster turnaround times, and more time for strategic activities.

Improving Cash Flow with Sage

Managing cash flow effectively is crucial for the health of any business. By optimizing the process of creating, sending, and tracking financial records, businesses can accelerate payment cycles and improve cash flow. Leveraging the right tools to automate and streamline these processes can lead to more predictable financial outcomes and greater stability.

One of the best ways to improve cash flow is by speeding up the time it takes to issue and track payment requests. Automated systems can ensure that documents are sent promptly and follow-ups are timely, reducing delays in payment. Additionally, consistent, professional-looking records can enhance client trust and encourage faster payments.

Key Strategies for Enhancing Cash Flow

| Strategy | Benefit |

|---|---|

| Automated Payment Requests | Faster generation and sending of payment requests reduces delays and keeps cash flowing smoothly. |

| Recurring Billing Setup | Helps maintain regular revenue streams, ensuring a steady flow of funds for ongoing expenses. |

| Payment Tracking and Reminders | Automated reminders ensure timely follow-ups, minimizing the risk of overdue payments. |

| Client Payment Preferences | Offering multiple payment options makes it easier for clients to pay promptly, reducing delays. |

By implementing these strategies, businesses can reduce administrative overhead, speed up payment cycles, and improve overall cash flow. The key lies in leveraging technology to make the process as efficient and seamless as possible, ensuring that funds are available when needed most.

Common Mistakes in Invoice Creation

Creating accurate financial documents is essential for maintaining smooth business operations. However, small errors in document creation can lead to payment delays, confusion, or even legal issues. Recognizing common mistakes in the creation process can help avoid these issues and ensure that transactions are handled efficiently and professionally.

- Missing or Incorrect Details: Failing to include essential information, such as client names, addresses, or itemized services, can delay payments and cause misunderstandings.

- Incorrect Calculation of Totals: Errors in adding up charges, taxes, or discounts can lead to incorrect amounts being requested, creating confusion and trust issues.

- Failure to Set Clear Payment Terms: Without clear terms on due dates, late fees, or payment methods, clients may not understand when or how to pay, which can delay cash flow.

- Not Including an Invoice Number: Every payment request should have a unique identifier. Omitting an invoice number makes it difficult to track payments and creates administrative challenges.

- Inconsistent Formatting: A lack of consistency in document structure can make it difficult for clients to quickly understand the terms and details of a transaction, which can lead to confusion.

- Missing Contact Information: Failing to provide clear contact details for follow-ups or inquiries can cause delays when clients need assistance or clarification.

- Incorrect Client Information: Sending documents with outdated or incorrect client details, such as wrong addresses or contact numbers, can lead to undelivered requests and delays in payments.

By being mindful of these common mistakes and taking the necessary steps to avoid them, businesses can ensure smoother transactions, faster payments, and stronger relationships with clients.

Generating Professional Invoices Quickly

Creating high-quality payment requests swiftly is essential for maintaining efficiency in business operations. A streamlined process allows businesses to focus on their core activities, while ensuring that clients receive accurate and timely documents. The key to generating professional documents quickly lies in leveraging the right tools and strategies to automate and simplify the creation process.

Tips for Fast and Efficient Document Creation

- Use Pre-set Layouts: Start with a pre-designed structure to avoid spending time on formatting and design. Choose a layout that includes all the necessary fields and details, so you only need to enter the specific information for each transaction.

- Automate Regular Entries: For recurring clients or services, set up automated document generation to quickly produce and send payment requests without re-entering the same details each time.

- Utilize Pre-filled Client Information: Make use of stored client information to pre-fill fields such as names, addresses, and payment terms, ensuring faster document creation.

- Batch Processing: If handling multiple requests, use batch processing tools to generate several documents at once, saving time and reducing manual effort.

- Clear and Concise Layout: Keep your layout simple and organized. This not only speeds up the process but also makes the document easier for clients to read and understand, reducing back-and-forth for clarification.

Why Speed Matters

- Faster Payments: The quicker the payment request is sent, the sooner clients can make payments, improving cash flow.

- Professionalism: A fast, efficient process shows clients that you value their time and business, fostering stronger professional relationships.

- Less Time Spent on Administration: By speeding up the document creation process, you can allocate more time to other aspects of the business, increasing overall productivity.

By applying these strategies, businesses can create polished and professional documents in a fraction of the time, enhancing both efficiency and client satisfaction.

Enhancing Accuracy with Sage Features

Ensuring precision in financial documents is crucial for the success of any business. Even minor errors can lead to payment delays, misunderstandings with clients, and additional administrative work. By utilizing the right tools and features, businesses can eliminate common mistakes, automate repetitive tasks, and maintain accurate records effortlessly.

Key Features for Improved Precision

- Automated Calculations: Automated tools help eliminate human errors in calculations, ensuring that totals, taxes, and discounts are always correct.

- Built-in Error Checks: Many systems include features that automatically check for inconsistencies, like missing details or incorrect amounts, before documents are sent out.

- Standardized Data Entry: Consistent fields for client information, payment terms, and service descriptions reduce the chances of typos and inaccuracies.

- Pre-filled Client Data: Using stored data for clients allows for faster, more accurate document creation with fewer chances for errors in contact details or pricing.

How These Features Contribute to Accuracy

- Reduced Manual Input: Automating the entry of routine data minimizes the risk of human error and saves time.

- Consistency: By using predefined structures and fields, the documents maintain a consistent format, making them easier to understand and harder to misinterpret.

- Real-Time Validation: Features like real-time validation help identify mistakes as soon as they occur, allowing for corrections before documents are finalized.

By leveraging these features, businesses can enhance the accuracy of their financial documents, reduce costly errors, and ensure smoother transactions with clients.

Creating Custom Fields in Sage Invoices

Personalizing financial documents with custom fields allows businesses to tailor their records to meet specific client needs and internal requirements. Adding custom fields can provide additional clarity and make documents more relevant, whether for tracking special requests, applying discounts, or noting specific terms. This level of customization ensures that every document meets business standards while remaining clear and professional.

By incorporating unique fields, businesses can capture all the necessary details that standard formats may overlook. Custom fields can range from payment methods, project codes, or special client instructions, ensuring that no critical information is missed. This also streamlines internal processes, as employees don’t need to manually add the same information each time, reducing errors and improving efficiency.

How to Add Custom Fields

- Select the Document Layout: Start by choosing the layout you wish to customize. Most systems offer options to modify specific templates without altering the entire structure.

- Access Custom Field Settings: Navigate to the settings or configuration menu where custom fields can be defined and added to the document.

- Define Field Type: Decide whether the custom field will be a text box, dropdown menu, or checkbox, based on the type of data you need to capture.

- Enter Field Details: Assign a name and description to the field to ensure clarity when filling out the document.

- Save and Test: After adding the custom field, save the changes and create a sample document to check the formatting and functionality.

Creating custom fields not only enhances the usefulness of financial documents but also improves consistency, accuracy, and ease of use for both your team and clients. By adjusting documents to better reflect the needs of your business, you ensure that every transaction is recorded with the right information at the right time.

Tips for Efficient Invoice Management

Managing payment requests efficiently is essential for maintaining smooth business operations. A well-organized system not only helps ensure timely payments but also reduces administrative stress, allowing teams to focus on core tasks. By adopting best practices for managing these documents, businesses can streamline processes, improve accuracy, and enhance client satisfaction.

Best Practices for Efficient Management

- Implement a Clear Filing System: Keep track of documents by using a digital filing system with clear categories for each client, project, or time period. This makes it easier to locate specific records when needed.

- Automate Reminders: Set up automatic reminders to follow up on overdue payments. This minimizes the need for manual tracking and helps maintain consistent cash flow.

- Standardize Formats: Use a consistent structure for all documents, making it easier for clients to understand and process them. Standardization also reduces errors and speeds up document creation.

- Monitor Payment Status: Regularly check the status of payments to identify any overdue or pending accounts. This proactive approach ensures that no payment is forgotten.

- Use Electronic Payments: Encourage clients to pay electronically. Digital payment options are faster and reduce the risk of errors compared to traditional methods like checks or cash.

How to Streamline Your Workflow

- Integrate with Other Software: Link your payment request system with other business tools such as customer relationship management (CRM) or project management software to reduce manual data entry.

- Review and Optimize Processes: Regularly evaluate your workflow and identify areas for improvement. Small adjustments can lead to significant time savings and a more efficient process.

- Delegate Tasks: Assign specific individuals to manage the payment request process to ensure accountability and prevent bottlenecks.

By following these tips, businesses can significantly improve the efficiency of their payment request management, reduce administrative burdens, and ensure a more streamlined operation overall.

How to Handle Invoice Disputes

Disagreements over payment requests are a common challenge in business transactions. Whether the issue stems from incorrect charges, misunderstood terms, or missed services, addressing these disputes quickly and professionally is essential for maintaining strong client relationships and protecting your cash flow. An effective dispute resolution strategy can prevent long delays and ensure that misunderstandings are resolved amicably.

Steps to Resolve Disputes Efficiently

- Review the Details: Before responding, thoroughly review the document and all related communications to verify the accuracy of the charges and terms. Ensure that the client’s concern is valid and that all the details match the agreement.

- Communicate Clearly: Reach out to the client promptly and professionally. Acknowledge their concerns and express a willingness to resolve the issue. Clear and polite communication can often prevent further escalation.

- Provide Documentation: If there’s any confusion over specific charges or terms, offer supporting documents or records that clarify the issue. This might include contracts, delivery confirmations, or email exchanges that outline the agreed-upon terms.

- Offer Solutions: Depending on the nature of the dispute, propose a fair resolution. This could involve a discount, partial refund, or an alternative payment arrangement. Always try to offer a solution that benefits both parties.

Preventing Future Disputes

- Clarify Terms Upfront: Make sure all payment terms are clear from the start. This includes specifying due dates, penalties for late payments, and what is expected from both parties.

- Use Standardized Documents: Utilizing consistent, professional records for every transaction can reduce misunderstandings and ensure that everyone is on the same page.

- Set Expectations for Communication: Encourage regular communication throughout the transaction process. This helps prevent surprises and ensures that clients feel informed and confident about their commitments.

Handling payment disputes effectively requires patience, professionalism, and a proactive approach. By addressing issues promptly and keeping communication open, businesses can preserve their reputation and maintain strong, positive client relationships.

Ensuring Compliance with Sage Invoices

Maintaining compliance with legal and financial regulations is a critical aspect of any business. Ensuring that payment request documents adhere to industry standards and tax laws not only protects your company but also fosters trust with clients. By following best practices and utilizing the right tools, businesses can avoid penalties and streamline their operations to meet regulatory requirements.

Steps to Ensure Compliance

- Adhere to Local Tax Laws: Ensure that the required tax rates are applied to your records based on the region of your business and clients. Different jurisdictions may have varying tax requirements, so it’s important to stay updated on any changes in the law.

- Include Mandatory Information: Make sure all necessary details are present, such as the correct business name, contact information, a unique reference number, and clear payment terms. Missing elements could lead to confusion and delays in processing.

- Track Payment Due Dates: Set clear due dates and ensure that they comply with any applicable terms. Late payment penalties or discounts for early payment should also be outlined and consistent with agreements made with your clients.

- Automate Tax Calculations: Use automated systems to calculate taxes based on the location and type of service or product sold. This reduces the risk of human error and ensures accurate tax reporting.

How to Stay Updated with Compliance Standards

- Regularly Review Legislation: Keep track of any changes in tax laws, invoicing rules, or industry regulations. Subscribe to relevant newsletters, and attend seminars or webinars to stay informed.

- Consult with Legal Experts: Work with legal professionals to ensure your practices align with current laws. They can help review documents and provide advice on how to adjust your processes for compliance.

- Implement Regular Audits: Conduct internal audits of your payment request documents and related systems to ensure that everything is in line with the latest regulations. This will help identify any potential compliance gaps.

By staying vigilant and adhering to these guidelines, businesses can ensure that their payment processes meet all required standards and avoid potential issues down the line. Compliance not only safeguards the c